UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

(RULE 14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

|

☒ |

Preliminary Proxy Statement |

|

|

|

|

☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

|

|

|

☐ |

Definitive Proxy Statement |

|

|

|

|

☐ |

Definitive Additional Materials |

|

|

|

|

☐ |

Soliciting Material Pursuant to § 240.14a-12. |

Extreme Networks, Inc.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement if Other Than the Registrant)

|

Payment of Filing Fee (Check the appropriate box): |

||

|

|

|

|

|

☒ |

No fee required |

|

|

|

|

|

|

☐ |

Fee computed on table below per Exchange Act Rules 14-a-6(i)(4) and 0-11. |

|

|

|

|

|

|

|

(1) |

Title of each class of securities to which transaction applies:

|

|

|

|

|

|

|

(2) |

Aggregate number of securities to which transaction applies:

|

|

|

|

|

|

|

(3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

|

|

|

(4) |

Proposed maximum aggregate value of transaction:

|

|

|

|

|

|

|

(5) |

Total fee paid:

|

|

|

|

|

|

☐ |

Fee paid previously with preliminary materials. |

|

|

|

|

|

|

☐ |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

|

|

|

|

|

(1) |

Amount Previously Paid:

|

|

|

|

|

|

|

(2) |

Form, Schedule or Registration Statement No.:

|

|

|

|

|

|

|

(3) |

Filing Party:

|

September 22, 2020

Dear Stockholder:

You are cordially invited to attend the 2020 Annual Meeting of Stockholders of Extreme Networks, Inc. to be held on Thursday, November 5, 2020 at 11:00 am Eastern Time. This year’s Annual Meeting of Stockholders will be a virtual, live audio meeting of stockholders. All references herein to our “Annual Meeting of Stockholders” or “Annual Meeting” refers to our virtual Annual Meeting of Stockholders.

Details of business to be conducted at the Annual Meeting are described in the Notice of Annual Meeting of Stockholders and Proxy Statement. Accompanying this Proxy Statement is the Company’s 2020 Annual Report to Stockholders.

We are pleased to take advantage of Securities and Exchange Commission rules that allow companies to furnish proxy materials to stockholders over the Internet. We believe these rules allow us to provide our stockholders with the information they need, while lowering the costs of delivery and, more importantly, reducing the environmental impact of the Annual Meeting. On or about September 22, 2020, you were provided with a Notice of Internet Availability of Proxy Materials (“Notice”) and provided access to our proxy materials over the Internet. The Notice also provides instructions on how to vote online or by telephone and includes instructions on how to receive a paper copy of the proxy materials by mail.

Whether or not you plan to attend our Annual Meeting, you can ensure that your shares are represented at the meeting by promptly voting and submitting your proxy by telephone, by Internet or, if you have received a paper copy of your proxy materials by mail, by completing, signing, dating and returning your proxy card in the envelope provided.

If you have any further questions concerning the Annual Meeting or any of the proposals, please contact Stan Kovler, our Vice President of Corporate Strategy and Investor Relations, at (919) 595-4196. We look forward to your attendance at the Annual Meeting.

|

Yours Truly, |

|

|

|

|

|

Edward B. Meyercord |

|

President and Chief Executive Officer |

YOUR VOTE IS VERY IMPORTANT. Whether or not you plan to attend the Annual Meeting of Stockholders, we urge you to vote and submit your proxy by telephone, the Internet or by mail in order to ensure the presence of a quorum. If you attend the meeting and do not hold your shares through an account with a brokerage firm, bank or other nominee, you will have the right to revoke the proxy and vote your shares in person. If you hold your shares through an account with a brokerage firm, bank or other nominee, please follow the instructions you receive from them to vote your shares and revoke your vote, if necessary.

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held November 5, 2020

TO THE STOCKHOLDERS:

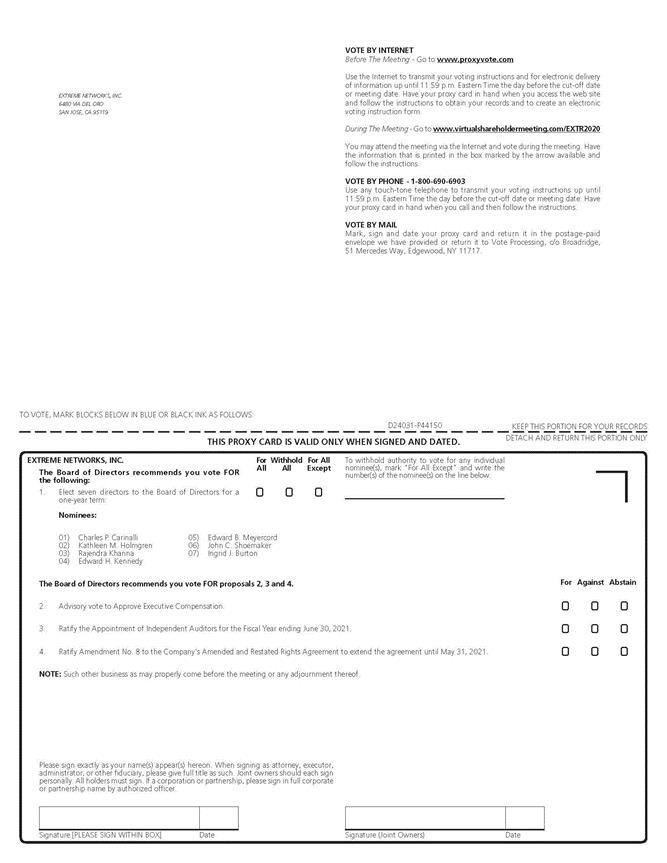

Notice is hereby given that the 2020 Annual Meeting of Stockholders of Extreme Networks, Inc. will be held on Thursday, November 5, 2020 at 11:00 am Eastern Time. This year’s Annual Meeting of Stockholders will be a virtual, live audio meeting of stockholders. In order to participate online you must register before the meeting at www.proxyvote.com, or during the meeting at www.virtualshareholdermeeting.com/EXTR2020, with the 16-digit code printed in the box marked by the arrow on your proxy materials and follow the on-screen instructions. Once registered, you will be able to attend the meeting online where you will be able to listen to the meeting live and vote.

|

|

1. |

Elect seven directors to the Board of Directors for a one-year term; |

|

|

2. |

Hold an advisory vote to approve our named executive officers’ compensation; |

|

|

3. |

Ratify the appointment of Ernst & Young LLP as our independent auditors for our fiscal year ending June 30, 2021; |

|

|

4. |

Ratify Amendment No. 8 to the Company’s Amended and Restated Rights Agreement, which extends that agreement through May 31, 2021; and |

|

|

5. |

Transact such other business as may properly come before the meeting or any adjournments or postponements thereof. |

Our Board of Directors recommends a vote “FOR” each of the nominees in Item 1, “FOR” Items 2, 3, and 4. Stockholders of record at the close of business on September 14, 2020 are entitled to notice of, and to vote at, this meeting and any adjournment or postponement thereof. Commencing ten days prior to the meeting, a complete list of stockholders entitled to attend and vote at the meeting will be available for review by any stockholder during normal business hours at our offices located at 6480 Via Del Oro, San Jose, California 95119.

|

BY ORDER OF THE BOARD OF DIRECTORS, |

|

|

|

Katayoun (“Katy”) Motiey Chief Administrative and Sustainability Officer and Corporate Secretary |

San Jose, California

September 22, 2020

YOUR VOTE IS IMPORTANT: Please vote your shares via telephone or the Internet, as described in the accompanying materials, to assure that your shares are represented at the meeting, or, if you received a paper copy of the proxy card by mail, you may mark, sign and date the proxy card and return it in the enclosed postage-paid envelope. If you attend the meeting, you may choose to vote online at the virtual meeting even if you have previously voted your shares.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON November 5, 2020: This Proxy Statement and the financial and other information concerning Extreme Networks contained in our Annual Report to Stockholders for the fiscal year ended June 30, 2020 are available on the Internet and may be viewed at www.proxyvote.com, where you may also cast your vote.

TO THE PROXY STATEMENT

|

1 |

|

|

1 |

|

|

1 |

|

|

1 |

|

|

1 |

|

|

1 |

|

|

2 |

|

|

2 |

|

|

2 |

|

|

3 |

|

|

3 |

|

|

|

|

|

4 |

|

|

4 |

|

|

|

|

|

5 |

|

|

5 |

|

|

7 |

|

|

|

|

|

7 |

|

|

7 |

|

|

8 |

|

|

8 |

|

|

8 |

|

|

8 |

|

|

9 |

|

|

10 |

|

|

11 |

|

|

12 |

|

|

12 |

|

|

12 |

|

|

12 |

|

|

13 |

|

|

|

|

|

16 |

|

|

|

|

|

PROPOSAL TWO: ADVISORY VOTE TO APPROVE EXECUTIVE COMPENSATION |

19 |

|

19 |

|

|

19 |

|

|

|

|

|

20 |

|

|

21 |

|

|

21 |

|

|

|

|

|

22 |

|

|

22 |

|

|

25 |

|

|

25 |

i

ii

EXTREME NETWORKS, INC.

PROXY STATEMENT

INFORMATION CONCERNING SOLICITATION AND VOTING

Our Board of Directors, or our Board, is soliciting your proxy for the 2020 Annual Meeting of Stockholders to be held on Thursday November 5, 2020, or at any postponements or adjournments of the meeting, for the purposes set forth in the accompanying Notice of Annual Meeting of Stockholders. This proxy statement and related materials are first being made available to stockholders on or about September 22, 2020. References in this proxy statement to the “Company,” “we,” “our,” “us” and “Extreme Networks” are to Extreme Networks, Inc., and references to the “Annual Meeting” are to the 2020 Annual Meeting of Stockholders. When we refer to the Company’s fiscal year, we mean the annual period ending on June 30. This proxy statement covers our 2020 fiscal year, which was from July 1, 2019 through June 30, 2020 (“fiscal 2020”).

Who May Vote, Record Date, Admission to Meeting

Only holders of record of the Company’s common stock at the close of business on September 14, 2020 (the “Record Date”) will be entitled to notice of, and to vote at, the meeting and any adjournment thereof. As of the Record Date, _______ shares of common stock were outstanding and entitled to vote. You are entitled to one vote for each share you hold.

You are entitled to attend the Annual Meeting if you were a stockholder of record or a beneficial owner of our common stock as of the Record Date, or if you hold a valid legal proxy for the Annual Meeting. To request a legal proxy, please follow the instructions at www.proxyvote.com or request a paper copy of the materials, which will contain the appropriate instructions.

If your shares are registered in the name of a broker, bank or other nominee, you may be asked to provide proof of beneficial ownership as of the Record Date, such as a brokerage account statement or voting instruction form provided by your record holder, or other similar evidence of ownership, as well as picture identification, for admission. If you wish to be able to vote in person (virtually) at the Annual Meeting, you must obtain a legal proxy from your broker, bank or other nominee and present it to the inspector of elections together with your ballot at the Annual Meeting. You may vote online at the 2020 Annual Meeting by attending the 2020 Annual Meeting online. To attend the 2020 Annual Meeting online, you must register before the meeting at www.proxyvote.com, or during the meeting at www.virtualshareholdermeeting.com/EXTR2020, with the 16-digit code printed in the box marked by the arrow on your proxy materials and follow the on-screen instructions. You can vote by mail by requesting a paper copy of the proxy materials, which will include a proxy card.

A broker non-vote occurs when a broker submits a proxy card with respect to shares held in a fiduciary capacity (typically referred to as being held in “street name”), but cannot vote on a particular matter because the broker has not received voting instructions from the beneficial owner. Under the rules that govern brokers who are voting with respect to such shares, brokers have the discretion to vote such shares on routine matters, but not on non-routine matters. Routine matters include the ratification of selection of auditors. Non-routine matters include the election of directors and amendments to or the adoption of stock plans.

Our bylaws provide that a majority of the shares of our common stock issued and outstanding and entitled to vote at the meeting as of the Record Date must be represented at the meeting, either in person (virtually) or by proxy, to constitute a quorum for the transaction of business at the meeting, except to the extent that the presence of a larger number may be required by law. Your shares will be counted towards the quorum only if you submit a valid proxy, if your broker, banker or other nominee submits a proxy on your behalf, or if you vote in person (virtually) at the virtual meeting. Abstentions and broker non-votes will be counted as present for purposes of determining the presence of a quorum.

The SEC’s proxy rules set forth how companies must provide proxy materials. These rules are often referred to as “notice and access.” Under the notice and access model, a company may select either of the following options for making proxy materials

1

available to stockholders: (i) the full set delivery option; or (ii) the notice only option. A company may use a single method for all its stockholders, or use the full set delivery option for some stockholders and the notice only option for others.

Under the full set delivery option, a company delivers all proxy materials to its stockholders by mail or, if a stockholder has previously agreed, electronically. In addition to delivering proxy materials to stockholders, the company must post all proxy materials on a publicly accessible web site (other than the SEC’s web site) and provide information to stockholders about how to access that web site and the hosted materials. Under the notice only option, instead of delivering its proxy materials to stockholders, the company delivers a “Notice of Internet Availability of Proxy Materials” that outlines (i) information regarding the date and time of the meeting of stockholders, as well as the items to be considered at the meeting; (ii) information regarding the web site where the proxy materials are posted; and (iii) various means by which a stockholder can request printed or emailed copies of the proxy materials.

In connection with our 2020 Annual Meeting, we have elected to use the notice only option. Accordingly, you should have received a notice by mail, unless you requested a full set of materials from prior mailings, instructing you how to access proxy materials at www.proxyvote.com and providing you with a control number you can use to vote your shares. You may request that the Company also deliver to you printed or emailed copies of the proxy materials.

All shares represented by a valid proxy, timely submitted to the Company, will be voted. Where a proxy specifies a stockholder’s choice with respect to any matter to be acted upon, the shares will be voted in accordance with that specification. If no choice is indicated on the proxy, the shares will be voted in favor of the proposal. If your shares are registered under your own name, you may revoke your proxy at any time before the Annual Meeting by (i) delivering to the Corporate Secretary at the Company’s headquarters either a written instrument revoking the proxy or a duly executed proxy with a later date, or (ii) attending the virtual Annual Meeting and voting online. If you hold shares in street name, through a broker, bank or other nominee, you must contact the broker, bank or other nominee to revoke your proxy.

Vote Required to Adopt Proposals

The holder of each share of the Company’s common stock outstanding on the Record Date is entitled to one vote on each of the director nominees and one vote on each other matter. The director nominees who receive the highest number of “For” votes will be elected as directors. All other matters shall be determined by a majority of the votes cast affirmatively or negatively on the matter.

Effect of Abstentions and Broker Non-Votes

Votes withheld from any nominee, abstentions and “broker non-votes” (i.e., where a broker has not received voting instructions from the beneficial owner and for which the broker does not have discretionary power to vote on a particular matter) are counted as present for purposes of determining the presence of a quorum. Shares voting “withheld” have no effect on the election of directors. Abstentions have no effect on the advisory vote to approve our named executive officers’ compensation, the ratification of the appointment of Ernst & Young LLP as our independent auditors for the fiscal year ending June 30, 2021, or the ratification of Amendment No. 8 to our Amended and Restated Rights Agreement.

If you are a beneficial owner and hold your shares in “street name,” it is critical that you cast your vote if you want it to count in the election of directors and with respect to the other proposals included in this proxy. The rules governing brokers, banks and other nominees who are voting with respect to shares held in street name provide such nominees the discretion to vote on routine matters, but not on non-routine matters. Routine matters to be addressed at the Annual Meeting include the ratification of auditors. Non-routine matters include the election of directors, the advisory vote to approve our named executive officers’ compensation, and the ratification of Amendment No. 8 to our Amended and Restated Rights Agreement. Banks and brokers may not vote on these non-routine matters if you do not provide specific voting instructions. Accordingly, we encourage you to vote promptly, even if you plan to attend the virtual Annual Meeting.

If you complete and submit your proxy card or the voting instruction card provided by your broker, bank or other nominee, the persons named as proxies will follow your instructions. If you do not direct how to vote on a proposal, the persons named as proxies will vote as the Board recommends on that proposal. Depending on how you hold your shares, you may vote in one of the following ways:

Stockholders of Record: You may vote by proxy, over the Internet or by telephone. Please follow the instructions provided in the Notice of Internet Availability of Proxy Materials or on the proxy card you received. You may also vote online at the Annual Meeting by attending the Annual Meeting online. To attend the Annual Meeting online, you must register online at

2

www.proxyvote.com, or during the meeting at www.virtualshareholdermeeting.com/EXTR2020, with the 16-digit code printed in the box marked by the arrow on your proxy materials and follow the on-screen instructions.

Beneficial Stockholders: Your broker, bank or other nominee will provide you with a voting instruction card for your use in instructing it how to vote your shares. Since you are not the stockholder of record, you may not vote your shares online at the virtual Annual Meeting unless you request and obtain a valid proxy from your broker, bank or other nominee, or by requesting one on www.proxyvote.com.

Votes submitted by telephone or via the Internet must be received by 11:59 p.m., Eastern Standard Time, on November 4, 2020. Submitting your proxy by telephone or via the Internet will not affect your right to vote in person should you decide to attend the Annual Meeting.

If you are a stockholder of record, you may revoke your proxy and change your vote at any time before the polls close by returning a later-dated proxy card, by voting again by Internet or telephone as more fully detailed on your proxy card, or by delivering written instructions to the Corporate Secretary at the Company’s headquarters before the Annual Meeting. Attendance at the virtual Annual Meeting will not cause your previously voted proxy to be revoked unless you specifically request revocation or vote online at the virtual Annual Meeting. If your shares are held by a broker, bank or other nominee, you may change your vote by submitting new voting instructions to your broker, bank or other nominee in accordance with the nominees directions, or, if you have obtained a legal proxy from your broker, bank or other nominee giving you the right to vote your shares, by attending the Annual Meeting and voting online.

If you return a signed and dated proxy card without marking any voting selections, your shares will be voted as follows:

|

|

• |

“FOR” the election of each nominee for director; |

|

|

• |

“FOR” the approval of our named executive officers’ compensation; |

|

|

• |

“FOR” the ratification of the appointment of Ernst & Young LLP as our independent auditors for our fiscal year ending June 30, 2021; and |

|

|

• |

“FOR” the ratification of the extension of the term of the Amended and Restated Shareholder Rights Plan to May 31, 2021; |

If any other matter is properly presented at the 2020 Annual Meeting, your proxyholder (one of the individuals named on your proxy card) will vote your shares in his or her discretion.

We will bear the entire cost of soliciting proxies. In addition to soliciting stockholders by mail, we will request banks, brokers and other intermediaries holding shares of our common stock beneficially owned by others to obtain proxies from the beneficial owners and will reimburse them for their reasonable expenses in so doing. We may use the services of our officers, directors and other employees to solicit proxies, personally or by telephone, without additional compensation. The Company has engaged Okapi Partners to assist in the solicitation of proxies and provide related advice, informational support, and outreach for a services fee and the reimbursement of customary disbursements that are not expected to exceed $26,000 in the aggregate.

We will announce preliminary voting results at the Annual Meeting. We will report final results in a Current Report on Form 8-K filed with the SEC within four business days of the Annual Meeting.

3

ELECTION OF DIRECTORS

The terms of our current directors expire upon the election and qualification of the directors to be elected at the 2020 Annual Meeting. The Board has nominated seven persons for election at the Annual Meeting to serve until the 2021 Annual Meeting of Stockholders and until their successors are duly elected and qualified. Our Board’s nominees for election at the 2020 Annual Meeting are Edward B. Meyercord, Ingrid J. Burton, Charles P. Carinalli, Kathleen M. Holmgren, Raj Khanna, Edward H. Kennedy, and John C. Shoemaker, all of whom are presently directors of Extreme Networks.

Please see below under the heading “Board of Directors” for information concerning the nominees. If elected, each nominee will serve as a director until the Annual Meeting of stockholders in 2021 and until his or her successor is elected and qualified, or until his or her earlier resignation or removal.

Each nominee has indicated to us that he or she will serve if elected. As of the date of this Proxy Statement, the Board is not aware of any nominee who is unable or who will decline to serve as a director. However, if a nominee declines to serve or becomes unavailable for any reason, the proxies may be voted for a substitute nominee designated by the Nominating, Governance and Social Responsibility Committee or our Board.

Vote Required and Board of Directors Recommendation

The persons receiving the highest number of votes represented by outstanding shares of common stock present or represented by proxy and entitled to vote at the 2020 Annual Meeting will be elected to the Board, provided a quorum is present. Votes “For”, votes to “Withhold” authority, and “Broker Non-Votes” will each be counted as present for purposes of determining the presence of a quorum, but broker non-votes will have no effect on the outcome of the election. If you sign and return a proxy card without giving specific voting instructions as to the election of any director, your shares will be voted in favor of the nominees recommended by our Board.

OUR BOARD UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE NOMINEES NAMED ABOVE.

4

The following table provides biographical information for each nominee to our Board of Directors.

|

Name |

|

Age |

|

Director Since |

|

John C. Shoemaker, Director and Chairman of the Board |

|

77 |

|

2007 |

|

Edward B. Meyercord, Director, President, and Chief Executive Officer |

|

55 |

|

2009 |

|

Ingrid J. Burton, Director |

|

58 |

|

2019 |

|

Charles P. Carinalli, Director |

|

72 |

|

1996 |

|

Kathleen M. Holmgren, Director |

|

62 |

|

2015 |

|

Edward H. Kennedy, Director |

|

65 |

|

2011 |

|

Raj Khanna, Director |

|

74 |

|

2014 |

There are no family relationships among any of our directors or executive officers.

The biography of each of our director nominees below contains information regarding the person’s service as a director, business experience, other director positions held currently or at any time during the last five years, information regarding involvement in certain legal or administrative proceedings, and the experiences, qualifications, attributes or skills that caused the Nominating, Corporate Governance and Social Responsibility Committee and our Board to determine that the person should serve as a director.

Nominees for Election at 2020 Annual Meeting

Edward B. Meyercord. Mr. Meyercord has served as our Chief Executive Officer and President and as a member of our board since April 2015. Mr. Meyercord joined our Board of Directors as an independent director in October 2009 and served as Chairman from March 2011 until August 2015. Prior to assuming his operating role at Extreme Networks in April 2015, Mr. Meyercord was Chief Executive Officer and Director at Critical Alert Systems, LLC, a privately held software-driven, healthcare information technology company that he co-founded in July 2010. Prior to that, Mr. Meyercord served as Chief Executive Officer, President and Director of Cavalier Telephone, LLC, a privately held voice, video and data services company from 2006 to 2009. He served as Chief Executive Officer, President and Director of Talk America Holdings, Inc., a publicly traded company that provided phone and internet services to consumers and small businesses throughout the United States. Earlier in his career, Mr. Meyercord served as a Vice President in the investment banking division of Salomon Brothers Inc. (now part of Citigroup, Inc.), a Wall Street investment bank from 1993 to 1996. From August 2009 to May 2011, he also served on the board of Tollgrade Communications, Inc., a then-publicly traded telecommunications company. Mr. Meyercord holds a Bachelor of Arts degree in economics from Trinity College in Hartford, CT, and a Master of Business Administration degree from the Stern School of Business at New York University.

Mr. Meyercord brings to the Board his extensive executive experience in leadership, executive management, mergers and acquisitions, corporate strategy and corporate finance. His background in the healthcare and telecommunications industries provides our Board with valuable industry expertise in several of our key markets. Also, the Board believes it is valuable to have the Company’s Chief Executive Officer serve on the Board to bring in-depth perspective on the Company’s current operations, strategy, financial condition and competitive position.

Ingrid J. Burton. Ms. Burton has served as one of our directors since August 22, 2019. From February 2018 through August 2020, Ms. Burton served as the Chief Marketing Officer of H20.ai, a leader in open source in artificial intelligence and machine learning. Ms. Burton was the Chief Marketing Officer at Hortonworks, a data software company, from July 2015 to March 2017. Ms. Burton was the Senior Vice President, Technology and Innovation Marketing at SAP, a global software company, from January 2013 to May 2015. Prior to joining SAP, Ms. Burton held chief marketing officer positions with Silver Spring Networks, a provider of smart grid products, and Plantronics, an electronics company providing audio communications equipment for businesses and consumers. She held various senior executive management positions with Sun Microsystems for more than 20 years, including serving as head of marketing and driving the company and Java brand, global citizenship, championing open source initiative and leading product and strategic marketing teams. She has advised various Silicon Valley startups, driving strategies for market and technology trends, SaaS, cloud computing, open source, internet of things, community engagement and big data. Ms. Burton has been a board advisor to Drivescale, a privately held data center infrastructure company, since October 2016, and she served on the Board of Directors of Aerohive Networks, Inc. from March 2019 to August 2019, at which time it was acquired by Extreme Networks. Ms. Burton holds a Bachelor of Arts degree in math with a concentration in computer science from San Jose State University.

Ms. Burton brings to the Board extensive marketing and management expertise as well as experience in building brands, creating demand and growing businesses for both established technology innovators and industry pioneers.

5

Charles P. Carinalli. Mr. Carinalli has served as one of our directors since October 1996. Mr. Carinalli has been a Principal of Carinalli Ventures since January 2002. From 1999 to May 2002, Mr. Carinalli was Chief Executive Officer and a director of Adaptive Silicon, Inc., a privately held developer of semiconductor products. From November 2000 to November 2001, Mr. Carinalli served as Chairman of Clearwater Communications, Inc., a privately held telecommunications company. From December 1996 to July 1999, Mr. Carinalli served as President, Chief Executive Officer and a director of WaveSpan Corporation, a developer of wireless broadband access systems until the company was acquired by Proxim, Inc., a broadband wireless networking systems company. From 1970 to 1996, Mr. Carinalli served in various positions at National Semiconductor Corporation, a publicly traded semiconductor company that developed and sold analog-based semiconductor and integrated communication products, most recently serving as Senior Vice President and Chief Technical Officer. Mr. Carinalli served on the Board of Directors of Fairchild Semiconductor International, Inc., a publicly traded semiconductor company beginning in February 2002 until its acquisition by ON Semiconductor, a publicly traded semiconductor company, in September 2016. Mr. Carinalli formerly served on the Board of Directors of Atmel Corporation, a publicly traded semiconductor company, from February 2008 until its acquisition by Microchip Technology in April 2016. He also is a member of the Board of Directors of the privately held companies Algorithmic Intuition, Inc., a medical electronics company, and Dhaani Systems, an IT-energy management company. Mr. Carinalli holds a Bachelor of Science degree in electrical engineering from the University of California, Berkeley and a Master of Science degree in electrical engineering from Santa Clara University.

Mr. Carinalli brings to the Board extensive engineering and engineering management expertise, as well as general management expertise and technology expertise, which aids our Board in understanding product development, engineering management and strategic planning, as well as risk assessment and planning.

Kathleen M. Holmgren. Ms. Holmgren has served as one of our directors since November 2015. Ms. Holmgren currently serves on the Board of Directors and previously served until March 2018 as the Chief Officer of Future Workforce at Automation Anywhere, Inc., a privately held developer of robotic process automation and testing software, which she joined as Chief Operating Officer in 2013. She has served as a director of Automation Anywhere, Inc. since 2013 and currently serves as the Chair of the Audit Committee. Since 2008, Ms. Holmgren has served as a Principal at Sage Advice Partners, a management consulting firm specializing in the high-tech and green-tech markets. From October 2009 to December 2016, she served as a director at the Alliance of Chief Executives, LLC, an organization for chief executive officers. Ms. Holmgren served as President and Chief Executive Officer of Mendocino Software, a privately held enterprise-class application data developer, from November 2007 to March 2008. Prior to November 2007, Ms. Holmgren spent over 20 years at Sun Microsystems, Inc., a publicly held enterprise software company acquired by Oracle Corporation in 2010, where she held increasingly senior roles, culminating in Senior Vice President, Storage Systems. She joined the board of Calavo Growers, Inc., a publicly traded food and distribution company, in January 2017. In May 2017, she joined the board of Fresh Realm, LLC, a privately held delivery and business platform for the perishable food industry, representing Calavo Growers’ interests. Ms. Holmgren served on the Board of Group Delphi, a private design and media production company, from July 2014 through December 2019. Ms. Holmgren holds a Bachelor of Science degree in industrial engineering from California Polytechnic State University, where she served as a member of the Dean’s Advisory Board from 1994 through May 2020, and a Master of Business Administration degree from the Stanford Graduate School of Business.

Ms. Holmgren brings to the Board her knowledge and expertise in executive leadership in the storage, computer systems, enterprise software and management consulting industries, and provides expertise in operations, strategic planning and risk assessment and planning.

Edward H. Kennedy. Mr. Kennedy has served as one of our directors since April 2011. From June 2017 to September 2018, Mr. Kennedy served as the president and Chief Executive Officer of Cenx, Inc., a carrier network assurance software company, which was subsequently acquired by Ericsson. From June 2010 to April 2017, Mr. Kennedy served as the Chief Executive Officer and President of Tollgrade Communications, Inc., which was subsequently acquired by Enghouse Systems, a Canadian-based, publicly traded software and services company, in April 2017. Mr. Kennedy previously served as the Chief Executive Officer and President of Rivulet Communications, Inc., a medical video networking company, from 2007 until it was acquired by NDS Surgical Imaging, LLC, a medical imaging and informatics systems company, in 2010. He also previously served as President of Tellabs North American Operations, an optical network technology company, and as Executive Vice President of Tellabs, Inc. from 2002 to 2004. Mr. Kennedy co-founded Ocular Networks, Inc., a provider of optical networking technologies, in 1999 and served as its Chief Executive Officer and President until it was sold to Tellabs, Inc. in 2002. He has also held various executive positions at several telecommunication equipment companies, including Alcatel-Lucent S.A. (previously Alcatel Data Network), a publicly traded French global telecommunications equipment company, and Newbridge Networks Corporation, a then-publicly traded Canadian digital networking equipment company. Mr. Kennedy was also a Venture Partner at Columbia Capital, a private equity investment firm, from 2005 to 2007, where he advised regarding investments into new and existing portfolio companies. Mr. Kennedy served as a director for Avizia, a privately held telemedicine platform company, from 2014 until its merger with American Well in July 2018. Between the period of 2007 through 2010, he served as director of privately held Imagine Communications Corporation, until its acquisition by Harris Broadcast. From 2005 through 2011, Mr. Kennedy was a director of privately held high-bandwidth equipment provider Hatteras Networks, which was acquired by Overture in 2011. He also previously served as a director of Visual Networks, Inc., a

6

publicly traded network and performance management solutions provider, from 2002 until it was acquired by Fluke Electronic Corporation, an electronic test tools and software company, in 2006. He currently serves on the Board of Trustees of Flint Hill School and on the Executive Parent Board of Villanova University. Mr. Kennedy holds a Bachelor of Science degree in electrical engineering from Virginia Polytechnic Institute and State University.

Mr. Kennedy brings to the Board his extensive financial and executive leadership experience in technology companies, including networking companies, and provides management and financial expertise to our Board.

Raj Khanna. Mr. Khanna has served as one of our directors since December 2014. Since 2012, Mr. Khanna has served as an independent consultant, assisting companies with finance and internal audit issues. From 2004 to 2011, Mr. Khanna served as Vice President of Corporate Audit at Qualcomm, Inc., a publicly traded semiconductor company. Prior to Qualcomm, Mr. Khanna held various finance roles at Sun Microsystems, Inc., from 1991 to 2004, including International Controller, Vice President Finance for Global Services Business and Senior Director of Finance for Strategic Business Units, and at Xerox Corporation, a provider of document management technology and services, from 1974 to 1991. Mr. Khanna holds a Bachelor of Technology degree in mechanical engineering from the Indian Institute of Technology and a Master of Business Administration degree from the University of Rochester, New York.

Mr. Khanna brings to the Board his extensive experience leading finance and internal audit teams, including the establishment of financial controls and processes, delivering financial investment and M&A guidance, and providing strategic advice and direction regarding business model changes.

John C. Shoemaker. Mr. Shoemaker has served as one of our directors since October 2007. He currently serves as a consultant to the high technology industry and also serves as a mentor to corporate executives. From 1990 to June 2004, Mr. Shoemaker held various executive management positions at Sun Microsystems, Inc., including serving as Executive Vice President, Worldwide Operations Organizations and as Executive Vice President, and General Manager for its Computer Systems Division. Mr. Shoemaker previously served in a number of senior executive positions with the Xerox Corporation, a provider of document management technology and services, including as Senior Vice President, World Wide Marketing. Since 2017, he has been an advisor to Nyriad Limited, a privately held software development company, and from 2017 through 2019, he was an advisor to GoodSocial, a privately held SaaS and mobile platform connecting volunteers and non-profits. Mr. Shoemaker served as a director of Altera Corporation, a publicly traded provider of programmable logic solutions, from 2007 until it was acquired by Intel Corporation, a publicly traded semiconductor company, in December 2015. Mr. Shoemaker served as a director of SonicWall, Inc., a provider of IT security and data backup and recovery solutions, from 2004 to 2010 and as Chairman of the Board from 2006 to 2010. Mr. Shoemaker holds a Bachelor of Arts degree in political science and business administration from Hanover College, where he currently is a Trustee Emeritus, and a Master of Business Administration degree from Indiana University’s Kelley School of Business, where he is a member of the School of Business Dean’s Advisory Council, the School of Informatics, Computer Science and Engineering Dean’s Advisory Council, and the Johnson Center for Entrepreneurship Board. In 2019, he was awarded an Honorary Doctorate of Humane Letters by Indiana University and was named Entrepreneur of the Year by the Kelley School of Business.

Mr. Shoemaker brings to the Board his extensive executive experience in senior level management positions in the technology industry, particularly in hardware systems, and provides strong operational, management and financial expertise to our Board.

Arrangements Regarding Appointment of Directors

None of our directors are appointed pursuant to any arrangement with the Company. Pursuant to the offer letter between the Company and Mr. Meyercord respecting his employment, Mr. Meyercord must immediately resign as a director of the Board when his employment with the Company terminates.

Our Board currently consists of seven directors. Our Board has reviewed the criteria for determining the independence of the Company’s directors under Nasdaq Rule 5605, Item 407(a) of Regulation S-K of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). It has affirmatively determined that, other than Mr. Meyercord, each member of our Board is independent under such criteria. The Board has determined that as of the date of this Proxy Statement the Board is comprised of a majority of directors who qualify under the rules adopted by the SEC and Nasdaq.

Directors to be elected at the 2020 Annual Meeting are to hold office until the 2021 Annual Meeting and until their respective successors are elected and qualified.

7

Board and Leadership Structure

Our current leadership structure separates the roles of the Chief Executive Officer and the Chairman of our Board. Mr. Shoemaker has served as the Independent Chairman of our Board since February 2017. While our bylaws and Corporate Governance Guidelines do not require that the Chairman of our Board and Chief Executive Officer positions be separate, our Board believes that separating these positions is the appropriate leadership structure for us at this time and results in an effective balancing of responsibilities, experience and independent perspective to meet the current corporate governance needs and oversight responsibilities of our Board. Separating these positions allows our Chief Executive Officer to focus on setting our strategic direction and overseeing our day-to-day leadership and performance, while allowing the Chairman of our Board to lead our Board in its fundamental role of providing advice to, and independent oversight of, management.

Mr. Shoemaker’s duties as Independent Chairman include:

|

|

• |

chairing executive sessions of the independent directors; |

|

|

• |

ensuring that independent directors have adequate opportunities to meet without management present; |

|

|

• |

serving as designated contact for communication to independent directors, including being available for consultation and direct communication with major stockholders; |

|

|

• |

ensuring that the independent directors have an opportunity to provide input on the agenda for meetings of our Board; |

|

|

• |

assuring that there is sufficient time for discussion of all agenda items; and |

|

|

• |

being identified as the recipient of communications with stockholders in the annual meeting proxy statement. |

Our Board appoints our President and Chief Executive Officer, Chief Financial Officer, Corporate Secretary and all executive officers. All executive officers serve at the discretion of our Board. Each of our executive officers devotes his or her full time to our affairs. Our directors devote time to our affairs as is necessary to discharge their duties. In addition, our Board has the authority to retain its own advisers, at the Company’s expense, to assist it in the discharge of its duties.

Board’s Role in Risk Oversight

Our Board has an active role in overseeing management of the risks we face. This role is one of informed oversight rather than direct management of risk. Our Board regularly reviews and consults with management on the Company’s strategic direction and the challenges and risks we face. Our Board also reviews and discusses with management on a quarterly basis its financial results and forecasts. The Audit Committee of our Board oversees management of the Company’s financial risks, and oversees and reviews our risk management policies, including the Company’s investment policies and anti-fraud program. The Compensation Committee of our Board oversees our management of risks relating to and arising from our compensation plans and arrangements. These committees periodically report on these matters to the full Board.

Management is tasked with the direct management and oversight of legal, financial and commercial compliance matters, which includes identification and mitigation of associated areas of risk. Our Chief Administrative and Sustainability Officer provides regular reports of legal risks and developments to the Audit Committee and to our full Board. Our Chief Financial Officer, Corporate Controller and Senior Director of Internal Audit provide regular reports to the Audit Committee concerning financial, tax and audit related risks. In addition, the Audit Committee receives periodic reports from management on our compliance programs and efforts, our investment policies and practices, and the results of various internal audit projects. The Compensation Committee’s compensation consultant, together with our Chief People Officer and other members of management, provides analysis of risks related to our compensation programs and practices to the Compensation Committee.

Meetings of the Board of Directors

Our Board held nine meetings during the fiscal year ended June 30, 2020. No director attended fewer than 75 percent of the aggregate of the meetings of our Board held during the period for which he or she has been a director during fiscal 2020 and the meetings of the committees on which he or she served which were held during the periods in fiscal 2020 that he or she served on such committees.

Director Attendance at Annual Meetings

We encourage director attendance at the Annual Meeting and we use reasonable efforts to schedule our Annual Meeting of stockholders at a time and date to maximize attendance by directors, taking into account our directors’ schedules. All of our current directors attended our 2019 Annual Meeting of Stockholders.

8

The independent members of our Board meet regularly in executive session (without the presence or participation of non-independent directors), generally before or after a regularly scheduled Board meeting or at such other times as determined by our independent directors or our Chairman. Executive sessions of the independent directors are chaired by our Chairman. The executive sessions include discussions regarding guidance to be provided to the Chief Executive Officer and such other topics as the independent directors determine.

Committees of the Board of Directors

In fiscal 2020, our Board had the following three standing committees: Audit Committee; Compensation Committee; and Nominating, Governance and Social Responsibility Committee. Our Board has adopted a written charter for each of these committees, which are available on the Corporate Governance section of the Investor Relations page of our website at investor.ExtremeNetworks.com.

Fiscal 2020 Committee Membership

The members and Chairmen of our standing committees as of June 30, 2020 were as follows:

|

Name |

|

Audit Committee |

|

Compensation Committee |

|

Nominating, Governance and Social Responsibility Committee |

|

Ingrid J. Burton |

|

|

|

|

|

Member |

|

Charles P. Carinalli |

|

|

|

Chairman |

|

Member |

|

Kathleen M. Holmgren |

|

Member |

|

|

|

Member |

|

Edward H. Kennedy |

|

Member |

|

Member |

|

|

|

Raj Khanna |

|

Chairman |

|

|

|

|

|

John C. Shoemaker |

|

|

|

Member |

|

Chairman |

Audit Committee. The current members of the Audit Committee are Messrs. Khanna and Kennedy and Ms. Holmgren. Mr. Khanna serves as Chairman. Our Board has determined that each member of the Audit Committee (i) is independent as defined in applicable Nasdaq rules; (ii) meets the criteria for independence set forth in Rule 10A-3(b)(1) under the Exchange Act; (iii) has not participated in the preparation of financial statements of the Company or any current subsidiary of the Company at any time during the past three years; and (iv) is able to read and understand fundamental financial statements, including a company’s balance sheet, income statement and cash flow statement. Our Board further has determined that Mr. Khanna and Mr. Kennedy are “audit committee financial experts,” as defined by Item 407(d)(5) of Regulation S-K of the Exchange Act. Additionally, our Board has determined that Mr. Khanna and Mr. Kennedy have past employment experience in finance or accounting, requisite professional certification in accounting or other comparable experience or background that results in their financial sophistication, including being or having been a chief executive officer, chief financial officer or other senior officer with financial oversight responsibilities.

The Audit Committee: retains our independent auditors; approves the planned scope, proposed fee arrangements and terms of engagement of the independent auditors; reviews the results of the annual audit of our financial statements and the interim reviews of our unaudited financial statements; evaluates the adequacy of accounting and financial controls; reviews the independence of our auditors; and oversees our financial reporting on behalf of the Board. The Audit Committee is also responsible for establishing procedures for the receipt, retention and treatment of complaints received by us regarding accounting or internal auditing controls, including anonymous submission by our employees of concerns regarding accounting or auditing matters that may be submitted through our Whistleblower Hotline. In addition, the Audit Committee reviews with our independent auditors the scope and timing of their audit services and any other services they are asked to perform, the independent auditor’s report on our consolidated financial statements following completion of their audit, and our critical accounting policies and procedures and policies with respect to our internal accounting and financial controls. The Audit Committee also assists our Board in fulfilling its oversight responsibilities with respect to financial risks, including risk management in the areas of financial reporting, internal controls, investments and compliance with legal and regulatory requirements. The Audit Committee annually reviews and reassesses the adequacy of its Audit Committee Charter. The Audit Committee held nine meetings during fiscal 2020.

9

Compensation Committee. The current members of the Compensation Committee are Messrs. Carinalli, Kennedy, and Shoemaker. Mr. Carinalli serves as Chairman. All members of the Compensation Committee are independent for purposes of the Nasdaq Marketplace Rules, and are “non-employee directors” for purposes of Rule 16b-3 under the Exchange Act and “outside directors” for purposes of Section 162(m) of the Internal Revenue Code. The Compensation Committee is responsible for discharging our Board’s responsibilities relating to compensation and benefits of our executive officers and evaluates and reports to our Board on matters concerning management performance, officer compensation and benefits plans and programs. In carrying out its responsibilities, the Compensation Committee reviews all components of executive officer compensation for consistency with our compensation philosophy. The Compensation Committee also administers our stock option plans and stock incentive plans. The Compensation Committee assists our Board in fulfilling its oversight responsibilities with respect to the management of risks arising from our compensation policies and programs. Our President and Chief Executive Officer and our Chief People Officer assist the Compensation Committee in its deliberations with respect to the compensation of our executive officers, provided, however, that neither individual participates in the Compensation Committee’s deliberations or voting regarding his or her own compensation. In connection with the Company’s annual compensation review, each executive officer discusses his or her individual performance with our Chief Executive Officer, who addresses such performance with the Compensation Committee, and the Chief Executive Officer discusses his individual performance directly with the Compensation Committee. The Compensation Committee annually reviews and reassesses the adequacy of its Compensation Committee Charter. The Compensation Committee held eight meetings during fiscal 2020.

In fiscal 2020, as permitted by its Charter, and subject to the provisions of Section 152 of the Delaware General Corporation Law, the Compensation Committee delegated to management the ability to award time-based restricted stock units under the Company’s 2013 Equity Incentive Plan to employees of the Company at the level of Vice President and below. The delegation provided for limitations on the number of shares covered by the individual and aggregate awards, vesting over three years, and quarterly reporting to the Compensation Committee. The Compensation Committee has made a similar delegation for fiscal 2021, except in fiscal 2021 has approved the vesting over two years for employees other than the named executive officers. The Company’s Chief Executive Officer presently approves such awards, with additional approval by the Company’s Chief Financial Officer, Chief Administrative and Sustainability Officer, and Chief People Officer given before the effective date of grant.

The Compensation Committee may retain, at the Company’s expense, one or more independent compensation consultants. As described under the heading “Executive Compensation and Other Matters—Compensation Discussion and Analysis,” the Compensation Committee was advised by Compensia, Inc., a national compensation consulting firm, with respect to various compensation matters during fiscal 2020. Compensia has served as the Compensation Committee’s compensation consultant since fiscal year 2013. The Compensation Committee has reviewed and is satisfied with the qualifications, performance and independence of Compensia. Compensia provides no services to the Company, other than services for the Compensation Committee.

For more information about the Compensation Committee’s role and practices regarding executive compensation, see the discussion below under the heading “Executive Compensation and Other Matters.”

Nominating, Governance and Social Responsibility Committee. The current members of the Nominating, Governance and Social Responsibility Committee are Messrs. Shoemaker and Carinalli and Mses. Burton and Holmgren. Mr. Shoemaker serves as Chairman. Each member of the Nominating, Governance and Social Responsibility Committee is independent. The Nominating, Governance and Social Responsibility Committee identifies, reviews, evaluates and nominates candidates to serve on our Board; recommends and approves corporate governance principles, codes of conduct and compliance mechanisms applicable to us, including our Corporate Governance Guidelines; reviews, assesses and oversees matters related to corporate social responsibility; and assists our Board in its annual reviews of the performance of our Board and each committee of the Board. The Nominating, Governance and Social Responsibility Committee assists our Board in fulfilling its oversight responsibilities with respect to the management of risks associated with board organization, membership and structure, succession planning for our directors and executive officers, and corporate governance. The Nominating, Governance and Social Responsibility Committee reviews, assesses, and provides oversight to corporate social responsibility, including diversity and inclusion goals, environmental matters, and philanthropic initiatives. The Nominating, Governance and Social Responsibility Committee periodically reviews and reassesses the adequacy of its Nominating, Governance and Social Responsibility Committee Charter. The Nominating, Governance and Social Responsibility Committee held four meetings during fiscal 2020. The Nominating, Governance and Social Responsibility Committee changed its name from Nominating and Corporate Governance Committee in connection with a change to its charter effective September 25, 2019 to review, assess, and provide oversight with respect to corporate social responsibility.

Compensation Committee Interlocks and Insider Participation

None of our executive officers has served on the Board of Directors or compensation committee of any other entity that has, or has had, one or more executive officers who served as a member of our Board or Compensation Committee during fiscal 2020. No member of the Compensation Committee was, during fiscal 2020 or any prior period, an officer or employee of the Company.

10

Director Qualifications. In fulfilling its responsibilities, the Nominating, Governance and Social Responsibility Committee considers numerous factors in reviewing possible candidates for nomination as director, including:

|

|

• |

the appropriate size of our Board and its committees; |

|

|

• |

the perceived needs of our Board for particular skills, industry expertise, background and business experience; |

|

|

• |

the skills, background, reputation, and business experience of nominees and the skills, background, reputation, and business experience already possessed by other members of our Board; |

|

|

• |

the nominees’ independence from management; |

|

|

• |

the nominees’ experience with accounting rules and practices; |

|

|

• |

the nominees’ background with regard to executive compensation; |

|

|

• |

the applicable regulatory and listing requirements, including independence requirements and legal considerations, such as antitrust compliance; |

|

|

• |

the benefits of a constructive working relationship among directors; and |

|

|

• |

the desire to balance the considerable benefit of continuity with the periodic injection of the fresh perspective provided by new members. |

While we do not have a formal diversity policy for membership on the Board, the Nominating, Governance and Social Responsibility Committee considers many factors, including character, judgment, independence, age, education, expertise, diversity of experience, length of service, other commitments and ability to serve on committees of our Board, in evaluating potential candidates. It also considers individual attributes that contribute to board heterogeneity, including race, gender, and national origin. The Nominating, Governance and Social Responsibility Committee does not assign any particular weighting or priority to any of these factors or attributes.

There are no stated minimum criteria for director nominees, although the factors and attributes discussed above will play a material role in the recommendation of a candidate by the Nominating, Governance and Social Responsibility Committee. The Nominating, Governance and Social Responsibility Committee also believes it appropriate for one or more key members of management to participate as members of our Board.

Identifying and Evaluating Candidates for Nomination as Director. The Nominating, Governance and Social Responsibility Committee annually evaluates the current members of our Board who are willing to continue in service to determine whether to recommend to the full Board that these directors be submitted to the stockholders for re-election.

Candidates for nomination as director come to the attention of the Nominating, Governance and Social Responsibility Committee from time to time through incumbent directors, management, stockholders or third parties. These candidates may be considered at meetings of the Nominating, Governance and Social Responsibility Committee at any point during the year. Additionally, the Nominating, Governance and Social Responsibility Committee may poll directors and management for suggestions or conduct research to identify possible candidates if it believes that our Board requires additional members or nominees, or should add additional skills or experience. The Nominating, Governance and Social Responsibility Committee may engage a third-party search firm to assist in identifying qualified candidates, as it deems appropriate.

The Nominating, Governance and Social Responsibility Committee will consider candidates for directors proposed by its stockholders. For annual meetings occurring after our 2020 Annual Meeting, to be evaluated in connection with the Nominating, Governance and Social Responsibility Committee’s established procedures for evaluating potential director nominees, any recommendation for director nominee submitted by a stockholder must be sent in writing to the Corporate Secretary at our corporate headquarters and must be received at our principal executive offices not earlier than the close of business 120 days prior to the one-year anniversary of the preceding year’s annual meeting and not later than the close of business 90 days prior to such one-year anniversary, except that if no annual meeting was held in the previous year or the date of the annual meeting has been changed by more than 30 calendar days from the date contemplated at the time of the previous year’s proxy statement, notice by the stockholders to be timely must be received not later than the close of business on the later of the 90th day prior to the annual meeting or the 10th day following the date on which public announcement of the date of such meeting is first made. For purposes of the foregoing, “public announcement” shall mean disclosure in a press release reported by the Dow Jones News Service, Associated Press or comparable national news service or in a document publicly filed or furnished by us with the SEC. The recommendation for director nominee submitted by a stockholder must contain the information required by our bylaws. You may contact our Corporate Secretary at our principal executive offices for a copy of the relevant bylaw provisions regarding the requirements for making stockholder proposals and nominating director candidates. Candidates recommended by our stockholders will be evaluated against the same factors as are applicable to candidates proposed by directors or management.

11

All directors and director nominees must submit a completed directors’ and officers’ questionnaire as part of the nominating process. The evaluation process may also include interviews and additional background and reference checks for non-incumbent nominees, at the discretion of the Nominating, Governance and Social Responsibility Committee.

Board Member Resignation Policy

In the event one or more incumbent directors fails to receive the affirmative vote of a majority of the votes cast at an election that is not a contested election, that director shall promptly tender his or her irrevocable resignation to the Board. The Nominating, Governance and Social Responsibility Committee shall recommend to the Board whether to accept or reject the resignation of such incumbent director or whether other action should be taken. The Board shall act on the resignation, taking into account the recommendation of the Nominating, Governance and Social Responsibility Committee, and within ninety (90) days after the date of certification of the election results, the Board shall disclose its decision and the rationale regarding whether to accept the resignation (or the reasons for rejecting the resignation, if applicable) in a press release, a filing with the SEC or by other public announcement. The director whose resignation is under consideration may not participate in any deliberation or vote of the Nominating, Governance and Social Responsibility Committee or the Board regarding his or her resignation. The Nominating, Governance and Social Responsibility Committee and the Board may consider any factors and other information they deem appropriate and relevant in deciding whether to accept a director’s resignation. If an incumbent director fails to receive the required vote for re-election in an election that is not a contested election and such director’s resignation is not accepted by the Board, such director will continue to serve until his or her successor is duly elected and qualified or until his or her death, resignation or removal. If such director’s resignation is accepted by the Board, or if a nominee for director is not elected and the nominee is not an incumbent director, then the Board may fill any resulting vacancy pursuant to the terms of the Company’s bylaws.

John Shoemaker, our Independent Chairman, is responsible for receiving, distributing and arranging responses to communications from our stockholders to our Board. Stockholders may communicate with our Board by transmitting correspondence by mail addressed as follows:

Chairman of the Board (or individually named director(s))

Extreme Networks, Inc.

6480 Via Del Oro

San Jose, California 95119

The Chairman transmits each communication as soon as practicable to the identified director addressee(s), unless (i) there are safety or security concerns that mitigate against further transmission of the communication; or (ii) the communication contains commercial matters not related to the stockholder’s stock ownership, as determined by the Chairman in consultation with legal counsel. Our Board or individual directors are advised of any communication withheld for safety or security reasons as soon as practicable. Our directors have requested that the Chairman not forward to them advertisements, solicitations for periodicals or other subscriptions, and other similar communications.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires our executive officers, directors and persons who beneficially own more than 10 percent of our common stock to file initial reports of beneficial ownership and reports of changes in beneficial ownership with the SEC. These persons are required by SEC regulations to furnish us with copies of all Section 16(a) forms filed by such person. Based solely on our review of the forms furnished to us and written representations from certain reporting persons, we believe that all filing requirements applicable to our executive officers, directors and persons who beneficially own more than 10 percent of our common stock were complied with in the fiscal year ended June 30, 2020, other than the inadvertent late filings of: (i) one Form 4 on September 5, 2019 for Remi Thomas reporting acquisition of restricted stock units on August 28, 2019; (ii) one Form 4 on September 5, 2019 for Robert Gault reporting acquisition of restricted stock units on August 28, 2019; and (iii) one Form 4 on September 5, 2019 for Edward B. Meyercord reporting acquisition of restricted stock units on August 28, 2019.

Code of Ethics and Corporate Governance Materials

Our Board has adopted charters for its Audit, Compensation, and Nominating, Governance and Social Responsibility Committees, which are available on the Corporate Governance section of our Investor Relations page of our website at investor.ExtremeNetworks.com. Our Board has also adopted a Code of Business Conduct and Ethics that applies to all of our employees, officers and directors. The Code of Business Conduct and Ethics can be found on our website on the Corporate

12

Governance section of our Investor Relations page of our website at investor.ExtremeNetworks.com. We intend to satisfy the disclosure requirements under the Exchange Act regarding an amendment to or waiver from a provision of our Code of Business Conduct and Ethics by posting such information on our website.

Environmental, Social and Governance

In fiscal 2020, our Board amended the charter of our Nominating and Corporate Governance Committee to include social responsibility within the committee’s mandate, and to re-name the committee as the Nominating, Governance and Social Responsibility Committee. The Nominating, Governance, and Social Responsibility Committee is charged with providing oversight of Extreme’s initiatives in the arena of corporate social responsibility, including diversity and inclusion goals, environmental matters, and philanthropic initiatives. Executive leadership reports on these matters to the Nominating, Governance and Social Responsibility Committee on a quarterly basis.

To support this initiative on a day-to-day basis, we have created a Corporate Social Responsibility (“CSR”) Council, a cross-functional team of employees with a passion for improving not only what we do, but how we do it. The CSR Council is led by Katy Motiey, our Chief Administrative and Sustainability Officer. The CSR Council will soon publish our inaugural Corporate Social Responsibility Report to summarize our current activities in this regard. The CSR Council intents to publish our long-term goals in calendar year 2020. In the future, the CSR Report will be expanded to include progress on and status of those goals.

Our CSR model can be divided into five key areas – Human Capital, Environment, Social Capital, Business Model & Innovation, and Leadership & Governance, each led by an Extreme employee, and in many cases on a cross-functional basis. Within each of these broad areas, we have focused on one or more subsets where we can direct our resources most effectively.

|

CSR Category |

Area of Extreme Focus |

|

Human Capital |

Diversity & Inclusion |

|

Environment |

Corporate reduction of carbon footprint, product sustainability |

|

Social Capital |

Philanthropy |

|

Business Model & Innovation |

Data Privacy & Ethics |

|

Leadership & Governance |

Corporate Governance & Ethics |

Diversity & Inclusion

Our core values are Teamwork, Transparency, Candor, Curiosity, Ownership, and Inclusion. As we increase the breadth of our portfolio and scale of our organization, we will continue our practice of hiring – and partnering with – a diversified workforce to broaden our Company’s perspective and promote the exchange of ideas. Empowerment of our people is an integral part of how we run our business.

In fiscal 2018, we established an International Women’s Leadership Council (“WLC”) that has continued to grow in numbers and in strength through fiscal 2020. Members of the WLC strive to create a culture that values, promotes, and leverages the advancement of women based upon transparency, performance, and merit. The WLC regularly offers skills development seminars for all employees on topics such as negotiating, critical decision making, and working from home. The group leads a celebration for International Women’s Day and supports a mentorship and ambassadorship program. In connection with the WLC, our Chief Administrative and Sustainability Officer has conducted over 80 interviews of leaders within Extreme, focusing on diversity and inclusion issues. Four subcommittees support the work of the WLC by focusing on mentorship and sponsorship (Team Inspire), recruitment and internships (Team Tens), advancement and methodology of promotion (Team Rise), and integration of culture and people (Team Solidarity). The WLC is supported by a dedicated consultant who reports to our President and Chief Executive Officer.

One-third of our independent directors are female, and over one-third of our CEO’s direct reports are women. One of his direct reports is Black, and two are of Middle Eastern origin. We believe this brings a diversity of thought and leadership styles to the Board.

We are making strides to recognize and promote racial and ethnic diversity as well. In the wake of the George Floyd murder and Black Lives Matter protests, our leadership team acted quickly to show understanding and support. We have since started an employee resource group for African American and Black employees. Black@Extreme (“BEX”) champions and facilitates workplace diversity by embracing cultural, ethnic, and racial differences, by providing programming that promotes inclusion in recruitment activities, offers formalized development, and enables a more collaborative and diverse work environment. The four subcommittees comprising BEX address dialogue and awareness, development and mentorship, recruitment and retention, and community and network. BEX has already started a Toastmaster (public speaking) group and book clubs, and has other exciting planned initiatives.

13

Our efforts toward diversity and inclusion have an external focus as well. In fiscal 2021, we plan to implement a Supplier Diversity Program. The Supplier Diversity Program will facilitate identification, qualification, and selection of diverse suppliers by providing resources to Company managers who are selecting suppliers. It will also provide accountability and reporting tools so we can measure progress. We intend to develop relationships with entities that provide resources to promote supplier diversity and will work on developing broader relationships with its diverse suppliers.

Sustainability - Reduction of Carbon Footprint

In recent years, we have implemented policies and undertaken various projects to increase its focus on environmental sustainability.

In fiscal 2019, we installed a 2.2-megawatt Bloom Energy System at its San Jose headquarters to operate as a microgrid. Bloom Energy Servers convert natural gas or biogas fuel into electricity without combustion via an electro-chemical reaction, thus generating virtually no particulate emissions such as NOx or SOx, which contribute to air pollution. The fuel cell technology also reduces carbon dioxide emissions and nearly eliminates the water required to produce energy. These environmental benefits come with a cost saving. We saved approximately $348,000 in energy costs in fiscal 2020.

We have taken other steps to reduce the carbon footprint of the Company and its employees. We have long been supportive of employees working remotely, even prior to the COVID-19 pandemic and the work-from-home orders. This results in fewer miles driven than if all employees were required to report to the office on a daily basis. For employees in San Jose, California and Morrisville, North Carolina who do commute to the office, electric vehicle charging stations are freely available to employees. Use of electric vehicle charging stations avoided 10,697.8 kilograms of greenhouse gas emissions during the second half of fiscal 2020.

As with most companies during the COVID-19 pandemic, business travel almost completely dropped off in the last half of our fiscal 2020. In fiscal 2020, our carbon footprint related to air travel decreased 50% year-over-year. Though we expect a slow increase in business travel moving forward, we anticipate the volume of business travel will not return to pre-COVID-19 levels thanks to the success of our remote working program.

Our physical facilities are designed and used with sustainability in mind. We have an active waste management policy in all of its offices and employees are encouraged to recycle. Lighting in many of our corporate offices is sensor-driven to reduce electricity consumption. Our office building in Morrisville, North Carolina is LEED-certified.

Sustainability - Product Sustainability

We continue to seek ways to design, manufacture, and deliver software-driven networking solutions in an environmentally and socially sustainable manner.

During fiscal 2020, we completed 90% of our planned hardware refresh cycle for our products and our Gen4 portfolio uses next generation silicon built using smaller process technology, enabling lower power dissipation for equivalent function.

We expect our suppliers to adhere to our quality standards and to do so in a manner that complies with our ethical, human rights, legal, confidentiality, and environmental standards. These standards are outlined for suppliers in our Supplier Code of Conduct.

We comply with environmentally related product regulations for global areas where we manufacture, ship, and sell products. All our products must be designed to comply with our Green Environmental Compliance Specification (“GECS"). Specifically, we and our suppliers ensure that our products and the components used in those products are Restriction of Hazardous Substances (“ROHS”) and Waste from Electrical and Electronic Equipment (“WEEE”) compliant and that our engineering team designs our products with recycling and recovery in mind. Our suppliers are required to comply with the Responsible Business Alliance Code of Conduct (latest version), and have a management system in place covering labor, health and safety, environmental concerns, and ethics.