| (WFA Income Funds - R6) | (Wells Fargo Advantage Short Duration Government Bond Fund) | |||||||||||||||||||||||||||

|

Investment Objective |

|||||||||||||||||||||||||||

|

The Fund seeks to provide current income consistent with capital preservation. |

|||||||||||||||||||||||||||

|

Fees and Expenses |

|||||||||||||||||||||||||||

|

These tables are intended to help you understand the various costs and expenses you will pay if you buy and hold shares of the Fund. |

|||||||||||||||||||||||||||

Shareholder Fees (fees paid directly from your investment) |

|||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) |

[1] | ||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||

|

Example of Expenses |

|||||||||||||||||||||||||||

|

The example below is intended to help you compare the costs of investing in the Fund with the costs of investing in other mutual funds. The example assumes a $10,000 initial investment, 5% annual total return, and that operating expenses remain the same as in the tables above. The example also assumes that the Total Annual Fund Operating Expenses After Fee Waiver shown above will only be in place for the length of the current waiver commitment. Although your actual costs may be higher or lower, based on these assumptions your costs would be: |

|||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||

|

Portfolio Turnover |

|||||||||||||||||||||||||||

|

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or "turns over" its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund's performance. During the most recent fiscal year, the Fund's portfolio turnover rate was 399% of the average value of its portfolio. |

|||||||||||||||||||||||||||

|

Principal Investment Strategies |

|||||||||||||||||||||||||||

|

Under normal circumstances, we invest:

We invest principally in U.S. Government obligations, including debt securities issued or guaranteed by the U.S. Treasury, U.S. Government agencies or government-sponsored entities. We will purchase only securities that are rated, at the time of purchase, within the two highest rating categories assigned by a Nationally Recognized Statistical Ratings Organization, or are deemed by us to be of comparable quality. As part of our investment strategy, we may invest in stripped securities or enter into mortgage dollar rolls and reverse repurchase agreements. While we may purchase securities of any maturity or duration, under normal circumstances, we expect the portfolio's overall dollar-weighted average effective duration to be less than that of a 3-year U.S. Treasury note. "Dollar-Weighted Average Effective Duration" is an aggregate measure of the sensitivity of a fund's fixed income portfolio securities to changes in interest rates. As a general matter, the price of a fixed income security with a longer effective duration will fluctuate more in response to changes in interest rates than the price of a fixed income security with a shorter effective duration. We invest in debt securities that we believe offer competitive returns and are undervalued, offering additional income and/or price appreciation potential, relative to other debt securities of similar credit quality and interest rate sensitivity. As part of our investment strategy, we invest in mortgage-backed securities guaranteed by U.S. Government agencies that we believe will sufficiently outperform U.S. Treasuries. We may sell a security that has achieved its desired return or if we believe the security or its sector has become overvalued. We may also sell a security if a more attractive opportunity becomes available or if the security is no longer attractive due to its risk profile or as a result of changes in the overall market environment. |

|||||||||||||||||||||||||||

|

Principal Investment Risks |

|||||||||||||||||||||||||||

|

An investment in the Fund may lose money, is not a deposit of Wells Fargo Bank, N.A. or its affiliates, is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other governmental agency, and is primarily subject to the risks briefly summarized below. Debt Securities Risk. The issuer of a debt security may fail to pay interest or principal when due, and changes in market interest rates may reduce the value of debt securities or reduce the Fund's returns. Issuer Risk. The value of a security may decline because of adverse events or circumstances that directly relate to conditions at the issuer or any entity providing it credit or liquidity support. Liquidity Risk. A security may not be able to be sold at the time desired or without adversely affecting the price. Management Risk. There is no guarantee of the Fund's performance or that the Fund will meet its objective. The market value of your investment may decline and you may suffer investment loss. Market Risk. The market price of securities owned by the Fund may rapidly or unpredictably decline due to factors affecting securities markets generally or particular industries. Mortgage- and Asset-Backed Securities Risk. Mortgage- and asset-backed securities may decline in value when defaults on the underlying mortgage or assets occur and may exhibit additional volatility in periods of changing interest rates. When interest rates decline, the prepayment of mortgages or assets underlying such securities may require the Fund to reinvest such prepaid funds at lower prevailing interest rates, resulting in reduced returns. Regulatory Risk. Changes in government regulations may adversely affect the value of a security. An insufficiently regulated industry or market might also permit inappropriate practices that adversely affect an investment. Stripped Securities Risk. Stripped securities are the separate income or principal components of debt securities. These securities are particularly sensitive to changes in interest rates, and therefore subject to greater fluctuations in price than typical interest bearing debt securities. For example, stripped mortgage-backed securities have greater interest rate risk than mortgage-backed securities with like maturities, and stripped treasury securities have greater interest rate risk than traditional government securities with identical credit ratings. U.S. Government Obligations Risk. U.S. Government obligations may be adversely impacted by changes in interest rates, and may not be backed by the full faith and credit of the U.S. Government. |

|||||||||||||||||||||||||||

|

Performance |

|||||||||||||||||||||||||||

|

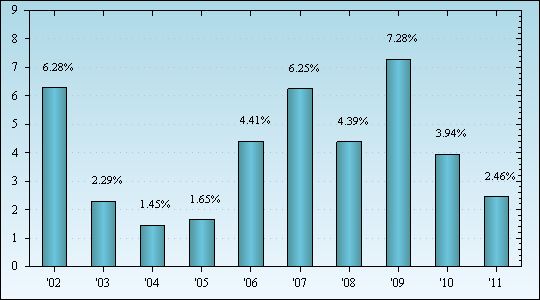

The following information provides some indication of the risks of investing in the Fund by showing changes in the Fund's performance from year to year. The Fund's average annual total returns are compared to the performance of one or more indices. Past performance is no guarantee of future results. Current month-end performance is available on the Fund's Web site at wellsfargoadvantagefunds.com. |

|||||||||||||||||||||||||||

|

Calendar Year Total Returns as of 12/31 each year Class R6 |

[2] | ||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||

Highest Quarter: 1st Quarter 2009 +3.54% Lowest Quarter: 2nd Quarter 2004 -1.14% Year-to-date total return as of 9/30/2012 is 2.14% |

|||||||||||||||||||||||||||

Average Annual Total Returns for the periods ended 12/31/2011 |

[2] | ||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||