| (Wells Fargo Advantage C&B Large Cap Value Fund) | |||||||||||||||||||||||||||||||||

|

Investment Objective | |||||||||||||||||||||||||||||||||

|

The Fund seeks maximum long-term total return (current income and capital appreciation), consistent with minimizing risk to principal. | |||||||||||||||||||||||||||||||||

|

Fees and Expenses | |||||||||||||||||||||||||||||||||

|

These tables are intended to help you understand the various costs and expenses you will pay if you buy and hold shares of the Fund. | |||||||||||||||||||||||||||||||||

| Shareholder Fees (fees paid directly from your investment) | |||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||

| Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | |||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||

|

Example of Expenses | |||||||||||||||||||||||||||||||||

|

The example below is intended to help you compare the costs of investing in the Fund with the costs of investing in other mutual funds. The example assumes a $10,000 initial investment, 5% annual total return, and that operating expenses remain the same as in the tables above. The example also assumes that the Total Annual Fund Operating Expenses After Fee Waiver shown above will only be in place for the length of the current waiver commitment. Although your actual costs may be higher or lower, based on these assumptions your costs would be: | |||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||

|

Portfolio Turnover | |||||||||||||||||||||||||||||||||

|

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or "turns over" its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund's performance. For the eight months ended May 31, 2011, the Fund's portfolio turnover rate was 17% of the average value of its portfolio. | |||||||||||||||||||||||||||||||||

|

Principal Investment Strategies | |||||||||||||||||||||||||||||||||

|

The Fund is a gateway fund that invests substantially all of its assets in the C&B Large Cap Value Portfolio, a master portfolio with a substantially identical investment objective and substantially similar investment strategies. We may invest in additional master portfolios, in other Wells Fargo Advantage Funds, or directly in a portfolio of securities. Under normal circumstances, we invest at least 80% of the Fund's net assets in equity securities of large-capitalization companies. We invest principally in equity securities of large-capitalization companies, which we define as companies with market capitalizations within the range of the Russell 1000® Index. The market capitalization range of the Russell 1000® Index was $526 million to $384 billion, as of June 27, 2011, and is expected to change frequently. We manage a relatively focused portfolio of 30 to 50 companies that enables us to provide adequate diversification while allowing the composition and performance of the portfolio to behave differently than the market. We select securities for the portfolio based on an analysis of a company's financial characteristics and an assessment of the quality of a company's management. In selecting a company, we consider criteria such as return on equity, balance sheet strength, industry leadership position and cash flow projections. We further narrow the universe of acceptable investments by undertaking intensive research including interviews with a company's top management, customers and suppliers. We believe our assessment of business quality and emphasis on valuation will protect the portfolio's assets in down markets, while our insistence on strength in leadership, financial condition and cash flow position will produce competitive results in all but the most speculative markets. We regularly review the investments of the portfolio and may sell a portfolio holding when it has achieved its valuation target, there is deterioration in the underlying fundamentals of the business, or we have identified a more attractive investment opportunity. | |||||||||||||||||||||||||||||||||

|

Principal Investment Risks | |||||||||||||||||||||||||||||||||

|

An investment in the Fund is not a deposit of Wells Fargo Bank, N.A. or its affiliates and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other governmental agency. Focused Portfolio Risk. Since the Fund tends to invest in a smaller number of stocks than do many other similar mutual funds, changes in the value of individual stocks held by the Fund may have a larger impact on the Fund's net asset value than if the Fund were more broadly invested. Issuer Risk. The value of a security may decline because of adverse events or circumstances that directly relate to conditions at the issuer or any entity providing it credit or liquidity support. Larger Company Securities Risk. Securities of companies with larger market capitalizations may underperform securities of companies with smaller and mid-sized market capitalizations in certain economic environments. Liquidity Risk. A security may not be able to be sold at the time desired or without adversely affecting the price. Management Risk. There is no guarantee of the Fund's performance or that the Fund will meet its objective. The market value of your investment may decline and you may suffer investment loss. Market Risk. The market price of securities owned by the Fund may rapidly or unpredictably decline due to factors affecting securities markets generally or particular industries. Regulatory Risk. Changes in government regulations may adversely affect the value of a security. An insufficiently regulated industry or market might also permit inappropriate practices that adversely affect an investment. Value Style Investment Risk. Value stocks may lose value and may be subject to prolonged depressed valuations. | |||||||||||||||||||||||||||||||||

|

Performance | |||||||||||||||||||||||||||||||||

|

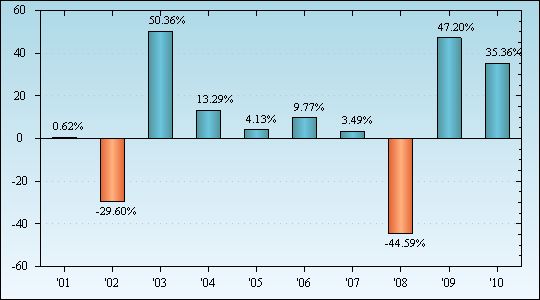

The following information provides some indication of the risks of investing in the Fund by showing changes in the Fund's performance from year to year. The Fund's average annual total returns are compared to the performance of an appropriate broad-based index(es). Past performance before and after taxes is no guarantee of future results. Current month-end performance is available on the Fund's Web site at wellsfargo.com/advantagefunds. | |||||||||||||||||||||||||||||||||

|

Calendar Year Total Returns as of 12/31 each year Administrator Class | |||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||

Highest Quarter: 2nd Quarter 2003 +20.94% Lowest Quarter: 4th Quarter 2008 -23.70% Year-to-date total return as of 6/30/2011 is +5.43% | |||||||||||||||||||||||||||||||||

Average Annual Total Returns for the periods ended 12/31/2010 | |||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||

|

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state, local or foreign taxes. Actual after-tax returns depend on an investor's tax situation and may differ from those shown, and after-tax returns shown are not relevant to tax-exempt investors or investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) Plans or Individual Retirement Accounts. | |||||||||||||||||||||||||||||||||

| (Wells Fargo Advantage Index Fund) | |||||||||||||||||||||||||||||||||

|

Investment Objective | |||||||||||||||||||||||||||||||||

|

The Fund seeks to replicate the total return of the S&P 500® Index, before fees and expenses. | |||||||||||||||||||||||||||||||||

|

Fees and Expenses | |||||||||||||||||||||||||||||||||

|

These tables are intended to help you understand the various costs and expenses you will pay if you buy and hold shares of the Fund. | |||||||||||||||||||||||||||||||||

| Shareholder Fees (fees paid directly from your investment) | |||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||

| Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | |||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||

|

Example of Expenses | |||||||||||||||||||||||||||||||||

|

The example below is intended to help you compare the costs of investing in the Fund with the costs of investing in other mutual funds. The example assumes a $10,000 initial investment, 5% annual total return, and that operating expenses remain the same as in the tables above. The example also assumes that the Total Annual Fund Operating Expenses After Fee Waiver shown above will only be in place for the length of the current waiver commitment. Although your actual costs may be higher or lower, based on these assumptions your costs would be: | |||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||

|

Portfolio Turnover | |||||||||||||||||||||||||||||||||

|

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or "turns over" its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund's performance. For the ten months ended May 31, 2011, the Fund's portfolio turnover rate was 3% of the average value of its portfolio. | |||||||||||||||||||||||||||||||||

|

Principal Investment Strategies | |||||||||||||||||||||||||||||||||

|

The Fund is a gateway fund that invests substantially all of its assets in the Index Portfolio, a master portfolio with a substantially identical investment objective and substantially similar investment strategies. Under normal circumstances, we invest at least 80% of the Fund's net assets in a diversified portfolio of equity securities designed to replicate the holdings and weightings of the stocks compirsing the S&P 500® Index. We invest in substantially all of the common stocks comprising the S&P 500® Index and attempt to achieve at least a 95% correlation between the performance of the S&P 500® Index and the Fund's investment results, before fees and expenses. This correlation is sought regardless of market conditions. If we are unable to achieve this correlation, then we will closely monitor the performance and composition of the S&P 500® Index and adjust the Fund's securities holdings as necessary to seek the correlation. A precise duplication of the performance of the S&P 500® Index would mean that the net asset value ("NAV") of Fund shares, including dividends and capital gains, would increase or decrease in exact proportion to changes in the S&P 500® Index. Such a 100% correlation is not feasible. Our ability to track the performance of the S&P 500® Index may be affected by, among other things, transaction costs and shareholder purchases and redemptions. We continuously monitor the performance and composition of the S&P 500® Index and adjust the Fund's portfolio as necessary to reflect any changes to the S&P 500® Index and to maintain a 95% or better performance correlation before fees and expenses. Furthermore, we may use futures to manage risk or to enhance return. | |||||||||||||||||||||||||||||||||

|

Principal Investment Risks | |||||||||||||||||||||||||||||||||

|

An investment in the Fund is not a deposit of Wells Fargo Bank, N.A. or its affiliates and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other governmental agency. Counter-Party Risk. A Fund may incur a loss if the other party to an investment contract, such as a derivative or a repurchase or reverse repurchase agreement, fails to fulfill its contractual obligation to the Fund. Derivatives Risk. The use of derivatives such as futures, options and swap agreements, can lead to losses, including those magnified by leverage, particularly when derivatives are used to enhance return rather than offset risk. Futures Risk. Because the futures utilized by a Fund are standardized and exchange-traded, where the exchange serves as the ultimate counterparty for all contracts, the primary credit risk on futures contracts is the creditworthiness of the exchange itself. Futures are also subject to market risk, interest rate risk (in the case of futures contracts relating to income producing securities) and index tracking risk (in the case of stock index futures). Index Tracking Risk. The ability to track an index may be affected by, among other things, transaction costs and shareholder purchases and redemptions. Issuer Risk. The value of a security may decline because of adverse events or circumstances that directly relate to conditions at the issuer or any entity providing it credit or liquidity support. Larger Company Securities Risk. Securities of companies with larger market capitalizations may underperform securities of companies with smaller and mid-sized market capitalizations in certain economic environments. Leverage Risk. Leverage created by borrowing or certain investments, such as derivatives and reverse repurchase agreements, can diminish the Fund's performance and increase the volatility of the Fund's net asset value. Liquidity Risk. A security may not be able to be sold at the time desired or without adversely affecting the price. Management Risk. There is no guarantee of the Fund's performance or that the Fund will meet its objective. The market value of your investment may decline and you may suffer investment loss. Market Risk. The market price of securities owned by the Fund may rapidly or unpredictably decline due to factors affecting securities markets generally or particular industries. Regulatory Risk. Changes in government regulations may adversely affect the value of a security. An insufficiently regulated industry or market might also permit inappropriate practices that adversely affect an investment. | |||||||||||||||||||||||||||||||||

|

Performance | |||||||||||||||||||||||||||||||||

|

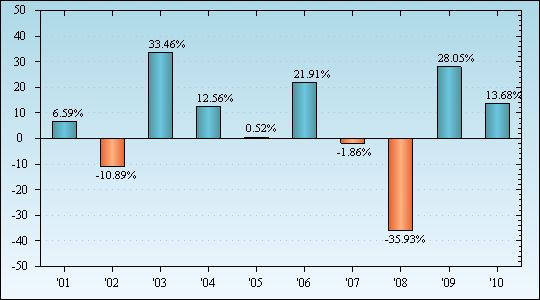

The following information provides some indication of the risks of investing in the Fund by showing changes in the Fund's performance from year to year. The Fund's average annual total returns are compared to the performance of an appropriate broad-based index(es). Past performance before and after taxes is no guarantee of future results. Current month-end performance is available on the Fund's Web site at wellsfargo.com/advantagefunds. | |||||||||||||||||||||||||||||||||

|

Calendar Year Total Returns as of 12/31 each year Administrator Class | |||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||

Highest Quarter: 2nd Quarter 2009 +15.89% Lowest Quarter: 4th Quarter 2008 -22.02% Year-to-date total return as of 6/30/2011 is +5.93% | |||||||||||||||||||||||||||||||||

|

Average Annual Total Returns for the periods ended 12/31/2010 | |||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||

|

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state, local or foreign taxes. Actual after-tax returns depend on an investor's tax situation and may differ from those shown, and after-tax returns shown are not relevant to tax-exempt investors or investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) Plans or Individual Retirement Accounts. | |||||||||||||||||||||||||||||||||

| (Wells Fargo Advantage Emerging Growth Fund) | |||||||||||||||||||||||||||||||||

|

Investment Objective | |||||||||||||||||||||||||||||||||

|

The Fund seeks long-term capital appreciation. | |||||||||||||||||||||||||||||||||

|

Fees and Expenses | |||||||||||||||||||||||||||||||||

|

These tables are intended to help you understand the various costs and expenses you will pay if you buy and hold shares of the Fund. | |||||||||||||||||||||||||||||||||

| Shareholder Fees (fees paid directly from your investment) | |||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||

| Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | [1] | ||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||

|

Example of Expenses | |||||||||||||||||||||||||||||||||

|

The example below is intended to help you compare the costs of investing in the Fund with the costs of investing in other mutual funds. The example assumes a $10,000 initial investment, 5% annual total return, and that operating expenses remain the same as in the tables above. The example also assumes that the Total Annual Fund Operating Expenses After Fee Waiver shown above will only be in place for the length of the current waiver commitment. Although your actual costs may be higher or lower, based on these assumptions your costs would be: | |||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||

|

Portfolio Turnover | |||||||||||||||||||||||||||||||||

|

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or "turns over" its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund's performance. For the eight months ended May 31, 2011, the Fund's portfolio turnover rate was 59% of the average value of its portfolio. | |||||||||||||||||||||||||||||||||

|

Principal Investment Strategies | |||||||||||||||||||||||||||||||||

|

The Fund is a gateway fund that invests substantially all of its assets in the Emerging Growth Portfolio, a master portfolio with a substantially identical investment objective and substantially similar investment strategies. We may invest in additional master portfolios, in other Wells Fargo Advantage Funds, or directly in a portfolio of securities. Under normal circumstances, we invest at least 80% of the Fund's total assets in equity securities of small-capitalization companies and up to 25% of the Fund's total assets in equity securities of foreign issuers through ADRs and similar investments. We invest principally in equity securities of small-capitalization companies that we believe have prospects for robust and sustainable growth of revenues and earnings. We define small-capitalization companies as those with market capitalizations of $3 billion or less. Small-capitalization companies may include both domestic and foreign small-capitalization companies. We may also invest in equity securities of foreign issuers through ADRs and similar investments. We seek small-capitalization companies that are in their emerging phase of their life cycle. We believe earnings and revenue growth relative to expectations are critical factors in determining stock price movements. Thus, our investment process is centered around finding emerging growth companies with under-appreciated prospects for robust and sustainable growth in earnings and revenue. To find that growth, we use bottom-up research, emphasizing companies whose management teams have a history of successfully executing their strategy and whose business model has sufficient profit potential. We forecast revenue and earnings revision opportunities, along with other key financial metrics to assess investment potential. We then combine that company-specific analysis with our assessment of secular and timeliness trends to form a buy/sell decision about a particular stock. We may invest in any sector and at times we may emphasize one or more particular sectors. We sell a company's securities when we see deterioration in fundamentals that leads us to become suspicious of a company's prospective growth profile or the profitability potential of its business model, as this often leads to lower valuation potential. We may also sell or trim a position when we need to raise money to fund the purchase of a better idea or when valuation is extended beyond our bullish expectations. | |||||||||||||||||||||||||||||||||

|

Principal Investment Risks | |||||||||||||||||||||||||||||||||

|

An investment in the Fund is not a deposit of Wells Fargo Bank, N.A. or its affiliates and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other governmental agency. Foreign Investment Risk. Foreign investments face the potential of heightened illiquidity, greater price volatility and adverse effects of political, regulatory, tax, currency, economic or other macroeconomic developments. Growth Style Investment Risk. Growth stocks may be more expensive relative to the values of other stocks and carry potential for significant volatility and loss. Issuer Risk. The value of a security may decline because of adverse events or circumstances that directly relate to conditions at the issuer or any entity providing it credit or liquidity support. Liquidity Risk. A security may not be able to be sold at the time desired or without adversely affecting the price. Management Risk. There is no guarantee of the Fund's performance or that the Fund will meet its objective. The market value of your investment may decline and you may suffer investment loss. Market Risk. The market price of securities owned by the Fund may rapidly or unpredictably decline due to factors affecting securities markets generally or particular industries. Regulatory Risk. Changes in government regulations may adversely affect the value of a security. An insufficiently regulated industry or market might also permit inappropriate practices that adversely affect an investment. Smaller Company Securities Risk. Securities of companies with smaller market capitalizations tend to be more volatile and less liquid than larger company stocks. | |||||||||||||||||||||||||||||||||

|

Performance | |||||||||||||||||||||||||||||||||

|

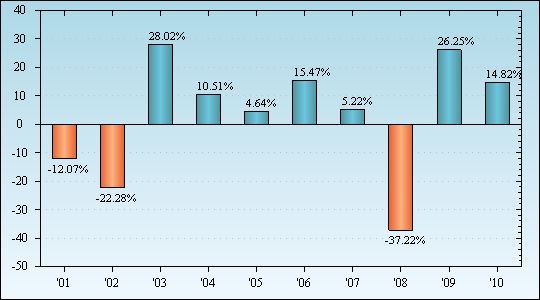

The following information provides some indication of the risks of investing in the Fund by showing changes in the Fund's performance from year to year. The Fund's average annual total returns are compared to the performance of an appropriate broad-based index(es). Past performance before and after taxes is no guarantee of future results. Current month-end performance is available on the Fund's Web site at wellsfargo.com/advantagefunds. | |||||||||||||||||||||||||||||||||

|

Calendar Year Total Returns as of 12/31 each year Administrator Class | |||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||

Highest Quarter: 4th Quarter 2010 +19.56% Lowest Quarter: 4th Quarter 2008 -23.56% Year-to-date total return as of 6/30/2011 is +15.66% | |||||||||||||||||||||||||||||||||

Average Annual Total Returns for the periods ended 12/31/2010 | |||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||

|

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state, local or foreign taxes. Actual after-tax returns depend on an investor's tax situation and may differ from those shown, and after-tax returns shown are not relevant to tax-exempt investors or investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) Plans or Individual Retirement Accounts. | |||||||||||||||||||||||||||||||||

| (Wells Fargo Advantage Equity Value Fund) | |||||||||||||||||||||||||||||||||

|

Investment Objective | |||||||||||||||||||||||||||||||||

|

The Fund seeks long-term capital appreciation. | |||||||||||||||||||||||||||||||||

|

Fees and Expenses | |||||||||||||||||||||||||||||||||

|

These tables are intended to help you understand the various costs and expenses you will pay if you buy and hold shares of the Fund. | |||||||||||||||||||||||||||||||||

| Shareholder Fees (fees paid directly from your investment) | |||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||

| Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | [1] | ||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||

|

Example of Expenses | |||||||||||||||||||||||||||||||||

|

The example below is intended to help you compare the costs of investing in the Fund with the costs of investing in other mutual funds. The example assumes a $10,000 initial investment, 5% annual total return, and that operating expenses remain the same as in the tables above. The example also assumes that the Total Annual Fund Operating Expenses After Fee Waiver shown above will only be in place for the length of the current waiver commitment. Although your actual costs may be higher or lower, based on these assumptions your costs would be: | |||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||

|

Portfolio Turnover | |||||||||||||||||||||||||||||||||

|

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or "turns over" its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund's performance. For the eight months ended May 31, 2011, the Fund's portfolio turnover rate was 90% of the average value of its portfolio. | |||||||||||||||||||||||||||||||||

|

Principal Investment Strategies | |||||||||||||||||||||||||||||||||

|

The Fund is a gateway fund that invests substantially all of its assets in the Equity Value Portfolio, a master portfolio with a substantially identical investment objective and substantially similar investment strategies. We may invest in additional master portfolios, in other Wells Fargo Advantage Funds, or directly in a portfolio of securities. Under normal circumstances, we invest at least 80% of the Fund's net assets in equity securities of large-capitalization companies. We invest principally in equity securities of large-capitalization companies, which we define as companies with market capitalizations within the range of the Russell 1000® Index. The market capitalization range of the Russell 1000® Index was $526 million to $384 billion, as of June 27, 2011, and is expected to change frequently. In making investment decisions for the Fund, we apply a fundamentals-driven, company-specific analysis. As part of the analysis, we evaluate criteria such as price to earnings, price to book, and price to sales ratios, and cash flow. We also evaluatethe companies' sales and expense trends, changes in earnings estimates and market position, as well as the industry outlook. We look for catalysts that could positively, or negatively, affect prices of current and potential companies for the Fund. Additionally, we seek confirmation of earnings potential before investing in a security. We also apply a rigorous screening process to manage the portfolio's overall risk profile. We generally consider selling a stock when it has achieved its fair value, when the issuer's business fundamentals have deteriorated, or if the potential for positive change is no longer evident. | |||||||||||||||||||||||||||||||||

|

Principal Investment Risks | |||||||||||||||||||||||||||||||||

|

An investment in the Fund is not a deposit of Wells Fargo Bank, N.A. or its affiliates and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other governmental agency. Issuer Risk. The value of a security may decline because of adverse events or circumstances that directly relate to conditions at the issuer or any entity providing it credit or liquidity support. Larger Company Securities Risk. Securities of companies with larger market capitalizations may underperform securities of companies with smaller and mid-sized market capitalizations in certain economic environments. Liquidity Risk. A security may not be able to be sold at the time desired or without adversely affecting the price. Management Risk. There is no guarantee of the Fund's performance or that the Fund will meet its objective. The market value of your investment may decline and you may suffer investment loss. Market Risk. The market price of securities owned by the Fund may rapidly or unpredictably decline due to factors affecting securities markets generally or particular industries. Regulatory Risk. Changes in government regulations may adversely affect the value of a security. An insufficiently regulated industry or market might also permit inappropriate practices that adversely affect an investment. Value Style Investment Risk. Value stocks may lose value and may be subject to prolonged depressed valuations. | |||||||||||||||||||||||||||||||||

|

Performance | |||||||||||||||||||||||||||||||||

|

The following information provides some indication of the risks of investing in the Fund by showing changes in the Fund's performance from year to year. The Fund's average annual total returns are compared to the performance of an appropriate broad-based index(es). Past performance before and after taxes is no guarantee of future results. Current month-end performance is available on the Fund's Web site at wellsfargo.com/advantagefunds. | |||||||||||||||||||||||||||||||||

|

Calendar Year Total Returns as of 12/31 each year Administrator Class | |||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||

Highest Quarter: 3rd Quarter 2009 +19.43% Lowest Quarter: 4th Quarter 2008 -22.00% Year-to-date total return as of 6/30/2011 is +6.04% | |||||||||||||||||||||||||||||||||

Average Annual Total Returns for the periods ended 12/31/2010 | |||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||

|

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state, local or foreign taxes. Actual after-tax returns depend on an investor's tax situation and may differ from those shown, and after-tax returns shown are not relevant to tax-exempt investors or investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) Plans or Individual Retirement Accounts. | |||||||||||||||||||||||||||||||||

| (Wells Fargo Advantage Diversified Equity Fund) | |||||||||||||||||||||||||||||||||

|

Investment Objective | |||||||||||||||||||||||||||||||||

|

The Fund seeks long-term capital appreciation. | |||||||||||||||||||||||||||||||||

|

Fees and Expenses | |||||||||||||||||||||||||||||||||

|

These tables are intended to help you understand the various costs and expenses you will pay if you buy and hold shares of the Fund. | |||||||||||||||||||||||||||||||||

| Shareholder Fees (fees paid directly from your investment) | |||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||

| Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | |||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||

|

Example of Expenses | |||||||||||||||||||||||||||||||||

|

The example below is intended to help you compare the costs of investing in the Fund with the costs of investing in other mutual funds. The example assumes a $10,000 initial investment, 5% annual total return, and that operating expenses remain the same as in the tables above. The example also assumes that the Total Annual Fund Operating Expenses After Fee Waiver shown above will only be in place for the length of the current waiver commitment. Although your actual costs may be higher or lower, based on these assumptions your costs would be: | |||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||

|

Portfolio Turnover | |||||||||||||||||||||||||||||||||

|

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or "turns over" its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund's performance. For the eight months ended May 31, 2011, the Fund's portfolio turnover rate was 48% of the average value of its portfolio. | |||||||||||||||||||||||||||||||||

|

Principal Investment Strategies | |||||||||||||||||||||||||||||||||

|

The Fund is a gateway fund that uses a "multi-style" equity investment approach designed to reduce the price and return volatility of the Fund and to provide more consistent returns. "Style" means either an approach to selecting investments, or a type of investment that is selected for a portfolio. Currently, the Fund's portfolio combines the different equity investment styles of several master portfolios. The investment styles of the master portfolios in which we currently invest include the large cap growth style, the large cap blend style (an index tracking style), the large cap value style, the small cap style and the international style. We may invest in additional or fewer master portfolios, in other Wells Fargo Advantage Funds, or directly in a portfolio of securities. See "Portfolio Allocation and Management" on page 45 of the Prospectus for the percentage breakdown of the Fund's assets allocated across different master portfolios. Under normal circumstances, we invest at least 80% of the Fund's net assets in equity securities. We consider the Fund's absolute level of risk, as well as its risk relative to its benchmark in determining the allocation between the different investment styles. We may make changes to the current allocations at any time in response to market and other conditions. The percentage of Fund assets that we invest in each master portfolio may temporarily deviate from the current allocations due to changes in market value. We may use cash flows or effect transactions to re-establish the allocations. In addition, certain of the master portfolios in which the Fund may invest may employ a variety of derivative instruments such as futures and options. To the extent that one or more master portfolios is invested in such derivatives, the Fund will be exposed to the risks associated with such investments. | |||||||||||||||||||||||||||||||||

|

Principal Investment Risks | |||||||||||||||||||||||||||||||||

|

An investment in the Fund is not a deposit of Wells Fargo Bank, N.A. or its affiliates and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other governmental agency. Counter-Party Risk. A Fund may incur a loss if the other party to an investment contract, such as a derivative or a repurchase or reverse repurchase agreement, fails to fulfill its contractual obligation to the Fund. Derivatives Risk. The use of derivatives such as futures, options and swap agreements, can lead to losses, including those magnified by leverage, particularly when derivatives are used to enhance return rather than offset risk. Emerging Markets Risk. Foreign investment risks are typically greater for securities in emerging markets, which can be more vulnerable to recessions, currency volatility, inflation and market failure. Foreign Investment Risk. Foreign investments face the potential of heightened illiquidity, greater price volatility and adverse effects of political, regulatory, tax, currency, economic or other macroeconomic developments. Futures Risk. Because the futures utilized by a Fund are standardized and exchange-traded, where the exchange serves as the ultimate counterparty for all contracts, the primary credit risk on futures contracts is the creditworthiness of the exchange itself. Futures are also subject to market risk, interest rate risk (in the case of futures contracts relating to income producing securities) and index tracking risk (in the case of stock index futures). Growth Style Investment Risk. Growth stocks may be more expensive relative to the values of other stocks and carry potential for significant volatility and loss. Index Tracking Risk. The ability to track an index may be affected by, among other things, transaction costs and shareholder purchases and redemptions. Issuer Risk. The value of a security may decline because of adverse events or circumstances that directly relate to conditions at the issuer or any entity providing it credit or liquidity support. Larger Company Securities Risk. Securities of companies with larger market capitalizations may underperform securities of companies with smaller and mid-sized market capitalizations in certain economic environments. Leverage Risk. Leverage created by borrowing or certain investments, such as derivatives and reverse repurchase agreements, can diminish the Fund's performance and increase the volatility of the Fund's net asset value. Liquidity Risk. A security may not be able to be sold at the time desired or without adversely affecting the price. Management Risk. There is no guarantee of the Fund's performance or that the Fund will meet its objective. The market value of your investment may decline and you may suffer investment loss. Market Risk. The market price of securities owned by the Fund may rapidly or unpredictably decline due to factors affecting securities markets generally or particular industries. Multi-Style Management Risk. The management of the Fund's portfolio using different investment styles can result in higher transaction costs and lower tax efficiency than other funds which adhere to a single investment style. Options Risk. An investment in options may be subject to greater fluctuation than an investment in the underlying instruments themselves. A Fund that purchases options is subject to the risk of a complete loss of premiums, while a Fund that writes options could be in a worse position than it would have been had it not written the option. There can be no assurance that a liquid market will exist when a Fund seeks to close out an option position. Regulatory Risk. Changes in government regulations may adversely affect the value of a security. An insufficiently regulated industry or market might also permit inappropriate practices that adversely affect an investment. Smaller Company Securities Risk. Securities of companies with smaller market capitalizations tend to be more volatile and less liquid than larger company stocks. Value Style Investment Risk. Value stocks may lose value and may be subject to prolonged depressed valuations. | |||||||||||||||||||||||||||||||||

|

Performance | |||||||||||||||||||||||||||||||||

|

The following information provides some indication of the risks of investing in the Fund by showing changes in the Fund's performance from year to year. The Fund's average annual total returns are compared to the performance of an appropriate broad-based index(es). Past performance before and after taxes is no guarantee of future results. Current month-end performance is available on the Fund's Web site at wellsfargo.com/advantagefunds. | |||||||||||||||||||||||||||||||||

|

Calendar Year Total Returns as of 12/31 each year Administrator Class | |||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||

Highest Quarter: 2nd Quarter 2009 +16.70% Lowest Quarter: 4th Quarter 2008 -22.56% Year-to-date total return as of 6/30/2011 is +6.45% | |||||||||||||||||||||||||||||||||

Average Annual Total Returns for the periods ended 12/31/2010 | |||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||

|

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state, local or foreign taxes. Actual after-tax returns depend on an investor's tax situation and may differ from those shown, and after-tax returns shown are not relevant to tax-exempt investors or investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) Plans or Individual Retirement Accounts. | |||||||||||||||||||||||||||||||||

| (Wells Fargo Advantage Small Company Value Fund) | |||||||||||||||||||||||||||||||||

|

Investment Objective | |||||||||||||||||||||||||||||||||

|

The Fund seeks long-term capital appreciation. | |||||||||||||||||||||||||||||||||

|

Fees and Expenses | |||||||||||||||||||||||||||||||||

|

These tables are intended to help you understand the various costs and expenses you will pay if you buy and hold shares of the Fund. | |||||||||||||||||||||||||||||||||

| Shareholder Fees (fees paid directly from your investment) | |||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||

| Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | |||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||

|

Example of Expenses | |||||||||||||||||||||||||||||||||

|

The example below is intended to help you compare the costs of investing in the Fund with the costs of investing in other mutual funds. The example assumes a $10,000 initial investment, 5% annual total return, and that operating expenses remain the same as in the tables above. The example also assumes that the Total Annual Fund Operating Expenses After Fee Waiver shown above will only be in place for the length of the current waiver commitment. Although your actual costs may be higher or lower, based on these assumptions your costs would be: | |||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||

|

Portfolio Turnover | |||||||||||||||||||||||||||||||||

|

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or "turns over" its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund's performance. For the eight months ended May 31, 2011, the Fund's portfolio turnover rate was 47% of the average value of its portfolio. | |||||||||||||||||||||||||||||||||

|

Principal Investment Strategies | |||||||||||||||||||||||||||||||||

|

The Fund is a gateway fund that invests substantially all of its assets in the Small Company Value Portfolio, a master portfolio with a substantially identical investment objective and substantially similar investment strategies. We may invest in additional master portfolios, in other Wells Fargo Advantage Funds, or directly in a portfolio of securities. Under normal circumstances, we invest at least 80% of the Fund's net assets in equity securities of small-capitalization companies. We invest principally in equity securities of small-capitalization companies, which we define as companies with market capitalizations within the range of the Russell 2000® Index. The market capitalization range of the Russell 2000® Index was $22 million to $3.1 billion, as of June 27, 2011 and is expected to change frequently. We seek to identify the least expensive small cap stocks across different sectors. To narrow the universe of possible candidates, we use a proprietary, quantitative screening process to emphasize companies exhibiting traditional value characteristics and to rank stocks within each sector based on these criteria. This valuation analysis allows us to focus our fundamental research efforts on the stocks that we believe are the most undervalued relative to their respective small cap peer group. We analyze each company's fundamental operating characteristics (such as price to earnings ratios, cash flows, company operations, including company prospects and profitability) to identify those companies that are the most promising within their peer group based on factors that have historically determined subsequent outperformance for a given sector. Fundamental research is primarily conducted through financial statement analysis and meetings with company management, however, third-party research is also used for due diligence purposes. We may sell a stock when it becomes fairly valued or when signs of fundamental deterioration appear. | |||||||||||||||||||||||||||||||||

|

Principal Investment Risks | |||||||||||||||||||||||||||||||||

|

An investment in the Fund is not a deposit of Wells Fargo Bank, N.A. or its affiliates and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other governmental agency. Issuer Risk. The value of a security may decline because of adverse events or circumstances that directly relate to conditions at the issuer or any entity providing it credit or liquidity support. Liquidity Risk. A security may not be able to be sold at the time desired or without adversely affecting the price. Management Risk. There is no guarantee of the Fund's performance or that the Fund will meet its objective. The market value of your investment may decline and you may suffer investment loss. Market Risk. The market price of securities owned by the Fund may rapidly or unpredictably decline due to factors affecting securities markets generally or particular industries. Regulatory Risk. Changes in government regulations may adversely affect the value of a security. An insufficiently regulated industry or market might also permit inappropriate practices that adversely affect an investment. Smaller Company Securities Risk. Securities of companies with smaller market capitalizations tend to be more volatile and less liquid than larger company stocks. Value Style Investment Risk. Value stocks may lose value and may be subject to prolonged depressed valuations. | |||||||||||||||||||||||||||||||||

|

Performance | |||||||||||||||||||||||||||||||||

|

The following information provides some indication of the risks of investing in the Fund by showing changes in the Fund's performance from year to year. The Fund's average annual total returns are compared to the performance of an appropriate broad-based index(es). Past performance before and after taxes is no guarantee of future results. Current month-end performance is available on the Fund's Web site at wellsfargo.com/advantagefunds. | |||||||||||||||||||||||||||||||||

|

Calendar Year Total Returns as of 12/31 each year Administrator Class | |||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||

Highest Quarter: 2nd Quarter 2009 +34.35% Lowest Quarter: 4th Quarter 2008 -31.67% Year-to-date total return as of 6/30/2011 is +6.90% | |||||||||||||||||||||||||||||||||

Average Annual Total Returns for the periods ended 12/31/2010 | |||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||

|

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state, local or foreign taxes. Actual after-tax returns depend on an investor's tax situation and may differ from those shown, and after-tax returns shown are not relevant to tax-exempt investors or investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) Plans or Individual Retirement Accounts. | |||||||||||||||||||||||||||||||||

| (Wells Fargo Advantage Small Company Growth Fund) | |||||||||||||||||||||||||||||||||

|

Investment Objective | |||||||||||||||||||||||||||||||||

|

The Fund seeks long-term capital appreciation. | |||||||||||||||||||||||||||||||||

|

Fees and Expenses | |||||||||||||||||||||||||||||||||

|

These tables are intended to help you understand the various costs and expenses you will pay if you buy and hold shares of the Fund. | |||||||||||||||||||||||||||||||||

| Shareholder Fees (fees paid directly from your investment) | |||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||

| Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | |||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||

|

Example of Expenses | |||||||||||||||||||||||||||||||||

|

The example below is intended to help you compare the costs of investing in the Fund with the costs of investing in other mutual funds. The example assumes a $10,000 initial investment, 5% annual total return, and that operating expenses remain the same as in the tables above. The example also assumes that the Total Annual Fund Operating Expenses After Fee Waiver shown above will only be in place for the length of the current waiver commitment. Although your actual costs may be higher or lower, based on these assumptions your costs would be: | |||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||

|

Portfolio Turnover | |||||||||||||||||||||||||||||||||

|

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or "turns over" its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund's performance. For the eight months ended May 31, 2011, the Fund's portfolio turnover rate was 70% of the average value of its portfolio. | |||||||||||||||||||||||||||||||||

|

Principal Investment Strategies | |||||||||||||||||||||||||||||||||

|

The Fund is a gateway fund that invests substantially all of its assets in the Small Company Growth Portfolio, a master portfolio with a substantially identical investment objective and substantially similar investment strategies. We may invest in additional master portfolios, in other Wells Fargo Advantage Funds, or directly in a portfolio of securities. Under normal circumstances, we invest at least 80% of the Fund's net assets in equity securities of small-capitalization companies. We invest principally in equity securities of small-capitalization companies, which we define as companies with market capitalizations of $3 billion or less. We may also invest in equity securities of foreign issuers through ADRs and similar investments. In selecting securities for the Fund, we conduct rigorous research to identify companies where the prospects for rapid earnings growth (Discovery phase) or significant change (Rediscovery phase) have yet to be well understood, and are therefore not reflected in the current stock price. This research includes meeting with the management of several hundred companies each year and conducting independent external research. Companies that fit into the Discovery phase are those with rapid long-term (3-5 year) earnings growth prospects. Companies that fit into the Rediscovery phase, are those that have the prospect for sharply accelerating near-term earnings (next 12-18 months), or companies selling at a meaningful discount to their underlying asset value. We may decrease certain stock holdings when their positions rise relative to the overall portfolio. We may sell a stock in its entirety when it reaches our sell target price, which is set at the time of purchase. We may also sell stocks that experience adverse fundamental news, have significant short-term price declines, or in order to provide funds for new stock purchases. | |||||||||||||||||||||||||||||||||

|

Principal Investment Risks | |||||||||||||||||||||||||||||||||

|

An investment in the Fund is not a deposit of Wells Fargo Bank, N.A. or its affiliates and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other governmental agency. Foreign Investment Risk. Foreign investments face the potential of heightened illiquidity, greater price volatility and adverse effects of political, regulatory, tax, currency, economic or other macroeconomic developments. Growth Style Investment Risk. Growth stocks may be more expensive relative to the values of other stocks and carry potential for significant volatility and loss. Issuer Risk. The value of a security may decline because of adverse events or circumstances that directly relate to conditions at the issuer or any entity providing it credit or liquidity support. Liquidity Risk. A security may not be able to be sold at the time desired or without adversely affecting the price. Management Risk. There is no guarantee of the Fund's performance or that the Fund will meet its objective. The market value of your investment may decline and you may suffer investment loss. Market Risk. The market price of securities owned by the Fund may rapidly or unpredictably decline due to factors affecting securities markets generally or particular industries. Regulatory Risk. Changes in government regulations may adversely affect the value of a security. An insufficiently regulated industry or market might also permit inappropriate practices that adversely affect an investment. Smaller Company Securities Risk. Securities of companies with smaller market capitalizations tend to be more volatile and less liquid than larger company stocks. | |||||||||||||||||||||||||||||||||

|

Performance | |||||||||||||||||||||||||||||||||

|

The following information provides some indication of the risks of investing in the Fund by showing changes in the Fund's performance from year to year. The Fund's average annual total returns are compared to the performance of an appropriate broad-based index(es). Past performance before and after taxes is no guarantee of future results. Current month-end performance is available on the Fund's Web site at wellsfargo.com/advantagefunds. | |||||||||||||||||||||||||||||||||

|

Calendar Year Total Returns as of 12/31 each year Administrator Class | |||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||

Highest Quarter: 2nd Quarter 2009 +24.44% Lowest Quarter: 4th Quarter 2008 -28.32% Year-to-date total return as of 6/30/2011 is +12.19% | |||||||||||||||||||||||||||||||||

Average Annual Total Returns for the periods ended 12/31/2010 | |||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||

|

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state, local or foreign taxes. Actual after-tax returns depend on an investor's tax situation and may differ from those shown, and after-tax returns shown are not relevant to tax-exempt investors or investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) Plans or Individual Retirement Accounts. | |||||||||||||||||||||||||||||||||

| (Wells Fargo Advantage International Value Fund) | |||||||||||||||||||||||||||||||||

|

Investment Objective | |||||||||||||||||||||||||||||||||

|

The Fund seeks long-term capital appreciation. | |||||||||||||||||||||||||||||||||

|

Fees and Expenses | |||||||||||||||||||||||||||||||||

|

These tables are intended to help you understand the various costs and expenses you will pay if you buy and hold shares of the Fund. | |||||||||||||||||||||||||||||||||

|

Shareholder Fees (fees paid directly from your investment) | |||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||

|

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | |||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||

|

Example of Expenses | |||||||||||||||||||||||||||||||||

|

The example below is intended to help you compare the costs of investing in the Fund with the costs of investing in other mutual funds. The example assumes a $10,000 initial investment, 5% annual total return, and that operating expenses remain the same as in the tables above. The example also assumes that the Total Annual Fund Operating Expenses After Fee Waiver shown above will only be in place for the length of the current waiver commitment. Although your actual costs may be higher or lower, based on these assumptions your costs would be: | |||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||

|

Portfolio Turnover | |||||||||||||||||||||||||||||||||

|

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or "turns over" its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund's performance. For the eight months ended May 31, 2011, the Fund's portfolio turnover rate was 16% of the average value of its portfolio. | |||||||||||||||||||||||||||||||||

|

Principal Investment Strategies | |||||||||||||||||||||||||||||||||

|

The Fund is a gateway fund that invests substantially all of its assets in the International Value Portfolio, a master portfolio with a substantially identical investment objective and substantially similar investment strategies. We may invest in additional master portfolios, in other Wells Fargo Advantage Funds, or directly in a portfolio of securities. Under normal circumstances, we invest at least 80% of the Fund's net assets in equity securities of foreign issuers, and up to 20% of the Fund's total assets in emerging market equity securities. We invest principally in the equity securities of foreign issuers which we believe are undervalued in the marketplace at the time of purchase and show recent positive signals, such as an appreciation in prices and increase in earnings. We consider equity securities of foreign issuers (or foreign securities) to be equity securities: (1) issued by companies with their principal place of business or principal office, or both, as determined in our reasonable discretion, in a country other than the U.S.; or (2) issued by companies for which the principal securities trading market is a country other than the U.S. We invest in the securities of companies located in at least three countries, not including the U.S. The types of securities in which we normally invest include common stock, preferred stock, rights, warrants and American Depositary Receipts (ADRs). We may use futures or options to manage risk or to enhance return. Factors we consider in determining undervaluation include dividend yield, earnings relative to price, cash flow relative to price and book value relative to market value. We believe that these securities have the potential to produce future returns if their future growth exceeds the market's low expectations. We use a quantitative investment model to make investment decisions for the Fund. The investment model is designed to take advantage of judgmental biases that influence the decisions of many investors, such as the tendency to develop a "mindset" about a company or to wrongly equate a good company with a good investment irrespective of price. The investment model ranks securities based on fundamental measures of value (such as the dividend yield) and indicators of near-term recovery (such as recent price appreciation). This investment strategy seeks to manage overall portfolio risk while attempting to increase the expected return. A stock is typically sold if the model indicates a decline in its ranking or if a stock's relative portfolio weight has appreciated significantly (relative to the benchmark). | |||||||||||||||||||||||||||||||||

|

Principal Investment Risks | |||||||||||||||||||||||||||||||||

|

An investment in the Fund is not a deposit of Wells Fargo Bank, N.A. or its affiliates and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other governmental agency. Counter-Party Risk. A Fund may incur a loss if the other party to an investment contract, such as a derivative or a repurchase or reverse repurchase agreement, fails to fulfill its contractual obligation to the Fund. Derivatives Risk. The use of derivatives such as futures, options and swap agreements, can lead to losses, including those magnified by leverage, particularly when derivatives are used to enhance return rather than offset risk. Emerging Markets Risk. Foreign investment risks are typically greater for securities in emerging markets, which can be more vulnerable to recessions, currency volatility, inflation and market failure. Foreign Currency Transactions Risk. Foreign securities are often denominated in foreign currencies. As a result, the value of a Fund's shares is affected by changes in exchange rates. A Fund may enter into foreign currency futures contracts and foreign currency exchange contracts to manage this risk. Foreign Investment Risk. Foreign investments face the potential of heightened illiquidity, greater price volatility and adverse effects of political, regulatory, tax, currency, economic or other macroeconomic developments. Futures Risk. Because the futures utilized by a Fund are standardized and exchange-traded, where the exchange serves as the ultimate counterparty for all contracts, the primary credit risk on futures contracts is the creditworthiness of the exchange itself. Futures are also subject to market risk, interest rate risk (in the case of futures contracts relating to income producing securities) and index tracking risk (in the case of stock index futures). Issuer Risk. The value of a security may decline because of adverse events or circumstances that directly relate to conditions at the issuer or any entity providing it credit or liquidity support. Leverage Risk. Leverage created by borrowing or certain investments, such as derivatives and reverse repurchase agreements, can diminish the Fund's performance and increase the volatility of the Fund's net asset value. Liquidity Risk. A security may not be able to be sold at the time desired or without adversely affecting the price. Management Risk. There is no guarantee of the Fund's performance or that the Fund will meet its objective. The market value of your investment may decline and you may suffer investment loss. Market Risk. The market price of securities owned by the Fund may rapidly or unpredictably decline due to factors affecting securities markets generally or particular industries. Options Risk. An investment in options may be subject to greater fluctuation than an investment in the underlying instruments themselves. A Fund that purchases options is subject to the risk of a complete loss of premiums, while a Fund that writes options could be in a worse position than it would have been had it not written the option. There can be no assurance that a liquid market will exist when a Fund seeks to close out an option position. Regulatory Risk. Changes in government regulations may adversely affect the value of a security. An insufficiently regulated industry or market might also permit inappropriate practices that adversely affect an investment. Smaller Company Securities Risk. Securities of companies with smaller market capitalizations tend to be more volatile and less liquid than larger company stocks. Value Style Investment Risk. Value stocks may lose value and may be subject to prolonged depressed valuations. | |||||||||||||||||||||||||||||||||

|

Performance | |||||||||||||||||||||||||||||||||

|

The following information provides some indication of the risks of investing in the Fund by showing changes in the Fund's performance from year to year. The Fund's average annual total returns are compared to the performance of an appropriate broad-based index(es). Past performance before and after taxes is no guarantee of future results. Current month-end performance is available on the Fund's Web site at wellsfargo.com/advantagefunds. | |||||||||||||||||||||||||||||||||

|

Calendar Year Total Returns as of 12/31 each year Administrator Class | |||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||

Highest Quarter: 2nd Quarter 2009 +30.27% Lowest Quarter: 4th Quarter 2008 -19.84% Year-to-date total return as of 6/30/2011 is +5.51% | |||||||||||||||||||||||||||||||||

Average Annual Total Returns for the periods ended 12/31/2010 | |||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||

|

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state, local or foreign taxes. Actual after-tax returns depend on an investor's tax situation and may differ from those shown, and after-tax returns shown are not relevant to tax-exempt investors or investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) Plans or Individual Retirement Accounts. | |||||||||||||||||||||||||||||||||

| (Wells Fargo Advantage Diversified Small Cap Fund) | |||||||||||||||||||||||||||||||||

|

Investment Objective | |||||||||||||||||||||||||||||||||

|

The Fund seeks long-term capital appreciation. | |||||||||||||||||||||||||||||||||

|

Fees and Expenses | |||||||||||||||||||||||||||||||||

|

These tables are intended to help you understand the various costs and expenses you will pay if you buy and hold shares of the Fund. | |||||||||||||||||||||||||||||||||

| Shareholder Fees (fees paid directly from your investment) | |||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||

| Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | |||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||

|

Example of Expenses | |||||||||||||||||||||||||||||||||

|

The example below is intended to help you compare the costs of investing in the Fund with the costs of investing in other mutual funds. The example assumes a $10,000 initial investment, 5% annual total return, and that operating expenses remain the same as in the tables above. The example also assumes that the Total Annual Fund Operating Expenses After Fee Waiver shown above will only be in place for the length of the current waiver commitment. Although your actual costs may be higher or lower, based on these assumptions your costs would be: | |||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||

|

Portfolio Turnover | |||||||||||||||||||||||||||||||||

|

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or "turns over" its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund's performance. For the eight months ended May 31, 2011, the Fund's portfolio turnover rate was 58% of the average value of its portfolio. | |||||||||||||||||||||||||||||||||

|

Principal Investment Strategies | |||||||||||||||||||||||||||||||||

|

The Fund is a gateway fund that invests in a "multi-style" approach designed to minimize the volatility and risk of investing in equity securities of small-capitalization companies. "Style" means either an approach to selecting investments, or a type of investment that is selected for a portfolio. We use several different small-capitalization equity styles in order to reduce the risk of price and return volatility associated with reliance on a single investment style. Currently, the Fund's portfolio combines the small-capitalization equity styles of several master portfolios. Small capitalization companies are defined by the individual master portfolios in which the Fund invests. We may invest in additional or fewer master portfolios, in other Wells Fargo Advantage Funds, or directly in a portfolio of securities. See "Portfolio Allocation and Management" on page 47 of the Prospectus for the percentage breakdown of the Fund's assets allocated across different master portfolios. Under normal circumstances, we invest at least 80% of the Fund's net assets in equity securities of small-capitalization companies. We consider the Fund's absolute level of risk, as well as its risk relative to its benchmark in determining the allocation between the different investment styles. We may make changes to the current allocations at any time in response to market and other conditions. The percentage of Fund assets that we invest in each master portfolio may temporarily deviate from the current allocations due to changes in market value. We may use cash flows or effect transactions to re-establish the allocations. In addition, certain of the master portfolios in which the Fund may invest may employ a variety of derivative instruments such as options. To the extent that one or more master portfolios is invested in such derivatives, the Fund will be exposed to the risks associated with such investments. | |||||||||||||||||||||||||||||||||

|

Principal Investment Risks | |||||||||||||||||||||||||||||||||

|

An investment in the Fund is not a deposit of Wells Fargo Bank, N.A. or its affiliates and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other governmental agency. Counter-Party Risk. A Fund may incur a loss if the other party to an investment contract, such as a derivative or a repurchase or reverse repurchase agreement, fails to fulfill its contractual obligation to the Fund. Derivatives Risk. The use of derivatives such as futures, options and swap agreements, can lead to losses, including those magnified by leverage, particularly when derivatives are used to enhance return rather than offset risk. Foreign Investment Risk. Foreign investments face the potential of heightened illiquidity, greater price volatility and adverse effects of political, regulatory, tax, currency, economic or other macroeconomic developments. Growth Style Investment Risk. Growth stocks may be more expensive relative to the values of other stocks and carry potential for significant volatility and loss. Issuer Risk. The value of a security may decline because of adverse events or circumstances that directly relate to conditions at the issuer or any entity providing it credit or liquidity support. Leverage Risk. Leverage created by borrowing or certain investments, such as derivatives and reverse repurchase agreements, can diminish the Fund's performance and increase the volatility of the Fund's net asset value. Liquidity Risk. A security may not be able to be sold at the time desired or without adversely affecting the price. Management Risk. There is no guarantee of the Fund's performance or that the Fund will meet its objective. The market value of your investment may decline and you may suffer investment loss. Market Risk. The market price of securities owned by the Fund may rapidly or unpredictably decline due to factors affecting securities markets generally or particular industries. Options Risk. An investment in options may be subject to greater fluctuation than an investment in the underlying instruments themselves. A Fund that purchases options is subject to the risk of a complete loss of premiums, while a Fund that writes options could be in a worse position than it would have been had it not written the option. There can be no assurance that a liquid market will exist when a Fund seeks to close out an option position. Regulatory Risk. Changes in government regulations may adversely affect the value of a security. An insufficiently regulated industry or market might also permit inappropriate practices that adversely affect an investment. Smaller Company Securities Risk. Securities of companies with smaller market capitalizations tend to be more volatile and less liquid than larger company stocks. Value Style Investment Risk. Value stocks may lose value and may be subject to prolonged depressed valuations. | |||||||||||||||||||||||||||||||||

|

Performance | |||||||||||||||||||||||||||||||||

|

The following information provides some indication of the risks of investing in the Fund by showing changes in the Fund's performance from year to year. The Fund's average annual total returns are compared to the performance of an appropriate broad-based index(es). Past performance before and after taxes is no guarantee of future results. Current month-end performance is available on the Fund's Web site at wellsfargo.com/advantagefunds. | |||||||||||||||||||||||||||||||||

|

Calendar Year Total Returns as of 12/31 each year Administrator Class | |||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||

Highest Quarter: 2nd Quarter 2009 +22.79% Lowest Quarter: 4th Quarter 2008 -26.62% Year-to-date total return as of 6/30/2011 is +6.83% | |||||||||||||||||||||||||||||||||

Average Annual Total Returns for the periods ended 12/31/2010 | |||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||

|

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state, local or foreign taxes. Actual after-tax returns depend on an investor's tax situation and may differ from those shown, and after-tax returns shown are not relevant to tax-exempt investors or investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) Plans or Individual Retirement Accounts. | |||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||