As filed with the Securities and Exchange Commission on February 22, 2010

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-14

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

|

|

|

|

|

|

|

|

|

Pre-Effective Amendment No. __ |

|

|

|

|

|

Post-Effective Amendment No. |

|

|

(Check appropriate box or boxes)

Exact Name of Registrant as Specified in Charter:

WELLS FARGO FUNDS TRUST

Area Code and Telephone Number: (800) 552-9612

Address of Principal Executive Offices, including Zip Code:

525 Market Street

San Francisco, California 94163

Name and Address of Agent for Service:

C. David Messman

c/oWellsFargo Funds Management, LLC

525 Market Street, 12th Floor

San Francisco, California 94105

With copies to:

Marco E. Adelfio, Esq.

GOODWIN PROCTER LLP

901 NEW YORK AVENUE, N.W.

WASHINGTON, D.C. 20001

It is proposed that this filing will become effective on March 24, 2010 pursuant to Rule 488.

No filing fee is required under the Securities Act of 1933 because an indefinite number of shares of beneficial interest in the Registrant has previously been registered pursuant to Rule 24f-2 under the Investment Company Act of 1940, as amended.

WELLS FARGO FUNDS TRUST

PART A

PROSPECTUS/PROXY STATEMENT

DRAFT 2/18/10

Long Term Funds (mergers)/EVG vote only

[co-branded logos]

Your Prompt Response is Requested

The enclosed document is a combined prospectus/proxy statement with proposals that pertain to certain Evergreen Funds. As a shareholder of one or more of the Funds, you are being asked to approve a merger of your fund(s) into a Wells Fargo Advantage Fund.

The voting process will only take a few minutes

Instructions for returning your proxy are enclosed. Please be sure to respond by June 8, 2010, regardless of the number of shares you own.

Highlights of proxy proposals

For your convenience, the following information highlights the principal aspects of the proposals in the proxy. Full details are provided in the prospectus/proxy statement. We encourage you to read it carefully.

|

Why have the proposals for the merger of these Funds been put forward at this time?

|

The enclosed prospectus/proxy statement for the merger of your funds is part of the overall proposal to combine the fund lineups of the Wells Fargo Advantage Funds and the Evergreen Funds. As a result of the merger between Wells Fargo & Company and Wachovia Corporation, Wells Fargo Funds Management, LLC, the investment adviser to the Wells Fargo Advantage Funds, and Evergreen Investment Management Company, LLC, the investment adviser to the Evergreen funds, recommended that the Boards of Trustees of the two fund families approve combining the fund families under the Wells Fargo Advantage Funds name.

|

|

What am I being asked to vote on?

|

As a shareholder of the merging (Target) fund, you are being asked to approve the merger of your fund into a surviving (Acquiring) fund. Your Fund’s Board of Trustees believes that the merger is in the best interests of your Fund and that the interests of existing shareholders would not be diluted as a result of the merger. As such, they recommend that you vote to approve it.

Upon approval by shareholders and the satisfaction of other closing conditions, the merging fund will transfer all of its assets to the acquiring fund, and the acquiring fund will assume all of the liabilities of the target fund in exchange for shares of a comparable class of the acquiring fund. The acquiring fund shares that you receive in a merger will have a total dollar value equal to that of the target fund shares that you hold at the time of the merger. Each merging fund and its corresponding acquiring fund are listed below: Merging (Target) Fund Surviving (Acquiring) Fund Evergreen Equity Index Fund Wells Fargo Advantage Index Fund Evergreen Fundamental Mid Cap Value Wells Fargo Advantage Mid Cap

Fund

Disciplined Fund1| Evergreen Mid Cap Growth Fund Wells Fargo Advantage Mid Cap Growth

Fund Evergreen Short-Intermediate Municipal Wells Fargo Advantage Short-Term Bond

Fund

Municipal Bond Fund Evergreen Intermediate Municipal Bond Wells Fargo Advantage Intermediate

Fund

Tax/AMT-Free Fund Evergreen High Income Municipal Bond Wells Fargo Advantage Municipal Bond

Fund

Fund Evergreen Municipal Bond Fund Wells Fargo Advantage Municipal Bond Fund Evergreen California Municipal Bond Fund Wells Fargo Advantage California Tax-

Free Fund Evergreen U.S. Government Fund Wells Fargo Advantage Government

Securities Fund Evergreen International Equity Fund Wells Fargo Advantage International Core Fund2

|

|

Why has my Fund’s Board of Trustees recommended that I vote in favor of approving a merger? |

Among the factors the Boards considered in recommending the mergers were the following: Similarities and differences between the investment strategies of the target and acquiring funds. Shareholders will not bear any direct expenses in connection with the mergers. The mergers are expected to be non-taxable events for U.S. federal income tax purposes.

|

|

How do I vote my shares?

|

Please read the enclosed proxy materials, consider the information provided carefully, and then vote promptly. The voting process only takes a few minutes. You can vote your shares in one of four ways: Vote online at the Web site address listed on your proxy card. Call the toll-free number printed on your proxy card. Complete and sign the enclosed proxy card and return by mail in the enclosed postage paid return envelope (if mailed in the United States). Attend the special meeting scheduled to be held on June 8, 2010. Whether or not you expect to attend the meeting, we encourage you to vote online or by phone or mail.

|

|

What is the due date for returning my vote? |

A final vote will take place at a special meeting of shareholders scheduled for June 8, 2010. Your vote must be received by that date. |

|

Is this a taxable event for shareholders? |

No. Each merger is expected to be a non-taxable event for U.S. federal income tax purposes.

|

|

Whom should I call with questions about the voting process? |

If you have any questions about any proposal or related proxy materials, please call your investment professional, trust officer, or an Evergreen client service representative at 1-800-343-2898, Monday through Friday, 9:00 a.m. to 6:00 p.m., Eastern Time, or a Wells Fargo Advantage Funds client service representative at 1-800-222-8222, 24 hours a day, seven days a week. If you have any questions about the voting process or if you would like to vote by telephone, you may call our proxy solicitor, [ name ] at [ phone number ].

|

1 Immediately following the Merger, the Fund's name will be changed to Wells Fargo Advantage Special Mid Cap Value Fund.

2 Immediately following the Merger, the Fund's name will be changed to Wells Fargo Advantage International Equity Fund.

[Back cover]

Evergreen Investments Logo

Wells Fargo Advantage Funds Logo

Evergreen Investment Management Company, LLC, is a subsidiary of Wells Fargo & Company and is an affiliate of Wells Fargo & Company’s broker/dealer subsidiaries. Evergreen InvestmentsSM is a service mark of Evergreen Investment Management Company, LLC.

Wells Fargo Funds Management, LLC, a wholly owned subsidiary of Wells Fargo & Company, provides investment advisory and administrative services for Wells Fargo Advantage Funds. Other affiliates of Wells Fargo & Company provide subadvisory and other services for the Wells Fargo Advantage Funds.

Wells Fargo Funds Distributor, LLC, Member FINRA/SIPC, an affiliate of Wells Fargo & Company, is the distributor of the Evergreen Funds and the Wells Fargo Advantage Funds. 120078 2-10

NOT FDIC INSURED • NO BANK GUARANTEE • MAY LOSE VALUE

© 2010 Wells Fargo Funds Management, LLC. All rights reserved.

DRAFT 2/18/10

Long Term Funds (mergers)/EVG vote only

[co-branded logos]

Your Prompt Response is Requested

The enclosed document is a combined prospectus/proxy statement with proposals that pertain to certain Evergreen Funds. As a shareholder of one or more of the Funds, you are being asked to approve a merger of your fund(s) into a Wells Fargo Advantage Fund.

The voting process will only take a few minutes

Instructions for returning your proxy are enclosed. Please be sure to respond by June 8, 2010, regardless of the number of shares you own.

Highlights of proxy proposals

For your convenience, the following information highlights the principal aspects of the proposals in the proxy. Full details are provided in the prospectus/proxy statement. We encourage you to read it carefully.

|

Why have the proposals for the merger of these Funds been put forward at this time?

|

The enclosed prospectus/proxy statement for the merger of your funds is part of the overall proposal to combine the fund lineups of the Wells Fargo Advantage Funds and the Evergreen Funds. As a result of the merger between Wells Fargo & Company and Wachovia Corporation, Wells Fargo Funds Management, LLC, the investment adviser to the Wells Fargo Advantage Funds, and Evergreen Investment Management Company, LLC, the investment adviser to the Evergreen funds, recommended that the Boards of Trustees of the two fund families approve combining the fund families under the Wells Fargo Advantage Funds name.

|

|

What am I being asked to vote on?

|

As a shareholder of the merging (Target) fund, you are being asked to approve the merger of your fund into a surviving (Acquiring) fund. Your Fund’s Board of Trustees believes that the merger is in the best interests of your Fund and that the interests of existing shareholders would not be diluted as a result of the merger. As such, they recommend that you vote to approve it.

Upon approval by shareholders and the satisfaction of other closing conditions, the merging fund will transfer all of its assets to the acquiring fund, and the acquiring fund will assume all of the liabilities of the target fund in exchange for shares of a comparable class of the acquiring fund. The acquiring fund shares that you receive in a merger will have a total dollar value equal to that of the target fund shares that you hold at the time of the merger. Each merging fund and its corresponding acquiring fund are listed below: Merging (Target) Fund Surviving (Acquiring) Fund Evergreen Equity Index Fund Wells Fargo Advantage Index Fund Evergreen Fundamental Mid Cap Value Wells Fargo Advantage Mid Cap

Fund

Disciplined Fund1| Evergreen Mid Cap Growth Fund Wells Fargo Advantage Mid Cap Growth

Fund Evergreen Short-Intermediate Municipal Wells Fargo Advantage Short-Term Bond

Fund

Municipal Bond Fund Evergreen Intermediate Municipal Bond Wells Fargo Advantage Intermediate

Fund

Tax/AMT-Free Fund Evergreen High Income Municipal Bond Wells Fargo Advantage Municipal Bond

Fund

Fund Evergreen Municipal Bond Fund Wells Fargo Advantage Municipal Bond Fund Evergreen California Municipal Bond Fund Wells Fargo Advantage California Tax-

Free Fund Evergreen U.S. Government Fund Wells Fargo Advantage Government

Securities Fund Evergreen International Equity Fund Wells Fargo Advantage International Core Fund2

|

|

Why has my Fund’s Board of Trustees recommended that I vote in favor of approving a merger? |

Among the factors the Boards considered in recommending the mergers were the following: Similarities and differences between the investment strategies of the target and acquiring funds. Shareholders will not bear any direct expenses in connection with the mergers. The mergers are expected to be non-taxable events for U.S. federal income tax purposes.

|

|

How do I vote my shares?

|

Please read the enclosed proxy materials, consider the information provided carefully, and then vote promptly. The voting process only takes a few minutes. You can vote your shares in one of four ways: Vote online at the Web site address listed on your proxy card. Call the toll-free number printed on your proxy card. Complete and sign the enclosed proxy card and return by mail in the enclosed postage paid return envelope (if mailed in the United States). Attend the special meeting scheduled to be held on June 8, 2010. Whether or not you expect to attend the meeting, we encourage you to vote online or by phone or mail.

|

|

What is the due date for returning my vote? |

A final vote will take place at a special meeting of shareholders scheduled for June 8, 2010. Your vote must be received by that date. |

|

Is this a taxable event for shareholders? |

No. Each merger is expected to be a non-taxable event for U.S. federal income tax purposes.

|

|

Whom should I call with questions about the voting process? |

If you have any questions about any proposal or related proxy materials, please call your investment professional, trust officer, or an Evergreen client service representative at 1-800-343-2898, Monday through Friday, 9:00 a.m. to 6:00 p.m., Eastern Time, or a Wells Fargo Advantage Funds client service representative at 1-800-222-8222, 24 hours a day, seven days a week. If you have any questions about the voting process or if you would like to vote by telephone, you may call our proxy solicitor, [ name ] at [ phone number ].

|

1 Immediately following the Merger, the Fund's name will be changed to Wells Fargo Advantage Special Mid Cap Value Fund.

2 Immediately following the Merger, the Fund's name will be changed to Wells Fargo Advantage International Equity Fund.

[Back cover]

Evergreen Investments Logo

Wells Fargo Advantage Funds Logo

Evergreen Investment Management Company, LLC, is a subsidiary of Wells Fargo & Company and is an affiliate of Wells Fargo & Company’s broker/dealer subsidiaries. Evergreen InvestmentsSM is a service mark of Evergreen Investment Management Company, LLC.

Wells Fargo Funds Management, LLC, a wholly owned subsidiary of Wells Fargo & Company, provides investment advisory and administrative services for Wells Fargo Advantage Funds. Other affiliates of Wells Fargo & Company provide subadvisory and other services for the Wells Fargo Advantage Funds.

Wells Fargo Funds Distributor, LLC, Member FINRA/SIPC, an affiliate of Wells Fargo & Company, is the distributor of the Evergreen Funds and the Wells Fargo Advantage Funds. 120078 2-10

NOT FDIC INSURED • NO BANK GUARANTEE • MAY LOSE VALUE

© 2010 Wells Fargo Funds Management, LLC. All rights reserved.

EVERGREEN FUNDS

200 Berkeley Street

Boston, MA 02116-5034

1.800.343.2898

____, 2010

Dear Shareholder,

On December 31, 2008, the parent company of the investment adviser to the Evergreen funds, Wachovia Corporation ("Wachovia"), and the parent company of the investment adviser to Wells Fargo Advantage Funds®, Wells Fargo & Company ("Wells Fargo"), merged. Since that date, the investment adviser to the Evergreen funds, Evergreen Investment Management Company, LLC ("EIMC"), and the investment adviser to Wells Fargo Advantage Funds, Wells Fargo Funds Management, LLC ("Funds Management"), have considered rationalizing and reorganizing their mutual fund businesses. After multiple presentations to and discussions with the Boards of Trustees of both the Evergreen funds and Wells Fargo Advantage Funds regarding these matters, on December 30, 2009, EIMC proposed to the Boards of Trustees of the Evergreen funds, and on January 11, 2010, Funds Management proposed to the Boards of Trustees of Wells Fargo Advantage Funds, the mergers outlined in the table below. Both the Boards of Trustees of the Evergreen funds and Wells Fargo Advantage Funds approved the proposed mergers and the related Agreement and Plan of Reorganization subject to the approval by shareholders of each Target Fund (as set forth in the table below), as part of a comprehensive set of mutual fund mergers across the two fund families.

As a result, you are invited to vote on a proposal to merge your Target Fund into a corresponding Acquiring Fund (as set forth in the table below) (each a "Merger," and collectively, the "Mergers"). The Board of Trustees of each Target Trust (as set forth in the table below) has unanimously approved the Target Fund's Merger and recommends that you vote FOR this proposal.

| Target Fund | Target Trust | Acquiring Fund | Acquiring Trust | |||||

| Evergreen Equity Index Fund | Evergreen Select Equity Trust | Wells Fargo Advantage Index Fund | Wells Fargo Funds Trust | |||||

| Evergreen Fundamental Mid Cap Value Fund | Evergreen Equity Trust | Wells Fargo Advantage Mid Cap Disciplined Fund1 | Wells Fargo Funds Trust | |||||

| Evergreen Mid Cap Growth Fund | Evergreen Equity Trust | Wells Fargo Advantage Mid Cap Growth Fund | Wells Fargo Funds Trust | |||||

| Evergreen Short-Intermediate Municipal Bond Fund | Evergreen Municipal Trust | Wells Fargo Advantage Short-Term Municipal Bond Fund | Wells Fargo Funds Trust | |||||

| Evergreen Intermediate Municipal Bond Fund | Evergreen Select Fixed Income Trust | Wells Fargo Advantage Intermediate Tax/AMT-Free Fund | Wells Fargo Funds Trust | |||||

| Evergreen High Income Municipal Bond Fund | Evergreen Municipal Trust | Wells Fargo Advantage Municipal Bond Fund | Wells Fargo Funds Trust | |||||

| Evergreen Municipal Bond Fund | Evergreen Municipal Trust | Wells Fargo Advantage Municipal Bond Fund | Wells Fargo Funds Trust | |||||

| Evergreen California Municipal Bond Fund | Evergreen Municipal Trust | Wells Fargo Advantage California Tax-Free Fund | Wells Fargo Funds Trust | |||||

| Evergreen U.S. Government Fund | Evergreen Fixed Income Trust | Wells Fargo Advantage Government Securities Fund | Wells Fargo Funds Trust | |||||

| Evergreen International Equity Fund | Evergreen International Trust | Wells Fargo Advantage International Core Fund2 | Wells Fargo Funds Trust | |||||

| 1 | Immediately following the Merger, the fund's name will be changed to Wells Fargo Advantage Special Mid Cap Value Fund. |

| 2 | Immediately following the Merger, the fund's name will be changed to Wells Fargo Advantage International Equity Fund. |

If approved by shareholders, this is how each Merger will work:

-

Each Target Fund will transfer all of its assets to the corresponding Acquiring Fund.

-

Each Acquiring Fund will assume all of the liabilities of the corresponding Target Fund.

-

Each Acquiring Fund will issue new shares that will be distributed to you in an amount equal to the value of your Target Fund shares.

-

If the Merger is consummated, each Target Fund shareholder will become a shareholder of the corresponding Acquiring Fund and will have his or her investment managed in accordance with the Acquiring Fund's investment strategies.

-

You will not incur any sales charges or similar transaction charges as a result of the Merger.

-

It is expected that the Merger will be a non-taxable event for shareholders for U.S. federal income tax purposes.

Details about each Target Fund's and Acquiring Fund's investment goals, principal investment strategies, portfolio management team, past performance, principal risks, fees, and expenses, along with additional information about the proposed Mergers, are contained in the attached prospectus/proxy statement. Please read it carefully.

A special meeting of each Target Fund's shareholders will be held on ___, 2010. Although you are welcome to attend the meeting in person, you do not need to do so in order to vote your shares. Please complete, date, sign and return the enclosed proxy card in the postage-paid envelope provided. You may also vote by telephone or the internet by following the voting instructions as outlined at the end of this prospectus/proxy statement. If your Target Fund does not receive your vote after several weeks, you may receive a telephone call from [PROXY SOLICITOR], our proxy solicitor, requesting your vote. If you have any questions about the Mergers or the proxy card, please call [PROXY SOLICITOR] at (800) ____ (toll-free).

Remember, your vote is important to us, no matter how many shares you own. Please take this opportunity to vote. Thank you for taking this matter seriously and participating in this important process.

Sincerely,

W. Douglas Munn

President

Evergreen Funds

EVERGREEN FUNDS

200 Berkeley Street

Boston, MA 02116-5034

1.800.343.2898

____, 2010

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS TO BE HELD ON ___

A Special Meeting (the "Meeting") of Shareholders of your Target Fund, a series of the Target Trust, each set forth in the table below, will be held at the offices of Wells Fargo Advantage Funds®, 525 Market Street, San Francisco, California 94105 on ___, 2010 at 10:00 a.m., Pacific time.

| Target Fund | Target Trust | Acquiring Fund | Acquiring Trust | |||||

| Evergreen Equity Index Fund | Evergreen Select Equity Trust | Wells Fargo Advantage Index Fund | Wells Fargo Funds Trust | |||||

| Evergreen Fundamental Mid Cap Value Fund | Evergreen Equity Trust | Wells Fargo Advantage Mid Cap Disciplined Fund1 | Wells Fargo Funds Trust | |||||

| Evergreen Mid Cap Growth Fund | Evergreen Equity Trust | Wells Fargo Advantage Mid Cap Growth Fund | Wells Fargo Funds Trust | |||||

| Evergreen Short-Intermediate Municipal Bond Fund | Evergreen Municipal Trust | Wells Fargo Advantage Short-Term Municipal Bond Fund | Wells Fargo Funds Trust | |||||

| Evergreen Intermediate Municipal Bond Fund | Evergreen Select Fixed Income Trust | Wells Fargo Advantage Intermediate Tax/AMT-Free Fund | Wells Fargo Funds Trust | |||||

| Evergreen High Income Municipal Bond Fund | Evergreen Municipal Trust | Wells Fargo Advantage Municipal Bond Fund | Wells Fargo Funds Trust | |||||

| Evergreen Municipal Bond Fund | Evergreen Municipal Trust | Wells Fargo Advantage Municipal Bond Fund | Wells Fargo Funds Trust | |||||

| Evergreen California Municipal Bond Fund | Evergreen Municipal Trust | Wells Fargo Advantage California Tax-Free Fund | Wells Fargo Funds Trust | |||||

| Evergreen U.S. Government Fund | Evergreen Fixed Income Trust | Wells Fargo Advantage Government Securities Fund | Wells Fargo Funds Trust | |||||

| Evergreen International Equity Fund | Evergreen International Trust | Wells Fargo Advantage International Core Fund2 | Wells Fargo Funds Trust | |||||

| 1 | Immediately following the Merger, the fund's name will be changed to Wells Fargo Advantage Special Mid Cap Value Fund. |

| 2 | Immediately following the Merger, the fund's name will be changed to Wells Fargo Advantage International Equity Fund. |

With respect to your Target Fund, the Meeting is being held for the following purposes:

-

To consider and act upon an Agreement and Plan of Reorganization (the "Plan") dated as of ___, 2010, providing for the acquisition of all of the assets of the Target Fund by the corresponding Acquiring Fund in exchange for shares of the Acquiring Fund (the "Acquisition Shares") and the assumption by the Acquiring Fund of all of the liabilities of the Target Fund. The Plan also provides for the prompt distribution of the Acquisition Shares to shareholders of the corresponding Target Fund in liquidation of the Target Fund.

-

To transact any other business which may properly come before the Meeting or any adjournment(s) thereof.

Any adjournment(s) of the Meeting will be held at the above address. The Board of Trustees of your Target Fund has fixed the close of business on March 10, 2010 as the record date (the "Record Date") for the Meeting. Only shareholders of record as of the close of business on the Record Date will be entitled to this notice, and to vote at the Meeting or any adjournment(s) thereof.

IT IS IMPORTANT THAT PROXY CARDS OR VOTING INSTRUCTION CARDS BE RETURNED PROMPTLY. ALL SHAREHOLDERS ARE URGED TO COMPLETE, DATE, SIGN AND RETURN THEIR ENCLOSED PROXY CARD OR VOTING INSTRUCTION CARD IN THE ENCLOSED POSTAGE-PAID ENVELOPE, OR TO VOTE USING ONE OF THE OTHER METHODS DESCRIBED AT THE END OF THE PROSPECTUS/PROXY STATEMENT SO THAT YOUR SHARES MAY BE REPRESENTED AT THE MEETING. YOUR PROMPT ATTENTION TO THE ENCLOSED PROXY CARD OR VOTING INSTRUCTION CARD WILL HELP TO AVOID THE EXPENSE OF FURTHER SOLICITATION.

By order of the Board of Trustees,

Michael H. Koonce

Secretary

EVERGREEN FUNDS

200 Berkeley Street

Boston, MA 02116-5034

1.800.343.2898

WELLS FARGO FUNDS TRUST

525 Market Street, 12th Floor

San Francisco, CA 94105

1.800.222.8222

____, 2010

PROSPECTUS/PROXY STATEMENT

This prospectus/proxy statement contains information you should know before voting on the proposed merger (the "Merger") of your Target Fund into the corresponding Acquiring Fund as set forth and defined in the table below, each of which is a series of a registered open-end management investment company. If approved, the Merger will result in your receiving shares of the Acquiring Fund in exchange for your shares of the Target

Fund.

| Target Fund | Target Trust | Acquiring Fund | Acquiring Trust | |||||

| Evergreen Equity Index Fund | Evergreen Select Equity Trust | Wells Fargo Advantage Index Fund | Wells Fargo Funds Trust | |||||

| Evergreen Fundamental Mid Cap Value Fund | Evergreen Equity Trust | Wells Fargo Advantage Mid Cap Disciplined Fund1 | Wells Fargo Funds Trust | |||||

| Evergreen Mid Cap Growth Fund | Evergreen Equity Trust | Wells Fargo Advantage Mid Cap Growth Fund | Wells Fargo Funds Trust | |||||

| Evergreen Short-Intermediate Municipal Bond Fund | Evergreen Municipal Trust | Wells Fargo Advantage Short-Term Municipal Bond Fund | Wells Fargo Funds Trust | |||||

| Evergreen Intermediate Municipal Bond Fund | Evergreen Select Fixed Income Trust | Wells Fargo Advantage Intermediate Tax/AMT-Free Fund | Wells Fargo Funds Trust | |||||

| Evergreen High Income Municipal Bond Fund | Evergreen Municipal Trust | Wells Fargo Advantage Municipal Bond Fund | Wells Fargo Funds Trust | |||||

| Evergreen Municipal Bond Fund | Evergreen Municipal Trust | Wells Fargo Advantage Municipal Bond Fund | Wells Fargo Funds Trust | |||||

| Evergreen California Municipal Bond Fund | Evergreen Municipal Trust | Wells Fargo Advantage California Tax-Free Fund | Wells Fargo Funds Trust | |||||

| Evergreen U.S. Government Fund | Evergreen Fixed Income Trust | Wells Fargo Advantage Government Securities Fund | Wells Fargo Funds Trust | |||||

| Evergreen International Equity Fund | Evergreen International Trust | Wells Fargo Advantage International Core Fund2 | Wells Fargo Funds Trust | |||||

| 1 | Immediately following the Merger, the fund's name will be changed to Wells Fargo Advantage Special Mid Cap Value Fund. |

| 2 | Immediately following the Merger, the fund's name will be changed to Wells Fargo Advantage International Equity Fund. |

The Target and Acquiring Funds listed above are collectively referred to as the "Funds." The Target and Acquiring Trusts listed above are collectively referred to as the "Trusts."

Please read this prospectus/proxy statement carefully and retain it for future reference. Additional information concerning each Fund and/or Merger has been filed with the Securities and Exchange Commission ("SEC").

The prospectuses of each Target Fund and each Acquiring Fund are incorporated into this document by reference and are legally deemed to be part of this prospectus/proxy statement.

The Statement of Additional Information relating to this prospectus/proxy statement (the "Merger SAI"), dated the same date as this prospectus/proxy statement, is also incorporated into this document by reference and is legally deemed to be part of this prospectus/proxy statement.

The Statement of Additional Information ("SAI"), and the annual and semi-annual reports of each Target Fund and each Acquiring Fund are incorporated into the Merger SAI by reference and are legally deemed to be part of the Merger SAI.

Copies of the Acquiring Fund's prospectus accompany this prospectus/proxy statement.

Copies of these documents pertaining to a Target Fund are available upon request without charge by writing to the address above, calling 1.800.343.2898 or visiting the Evergreen funds Web site at www.evergreeninvestments.com. Copies of documents pertaining to an Acquiring Fund are available upon request without charge by writing to Wells Fargo Advantage Funds®, P.O. Box 8266, Boston, MA 02266-8266, calling 1.800.222.8222 or visiting the Wells Fargo Advantage Funds Web site at www.wellsfargo.com/advantagefunds.

You may also view or obtain these documents from the SEC: by phone at 1.800.SEC.0330 (duplicating fee required); in person or by mail at Public Reference Section, Securities and Exchange Commission, 100 F. Street, N.E., Washington, D.C. 20549-0213 (duplicating fee required); by email at publicinfo@sec.gov (duplicating fee required); or by internet at www.sec.gov.

The SEC has not approved or disapproved these securities or determined if this prospectus/proxy statement is truthful or complete. Any representation to the contrary is a criminal offense.

The shares offered by this prospectus/proxy statement are not deposits of a bank, and are not insured, endorsed or guaranteed by the FDIC or any government agency and involve investment risk, including possible loss of your original investment.

| Evergreen California Municipal Bond Fund |

| Evergreen Equity Index Fund |

| Evergreen Fundamental Mid Cap Value Fund |

| Evergreen Growth Fund |

| Evergreen High Income Municipal Bond Fund |

| Evergreen Intermediate Municipal Bond Fund |

| Evergreen Mid Cap Growth Fund |

| Evergreen Municipal Bond Fund |

| Evergreen Short-Intermediate Municipal Bond Fund |

| Evergreen Small-Mid Growth Fund |

| WF California Tax-Free Fund |

| WF Emerging Growth Fund |

| WF Government Securities Fund |

| WF Index Fund |

| WF Intermediate Tax/AMT-Free Fund |

| WF Mid Cap Disciplined Fund |

| WF Mid Cap Growth Fund |

| WF Municipal Bond Fund |

| WF Short-Term Municipal Bond Fund |

Table of Contents

OVERVIEW

This section summarizes the primary features and consequences of your Merger. This summary is qualified in its entirety by reference to the information contained elsewhere in this prospectus/proxy statement, in the Merger SAI, in each Fund's prospectus, in each Fund's financial statements contained in the annual and semi-annual reports, and in each Fund's SAI, and to the Agreements and Plans of Reorganization (each a "Plan"), forms of which are attached as Exhibit A hereto.

Key Features of the Mergers

The Plan sets forth the key features of each Merger and generally provides for the following:

-

the transfer of all of the assets of the Target Fund to the Acquiring Fund in exchange for shares of the Acquiring Fund;

-

the assumption by the Acquiring Fund of all of the liabilities of the Target Fund;

-

the liquidation of the Target Fund by distributing the shares of the Acquiring Fund to the Target Fund's shareholders; and

-

the assumption of the costs of each Merger (other than costs incurred from securities transactions in connection with the Merger) by Wells Fargo Funds Management, LLC ("Funds Management") and/or Evergreen Investment Management Company, LLC ("EIMC") or one of its affiliates.

The Mergers are scheduled to take place on or about July 9, 2010 or July 16, 2010, as set forth in Exhibit A. For a more complete description of the Mergers, see the section entitled "Agreements and Plans of Reorganization," as well as Exhibit A.

Board of Trustees Recommendation

At a meeting held on December 30, 2009 for the Board of Trustees of the Evergreen funds, the Trustees of your Target Fund, including a majority of the Trustees who are not "interested persons" of your Target Fund, as that term is defined in the Investment Company Act of 1940, as amended (the "1940 Act") (the "Independent Trustees"), considered and unanimously approved the Merger of your Target Fund.

Before approving the Mergers, the Trustees reviewed, among other things, information about the Funds and the proposed transactions. Those materials set forth a comparison of various factors, such as the relative sizes of the Funds, the performance records of the Funds, and the expenses of the Funds, as well as similarities and differences between the Funds' investment goals, principal investment strategies and specific portfolio characteristics.

The Board of Trustees of your Target Fund, including all of the Independent Trustees, has concluded that the Merger would be in the best interests of your Target Fund, and that existing shareholders' interests would not be diluted as a result of the Merger. Accordingly, the Trustees have submitted the Plan to the Target Fund's shareholders and unanimously recommended its approval. The Board of Trustees of Wells Fargo Advantage Funds has also approved the Plan on behalf of each Acquiring Fund.

For further information about the considerations of your Target Trust's Board, please see the section entitled "Reasons for the Mergers."

Merger Summary (Goals, Strategies, Risks, Performance, Expense, Management and Tax Information)

The following section provides a comparison between the Funds with respect to their investment goals, principal investment strategies, fundamental investment policies, risks, performance records, sales charges and expenses. It also provides information about what the management and share class structure of your Acquiring Fund will be after the Merger. The information below is only a summary; for more detailed information, please see the rest of this prospectus/proxy statement and each Fund's prospectus and SAI. In this section, references to "we" in the principal investment strategy discussion for a Wells Fargo Advantage Fund generally refer to Funds Management, a sub-adviser, or the portfolio manager(s).

Wells Fargo Advantage Index Fund, an Acquiring Fund, is a gateway fund in a master/gateway structure. This structure is more commonly known as a master/feeder structure. In this structure, a gateway or feeder fund invests substantially all of its assets in a master portfolio or other funds of Wells Fargo Advantage Funds, and may invest directly in securities, to achieve its investment objective. References to the investment activities of a gateway fund are intended to refer to the investment activities of the master portfolio in which it invests.

EVERGREEN EQUITY INDEX FUND INTO WELLS FARGO ADVANTAGE INDEX FUND

Share Class Information

The following table illustrates the share class of the Acquiring Fund you will receive as a result of the Merger in exchange for the shares you own in your Target Fund.

| If you own this class of shares of Evergreen Equity Index Fund: | You will get this class of shares of Wells Fargo Advantage Index Fund: | ||||

| Class A | Class A | ||||

| Class B | Class B | ||||

| Class C | Class C1 | ||||

| Class I | Administrator Class | ||||

| Class IS2 | Class A |

| 1 | Class will be created to receive the assets of the corresponding share class set forth above. |

| 2 | Following completion of the Mergers, former Class IS shareholders of any Target Fund who receive Class A shares of a Wells Fargo Advantage Fund in a Merger may buy additional Class A shares of that Wells Fargo Advantage Fund at net asset value (i.e., without a front-end sales charge). Those shareholders may also exchange Class A shares of that Wells Fargo Advantage Fund for Class A shares of a different Wells Fargo Advantage Fund at net asset value, after which, subsequent purchases of shares of that other Fund may also be made at net asset value. |

The Acquiring Fund shares you receive as a result of the Merger will have the same total value as the total value of your Target Fund shares as of the close of business on the business day immediately prior to the Merger.

The procedures for buying, selling and exchanging shares of the Funds are similar. For additional information, see the section entitled "Buying, Selling and Exchanging Fund Shares." This section also contains important information for foreign shareholders of a Target Fund, defined as shareholders whose accounts do not currently have both a U.S. address and tax payer identification number on record with the Funds. Following the Merger, foreign shareholders will not be able to make additional investments into a Wells Fargo Advantage Fund.

Investment Goal and Strategy Comparison

The following section compares the investment goals, principal investment strategies and fundamental investment policies of the Funds. The investment goals of the Funds may be changed without shareholder approval.

The Funds' investment goals and investment strategies are substantially similar. Each Fund normally seeks to invest in a portfolio of securities the total return of which will be similar to the total return of the S&P 500® Index. Unlike Evergreen Equity Index Fund, Wells Fargo Advantage Index Fund is a gateway fund that invests substantially all of its assets in the Index Portfolio. This means Wells Fargo Advantage Index Fund is subject to any additional fees and expenses of the Index Portfolio.

A more complete description of each Fund's investment goals and strategies is below.

| EVERGREEN EQUITY INDEX FUND (Target Fund) | WELLS FARGO ADVANTAGE INDEX FUND (Acquiring Fund) | ||||

| INVESTMENT GOAL | |||||

| The Fund seeks investment results that achieve price and yield performance similar to the S&P 500® Index. | The Fund seeks to replicate the total return of the S&P 500® Index, before fees and expenses. | ||||

| PRINCIPAL INVESTMENT STRATEGIES | |||||

| The Fund invests substantially all of its assets in equity securities that represent a composite of the S&P 500® Index (S&P 500). The S&P 500 is an unmanaged index of 500 common stocks chosen by Standard & Poor's to reflect the industries of the U.S. economy and is often considered a proxy for the stock market in general. The S&P 500 includes both growth and value stocks. "Value" stocks are stocks which are considered to be currently undervalued in the marketplace. "Growth" stocks are stocks of companies which are considered to have anticipated earnings ranging from steady to accelerated growth. | Under normal circumstances, we invest at least 80% of the Fund's net assets in a diversified portfolio of equity securities designed to replicate the holdings and weightings of the stocks comprising the S&P 500 Index. | ||||

| The Fund is not part of a master/gateway structure. | The Fund is a gateway fund that invests substantially all of its assets in the Index Portfolio, a master portfolio with a substantially identical investment objective and substantially similar investment strategies. | ||||

| To replicate the performance of the S&P 500, the Fund's portfolio manager uses a passive management approach. The Fund intends to sell a portfolio investment when it is removed from the S&P 500. | We invest in substantially all of the common stocks comprising the S&P 500 Index and attempt to achieve at least a 95% correlation between the performance of the S&P 500 Index and the Fund's investment results, before fees and expenses. This correlation is sought regardless of market conditions. If we are unable to achieve this correlation, then we will closely monitor the performance and composition of the S&P 500 Index and adjust the Fund's securities as necessary to seek the correlation. A precise duplication of the performance of the S&P 500 Index would mean that the NAV of Fund shares, including dividends and capital gains, would increase or decrease in exact proportion to changes in the S&P 500 Index. Such a 100% correlation is not feasible. Our ability to track the performance of the S&P 500 Index may be affected by, among other things, transaction costs and shareholder purchases and redemptions. We continuously monitor the performance and composition of the S&P 500 Index and adjust the Fund's portfolio as necessary to reflect any changes to the S&P 500 Index and to maintain a 95% or better performance correlation before fees and expenses. | ||||

| The Fund may, but will not necessarily, use derivatives. | Furthermore, we may use futures, options, repurchase or reverse repurchase agreements or swap agreements, as well as other derivatives, to manage risk or to enhance return. | ||||

| Although not a principal investment strategy, the Fund may, but will not necessarily, temporarily invest up to 100% of its assets in cash and/or high-quality money market instruments in response to adverse economic, political or market conditions. This strategy is inconsistent with the Fund's investment goal and principal investment strategies and, if employed, could result in a lower return and loss of market opportunity. | The Fund may hold some of its assets in cash or in money market instruments, including U.S. Government obligations, shares of other mutual funds and repurchase agreements, or make other short-term investments to either maintain liquidity or for short-term defensive purposes when we believe it is in the best interests of the shareholders to do so. During these periods, the Fund may not achieve its objective. | ||||

The fundamental investment policies of the Target and Acquiring Funds are substantively similar. For a comparative chart of fundamental investment policies, please see Exhibit B.

Principal Risk Comparison

Because the Evergreen funds and Wells Fargo Advantage Funds were unaffiliated fund families until January 2009, the Funds have historically used different terms and descriptions to describe their principal risks. Nonetheless, due to the similarity of the Funds' investment strategies, the Funds are generally subject to similar types of risks. Listed below are the principal risks that apply to an investment in Wells Fargo Advantage Index Fund. A description of those risks can be found in the section of this prospectus/proxy statement entitled "Risk Descriptions." Although both Funds may be subject to the risks listed below, they may be subject to a particular risk to different degrees.

Principal Risks

Counter-Party Risk

Derivatives Risk

Index Tracking Risk

Issuer Risk

Leverage Risk

Liquidity Risk

Management Risk

Market Risk

Regulatory Risk

A discussion of the principal risks associated with the investment in the Target Fund may be found in the Target Fund's prospectus. In addition, each Fund has other investment policies, practices and restrictions which, together with the Fund's related risks, are also set forth in the Fund's prospectus and SAI.

Fund Performance Comparison

The following bar chart and table illustrate how each Fund's returns have varied from year to year and compare the Fund's returns with those of one or more broad-based securities indexes. Past performance (before and after taxes) is not necessarily an indication of future results. Current month-end performance information is available for an Evergreen fund at www.evergreeninvestments.com and for a Wells Fargo Advantage Fund at www.wellsfargo.com/advantagefunds. The bar chart does not reflect applicable sales charges; if it did, returns would be lower than those shown. Evergreen Equity Index Fund would be the accounting and performance survivor following the Merger.

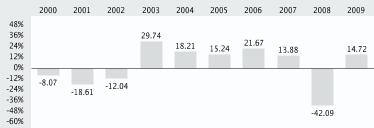

Year-by-Year Total Return for Class I Shares (%) for Evergreen Equity Index Fund

| Highest Quarter: | 2nd Quarter 2009 | +15.89% |

| Lowest Quarter: | 4th Quarter 2008 | -22.02% |

Year-by-Year Total Return for Administrator Class Shares (%) for Wells Fargo Advantage Index Fund

| Highest Quarter: | 2nd Quarter 2009 | +15.95% |

| Lowest Quarter: | 4th Quarter 2008 | -22.11% |

| Average Annual Total Returns for the periods ended 12/31/2009 | ||||||||||

| Evergreen Equity Index Fund | Inception Date of Share Class | 1 Year | 5 Year | 10 Year | ||||||

| Class A (before taxes) | 11/4/1998 | 19.94% | -1.07% | -1.95% | ||||||

| Class B (before taxes)1 | 11/3/1998 | 19.96% | -1.20% | -2.21% | ||||||

| Class C (before taxes) | 4/30/1999 | 24.00% | -0.84% | -2.20% | ||||||

| Class I (before taxes) | 2/14/1985 | 26.25% | 0.15% | -1.22% | ||||||

| Class I (after taxes on distributions) | 2/14/1985 | 25.28% | -0.41% | -1.70% | ||||||

| Class I (after taxes on distributions and the sale of Fund Shares) | 2/14/1985 | 18.16% | 0.07% | -1.17% | ||||||

| Class IS (before taxes) | 10/9/1996 | 25.92% | -0.10% | -1.47% | ||||||

| S&P 500® Index (reflects no deduction for fees, expenses, or taxes) | 26.46% | 0.42% | -0.95% | |||||||

| 1 | The returns shown for Class B shares do not reflect the conversion of Class B shares to Class A shares. |

| 2 | After-tax returns are shown for only one class and after-tax returns for other classes will vary. The after-tax returns shown are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. After-tax returns on distributions and the sale of Fund shares assume a complete sale of Fund shares at the end of the measurement period, resulting in capital gains taxes or tax benefits when capital losses occur. Actual after-tax returns will depend on your individual tax situation and may differ from those shown. The after-tax returns shown are not relevant to you if you hold your Fund shares through tax-deferred arrangements, such as 401(k) plans or Individual Retirement Accounts. |

| Average Annual Total Returns for the periods ended 12/31/2009 | ||||||||||

| Wells Fargo Advantage Index Fund | Inception Date of Share Class | 1 Year | 5 Year | 10 Year | ||||||

| Class A (before taxes)1 | 7/18/2008 | 18.75% | -1.40% | -2.09% | ||||||

| Class B (before taxes)1 | 7/18/2008 | 19.95% | -1.40% | -2.25% | ||||||

| Class C (before taxes)2 | TBD | 26.46% | 0.14% | -1.15% | ||||||

| Administrator Class (before taxes) | 11/11/1994 | 26.46% | 0.14% | -1.15% | ||||||

| Administrator Class (after taxes on distributions)3 | 11/11/1994 | 25.74% | -0.77% | -1.91% | ||||||

| Administrator Class (after taxes on distributions and the sale of Fund Shares)3 | 11/11/1994 | 17.20% | -0.22% | -1.30% | ||||||

| S&P 500® Index (reflects no deduction for fees, expenses, or taxes)4,5 | 26.46% | 0.42% | -0.95% | |||||||

| 1 | Performance shown prior to the inception of the Class A and Class B shares reflects the performance of the Administrator Class shares, adjusted for Class A or Class B sales charges and expenses, as applicable. |

| 2 | Performance shown for the Class C shares reflects the performance of the Administrator Class shares, and includes expenses that are not applicable to and lower than those of the Class C shares. The Administrator Class shares annual returns are substantially similar to what the Class C share returns would be because the Administrator Class and Class C shares are invested in the same portfolio and their returns differ only to the extent that they do not have similar expenses. |

| 3 | After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state, local or foreign taxes. Actual after-tax returns depend on an investor's tax situation and may differ from those shown, and after-tax returns shown are not relevant to tax-exempt investors or investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) Plans or Individual Retirement Accounts. After-tax returns are shown only for the Administrator Class shares. After-tax returns for other share classes will vary. |

| 4 | Standard & Poor's, S&P, S&P 500 Index, Standard and Poor's 500 and 500 are trademarks of McGraw Hill, Inc. and have been licensed for use by the Fund. The Fund is not sponsored, endorsed, sold or promoted by S&P and S&P makes no representation or warranty regarding the advisability of investing in the Fund. |

| 5 | The S&P 500® Index consists of 500 stocks chosen for market size, liquidity, and industry group representation. It is a market value weighted index with each stock's weight in the Index proportionate to its market value. S&P 500® is a registered trademark of Standard and Poor's. You cannot invest directly in an index. |

Shareholder Fee and Fund Expense Comparison

The sales charges and expenses for each class of shares of your Target Fund may be different than those of the corresponding class of shares of the Acquiring Fund. This section compares the fees and expenses you pay if you buy, hold, and sell shares of the Target Fund and the Acquiring Fund, and the tables entitled "Pro Forma" also show what your fees and expenses would be if the Merger takes place. You may qualify for sales charge discounts if you and your family invest, or agree to invest in the future, at least $50,000 in the Target Fund's family of funds or $50,000 in the Acquiring Fund's family of funds. Information regarding sales charges and sales charge discounts applicable to investments in the Acquiring Fund's family of funds is available in the "Buying, Selling and Exchanging Fund Shares -- Wells Fargo Advantage Funds" section of this prospectus/proxy statement. More information about these and other discounts is available from your financial professional and in the Funds' prospectuses.

The sales charge schedules applicable to Class A, Class B, and Class C shares of Wells Fargo Advantage Index Fund are identical to the sales charge schedules for the corresponding class of shares of Evergreen Equity Index Fund except that (i) Wells Fargo Advantage Index Fund's front-end sales charges on purchases of Class A shares of less than $50,000 are 1.00% higher than similar purchases of Evergreen Equity Index Fund's Class A shares; (ii) Wells Fargo Advantage Index Fund's front-end sales charges on purchases of Class A shares between $50,000 and $99,999 and $250,000 and $499,999 are 0.25% higher than similar purchases of Evergreen Equity Index Fund's Class A shares; and (iii) the contingent deferred sales charge you may pay when you redeem Class B or Class C shares of Wells Fargo Advantage Index Fund (other than those you receive in connection with the Merger) will be based on the net asset value of your shares when they were purchased, not the lower of (x) that amount or (y) the value of the shares at the time of redemption, as is the case for Class B and Class C shares of Evergreen Equity Index Fund.

The following tables allow you to compare the maximum sales charges of the Funds. The Pro Forma table also shows you what the maximum sales charges will be, assuming the Merger takes place. The Target Fund shareholders will not pay any front-end or deferred sales charges in connection with the Merger.

Shareholder Fees (fees paid directly from your investment)

| Evergreen Equity Index Fund | ||||||

| Class A | Class B | Class C | Class I, Class IS |

|||

| Maximum front-end sales charge (load) imposed on purchases (as a % of offering price) | 4.75%1 | None | None | None | ||

| Maximum deferred sales charge (load) (as a % of either the redemption amount or initial investment, whichever is lower) | None1 | 5.00% | 1.00% | None | ||

| 1 | Investments of $1 million or more are not subject to a front-end sales charge, but will be subject to a deferred sales charge of 1.00% if you sell the shares within eighteen months of purchase. |

| Wells Fargo Advantage Index Fund | ||||||

| Class A | Class B | Administrator Class | ||||

| Maximum sales charge (load) imposed on purchases (as a percentage of the offering price) | 5.75%1 | None | None | |||

| Maximum deferred sales charge (load) (as a percentage of the net asset value at purchase) | None1 | 5.00% | None | |||

| 1 | Investments of $1 million or more are not subject to a front-end sales charge, but will be subject to a deferred sales charge of 1.00% if you sell the shares within eighteen months of purchase. |

| Wells Fargo Advantage Index Fund (Pro Forma) | ||||||

| Class A1 | Class B | Class C | Administrator Class | |||

| Maximum sales charge (load) imposed on purchases (as a percentage of the offering price) | 5.75%2 | None | None | None | ||

| Maximum deferred sales charge (load) (as a percentage of the net asset value at purchase) | None2 | 5.00% | 1.00% | None | ||

| 1 | Following completion of the Mergers, former Class IS shareholders of any Target Fund who receive Class A shares of a Wells Fargo Advantage Fund in a Merger may buy additional Class A shares of that Wells Fargo Advantage Fund at net asset value (i.e., without a front-end sales charge). Those shareholders may also exchange Class A shares of that Wells Fargo Advantage Fund for Class A shares of a different Wells Fargo Advantage Fund at net asset value, after which, subsequent purchases of shares of that other Fund may also be made at net asset value. |

| 2 | Investments of $1 million or more are not subject to a front-end sales charge, but will be subject to a deferred sales charge of 1.00% if you sell the shares within eighteen months of purchase. |

The following tables allow you to compare the annual operating expenses of the Funds. The net and gross total annual fund operating expenses for both the Target and the Acquiring Funds set forth in the following tables are based on the actual expenses for the twelve-month period ended September 30, 2009. The pro forma expense table shows you what the net and gross total annual fund operating expenses would have been for the Acquiring Fund for the twelve-month period ended September 30, 2009, assuming the Merger had taken place at the beginning of that period. Exhibit C contains expense tables and examples for both the Target and Acquiring Funds based upon the actual expenses incurred by such Funds during their most recently completed fiscal years. Exhibit C also includes pro forma expense tables and examples for the Acquiring Fund based on the date of the Acquiring Fund's most recent financial statements.

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment)

| Evergreen Equity Index Fund | ||||

| Total Annual Fund Operating Expenses1,2 | ||||

| Class A | 1.09% | |||

| Class B | 1.84% | |||

| Class C | 1.84% | |||

| Class I | 0.84% | |||

| Class IS | 1.09% | |||

| 1 | The Total Annual Fund Operating Expenses in the table above include fees and expenses of 0.01% or less that were incurred indirectly by the Fund as a result of its investment in other investment companies. |

| 2 | The Total Annual Fund Operating Expenses listed above do not reflect voluntary fee waivers and/or expense reimbursements made by the Fund's investment adviser in order to reduce expense ratios. Including current voluntary fee waivers and/or expense reimbursements, Total Annual Fund Operating Expenses were 0.57% for Class A, 1.32% for Class B, 1.32% for Class C, 0.32% for Class I, and 0.57% for Class IS. The Fund's investment adviser may cease these voluntary waivers and/or reimbursements at any time. |

| Wells Fargo Advantage Index Fund | ||||||

| Total Annual Fund Operating Expenses (Before Waiver)1,2 | Total Annual Fund Operating Expenses (After Waiver)3 | |||||

| Class A | 0.73% | 0.62% | ||||

| Class B | 1.48% | 1.37% | ||||

| Administrator Class | 0.40% | 0.25% | ||||

| 1 | Expenses have been adjusted as necessary from amounts incurred during the Fund's most recent fiscal year to reflect current fees and expenses. |

| 2 | Includes gross expenses allocated from the master porfolio in which the Fund invests. |

| 3 | Funds Management has committed through 1/31/2011, to waive fees and/or reimburse expenses to the extent necessary to ensure that the Fund's Total Annual Fund Operating Expenses (After Waiver), including the underlying master portfolios' fees and expenses, and excluding brokerage commissions, interest, taxes, and extraordinary expenses do not exceed the Total Annual Fund Operating Expenses (After Waiver) shown. After this date, the Total Annual Fund Operating Expenses (After Waiver) may be increased only with the approval of the Board of Trustees. |

| Wells Fargo Advantage Index Fund (Pro Forma) | ||||||

| Total Annual Fund Operating Expenses (Before Waiver)1 | Total Annual Fund Operating Expenses (After Waiver)2 | |||||

| Class A | 0.67% | 0.56% | ||||

| Class B | 1.42% | 1.31% | ||||

| Class C | 1.42% | 1.31% | ||||

| Administrator Class | 0.36% | 0.25% | ||||

| 1 | Includes gross expenses allocated from the master porfolio in which the Fund invests. |

| 2 | Funds Management has committed for three years after the closing of the Merger to waive fees and/or reimburse expenses to the extent necessary to ensure that the Fund's Total Annual Fund Operating Expenses (After Waiver), including the underlying master portfolios' fees and expenses, and excluding brokerage commissions, interest, taxes, and extraordinary expenses do not exceed the Total Annual Fund Operating Expenses (After Waiver) shown. After this time, the Total Annual Fund Operating Expenses (After Waiver) may be increased only with the approval of the Board of Trustees. |

Each Fund has adopted a distribution plan pursuant to Rule 12b-1 under the 1940 Act ("Distribution Plan"). The fees charged to Class B and Class C shares of Evergreen Equity Index Fund pursuant to the Fund's Distribution Plan are 0.25% more than the Distribution Plan fees borne by Class B and Class C shares of Wells Fargo Advantage Index Fund, respectively. However, each of those Wells Fargo Advantage Index Fund share classes are subject to a shareholder servicing fee equal to 0.25%. The fees borne by Class A and Class IS shares of Evergreen Equity Index Fund pursuant to that Fund's Distribution Plan are 0.25%; Class A shares of Wells Fargo Advantage Index Fund do not bear fees under a distribution plan, but are subject to a shareholder servicing fee equal to 0.25%. While neither Class I shares of Evergreen Equity Index Fund nor Administrator Class shares of Wells Fargo Advantage Index Fund are subject to fees under a distribution plan, Administrator Class shares are subject to a shareholder servicing fee equal to 0.25%.

Portfolio Turnover. The Target and Acquiring Funds pay transaction costs, such as commissions or dealer mark-ups, when each buys and sells securities (or "turns over" its portfolio). A higher portfolio turnover may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in the annual fund operating expenses or in the example, affect each Fund's performance. During the most recent fiscal year, the Target Fund's portfolio turnover rate was 6% of the average value of its portfolio and the Acquiring Fund's portfolio turnover rate was 10% of the average value of its portfolio.

Fund Management Information

The following table identifies the investment adviser, investment sub-adviser and portfolio manager(s) for the Acquiring Fund. Further information about the management of the Acquiring Fund can be found under the section entitled "Management of the Funds."

| Wells Fargo Advantage Index Fund | ||

| Investment Adviser | Funds Management | |

| Investment Sub-adviser | Wells Capital Management Incorporated | |

| Portfolio Manager | William E. Zieff |

Tax Information

It is expected that the Merger will be tax-free to shareholders for U.S. federal income tax purposes, and receipt of an opinion substantially to that effect from Proskauer Rose LLP, special tax counsel to the Acquiring Fund, is a condition to the obligation of the Funds to consummate the Merger. This means that neither shareholders nor your Target or Acquiring Fund will recognize a gain or loss directly as a result of the Merger. However, because the Merger will end the tax year of your Target Fund, the Merger may accelerate taxable distributions from your Target Fund to its shareholders.

The cost basis and holding period of your Target Fund shares will carry over to the shares of the Acquiring Fund you receive as a result of the Merger. At any time prior to the consummation of the Merger, a shareholder may redeem shares, likely resulting in recognition of a gain or a loss to the shareholder for U.S. federal income tax purposes if the shareholder holds the shares in a taxable account.

A substantial portion of the securities held by your Target Fund may be disposed of in connection with the Merger. This could result in additional portfolio transaction costs to your Target Fund and increased taxable distributions to shareholders of your Target Fund. The actual tax impact of such sales will depend on the difference between the price at which such portfolio assets are sold and your Target Fund's basis in such assets. Any net realized capital gains from sales that occur prior to the Merger will be distributed to your Target Fund's shareholders as capital gain dividends (to the extent of the excess of net realized long-term capital gains over net realized short-term capital losses) and/or ordinary dividends (to the extent of the excess of net realized short-term capital gains over net realized long-term capital losses) during or with respect to the year of sale (after reduction by any available capital loss carryforwards), and such distributions will be taxable to shareholders.

Certain other U.S. federal income tax consequences are discussed below under "Material U.S. Federal Income Tax Consequences of the Mergers."

EVERGREEN FUNDAMENTAL MID CAP VALUE FUND INTO WELLS FARGO ADVANTAGE MID CAP DISCIPLINED FUND

Share Class Information

The following table illustrates the share class of the Acquiring Fund you will receive as a result of the Merger in exchange for the shares you own in your Target Fund.

| If you own this class of shares of Evergreen Fundamental Mid Cap Value Fund: | You will get this class of shares of Wells Fargo Advantage Mid Cap Disciplined Fund: | ||||

| Class A | Class A | ||||

| Class B1 | Class A | ||||

| Class C | Class C | ||||

| Class I2 | Institutional Class |

| 1 | Former Class B shareholders of the Target Fund will not be subject to a contingent deferred sales charge upon the redemption of the Class A shares they receive as a result of the Merger, but will have to pay a front-end sales charge on additional purchases of Class A shares of the Acquiring Fund as described below. |

| 2 | Following completion of the Mergers, former Class I shareholders of any applicable Evergreen Target Fund will not need to meet the minimum investment amount or the institutional entity requirements applicable to the Institutional Class shares of any Wells Fargo Advantage Fund received in a Merger. |

The Acquiring Fund shares you receive as a result of the Merger will have the same total value as the total value of your Target Fund shares as of the close of business on the business day immediately prior to the Merger.

The procedures for buying, selling and exchanging shares of the Funds are similar. For additional information, see the section entitled "Buying, Selling and Exchanging Fund Shares." This section also contains important information for foreign shareholders of a Target Fund, defined as shareholders whose accounts do not currently have both a U.S. address and tax payer identification number on record with the Funds. Following the Merger, foreign shareholders will not be able to make additional investments into a Wells Fargo Advantage Fund.

Investment Goal and Strategy Comparison

The following section compares the investment goals, principal investment strategies and fundamental investment policies of the Funds. The investment goals of the Funds may be changed without shareholder approval.

The Funds' investment goals and investment strategies are substantially similar. Both Funds seek long-term capital growth by normally investing at least 80% of their net assets in medium-capitalization companies. The portfolio managers for each Fund look for significantly undervalued companies that they believe have the potential for above average capital growth with below average risk.

A more complete description of each Fund's investment goals and strategies is below.

| EVERGREEN FUNDAMENTAL MID CAP VALUE FUND (Target Fund) | WELLS FARGO ADVANTAGE MID CAP DISCIPLINED FUND (Acquiring Fund) | ||||

| INVESTMENT GOAL | |||||

| The Fund seeks long-term capital growth. | The Fund seeks long-term capital appreciation. | ||||

| PRINCIPAL INVESTMENT STRATEGIES | |||||

| Under normal market conditions, the Fund invests at least 80% of its assets in common stocks of medium-sized U.S. companies (i.e., companies whose market capitalizations fall within the market capitalization range of the companies tracked by the Russell Midcap® Index, measured at the time of purchase). In addition, the Fund seeks to maintain a dollar-weighted average market capitalization that falls within the range of the Russell Midcap® Index. As of December 31, 2009, the Russell Midcap® Index had a market capitalization range of approximately $263 million to $15.6 billion. The remaining 20% of the Fund's assets may be invested in other types of investments, including, without limitation, common stocks of companies of any size, preferred stocks, and securities convertible into common stocks. | Under normal circumstances, we invest at least 80% of the Fund's net assets in equity securities of medium-capitalization companies. We invest principally in equity securities of medium-capitalization companies, which we define as securities of companies with market capitalizations within the range of the Russell Midcap® Index. The market capitalization range of the Russell Midcap® Index was $263 million to $15.6 billion, as of December 31, 2009, and is expected to change frequently. | ||||

| The Fund's principal investment strategies do not include a strategy for investing in equity securities of foreign issuers. | The Fund's principal investment strategies do not include a strategy for investing in equity securities of foreign issuers.1 | ||||

| The Fund may, but will not necessarily, use derivatives. | We may use futures, options or swap agreements, as well as other derivatives, to manage risk or to enhance return. | ||||

| The portfolio manager employs a value style of investing and looks for significantly undervalued companies that he believes have the potential for above average capital growth with below average risk. Typical investments include stocks of companies that have low price-to-earnings ratios, are out of favor in the marketplace, are selling significantly below their stated or replacement book value or are undergoing a reorganization or other corporate action that may create above average price appreciation. | We look for significantly undervalued companies that we believe have the potential for above average capital growth with below average risk. Rigorous fundamental research drives our search for undervalued, high quality companies, defined as industry leaders with strong balance sheets and superior cash flows. We utilize quantitative screens to narrow the investment universe by assessing companies' financial statement strength and looking for high cash flows and low financial leverage. Through detailed qualitative research, we then identify stocks valued below their estimated intrinsic value with hidden opportunities for above-average appreciation. Typical investments include stocks of companies that have low price-to-earnings ratios, are generally out of favor in the marketplace, are selling significantly below their stated or replacement book value or are undergoing a reorganization or other corporate action that may create above-average price appreciation.1 | ||||

| The Fund will consider selling a portfolio investment when a portfolio manager believes the issuer's investment fundamentals are beginning to deteriorate, when the investment no longer appears consistent with the portfolio manager's investment methodology, when the Fund must meet redemptions, in order to take advantage of more attractive investment opportunities, or for other investment reasons which a portfolio manager deems appropriate. | We regularly review the investments of the portfolio and may sell a portfolio holding when a stock's price nears its intrinsic value appreciation target, the macro environment becomes unfavorable, short-term downside risks increase, the company's fundamentals have deteriorated or we identify a more attractive investment opportunity.1 | ||||

| Although not a principal investment strategy, the Fund may, but will not necessarily, temporarily invest up to 100% of its assets in cash and/or high-quality money market instruments in response to adverse economic, political or market conditions. This strategy is inconsistent with the Fund's investment goal and principal investment strategies and, if employed, could result in a lower return and loss of market opportunity. | The Fund may hold some of its assets in cash or in money market instruments, including U.S. Government obligations, shares of other mutual funds and repurchase agreements, or make other short-term investments to either maintain liquidity or for short-term defensive purposes when we believe it is in the best interests of the shareholders to do so. During these periods, the Fund may not achieve its objective. | ||||

| 1 | Reflects the investment strategy of the Fund to be effective at the time of the Merger. |

The fundamental investment policies of the Target and Acquiring Funds are substantively similar. For a comparative chart of fundamental investment policies, please see Exhibit B.

Principal Risk Comparison

Because the Evergreen funds and Wells Fargo Advantage Funds were unaffiliated fund families until January 2009, the Funds have historically used different terms and descriptions to describe their principal risks. Nonetheless, due to the similarity of the Funds' investment strategies, the Funds are generally subject to similar types of risks. Listed below are the principal risks that apply to an investment in Wells Fargo Advantage Mid Cap Disciplined Fund. A description of those risks can be found in the section of this prospectus/proxy statement entitled "Risk Descriptions." Although both Funds may be subject to the risks listed below, they may be subject to a particular risk to different degrees.

Principal Risks1

Active Trading Risk

Counter-Party Risk

Derivatives Risk

Issuer Risk

Leverage Risk

Liquidity Risk

Management Risk

Market Risk

Regulatory Risk

Smaller Company Securities Risk

Value Style Investment Risk

| 1 | Reflects the principal risks of the Fund to be effective at the time of the Merger. |

A discussion of the principal risks associated with the investment in the Target Fund may be found in the Target Fund's prospectus. In addition, each Fund has other investment policies, practices and restrictions which, together with the Fund's related risks, are also set forth in the Fund's prospectus and SAI.

Fund Performance Comparison

The following bar chart and table illustrate how each Fund's returns have varied from year to year and compare the Fund's returns with those of one or more broad-based securities indexes. Past performance (before and after taxes) is not necessarily an indication of future results. Current month-end performance information is available for an Evergreen fund at www.evergreeninvestments.com and for a Wells Fargo Advantage Fund at www.wellsfargo.com/advantagefunds. The bar chart does not reflect applicable sales charges; if it did, returns would be lower than those shown.

Year-by-Year Total Return for Class I Shares (%) for Evergreen Fundamental Mid Cap Value Fund

| Highest Quarter: | 3rd Quarter 2009 | +19.42% |

| Lowest Quarter: | 4th Quarter 2008 | -21.52% |

Year-by-Year Total Return for Institutional Class Shares (%) for Wells Fargo Advantage Mid Cap Disciplined Fund

| Highest Quarter: | 4th Quarter 2001 | +23.93% |

| Lowest Quarter: | 4th Quarter 2008 | -21.80% |

| Average Annual Total Returns for the periods ended 12/31/2009 | ||||||||||

| Evergreen Fundamental Mid Cap Value Fund | Inception Date of Share Class | 1 Year | 5 Year | Performance Since 9/28/2007 | ||||||

| Class A (before taxes) | 9/28/2007 | 19.75% | N/A | -8.04% | ||||||

| Class B (before taxes) | 9/28/2007 | 21.19% | N/A | -7.50% | ||||||

| Class C (before taxes) | 9/28/2007 | 25.21% | N/A | -6.21% | ||||||

| Class I (before taxes) | 9/28/2007 | 27.32% | N/A | -5.36% | ||||||

| Class I (after taxes on distributions) | 9/28/2007 | 27.11% | N/A | -5.50% | ||||||

| Class I (after taxes on distributions and the sale of Fund Shares) | 9/28/2007 | 18.02% | N/A | -4.55% | ||||||

| Russell Midcap Value Index (reflects no deduction for fees, expenses, or taxes) | 34.21% | N/A | -10.58% | |||||||

| 1 | After-tax returns are shown for only one class and after-tax returns for other classes will vary. The after-tax returns shown are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. After-tax returns on distributions and the sale of Fund shares assume a complete sale of Fund shares at the end of the measurement period, resulting in capital gains taxes or tax benefits when capital losses occur. Actual after-tax returns will depend on your individual tax situation and may differ from those shown. The after-tax returns shown are not relevant to you if you hold your Fund shares through tax-deferred arrangements, such as 401(k) plans or Individual Retirement Accounts. |

| Average Annual Total Returns for the periods ended 12/31/2009 | ||||||||||

| Wells Fargo Advantage Mid Cap Disciplined Fund | Inception Date of Share Class | 1 Year | 5 Year | 10 Year | ||||||

| Class A (before taxes)1 | 7/31/2007 | 24.33% | 1.12% | 8.18% | ||||||

| Class C (before taxes)1 | 7/31/2007 | 30.10% | 1.60% | 8.17% | ||||||

| Institutional Class (before taxes)2 | 4/11/2005 | 32.43% | 2.69% | 9.02% | ||||||

| Institutional Class (after taxes on distributions)3 | 4/11/2005 | 31.85% | 0.77% | 7.12% | ||||||

| Institutional Class (after taxes on distributions and the sale of Fund Shares)3 | 4/11/2005 | 21.07% | 1.47% | 6.93% | ||||||

| Russell Midcap® Value Index (reflects no deduction for fees, expenses, or taxes)4 | 34.21% | 1.98% | 7.58% | |||||||

| 1 | Performance shown prior to the inception of the Class A shares reflects the performance of the Investor Class shares, and includes expenses that are not applicable to and are higher than those of Class A shares, but has been adjusted to reflect Class A sales charges. Performance shown prior to the inception of Class C shares reflects the performance of the Investor Class shares, adjusted to reflect Class C sales charges and expenses. |

| 2 | Performance shown prior to the inception of the Institutional Class shares reflects the performance of the Investor Class shares and includes expenses that are not applicable to and are higher than those of Institutional Class shares. |

| 3 | After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state, local or foreign taxes. Actual after-tax returns depend on an investor's tax situation and may differ from those shown, and after-tax returns shown are not relevant to tax-exempt investors or investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) Plans or Individual Retirement Accounts. After-tax returns are shown only for the Institutional Class shares. After-tax returns for other share classes will vary. |

| 4 | The Russell Midcap® Value Index measures the performance of those Russell Midcap® companies with lower price-to-book ratios and lower forecasted growth values. The stocks are also members of the Russell 1000® Value Index. You cannot invest directly in an index. |

Shareholder Fee and Fund Expense Comparison

The sales charges and expenses for each class of shares of your Target Fund may be different than those of the corresponding class of shares of the Acquiring Fund. This section compares the fees and expenses you pay if you buy, hold, and sell shares of the Target Fund and the Acquiring Fund, and the tables entitled "Pro Forma" also show what your fees and expenses would be if the Merger takes place. You may qualify for sales charge discounts if you and your family invest, or agree to invest in the future, at least $50,000 in the Target Fund's family of funds or $50,000 in the Acquiring Fund's family of funds. Information regarding sales charges and sales charge discounts applicable to investments in the Acquiring Fund's family of funds is available in the "Buying, Selling and Exchanging Fund Shares -- Wells Fargo Advantage Funds" section of this prospectus/proxy statement. More information about these and other discounts is available from your financial professional and in the Funds' prospectuses.