2013 EEI Financial Conference November 11-12, 2013 Patrick J. Goodman Executive Vice President and Chief Financial Officer

This presentation contains statements that do not directly or exclusively relate to historical facts. These statements are “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements can typically be identified by the use of forward-looking words, such as “will,” “may,” “could,” “project,” “believe,” “anticipate,” “expect,” “estimate,” “continue,” “intend,” “potential,” “plan,” “forecast” and similar terms. These statements are based upon MidAmerican Energy Holdings Company’s (“MidAmerican”) and its subsidiaries’ (collectively, the “Company”) current intentions, assumptions, expectations and beliefs and are subject to risks, uncertainties and other important factors. Many of these factors are outside the control of the Company and could cause actual results to differ materially from those expressed or implied by such forward-looking statements. These factors include, among others: – general economic, political and business conditions, as well as changes in, and compliance with, laws and regulations, including reliability and safety standards, affecting the Company’s operations or related industries; – changes in, and compliance with, environmental laws, regulations, decisions and policies that could, among other items, increase operating and capital costs, reduce facility output, accelerate facility retirements or delay facility construction or acquisition; – the outcome of rate cases and other proceedings conducted by regulatory commissions or other governmental and legal bodies and the Company’s ability to recover costs in rates in a timely manner; – changes in economic, industry, competition or weather conditions, as well as demographic trends, new technologies and various conservation, energy efficiency and distributed generation measures and programs, that could affect customer growth and usage, electricity and natural gas supply or MidAmerican’s ability to obtain long-term contracts with customers and suppliers; – a high degree of variance between actual and forecasted load or generation that could impact the Company’s hedging strategy and the cost of balancing its generation resources with its retail load obligations; – performance and availability of the Company’s facilities, including the impacts of outages and repairs, transmission constraints, weather, including wind, solar and hydroelectric conditions, and operating conditions; – changes in prices, availability and demand for wholesale electricity, coal, natural gas, other fuel sources and fuel transportation that could have a significant impact on generating capacity and energy costs; – the financial condition and creditworthiness of the Company’s significant customers and suppliers; – changes in business strategy or development plans; – availability, terms and deployment of capital, including reductions in demand for investment-grade commercial paper, debt securities and other sources of debt financing and volatility in the London Interbank Offered Rate, the base interest rate for MidAmerican’s and its subsidiaries’ credit facilities; – changes in MidAmerican’s and its subsidiaries’ credit ratings; – risks relating to nuclear generation; – the impact of certain contracts used to mitigate or manage volume, price and interest rate risk, including increased collateral requirements, and changes in commodity prices, interest rates and other conditions that affect the fair value of certain contracts; Forward-Looking Statements 2

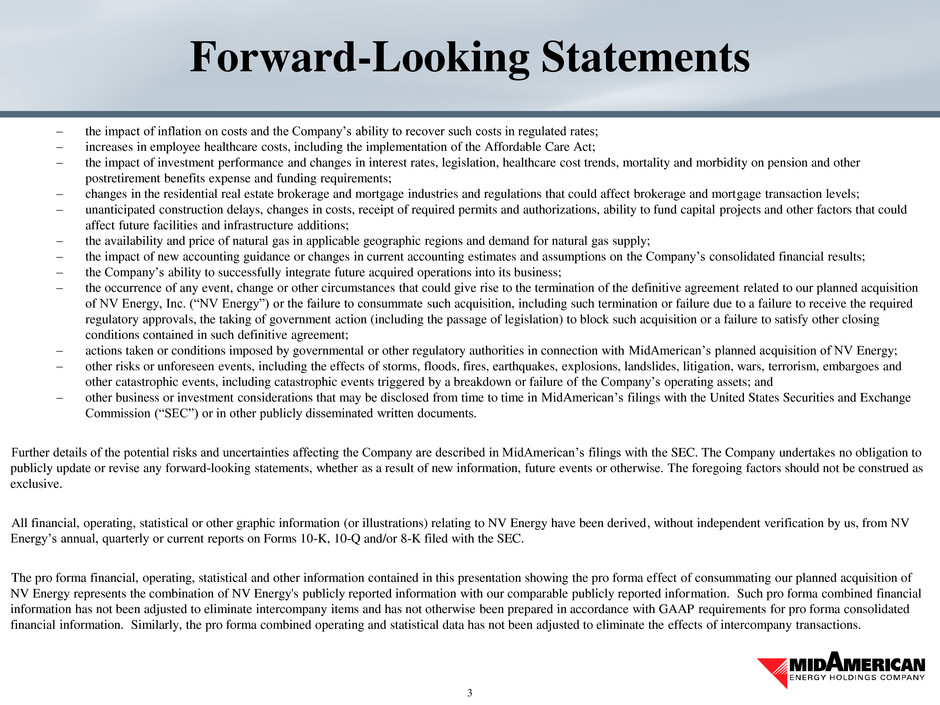

– the impact of inflation on costs and the Company’s ability to recover such costs in regulated rates; – increases in employee healthcare costs, including the implementation of the Affordable Care Act; – the impact of investment performance and changes in interest rates, legislation, healthcare cost trends, mortality and morbidity on pension and other postretirement benefits expense and funding requirements; – changes in the residential real estate brokerage and mortgage industries and regulations that could affect brokerage and mortgage transaction levels; – unanticipated construction delays, changes in costs, receipt of required permits and authorizations, ability to fund capital projects and other factors that could affect future facilities and infrastructure additions; – the availability and price of natural gas in applicable geographic regions and demand for natural gas supply; – the impact of new accounting guidance or changes in current accounting estimates and assumptions on the Company’s consolidated financial results; – the Company’s ability to successfully integrate future acquired operations into its business; – the occurrence of any event, change or other circumstances that could give rise to the termination of the definitive agreement related to our planned acquisition of NV Energy, Inc. (“NV Energy”) or the failure to consummate such acquisition, including such termination or failure due to a failure to receive the required regulatory approvals, the taking of government action (including the passage of legislation) to block such acquisition or a failure to satisfy other closing conditions contained in such definitive agreement; – actions taken or conditions imposed by governmental or other regulatory authorities in connection with MidAmerican’s planned acquisition of NV Energy; – other risks or unforeseen events, including the effects of storms, floods, fires, earthquakes, explosions, landslides, litigation, wars, terrorism, embargoes and other catastrophic events, including catastrophic events triggered by a breakdown or failure of the Company’s operating assets; and – other business or investment considerations that may be disclosed from time to time in MidAmerican’s filings with the United States Securities and Exchange Commission (“SEC”) or in other publicly disseminated written documents. Further details of the potential risks and uncertainties affecting the Company are described in MidAmerican’s filings with the SEC. The Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. The foregoing factors should not be construed as exclusive. All financial, operating, statistical or other graphic information (or illustrations) relating to NV Energy have been derived, without independent verification by us, from NV Energy’s annual, quarterly or current reports on Forms 10-K, 10-Q and/or 8-K filed with the SEC. The pro forma financial, operating, statistical and other information contained in this presentation showing the pro forma effect of consummating our planned acquisition of NV Energy represents the combination of NV Energy's publicly reported information with our comparable publicly reported information. Such pro forma combined financial information has not been adjusted to eliminate intercompany items and has not otherwise been prepared in accordance with GAAP requirements for pro forma consolidated financial information. Similarly, the pro forma combined operating and statistical data has not been adjusted to eliminate the effects of intercompany transactions. Forward-Looking Statements 3

• Own and operate a portfolio of high-quality utility businesses – Focus on operational efficiency, cost control and customer service – Cooperative approach with regulators and customers – Pursue internal capital investment opportunities to expand regulated asset base • Maintain prudent financial and risk management policies – Committed to holdings company and subsidiary credit profile – Stable and highly diversified asset base • Grow and diversify through a disciplined acquisition strategy – Target additional energy assets – Focus on long-term risk-adjusted returns – Continue to utilize ring-fencing approach – Capitalize on access to long-term capital from Berkshire Hathaway – Continue track record of proven integration capabilities and improving operating and financial performance MidAmerican’s strategy has delivered outstanding results Proven Corporate Strategy 4

MidAmerican Energy Holdings Company 5 United Kingdom Philippines As of, and for the 12 months ended, Sept. 30, 2013 • $56.2 billion of assets • $12.4 billion of revenue • 7.1 million electric and natural gas customers worldwide • 17,000 miles of natural gas pipeline • 17,100 employees worldwide • 22,369 MW(1) owned generation capacity Coal 42% Natural Gas 22% Wind 21% Hydro 6% Solar 6% Nuclear and other 3% (1) Net MW owned in operation and under construction as of Sept. 30, 2013

• Diversified portfolio of regulated assets – Weather, customer, regulatory, generation, economic and catastrophic risk diversity • Berkshire Hathaway ownership – Access to capital from Berkshire Hathaway allows us to take advantage of market opportunities – Berkshire Hathaway is a long-term holder of assets; its owner for life philosophy promotes stability and helps make MidAmerican the buyer of choice in the eyes of certain sellers and regulators – Tax appetite of Berkshire Hathaway has allowed us to realize significant tax benefits • No dividend requirement – Cash flow is retained in the business and used to help fund growth MidAmerican Competitive Advantage 6

NV Energy Acquisition 7 • On May 29, 2013, MidAmerican and NV Energy announced a transaction whereby MidAmerican will acquire all of the outstanding shares of NV Energy for $23.75 per share in cash, for a total of approximately $5.6 billion • NV Energy’s shareholders approved the transaction on Sept. 25, 2013 • Regulatory filings needed for the transaction have been made – HSR (review completed) – FERC 203 and PUCN (approvals pending) • Nevada Power and Sierra Pacific Power are public utilities that generate, transmit and distribute electric energy in Nevada; Sierra Pacific Power also provides natural gas service in Nevada – Electric service to 2.4 million Nevadans • Approximately 90% of state population • 1.2 million accounts • 40 million tourists annually – Nearly 46,000 square-mile service territory and approximately 3,800 miles of transmission – $12 billion of assets and almost 6,000 MW of owned generating capacity as of Dec. 31, 2012 – NV Energy owned and contracted generation mix(1): Coal 16% Natural Gas 78% Renewables 6% 8,250 Net MW Commitment to retire 75% of coal generation capacity by the end of 2019 MidAmerican Energy NV Energy PacifiCorp Kern River Gas Transmission Pipeline Northern Natural Gas Pipeline (1) 2013 peak MW

NV Energy Acquisition 8 • $23.75 for each share of NV Energy common stock; total purchase price for the shares is approximately $5.6 billion (1) The junior subordinated debentures to be sold to Berkshire Hathaway Inc. and its subsidiaries would be unsecured and junior in right of payment to MidAmerican’s senior debt. The junior subordinated debentures are expected to (i) have a 30 year maturity; (ii) bear interest at a floating rate equal to the London Interbank Offered Rate (“LIBOR”) plus 200 basis for the first three years; LIBOR plus 300 basis points for years four through seven, but if at least 50% of principal is repaid before the end of year three, the interest rate will remain at LIBOR plus 200 basis points for years four through seven; and LIBOR plus 375 basis points for years eight through 30; and (iii) be redeemable at MidAmerican’s option from time to time at par plus accrued interest. Berkshire Hathaway Inc. and its subsidiaries will be restricted from transferring the debentures to third parties. ($ billions) U es of Cash Sources of Cash Purchase Price $5.6 MidAmerican Equity From Existing Shareholders $1.0 Junior Subordinated Debentures Issued to Berkshire (1) 2.6 MidAmerican Senior Debt 2.0 Total Uses at Closing $5.6 Total Sources at Closing $5.6

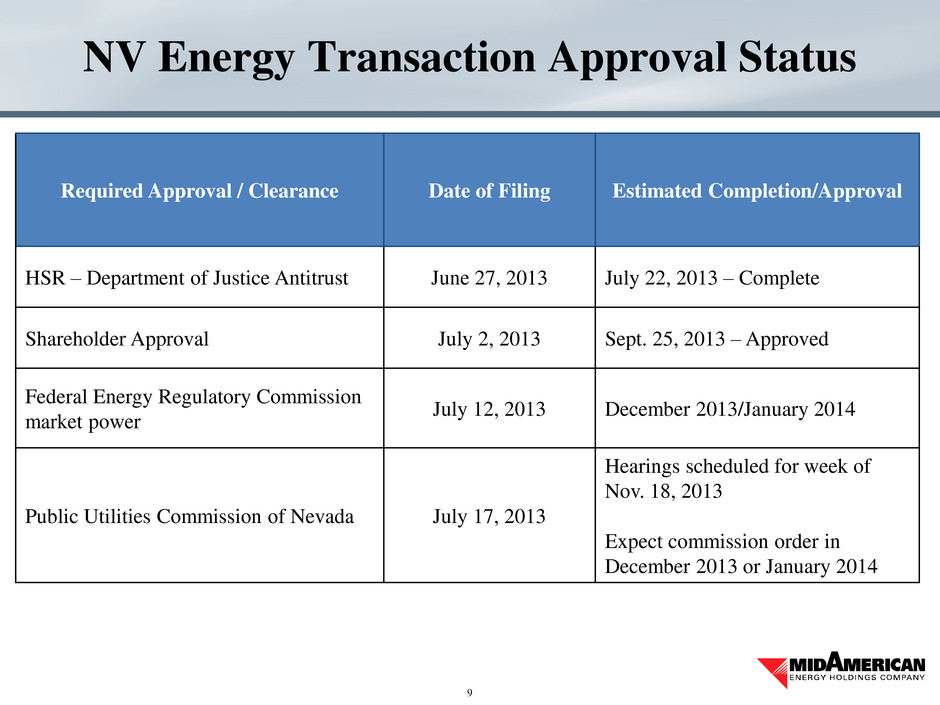

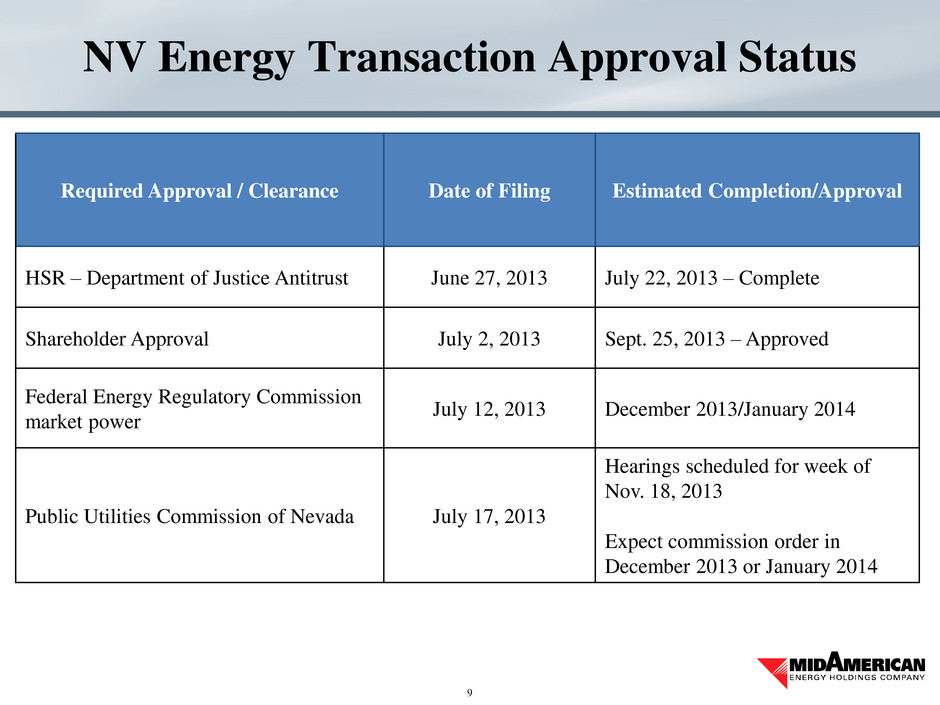

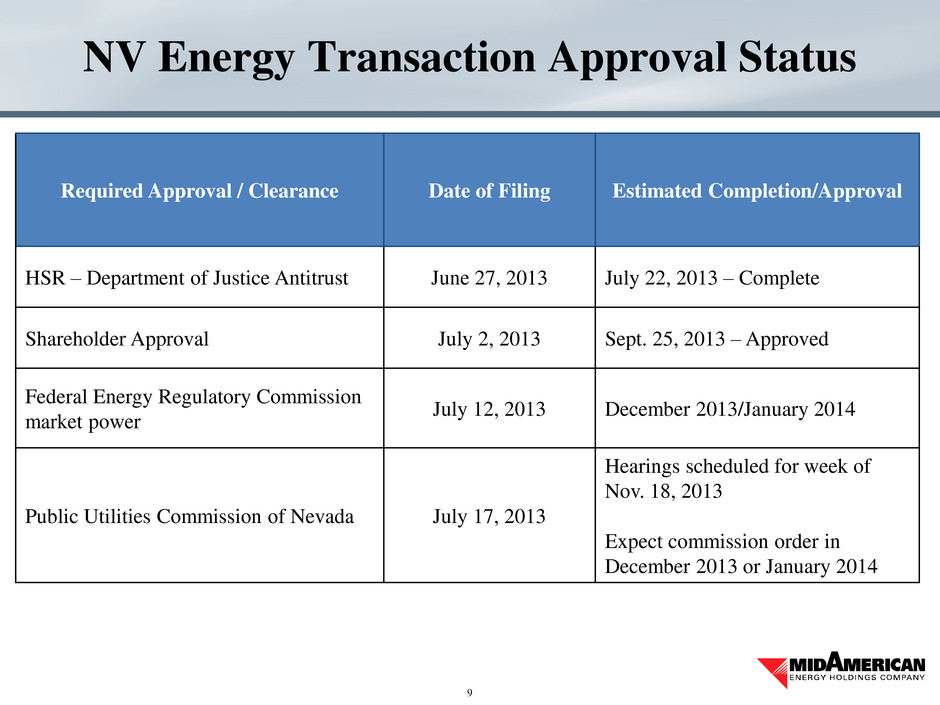

NV Energy Transaction Approval Status 9 Required Approval / Clearance Date of Filing Estimated Completion/Approval HSR – Department of Justice Antitrust June 27, 2013 July 22, 2013 – Complete Shareholder Approval July 2, 2013 Sept. 25, 2013 – Approved Federal Energy Regulatory Commission market power July 12, 2013 December 2013/January 2014 Public Utilities Commission of Nevada July 17, 2013 Hearings scheduled for week of Nov. 18, 2013 Expect commission order in December 2013 or January 2014

Pro Forma, MidAmerican Energy Holdings Company (Including NV Energy) 10 Pro Forma as of, and for the 12 months ended, Sept. 30, 2013 • $70.4 billion of assets • $15.3 billion of revenue • 8.4 million electric and natural gas customers worldwide • 17,000 miles of natural gas pipeline • Nearly 20,000 employees worldwide • 28,447 MW(1) owned generation capacity Coal 37% Natural Gas 35% Wind 17% Hydro 4% Solar 4% Nuclear and other 3% United Kingdom Philippines (1) Net MW owned in operation and under construction as of Sept. 30, 2013

Core Principles 11 Balancing MidAmerican’s core principles is essential Customer service Environmental respect Employee commitment Regulatory integrity Financial strength Operational excellence Plan Execute Measure Correct

Customer Service – Deliver Efficient, Effective and Reliable Service 12 TQS Results 2013 2013 Top 5 Utilities on Overall Customer Satisfaction Rank Utility Very Satisfied 1 MidAmerican 95.3% 2 Southern Company 95.2% 3 South Carolina Electric and Gas 93.7% 4 Portland General Electric 90.9% 5 We Energies 88.5% 54 Company name not available 34.5% Mastio Results 2013 No. 1 for the 8th consecutive year Interstate Pipelines 2003 2013 Northern Natural Gas 43 1 Kern River 10 2 Top 3 for the 10th consecutive year

Employee Commitment – Improve Safety Culture and Environment 13 0 1 2 3 4 5 6 7 8 9 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 1.07 MidAmerican Businesses with Incident Rate ≤ 1.0 CalEnergy Philippines 15 years Northern Powergrid 8 years Northern Natural Gas 3 years HomeServices of America 3 years Kern River 1 year Significant improvement through September 2013 – 0.77 Top Decile MidAmerican Energy Holdings Company Incident Rate

Coal 37% Natural Gas 30% Nuclear 19% Hydro 7% Geothermal, Solar, Wind 5% Other 2% Environmental Respect – Diversify to Prepare for the Future 14 2012 U.S. Utility Generation Capacity Mix (Source: EEI) Coal 42% Natural Gas 22% Nuclear and other 3% Wind 21% Hydro 6% Solar 6% Sept. 30, 2013 MidAmerican Generation Capacity Mix (1) (1) Net MW owned in operation and under construction as of Sept. 30, 2013 Coal 37% Natural Gas 35% Nuclear and other 3% Wind 17% Hydro 4% Solar 4% Sept. 30, 2013 MidAmerican Pro Forma with NV Energy Generation Capacity Mix (1)

Environmental Respect – MidAmerican Owned Wind Resources (Regulated) 15 1999 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013-2015 Total PacifiCorp MidAmerican Energy Total 32.1 - - 100.5 140.4 381.7 265.5 111.0 - - - 1,031.2 $2.1 - 160.5 200.0 99.0 201.5 623.3 - - 593.4 406.9 1,050.0 3,334.6 $5.8 32.1 160.5 200.0 199.5 341.9 1,005.0 265.5 111.0 593.4 406.9 1,050.0 4,365.8 $7.9 Investment (billions) Owned Wind Generation Capacity (1) • Most recent addition is $1.9 billion, 1,050 MW project at MidAmerican Energy announced May 2013 • Largest single economic development project in Iowa • Iowa Utilities Board pre-approved 11.625% return on equity (1) Net MW owned in operation and under construction as of Sept. 30, 2013

Environmental Respect – Prepare for the Future 16 Bishop Hill II 81 MW Pinyon Pines I and II 300 MW Agua Caliente 290 MWAC Topaz Solar Farms 550 MWAC Solar Star Projects 579 MWAC • Our unregulated businesses bring diversity and predictable, contracted cash flows, while mitigating environmental risks

Regulatory Integrity – Achieve Balanced Outcomes 17 Company Average Rate ($/kWh) Highest Average Rates ($/kWh) by State: Hawaii – $0.3360; Connecticut – $0.1627; New York – $0.1570; New Jersey – $0.1523; New Hampshire – $0.1469 Pacific Region Pacific Power $0.0873 Pacific Region $0.1284 Mountain Region Rocky Mountain Power $0.0730 Mountain Region $0.0889 Midwest Region MidAmerican Energy Company $0.0657 Midwest Region $0.0891

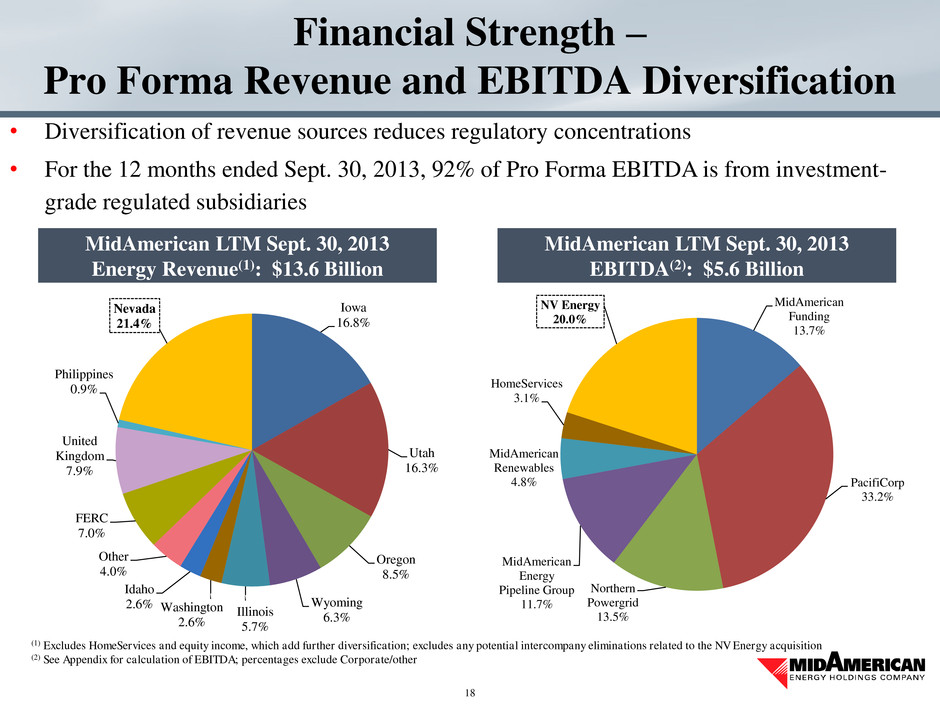

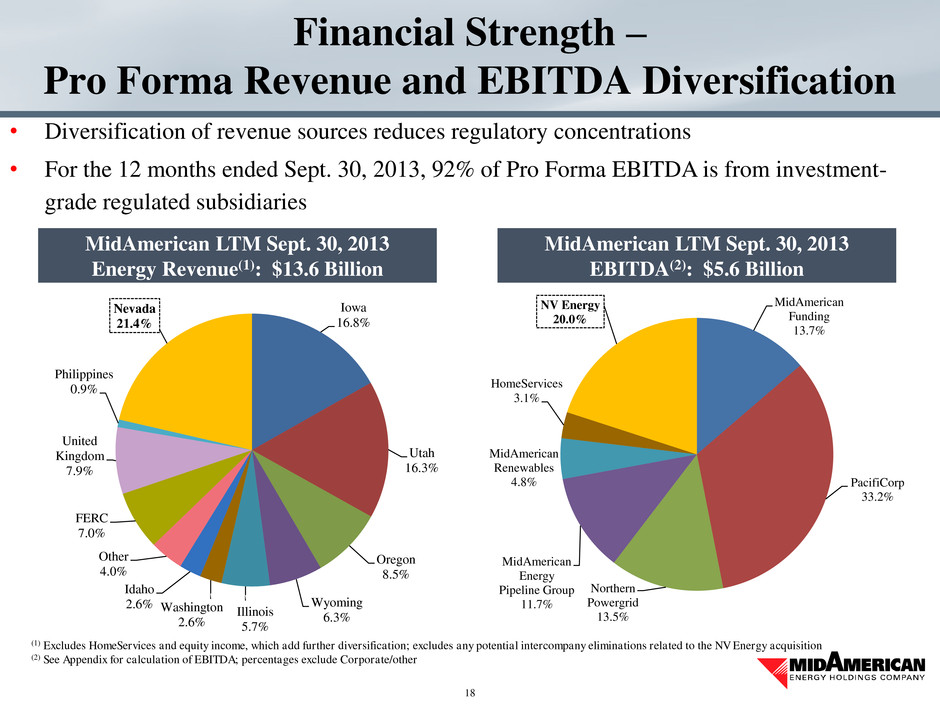

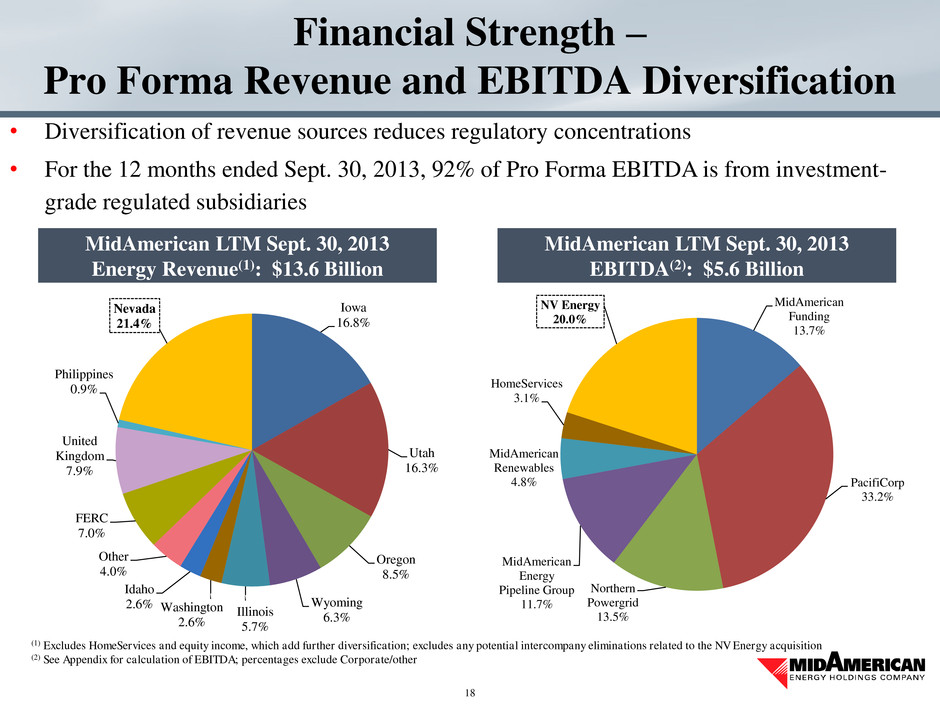

18 Financial Strength – Pro Forma Revenue and EBITDA Diversification • Diversification of revenue sources reduces regulatory concentrations • For the 12 months ended Sept. 30, 2013, 92% of Pro Forma EBITDA is from investment- grade regulated subsidiaries (1) Excludes HomeServices and equity income, which add further diversification; excludes any potential intercompany eliminations related to the NV Energy acquisition (2) See Appendix for calculation of EBITDA; percentages exclude Corporate/other MidAmerican LTM Sept. 30, 2013 Energy Revenue(1): $13.6 Billion Iowa 16.8% Utah 16.3% Oregon 8.5% Wyoming 6.3% Illinois 5.7% Washington 2.6% Idaho 2.6% Other 4.0% FERC 7.0% United Kingdom 7.9% Philippines 0.9% Nevada 21.4% MidAmerican Funding 13.7% PacifiCorp 33.2% Northern Powergrid 13.5% MidAmerican Energy Pipeline Group 11.7% MidAmerican Renewables 4.8% HomeServices 3.1% NV Energy 20.0% MidAmerican LTM Sept. 30, 2013 EBITDA(2): $5.6 Billion

19 • MidAmerican Energy Company includes Wind VIII construction costs of $391 million in 2013; 2014 and 2015 include $522 million and $447 million, respectively, related to contracts already entered into as well as the estimated balance of payments up to the cost cap of approximately $1.9 billion established by the Iowa Utilities Board • Capital expenditures related to transmission projects are projected to total approximately $1.4 billion from 2013-2015 for PacifiCorp and MidAmerican Energy Company • MidAmerican Renewables is projected to spend approximately $4 billion from 2013-2015 $4,396 $5,484 $4,582 $0 $1,000 $2,000 $3,000 $4,000 $5,000 $6,000 2013 2014 2015 $ m illi on s PacifiCorp MidAmerican Energy Company Northern Powergrid Holdings MidAmerican Renewables MidAmerican Energy Pipeline Group and Other NV Energy Operational Excellence – Reinvesting in Our Business Projected Capital Expenditures

• Since the acquisition by Berkshire Hathaway in March 2000, MidAmerican has realized significant growth in its assets and returns $6.5 $31.9 $34.2 $37.6 $39.4 $0 $10 $20 $30 $40 $50 2001 2010 2011 2012 Sept. 2013 Billions $143 $1,238 $1,331 $1,472 $1,601 $0 $500 $1,000 $1,500 $2,000 2001 2010 2011 2012 LTM 9/30/13 Millions $847 $2,759 $3,220 $4,327 $4,328 $0 $1,000 $2,000 $3,000 $4,000 $5,000 2001 2010 2011 2012 LTM 9/30/13 Millions $1.7 $13.2 $14.1 $15.7 $17.2 $0 $5 $10 $15 $20 2001 2010 2011 2012 Sept. 2013 Billions Net Income Attributable to MidAmerican MidAmerican Shareholders’ Equity Property, Plant and Equipment (Net) Cash Flows From Operations MidAmerican Financial Summary 20

Credit Metrics and Financial Strength 21 • MidAmerican Key Credit Ratios(1) – Credit ratios continue to be strong and supportive of our credit rating as business performance has remained resilient to challenging economic conditions in our industry and equity is retained and reinvested • Ratings (Issuer or senior unsecured ratings unless noted) – Since 2001, MidAmerican has strengthened its credit metrics and credit ratings (1) Refer to the appendix for the calculations of key ratios (2) Ratings for PacifiCorp, MidAmerican Energy Company and Kern River Funding Corp. are senior secured rating Moody’s S&P Fitch MidAmerican Energy Holdings Company Baa1 BBB+ BBB+ PacifiCorp (2) A2 A A- MidAmerica Energy Company (2) Aa3 A A+ Northern Natural Gas Company A2 A A Kern River Funding Corp. (2) A2 A- A- Northern Powergrid (Northeast) A3 A- A- Northern Powergrid (Yorkshire) A3 A- A LTM 9/30/13 2012 2011 2001 FFO Interest Coverage 4.8x 4.6x 4.1x 2.3x FFO to Adjusted Debt 19.6% 19.8% 18.1% 9.1% Adjusted Debt to Total Capitalization 56.9% 57.6% 58.2% 72.2% Total Assets ($ billions) $56.2 $52.5 $47.7 $13.0

Credit Metrics 22 Note: Refer to the appendix for the calculations of key ratios LTM 9/30/13 2012 2011 Regulated Utilities PacifiCorp FFO Interest Coverage 4.7x 4.8x 4.8x FFO to Debt 20.3% 21.3% 21.6% Debt to Total Capitalization 47.3% 47.3% 48.6% MidAmerican Energy FFO Interest Coverage 7.4x 7.7x 8.1x FFO to Debt 21.4% 29.2% 36.1% Debt to Total Capitalization 52.9% 47.3% 48.8% Regulated Pipelines Northern Natural Gas FFO Interest Coverage 7.2x 6.3x 6.5x FFO to Debt 31.8% 30.8% 32.6% Debt to Total Capitalization 40.7% 41.1% 42.7% Kern River FFO Interest Coverage 8.0x 7.5x 6.3x FFO to Debt 43.0% 39.5% 31.7% Debt to Total Capitalization 41.0% 41.6% 45.2% Regulated Distribution Northern Powergrid FFO Interest Coverage 4.8x 4.7x 4.6x FFO to Debt 22.3% 21.4% 25.4% Debt to Total Capitalization 44.6% 47.4% 49.2%

• Despite tepid economic growth, our regulated businesses continue to perform well, and our unregulated businesses MidAmerican Renewables and HomeServices are realizing increased net income Financial Information ($ millions) 23 LTM 9/30/2013 12/31/2012 12/31/2011 PacifiCorp 1,122$ 1,034$ 1,099$ MidAmerican Funding 337 369 428 MidAmerican Energy Pipeline Group 452 465 468 Northern Powergrid Holdings 583 565 615 MidAmerican Renewables 178 93 106 HomeServices 130 62 24 Corporate/other (44) (21) (56) Total operating income 2,758 2,567 2,684 Interest expense (1,185) (1,176) (1,170) Interest expense on MidAmerican subordinated debt - - (26) Capitalized interest 75 54 40 Allowance for equity funds 74 74 72 Other 71 56 (7) Income before income tax expense and other 1,793 1,575 1,593 Income tax expense (232) (148) (294) Other 40 45 32 Net income attributable to MidAmerican shareholders 1,601$ 1,472$ 1,331$ Years Ended

Retail Electric Sales – Weather Normalized 24 Year-to-Date September 30 Variance (GWh) 2013 2012 Actual Percent PacifiCorp Residential 11,217 11,594 (377) -3.3% Commercial 12,557 12,476 81 0.6% Industrial and Other 16,791 16,420 371 2.3% Total 40,565 40,490 75 0.2% MidAmerican Energy Residential 4,902 4,803 99 2.1% Commercial 3,121 3,132 (11) -0.4% Industrial and Other 8,608 8,574 34 0.4% Total 16,631 16,509 122 0.7% Northern Powergrid Residential 9,496 9,593 (97) -1.0% Commercial 4,385 4,390 (5) -0.1% Industrial and Other 13,837 13,692 145 1.1% Total 27,718 27,675 43 0.2%

Retail Electric Sales – Actual 25 Year-to-Date September 30 Variance (GWh) 2013 2012 Actual Percent PacifiCorp Residential 11,883 11,896 (13) -0.1% Commercial 12,839 12,633 206 1.6% Industrial and Other 16,930 16,420 510 3.1% Total 41,652 40,949 703 1.7% MidAmerican Energy Residential 5,057 4,986 71 1.4% Commercial 3,179 3,175 4 0.1% Industrial and Other 8,608 8,575 33 0.4% Total 16,844 16,736 108 0.6% Northern Powergrid Residential 9,677 9,689 (12) -0.1% Commercial 4,452 4,440 12 0.3% Industrial and Other 13,887 13,740 147 1.1% Total 28,016 27,869 147 0.5%

(1) Net MW owned in operation and under construction as of Sept. 30, 2013 (2) All or some of the renewable energy attributes associated with generation from these generating facilities may be: (a) used in future years to comply with renewable portfolio standards or other regulatory requirements or (b) sold to third parties in the form of renewable energy credits or other environmental commodities • Headquartered in Portland, Oregon • 6,045 employees • 1.8 million electric customers in six western states • 11,222 MW(1) of owned generation capacity • Owned generating capacity by fuel type: 9/30/13(1) 3/31/06 – Coal 55% 72% – Natural gas 25% 13% – Hydro(2) 10% 14% – Wind, geothermal and other(2) 10% 1% PacifiCorp 26 (a) Access to other entities’ transmission lines through wheeling arrangements

PacifiCorp – Business Update 27 • Higher retail prices approved by regulators, primarily to recover capital investments and higher energy costs, reflected fair outcomes – Multi-year rate plans in several states to stabilize financial outcomes for our customers and the company – Multi-party settlement reached in Oregon general rate case for a $24 million, or 2%, annual increase (subject to commission approval and including revised depreciation rates) – Awaiting order in Washington general rate case • Actual retail load for the nine months ended Sept. 30, 2013, was 41,652 gigawatt-hours, a 1.7% increase versus the first nine months of 2012 • Lake Side 2, a 645-MW natural gas-fueled plant (combined-cycle combustion turbine), is under construction next to the existing Lake Side plant located near Vineyard, Utah, with completion expected in second quarter 2014 • Mona-Oquirrh transmission line was placed in service in May 2013 • Sigurd-Red Butte transmission line is under construction in Utah with completion expected in 2015 • June 2013 debt issuance of $300 million due 2023 was completed at 2.95% • Continued focus on capital expenditure levels and operating cost efficiencies

• Headquartered in Des Moines, Iowa • 3,534 employees • 1.4 million electric and natural gas customers in four Midwestern states • 8,440 MW(1) of owned generation capacity • Owned generating capacity by fuel type: 9/30/13(1) 12/31/00 – Coal 40% 70% – Natural gas 15% 19% – Wind(2) 40% 0% – Nuclear and other 5% 11% MidAmerican Energy 28 SOUTH DAKOTA NEBRASKA KANSAS MISSOURI ILLINOIS WISCONSIN MINNESOTA IOWA MidAmerican Energy Service Territory Major Generating Facilities Wind Projects Wind Projects Under Construction (1) Net MW owned in operation and under construction as of Sept. 30, 2013 (2) All or some of the renewable energy attributes associated with generation from these generating facilities may be: (a) used in future years to comply with renewable portfolio standards or other regulatory requirements or (b) sold to third parties in the form of renewable energy credits or other environmental commodities

MidAmerican Energy – Business Update 29 • Iowa electric rate increase filed May 17, 2013, proposing a phased-in increase to base rates of $135 million at annualized amounts of $45 million (3.6%) effective August 2013, $45 million effective January 2015, and $45 million effective January 2016 • Iowa rate request also proposes adjustment clauses for retail energy, including the pre-tax value of federal production tax credits and Midcontinent Independent System Operator transmission costs • Customer growth, improved industrial sales, and colder winter weather helped offset milder summer weather and increased actual retail electric sales to 16,844 gigawatt-hours for the nine months ended Sept. 30, 2013, a 0.6% increase over the same period for 2012 • Currently constructing 1,050 MW (nominal ratings) of wind-powered generation facilities in Iowa, expected to be completed by 2015, with a cost cap of $1.9 billion established by the Iowa Utilities Board • Currently constructing transmission lines in Iowa and Illinois anticipated to go into service in 2015-2018, with an estimated cost of $550 million, that have been designated as Multi-Value Projects by MISO • Scrubber/baghouse construction projects in progress at Neal Energy Center Units 3 and 4 and Ottumwa Generating Station, with completion anticipated in early 2014, late 2013, and late 2014, respectively • Continue to receive high customer satisfaction ratings for gas and electric service • Completed September 2013 debt issuance of $950 million, comprised of three tranches: $350 million at 2.40% due 2019; $250 million at 3.70% due 2023; $350 million at 4.80% due 2043

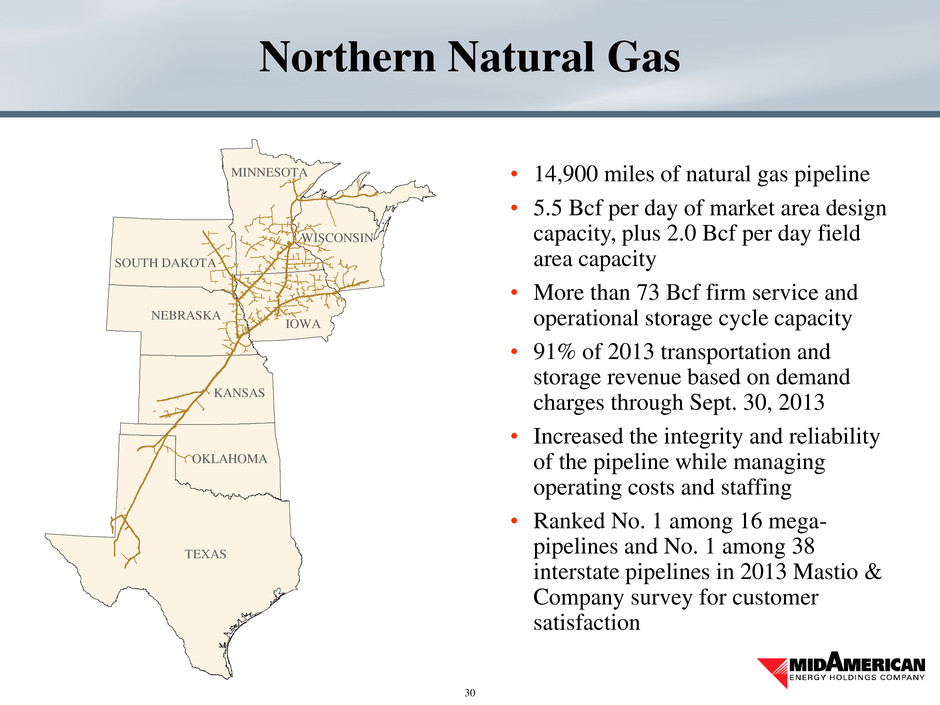

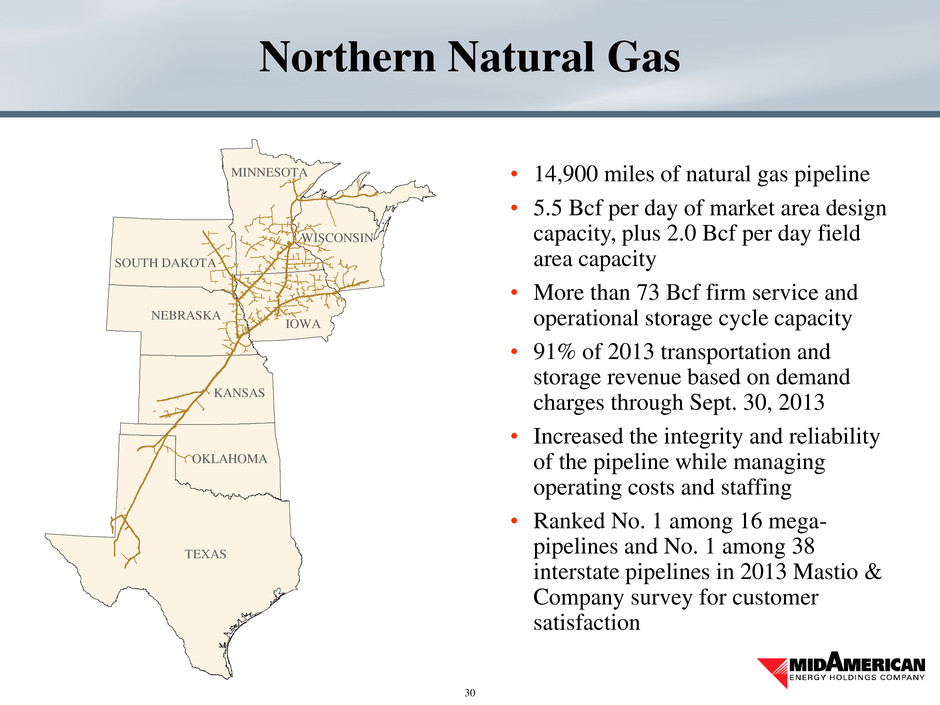

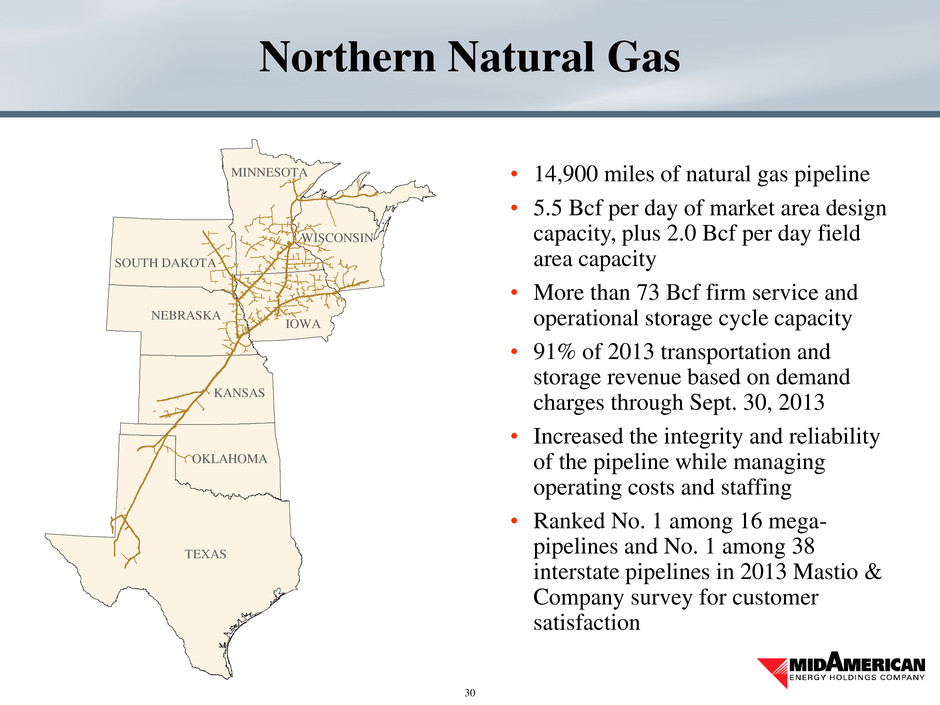

• 14,900 miles of natural gas pipeline • 5.5 Bcf per day of market area design capacity, plus 2.0 Bcf per day field area capacity • More than 73 Bcf firm service and operational storage cycle capacity • 91% of 2013 transportation and storage revenue based on demand charges through Sept. 30, 2013 • Increased the integrity and reliability of the pipeline while managing operating costs and staffing • Ranked No. 1 among 16 mega- pipelines and No. 1 among 38 interstate pipelines in 2013 Mastio & Company survey for customer satisfaction Northern Natural Gas 30 MINNESOTA WISCONSIN IOWA SOUTH DAKOTA NEBRASKA KANSAS OKLAHOMA TEXAS

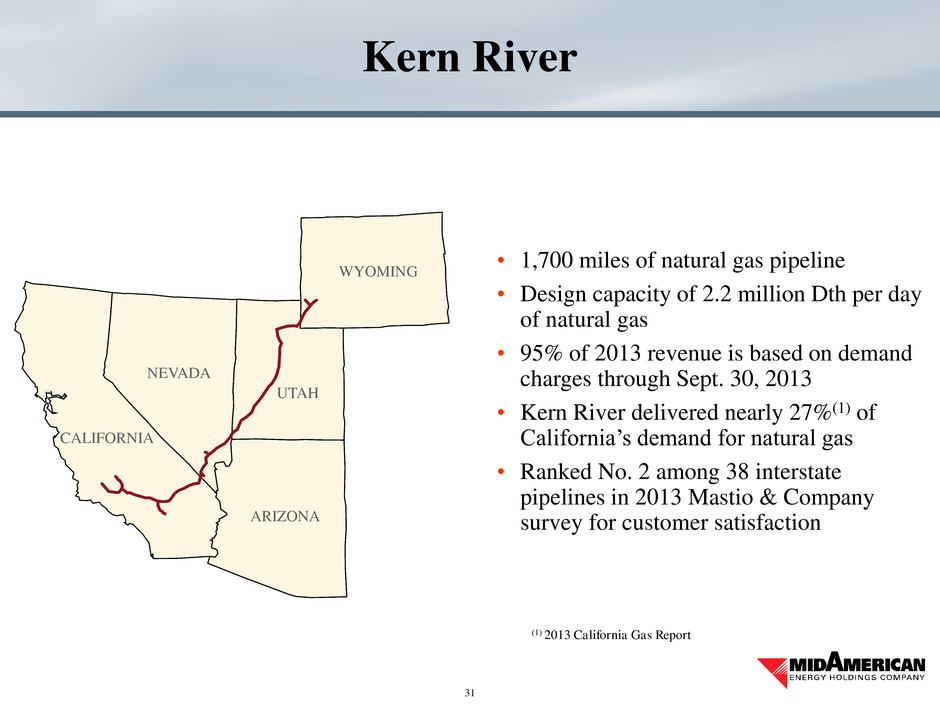

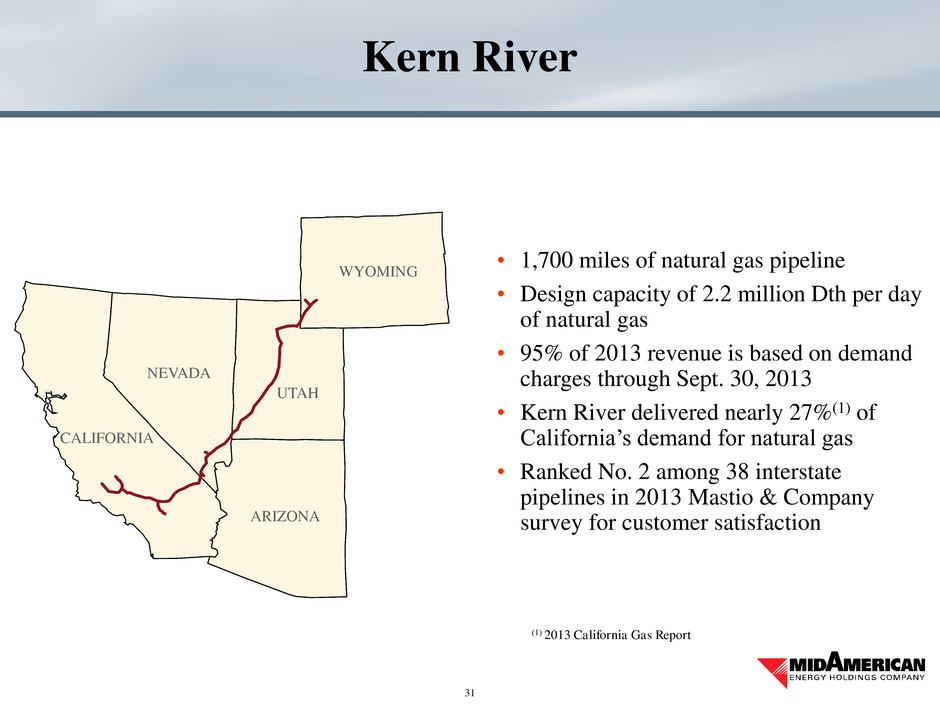

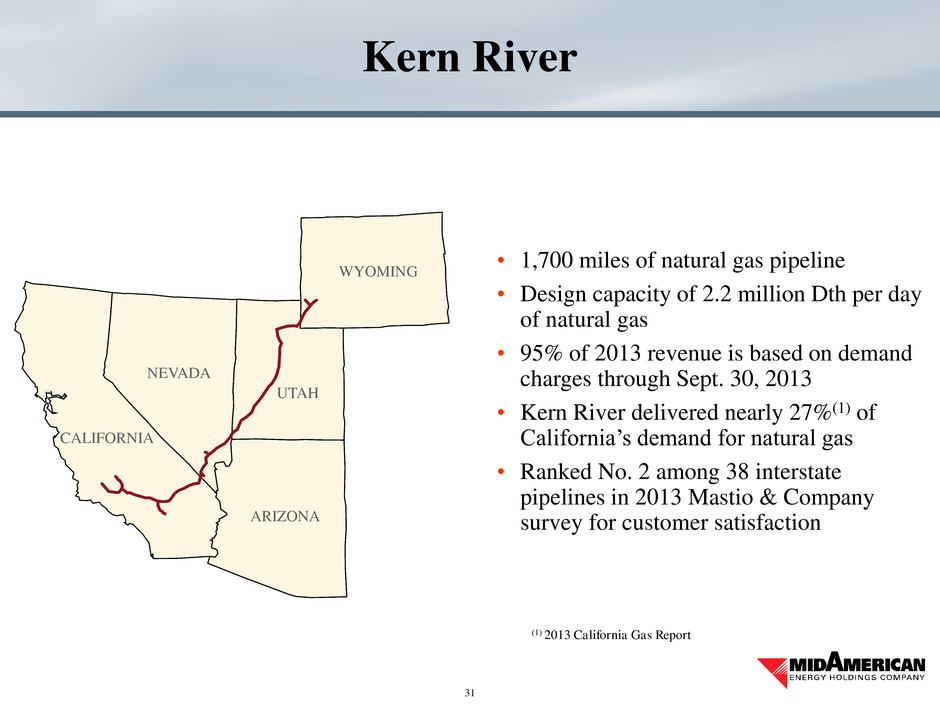

• 1,700 miles of natural gas pipeline • Design capacity of 2.2 million Dth per day of natural gas • 95% of 2013 revenue is based on demand charges through Sept. 30, 2013 • Kern River delivered nearly 27%(1) of California’s demand for natural gas • Ranked No. 2 among 38 interstate pipelines in 2013 Mastio & Company survey for customer satisfaction Kern River 31 CALIFORNIA NEVADA ARIZONA UTAH WYOMING (1) 2013 California Gas Report

Leeds Edinburgh Middlesbrough Newcastle Upon Tyne Sheffield York Northeast Yorkshire • 3.9 million end-users in northern England • 58,000 miles of distribution lines • Approximately 68% of 2013 distribution revenue from residential and commercial customers through Sept. 30, 2013 • Distribution revenue (£ millions) • U.K. Distribution Price Control Review 5 commenced April 2010; plans are in place and delivering out- performance • Plans have been submitted to the Regulator for the next price control, Electricity Distribution 1, commencing April 2015 under the RIIO framework with a decision expected in November 2013 Nine Months Ended 9/30/13 9/30/12 Residential £237 £224 Commercial 86 79 Industrial 148 138 Other 7 7 Total £478 £448 Northern Powergrid 32

MidAmerican Renewables 33 (1) Based on net owned capacity of 2,707 MW in operation and under construction as of Sept. 30, 2013 (2) 82% of the company’s interests in the Imperial Valley projects’ contract capacity are sold to SCE under long-term PPAs expiring in 2016 through 2026 MidAmerican Solar Geothermal Plants Natural Gas Plants MidAmerican Wind MidAmerican Hydro CalEnergy Philippines Solar 47% Wind 14% Geothermal 6% Hydro 5% Natural Gas 28% Portfolio Composition (1) 2013-2015 7% 2016-2026 32% 2027+ 61% Contract Maturities (1) Location Installed PPA Expiration Offtaker Net or Contract Capacity (MW) Net Owned Capacity (MW) SOLAR Solar Star I and II CA 2013-2015 2035 SCE 579 579 Topaz CA 2013-2015 2040 PG&E 550 550 Agua Caliente AZ 2012-2013 2039 PG&E 290 142 1,419 1,271 WIND Pinyon Pines I & II CA 2012 2035 SCE 300 300 Bishop Hill II IL 2012 2032 Ameren 81 81 381 381 GEOTHERMAL Imperial Valley Projects CA 1982-2000 SCE (2) SCE (2) 327 164 HYDROELECTRIC Casecnan Project Phil. 2001 2021 NIA 150 128 Wailuku HI 1993 2023 Hawaii Electric 10 5 160 133 NATURAL GAS Cordova IL 2001 2019 Constellation 537 537 Power Resources TX 1988 2015 EDF Trading 212 106 Saranac NY 1994 2015 TransAlta Energy Mktg 240 90 Yuma AZ 1994 2024 SDG&E 50 25 1,039 758 Total Owned and Under Construction 3,326 2,707

Unregulated Solar 34 Topaz • Expected cost of $2.44 billion with completion in first quarter 2015 • Project is 60% complete as of Sept. 30, 2013 • Project will use approximately 8.4 million First Solar Series 3 thin-film panels; over 5 million panels installed as of Sept. 30, 2013 Solar Star I and II • Expected cost of $2.75 billion with completion in late 2015 • Project is 14% complete as of Sept. 30, 2013 • Projects will use approximately 1.7 million SunPower E20 435-watt monocrystalline silicon modules and the T0 single axis tracking technology Agua Caliente • Expected cost of $1.7 billion (51% owned by NRG Energy, Inc.) with completion in December 2013 • Project is 98% complete as of Sept. 30, 2013 • Project will use approximately 5 million First Solar Series 3 thin-film panels; nearly 4.8 million panels installed as of Sept. 30, 2013 CALIFORNIA ARIZONA UTAH NEVADA Topaz Solar Star Agua Caliente

Pinyon Pines I and II • 168-MW Pinyon Pines I and 132-MW Pinyon Pines II located in Kern County, California • 3.0-MW Vestas turbines with an 80-meter hub height and 90-meter rotor diameter • Project completed in late fourth quarter 2012 • Power purchase agreements with Southern California Edison through 2035 • Project cost of $927 million • Through September 2013, availability is 99.0% and capacity factor is 27.9% 35 Unregulated Wind Bishop Hill II • 81-MW project located in Henry County, Illinois, approximately 20 miles southeast of Rock Island, Illinois • 1.62-MW GE turbines with 100-meter hub height and 100-meter rotor diameter • 20-year power purchase agreement with Ameren Illinois Company • Project completed in mid-November 2012 • Project cost of $179 million • Through September 2013, availability is 97.3% and capacity factor is 35.1%

Financing Plan 2014 36 • PacifiCorp – Anticipate a $300-$400 million 2014 debt financing • MidAmerican Energy Company – Anticipate a $800-$900 million 2014 debt financing • Solar Star – Completed nonrecourse project financing of $1.0 billion at 5.375% in June 2013; an additional financing of up to approximately $280 million remains available and will be considered during 2014

Other Business Opportunities and Growth 37 • MidAmerican and TransAlta created a new strategic partnership to develop, build and operate new natural gas-fueled electricity generation projects in Canada – Continued emphasis on smaller cogeneration projects with solid long-term power purchase agreements – Several projects are under development plus consideration for a combined-cycle plant, Sundance 7, which is a proposed 800-MW facility that is grid connected and designed to serve Alberta load growth as coal plants retire • MidAmerican is pursuing transmission opportunities in both the U.S. and Canada through the following joint ventures: – Electric Transmission Texas – Electric Transmission America – TAMA Transmission

Appendix

CE Casecnan Water and Energy Organizational Structure 39 Acquisition Pending (1) (1) The acquisition of NV Energy is expected to close in early 2014 and is subject to approval by federal and state regulators (2) PacifiCorp, MidAmerican Energy, Kern River, Nevada Power and Sierra Pacific ratings are senior secured Baa1/BBB+/BBB+ Aa2/AA/A+ 90% A2/A/A Regulated Natural Gas Transmission A2/A/A-(2) Regulated Electric Utility Baa1/BBB+/A- Holding Company Aa3/A/A+(2) Regulated Electric and Gas Utility Real Estate Brokerage and Franchises Contracted Non-utility Power Generation Regulated Electricity Transmission Holding Company A3/BBB+/BBB+(2) Regulated Electric Utility A3/BBB+/BBB+(2) Regulated Electric and Gas Utility A2/A-/A-(2) Regulated Natural Gas Transmission 2012 Berkshire Hathaway ($ billions) Revenue $ 162.5 Net Income $ 14.8 Equity $ 187.6 2012 MidAmerican ($ billions) Revenue $ 11.5 Net Income $ 1.5 Equity $ 15.7

Rocky Mountain Power Regulatory Accomplishments 40 • Utah Energy Balancing Account: – In October 2013, the commission approved recovery of $15 million of deferred net power costs over a two-year period effective November 2013 • Wyoming Energy Cost Adjustment Mechanism: – In September 2013, the commission approved a stipulation in which the parties agreed to recovery of $17 million over three years – The new rates were effective on an interim basis in May 2013 with final rates effective November 2013 REC and Sulfur Dioxide Revenue Adjustment Mechanism (RRA): – In September 2013, the commission approved a stipulation requesting a decrease in the RRA surcredit of $15 million – The new rates were effective on an interim basis in May 2013 with final rates effective November 2013

Rocky Mountain Power Regulatory Accomplishments 41 • Idaho Energy Cost Adjustment Mechanism: – In March 2013, the commission approved the recovery of $16 million of deferred net power costs, of which $9 million will be collected over a one-year period and the remainder collected over a three-year period effective April 2013 Multi-party Stipulation in Lieu of General Rate Case: – In October 2013, the commission approved a multi-party stipulation to increase base rates $2 million effective January 2014, as well as the following items: • Deferral of any removal costs associated with the retirement of the Carbon coal- fueled generating facility and any incremental depreciation expense reflected in the depreciation study that is pending commission approval, with timing of recovery to be determined in a future proceeding • A resource adder to provide a means for recovery of costs associated with Lake Side 2 via the energy cost adjustment mechanism effective January 2015 for an estimated $5 million annually with deferral to continue until Lake Side 2 is included in base rates • Specify January 2016 as the earliest effective date PacifiCorp could seek an increase to customers’ base rates

Pacific Power Regulatory Accomplishments 42 • Oregon 2013 General Rate Case: – A multi-party stipulation was filed with the commission reflecting an annual increase of $24 million, or an average price increase of 2%, effective January 2014 – In addition, the stipulation provides for the implementation of a separate tariff rider for Lake Side 2 when placed into service in mid-2014 – The stipulation also specifies that January 2016 is the earliest effective date that PacifiCorp could seek an increase to customers’ base rates through a general rate case Settled Items from the 2012 General Rate Case: – In December 2012, the commission approved the 2012 general rate case stipulation to become effective January 2013, as well as the following items: • Prudency of capital and operating expenses associated with PacifiCorp’s emissions control investments at certain coal-fueled generating facilities but ordered a one-time credit of $17 million to be credited to customers in 2013 through a separate tariff rider • A power cost adjustment mechanism with certain modifications from PacifiCorp's proposal • A separate tariff rider for the Mona-Oquirrh transmission line effective June 2013

Pacific Power Regulatory Accomplishments 43 • Washington 2013 General Rate Case: – In January 2013, PacifiCorp filed a general rate case requesting an annual increase of $37 million, or an average price increase of 12%, as amended in August 2013 – Includes the impacts associated with investment in facilities since the last general rate case filing and the projected increases in net power costs – A commission decision is expected by December 2013 • California Post Test Year Adjustment Mechanism (PTAM): – The annual PTAM attrition adjustment was approved by the commission effective January 2013, for a rate increase of $1 million, or 1% overall – The commission approved a rate increase of $1 million or 1% overall, effective July 2013, pursuant to PacifiCorp’s PTAM for major capital additions filing to add Mona-Oquirrh to rates

• Depreciation Rate Study: – PacifiCorp filed applications for depreciation rate changes with the commissions in Utah, Oregon, Wyoming, Washington and Idaho. The increase in annual depreciation expense is on a state- allocated basis and the applications include the impact of the early retirement of the Carbon facility in 2015 – PacifiCorp has authorization to defer the increase in depreciation expense associated with the early retirement of the Carbon facility in Utah, Wyoming and Idaho to facilitate recovery through 2020, which is the end of the depreciation life previously used for setting rates in these states; in Oregon, PacifiCorp is recovering costs associated with the Carbon facility through 2015 – The new depreciation rates become effective Jan. 1, 2014 • Utah – The commission approved an all-party stipulation in September 2013 resulting in an annual increase in depreciation expense of $10 million, which reflects the deferrals associated with the Carbon facility through 2020 • Wyoming – The commission approved an all-party stipulation in October 2013 resulting in an annual increase in depreciation expense of $10 million, which reflects the deferrals associated with the Carbon facility through 2020 Regulatory Accomplishments Depreciation Rate Study 44

• Idaho – The all-party stipulation filed September 2013 requests an annual increase of $2 million in depreciation expense, which reflects the deferrals associated with the Carbon facility through 2020 and is pending approval • Oregon – In September 2013, the commission issued an order approving a stipulation to implement revised depreciation rates that would result in an annual increase in depreciation expense of $30 million • Washington – PacifiCorp’s application to implement revised depreciation rates requests an annual decrease in depreciation expense of less than $1 million and is pending approval in the general rate case Regulatory Accomplishments Depreciation Rate Study 45

• The Environmental Protection Agency released its re-proposed standards for new fossil- fueled electric generating units Sept. 20, 2013, consistent with President Obama’s Climate Action Plan of June 25, 2013 – These standards do not apply to existing, currently operating fossil-fueled facilities, units undergoing modifications, or to reconstructed units; the EPA intends to propose separate standards for existing, modified and reconstructed units by June 2014 • MidAmerican Energy is subject to the Clean Air Interstate Rule • PacifiCorp is not subject to the Clean Air Interstate Rule; emission reduction projects are based on regional haze requirements • EPA has proposed a federal implementation plan for regional haze in Wyoming and finalized a federal implementation plan for regional haze in Arizona – EPA’s final action (for NOx and PM) in Wyoming is currently scheduled for Nov. 21, 2013, under consent order; EPA has requested an extension of that date with environmental groups party to the underlying litigation due to the recent government furlough – EPA’s action in Arizona (for NOx and PM) is currently being litigated; compliance deadline for installation of SCR on Cholla Unit 4 remains Jan. 4, 2018 • EPA issued a final rule on the Utah plan Oct. 30, 2012 – Final rule approved the plan regarding SO2, disapproved the plan regarding NOx and PM, but did not issue a federal implementation plan; EPA has the ability to issue a federal implementation plan within two years, unless the state submits an approvable plan Environmental Update 46

• Of MidAmerican’s nearly 9,860 MW(1) of operated or wholly owned coal-fueled generation: – 92% of generation has low-NOx burners and/or over-fire air for nitrogen oxides controls – 90% of generation has scrubbers for sulfur dioxide control – 8% of generation has activated carbon injection for mercury controls; an additional 17% meets the mercury emissions requirements of the Mercury and Air Toxics Standards without the need for additional controls – 64% of generation has baghouses for particulate matter control • To ensure timely compliance, MidAmerican continues to review proposed regulations and legislation and analyze associated current impacts of environmental requirements on the coal-fueled fleet Consolidated Environmental Position 47 (1) Excludes PacifiCorp’s minority-owned Craig, Colstrip and Hayden plants

• Of PacifiCorp’s 5,759 MW(1) of operated or wholly owned coal-fueled generation: – 86% of generation has nitrogen oxides controls with low-NOx burners and over-fire air – 93% of generation has scrubbers for sulfur dioxide control – 50% of generation has baghouses for particulate matter control – 29% of generation meets the mercury emissions requirements of the Mercury and Air Toxics Standards • Following completion of plans to retire or convert 502 MW of coal-fueled generation by year-end 2015, 96% of coal-fueled generation will be controlled by scrubbers and 62% will be controlled by baghouses; 100% of coal-fueled generation will meet mercury emissions requirements by April 2015 – Plan to retire Carbon Units 1 and 2 (172 MW) in April 2015 and convert Naughton Unit 3 (330 MW) to natural gas by July 2015(2) • Environmental capital expenditures forecast(3) ($ millions): 2013 2014 2015 $141 $173 $130 PacifiCorp Environmental Position 48 (1) Excludes minority-owned Craig, Colstrip and Hayden plants (2) Natural gas conversion of Naughton Unit 3 may ultimately be deferred to 2018, pending EPA approval (3) Environmental capital expenditures forecast includes PacifiCorp’s share of minority-owned Craig, Colstrip and Hayden plants

• Of MidAmerican Energy’s nearly 4,100 MW of operated coal-fueled generation: – 100% of generation has nitrogen oxides controls • Low-NOx burners and/or over-fire air on all units • One selective catalytic reduction system on Walter Scott, Jr. Energy Center Unit 4 – 71% of generation has scrubbers and baghouses for sulfur dioxide control – 20% of generation has activated carbon injection for mercury control • By 2016, after conversion to natural gas or retirement of 655 MW of operated coal- fueled generation, 100% of coal-fueled generation controlled with scrubbers, baghouses and mercury controls, and 58% with post combustion NOx controls – Plan to retire George Neal Units 1 and 2 (401 MW) and Walter Scott, Jr. Units 1 and 2 (120 MW) and fuel Riverside (134 MW) with natural gas • Environmental capital expenditures forecast ($ millions): 2013 2014 2015 $214 $154 $ 55 MidAmerican Energy Environmental Position 49

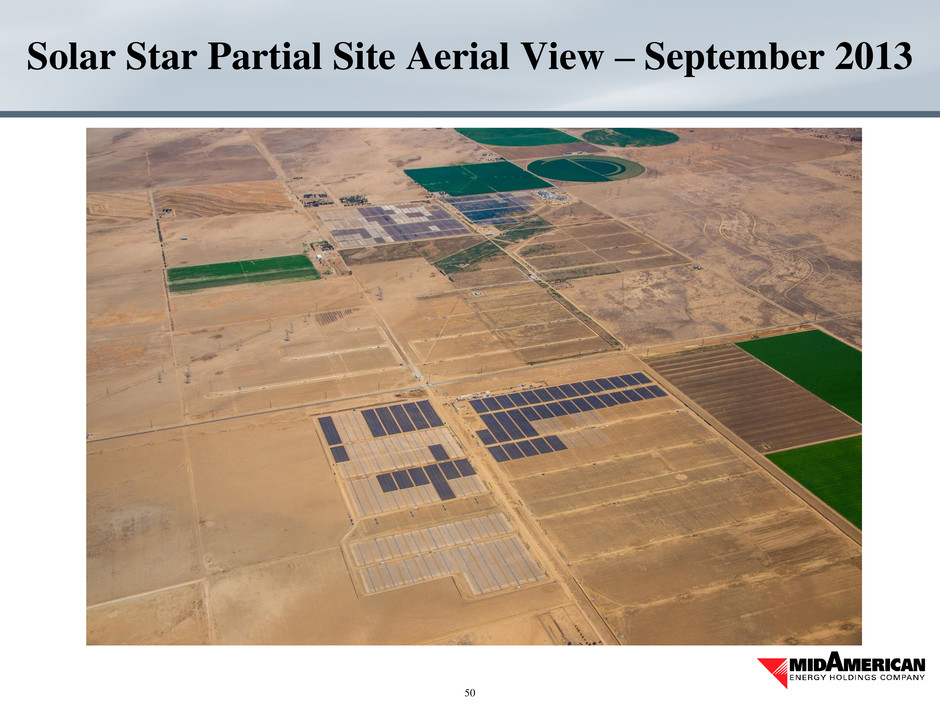

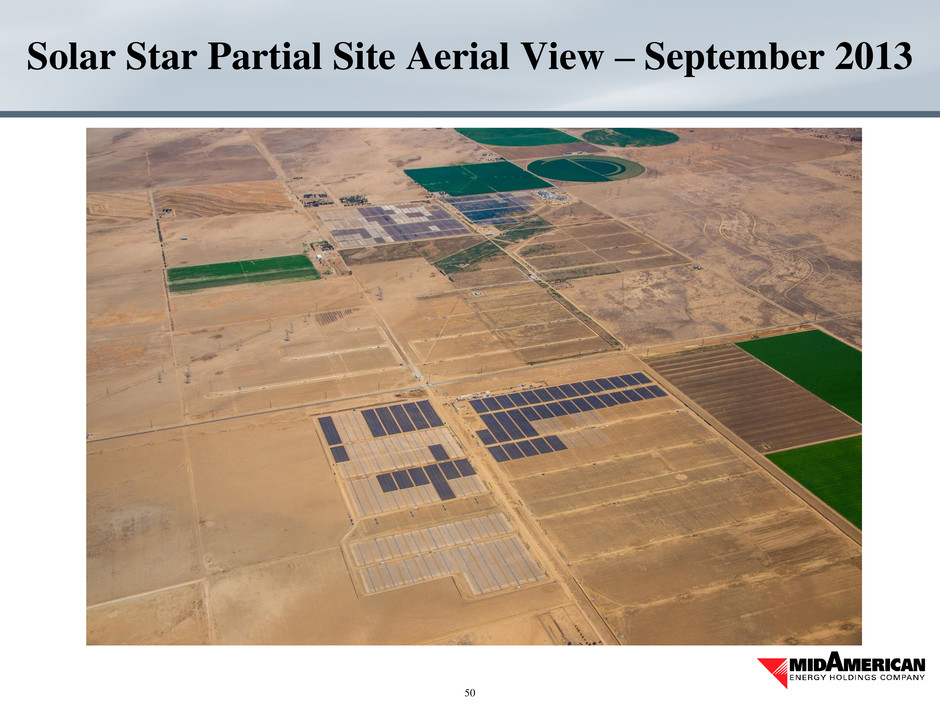

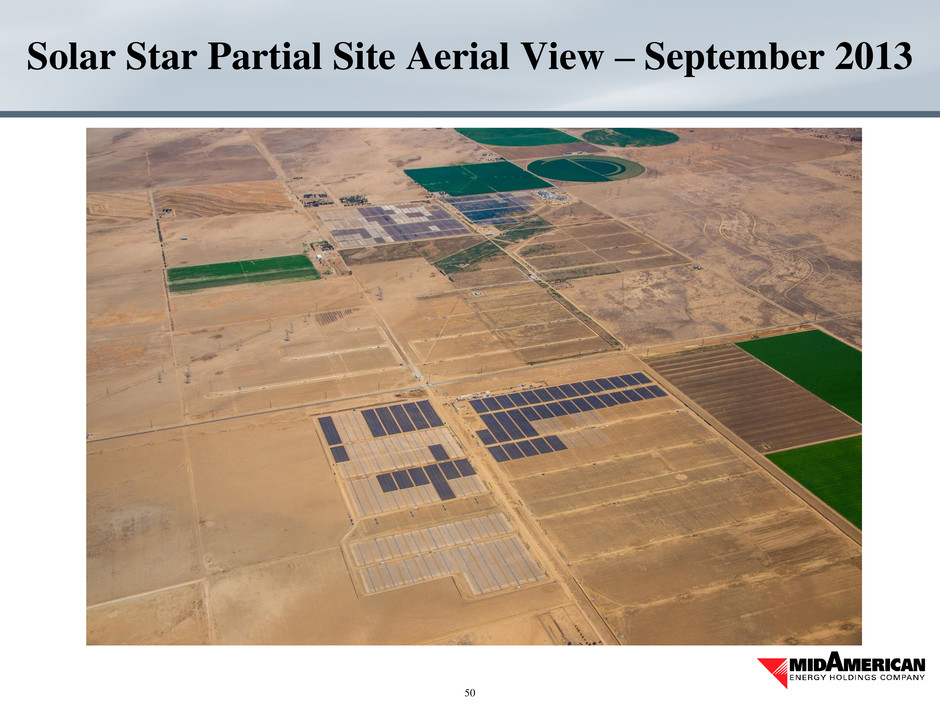

Solar Star Partial Site Aerial View – September 2013 50 Whirlwind Substation

• Construction – As of Sept. 30, 2013, the project is 14% complete, versus the engineering, procurement and construction schedule of 17% – SunPower’s initial supplier’s quality issues related to improperly welded panel tracking equipment delivered and installed at the plant have been resolved; current focus is now on ramping up production of the two factories supplying tracking equipment out of Phoenix, Arizona; a detailed recovery plan prepared in July 2013 is being monitored daily – Given current progress, it is presently expected that the first full block of capacity from Solar Star II will be completed by Dec. 31, 2013, in line with the engineering, procurement, construction contract schedule; the first full block of capacity from Solar Star I is scheduled to be completed in mid-January 2014, missing the Dec. 31, 2013 contracted date – Liquidated damage provisions negotiated in the engineering, procurement, construction contract provide an incentive for SunPower to achieve key milestones and fully protect MidAmerican Solar in the event SunPower misses the Dec. 31, 2013 contract date for either project Solar Star Project Status 51

• Commissioning and Contract Management – Back feeds for Solar Star I Substation 1A and Solar Star II Substation 2B were completed Sept. 17, 2013, and Sept. 20, 2013, respectively – The point-to-point metering and telemetry testing completed on Sept. 24, 2013, for Solar Star I and on Sept. 25, 2013, for Solar Star II; the California ISO confirmed that both tests were successful – On Sept. 25, 2013, the California ISO confirmed the assignment of Southern California Edison as the market scheduling coordinator for both projects effective Oct. 1, 2013 – Final meter certification forms were submitted to the California ISO the week of Sept. 23, 2013; synchronization to the transmission grid occurred on Oct. 1, 2013 Solar Star Project Status 52

Solar Star Major Project Milestones 53 Completed Milestones • December 2012 MidAmerican Renewables acquired 100% of the project • January 2013 Construction began on-site • October 2013 Plant synchronized to the grid (on schedule) Projected Milestones • December 2013 19 MW in-service • Mid-January 2014 38 MW in-service (Original milestone December 2013) • April 2014 170 MW in-service • July 2014 243 MW in-service • December 2014 354 MW in-service • June 2015 505 MW in-service • October 2015 Final block placed in-service (579 MW)/guaranteed substantial completion date

Topaz Site Aerial View – September 2013 Substation & Switchyard Construction Office Area Carrisa Plains School Transmission Line 54 Legend Block Layout Mitigation & Project Land

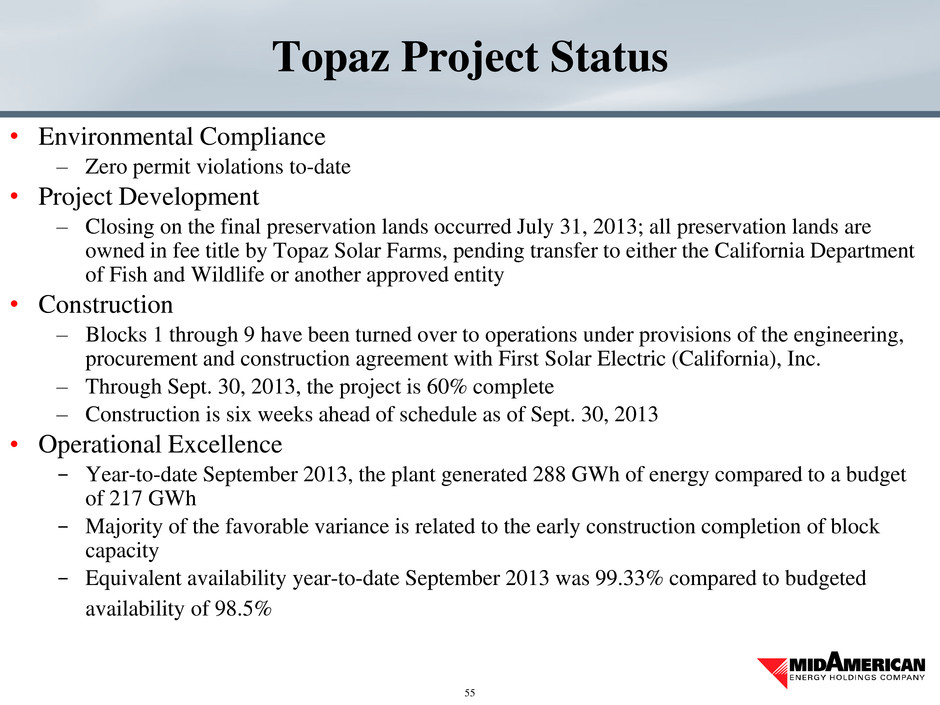

• Environmental Compliance – Zero permit violations to-date • Project Development – Closing on the final preservation lands occurred July 31, 2013; all preservation lands are owned in fee title by Topaz Solar Farms, pending transfer to either the California Department of Fish and Wildlife or another approved entity • Construction – Blocks 1 through 9 have been turned over to operations under provisions of the engineering, procurement and construction agreement with First Solar Electric (California), Inc. – Through Sept. 30, 2013, the project is 60% complete – Construction is six weeks ahead of schedule as of Sept. 30, 2013 • Operational Excellence - Year-to-date September 2013, the plant generated 288 GWh of energy compared to a budget of 217 GWh - Majority of the favorable variance is related to the early construction completion of block capacity - Equivalent availability year-to-date September 2013 was 99.33% compared to budgeted availability of 98.5% Topaz Project Status 55

Topaz Major Project Milestones 56 Completed Milestones • December 2011 Construction began on-site • January 2012 MidAmerican Renewables purchased 100% of the project • February 2013 Plant synchronized to the grid (two months behind schedule) • June 2013 200 MW in-service (two months ahead of schedule) • July 2013 241 MW in-service (three months ahead of schedule) • September 2013 Blocks 1 through 9 granted commercial operation status Projected Milestones • December 2013 281 MW in-service (on schedule) • December 2014 533 MW in-service (on schedule) • February 2015 Final block placed in-service (on schedule) • May 2015 Guaranteed substantial completion date

Agua Caliente Site Aerial View – September 2013 57 Switchyard 500 kV Transmission Line Block 12

• Construction and Commissioning Status − In July 2013 MidAmerican Solar was successful in working with NRG Energy, First Solar, and the U.S. Department of Energy to formally accelerate completion of the plant; a change order to the engineering, procurement and construction contract was executed − Blocks 1 through 11, totaling 304 MWAC of peak generating capacity, have been formally turned over and placed into commercial service − The final Block 12 (11 MW), will be placed in-service in late December 2013 • This is ahead of the guaranteed substantial completion date of March 31, 2014 • Operational Excellence - Year-to-date September 2013, the plant generated 524 GWh of energy compared to a budget of 475 GWh - The majority of the favorable variance is related to early construction completion and commissioning of block capacity - Equivalent availability year-to-date September 2013 was 99.37% compared to a benchmark of 99% Agua Caliente Project Status 58

Financial Information ($ millions) 59 LTM Operating Revenue 9/30/2013 12/31/2012 12/31/2011 PacifiCorp 5,056$ 4,882$ 4,586$ MidAmerican Funding 3,344 3,247 3,503 MidAmerican Energy Pipeline Group 955 968 977 Northern Powergrid Holdings 1,084 1,035 1,014 MidAmerican Renewables 300 166 161 HomeServices 1,682 1,312 992 Corporate/other (48) (62) (60) Total operating revenue 12,373$ 11,548$ 11,173$ Years Ended

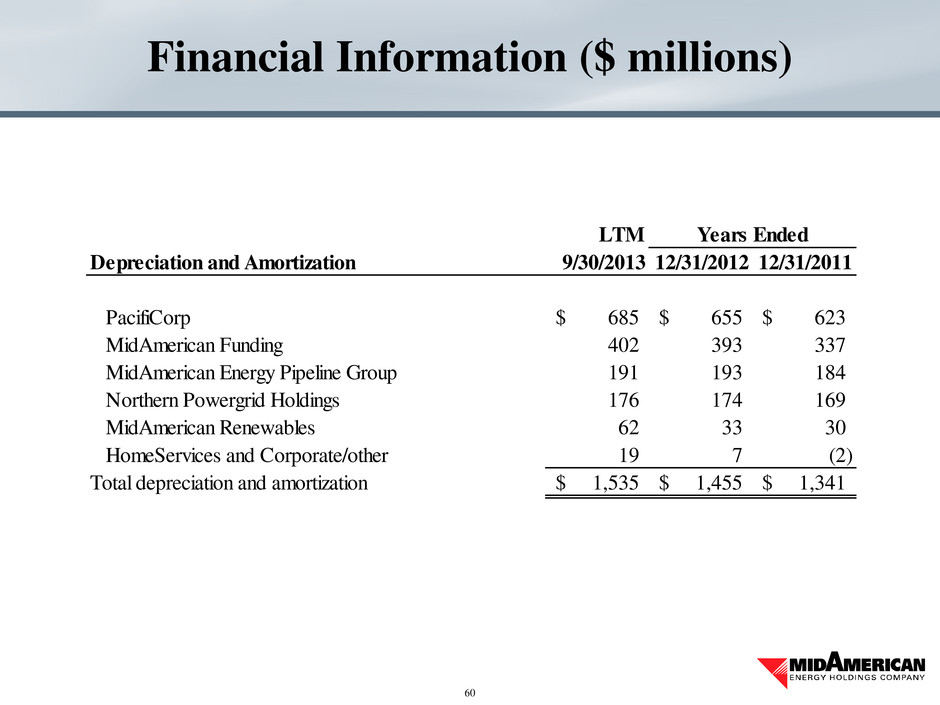

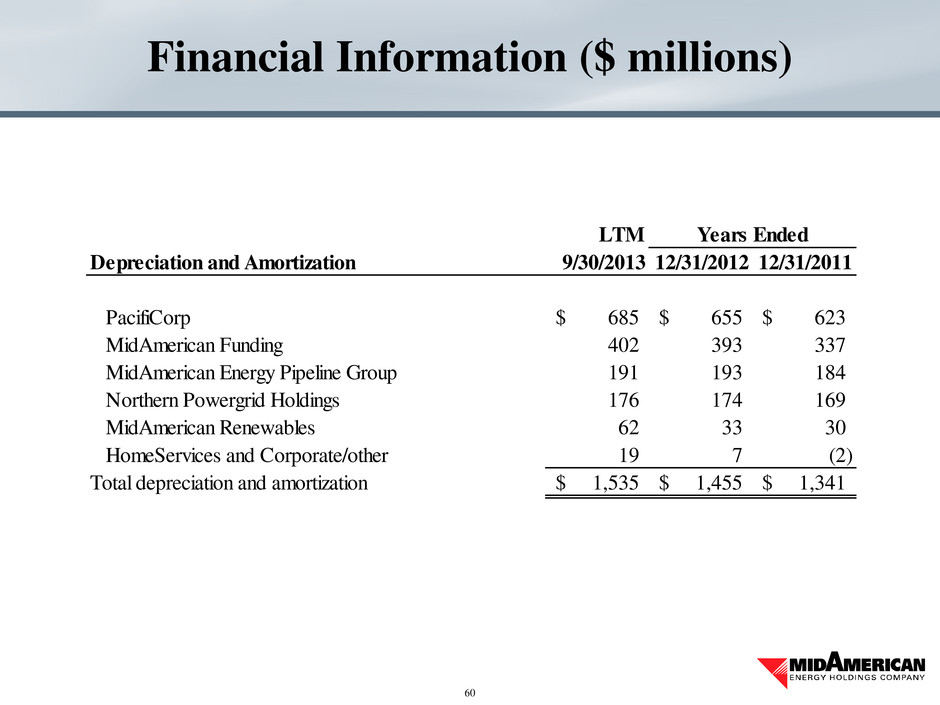

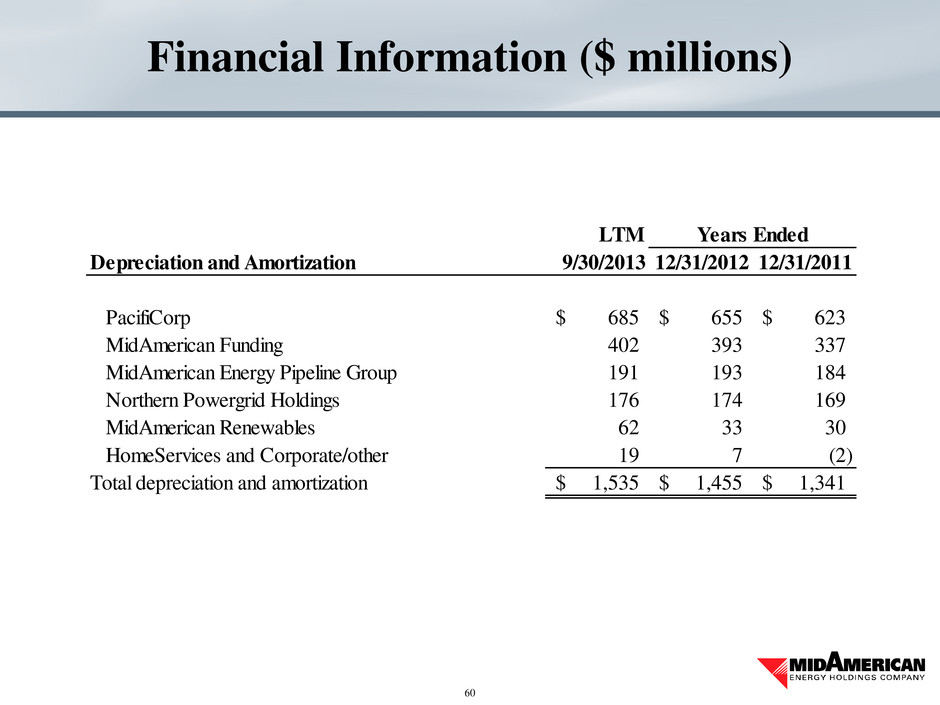

Financial Information ($ millions) 60 LTM Depreciation and Amortization 9/30/2013 12/31/2012 12/31/2011 PacifiCorp 685$ 655$ 623$ MidAmerican Funding 402 393 337 MidAmerican Energy Pipeline Group 191 193 184 Northern Powergrid Holdings 176 174 169 MidAmerican Renewables 62 33 30 HomeServices and Corporate/other 19 7 (2) Total depreciation and amortization 1,535$ 1,455$ 1,341$ Years Ended

Financial Information ($ millions) 61 LTM Interest Expense 9/30/2013 12/31/2012 12/31/2011 PacifiCorp 392$ 393$ 406$ MidAmerican Funding 165 167 183 MidAmerican Energy Pipeline Group 82 92 101 Northern Powergrid Holdings 141 139 151 MidAmerican Renewables 116 70 18 Other reportable segments and corporate/other 289 315 337 Total interest expense 1,185$ 1,176$ 1,196$ Years Ended

(1) Excludes amounts for non-cash equity allowances for funds used during construction and other non-cash items (2)Excludes costs for which payment is not contractually due until a future period of $100 million for the twelve months ended Sept. 30, 2013, $406 million for the year ended Dec. 31, 2012, and $647 million for the year ended Dec. 31, 2011 Financial Information ($ millions) 62 LTM Capital Expenditures (1) 9/30/2013 12/31/2012 12/31/2011 PacifiCorp 1,061$ 1,346$ 1,506$ MidAmerican Funding (2) 799 645 566 MidAmerican Energy Pipeline Group 139 152 289 Northern Powergrid Holdings 631 454 309 MidAmerican Renewables 1,257 770 4 Other reportable segments and corporate/other 29 13 10 Total capital expenditures 3,916$ 3,380$ 2,684$ Years Ended

Financial Information ($ millions) 63 Total Assets 9/30/2013 12/31/2012 12/31/2011 PacifiCorp 23,164$ 22,973$ 22,364$ MidAmerican Funding 14,445 13,355 12,430 MidAmerican Energy Pipeline Group 4,819 4,865 4,854 Northern Powergrid Holdings 6,610 6,418 5,690 MidAmerican Renewables 3,984 3,342 890 HomeServices 1,358 899 649 Corporate/other 1,780 615 841 Total assets 56,160$ 52,467$ 47,718$

• As of Sept. 30, 2013, approximately 96% of total debt was fixed-rate debt • As of Sept. 30, 2013, long-term debt had a weighted average life of approximately 14 years and a weighted average interest rate of approximately 5.3% Capitalization ($ millions) 64 Capitalization 9/30/2013 12/31/2012 Short-term debt 158$ 887$ Current portion of long-term debt 1,280 1,137 MidAmerican senior debt 4,371 4,621 Subsidiary debt 17,141 14,977 Total debt 22,950 21,622 Noncontrolling interests 140 168 MidAmerican shareholders᾽ equity 17,223 15,742 Total capitalization 40,313$ 37,532$ Adjusted debt/capitalization 56.9% 57.6%

Non-GAAP Financial Measures MidAmerican (Consolidated) 65 (1) As a result of changes in accounting guidance, certain amounts have been reclassified to conform to the other periods presented (2) FFO Interest Coverage equals the sum of FFO and Adjusted Interest divided by Adjusted Interest (3) Debt includes short-term debt, MidAmerican senior debt, MidAmerican subordinated debt and subsidiary debt (including current maturities) (4) FFO to Adjusted Debt equals FFO divided by Adjusted Debt (5) Adjusted Debt to Total Capitalization equals Adjusted Debt divided by Capitalization LTM FFO 9/30/2013 2012 2011 2001 (1) Net cash flows from operating activities 4,328$ 4,327$ 3,220$ 847$ +/- Changes in other operating assets and liabilities, net of effects from acquisitions 176 (40) 382 (196) FFO 4,504$ 4,287$ 3,602$ 651$ Adjusted Interest Interest expense 1,185$ 1,176$ 1,196$ 587$ Interest expense on subordinated debt - - (26) (88) Adjusted Interest 1,185$ 1,176$ 1,170$ 499$ FFO Interest Coverage (2) 4.8x 4.6x 4.1x 2.3x Adjusted Debt Debt(3) 22,950$ 21,622$ 19,937$ 8,050$ Subordinated debt - - (22) (888) Adjusted Debt 22,950$ 21,622$ 19,915$ 7,162$ FFO to Adjusted Debt (4) 19.6% 19.8% 18.1% 9.1% Capitalization Total MidAmerican shareholders’ equity 17,223$ 15,742$ 14,092$ 1,708$ Adjusted debt 22,950 21,622 19,915 7,162 Subordinated debt - - 22 888 Noncontrolling interests 140 168 173 165 Capitalization 40,313$ 37,532$ 34,202$ 9,923$ Adjusted Debt to Total Capitalization (5) 56.9% 57.6% 58.2% 72.2% EBITDA Net income 1,636$ Interest expense 1,185 Capitalized interest (75) Income tax expense 232 Depreciation and amortization 1,535 EBITDA 4,513$

Non-GAAP Financial Measures PacifiCorp 66 (1) FFO Interest Coverage equals the sum of FFO and Interest divided by Interest (2) Debt includes short-term debt and current maturities (3) FFO to Debt equals FFO divided by Debt (4) Debt to Total Capitalization equals Debt divided by Capitalization LTM FFO 9/30/2013 2012 2011 Net cash flows from operating activities 1,569$ 1,627$ 1,636$ +/- Changes in other operating assets and liabilities, net of effects from acquisitions (169) (169) (144) FFO 1,400$ 1,458$ 1,492$ Interest expense 382$ 380$ 392$ FFO Interest Coverage (1) 4.7x 4.8x 4.8x Debt (2) 6,888$ 6,861$ 6,901$ FFO to Debt (3) 20.3% 21.3% 21.6% Capitalization PacifiCorp shareholders’ equity 7,680$ 7,644$ 7,312$ Debt 6,888 6,861 6,901 Capitalization 14,568$ 14,505$ 14,213$ Debt to Total Capitalization (4) 47.3% 47.3% 48.6%

Non-GAAP Financial Measures MidAmerican Energy 67 (1) FFO Interest Coverage equals the sum of FFO and Interest divided by Interest (2) Debt includes short-term debt and current maturities (3) FFO to Debt equals FFO divided by Debt (4) Debt to Total Capitalization equals Debt divided by Capitalization LTM FFO 9/30/2013 2012 2011 Net cash flows from operating activities 761$ 1,276$ 770$ +/- Changes in other operating assets and liabilities, net of effects from acquisitions 143 (323) 354 FFO 904$ 953$ 1,124$ Interest expense 142$ 143$ 158$ FFO Interest Coverage (1) 7.4x 7.7x 8.1x Debt (2) 4,218$ 3,259$ 3,115$ FFO to Debt (3) 21.4% 29.2% 36.1% Capitalization MidAmerican Energy shareholders’ equity 3,758$ 3,635$ 3,271$ Debt 4,218 3,259 3,115 Noncontrolling interests - - 1 Capitalization 7,976$ 6,894$ 6,387$ Debt to Total Capitalization (4) 52.9% 47.3% 48.8%

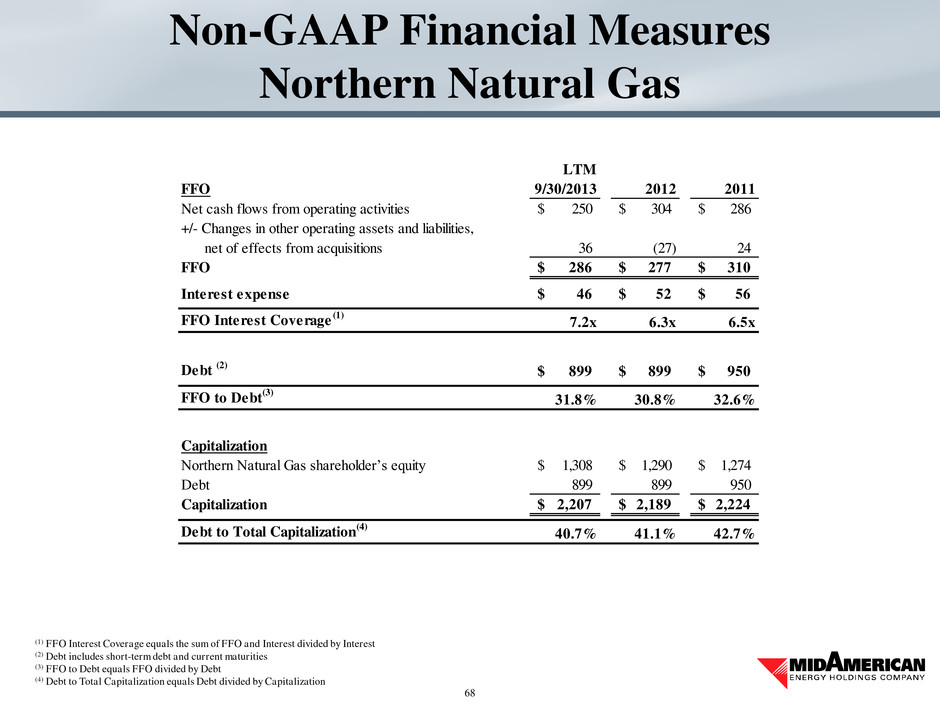

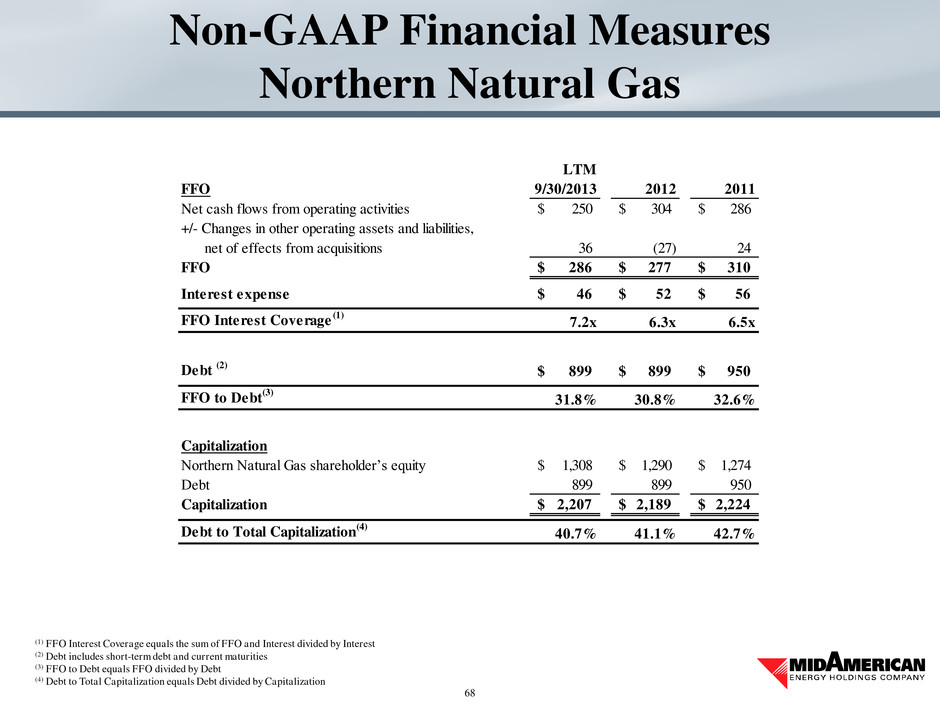

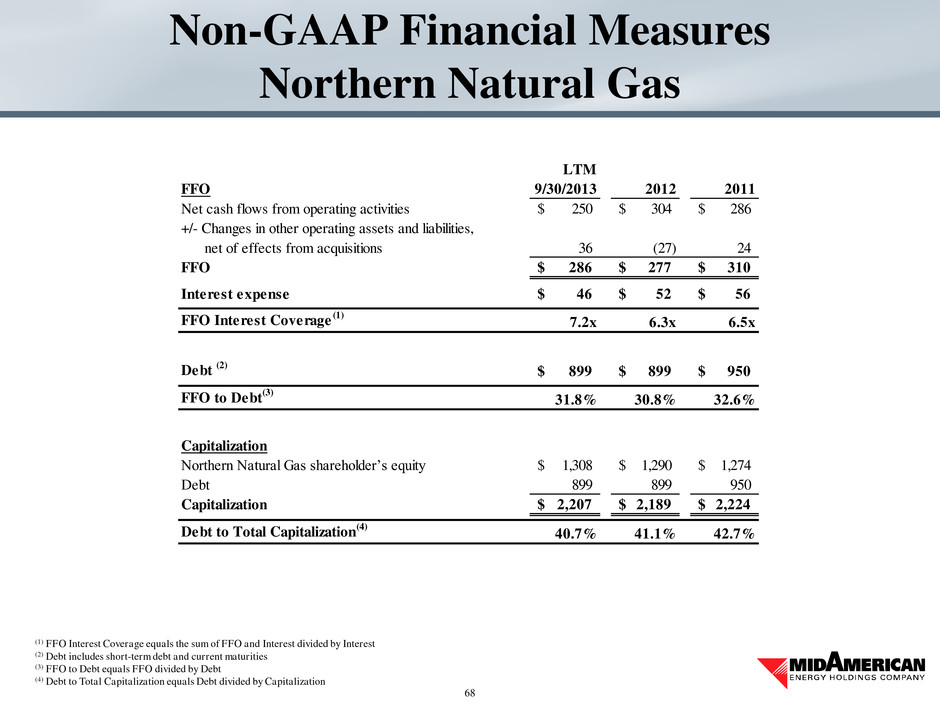

Non-GAAP Financial Measures Northern Natural Gas 68 (1) FFO Interest Coverage equals the sum of FFO and Interest divided by Interest (2) Debt includes short-term debt and current maturities (3) FFO to Debt equals FFO divided by Debt (4) Debt to Total Capitalization equals Debt divided by Capitalization LTM FFO 9/30/2013 2012 2011 Net cash flows from operating activities 250$ 304$ 286$ +/- Changes in other operating assets and liabilities, net of effects from acquisitions 36 (27) 24 FFO 286$ 277$ 310$ Interest expense 46$ 52$ 56$ FFO Interest Coverage (1) 7.2x 6.3x 6.5x Debt (2) 899$ 899$ 950$ FFO to Debt (3) 31.8% 30.8% 32.6% Capitalization Northern Natural Gas shareholder’s equity 1,308$ 1,290$ 1,274$ Debt 899 899 950 Capitalization 2,207$ 2,189$ 2,224$ Debt to Total Capitalization (4) 40.7% 41.1% 42.7%

Non-GAAP Financial Measures Kern River 69 (1) FFO Interest Coverage equals the sum of FFO and Interest divided by Interest (2) Debt includes short-term debt and current maturities (3) FFO to Debt equals FFO divided by Debt (4) Debt to Total Capitalization equals Debt divided by Capitalization LTM FFO 9/30/2013 2012 2011 Net cash flows from operating activities 240$ 249$ 227$ +/- Changes in other operating assets and liabilities, net of effects from acquisitions 4 (1) - FFO 244$ 248$ 227$ Interest expense 35$ 38$ 43$ FFO Interest Coverage (1) 8.0x 7.5x 6.3x Debt (2) 568$ 628$ 716$ FFO to Debt (3) 43.0% 39.5% 31.7% Capitalization Partners’ capital 817$ 880$ 868$ Debt 568 628 716 Capitalization 1,385$ 1,508$ 1,584$ Debt to Total Capitalization (4) 41.0% 41.6% 45.2%

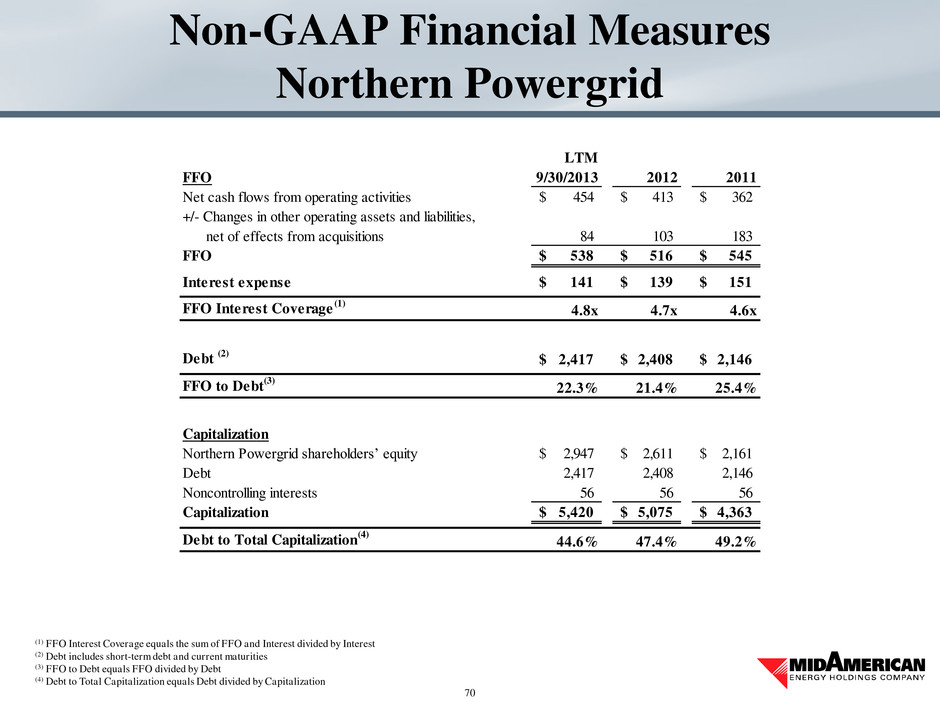

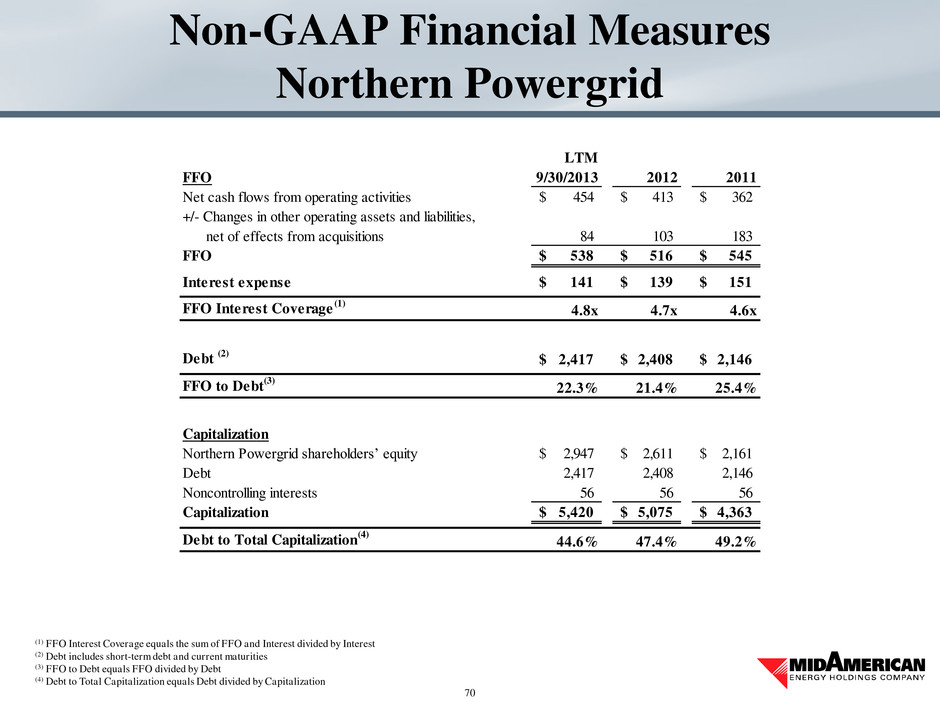

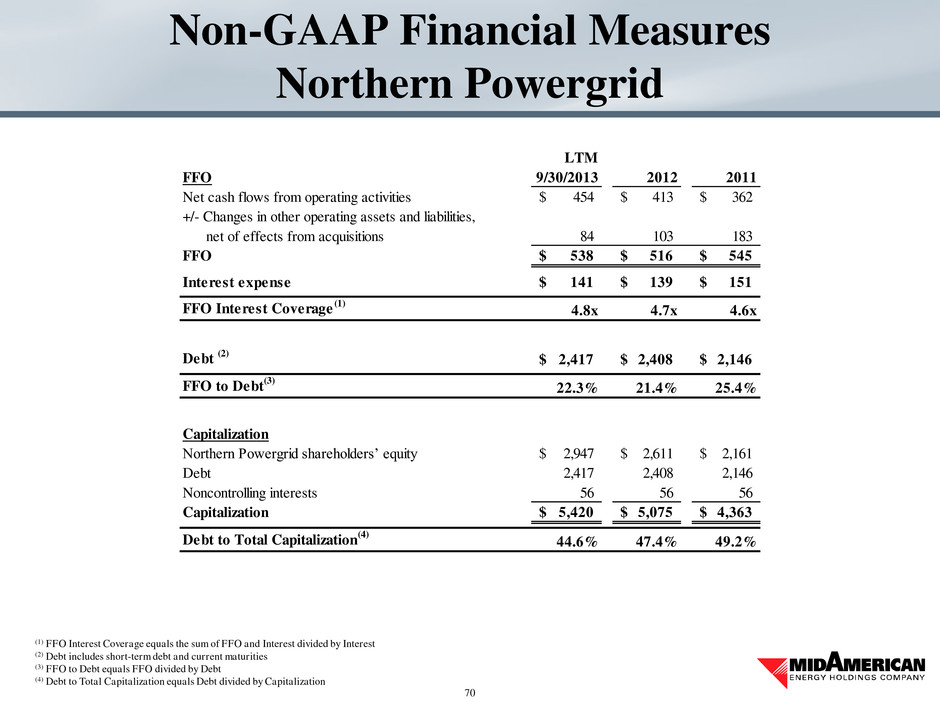

Non-GAAP Financial Measures Northern Powergrid 70 (1) FFO Interest Coverage equals the sum of FFO and Interest divided by Interest (2) Debt includes short-term debt and current maturities (3) FFO to Debt equals FFO divided by Debt (4) Debt to Total Capitalization equals Debt divided by Capitalization LTM FFO 9/30/2013 2012 2011 Net cash flows from operating activities 454$ 413$ 362$ +/- Changes in other operating assets and liabilities, net of effects from acquisitions 84 103 183 FFO 538$ 516$ 545$ Interest expense 141$ 139$ 151$ FFO Interest Coverage (1) 4.8x 4.7x 4.6x Debt (2) 2,417$ 2,408$ 2,146$ FFO to Debt (3) 22.3% 21.4% 25.4% Capitalization Northern Powergrid shareholders’ equity 2,947$ 2,611$ 2,161$ Debt 2,417 2,408 2,146 Noncontrolling interests 56 56 56 Capitalization 5,420$ 5,075$ 4,363$ Debt to Total Capitalization (4) 44.6% 47.4% 49.2%

Non-GAAP Financial Measures NV Energy 71 LTM EBITDA 9/30/2013 Net income 289$ Interest expense 302 Capitalized interest (8) Income tax expense 150 Depreciation and amortization 388 EBITDA 1,121$