As filed with the Securities and Exchange Commission on February 19, 2010

Registration No. 333-______

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-14

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

|

|

|

|

|

|

|

|

|

Pre-Effective Amendment No. __ |

|

|

|

|

|

Post-Effective Amendment No. |

|

|

(Check appropriate box or boxes)

Exact Name of Registrant as Specified in Charter:

WELLS FARGO FUNDS TRUST

Area Code and Telephone Number: (800) 552-9612

Address of Principal Executive Offices, including Zip Code:

525 Market Street

San Francisco, California 94163

Name and Address of Agent for Service:

C. David Messman

c/oWells Fargo Funds Management, LLC

525 Market Street, 12th Floor

San Francisco, California 94105

With copies to:

Marco E. Adelfio, Esq.

GOODWIN PROCTER LLP

901 NEW YORK AVENUE, N.W.

WASHINGTON, D.C. 20001

It is proposed that this filing will become effective on March 22, 2010 pursuant to Rule 488.

No filing fee is required under the Securities Act of 1933 because an indefinite number of shares of beneficial interest in the Registrant has previously been registered pursuant to Rule 24f-2 under the Investment Company Act of 1940, as amended.

WELLS FARGO FUNDS TRUST

PART A

PROSPECTUS/PROXY STATEMENT

<

DRAFT 2/18/10

WFAF & EVG Long Term Funds (mergers into shells)

[cobranded logos ]

Your Prompt Response is Requested

<

The enclosed document is a combined prospectus/proxy statement with proposals that pertain to certain Evergreen Funds. As a shareholder of one or more of the Funds, you are being asked to approve a merger of your Fund(s) into a Wells Fargo Advantage Fund.

<

The voting process will only take a few minutes

Instructions for returning your proxy are enclosed. Please be sure to respond by June 8, 2010, regardless of the number of shares you own.

<

Highlights of proxy proposals

For your convenience, the following information highlights the principal aspects of the proposals in the proxy. Full details are provided in the prospectus/proxy statement. We encourage you to read it carefully.

|

Why have the proposals for the merger of these Funds been put forward at this time? < |

The enclosed prospectus/proxy statement for the merger of your funds is part of the overall proposal to combine the fund lineups of the Wells Fargo Advantage Funds and the Evergreen Funds. As a result of the merger between Wells Fargo & Company and Wachovia Corporation, Wells Fargo Funds Management, LLC, the investment adviser to the Wells Fargo Advantage Funds, and Evergreen Investment Management Company, LLC, the investment adviser to the Evergreen funds, recommended that the Boards of Trustees of the two fund families approve combining the fund families under the Wells Fargo Advantage Funds name. < |

|

What am I being asked to vote on? < |

As a shareholder of the merging (Target) fund, you are being asked to approve the merger of your fund into a surviving (Acquiring) fund. Your Fund’s Board of Trustees believes that the merger is in the best interests of your fund and that the interests of existing shareholders would not be diluted as a result of the merger. As such, they recommend that you vote to approve it. < Upon approval by shareholders and the satisfaction of other closing conditions, the merging fund will transfer all of its assets to the acquiring fund, and the acquiring fund will assume all of the liabilities of the target fund in exchange for shares of a comparable class of the acquiring fund. The acquiring fund shares that you receive in a merger will have a total dollar value equal to that of the target fund shares that you hold at the time of the merger. < Merging (Target) Fund Surviving (Acquiring) Fund Evergreen Disciplined Value Fund Wells Fargo Advantage Disciplined Value

Fund Evergreen Emerging Markets Growth Fund Wells Fargo Advantage Emerging Markets

Equity Fund II1 Evergreen Equity Income Fund Wells Fargo Advantage Classic Value

Fund Evergreen Golden Large Cap Core Fund Wells Fargo Advantage Large Cap Core

Fund Evergreen Large Company Growth Fund Wells Fargo Advantage Premier Large

Company Growth Fund Wells Fargo Advantage Emerging Markets Wells Fargo Advantage Emerging Markets Equity

Fund

Equity Fund II1 Wells Fargo Advantage Equity Income Wells Fargo Advantage Disciplined Value Fund Fund < Wells Fargo Advantage Large Company Wells Fargo Advantage Large Cap Core Core

Fund

Fund Wells Fargo Advantage Large Company Wells Fargo Advantage Premier Large Growth

Fund

Company Growth Fund Wells Fargo Advantage Specialized Wells Fargo Advantage Classic Value Financial Services

Fund Fund Wells Fargo Advantage U.S. Value Fund Wells Fargo Advantage Disciplined Value Fund < |

|

Why has my Fund’s Board of Trustees recommended that I vote in favor of approving a merger? |

Among the factors the Boards considered in recommending the mergers were the following: Similarities and differences between the investment strategies of the target and acquiring funds. Shareholders will not bear any direct expenses in connection with the mergers. The mergers are expected to be non-taxable events for U.S. federal income tax purposes. < |

|

How do I vote my shares? < |

You can vote your shares in one of four ways: Vote online at the Web site address listed on your proxy card. Call the toll-free number printed on your proxy card. Complete and sign the enclosed proxy card and return by mail in the enclosed postage paid return envelope (if mailed in the United States). Attend the special meeting scheduled to be held on June 8, 2010. Whether or not you expect to attend the meeting, we encourage you to vote online or by phone or mail. < |

|

What is the due date for returning my vote? |

A final vote will take place at a special meeting of shareholders scheduled to take place on June 8, 2010. Your vote must be received by that date. |

|

Is this a taxable event for shareholders? |

No. Each merger is expected to be a non-taxable event for U.S. federal income tax purposes. < |

|

Whom should I call with questions about the voting process? |

If you have any questions about any proposal or related proxy materials, please call your investment professional, trust officer, or an Evergreen client service representative at 1-800-343-2898, Monday through Friday, 9:00 a.m. to 6:00 p.m., Eastern Time, or a Wells Fargo Advantage Funds client service representative at 1-800-222-8222, 24 hours a day, seven days a week. If you have any questions about the voting process or if you would like to vote by telephone, you may call our proxy solicitor, [ name ] at [ phone number ]. < < |

<

If the merger of the Wells Fargo Advantage Emerging Markets Fund into the Fund is approved, immediately following the merger the Fund's name will be changed to Wells Fargo Advantage Emerging Markets Equity Fund.

<

<

<

<

[Back cover]

Evergreen Investments logo

Wells Fargo Advantage Funds logo

<

<

Evergreen Investment Management Company, LLC, is a subsidiary of Wells Fargo & Company and is an affiliate of Wells Fargo & Company’s broker/dealer subsidiaries. Evergreen InvestmentsSM is a service mark of Evergreen Investment Management Company, LLC.

<

Wells Fargo Funds Management, LLC, a wholly owned subsidiary of Wells Fargo & Company, provides investment advisory and administrative services for Wells Fargo Advantage Funds. Other affiliates of Wells Fargo & Company provide subadvisory and other services for the Wells Fargo Advantage Funds.

<

Wells Fargo Funds Distributor, LLC, Member FINRA/SIPC, an affiliate of Wells Fargo & Company, is the distributor of the Evergreen Funds and the Wells Fargo Advantage Funds. 120079 2-10

<

NOT FDIC INSURED • NO BANK GUARANTEE • MAY LOSE VALUE

<

© 2010 Wells Fargo Funds Management, LLC. All rights reserved.

EVERGREEN FUNDS

200 Berkeley Street

Boston, MA 02116-5034

1.800.343.2898

WELLS FARGO FUNDS TRUST

525 Market Street, 12th Floor

San Francisco, CA 94105

1.800.222.8222

____, 2010

Dear Shareholder,

On December 31, 2008, the parent company of the investment adviser to the Evergreen funds, Wachovia Corporation ("Wachovia"), and the parent company of the investment adviser to Wells Fargo Advantage Funds®, Wells Fargo & Company ("Wells Fargo"), merged. Since that date, the investment adviser to the Evergreen funds, Evergreen Investment Management Company, LLC ("EIMC"), and the investment adviser to Wells Fargo Advantage Funds, Wells Fargo Funds Management, LLC ("Funds Management"), have considered rationalizing and reorganizing their mutual fund businesses. After multiple presentations to and discussions with the Boards of Trustees of both the Evergreen funds and Wells Fargo Advantage Funds regarding these matters, on December 30, 2009, EIMC proposed to the Boards of Trustees of the Evergreen funds, and on January 11, 2010, Funds Management proposed to the Boards of Trustees of Wells Fargo Advantage Funds, the mergers outlined in the table below. Both the Boards of Trustees of the Evergreen funds and Wells Fargo Advantage Funds approved the proposed mergers and the related Agreement and Plan of Reorganization subject to the approval by shareholders of each Target Fund (as set forth in the table below), as part of a comprehensive set of mutual fund mergers across the two fund families.

As a result, you are invited to vote on a proposal to merge your Target Fund into a corresponding Acquiring Fund (as set forth in the table below) (each a "Merger," and collectively, the "Mergers"). The Board of Trustees of each Target Trust (as set forth in the table below) has unanimously approved the Target Fund's Merger and recommends that you vote FOR this proposal.

| Target Fund | Target Trust | Acquiring Fund | Acquiring Trust | |||||

| Evergreen Equity Income Fund | Evergreen Equity Trust | Wells Fargo Advantage Classic Value Fund | Wells Fargo Funds Trust | |||||

| Wells Fargo Advantage Specialized Financial Services Fund | Wells Fargo Funds Trust | Wells Fargo Advantage Classic Value Fund | Wells Fargo Funds Trust | |||||

| Evergreen Disciplined Value Fund | Evergreen Equity Trust | Wells Fargo Advantage Disciplined Value Fund | Wells Fargo Funds Trust | |||||

| Wells Fargo Advantage U.S. Value Fund | Wells Fargo Funds Trust | Wells Fargo Advantage Disciplined Value Fund | Wells Fargo Funds Trust | |||||

| Wells Fargo Advantage Equity Income Fund | Wells Fargo Funds Trust | Wells Fargo Advantage Disciplined Value Fund | Wells Fargo Funds Trust | |||||

| Evergreen Golden Large Cap Core Fund | Evergreen Equity Trust | Wells Fargo Advantage Large Cap Core Fund | Wells Fargo Funds Trust | |||||

| Wells Fargo Advantage Large Company Core Fund | Wells Fargo Funds Trust | Wells Fargo Advantage Large Cap Core Fund | Wells Fargo Funds Trust | |||||

| Evergreen Large Company Growth Fund | Evergreen Equity Trust | Wells Fargo Advantage Premier Large Company Growth Fund | Wells Fargo Funds Trust | |||||

| Wells Fargo Advantage Large Company Growth Fund | Wells Fargo Funds Trust | Wells Fargo Advantage Premier Large Company Growth Fund | Wells Fargo Funds Trust | |||||

| Evergreen Emerging Markets Growth Fund | Evergreen International Trust | Wells Fargo Advantage Emerging Markets Equity Fund II1 | Wells Fargo Funds Trust | |||||

| Wells Fargo Advantage Emerging Markets Equity Fund | Wells Fargo Funds Trust | Wells Fargo Advantage Emerging Markets Equity Fund II1 | Wells Fargo Funds Trust | |||||

| 1 | If the Merger of Wells Fargo Advantage Emerging Markets Equity Fund into the Fund is approved, immediately following that Merger the Fund's name will be changed to Wells Fargo Advantage Emerging Markets Equity Fund. |

If approved by shareholders, this is how each Merger will work:

-

Each Target Fund will transfer all of its assets to the corresponding Acquiring Fund.

-

Each Acquiring Fund will assume all of the liabilities of the corresponding Target Fund.

-

Each Acquiring Fund will issue new shares that will be distributed to you in an amount equal to the value of your Target Fund shares.

-

If the Merger is consummated, each Target Fund shareholder will become a shareholder of the corresponding Acquiring Fund and will have his or her investment managed in accordance with the Acquiring Fund's investment strategies.

-

You will not incur any sales charges or similar transaction charges as a result of the Merger.

-

It is expected that the Merger will be a non-taxable event for shareholders for U.S. federal income tax purposes.

Details about each Target Fund's and Acquiring Fund's investment goals, principal investment strategies, portfolio management team, past performance, principal risks, fees, and expenses, along with additional information about the proposed Mergers, are contained in the attached prospectus/proxy statement. Please read it carefully.

A special meeting of each Target Fund's shareholders will be held on June 8, 2010. Although you are welcome to attend the meeting in person, you do not need to do so in order to vote your shares. If you do not expect to attend the meeting, please complete, date, sign and return the enclosed proxy card in the postage-paid envelope provided. You may also vote by telephone or the internet by following the voting instructions as outlined at the end of this prospectus/proxy statement. If your Target Fund does not receive your vote after several weeks, you may receive a telephone call from [PROXY SOLICITOR], our proxy solicitor, requesting your vote. If you have any questions about the Mergers or the proxy card, please call [PROXY SOLICITOR] at (800) ____ (toll-free).

Remember, your vote is important to us, no matter how many shares you own. Please take this opportunity to vote. Thank you for taking this matter seriously and participating in this important process.

Sincerely,

Karla Rabusch

President

Wells Fargo Funds Trust

W. Douglas Munn

President

Evergreen Funds

EVERGREEN FUNDS

200 Berkeley Street

Boston, MA 02116-5034

1.800.343.2898

____, 2010

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS TO BE HELD ON ___

A Special Meeting (the "Meeting") of Shareholders of your Target Fund, a series of the Target Trust, each set forth in the table below, will be held at the offices of Wells Fargo Advantage Funds®, 525 Market Street, San Francisco, California 94105 on ___, 2010 at 10:00 a.m., Pacific time.

| Target Fund | Target Trust | Acquiring Fund | Acquiring Trust | |||||

| Evergreen Disciplined Value Fund | Evergreen Equity Trust | Wells Fargo Advantage Disciplined Value Fund | Wells Fargo Funds Trust | |||||

| Evergreen Emerging Markets Growth Fund | Evergreen International Trust | Wells Fargo Advantage Emerging Markets Equity Fund II1 | Wells Fargo Funds Trust | |||||

| Evergreen Equity Income Fund | Evergreen Equity Trust | Wells Fargo Advantage Classic Value Fund | Wells Fargo Funds Trust | |||||

| Evergreen Golden Large Cap Core Fund | Evergreen Equity Trust | Wells Fargo Advantage Large Cap Core Fund | Wells Fargo Funds Trust | |||||

| Evergreen Large Company Growth Fund | Evergreen Equity Trust | Wells Fargo Advantage Premier Large Company Growth Fund | Wells Fargo Funds Trust | |||||

| 1 | If the Merger of Wells Fargo Advantage Emerging Markets Equity Fund into the Fund is approved, immediately following that Merger the Fund's name will be changed to Wells Fargo Advantage Emerging Markets Equity Fund. |

With respect to your Target Fund, the Meeting is being held for the following purposes:

-

To consider and act upon an Agreement and Plan of Reorganization (the "Plan") dated as of ___, 2010, providing for the acquisition of all of the assets of the Target Fund by the corresponding Acquiring Fund in exchange for shares of the Acquiring Fund (the "Acquisition Shares") and the assumption by the Acquiring Fund of all of the liabilities of the Target Fund. The Plan also provides for the prompt distribution of the Acquisition Shares to shareholders of the corresponding Target Fund in liquidation of the Target Fund.

-

To transact any other business which may properly come before the Meeting or any adjournment(s) thereof.

Any adjournment(s) of the Meeting will be held at the above address. The Board of Trustees of your Target Fund has fixed the close of business on March 10, 2010 as the record date (the "Record Date") for the Meeting. Only shareholders of record as of the close of business on the Record Date will be entitled to this notice, and to vote at the Meeting or any adjournment(s) thereof.

IT IS IMPORTANT THAT PROXY CARDS OR VOTING INSTRUCTION CARDS BE RETURNED PROMPTLY. ALL SHAREHOLDERS ARE URGED TO COMPLETE, DATE, SIGN AND RETURN THEIR ENCLOSED PROXY CARD OR VOTING INSTRUCTION CARD IN THE ENCLOSED POSTAGE-PAID ENVELOPE, OR TO VOTE USING ONE OF THE OTHER METHODS DESCRIBED AT THE END OF THE PROSPECTUS/PROXY STATEMENT SO THAT YOUR SHARES MAY BE REPRESENTED AT THE MEETING. YOUR PROMPT ATTENTION TO THE ENCLOSED PROXY CARD OR VOTING INSTRUCTION CARD WILL HELP TO AVOID THE EXPENSE OF FURTHER SOLICITATION.

By order of the Board of Trustees,

Michael H. Koonce

Secretary

WELLS FARGO FUNDS TRUST

525 Market Street, 12th Floor

San Francisco, CA 94105

1.800.222.8222

____, 2010

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS TO BE HELD ON ___

A Special Meeting (the "Meeting") of Shareholders of your Target Fund, a series of the Target Trust, each set forth in the table below, will be held at the offices of Wells Fargo Advantage Funds®, 525 Market Street, San Francisco, California 94105 on ___, 2010 at 10:00 a.m., Pacific time.

| Target Fund | Target Trust | Acquiring Fund | Acquiring Trust | |||||

| Wells Fargo Advantage Emerging Markets Equity Fund | Wells Fargo Funds Trust | Wells Fargo Advantage Emerging Markets Equity Fund II1 | Wells Fargo Funds Trust | |||||

| Wells Fargo Advantage Equity Income Fund | Wells Fargo Funds Trust | Wells Fargo Advantage Disciplined Value Fund | Wells Fargo Funds Trust | |||||

| Wells Fargo Advantage Large Company Core Fund | Wells Fargo Funds Trust | Wells Fargo Advantage Large Cap Core Fund | Wells Fargo Funds Trust | |||||

| Wells Fargo Advantage Large Company Growth Fund | Wells Fargo Funds Trust | Wells Fargo Advantage Premier Large Company Growth Fund | Wells Fargo Funds Trust | |||||

| Wells Fargo Advantage Specialized Financial Services Fund | Wells Fargo Funds Trust | Wells Fargo Advantage Classic Value Fund | Wells Fargo Funds Trust | |||||

| Wells Fargo Advantage U.S. Value Fund | Wells Fargo Funds Trust | Wells Fargo Advantage Disciplined Value Fund | Wells Fargo Funds Trust | |||||

| 1 | If the Merger of Wells Fargo Advantage Emerging Markets Equity Fund into the Fund is approved, immediately following that Merger the Fund's name will be changed to Wells Fargo Advantage Emerging Markets Equity Fund. |

With respect to each Target Fund, the Meeting is being held for the following purposes:

-

To consider and act upon an Agreement and Plan of Reorganization (the "Plan") dated as of February __, 2010, providing for the acquisition of all of the assets of the Target Fund by the corresponding Acquiring Fund in exchange for shares of the Acquiring Fund (the "Acquisition Shares") and the assumption by the Acquiring Fund of all of the liabilities of the Target Fund. The Plan also provides for the prompt distribution of the Acquisition Shares to shareholders of the corresponding Target Fund in liquidation of the Target Fund.

-

To transact any other business which may properly come before the Meeting or any adjournment(s) thereof.

Any adjournment(s) of the Meeting will be held at the above address. The Board of Trustees of your Target Fund has fixed the close of business on March 10, 2010 as the record date (the "Record Date") for the Meeting. Only shareholders of record as of the close of business on the Record Date will be entitled to this notice, and to vote at the Meeting or any adjournment(s) thereof.

IT IS IMPORTANT THAT PROXY CARDS BE RETURNED PROMPTLY. ALL SHAREHOLDERS ARE URGED TO COMPLETE, DATE, SIGN AND RETURN THEIR ENCLOSED PROXY CARD IN THE ENCLOSED POSTAGE-PAID ENVELOPE, OR TO VOTE USING ONE OF THE OTHER METHODS DESCRIBED AT THE END OF THE PROSPECTUS/PROXY STATEMENT SO THAT YOUR SHARES MAY BE REPRESENTED AT THE MEETING. YOUR PROMPT ATTENTION TO THE ENCLOSED PROXY CARD WILL HELP TO AVOID THE EXPENSE OF FURTHER SOLICITATION.

By order of the Board of Trustees,

C. David Messman

Secretary

EVERGREEN FUNDS

200 Berkeley Street

Boston, MA 02116-5034

1.800.343.2898

WELLS FARGO FUNDS TRUST

525 Market Street, 12th Floor

San Francisco, CA 94105

1.800.222.8222

____, 2010

PROSPECTUS/PROXY STATEMENT

This prospectus/proxy statement contains information you should know before voting on the proposed merger (the "Merger") of your Target Fund into the corresponding Acquiring Fund as set forth and defined in the table below, each of which is a series of a registered open-end management investment company. If approved, the Merger will result in your receiving shares of the Acquiring Fund in exchange for your shares of the Target

Fund.

| Target Fund | Target Trust | Acquiring Fund | Acquiring Trust | |||||

| Evergreen Equity Income Fund | Evergreen Equity Trust | Wells Fargo Advantage Classic Value Fund | Wells Fargo Funds Trust | |||||

| Wells Fargo Advantage Specialized Financial Services Fund | Wells Fargo Funds Trust | Wells Fargo Advantage Classic Value Fund | Wells Fargo Funds Trust | |||||

| Evergreen Disciplined Value Fund | Evergreen Equity Trust | Wells Fargo Advantage Disciplined Value Fund | Wells Fargo Funds Trust | |||||

| Wells Fargo Advantage U.S. Value Fund | Wells Fargo Funds Trust | Wells Fargo Advantage Disciplined Value Fund | Wells Fargo Funds Trust | |||||

| Wells Fargo Advantage Equity Income Fund | Wells Fargo Funds Trust | Wells Fargo Advantage Disciplined Value Fund | Wells Fargo Funds Trust | |||||

| Evergreen Golden Large Cap Core Fund | Evergreen Equity Trust | Wells Fargo Advantage Large Cap Core Fund | Wells Fargo Funds Trust | |||||

| Wells Fargo Advantage Large Company Core Fund | Wells Fargo Funds Trust | Wells Fargo Advantage Large Cap Core Fund | Wells Fargo Funds Trust | |||||

| Evergreen Large Company Growth Fund | Evergreen Equity Trust | Wells Fargo Advantage Premier Large Company Growth Fund | Wells Fargo Funds Trust | |||||

| Wells Fargo Advantage Large Company Growth Fund | Wells Fargo Funds Trust | Wells Fargo Advantage Premier Large Company Growth Fund | Wells Fargo Funds Trust | |||||

| Evergreen Emerging Markets Growth Fund | Evergreen International Trust | Wells Fargo Advantage Emerging Markets Equity Fund II1 | Wells Fargo Funds Trust | |||||

| Wells Fargo Advantage Emerging Markets Equity Fund | Wells Fargo Funds Trust | Wells Fargo Advantage Emerging Markets Equity Fund II1 | Wells Fargo Funds Trust | |||||

| 1 | If the Merger of Wells Fargo Advantage Emerging Markets Equity Fund into the Fund is approved, immediately following that Merger the Fund's name will be changed to Wells Fargo Advantage Emerging Markets Equity Fund. |

The Target and Acquiring Funds listed above are collectively referred to as the "Funds." The Target and Acquiring Trusts listed above are collectively referred to as the "Trusts."

Please read this prospectus/proxy statement carefully and retain it for future reference. Additional information concerning each Fund and/or Merger has been filed with the Securities and Exchange Commission ("SEC").

The prospectuses of each Target Fund are incorporated into this document by reference and are legally deemed to be part of this prospectus/proxy statement.

The Statement of Additional Information relating to this prospectus/proxy statement (the "Merger SAI"), dated the same date as this prospectus/proxy statement, is also incorporated into this document by reference and is legally deemed to be part of this prospectus/proxy statement.

The Statement of Additional Information ("SAI"), and the annual and semi-annual reports of each Target Fund are incorporated into the Merger SAI by reference and are legally deemed to be part of the Merger SAI.

Copies of these documents pertaining to an Evergreen Target Fund are available upon request without charge by writing to the address above, calling 1.800.343.2898 or visiting the Evergreen funds' Web site at www.evergreeninvestments.com. Copies of these documents pertaining to a Wells Fargo Target Fund are available upon request without charge by writing to Wells Fargo Advantage Funds®, P.O. Box 8266, Boston, MA 02266-8266, calling 1.800.222.8222 or visiting the Wells Fargo Advantage Funds Web site at www.wellsfargo.com/advantagefunds.

Each Acquiring Fund is a "Shell Fund" being registered with the SEC in order to receive the assets and assume the liabilities of its corresponding Target Fund. As such, prospectuses, SAIs and annual and semi-annual reports for the Acquiring Funds are not yet available as of the date of this prospectus/proxy statement. Additional information about the Acquiring Funds may be found in Exhibit E and the Merger SAI, and references throughout this prospectus/proxy statement to an Acquiring Fund's prospectus and SAI should be read as references to these sources.

You may also view or obtain these documents from the SEC: by phone at 1.800.SEC.0330 (duplicating fee required); in person or by mail at Public Reference Section, Securities and Exchange Commission, 100 F. Street, N.E., Washington, D.C. 20549-0213 (duplicating fee required); by email at publicinfo@sec.gov (duplicating fee required); or by internet at www.sec.gov.

The SEC has not approved or disapproved these securities or determined if this prospectus/proxy statement is truthful or complete. Any representation to the contrary is a criminal offense.

The shares offered by this prospectus/proxy statement are not deposits of a bank, and are not insured, endorsed or guaranteed by the FDIC or any government agency and involve investment risk, including possible loss of your original investment.

| Evergreen Disciplined Value Fund |

| Evergreen Emerging Markets Growth Fund |

| Evergreen Equity Income Fund |

| Evergreen Golden Large Cap Core Fund |

| Evergreen High Income Fund |

| Evergreen International Equity Fund |

| Evergreen Large Company Growth Fund |

| Evergreen Small Cap Value Fund |

| Evergreen Special Values Fund |

| WF Emerging Markets Equity Fund |

| WF Equity Income Fund |

| WF International Equity Fund |

| WF Large Company Core Fund |

| WF Large Company Growth Fund |

| WF Specialized Financial Services Fund |

| WF Strategic Income Fund |

| WF U.S. Value Fund |

Table of Contents

|

2 |

|

|

2 |

|

|

Merger Summary (Goals, Strategies, Risks, Performance, Expense, Management and Tax Information) |

|

|

3 |

|

|

12 |

|

|

25 |

|

|

35 |

|

|

45 |

|

|

54 |

|

|

57 |

|

|

60 |

|

|

68 |

|

|

Material U.S. Federal Income Tax Consequences of the Mergers |

69 |

|

80 |

|

|

89 |

|

|

92 |

|

|

94 |

|

|

100 |

|

|

101 |

|

|

101 |

|

|

102 |

|

|

Instructions for Executing Proxy Card / Voting Instructions Card |

103 |

|

A-1 |

|

|

Exhibit B - Comparison of the Funds' Fundamental Investment Policies |

B-1 |

|

Exhibit C - Additional Target and Acquiring Fund Expense Information |

C-1 |

|

D-1 |

|

|

E-1 |

|

|

F-1 |

|

OVERVIEW

This section summarizes the primary features and consequences of your Merger. This summary is qualified in its entirety by reference to the information contained elsewhere in this prospectus/proxy statement, in the Merger SAI, in each Target Fund's prospectus, in each Target Fund's financial statements contained in the annual and semi-annual reports, and in each Target Fund's SAI, and in the Agreement and Plan of Reorganization (the "Plan"), a form of which is attached as Exhibit A hereto.

Key Features of the Mergers

The Plan sets forth the key features of each Merger and generally provides for the following:

-

the transfer of all of the assets of the Target Fund to the Acquiring Fund in exchange for shares of the Acquiring Fund;

-

the assumption by the Acquiring Fund of all of the liabilities of the Target Fund;

-

the liquidation of the Target Fund by distributing the shares of the Acquiring Fund to the Target Fund's shareholders; and

-

the assumption of the costs of each Merger (other than costs incurred from securities transactions in connection with the Merger) by Wells Fargo Funds Management, LLC ("Funds Management") and/or Evergreen Investment Management Company, LLC ("EIMC") or one of its affiliates.

The Mergers are scheduled to take place on or about July 16, 2010. For a more complete description of the Mergers, see the section entitled "Agreement and Plan of Reorganization," as well as Exhibit A.

Board of Trustees Recommendation

At a meeting held on December 30, 2009 for the Boards of Trustees of the Evergreen funds, and on January 11, 2010 for the Board of Trustees of Wells Fargo Advantage Funds, the Trustees of your Target Fund, including a majority of the Trustees who are not "interested persons" of your Target Fund, as that term is defined in the Investment Company Act of 1940, as amended (the "1940 Act") (the "Independent Trustees"), considered and unanimously approved the Merger of your Target Fund.

Before approving the Mergers, the Trustees reviewed, among other things, information about the Funds and the proposed transactions. Those materials set forth a comparison of various factors, such as the relative sizes of the Funds, the performance records of the Funds, and the expenses of the Funds, as well as similarities and differences between the Funds' investment goals, principal investment strategies and specific portfolio characteristics.

The Board of Trustees of your Target Fund, including all of the Independent Trustees, has concluded that the Merger would be in the best interests of your Target Fund, and that existing shareholders' interests would not be diluted as a result of the Merger. Accordingly, the Trustees have submitted the Plan to the Target Fund's shareholders and unanimously recommend its approval. The Board of Trustees of Wells Fargo Advantage Funds has also approved the Plan on behalf of each Acquiring Fund.

For further information about the considerations of each Target Trust's Board, please see the section entitled "Reasons for the Mergers."

Merger Summary (Goals, Strategies, Risks, Performance, Expense, Management and Tax Information)

The following section provides a comparison between the Funds with respect to their investment goals, principal investment strategies, fundamental investment policies, risks, performance records, sales charges and expenses. It also provides information about what the management and share class structure of your Acquiring Fund will be after the Merger. The information below is only a summary; for more detailed information, please see the rest of this prospectus/proxy statement and each Target Fund's prospectus and SAI. In this section, references to "we" in the principal investment strategy discussion for a Wells Fargo Advantage Fund generally refer to Funds Management, a sub-adviser, or the portfolio manager(s).

Wells Fargo Advantage Equity Income Fund and Wells Fargo Advantage Large Company Growth Fund, each a Target Fund, are gateway funds in a master/gateway structure. This structure is more commonly known as a mater/feeder structure. In this structure, a gateway or feeder fund invests substantially all of its assets in one or more master portfolios or other funds of Wells Fargo Advantage Funds, and may invest directly in securities, to achieve its investment objective. References to the investment activities of a gateway fund are intended to refer to the investment activities of the master portfolio(s) in which it invests.

EVERGREEN EQUITY INCOME FUND AND WELLS FARGO ADVANTAGE SPECIALIZED FINANCIAL SERVICES FUND INTO WELLS FARGO ADVANTAGE CLASSIC VALUE FUND

In addition to your Target Fund, shareholders in one or more other Target Funds are being asked to approve a Merger into your Acquiring Fund. Your Merger is not contingent upon approval of any other Merger by shareholders of any other Target Fund.

Share Class Information

The following table illustrates the share class of the Acquiring Fund you will receive in exchange for the shares you own in your Target Fund.

| If you own this class of shares of Evergreen Equity Income Fund: | You will get this class of shares of Wells Fargo Advantage Classic Value Fund:1 | ||||

| Class A | Class A | ||||

| Class B | Class B | ||||

| Class C | Class C | ||||

| Class I | Administrator Class | ||||

| Class R | Class R |

| 1 | The Fund is a shell fund ("Shell Fund") being created to receive the assets of one or more Target Funds. |

| If you own this class of shares of Wells Fargo Advantage Specialized Financial Services Fund: | You will get this class of shares of Wells Fargo Advantage Classic Value Fund:1 | ||||

| Class A | Class A | ||||

| Class B | Class B | ||||

| Class C | Class C |

| 1 | The Fund is a shell fund ("Shell Fund") being created to receive the assets of one or more Target Funds. |

The Acquiring Fund shares you receive as a result of the Merger will have the same total value as the total value of your Target Fund shares as of the close of business on the business day immediately prior to the Merger.

The procedures for buying, selling and exchanging shares of the Funds are similar. For additional information, see the section entitled "Buying, Selling and Exchanging Fund Shares." This section also contains important information for foreign shareholders of an Evergreen Target Fund, defined as shareholders whose accounts do not currently have both a U.S. address and tax payer identification number on record with the Funds. Following the Merger, foreign shareholders will no longer be able to make additional investments into a Wells Fargo Advantage Fund.

Investment Goal and Strategy Comparison

The following section compares the investment goals, principal investment strategies and fundamental investment policies of the Funds. The investment goals of the Funds may be changed without shareholder approval.

Evergreen Equity Income Fund and Wells Fargo Advantage Classic Value Fund. Evergreen Equity Income Fund and Wells Fargo Advantage Classic Value Fund have similar investment goals and strategies. Wells Fargo Advantage Classic Value Fund seeks long-term capital appreciation as its investment objective and Evergreen Equity Income Fund seeks current income and capital growth in the value of its shares. While Evergreen Equity Income Fund normally invests at least 80% of its assets in equity securities that produce income, including common stocks and securities convertible into common stocks, across all market capitalizations, Wells Fargo Advantage Classic Value Fund invests at least 80% of its assets in equity securities of large-capitalization companies. This means that an investment in Wells Fargo Advantage Classic Value Fund may produce less income than a similar investment in Evergreen Equity Income Fund, and Evergreen Equity Income Fund may invest a greater percentage of its assets in securities of small- and medium-capitalization companies. Unlike Evergreen Equity Income Fund, which invests in both value- and growth-oriented equity securities, Wells Fargo Advantage Classic Value Fund primarily uses a value-oriented style of investment. This means that Wells Fargo Advantage Classic Value Fund may be subject to value style investment risk to a greater extent than Evergreen Equity Income Fund.

Evergreen Equity Income Fund may invest up to 50% of its assets in foreign securities and up to 20% of its assets in investment grade bonds and convertible debentures of any quality. In contrast, Wells Fargo Advantage Classic Value Fund may invest up to 20% of its assets in equity securities of foreign issuers, and generally does not invest in debt or convertible securities as part of its principal investment strategies.

A more complete description of each Fund's investment goals and strategies is below.

| EVERGREEN EQUITY INCOME FUND (Target Fund) | WELLS FARGO ADVANTAGE CLASSIC VALUE FUND (Acquiring Fund) | ||||

| INVESTMENT GOAL | |||||

| The Fund seeks current income and capital growth in the value of its shares. | The Fund seeks long-term capital appreciation. | ||||

| PRINCIPAL INVESTMENT STRATEGIES | |||||

| The Fund normally invests at least 80% of its assets in equity securities that produce income, including common stocks and securities convertible into common stocks, across all market capitalizations. The Fund may invest up to 20% of its assets in investment grade bonds and convertible debentures of any quality. A security is considered to be investment grade if it is rated in the top four ratings categories by one or more nationally recognized statistical ratings organizations. Security ratings are determined at the time of investment based on ratings received by nationally recognized statistical ratings organizations or, if a security is not rated, it will be deemed to have the same rating as a security determined to be of comparable quality by the Fund's portfolio manager. If a security is rated by more than one nationally recognized statistical ratings organization, the highest rating is used. The Fund may retain any security whose rating has been downgraded after purchase if the Fund's portfolio manager considers the retention advisable. | Under normal circumstances, we invest at least 80% of the Fund's net assets in equity securities of large-capitalization companies, which we define as companies with market capitalizations within the range of the Russell 1000® Value Index. The market capitalization range of the Russell 1000® Value Index was $263 million to $324 billion, as of December 31, 2009, and is expected to change frequently. | ||||

| The Fund may, but will not necessarily, use derivatives. | Furthermore, we may use futures, options or swap agreements, as well as other derivatives, to manage risk or to enhance return. | ||||

| The Fund may invest up to 50% of its assets in foreign securities. | The Fund may invest up to 20% of the Fund's total assets in equity securities of foreign issuers, including ADRs and similar investments. | ||||

| The Fund's stock selection is based on a diversified style of equity management that allows it to invest in both value and growth-oriented equity securities. "Value" securities are securities which the Fund's portfolio managers believe are currently undervalued in the marketplace based on, for example, low price-to-earnings and low price-to-cash-flow multiples. "Growth" securities are securities of companies which the Fund's portfolio managers believe have anticipated earnings ranging from steady to accelerated growth. | We are value-oriented long-term fundamental investors who seek to own businesses whose economics we understand well. We primarily focus on companies that are structurally well positioned through a combination of favorable industry forces and company-specific competitive advantages. We use the results of our fundamental analysis to come up with a range of intrinsic values for the business underlying each equity security. Our goal is to purchase equity securities with a margin of safety, which we believe comes from both our purchase price relative to our range of value estimates and the quality of the businesses that we are purchasing. | ||||

| The Fund will consider selling a portfolio investment when a portfolio manager believes the issuer's investment fundamentals are beginning to deteriorate, when the investment no longer appears consistent with the portfolio manager's investment methodology, when the Fund must meet redemptions, in order to take advantage of more attractive investment opportunities, or for other investment reasons which a portfolio manager deems appropriate. | We look to sell our holdings when the valuation is no longer favorable, our assessment of the quality of the business changes or when we find more attractive opportunities. | ||||

| Although not a principal investment strategy, the Fund may, but will not necessarily, temporarily invest up to 100% of its assets in cash and/or high-quality money market instruments in response to adverse economic, political or market conditions. This strategy is inconsistent with the Fund's investment goal and principal investment strategies and, if employed, could result in a lower return and loss of market opportunity. | The Fund may hold some of its assets in cash or in money market instruments, including U.S. Government obligations, shares of other mutual funds and repurchase agreements, or make other short-term investments to either maintain liquidity or for short-term defensive purposes when we believe it is in the best interests of the shareholders to do so. During these periods, the Fund may not achieve its objective. | ||||

Wells Fargo Advantage Specialized Financial Services Fund and Wells Fargo Advantage Classic Value Fund. Although each Fund seeks long-term capital appreciation as its investment goal, Wells Fargo Advantage Specialized Financial Services Fund normally invests at least 80% of its net assets in equity securities of financial services companies, whereas Wells Fargo Advantage Classic Value Fund invests at least 80% of its net assets in equity securities of large-capitalization companies. This means that Wells Fargo Advantage Classic Value Fund may invest in a wider variety of industries and sectors than Wells Fargo Advantage Specialized Financial Services Fund, and therefore, may not experience gains and losses based on the performance of the financial sector to the same extent as Wells Fargo Advantage Specialized Financial Services Fund.

Wells Fargo Advantage Specialized Financial Services Fund does not invest in foreign securities as part of its principal investment strategies, while Wells Fargo Advantage Classic Value Fund may invest up to 20% of its assets in equity securities of foreign issuers. This means that Wells Fargo Advantage Classic Value Fund may have substantially higher exposure to foreign securities than Wells Fargo Advantage Specialized Financial Services Fund.

A more complete description of each Fund's investment goals and strategies is below.

| WELLS FARGO ADVANTAGE SPECIALIZED FINANCIAL SERVICES FUND (Target Fund) | WELLS FARGO ADVANTAGE CLASSIC VALUE FUND (Acquiring Fund) | ||||

| INVESTMENT GOAL | |||||

| The Fund seeks long-term capital appreciation. | The Fund seeks long-term capital appreciation. | ||||

| PRINCIPAL INVESTMENT STRATEGIES | |||||

| Under normal circumstances, we invest at least 80% of the Fund's net assets in equity securities of financial services companies. We invest principally in equity securities of financial services companies (such as financial services holding companies, bank holding companies, commercial banks, savings and loan associations, brokerage companies, insurance companies, real estate-related companies, leasing companies, and consumer and industrial finance companies). | Under normal circumstances, we invest at least 80% of the Fund's net assets in equity securities of large-capitalization companies, which we define as companies with market capitalizations within the range of the Russell 1000® Value Index. The market capitalization range of the Russell 1000® Value Index was $263 million to $324 billion, as of December 31, 2009, and is expected to change frequently. | ||||

| We may also use futures, options or swap agreements, as well as other derivatives, to manage risk or to enhance return. | Furthermore, we may use futures, options or swap agreements, as well as other derivatives, to manage risk or to enhance return. | ||||

| The Fund does not invest in foreign securities as part of its principal investment strategies. | The Fund may invest up to 20% of the Fund's total assets in equity securities of foreign issuers, including ADRs and similar investments. | ||||

| In researching potential investments, we screen for companies based on fundamentals such as price to book ratio, price to earnings ratio, capital adequacy, and credit quality. In addition, we examine companies for growth potential, whether by new product introductions, geographic expansion, or merger and acquisition activities. We examine the current economic environment to determine which companies in the financial services sector are likely to benefit or be hurt by changes in the market environment or government regulatory actions. We concentrate the Fund's investments in the financial services sector. | We are value-oriented long-term fundamental investors who seek to own businesses whose economics we understand well. We primarily focus on companies that are structurally well positioned through a combination of favorable industry forces and company-specific competitive advantages. We use the results of our fundamental analysis to come up with a range of intrinsic values for the business underlying each equity security. Our goal is to purchase equity securities with a margin of safety, which we believe comes from both our purchase price relative to our range of value estimates and the quality of the businesses that we are purchasing. | ||||

| We continuosly monitor the Fund's existing holdings to determine if fundamentals have changed. We may reduce or eliminate exposure to a stock when we identify a more attractive investment opportunity, and/or when a company's fundamentals change. | We look to sell our holdings when the valuation is no longer favorable, our assessment of the quality of the business changes or when we find more attractive opportunities. | ||||

| The Fund may hold some of its assets in cash or in money market instruments, including U.S. Government obligations, shares of other mutual funds and repurchase agreements, or make other short-term investments to either maintain liquidity or for short-term defensive purposes when we believe it is in the best interests of the shareholders to do so. During these periods, the Fund may not achieve its objective. | The Fund may hold some of its assets in cash or in money market instruments, including U.S. Government obligations, shares of other mutual funds and repurchase agreements, or make other short-term investments to either maintain liquidity or for short-term defensive purposes when we believe it is in the best interests of the shareholders to do so. During these periods, the Fund may not achieve its objective. | ||||

The fundamental investment policies of the Target and Acquiring Funds are substantively similar. For a comparative chart of fundamental investment policies, please see Exhibit B.

Principal Risk Comparison

Because the Evergreen funds and Wells Fargo Advantage Funds were unaffiliated fund families until January 2009, the Funds have historically used different terms and descriptions to describe their principal risks. Nonetheless, due to the similarity of the Funds' investment strategies, the Funds are generally subject to similar types of risks. Listed below are the principal risks that apply to an investment in Wells Fargo Advantage Classic Value Fund. A description of those risks can be found in the section of this prospectus/proxy statement entitled "Risk Descriptions." Although each of the Funds may be subject to all or substantially all of the risks listed below, they may be subject to a particular risk to different degrees. For example, Wells Fargo Advantage Classic Value Fund does not generally invest in debt or convertible securities or stock of small- and medium-capitalization companies as part of its principal investment strategies. Accordingly, an investment in Evergreen Equity Income Fund may be subject to risks associated with those investments, including, for example, credit risk, interest rate risk and smaller company securities risk to a greater extent than an investment in Wells Fargo Advantage Classic Value Fund.

An investment in Wells Fargo Advantage Classic Value Fund may be subject to foreign investment risk to a greater degree than an investment in Wells Fargo Advantage Specialized Financial Services Fund, which does not invest in foreign securities as part of its principal investment strategies. Furthermore, because Wells Fargo Advantage Classic Value Fund invests primarily in large-capitalization companies in various industries and sectors, an investment in Wells Fargo Advantage Specialized Financial Services Fund may be subject to risks associated with the financial services sector to a greater extent than an investment in Wells Fargo Advantage Classic Value Fund.

Principal Risks

Counter-Party Risk

Derivatives Risk

Foreign Investment Risk

Issuer Risk

Leverage Risk

Liquidity Risk

Management Risk

Market Risk

Regulatory Risk

Value Style Investment Risk

A discussion of the principal risks associated with an investment in the Target Fund may be found in the Target Fund's prospectus. In addition, each Fund has other investment policies, practices and restrictions which, together with the Fund's related risks, are also set forth for the Target Fund in the Fund's prospectus and SAI and, for the Acquiring Fund, in this prospectus/proxy statement and the Merger SAI.

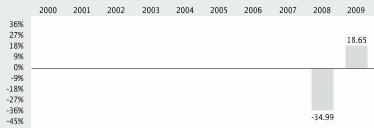

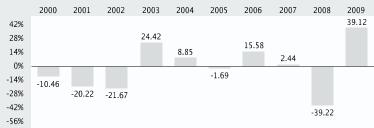

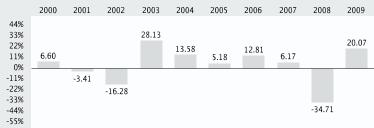

Fund Performance Comparison

The following bar chart and table illustrate how each Target Fund's returns have varied from year to year and compare the Target Funds' returns with those of one or more broad-based securities indexes. Past performance (before and after taxes) is not necessarily an indication of future results. Current month-end performance information is available for an Evergreen Target Fund at www.evergreeninvestments.com and for a Wells Fargo Target Fund at www.wellsfargo.com/advantagefunds. The bar chart does not reflect applicable sales charges; if it did, returns would be lower than those shown. Since the Acquiring Fund is a Shell Fund, it has not yet commenced operations and therefore, performance information for the Acquiring Fund is not yet available.

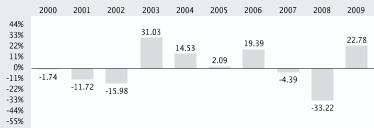

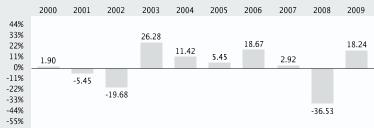

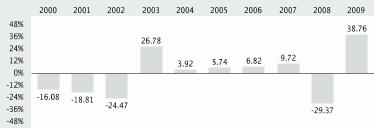

Year-by-Year Total Return for Class A Shares (%) for Evergreen Equity Income Fund

| Highest Quarter: | 2nd Quarter 2009 | +19.49% |

| Lowest Quarter: | 4th Quarter 2008 | -22.80% |

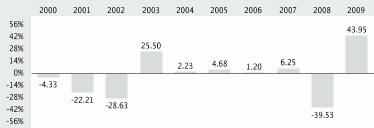

Year-by-Year Total Return for Class A Shares (%) for Wells Fargo Advantage Specialized Financial Services Fund

| Highest Quarter: | 3rd Quarter 2009 | +26.87% |

| Lowest Quarter: | 4th Quarter 2008 | -35.46% |

| Average Annual Total Returns for the periods ended 12/31/20091 | ||||||||||

| Evergreen Equity Income Fund | Inception Date of Share Class | 1 Year | 5 Year | 10 Year | ||||||

| Class A (before taxes) | 1/3/1995 | 18.84% | -0.84% | 2.02% | ||||||

| Class B (before taxes) | 1/3/1995 | 20.16% | -0.67% | 1.88% | ||||||

| Class C (before taxes) | 1/3/1995 | 24.07% | -0.38% | 1.87% | ||||||

| Class I (before taxes) | 8/31/1978 | 26.33% | 0.62% | 2.90% | ||||||

| Class I (after taxes on distributions) | 8/31/1978 | 26.06% | -0.65% | 1.64% | ||||||

| Class I (after taxes on distributions and the sale of Fund Shares) | 8/31/1978 | 17.35% | 0.36% | 2.07% | ||||||

| Class R (before taxes) | 10/10/2003 | 25.71% | 0.10% | 2.57% | ||||||

| Russell 1000 Value Index (reflects no deduction for fees, expenses, or taxes) | 19.69% | -0.25% | 2.47% | |||||||

| 1 | Historical performance shown for Class R prior to its inception is based on the performance of Class I, the original class offered. The historical returns for Class R have not been adjusted to reflect the effect of its 12b-1 fee. The Fund incurs a 12b-1 fee of 0.50% for Class R. Class I does not pay a 12b-1 fee. If these fees had been reflected, 10 year returns for Class R would have been lower. |

| 2 | The returns shown for Class B shares do not reflect the conversion of Class B shares to Class A shares. |

| 3 | After-tax returns are shown for only one class and after-tax returns for other classes will vary. The after-tax returns shown are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. After-tax returns on distributions and the sale of Fund shares assume a complete sale of Fund shares at the end of the measurement period, resulting in capital gains taxes or tax benefits when capital losses occur. Actual after-tax returns will depend on your individual tax situation and may differ from those shown. The after-tax returns shown are not relevant to you if you hold your Fund shares through tax-deferred arrangements, such as 401(k) plans or Individual Retirement Accounts. |

| Average Annual Total Returns for the periods ended 12/31/2009 | ||||||||||

| Wells Fargo Advantage Specialized Financial Services Fund | Inception Date of Share Class | 1 Year | 5 Year | 10 Year | ||||||

| Class A (before taxes) | 7/2/1962 | 13.60% | -11.24% | -2.53% | ||||||

| Class A (after taxes on distributions) | 7/2/1962 | 13.33% | -12.29% | -4.37% | ||||||

| Class A (after taxes on distributions and the sale of Fund Shares) | 7/2/1962 | 8.80% | -8.98% | -2.07% | ||||||

| Class B (before taxes) | 5/1/1997 | 14.45% | -11.51% | -2.53% | ||||||

| Class C (before taxes) | 5/1/1997 | 20.25% | -10.70% | -2.67% | ||||||

| S&P 500 Index (reflects no deduction for fees, expenses, or taxes) | 26.46% | 0.42% | -0.95% | |||||||

| S&P Financial Index (reflects no deduction for fees, expenses, or taxes) | 17.22% | -11.56% | -2.60% | |||||||

| 1 | After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state, local or foreign taxes. Actual after-tax returns depend on an investor's tax situation and may differ from those shown, and after-tax returns shown are not relevant to tax-exempt investors or investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) Plans or Individual Retirement Accounts. After-tax returns are shown only for the Class A shares. After-tax returns for other share classes will vary. |

| 2 | The S&P 500 Index consists of 500 stocks chosen for market size, liquidity, and industry group representation. It is a market value weighted index with each stock's weight in the Index proportionate to its market value. S&P 500 is a registered trademark of Standard and Poor's. You cannot invest directly in an index. |

| 3 | The S&P Financial Index is a market capitalization-weighted index of companies involved in activities such as banking, consumer finance, investment banking and brokerage, asset management, insurance and investment, and real estate, including REITs.You cannot invest directly in an index. |

Shareholder Fee and Fund Expense Comparison

The sales charges and expenses for each class of shares of your Target Fund may be different than those of the corresponding class of shares of the Acquiring Fund. This section compares the fees and expenses you pay if you buy, hold, and sell shares of each Target Fund and the Acquiring Fund, and the tables entitled "Pro Forma" also show what your fees and expenses would be if the Merger takes place. You may qualify for sales charge discounts if you and your family invest, or agree to invest in the future, at least $50,000 in a Target Fund's family of funds or $50,000 in the Acquiring Fund's family of funds. Information regarding sales charges and sales charge discounts applicable to investments in the Acquiring Fund's family of funds is available in the "Buying, Selling and Exchanging Funds Shares - Wells Fargo Advantage Funds" section of this prospectus/proxy statement. More information about these and other discounts is available from your financial professional and, for the Target Fund, in the Fund's prospectus and, for the Acquiring Funds, in this prospectus/proxy statement and Exhibit E.

The sales charge schedule applicable to Class A shares of Wells Fargo Advantage Classic Value Fund differs from the schedule applicable to Evergreen Equity Income Fund in the following ways: (i) Wells Fargo Advantage Classic Value Fund's front-end sales charges on purchases of Class A shares between $50,000 and $99,999; and (ii) those between $250,000 and $499,000 are higher than Evergreen Equity Income Fund's front-end sales charge on similar purchases of Class A shares. The sales charge schedules applicable to Class B and Class C shares of Wells Fargo Advantage Classic Value Fund are identical to the sales charge schedules for the corresponding classes of shares of Evergreen Equity Income Fund. The contingent deferred sales charge you may pay when you redeem Class C shares of Wells Fargo Advantage Classic Value Fund (other than those you receive in connection with the Merger) will be based on the net asset value of your shares when those shares were purchased, not the lower of (i) that amount or (ii) the value of the shares at the time of redemption, as is the case for Class C shares of Evergreen Equity Income Fund.

The sales charge schedules applicable to Class A, Class B, and Class C shares of Wells Fargo Advantage Classic Value Fund are identical to the sales charge schedules for the corresponding classes of shares of Wells Fargo Advantage Specialized Financial Services Fund.

The following tables allow you to compare the maximum sales charges of the Funds. The Pro Forma table also shows you what the maximum sales charges will be, assuming the Mergers take place. The Target Fund shareholders will not pay any front-end or deferred sales charges in connection with the Merger.

Shareholder Fees (fees paid directly from your investment)

| Evergreen Equity Income Fund | ||||||

| Class A | Class B | Class C | Class I, Class R |

|||

| Maximum front-end sales charge (load) imposed on purchases (as a % of offering price) | 5.75%1 | None | None | None | ||

| Maximum deferred sales charge (load) (as a % of either the redemption amount or initial investment, whichever is lower) | None1 | 5.00% | 1.00% | None | ||

| 1 | Investments of $1 million or more are not subject to a front-end sales charge, but will be subject to a deferred sales charge of 1.00% if you sell the shares within eighteen months of purchase. |

| Wells Fargo Advantage Specialized Financial Services Fund | ||||||

| Class A | Class B | Class C | ||||

| Maximum sales charge (load) imposed on purchases (as a percentage of the offering price) | 5.75%1 | None | None | |||

| Maximum deferred sales charge (load) (as a percentage of the net asset value at purchase) | None1 | 5.00% | 1.00% | |||

| 1 | Investments of $1 million or more are not subject to a front-end sales charge, but will be subject to a deferred sales charge of 1.00% if you sell the shares within eighteen months of purchase. |

| Wells Fargo Advantage Classic Value Fund (Pro Forma) | ||||||

| Class A | Class B | Class C | Administrator Class, Class R |

|||

| Maximum sales charge (load) imposed on purchases (as a percentage of the offering price) | 5.75%1 | None | None | None | ||

| Maximum deferred sales charge (load) (as a percentage of the net asset value at purchase) | None1 | 5.00% | 1.00% | None | ||

| 1 | Investments of $1 million or more are not subject to a front-end sales charge, but will be subject to a deferred sales charge of 1.00% if you sell the shares within eighteen months of purchase. |

The following tables allow you to compare the annual operating expenses of the Funds. The net and gross total annual fund operating expenses for each Target Fund set forth in the following tables are based on the actual expenses for the twelve-month period ended September 30, 2009. The pro forma expense table below labeled "Wells Fargo Advantage Classic Value Fund (Pro Forma Assuming Merger of Both Target Funds with Acquiring Fund)" shows you what the net and gross total annual fund operating expenses would have been for the Acquiring Fund for the twelve-month period ended September 30, 2009, assuming the Mergers of both Target Funds with the Acquiring Fund had taken place at the beginning of that period. If the Merger of Evergreen Equity Income Fund with the Acquiring Fund is the only Merger approved by shareholders, the pro forma expenses would have been approximately the same. The pro forma expense table below labeled "Wells Fargo Advantage Classic Value Fund (Pro Forma Assuming Merger of WFA Specialized Financial Services Fund Only with Acquiring Fund)" shows you what the net and gross total annual fund operating expenses would have been for the Acquiring Fund for the twelve-month period ended September 30, 2009, assuming only the Merger of Wells Fargo Advantage Specialized Financial Services Fund with the Acquiring Fund had taken place at the beginning of that period. Exhibit C contains expense tables and examples for each Target Fund based upon the actual expenses incurred by the Target Fund during its most recently completed fiscal year. Exhibit C also includes pro forma expense tables and examples for the Acquiring Fund as of the Target Funds' most recent financial statements. Since the Acquiring Fund has not yet commenced operations, the information presented is based on estimates.

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment)

| Evergreen Equity Income Fund | ||||

| Total Annual Fund Operating Expenses | ||||

| Class A | 1.30% | |||

| Class B | 2.05% | |||

| Class C | 2.05% | |||

| Class I | 1.05% | |||

| Class R | 1.55% | |||

| Wells Fargo Advantage Specialized Financial Services Fund | ||||||

| Total Annual Fund Operating Expenses (Before Waiver)1 | Total Annual Fund Operating Expenses (After Waiver)2,3 | |||||

| Class A | 1.69% | 1.35% | ||||

| Class B | 2.44% | 2.10% | ||||

| Class C | 2.44% | 2.10% | ||||

| 1 | Expenses have been adjusted as necessary from amounts incurred during the Fund's most recent fiscal year to reflect current fees and expenses. |

| 2 | The Total Annual Fund Operating Expenses (After Waiver) shown here include the expenses of any money market fund or other fund held by the Fund. |

| 3 | Funds Management has committed through 2/28/2011, to waive fees and/or reimburse expenses to the extent necessary to ensure that the Fund's Total Annual Fund Operating Expenses (After Waiver) excluding brokerage commissions, interest, taxes, extraordinary expenses, and the expenses of any money market fund or other fund held by the Fund do not exceed the Total Annual Fund Operating Expenses (After Waiver) shown. After this date, the Total Annual Fund Operating Expenses (After Waiver) may be increased only with the approval of the Board of Trustees. |

| Wells Fargo Advantage Classic Value Fund (Pro Forma Assuming Merger of Both Target Funds with Acquiring Fund) | ||||||

| Total Annual Fund Operating Expenses (Before Waiver) | Total Annual Fund Operating Expenses (After Waiver)1 | |||||

| Class A | 1.26% | 1.25% | ||||

| Class B | 2.01% | 2.00% | ||||

| Class C | 2.01% | 2.00% | ||||

| Administrator Class | 1.10% | 1.00% | ||||

| Class R | 1.51% | 1.50% | ||||

| 1 | Funds Management has committed for three years after the closing of the Merger to waive fees and/or reimburse expenses to the extent necessary to ensure that the Fund's Total Annual Fund Operating Expenses (After Waiver), excluding brokerage commissions, interest, taxes, extraordinary expenses, and the expenses of any money market fund or other fund held by the Fund, do not exceed the Total Annual Fund Operating Expenses (After Waiver) shown. After this time, the Total Annual Fund Operating Expenses (After Waiver) may be increased only with the approval of the Board of Trustees. |

| Wells Fargo Advantage Classic Value Fund (Pro Forma Assuming Merger of WFA Specialized Financial Services Fund Only with Acquiring Fund) | ||||||

| Total Annual Fund Operating Expenses (Before Waiver) | Total Annual Fund Operating Expenses (After Waiver)1 | |||||

| Class A | 1.33% | 1.25% | ||||

| Class B | 2.08% | 2.00% | ||||

| Class C | 2.08% | 2.00% | ||||

| 1 | Funds Management has committed for three years after the closing of the Merger to waive fees and/or reimburse expenses to the extent necessary to ensure that the Fund's Total Annual Fund Operating Expenses (After Waiver), excluding brokerage commissions, interest, taxes, extraordinary expenses, and the expenses of any money market fund or other fund held by the Fund, do not exceed the Total Annual Fund Operating Expenses (After Waiver) shown. After this time, the Total Annual Fund Operating Expenses (After Waiver) may be increased only with the approval of the Board of Trustees. |

Each Fund has adopted a distribution plan pursuant to Rule 12b-1 under the 1940 Act ("Distribution Plan"). The fees charged to Class B, Class C, and Class R shares of Evergreen Equity Income Fund pursuant to the Fund's Distribution Plan are 0.25% more than the Distribution Plan fees borne by Class B, Class C, and Class R shares of Wells Fargo Advantage Classic Value Fund, respectively. However, each of those Wells Fargo Advantage Classic Value Fund share classes are subject to a shareholder servicing fee equal to 0.25%. The fees borne by Class A shares of Evergreen Equity Income Fund pursuant to that Fund's Distribution Plan are 0.25%; Class A shares of Wells Fargo Advantage Classic Value Fund do not bear fees under a distribution plan, but are subject to a shareholder servicing fee equal to 0.25%. While neither Class I shares of Evergreen Equity Income Fund nor Administrator Class shares of Wells Fargo Advantage Classic Value Fund are subject to fees under a distribution plan, Administrator Class shares are subject to a shareholder servicing fee equal to 0.25%.

The fees charged to Class A, Class B, and Class C shares of Wells Fargo Advantage Specialized Financial Services Fund pursuant to its Distribution Plan and shareholder servicing plan are identical to the Distribution Plan fees borne by Class A, Class B, and Class C shares of Wells Fargo Advantage Classic Value Fund, respectively.

Portfolio Turnover. The Target and Acquiring Funds pay transaction costs, such as commissions or dealer mark-ups, when each buys and sells securities (or "turns over" its portfolio). A higher portfolio turnover may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in the annual fund operating expenses or in the example, affect each Fund's performance. During the most recent fiscal year, Evergreen Equity Income Fund's portfolio turnover rate was 19% of the average value of its portfolio and Wells Fargo Advantage Specialized Financial Services Fund's portfolio turnover rate was 7% of the average value of its portfolio. Since the Acquiring Fund has not yet commenced operations, its portfolio turnover rate is not yet available.

Fund Management Information

The following table identifies the investment adviser, investment sub-adviser and portfolio manager(s) for the Acquiring Fund. Further information about the management of the Acquiring Fund can be found under the section entitled "Management of the Funds."

| Wells Fargo Advantage Classic Value Fund | ||

| Investment Adviser | Funds Management | |

| Investment Sub-adviser | Wells Capital Management Incorporated | |

| Portfolio Managers | Walter T. McCormick, CFA Gary Mishuris, CFA |

|

Tax Information

It is expected that the Merger will be tax-free to shareholders for U.S. federal income tax purposes, and receipt of an opinion substantially to that effect from Proskauer Rose LLP, special tax counsel to the Acquiring Fund, is a condition to the obligation of the Funds to consummate the Merger. This means that neither shareholders nor your Target or Acquiring Fund will recognize a gain or loss directly as a result of the Merger. However, because the Merger will end the tax year of your Target Fund, the Merger may accelerate taxable distributions from your Target Fund to its shareholders.

The cost basis and holding period of your Target Fund shares will carry over to the shares of the Acquiring Fund you receive as a result of the Merger. At any time prior to the consummation of the Merger, a shareholder may redeem shares, likely resulting in recognition of a gain or a loss to the shareholder for U.S. federal income tax purposes if the shareholder holds the shares in a taxable account.

A substantial portion of the securities held by your Target Fund may be disposed of in connection with the Merger. This could result in additional portfolio transaction costs to your Target Fund and increased taxable distributions to shareholders of your Target Fund. The actual tax impact of such sales will depend on the difference between the price at which such portfolio assets are sold and your Target Fund's basis in such assets. Any net realized capital gains from sales that occur prior to the Merger will be distributed to your Target Fund's shareholders as capital gain dividends (to the extent of the excess of net realized long-term capital gains over net realized short-term capital losses) and/or ordinary dividends (to the extent of the excess of net realized short-term capital gains over net realized long-term capital losses) during or with respect to the year of sale (after reduction by any available capital loss carryforwards), and such distributions will be taxable to shareholders.

Certain other U.S. federal income tax consequences are discussed below under "Material U.S. Federal Income Tax Consequences of the Mergers."

EVERGREEN DISCIPLINED VALUE FUND, WELLS FARGO ADVANTAGE U.S. VALUE FUND AND WELLS FARGO ADVANTAGE EQUITY INCOME FUND INTO WELLS FARGO ADVANTAGE DISCIPLINED VALUE FUND

In addition to your Target Fund, shareholders in one or more other Target Funds are being asked to approve a Merger into your Acquiring Fund. Your Merger is not contingent upon approval of any other Merger by shareholders of any other Target Fund.

Share Class Information

The following table illustrates the share class of the Acquiring Fund you will receive in exchange for the shares you own in your Target Fund.

| If you own this class of shares of Evergreen Disciplined Value Fund: | You will get this class of shares of Wells Fargo Advantage Disciplined Value Fund:1 | ||||

| Class A | Class A | ||||

| Class B2 | Class A | ||||

| Class C | Class C | ||||

| Class I | Administrator Class |

| 1 | The Fund is a shell fund ("Shell Fund") being created to receive the assets of one or more Target Funds. |

| 2 | Former Class B shareholders of the Target Fund will not be subject to a contingent deferred sales charge upon the redemption of the Class A shares they receive as a result of the Merger, but will have to pay a front-end sales charge on additional purchases of Class A shares of the Acquiring Fund as described below. |

| If you own this class of shares of Wells Fargo Advantage U.S. Value Fund: | You will get this class of shares of Wells Fargo Advantage Disciplined Value Fund:1 | ||||

| Class A | Class A | ||||

| Class B2 | Class A | ||||

| Class C | Class C | ||||

| Administrator Class | Administrator Class | ||||

| Investor Class | Investor Class |

| 1 | The Fund is a shell fund ("Shell Fund") being created to receive the assets of one or more Target Funds. |

| 2 | Former Class B shareholders of the Target Fund will not be subject to a contingent deferred sales charge upon the redemption of the Class A shares they receive as a result of the Merger, but will have to pay a front-end sales charge on additional purchases of Class A shares of the Acquiring Fund as described below. |

| If you own this class of shares of Wells Fargo Advantage Equity Income Fund: | You will get this class of shares of Wells Fargo Advantage Disciplined Value Fund:1 | ||||

| Class A | Class A | ||||

| Class B2 | Class A | ||||

| Class C | Class C | ||||

| Administrator Class | Administrator Class |

| 1 | The Fund is a shell fund ("Shell Fund") being created to receive the assets of one or more Target Funds. |

| 2 | Former Class B shareholders of the Target Fund will not be subject to a contingent deferred sales charge upon the redemption of the Class A shares they receive as a result of the Merger, but will have to pay a front-end sales charge on additional purchases of Class A shares of the Acquiring Fund as described below. |

The Acquiring Fund shares you receive as a result of the Merger will have the same total value as the total value of your Target Fund shares as of the close of business on the business day immediately prior to the Merger.

The procedures for buying, selling and exchanging shares of the Funds are similar. For additional information, see the section entitled "Buying, Selling and Exchanging Fund Shares." This section also contains important information for foreign shareholders of an Evergreen Target Fund, defined as shareholders whose accounts do not currently have both a U.S. address and tax payer identification number on record with the Funds. Following the Merger, foreign shareholders will no longer be able to make additional investments into a Wells Fargo Advantage Fund.

Investment Goal and Strategy Comparison

The following section compares the investment goals, principal investment strategies and fundamental investment policies of the Funds. The investment goals of the Funds may be changed without shareholder approval.

Evergreen Disciplined Value Fund and Wells Fargo Advantage Disciplined Value Fund. Evergreen Disciplined Value Fund and Wells Fargo Advantage Disciplined Value Fund have similar investment goals and strategies. Evergreen Disciplined Value Fund seeks to provide long-term capital growth, with income as a secondary consideration, and Wells Fargo

Advantage Disciplined Value Fund seeks long-term capital appreciation. While Wells Fargo Advantage Disciplined Value Fund normally invests at least 80% of its assets in equity securities of large-capitalization companies, Evergreen Disciplined Value Fund normally invests at least 65%, and under normal conditions, substantially all, of its assets in equity securities of large U.S. companies. This means Evergreen Disciplined Value Fund may invest a greater percentage of its assets in

small- and medium-capitalization companies.

A more complete description of each Fund's investment goals and strategies is below.

| EVERGREEN DISCIPLINED VALUE FUND (Target Fund) | WELLS FARGO ADVANTAGE DISCIPLINED VALUE FUND (Acquiring Fund) | ||||

| INVESTMENT GOAL | |||||

| The Fund seeks to provide long-term capital growth, with income as a secondary consideration. | The Fund seeks long-term capital appreciation. | ||||

| PRINCIPAL INVESTMENT STRATEGIES | |||||

| The Fund normally invests at least 65%, and under normal conditions, substantially all, of its assets in the equity securities of large U.S. companies (i.e., companies whose market capitalizations fall within the range tracked by the Russell 1000® Value Index, measured at the time of purchase). The Fund seeks to maintain a dollar-weighted average market capitalization that falls within the market capitalization range of the companies tracked by the Russell 1000® Value Index. As of December 31, 2009, the Russell 1000® Value Index had a market capitalization range of approximately $263 million to $324 billion. | Under normal circumstances, we invest at least 80% of the Fund's total assets in equity securities of large-capitalization companies. We define large-capitalization companies as companies with market capitalizations within the range of the Russell 1000® Value Index. The market capitalization range of the Russell 1000® Value Index was approximately $263 million to $324 billion, as of December 31, 2009, and is expected to change frequently. | ||||

| The Fund may, but will not necessarily, use derivatives. | Furthermore, we may use futures, options or swap agreements, as well as other derivatives, to manage risk or to enhance return. | ||||