AS FILED WITH THE SECURITIES AND EXCHANGE COMMISSION ON MAY 26, 2011

1933 Act No. 333-_________

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington D.C. 20549

FORM N-14

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

Pre-Effective Amendment No. [ ]

Post-Effective Amendment No. [ ]

(Check appropriate box or boxes)

WELLS FARGO FUNDS TRUST

(Exact Name of Registrant as Specified in Charter)

525 Market Street

San Francisco, California 94105

(Address of Principal Executive Offices)

(800) 222-8222

(Registrant's Telephone Number)

C. David Messman

Wells Fargo Funds Management, LLC

525 Market Street, 12th Floor

San Francisco, California 94105

(Name and Address of Agent for Service)

With a copy to:

Marco E. Adelfio, Esq.

Goodwin Procter LLP

901 New York Avenue, N.W.

Washington, D.C. 20001

It is proposed that this filing will become effective on June 27, 2011 pursuant to Rule 488.

No filing fee is required under the Securities Act of 1933 because an indefinite number of shares of beneficial interest in the Registrant has previously been registered pursuant to Rule 24f-2 under the Investment Company Act of 1940, as amended.

WELLS FARGO FUNDS TRUST

PART A

PROSPECTUS/PROXY STATEMENT

WELLS FARGO FUNDS TRUST July 1, 2011 Dear Shareholder, On May 18, 2011, the investment adviser to Wells Fargo Advantage Funds®, Wells Fargo Funds Management, LLC ("Funds Management"), proposed to the Board of Trustees of Wells Fargo Funds Trust, the

mergers outlined in the table below. The Board of Trustees approved the proposed mergers and the related Agreement and Plan

of Reorganization, subject to the approval by shareholders of each Target Fund shown in the table below. As a result, you are invited to vote on a proposal to merge your Target Fund into the corresponding Acquiring Fund shown in

the table below (each, a "Merger" and together, the "Mergers"). The Board of Trustees has unanimously approved each Merger

and recommends that you vote FOR this proposal. Target Fund Acquiring Fund Wells Fargo Advantage Disciplined Value Fund Wells Fargo Advantage Large Company Value Fund Wells Fargo Advantage Disciplined Global Equity Fund Wells Fargo Advantage Intrinsic World Equity Fund If approved by shareholders, this is a general summary of how each Merger will work:

Each Target Fund will transfer all of its assets to the corresponding Acquiring Fund.

525 Market Street, 12th Floor

San Francisco, CA 94105

1.800.222.8222

Each Acquiring Fund will assume all of the liabilities of the corresponding Target Fund.

Each Acquiring Fund will issue new shares that will be distributed to you in an amount equal to the value of your Target Fund shares.

-

Each Target Fund shareholder will become a shareholder of the corresponding Acquiring Fund and will have his or her investment managed in accordance with the Acquiring Fund's investment strategies.

-

You will not incur any sales charges or similar transaction charges as a result of the Merger.

-

It is expected that the Merger will not be taxable to the Target Fund or its shareholders for U.S. federal income tax purposes.

Details about your Target Fund's and Acquiring Fund's investment goals, principal investment strategies, management, past performance, principal risks, fees, and expenses, along with additional information about the Mergers, are contained in the attached prospectus/proxy statement. Please read it carefully.

A special meeting of each Target Fund's shareholders will be held on August 19, 2011. Although you are welcome to attend the meeting in person, you do not need to do so in order to vote your shares. If you do not expect to attend the meeting, please complete, date, sign and return the enclosed proxy card in the postage-paid envelope provided. You may also vote by other means, such as by telephone, by following the voting instructions as outlined in your proxy card. If your Target Fund does not receive your vote after several weeks, you may receive a telephone call from The Altman Group requesting your vote. The Altman Group has been retained to act as our proxy solicitor and will receive approximately __ as compensation for seeking shareholder votes and answering shareholder questions. That cost and any other expenses of the Mergers will be paid by Funds Management or one of its affiliates and so will not be borne by shareholders of any Fund. If you have any questions about the Mergers or the proxy card, please call The Altman Group at (866) 828-6931 (toll-free).

Remember, your vote is important to us, no matter how many shares you own. Please take this opportunity to vote. Thank you for taking this matter seriously and participating in this important process.

Sincerely,

Karla Rabusch

President

Wells Fargo Funds Management, LLC

WELLS FARGO FUNDS TRUST

525 Market Street, 12th Floor

San Francisco, CA 94105

1.800.222.8222

July 1, 2011

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS TO BE HELD ON AUGUST 19, 2011

A Special Meeting (the "Meeting") of Shareholders of each Target Fund, each a series of Wells Fargo Funds Trust (the "Trust"), as set forth in the table below, will be held at the offices of Wells Fargo Advantage Funds®, 525 Market Street, San Francisco, California 94105 on August 19, 2011 at 10:00 a.m., Pacific time.

|

Target Fund |

Acquiring Fund |

|

Wells Fargo Advantage Disciplined Value Fund |

Wells Fargo Advantage Large Company Value Fund |

|

Wells Fargo Advantage Disciplined Global Equity Fund |

Wells Fargo Advantage Intrinsic World Equity Fund |

With respect to each Target Fund, the Meeting is being held for the following purposes:

-

To consider and act upon an Agreement and Plan of Reorganization (the "Plan") dated as of __, providing for the reorganization of the Target Fund, including the acquisition of all of the assets of the Target Fund by the corresponding Acquiring Fund in exchange for shares of the Acquiring Fund (the "Acquisition Shares") and the assumption by the Acquiring Fund of all of the liabilities of the Target Fund. The Plan also provides for the prompt distribution of the Acquisition Shares to shareholders of the corresponding Target Fund in liquidation of the Target Fund.

-

To transact any other business which may properly come before the Meeting or any adjournment(s) thereof.

Any adjournment(s) of the Meeting will be held at the above address. The Board of Trustees of the Trust has fixed the close of business on May 26, 2011 as the record date (the "Record Date") for the Meeting. Only shareholders of record as of the close of business on the Record Date will be entitled to this notice, and to vote at the Meeting or any adjournment(s) thereof.

IT IS IMPORTANT THAT PROXY CARDS BE RETURNED PROMPTLY. ALL SHAREHOLDERS ARE URGED TO COMPLETE, DATE, SIGN AND RETURN WITHOUT DELAY THEIR ENCLOSED PROXY CARD IN THE ENCLOSED POSTAGE-PAID ENVELOPE, OR TO VOTE USING ONE OF THE OTHER METHODS DESCRIBED AT THE END OF THE PROSPECTUS/PROXY STATEMENT SO THAT YOUR SHARES MAY BE REPRESENTED AT THE MEETING. YOUR PROMPT ATTENTION TO THE ENCLOSED PROXY CARD WILL HELP TO AVOID THE EXPENSE OF FURTHER SOLICITATION.

By order of the Board of Trustees,

C. David Messman

Secretary

WELLS FARGO FUNDS TRUST

525 Market Street, 12th Floor

San Francisco, CA 94105

1.800.222.8222

July 1, 2011

PROSPECTUS/PROXY STATEMENT

This prospectus/proxy statement contains information you should know before voting on the proposed merger (the "Merger") of your Target Fund into the corresponding Acquiring Fund as set forth and defined in the table below, each of which is a series of Wells Fargo Funds Trust (the "Trust"), a registered open-end management investment company. If approved, the Merger will result in your receiving shares of the Acquiring Fund in exchange for your shares of the Target Fund.

|

Target Fund |

Acquiring Fund |

|

Wells Fargo Advantage Disciplined Value Fund |

Wells Fargo Advantage Large Company Value Fund |

|

Wells Fargo Advantage Disciplined Global Equity Fund |

Wells Fargo Advantage Intrinsic World Equity Fund |

The Target Funds and Acquiring Funds listed above are collectively referred to as the "Funds."

Please read this prospectus/proxy statement carefully and retain it for future reference. Additional information concerning each Fund and Merger has been filed with the Securities and Exchange Commission ("SEC").

The prospectuses of each Target Fund and each Acquiring Fund are incorporated into this document by reference and are legally deemed to be part of this prospectus/proxy statement. The statement of additional information ("SAI") relating to this prospectus/proxy statement (the "Merger SAI"), dated the same date as this prospectus/proxy statement, is also incorporated by reference into this document and is legally deemed to be part of this prospectus/proxy statement. The SAI and the annual reports of each Target Fund and each Acquiring Fund are incorporated into the Merger SAI by reference and are legally deemed to be part of the Merger SAI. Copies of these documents pertaining to either a Target Fund or an Acquiring Fund are available upon request without charge by writing to Wells Fargo Advantage Funds®, P.O. Box 8266, Boston, MA 02266-8266, calling 1.800.222.8222 or visiting the Wells Fargo Advantage Funds Web site at www.wellsfargo.com/advantagefunds.

You may also view or obtain these documents from the SEC: by phone at 1.800.SEC.0330 (duplicating fee required); in person or by mail at Public Reference Section, Securities and Exchange Commission, 100 F Street, N.E., Washington, D.C. 20549-0213 (duplicating fee required); by email at publicinfo@sec.gov (duplicating fee required); or by internet at www.sec.gov.

The SEC has not approved or disapproved these securities or determined if this prospectus/proxy statement is truthful or complete. Any representation to the contrary is a criminal offense.

The shares offered by this prospectus/proxy statement are not deposits of a bank, and are not insured, endorsed or guaranteed by the FDIC or any government agency and involve investment risk, including possible loss of your original investment.

Table of Contents

OVERVIEW

This section summarizes the primary features and consequences of each Merger. This summary is qualified in its entirety by reference to the information contained elsewhere in this prospectus/proxy statement, in the Merger SAI, in each Fund's prospectus, in each Fund's financial statements contained in its annual report, in each Fund's SAI, and in the Agreement and Plan of Reorganization (the "Plan"), a form of which is attached as Exhibit A hereto.

Key Features of the Mergers

The Plan sets forth the key features of each Merger and generally provides for the following:

-

the transfer of all of the assets of the Target Fund to the Acquiring Fund in exchange for shares of the Acquiring Fund;

-

the assumption by the Acquiring Fund of all of the liabilities of the Target Fund;

-

the liquidation of the Target Fund by distributing the shares of the Acquiring Fund to the Target Fund's shareholders; and

-

the assumption of the costs of each Merger by Wells Fargo Funds Management, LLC ("Funds Management") or one of its affiliates.

The Mergers are scheduled to take place on or about August 29, 2011. For a more complete description of the Mergers, see the section entitled "Agreement and Plan of Reorganization," as well as Exhibit A.

Board of Trustees Recommendation

At a meeting held on May 18, 2011, the Board of Trustees of the Trust, including a majority of the Trustees who are not "interested persons" of each Target Fund, as that term is defined in the Investment Company Act of 1940, as amended (the "1940 Act") (the "Independent Trustees"), considered and unanimously approved the Merger of each Target Fund.

Before approving the Merger, the Trustees reviewed, among other things, information about the Funds and the Mergers. This included, among other things, a comparison of various factors, such as the relative sizes of the Funds, the performance records of the Funds, and the expenses of the Funds (including pro forma expense information of each Acquiring Fund following the Mergers), as well as the similarities and differences between the Funds' investment goals, principal investment strategies and specific portfolio characteristics.

Shareholders are being asked to approve new Sub-Advisory Agreements with Golden Capital Management, LLC ("Golden Capital") for the Wells Fargo Advantage Disciplined U.S. Core Fund (the "Disciplined U.S. Core Fund") and the Wells Fargo Advantage Index Portfolio (the "Index Portfolio") in anticipation of the expected termination of the current investment sub-advisory agreements (the "Current Agreements") between Wells Fargo Funds Management, LLC ("Funds Management") and Wells Capital Management Incorporated ("Wells Capital"). The expected termination of the Current Agreements results from Wells Capital's agreement to acquire an additional 20% ownership interest in Golden Capital in exchange for the contribution by Wells Capital of its Global Strategy Products advisory business to Golden Capital.

The Board of Trustees of the Trust, including all of the Independent Trustees, has concluded that the Merger would be in the best interests of your Target Fund, and that existing shareholders' interests will not be diluted as a result of the Merger. Accordingly, the Trustees have submitted the Plan to the Target Fund's shareholders and unanimously recommended its approval. The Board of Trustees of the Trust has also approved the Plan on behalf of each Acquiring Fund.

For further information about the considerations of the Board of Trustees, please see the section entitled "Board Considerations."

Merger Summary (Goals, Strategies, Risks, Performance, Expense, Management and Tax Information)

The following section provides a comparison between the Funds with respect to their investment goals, principal investment strategies, fundamental investment policies, risks, performance records, and expenses. It also provides information about what the management and share class structure of your Acquiring Fund will be after the Merger. The information below is only a summary; for more detailed information, please see the rest of this prospectus/proxy statement and each Fund's prospectus and SAI. In this section, percentages of a Fund's "net assets" are measured as percentages of net assets plus borrowings for investment purposes. References to "we" in the principal investment strategy discussion for a Fund generally refer to Funds Management or a sub-adviser.

WELLS FARGO ADVANTAGE DISCIPLINED VALUE FUND INTO WELLS FARGO ADVANTAGE LARGE COMPANY VALUE FUND

Share Class Information

The following table illustrates the share class of the Acquiring Fund you will receive as a result of the Merger in exchange for the shares you own in your Target Fund.

|

If you own this class of shares of Wells Fargo Advantage Disciplined Value Fund: |

You will receive this class of shares of Wells Fargo Advantage Large Company Value Fund: |

||||

|

Class A |

Class A |

||||

|

Class C |

Class C |

||||

|

Administrator Class |

Administrator Class |

||||

|

Institutional Class |

Institutional Class |

||||

|

Investor Class |

Investor Class |

The Acquiring Fund shares you receive as a result of the Merger will have the same total value as the total value of your Target Fund shares as of the close of business on the business day immediately prior to the Merger.

The procedures for buying, selling and exchanging shares of the Funds are the same. For additional information with respect to the share classes listed above, see the section entitled "Share Class Information." Additional information on how you can buy, redeem or exchange shares of each Fund is available in the Fund's prospectus and SAI.

Investment Goal and Strategy Comparison

The following section compares the investment goals, principal investment strategies and fundamental investment policies of the Funds. The investment goals of the Funds may be changed without shareholder approval.

The Funds' investment goals are identical in that both Funds seek long-term capital appreciation. In addition, each Fund normally invests at least 80% of its assets in equity securities of large-capitalization companies, which we define as companies with market capitalizations within the range of the Russell 1000® Index. The Funds' principal investment strategies are similar. However, the Wells Fargo Advantage Large Company Value Fund has a policy that allows it to invest up to 25% of its assets in equity securities of foreign issuers through ADRs and similar investments, whereas the Wells Fargo Advantage Disciplined Value Fund may invest in foreign securities but does not do so as part of its principal investment strategy. A more complete description of each Fund's investment goals and principal investment strategies is provided below.

|

WELLS FARGO ADVANTAGE DISCIPLINED VALUE FUND (Target Fund) |

WELLS FARGO ADVANTAGE LARGE COMPANY VALUE FUND (Acquiring Fund) |

||||

|

INVESTMENT GOAL |

|||||

|

The Fund seeks long-term capital appreciation. |

The Fund seeks long-term capital appreciation. |

||||

|

PRINCIPAL INVESTMENT STRATEGIES |

|||||

|

Under normal circumstances, we invest at least 80% of the Fund's total assets in equity securities of large-capitalization companies. We define large-capitalization companies as companies with market capitalizations within the range of the Russell 1000® Index. The market capitalization range of the Russell 1000® Index was approximately $348 million to $275 billion, as of June 28, 2010, and is expected to change frequently. |

Under normal circumstances,we invest at least 80% of the Fund's net assets in equity securities of large-capitalization companies and up to 25% of the Fund's total assets in equity securities of foreign issuers through ADRs and similar investments. We invest principally in equity securities of large-capitalization companies, which we define as companies with market capitalizations within the range of the Russell 1000® Index. The market capitalization range of the Russell 1000® Index was $348 million to $275 billion, as of June 28, 2010, and is expected to change frequently. |

||||

|

Furthermore, we may use futures, options or swap agreements, as well as other derivatives, to manage risk or to enhance return. |

Furthermore, we may use futures, options or swap agreements, as well as other derivatives, to manage risk or to enhance return. |

||||

|

We employ a quantitative investment approach that seeks to identify companies with favorable investment characteristics in the areas of valuation, investor sentiment and quality. These fundamentally-based ideas are combined to drive stock selection. For example, stock selection characteristics include high relative cash-flow generation, favorable earnings estimate revisions, and strong corporate financial measures, among others. In the aggregate, our approach seeks to offer portfolio risk characteristics similar to those of the Russell 1000® Value Index, while emphasizing those investment characteristics we consider most likely to lead to performance greater than that of the Russell 1000® Value Index. |

Our investment process is highly aware of our sector allocations against our benchmark because we seek outperformance through stock selection rather than overweighting or underweighting certain sectors. We begin our process by ranking approximately 5,000 stocks by market capitalization. Stocks that pass this screen for us will be in the top 20% of market capitalization. We then use our own predetermined criteria (e.g., debt as a portion of firms' total value; net profits as a portion of firms' total revenue; and price-to-earnings ratios) to refine the resulting investment candidates. From there, we perform quantitative financial statement analyses focusing on the strengths and trends in income statements, cash flow statements and balance sheets. Next, using proprietary modeling that determines the valuation of each stock relative to its peers in its respective business sector, we filter the remaining stocks. Our last filter consists of our qualitative assessments for each stock combining inputs that include our assessments of management teams, competitive strengths, business trends, and catalysts in companies' respective businesses. The resulting final portfolio consists of a diverse group of stocks, each of which is believed to have compelling valuations relative to its respective business sector peers and attractive metrics in terms of its appreciation potential. |

||||

|

We regularly review the investments of the portfolio and may sell a portfolio holding when, among other reasons, we believe there is deterioration in the underlying fundamentals of the business, or we have identified a more attractive investment opportunity. |

In general, a stock may be sold if its valuation rises significantly within its respective industry peer group, if its position appreciates above 4% of the portfolio's total market value, if a company's management strategy deviates negatively from our expectations, or if a company's financial statements start to degrade materially. |

||||

The fundamental investment policies of the Funds are identical. For a comparative chart of fundamental investment policies, please see Exhibit B.

Principal Risk Comparison

The principal risks of your Target Fund are substantially similar, but not identical to those of the Acquiring Fund due to the similarity of the Target Fund's and Acquiring Fund's investment goals and strategies. Although each of the Funds may be subject to all or substantially all of the risks listed below, they may be subject to a particular risk to different degrees or not at all. For example, because the Target Fund does not invest in equity securities of foreign issuers as part of its principal investment strategy, Foreign Investment Risk is not a principal risk of the Target Fund. In addition, there may be differences in risk disclosure in the Funds' prospectuses that do not necessarily correspond to actual differences in strategies.

The below table compares the principal risks factors of the Target Fund with those of the Acquiring Fund. These risks are described in the section entitled "Risk Descriptions."

|

WELLS FARGO ADVANTAGE DISCIPLINED VALUE FUND (Target Fund) |

WELLS FARGO ADVANTAGE LARGE COMPANY VALUE FUND (Acquiring Fund) |

||||

|

Counter-Party Risk |

Counter-Party Risk |

||||

|

Derivatives Risk |

Derivatives Risk |

||||

|

Not subject to Foreign Investment Risk |

Foreign Investment Risk |

||||

|

Issuer Risk |

Issuer Risk |

||||

|

Larger Company Securities Risk |

Larger Company Securities Risk |

||||

|

Leverage Risk |

Leverage Risk |

||||

|

Liquidity Risk |

Liquidity Risk |

||||

|

Management Risk |

Management Risk |

||||

|

Market Risk |

Market Risk |

||||

|

Regulatory Risk |

Regulatory Risk |

||||

|

Value Style Investment Risk |

Value Style Investment Risk |

In addition, each Fund has other investment policies, practices and restrictions which, together with the Fund's related risks, are set forth in the Fund's prospectus and SAI.

Fund Performance Comparison

The following information provides some indication of the risks of investing in each Fund by showing changes in each Fund's performance from year to year. Past performance before and after taxes is no guarantee of future results. Current month-end performance information is available at www.wellsfargo.com/advantagefunds.

For additional information about the performance history of the Funds, please see Exhibit C.

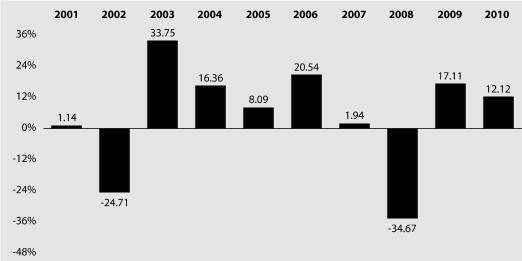

Calendar Year Total Returns for Administrator Class Shares (%) of the Wells Fargo Advantage Disciplined Value Fund as of 12/31 each year

|

Highest Quarter: |

2nd Quarter 2003 |

+16.92% |

|

Lowest Quarter: |

4th Quarter 2008 |

-20.64% |

|

Year-to-date total return as of 3/31/2011 is +8.03% |

||

|

Average Annual Total Returns for the periods ended 12/31/2010 (Returns reflect applicable sales charges) |

||||||||||

|

|

Inception Date of Share Class |

|

1 Year |

|

5 Year |

|

10 Year |

|||

|

Class A (before taxes) |

3/18/2005 |

5.46% |

-0.34% |

2.22% |

||||||

|

Class C (before taxes) |

3/18/2005 |

9.96% |

0.04% |

2.02% |

||||||

|

Administrator Class (before taxes) |

5/8/1992 |

12.12% |

1.06% |

3.05% |

||||||

|

Administrator Class (after taxes on distributions) |

5/8/1992 |

11.89% |

0.18% |

2.10% |

||||||

|

Administrator Class (after taxes on distributions and the sale of Fund Shares) |

5/8/1992 |

8.16% |

0.86% |

2.49% |

||||||

|

Institutional Class (before taxes) |

7/30/2010 |

12.21% |

1.08% |

3.06% |

||||||

|

Investor Class (before taxes) |

7/16/2010 |

11.96% |

1.03% |

3.03% |

||||||

|

Russell 1000® Value Index (reflects no deduction for fees, expenses, or taxes) |

15.51% |

1.28% |

3.26% |

|||||||

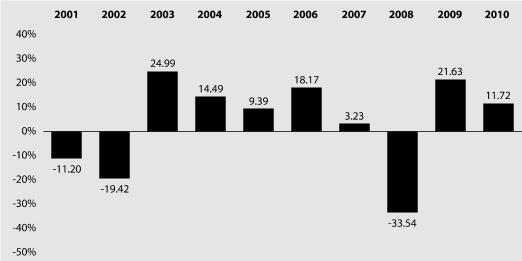

Calendar Year Total Returns for Administrator Class Shares (%) of the Wells Fargo Advantage Large Company Value Fund as of 12/31 each year

|

Highest Quarter: |

3rd Quarter 2009 |

+17.65% |

|

Lowest Quarter: |

4th Quarter 2008 |

-21.59% |

|

Year-to-date total return as of 3/31/2011 is +6.46% |

||

|

Average Annual Total Returns for the periods ended 12/31/2010 (Returns reflect applicable sales charges) |

||||||||||

|

Inception Date of Share Class |

1 Year |

5 Year |

10 Year |

|||||||

|

Class A (before taxes) |

3/31/2008 |

4.99% |

0.39% |

1.15% |

||||||

|

Class C (before taxes) |

3/31/2008 |

9.45% |

0.90% |

1.08% |

||||||

|

Administrator Class (before taxes) |

12/31/2001 |

11.72% |

1.95% |

2.12% |

||||||

|

Administrator Class (after taxes on distributions) |

12/31/2001 |

11.48% |

0.92% |

1.16% |

||||||

|

Administrator Class (after taxes on distributions and the sale of Fund Shares) |

12/31/2001 |

7.91% |

1.61% |

1.61% |

||||||

|

Institutional Class (before taxes) |

3/31/2008 |

11.82% |

2.05% |

2.17% |

||||||

|

Investor Class (before taxes) |

7/1/1993 |

11.26% |

1.56% |

1.75% |

||||||

|

Russell 1000® Value Index (reflects no deduction for fees, expenses, or taxes) |

15.51% |

1.28% |

3.26% |

|||||||

Shareholder Fee and Fund Expense Comparison

For information about the share class of the Acquiring Fund that you will receive in connection with the Merger, please see the section entitled "Share Class Information" above.

The sales charges for each class of shares of your Target Fund are identical to those of the corresponding class of shares of the Acquiring Fund. This section compares the fees and expenses you pay if you buy, hold, and sell shares of the Target Fund and the Acquiring Fund.

The following tables entitled "Shareholder Fees" allow you to compare the maximum sales charges of the Funds. The Pro Forma table also shows you what the sales charges will be, assuming the Merger takes place. The Target Fund shareholders will not pay any front-end or deferred sales charges in connection with the Merger.

You may qualify for sales charge discounts if you and your family invest, or agree to invest in the future, at least $50,000 in the aggregate in specified classes of Wells Fargo Advantage Funds. More information about these and other discounts is available in the "Buying, Selling and Exchanging Fund Shares" section of this prospectus/proxy statement and from your financial professional and in the Funds' prospectuses.

The following tables entitled "Annual Fund Operating Expenses" allow you to compare the annual operating expenses of the Funds. The total annual fund operating expenses for both Funds set forth in the following tables are based on the actual expenses incurred for each Fund's most recent fiscal year ended July 31, 2010. The pro forma expense table shows you what the total annual fund operating expenses (before and after waiver) would have been for the Acquiring Fund for the twelve-month period ended January 31, 2011, assuming the Merger had taken place at the beginning of that period.

Shareholder Fees (fees paid directly from your investment)

|

Wells Fargo Advantage Disciplined Value Fund |

|||||||||||||||

|

|

|

Class A |

|

Class C |

|

Administrator Class |

|

Institutional Class |

|

Investor Class |

|||||

|

Maximum sales charge (load) imposed on purchases (as a percentage of the offering price) |

5.75% |

None |

None |

None |

None |

||||||||||

|

Maximum deferred sales charge (load) (as a percentage of offering price) |

None |

1.00% |

None |

None |

None |

||||||||||

|

Wells Fargo Advantage Large Company Value Fund (Pre-Merger) |

|||||||||||||||

|

|

|

Class A |

|

Class C |

|

Administrator Class |

|

Institutional Class |

|

Investor Class |

|||||

|

Maximum sales charge (load) imposed on purchases (as a percentage of the offering price) |

5.75% |

None |

None |

None |

None |

||||||||||

|

Maximum deferred sales charge (load) (as a percentage of offering price) |

None |

1.00% |

None |

None |

None |

||||||||||

|

Wells Fargo Advantage Large Company Value Fund (Pro Forma) |

|||||||||||||||

|

|

|

Class A |

|

Class C |

|

Administrator Class |

|

Institutional Class |

|

Investor Class |

|||||

|

Maximum sales charge (load) imposed on purchases (as a percentage of the offering price) |

5.75% |

None |

None |

None |

None |

||||||||||

|

Maximum deferred sales charge (load) (as a percentage of offering price) |

None |

1.00% |

None |

None |

None |

||||||||||

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment)

|

Wells Fargo Advantage Disciplined Value Fund |

||||||||||||||

|

|

Management Fees |

Distribu- |

Other Expenses |

|

Total Annual Fund Operating Expenses1 |

|

Waiver of Fund Expenses |

|

Total Annual Fund Operating Expenses After Fee Waiver2 |

|||||

|

Class A |

0.55% |

0.00% |

0.69% |

1.24% |

0.14% |

1.10% |

||||||||

|

Class C |

0.55% |

0.75% |

0.69% |

1.99% |

0.14% |

1.85% |

||||||||

|

Administrator Class |

0.55% |

0.00% |

0.53% |

1.08% |

0.23% |

0.85% |

||||||||

|

Institutional Class |

0.55% |

0.00% |

0.26% |

0.81% |

0.16% |

0.65% |

||||||||

|

Investor Class |

0.55% |

0.00% |

0.76% |

1.31% |

0.14% |

1.17% |

||||||||

| 1 | Expenses have been adjusted as necessary from amounts incurred during the Fund's most recent fiscal year to reflect current fees and expenses. |

| 2 | Funds Management has committed through July 18, 2013 to waive fees and/or reimburse expenses to the extent necessary to ensure that the Fund's Total Annual Fund Operating Expenses After Fee Waiver, excluding brokerage commissions, interest, taxes, extraordinary expenses, and the expenses of any money market fund or other fund held by the Fund, do not exceed the Total Annual Fund Operating Expenses After Fee Waiver shown. After this time, the Total Annual Fund Operating Expenses After Fee Waiver may be increased or the commitment to maintain the same may be terminated only with the approval of the Board of Trustees. |

|

Wells Fargo Advantage Large Company Value Fund (Pre-Merger) |

||||||||||||||

|

|

Management Fees |

Distribu- |

Other Expenses |

|

Acquired Fund Fees and Expenses |

Total Annual Fund Operating Expenses |

Waiver of Fund Expenses |

|

Total Annual Fund Operating Expenses After Fee Waiver2 |

|||||

|

Class A |

0.65% |

0.00% |

0.70% |

0.01% |

1.36% |

0.10% |

1.26% |

|||||||

|

Class C |

0.65% |

0.75% |

0.70% |

0.01% |

2.11% |

0.10% |

2.01% |

|||||||

|

Administrator Class |

0.65% |

0.00% |

0.54% |

0.01% |

1.20% |

0.23% |

0.97% |

|||||||

|

Institutional Class |

0.65% |

0.00% |

0.27% |

0.01% |

0.93% |

0.17% |

0.76% |

|||||||

|

Investor Class |

0.65% |

0.00% |

0.77% |

0.01% |

1.43% |

0.10% |

1.33% |

|||||||

| 1 | Expenses have been adjusted as necessary from amounts incurred during the Fund's most recent fiscal year to reflect current fees and expenses. |

| 2 | Funds Management has committed through November 30, 2011 to waive fees and/or reimburse expenses to the extent necessary to ensure that the Fund's Total Annual Fund Operating Expenses After Fee Waiver, excluding brokerage commissions, interest, taxes, extraordinary expenses, and the expenses of any money market fund or other fund held by the Fund, do not exceed 1.25% for Class A, 2.00% for Class C, 0.96% for Administrator Class, 0.75% for Institutional Class, and 1.32% for Investor Class. After this time, the Total Annual Fund Operating Expenses After Fee Waiver may be increased or the commitment to maintain the same may be terminated only with the approval of the Board of Trustees. |

|

Wells Fargo Advantage Large Company Value Fund (Pro Forma) |

||||||||||||||

|

|

Management Fees |

Distribu- |

Other Expenses |

|

Total Annual Fund Operating Expenses1 |

|

Waiver of Fund Expenses |

|

Total Annual Fund Operating Expenses After Fee Waiver2 |

|||||

|

Class A |

0.65% |

0.00% |

0.64% |

1.29% |

0.19% |

1.10% |

||||||||

|

Class C |

0.65% |

0.75% |

0.64% |

2.04% |

0.19% |

1.85% |

||||||||

|

Administrator Class |

0.65% |

0.00% |

0.48% |

1.13% |

0.28% |

0.85% |

||||||||

|

Institutional Class |

0.65% |

0.00% |

0.21% |

0.86% |

0.21% |

0.65% |

||||||||

|

Investor Class |

0.65% |

0.00% |

0.71% |

1.36% |

0.19% |

1.17% |

||||||||

| 1 | Expenses have been adjusted as necessary from amounts incurred during the Fund's most recent fiscal year to reflect current fees and expenses. |

| 2 | Funds Management has committed from the date of the Merger through July 18, 2013 to waive fees and/or reimburse expenses to the extent necessary to ensure that the Fund's Total Annual Fund Operating Expenses After Fee Waiver, excluding brokerage commissions, interest, taxes, extraordinary expenses, and the expenses of any money market fund or other fund held by the Fund, do not exceed the Total Annual Fund Operating Expenses After Fee Waiver shown. After this time, the Total Annual Fund Operating Expenses After Fee Waiver may be increased or the commitment to maintain the same may be terminated only with the approval of the Board of Trustees. |

Example of Fund Expenses

The example below is intended to help you compare the costs of investing in the Target Fund with the costs of investing in the Acquiring Fund, both before and after the Merger, and are for illustration only. The example assumes a $10,000 initial investment, 5% annual total return, and that operating expenses remain the same as in the tables above. The fee waiver in the Total Annual Fund Operating Expenses After Fee Waiver is only reflected for the length of the waiver commitment in each of the following time periods. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

|

Wells Fargo Advantage Disciplined Value Fund |

||||||||||||||

|

|

If you sold your shares, you would pay: |

|

|

|

|

|

|

|

If you held your shares, you would pay: |

|||||

|

After: |

Class A |

Class C |

Administrator Class |

Institutional Class |

Investor Class |

Class C |

||||||||

|

1 Year |

$681 |

$288 |

$87 |

$66 |

$119 |

$188 |

||||||||

|

3 Years |

$905 |

$582 |

$271 |

$208 |

$372 |

$582 |

||||||||

|

5 Years |

$1,177 |

$1,032 |

$525 |

$400 |

$676 |

$1,032 |

||||||||

|

10 Years |

$1,852 |

$2,281 |

$1,251 |

$954 |

$1,540 |

$2,281 |

||||||||

|

Wells Fargo Advantage Large Company Value Fund (Pre-Merger) |

||||||||||||||

|

|

If you sold your shares, you would pay: |

|

|

|

|

|

|

|

If you held your shares, you would pay: |

|||||

|

After: |

Class A |

Class C |

Administrator Class |

Institutional Class |

Investor Class |

Class C |

||||||||

|

1 Year |

$696 |

$304 |

$99 |

$78 |

$135 |

$204 |

||||||||

|

3 Years |

$972 |

$651 |

$358 |

$279 |

$443 |

$651 |

||||||||

|

5 Years |

$1,268 |

$1,125 |

$638 |

$498 |

$772 |

$1,125 |

||||||||

|

10 Years |

$2,108 |

$2,434 |

$1,434 |

$1,127 |

$1,704 |

$2,434 |

||||||||

|

Wells Fargo Advantage Large Company Value Fund (Pro Forma) |

||||||||||||||

|

|

If you sold your shares, you would pay: |

|

|

|

|

|

|

|

If you held your shares, you would pay: |

|||||

|

After: |

Class A |

Class C |

Administrator Class |

Institutional Class |

Investor Class |

Class C |

||||||||

|

1 Year |

$681 |

$288 |

$87 |

$66 |

$119 |

$188 |

||||||||

|

3 Years |

$924 |

$602 |

$302 |

$231 |

$392 |

$602 |

||||||||

|

5 Years |

$1,207 |

$1,062 |

$567 |

$434 |

$707 |

$1,062 |

||||||||

|

10 Years |

$2,010 |

$2,338 |

$1,323 |

$1,021 |

$1,601 |

$2,338 |

||||||||

The Target Fund and Acquiring Fund have each adopted a distribution plan pursuant to Rule 12b-1 under the 1940 Act (a "Distribution Plan") for Class C shares. Each Fund has a shareholder servicing fee of up to 0.25% for Class A, Class C, Administrator Class and Investor Class shares.

Portfolio Turnover. The Target Fund and Acquiring Fund pay transaction costs, such as commissions or dealer mark-ups, when each buys and sells securities (or "turns over" its portfolio). A higher portfolio turnover may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in the annual fund operating expenses or in the example, affect each Fund's performance. During the most recent fiscal year, the Target Fund's portfolio turnover rate was 71% of the average value of its portfolio and the Acquiring Fund's portfolio turnover rate was 42% of the average value of its portfolio.

Fund Management Information

The following table identifies the investment adviser, investment sub-adviser and portfolio manager(s) for the Acquiring Fund. Further information about the management of the Acquiring Fund can be found under the section entitled "Management of the Funds."

|

Wells Fargo Advantage Large Company Value Fund |

||

|

Investment Adviser |

Wells Fargo Funds Management, LLC |

|

|

Investment Sub-Adviser |

Phocas Financial Corporation |

|

|

Portfolio Manager, Title/Managed Since |

Stephen L. Block, CFA, Portfolio Manager / 2008 |

|

Tax Information

It is expected that the Merger will be tax-free to the Funds and their shareholders for U.S. federal income tax purposes, and receipt of an opinion substantially to that effect from Proskauer Rose LLP, special tax counsel to the Acquiring Fund, is a condition to the obligation of the Funds to consummate the Merger. This means that neither shareholders nor your Target or Acquiring Fund will recognize a gain or loss for U.S. federal income tax purposes directly as a result of the Merger. However, because the Merger will end the tax year of your Target Fund, the Merger may accelerate taxable distributions from your Target Fund to its shareholders.

The cost basis and holding period of your Target Fund shares will carry over to the shares of the Acquiring Fund you receive as a result of the Merger for U.S. federal income tax purposes. At any time prior to the consummation of the Merger, a shareholder may redeem shares, likely resulting in recognition of a gain or loss to the shareholder for U.S. federal income tax purposes if the shareholder holds the shares in a taxable account.

A substantial portion of the securities held by the Target Fund may be disposed of in connection with the Merger. This could result in additional portfolio transaction costs to the Target Fund and increased taxable distributions to shareholders of the Target Fund. The actual tax impact of such sales will depend on the difference between the price at which such portfolio assets are sold and the Target Fund's basis in such assets. Any net realized capital gain from sales that occur prior to the Merger will be distributed to the Target Fund's shareholders as capital gain dividends (to the extent of the excess of net realized long-term capital gain over net realized short-term capital loss) and/or ordinary dividends (to the extent of the excess of net realized short-term capital gain over net realized long-term capital loss) during or with respect to the year of sale (after reduction by any available capital loss carryforwards), and such distributions will be taxable to shareholders.

U.S. federal income tax law generally in effect for this purpose permits each of the Funds to carry forward net capital losses for up to eight taxable years. The Target Fund may be presently entitled to significant net capital loss carryforwards for U.S. federal income tax purposes, as detailed in "Material U.S. Federal Income Tax Consequences of the Mergers." The Merger will cause the tax year of the Target Fund to close, resulting in an earlier expiration of net capital loss carryforwards than would otherwise occur. In addition, your Merger is expected to result in a limitation on the ability of the Acquiring Fund to use its own capital loss carryforwards, if any, and, potentially, to use unrealized capital losses inherent in the tax basis of its current assets, if any, once realized.

Certain other U.S. federal income tax consequences are discussed below under "Material U.S. Federal Income Tax Consequences of the Mergers."

WELLS FARGO ADVANTAGE DISCIPLINED GLOBAL EQUITY FUND INTO WELLS FARGO ADVANTAGE INTRINSIC WORLD EQUITY FUND

Share Class Information

The following table illustrates the share class of the Acquiring Fund you will receive as a result of the Merger in exchange for the shares you own in your Target Fund.

|

If you own this class of shares of Wells Fargo Advantage Disciplined Global Equity Fund: |

You will receive this class of shares of Wells Fargo Advantage Intrinsic World Equity Fund: |

||||

|

Class A |

Class A |

||||

|

Class C |

Class C |

||||

|

Administrator Class |

Administrator Class |

||||

|

Institutional Class |

Institutional Class |

The Acquiring Fund shares you receive as a result of the Merger will have the same total value as the total value of your Target Fund shares as of the close of business on the business day immediately prior to the Merger.

The procedures for buying, selling and exchanging shares of the Funds are the same. For additional information with respect to the share classes listed above, see the section entitled "Share Class Information." Additional information on how you can buy, redeem or exchange shares of each Fund is available in the Fund's prospectus and SAI.

Investment Goal and Strategy Comparison

The following section compares the investment goals, principal investment strategies and fundamental investment policies of the Funds. The investment goals of the Funds may be changed without shareholder approval.

The Funds' investment goals are identical in that both Funds seek long-term capital appreciation. In addition, each Fund normally invests at least 80% of its net assets in equity securities of companies located in no fewer than three countries, which may include the U.S., and each Fund may invest more than 25% of its total assets in any one country. The Funds' principal investment strategies are similar. However, (i) the Wells Fargo Advantage Intrinsic World Equity Fund has a policy to invest between 30% and 70% of the Fund's total assets in equity securities of U.S. companies, whereas the Wells Fargo Advantage Disciplined Global Equity Fund does not have an express policy to invest a particular percentage of assets in equity securities of U.S. companies, and (ii) the Wells Fargo Advantage Intrinsic World Equity Fund has a policy to invest in equity securities of approximately 40 to 60 companies located worldwide, whereas the Wells Fargo Advantage Disciplined Global Equity Fund generally invests in a larger number of companies. A more complete description of each Fund's investment goals and principal investment strategies is provided below.

|

WELLS FARGO ADVANTAGE DISCIPLINED GLOBAL EQUITY FUND (Target Fund) |

WELLS FARGO ADVANTAGE INTRINSIC WORLD EQUITY FUND (Acquiring Fund) |

||||

|

INVESTMENT GOAL |

|||||

|

The Fund seeks long-term capital appreciation. |

The Fund seeks long-term capital appreciation. |

||||

|

PRINCIPAL INVESTMENT STRATEGIES |

|||||

|

Under normal circumstances, we invest at least 80% of the Fund's net assets in equity securities of companies located in no fewer than three countries, which may include the U.S., and we may invest more than 25% of the Fund's total assets in any one country. |

Under normal circumstances, we invest at least 80% of the Fund's net assets in equity securities of companies located in no fewer than three countries, which may include the U.S., and may invest more than 25% of its total assets in any one country. |

||||

|

We normally invest up to 20% of the Fund's total assets in emerging market equity securities. We invest primarily in developed countries, but may invest in emerging markets. |

We invest primarily in developed countries, but may invest up to 20% of the Fund's total assets in emerging market equity securities. |

||||

|

Under normal circumstances, we invest between 30% and 70% of the Fund's total assets in equity securities of U.S. companies. |

|||||

|

We invest principally in equity securities of approximately 40 to 60 companies located worldwide. |

|||||

|

We consider foreign securities to be securities: (1) issued by companies with their principal place of business or principal office or both, as determined in our reasonable discretion, in a country other than the U.S.; or (2) issued by companies for which the principal securities trading market is a country other than the U.S. |

We consider foreign securities to be securities: (1) issued by companies with their principal place of business or principal office or both, as determined in our reasonable discretion, in a country other than the U.S.; or (2) issued by companies for which the principal securities trading market is a country other than the U.S. |

||||

|

We employ a quantitative investment approach to identify companies with favorable investment characteristics in the areas of valuation, investor sentiment and quality. In the aggregate, our approach seeks to offer portfolio risk characteristics similar to those of the benchmark, while emphasizing those investment characteristics we consider most likely to lead to performance greater than that of the benchmark. We regularly review the investments of the portfolio and may sell a portfolio holding when among other reasons, we believe there is deterioration in the underlying fundamentals of the business, or we have identified a more attractive investment opportunity. |

We utilize a long-term focus that is intended to take advantage of investment opportunities presented by what we believe are short-term price anomalies in high-quality stocks. We seek to identify companies with established operating histories, financial strength and management expertise, among other factors. We seek stocks that are trading at a discount to what we believe are their intrinsic values. Fundamental research is performed to identify securities for the portfolio with one or more catalysts present that we believe will unlock the intrinsic value of the securities. These catalysts may include productive use of strong free cash flow, productivity gains, positive change in management or control, innovative or competitively superior products, increasing shareholder focus, or resolution of ancillary problems or misperceptions. We may sell a holding if the value potential is realized, if warning signs emerge of beginning fundamental deterioration or if the valuation is no longer compelling relative to other investment opportunities. We may invest in any sector or country, and at times we may emphasize one or more particular sectors or countries. |

||||

|

We reserve the right to hedge the portfolio's foreign currency exposure by purchasing or selling currency futures and foreign currency forward contracts. However, under normal circumstances, we will not engage in extensive foreign currency hedging. Furthermore, we may use futures, options or swap agreements, as well as other derivatives, to manage risk or to enhance return. |

We reserve the right to hedge the portfolio's foreign currency exposure by purchasing or selling currency futures and foreign currency forward contracts. However, under normal circumstances, we will not engage in extensive foreign currency hedging. Furthermore, we may use futures, options or swap agreements, as well as other derivatives, to manage risk or to enhance return. |

||||

The fundamental investment policies of the Funds are identical. For a comparative chart of fundamental investment policies, please see Exhibit B.

Principal Risk Comparison

The principal risks of your Target Fund are generally similar, but not identical to those of the Acquiring Fund due to the similarity of the Target Fund's and Acquiring Fund's investment goals and strategies. Although each of the Funds may be subject to all or substantially all of the risks listed below, they may be subject to a particular risk to different degrees or not at all. For example, both Focused Portfolio Risk and Foreign Currency Transaction Risk while an investment in the Target Fund is generally not subject to either risk as a principal risk. In addition, there may be differences in risk disclosure in the Funds' prospectuses that do not necessarily correspond to actual differences in strategies.

The below table compares the principal risks factors of the Target Fund with those of the Acquiring Fund. These risks are described in the section entitled "Risk Descriptions."

|

WELLS FARGO ADVANTAGE DISCIPLINED GLOBAL EQUITY FUND (Target Fund) |

WELLS FARGO ADVANTAGE INTRINSIC WORLD EQUITY FUND (Acquiring Fund) |

||||

|

Counter-Party Risk |

Counter-Party Risk |

||||

|

Country Concentration Risk |

Country Concentration Risk |

||||

|

Derivatives Risk |

Derivatives Risk |

||||

|

Emerging Markets Risk |

Emerging Markets Risk |

||||

|

Not subject to Focused Portfolio Risk |

Focused Portfolio Risk |

||||

|

Foreign Currency Transaction Risk |

Foreign Currency Transaction Risk |

||||

|

Foreign Investment Risk |

Foreign Investment Risk |

||||

|

Growth Style Investment Risk |

Not subject to Growth Style Investment Risk |

||||

|

Issuer Risk |

Issuer Risk |

||||

|

Leverage Risk |

Leverage Risk |

||||

|

Liquidity Risk |

Liquidity Risk |

||||

|

Management Risk |

Management Risk |

||||

|

Market Risk |

Market Risk |

||||

|

Regulatory Risk |

Regulatory Risk |

||||

|

Smaller Companies Securities Risk |

Smaller Companies Securities Risk |

||||

|

Value Style Investment Risk |

Value Style Investment Risk |

In addition, each Fund has other investment policies, practices and restrictions which, together with the Fund's related risks, are set forth in the Fund's prospectus and SAI.

Fund Performance Comparison

The following information provides some indication of the risks of investing in each Fund by showing changes in each Fund's performance from year to year. Past performance before and after taxes is no guarantee of future results. Current month-end performance information is available at www.wellsfargo.com/advantagefunds.

For additional information about the performance history of the Funds, please see Exhibit C.

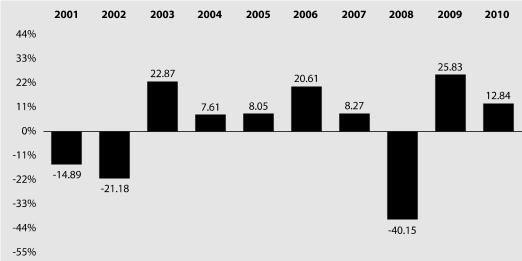

Calendar Year Total Returns for Class A Shares (%) of the Wells Fargo Advantage Disciplined Global Equity Fund as of 12/31 each year

|

Highest Quarter: |

2nd Quarter 2009 |

+19.39% |

|

Lowest Quarter: |

4th Quarter 2008 |

-20.40% |

|

Year-to-date total return as of 3/31/2011 is +5.35% |

||

|

Average Annual Total Returns for the periods ended 12/31/2010 (Returns reflect applicable sales charges) |

||||||||||

|

|

Inception Date of Share Class |

|

1 Year |

|

5 Year |

|

10 Year |

|||

|

Class A (before taxes) |

6/3/1996 |

6.36% |

0.90% |

0.03% |

||||||

|

Class A (after taxes on distributions) |

6/3/1996 |

6.18% |

0.04% |

-0.41% |

||||||

|

Class A (after taxes on distributions and the sale of Fund Shares) |

6/3/1996 |

4.36% |

0.87% |

0.07% |

||||||

|

Class C (before taxes) |

6/3/1996 |

11.06% |

1.36% |

-0.11% |

||||||

|

Administrator Class (before taxes) |

11/1/1995 |

13.17% |

2.37% |

0.89% |

||||||

|

Institutional Class (before taxes) |

7/30/2010 |

13.31% |

2.39% |

0.91% |

||||||

|

MSCI World Index (Net) (reflects no deduction for fees, expenses, or taxes) |

11.76% |

2.43% |

2.31% |

|||||||

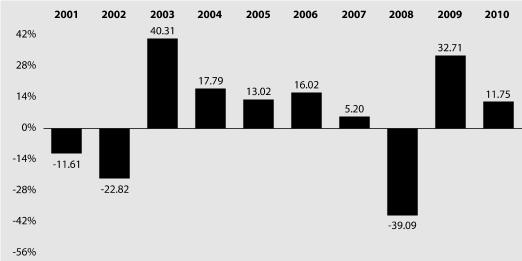

Calendar Year Total Returns for Class A Shares (%) of the Wells Fargo Advantage Intrinsic World Equity Fund as of 12/31 each year

|

Highest Quarter: |

2nd Quarter 2009 |

+25.16% |

|

Lowest Quarter: |

4th Quarter 2008 |

-18.80% |

|

Year-to-date total return as of 3/31/2011 is +5.70% |

||

|

Average Annual Total Returns for the periods ended 12/31/2010 (Returns reflect applicable sales charges) |

||||||||||

|

|

Inception Date of Share Class |

|

1 Year |

|

5 Year |

|

10 Year |

|||

|

Class A (before taxes) |

4/30/1996 |

5.31% |

0.77% |

2.85% |

||||||

|

Class A (after taxes on distributions) |

4/30/1996 |

5.20% |

-0.60% |

2.15% |

||||||

|

Class A (after taxes on distributions and the sale of Fund Shares) |

4/30/1996 |

3.60% |

0.60% |

2.45% |

||||||

|

Class C (before taxes) |

5/18/2007 |

9.93% |

1.23% |

2.70% |

||||||

|

Administrator Class (before taxes) |

5/18/2007 |

12.09% |

2.15% |

3.55% |

||||||

|

Institutional Class (before taxes) |

7/30/2010 |

12.11% |

2.15% |

3.55% |

||||||

|

MSCI World Index (Net) (reflects no deduction for fees, expenses, or taxes) |

11.76% |

2.43% |

2.31% |

|||||||

Shareholder Fee and Fund Expense Comparison

For information about the share class of the Acquiring Fund that you will receive in connection with the Merger, please see the section entitled "Share Class Information" above.

The sales charges for each class of shares of your Target Fund are identical to those of the corresponding class of shares of the Acquiring Fund. This section compares the fees and expenses you pay if you buy, hold, and sell shares of the Target Fund and the Acquiring Fund.

The following tables entitled "Shareholder Fees" allow you to compare the maximum sales charges of the Funds. The Pro Forma table also shows you what the sales charges will be, assuming the Merger takes place. The Target Fund shareholders will not pay any front-end or deferred sales charges in connection with the Merger.

You may qualify for sales charge discounts if you and your family invest, or agree to invest in the future, at least $50,000 in the aggregate in specified classes of Wells Fargo Advantage Funds. More information about these and other discounts is available in the "Buying, Selling and Exchanging Fund Shares" section of this prospectus/proxy statement and from your financial professional and in the Funds' prospectuses.

The following tables entitled "Annual Fund Operating Expenses" allow you to compare the annual operating expenses of the Funds. The total annual fund operating expenses for both Funds set forth in the following tables are based on the actual expenses incurred for the each Fund's most recent fiscal year ended October 31, 2010. The pro forma expense table shows you what the total annual fund operating expenses (before and after waiver) would have been for the Acquiring Fund for the twelve-month period ended October 31, 2010, assuming the Merger had taken place at the beginning of that period.

Shareholder Fees (fees paid directly from your investment)

|

Wells Fargo Advantage Disciplined Global Equity Fund |

||||||||||||

|

|

|

Class A |

|

Class C |

|

Administrator Class |

|

Institutional Class |

||||

|

Maximum sales charge (load) imposed on purchases (as a percentage of the offering price) |

5.75% |

None |

None |

None |

||||||||

|

Maximum deferred sales charge (load) (as a percentage of offering price) |

None |

1.00% |

None |

None |

||||||||

|

Wells Fargo Advantage Intrinsic World Equity Fund (Pre-Merger) |

||||||||||||

|

|

|

Class A |

|

Class C |

|

Administrator Class |

|

Institutional Class |

||||

|

Maximum sales charge (load) imposed on purchases (as a percentage of the offering price) |

5.75% |

None |

None |

None |

||||||||

|

Maximum deferred sales charge (load) (as a percentage of offering price) |

None |

1.00% |

None |

None |

||||||||

|

Wells Fargo Advantage Intrinsic World Equity Fund (Pro Forma) |

||||||||||||

|

|

|

Class A |

|

Class C |

|

Administrator Class |

|

Institutional Class |

||||

|

Maximum sales charge (load) imposed on purchases (as a percentage of the offering price) |

5.75% |

None |

None |

None |

||||||||

|

Maximum deferred sales charge (load) (as a percentage of offering price) |

None |

1.00% |

None |

None |

||||||||

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment)

|

Wells Fargo Advantage Disciplined Global Equity Fund |

||||||||||||||

|

|

Management Fees |

Distribu- |

Other Expenses |

|

Total Annual Fund Operating Expenses1 |

|

Waiver of Fund Expenses |

|

Total Annual Fund Operating Expenses After Fee Waiver2 |

|||||

|

Class A |

0.70% |

0.00% |

0.91% |

1.61% |

0.21% |

1.40% |

||||||||

|

Class C |

0.70% |

0.75% |

0.91% |

2.36% |

0.21% |

2.15% |

||||||||

|

Administrator Class |

0.70% |

0.00% |

0.75% |

1.45% |

0.30% |

1.15% |

||||||||

|

Institutional Class |

0.70% |

0.00% |

0.48% |

1.18% |

0.23% |

0.95% |

||||||||

| 1 | Expenses have been adjusted as necessary from amounts incurred during the Fund's most recent fiscal year to reflect current fees and expenses. |

| 2 | Funds Management has committed through July 18, 2013 to waive fees and/or reimburse expenses to the extent necessary to ensure that the Fund's Total Annual Fund Operating Expenses After Fee Waiver, excluding brokerage commissions, interest, taxes, extraordinary expenses, and the expenses of any money market fund or other fund held by the Fund, do not exceed the Total Annual Fund Operating Expenses After Fee Waiver shown. After this time, the Total Annual Fund Operating Expenses After Fee Waiver may be increased or the commitment to maintain the same may be terminated only with the approval of the Board of Trustees. |

|

Wells Fargo Advantage Intrinsic World Equity Fund (Pre-Merger) |

||||||||||||||

|

|

Management Fees |

Distribu- |

Other Expenses |

|

Total Annual Fund Operating Expenses1 |

|

Waiver of Fund Expenses |

|

Total Annual Fund Operating Expenses After Fee Waiver2 |

|||||

|

Class A |

0.80% |

0.00% |

0.79% |

1.59% |

0.19% |

1.40% |

||||||||

|

Class C |

0.80% |

0.75% |

0.79% |

2.34% |

0.19% |

2.15% |

||||||||

|

Administrator Class |

0.80% |

0.00% |

0.63% |

1.43% |

0.28% |

1.15% |

||||||||

|

Institutional Class |

0.80% |

0.00% |

0.36% |

1.16% |

0.21% |

0.95% |

||||||||

| 1 | Expenses have been adjusted as necessary from amounts incurred during the Fund's most recent fiscal year to reflect current fees and expenses. |

| 2 | Funds Management has committed through July 18, 2013 to waive fees and/or reimburse expenses to the extent necessary to ensure that the Fund's Total Annual Fund Operating Expenses After Fee Waiver, excluding brokerage commissions, interest, taxes, extraordinary expenses, and the expenses of any money market fund or other fund held by the Fund, do not exceed the Total Annual Fund Operating Expenses After Fee Waiver shown. After this time, the Total Annual Fund Operating Expenses After Fee Waiver may be increased or the commitment to maintain the same may be terminated only with the approval of the Board of Trustees. |

|

Wells Fargo Advantage Intrinsic World Equity Fund (Pro Forma) |

||||||||||||||

|

|

Management Fees |

Distribu- |

Other Expenses |

|

Total Annual Fund Operating Expenses1 |

|

Waiver of Fund Expenses |

|

Total Annual Fund Operating Expenses After Fee Waiver2 |

|||||

|

Class A |

0.80% |

0.00% |

0.76% |

1.56% |

0.16% |

1.40% |

||||||||

|

Class C |

0.80% |

0.75% |

0.76% |

2.31% |

0.16% |

2.15% |

||||||||

|

Administrator Class |

0.80% |

0.00% |

0.60% |

1.40% |

0.25% |

1.15% |

||||||||

|

Institutional Class |

0.80% |

0.00% |

0.33% |

1.13% |

0.18% |

0.95% |

||||||||

| 1 | Expenses have been adjusted as necessary from amounts incurred during the Fund's most recent fiscal year to reflect current fees and expenses. |

| 2 | Funds Management has committed from the date of the Merger through July 18, 2013 to waive fees and/or reimburse expenses to the extent necessary to ensure that the Fund's Total Annual Fund Operating Expenses After Fee Waiver, excluding brokerage commissions, interest, taxes, extraordinary expenses, and the expenses of any money market fund or other fund held by the Fund, do not exceed the Total Annual Fund Operating Expenses After Fee Waiver shown. After this time, the Total Annual Fund Operating Expenses After Fee Waiver may be increased or the commitment to maintain the same may be terminated only with the approval of the Board of Trustees. |

Example of Fund Expenses

The example below is intended to help you compare the costs of investing in the Target Fund with the costs of investing in the Acquiring Fund, both before and after the Merger, and are for illustration only. The example assumes a $10,000 initial investment, 5% annual total return, and that operating expenses remain the same as in the tables above. The fee waiver in the Total Annual Fund Operating Expenses After Fee Waiver is only reflected for the length of the waiver commitment in each of the following time periods. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

|

Wells Fargo Advantage Disciplined Global Equity Fund |

||||||||||||||

|

|

If you sold your shares, you would pay: |

|

|

|

|

|

|

|

If you held your shares, you would pay: |

|||||

|

After: |

Class A |

Class C |

Administrator Class |

Institutional Class |

Class C |

|||||||||

|

1 Year |

$709 |

$318 |

$117 |

$97 |

$218 |

|||||||||

|

3 Years |

$1,014 |

$695 |

$398 |

$328 |

$695 |

|||||||||

|

5 Years |

$1,362 |

$1,221 |

$734 |

$603 |

$1,221 |

|||||||||

|

10 Years |

$2,342 |

$2,663 |

$1,682 |

$1,390 |

$2,663 |

|||||||||

|

Wells Fargo Advantage Intrinsic World Equity Fund (Pre-Merger) |

||||||||||||||

|

|

If you sold your shares, you would pay: |

|

|

|

|

|

|

|

If you held your shares, you would pay: |

|||||

|

After: |

Class A |

Class C |

Administrator Class |

Institutional Class |

Class C |

|||||||||

|

1 Year |

$709 |

$318 |

$117 |

$97 |

$218 |

|||||||||

|

3 Years |

$1,012 |

$693 |

$396 |

$326 |

$693 |

|||||||||

|

5 Years |

$1,356 |

$1,215 |

$727 |

$597 |

$1,215 |

|||||||||

|

10 Years |

$2,324 |

$2,646 |

$1,663 |

$1,370 |

$2,646 |

|||||||||

|

Wells Fargo Advantage Intrinsic World Equity Fund (Pro Forma) |

||||||||||||||

|

|

If you sold your shares, you would pay: |

|

|

|

|

|

|

|

If you held your shares, you would pay: |

|||||

|

After: |

Class A |

Class C |

Administrator Class |

Institutional Class |

Class C |

|||||||||

|

1 Year |

$709 |

$318 |

$117 |

$97 |

$218 |

|||||||||

|

3 Years |

$1,009 |

$690 |

$393 |

$322 |

$690 |

|||||||||

|

5 Years |

$1,347 |

$1,205 |

$717 |

$587 |

$1,205 |

|||||||||

|

10 Years |

$2,298 |

$2,620 |

$1,635 |

$1,342 |

$2,620 |

|||||||||

The Target Fund and Acquiring Fund have each adopted a distribution plan pursuant to Rule 12b-1 under the 1940 Act (a "Distribution Plan") for Class C shares. Each Fund has a shareholder servicing fee of up to 0.25% for Class A, Class C and Administrator Class shares.

Portfolio Turnover. The Target Fund and Acquiring Fund pay transaction costs, such as commissions or dealer mark-ups, when each buys and sells securities (or "turns over" its portfolio). A higher portfolio turnover may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in the annual fund operating expenses or in the example, affect each Fund's performance. During the most recent fiscal year, the Target Fund's portfolio turnover rate was 58% of the average value of its portfolio and the Acquiring Fund's portfolio turnover rate was 11% of the average value of its portfolio.

Fund Management Information

The following table identifies the investment adviser, investment sub-adviser and portfolio manager(s) for the Acquiring Fund. Further information about the management of the Acquiring Fund can be found under the section entitled "Management of the Funds."

|

Wells Fargo Advantage Intrinsic World Equity Fund |

||

|

Investment Adviser |

Wells Fargo Funds Management, LLC |

|

|

Investment Sub-adviser |

Metropolitan West Capital Management, LLC |

|

|

Portfolio Manager, Title/Managed Since |

Gary Lisenbee, Portfolio Manager/2007 |

|

Tax Information

It is expected that the Merger will be tax-free to the Funds and their shareholders for U.S. federal income tax purposes, and receipt of an opinion substantially to that effect from Proskauer Rose LLP, special tax counsel to the Acquiring Fund, is a condition to the obligation of the Funds to consummate the Merger. This means that neither shareholders nor your Target or Acquiring Fund will recognize a gain or loss for U.S. federal income tax purposes directly as a result of the Merger. However, because the Merger will end the tax year of your Target Fund, the Merger may accelerate taxable distributions from your Target Fund to its shareholders.

The cost basis and holding period of your Target Fund shares will carry over to the shares of the Acquiring Fund you receive as a result of the Merger for U.S. federal income tax purposes. At any time prior to the consummation of the Merger, a shareholder may redeem shares, likely resulting in recognition of a gain or loss to the shareholder for U.S. federal income tax purposes if the shareholder holds the shares in a taxable account.

A substantial portion of the securities held by the Target Fund may be disposed of in connection with the Merger. This could result in additional portfolio transaction costs to the Target Fund and increased taxable distributions to shareholders of the Target Fund. The actual tax impact of such sales will depend on the difference between the price at which such portfolio assets are sold and the Target Fund's basis in such assets. Any net realized capital gain from sales that occur prior to the Merger will be distributed to the Target Fund's shareholders as capital gain dividends (to the extent of the excess of net realized long-term capital gain over net realized short-term capital loss) and/or ordinary dividends (to the extent of the excess of net realized short-term capital gain over net realized long-term capital loss) during or with respect to the year of sale (after reduction by any available capital loss carryforwards), and such distributions will be taxable to shareholders.

U.S. federal income tax law generally in effect for this purpose permits each of the Funds to carry forward net capital losses for up to eight taxable years. The Target Fund may be presently entitled to significant net capital loss carryforwards for U.S. federal income tax purposes, as detailed in "Material U.S. Federal Income Tax Consequences of the Mergers." The Merger will cause the tax year of the Target Fund to close, resulting in an earlier expiration of net capital loss carryforwards than would otherwise occur. In addition, your Merger is expected to result in a limitation on the ability of the Acquiring Fund to use carryforwards of the Target Fund, if any, and, potentially, to use unrealized capital losses inherent in the tax basis of the assets acquired, if any, once realized.

Certain other U.S. federal income tax consequences are discussed below under "Material U.S. Federal Income Tax Consequences of the Mergers."

RISK DESCRIPTIONS

An investment in each Fund is subject to certain risks. There is no assurance that the return of a Fund will be positive or that a Fund will meet its investment goal. An investment in a Fund is not a deposit of Wells Fargo Bank, N.A. or its affiliates; is not insured, or guaranteed by the Federal Deposit Insurance Corporation or any other government agency; and is subject to investment risks, including possible loss of your original investment. Like most investments, your investment in a Fund could result in a loss of money. The following provides additional information regarding the various risks referenced in the section entitled "Merger Summary."

Counter-Party Risk

When a Fund enters into an investment contract, such as a derivative or a repurchase or reverse repurchase agreement, the

Fund is exposed to the risk that the other party will not fulfill its contractual obligation. For example, in a repurchase

agreement, there exists the risk that where the Fund buys a security from a seller that agrees to repurchase the security

at an agreed upon price and time, the seller will not repurchase the security. Similarly, the Fund is exposed to counter-party

risk if it engages in a reverse repurchase agreement where a broker-dealer agrees to buy securities and the Fund agrees to

repurchase them at a later date.

Country Concentration Risk

A Fund that concentrates its investments in a limited number of countries will be more vulnerable to adverse financial, economic,

political or other developments affecting those countries than a fund that invests its assets more broadly, and the value

of the Fund's shares may be more volatile.

Derivatives Risk

The term "derivatives" covers a broad range of investments, including futures, options and swap agreements. In general, a

derivative refers to any financial instrument whose value is derived, at least in part, from the price of another security

or a specified index, asset or rate. For example, a swap agreement is a commitment to make or receive payments based on agreed

upon terms, and whose value and payments are derived by changes in the value of an underlying financial instrument. The use

of derivatives presents risks different from, and possibly greater than, the risks associated with investing directly in traditional

securities. The use of derivatives can lead to losses because of adverse movements in the price or value of the underlying

asset, index or rate, which may be magnified by certain features of the derivatives. These risks are heightened when the portfolio