As filed with the Securities and Exchange Commission on February 16, 2010

Registration No. 333-74295

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-14

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

|

|

|

|

|

|

|

|

|

Pre-Effective Amendment No. __ |

|

|

|

|

|

Post-Effective Amendment No. |

|

|

(Check appropriate box or boxes)

Exact Name of Registrant as Specified in Charter:

WELLS FARGO FUNDS TRUST

Area Code and Telephone Number: (800) 552-9612

Address of Principal Executive Offices, including Zip Code:

525 Market Street

San Francisco, California 94163

Name and Address of Agent for Service:

C. David Messman

c/oWellsFargo Funds Management, LLC

525 Market Street, 12th Floor

San Francisco, California 94105

With copies to:

Marco E. Adelfio, Esq.

GOODWIN PROCTER LLP

901 NEW YORK AVENUE, N.W.

WASHINGTON, D.C. 20001

It is proposed that this filing will become effective on March 18, 2010 pursuant to Rule 488.

No filing fee is required under the Securities Act of 1933 because an indefinite number of shares of beneficial interest in the Registrant has previously been registered pursuant to Rule 24f-2 under the Investment Company Act of 1940, as amended.

WELLS FARGO FUNDS TRUST

PART A

PROSPECTUS/PROXY STATEMENT

DRAFT 2/16/10

Retail & Institutional Money Market Funds (mergers)

[Co-branded logos]

Your Prompt Response Is Requested

The enclosed document is a combined prospectus and proxy statement with proposals that pertain to the reorganization of certain Wells Fargo Advantage Funds. As a shareholder of one or more of the funds, you are being asked to approve a merger of your merging fund(s) into an acquiring Wells Fargo Advantage Fund.

The voting process will only take a few minutes

Instructions for returning your proxy vote are enclosed. Please be sure to respond by June 8, 2010, regardless of the number of shares you own. Your timely response will help ensure a smooth integration of your funds.

Highlights of proxy proposals

For your convenience, the following information highlights the principal aspects of the proposals in the proxy. Full details are provided in the proxy statement.

|

Why have the proposals for the merger of these Funds been put forward at this time?

|

The enclosed prospectus/proxy statement for the merger of your funds is part of the overall proposal to combine the fund lineup of Wells Fargo Advantage Funds and Evergreen Funds. As a result of the merger between Wells Fargo & Company and Wachovia Corporation, Wells Fargo Funds Management, LLC, the investment advisor to the Wells Fargo Advantage Funds, and Evergreen Investment Management Company, LLC, the investment advisor to the Evergreen Funds, recommended that the Boards of Trustees of the two fund families approve combining the fund families under the Wells Fargo Advantage Funds name.

|

|

What am I being asked to vote on?

|

As a shareholder of the merging (Target) fund, you are being asked to approve the merger of your fund into a surviving (Acquiring) fund. Your fund’s Board of Trustees believes that the merger is in the best interests of your fund and that the interests of existing shareholders would not be diluted as a result of the merger. As such, they recommend that you vote to approve it.

Upon approval by shareholders and the satisfaction of other closing conditions, the merging fund will transfer all of its assets to the acquiring fund, and the acquiring fund will assume all of the liabilities of the target fund in exchange for shares of a comparable class of the acquiring fund. After the merger, you will receive shares of the surviving fund equal to the number of shares you held in the merging fund.

Each merging fund and its corresponding acquiring fund are listed below:

Merging (Target) Fund Surviving (Acquiring) Fund Evergreen Institutional Treasury Wells Fargo Advantage Treasury Plus Money Market Fund Money Market Fund

Evergreen U.S. Government Money Wells Fargo Advantage Government

|

|

Why has my fund’s Board of Trustees recommended that I vote in favor of approving a merger? |

Among the factors the Boards considered in recommending the mergers were the following: Similarities and differences between the investment strategies of the target and acquiring funds. Shareholders will not bear any direct expenses in connection with the mergers. The mergers are expected to be a nontaxable event for U.S. federal income tax purposes.

|

|

How do I vote my shares?

|

Please read the enclosed proxy materials, consider the information provided carefully, and then vote promptly. The voting process only takes a few minutes. You may complete, date, sign, and mail your proxy ballot; no postage is necessary if you mail it within the United States. Alternatively, you may vote by calling the toll-free number printed on your proxy ballot, or via the Internet according to the enclosed voting instructions provided on your proxy ballot.

|

|

What is the due date for returning my vote? |

A final vote will take place at a special meeting of shareholders scheduled on June 8, 2010. Your vote must be received by that date. |

|

Is this a taxable event for shareholders? |

No. Each merger is expected to be a nontaxable event for U.S. federal income tax purposes.

|

|

Whom should I call with questions about the voting process? |

If you have any questions about any proposal or related proxy materials, please call your investment professional, trust officer, or an Evergreen client service representative at 1-800-847-5397, Monday through Friday, 8 a.m. to 6 p.m., Eastern Time, or a Wells Fargo Advantage Funds client service representative at 1-800-260-5969, Monday through Friday, 8 a.m. to 7 p.m., Eastern Time. If you have any questions about the voting process or if you would like to vote by telephone, you may call our proxy solicitor, [ name ] at [ phone number ].

|

[Back cover]

Evergreen Investments (logo)

Wells Fargo Advantage Funds (logo)

An investment in a money market fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although the Funds seek to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in a money market fund. A portion of a Municipal Fund’s income may be subject to federal, state, and/or local income taxes or the alternative minimum tax (AMT).

Evergreen Investment Management Company, LLC, is a subsidiary of Wells Fargo & Company and is an affiliate of Wells Fargo & Company’s broker/dealer subsidiaries. Evergreen Investments SM is a service mark of Evergreen Investment Management Company, LLC.

Wells Fargo Funds Management, LLC, a wholly owned subsidiary of Wells Fargo & Company, provides investment advisory and administrative services for Wells Fargo Advantage Funds. Other affiliates of Wells Fargo & Company provide subadvisory and other services for the Wells Fargo Advantage Funds.

Wells Fargo Funds Distributor, LLC, Member FINRA/SIPC, an affiliate of Wells Fargo & Company, is the distributor of the Evergreen Funds and the Wells Fargo Advantage Funds. 120639 02-10

NOT FDIC INSURED • NO BANK GUARANTEE • MAY LOSE VALUE

© 2010 Wells Fargo Funds Management, LLC. All rights reserved.

EVERGREEN FUNDS

200 Berkeley Street

Boston, MA 02116-5034

1.800.343.2898

____, 2010

Dear Shareholder,

On December 31, 2008, the parent company of the investment adviser to the Evergreen funds, Wachovia Corporation ("Wachovia"), and the parent company of the investment adviser to Wells Fargo Advantage Funds®, Wells Fargo & Company ("Wells Fargo"), merged. Since that date, the investment adviser to the Evergreen funds, Evergreen Investment Management Company, LLC ("EIMC"), and the investment adviser to Wells Fargo Advantage Funds, Wells Fargo Funds Management, LLC ("Funds Management"), have considered rationalizing and reorganizing their mutual fund businesses. After multiple presentations to and discussions with the Boards of Trustees of both the Evergreen funds and Wells Fargo Advantage Funds regarding these matters, on December 30, 2009, EIMC proposed to the Boards of Trustees of the Evergreen funds, and on January 11, 2010, Funds Management proposed to the Boards of Trustees of Wells Fargo Advantage Funds, the mergers outlined in the table below. Both the Boards of Trustees of the Evergreen funds and Wells Fargo Advantage Funds approved the proposed mergers and the related Agreement and Plan of Reorganization subject to the approval by shareholders of each Target Fund (as set forth in the table below), as part of a comprehensive set of mutual fund mergers across the two fund families.

As a result, you are invited to vote on a proposal to merge your Target Fund into a corresponding Acquiring Fund (as set forth in the table below) (each a "Merger," and collectively, the "Mergers"). The Board of Trustees of your Target Trust (as set forth in the table below) has unanimously approved your Target Fund's Merger and recommends that you vote FOR this proposal.

| Target Fund | Target Trust | Acquiring Fund | Acquiring Trust | |||||

| Evergreen Institutional Treasury Money Market Fund | Evergreen Select Money Market Trust | Wells Fargo Advantage Treasury Plus Money Market Fund | Wells Fargo Funds Trust | |||||

| Evergreen Treasury Money Market Fund | Evergreen Money Market Trust | Wells Fargo Advantage Treasury Plus Money Market Fund | Wells Fargo Funds Trust | |||||

| Evergreen Institutional U.S. Government Money Market Fund | Evergreen Select Money Market Trust | Wells Fargo Advantage Government Money Market Fund | Wells Fargo Funds Trust | |||||

| Evergreen U.S. Government Money Market Fund | Evergreen Money Market Trust | Wells Fargo Advantage Government Money Market Fund | Wells Fargo Funds Trust |

If approved by shareholders, this is how each Merger will work:

-

Each Target Fund will transfer all of its assets to the corresponding Acquiring Fund.

-

Each Acquiring Fund will assume all of the liabilities of the corresponding Target Fund.

-

Each Acquiring Fund will issue new shares that will be distributed to you in an amount equal to the value of your corresponding Target Fund shares.

-

If the Merger is consummated, each Target Fund shareholder will become a shareholder of the corresponding Acquiring Fund and will have his or her investment managed in accordance with the Acquiring Fund's investment strategies.

-

You will not incur any sales charges or similar transaction charges as a result of the Merger.

-

It is expected that the Merger will be a non-taxable event for shareholders for U.S. federal income tax purposes.

Details about each Target Fund's and Acquiring Fund's investment goals, principal investment strategies, portfolio management team, past performance, principal risks, fees, and expenses, along with additional information about the proposed Mergers, are contained in the attached prospectus/proxy statement. Please read it carefully.

A special meeting of each Target Fund's shareholders will be held on ___, 2010. Although you are welcome to attend the meeting in person, you do not need to do so in order to vote your shares. Please complete, date, sign and return the enclosed proxy card in the postage-paid envelope provided. You may also vote by telephone or the internet by following the voting instructions as outlined at the end of this prospectus/proxy statement. If your Target Fund does not receive your vote after several weeks, you may receive a telephone call from [PROXY SOLICITOR], our proxy solicitor, requesting your vote. If you have any questions about the Mergers or the proxy card, please call [PROXY SOLICITOR] at (800) ____ (toll-free).

Remember, your vote is important to us, no matter how many shares you own. Please take this opportunity to vote. Thank you for taking this matter seriously and participating in this important process.

Sincerely,

W. Douglas Munn

President

Evergreen Funds

EVERGREEN FUNDS

200 Berkeley Street

Boston, MA 02116-5034

1.800.343.2898

____, 2010

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS TO BE HELD ON ___

A Special Meeting (the "Meeting") of Shareholders of your Target Fund, a series of the Target Trust, each set forth in the table below, will be held at the offices of Wells Fargo Advantage Funds®, 525 Market Street, San Francisco, California 94105 on ___, 2010 at 10:00 a.m., Pacific time.

| Target Fund | Target Trust | Acquiring Fund | Acquiring Trust | |||||

| Evergreen Institutional Treasury Money Market Fund | Evergreen Select Money Market Trust | Wells Fargo Advantage Treasury Plus Money Market Fund | Wells Fargo Funds Trust | |||||

| Evergreen Treasury Money Market Fund | Evergreen Money Market Trust | Wells Fargo Advantage Treasury Plus Money Market Fund | Wells Fargo Funds Trust | |||||

| Evergreen Institutional U.S. Government Money Market Fund | Evergreen Select Money Market Trust | Wells Fargo Advantage Government Money Market Fund | Wells Fargo Funds Trust | |||||

| Evergreen U.S. Government Money Market Fund | Evergreen Money Market Trust | Wells Fargo Advantage Government Money Market Fund | Wells Fargo Funds Trust |

With respect to your Target Fund, the Meeting is being held for the following purposes:

-

To consider and act upon an Agreement and Plan of Reorganization (the "Plan") dated as of ___, 2010, providing for the acquisition of all of the assets of the Target Fund by the corresponding Acquiring Fund in exchange for shares of the Acquiring Fund (the "Acquisition Shares") and the assumption by the Acquiring Fund of all of the liabilities of the Target Fund. The Plan also provides for the prompt distribution of the Acquisition Shares to shareholders of the corresponding Target Fund in liquidation of the Target Fund.

-

To transact any other business which may properly come before the Meeting or any adjournment(s) thereof.

Any adjournment(s) of the Meeting will be held at the above address. The Board of Trustees of your Target Fund has fixed the close of business on March 10, 2010 as the record date (the "Record Date") for the Meeting. Only shareholders of record as of the close of business on the Record Date will be entitled to this notice, and to vote at the Meeting or any adjournment(s) thereof.

IT IS IMPORTANT THAT PROXY CARDS OR VOTING INSTRUCTION CARDS BE RETURNED PROMPTLY. ALL SHAREHOLDERS ARE URGED TO COMPLETE, DATE, SIGN AND RETURN THEIR ENCLOSED PROXY CARD OR VOTING INSTRUCTION CARD IN THE ENCLOSED POSTAGE-PAID ENVELOPE, OR TO VOTE USING ONE OF THE OTHER METHODS DESCRIBED AT THE END OF THE PROSPECTUS/PROXY STATEMENT SO THAT YOUR SHARES MAY BE REPRESENTED AT THE MEETING. YOUR PROMPT ATTENTION TO THE ENCLOSED PROXY CARD OR VOTING INSTRUCTION CARD WILL HELP TO AVOID THE EXPENSE OF FURTHER SOLICITATION.

By order of the Board of Trustees,

Michael H. Koonce

Secretary

EVERGREEN FUNDS

200 Berkeley Street

Boston, MA 02116-5034

1.800.343.2898

WELLS FARGO FUNDS TRUST

525 Market Street, 12th Floor

San Francisco, CA 94105

1.800.222.8222

____, 2010

PROSPECTUS/PROXY STATEMENT

This prospectus/proxy statement contains information you should know before voting on the proposed merger (the "Merger") of your Target Fund into the corresponding Acquiring Fund as set forth and defined in the table below, each of which is a series of a registered open-end management investment company. If approved, the Merger will result in your receiving shares of the Acquiring Fund in exchange for your shares of the Target Fund.

| Target Fund | Target Trust | Acquiring Fund | Acquiring Trust | |||||

| Evergreen Institutional Treasury Money Market Fund | Evergreen Select Money Market Trust | Wells Fargo Advantage Treasury Plus Money Market Fund | Wells Fargo Funds Trust | |||||

| Evergreen Treasury Money Market Fund | Evergreen Money Market Trust | Wells Fargo Advantage Treasury Plus Money Market Fund | Wells Fargo Funds Trust | |||||

| Evergreen Institutional U.S. Government Money Market Fund | Evergreen Select Money Market Trust | Wells Fargo Advantage Government Money Market Fund | Wells Fargo Funds Trust | |||||

| Evergreen U.S. Government Money Market Fund | Evergreen Money Market Trust | Wells Fargo Advantage Government Money Market Fund | Wells Fargo Funds Trust |

The Target and Acquiring Funds listed above are collectively referred to as the "Funds." The Target and Acquiring Trusts listed above are collectively referred to as the "Trusts."

Please read this prospectus/proxy statement carefully and retain it for future reference. Additional information concerning each Fund and/or Merger has been filed with the Securities and Exchange Commission ("SEC").

The prospectuses of each Target Fund and each Acquiring Fund are incorporated into this document by reference and are legally deemed to be part of this prospectus/proxy statement.

The Statement of Additional Information relating to this prospectus/proxy statement (the "Merger SAI"), dated the same date as this prospectus/proxy statement, is also incorporated into this document by reference and is legally deemed to be part of this prospectus/proxy statement.

The Statement of Additional Information ("SAI") and the annual and semi-annual reports of each Target Fund and each Acquiring Fund are incorporated into the Merger SAI by reference and are legally deemed to be part of the Merger SAI.

A copy of your Acquiring Fund's prospectus accompanies this prospectus/proxy statement.

Copies of these documents pertaining to a Target Fund are available upon request without charge by writing to the address above, calling 1.800.343.2898 or visiting the Evergreen Funds' Web site at www.evergreeninvestments.com. Copies of these documents pertaining to an Acquiring Fund are available upon request without charge by writing to Wells Fargo Advantage Funds®, P.O. Box 8266, Boston, MA 02266-8266, calling 1.800.222.8222 or visiting the Wells Fargo Advantage Funds Web site at www.wellsfargo.com/advantagefunds.

You may also view or obtain these documents from the SEC: by phone at 1.800.SEC.0330 (duplicating fee required); in person or by mail at Public Reference Section, Securities and Exchange Commission, 100 F. Street, N.E., Washington, D.C. 20549-0213 (duplicating fee required); by email at publicinfo@sec.gov (duplicating fee required); or by internet at www.sec.gov.

The SEC has not approved or disapproved these securities or determined if this prospectus/proxy statement is truthful or complete. Any representation to the contrary is a criminal offense.

The shares offered by this prospectus/proxy statement are not deposits of a bank, and are not insured, endorsed or guaranteed by the FDIC or any government agency and involve investment risk, including possible loss of your original investment.

Table of Contents

OVERVIEW

This section summarizes the primary features and consequences of your Merger. This summary is qualified in its entirety by reference to the information contained elsewhere in this prospectus/proxy statement, in the Merger SAI, in each Fund's prospectus, in each Fund's financial statements contained in the annual and semi-annual reports, and in each Fund's SAI, and to the Agreement and Plan of Reorganization (the "Plan"), a form of which is attached as Exhibit A hereto.

Key Features of the Mergers

The Plan sets forth the key features of each Merger and generally provides for the following:

-

the transfer of all of the assets of the Target Fund to the Acquiring Fund in exchange for shares of the Acquiring Fund;

-

the assumption by the Acquiring Fund of all of the liabilities of the Target Fund;

-

the liquidation of the Target Fund by distributing the shares of the Acquiring Fund to the Target Fund's shareholders; and

-

the assumption of the costs of each Merger (other than costs incurred from securities transactions in connection with the Merger) by Wells Fargo Funds Management, LLC ("Funds Management") and/or Evergreen Investment Management Company, LLC ("EIMC") or one of its affiliates.

The Mergers are scheduled to take place on or about July 9, 2010. For a more complete description of the Mergers, see the section entitled "Agreement and Plan of Reorganization," as well as Exhibit A.

Board of Trustees Recommendation

At a meeting held on December 30, 2009 for the Board of Trustees of the Evergreen funds, the Trustees of your Target Fund, including a majority of the Trustees who are not "interested persons" of your Target Fund, as that term is defined in the Investment Company Act of 1940, as amended (the "1940 Act") (the "Independent Trustees"), considered and unanimously approved the Merger of your Target Fund.

Before approving the Mergers, the Trustees reviewed, among other things, information about the Funds and the proposed transactions. Those materials set forth a comparison of various factors, such as the relative sizes of the Funds, the performance records of the Funds, and the expenses of the Funds, as well as similarities and differences between the Funds' investment goals, principal investment strategies and specific portfolio characteristics.

The Board of Trustees of your Target Fund, including all of the Independent Trustees, has concluded that the Merger would be in the best interests of your Target Fund, and that existing shareholders' interests would not be diluted as a result of the Merger. Accordingly, the Trustees have submitted the Plan to the Target Fund's shareholders and unanimously recommended its approval. The Board of Trustees of Wells Fargo Advantage Funds has also approved the Plan on behalf of each Acquiring Fund.

For further information about the considerations of your Target Trust's Board, please see the section entitled "Reasons for the Mergers."

Merger Summary (Goals, Strategies, Risks, Performance, Expense, Management and Tax Information)

The following section provides a comparison between the Funds with respect to their investment goals, principal investment strategies, fundamental investment policies, risks, performance records, sales charges and expenses. It also provides information about what the management and share class structure of your Acquiring Fund will be after the Merger. The information below is only a summary; for more detailed information, please see the rest of this prospectus/proxy statement and each Fund's prospectus and SAI.

EVERGREEN INSTITUTIONAL TREASURY MONEY MARKET FUND AND EVERGREEN TREASURY MONEY MARKET FUND INTO WELLS FARGO ADVANTAGE TREASURY PLUS MONEY MARKET FUND

In addition to your Target Fund, shareholders in one or more other Target Funds are being asked to approve a Merger into your Acquiring Fund. Your Merger is not contingent upon approval of any other Merger by shareholders of any other Target Fund.

Share Class Information

The following tables illustrate the share class of the Acquiring Fund you will receive as a result of the Merger in exchange for the shares you own in your Target Fund.

| If you own this class of shares of Evergreen Institutional Treasury Money Market Fund: | You will get this class of shares of Wells Fargo Advantage Treasury Plus Money Market Fund: | ||||

| Administrative Class1 | Institutional Class | ||||

| Institutional Service Class | Service Class | ||||

| Institutional Class2 | Institutional Class | ||||

| Investor Class1 | Institutional Class | ||||

| Participant Class | Service Class |

| 1 | Following completion of the Mergers, former Administrative and Investor Class shareholders of any applicable Target Fund will not need to meet the eligibility requirements applicable to the Institutional Class shares of any Wells Fargo Advantage Fund received in the Merger. |

| 2 | Following completion of the Mergers, former Institutional Class shareholders of any applicable Target Fund will not need to meet the minimum investment amount or the institutional entity requirements applicable to the Institutional Class shares of any Wells Fargo Advantage Fund received in a Merger. |

| If you own this class of shares of Evergreen Treasury Money Market Fund: | You will get this class of shares of Wells Fargo Advantage Treasury Plus Money Market Fund: | ||||

| Class A | Class A | ||||

| Class I | Service Class | ||||

| Class S | Sweep Class1 |

| 1 | Class will be created to receive the assets of the corresponding share class set forth above. |

After the Merger, you will receive a number of shares of the Acquiring Fund equal to the number of shares you held in the Target Fund. Both Funds use the "amortized cost" method of valuation to value their investments. For an explanation of how that method may affect the value of the shares you receive in the Merger, please see the section of this prospectus/proxy statement entitled "Pricing Fund Shares."

The procedures for buying, selling and exchanging shares of the Funds are similar. For additional information, see the section entitled "Buying, Selling and Exchanging Fund Shares." This section also contains important information for foreign shareholders of a Target Fund defined as shareholders whose accounts do not currently have both a U.S. address and tax payer identification number on record with the Funds. Following the Merger, foreign shareholders will not be able to make additional investments into a Wells Fargo Advantage Fund.

Investment Goal and Strategy Comparison

The following section compares the investment goals, principal investment strategies and fundamental investment policies of the Funds. The investment goals of the Funds may be changed without shareholder approval.

Evergreen Institutional Treasury Money Market Fund and Wells Fargo Advantage Treasury Plus Money Market Fund. The Funds' investment goals and investment strategies are similar. Evergreen Institutional Treasury Money Market Fund seeks to maintain stability of principal while earning current income and providing liquidity, whereas the Wells Fargo Advantage Treasury Plus Money Market Fund seeks current income, while preserving capital and liquidity. Each Fund normally invests at least 80% of its assets in short-term U.S. Treasury obligations and repurchase agreements collateralized by U.S. Treasury obligations. One difference between the Funds' investment strategies is that Evergreen Institutional Treasury Money Market Fund may invest up to 20% of its assets in other debt obligations, but typically invests this amount in repurchase agreements with respect to securities issued or guaranteed by the Government National Mortgage Association ("GNMA"). This means that Evergreen Institutional Treasury Money Market Fund may have more exposure to securities issued or guaranteed by GNMA than does the Wells Fargo Advantage Treasury Plus Money Market Fund.

A more complete description of each Fund's investment goals and strategies is below.

| EVERGREEN INSTITUTIONAL TREASURY MONEY MARKET FUND (Target Fund) | WELLS FARGO ADVANTAGE TREASURY PLUS MONEY MARKET FUND (Acquiring Fund) | ||||

| INVESTMENT GOAL | |||||

| The Fund seeks to maintain stability of principal while earning current income and providing liquidity. | The Fund seeks current income, while preserving capital and liquidity. | ||||

| PRINCIPAL INVESTMENT STRATEGIES | |||||

| The Fund normally invests at least 80% of its assets in short-term U.S. Treasury obligations and repurchase agreements with respect to such securities. U.S. Treasury securities are guaranteed as to principal and interest by, and supported by the full faith and credit of, the U.S. government. The Fund may invest up to 20% of its assets in other debt obligations, but typically invests this portion in repurchase agreements with respect to securities issued or guaranteed by GNMA. Securities issued by GNMA are also backed by the full faith and credit of the U.S. government. | Under normal circumstances, the Fund invests exclusively in high-quality, short-term money market instruments that consist of U.S. Treasury obligations and repurchase agreements collateralized by U.S. Treasury obligations. The Fund actively manages a portfolio of short-term obligations issued by the U.S. Treasury and repurchase agreements collateralized by U.S. Treasury obligations. | ||||

| The portfolio managers focus primarily on the interest rate environment in determining which securities to purchase for the portfolio. Generally, in a rising rate environment, the Fund will invest in securities with shorter maturities. If interest rates are high, the Fund will generally invest in securities with longer maturities; however, the Fund will not acquire any security with a remaining maturity of greater than 397 days, unless such security has a maturity shortening feature which reduces its final maturity to no greater than 397 days. The Fund generally maintains a dollar-weighted average maturity of 60 days or less. Maturity generally measures the time until final payment on a fixed income security is due. | Security selection is based on several factors, including yield and maturity, while taking into account the Fund's overall level of liquidity and average maturity. | ||||

The fundamental investment policies of the Target and Acquiring Funds are substantively similar. For a comparative chart of fundamental investment policies, please see Exhibit B.

Evergreen Treasury Money Market Fund and Wells Fargo Advantage Treasury Plus Money Market Fund. The Funds' investment goals and investment strategies are similar. Evergreen Treasury Money Market Fund seeks to maintain stability of principal while earning current income and providing liquidity, whereas the Wells Fargo Advantage Treasury Plus Money Market Fund seeks current income, while preserving capital and liquidity. Evergreen Treasury Money Market Fund normally invests at least 80% of its assets in short-term U.S. Treasury obligations and repurchase agreements with respect to such securities, while the Wells Fargo Advantage Treasury Plus Money Market Fund normally invests exclusively in high-quality, short-term money market instruments consisting of U.S. Treasury obligations and repurchase agreements collateralized by U.S. Treasury obligations. One difference between the Funds' investment strategies is that Evergreen Treasury Money Market Fund may invest up to 20% of its assets in other debt obligations, but typically invests this amount in repurchase agreements with respect to securities issued or guaranteed by GNMA. This means that Evergreen Treasury Money Market Fund may have more exposure to securities issued or guaranteed by GNMA than does the Wells Fargo Advantage Treasury Plus Money Market Fund.

A more complete description of each Fund's investment goals and strategies is below.

| EVERGREEN TREASURY MONEY MARKET FUND (Target Fund) | WELLS FARGO ADVANTAGE TREASURY PLUS MONEY MARKET FUND (Acquiring Fund) | ||||

| INVESTMENT GOAL | |||||

| The Fund seeks to maintain stability of principal while earning current income and providing liquidity. | The Fund seeks current income, while preserving capital and liquidity. | ||||

| PRINCIPAL INVESTMENT STRATEGIES | |||||

| The Fund normally invests at least 80% of its assets in short-term U.S. Treasury obligations and repurchase agreements with respect to such securities. U.S. Treasury securities are guaranteed as to principal and interest by, and supported by the full faith and credit of, the U.S. government. The Fund may invest up to 20% of its assets in other debt obligations, but typically invests this portion in repurchase agreements with respect to securities issued or guaranteed by GNMA. Securities issued by GNMA are also backed by the full faith and credit of the U.S. government. | Under normal circumstances, the Fund invests exclusively in high-quality, short-term money market instruments that consist of U.S. Treasury obligations and repurchase agreements collateralized by U.S. Treasury obligations. The Fund actively manages a portfolio of short-term obligations issued by the U.S. Treasury and repurchase agreements collateralized by U.S. Treasury obligations. | ||||

| The portfolio managers focus primarily on the interest rate environment in determining which securities to purchase for the portfolio. Generally, in a rising rate environment, the Fund will invest in securities with shorter maturities. If interest rates are high, the Fund will generally invest in securities with longer maturities; however, the Fund will not acquire any security with a remaining maturity of greater than 397 days, unless such security has a maturity shortening feature which reduces its final maturity to no greater than 397 days. The Fund generally maintains a dollar-weighted average maturity of 60 days or less. Maturity generally measures the time until final payment on a fixed income security is due. | Security selection is based on several factors, including yield and maturity, while taking into account the Fund's overall level of liquidity and average maturity. | ||||

The fundamental investment policies of the Target and Acquiring Funds are substantively similar. For a comparative chart of fundamental investment policies, please see Exhibit B.

Principal Risk Comparison

Because the Evergreen funds and Wells Fargo Advantage Funds were unaffiliated fund families until January 2009, the Funds have historically used different terms and descriptions to describe their principal risks. Nonetheless, due to the similarity of the Funds' investment strategies, the Funds are generally subject to similar types of risks. Listed below are the principal risks that apply to an investment in the Wells Fargo Advantage Treasury Plus Money Market Fund. A description of those risks can be found in the section of this prospectus/proxy statement entitled "Risk Descriptions." Although both Funds may be subject to the risks listed below, they may be subject to a particular risk to different degrees.

Principal Risks

Counter-Party Risk

Debt Securities Risk

Issuer Risk

Management Risk

Market Risk

Money Market Fund Risk

Regulatory Risk

A discussion of the principal risks associated with an investment in the Target Fund may be found in the Target Fund's prospectus. In addition, each Fund has other investment policies, practices and restrictions which, together with the Fund's related risks, are also set forth in the Fund's prospectus and SAI.

Fund Performance Comparison

The following bar charts and tables illustrate how each Fund's returns have varied from year to year and compare the Target Fund's returns with those of one or more broad-based securities indexes. Past performance is not necessarily an indication of future results. Current month-end performance information is available for an Evergreen fund at www.evergreeninvestments.com and for a Wells Fargo Advantage Fund at www.wellsfargo.com/advantagefunds.

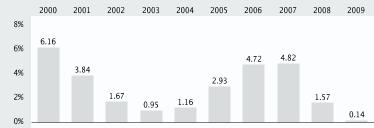

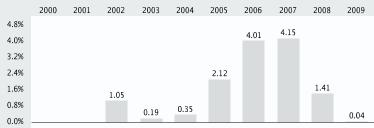

Year-by-Year Total Return for Institutional Class Shares (%) for Evergreen Institutional Treasury Money Market Fund

To obtain 7-day yield information, call (800) 847-5397.

| Highest Quarter: | 4th Quarter 2000 | +1.60% |

| Lowest Quarter: | 4th Quarter 2009 | +0.00% |

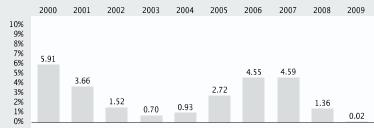

Year-by-Year Total Return for Class I Shares (%) for Evergreen Treasury Money Market Fund

To obtain 7-day yield information, call (800) 343-2898.

| Highest Quarter: | 4th Quarter 2000 | +1.54% |

| Lowest Quarter: | 4th Quarter 2009 | +0.00% |

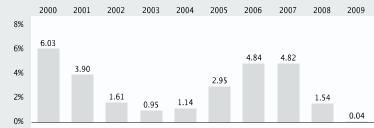

Year-by-Year Total Return for Institutional Shares (%) for Wells Fargo Advantage Treasury Plus Money Market Fund

To obtain 7-day yield information, call (800) 222-8222.

| Highest Quarter: | 4th Quarter 2000 | +1.58% |

| Lowest Quarter: | 4th Quarter 2009 | +0.00% |

| Average Annual Total Returns for the periods ended 12/31/20091 | ||||||||||

| Evergreen Institutional Treasury Money Market Fund | Inception Date of Share Class | 1 Year | 5 Year | 10 Year | ||||||

| Administrative Class | 5/1/2001 | 0.11% | 2.77% | 2.74% | ||||||

| Institutional Class | 11/20/1996 | 0.14% | 2.82% | 2.78% | ||||||

| Investor Class | 5/1/2001 | 0.09% | 2.73% | 2.69% | ||||||

| Institutional Service Class | 11/27/1996 | 0.03% | 2.59% | 2.54% | ||||||

| Participant Class | 5/1/2001 | 0.02% | 2.41% | 2.39% | ||||||

| BofA Merrill Lynch 3 Month U.S. Treasury Bill Index2 (reflects no deduction for fees, expenses, or taxes) | 0.21% | 3.02% | 2.99% | |||||||

| 1 | Historical performance shown for Administrative Class, Investor Class and Participant Class prior to their inception is based on the performance of Institutional Class, the original class offered. The historical returns have not been adjusted to reflect the effect of each class' 12b-1 fee. These fees are 0.05% for Administrative Class, 0.10% for Investor Class and 0.50% for Participant Class. Institutional Class does not pay a 12b-1 fee. If these fees had been reflected, 10 year returns would have been lower. |

| 2 | Copyright 2010. BofA Merrill Lynch, Pierce, Fenner & Smith Incorporated. All rights reserved. |

| Average Annual Total Returns for the periods ended 12/31/20091 | ||||||||||

| Evergreen Treasury Money Market Fund | Inception Date of Share Class | 1 Year | 5 Year | 10 Year | ||||||

| Class A | 3/6/1991 | 0.02% | 2.40% | 2.31% | ||||||

| Class I | 3/6/1991 | 0.02% | 2.63% | 2.58% | ||||||

| Class S | 6/30/2000 | 0.02% | 2.17% | 2.06% | ||||||

| BofA Merrill Lynch 3 Month U.S. Treasury Bill Index2 (reflects no deduction for fees, expenses, or taxes) | 0.21% | 3.02% | 2.99% | |||||||

| 1 | Historical performance shown for Class S prior to its inception is based on the performance of Class A, one of the original classes offered along with Class I. The historical returns for Class S have not been adjusted to reflect the effect of its 12b-1 fee. These fees are 0.30% for Class A and 0.60% for Class S. Class I does not pay a 12b-1 fee. If these fees had been reflected, 10 year returns for Class S would have been lower. |

| 2 | Copyright 2010. BofA Merrill Lynch, Pierce, Fenner & Smith Incorporated. All rights reserved. |

| Average Annual Total Returns for the periods ended 12/31/2009 | ||||||||||

| Wells Fargo Advantage Treasury Plus Money Market Fund | Inception Date of Share Class | 1 Year | 5 Year | 10 Year | ||||||

| Class A1 | 7/28/2003 | 0.01% | 2.47% | 2.38% | ||||||

| Institutional Class | 10/1/1985 | 0.04% | 2.82% | 2.76% | ||||||

| Service Class | 10/1/1985 | 0.01% | 2.58% | 2.52% | ||||||

| Sweep Class2 | TBD | 0.01% | 2.58% | 2.52% | ||||||

| 1 | Performance shown prior to the inception of the Class A shares reflects the performance of the Service Class shares, adjusted to reflect Class A expenses. |

| 2 | Performance shown for the Sweep Class reflects the performance of the Service Class shares, and includes expenses that are not applicable to and lower than those of the Sweep Class shares. The Service Class shares annual returns are substantially similar to what the Sweep Class share returns would be because the Service and Sweep Class shares are invested in the same portfolio and their returns differ only to the extent that they do not have similar expenses. |

Shareholder Fee and Fund Expense Comparison

The expenses for each class of shares of your Target Fund may be different than those of the corresponding class of shares of the Acquiring Fund. With respect to both the Target and Acquiring Funds, no sales charges are imposed on either purchases or sales of fund shares.

The following tables allow you to compare the annual operating expenses of the Funds. The net and gross total annual fund operating expenses for both the Target and the Acquiring Funds set forth in the following tables are based on the actual expenses for the twelve-month period ended September 30, 2009. The pro forma expense table shows you what the net and gross total annual fund operating expenses would have been for the Acquiring Fund for the twelve-month period ended September 30, 2009, assuming each Merger had taken place at the beginning of that period. The pro forma expense information assumes that shareholders of each Target Fund approve their respective Merger with the Acquiring Fund and that each Merger is consummated. If one, but not both, of those Mergers is consummated, the pro forma expense information shown would have been higher. Exhibit C contains expense tables and examples for both Target and Acquiring Funds based upon the actual expenses incurred by such Funds during their most recently completed fiscal year. Exhibit C also includes a pro forma expense table and examples for the Acquiring Fund based on the date of the Acquiring Fund's most recent financial statements.

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment)

| Evergreen Institutional Treasury Money Market Fund | ||||

| Total Annual Fund Operating Expenses1 | ||||

| Administrative Class | 0.24% | |||

| Institutional Class | 0.19% | |||

| Investor Class | 0.29% | |||

| Institutional Service Class | 0.44% | |||

| Participant Class | 0.69% | |||

| 1 | The Total Annual Fund Operating Expenses listed above do not reflect voluntary fee waivers and/or expense reimbursements made by the Fund's investment adviser in order to reduce expense ratios. Including current voluntary fee waivers and/or expense reimbursements, Total Annual Fund Operating Expenses were 0.39% for Institutional Service Class and 0.45% for Participant Class. The Fund's investment adviser may cease these voluntary waivers and/or reimbursements at any time. |

| Evergreen Treasury Money Market Fund | ||||

| Total Annual Fund Operating Expenses1 | ||||

| Class A | 0.74% | |||

| Class I | 0.44% | |||

| Class S | 1.04% | |||

| 1 | The Total Annual Fund Operating Expenses listed above do not reflect voluntary fee waivers and/or expense reimbursements made by the Fund's investment adviser in order to reduce expense ratios. Including current voluntary fee waivers and/or expense reimbursements, Total Annual Fund Operating Expenses were 0.41% for Class A, 0.37% for Class I and 0.44% for Class S. The Fund's investment advisor may cease these voluntary waivers and/or reimbursements at any time. |

| Wells Fargo Advantage Treasury Plus Money Market Fund | ||||||

| Total Annual Fund Operating Expenses (Before Waiver)1 | Total Annual Fund Operating Expenses (After Waiver)2,3 | |||||

| Class A | 0.65% | 0.65% | ||||

| Institutional Class | 0.26% | 0.20% | ||||

| Service Class | 0.55% | 0.50% | ||||

| 1 | Expenses have been adjusted as necessary from amounts incurred during the Fund's most recent fiscal year to reflect current fees and expenses. |

| 2 | Funds Management has committed through 6/30/2010, to waive fees and/or reimburse expenses to the extent necessary to ensure that the Fund's Total Annual Fund Operating Expenses (After Waiver) excluding brokerage commissions, interest, taxes, extraordinary expenses, and the expenses of any money market fund or other fund held by the Fund do not exceed the Total Annual Fund Operating Expenses (After Waiver) shown. After this date, the Total Annual Fund Operating Expenses (After Waiver) may be increased only with the approval of the Board of Trustees. |

| 3 | The Total Annual Fund Operating Expenses listed above do not reflect voluntary fee waivers and/or expense reimbursements made by the Fund's investment adviser in order to reduce expense ratios. Including current voluntary fee waivers and/or expense reimbursements, Total Annual Fund Operating Expenses (After Waiver) were 0.22% for Class A, 0.18% for Institutional Class, and 0.22% for Service Class. The Fund's investment adviser may cease these voluntary waivers and/or reimbursements at any time. |

| Wells Fargo Advantage Treasury Plus Money Market Fund (Pro Forma) | ||||||

| Total Annual Fund Operating Expenses (Before Waiver) | Total Annual Fund Operating Expenses (After Waiver)1 | |||||

| Class A | 0.62% | 0.62% | ||||

| Institutional Class | 0.23% | 0.20% | ||||

| Service Class | 0.52% | 0.45% | ||||

| Sweep Class | 0.97% | 0.97% | ||||

| 1 | Funds Management has committed for three years after the closing of the Merger to waive fees and/or reimburse expenses to the extent necessary to ensure that the Fund's Total Annual Fund Operating Expenses (After Waiver) excluding brokerage commissions, interest, taxes, extraordinary expenses, and the expenses of any money market fund or other fund held by the Fund do not exceed 0.65% for Class A, 0.20% for Institutional Class, 0.45% for Service Class, and 1.05% for Sweep Class. After this time, the Total Annual Fund Operating Expenses (After Waiver) may be increased only with the approval of the Board of Trustees. |

Evergreen Institutional Treasury Money Market Fund, Evergreen Treasury Money Market Fund, and the Wells Fargo Advantage Treasury Plus Money Market Fund have each adopted a distribution plan pursuant to Rule 12b-1 under the 1940 Act (a "Distribution Plan"). The fees charged to the Administrative Class, Institutional Service Class, Investor Class, and Participant Class shares of Evergreen Institutional Treasury Money Market Fund pursuant to the Fund's Distribution Plan are 0.05%, 0.25%, 0.10%, and 0.50%, respectively. The fees charged to Class A and Class S shares of Evergreen Treasury Money Market Fund pursuant to the Fund's Distribution Plan are 0.30% and 0.60%, respectively. Institutional Class shares of Evergreen Institutional Treasury Money Market Fund and Class I shares of Evergreen Treasury Money Market Fund are not subject to any fees under the Funds' Distribution Plans. The fees charged to the Sweep Class shares of the Wells Fargo Advantage Treasury Plus Money Market Fund pursuant to the Fund's Distribution Plan are 0.35%. Service Class, Institutional Class, and Class A shares of the Wells Fargo Advantage Treasury Plus Money Market Fund are not subject to any fees under the Fund's Distribution Plan. However, the Service Class, Class A, and Sweep Class shares of the Wells Fargo Advantage Treasury Plus Money Market Fund are subject to a shareholder servicing fee of 0.25%.

Fund Management Information

The following table identifies the investment adviser and investment sub-adviser for the Acquiring Fund. Further information about the management of the Acquiring Fund can be found under the section entitled "Management of the Funds."

| Wells Fargo Advantage Treasury Plus Money Market Fund | ||

| Investment Adviser | Funds Management | |

| Investment Sub-adviser | Wells Capital Management Incorporated | |

Tax Information

It is expected that the Merger will be tax-free to shareholders for U.S. federal income tax purposes, and receipt of an opinion substantially to that effect from Proskauer Rose LLP, special tax counsel to the Acquiring Fund, is a condition to the obligation of the Funds to consummate the Merger. This means that neither shareholders nor your Target or Acquiring Fund will recognize a gain or loss directly as a result of the Merger.

The cost basis and holding period of your Target Fund shares will carry over to the shares of the Acquiring Fund you receive as a result of the Merger.

Certain other U.S. federal income tax consequences are discussed below under "Material U.S. Federal Income Tax Consequences of the Mergers."

EVERGREEN INSTITUTIONAL U.S. GOVERNMENT MONEY MARKET FUND AND EVERGREEN U.S. GOVERNMENT MONEY MARKET FUND INTO WELLS FARGO ADVANTAGE GOVERNMENT MONEY MARKET FUND

In addition to your Target Fund, shareholders in one or more other Target Funds are being asked to approve a Merger into your Acquiring Fund. Your Merger is not contingent upon approval of any other Merger by shareholders of any other Target Fund.

Share Class Information

The following tables illustrate the share class of the Acquiring Fund you will receive as a result of the Merger in exchange for the shares you own in your Target Fund.

| If you own this class of shares of Evergreen Institutional U.S. Government Money Market Fund: | You will get this class of shares of Wells Fargo Advantage Government Money Market Fund: | ||||

| Institutional Service Class | Service Class | ||||

| Institutional Class1 | Institutional Class | ||||

| Investor Class2 | Institutional Class | ||||

| Participant Class | Service Class |

| 1 | Following completion of the Mergers, former Institutional Class shareholders of any applicable Target Fund will not need to meet the minimum investment amount or the institutional entity requirements applicable to the Institutional Class shares of any Wells Fargo Advantage Fund received in a Merger. |

| 2 | Following completion of the Mergers, former Investor Class shareholders of any applicable Target Fund will not need to meet the eligibility requirements applicable to the Institutional Class shares of any Wells Fargo Advantage Fund received in the Merger. |

| If you own this class of shares of Evergreen U.S. Government Money Market Fund: | You will get this class of shares of Wells Fargo Advantage Government Money Market Fund: | ||||

| Class A | Class A | ||||

| Class S | Sweep Class1 |

| 1 | Class will be created to receive the assets of the corresponding share class set forth above. |

After the Merger, you will receive a number of shares of the Acquiring Fund equal to the number of shares you held in the Target Fund. Both Funds use the "amortized cost" method of valuation to value their investments. For an explanation of how that method may affect the value of the shares you receive in the Merger, please see the section of this prospectus/proxy statement entitled "Pricing Fund Shares."

The procedures for buying, selling and exchanging shares of the Funds are similar. For additional information, see the section entitled "Buying, Selling and Exchanging Fund Shares." This section also contains important information for foreign shareholders of a Target Fund defined as shareholders whose accounts do not currently have both a U.S. address and tax payer identification number on record with the Funds. Following the Merger, foreign shareholders will not be able to make additional investments into a Wells Fargo Advantage Fund.

Investment Goal and Strategy Comparison

The following section compares the investment goals, principal investment strategies and fundamental investment policies of the Funds. The investment goals of the Funds may be changed without shareholder approval.

Evergreen Institutional U.S. Government Money Market Fund and Wells Fargo Advantage Government Money Market Fund. The Funds' investment goals and investment strategies are similar. Evergreen Institutional U.S. Government Money Market Fund seeks to achieve as high a level of current income as is consistent with preserving capital and providing liquidity, while the Wells Fargo Advantage Government Money Market Fund seeks current income, while preserving capital and liquidity. Evergreen Institutional U.S. Government Money Market Fund normally invests at least 80% of its assets in high-quality, short-term money market securities that are issued or guaranteed by the U.S. Government, its agencies or instrumentalities and repurchase agreements with respect to such securities, while the Wells Fargo Advantage Government Money Market Fund normally invests exclusively in high-quality, short-term money market instruments that consist of U.S. Treasury obligations and repurchase agreements collateralized by U.S. Government obligations.

A more complete description of each Fund's investment goals and strategies is below.

| EVERGREEN INSTITUTIONAL U.S. GOVERNMENT MONEY MARKET FUND (Target Fund) | WELLS FARGO ADVANTAGE GOVERNMENT MONEY MARKET FUND (Acquiring Fund) | ||||

| INVESTMENT GOAL | |||||

| The Fund seeks to achieve as high a level of current income as is consistent with preserving capital and providing liquidity. | The Fund seeks current income, while preserving capital and liquidity. | ||||

| PRINCIPAL INVESTMENT STRATEGIES | |||||

| The Fund normally invests at least 80% of its assets in high-quality, short-term money market securities that are issued or guaranteed by the U.S. Government, its agencies or instrumentalities and repurchase agreements with respect to such securities. | Under normal circumstances, the Fund invests exclusively in high-quality, short-term money market instruments that consist of U.S. Government obligations and repurchase agreements collateralized by U.S. Government obligations. The Fund actively manages a portfolio of short-term U.S. Government obligations and repurchase agreements collateralized by U.S. Government obligations. These investments may have fixed, floating, or variable rates of interest. | ||||

| The portfolio managers focus primarily on the interest rate environment in determining which securities to purchase for the portfolio. Generally, in a rising rate environment, the Fund will invest in securities with shorter maturities. If interest rates are high, the Fund will generally invest in securities with longer maturities; however, the Fund will not acquire any security with a remaining maturity of greater than 397 days, unless such security has a maturity shortening feature which reduces its final maturity to no greater than 397 days. | Security selection is based on several factors, including yield and maturity, while taking into account the Fund's overall level of liquidity and average maturity. | ||||

The fundamental investment policies of the Target and Acquiring Funds are substantively similar. For a comparative chart of fundamental investment policies, please see Exhibit B.

Evergreen U.S. Government Money Market Fund and Wells Fargo Advantage Government Money Market Fund. The Funds' investment goals and investment strategies are similar. Evergreen U.S. Government Money Market Fund seeks to achieve as high a level of current income as is consistent with preserving capital and maintaining liquidity, while the Wells Fargo Advantage Government Money Market Fund seeks current income, while preserving capital and liquidity. Evergreen U.S. Government Money Market Fund normally invests at least 80% of its assets in high-quality, short-term money market securities that are issued or guaranteed by the U.S. Government, its agencies or instrumentalities and repurchase agreements with respect to such securities, while the Wells Fargo Advantage Government Money Market Fund normally invests exclusively in high-quality, short-term money market instruments that consist of U.S. Government obligations and repurchase agreements collateralized by U.S. Government obligations.

A more complete description of each Fund's investment goals and strategies is below.

| EVERGREEN U.S. GOVERNMENT MONEY MARKET FUND (Target Fund) | WELLS FARGO ADVANTAGE GOVERNMENT MONEY MARKET FUND (Acquiring Fund) | ||||

| INVESTMENT GOAL | |||||

| The Fund seeks to achieve as high a level of current income as is consistent with preserving capital and providing liquidity. | The Fund seeks current income, while preserving capital and liquidity. | ||||

| PRINCIPAL INVESTMENT STRATEGIES | |||||

| The Fund normally invests at least 80% of its assets in high-quality, short-term money market securities that are issued or guaranteed by the U.S. Government, its agencies or instrumentalities and repurchase agreements with respect to such securities. | Under normal circumstances, the Fund invests exclusively in high-quality, short-term money market instruments that consist of U.S. Government obligations and repurchase agreements collateralized by U.S. Government obligations. The Fund actively manages a portfolio of short-term U.S. Government obligations and repurchase agreements collateralized by U.S. Government obligations. These investments may have fixed, floating, or variable rates of interest. | ||||

| The portfolio managers focus primarily on the interest rate environment in determining which securities to purchase for the portfolio. Generally, in a rising rate environment, the Fund will invest in securities with shorter maturities. If interest rates are high, the Fund will generally invest in securities with longer maturities; however, the Fund will not acquire any security with a remaining maturity of greater than 397 days, unless such security has a maturity shortening feature which reduces its final maturity to no greater than 397 days. | Security selection is based on several factors, including yield and maturity, while taking into account the Fund's overall level of liquidity and average maturity. | ||||

The fundamental investment policies of the Target and Acquiring Funds are substantively similar. For a comparative chart of fundamental investment policies, please see Exhibit B.

Principal Risk Comparison

Because the Evergreen funds and Wells Fargo Advantage Funds were unaffiliated fund families until January 2009, the Funds have historically used different terms and descriptions to describe their principal risks. Nonetheless, due to the similarity of the Funds' investment strategies, the Funds are generally subject to similar types of risks. Listed below are the principal risks that apply to an investment in the Wells Fargo Advantage Government Money Market Fund. A description of those risks can be found in the section of this prospectus/proxy statement entitled "Risk Descriptions." Although each of the Funds may be subject to all or substantially all of the risks listed below, they may be subject to a particular risk to different degrees.

Principal Risks

Counter-Party Risk

Debt Securities Risk

Issuer Risk

Management Risk

Market Risk

Money Market Fund Risk

Regulatory Risk

U.S. Government Obligations Risk

A discussion of the principal risks associated with an investment in the Target Fund may be found in the Target Fund's prospectus. In addition, each Fund has other investment policies, practices and restrictions which, together with the Fund's related risks, are also set forth in the Fund's prospectus and SAI.

Fund Performance Comparison

The following bar charts and tables illustrate how each Fund's returns have varied from year to year and compare the Target Fund's returns with those of one or more broad-based securities indexes. Past performance is not necessarily an indication of future results. Current month-end performance information is available for an Evergreen fund at www.evergreeninvestments.com and for a Wells Fargo Advantage Fund at www.wellsfargo.com/advantagefunds.

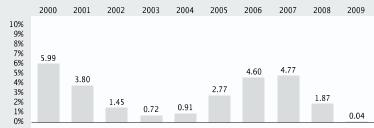

Year-by-Year Total Return for Institutional Service Class Shares (%) for Evergreen Institutional U.S. Government Money Market Fund

To obtain 7-day yield information, call (800) 847-5397.

| Highest Quarter: | 4th Quarter 2000 | +1.56% |

| Lowest Quarter: | 3rd Quarter 2009 | +0.01% |

Year-by-Year Total Return for Class S Shares (%) for Evergreen U.S. Government Money Market Fund

To obtain 7-day yield information, call (800) 343-2898.

| Highest Quarter: | 4th Quarter 2006 | +1.08% |

| Lowest Quarter: | 4th Quarter 2009 | +0.01% |

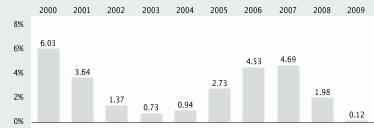

Year-by-Year Total Return for Service Class Shares (%) for Wells Fargo Advantage Government Money Market Fund

To obtain 7-day yield information, call (800) 222-8222.

| Highest Quarter: | 4th Quarter 2000 | +1.54% |

| Lowest Quarter: | 2nd Quarter 2009 | +0.00% |

| Average Annual Total Returns for the periods ended 12/31/20091 | ||||||||||

| Evergreen Institutional U.S. Government Money Market Fund | Inception Date of Share Class | 1 Year | 5 Year | 10 Year | ||||||

| Institutional Class | 10/1/1999 | 0.23% | 3.02% | 2.90% | ||||||

| Investor Class | 5/1/2001 | 0.17% | 2.93% | 2.82% | ||||||

| Institutional Service Class | 10/1/1999 | 0.12% | 2.80% | 2.66% | ||||||

| Participant Class | 5/1/2001 | 0.06% | 2.58% | 2.49% | ||||||

| BofA Merrill Lynch 3 Month U.S. Treasury Bill Index2 (reflects no deduction for fees, expenses, or taxes) | 0.21% | 3.02% | 2.99% | |||||||

| 1 | Historical performance shown for Investor Class and Participant Class prior to their inception is based on the performance of Institutional Class, one of the original classes offered along with Institutional Service Class. The historical returns have not been adjusted to reflect the effect of each class' 12b-1 fee. These fees are 0.10% for Investor Class, 0.25% for Institutional Service Class and 0.50% for Participant Class. Institutional Class does not pay a 12b-1 fee. If these fees had been reflected, 10 year returns would have been lower. |

| 2 | Copyright 2010. BofA Merrill Lynch, Pierce, Fenner & Smith Incorporated. All rights reserved. |

| Average Annual Total Returns for the periods ended 12/31/2009 | ||||||||||

| Evergreen U.S. Government Money Market Fund | Inception Date of Share Class | 1 Year | 5 Year | Performance Since 6/26/2001 | ||||||

| Class A | 6/26/2001 | 0.06% | 2.58% | 1.88% | ||||||

| Class S | 6/26/2001 | 0.04% | 2.33% | 1.69% | ||||||

| BofA Merrill Lynch 3 Month U.S. Treasury Bill Index1 (reflects no deduction for fees, expenses, or taxes) | 0.21% | 3.02% | 2.47% | |||||||

| 1 | Copyright 2010. BofA Merrill Lynch, Pierce, Fenner & Smith Incorporated. All rights reserved. |

| Average Annual Total Returns for the periods ended 12/31/2009 | ||||||||||

| Wells Fargo Advantage Government Money Market Fund | Inception Date of Share Class | 1 Year | 5 Year | 10 Year | ||||||

| Class A | 11/8/1999 | 0.02% | 2.68% | 2.50% | ||||||

| Institutional Class1 | 7/28/2003 | 0.15% | 3.06% | 2.85% | ||||||

| Service Class | 11/16/1987 | 0.04% | 2.79% | 2.67% | ||||||

| Sweep Class2 | TBD | 0.04% | 2.79% | 2.67% | ||||||

| 1 | Performance shown prior to the inception of the Institutional Class shares reflects the performance of the Service Class shares, and includes expenses that are not applicable to and higher than those of the Institutional Class shares. |

| 2 | Performance shown for the Sweep Class reflects the performance of the Service Class shares, and includes expenses that are not applicable to and lower than those of the Sweep Class shares. The Service Class shares annual returns are substantially similar to what the Sweep Class share returns would be because the Service and Sweep Class shares are invested in the same portfolio and their returns differ only to the extent that they do not have similar expenses. |

Shareholder Fee and Fund Expense Comparison

The expenses for each class of shares of your Target Fund may be different than those of the corresponding class of shares of the Acquiring Fund. With respect to both the Target and Acquiring Funds, no sales charges are imposed on either purchases or sales of fund shares.

The following tables allow you to compare the annual operating expenses of the Funds. The net and gross total annual fund operating expenses for both the Target and the Acquiring Funds set forth in the following tables are based on the actual expenses for the twelve-month period ended September 30, 2009. The pro forma expense table shows you what the net and gross total annual fund operating expenses would have been for the Acquiring Fund for the twelve-month period ended September 30, 2009, assuming each Merger had taken place at the beginning of that period. The pro forma expense information assumes that shareholders of each Target Fund approve their respective Merger with the Acquiring Fund and that each Merger is consummated. If one, but not both, of those Mergers is consummated, the pro forma expense information shown would have been higher. Exhibit C contains expense tables and examples for both Target and Acquiring Funds based upon the actual expenses incurred by such Funds during their most recently completed fiscal year. Exhibit C also includes a pro forma expense table and examples for the Acquiring Fund based on the date of the Acquiring Fund's most recent financial statements.

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment)

| Evergreen Institutional U.S. Government Money Market Fund | ||||

| Total Annual Fund Operating Expenses1 | ||||

| Institutional Class | 0.22% | |||

| Investor Class | 0.32% | |||

| Institutional Service Class | 0.47% | |||

| Participant Class | 0.72% | |||

| 1 | The Total Annual Fund Operating Expenses listed above do not reflect voluntary fee waivers and/or expense reimbursements made by the Fund's investment adviser in order to reduce expense ratios. Including current voluntary fee waivers and/or expense reimbursements, Total Annual Fund Operating Expenses were 0.31% for Investor Class, 0.41% for Institutional Service Class, and 0.54% for Participant Class. The Fund's investment adviser may cease these voluntary waivers and/or reimbursements at any time. |

| Evergreen U.S. Government Money Market Fund | ||||

| Total Annual Fund Operating Expenses1 | ||||

| Class A | 0.79% | |||

| Class S | 1.09% | |||

| 1 | The Total Annual Fund Operating Expenses listed above do not reflect voluntary fee waivers and/or expense reimbursements made by the Fund's investment adviser in order to reduce expense ratios. Including current voluntary fee waivers and/or expense reimbursements, Total Annual Fund Operating Expenses were 0.58% for Class A and 0.63% for Class S. The Fund's investment adviser may cease these voluntary waivers and/or reimbursements at any time. |

| Wells Fargo Advantage Government Money Market Fund | ||||||

| Total Annual Fund Operating Expenses (Before Waiver)1 | Total Annual Fund Operating Expenses (After Waiver)2,3 | |||||

| Class A | 0.63% | 0.63% | ||||

| Institutional Class | 0.24% | 0.20% | ||||

| Service Class | 0.53% | 0.50% | ||||

| 1 | Expenses have been adjusted as necessary from amounts incurred during the Fund's most recent fiscal year to reflect current fees and expenses. |

| 2 | Funds Management has committed through 6/30/2010, to waive fees and/or reimburse expenses to the extent necessary to ensure that the Fund's Total Annual Fund Operating Expenses (After Waiver) excluding brokerage commissions, interest, taxes, extraordinary expenses, and the expenses of any money market fund or other fund held by the Fund do not exceed 0.65% for Class A, 0.20% for Institutional Class, and 0.50% for Service Class. After this date, the Total Annual Fund Operating Expenses (After Waiver) may be increased only with the approval of the Board of Trustees. |

| 3 | The Total Annual Fund Operating Expenses listed above do not reflect voluntary fee waivers and/or expense reimbursements made by the Fund's investment adviser in order to reduce expense ratios. Including current voluntary fee waivers and/or expense reimbursements, Total Annual Fund Operating Expenses (After Waiver) were 0.44% for Class A and 0.40% for Service Class. The Fund's investment adviser may cease these voluntary waivers and/or reimbursements at any time. |

| Wells Fargo Advantage Government Money Market Fund (Pro Forma) | ||||||

| Total Annual Fund Operating Expenses (Before Waiver) | Total Annual Fund Operating Expenses (After Waiver)1 | |||||

| Class A | 0.62% | 0.62% | ||||

| Institutional Class | 0.23% | 0.20% | ||||

| Service Class | 0.52% | 0.50% | ||||

| Sweep Class | 0.97% | 0.97% | ||||

| 1 | Funds Management has committed for three years after the closing of the Merger to waive fees and/or reimburse expenses to the extent necessary to ensure that the Fund's Total Annual Fund Operating Expenses (After Waiver) excluding brokerage commissions, interest, taxes, extraordinary expenses, and the expenses of any money market fund or other fund held by the Fund do not exceed 0.65% for Class A, 0.20% for Institutional Class, 0.50% for Service Class, and 1.05% for Sweep Class. After this time, the Total Annual Fund Operating Expenses (After Waiver) may be increased only with the approval of the Board of Trustees. |

Evergreen Institutional U.S. Government Money Market Fund, Evergreen U.S. Government Money Market Fund, and the Wells Fargo Advantage Government Money Market Fund have each adopted a distribution plan pursuant to Rule 12b-1 under the 1940 Act (a "Distribution Plan"). The fees charged to the Institutional Service Class, Investor Class, and Participant Class shares of Evergreen Institutional U.S. Government Money Market Fund pursuant to the Fund's Distribution Plan are 0.25%, 0.10%, and 0.50%, respectively. Institutional Class shares of Evergreen Institutional U.S. Government Money Market Fund are not subject to any fees under the Fund's Distribution Plan. The fees charged to Class A and Class S shares of Evergreen U.S. Government Money Market Fund pursuant to the Fund's Distribution Plan are 0.30% and 0.60%, respectively. The fees charged to the Sweep Class shares of the Wells Fargo Advantage Government Money Market Fund pursuant to the Fund's Distribution Plan are 0.35%. Service Class, Institutional Class, and Class A shares of the Wells Fargo Advantage Government Money Market Fund are not subject to any fees under the Fund's Distribution Plan. However, the Service Class, Class A, and Sweep Class shares of the Wells Fargo Advantage Government Money Market Fund are subject to a shareholder servicing fee of 0.25%.

Fund Management Information

The following table identifies the investment adviser and investment sub-adviser for the Acquiring Fund. Further information about the management of the Acquiring Fund can be found under the section entitled "Management of the Funds."

| Wells Fargo Advantage Government Money Market Fund | ||

| Investment Adviser | Funds Management | |

| Investment Sub-adviser | Wells Capital Management Incorporated | |

Tax Information

It is expected that the Merger will be tax-free to shareholders for U.S. federal income tax purposes, and receipt of an opinion substantially to that effect from Proskauer Rose LLP, special tax counsel to the Acquiring Fund, is a condition to the obligation of the Funds to consummate the Merger. This means that neither shareholders nor your Target or Acquiring Fund will recognize a gain or loss directly as a result of the Merger.

The cost basis and holding period of your Target Fund shares will carry over to the shares of the Acquiring Fund you receive as a result of the Merger.

Certain other U.S. federal income tax consequences are discussed below under "Material U.S. Federal Income Tax Consequences of the Mergers."

RISK DESCRIPTIONS

An investment in each Fund is subject to certain risks. There is no assurance that investment performance of a Fund will be positive or that the Fund will meet its investment goal. An investment in a mutual fund is not a deposit with a bank; is not insured, endorsed or guaranteed by the FDIC or any government agency; and is subject to investment risks, including possible loss of your original investment. Like most investments, your investment in a Fund could fluctuate significantly in value over time and could result in a loss of money. The following provides additional information regarding the various risks referenced in the section entitled "Merger Summary."

-

Counter-Party Risk. When a Fund enters into a repurchase agreement, an agreement where it buys a security from a seller that agrees to repurchase the security at an agreed upon price and time, the Fund is exposed to the risk that the other party will not fulfill its contractual obligation. Similarly, the Fund is exposed to the same risk if it engages in a reverse repurchase agreement where a broker-dealer agrees to buy securities and the Fund agrees to repurchase them at a later date.

-

Debt Securities Risk. Debt securities, such as notes and bonds, are subject to credit risk and interest rate risk. Credit risk is the possibility that an issuer of an instrument will be unable to make interest payments or repay principal when due. Changes in the financial strength of an issuer or changes in the credit rating of a security may affect its value. Interest rate risk is the risk that market interest rates may increase, which tends to reduce the resale value of certain debt securities, including U.S. Government obligations. Debt securities with longer durations are generally more sensitive to interest rate changes than those with shorter durations. Changes in market interest rates do not affect the rate payable on an existing debt security, unless the instrument has adjustable or variable rate features, which can reduce its exposure to interest rate risk. Changes in market interest rates may also extend or shorten the duration of certain types of instruments, such as asset-backed securities, thereby affecting their value and returns. Debt securities may also have, or become subject to, liquidity constraints.

-

Issuer Risk. The value of a security may decline for a number of reasons that directly relate to the issuer or an entity providing credit support or liquidity support, such as management performance, financial leverage, and reduced demand for the issuer's goods, services or securities.

-

Management Risk. We cannot guarantee that a Fund will meet its investment objective. We do not guarantee the performance of a Fund, nor can we assure you that the market value of your investment will not decline. We will not "make good" on any investment loss you may suffer, nor does anyone we contract with to provide services, such as selling agents or investment advisers, promise to make good on any such losses.

-

Market Risk. The market price of securities owned by a Fund may go up or down, sometimes rapidly or unpredictably. Securities may decline in value or become illiquid due to factors affecting securities markets generally or particular industries represented in the securities markets. The value or liquidity of a security may decline or become illiquid due to general market conditions which are not specifically related to a particular company, such as real or perceived adverse economic conditions, changes in the general outlook for corporate earnings, changes in interest or currency rates or adverse investor sentiment generally. They may also decline in value or become illiquid due to factors that affect a particular industry or industries, such as labor shortages or increased production costs and competitive conditions within an industry. During a general downturn in the securities markets, multiple asset classes may decline in value or become illiquid simultaneously.

-

Money Market Fund Risk. Although each Fund seeks to maintain the value of your investment at $1.00 per share, there is no assurance that it will be able to do so, and it is possible to lose money by investing in a Fund. Generally, short-term funds such as money market funds do not earn as high a level of income as funds that invest in longer-term instruments. Because the Funds invest in short-term instruments, the Fund's dividend yields may be low when short-term market interest rates are low.

-

Regulatory Risk. Changes in government regulations may adversely affect the value of a security. An insufficiently regulated market might also permit inappropriate practices that adversely affect an investment. Changes in government regulations may adversely affect the value of a security. An insufficiently regulated market might also permit inappropriate practices that adversely affect an investment. In addition, the SEC recently adopted amendments to its rules relating to money market funds. Among other changes, the amendments will impose more stringent average maturity limits, higher credit quality standards and new liquidity requirements on money market funds. While these amendments are designed to further reduce the risks associated with investments in money market funds, they also may reduce a money market fund's yield potential.

-

U.S. Government Obligations Risk. U.S. Government obligations include securities issued by the U.S. Treasury, U.S. Government agencies or government-sponsored entities. While U.S. Treasury obligations are backed by the "full faith and credit" of the U.S. Government, securities issued by U.S. Government agencies or government-sponsored entities may not be guaranteed by the full faith and credit of the U.S. Government. The Government National Mortgage Association (GNMA), a wholly owned U.S. Government corporation, is authorized to guarantee, with the full faith and credit of the U.S. Government, the timely payment of principal and interest on securities issued by institutions approved by GNMA and backed by pools of mortgages insured by the Federal Housing Administration or the Department of Veterans Affairs. U.S. Government agencies or government-sponsored entities (i.e., not backed by the full faith and credit of the U.S. Government) include the Federal National Mortgage Association (FNMA) and the Federal Home Loan Mortgage Corporation (FHLMC). Pass-through securities issued by FNMA are guaranteed as to timely payment of principal and interest by FNMA but are not backed by the full faith and credit of the U.S. Government. FHLMC guarantees the timely payment of interest and ultimate collection or scheduled payment of principal, but its participation certificates are not backed by the full faith and credit of the U.S. Government. If a government-sponsored entity is unable to meet its obligations, the performance of a Fund that holds securities of the entity will be adversely impacted. U.S. Government obligations are subject to low but varying degrees of credit risk, and are still subject to interest rate and market risk.

MANAGEMENT OF THE FUNDS