|

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

|

||

|

FORM 20-F

|

||

|

[ ] REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

|

||

|

[ X ] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE FISCAL YEAR ENDED DECEMBER 31, 2012

OR

|

||

|

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

|

||

|

[ ] SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT of 1934

Date of event requiring this shell company report ……………………

|

||

|

For the transition period from __________ to __________.

|

||

|

Commission File No. 001-14835

|

||

|

NORTHCORE TECHNOLOGIES INC.

(Exact name of Registrant as specified in its charter)

|

||

|

Not Applicable

(Translation of Registrant’s name into English)

|

||

|

ONTARIO, CANADA

(Jurisdiction of incorporation or organization)

|

||

|

302 The East Mall, Suite 300 Toronto, Ontario M9B 6C7

(Address of principal executive offices)

|

||

|

Securities registered or to be registered pursuant to Section 12(b) of the Act.

None

|

||

|

Securities registered or to be registered pursuant to Section 12(g) of the Act.

Common Shares

|

||

|

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.

None

|

||

|

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the Annual Report.

|

||

|

234,625,479 Common Shares as of December 31, 2012

|

||

|

Indicate by check mark if the registrant is a well-known seasoned issuer as defined in Rule 405 of the Securities Act

Yes _____ No ___X___

|

||

|

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15 (d) of the Securities Exchange Act of 1934.

Yes _____ No ___X___

|

||

|

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

|

||

|

Yes X No ______

|

||

|

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

Large Accelerated filer [ ] Accelerated filer [ ] Non-accelerated filer [ X ]

|

||

|

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

U.S. GAAP [ ] International Financial Reporting Standards as issued Other [ ]

by the International Accounting Standards Board [ X ]

|

||

|

Indicate by check mark which financial statement item the registrant has elected to follow.

|

||

|

Item 17 ______ Item 18 __X__

|

||

|

If this an annual report, indicate by check mark whether the registrant is a shell company (as determined in Rule 12b-2 of the Exchange Act).

Yes ______ No __X__

|

Northcore Technologies Inc. 2

NORTHCORE TECHNOLOGIES INC.

Annual Report on Form 20-F for the Fiscal Year

Ended December 31, 2012

FORWARD LOOKING STATEMENTS

From time to time, we make oral and written statements that may be considered "forward looking statements" (rather than historical facts). We are taking advantage of the "safe-harbour" provisions of the Private Securities Litigation Reform Act of 1995 for any forward-looking statements we may make from time to time, including the forward-looking statements in this Annual Report.

You can identify these statements when you see words such as "may", "expect", "anticipate", "estimate", "believe", "intend", and other similar expressions. These forward-looking statements relate, among other items, to:

|

·

|

our future capital needs;

|

|

·

|

future expectations as to profitability and operating results;

|

|

·

|

our ability to further develop business relationships and revenues;

|

|

·

|

our expectations about the markets for our products and services;

|

|

·

|

acceptance of our products and services;

|

|

·

|

competitive factors;

|

|

·

|

our ability to maintain operating expenses;

|

|

·

|

our ability to attract and retain employees;

|

|

·

|

new products and technological changes;

|

|

·

|

our ability to develop appropriate strategic alliances;

|

|

·

|

protection of our proprietary technology;

|

|

·

|

our ability to acquire complementary products or businesses and integrate them into our business;

|

|

·

|

our ability to increase revenue from existing products and services;

|

|

·

|

our ability to expand the scope of our product offering; and

|

|

·

|

geographic expansion of our business.

|

We have based these forward-looking statements largely on our current plans and expectations. Forward-looking statements are subject to risks and uncertainties, some of which are beyond our control. Our actual results could differ materially from those described in our forward-looking statements as a result of the factors described in the “Risk Factors” included elsewhere in this Annual Report, including, among others:

|

·

|

the timing of our future capital needs and our ability to raise additional capital when needed;

|

|

·

|

increasingly longer sales cycles;

|

|

·

|

potential fluctuations in our financial results and our difficulties in forecasting;

|

|

·

|

volatility of the stock markets and fluctuations in the market price of our stock;

|

|

·

|

the ability to buy and sell our shares on the Over the Counter Bulletin Board;

|

|

·

|

our ability to compete with other companies in our industry;

|

|

·

|

our dependence upon a limited number of customers;

|

|

·

|

our ability to retain and attract key personnel;

|

|

·

|

risk of significant delays in product development;

|

|

·

|

failure to timely develop or license new technologies;

|

|

·

|

risks relating to any requirement to correct or delay the release of products due to software bugs or errors;

|

|

·

|

risk of system failure or interruption;

|

|

·

|

risks associated with any further dramatic expansions and retractions in the future;

|

|

·

|

risks associated with international operations;

|

Northcore Technologies Inc. 3

|

·

|

problems which may arise in connection with the acquisition or integration of new businesses, products, services, technologies or other strategic relationships;

|

|

·

|

risks associated with protecting our intellectual property, and potentially infringing the intellectual property rights of others;

|

|

·

|

fluctuations in currency exchanges;

|

|

·

|

risks to holders of our common shares following any issuance of our preferred shares; and

|

|

·

|

the ability to enforce legal claims against us or our officers or directors.

|

We do not have, and do not undertake, any obligation to publicly update or revise any forward-looking statements contained in this Annual Report, whether as a result of new information, future events or otherwise. Because of these risks and uncertainties, the forward-looking statements and circumstances discussed in this Annual Report might not transpire.

Trademarks or trade names, which we own and are used in this Annual Report, include: DYN@MIC BUYER™, DYN@MIC SELLER™ and WORKING CAPITAL ENGINE™. Each trademark, trade name, or service mark of any other company appearing in this Annual Report belongs to its holder.

Northcore Technologies Inc. 4

TABLE OF CONTENTS

|

Page

|

||

|

PART I

|

7

|

|

|

ITEM 1 - IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISORS

|

7

|

|

|

ITEM 2 - OFFER STATISTICS AND EXPECTED TIMETABLE

|

7

|

|

|

ITEM 3 - KEY INFORMATION

|

7

|

|

| A. Selected Financial Data |

7

|

|

| B. Capitalization and Indebtedness |

10

|

|

| C. Reasons For The Offer And Use Of Proceeds |

10

|

|

| D. Risk Factors |

10

|

|

|

ITEM 4 - INFORMATION ON THE COMPANY

|

17

|

|

| A. History and Development of the Company |

17

|

|

| B. Business Overview |

21

|

|

| C. Organizational Structure |

30

|

|

| D. Property, Plant and Equipment | ||

| ITEM 4A - UNRESOLVED STAFF COMMENTS |

31

|

|

|

ITEM 5 - OPERATING AND FINANCIAL REVIEW AND PROSPECTS -

|

||

| 31 | ||

| MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | ||

| A. Operating Results | 32 | |

| B. Liquidity and Capital Resources | 37 | |

| C. Research and Development, Patents, and Licenses, Etc. | 40 | |

| D. Trend Information | 40 | |

| E. Off-Balance Sheet Arrangements | 41 | |

| F. Tabular Disclosure of Contractual Obligations | 41 | |

| ITEM 6 - DIRECTORS, SENIOR MANAGEMENT AND EMPLOYEES | 41 | |

| A. Directors And Senior Management | 41 | |

| B. Compensation | 43 | |

| C. Board Practices | 44 | |

| C.1. Audit Committee Information | 45 | |

| D. Employees | 47 | |

| E. Share Ownership | 47 | |

| ITEM 7 - MAJOR SHAREHOLDERS AND RELATED PARTY TRANSACTIONS | 47 | |

| A. Major Shareholders | 47 | |

| B. Related Party Transactions | 48 | |

| ITEM 8 - FINANCIAL INFORMATION | 48 | |

| ITEM 9 - THE OFFER AND LISTING | 48 | |

Northcore Technologies Inc. 5

|

ITEM 10 - ADDITIONAL INFORMATION

|

51

|

|

| A. Share Capital |

51

|

|

| B. Memorandum and Articles of Association |

51

|

|

| C. Material Contracts |

54

|

|

| D. Exchange Controls |

55

|

|

| E. Taxation |

55

|

|

| F. Dividends and Paying Agents |

61

|

|

| G. Statements by Experts | 60 | |

| H. Documents on Display |

61

|

|

| I. Subsidiary Information | 61 | |

| ITEM 11 - QUANTITATIVE AND QUALITATIVE DISCLOSURE ABOUT MARKET RISK |

61

|

|

|

ITEM 12 - DESCRIPTION OF SECURITIES OTHER THAN EQUITY SECURITIES

|

61

|

|

|

PART II

|

61

|

|

|

ITEM 13 - DEFAULTS, DIVIDEND ARREARAGES AND DELINQUENCIES

|

61

|

|

|

ITEM 14 - MATERIAL MODIFICATIONS TO THE RIGHTS OF SECURITY HOLDERS AND USE OF PROCEEDS

|

61 | |

| ITEM 15 - CONTROLS AND PROCEDURES | 61 | |

| ITEM 16 [RESERVED] | 63 | |

| ITEM 16 | 63 | |

| A. Audit Committee Financial Expert | 63 | |

| B. Code of Ethics | 63 | |

| C. Principal Accountant Fees and Services | 63 | |

| D. Exemptions from the Listing Standards For Audit Committees | 63 | |

| E. Purchases of Equity Securities by the Issuer and Affiliated Purchasers | 64 | |

|

PART III

|

64

|

|

|

ITEM 17 - FINANCIAL STATEMENTS

|

64

|

|

| ITEM 18 - FINANCIAL STATEMENTS - FINANCIAL STATEMENTS |

64

|

|

| ITEM 19 - EXHIBITS | 64 | |

Northcore Technologies Inc. 6

Unless otherwise indicated, all references in this Annual Report to “dollars” or “$” are references to Canadian dollars. Our financial statements are expressed in Canadian dollars. Except as otherwise noted, certain financial information presented in this Annual Report has been translated from Canadian dollars to U.S. dollars at an exchange rate of Cdn$0.9958 to US$1.00 (or US$1.0042 to Cdn$1.00), the noon buying rate in New York City on December 31, 2012 for cable transfers in Canadian dollars as certified for customs purposes by the Federal Reserve Bank of New York. These translations are not intended to suggest that Canadian dollars have been or could be converted into U.S. dollars at that or any other rate.

PART I

ITEM 1 - IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISORS

Not applicable.

ITEM 2 - OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable.

ITEM 3 - KEY INFORMATION

|

A.

|

SELECTED FINANCIAL DATA

|

The selected financial data set forth below should be read in conjunction with, and is qualified by reference to, our consolidated financial statements and the related notes, and the section "Operating and Financial Review and Prospects" included elsewhere in this Annual Report. The consolidated statement of operations data for the years ended December 31, 2012, 2011 and 2010 and consolidated statements of financial position data as of December 31, 2012 and 2011, as set forth below, are derived from our audited consolidated financial statements and the related notes included elsewhere in this Annual Report in accordance with International Financial Reporting Standards. The consolidated statement of operations and comprehensive loss data for the years ended December 31, 2009 and 2008 and the consolidated statements of financial positions data as at December 31, 2009 and 2008 have been derived from our audited consolidated financial statements for those years in accordance with Canadian generally accepted accounting principles and reconciled to accounting principles generally accepted in the United States of America, which are not included in this Annual Report but have previously been filed with the Commission.

Basis of Presentation

The accompanying consolidated financial statements have been prepared in accordance with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB”). These consolidated financial statements have been prepared on a historical cost basis other than certain financial assets and liabilities measured at fair value.

The Company’s consolidated financial statements were previously prepared in accordance with Canadian generally accepted accounting principles (“previous GAAP”). The adoption of IFRS has not had a material impact on the Company’s operations, strategic decisions, cash flow and capital expenditures.

Northcore Technologies Inc. 7

Historical results are not necessarily indicative of results to be expected for any future period.

| Year Ended December 31, | ||||||||||||

|

2012

(Cdn$)

|

2011

(Cdn$)

|

2010

(Cdn$)

|

||||||||||

|

IFRS

|

||||||||||||

|

(in thousands except for per share amounts)

|

||||||||||||

|

Consolidated Statement of Operations and Comprehensive Loss

|

||||||||||||

|

Revenues

|

1,362 | 785 | 582 | |||||||||

|

Income from GE Asset Manager, LLC

|

82 | 69 | 43 | |||||||||

|

Operating expenses:

|

||||||||||||

|

General and administrative

|

1,685 | 1,670 | 1,440 | |||||||||

|

Customer service and technology

|

1,113 | 726 | 734 | |||||||||

|

Sales and marketing

|

225 | 260 | 188 | |||||||||

|

Stock-based compensation

|

425 | 1,873 | 517 | |||||||||

|

Depreciation

|

61 | 32 | 22 | |||||||||

|

Finance costs

|

- | 227 | 269 | |||||||||

|

Other expenses (net)

|

- | - | 487 | |||||||||

|

Total expenses

|

3,509 | 4,788 | 3,657 | |||||||||

|

Loss from operations before income taxes

|

(2,065 | ) | (3,934 | ) | (3,032 | ) | ||||||

|

Recovery of income taxes

|

(36 | ) | - | - | ||||||||

|

LOSS AND COMPREHENSIVE LOSS FOR THE YEAR

|

(2,029 | ) | (3,934 | ) | (3,032 | ) | ||||||

|

Loss per share (1)

|

(0.009 | ) | (0.020 | ) | (0.019 | ) | ||||||

|

Weighted average number of common shares

|

232,715 | 196,180 | 162,899 | |||||||||

|

As at December 31,

|

||||||||||||

|

2012

(Cdn$)

|

2011

(Cdn$)

|

2010

(Cdn$)

|

||||||||||

|

IFRS

|

||||||||||||

|

(in thousands)

|

||||||||||||

|

Consolidated Statement of Financial Position (2)

|

||||||||||||

|

Total assets

|

2,715 | 2,909 | 284 | |||||||||

|

Total Liabilities

|

868 | 415 | 1,857 | |||||||||

|

Shareholders’ equity (deficiency)

|

1,847 | 2,494 | (1,573 | ) | ||||||||

|

Total liabilities and shareholders’ equity

|

2,715 | 2,909 | 284 | |||||||||

(1) For each fiscal year, the Company excluded the effect of all convertible debt, stock options and share-purchase warrants in the calculation of diluted loss per share, as their impact would have been anti-dilutive.

(2) The Company has not paid dividend since its formation.

Northcore Technologies Inc. 8

Historical results are not necessarily indicative of results to be expected for any future period.

|

Year Ended December 31,

|

||||||||

|

2009

(Cdn$)

|

2008

(Cdn$)

|

|||||||

|

(CANADIAN GAAP)

|

||||||||

|

(in thousands except for per share amounts)

|

||||||||

|

Consolidated Statement of Operations and Comprehensive Loss

|

||||||||

|

Revenues

|

759 | 741 | ||||||

|

Operating expenses:

|

||||||||

|

General and administrative

|

1,269 | 1,485 | ||||||

|

Customer service and technology

|

738 | 689 | ||||||

|

Sales and marketing

|

181 | 117 | ||||||

|

Stock-based compensation

|

183 | 43 | ||||||

|

Depreciation

|

29 | 33 | ||||||

|

Finance costs

|

768 | 729 | ||||||

|

Other expenses (net)

|

- | - | ||||||

|

Total expenses

|

3,168 | 3,096 | ||||||

|

Loss from operations

|

(2,409 | ) | (2,355 | ) | ||||

|

Loss per share (1)

|

(0.02 | ) | (0.02 | ) | ||||

|

|

||||||||

|

Weighted average number of common shares

|

140,434 | 108,861 | ||||||

|

Consolidated Statement of Operations Data (U.S. GAAP): (3)

|

||||||||

|

Loss for the year as reported under U.S. GAAP

|

$ | (2,285 | ) | $ | (2,204 | ) | ||

|

As at December 31,

|

||||||||

|

2009

(Cdn$)

|

2008

(Cdn$)

|

|||||||

|

(CANADIAN GAAP)

|

||||||||

|

(in thousands)

|

||||||||

|

Consolidated Statement of Financial Position (2)

|

||||||||

|

Total assets

|

1,105 | 812 | ||||||

|

Shareholders’ equity (deficiency)

|

(16 | ) | (2,403 | ) | ||||

|

Total liabilities and shareholders’ equity

|

1,105 | 812 | ||||||

|

Consolidated Balance Sheet Data

(U.S. GAAP): (3)

|

||||||||

|

Total assets

|

872 | 731 | ||||||

|

Shareholders’ deficiency

|

(3,283 | ) | (2,037 | ) | ||||

(1) For each fiscal year, the Company excluded the effect of all convertible debt, stock options and share-purchase warrants in the calculation of diluted loss per share, as their impact would have been anti-dilutive.

(2) The Company has not paid dividend since its formation.

(3) The significant differences between Canadian GAAP and U.S. GAAP arise primarily from the accounting differences relating to the secured subordinated notes issued.

(4) The financial data for the years ended December 31, 2009 and 2008 shown separately from 2012, 2011 and 2010 as the information is not comparable with the data presented based on IFRS.

Northcore Technologies Inc. 9

EXCHANGE RATES

The following tables set forth, for the periods indicated, certain exchange rates based on the noon buying rate in New York City for cable transfers in Canadian dollars, as certified for customs purposes by the Federal Reserve Bank of New York. Such rates are the number of U.S. dollars per one Canadian dollar and are the inverse of the rates quoted by the Federal Reserve Board of New York for Canadian Dollars per U.S. $1.00. On February 28, 2013, the exchange rate was CAD$1.00 = US$0.9721.

|

Year Ended December 31,

|

||||||

|

Rate

|

2012

|

2011

|

2010

|

2009

|

2008

|

|

|

Average during year (1)

|

1.0005

|

1.0151

|

0.9663

|

0.8799

|

0.9297

|

|

|

(1) The average rate is the average of the exchange rates on the last day of each month during the year.

|

||||||

|

Month

|

High during month

|

Low during month

|

|

September 2012

|

1.0299

|

1.0100

|

|

October 2012

|

1.0243

|

0.9859

|

|

November 2012

|

1.0074

|

0.9993

|

|

December 2012

|

1.0162

|

1.0059

|

|

January 2013

|

1.0164

|

0.9923

|

|

February 2013

|

1.0041

|

0.9722

|

|

B.

|

CAPITALIZATION AND INDEBTEDNESS

|

Not applicable.

|

C.

|

REASONS FOR THE OFFER AND USE OF PROCEEDS.

|

Not applicable.

|

D.

|

RISK FACTORS

|

The following is a summary of certain risks and uncertainties, which we face in our business. This summary is not meant to be exhaustive. These Risk Factors should be read in conjunction with other cautionary statements, which we make in this Annual Report and in our other public reports, registration statements and public announcements.

WE WILL NEED ADDITIONAL CAPITAL AND IF WE ARE UNABLE TO SECURE ADDITIONAL FINANCING WHEN WE NEED IT, WE MAY BE REQUIRED TO SIGNIFICANTLY CURTAIL OR CEASE OUR OPERATIONS

We have not yet realized profitable operations and have relied on non-operational sources of financing to fund our operations. Since we began our operations, we have been funded primarily through the sale of securities to investors in a series of private placements, convertible debt instruments, sales of equity to, and investments from, strategic partners, gains from investments, option exercises, a rights offering and, to a limited extent, through cash flow from operations. While our Company’s consolidated financial statements for the year-ended December 31, 2012, have been prepared on the basis of accounting principles applicable to a going concern, certain adverse conditions and events cast substantial doubt upon the validity of this assumption. Our ability to continue as a going concern will be dependent on management’s ability to successfully execute its business plan including a substantial increase in revenue as well as maintaining operating expenses at or near the same level as 2012. We cannot provide assurance that we will be able to execute on our business plan or assure that efforts to raise additional financings would be successful.

Northcore Technologies Inc. 10

Management believes that continued existence beyond 2012 is dependent on its ability to increase revenue from existing products, and to expand the scope of its product offering which entails a combination of internally developed software and partnerships with third parties. Management further believes that ability to raise additional financing during 2013 is also critical for continued existence of the Company. As of December 31, 2012, we had cash and short-term investments of $62,000.

We do not have any committed sources of additional financing at this time and we are uncertain whether additional funding will be available when we need it on terms that will be acceptable to us. If we are not able to obtain financing when we need it, we would be unable to carry out our business plan and would have to significantly curtail or cease our operations. We have included in Note 2 to our consolidated financial statements for the year ended December 31, 2012, a discussion about our ability to continue as a going concern. Potential sources of financing include strategic relationships, public or private sales of our shares, debt, convertible securities or other arrangements. If we raise funds by selling additional shares, including common shares or other securities convertible into common shares, the ownership interests of our existing shareholders will be diluted. If we raise funds by selling preferred shares, such shares may carry more voting rights, higher dividend payments or more favorable rights upon distribution than those for the common shares. If we incur debt, the holders of such debt may be granted security interests in our assets. Because of our potential long-term capital requirements, we may seek to access the public or private equity or debt markets whenever conditions are favorable, even if we do not have an immediate need for additional capital at that time. If we fail to obtain financing when we need it, it would have a material adverse effect on our business, financial condition, cash flows and results of operations.

WE ARE NOT PROFITABLE AND WE MAY NEVER BECOME PROFITABLE

We have accumulated losses of $125 million as of December 31, 2012. For the year ended December 31, 2012 our loss was $2.029 million. We have never been profitable and expect to continue to incur losses for the foreseeable future. We cannot assure you that we will earn profits or generate positive cash flows from operations in the future.

WE MAY EXPERIENCE INCREASINGLY LONGER SALES CYCLES

A significant portion of our revenue in any quarter is derived from a relatively small number of contracts. We often experience sales cycles of six (6) to eighteen (18) months. If the length of our sales cycles increases, our revenues may decrease and our quarterly results would be adversely affected. In addition, our current and future expense levels are based largely on our investment plans and estimates of future revenues and are, to a large extent, fixed. We may be unable to adjust spending in a timely manner to compensate for any unexpected revenue shortfall. Any significant shortfall in revenues relative to our planned expenditures would have a material adverse effect on our business, financial condition, cash flows and results of operations.

POTENTIAL FLUCTUATIONS IN OUR FINANCIAL RESULTS MAKE FINANCIAL FORECASTING DIFFICULT

Our operating results have varied on a quarterly basis in the past and may fluctuate significantly as a result of a variety of factors, many of which are outside our control. Factors that may affect our quarterly operating results include:

|

·

|

General economic conditions as well as economic conditions specific to our industry;

|

|

·

|

Long sales cycles, which characterize our industry;

|

|

·

|

Implementation delays, which can affect payment and recognition of revenue;

|

|

·

|

Any decision by us to reduce prices for our solutions in response to price reductions by competitors;

|

|

·

|

The amount and timing of operating costs and capital expenditures relating to monitoring or expanding our business, operations and infrastructure; and

|

|

·

|

The timing of, and our ability to integrate, any future acquisition, technologies or products or any strategic investments or relationships into which we may enter.

|

Northcore Technologies Inc. 11

Due to these factors, our quarterly revenues and operating results are difficult to forecast. We believe that period-to-period comparisons of our operating results may not be meaningful and should not be relied upon as an indication of future performance. In addition, it is likely that in one or more future quarters, our operating results will fall below the expectations of securities analysts and investors. In such event, the trading price of our common shares would almost certainly be materially adversely affected.

OUR SHARE PRICE HAS FLUCTUATED SUBSTANTIALLY AND MAY CONTINUE TO DO SO

The trading price of our common shares on The Toronto Stock Exchange and on the Nasdaq Over the Counter Bulletin Board (“OTCBB”) has fluctuated significantly in the past and could be subject to wide fluctuations in the future. The market prices for securities of technology companies have been highly volatile. These companies have experienced extreme price and volume fluctuations that have often been unrelated or disproportionate to their operating performance. Broad market and industry factors may materially and adversely affect the market price of our common shares, regardless of our operating performance. In addition, fluctuations in our operating results and concerns regarding our competitive position can have an adverse and unpredictable effect on the market price of our shares.

In the past, following periods of volatility in the market price of a company’s securities, securities class-action litigation has often been instituted against that company. Such litigation, if instituted against us, could result in substantial costs and a diversion of management’s attention and resources, which could have a material adverse effect on our business, results of operations, cash flow, financial condition and prospects. If we do not prevail in any such action, which may be brought, we could be forced to pay damages.

THE ABILITY TO BUY OR SELL OUR COMMON SHARES ON THE OTCBB MAY BE LIMITED

Our common shares trade on the OTCBB. The OTCBB is generally considered to be a less efficient market than the Nasdaq National Market or the Nasdaq SmallCap Market on which our shares previously traded. As a result, the ability to buy or sell our common shares on the OTCBB may be limited. In addition, since our shares are no longer listed on the Nasdaq National Market or Nasdaq SmallCap Market, our shares may be subject to the “penny stock” regulations described below. De-listing from the Nasdaq National Market and the Nasdaq SmallCap Market does not affect the listing of our common shares on The Toronto Stock Exchange.

OUR COMMON SHARES ARE SUBJECT TO “PENNY STOCK” REGULATIONS WHICH MAY AFFECT YOUR ABILITY TO BUY OR SELL OUR COMMON SHARES

Our shares are characterized as “penny stocks” which may severely affect market liquidity. The Securities Enforcement and Penny Stock Reform Act of 1990 require additional disclosure relating to the market for penny stocks in connection with trades in any stock defined as a penny stock.

Securities and Exchange Commission regulations generally define a penny stock to be an equity security that has a market price of less than US$5.00 per share, subject to certain exceptions. The regulations require, prior to any transaction involving a penny stock, delivery of a disclosure schedule explaining the penny stock market and the risks associated therewith. The penny stock regulations may adversely affect the market liquidity of our common shares by limiting the ability of broker/dealers to trade the shares and the ability of purchasers of our common shares to sell in the secondary market. Certain institutions and investors will not invest in penny stocks.

THE MARKETS IN WHICH WE OPERATE ARE HIGHLY COMPETITIVE

The market for asset lifecycle management solutions is rapidly evolving and intensely competitive. We face significant competition in each segment of our business (asset sourcing, procurement, asset management and asset disposition). We expect that competition will further intensify as larger existing companies expand their product lines and industry consolidation accelerates.

Many of our competitors have longer operating histories, larger customer bases, greater brand recognition and significantly greater financial, marketing and other resources than we. We cannot be certain that we will be able to compete with them effectively. If we fail to do so, it would have a material adverse effect on our business, financial condition, cash flows and results of operations.

Northcore Technologies Inc. 12

IMPACT OF CURRENT GLOBAL ECONOMIC CONDITIONS

Recently, global financial markets and economic conditions have been, and may continue to be, disrupted and volatile. As a result of concerns about the stability of financial markets generally and the solvency of creditors specifically, the cost of obtaining money from the credit markets generally has increased as many lenders and institutional investors have increased interest rates, enacted tighter lending standards, refused to refinance existing debt on terms similar to current debt and in some cases, ceased to provide funding to borrowers. Concerns about the current economic situation may also have the effect of tightening the equity markets making any equity based financing which we may desire to undertake difficult to obtain, or obtainable only on terms and conditions which we may find burdensome or unacceptable. These issues, along with the current weak economic conditions have made, and may continue to make, it more difficult for us to obtain necessary funding on reasonable and competitive terms, and as a result, our ability to continue our businesses, pursue improvements, and continue future growth may be limited or curtailed. In addition, current weak economic conditions may negatively impact our customers’ ability to obtain financing and fund their businesses. As a result, we may incur decreases in sales, which will negatively impact our revenue.

WE DEPEND HEAVILY ON A SMALL NUMBER OF CUSTOMERS, AND IF WE LOSE ANY OF THEM OR THEY REDUCE THEIR BUSINESS WITH US, WE WOULD LOSE A SUBSTANTIAL PORTION OF OUR REVENUES

In 2012, one customer accounted for 31 percent (2011- two customers accounted for 50 percent and 31 percent, respectively) of total revenues. If our relationships with any of these customers is severed or meaningfully altered, we would experience a significant decline in our performance, particularly through reduced revenues, which would have a material adverse effect on our business, financial condition, cash flows and results of operations.

WE MAY NOT BE ABLE TO RETAIN OR ATTRACT THE HIGHLY SKILLED PERSONNEL WE NEED

Our success is substantially dependent on the ability and experience of our senior management and other key personnel. We do not have long-term employment agreements with any of our key personnel and maintain no “key person” life insurance policies.

We may need to hire new or additional personnel to respond to attrition or future growth of our business. However, there is significant competition for qualified personnel. We cannot be certain we will be able to retain existing personnel or hire additional, qualified personnel when needed.

SIGNIFICANT DELAYS IN PRODUCT DEVELOPMENT WOULD HARM OUR REPUTATION AND RESULT IN LOSS OF REVENUE

If we experience significant product development delays, our position in the market would be harmed, and our revenues could be substantially reduced, which would adversely affect our operating results. As a result of the complexities inherent in our software, major new product enhancements and new products often require long development and test periods before they are released. On occasion, we have experienced delays in the scheduled release date of new or enhanced products, and we may experience delays in the future. Delays may occur for many reasons, including an inability to hire a sufficient number of developers, discovery of bugs and errors or a failure of our current or future products to conform to industry requirements. Any such delay, or the failure of new products or enhancements in achieving market acceptance, could materially impact our business and reputation and result in a decrease in our revenues.

Northcore Technologies Inc. 13

WE MAY HAVE TO EXPEND SIGNIFICANT RESOURCES TO KEEP PACE WITH RAPID TECHNOLOGICAL CHANGE

Our industry is characterized by rapid technological change, changes in user and customer requirements, frequent new service or product introductions embodying new technologies and the emergence of new industry standards and practices. Any of these could hamper our ability to compete or render our proprietary technology obsolete. Our future success will depend, in part, on our ability to:

|

·

|

Develop new proprietary technology that addresses the increasingly sophisticated and varied needs of our existing and prospective customers;

|

|

·

|

Anticipate and respond to technological advances and emerging industry standards and practices on a timely and cost-effective basis;

|

|

·

|

Continually improve the performance, features and reliability of our products in response to evolving market demands; and

|

|

·

|

License leading technologies.

|

We may be required to make substantial expenditures to accomplish the foregoing or to modify or adapt our services or infrastructure. If we are unable to do so, it would have a material adverse effect on our business, financial condition, cash flows and results of operations.

OUR BUSINESS COULD BE SUBSTANTIALLY HARMED IF WE HAVE TO CORRECT OR DELAY THE RELEASE OF PRODUCTS DUE TO SOFTWARE BUGS OR ERRORS

We sell complex software applications and services. Our applications may contain undetected errors or bugs when first introduced or as new versions are released. Our software products may also contain undetected viruses. Further, software we license from third parties and incorporate into our products may contain errors, bugs or viruses. Errors, bugs and viruses may result in any of the following:

|

·

|

Adverse customer reactions;

|

|

·

|

Negative publicity regarding our business and our products;

|

|

·

|

Harm to our reputation;

|

|

·

|

Loss of or delay in market acceptance;

|

|

·

|

Loss of revenue or required product changes;

|

|

·

|

Diversion of development resources and increased development expenses;

|

|

·

|

Increased service and warranty costs;

|

|

·

|

Legal action by our customers; and

|

|

·

|

Increased insurance costs.

|

SYSTEMS DEFECTS, FAILURES OR BREACHES OF SECURITY COULD CAUSE A SIGNIFICANT DISRUPTION TO OUR BUSINESS, DAMAGE OUR REPUTATION AND EXPOSE US TO LIABILITY

We host certain websites and applications for our customers. Our systems are vulnerable to a number of factors that may cause interruptions in our ability to enable or host solutions for third parties, including, among others:

|

·

|

Damage from human error, tampering and vandalism;

|

|

·

|

Breaches of security;

|

|

·

|

Fire and power losses;

|

|

·

|

Telecommunications failures and capacity limitations; and

|

|

·

|

Software or hardware defects.

|

Northcore Technologies Inc. 14

Despite the precautions we have taken and plan to take, the occurrence of any of these events or other unanticipated problems could result in service interruptions, which could damage our reputation, and subject us to loss of business and significant repair costs. Certain of our contracts require that we pay penalties or permit a customer to terminate the contract if we are unable to maintain minimum performance levels. Although we continue to take steps to enhance the security of our systems and ensure that appropriate back-up systems are in place, our systems are not now, nor will they ever be, fully secure.

OUR BUSINESS HAS UNDERGONE DRAMATIC EXPANSION AND RETRACTION PHASES SINCE OUR FORMATION. WE MAY NOT BE ABLE TO MANAGE FURTHER DRAMATIC EXPANSIONS AND RETRACTIONS IN THE FUTURE

Our business has undergone dramatic expansion and retraction since our formation, which has placed significant strain on our management resources. If we should grow or retract dramatically in the future, there may be further significant demands on our management, administrative, operating and financial resources. In order to manage these demands effectively, we will need to expand and improve our operational, financial and management information systems and motivate, manage and retain employees. We cannot assure you that we will be able to do so, that our management, personnel or systems will be adequate, or that we will be able to achieve levels of revenue commensurate with the resulting levels of operating expenses.

SALES TO CUSTOMERS OUTSIDE CANADA ACCOUNT FOR A SIGNIFICANT PORTION OF OUR REVENUE, WHICH EXPOSES US TO CERTAIN RISKS

While we currently operate out of Canada, many of our customers are based outside of Canada. There are risks inherent in doing business outside Canada, including:

|

·

|

Differing laws and regulatory requirements;

|

|

·

|

Political and economic risks;

|

|

·

|

Currency and foreign exchange fluctuations and controls;

|

|

·

|

Tariffs, customs, duties and other trade barriers;

|

|

·

|

Longer payment cycles and problems in collecting accounts receivable;

|

|

·

|

Potentially adverse tax consequences; and

|

|

|

Any of these risks could adversely affect the success of our business;

|

ACQUISITIONS OF COMPANIES OR TECHNOLOGIES MAY RESULT IN DISRUPTIONS TO OUR BUSINESS AND/OR DISTRACTIONS FOR OUR MANAGEMENT

In the future, we may seek to acquire other businesses or make investments in complementary businesses or technologies. We may not be able to acquire or manage additional businesses profitably or successfully integrate any acquired businesses with our business. Businesses that we acquire may have liabilities that we underestimate or do not discover during our pre-acquisition investigations. Certain liabilities, even if we do not expressly assume them, may be imposed on us as the successor to the business. Further, each acquisition may involve other special risks that could cause the acquired businesses to fail to meet our expectations. For example:

|

·

|

The acquired businesses may not achieve expected results;

|

|

·

|

We may not be able to retain key personnel of the acquired businesses;

|

|

·

|

We may incur substantial, unanticipated costs, delays or other operational or financial problems when we try to integrate businesses we acquire with our own;

|

|

·

|

Our management’s attention may be diverted; or

|

|

·

|

Our management may not be able to manage the combined entity effectively or to make acquisitions and grow our business internally at the same time.

|

The occurrence of one or more of these factors could have a material adverse effect on our business, financial condition, cash flows and results of operations. In addition, we may incur debt or issue equity securities to pay for any future acquisitions or investments, which could dilute the ownership interest of our existing shareholders.

Northcore Technologies Inc. 15

IF WE ARE UNABLE TO SUCCESSFULLY PROTECT OUR INTELLECTUAL PROPERTY OR OBTAIN CERTAIN LICENSES, OUR COMPETITIVE POSITION MAY BE WEAKENED

Our performance and ability to compete are dependent in part on our technology. We rely on a combination of patent, copyright, trademark and trade secret laws as well as confidentiality agreements and technical measures, to establish and protect our rights in the technology we develop. We cannot guarantee that any patents issued to us will afford meaningful protection for our technology. Competitors may develop similar technologies which do not conflict with our patents. Others may challenge our patents and, as a result, our patents could be narrowed or invalidated.

Our software is protected by common law copyright laws, as opposed to registration under copyright statutes. Common law protection may be narrower than that which we could obtain under registered copyrights. As a result, we may experience difficulty in enforcing our copyrights against certain third parties. The source code for our proprietary software is protected as a trade secret. As part of our confidentiality protection procedures, we generally enter into agreements with our employees and consultants and limit access to, and distribution of, our software, documentation and other proprietary information. We cannot assure you that the steps we take will prevent misappropriation of our technology or that agreements entered into for that purpose will be enforceable. In order to protect our intellectual property, it may be necessary for us to sue one or more third parties. While this has not been necessary to date, there can be no guarantee that we will not be required to do so in future to protect our rights. The laws of other countries may afford us little or no protection for our intellectual property.

We also rely on a variety of technology that we license from third parties, including our database and Internet server software, which is used to perform key functions. These third-party technology licenses may not continue to be available to us on commercially reasonable terms, or at all. If we are unable to maintain these licenses or obtain upgrades to these licenses, we could be delayed in completing or prevented from offering some products or services.

OTHERS COULD CLAIM THAT WE INFRINGE ON THEIR INTELLECTUAL PROPERTY RIGHTS, WHICH MAY RESULT IN COSTLY AND TIME-CONSUMING LITIGATION

Our success will also depend partly on our ability to operate without infringing upon the proprietary rights of others, as well as our ability to prevent others from infringing on our proprietary rights. We may be required at times to take legal action in order to protect our proprietary rights. Also, from time to time, we may receive notice from third parties claiming that we infringe their patent or other proprietary rights. In the past, a certain third party claimed that certain of our technology infringed their intellectual property rights. The claim with the particular third party has been resolved in a prior period through a licensing arrangement. There can be no assurances that other third parties will not make similar claims in the future.

We believe that infringement claims will increase in the technology sector as competition intensifies. Despite our best efforts, we may be sued for infringing on the patent or other proprietary rights of others. Such litigation is costly, and even if we prevail, the cost of such litigation could harm us. If we do not prevail or cannot fund a complete defense, in addition to any damages we might have to pay, we could be required to stop the infringing activity or obtain a license. We cannot be certain that any required license would be available to us on acceptable terms, or at all. If we fail to obtain a license, or if the terms of a license are burdensome to us, this could have a material adverse effect on our business, financial condition, cash flows and results of operations.

WE ARE SUBJECT TO RISKS ASSOCIATED WITH EXCHANGE RATE FLUCTUATIONS

The Company’s revenue from software licensing and related services and e-commerce enabling agreements is transacted in various currencies including the Canadian dollar and U.S. dollar. As the majority of our revenues are realized in U.S. dollar and our expenses are transacted in Canadian dollar, the appreciation of the U.S. dollar against the Canadian dollar may have a favorable impact on our results. The Company does not use derivative instruments to manage exposure to foreign exchange fluctuations. Fluctuations in the exchange rates of these currencies or the exchange rate of other currencies against the Canadian dollar could have a material adverse effect on our business, financial condition, cash flows and results of operations.

Northcore Technologies Inc. 16

OUR PREFERRED SHARES COULD PREVENT OR DELAY A TAKEOVER THAT SOME OR A MAJORITY OF SHAREHOLDERS CONSIDER FAVORABLE

Our Board of Directors, without any further vote of our shareholders, may issue preferred shares and determine the price, preferences, rights and restrictions of those shares. The rights of the holders of common shares will be subject to, and may be adversely affected by, the rights of the holders of any series of preferred shares that may be issued in the future. That means, for example, that we can issue preferred shares with more voting rights, higher dividend payments or more favorable rights upon distribution than those for our common shares. If we issue certain types of preferred shares in the future, it may also be more difficult for a third party to acquire a majority of our outstanding voting shares and such issuance may, in certain circumstances, deter or delay mergers, tender offers or other possible transactions that may be favored by some or a majority of our shareholders.

IT MAY BE DIFFICULT FOR YOU TO ENFORCE LEGAL CLAIMS AGAINST US OR OUR OFFICERS OR DIRECTORS

We are incorporated under the laws of the Province of Ontario, Canada. All of our directors and officers are residents of Canada and substantially all of our assets and the assets of such persons are located outside the United States. As a result, it may be difficult for holders of common shares to effect service of legal process within the United States upon those directors and officers who are not residents of the United States. It may also be difficult to realize in the United States upon judgments of courts of the United States without enforcing such judgments in our home jurisdiction or the jurisdiction of residence of the director or officer concerned.

ITEM 4 - INFORMATION ON THE COMPANY

A. HISTORY AND DEVELOPMENT OF THE COMPANY

Northcore Technologies Inc. (“Northcore, or the “Company”) was formed pursuant to the Business Corporations Act (Ontario). The business began as Internet Liquidators Inc. (“IL Inc.”), a business corporation formed under the laws of Ontario, Canada, in September 1995 and after a series of corporate reorganizations, as described below, developed into the present Company.

In May 1996, Internet Liquidators International Inc. (“ILI Inc.”), also an Ontario company, acquired all of the shares of IL Inc. The two companies, IL Inc. and ILI Inc., were amalgamated on January 9, 1997. By articles of amendment dated June 25 1998, the name of ILI Inc. was changed to Bid.Com International Inc.

On October 11, 2001, Bid.Com acquired substantially all of the shares of ADB Systemer ASA, a public limited liability company organized under the laws of the Kingdom of Norway. As part of the acquisition of ADB Systemer, Bid.Com completed a two for one share consolidation and changed its name to ADB Systems International Inc. (“ADB Inc.”) by articles of amendment dated October 11, 2001.

During 2002, ADB Inc. entered into a series of agreements with the Brick Warehouse Corporation (“The Brick”) whereby the parties agreed to cooperate in online retail operations that utilized the retail technology that the Company had developed and operated under the name “Bid.Com International Inc.” in the online sale of consumer products to be supplied by The Brick. In connection with these transactions The Brick granted to the Company a secured loan and the Company completed a corporate reorganization by plan of arrangement, as described below.

On August 20, 2002, a new Ontario company was formed called ADB Systems International Ltd. (“ADB Ltd.”), which was incorporated by certificate and Articles of Incorporation. Pursuant to a plan of arrangement approved by the shareholders of ADB Inc. on October 22, 2002 and by the Ontario Superior Court of Justice on October 24, 2002 (the “Arrangement”) the shareholders of ADB Inc. exchanged their shares of ADB Inc. for shares of ADB Ltd., as the Company was then known, on a one-for-one basis on October 31, 2002. As a result of the Arrangement, the business of ADB Inc., including all assets and liabilities of ADB Inc. (other than those related to retail activities, which remained with ADB Inc.), was transferred to the Company in the form of a return of capital. The name of ADB Inc. was subsequently changed to Bid.Com International Ltd. and on June 30, 2003, the Company exercised its option to transfer to The Brick all of the issued shares of Bid.Com International Ltd. (formerly ADB Inc.) in satisfaction of the outstanding principal amount and accrued interest on the loan then owing to The Brick.

Northcore Technologies Inc. 17

On June 30, 2006, in connection with the disposition of the Company’s Norwegian subsidiary ADB Systemer AS, the Company changed its name, by articles of amendment, to Northcore Technologies Inc. Effective July 18, 2006 the Company’s stock symbols were changed to NTI on the TSX and to NTLNF on the over-the-counter bulletin board (OTCBB).

On March 27, 2012 the Company entered into an agreement to acquire Envision Online Media Inc.; a software development company and Kahootkids! Inc.; a social media company. Both the companies are Ottawa based. The purchase price of $1,000,000 was satisfied by $300,000 cash payment and $700,000 through the issuance of 7,778,000 common shares at $0.12. The cash payment was satisfied by $100,000 cash payment at closing with the remaining $200,000 to be paid over the next two years, subject to achieving specific performance criteria.

The principal and registered office of the Company is located at 302 The East Mall, Suite 300 Toronto, Ontario, Canada, M9B 6C7 and our telephone number is (416) 640-0400. Additional information on the Company can be found at www.northcore.com. The information contained on our web site is not deemed to be part of this Annual Report.

MAJOR DEVELOPMENTS

Significant product and business developments over the last three fiscal years have been as follows:

FISCAL 2012

Northcore completed a number of customer and operational activities throughout the course of 2012. These activities were designed to accelerate revenue opportunities, solidify our financial position, and strengthen our abilities to work with our customers and partners.

OPERATIONAL ACTIVITIES

|

·

|

Acquired Envision Online Media Inc., an Ottawa based Content Management specialist;

|

|

·

|

Filed additional patents to support the proprietary implementation of viral accelerators and to expand the scope of the Company’s existing patents in the delivery of online Dutch Auctions;

|

|

·

|

Integrated the financial management and reporting functions of Envision into the Northcore management framework;

|

|

·

|

Completed a new implementation of the Company's Dutch Auction transaction engine; and

|

|

·

|

Completed development on a new version of Northcore’s legacy Material Management application.

|

CUSTOMER ACTIVITIES

During 2012, Northcore focused on expanding the breadth of existing customer relationships and extending the product line in order to open up new opportunities. Results of this strategy include:

|

·

|

Designed and deployed a back end server platform to support the "Intelligent Agent" initiative for a major strategic partner;

|

|

·

|

Implemented a series of major enhancements into a customer deployment of Asset Seller liquidation platform;

|

|

·

|

Delivered the first implementation of Northcore’s core architecture on the iPad IOS platform for a major partner;

|

|

·

|

Hosted a series of commercial auction events for a major strategic partner;

|

|

·

|

Implemented a new platform instance for a key enterprise client and one of the five largest food and beverage companies in North America;

|

|

·

|

Delivered a number of customer web platforms and content management solutions through Envision Online Media; and

|

|

·

|

Launched a Dutch Auction platform for the Wine and Spirits industry.

|

Northcore Technologies Inc. 18

JOINT VENTURE WITH GE COMMERCIAL FINANCE

Throughout 2012, Northcore executed a number of initiatives through its joint venture entity, GE Asset Manager, LLC. The goal was to acquire new clients while strengthening and expanding pre-existing relationships.

Significant effort was spent on the evolution of the product platform with a new release of Asset Seller successfully deployed and an Asset Management Mobile 'App' becoming part of the core offering. During the same period, existing installations made inroads in terms of user base and corporate importance, while critical new customers were activated.

The partners remain committed to the product set and look forward to new opportunities in the coming year.

FISCAL 2011

Northcore completed a number of customer and operational activities throughout the course of 2011. These activities were designed to accelerate revenue opportunities, solidify our financial position, and strengthen our abilities to work with our customers and partners.

OPERATIONAL ACTIVITIES

|

·

|

Recruited a new CEO, Chairman and two Board of Directors members to assist with corporate realignment and growth initiatives;

|

|

·

|

Completed the acquisition of the Discount This asset base, inclusive of unique Intellectual Property, to serve as the basis for a coordinated IP strategy;

|

|

·

|

Opened a U.S. based office in Naples, Florida to facilitate greater access to American market opportunities;

|

|

·

|

Completed major upgrades to production information technology infrastructure, including Server Architecture, Database Management Systems and Operating Environments;

|

|

·

|

Launched a strategic initiative with Pellegrino and Associates to position Northcore to take advantage of high growth domains with its proprietary Working Capital Engine and Dutch Auction IP portfolio;

|

|

·

|

Closed an equity private placement, generating net proceeds of $713,000 through the issuance of common shares and warrants;

|

|

·

|

Secured $3,574,000 in proceeds through the exercise of warrants and options by current holders; and

|

|

·

|

Continued to strengthen our balance sheet through the conversion of all remaining secured subordinated notes into equity and repayment of notes payable.

|

CUSTOMER ACTIVITIES

During 2011, Northcore focused on expanding the breadth of existing customer relationships and extending the product line in order to open up new opportunities. Results of this strategy include:

|

·

|

Successful deployment of Northcore’s e-tendering technology for the Irish Government Health Services Executive’s initial online acquisition pilot, resulting in a 30 percent savings on a €30 million acquisition;

|

|

·

|

Launch of the Home Hardware Dealer-Owners Connect website at the bi-annual Home Hardware market showcase;

|

|

·

|

Formation of a Social Commerce Group to focus on helping corporations leverage social media to accelerate buying and selling;

|

|

·

|

Contractual renewal of multiple long-term enterprise clients;

|

|

·

|

Execution of new contractual agreements with customers in multiple industry segments;

|

|

·

|

Implementation of an “Intelligent Agent” data extraction initiative for a major strategic partner; and

|

|

·

|

Awarded of Vendor of Record status by Ontario Government.

|

Northcore Technologies Inc. 19

JOINT VENTURE WITH GE COMMERCIAL FINANCE

Throughout 2011, Northcore continued to strengthen the relationship with GE Capital and engage on a number of initiatives through its joint venture entity, GE Asset Manager, LLC.

The technology underpinnings of the associated products of Asset Seller and Asset Tracker have evolved and seen considerable success in implementations for such important customers such as the NACCO Material Handling Group and the Bobcat Company. The year also saw accelerated forays into the mobile device space with delivery of Asset Management "Apps". During this period cornerstone client remarketing portals such as GEasset.com, nfsassetseller.com and ToroUsed.com have also continued to gain in terms of customer base and item sell-through.

Both founding partners believe that the opportunities for the venture are significant and look forward to bringing compelling offerings to a growing client base in 2012.

FISCAL 2010

|

Northcore completed a number of customer and operational activities throughout the course of 2010. These activities were designed to accelerate revenue opportunities, solidify our financial position, and strengthen our abilities to work with our customers and partners.

|

FINANCING ACTIVITIES

|

·

|

Closed an equity transaction with GEM Global Yield Fund Limited, securing net cash proceeds of $300,000. As a result of the transaction, Northcore issued 2,191,000 common shares for the first tranche draw and 6,000,000 warrants to finalize the availability of the committed $6,000,000 equity line of credit with GEM;

|

|

·

|

Closed the first tranche of equity private placement on December 22, 2010, securing net proceeds of $625,000 through the issuance of common shares and warrants. The second tranche closed for net proceeds of $713,000 on February 14, 2011 as a subsequent event to the year; and

|

|

·

|

Continued to strengthen our balance sheet through the conversion of $145,000 secured subordinated notes into equity combined with $143,000 of new equity through the exercise of the associated warrants.

|

CUSTOMER ACTIVITIES

During 2010, Northcore focused on expanding the breadth of existing customer relationships and extending the product line in order to open up new opportunities. Results of this strategy include:

|

·

|

Completed the development cycle and large scale roll out of a holistic remarketing platform to the Yale and Hyster dealer community, combining mobile computing with Asset Tracker and Asset Seller;

|

|

·

|

Delivered and deployed a customized Asset Seller platform to Xstrata Corporation to effect the disposition of surplus mining assets;

|

|

·

|

Initiated initial user interface design for the Group Purchasing platform subsequently named Discount This;

|

|

·

|

Increased the volume of third party auction events in the light-duty construction equipment and utility vehicle categories, with successful value realization and improved sales cycle efficiency;

|

|

·

|

Evidenced continued effectiveness in the remarketing of corporate aircraft and established Asset Seller as a leading platform for sales of high value asset categories by displaying showcased items in unprecedented rich detail;

|

|

·

|

Awarded two supply arrangements with the Canadian Federal Government, qualifying Northcore for the provision of business technology services, one directly and one in partnership with Ottawa based Donna Cona Inc.;

|

|

·

|

Completed the development of additional security modules required for Northcore’s core products to achieve US bank certification;

|

|

·

|

Entered into a collaborative sales and marketing agreement with Revere Corporation where both parties can now serve their customers with a broader product offering; and

|

|

·

|

Delivered a number of enhancements to a customized Asset Tracker application used by a Global Electronics Leasing corporation.

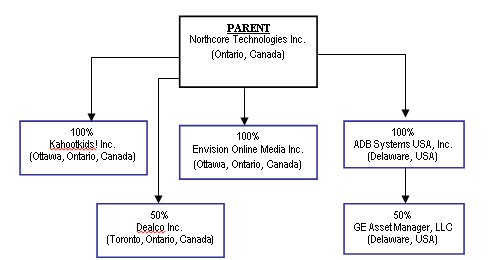

|

Northcore Technologies Inc. 20

JOINT VENTURE WITH GE COMMERCIAL FINANCE

Throughout 2010, Northcore maintained a strong focus on GE Asset Manager, our joint venture with GE Commercial Finance. The year saw significant enhancements made to the entire portfolio of Joint Venture products, with substantial new releases of Asset Seller and Asset Tracker delivered to clients. In addition Northcore worked closely with GE internal teams to execute tasks required to achieve Bank Certification for internal and customer facing applications.

Remarketing portals such as GEasset.com and ToroUsed.com have also experience solid results in terms of viewership and sell-through.

In specific, the joint venture has shown its efficacy in helping partners accelerate remarketing and redeployment of fixed assets in spite of a sub-optimal economic climate. Both stakeholders remain committed to helping the venture achieve its full potential and a broader reach to GE customers.

COMPANY’S JOINT VENTURE WITH GE COMMERCIAL FINANCE

On December 31, 2003 the Company, through its wholly owned subsidiary, entered into an Amended and Restated Operating Agreement (the “Operating Agreement”) with General Electric Capital Corporation through its business division GE Commercial Finance. This agreement was entered into in connection with the establishment of GE Asset Manager, LLC, a joint business venture in which both GE Commercial Finance and Northcore hold a 50 percent interest. The joint venture carries on business under the name GE Commercial Finance Asset Manager (“GE Asset Manager”, “GEAM”), is an integrated, web-based business enabling mid- and large-size organizations to reduce operating costs by simplifying and consolidating their asset management programs. GEAM features all-in-one capabilities designed for sourcing of new equipment, tracking and reallocation of existing assets, automated appraisal management and disposition of surplus equipment.

PRINCIPAL CAPITAL EXPENDITURES AND DIVESTITURES

For a description of principal capital expenditures and divestitures, see ITEM 5 - OPERATING AND FINANCIAL REVIEW AND PROSPECTS MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS As of February 28, 2013 we do not have any significant current capital divestitures or any current capital expenditures.

B. BUSINESS OVERVIEW

Northcore Technologies Inc. (“Northcore” or the “Company”) provides enterprise level software products and services that enable its customers to purchase, manage and dispose of capital equipment. Utilizing award-winning, multi-patented technology, as well as powerful, holistic Social Commerce tools, Northcore's solutions support customers throughout the entire asset lifecycle. Northcore’s portfolio companies include Envision Online Media Inc. (“Envision”), a specialist in the delivery of content management solutions and Kahootkids! Inc. (operating as “Kuklamoo”), a family information web destination and national daily deal site targeting families with children. Our integrated software solutions and support services are designed for organizations in the financial services, manufacturing, oil and gas, mining, and government sectors to:

|

·

|

Streamline the sourcing and procurement of critical assets, while reducing purchasing costs;

|

|

·

|

Track the location of assets to support improved asset utilization and redeployment of idle equipment;

|

|

·

|

Manage the appraisal of used equipment more effectively, resulting in a better understanding of fair market values; and

|

|

·

|

Accelerate the sale of surplus assets while generating higher yields.

|

Northcore owns 50 percent of GE Asset Manager, LLC (“GE Asset Manager” or “GEAM”), a joint business venture with GE Capital Corporation, through its business division GE Commercial Finance, Capital Solutions. Northcore also owns 50 percent of Dealco Inc. (operating as “PriceDutch”), a Toronto based technology company, servicing the daily deal and online e-commerce industries.

Northcore’s shares trade on both the Toronto Stock Exchange (TSX: NTI) and the OTC Bulletin Board (OTCBB: NTLNF). The principal and registered office of the Company is located at 302 The East Mall, Suite 300, Toronto, Ontario, Canada, M9B 6C7.

Northcore Technologies Inc. 21

GEAM offers a suite of integrated, web-based solutions that are designed to help organizations gain greater control of their capital assets and implement new process efficiencies to their operational activities which we believe enables our customers to:

|

·

|

Automate sourcing and tendering processes;

|

|

·

|

Track and re-deploy assets more effectively;

|

|

·

|

Automate equipment appraisals; and

|

|

|

Efficiently market and sell surplus equipment.

|

We believe however, that the current economic turmoil bodes well for Northcore. In times where access to new capital is reduced, or rendered more difficult, companies are motivated to “stretch” existing capital investments by redeploying idle and surplus assets back into productive use. In addition, assets that are ultimately unneeded represent a “harvest” opportunity, if they can be liquidated efficiently. The product suite offered by Northcore and by extension our joint venture, GE Asset Manager, LLC, provides an efficient, cost effective solution to help organizations achieve these goals.

INDUSTRY BACKGROUND AND OVERVIEW

Asset management applications have existed for more than thirty years, initially through computerized maintenance management systems (CMMS), and more recently including more comprehensive and robust enterprise asset management (EAM) and enterprise resource planning (ERP) solutions. These early systems automated daily management of assets, while more recent ERP solutions consolidated basic asset information with financial information at the corporate level. Asset Management applications, as provided by Northcore, encompass elements of both approaches, and are increasingly delivered via web-based or hosted systems.

Current asset management systems provide a number of capabilities including maintenance scheduling, materials management, electronic procurement, and asset tracking. In essence, asset management activities have evolved to integrate all aspects of an asset’s lifecycle.

There are a number of industry trends driving the demand for asset management capabilities, including the need to:

|

·

|

Improve the utilization of assets;

|

|

·

|

Comply with industry standards and requirement such as, Sarbanes-Oxley financial requirements;

|

|

·

|

Reduce operating expenses and improve bottom-line performance; and

|

|

·

|

Introduce new operational efficiencies.

|

PRODUCTS AND SERVICES

The Company offers solutions to manage all aspects of the asset lifecycle – sourcing/procurement, maintenance, materials management and disposition. Below is a detailed description of our offerings:

Dyn@mic Buyer (TM)

An on-line sourcing solution, Dyn@mic Buyer automates tendering activities, and can be used to improve the decision-making process involved in the sourcing of goods by providing automated analysis and selection among competing supplier bids, based on a variety of pre-determined factors.

Key features include:

|

·

|

The ability for buyers to create tenders using automated tools that accelerate the purchasing process and reduce procurement costs.

|

|

·

|

Capabilities for buyers to post and distribute their tenders on-line to qualified suppliers.

|

|

·

|

The ability for buyers to assign values to criteria involved in the purchase decision, such as price, product availability, post-sales support and certification standards. Buyers then weigh suppliers’ responses to tender questions for evaluation.

|

Northcore Technologies Inc. 22

|

·

|

Functionality that allows for the posting of detailed technical information, question and answer forums, and automatic e-mail notification of amended or new buyer-posted documents.

|

|

·

|

Capabilities to allow for the use of sealed bid-sourcing formats enabling users to post their product or service requirements to selected vendors. The sealed bid system differs from the request for quotation in that the vendors only have one opportunity to supply a bid. Only after the close of the auction is the user able to view the vendor bids.

|

Dyn@mic Buyer is delivered to our customers via a hosted model. Fees for Dyn@mic Buyer are determined on an annual basis, depending on the number of sourcing events identified by customers. Service fees are charged separately for implementation, systems integration, training and other consulting activities. Dyn@mic Buyer can be bundled with our procurement solutions or used separately depending on customer requirements.

Dyn@mic Seller (TM)

An on-line sales solution designed to help our customers with the disposition of surplus assets and equipment. Dyn@mic Seller integrates multiple pricing methods, such as fixed priced, top bid (auction), Dutch (declining price) and hybrids, through private-labeled websites. Dyn@mic Seller is delivered through a hosted model.

Key capabilities of the product include:

· Traditional rising price auctions, where the highest bids win the items being sold. The rising price auction allows participants to competitively bid on available products by incrementally adjusting their bid amounts. Our user interface allows users to easily identify current leading bidders, minimum new bids and initial bid pricing. Participants are informed of their bid status, and advised whether they have won, been outbid, approved or declined via electronic mail.

· A patented Dutch (declining) auction format, in which a starting price is set and a limited time period is allocated for a fixed quantity of the product to be sold. As time advances, the price drops in small increments until the asset is sold. The declining bid auction allows participants to bid in a real-time format utilizing on-screen data which provides the time and quantity remaining as well as the falling price of the items for sale.

· Hybrid auction formats that blend multiple pricing formats to meet a customer’s particular needs.

· Fixed price sales where assets are sold in a catalogue or directory format. The purchaser cannot bid on the price, but merely elects whether or not to purchase the good or service.

Our customers pay monthly hosting fees for use of Dyn@mic Seller and typically also enter into a revenue sharing arrangement with us. Service fees for implementation, systems integration, training and other consulting activities are charged separately.

RELATED SERVICES

In connection with our software offerings, we provide the following services to our customers:

CONSULTING