January 2018 Non-Confidential J.P. Morgan Healthcare Conference Exhibit 99.1

Forward-Looking Statements This presentation includes forward-looking statements that involve a number of risks and uncertainties, including statements about our investigative stage drug candidates, including with respect to their potential (including to become first or best-in-class), safety, efficacy, indications, significance of data, development plans, differentiation, the market and unmet needs and commercialization, expected data readouts and initiation of new clinical trials; our focus, goals, strategy, plans, timelines and guidance; our partnered programs; financial and other guidance; and other statements that are not historical facts, including statements that may include words such as “may,” “will,” “intend,” “plan,” “expect,” “potential” or other similar words. For such statements, we claim the protection of the Private Securities Litigation Reform Act of 1995. Actual events or results may differ materially from expectations, and you are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the time they were made. Factors that could cause actual results to differ materially from such statements include, without limitation: the timing and outcome of research, development and regulatory review is uncertain; results of clinical trials and other studies are subject to different interpretations and may not be predictive of future results; clinical and nonclinical data is voluminous and detailed, and regulatory agencies may interpret or weigh the importance of data differently and reach different conclusions than Arena or others, request additional information, have additional recommendations or change their guidance or requirements; unexpected or unfavorable new data; our drug candidates may not advance in development or be approved for marketing; clinical trials and other studies may not proceed at the time or in the manner expected or at all; data and information related to our programs may not meet regulatory requirements or otherwise be sufficient for further development, regulatory review, partnering or approval; top-line data may not accurately reflect the complete results of a particular study or trial; other risks related to developing, seeking regulatory approval of and commercializing drugs, including regulatory, manufacturing, supply and marketing issues and drug availability; we expect to need additional funds to advance all of our programs, and you and others may not agree with the manner in which we allocate our resources; Arena's and third parties' intellectual property rights; competition; reimbursement and pricing decisions; risks related to relying on partners and other third parties; and satisfactory resolution of litigation or other disagreements. Additional factors that could cause actual results to differ materially from those stated or implied by our forward-looking statements are disclosed in our SEC filings, including under the heading “Risk Factors” in our Quarterly Report on Form 10-Q for the quarter ended September 30, 2017. We disclaim any intent or obligation to update these forward-looking statements, other than as may be required under applicable law.

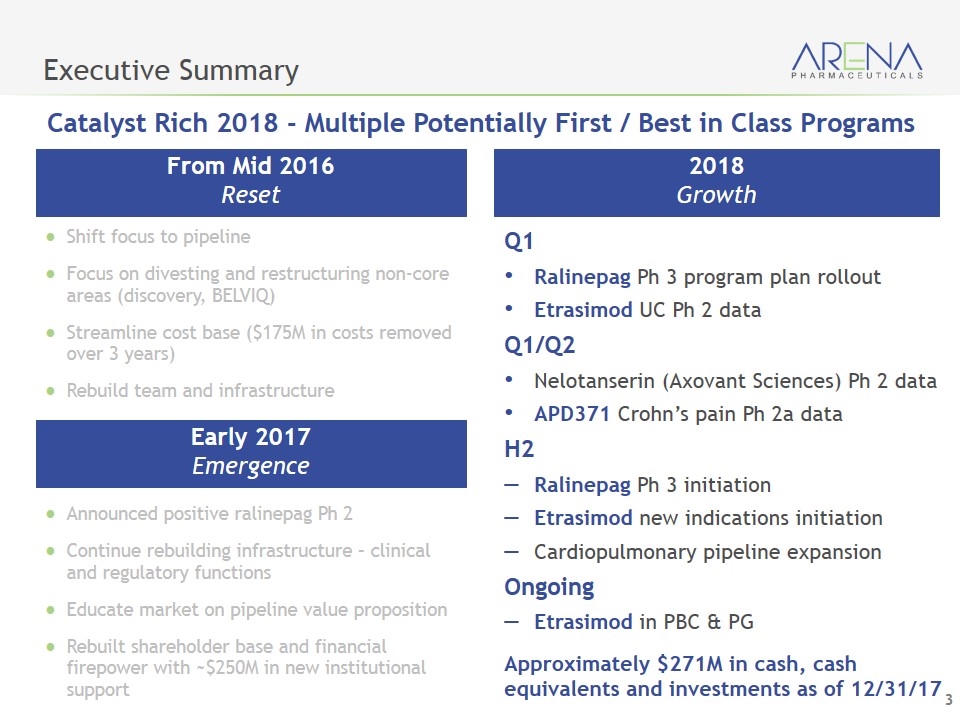

Executive Summary Shift focus to pipeline Focus on divesting and restructuring non-core areas (discovery, BELVIQ) Streamline cost base ($175M in costs removed over 3 years) Rebuild team and infrastructure From Mid 2016 Reset Q1 Ralinepag Ph 3 program plan rollout Etrasimod UC Ph 2 data Q1/Q2 Nelotanserin (Axovant Sciences) Ph 2 data APD371 Crohn’s pain Ph 2a data H2 Ralinepag Ph 3 initiation Etrasimod new indications initiation Cardiopulmonary pipeline expansion Ongoing Etrasimod in PBC & PG Approximately $271M in cash, cash equivalents and investments as of 12/31/17 2018 Growth Announced positive ralinepag Ph 2 Continue rebuilding infrastructure – clinical and regulatory functions Educate market on pipeline value proposition Rebuilt shareholder base and financial firepower with ~$250M in new institutional support Early 2017 Emergence Catalyst Rich 2018 - Multiple Potentially First / Best in Class Programs

Program Therapeutic Area/Indication PC P1 P2a P2b P3 Timing Ralinepag Potent IP Receptor Agonist Pulmonary Arterial Hypertension (PAH) Ph 3 Preparations Etrasimod Optimized Activity S1P Receptor Modulator Ulcerative Colitis (UC) Ph 2 Data Q1 2018 Pyoderma Gangrenosum (PG) Initiated Ph 2 Primary Biliary Cholangitis (PBC) Initiated Ph 2 APD371 Highly Selective Full Agonist to CB2 Pain Associated with Crohn’s Disease Ph 2 Data Q1/2 2018 Focus on Pipeline Differentiated Assets with High-Value Potential

A Next-Generation, Oral, Selective Prostacyclin Receptor (IP) Agonist for the Treatment of Pulmonary Arterial Hypertension Ralinepag

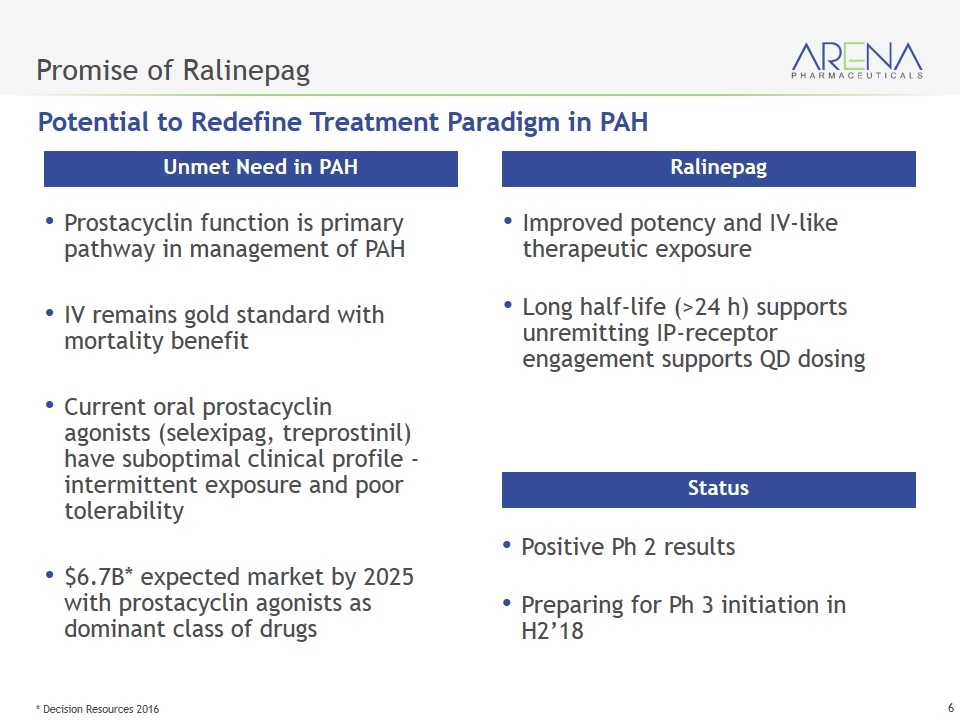

Promise of Ralinepag Prostacyclin function is primary pathway in management of PAH IV remains gold standard with mortality benefit Current oral prostacyclin agonists (selexipag, treprostinil) have suboptimal clinical profile - intermittent exposure and poor tolerability $6.7B* expected market by 2025 with prostacyclin agonists as dominant class of drugs Unmet Need in PAH Improved potency and IV-like therapeutic exposure Long half-life (>24 h) supports unremitting IP-receptor engagement supports QD dosing Ralinepag Positive Ph 2 results Preparing for Ph 3 initiation in H2’18 Status Potential to Redefine Treatment Paradigm in PAH * Decision Resources 2016

IP Receptor Binding cAMP Activation 6.5x vs. MRE-269* Ralinepag’s More Potent IP Agonism Translates to Improved Tissue Responses vs. Selexipag* in Vitro More potent vasodilation, inhibition of vascular remodeling and platelet aggregation suggests that ralinepag may improve on selexipag in the clinical management of PAH *MRE-269 is the active metabolite of selexipag cAMP, cyclic adenosine monophosphate; PAH, pulmonary arterial hypertension; SMC, smooth muscle cell 1Shen et al ERS 2017 (submitted); 2Shen et al AHA 2016 3Tran et al J Med Chem 2016 Vasodilation1 (Human PAH Tissue) Inhibition of SMC Proliferation2 (Human PAH Tissue) Ralinepag potency: 7.5x vs. selexipag 0 20 40 60 80 100 -10 Log [Agonist] M % Response -9 -8 -7 -6 -5 MRE-269 Ralinepag -9 -8 -7 -6 -5 -4 -20 0 20 40 60 80 100 MRE-269 (n=2, N=1) Ralinepag (n=10, N=3) Vasoconstriction % (100 nM U46619) Log [Drug] M Vasorelaxation Inhibition of SMC Proliferation Inhibition of Platelet Aggregation MRE-269* Ralinepag Ralinepag potency: 10x vs. selexipag Log [Drug] M % Cell proliferation (wrt 9% serum) 100 60 80 -12 -11 -10 -9 -8 -7 -6 -5 P<0.001 Platelet Inhibition3 (Normal Human Cells)

Achieving Continuous Therapeutic Range Exposure, Mimicking IV Infusion, Should Enhance Oral Efficacy Ralinepag Has a Prolonged Half-Life Ralinepag’s unique PK profile is expected to provide a low peak-to-trough ratio, approximating continuous IV infusion Conc, concentration; Cmax/min, maximal/minimum concentration; IV, intravenous; PK, pharmacokinetic; T½, half-life 1Tapson VF, et al. Am J Respir Crit Care Med. 2009;179:A1040; 2Skoro-Sajer N, et al. Expert Opin Pharmacother. 2014;15(3):429–436; 3Arena Pharmaceuticals data on file Compound t½ (Hr) Ralinepag ~20–26 hrs3 Selexipag 8 hrs2 Treprostinil 4.5 hrs1 Potential to Maintain Consistent Exposure and Minimize Cmax and Cmin Related Issues Long T½ low peak to trough Short T½ high peak to trough Long T½ modified release 1 10 0 24 36 48 60 72 12 Time (h) Plasma Conc. (ng/mL Adverse Events Therapeutic Range Oral IP agonists with interrupted therapeutic coverage (e.g., beraprost, treprostinil) have shown disappointing efficacy Low peak-to-trough ratio is key to minimizing Cmax related tolerability issues and limiting Cmin related efficacy issues of oral agents Limited Efficacy

Ralinepag Significantly Improved Pulmonary Vascular Resistance (PVR); ITT Population Primary Endpoint: Change in PVR Geometric Mean Ratio (GMR) [Expressed as Percent Change] Treatment Effect Comparison -25.8% over placebo (p=0.02) Mean absolute change from baseline: placebo 25.5, ralinepag -175.7 dyn.s.cm-5 Secondary Endpoint Unprecedented P2 Efficacy in Contemporary Patient Population

The overall safety and tolerability profile consistent with the known profile of the prostacyclin therapy class Adverse events that occurred most frequently on ralinepag were similar to the on-target effects expected for prostacylin therapies: Headache, nausea, diarrhea, jaw pain, flushing Events were more frequent during dose titration; consistent reduction in adverse event frequency during maintenance period During 25 week safety assessment period 12.5% of patients discontinued ralinepag and 10.0% patients discontinued placebo due to adverse events Serious adverse events occurred in 4 (10%) patients taking ralinepag and 6 (28.6%) patients taking placebo 2 deaths occurred among placebo patients; 0 deaths on ralinepag Safety and Tolerability

Ralinepag Phase 3 Clinical Program Additional Details on Planned Path Forward Ph 3 Program Priorities Exercise Capacity Clinical Worsening Comparator / Head to Head Example Endpoints CPET 6MWD Treadmill Time to Events - Confidential - Time to Market Label Physician Experience Comparative Data 1 2 3 4

Oral, Next Generation, S1P Receptor Modulator Optimized Activity Being Evaluated for Multiple Autoimmune Diseases Etrasimod

Promise of Etrasimod Unmet need for safe and effective oral agents addressing a broad range of autoimmune indications S1P modulation offers the promise of effective treatment in 80+ conditions First-generation pan-S1P modulators (fingolimod - Gilenya) risk-benefit profile limits utility Second-generation S1P modulator, ozanimod, has inherent negative pharmacologic and pharmacokinetic properties Unmet Need in Autoimmune Disease Optimized pharmacology to avoid off-target activity and ensure broad safety margin Pharmacokinetics may provide improved risk-benefit Potentially supports multiple target patient populations across a broader range of conditions Etrasimod Ph 2 trial in UC, data Q1’18 Ph 2 in PG and PBC initiated and ongoing Status Potential Best-in-Class Oral Agent with Broad Clinical Utility

Associated with Cardiac, Pulmonary & Possible Tumor-related Risks Decreased Inflammation & Improvement in Autoimmune Disorders Positive Outcome Negative Outcome Dendritic Cells Reduces Immune Cell Migration, Differentiation & Proliferation Increased Vasoconstriction, Fibrosis & Proliferation T-Lymphocytes Oligodendrocytes S1PR2 S1PR3 Etrasimod’s Highly Selective S1P Modulation May Avoid Off-Target Activity No Activity Receptor Binding S1PR1 S1PR4 S1PR5 Etrasimod S1P = sphingosine-1-phosphate; UC = ulcerative colitis. *Data generated at Arena or under sponsored research by Arena.

In Contrast with Other S1P Modulators, Etrasimod Does Not Induce S1PR2 Internalization (In Vitro Studies) S1P Agonists Induce S1PR1 Internalization (S1PR1 Internalization Assay) Etrasimod Does Not Induce S1PR2 Internalization (S1PR2 Internalization Assay) -12 -11 -10 -9 -8 -7 -6 -5 log [Agonist] (M) Mean Fluorescence Intensity (% DMSO treated control) 60 80 90 100 110 70 Etrasimod Fingolimod Ozanimod Amiselimod -12 -11 -10 -9 -8 -7 -6 -5 -4 log [Agonist] (M) Mean Fluorescence Intensity (% DMSO treated control) 40 80 90 100 110 50 60 70 Etrasimod Fingolimod Ozanimod Amiselimod Arena Data on File; DMSO = dimethylsulfoxide; S1P = sphingosine-1-phosphate

Optimal Selectivity Opportunity to be best-in-class therapy More Selective S1P2 internalization Ozanimod2 (Celgene) Nonselective Promiscuous binding can lead to off-target effects4 & more AEs5 a Elevated LFTs ≥ 3 × upper limit of normal. *Note – Data Collected from Separate Studies – Cannot be Directly Compared MAD, multiple ascending dose; LFT, liver function test; PFTs, pulmonary function tests. 1. Gilenya® Prescribing Information. Novartis Pharmaceuticals, East Hanover, NJ; 2016. 2. Sandborn WJ, et al. N Engl J Med. 2016;374:1754-1762. 3. Data on File, Arena Pharmaceuticals. 4. Blaho VA, et al. J Lipid Res. 2014;55:1596–1608. 5. Olivera P, et al. Gut. 2017;66(25):199-209. 6.Kappos L, et al. N Engl J Med 2010;362:387-401. Newer S1P Receptor Modulators Promise Improved Efficacy and Safety Etrasimod3 (Arena) Fingolimod1 (Novartis) First-Generation S1P Receptor Modulator Second-Generation S1P Receptor Modulator Rapid lymphocyte lowering & recovery (2 mg/day) Phase 1: ~69% Phase 2: TBD Lymphocyte lowering (Up to 2 mg/day) Phase 1: ~65% Phase 2: ~49% Lymphocyte lowering (0.5 mg/day) Phase 1: ~70%1 Phase 2 & 3: ~73%6 Safety No LFT elevationsa No abnormal PFTs No titration No clinically significant first dose bradycardia Safety Elevated LFTsa Abnormal PFTs Titration required to blunt bradycardia Safety Elevated LFTsa Abnormal PFTs Bradycardia, AV Block Macular Edema Carcinoma Potential Best-in-Class S1P Receptor Modulator

Etrasimod Has a Quick Onset of Action – Phase 1 Data *After dose escalation of ozanimod (0.3 mg/d on days 1–3; 0.6 mg/d on days 4 and 5; 1 mg/d on days 6 and 7; and 3 mg/d on days 8–10. Data truncated at day 11 (ozanimod) and 15 (etrasimod) to show on-treatment onset effects Sources: 1-Tran JQ et al, J Clin Pharmacol. 2017;57:988-996. 2- ADP334 P1 Data on File Note – Data Collected from Separate Studies – Cannot be Directly Compared Ozanimod1 Etrasimod2 Ozanimod, 2 mg (Dose Escalation*) Placebo Mean % Change from Baseline 30 20 10 0 –10 –20 –30 –40 –50 –60 –70 –80 –1 0 1 2 3 4 5 6 7 8 9 10 11 Study Day Study Day 30 20 10 0 –10 –20 –30 –40 –50 –60 –70 –80 –1 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 Mean % Change from Baseline Etrasimod, 2 mg (Fixed Dose) Placebo At Day 3, etrasimod showed ~53% lymphocyte reduction At Day 3, ozanimod showed ~15% lymphocyte reduction

Etrasimod Has a Quick Offset of Action – Phase 1 Data Sources: 1-Tran JQ et al, J Clin Pharmacol. 2017;57:988-996. 2- ADP334 P1 Data on File; Ozanimod1 Etrasimod2 Ozanimod, 1 mg (Fixed dose) Placebo Etrasimod, 2 mg (Fixed Dose) Placebo Treatment days Within 1 week after last dose of etrasimod, lymphocytes returned to within 5% of baseline At 2 weeks after last dose of ozanimod, lymphocyte levels still ~40% below baseline Study Day 30 Mean % Change in Lymphocyte Count 20 10 0 –10 –20 –30 –40 –50 –60 –70 –80 1 8 15 22 29 36 43 Study Day 30 Mean % Change in Lymphocyte Count 20 10 0 –10 –20 –30 –40 –50 –60 –70 –80 1 5 7 9 15 21 23 28 Note – Data Collected from Separate Studies – Cannot be Directly Compared

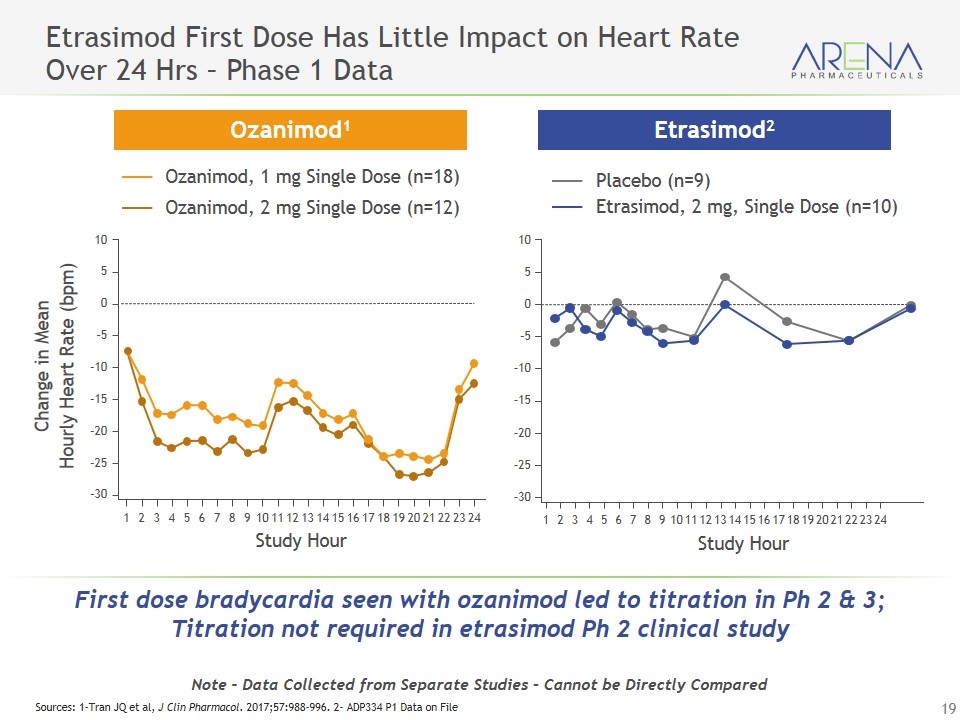

Etrasimod First Dose Has Little Impact on Heart Rate Over 24 Hrs – Phase 1 Data Ozanimod, 1 mg Single Dose (n=18) Ozanimod, 2 mg Single Dose (n=12) Placebo (n=9) Etrasimod, 2 mg, Single Dose (n=10) Ozanimod1 Etrasimod2 Note – Data Collected from Separate Studies – Cannot be Directly Compared Sources: 1-Tran JQ et al, J Clin Pharmacol. 2017;57:988-996. 2- ADP334 P1 Data on File 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 10 0 –10 –20 –30 5 –5 –15 –25 Study Hour Change in Mean Hourly Heart Rate (bpm) 10 0 –10 –20 –30 5 –5 –15 –25 Study Hour 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 First dose bradycardia seen with ozanimod led to titration in Ph 2 & 3; Titration not required in etrasimod Ph 2 clinical study

Enrolled patients with moderate to severe UC (3-component Mayo score of 4-9 that includes endoscopic sub score >2, rectal bleeding score >1) Efficacy endpoints include improvement in Mayo Clinical Score (3-component, total), response, remission, mucosal healing versus placebo and dose response Safety and tolerability 12-week study followed by an open-label extension Etrasimod Phase 2 Trial in UC Endpoints Include Mayo Score (3-component, total) Week 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 Randomized, double-blind, placebo-controlled, parallel-group, dose-ranging study 12-Week Induction Phase Exit/Transition to Extension Study 12-Week Treatment Period 1 mg q.d. APD334 2 mg q.d. APD334 Placebo Transition Directly into 36-Week Extension Study (APD334-005) 120 to 160 Patients Randomized 1:1:1 Week 14 Follow-up Safety Visit Exit/End of Study ~28-Day Screening Period Follow-up

Etrasimod Clinical Program Expanding Indications 1. Vavricka, SR et al. ”Extraintestinal Manifestations of Inflammatory Bowel Disease” Inflammatory Bowel Diseases August 2015 2. Taverela VF. ”Review article: skin complications associated with inflammatory bowel disease” Aliment Pharmacol Ther 2004 3. US Department of Health & Human Services National Institutes of Health (https://rarediseases.info.nih.gov/diseases/7510/pyoderma-gangrenosum) 4. Purohit T and Cappell MS. ”Primary biliary cirrhosis: Pathophysiology, clinical presentation and therapy” World J Hepatol May 2015 Indication Pyoderma Gangrenosum (PG) Primary Biliary Cholangitis (PBC) Background Rare/serious skin disease Painful nodules form enlarging ulcers Chronic liver disease T Lymphocytes accumulate in liver, resulting in destruction of bile ducts Market Size 1 in 100,000 people in US3 40 cases per 100,000 people in US4 Rationale Aberrant T lymphocyte response3 & benefit of immunosuppression4 support the proposed study lymphocyte reduction in PG Inhibition of dendritic cell migration via S1P4 modulation PBC is considered an immune-mediated disease as S1P1 sensitive T-cells are present in liver of PBC patients5 S1P1 mediated reduction of circulating & hepatic lymphocyte levels potential to improve PBC Status Ph2 Initiated Ph2 Initiated

APD371 Peripherally Restricted, Highly–Selective, Full Agonist to Cannabinoid 2 Receptor (CB2) Being Evaluated for Treatment of Pain Associated with Crohn’s Disease

Promise of APD371 Opioid epidemic is a public health emergency No drugs developed for the treatment of visceral pain including: Inflammatory bowel disease Interstitial cystitis Pancreatitis Endometriosis Chronic prostatitis 1/8 IBD patients on chronic opioids Unmet Need in Pain Designed to be peripherally restricted 1,000 fold more selective for CB2 vs. CB1 Avoids psychotropic activity Full agonism avoids tachyphylaxis APD371 Ph 2a ongoing for the treatment of pain associated with Crohn’s disease, data Q1/Q2’18 Status Unmet Need in Non-Opioid Pain Management

CB2 Receptors Are Expressed in the Enteric Nervous System and Immune Cells Within GI Tract CB2 receptors located in target tissue, neurons & local immune cells in GI tract CB2 receptor also expressed on visceral afferent nerves During inflammation, enhanced expression on epithelial cells at the ulcer margins (red) & infiltrating immune cells Supporting rationale for inflammatory & non-inflammatory pain signaling CB2 Receptor Expression in the GI Tract CB2 receptors represent a pathophysiological mechanism in GI tract to regulate abnormal motility, modulate intestinal inflammation & limit visceral sensitivity/pain The anti-hyperalgesic actions of the cannabinoid anandamide and the putative CB2 receptor agonist palmitoylethanolamide in visceral and somatic inflammatory pain Siaˆn I. Jaggar, Fauzia S. Hasnie, Senthy Sellaturay, Andrew S.C. Rice* ; Pain accepted 11 February 1998. Activation of the cannabinoid 2 (CB2) receptor inhibits murine mesenteric afferent nerve activity, Hillsely, Neurogastro Motil (2007) 19, 769–777. Pharmacological Evaluation of a Novel Cannabinoid 2 (CB2) Ligand, PF-03550096, In Vitro and In Vivo by Using a Rat Model of Visceral Hypersensitivity Akira Kikuchi, Pharmacol Sci 106, 219 – 224 (2008)2 Journal of Pharmacological Sciences ©2008 The Japanese Pharmacological Society

Executive Summary Shift focus to pipeline Focus on divesting and restructuring non-core areas (discovery, BELVIQ) Streamline cost base ($175M in costs removed over 3 years) Rebuild team and infrastructure From Mid 2016 Reset Q1 Ralinepag Ph 3 program plan rollout Etrasimod UC Ph 2 data Q1/Q2 Nelotanserin (Axovant Sciences) Ph 2 data APD371 Crohn’s pain Ph 2a data H2 Ralinepag Ph 3 initiation Etrasimod new indications initiation Cardiopulmonary pipeline expansion Ongoing Etrasimod in PBC & PG Approximately $271M in cash, cash equivalents and investments as of 12/31/17 2018 Growth Announced positive ralinepag Ph 2 Continue rebuilding infrastructure – clinical and regulatory functions Educate market on pipeline value proposition Rebuilt shareholder base and financial firepower with ~$250M in new institutional support Early 2017 Emergence Catalyst Rich 2018 - Multiple Potentially First / Best in Class Programs

NASDAQ: ARNA Thank you