UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

(Mark One) |

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the fiscal year ended |

|

|

|

or |

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

|

|

For the transition period from to |

|

Commission File No.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

Registrant’s telephone number, including area code: (

Title of Each Class |

|

Trading Symbol(s) |

|

Name of Each Exchange On Which Registered |

|

|

The |

SECURITIES REGISTERED PURSUANT TO SECTION 12(g) OF THE ACT: NONE

Indicate by check mark if the registrant is a well‑known seasoned issuer, as defined in Rule 405 of the Securities Act.

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether registrant is a large accelerated filer, an accelerated filer or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act (Check One):

|

|

|

|

Accelerated filer ☐ |

Non‑accelerated filer ☐ |

Smaller reporting company |

|

|

|

|

Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b‑2 of the Exchange Act). Yes

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant based upon the closing price of the registrant’s Common Stock on The Nasdaq Global Select Market on June 30, 2022 was $

On February 14, 2023, there were

DOCUMENTS INCORPORATED BY REFERENCE

Specified portions of the registrant’s definitive Proxy Statement to be issued in conjunction with the registrant’s 2023 Annual Meeting of Stockholders, which is expected to be filed not later than 120 days after the registrant’s fiscal year ended December 31, 2022, are incorporated by reference into Part III of this Annual Report. Except as expressly incorporated by reference, the registrant’s Proxy Statement shall not be deemed to be a part of this Annual Report on Form 10-K.

INNOVIVA, INC.

2022 Form 10‑K Annual Report

Table of Contents

|

|

Page |

|

PART I |

|

Item 1. |

4 |

|

Item 1A. |

33 |

|

Item 1B. |

69 |

|

Item 2. |

69 |

|

Item 3. |

69 |

|

Item 4. |

69 |

|

|

PART II |

|

Item 5. |

70 |

|

Item 6. |

71 |

|

Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

72 |

Item 7A. |

84 |

|

Item 8. |

85 |

|

Item 9. |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

134 |

Item 9A. |

134 |

|

Item 9B. |

137 |

|

Item 9C. |

Disclosure Regarding Foreign Jurisdictions that Prevent Inspections |

137 |

|

PART III |

|

Item 10. |

138 |

|

Item 11. |

138 |

|

Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

138 |

Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

138 |

Item 14. |

138 |

|

|

PART IV |

|

Item 15. |

139 |

|

Item 16. |

139 |

|

140 |

||

143 |

||

2

Special Note Regarding Forward‑Looking Statements

This Annual Report on Form 10‑K contains forward‑looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (the “Securities Act”). Such forward‑looking statements involve substantial risks, uncertainties and assumptions. All statements in this Annual Report on Form 10‑K, other than statements of historical fact, including, without limitation, statements regarding our strategy, future operations, future financial position, future revenue, projected costs, prospects, plans, intentions, expectations, goals and objectives may be forward‑looking statements. The words “anticipates,” “believes,” “could,” “designed,” “estimates,” “expects,” “goal,” “intends,” “may,” “objective,” “plans,” “projects,” “pursuing,” “will,” “would” and similar expressions (including the negatives thereof) are intended to identify forward‑looking statements, although not all forward‑looking statements contain these identifying words. We may not actually achieve the plans, intentions, expectations or objectives disclosed in our forward‑looking statements and the assumptions underlying our forward‑looking statements may prove incorrect. Therefore, you should not place undue reliance on our forward‑looking statements. Actual results or events could differ materially from the plans, intentions, expectations and objectives disclosed in the forward‑looking statements that we make. All written and verbal forward‑looking statements attributable to us or any person acting on our behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this section.

Important factors that we believe could cause actual results or events to differ materially from our forward‑looking statements include, but are not limited to, risks related to: lower than expected future royalty revenue from respiratory products partnered with GSK, the commercialization of RELVAR®/BREO® ELLIPTA®, ANORO® ELLIPTA®, GIAPREZA® and XERAVA® in the jurisdictions in which these products have been approved; the strategies, plans and objectives of the Company (including the Company's growth strategy and corporate development initiatives); the timing, manner, and amount of potential capital returns to shareholders; the status and timing of clinical studies, data analysis and communication of results; the potential benefits and mechanisms of action of product candidates; expectations for product candidates through development and commercialization; the timing of regulatory approval of product candidates; and projections of revenue, expenses and other financial items; the impact of the novel coronavirus (“COVID-19”); the timing, manner and amount of capital deployment, including potential capital returns to stockholders; and risks related to the Company’s growth strategy and risks discussed in “Risk Factors” in Item 1A of Part I, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in Item 7 of Part II and elsewhere in this Annual Report on Form 10‑K. Our forward‑looking statements in this Annual Report on Form 10‑K are based on current expectations as of the date hereof and we do not assume any obligation to update any forward‑looking statements on account of new information, future events or otherwise, except as required by law.

We encourage you to read Management’s Discussion and Analysis of our Financial Condition and Results of Operations and our consolidated financial statements contained in this Annual Report on Form 10‑K. We also encourage you to read Item 1A of Part I of this Annual Report on Form 10‑K, entitled “Risk Factors,” which contains a more complete discussion of the risks and uncertainties associated with our business. In addition to the risks described above and in Item 1A of this report, other unknown or unpredictable factors also could affect our results. Therefore, the information in this report should be read together with other reports and documents that we file with the Securities and Exchange Commission (“SEC”) from time to time, including on Form 10‑Q and Form 8‑K, which may supplement, modify, supersede or update those risk factors. As a result of these factors, we cannot assure you that the forward‑looking statements in this report will prove to be accurate. Furthermore, if our forward‑looking statements prove to be inaccurate, the inaccuracy may be material. In light of the significant uncertainties in these forward‑looking statements, you should not regard these statements as a representation or warranty by us or any other person that we will achieve our objectives and plans in any specified time frame, or at all.

3

PART I

ITEM 1. BUSINESS

Overview

Innoviva, Inc. (“Innoviva”, the “Company”, the “Registrant” or “we” and other similar pronouns) is a diversified holding company with a portfolio of royalties and other healthcare assets. Our royalty portfolio contains respiratory assets partnered with Glaxo Group Limited (“GSK”), including RELVAR®/BREO® ELLIPTA® (fluticasone furoate/vilanterol, “FF/VI”) and ANORO® ELLIPTA® (umeclidinium bromide/vilanterol, “UMEC/VI”). Under the Long-Acting Beta2 Agonist (“LABA”) Collaboration Agreement, Innoviva is entitled to receive royalties from GSK on sales of RELVAR®/BREO® ELLIPTA® as follows: 15% on the first $3.0 billion of annual global net sales and 5% for all annual global net sales above $3.0 billion; and royalties from the sales of ANORO® ELLIPTA®, which tier upward at a range from 6.5% to 10%. Innoviva was also entitled to 15% of royalty payments made by GSK under its agreements originally entered into with us, and since assigned to Theravance Respiratory Company, LLC (“TRC”), including TRELEGY® ELLIPTA® and any other product or combination of products that may be discovered or developed in the future under the LABA Collaboration Agreement and the Strategic Alliance Agreement with GSK (referred to herein as the “GSK Agreements”), which were assigned to TRC other than RELVAR®/BREO® ELLIPTA® and ANORO® ELLIPTA®. We sold our 15% ownership interest in TRC on July 20, 2022, and are no longer entitled to receive royalties on sales of TRELEGY® ELLIPTA® products.

We expanded our portfolio of royalties and innovative healthcare assets through the acquisition of Entasis Therapeutics Holdings Inc. (“Entasis”) on July 11, 2022 and the acquisition of La Jolla Pharmaceutical Company (“La Jolla”) on August 22, 2022. Our commercial and marketed products include GIAPREZA® (angiotensin II), approved in the United States (“U.S.”) to increase blood pressure in adults with septic or other distributive shock, and XERAVA® (eravacycline) approved in the U.S. for the treatment of complicated intra-abdominal infections in adults. Our development pipeline includes medicines for the treatment of bacterial infections, such as our lead asset sulbactam-durlobactam (“SUL-DUR”).

Our headquarters are located at 1350 Old Bayshore Highway, Suite 400, Burlingame, CA 94010. The Company was incorporated in Delaware in November 1996 under the name Advanced Medicine, Inc., and began operations in May 1997. It later changed its name to Theravance, Inc. in April 2002. In June 2014, we spun-off our research and development operations. In January 2016, we rebranded and changed our name to Innoviva, Inc.

Our Strategy

Our corporate strategy is currently focused on increasing stockholder value by, among other things, maximizing the potential value of our respiratory assets partnered with GSK, optimizing our operations and augmenting capital allocation. We continue to diversify our royalty management business through actively pursuing opportunistic acquisitions of promising companies and assets in the healthcare industry and enhancing the returns on our capital. In particular, our recent acquisitions of Entasis and La Jolla created a robust hospital and infectious disease platform.

Our Royalty Product Portfolio

Our Relationship with GSK

LABA Collaboration

In November 2002, we entered into our LABA Collaboration Agreement with GSK to develop and commercialize once‑daily products for the treatment of chronic obstructive pulmonary disease (“COPD”) and asthma. The collaboration has developed three combination products, two of which we still retain rights in. Those two are as follows:

4

As a result of the launch and approval of RELVAR®/BREO® ELLIPTA® and ANORO® ELLIPTA® in the U.S., Japan and Europe, in accordance with the LABA Collaboration Agreement, we paid milestone fees to GSK totaling $220.0 million during the year ended December 31, 2014. The milestone fees paid to GSK were recognized as capitalized fees paid, which are being amortized over their estimated useful lives commencing upon the commercial launch of the products.

Competition

We anticipate that RELVAR®/BREO® ELLIPTA® (FF/VI) and ANORO® ELLIPTA® (UMEC/VI) will compete with a number of approved bronchodilator drugs alone or in combination, including each other and drug candidates under development that are designed to treat asthma and COPD. These include but are not limited to:

5

In addition, several firms have been developing new formulations of Advair/Seretide (salmeterol /fluticasone propionate) and Symbicort (formoterol fumerate/budesonide) which may be marketed as generics or branded generics relative to the existing products from GSK and AstraZeneca, respectively. All of these efforts represent potential competition for any of our partnered products. Efforts have intensified following the publication of FDA draft guidance for the approval of fully substitutable versions of Advair and Symbicort in late 2013 and mid-2015, respectively. Current examples of these products include the marketed products Duoresp/Biresp from Teva (generic Symbicort), AirFluSal Forspiro by Sandoz, Rolenium by Elpen and Sirdupla by Mylan (all generic versions of Seretide) which are all available in a wide number of countries in the E.U. Numerous companies have brought to market generic forms of the ICS/LABA drug Advair® since certain patents covering the Advair® delivery device expired in 2016. In March 2017, Mylan N.V. received a complete response letter from the FDA relating to its Abbreviated New Drug Application (“ANDA”) for fluticasone propionate 100, 250, 500 mcg and salmeterol 50 mcg inhalation powder. In May 2017, Hikma announced that it received a complete response letter from the FDA relating to its ANDA for fluticasone propionate and salmeterol inhalation powder, and in February 2018, Novartis announced that its generic division Sandoz had received a complete response letter from the FDA in response to its ANDA for a third fluticasone propionate and salmeterol product. In January 2019, Mylan announced that the FDA approved Wixela™ Inhu™ (fluticasone propionate and salmeterol inhalation powder, USP), the first generic of Advair Diskus® and Sandoz terminated development of generic Advair. Teva announced that the FDA approved two of its products for adolescent and adult patients with asthma, one of which is AirDuo™ RespiClick® (fluticasone propionate and salmeterol inhalation powder), a non-AB substitutable generic version of Advair®. In May 2020, Cipla filed for FDA approval of a generic version of Advair®. In April 2021, Hikma launched a generic version of Advair Diskus® in the U.S. In January 2020, Astra Zeneca launched an authorized generic version of Symbicort. In August 2021, Lupin launched Luforbec®, a branded generic alternative to Foster, in select European markets.

In general, these manufacturers are required to conduct a number of clinical efficacy, pharmacokinetic and device studies to demonstrate equivalence to Advair, per the FDA’s September 2013 Draft Guidance Document. These studies are designed to demonstrate that the generic product has the same active ingredient(s), dosage form, strength, exposure and clinical efficacy as the branded product. These generic equivalents, which must meet the same exacting quality standards as branded products, may be significantly less costly to bring to market, and companies that produce generic equivalents are generally able to offer their products at lower prices. Thus, after the introduction of a generic competitor, a significant percentage of the sales of any branded product and products that may compete with such branded product is typically lost to the generic product. In addition, in April 2016, the FDA issued a draft guidance document covering Fluticasone Furoate/Vilanterol Trifenatate (FF/VI), the active ingredients used in RELVAR®/BREO® ELLIPTA®.

6

Our Integrated Hospital / Infectious Disease Business

Commercial and Marketed Products

The following table summarizes our commercial and marketed products:

GIAPREZA® (angiotensin II)

GIAPREZA® (angiotensin II) injection is approved by the U.S. FDA as a vasoconstrictor indicated to increase blood pressure in adults with septic or other distributive shock. GIAPREZA is approved by the European Commission (“EC”) and by the Great Britain Medicines and Health Care Products Regulatory Agency (“MHRA”) for the treatment of refractory hypotension in adults with septic or other distributive shock who remain hypotensive despite adequate volume restitution and application of catecholamines and other available vasopressor therapies. GIAPREZA mimics the body’s endogenous angiotensin II peptide, which is central to the renin-angiotensin-aldosterone system (“RAAS”), which in turn regulates blood pressure. GIAPREZA is marketed in the U.S. by La Jolla and is marketed in Europe and Great Britain by PAION Deutschland GmbH (“PAION”) on behalf of La Jolla.

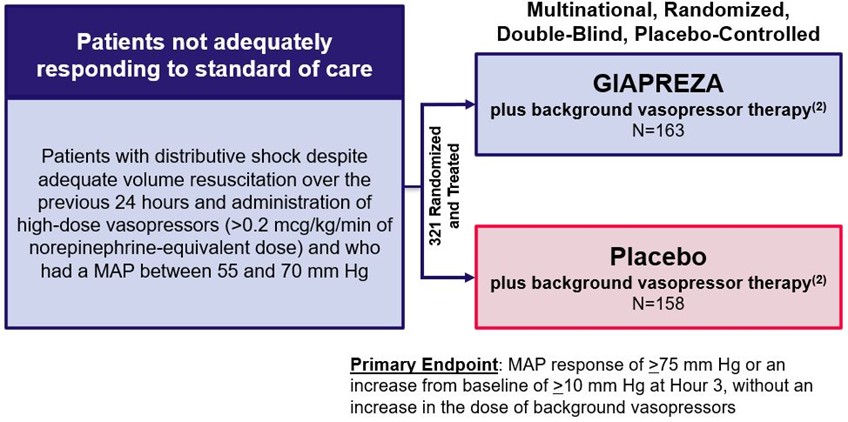

Angiotensin II for the Treatment of High-Output Shock (“ATHOS-3”)

GIAPREZA was approved by the U.S. FDA, EC and MHRA based on the results of ATHOS-3, which were published in the New England Journal of Medicine in August 2017. ATHOS-3 was a multinational, randomized, double-blind, placebo-controlled study in which 321 adults with septic or other distributive shock who remained hypotensive despite fluid and vasopressor therapy received either GIAPREZA or placebo, both in addition to background vasopressor therapy. The primary endpoint was mean arterial pressure

7

(“MAP”) response, defined as a MAP of 75 mm Hg or higher or an increase in MAP from baseline of at least 10 mm Hg without an increase in the dose of background vasopressors at Hour 3 (Khanna et al, New England Journal of Medicine 2017; 377:419–430).

ATHOS-3 Study Design(1)

MAP=mean arterial pressure

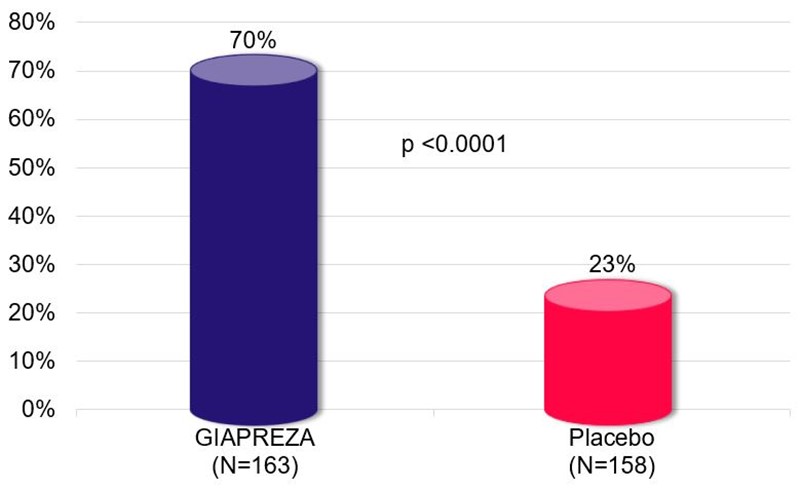

GIAPREZA significantly improved blood pressure response. Specifically, the primary endpoint was achieved by 70% of GIAPREZA-treated patients compared to 23% of placebo-treated patients (p <0.0001).

Primary Endpoint: Mean Arterial Pressure Response(1),(2)

8

GIAPREZA provides the ability to rapidly achieve and adjust therapeutic response. GIAPREZA rapidly increased MAP with a median time to MAP response of approximately 5 minutes. The plasma half-life of GIAPREZA is less than 1 minute.

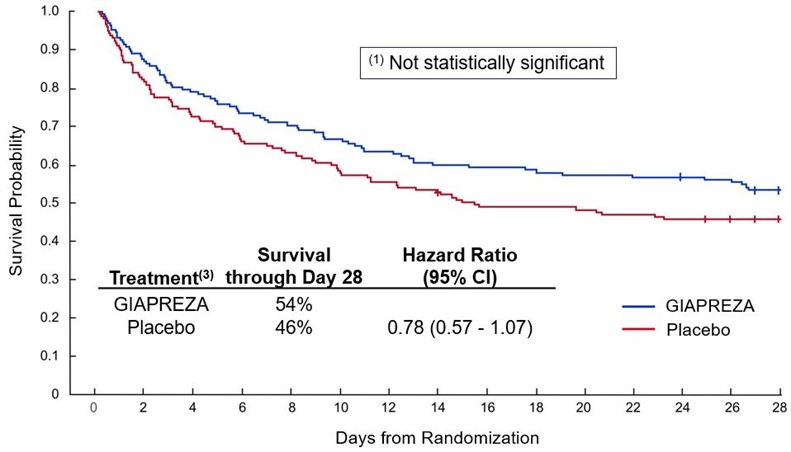

In addition, a positive survival trend was observed. Mortality through Day 28 was 46% on GIAPREZA and 54% on placebo (hazard ratio 0.78; 95% confidence interval 0.57–1.07).

Positive Survival Trend Observed (N=321)(1),(2)

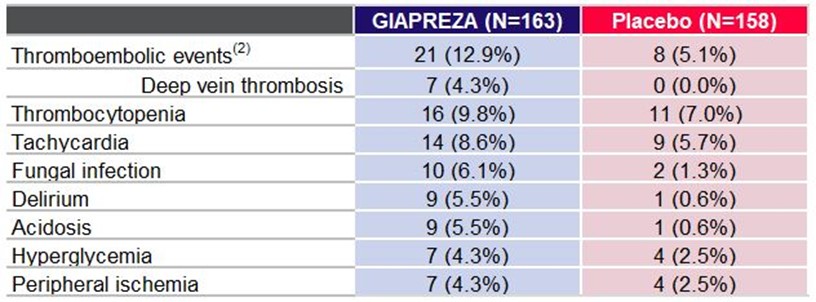

The most common adverse reactions that were reported in greater than 10% of GIAPREZA-treated patients were thromboembolic events.

9

Adverse Reactions Occurring in ≥4% of Patients Treated with GIAPREZA and ≥1.5% More Often than in Placebo-treated Patients(1)

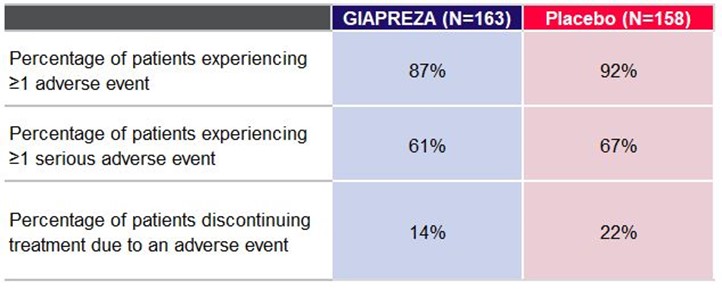

Percentage of Patients Experiencing ≥1 Adverse Event, ≥1 Serious Adverse Event and Discontinuing Treatment Due to an Adverse Event(1)

XERAVA® (eravacycline)

XERAVA® (eravacycline) for injection is approved by the U.S. FDA and Singapore Health Sciences Authority (“HSA”) as a tetracycline class antibacterial indicated for the treatment of cIAI due to susceptible microorganisms in patients 18 years of age and older. XERAVA is approved by the EC, MHRA, and the Hong Kong Department of Health (“DoH”) for the treatment of cIAI in adults. XERAVA is marketed in the U.S. by our wholly owned subsidiary, Tetraphase Pharmaceuticals, Inc. (“Tetraphase”), and is marketed in Europe and Great Britain by PAION on behalf of Tetraphase and is marketed in mainland China, Taiwan, Hong Kong, Macau, South Korea, Singapore, the Malaysian Federation, the Kingdom of Thailand, the Republic of Indonesia, the Socialist Republic of Vietnam and the Republic of the Philippines by Everest Medicines Limited (“Everest”). Everest submitted an NDA in China, which was accepted by the China National Medical Products Administration (“NMPA”) in March 2021.

cIAIs are the second most common source of severe sepsis in the ICU (Brun-Buisson et al, JAMA 1995; 274(12):968–974). cIAIs are defined as consequences of perforations of the gastrointestinal tract that result in contamination of the peritoneal space (Solomkin et al, Clinical Infectious Diseases 2018; 69(6):921–929).

Investigating Gram-negative Infections Treated with Eravacycline (“IGNITE”)

XERAVA was approved by the U.S. FDA, HSA, EC, MHRA, and DoH based on the results of IGNITE1 and IGNITE4, which were published in JAMA Surgery in March 2017 and Clinical Infectious Diseases in December 2018, respectively.

10

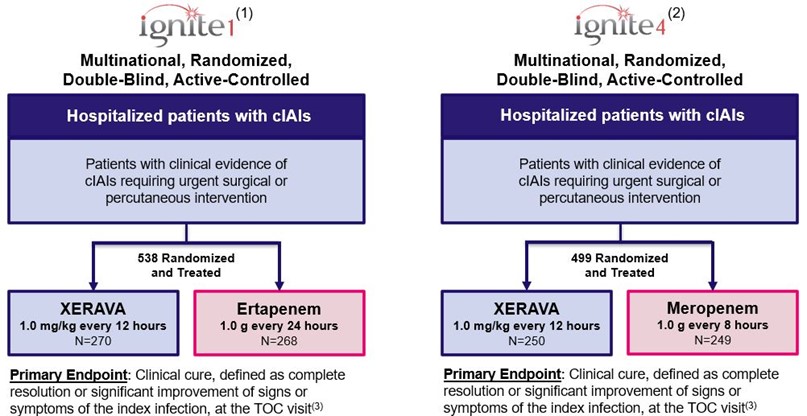

IGNITE1 was a multinational, randomized, double-blind, active-controlled study in 538 patients with clinical evidence of cIAIs requiring urgent surgical or percutaneous intervention who received either XERAVA or ertapenem. The primary endpoint was clinical cure, defined as complete resolution or significant improvement of signs or symptoms of the index infection, at the test of cure (“TOC”) visit. The TOC visit was conducted 25 to 31 calendar days after the first dose of the study drug was administered.

IGNITE4 was a multinational, randomized, double-blind, active controlled study in 499 patients with clinical evidence of cIAIs requiring urgent surgical or percutaneous intervention who received either XERAVA or meropenem. The primary endpoint was clinical cure, defined as complete resolution or significant improvement of signs or symptoms of the index infection, at the TOC visit. The TOC visit was conducted 25 to 31 calendar days after the first dose of the study drug was administered.

IGNITE1 and IGNITE4 Study Design

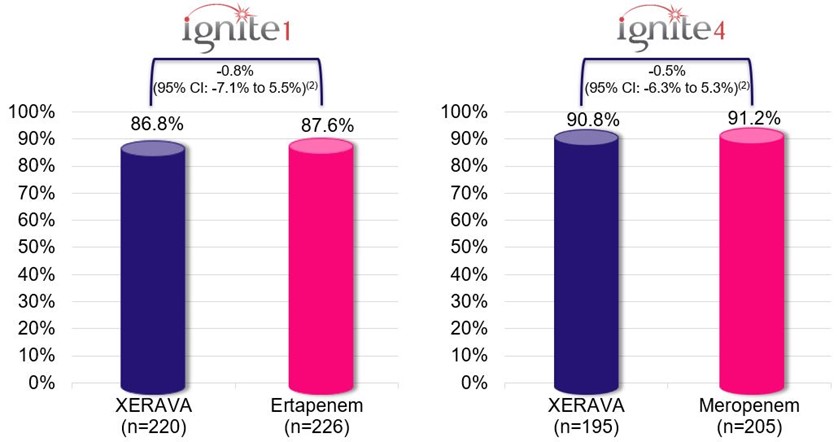

XERAVA demonstrated statistical noninferiority in clinical cure rate in the micro-ITT population, which included all randomized subjects who had baseline bacterial pathogens that caused cIAIs and against at least one of which the investigational drug has in vitro (in a test tube) antibacterial activity (N=846).

11

Primary Endpoint: Clinical Cure Rate(1)

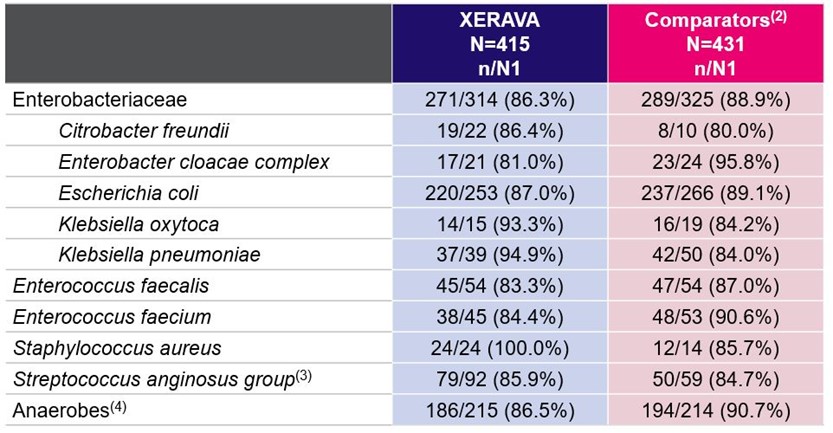

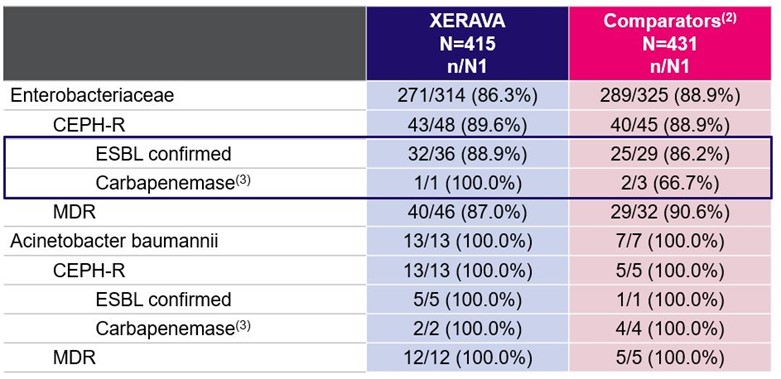

Clinical cure rates across patients with gram-negative, gram-positive and anaerobic pathogens, including those with resistant strains, are shown in the following tables.

Clinical Cure Rates at TOC by Selected Baseline Pathogens in the Micro-ITT Population(1)

N=Number of subjects in the micro-ITT Population; N1=Number of subjects with a specific pathogen; n=Number of subjects with a clinical cure at the TOC visit

12

XERAVA Demonstrated High Clinical Cure Rates Against Resistant Pathogens(1)

CEPH-R=cephalosporin-resistant; ESBL=extended-spectrum β-lactamases; MDR=multidrug resistance;

N=Number of subjects in the micro-ITT Population; N1=Number of subjects with a specific pathogen; n=Number of subjects with a clinical cure at the TOC visit

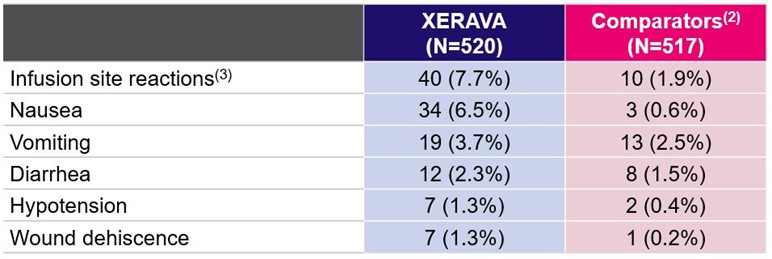

The most common adverse reactions that were reported in XERAVA-treated patients in IGNITE1 and IGNITE4 were infusion site reactions.

Selected Adverse Reactions Reported in ≥1% of Patients Receiving XERAVA(1)

Sales and Marketing Organization

We employ an experienced sales and marketing team dedicated to the commercialization of GIAPREZA and XERAVA. As of December 31, 2022, this team consisted of 35 professionals, including 27 critical care specialists.

Customers

During the year ended December 31, 2022, 503 hospitals in the U.S. purchased GIAPREZA, and 874 hospitals and other healthcare organizations in the U.S. purchased XERAVA. Hospitals and other healthcare organizations generally purchase our products through a network of specialty and wholesale distributors. These specialty and wholesale distributors are considered our

13

customers for accounting purposes. We do not believe that the loss of one of these distributors would significantly impact the ability to distribute our products, as we expect that sales volume would be absorbed by the remaining distributors. Due to the relatively short lead-time required to fill orders for GIAPREZA and XERAVA, backlog is not material to our business.

Competition

Catecholamines (primarily norepinephrine), which are available as generics and inexpensive, are typically used first line to treat distributive shock, while vasopressin, including Vasostrict® (Endo International plc) and vasopressin generic drugs, is typically used second line. In the randomized, Phase 3 study ATHOS-3, GIAPREZA demonstrated clinical benefit in patients who were not adequately responding to available vasopressors, including catecholamines and vasopressin. GIAPREZA’s principal competition as a treatment in patients not adequately responding to available vasopressors is the use of these same vasopressors at increased doses. If we are unable to successfully change treatment practices, the commercial prospects for GIAPREZA will be limited, and our business may suffer.

XERAVA competes with a number of antibiotics that are currently marketed for the treatment of cIAI and other multidrug resistant infections, including: AVYCAZ (ceftazidime and avibactam, marketed by AbbVie Inc.); MERREM IV® (meropenem, marketed by AstraZeneca PLC); PRIMAXIN® (imipenem and cilastatin, marketed by Merck & Co., Inc.); RECARBRIO™ (imipenem, cilastatin, and relebactam, marketed by Merck & Co., Inc.); TYGACIL® (tigecycline, marketed by Pfizer Inc.); VABOMERE™ (meropenem and vaborbactam, marketed by Melinta Therapeutics, Inc.); ZERBAXA® (ceftolozane and tazobactam, marketed by Merck & Co., Inc.); ZOSYN® (piperacillin and tazobactam, marketed by Pfizer Inc.); and current and future generic versions of marketed antibiotics. If we are unable to successfully change treatment practices, the commercial prospects for XERAVA will be limited, and our business may suffer.

Regulatory Exclusivity

GIAPREZA and XERAVA are New Chemical Entities (“NCEs”) approved by the U.S. FDA. In the U.S., NCEs approved by the FDA are eligible for market exclusivity under the U.S. Federal Food, Drug, and Cosmetic Act (“FDCA”), which can prevent the approval of generic versions of the NCE for 5 to 7.5 years from the date of the initial approval of the NCE. Specifically, the FDCA provides a 5-year period of marketing exclusivity within the U.S. to the applicant that gains approval of an NDA for an NCE. A drug is an NCE if the FDA has not previously approved any other new drug containing the same active moiety, which is the molecule or ion responsible for the action of the drug substance. During the exclusivity period, the FDA may not accept for review an Abbreviated New Drug Application (“ANDA”) or a 505(b)(2) NDA submitted by another company for another version of such drug where the applicant does not own or have a legal right of reference to all of the data required for approval. However, an application may be submitted 4 years after the NDA approval of the NCE if it contains a certification of patent invalidity or non-infringement. Should the NDA holder commence litigation against the ANDA filer within 45 days of receipt of the certification notice, an automatic stay of the approval of any generic competition goes into effect until the earlier of: (i) 30 months from the receipt of the certification; or (ii) a court ruling of patent invalidity or non-infringement for the relevant patents. In the absence of a court ruling, the 30-month stay will be extended by such amount of time (if any) that is required for 7.5 years to have elapsed from the date of NDA approval of the NCE.

On February 15, 2022, La Jolla received a paragraph IV notice of certification (the “Notice Letter”) from Gland Pharma Limited (“Gland”) advising that Gland had submitted an Abbreviated New Drug Application (“ANDA”) to the FDA seeking approval to manufacture, use or sell a generic version of GIAPREZA in the U.S. prior to the expiration of U.S. Patent Nos.: 9,220,745; 9,572,856; 9,867,863; 10,028,995; 10,335,451; 10,493,124; 10,500,247; 10,548,943; 11,096,983; and 11,219,662 (the “GIAPREZA Patents”), which are listed in the FDA’s Approved Drug Products with Therapeutic Equivalence Evaluations (the “Orange Book”). The Notice Letter alleges that the GIAPREZA Patents are invalid, unenforceable and/or will not be infringed by the commercial manufacture, use or sale of the generic product described in Gland’s ANDA.

On March 29, 2022, La Jolla filed a complaint for patent infringement of the GIAPREZA Patents against Gland and certain related entities in the United States District Court for the District of New Jersey in response to Gland’s ANDA filing. In accordance with the Hatch-Waxman Act, because GIAPREZA is a new chemical entity and La Jolla filed a complaint for patent infringement within 45 days of receipt of the Notice Letter, the FDA cannot approve Gland’s ANDA any earlier than 7.5 years from the approval of the GIAPREZA NDA unless the District Court finds that all of the asserted claims of the patents-in-suit are invalid, unenforceable and/or not infringed. We intend to vigorously enforce our intellectual property rights relating to GIAPREZA.

Under the Generating Antibiotic Incentives Now (“GAIN”) provisions of the FDA Safety and Innovation Act (“FDASIA”), the FDA may designate a product as a qualified infectious disease product (“QIDP”). In order to receive this designation, a drug must qualify as an antibacterial or antifungal drug for human use intended to treat serious or life-threatening infections. We obtained a QIDP designation for the IV formulation of XERAVA for cIAI in July 2013. Upon approving an application for a QIDP, the FDA will extend by an additional 5 years any non-patent marketing exclusivity period awarded, such as a 5-year exclusivity period awarded for

14

an NCE. This extension is in addition to any pediatric exclusivity extension awarded. XERAVA has been awarded this 5-year exclusivity under FDASIA.

Our Product Candidates

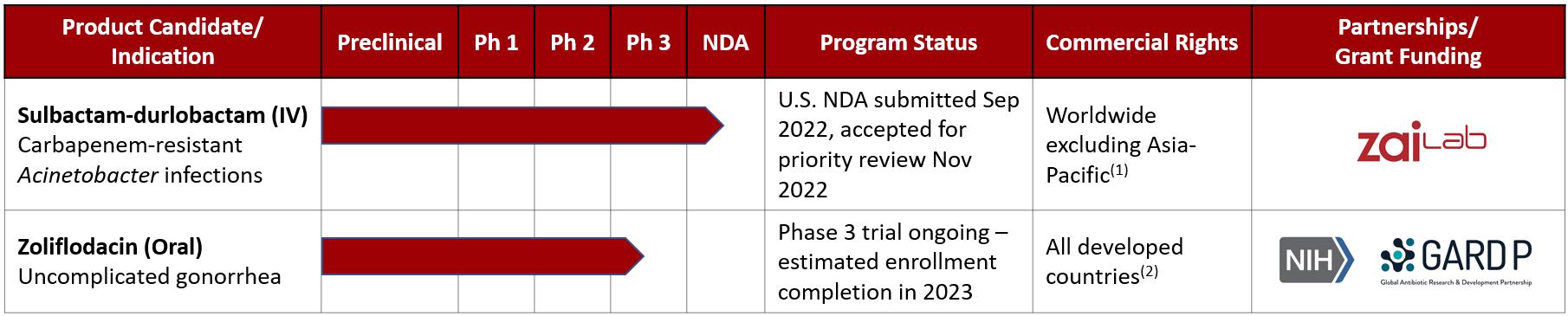

The following table summarizes the status of our primary product candidates:

SUL-DUR

Overview

Our lead product candidate, SUL-DUR, is a novel IV antibiotic. The product is a combination of sulbactam, a β-lactam antibiotic, and durlobactam, our novel β-lactamase inhibitor (“BLI”) with broad spectrum β-lactamase coverage including Classes A, C and D, that we are developing for the treatment of a variety of serious infections caused by carbapenem-resistant Acinetobacter. We have completed three separate Phase 1 clinical trials, including one evaluating the penetration of SUL-DUR into the lung and one in renally impaired patients. Subsequently, we completed a Phase 2 clinical trial in patients with cUTIs. We initiated ATTACK, our single Phase 3 registration trial in 2019, that evaluated SUL-DUR in patients with confirmed carbapenem-resistant Acinetobacter pneumonia and/or bloodstream infections. We believe SUL-DUR has the ability to improve outcomes of patients with multidrug-resistant Acinetobacter infections, reducing their overall mortality. We announced positive top-line Phase 3 data in October 2021 and based on our positive top-line Phase 3 data and the totality of our preclinical and clinical data, we filed a new drug application (“NDA”) with the FDA in September 2022. The NDA was accepted for filing by the U.S. FDA. We believe SUL-DUR has the ability to improve outcomes of patients with multidrug-resistant Acinetobacter infections, reducing their overall mortality.

Acinetobacter

Acinetobacter is a Gram-negative, opportunistic human pathogen that predominantly infects critically ill patients often resulting in severe pneumonia and bloodstream infections but can also infect other body sites as well. Once thought to be mostly benign, Acinetobacter is now considered a global threat in the healthcare setting due in part to its ability to acquire multidrug resistance at rates not previously seen in other bacteria. In addition, Acinetobacter has the ability to remain viable for up to 100 days in dry conditions and easily spreads via air or water droplets, which explains why the pathogen can often be found in many locations in the intensive care unit, or ICU, including bedrails, bedside tables, monitors of mechanical ventilators, intravenous pumps, door handles, stethoscopes and many other locations. Of significant concern, one study reported greater than 98% of Acinetobacter isolates in an ICU from non-clinical sources such as bedrails and door handles, were determined to be multidrug resistant.

Pneumonia and bloodstream infections caused by drug-resistant Acinetobacter can have mortality rates approaching 50%. Antibiotic-resistance rates of Acinetobacter to current standard-of-care treatments are some of the highest reported, between 30% and 50% in the United States and greater than 90% in parts of Europe and Asia. Acinetobacter resistance to β-lactams is primarily driven by the expression of Class D β-lactamases, often in combination with Class A and/or Class C β-lactamases. There are currently no effective antibiotics indicated for the treatment of multidrug-resistant Acinetobacter infections. Durlobactam is the first clinical-stage BLI with sufficient broad-spectrum activity against class A, C, and D β-lactamases to potentially restore the efficacy of β-lactam antibiotics against multidrug-resistant Acinetobacter.

Sulbactam, the β-lactam antibiotic used in SUL-DUR has superior microbiological potency against Acinetobacter compared to other β-lactam antibiotics based on in vitro and in vivo analyses. Historically, physicians used sulbactam to successfully treat Acinetobacter infections before development of broad β-lactamase mediated resistance rendered sulbactam on its own largely

15

ineffective. We believe our data demonstrates that combining durlobactam with sulbactam can effectively restore the activity of sulbactam against multidrug-resistant strains of Acinetobacter.

Market Opportunity

We estimate that there are up to 200,000 hospital-treated Acinetobacter infections annually in the United States and Europe, of which up to 100,000 are carbapenem-resistant Acinetobacter infections, which we regard as our initial target markets for SUL-DUR. We also believe there could be a significant market opportunity in Asia-Pacific, Central and South America, Russia and the Middle East given resistance rates exceeding 80% in some countries. If approved, we believe SUL-DUR has the potential to address the issues of resistance facing existing regimens, which is currently limiting the utility of the carbapenems, and tolerability, which is a concern with regimens containing colistin. There are currently no antibiotics indicated for the treatment of carbapenem-resistant Acinetobacter infections.

Clinical Development Plan

Completed Clinical Trials

Phase 3 registration trial: We completed ATTACK, a Phase 3 registration trial of SUL-DUR for the treatment of patients with carbapenem-resistant Acinetobacter infections, with positive top-line data announced in October 2021. ATTACK enrolled 207 patients at 95 clinical sites in 16 countries. This was a two-part trial with Part A being the randomized, comparative portion (SUL-DUR vs colistin) in patients with documented Acinetobacter hospital-acquired bacterial pneumonia (HABP), ventilator-associated bacterial pneumonia (VAPB), ventilated pneumonia (VP), or bacteremia, and Part B being an open-labeled portion including Acinetobacter infections resistant to, or having previously failed colistin or polymyxin B treatment. Baseline Acinetobacter isolates tested were greater than 95% carbapenem resistant.

SUL-DUR met the primary efficacy endpoint of 28-day all-cause mortality compared to colistin in the CRABC m-MITT population of Part A. SUL-DUR mortality was 19.0% (12/63) compared to 32.3% (20/62) in the colistin arm (treatment difference of -13.2%; 95% CI: -30.0, 3.5). Similar trends were demonstrated in 28-day and 14-day all-cause mortality favoring SUL-DUR across all study populations evaluated to date. A statistically significant difference in clinical cure at Test of Cure (TOC) was observed with 61.9% in SUL-DUR arm compared to 40.3% in the colistin arm (95% CI 2.9-40.3). In Part B, the 28-day all-cause mortality was 17.9% (5/28) and consistent with that observed in Part A.

Safety analyses from a total of 177 patients treated with SUL-DUR suggested that SUL-DUR was generally well-tolerated with a favorable safety profile compared to colistin. SUL-DUR met the primary safety objective with a statistically significant lower incidence of nephrotoxicity as measured by the RIFLE classification for acute kidney injury. SUL-DUR nephrotoxicity was 13.2% (12/91) versus 37.6% (32/85) in the colistin arm (p = 0. 0002). Overall adverse events (AEs) in the safety population were comparable between treatment groups with 87.9% (80/91) in the SUL-DUR arm vs. 94.2% (81/86) in the colistin arm in Part A, 89.3% (25/28) in Part B. Drug related AEs were 12.1% (10.7% in Part B) with SUL-DUR compared to 30.2% with colistin. The most common non-infectious AEs (≥10%) in the SUL-DUR arm were diarrhea (16.5%), allergic and hypersensitivity reactions (16.5%), anemia (13.2%) and hypokalemia (12.1%) in Part A. These AEs were also >10% in the colistin arm as was acute kidney injury.

On November 30, 2022, we announced that the U.S. FDA accepted for Priority Review the new drug application (NDA) for SUL-DUR. The FDA is currently planning to hold an advisory committee meeting to discuss this application. The target PDUFA date (or action date) is May 29, 2023.

Phase 2 clinical trial in cUTI patients: We completed a Phase 2 clinical trial in cUTI patients to provide additional safety and pharmacokinetic, or PK, data as well as efficacy data against carbapenem-resistant pathogens. Eighty patients were randomized to receive either a dose of SUL-DUR or placebo every six hours for seven days. Patients in both arms also received background therapy, which is current standard-of-care, with 500 mg of imipenem, or IMI, administered through IV every six hours. There were no serious adverse events reported and the adverse event profile of SUL-DUR plus IMI was similar to that of the IMI comparator arm. PK data observed in the Phase 2 trial was consistent with the PK data observed in the Phase 1 clinical trial in healthy volunteers.

We have completed three Phase 1 clinical trials, highlighted below, in addition to a Phase 2 clinical trial in patients with cUTIs. In all of these clinical trials, SUL-DUR was observed to be generally well tolerated.

Four-part Phase 1 first-in-human trial: Our four-part Phase 1 first-in-human clinical trial was conducted in Australia in 124 healthy volunteers. SUL-DUR was generally well tolerated, with no dose-related systemic adverse events or drug-related serious adverse events reported. SUL-DUR also exhibited linear dose-dependent increases in exposure and PK parameters across the dose range studied.

16

Phase 1 lung trial: Our Phase 1 lung trial assessed the concentration of SUL-DUR in lung fluid, an important metric to understand, because ATTACK includes patients with pneumonia and lack of appropriate lung tissue penetration has been found to contribute to reduced efficacy. We believe that the levels of SUL-DUR in the lung fluid achieved in this trial support its continued development as a potential treatment for pneumonia caused by Acinetobacter.

Phase 1 renal trial: Our Phase 1 renal trial analyzed serum levels in renally impaired patients and provided data to enable the development of a dose adjustment protocol for the type of patient targeted in our ongoing Phase 3 registration trial.

We submitted an IND for SUL-DUR to the U.S. FDA in June 2017, and the FDA notified us in July 2017 that we could proceed with this program. The FDA granted Fast Track and QIDP designation for SUL-DUR in September 2017 for the treatment of hospital-acquired and ventilator-acquired bacterial pneumonia and bloodstream infections due to Acinetobacter.

Global Acinetobacter Surveillance Data

Durlobactam has broad activity against a wide range of β-lactamases, including Classes A, C and D, unlike currently marketed BLIs that primarily cover only Class A and Class C β-lactamases. Durlobactam is the first BLI in clinical development with such a broad spectrum of in vitro activity.

SUL-DUR has also exhibited potent microbiological activity against Acinetobacter strains in vitro. Over a series of studies summarized in the figure below, we have compared the effectiveness of SUL-DUR, sulbactam alone and comparators in inhibiting 7,221 strains of Acinetobacter that were collected from patients around the world between 2011 and 2020. Amikacin and colistin were tested against 6,418 of the 7,221 strains. The plot in the figure below presents the cumulative percentage of these strains inhibited by increasing concentrations of each of the tested compounds. Sulbactam alone, as well as most of the other marketed antibiotics, had a very high MIC90 value of 64 mg/L, meaning that concentrations of 64 mg/L or greater were required to inhibit growth of 90% of the strains. The corresponding breakpoints, which are established by the Clinical & Lab Standards Institute, or CLSI, as the specified concentrations for each antibiotic that define whether a strain is considered resistant, are significantly lower than their MIC90 values. If the MIC90 of a drug is lower than its CLSI breakpoint, then that drug would be expected to be effective against more than 90% of the strains. If a drug’s MIC90 is higher than its breakpoint, the drug would not be expected to have broad efficacy against those strains. This cumulative analysis suggests that recent global strains of Acinetobacter are resistant to all the comparator antibiotics other than colistin, consistent with their significantly diminished clinical utility against Acinetobacter infections. In contrast, SUL-DUR had very potent activity, with a much lower MIC90 of 2 mg/L. This is lower than the CLSI breakpoint for sulbactam, which is 4 mg/L (in Unasyn®, a combination of sulbactam and ampicillin), suggesting that our chosen target exposure levels of SUL-DUR may be effective against more than 90% of global, multidrug resistant Acinetobacter strains. A subset of 926 isolates out of the 7,221 strains tested were from Chinese hospitals collected in 2016-2018. 831 of the 926 (84.6%) Chinese isolates were carbapenem-resistant. In contrast, SUL-DUR showed potent activity against this subset, with an MIC90 of 2 mg/L and 97.9% of isolates susceptible to ≤ 4 mg/L of SUL-DUR.

17

Competition

We are initially developing SUL-DUR for the treatment of multidrug-resistant Acinetobacter infections. Due to rising resistance rates, standard-of-care treatment for multidrug-resistant Acinetobacter infections often includes a combination of several last-line treatment options, including carbapenems, tetracyclines, polymyxins, and other generically available agents. Despite using best available therapy, mortality rates of patients with multidrug-resistant Acinetobacter infections are reported as high as 50%. As of the date of this report, we are not aware of any marketed antibiotic that is indicated for the treatment of multidrug-resistant Acinetobacter infections; however, we are aware of other potentially competitive products that have shown in vitro activity against some strains of Acinetobacter. Melinta Therapeutics Inc. currently markets minocycline. Although recently approved for treating cUTIs, Fetroja®, from Shionogi & Co., Ltd., includes in its label a specific warning of an observed increase in all-cause mortality in patients with carbapenem-resistant Gram-negative bacterial infections that were treated with the drug. BioVersys AG reported in May 2022 that their lead program BV100, being developed specifically for multidrug-resistant Acinetobacter infections, completed three Phase 1 clinical trials.

Commercial Approach

In the United States, our commercial strategy is driven by our understanding of where Acinetobacter infections are known to exist. Given that Acinetobacter infections more commonly occur in immunocompromised patients, treatment settings for these patients are frequently large intensive care units (ICUs), specialized centers like transplant, cancer, and burn, outpatient long-term acute centers (LTACs) and home infusion.

SUL-DUR has been developed specifically for multi-drug resistant Acinetobacter infections and we believe the unmet need and value proposition of SUL-DUR will support its use for treating infections caused by this serious Gram-negative pathogen. This value proposition includes:

Current Acinetobacter treatment protocols allow for clear positioning of SUL-DUR. Patients with suspected Acinetobacter infections are frequently treated with a broad-spectrum antibiotic, commonly a carbapenem, as first-line therapy. If susceptibility testing identifies that the causative bacterial pathogen is carbapenem-resistant Acinetobacter, the patient is then frequently switched to a colistin-based antibiotic regimen in an attempt to successfully treat the infection. Published literature, however, reports greater than 50% mortality rates using colistin-based regimens.

We believe that the data from the ATTACK Phase 3 registration trial demonstrate improved efficacy and safety profiles, that could result in SUL-DUR, if approved, being preferred to a colistin-based regimen for the treatment of multidrug-resistant, including carbapenem-resistant, Acinetobacter infections.

Multidrug-resistant Acinetobacter infections also present a significant unmet medical need in China and across the broader Asia/Pacific territory. Our collaboration and license agreement with Zai Lab, which included their participation in the ATTACK Phase 3 registration clinical trial, provides a potentially accelerated path for regulatory approval and commercialization in China and Asia-Pacific territories. Zai Lab supported the enrollment of approximately 25% of the evaluable patients in ATTACK from China, which we believe will support a regulatory submission in China. Under our agreement with Zai Lab, we receive upfront, milestone and royalty payments in addition to payment of certain Phase 3 registration clinical trial costs. We maintain 100% of the rights and associated economics in North America and Europe. Outside of the United States, we intend to work with multi-national pharmaceutical companies to leverage their commercialization capabilities in territories not covered by our agreement with Zai Lab. In January 2023, Zai Lab announced that the Center for Drug Evaluation of China’s National Medical Products Administration has granted priority review status to the NDA for SUL-DUR for the treatment of infections caused by Acinetobacter baumannii, including multidrug-resistant and carbapenem-resistant (CRAB) strains.

18

Zoliflodacin

Overview

Our second late-stage product candidate is zoliflodacin, a potential single oral dose cure for the treatment of uncomplicated gonorrhea caused by the bacterial pathogen N. gonorrhoeae. Gonorrhea is an area of significant medical need and zoliflodacin is the only novel single dose treatment in development that provides a potential monotherapy oral alternative to intramuscular injections of ceftriaxone for the treatment of gonorrhea, including infections caused by drug-resistant strains. Zoliflodacin targets the validated mechanism of action of the fluoroquinolone class of antibiotics but does so in a novel manner to avoid existing fluoroquinolone resistance. We have completed several Phase 1 clinical trials and a Phase 2 clinical trial of zoliflodacin in patients with uncomplicated gonorrhea. In collaboration with GARDP, in 2019 we initiated a single Phase 3 registration trial of zoliflodacin in patients with uncomplicated gonorrhea. GARDP will fund all the Phase 3 clinical trial and pharmaceutical development costs and in return will receive commercial rights for zoliflodacin in WHO-defined low-income and select middle-income countries. We have retained commercial rights in all other countries, including the major markets in North America, Europe and Asia-Pacific.

Gonorrhea

Uncomplicated gonorrhea is an N. gonorrhoeae infection of the urethra, cervix, pharynx or rectum, and is more common than complicated gonorrhea, which includes spread of the infection to other tissues and potentially the bloodstream. Gonorrhea can be associated with serious complications, including pelvic inflammatory disease, ectopic pregnancy and infertility, as well as an increased risk of human immunodeficiency virus, or HIV. Despite the continued use of effective antibiotics, it remains one of the most common sexually transmitted bacterial infections in the world with an estimated 82.4 million people worldwide infected each year. The occasional absence of symptoms, more frequent in women, is thought to be one reason for sustained levels of infection. Antibiotics remain the mainstay for treating uncomplicated gonorrhea caused by N. gonorrhoeae.

N. gonorrhoeae is the bacterial pathogen responsible for gonorrhea and has a strong propensity for uptake of chromosomal DNA from other genera of Neisseria which allows the bacteria to accumulate many mutations in chromosomal genes leading to frequent resistance of antibiotics. For example, penicillin was introduced for N. gonorrhoeae infections in 1943, and initial resistance was reported in 1945. Fluoroquinolone antibiotics were first used to treat gonorrhea in 1949 and have been one of the most successful classes of antibiotics against N. gonorrhoeae, but even so resistance was identified in 1969. One member of this class, ciprofloxacin, was introduced in 1980 and resistance was identified in 1990. More recently cephalosporin antibiotics, notably cefixime, had been widely used for the treatment of gonorrhea due to their oral administration along with a favorable efficacy and safety profile, although resistance by N. gonorrhoeae has been reported since 2007. As widespread use of these antibiotics drove the emergence of drug-resistant N. gonorrhoeae strains, treatment guidelines have subsequently been amended. Ceftriaxone is currently the only CDC-recommended option for the treatment of gonorrhea and, until recently, was administered with azithromycin, a broad-spectrum antibiotic, to provide coverage against other sexually transmitted diseases that tend to occur concurrently with gonorrhea. However, rising resistance of N. gonorrhoeae to azithromycin recently prompted the CDC to now recommend 500mg ceftriaxone monotherapy. Ceftriaxone is administered by intramuscular injection, which can be painful and may require patient monitoring by a healthcare administrator. Although ceftriaxone remains effective in most of the U.S., in Hawaii and Massachusetts as well as in several countries, including China, Japan, Vietnam, South Korea, France and Spain, N. gonorrhoeae strains with resistance to azithromycin and ceftriaxone have been reported, prompting concerns that multidrug-resistant gonorrhea may become a major community health issue.

Market Opportunity

N. gonorrhoeae is an immediate global public health threat with 82.4 million cases worldwide in 2020 (WHO estimate). Cases of gonorrhea in the United States have reached an estimated 1.6 million per year. The WHO worldwide estimate of approximately 82.4 million new cases includes infected adolescents and adults aged 15–49 years. The CDC estimates that the cases of gonorrhea in the United States have been increasing at least 10% per year since 2009. In April 2021, the CDC announced that sexually transmitted diseases in the U.S. reached all-time high for 6th consecutive year, with approximately 2.6 million cases of chlamydia, gonorrhea & syphilis reported in 2019.

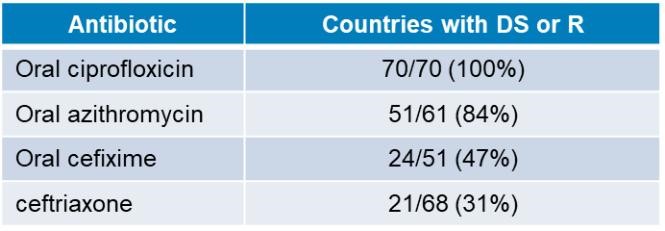

19

The results of a 2017-2018 survey of countries reporting decreased susceptibility, DS, or resistance, R, of N. gonorrhoeae to current antibiotics are reflected in the table below.

Historically, to reduce the risk of spreading drug-resistant N. gonorrhoeae, the CDC has changed treatment guidelines when resistance rates to recommended first-line treatments reach 5%. Since 2015, there has only been one recommended treatment on CDC guidelines for gonorrhea: 250mg intramuscular injection of ceftriaxone plus 1g of oral azithromycin. In 2020 the CDC once again updated its treatment guideline, now recommending a 500mg intramuscular injection of ceftriaxone for treatment of uncomplicated gonorrhea. This follows a 2019 update in the United Kingdom where recommended empirical treatment of gonorrhea is now 1 g intramuscular ceftriaxone monotherapy.

Clinical Development Plan

Ongoing Registration Trial

Phase 3 registration trial: In 2019, we announced the initiation of a global, multi-center Phase 3 registration trial in collaboration with GARDP who is conducting and funding all Phase 3 clinical trial and pharmaceutical development costs. Up to 18 clinical trial sites are planned across the U.S., Thailand, South Africa, the Netherlands and Belgium. Our Phase 3 registration trial is a multi-center, open-label, noninferiority trial in approximately 1,000 enrolled patients with uncomplicated gonorrhea who will be randomized on a 2:1 basis to receive either a single 3.0g oral dose of zoliflodacin or a regimen of 500mg intramuscular ceftriaxone plus 1g oral azithromycin. The primary endpoint will be the proportion of patients with microbiological cure at urethral or cervical sites, approximately six days after treatment. The Data Safety Monitoring Board, or DSMB, in May 2021 recommended to continue the study without modification. Despite the ongoing challenges with the COVID-19 pandemic, we have observed an increase in the enrollment rate recently and based on current enrollment rates we anticipate completion of trial enrollment in 2023. Based on our discussions with the U.S. FDA, we believe that the efficacy data from this single Phase 3 registration trial, if positive, along with the data from our other clinical trials of zoliflodacin, will be sufficient to support the submission of an NDA to the U.S. FDA.

Completed Clinical Trials

Phase 2 clinical proof-of-concept trial: We have completed a multi-center, randomized, open-label Phase 2 clinical trial comparing a single oral dose of 2.0g or 3.0g of zoliflodacin to 500mg intramuscular ceftriaxone for the treatment of uncomplicated gonorrhea. In this trial, 179 randomized patients received treatment and zoliflodacin was generally well tolerated, with efficacy outcomes comparable to ceftriaxone. Microbiological eradication and clinical cure in urogenital infections with a single dose of zoliflodacin, the primary endpoint of the trial, was comparable to ceftriaxone, with 100% cure rate in both the 3.0g zoliflodacin and ceftriaxone groups in the per-protocol population. The results of this clinical trial were published in The New England Journal of Medicine in 2018.

Phase 1 clinical trial: We evaluated zoliflodacin in two Phase 1 clinical trials studying 72 healthy volunteers in total. In one trial, we evaluated PKs and tolerability in 48 subjects and food effects in 18 subjects, and in the second trial, we evaluated absorption, distribution, metabolism and excretion in six subjects. Zoliflodacin was generally well tolerated in these trials at doses we would expect to be clinically active for treating uncomplicated gonorrhea. Administration of a high-fat meal was associated with an increase in zoliflodacin plasma concentration, suggesting that zoliflodacin could be administered with or without food.

Preclinical Data

We have generated biochemical, microbiological and in vivo data on zoliflodacin. The data suggest that zoliflodacin retains potent activity against contemporary clinical isolates in the U.S., Europe, China, Thailand and South Africa that are resistant to other antibiotic classes including fluroquinolones, which was expected given its novel mechanism of action. In addition, the data show

20

significant resistance against two of the four standard antibiotics indicated for gonorrhea, ciprofloxacin, a fluoroquinolone, and azithromycin, a macrolide.

Competition

We are initially developing zoliflodacin as a single oral dose treatment for uncomplicated gonorrhea. Gonorrhea is commonly treated with 500mg intramuscular ceftriaxone, a generically available agent. Additional generic cephalosporins and fluoroquinolones are also prescribed, but not recommended as primary treatment options given current resistance rates. Gepotidacin, currently under development for a variety of infections by GlaxoSmithKline plc, is the only potentially competitive product candidate in late-stage clinical development that we are aware of that is being developed for the treatment of uncomplicated urogenital gonorrhea. A Phase 3 clinical trial (EAGLE-1) was initiated by GlaxoSmithKline in October 2019. A prior Phase 2 clinical trial revealed the emergence of resistance to gepotidacin in 2 urogenital microbiological failures following administration of a single oral dose. In an attempt to overcome this resistance, gepotidacin will be given in two oral doses in the EAGLE-1 clinical trial; a 4-tablet 3000 milligram (mg) oral dose at the study site followed by another 4-tablet 3000mg oral dose as an outpatient.

Commercial Approach

Antibiotics to treat uncomplicated gonorrhea will typically be available through primary care physicians, outpatient clinics and emergency rooms, and numerous community sites. In addition, placement on CDC guidelines has historically driven awareness and uptake in the U.S. We have partnered with GARDP who will lead the commercialization of zoliflodacin in certain WHO-defined low-income and specified middle-income countries.

Zoliflodacin is a potential single dose cure (sachet in water) that can facilitate “expedited partner therapy” at home, which may lower the chance for a repeat infection from a partner. Expedited partner therapy, or EPT, is the clinical practice of treating the sex partners of patients diagnosed with chlamydia or gonorrhea by providing prescriptions or medications to the patient to take to his/her partner without the health care provider first examining the partner. Within the United States, EPT is permissible in 45 states, potentially allowable in 4 states and is only prohibited in one state.

Manufacturing

Manufacturing of RELVAR®/BREO®ELLIPTA® (FF/VI) and ANORO® ELLIPTA® (UMEC/VI) is performed by GSK.

We rely on third-party manufacturers to produce GIAPREZA and XERAVA and expect to continue to do so in the foreseeable future to meet our development and commercial needs. In all of our manufacturing agreements, we require that contract manufacturers produce active pharmaceutical ingredients (“APIs”) and drug products in accordance with the FDA’s current Good Manufacturing Practices (“cGMPs”) and all other applicable laws and regulations. We maintain confidentiality agreements with potential and existing manufacturers in order to protect our proprietary rights related to GIAPREZA and XERAVA. The long-term commercial success of GIAPREZA and XERAVA will depend in part on the ability of our contract manufacturers to supply cGMP-compliant API and drug product without interruption.

With respect to our product candidates, we currently rely on third-party contract manufacturers for our required raw materials, drug substance, and finished drug product for our preclinical research and clinical trials. Although we have contracts with these third parties to meet our current clinical supply needs, we do not have any current contractual relationships with these third parties for the manufacture of commercial supply of our product candidates after they are approved. As our product candidates approach potential approval by any regulatory agency, we intend to enter into agreements with third-party contract manufacturers for the commercial production of those products. We currently employ internal resources to manage our manufacturing vendor relationships and processes.

Government Regulation

Government authorities in the United States, at the federal, state and local level, and in other countries extensively regulate, among other things, the research, development, testing, manufacture, packaging, storage, recordkeeping, labeling, advertising, promotion, distribution, marketing, post-approval monitoring and reporting, import and export of our products and reimbursement. The process of obtaining regulatory approvals and the subsequent compliance with applicable federal, state, local and foreign statutes and regulation require the expenditure of substantial time and financial resources.

U.S. Government Regulation

In the United States, the process of obtaining regulatory approvals and the subsequent compliance with appropriate federal, state, local statutes and regulations requires the expenditure of substantial time and financial resources. The failure to comply with the

21

applicable requirements at any time during the product development process, approval process or after approval may subject an applicant to a variety of administrative or judicial sanctions, such as the FDA’s refusal to approve pending applications, withdrawal of an approval, imposition of a clinical hold, issuance of warning letters and untitled letters, product recalls, product seizures, total or partial suspension of production or distribution injunctions, fines, refusals of government contracts, restitution, disgorgement of profits or civil or criminal penalties.

Approval Processes

In the United States, the FDA regulates drugs under the Federal Food, Drug and Cosmetic Act, or the FDCA, the Public Health Service Act, or PHSA, and implementing regulations. The process of obtaining regulatory approvals and the subsequent compliance with applicable federal, state, local and foreign statutes and regulation require the expenditure of substantial time and financial resources. Failure to comply with the FDCA and other applicable U.S. requirements at any time during the product development process, approval process or after approval may subject us to a variety of administrative or judicial sanctions, any of which could have a material adverse effect on us. These sanctions could include:

The process required by the FDA before a drug may be marketed in the United States generally involves the following:

Once a pharmaceutical candidate is identified for development, it enters the preclinical testing stage. Preclinical tests include laboratory evaluations of product chemistry, toxicity and formulation, as well as animal studies. An IND sponsor must submit the results of the preclinical tests, together with manufacturing information and analytical data, to the FDA as part of the IND. Some preclinical or nonclinical testing may continue even after the IND is submitted. In addition to including the results of the preclinical studies, the IND will also include one or more protocols detailing, among other things, the objectives of the clinical trial, the parameters to be used in monitoring safety and the effectiveness criteria to be evaluated if the first phase lends itself to an efficacy determination. The IND automatically becomes effective 30 days after receipt by the FDA, unless the FDA, within the 30-day time period, places the IND on clinical hold. In such a case, the IND sponsor and the FDA must resolve any outstanding concerns before clinical trials can begin. A clinical hold may occur at any time during the life of an IND and may affect one or more specific studies or all studies conducted u1nder the IND.

All clinical trials must be conducted under the supervision of one or more qualified investigators in accordance with cGCP. They must be conducted under protocols detailing, among other things, the objectives of the trial, dosing procedures, subject selection and

22

exclusion criteria and the safety and effectiveness criteria to be evaluated. Each protocol and any amendments must be submitted to the FDA as part of the IND, and progress reports detailing the results of the clinical trials must be submitted at least annually to the FDA and more frequently in other situations, including the occurrence of serious adverse events. An IRB at each institution participating in the clinical trial must review and approve the protocol and any amendments before a clinical trial commences or continues at that institution, approve the information regarding the clinical trial and the informed consent form that must be provided to each trial subject or his or her legal representative, monitor the study until completed and otherwise comply with IRB regulations. Information about certain clinical trials must be submitted within specific timeframes to the National Institutes of Health for public dissemination on their ClinicalTrials.gov website.

Human clinical trials are typically conducted in three sequential phases that may overlap or be combined:

Phase 1, Phase 2 and Phase 3 testing may not be completed successfully within any specified period, if at all. The FDA or the sponsor may suspend or terminate a clinical trial at any time for a variety of reasons, including a finding that the research subjects or patients are being exposed to an unacceptable health risk. Similarly, an IRB can suspend or terminate approval of a clinical trial at its institution if the clinical trial is not being conducted in accordance with the IRB’s requirements or if the drug has been associated with unexpected serious harm to patients.

During the development of a new drug, sponsors are given opportunities to meet with the FDA at certain points, including prior to submission of an IND, at the end of Phase 2 and before an NDA is submitted. Meetings at other times may also be requested. These meetings can provide an opportunity for the sponsor to share information about the data gathered to date, for the FDA to provide advice and for the sponsor and the FDA to reach agreement on the next phase of development. Sponsors typically use the end-of-Phase 2 meeting to discuss their Phase 2 clinical results and present their plans for the pivotal Phase 3 clinical trial or trials that they believe will support approval of the new drug.

The Pediatric Research Equity Act, or PREA, requires a sponsor to conduct pediatric studies for certain drugs and biologics. Specifically, PREA requires original NDAs, biologic license applications, or BLAs, and supplements thereto for a new active ingredient, new indication, new dosage form, new dosing regimen or new route of administration to contain a pediatric assessment unless the sponsor has received a deferral or waiver.

Concurrent with clinical trials, companies usually complete additional animal safety studies and must also develop additional information about the chemistry and physical characteristics of the drug and finalize a process for manufacturing the product in accordance with cGMP requirements. The manufacturing process must be capable of consistently producing quality batches of the drug candidate and the manufacturer must develop methods for testing the quality, purity and potency of the final drugs. Additionally, appropriate packaging must be selected and tested and stability studies must be conducted to demonstrate that the drug candidate does not undergo unacceptable deterioration over its shelf-life.

The results of product development, preclinical studies and clinical trials, along with descriptions of the manufacturing process, analytical tests conducted on the chemistry of the drug, proposed labeling and other relevant information are submitted to the FDA as part of an NDA requesting approval to market the product for one or more indications. The submission of an NDA is subject to the payment of user fees, but a waiver of such fees may be obtained under specified circumstances. The FDA reviews all NDAs submitted to ensure that they are sufficiently complete for substantive review before it accepts them for filing. It may request additional information rather than accept an NDA for filing. In this event, the NDA must be resubmitted with the additional information. The resubmitted application also is subject to completeness review before the FDA accepts it for filing.

Once the submission is accepted for filing, the FDA begins an in-depth review. NDAs receive either standard or priority review. A drug that, if approved, would represent a significant improvement in the safety or effectiveness of the treatment, prevention or diagnosis of a serious disease or condition may receive priority review. Requests for priority review generally must be submitted at the

23

time of NDA submission. The FDA has agreed to specified performance goals in the review process of NDAs. Under that agreement, 90% of applications seeking approval of new molecular entities, or NMEs, are meant to be reviewed within ten months from the date on which FDA accepts the NDA for filing, and 90% of applications for NMEs that have been designated for “priority review” are meant to be reviewed within six months of the filing date. For applications seeking approval of drugs that are not NMEs, the ten-month and six-month review periods run from the date that FDA receives the application. The review process may be extended by the FDA for three additional months to consider a major amendment to the application following the original submission.

The FDA reviews an NDA to determine, among other things, whether a product is safe and effective for its intended use and whether its manufacturing complies with cGMP requirements to assure and preserve the product’s safety, identity, strength, quality and purity. The FDA may refer the NDA to an advisory committee for review and recommendation as to whether the application should be approved and under what conditions. The FDA is not bound by the recommendation of an advisory committee, but it generally follows such recommendation.

Before approving an NDA, the FDA will typically inspect the facility or facilities where the product is manufactured and tested. These pre-approval inspections may cover all facilities associated with NDA submission, including drug component manufacturing (such as active pharmaceutical ingredients), finished drug product manufacturing, and control testing laboratories. Additionally, before approving an NDA, the FDA will typically inspect one or more clinical sites to assure compliance with cGCP. In addition, the FDA may require, as a condition of approval, risk evaluation and mitigation strategies, or REMS (which may include requirements for, restricted distribution and use), enhanced labeling, special packaging or labeling, expedited reporting of certain adverse events, pre-approval of promotional materials, restrictions on direct-to-consumer advertising or commitments to conduct additional research post-approval.

On the basis of the FDA’s evaluation of the NDA and accompanying information, the FDA may issue an approval letter or a complete response letter. An approval letter authorizes commercial marketing of the product with specific prescribing information for specific indications. If the FDA ultimately decides that the NDA does not satisfy the criteria for approval, the FDA will issue a complete response letter to indicate that the agency will not approve the NDA in its present form. The complete response letter usually describes all of the specific deficiencies in the NDA identified by the FDA. If a complete response letter is issued, the applicant may either resubmit the NDA, addressing all of the deficiencies identified in the letter, or withdraw the application.

Expedited Review and Approval

The FDA has various programs, including Fast Track and priority review, which are intended to expedite or simplify the process for developing and/or reviewing drugs. Even if a drug qualifies for one or more of these programs, the FDA may later decide that the drug no longer meets the conditions for qualification or that the time period for FDA review or approval will not be shortened. Generally, drugs that may be eligible for these programs are those for serious or life-threatening conditions, those with the potential to address unmet medical needs and those that offer meaningful benefits over existing treatments. For example, Fast Track is a process designed to facilitate the clinical development and expedite the review of drugs to treat serious diseases with the potential, based on nonclinical or clinical data, to fill an unmet medical need. Priority review is designed to give drugs that offer a significant improvement in safety or effectiveness of treatment for a serious condition an expedited review within eight months from the completed submission (six months from filing) as compared to a standard review time of twelve months from the completed submission (10 months from filing) for a standard new molecular entity NDA. Although Fast Track and priority review do not affect the standards for approval, the FDA will attempt to facilitate early and frequent meetings with a sponsor of a Fast Track designated drug and expedite review of the application for a drug designated for priority review.

The Generating Antibiotic Incentives Now Act, or GAIN Act, is intended to provide incentives for the development of new QIDPs. A new drug that is designated as a QIDP after a request by the sponsor that is made before an NDA is submitted will be eligible, if approved, for an additional five years of exclusivity beyond any period of exclusivity to which it would have previously been eligible. In addition, a QIDP will receive priority review and qualify for a Fast Track designation. QIDPs are defined as antibacterial or antifungal drugs intended to treat serious or life-threatening infections, including those caused by an antibacterial or antifungal resistant pathogen or qualifying pathogens identified by the FDA. XERAVA and SUL-DUR have been designated by the FDA as a QIDP. Zoliflodacin has also been designated as a QIDP by the FDA for the treatment of uncomplicated gonorrhea.

Patent Term Restoration and Data Exclusivity

Depending upon the timing, duration and specifics of FDA approval of the use of our drugs, some of our U.S. patents may be eligible for limited patent term extension under the Drug Price Competition and Patent Term Restoration Act of 1984, commonly referred to as the Hatch-Waxman Amendments. As noted above, the Hatch-Waxman Amendments permit a patent restoration term of up to five years for a single patent for an approved product as compensation for patent term lost during product development and the FDA regulatory review process. However, patent term restoration cannot extend the remaining term of a patent beyond a total of 14

24

years from the product’s approval date and only those claims covering such approved drug product, a method for using it or a method for manufacturing it may be extended. Only one patent applicable to an approved drug is eligible for the extension and the application for the extension must be submitted prior to the expiration of the patent. The USPTO, in consultation with the FDA, reviews and approves the application for any patent term extension or restoration. We have applied for restoration of patent term for one U.S. Patent covering XERAVA and, in the future, we may apply for restoration of patent term for other currently owned or licensed patents to add patent life beyond its current expiration date, depending on the expected length of the clinical trials and other factors involved in the filing of the relevant NDA.