| Label |

Element |

Value |

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Document Type |

dei_DocumentType |

485BPOS |

|

| Document Period End Date |

dei_DocumentPeriodEndDate |

Mar. 31,

2011 |

|

| Registrant Name |

dei_EntityRegistrantName |

Wells Fargo Funds Trust |

|

| Central Index Key |

dei_EntityCentralIndexKey |

0001081400 |

|

| Amendment Flag |

dei_AmendmentFlag |

false |

|

| Document Creation Date |

dei_DocumentCreationDate |

Jul. 26,

2011 |

|

| Document Effective Date |

dei_DocumentEffectiveDate |

Aug.

01,

2011 |

|

| Prospectus Date |

rr_ProspectusDate |

Aug.

01,

2011 |

|

|

(WFA Specialty Funds - Retail) | (Wells Fargo Advantage Specialized Technology Fund)

|

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Objective [Heading] |

rr_ObjectiveHeading |

Investment Objective

|

|

| Objective, Primary [Text Block] |

rr_ObjectivePrimaryTextBlock |

The Fund seeks long-term capital appreciation.

|

|

| Expense [Heading] |

rr_ExpenseHeading |

Fees and Expenses

|

|

| Expense Narrative [Text Block] |

rr_ExpenseNarrativeTextBlock |

These tables are intended to help you understand the various costs and expenses you will pay if you buy and hold shares of the Fund. You may qualify for sales charge discounts if you and your family invest, or agree to invest in the future, at least $50,000 in the aggregate in specified classes of certain Wells Fargo Advantage Funds

®. More information about these and other discounts is available from your financial professional and in "A Choice of Share Classes" and "Reductions and Waivers of Sales Charges" on pages 36 and 38 of the Prospectus and "Additional Purchase and Redemption Information" on page 43 of the Statement of Additional Information.

|

|

| Shareholder Fees Caption [Text] |

rr_ShareholderFeesCaption |

Shareholder Fees (fees paid directly from your investment)

|

|

| Operating Expenses Caption [Text] |

rr_OperatingExpensesCaption |

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment)

|

|

| Portfolio Turnover [Heading] |

rr_PortfolioTurnoverHeading |

Portfolio Turnover

|

|

| Portfolio Turnover [Text Block] |

rr_PortfolioTurnoverTextBlock |

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or "turns over" its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund's performance. For the period from November 1, 2010 to March 31, 2011, the Fund's portfolio turnover rate was 43% of the average value of its portfolio.

|

|

| Portfolio Turnover, Rate |

rr_PortfolioTurnoverRate |

43.00% |

|

| Expense Breakpoint Discounts [Text] |

rr_ExpenseBreakpointDiscounts |

You may qualify for sales charge discounts if you and your family invest, or agree to invest in the future, at least $50,000 in the aggregate in specified classes of certain Wells Fargo Advantage Funds®. More information about these and other discounts is available from your financial professional and in "A Choice of Share Classes" and "Reductions and Waivers of Sales Charges" on pages 36 and 38 of the Prospectus and "Additional Purchase and Redemption Information" on page 43 of the Statement of Additional Information. |

|

| Expense Breakpoint, Minimum Investment Required [Amount] |

rr_ExpenseBreakpointMinimumInvestmentRequiredAmount |

50,000 |

|

| Expense Example [Heading] |

rr_ExpenseExampleHeading |

Example of Expenses

|

|

| Expense Example Narrative [Text Block] |

rr_ExpenseExampleNarrativeTextBlock |

The example below is intended to help you compare the costs of investing in the Fund with the costs of investing in other mutual funds. The example assumes a $10,000 initial investment, 5% annual total return, and that operating expenses remain the same as in the tables above. The example also assumes that the Total Annual Fund Operating Expenses After Fee Waiver shown above will only be in place for the length of the current waiver commitment. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

|

|

| Expense Example by, Year, Caption [Text] |

rr_ExpenseExampleByYearCaption |

Assuming Redemption at End of Period

|

|

| Expense Example, No Redemption, By Year, Caption [Text] |

rr_ExpenseExampleNoRedemptionByYearCaption |

Assuming No Redemption

|

|

| Strategy [Heading] |

rr_StrategyHeading |

Principal Investment Strategies

|

|

| Strategy Narrative [Text Block] |

rr_StrategyNarrativeTextBlock |

Under normal circumstances, we invest at least 80% of the Fund's net assets in equity securities of technology companies; up to 50% of the Fund's total assets in equity securities of foreign issuers, directly or through ADRs and similar investments; up to 25% of the Fund's total assets in any one foreign country, although investments in Japan may exceed this limitation; and primarily in issuers with average market capitalizations of $500 million or more, although we may invest up to 15% of the Fund's total assets in equity securities of issuers with market capitalizations below $100 million at the time of purchase.

We invest principally in equity securities of global technology companies including common stocks and preferred stocks, warrants, convertible debt securities, ADRs (and similar investments), shares of other mutual funds, and shares of foreign companies traded and settled on U.S. exchanges and over-the-counter markets.

We define technology companies as those with revenues primarily generated by technology products and services, such as computer, software, communications equipment and services, semi-conductor, health care, biotechnology, defense and aerospace, energy equipment and services, nanotechnology, electric manufacturing services and others. We concentrate the Fund's investments in the technology sector, and because we retain the flexibility to invest in a relatively small number of stocks, the Fund is also considered to be non-diversified.

We evaluate the fundamental value and prospects for growth of individual companies and focus on technology companies that we expect will have higher than average rates of growth and strong potential for capital appreciation. We develop forecasts of economic growth, inflation, and interest rates that we use to identify regions and individual countries that are likely to offer the best investment opportunities. We may reduce or eliminate exposure to a stock when we identify a more attractive investment opportunity and/or when a company's fundamentals change.

|

|

| Risk [Heading] |

rr_RiskHeading |

Principal Investment Risks

|

|

| Risk Narrative [Text Block] |

rr_RiskNarrativeTextBlock |

An investment in the Fund is not a deposit of Wells Fargo Bank, N.A. or its affiliates and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other governmental agency.

Convertible Securities Risk. Convertible securities generally offer lower interest or dividend yields than non-convertible securities of similar quality. The market value of convertible securities tends to decline as interest rates increase and may be affected by changes in the price of the underlying security. In the event of a liquidation of the issuing company, holders of convertible securities would generally be paid only after holders of any senior debt obligations.

Counter-Party Risk. A Fund may incur a loss if the other party to an investment contract, such as a derivative or a repurchase or reverse repurchase agreement, fails to fulfill its contractual obligation to the Fund.

Emerging Markets Risk. Foreign investment risks are typically greater for securities in emerging markets, which can be more vulnerable to recessions, currency volatility, inflation and market failure.

Foreign Investment Risk. Foreign investments face the potential of heightened illiquidity, greater price volatility and adverse effects of political, regulatory, tax, currency, economic or other macroeconomic developments.

Growth Style Investment Risk. Growth stocks may be more expensive relative to the values of other stocks and carry potential for significant volatility and loss.

Issuer Risk. The value of a security may decline because of adverse events or circumstances that directly relate to conditions at the issuer or any entity providing it credit or liquidity support.

Liquidity Risk. A security may not be able to be sold at the time desired or without adversely affecting the price.

Management Risk. There is no guarantee of the Fund's performance or that the Fund will meet its objective. The market value of your investment may decline and you may suffer investment loss.

Market Risk. The market price of securities owned by the Fund may rapidly or unpredictably decline due to factors affecting securities markets generally or particular industries.

Non-Diversification Risk. Because the percentage of a non-diversified fund's assets invested in the securities of a single issuer is not limited by the 1940 Act, greater investment in a single issuer makes a fund more susceptible to financial, economic or market events impacting such issuer.

Regulatory Risk. Changes in government regulations may adversely affect the value of a security. An insufficiently regulated industry or market might also permit inappropriate practices that adversely affect an investment.

Smaller Company Securities Risk. Securities of companies with smaller market capitalizations tend to be more volatile and less liquid than larger company stocks.

Technology Sector Risk. The Fund concentrates its investments in the technology sector and therefore may be more susceptible to financial, economic or market events impacting the technology sector. Specifically, such investments may experience greater volatility due to rapid product cycles and significant competitive pressures, and may become rapidly obsolete.

|

|

| Risk Lose Money [Text] |

rr_RiskLoseMoney |

There is no guarantee of the Fund's performance or that the Fund will meet its objective. |

|

| Risk Nondiversified Status [Text] |

rr_RiskNondiversifiedStatus |

Non-Diversification Risk. Because the percentage of a non-diversified fund's assets invested in the securities of a single issuer is not limited by the 1940 Act, greater investment in a single issuer makes a fund more susceptible to financial, economic or market events impacting such issuer. |

|

| Risk Not Insured Depository Institution [Text] |

rr_RiskNotInsuredDepositoryInstitution |

An investment in the Fund is not a deposit of Wells Fargo Bank, N.A. or its affiliates and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other governmental agency. |

|

| Bar Chart and Performance Table [Heading] |

rr_BarChartAndPerformanceTableHeading |

Performance

|

|

| Performance Narrative [Text Block] |

rr_PerformanceNarrativeTextBlock |

The following information provides some indication of the risks of investing in the Fund by showing changes in the Fund's performance from year to year. The Fund's average annual total returns are compared to the performance of an appropriate broad-based index(es). Past performance before and after taxes is no guarantee of future results. Current month-end performance is available on the Fund's Web site at wellsfargo.com/advantagefunds.

|

|

| Performance Availability Phone [Text] |

rr_PerformanceAvailabilityPhone |

1-800-222-8222 |

|

| Performance Availability Website Address [Text] |

rr_PerformanceAvailabilityWebSiteAddress |

Current month-end performance is available on the Fund's Web site at wellsfargo.com/advantagefunds. |

|

| Performance Past Does Not Indicate Future [Text] |

rr_PerformancePastDoesNotIndicateFuture |

Past performance before and after taxes is no guarantee of future results. |

|

| Bar Chart [Heading] |

rr_BarChartHeading |

Calendar Year Total Returns as of 12/31 each year (Returns do not reflect sales charges and would be lower if they did)

|

|

| Bar Chart Closing [Text Block] |

rr_BarChartClosingTextBlock |

Highest Quarter: 4th Quarter 2001 +39.40%

Lowest Quarter: 1st Quarter 2001 -32.80%

Year-to-date total return as of 6/30/2011 is +5.10%

|

|

| Performance Table Heading |

rr_PerformanceTableHeading |

Average Annual Total Returns for the periods ended 12/31/2010 (Returns reflect applicable sales charges)

|

|

| Performance Table Uses Highest Federal Rate |

rr_PerformanceTableUsesHighestFederalRate |

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state, local or foreign taxes. |

|

| Performance Table Not Relevant to Tax Deferred |

rr_PerformanceTableNotRelevantToTaxDeferred |

Actual after-tax returns depend on an investor's tax situation and may differ from those shown, and after-tax returns shown are not relevant to tax-exempt investors or investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) Plans or Individual Retirement Accounts. |

|

| Performance Table One Class of after Tax Shown [Text] |

rr_PerformanceTableOneClassOfAfterTaxShown |

After-tax returns are shown only for the Class A shares. After-tax returns for the Class B and Class C shares will vary. |

|

| Performance Table Closing [Text Block] |

rr_PerformanceTableClosingTextBlock |

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state, local or foreign taxes. Actual after-tax returns depend on an investor's tax situation and may differ from those shown, and after-tax returns shown are not relevant to tax-exempt investors or investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) Plans or Individual Retirement Accounts. After-tax returns are shown only for the Class A shares. After-tax returns for the Class B and Class C shares will vary.

|

|

|

(WFA Specialty Funds - Retail) | (Wells Fargo Advantage Specialized Technology Fund) | Class A

|

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Maximum sales charge (load) imposed on purchases (as a percentage of offering price) |

rr_MaximumSalesChargeImposedOnPurchasesOverOfferingPrice |

5.75% |

|

| Maximum deferred sales charge (load) (as a percentage of offering price) |

rr_MaximumDeferredSalesChargeOverOfferingPrice |

none

|

|

| Management Fees |

rr_ManagementFeesOverAssets |

1.05% |

|

| Distribution (12b-1) Fees |

rr_DistributionAndService12b1FeesOverAssets |

none

|

|

| Other Expenses |

rr_OtherExpensesOverAssets |

0.62% |

|

| Acquired Fund Fees and Expenses |

rr_AcquiredFundFeesAndExpensesOverAssets |

0.02% |

|

| Total Annual Fund Operating Expenses |

rr_ExpensesOverAssets |

1.69% |

|

| Fee Waivers |

rr_FeeWaiverOrReimbursementOverAssets |

none

|

|

| Total Annual Fund Operating Expenses After Expense Reimbursement |

rr_NetExpensesOverAssets |

1.69% |

[10] |

| Expense Example, with Redemption, 1 Year |

rr_ExpenseExampleYear01 |

737 |

|

| Expense Example, with Redemption, 3 Years |

rr_ExpenseExampleYear03 |

1,077 |

|

| Expense Example, with Redemption, 5 Years |

rr_ExpenseExampleYear05 |

1,440 |

|

| Expense Example, with Redemption, 10 Years |

rr_ExpenseExampleYear10 |

2,458 |

|

| Annual Return 2001 |

rr_AnnualReturn2001 |

(38.36%) |

|

| Annual Return 2002 |

rr_AnnualReturn2002 |

(41.33%) |

|

| Annual Return 2003 |

rr_AnnualReturn2003 |

72.47% |

|

| Annual Return 2004 |

rr_AnnualReturn2004 |

18.08% |

|

| Annual Return 2005 |

rr_AnnualReturn2005 |

8.15% |

|

| Annual Return 2006 |

rr_AnnualReturn2006 |

6.25% |

|

| Annual Return 2007 |

rr_AnnualReturn2007 |

28.55% |

|

| Annual Return 2008 |

rr_AnnualReturn2008 |

(44.95%) |

|

| Annual Return 2009 |

rr_AnnualReturn2009 |

58.44% |

|

| Annual Return 2010 |

rr_AnnualReturn2010 |

27.16% |

|

| Year to Date Return, Label |

rr_YearToDateReturnLabel |

Year-to-date total return as of 6/30/2011 is +5.10%

|

|

| Bar Chart, Year to Date Return, Date |

rr_BarChartYearToDateReturnDate |

Jun. 30,

2011 |

|

| Bar Chart, Year to Date Return |

rr_BarChartYearToDateReturn |

5.10% |

|

| Highest Quarterly Return, Label |

rr_HighestQuarterlyReturnLabel |

Highest Quarter: 4th Quarter 2001

|

|

| Highest Quarterly Return |

rr_BarChartHighestQuarterlyReturn |

39.40% |

|

| Lowest Quarterly Return, Label |

rr_LowestQuarterlyReturnLabel |

Lowest Quarter: 1st Quarter 2001

|

|

| Lowest Quarterly Return |

rr_BarChartLowestQuarterlyReturn |

(32.80%) |

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

19.62% |

|

| 5 Year |

rr_AverageAnnualReturnYear05 |

7.36% |

|

| 10 Year |

rr_AverageAnnualReturnYear10 |

1.28% |

|

| Inception Date of Share Class |

rr_AverageAnnualReturnInceptionDate |

Sep. 18,

2000 |

|

|

(WFA Specialty Funds - Retail) | (Wells Fargo Advantage Specialized Technology Fund) | Class A | (after taxes on distributions)

|

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

19.62% |

|

| 5 Year |

rr_AverageAnnualReturnYear05 |

7.36% |

|

| 10 Year |

rr_AverageAnnualReturnYear10 |

1.28% |

|

| Inception Date of Share Class |

rr_AverageAnnualReturnInceptionDate |

Sep. 18,

2000 |

|

|

(WFA Specialty Funds - Retail) | (Wells Fargo Advantage Specialized Technology Fund) | Class A | (after taxes on distributions and the sale of Fund Shares)

|

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

12.75% |

|

| 5 Year |

rr_AverageAnnualReturnYear05 |

6.38% |

|

| 10 Year |

rr_AverageAnnualReturnYear10 |

1.09% |

|

| Inception Date of Share Class |

rr_AverageAnnualReturnInceptionDate |

Sep. 18,

2000 |

|

|

(WFA Specialty Funds - Retail) | (Wells Fargo Advantage Specialized Technology Fund) | Class B

|

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Maximum sales charge (load) imposed on purchases (as a percentage of offering price) |

rr_MaximumSalesChargeImposedOnPurchasesOverOfferingPrice |

none

|

|

| Maximum deferred sales charge (load) (as a percentage of offering price) |

rr_MaximumDeferredSalesChargeOverOfferingPrice |

5.00% |

|

| Management Fees |

rr_ManagementFeesOverAssets |

1.05% |

|

| Distribution (12b-1) Fees |

rr_DistributionAndService12b1FeesOverAssets |

0.75% |

|

| Other Expenses |

rr_OtherExpensesOverAssets |

0.62% |

|

| Acquired Fund Fees and Expenses |

rr_AcquiredFundFeesAndExpensesOverAssets |

0.02% |

|

| Total Annual Fund Operating Expenses |

rr_ExpensesOverAssets |

2.44% |

|

| Fee Waivers |

rr_FeeWaiverOrReimbursementOverAssets |

none

|

|

| Total Annual Fund Operating Expenses After Expense Reimbursement |

rr_NetExpensesOverAssets |

2.44% |

[10] |

| Expense Example, with Redemption, 1 Year |

rr_ExpenseExampleYear01 |

747 |

|

| Expense Example, with Redemption, 3 Years |

rr_ExpenseExampleYear03 |

1,061 |

|

| Expense Example, with Redemption, 5 Years |

rr_ExpenseExampleYear05 |

1,501 |

|

| Expense Example, with Redemption, 10 Years |

rr_ExpenseExampleYear10 |

2,504 |

|

| Expense Example, No Redemption, 1 Year |

rr_ExpenseExampleNoRedemptionYear01 |

247 |

|

| Expense Example, No Redemption, 3 Years |

rr_ExpenseExampleNoRedemptionYear03 |

761 |

|

| Expense Example, No Redemption, 5 Years |

rr_ExpenseExampleNoRedemptionYear05 |

1,301 |

|

| Expense Example, No Redemption, 10 Years |

rr_ExpenseExampleNoRedemptionYear10 |

2,504 |

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

21.16% |

|

| 5 Year |

rr_AverageAnnualReturnYear05 |

7.52% |

|

| 10 Year |

rr_AverageAnnualReturnYear10 |

1.35% |

|

| Inception Date of Share Class |

rr_AverageAnnualReturnInceptionDate |

Sep. 18,

2000 |

|

|

(WFA Specialty Funds - Retail) | (Wells Fargo Advantage Specialized Technology Fund) | Class C

|

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Maximum sales charge (load) imposed on purchases (as a percentage of offering price) |

rr_MaximumSalesChargeImposedOnPurchasesOverOfferingPrice |

none

|

|

| Maximum deferred sales charge (load) (as a percentage of offering price) |

rr_MaximumDeferredSalesChargeOverOfferingPrice |

1.00% |

|

| Management Fees |

rr_ManagementFeesOverAssets |

1.05% |

|

| Distribution (12b-1) Fees |

rr_DistributionAndService12b1FeesOverAssets |

0.75% |

|

| Other Expenses |

rr_OtherExpensesOverAssets |

0.62% |

|

| Acquired Fund Fees and Expenses |

rr_AcquiredFundFeesAndExpensesOverAssets |

0.02% |

|

| Total Annual Fund Operating Expenses |

rr_ExpensesOverAssets |

2.44% |

|

| Fee Waivers |

rr_FeeWaiverOrReimbursementOverAssets |

none

|

|

| Total Annual Fund Operating Expenses After Expense Reimbursement |

rr_NetExpensesOverAssets |

2.44% |

[10] |

| Expense Example, with Redemption, 1 Year |

rr_ExpenseExampleYear01 |

347 |

|

| Expense Example, with Redemption, 3 Years |

rr_ExpenseExampleYear03 |

761 |

|

| Expense Example, with Redemption, 5 Years |

rr_ExpenseExampleYear05 |

1,301 |

|

| Expense Example, with Redemption, 10 Years |

rr_ExpenseExampleYear10 |

2,776 |

|

| Expense Example, No Redemption, 1 Year |

rr_ExpenseExampleNoRedemptionYear01 |

247 |

|

| Expense Example, No Redemption, 3 Years |

rr_ExpenseExampleNoRedemptionYear03 |

761 |

|

| Expense Example, No Redemption, 5 Years |

rr_ExpenseExampleNoRedemptionYear05 |

1,301 |

|

| Expense Example, No Redemption, 10 Years |

rr_ExpenseExampleNoRedemptionYear10 |

2,776 |

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

25.04% |

|

| 5 Year |

rr_AverageAnnualReturnYear05 |

7.80% |

|

| 10 Year |

rr_AverageAnnualReturnYear10 |

1.10% |

|

| Inception Date of Share Class |

rr_AverageAnnualReturnInceptionDate |

Sep. 18,

2000 |

|

|

(WFA Specialty Funds - Retail) | (Wells Fargo Advantage Specialized Technology Fund) | S&P 500 Index (reflects no deduction for fees, expenses, or taxes)

|

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

15.06% |

|

| 5 Year |

rr_AverageAnnualReturnYear05 |

2.29% |

|

| 10 Year |

rr_AverageAnnualReturnYear10 |

1.41% |

|

|

(WFA Specialty Funds - Retail) | (Wells Fargo Advantage Specialized Technology Fund) | S&P North American Technology TR Index (reflects no deduction for fees, expenses, or taxes)

|

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

12.65% |

|

| 5 Year |

rr_AverageAnnualReturnYear05 |

5.83% |

|

| 10 Year |

rr_AverageAnnualReturnYear10 |

(0.86%) |

|

|

(WFA Specialty Funds - Retail) | (Wells Fargo Advantage Health Care Fund)

|

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Objective [Heading] |

rr_ObjectiveHeading |

Investment Objective

|

|

| Objective, Primary [Text Block] |

rr_ObjectivePrimaryTextBlock |

The Fund seeks long-term capital appreciation.

|

|

| Expense [Heading] |

rr_ExpenseHeading |

Fees and Expenses

|

|

| Expense Narrative [Text Block] |

rr_ExpenseNarrativeTextBlock |

These tables are intended to help you understand the various costs and expenses you will pay if you buy and hold shares of the Fund. You may qualify for sales charge discounts if you and your family invest, or agree to invest in the future, at least $50,000 in the aggregate in specified classes of certain Wells Fargo Advantage Funds

®. More information about these and other discounts is available from your financial professional and in "A Choice of Share Classes" and "Reductions and Waivers of Sales Charges" on pages 36 and 38 of the Prospectus and "Additional Purchase and Redemption Information" on page 43 of the Statement of Additional Information.

|

|

| Shareholder Fees Caption [Text] |

rr_ShareholderFeesCaption |

Shareholder Fees (fees paid directly from your investment)

|

|

| Operating Expenses Caption [Text] |

rr_OperatingExpensesCaption |

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment)

|

|

| Portfolio Turnover [Heading] |

rr_PortfolioTurnoverHeading |

Portfolio Turnover

|

|

| Portfolio Turnover [Text Block] |

rr_PortfolioTurnoverTextBlock |

The Fund pays transaction costs, such as commissions,when it buys and sells securities (or "turns over"its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund's performance. For the period from November 1, 2010 to March 31, 2011, the Fund's portfolio turnover rate was 33% of the average value of its portfolio.

|

|

| Portfolio Turnover, Rate |

rr_PortfolioTurnoverRate |

33.00% |

|

| Expense Breakpoint Discounts [Text] |

rr_ExpenseBreakpointDiscounts |

You may qualify for sales charge discounts if you and your family invest, or agree to invest in the future, at least $50,000 in the aggregate in specified classes of certain Wells Fargo Advantage Funds®. More information about these and other discounts is available from your financial professional and in "A Choice of Share Classes" and "Reductions and Waivers of Sales Charges" on pages 36 and 38 of the Prospectus and "Additional Purchase and Redemption Information" on page 43 of the Statement of Additional Information. |

|

| Expense Breakpoint, Minimum Investment Required [Amount] |

rr_ExpenseBreakpointMinimumInvestmentRequiredAmount |

50,000 |

|

| Expense Example [Heading] |

rr_ExpenseExampleHeading |

Example of Expenses

|

|

| Expense Example Narrative [Text Block] |

rr_ExpenseExampleNarrativeTextBlock |

The example below is intended to help you compare the costs of investing in the Fund with the costs of investing in other mutual funds. The example assumes a $10,000 initial investment, 5% annual total return, and that operating expenses remain the same as in the tables above. The example also assumes that the Total Annual Fund Operating Expenses After Fee Waiver shown above will only be in place for the length of the current waiver commitment. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

|

|

| Expense Example by, Year, Caption [Text] |

rr_ExpenseExampleByYearCaption |

Assuming Redemption at End of Period

|

|

| Expense Example, No Redemption, By Year, Caption [Text] |

rr_ExpenseExampleNoRedemptionByYearCaption |

Assuming No Redemption

|

|

| Strategy [Heading] |

rr_StrategyHeading |

Principal Investment Strategies

|

|

| Strategy Narrative [Text Block] |

rr_StrategyNarrativeTextBlock |

Under normal circumstances, we invest at least 80% of the Fund's net assets in equity securities of healthcare companies. We invest up to 50% of the Fund's total assets in equity securities of foreign issuers, including ADRs and similar investments. We also invest up to 15% of the Fund's total assets in emerging market equity securities.

We invest principally in equity securities of healthcare companies across all market capitalizations. We define healthcare companies as those that develop, produce or distribute products or services related to the healthcare, life sciences, or medical industries and that we determine derive a substantial portion, i.e., more than 50%, of their sales from products and services in these industries. We concentrate the Fund's investments in the healthcare sector, and because we retain flexibility to invest in a relatively small number of stocks, the Fund is also considered to be non-diversified.

Our process focuses on a disciplined, bottom-up, fundamental investment approach to stock selection across a broad range of global healthcare and healthcare related industries. Companies we invest in include, but are not limited to, pharmaceutical companies, biotechnology companies, medical device and supply companies, managed care companies and healthcare information and service providers. Our emphasis is on long-term growth opportunities combined with intrinsic value analysis. Stock selection combines fundamental research and financial analysis to assess all candidates and we identify catalysts to unlock value and/or drive future growth. Intrinsic valuation price targets are established for each holding and stocks are sold when they reach our targets or when fundamentals deteriorate.

|

|

| Risk [Heading] |

rr_RiskHeading |

Principal Investment Risks

|

|

| Risk Narrative [Text Block] |

rr_RiskNarrativeTextBlock |

An investment in the Fund is not a deposit of Wells Fargo Bank, N.A. or its affiliates and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other governmental agency.

Counter-Party Risk. A Fund may incur a loss if the other party to an investment contract, such as a derivative or a repurchase or reverse repurchase agreement, fails to fulfill its contractual obligation to the Fund.

Emerging Markets Risk. Foreign investment risks are typically greater for securities in emerging markets, which can be more vulnerable to recessions, currency volatility, inflation and market failure.

Foreign Investment Risk. Foreign investments face the potential of heightened illiquidity, greater price volatility and adverse effects of political, regulatory, tax, currency, economic or other macroeconomic developments.

Growth Style Investment Risk. Growth stocks may be more expensive relative to the values of other stocks and carry potential for significant volatility and loss.

Healthcare Sector Risk. The Fund concentrates its investments in the healthcare sector and therefore may be more susceptible to financial, economic or market events impacting the healthcare sector. Moreover, many healthcare companies are subject to significant government regulation and may be affected by changes in governmental policies. As a result, investments in healthcare companies include the risk that the economic prospects, and the share prices, of such companies generally can fluctuate dramatically due to changes in the regulatory or competitive environments.

Issuer Risk. The value of a security may decline because of adverse events or circumstances that directly relate to conditions at the issuer or any entity providing it credit or liquidity support.

Liquidity Risk. A security may not be able to be sold at the time desired or without adversely affecting the price.

Management Risk. There is no guarantee of the Fund's performance or that the Fund will meet its objective. The market value of your investment may decline and you may suffer investment loss.

Market Risk. The market price of securities owned by the Fund may rapidly or unpredictably decline due to factors affecting securities markets generally or particular industries.

Non-Diversification Risk. Because the percentage of a non-diversified fund's assets invested in the securities of a single issuer is not limited by the 1940 Act, greater investment in a single issuer makes a fund more susceptible to financial, economic or market events impacting such issuer.

Regulatory Risk. Changes in government regulations may adversely affect the value of a security. An insufficiently regulated industry or market might also permit inappropriate practices that adversely affect an investment.

Smaller Company Securities Risk. Securities of companies with smaller market capitalizations tend to be more volatile and less liquid than larger company stocks.

Value Style Investment Risk. Value stocks may lose value and may be subject to prolonged depressed valuations.

|

|

| Risk Lose Money [Text] |

rr_RiskLoseMoney |

There is no guarantee of the Fund's performance or that the Fund will meet its objective. |

|

| Risk Nondiversified Status [Text] |

rr_RiskNondiversifiedStatus |

Non-Diversification Risk. Because the percentage of a non-diversified fund's assets invested in the securities of a single issuer is not limited by the 1940 Act, greater investment in a single issuer makes a fund more susceptible to financial, economic or market events impacting such issuer. |

|

| Risk Not Insured Depository Institution [Text] |

rr_RiskNotInsuredDepositoryInstitution |

An investment in the Fund is not a deposit of Wells Fargo Bank, N.A. or its affiliates and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other governmental agency. |

|

| Bar Chart and Performance Table [Heading] |

rr_BarChartAndPerformanceTableHeading |

Performance

|

|

| Performance Narrative [Text Block] |

rr_PerformanceNarrativeTextBlock |

The following information provides some indication of the risks of investing in the Fund by showing changes in the Fund's performance from year to year. The Fund's average annual total returns are compared to the performance of an appropriate broad-based index(es). Past performance before and after taxes is no guarantee of future results. Current month-end performance is available on the Fund's Web site at wellsfargo.com/advantagefunds.

|

|

| Performance Availability Phone [Text] |

rr_PerformanceAvailabilityPhone |

1-800-222-8222 |

|

| Performance Availability Website Address [Text] |

rr_PerformanceAvailabilityWebSiteAddress |

Current month-end performance is available on the Fund's Web site at wellsfargo.com/advantagefunds. |

|

| Performance Past Does Not Indicate Future [Text] |

rr_PerformancePastDoesNotIndicateFuture |

Past performance before and after taxes is no guarantee of future results. |

|

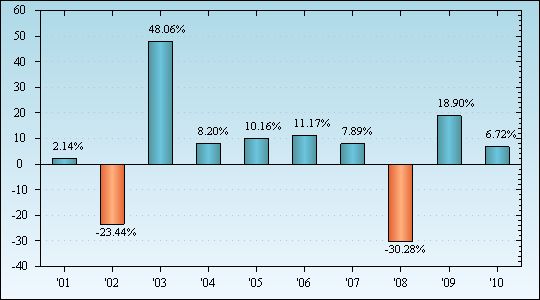

| Bar Chart [Heading] |

rr_BarChartHeading |

Calendar Year Total Returns for Class A as of 12/31 each year (Returns do not reflect sales charges and would be lower if they did)

|

|

| Bar Chart Closing [Text Block] |

rr_BarChartClosingTextBlock |

Highest Quarter: 2nd Quarter 2003 +25.31%

Lowest Quarter: 1st Quarter 2001 -21.30%

Year-to-date total return as of 6/30/2011 is +12.71%

|

|

| Performance Table Heading |

rr_PerformanceTableHeading |

Average Annual Total Returns for the periods ended 12/31/2010 (Returns reflect applicable sales charges)

|

|

| Performance Table Uses Highest Federal Rate |

rr_PerformanceTableUsesHighestFederalRate |

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state, local or foreign taxes. |

|

| Performance Table Not Relevant to Tax Deferred |

rr_PerformanceTableNotRelevantToTaxDeferred |

Actual after-tax returns depend on an investor's tax situation and may differ from those shown, and after-tax returns shown are not relevant to tax-exempt investors or investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) Plans or Individual Retirement Accounts. |

|

| Performance Table One Class of after Tax Shown [Text] |

rr_PerformanceTableOneClassOfAfterTaxShown |

After-tax returns are shown only for the Class A shares. After-tax returns for the Class B and Class C shares will vary. |

|

| Performance Table Closing [Text Block] |

rr_PerformanceTableClosingTextBlock |

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state, local or foreign taxes. Actual after-tax returns depend on an investor's tax situation and may differ from those shown, and after-tax returns shown are not relevant to tax-exempt investors or investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) Plans or Individual Retirement Accounts. After-tax returns are shown only for the Class A shares. After-tax returns for the Class B and Class C shares will vary.

|

|

|

(WFA Specialty Funds - Retail) | (Wells Fargo Advantage Health Care Fund) | Class A

|

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Maximum sales charge (load) imposed on purchases (as a percentage of offering price) |

rr_MaximumSalesChargeImposedOnPurchasesOverOfferingPrice |

5.75% |

|

| Maximum deferred sales charge (load) (as a percentage of offering price) |

rr_MaximumDeferredSalesChargeOverOfferingPrice |

none

|

|

| Management Fees |

rr_ManagementFeesOverAssets |

0.80% |

|

| Distribution (12b-1) Fees |

rr_DistributionAndService12b1FeesOverAssets |

none

|

|

| Other Expenses |

rr_OtherExpensesOverAssets |

0.80% |

|

| Acquired Fund Fees and Expenses |

rr_AcquiredFundFeesAndExpensesOverAssets |

0.01% |

|

| Total Annual Fund Operating Expenses |

rr_ExpensesOverAssets |

1.61% |

|

| Fee Waivers |

rr_FeeWaiverOrReimbursementOverAssets |

(0.14%) |

|

| Total Annual Fund Operating Expenses After Expense Reimbursement |

rr_NetExpensesOverAssets |

1.47% |

[8] |

| Expense Example, with Redemption, 1 Year |

rr_ExpenseExampleYear01 |

716 |

|

| Expense Example, with Redemption, 3 Years |

rr_ExpenseExampleYear03 |

1,027 |

|

| Expense Example, with Redemption, 5 Years |

rr_ExpenseExampleYear05 |

1,375 |

|

| Expense Example, with Redemption, 10 Years |

rr_ExpenseExampleYear10 |

2,353 |

|

| Annual Return 2001 |

rr_AnnualReturn2001 |

2.14% |

|

| Annual Return 2002 |

rr_AnnualReturn2002 |

(23.44%) |

|

| Annual Return 2003 |

rr_AnnualReturn2003 |

48.06% |

|

| Annual Return 2004 |

rr_AnnualReturn2004 |

8.20% |

|

| Annual Return 2005 |

rr_AnnualReturn2005 |

10.16% |

|

| Annual Return 2006 |

rr_AnnualReturn2006 |

11.17% |

|

| Annual Return 2007 |

rr_AnnualReturn2007 |

7.89% |

|

| Annual Return 2008 |

rr_AnnualReturn2008 |

(30.28%) |

|

| Annual Return 2009 |

rr_AnnualReturn2009 |

18.90% |

|

| Annual Return 2010 |

rr_AnnualReturn2010 |

6.72% |

|

| Year to Date Return, Label |

rr_YearToDateReturnLabel |

Year-to-date total return as of 6/30/2011 is +12.71%

|

|

| Bar Chart, Year to Date Return, Date |

rr_BarChartYearToDateReturnDate |

Jun. 30,

2011 |

|

| Bar Chart, Year to Date Return |

rr_BarChartYearToDateReturn |

12.71% |

|

| Highest Quarterly Return, Label |

rr_HighestQuarterlyReturnLabel |

Highest Quarter: 2nd Quarter 2003

|

|

| Highest Quarterly Return |

rr_BarChartHighestQuarterlyReturn |

25.31% |

|

| Lowest Quarterly Return, Label |

rr_LowestQuarterlyReturnLabel |

Lowest Quarter: 1st Quarter 2001

|

|

| Lowest Quarterly Return |

rr_BarChartLowestQuarterlyReturn |

(21.30%) |

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

0.61% |

|

| 5 Year |

rr_AverageAnnualReturnYear05 |

none

|

|

| 10 Year |

rr_AverageAnnualReturnYear10 |

3.27% |

|

| Inception Date of Share Class |

rr_AverageAnnualReturnInceptionDate |

Dec. 22,

1999 |

|

|

(WFA Specialty Funds - Retail) | (Wells Fargo Advantage Health Care Fund) | Class A | (after taxes on distributions)

|

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

0.61% |

|

| 5 Year |

rr_AverageAnnualReturnYear05 |

(0.39%) |

|

| 10 Year |

rr_AverageAnnualReturnYear10 |

2.78% |

|

| Inception Date of Share Class |

rr_AverageAnnualReturnInceptionDate |

Dec. 22,

1999 |

|

|

(WFA Specialty Funds - Retail) | (Wells Fargo Advantage Health Care Fund) | Class A | (after taxes on distributions and the sale of Fund Shares)

|

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

0.39% |

|

| 5 Year |

rr_AverageAnnualReturnYear05 |

(0.04%) |

|

| 10 Year |

rr_AverageAnnualReturnYear10 |

2.70% |

|

| Inception Date of Share Class |

rr_AverageAnnualReturnInceptionDate |

Dec. 22,

1999 |

|

|

(WFA Specialty Funds - Retail) | (Wells Fargo Advantage Health Care Fund) | Class B

|

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Maximum sales charge (load) imposed on purchases (as a percentage of offering price) |

rr_MaximumSalesChargeImposedOnPurchasesOverOfferingPrice |

none

|

|

| Maximum deferred sales charge (load) (as a percentage of offering price) |

rr_MaximumDeferredSalesChargeOverOfferingPrice |

5.00% |

|

| Management Fees |

rr_ManagementFeesOverAssets |

0.80% |

|

| Distribution (12b-1) Fees |

rr_DistributionAndService12b1FeesOverAssets |

0.75% |

|

| Other Expenses |

rr_OtherExpensesOverAssets |

0.80% |

|

| Acquired Fund Fees and Expenses |

rr_AcquiredFundFeesAndExpensesOverAssets |

0.01% |

|

| Total Annual Fund Operating Expenses |

rr_ExpensesOverAssets |

2.36% |

|

| Fee Waivers |

rr_FeeWaiverOrReimbursementOverAssets |

(0.14%) |

|

| Total Annual Fund Operating Expenses After Expense Reimbursement |

rr_NetExpensesOverAssets |

2.22% |

[8] |

| Expense Example, with Redemption, 1 Year |

rr_ExpenseExampleYear01 |

725 |

|

| Expense Example, with Redemption, 3 Years |

rr_ExpenseExampleYear03 |

1,009 |

|

| Expense Example, with Redemption, 5 Years |

rr_ExpenseExampleYear05 |

1,434 |

|

| Expense Example, with Redemption, 10 Years |

rr_ExpenseExampleYear10 |

2,399 |

|

| Expense Example, No Redemption, 1 Year |

rr_ExpenseExampleNoRedemptionYear01 |

225 |

|

| Expense Example, No Redemption, 3 Years |

rr_ExpenseExampleNoRedemptionYear03 |

709 |

|

| Expense Example, No Redemption, 5 Years |

rr_ExpenseExampleNoRedemptionYear05 |

1,234 |

|

| Expense Example, No Redemption, 10 Years |

rr_ExpenseExampleNoRedemptionYear10 |

2,399 |

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

0.88% |

|

| 5 Year |

rr_AverageAnnualReturnYear05 |

0.08% |

|

| 10 Year |

rr_AverageAnnualReturnYear10 |

3.36% |

|

| Inception Date of Share Class |

rr_AverageAnnualReturnInceptionDate |

Dec. 22,

1999 |

|

|

(WFA Specialty Funds - Retail) | (Wells Fargo Advantage Health Care Fund) | Class C

|

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Maximum sales charge (load) imposed on purchases (as a percentage of offering price) |

rr_MaximumSalesChargeImposedOnPurchasesOverOfferingPrice |

none

|

|

| Maximum deferred sales charge (load) (as a percentage of offering price) |

rr_MaximumDeferredSalesChargeOverOfferingPrice |

1.00% |

|

| Management Fees |

rr_ManagementFeesOverAssets |

0.80% |

|

| Distribution (12b-1) Fees |

rr_DistributionAndService12b1FeesOverAssets |

0.75% |

|

| Other Expenses |

rr_OtherExpensesOverAssets |

0.80% |

|

| Acquired Fund Fees and Expenses |

rr_AcquiredFundFeesAndExpensesOverAssets |

0.01% |

|

| Total Annual Fund Operating Expenses |

rr_ExpensesOverAssets |

2.36% |

|

| Fee Waivers |

rr_FeeWaiverOrReimbursementOverAssets |

(0.14%) |

|

| Total Annual Fund Operating Expenses After Expense Reimbursement |

rr_NetExpensesOverAssets |

2.22% |

[8] |

| Expense Example, with Redemption, 1 Year |

rr_ExpenseExampleYear01 |

325 |

|

| Expense Example, with Redemption, 3 Years |

rr_ExpenseExampleYear03 |

709 |

|

| Expense Example, with Redemption, 5 Years |

rr_ExpenseExampleYear05 |

1,234 |

|

| Expense Example, with Redemption, 10 Years |

rr_ExpenseExampleYear10 |

2,674 |

|

| Expense Example, No Redemption, 1 Year |

rr_ExpenseExampleNoRedemptionYear01 |

225 |

|

| Expense Example, No Redemption, 3 Years |

rr_ExpenseExampleNoRedemptionYear03 |

709 |

|

| Expense Example, No Redemption, 5 Years |

rr_ExpenseExampleNoRedemptionYear05 |

1,234 |

|

| Expense Example, No Redemption, 10 Years |

rr_ExpenseExampleNoRedemptionYear10 |

2,674 |

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

4.88% |

|

| 5 Year |

rr_AverageAnnualReturnYear05 |

0.45% |

|

| 10 Year |

rr_AverageAnnualReturnYear10 |

3.13% |

|

| Inception Date of Share Class |

rr_AverageAnnualReturnInceptionDate |

Dec. 22,

1999 |

|

|

(WFA Specialty Funds - Retail) | (Wells Fargo Advantage Health Care Fund) | S&P 500 Index (reflects no deduction for fees, expenses, or taxes)

|

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

15.06% |

|

| 5 Year |

rr_AverageAnnualReturnYear05 |

2.29% |

|

| 10 Year |

rr_AverageAnnualReturnYear10 |

1.41% |

|

|

(WFA Specialty Funds - Retail) | (Wells Fargo Advantage Health Care Fund) | S&P 1500 Supercomposite Healthcare Sector Index (reflects no deduction for fees, expenses, or taxes)

|

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

5.20% |

|

| 5 Year |

rr_AverageAnnualReturnYear05 |

2.27% |

|

| 10 Year |

rr_AverageAnnualReturnYear10 |

0.52% |

|

|

(WFA Specialty Funds - Retail) | (Wells Fargo Advantage Precious Metals Fund)

|

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Objective [Heading] |

rr_ObjectiveHeading |

Investment Objective

|

|

| Objective, Primary [Text Block] |

rr_ObjectivePrimaryTextBlock |

The Fund seeks long-term capital appreciation.

|

|

| Expense [Heading] |

rr_ExpenseHeading |

Fees and Expenses

|

|

| Expense Narrative [Text Block] |

rr_ExpenseNarrativeTextBlock |

These tables are intended to help you understand the various costs and expenses you will pay if you buy and hold shares of the Fund. You may qualify for sales charge discounts if you and your family invest, or agree to invest in the future, at least $50,000 in the aggregate in specified classes of certain Wells Fargo Advantage Funds

®. More information about these and other discounts is available from your financial professional and in "A Choice of Share Classes" and "Reductions and Waivers of Sales Charges" on pages 36 and 38 of the Prospectus and "Additional Purchase and Redemption Information" on page 43 of the Statement of Additional Information.

|

|

| Shareholder Fees Caption [Text] |

rr_ShareholderFeesCaption |

Shareholder Fees (fees paid directly from your investment)

|

|

| Operating Expenses Caption [Text] |

rr_OperatingExpensesCaption |

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment)

|

|

| Portfolio Turnover [Heading] |

rr_PortfolioTurnoverHeading |

Portfolio Turnover

|

|

| Portfolio Turnover [Text Block] |

rr_PortfolioTurnoverTextBlock |

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or "turns over" its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund's performance. For the period from November 1, 2010 to March 31, 2011, the Fund's portfolio turnover rate was 5% of the average value of its portfolio.

|

|

| Portfolio Turnover, Rate |

rr_PortfolioTurnoverRate |

5.00% |

|

| Expense Breakpoint Discounts [Text] |

rr_ExpenseBreakpointDiscounts |

You may qualify for sales charge discounts if you and your family invest, or agree to invest in the future, at least $50,000 in the aggregate in specified classes of certain Wells Fargo Advantage Funds®. More information about these and other discounts is available from your financial professional and in "A Choice of Share Classes" and "Reductions and Waivers of Sales Charges" on pages 36 and 38 of the Prospectus and "Additional Purchase and Redemption Information" on page 43 of the Statement of Additional Information. |

|

| Expense Breakpoint, Minimum Investment Required [Amount] |

rr_ExpenseBreakpointMinimumInvestmentRequiredAmount |

50,000 |

|

| Expense Example [Heading] |

rr_ExpenseExampleHeading |

Example of Expenses

|

|

| Expense Example Narrative [Text Block] |

rr_ExpenseExampleNarrativeTextBlock |

The example below is intended to help you compare the costs of investing in the Fund with the costs of investing in other mutual funds. The example assumes a $10,000 initial investment, 5% annual total return, and that operating expenses remain the same as in the tables above. The example also assumes that the Total Annual Fund Operating Expenses After Fee Waiver shown above will only be in place for the length of the current waiver commitment. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

|

|

| Expense Example by, Year, Caption [Text] |

rr_ExpenseExampleByYearCaption |

Assuming Redemption at End of Period

|

|

| Expense Example, No Redemption, By Year, Caption [Text] |

rr_ExpenseExampleNoRedemptionByYearCaption |

Assuming No Redemption

|

|

| Strategy [Heading] |

rr_StrategyHeading |

Principal Investment Strategies

|

|

| Strategy Narrative [Text Block] |

rr_StrategyNarrativeTextBlock |

Under normal circumstances, we invest at least 80% of the Fund's net assets in investments related to precious metals. We may invest any amount of the Fund's total assets in equity securities of foreign issuers, including ADRs and similar investments, and we may invest up to 40% of the Fund's total assets in emerging market equity securities. We may also invest up to 25% of the Fund's total assets, at the time of purchase, in debt securities linked to precious metals and common or preferred stocks of subsidiaries of the Fund that invest directly or indirectly in precious metals and minerals. The Fund may invest in foreign securities, including ADRs and similar investments, which are typically denominated in non-U.S. currencies, and may also invest in U.S. securities.

We invest principally in investments related to precious metals across all market capitalizations. We define precious metals companies as those that are engaged in, or which receive at least 50% of their revenues from the exploration, development, mining, processing, or dealing in gold or other precious metals and minerals, including, but not limited to, silver, platinum, and diamonds. We concentrate the Fund's investments in the precious metals sector, and because we retain the flexibility to invest in a relatively small number of stocks, the Fund is also considered to be non-diversified.

Primary emphasis is placed on precious metals related companies. The Fund's investment process takes a disciplined approach to risk management through top-down macroeconomic analysis and bottom-up stock selection. Among the macroeconomic influences considered include: geopolitical risks, the relative strength of the U.S. dollar, jewelry demand, inflation expectations, the seasonality of gold, investment demand and relative valuation levels for the precious metals universe. From a bottom-up perspective, management looks for high quality companies that are positioned to improve their relative value over time. We continually review the investments of the portfolio. Among the factors which may influence the reduction of a position are: the achievement of a valuation target, the deterioration in the underlying fundamentals of the business, or the identification of more attractive investment opportunity.

|

|

| Risk [Heading] |

rr_RiskHeading |

Principal Investment Risks

|

|

| Risk Narrative [Text Block] |

rr_RiskNarrativeTextBlock |

An investment in the Fund is not a deposit of Wells Fargo Bank, N.A. or its affiliates and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other governmental agency.

Counter-Party Risk. A Fund may incur a loss if the other party to an investment contract, such as a derivative or a repurchase or reverse repurchase agreement, fails to fulfill its contractual obligation to the Fund.

Debt Securities Risk. The issuer of a debt security may fail to pay interest or principal when due, and changes in market interest rates may reduce the value of debt securities or reduce the Fund's returns.

Emerging Markets Risk. Foreign investment risks are typically greater for securities in emerging markets, which can be more vulnerable to recessions, currency volatility, inflation and market failure.

Foreign Investment Risk. Foreign investments face the potential of heightened illiquidity, greater price volatility and adverse effects of political, regulatory, tax, currency, economic or other macroeconomic developments.

Growth Style Investment Risk. Growth stocks may be more expensive relative to the values of other stocks and carry potential for significant volatility and loss.

Issuer Risk. The value of a security may decline because of adverse events or circumstances that directly relate to conditions at the issuer or any entity providing it credit or liquidity support.

Liquidity Risk. A security may not be able to be sold at the time desired or without adversely affecting the price.

Management Risk. There is no guarantee of the Fund's performance or that the Fund will meet its objective. The market value of your investment may decline and you may suffer investment loss.

Market Risk. The market price of securities owned by the Fund may rapidly or unpredictably decline due to factors affecting securities markets generally or particular industries.

Non-Diversification Risk. Because the percentage of a non-diversified fund's assets invested in the securities of a single issuer is not limited by the 1940 Act, greater investment in a single issuer makes a fund more susceptible to financial, economic or market events impacting such issuer.

Precious Metals Sector Risk. The Fund concentrates its investments in securities related to precious metals and therefore may be more susceptible to financial, economic or market events impacting the precious metals sector.

Regulatory Risk. Changes in government regulations may adversely affect the value of a security. An insufficiently regulated industry or market might also permit inappropriate practices that adversely affect an investment.

Smaller Company Securities Risk. Securities of companies with smaller market capitalizations tend to be more volatile and less liquid than larger company stocks.

Subsidiary Risk. The Wells Fargo Advantage Precious Metals Fund has a subsidiary that may invest directly in precious metals or minerals. The value of the Fund's investment in its subsidiary may be adversely impacted by the risks associated with delivery, storage and maintenance, possible illiquidity, and the unavailability of accurate market valuations of precious metals or minerals as well as by custody and transaction costs associated with a subsidiary's investment in precious metals or minerals.

Value Style Investment Risk. Value stocks may lose value and may be subject to prolonged depressed valuations.

|

|

| Risk Lose Money [Text] |

rr_RiskLoseMoney |

There is no guarantee of the Fund's performance or that the Fund will meet its objective. |

|

| Risk Nondiversified Status [Text] |

rr_RiskNondiversifiedStatus |

Non-Diversification Risk. Because the percentage of a non-diversified fund's assets invested in the securities of a single issuer is not limited by the 1940 Act, greater investment in a single issuer makes a fund more susceptible to financial, economic or market events impacting such issuer. |

|

| Risk Not Insured Depository Institution [Text] |

rr_RiskNotInsuredDepositoryInstitution |

An investment in the Fund is not a deposit of Wells Fargo Bank, N.A. or its affiliates and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other governmental agency. |

|

| Bar Chart and Performance Table [Heading] |

rr_BarChartAndPerformanceTableHeading |

Performance

|

|

| Performance Narrative [Text Block] |

rr_PerformanceNarrativeTextBlock |

The following information provides some indication of the risks of investing in the Fund by showing changes in the Fund's performance from year to year. The Fund's average annual total returns are compared to the performance of an appropriate broad-based index(es). Past performance before and after taxes is no guarantee of future results. Current month-end performance is available on the Fund's Web site at wellsfargo.com/advantagefunds.

|

|

| Performance Availability Phone [Text] |

rr_PerformanceAvailabilityPhone |

1-800-222-8222 |

|

| Performance Availability Website Address [Text] |

rr_PerformanceAvailabilityWebSiteAddress |

Current month-end performance is available on the Fund's Web site at wellsfargo.com/advantagefunds. |

|

| Performance Past Does Not Indicate Future [Text] |

rr_PerformancePastDoesNotIndicateFuture |

Past performance before and after taxes is no guarantee of future results. |

|

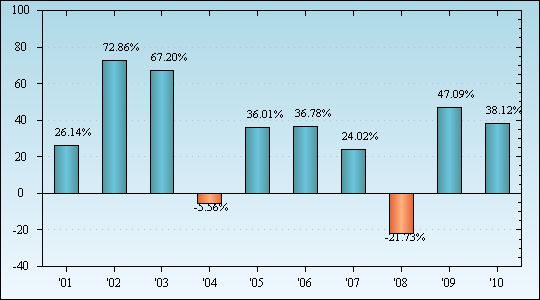

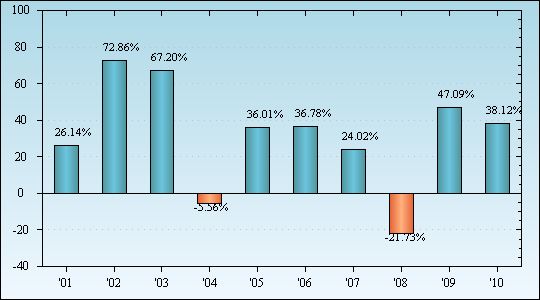

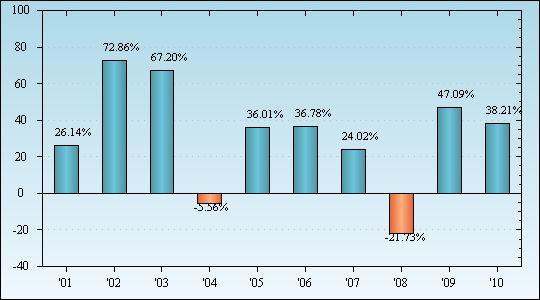

| Bar Chart [Heading] |

rr_BarChartHeading |

Calendar Year Total Returns for Class A as of 12/31 each year (Returns do not reflect sales charges and would be lower if they did)

|

|

| Bar Chart Closing [Text Block] |

rr_BarChartClosingTextBlock |

Highest Quarter: 1st Quarter 2002 +37.41%

Lowest Quarter: 3rd Quarter 2008 -28.94%

Year-to-date total return as of 6/30/2011 is -8.12%

|

|

| Performance Table Heading |

rr_PerformanceTableHeading |

Average Annual Total Returns for the periods ended 12/31/2010 (Returns reflect applicable sales charges)

|

|

| Performance Table Uses Highest Federal Rate |

rr_PerformanceTableUsesHighestFederalRate |

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state, local or foreign taxes. |

|

| Performance Table Not Relevant to Tax Deferred |

rr_PerformanceTableNotRelevantToTaxDeferred |

Actual after-tax returns depend on an investor's tax situation and may differ from those shown, and after-tax returns shown are not relevant to tax-exempt investors or investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) Plans or Individual Retirement Accounts. |

|

| Performance Table One Class of after Tax Shown [Text] |

rr_PerformanceTableOneClassOfAfterTaxShown |

After-tax returns are shown only for the Class A shares. After-tax returns for the Class B and Class C shares will vary. |

|

| Performance Table Closing [Text Block] |

rr_PerformanceTableClosingTextBlock |

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state, local or foreign taxes. Actual after-tax returns depend on an investor's tax situation and may differ from those shown, and after-tax returns shown are not relevant to tax-exempt investors or investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) Plans or Individual Retirement Accounts. After-tax returns are shown only for the Class A shares. After-tax returns for the Class B and Class C shares will vary.

|

|

|

(WFA Specialty Funds - Retail) | (Wells Fargo Advantage Precious Metals Fund) | Class A

|

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Maximum sales charge (load) imposed on purchases (as a percentage of offering price) |

rr_MaximumSalesChargeImposedOnPurchasesOverOfferingPrice |

5.75% |

|

| Maximum deferred sales charge (load) (as a percentage of offering price) |

rr_MaximumDeferredSalesChargeOverOfferingPrice |

none

|

|

| Management Fees |

rr_ManagementFeesOverAssets |

0.55% |

|

| Distribution (12b-1) Fees |

rr_DistributionAndService12b1FeesOverAssets |

none

|

|

| Other Expenses |

rr_OtherExpensesOverAssets |

0.60% |

|

| Acquired Fund Fees and Expenses |

rr_AcquiredFundFeesAndExpensesOverAssets |

0.01% |

|

| Total Annual Fund Operating Expenses |

rr_ExpensesOverAssets |

1.16% |

|

| Fee Waivers |

rr_FeeWaiverOrReimbursementOverAssets |

(0.06%) |

|

| Total Annual Fund Operating Expenses After Expense Reimbursement |

rr_NetExpensesOverAssets |

1.10% |

[5] |

| Expense Example, with Redemption, 1 Year |

rr_ExpenseExampleYear01 |

681 |

|

| Expense Example, with Redemption, 3 Years |

rr_ExpenseExampleYear03 |

911 |

|

| Expense Example, with Redemption, 5 Years |

rr_ExpenseExampleYear05 |

1,165 |

|

| Expense Example, with Redemption, 10 Years |

rr_ExpenseExampleYear10 |

1,893 |

|

| Annual Return 2001 |

rr_AnnualReturn2001 |

25.94% |

|

| Annual Return 2002 |

rr_AnnualReturn2002 |

72.38% |

|

| Annual Return 2003 |

rr_AnnualReturn2003 |

66.77% |

|

| Annual Return 2004 |

rr_AnnualReturn2004 |

(5.81%) |

|

| Annual Return 2005 |

rr_AnnualReturn2005 |

35.59% |

|

| Annual Return 2006 |

rr_AnnualReturn2006 |

36.38% |

|

| Annual Return 2007 |

rr_AnnualReturn2007 |

23.68% |

|

| Annual Return 2008 |

rr_AnnualReturn2008 |

(21.92%) |

|

| Annual Return 2009 |

rr_AnnualReturn2009 |

46.70% |

|

| Annual Return 2010 |

rr_AnnualReturn2010 |

37.84% |

|

| Year to Date Return, Label |

rr_YearToDateReturnLabel |

Year-to-date total return as of 6/30/2011 is -8.12%

|

|

| Bar Chart, Year to Date Return, Date |

rr_BarChartYearToDateReturnDate |

Jun. 30,

2011 |

|

| Bar Chart, Year to Date Return |

rr_BarChartYearToDateReturn |

(8.12%) |

|

| Highest Quarterly Return, Label |

rr_HighestQuarterlyReturnLabel |

Highest Quarter: 1st Quarter 2002

|

|

| Highest Quarterly Return |

rr_BarChartHighestQuarterlyReturn |

37.41% |

|

| Lowest Quarterly Return, Label |

rr_LowestQuarterlyReturnLabel |

Lowest Quarter: 3rd Quarter 2008

|

|

| Lowest Quarterly Return |

rr_BarChartLowestQuarterlyReturn |

(28.94%) |

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

29.91% |

|

| 5 Year |

rr_AverageAnnualReturnYear05 |

20.21% |

|

| 10 Year |

rr_AverageAnnualReturnYear10 |

27.78% |

|

| Inception Date of Share Class |

rr_AverageAnnualReturnInceptionDate |

Jan. 20,

1998 |

|

|

(WFA Specialty Funds - Retail) | (Wells Fargo Advantage Precious Metals Fund) | Class A | (after taxes on distributions)

|

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

26.62% |

|

| 5 Year |

rr_AverageAnnualReturnYear05 |

18.97% |

|

| 10 Year |

rr_AverageAnnualReturnYear10 |

26.89% |

|

| Inception Date of Share Class |

rr_AverageAnnualReturnInceptionDate |

Jan. 20,

1998 |

|

|

(WFA Specialty Funds - Retail) | (Wells Fargo Advantage Precious Metals Fund) | Class A | (after taxes on distributions and the sale of Fund Shares)

|

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

21.26% |

|

| 5 Year |

rr_AverageAnnualReturnYear05 |

17.46% |

|

| 10 Year |

rr_AverageAnnualReturnYear10 |

25.43% |

|

| Inception Date of Share Class |

rr_AverageAnnualReturnInceptionDate |

Jan. 20,

1998 |

|

|

(WFA Specialty Funds - Retail) | (Wells Fargo Advantage Precious Metals Fund) | Class B

|

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Maximum sales charge (load) imposed on purchases (as a percentage of offering price) |

rr_MaximumSalesChargeImposedOnPurchasesOverOfferingPrice |

none

|

|

| Maximum deferred sales charge (load) (as a percentage of offering price) |

rr_MaximumDeferredSalesChargeOverOfferingPrice |

5.00% |

|

| Management Fees |

rr_ManagementFeesOverAssets |

0.55% |

|

| Distribution (12b-1) Fees |

rr_DistributionAndService12b1FeesOverAssets |

0.75% |

|

| Other Expenses |

rr_OtherExpensesOverAssets |

0.60% |

|

| Acquired Fund Fees and Expenses |

rr_AcquiredFundFeesAndExpensesOverAssets |

0.01% |

|

| Total Annual Fund Operating Expenses |

rr_ExpensesOverAssets |

1.91% |

|

| Fee Waivers |

rr_FeeWaiverOrReimbursementOverAssets |

(0.06%) |

|

| Total Annual Fund Operating Expenses After Expense Reimbursement |

rr_NetExpensesOverAssets |

1.85% |

[5] |

| Expense Example, with Redemption, 1 Year |

rr_ExpenseExampleYear01 |

688 |

|

| Expense Example, with Redemption, 3 Years |

rr_ExpenseExampleYear03 |

888 |

|

| Expense Example, with Redemption, 5 Years |

rr_ExpenseExampleYear05 |

1,220 |

|

| Expense Example, with Redemption, 10 Years |

rr_ExpenseExampleYear10 |

1,936 |

|

| Expense Example, No Redemption, 1 Year |

rr_ExpenseExampleNoRedemptionYear01 |

188 |

|

| Expense Example, No Redemption, 3 Years |

rr_ExpenseExampleNoRedemptionYear03 |

588 |

|

| Expense Example, No Redemption, 5 Years |

rr_ExpenseExampleNoRedemptionYear05 |

1,020 |

|

| Expense Example, No Redemption, 10 Years |

rr_ExpenseExampleNoRedemptionYear10 |

1,936 |

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

31.80% |

|

| 5 Year |

rr_AverageAnnualReturnYear05 |

20.57% |

|

| 10 Year |

rr_AverageAnnualReturnYear10 |

27.89% |

|

| Inception Date of Share Class |

rr_AverageAnnualReturnInceptionDate |

Jan. 30,

1978 |

|

|

(WFA Specialty Funds - Retail) | (Wells Fargo Advantage Precious Metals Fund) | Class C

|

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Maximum sales charge (load) imposed on purchases (as a percentage of offering price) |

rr_MaximumSalesChargeImposedOnPurchasesOverOfferingPrice |

none

|

|

| Maximum deferred sales charge (load) (as a percentage of offering price) |

rr_MaximumDeferredSalesChargeOverOfferingPrice |

1.00% |

|

| Management Fees |

rr_ManagementFeesOverAssets |

0.55% |

|

| Distribution (12b-1) Fees |

rr_DistributionAndService12b1FeesOverAssets |

0.75% |

|

| Other Expenses |

rr_OtherExpensesOverAssets |

0.60% |

|

| Acquired Fund Fees and Expenses |

rr_AcquiredFundFeesAndExpensesOverAssets |

0.01% |

|

| Total Annual Fund Operating Expenses |

rr_ExpensesOverAssets |

1.91% |

|

| Fee Waivers |

rr_FeeWaiverOrReimbursementOverAssets |

(0.06%) |

|

| Total Annual Fund Operating Expenses After Expense Reimbursement |

rr_NetExpensesOverAssets |

1.85% |

[5] |

| Expense Example, with Redemption, 1 Year |

rr_ExpenseExampleYear01 |

288 |

|

| Expense Example, with Redemption, 3 Years |

rr_ExpenseExampleYear03 |

588 |

|

| Expense Example, with Redemption, 5 Years |

rr_ExpenseExampleYear05 |

1,020 |

|

| Expense Example, with Redemption, 10 Years |

rr_ExpenseExampleYear10 |

2,223 |

|

| Expense Example, No Redemption, 1 Year |

rr_ExpenseExampleNoRedemptionYear01 |

188 |

|

| Expense Example, No Redemption, 3 Years |

rr_ExpenseExampleNoRedemptionYear03 |

588 |

|

| Expense Example, No Redemption, 5 Years |

rr_ExpenseExampleNoRedemptionYear05 |

1,020 |

|

| Expense Example, No Redemption, 10 Years |

rr_ExpenseExampleNoRedemptionYear10 |

2,223 |

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

35.82% |

|

| 5 Year |

rr_AverageAnnualReturnYear05 |

20.75% |

|

| 10 Year |

rr_AverageAnnualReturnYear10 |

27.59% |

|

| Inception Date of Share Class |

rr_AverageAnnualReturnInceptionDate |

Jan. 29,

1998 |

|

|

(WFA Specialty Funds - Retail) | (Wells Fargo Advantage Precious Metals Fund) | FTSE Gold Mines Index (reflects no deduction for fees, expenses, or taxes)

|

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

29.93% |

|

| 5 Year |

rr_AverageAnnualReturnYear05 |

13.60% |

|

| 10 Year |

rr_AverageAnnualReturnYear10 |

20.36% |

|

|

(WFA Specialty Funds - Retail) | (Wells Fargo Advantage Precious Metals Fund) | S&P 500 Index (reflects no deduction for fees, expenses, or taxes)

|

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

15.06% |

|

| 5 Year |

rr_AverageAnnualReturnYear05 |

2.29% |

|

| 10 Year |

rr_AverageAnnualReturnYear10 |

1.41% |

|

|

(WFA Specialty Funds - Retail) | (Wells Fargo Advantage Utility & Telecommunications Fund)

|

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Objective [Heading] |

rr_ObjectiveHeading |

Investment Objective

|

|

| Objective, Primary [Text Block] |

rr_ObjectivePrimaryTextBlock |

The Fund seeks total return, consisting of current income and capital appreciation.

|

|

| Expense [Heading] |

rr_ExpenseHeading |

Fees and Expenses

|

|

| Expense Narrative [Text Block] |

rr_ExpenseNarrativeTextBlock |

These tables are intended to help you understand the various costs and expenses you will pay if you buy and hold shares of the Fund. You may qualify for sales charge discounts if you and your family invest, or agree to invest in the future, at least $50,000 in the aggregate in specified classes of certain Wells Fargo Advantage Funds

®. More information about these and other discounts is available from your financial professional and in "A Choice of Share Classes" and "Reductions and Waivers of Sales Charges" on pages 36 and 38 of the Prospectus and "Additional Purchase and Redemption Information" on page 43 of the Statement of Additional Information.

|

|

| Shareholder Fees Caption [Text] |

rr_ShareholderFeesCaption |

Shareholder Fees (fees paid directly from your investment)

|

|

| Operating Expenses Caption [Text] |

rr_OperatingExpensesCaption |

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment)

|

|

| Portfolio Turnover [Heading] |

rr_PortfolioTurnoverHeading |

Portfolio Turnover

|

|

| Portfolio Turnover [Text Block] |

rr_PortfolioTurnoverTextBlock |