UNITED STATES | ||||||||

SECURITIES AND EXCHANGE COMMISSION | ||||||||

Washington, D.C. 20549 | ||||||||

SCHEDULE 14A | ||||||||

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934 (Amendment No. ) | ||||||||

Filed by the Registrant x | ||||||||

Filed by a Party other than the Registrant o | ||||||||

| Check the appropriate box: | ||||||||

| o | Preliminary Proxy Statement | |||||||

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||||||

| x | Definitive Proxy Statement | |||||||

| o | Definitive Additional Materials | |||||||

| o | Soliciting Material under §240.14a-12 | |||||||

Umpqua Holdings Corporation | ||||||||

(Name of Registrant as Specified In Its Charter) | ||||||||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||||||

| Payment of Filing Fee (Check the appropriate box): | ||||||||

| x | No fee required. | |||||||

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||||||

| (1) | Title of each class of securities to which transaction applies: | |||||||

| (2) | Aggregate number of securities to which transaction applies: | |||||||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||||||

| (4) | Proposed maximum aggregate value of transaction: | |||||||

| (5) | Total fee paid: | |||||||

| o | Fee paid previously with preliminary materials. | |||||||

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||||||

| (1) | Amount Previously Paid: | |||||||

| (2) | Form, Schedule or Registration Statement No.: | |||||||

| (3) | Filing Party: | |||||||

| (4) | Date Filed: | |||||||

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD APRIL 20, 2020

___________________

The annual meeting of shareholders of Umpqua Holdings Corporation (the “Company”) will be held at The Porter Portland Hotel, Founders Room, 1355 SW 2nd Avenue, Portland, Oregon, at 3:00 p.m., local time, on Monday, April 20, 2020 to take action on the following:

ITEMS OF BUSINESS

•Election of Directors. Elect 11 nominees to the Company’s Board of Directors, to hold office until the 2021 annual meeting of shareholders and qualification and election of their successors.

•Ratification of Selection of Registered Public Accounting Firm. Non-binding vote on the Audit and Compliance Committee’s selection of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2020.

•Advisory Vote on Executive Compensation. Non-binding vote to approve the compensation of the named executive officers as described in the Proxy Statement for the annual meeting.

OTHER BUSINESS

•Consider and act upon such other business that is properly brought before the annual meeting or any adjournments or postponements thereof.

As of the date of this notice, the Board of Directors knows of no other matters that may be brought before shareholders at the meeting.

If you were a shareholder of record of Company common stock as of the close of business on February 12, 2020, you are entitled to receive this notice and vote at the annual meeting, and any adjournments or postponements thereof. The Proxy Statement for the annual meeting and proxy card are being sent or made available on or about March 5, 2020.

For instructions on voting, please refer to the instructions on the Notice of Internet Availability of Proxy Materials you received or, if you received a hard copy of the Proxy Statement, on the accompanying proxy card. You can request to receive proxy materials by mail or e-mail. You may vote by mail, and by telephone and on the internet. You will find our Proxy Statement, Form 10-K and other important information at our website: https://www.umpquabank.com/investor-relations. When you visit our site, you can also subscribe to e-mail alerts that will notify you when we file documents with the SEC and issue press releases. Your vote is important. Whether or not you expect to attend the annual meeting, it is important that your shares be represented and voted.

| By Order of the Board of Directors, | |||||

| |||||

| Andrew H. Ognall | |||||

| March 5, 2020 | EVP/General Counsel/Secretary | ||||

PROXY STATEMENT

2020 ANNUAL MEETING OF SHAREHOLDERS

TABLE OF CONTENTS

| PROXY SUMMARY | |||||

| ANNUAL MEETING BUSINESS | |||||

| ITEM 1. ELECTION OF DIRECTORS | |||||

| ITEM 2. RATIFICATION OF SELECTION OF REGISTERED PUBLIC ACCOUNTING FIRM | |||||

| INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | |||||

| AUDIT AND COMPLIANCE COMMITTEE REPORT | |||||

| ITEM 3. ADVISORY VOTE ON EXECUTIVE COMPENSATION | |||||

| OTHER BUSINESS | |||||

| CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION | |||||

| INFORMATION ABOUT EXECUTIVE OFFICERS | |||||

| SECURITY OWNERSHIP OF MANAGEMENT AND OTHERS | |||||

| CORPORATE GOVERNANCE OVERVIEW | |||||

| DELINQUENT SECTION 16(a) REPORTS | |||||

| SHAREHOLDER PROPOSALS FOR THE 2021 ANNUAL MEETING OF SHAREHOLDERS | |||||

| RELATED PARTY TRANSACTIONS | |||||

| DIRECTOR COMPENSATION | |||||

| COMPENSATION DISCUSSION AND ANALYSIS (“CD&A”) | |||||

| Section 1 - Executive Summary | |||||

| Section 2 - Performance and Pay | |||||

| Section 3 - Compensation Process and Decisions for 2019 | |||||

| Section 4 - Other Compensation Information | |||||

| COMPENSATION COMMITTEE REPORT | |||||

| COMPENSATION TABLES | |||||

| INCORPORATION BY REFERENCE | |||||

| QUESTIONS AND ANSWERS ABOUT VOTING AND THE SHAREHOLDER MEETING | |||||

These proxy materials are provided in connection with the solicitation of proxies by the Board of Directors of Umpqua Holdings Corporation for the annual meeting of shareholders and at any adjournments or postponements of the meeting. This Proxy Statement and accompanying proxy card are being sent or made available on or about March 5, 2020. In this Proxy Statement we refer to Umpqua Holdings Corporation as the “Company,” “Umpqua,” “we,” “us,” “our,” or similar references.

PROXY SUMMARY

This summary highlights information contained elsewhere in this Proxy Statement. This summary does not contain all the information you should consider, and you should carefully read the entire Proxy Statement before voting. For information about the meeting and voting please see Questions and Answers About Voting and the Shareholder Meeting at the end of this Proxy Statement. Your vote is very important. The Board of Directors is requesting that you allow your common stock to be represented at the annual meeting by proxy.

| 2019 BUSINESS HIGHLIGHTS | ||||||||||||||

| UMPQUA NEXT GEN STRATEGY | • | Advanced Umpqua Next Gen--our growth, differentiation and operational excellence strategy designed to improve the customer experience and our financial performance through cost savings, efficiency and revenue enhancement initiatives | ||||||||||||

| o | Commenced second phase of operational excellence project | |||||||||||||

| ♦ | completed redesign of commercial lending process to improve speed and quality of process and customer experience and rolled it out in key Oregon and Washington markets | |||||||||||||

| ♦ | completed Phase I projects in Q2 2019, achieving $25.0 million in savings | |||||||||||||

| ♦ | continued store rationalization | |||||||||||||

| o | Focused on enrolling customers in the Umpqua Go-To application, our Human Digital banking platform | |||||||||||||

| o | Continued emphasis on balanced growth | |||||||||||||

| ♦ | $1.3 billion year over year growth in average loan and lease, and deposit, balances | |||||||||||||

| ♦ | $21.0 million two-year incremental growth in non-mortgage fee revenue, an 8% compounded annual growth rate | |||||||||||||

| ♦ | strategic hires in corporate and commercial banking and global payments and deposits to advance balanced growth initiatives in lending, deposit gathering and fee revenue improvement | |||||||||||||

| • | Progress to 2020 financial goals | |||||||||||||

| o | Return on average tangible common equity (“ROATCE”) of 14.77% compared to 14.45% for the prior year | |||||||||||||

| o | Efficiency ratio of 56.97% compared to 60.61% for 2018 | |||||||||||||

| • | Named most admired financial services company in Oregon by the Portland Business Journal for the fifteenth consecutive year | |||||||||||||

2

| 2019 FINANCIAL RESULTS | ||||||||||||||

| GROWTH | • | Gross loan and lease growth of 4% and deposit growth of 6% | ||||||||||||

o | Total assets of $28.8 billion as of December 31, 2019 compared to $26.9 billion as of December 31, 2018 | |||||||||||||

| o | Gross loans and leases grew by $773.0 million year over year | |||||||||||||

| o | Deposits increased $1.3 billion year over year | |||||||||||||

| EARNINGS PERFORMANCE | • | Year-over-year diluted earnings per share increased 12%, reflecting success of Umpqua Next Gen initiatives | ||||||||||||

o | 2019 earnings per diluted share of $1.60 compared to $1.43 for 2018 | |||||||||||||

o | Net interest income decreased by $18.0 million, driven primarily by a decrease in short and long-term interest rates during the year, which led to a decline in net interest margin, partially offset by loan and lease growth | |||||||||||||

o | Non-interest income increased by $60.4 million, driven primarily by the $76.3 million net gain recorded from the sale of the Visa Class B stock and other debt securities, partially offset by a reduction in net residential mortgage banking revenue | |||||||||||||

o | Non-interest expense decreased by $20.4 million, driven by continued focus on cost savings initiatives | |||||||||||||

| CREDIT QUALITY | • | Maintained strong credit quality | ||||||||||||

o | Net charge-offs to average loans and leases of 0.29% for 2019 compared to 0.26% for 2018 | |||||||||||||

o | Non-performing assets to total assets ratio of 0.23% in 2019 compared to 0.36% | |||||||||||||

o | Classified loans to total loans of 0.83% in 2019 compared to 0.75% in 2018 | |||||||||||||

| PRUDENT CAPITAL MANAGEMENT | • | Increased dividends and grew book value | ||||||||||||

o | Declared dividends of $0.84 per share in 2019 compared to $0.82 in 2018 | |||||||||||||

o | Book value grew by 6% and tangible book value by 12% in 2019 (including the impact of dividends by 20%) | |||||||||||||

| • | All regulatory capital ratios remained in excess of well-capitalized thresholds and internal policy limits | |||||||||||||

3

GOVERNANCE | ||||||||||||||

| SHAREHOLDER ENGAGEMENT | • | Annual shareholder outreach program to discuss governance and compensation matters | ||||||||||||

| o | invite our 30 largest shareholders, representing over 60% of our outstanding shares to discuss governance and compensation matters | |||||||||||||

| o | regularly attend investor conferences and hold one-on-one meetings with additional shareholders | |||||||||||||

| o | reviewed potential overboarding concern with an investor and provided additional information to resolve the matter | |||||||||||||

| o | no material compensation concerns raised | |||||||||||||

| • | Review compensation specific feedback from shareholders with the Compensation Committee and governance feedback with the Nominating and Governance Committee | |||||||||||||

| BOARD OF DIRECTORS | • | Annual election of directors | ||||||||||||

| • | Average director tenure of eight years as of March 1, 2020, ranging from one to fifteen years | |||||||||||||

| • | Average director age of 57 as of March 1, 2020 | |||||||||||||

| • | Majority voting standard in Articles of Incorporation | |||||||||||||

| • | We continue to have a board with a diverse mix of professional experiences, gender, ethnicity and backgrounds | |||||||||||||

| • | Majority of the Board is independent with independent Audit, Compensation and Nominating and Governance Committees | |||||||||||||

| • | Annual strategic planning meeting | |||||||||||||

| • | Annual Board, committee and individual director evaluations | |||||||||||||

| • | No director serves on more than two other public company Boards | |||||||||||||

COMPENSATION | ||||||||||||||

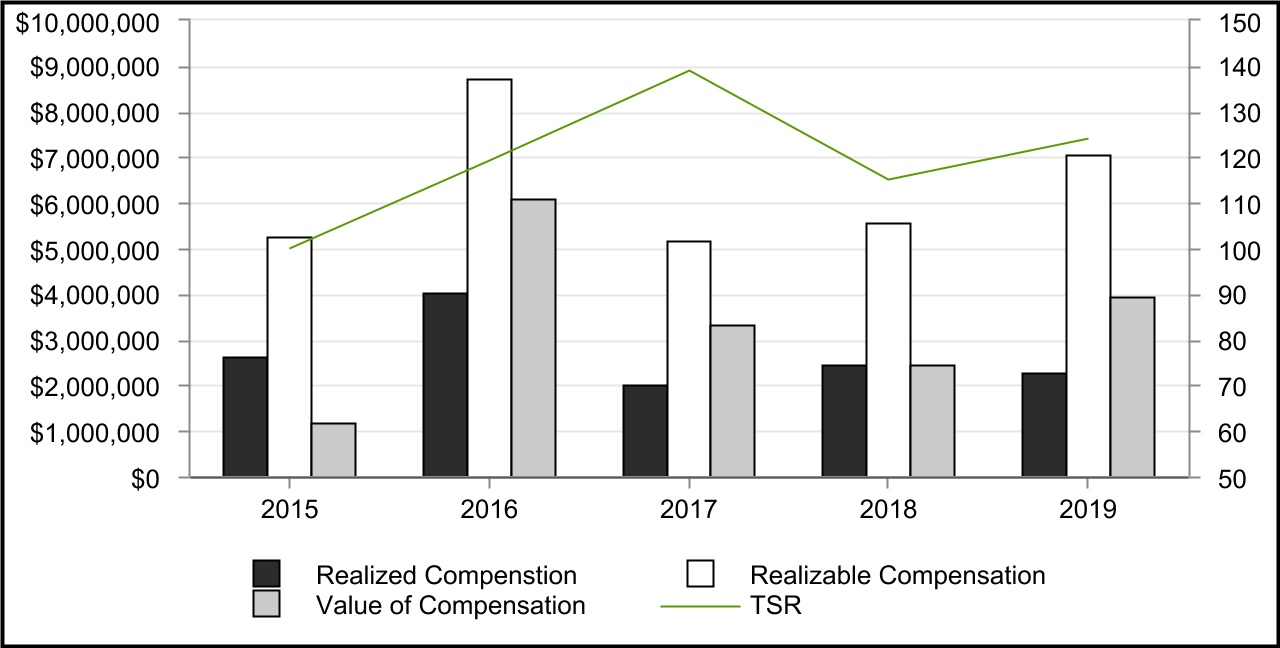

| LONG-TERM AND PERFORMANCE FOCUSED PROGRAM | • | Predominantly performance-based incentive programs with conditions that encourage long-term value creation | ||||||||||||

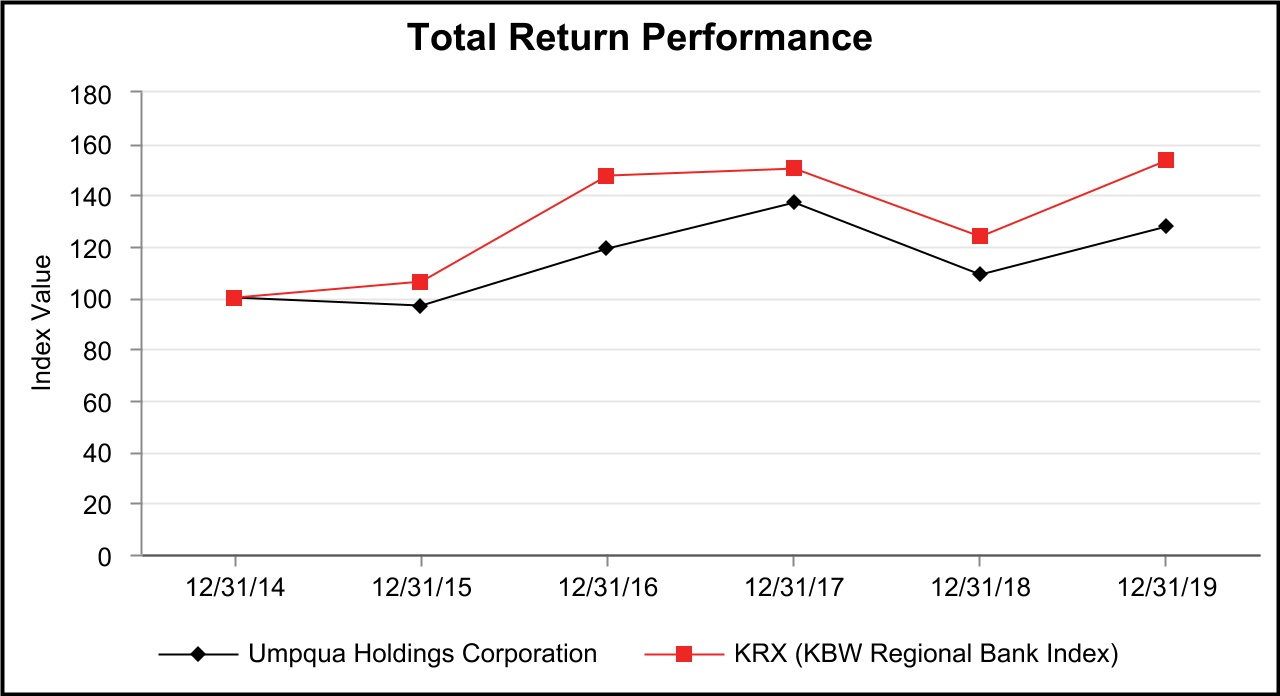

o | equity awards tied to total shareholder return (“TSR”) and ROATCE, each relative to a peer group | |||||||||||||

o | annual cash incentives tied to meaningful operating earnings per share results that are based on progress on key strategic initiatives | |||||||||||||

| • | "Circuit-breaker" provisions, which require a minimum level of performance to receive any payout, in incentive awards | |||||||||||||

| • | 100% of CEO awards based on objective performance conditions | |||||||||||||

4

| STRONG GOVERNANCE FEATURES | • | Stock retention, or hold-to-retirement, requirement for executive officers | ||||||||||||

| • | Clawback provisions applicable to all cash incentives and equity awards | |||||||||||||

| • | Minimum one-year equity award vesting requirement; three-year period on performance-based awards | |||||||||||||

| • | Avoid problematic pay practices such as single-trigger change-in-control provisions and tax gross-ups on severance or change-in-control benefits | |||||||||||||

| • | Independent Compensation Committee that engages its own advisors | |||||||||||||

| • | Stock ownership requirements for directors and executive officers | |||||||||||||

| • | Prohibit hedging and pledging transactions with Company stock | |||||||||||||

| • | Cutback for compensation that would be subject to a lost deduction under Section 280G of the Internal Revenue Code | |||||||||||||

| • | No dividends on unvested equity awards | |||||||||||||

| • | No significant perquisites | |||||||||||||

| • | No repricing, reload or exchange of stock options without shareholder approval | |||||||||||||

| • | Annual review of peer group for compensation purposes | |||||||||||||

| • | No guaranteed or discretionary bonuses for executives | |||||||||||||

| KEY COMPENSATION DECISIONS | • | Established annual cash incentive plan metrics with operating earnings per share (“OEPS”) component (representing 60-80% of target opportunity) and strategic component (representing 20% of target opportunity) for all executives and a goal component (representing 20% of target opportunity) for executives other than the CEO | ||||||||||||

o | OEPS component achieved at 75% level | |||||||||||||

o | Elements of strategic component were non-mortgage fee revenue growth, commercial and corporate banking relationship growth, new core deposit account generation and Umpqua Go-To application adoption | |||||||||||||

o | Strategic component achieved at 90% level | |||||||||||||

o | Goal component achieved at 100-115% level | |||||||||||||

o | Overall annual cash incentive plan payout ranges were 78% - 83% for named executive officers | |||||||||||||

| • | Annual best practices review and competitive assessment of total compensation with independent compensation consultant | |||||||||||||

| • | During annual review of compensation, the Compensation Committee approved an adjustment of salary for Tory Nixon after his first year in the role of Senior Executive Vice President/Chief Banking Officer reflecting the expanded responsibilities and Mr. O'Haver's assessment of his performance in the new position | |||||||||||||

| • | Executive equity awards remain primarily performance based, tied to relative TSR and ROATCE metrics | |||||||||||||

| • | Mid-year equity award to Chief Risk Officer Shotwell with successful advancement of key enterprise risk initiatives | |||||||||||||

| • | No material changes to overall compensation program with continued meaningful performance-based components | |||||||||||||

5

ANNUAL MEETING BUSINESS | ||

Proposal | Vote Required for Approval | Effect of Abstentions | Broker Discretionary Voting Allowed? | Effect of Broker Non-Votes | ||||||||||

1. Election of Directors | Majority* | No effect; not treated as a vote cast, except for quorum purposes | No | No Effect | ||||||||||

2. Ratification of Independent Registered Public Accounting Firm | Votes cast “For” exceed “Against” votes | No effect; not treated as a vote cast, except for quorum purposes | Yes | No Effect | ||||||||||

3. Advisory vote on executive compensation (“say on pay”) | Votes cast “For” exceed “Against” votes | No effect; not treated as a vote cast, except for quorum purposes | No | No Effect | ||||||||||

* See “Item 1. Election of Directors” for additional information about majority voting.

ITEM 1. ELECTION OF DIRECTORS

Our articles of incorporation and bylaws provide that each director is elected to serve a one-year term of office, expiring at the next annual meeting of shareholders, provided, however, that each director continues to serve until the director’s successor is elected and qualified or until there is a decrease in the number of directors. Our articles of incorporation establish the number of directors at between six and 19, with the exact number to be fixed from time to time by resolution of the Board of Directors. The number of directors is currently set at 11. Directors are elected by a majority of votes (votes cast "for" exceed votes cast "against") in an uncontested election.

Under Oregon law, an incumbent director nominee who is not re-elected at a shareholder meeting continues to serve on the Board until his or her successor is elected and qualified or until there is a decrease in the number of directors. The Board believes that it needs an orderly process to address the ongoing composition of the Board if one or more directors receive a majority of votes cast “against” their reelection. Accordingly, the Board maintains a requirement that any incumbent director nominee who receives more “against” votes than “for” votes in an uncontested election tender his or her resignation subject to acceptance or rejection by the Board. The Nominating and Governance Committee would then make a recommendation, and the Board would decide whether to accept or reject the tendered resignation within 90 days after the shareholder meeting. In determining the votes cast for the election of a director and whether a director received a majority, abstentions and broker non-votes are excluded. Shareholders are not entitled to cumulate votes in the election of directors. In a contested election, defined as more director candidates than director positions to be elected, the voting standard is a plurality of votes cast.

6

The Board has nominated the following 11 directors, including our CEO, for election to serve until the 2021 annual meeting and qualification and election of their successors:

| NOMINEE | AGE | PRINCIPAL OCCUPATION | DIRECTOR SINCE | ||||||||

| Peggy Fowler | 68 | Retired President and CEO of Portland General Electric | 2009 | ||||||||

| Stephen Gambee | 56 | President and CEO of Rogue Waste, Inc. | 2005 | ||||||||

| James Greene | 66 | Founder and Managing Partner of Sky D Ventures | 2012 | ||||||||

| Luis Machuca | 62 | President and CEO of Enli Health Intelligence | 2010 | ||||||||

| Cort O’Haver | 57 | President and CEO of Umpqua and Umpqua Bank | 2017 | ||||||||

| Maria Pope | 55 | President and CEO of Portland General Electric | 2014 | ||||||||

| John Schultz | 55 | Executive Vice President, Chief Legal and Administrative Officer, and Corporate Secretary of Hewlett Packard Enterprise | 2015 | ||||||||

| Susan Stevens | 69 | Retired head of Corporate Banking for the Americas at J.P. Morgan Securities | 2012 | ||||||||

| Hilliard Terry | 50 | Former Executive Vice President and Chief Financial Officer of Textainer Group Holdings Limited | 2010 | ||||||||

| Bryan Timm | 56 | Former President of Columbia Sportswear Company | 2004 | ||||||||

| Anddria Varnado | 34 | Vice President, Strategy & Business Development, of Macy's, Inc. | 2018 | ||||||||

Each of the nominees was elected to serve on the Board at the 2019 annual meeting. The individuals appointed as proxies intend to vote “FOR” the election of the nominees listed above. If any nominee is not available for election, the individuals named in the proxy intend to vote for such substitute nominee as the Board may designate, upon the recommendation of the Nominating and Governance Committee. Each nominee has agreed to serve on the Board and we have no reason to believe any nominee will be unavailable to serve. Additional information on our annual process to select directors is included below in Corporate Governance Overview - Director Criteria and Nomination Procedures section.

7

Nominees

The business experience, and position of each of the directors currently serving is stated below. We also provide information about skills, qualifications and attributes of each director that led to the conclusion that he or she should serve on our Board.

| Peggy Y. Fowler served as CEO and President of Portland General Electric Company (“PGE”) (NYSE: POR) from 2004 - 2008. She continued to serve on the PGE Board from 2009 - 2012, and previously served as Board Chair from 2001 - 2004. She is currently a director of Hawaiian Electric Industries (“HEI”) (NYSE:HE) and Cambia Health Solutions. | |||||||

| Qualifications and Experience: | ||||||||

Leadership: Strong leadership and business operations experience as President and CEO of PGE, director of Cambia Health Solutions, Inc., Chief Operating Officer of PGE’s Distribution Operations, Senior Vice President of PGE’s customer service and delivery and Vice President of PGE’s power production and supply. Industry: Banking industry experience as director of the Portland branch of the Federal Reserve Bank of San Francisco. Finance: Expertise serving as a committee member for several entities: Audit Committee for Hawaiian Electric Company; Finance Committee for PGE; and Audit, Investment and Executive and Nominating and Governance Committees for Cambia. Civic: Board service as a director for PGE Foundation and Mentor for International Women’s Forum. Governance: Current Chair of Umpqua's Board of Directors, Executive Committee and Nominating and Governance Committee; Chair of HEI Nominating and Corporate Governance Committee and member of HEI Compensation Committee. | ||||||||

| Stephen M. Gambee is CEO of Rogue Waste, Inc., a family owned business providing waste disposal, recycling and environmental services in Southern Oregon. Prior to assuming the duties of leading the family businesses in 1994, Mr. Gambee was a real estate economist employed by Robert Charles Lesser & Co./Hobson & Associates as the Pacific Northwest Director of Consulting. | |||||||

| Qualifications and Experience: | ||||||||

Leadership: Management, leadership, business operations and governmental relations experience as CEO of Rogue Waste, Inc., and Managing Member of Rogue Waste Systems, LLC, which are environmentally conscious waste management businesses. Civic: Currently Chair of Jackson County Board of Commissioners Economic Development Advisory Committee and Secretary of the Medford-Jackson County Chamber of Commerce. Mr. Gambee has also previously served as: Director and President of the Craterian Theater/Collier Center of the Performing Arts; Treasurer of YPO Oregon Evergreen Chapter; Director and Treasurer for Rogue Gallery and Art Center; and Director of the Jackson‑Josephine County Boys and Girls Club. Governance: Prior service as chair of an Umpqua Board committee. | ||||||||

8

| James S. Greene is Founder and Managing Partner of Sky D Ventures, a private equity and advisory services company serving the financial services and FinTech global market. Prior to Sky D Ventures, Mr. Greene was a general partner with an incubator of start-ups focused on digital platforms and solutions from November 2013 to October 2015. He was previously a Vice President with Cisco Systems, Inc. (NASDAQ: CSCO) in its Global Advanced Services Organization, a position he held from February 2012 to September 2013. He joined Cisco in 2005 as Vice President and Global Head of its Financial Services Consulting Business. From there he served as leader of Cisco’s global Strategic Partner Organization. | |||||||

| Qualifications and Experience: | ||||||||

Leadership: Business and technology strategy formulation, private equity and venture investing, business operations and information technology systems, solutions, sales and delivery. Senior executive roles at Accenture, CapGemini and Cisco Systems, Inc. Industry: Global Financial Services and Global FinTech. Big data platforms and solutions. Finance: Serving the global financial services industry and tech industry for 35 years. Civic: Neighborhood Association Board. Community sports teams. Governance: 10-year member of the Board of Electronics For Imaging, Inc., a public company (NASDAQ: EFII), where he served on the Board’s Audit Committee and Nominating and Governance Committee. Current member of Umpqua’s Executive, Finance and Capital, and Enterprise Risk and Credit Committees. He serves on several private company boards and private and public company advisory boards. | ||||||||

| Luis F. Machuca has been President and Chief Executive Officer of Enli Health Intelligence Corporation, a healthcare applications company that activates collaborative care, since January 2002. | |||||||

| Qualifications and Experience: | ||||||||

Leadership: Business operations and innovation technology experience as President and CEO of Enli as well as senior leadership roles at Intel Corp., EVP of the NEC Computer Services Division of PB-NEC Corp. and President and COO of eFusion Corp. Civic: Serves on the Cambia Health Solutions board of directors. He has served as director or trustee of the University of Portland Board of Regents, the Oregon Health & Science University Foundation Board of Trustees, the ENDfootwear Advisory Board, the Catholic Charities of Oregon Board of Directors, the Portland Metropolitan Family Services Board of Directors, the Jesuit High School Board of Trustees, the Lifeworks NW Board of Directors, and the Boy Scouts of America Cascade Pacific Council Executive Board. Governance: Chair of Umpqua's Compensation Committee and service on charitable and civic organization boards of directors. | ||||||||

9

| Cort L. O'Haver serves as director, President and Chief Executive Officer of Umpqua and Umpqua Bank, positions he has held since January 2017. Mr. O’Haver served as Commercial Bank President of Umpqua Bank from April 2014 to April 2016 when he became President of Umpqua Bank. He served as Senior Executive Vice President of Umpqua and Umpqua Bank from August 2013 to April 2014, and from March 2010 to August 2013 he served as Executive Vice President/Commercial Banking of Umpqua and Umpqua Bank. From October 2006 until he joined Umpqua, Mr. O'Haver was employed by Mechanics Bank as Executive Vice President and Director of Corporate Banking. Prior to that time, he was a Senior Vice President in charge of the Real Estate Lending Division at U.S. Bank, with responsibility for California, Oregon and Washington. | |||||||

| Qualifications and Experience: | ||||||||

Leadership: Extensive leadership, management and business operations experience with Umpqua Bank, Mechanics Bank and U.S. Bank. Industry: Over 30 years of commercial banking experience including positions with Mechanics Bank in California (corporate banking) and with U.S. Bank with responsibility for California, Oregon and Washington (real estate lending). | ||||||||

| Maria M. Pope is President and CEO of PGE. She was appointed President on October 1, 2017 and Chief Executive Officer on January 1, 2018. From March 2013 to January 2018, Ms. Pope served as Senior Vice President, Power Supply, Operations, and Resource Strategy for PGE. She serves as a general partner shareholder and director of Pope Resources, a Delaware limited partnership (NASDAQ: POPE), which announced its merger with Rayonier Inc. in January 2020. | |||||||

| Qualifications and Experience: | ||||||||

Leadership: Leadership and business management experience as CEO and previously a senior executive of PGE and her former positions as chief financial officer of Mentor Graphics Corp. and Pope & Talbot, Inc. Finance: CFO roles of three publicly traded companies and past Chair of the Audit Committees of TimberWest Forest Corp., Premera Blue Cross and Oregon Health & Sciences University (OHSU). Civic: Currently serves on the Oregon Global Warming Commission, the Federal Reserve Bank of San Francisco Portland Branch board of directors and The Nature Conservancy in Oregon board of directors. Prior Chair of OHSU’s Governing Board (appointed by the Governor, 2010) and prior Chair of the Oregon Symphony and Council of Forest Industries. | ||||||||

10

| John F. Schultz has served as Executive Vice President, Chief Legal and Administrative Officer, and Corporate Secretary of Hewlett Packard Enterprise (NYSE: HPE) since December 2017. Prior to that he served as HPE's Executive Vice President, General Counsel and Secretary from November 2015 to December 2017. HPE is a leading global provider of cutting-edge technology solutions to optimize traditional information technology and help build the secure, cloud-enabled, mobile-ready future uniquely suited to their customers’ needs. He served as Hewlett-Packard Company’s Executive Vice President and General Counsel prior to the company’s separation into HPE and HP Inc. and served as a member of the HP Executive Counsel from 2012-2015. | |||||||

| Qualifications and Experience: | ||||||||

Leadership/Skills: As chief administrative officer and general counsel for a publicly traded corporation, leads risk management functions, including ethics, litigation management, and cybersecurity. Civic: Nonprofit leadership. | ||||||||

| Susan F. Stevens was a senior executive who retired as head of Corporate Banking for the Americas at J.P. Morgan Securities Inc. in 2011. She held that position from 2006 until 2011. She was at J.P. Morgan for 15 years. Prior to 2006, she was a Managing Director in Loan Syndications, where she was head of the Investment Grade Syndications group from 2001 to 2006. She was head of Capital Markets at Wells Fargo Bank from 1992 to 1995. She was with Bank of America for 11 years before joining Wells Fargo. | |||||||

| Qualifications and Experience: | ||||||||

Industry: Over 35 years in the banking industry with broad industry knowledge and experience in client management, capital markets and risk management. Civic: Board of Trustees of the University of Oregon Foundation, Eugene, OR (2016-present) and The Neighborhood Coalition for Shelter, New York, NY (Chair of the Finance Committee, Treasurer and on the Executive Committee). Governance: Current Chair of the Umpqua Enterprise Risk and Credit Committee. She is a Board member of Red Duck Foods, a consumer products startup company, and served on the Audit Committee of the University of Oregon Foundation Board of Trustees from 2016-2019. | ||||||||

11

| Hilliard C. Terry, III, most recently served as Executive Vice President and Chief Financial Officer of Textainer Group Holdings Limited (NYSE: TGH), an intermodal marine container management and leasing company. Before joining Textainer in 2012, he was Vice President and Treasurer of Agilent Technologies, Inc. (NYSE: A), which he joined in 1999, prior to the company’s initial public offering and spinoff from Hewlett-Packard Company (HP). Mr. Terry held positions in investor relations and/or investment banking with Kenetech Corporation, VeriFone, Inc. and Goldman Sachs & Co. | |||||||

| Qualifications and Experience: | ||||||||

Leadership: Senior leadership and business management experience as a senior executive of small-cap specialty finance company and finance executive of a large-cap technology company. Marketing: Extensive investor communications and marketing experience as the Head of Investor Relations and primary spokesperson to the investment community for Agilent Technologies, Inc. and Global Marketing Manager for VeriFone, Inc., an HP subsidiary. Finance: Mr. Terry has 11 years of financial management experience. In his previous role as a public-company CFO, he oversaw the accounting, treasury, credit and collections, internal audit and risk management functions of Textainer. Previously he was responsible for Agilent’s global treasury organization which included corporate cash management, corporate finance, customer financing, foreign exchange, pension assets and risk management. He was also a member of the company’s Benefits Committee, which has fiduciary oversight for Agilent’s employee benefit and retirement programs. He oversaw investments of a multi-billion-dollar global corporate cash portfolio and defined benefit (pension) assets for the company. Governance: Current Chair of Umpqua’s Audit and Compliance Committee and prior service as Chair of Umpqua's Finance and Capital Committee. Civic: Former Board Member, Oakland Museum of California (member of the Executive and Nominating and Governance Committees). | ||||||||

| Bryan L. Timm served as President of Columbia Sportswear Company (NASDAQ: COLM) from February 2015 to June 2017, and held the office of Chief Operating Officer from May 2008 to June 2017. He previously served as Chief Financial Officer of Columbia Sportswear. | |||||||

| Qualifications and Experience: | ||||||||

Leadership: Senior leadership and business operations management experience at Columbia Sportswear; as a member of the College of Business and Economics Advisory Board for the University of Idaho; and as a member (2012) and Chair (2013) of the Policyowners’ Examining Committee at Northwestern Mutual Life Insurance Co. Finance: Audit and Compliance Committee Chair at Umpqua. Over twenty years serving in financial positions of publicly held companies including CFO of Columbia Sportswear. In addition to his C-level positions with Columbia Sportswear Company, Mr. Timm worked in various accounting, internal audit, and financial positions at publicly held Oregon Steel Mills (NYSE: OS) from 1991 to 1997, rising to Divisional Controller for CF&I Steel, Oregon Steel Mills’ largest division. From 1986 to 1991, he was an accountant with KPMG LLP. He is a CPA (lapsed) in the state of Oregon. Civic: Former Director of Doernbecher Children’s Hospital Foundation. Governance: Current Vice Chair of the Umpqua Board of Directors, Chair of the Umpqua Finance and Capital Committee, prior Chair of the Umpqua Audit and Compliance Committee. | ||||||||

12

| Anddria Varnado is Vice President, Strategy & Business Development, at Macy's, Inc. (NYSE: M), a leading retailer operating department and specialty stores with physical and digital footprints under the Macy's, Bloomingdale's and Bluemercury brands. Prior to Macy's, from 2016 to 2019, Ms. Varnado was the Global Head of Strategy & Business Development at Williams-Sonoma, Inc., with strategic responsibility of the portfolio of brands including Williams Sonoma, Pottery Barn, and West Elm. In these roles, Ms. Varnado has had responsibility for large-scale transformation efforts, mergers and acquisitions, and new brand and business development. Previously, Ms. Varnado fostered in-depth consumer and commerce-based expertise across management consulting, investment banking and product management roles. She was Management Consultant at ZS Associates from 2014 to 2016. | |||||||

| Qualifications and Experience: | ||||||||

| Leadership: Senior leadership and strong business management experience as an executive of Macy's, Inc. and previously Williams-Sonoma, Inc. Industry: Previous experience in the Financial Institutions Group within a Corporate & Investment Banking division; strategy development, retail operations and marketing expertise in consumer-facing companies. Civic: Non-profit engagement including Junior League, HBS Community Partners, and Management Leadership for Tomorrow. | ||||||||

Director Independence

The Board has determined that all directors except Messrs. Greene and O’Haver qualify as “independent,” as defined in NASDAQ listing rules. In 2016 and 2017, the Board of Directors asked Mr. Greene to serve as Board Chair of our former subsidiary, Pivotus Ventures, Inc. and provide management consulting to the Pivotus leadership team and work closely with Pivotus on strategic planning and collaboration initiatives. In December 2017, the Compensation Committee and the independent directors, excluding Mr. Greene, reviewed Mr. Greene’s work with Pivotus. The Compensation Committee considered the amount of time Mr. Greene spent on Pivotus initiatives and approved a one-time payment to Mr. Greene of $150,000 for Pivotus related work. Mr. Greene received no other payments and in 2018 and 2019 he received only the standard independent director compensation. Under NASDAQ rules, Mr. Greene cannot be considered independent for three years following the receipt of the payment for additional services. We expect that Mr. Greene will again qualify as an independent director under NASDAQ rules after December 2020.

In determining the independence of directors, we considered the responses to annual Director & Officer Questionnaires that indicated no transactions between the Company or its affiliates and directors other than banking transactions with Umpqua Bank and arrangements under which Umpqua Bank purchases waste disposal services in southern Oregon from a company affiliated with Mr. Gambee at standard, regulated rates, which in 2019 totaled $7,190. The Board also considered the lack of any other reported transactions or arrangements; directors are required to report conflicts of interest and transactions with the Company pursuant to our Corporate Governance Principles and Code of Ethics, which can be found on our website

https://www.umpquabank.com/investor-relations. See Related Party Transactions for additional information.

Board Recommendation

The Board of Directors recommends a vote “FOR” each of the nominees named in this Proxy Statement.

13

ITEM 2. RATIFICATION OF SELECTION OF REGISTERED PUBLIC ACCOUNTING FIRM

The Audit and Compliance Committee has selected the independent registered public accounting firm of Deloitte & Touche LLP (“Deloitte”) to act in such capacity for the fiscal year ending December 31, 2020. There are no affiliations between the Company and Deloitte, its partners, associates or employees, other than those which pertain to the engagement of Deloitte in the previous year as the Company’s independent registered public accounting firm and for certain permitted consulting services. Deloitte has served as the Company’s independent registered public accounting firm since 2018.

Shareholder ratification of the selection of Deloitte is not required by law, our articles of incorporation, our bylaws or otherwise. The Sarbanes-Oxley Act of 2002 requires the Audit and Compliance Committee to be directly responsible for the appointment and compensation of the independent registered public accounting firm and for oversight of the audit work. The Committee will consider the results of the shareholder vote on this proposal and, in the event of a negative vote, will reconsider its selection of Deloitte, but is not bound by the shareholder vote. Even if Deloitte’s appointment is ratified by the shareholders, the Committee may, in its discretion, appoint a new independent registered public accounting firm at any time if it determines that such a change would be in the interests of the Company and its shareholders. A representative of Deloitte is expected to attend the annual meeting and that representative will have the opportunity to make a statement, if he or she desires to do so, and to answer appropriate questions.

Board Recommendation

The Board of Directors recommends a vote “FOR” ratification of the selection of Deloitte & Touche LLP as the Company’s independent registered public accounting firm.

14

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Deloitte has audited our consolidated financial statements and internal controls over financial reporting as of and for the year ended December 31, 2019.

Independent Auditors’ Fees

The following table shows the fees incurred for professional services provided by Deloitte for 2019 and 2018:

| ($ in thousands) | 2019 | 2018 | |||||||||

| Audit Fees (a) | $ | 1,868 | $ | 1,495 | |||||||

| Audit-Related Fees (b) | $ | 184 | $ | 136 | |||||||

| All Other Fees (c) | $ | 2 | $ | 608 | |||||||

| Tax Fees (d) | $ | 90 | $ | 113 | |||||||

| Total Fees | $ | 2,144 | $ | 2,352 | |||||||

(a) Audit Fees for 2019 include:

•The integrated audits of the Company’s annual consolidated financial statements and internal control over financial reporting as of and for the year ended December 31, 2019, including compliance with the FDIC Improvement Act

•Reviews of the Company’s quarterly consolidated financial statements for the periods ended March 31, June 30, and September 30, 2019

•HUD and GNMA Audits for December 31, 2019

Audit Fees for 2018 include:

•The integrated audit of the Company’s annual consolidated financial statements and internal controls over financial reporting as of and for the year ended December 31, 2018, including compliance with the FDIC Improvement Act and Loss Share Agreements

•Reviews of the Company’s quarterly consolidated financial statements for the periods ended March 31, June 30, and September 30, 2018

•HUD and GNMA Audits for December 31, 2018

(b) Audit-Related Fees for 2019 represent billings by Deloitte for services provided during the twelve months ended December 31, 2019, and includes:

•Audit of the Umpqua Bank 401(k) and Profit Sharing Plan for the plan year ended December 31, 2018, audited during 2019

•Audit of the annual financial statements of Umpqua Investments, Inc., a wholly owned subsidiary of the Company

•Accounting consultations and other services related to the implementation of new or emerging accounting standards

Audit-Related Fees for 2018 represent billings by Deloitte for services provided during the twelve months ended December 31, 2018, and include:

•Accounting consultations and other services related to the implementation of new or emerging accounting standards

(c) All Other Fees for 2019 represent all other billings by Deloitte for the twelve months ended December 31, 2019, and include:

•Subscriptions to accounting research tools

All Other Fees for 2018 represent all other billings by Deloitte for the twelve months ended December 31, 2018, and includes:

•Services performed to assist with management’s evaluation of the Company’s information technology infrastructure

•Model validation services for a regulatory compliance application

•Subscriptions to accounting research tools

(d) Tax Fees include:

•Fees billed for professional services rendered for tax compliance, tax advice and tax planning.

| 2019 | 2018 | |||||||

| Ratio of All Other Fees to Total Fees | 0.09% | 25.85% | ||||||

15

The Audit and Compliance Committee discussed these services with the independent auditors and Company management and determined that they are permitted under the rules and regulations concerning auditor independence promulgated by the SEC to implement the Sarbanes-Oxley Act of 2002, as well as the American Institute of Certified Public Accountants.

Change in Accountants

The Audit and Compliance Committee conducted a competitive process to determine the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2018. The Committee invited several firms to participate in this process, including Moss Adams LLP, which audited the Company’s financial statements for the fiscal year ended December 31, 2017.

On May 30, 2018, the Committee approved the selection of Deloitte as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2018. On May 30, 2018, the Committee dismissed Moss Adams LLP as the Company’s independent registered public accounting firm.

The reports of Moss Adams LLP on the Company’s financial statements for each of the two fiscal years ended December 31, 2016 and 2017 did not contain an adverse opinion or a disclaimer of opinion, nor were the reports on the Company’s financial statements qualified or modified as to uncertainty, audit scope or accounting principles. In the fiscal years ended December 31, 2016 and 2017 and in the subsequent interim period through May 29, 2018, there were no “disagreements” (as that term is described in Item 304(a)(1)(iv) of Regulation S-K) between the Company and Moss Adams LLP on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedures, which, if not resolved to the satisfaction of Moss Adams LLP, would have caused Moss Adams LLP to make reference to the subject matter of the disagreement in connection with its report on the Company’s financial statements for such years. In the fiscal years ended December 31, 2016 and 2017 and in the subsequent interim period through May 29, 2018, there were no “reportable events” (as that term is described in Item 304(a)(1)(v) of Regulation S-K).

The Company provided Moss Adams LLP with a copy of the disclosures contained in this Proxy Statement.

During the fiscal years ended December 31, 2016 and 2017 and the subsequent interim period through May 30, 2018, neither the Company nor anyone on its behalf consulted with Deloitte with respect to (a) the application of accounting principles to a specified transaction, either completed or proposed, or the type of audit opinion that might be rendered on the Company’s consolidated financial statements, and neither a written report nor oral advice was provided to the Company that Deloitte concluded was an important factor considered by the Company in reaching a decision as to any accounting, auditing or financial reporting issue, or (b) any matter that was either the subject of a disagreement or a reportable event.

Pre-Approval Policy

The Audit and Compliance Committee pre-approved the services performed by Deloitte for the 2019 audit engagement in April 2019 in accordance with the Committee’s pre-approval policy and procedures. This policy describes the permitted audit, audit-related, tax, and other services (collectively, the “Permitted Services”) that the independent auditor may perform. The policy requires that a description of the services expected to be performed by the independent auditor in each of the disclosure categories in the above table be provided to the Committee for pre-approval.

Services provided by the independent auditor during the following year that are included in the Permitted Services list were pre-approved following the policies and procedures of the Audit and Compliance Committee. Any requests for audit, audit-related, tax, and other services not contemplated on the Permitted Services list must be submitted to the Committee for specific pre-approval and cannot commence until such approval has been granted. Normally, pre-approval is provided at regularly scheduled meetings. However, the authority to grant specific pre-approval between meetings, as necessary, has been delegated to the Chair of the Committee. The Chair must update the Committee at the next regularly scheduled meeting of any services that received his pre-approval.

16

In addition, although not required by the rules and regulations of the SEC, the Audit and Compliance Committee generally requests a range of fees associated with each proposed service. Providing a range of fees for a service incorporates appropriate oversight and control of the independent auditor relationship, while permitting the Company to receive immediate assistance from the independent auditor when time is of the essence.

The policy contains a de minimis provision to provide retroactive approval for permissible non-audit services if:

(i)The service is not an audit, review or other attest service; and

(ii)The aggregate amount of all such services provided under this provision does not exceed $5,000 per project if approved by the Principal Financial Officer or Principal Accounting Officer or $50,000 per project if approved by the Chair of the Audit and Compliance Committee.

AUDIT AND COMPLIANCE COMMITTEE REPORT

The Audit and Compliance Committee of the Board of Directors oversees the accounting, financial reporting and regulatory compliance processes of the Company, the audits of the Company’s financial statements, the qualifications of the public accounting firm engaged as the Company’s independent auditor and the performance of the Company’s internal and independent auditors. The Committee’s function is more fully described in its Board approved charter, available on our website: https://www.umpquabank.com/investor-relations. The Committee reviews that charter on an annual basis. The Board annually reviews the NASDAQ listing standards’ definition of “independence” for audit committee members and applicable SEC rules related to audit committee member independence and has determined that each member of the Audit and Compliance Committee meets those standards.

Management is responsible for the preparation, presentation and integrity of the Company’s financial statements. Management must adopt accounting and financial reporting principles, internal controls and procedures that are designed to ensure compliance with accounting standards, applicable laws and regulations. The Audit and Compliance Committee met with management regularly during the year to consider the adequacy of the Company’s internal controls and the objectivity of its financial reporting. The Committee discussed these matters with the Company’s independent auditors and with appropriate Company financial personnel and internal auditors. The Committee also discussed with the Company’s senior management and independent auditors the process used for certifications by the Company’s Chief Executive Officer, Chief Financial Officer and Principal Accounting Officer, which are required for certain of the Company’s filings with the SEC.

The Audit and Compliance Committee is responsible for hiring and overseeing the performance of the Company’s independent registered public accounting firm. The Company’s independent registered public accounting firm is responsible for performing an independent audit of the consolidated financial statements and expressing an opinion on the conformity of those financial statements with accounting principles generally accepted in the United States of America, and expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. The Committee engaged Deloitte as the Company’s independent registered public accounting firm to perform the audit of the Company’s financial statements for the period ending December 31, 2019. Deloitte has been engaged in this capacity since May 2018. The Committee assessed Deloitte’s activities and performance, and considered Deloitte’s independence from management and professionalism, and demonstrated understanding of the financial services industry and the Company’s business and significant accounting practices. In accordance with NASDAQ Listing Rules, Deloitte is registered as a public accounting firm with the Public Company Accounting Oversight Board (“PCAOB”).

The Audit and Compliance Committee reviewed and discussed the audited financial statements for the fiscal year ending December 31, 2019, with management. The Committee also met separately with both management and Deloitte to discuss and review those financial statements and reports prior to issuance. Management has represented, and Deloitte has confirmed to the Committee, that the financial statements were prepared in accordance with generally accepted accounting principles.

The Audit and Compliance Committee received from and discussed with Deloitte the matters required to be discussed by AS 1301 (Communications with Audit Committees, formerly Auditing Standard No. 16), as amended and as adopted by the PCAOB in Rule 3200. The Committee has received the written disclosure and the letter from Deloitte required by applicable requirements of the PCAOB regarding independence and has discussed with Deloitte the auditor's independence.

17

Based upon the review and discussions referred to above, the Audit and Compliance Committee recommended to the Board of Directors that the Company’s audited financial statements be included in the Company’s annual report on Form 10-K for the fiscal year ended December 31, 2019.

Submitted by the Audit and Compliance Committee:

Stephen Gambee

John Schultz

Susan Stevens

Hilliard Terry (Chair)

Bryan Timm

ITEM 3. ADVISORY VOTE ON EXECUTIVE COMPENSATION

The Board and management are committed to excellence in governance and recognize the interest our shareholders have expressed in the Company’s executive compensation program. As a part of that commitment, and in accordance with SEC rules, we ask our shareholders to approve an advisory resolution on the compensation of the named executive officers, as reported in this proxy statement. This proposal, commonly known as “say on pay,” gives shareholders the opportunity to approve or not approve our fiscal year 2019 compensation for named executive officers. Our shareholders previously voted in favor of an annual say on pay vote, and our Board determined to hold an annual vote.

This vote is not intended to address any specific item of compensation, but rather to address the compensation paid to our named executive officers as disclosed in this proxy statement, which we believe reflects our overall compensation policies and procedures relating to the named executive officers. While your vote is advisory and will not be binding on the Board, we strive to align our governance policies and practices with the interests of our shareholders. The Board takes into account the outcome of the say on pay vote when considering future compensation plans.

We are requesting your non-binding vote on the following resolution:

“RESOLVED, that the shareholders approve the compensation of the named executive officers as described in the Compensation Discussion and Analysis and the tabular and accompanying narrative disclosure of named executive officer compensation in the Proxy Statement for the 2020 Annual Meeting of Shareholders.”

Board Recommendation

The Board of Directors recommends a vote “FOR” approval of the resolution approving compensation of named executive officers.

OTHER BUSINESS

The Board of Directors knows of no other matters to be brought before the shareholders at the meeting. If other matters are properly presented for a vote at the meeting, the proxy holders will vote shares represented by proxies at their discretion in accordance with their judgment on such matters. At the meeting, management will report on our business and shareholders will have the opportunity to ask questions.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION

This proxy statement contains forward-looking statements about Umpqua that are intended to be covered by the safe harbor for “forward-looking statements” provided by the Private Securities Litigation Reform Act of 1995. These statements may include statements regarding compensation practices, governance matters, business strategies, management plans and objectives for future operations. All statements other than statements of historical fact are forward-looking statements. You can find many of these statements by looking for words such as “anticipates,” “expects,” “believes,” “estimates” and “intends” and words or phrases of similar meaning. Forward-looking statements involve substantial risks and uncertainties, many of which are difficult to predict and are generally beyond the control of Umpqua. Risks and uncertainties include, but are not limited to:

• competitive market pricing factors for compensation and benefits;

• changes in legal or regulatory requirements; and

• the ability to recruit and retain certain key management and staff.

18

There are many factors that could cause actual results to differ materially from those contemplated by forward-looking statements. For a more detailed discussion of some of the risk factors, see the section titled Risk Factors in Umpqua’s 10-K and other filings with the SEC. Umpqua does not intend to update these forward-looking statements. You should consider any written or oral forward-looking statements in light of this explanation, and we caution you about relying on forward-looking statements.

INFORMATION ABOUT EXECUTIVE OFFICERS

The age (as of March 1, 2020), business experience, and position of our executive officers and Section 16 officers other than President and Chief Executive Officer Cort O’Haver, about whom information is provided above, are as follows:

Rilla Delorier, age 52, serves as Executive Vice President/Chief Strategy Officer of Umpqua and Umpqua Bank, positions she has held since April 2017 when she joined Umpqua. Before joining Umpqua, Ms. Delorier spent 10 years in a variety of roles for SunTrust Bank including executive vice president of consumer channels (2014-2016), and chief marketing officer (2008-2014).

Ronald Farnsworth, age 49, serves as Executive Vice President/Chief Financial Officer of Umpqua and Umpqua Bank, positions he has held since January 2008 and Principal Financial Officer of Umpqua, a position he has held since May 2007.

Neal McLaughlin, age 51, serves as Executive Vice President/Treasurer of Umpqua and Umpqua Bank, positions he has held since February 2005 and served as Principal Accounting Officer from May 2007 to December 2019.

Frank Namdar, age 54, serves as Executive Vice President and Chief Credit Officer for Umpqua Bank, a position he has held since November 2018. From 2012 to 2018 Mr. Namdar was a senior credit officer at Umpqua Bank.

Torran (Tory) Nixon, age 58, serves as Senior Executive Vice President and Chief Banking Officer for Umpqua Bank, a position he has held since April 2018. As Chief Banking Officer, he oversees all customer-facing banking divisions and focuses on creating a seamless, human digital customer experience across the company’s retail, home lending, wholesale, and wealth management business lines. He previously served as Umpqua Bank’s Executive Vice President and Head of Commercial & Wealth from October 2016 to April 2018 and Executive Vice President/Commercial Banking from November 2015 to October 2016. Before joining Umpqua Bank in November 2015, Mr. Nixon served as Division President for the San Diego and Northern California Divisions of California Bank & Trust from April 2007 through November 2015.

Andrew Ognall, age 48, serves as Executive Vice President/General Counsel and corporate Secretary of Umpqua and Umpqua Bank, positions he has held since April 2014. From January 2011 to April 2014, Mr. Ognall was a partner with the Pacific Northwest law firm Lane Powell PC, focusing his practice on mergers and acquisitions, securities and corporate finance, corporate governance, executive compensation and general business matters.

David Shotwell, age 61, serves as Executive Vice President/Chief Risk Officer of Umpqua and Umpqua Bank, positions he has held since September 2016. Mr. Shotwell served as Umpqua Bank’s Chief Credit Officer from 2015 to 2018 and as Chief Lending Officer from 2010 to 2015.

Lisa White, age 37, serves as Senior Vice President/Corporate Controller of Umpqua and Umpqua Bank, and Principal Accounting Officer of Umpqua, positions she has held since January 2020. She previously served as Umpqua Bank's Senior Vice President/Bank Controller from April 2015 to January 2020 and Vice President/Assistant Controller of Loans and Initiatives from March 2011 to April 2015.

19

SECURITY OWNERSHIP OF MANAGEMENT AND OTHERS

The following table sets forth the shares of common stock beneficially owned as of February 12, 2020, the record date, by each director and each named executive officer, the directors and executive officers as a group and those persons known to beneficially own more than 5% of Umpqua’s common stock.

Title of Class | Name of Beneficial Owner | Amount and Nature of Beneficial Ownership | % of Class | ||||||||||||||

| Named Executive Officers | |||||||||||||||||

| * | Cort O’Haver | 158,446 | (1,2) | ** | |||||||||||||

| * | Ronald Farnsworth | 134,756 | (1,3,4) | ** | |||||||||||||

| * | Tory Nixon | 31,287 | (1,5) | ** | |||||||||||||

| * | David Shotwell | 30,973 | (1,6) | ** | |||||||||||||

| * | Rilla Delorier | 17,064 | (1,7) | ** | |||||||||||||

| Directors | |||||||||||||||||

| * | Stephen Gambee | 107,145 | (1,8,10) | ** | |||||||||||||

| * | Bryan Timm | 88,091 | (1,10) | ** | |||||||||||||

| * | Peggy Fowler | 86,092 | (1,9,10) | ** | |||||||||||||

| * | Luis Machuca | 57,928 | (1,10) | ** | |||||||||||||

| * | Hilliard Terry, III | 45,064 | (1,10) | ** | |||||||||||||

| * | James Greene | 39,922 | (1,10) | ** | |||||||||||||

| * | Susan Stevens | 38,552 | (1,10) | ** | |||||||||||||

| * | Maria Pope | 36,831 | (1,3,10) | ** | |||||||||||||

| * | John Schultz | 24,491 | (1,10) | ** | |||||||||||||

| * | Anddria Varnado | 3,925 | (1,11) | ** | |||||||||||||

| Directors and Executive Officers | |||||||||||||||||

| * | All directors and executive officers as a group (19 persons) | 1,044,021 | (12) | ** | |||||||||||||

| Beneficial Owners of more than 5% of Umpqua common stock | |||||||||||||||||

| * | The Vanguard Group 100 Vanguard Blvd., Malvern, PA 19355 | 22,663,597 | (13) | 10.3 | % | ||||||||||||

| * | BlackRock, Inc. 55 East 52nd St., New York, NY 10055 | 20,525,023 | (14) | 9.3 | % | ||||||||||||

| * | Eaton Vance Management 2 International Place, Boston, MA 02110 | 15,089,210 | (15) | 6.8 | % | ||||||||||||

| * | No par value common stock. | ||||||||||||||||

| ** | Less than 1.0%. | ||||||||||||||||

| (1) | Shares held directly with sole voting and investment power, unless otherwise indicated. Shares held in the dividend reinvestment plan have been rounded down to the nearest whole share. Includes shares held indirectly in deferred compensation plans, 401(k) plans, supplemental retirement plans, and IRAs. Includes shares for which the director or executive officer has the right to acquire beneficial ownership within 60 days of the date of this proxy statement. | ||||||||||||||||

| (2) | Excludes 226,912 shares of unvested performance or restricted share awards not eligible to vote. | ||||||||||||||||

| (3) | Includes shares held with or by his/her spouse. | ||||||||||||||||

| (4) | Excludes 63,176 shares of unvested performance or restricted share awards not eligible to vote. | ||||||||||||||||

| (5) | Excludes 66,627 shares of unvested performance or restricted share awards not eligible to vote. | ||||||||||||||||

| (6) | Excludes 48,783 shares of unvested performance or restricted share awards not eligible to vote. | ||||||||||||||||

| (7) | Excludes 56,061 shares of unvested performance or restricted share awards not eligible to vote. | ||||||||||||||||

| (8) | Includes 17,500 shares held by a corporation Mr. Gambee is deemed to control. | ||||||||||||||||

20

| (9) | Includes 86,092 shares held in a family trust. | ||||||||||||||||

| (10) | Excludes 3,509 shares of unvested restricted share awards not eligible to vote. | ||||||||||||||||

| (11) | Excludes 5,032 shares of unvested restricted share awards not eligible to vote. | ||||||||||||||||

| (12) | See footnotes (1) – (11); excludes an additional 74,068 shares of unvested performance or restricted share awards not eligible to vote. | ||||||||||||||||

| (13) | Information from Schedule 13G/A filed on February 12, 2020, for holdings as of December 31, 2019, which indicates such person has the sole voting power for 116,321 shares (and shared voting power for 35,680 shares) and sole dispositive power for 22,542,928 shares (and shared dispositive power for 120,669 shares). | ||||||||||||||||

| (14) | Information from Schedule 13G/A filed February 6, 2020, for holdings as of December 31, 2019, which indicates such person has sole voting power for 19,557,267 shares and sole dispositive power for 20,525,023 shares. | ||||||||||||||||

| (15) | Information from Schedule 13G/A filed February 13, 2020, for holdings as of December 31, 2019. | ||||||||||||||||

CORPORATE GOVERNANCE OVERVIEW

Our Board believes that its primary role as steward of the Company is to ensure that we maximize shareholder value in a manner consistent with legal requirements and the highest standards of integrity. The Board has adopted and adheres to a Statement of Governance Principles, which the Board and senior management believe represent sound governance practices and provide a framework to sustain our success and build long term value for our shareholders and stakeholders. We regularly review these governance principles and practices in light of Oregon corporate law, applicable federal law, SEC and banking agency regulations, NASDAQ listing standards and best practices suggested by recognized governance authorities.

Statement of Governance Principles and Charters

Our Statement of Governance Principles and the charter of each of our Board committees can be viewed on our website, https://www.umpquabank.com/investor-relations, and are also available in print to any shareholder who requests it. Each Board committee operates under a Board approved written charter.

Employee Code of Conduct/Code of Ethics for Financial Officers

The Company has adopted a code of conduct, referred to as the Business Ethics and Conflict of Interest Code. We require all employees to adhere to this ethics code in addressing legal and ethical issues that they encounter in the course of doing their work. This ethics code requires our employees to avoid conflicts of interest, comply with all laws and regulations, conduct business in an honest and ethical manner and otherwise act with integrity and in the Company’s best interest. All new employees are required to review and understand this ethics code and certify so. Each year all other employees are reminded of, and asked to affirmatively acknowledge, their obligation to follow this ethics code.

In addition, the Company has adopted a Code of Ethics for Financial Officers, which applies to our chief executive officer, our chief financial officer (principal financial officer), treasurer, corporate controller (principal accounting officer) and all other officers serving in a finance, accounting, tax or investor relations role. This code for financial officers supplements our Business Ethics and Conflict of Interest Code and is intended to promote honest and ethical conduct, full and accurate financial reporting and to maintain confidentiality of the Company’s proprietary and customer information.

Our Business Ethics and Conflict of Interest Code and Code of Ethics for Financial Officers are available in the Investor Relations section of our website, https://www.umpquabank.com/investor-relations.

Compliance and Ethics – Reporting and Training

Our employees may report confidential and anonymous complaints to an “ethics hotline” maintained by an independent vendor. These complaints may be made online or by calling a toll-free phone number. Complaints relating to financial matters are routed to our Chief Auditor and General Counsel, and to the Chair of the Audit and Compliance Committee. Employees may also report such matters directly to the Chair of the Audit and Compliance Committee. Other complaints, such as those dealing with human resources matters, are routed to an appropriate executive for review. Employees are encouraged to report any conduct that they believe in good faith to be a violation of law or a violation of our Business Ethics and Conflict of Interest Code. The Chair of the Audit and Compliance Committee provides periodic updates and an annual report to the Committee on the complaints received via the hotline.

21

Our regulatory compliance program is an integral part of our operations and includes the following features:

•Our Chief Compliance Officer oversees compliance with federal customer-facing regulations at Umpqua Bank and reports to the Audit and Compliance Committee at each regular meeting.

•All of our associates complete annual required training on ethics and the regulations that apply to their jobs.

•Our Bank Secrecy Act Officer oversees our compliance with anti-money laundering and anti-terrorist financing regulations.

Hedging and Pledging of Company Stock

We prohibit directors and executive officers from engaging in sale or hedging strategies, such as the purchase of financial instruments (including prepaid variable forward contracts, equity swaps, collars, and exchange funds) that could circumvent stock ownership and retention requirements or are designed to hedge or offset any decrease in the market value of the Company's stock. Directors and executive officers may not enter into puts, calls, short sales, sales against the box or any derivative transactions with respect to the purchase and disposition of Company shares. The Company and its affiliates will not make a loan to directors or executive officers secured by Company stock, and directors and executive officers are not permitted to pledge Company stock.

Director Criteria and Nomination Procedures

Our Statement of Governance Principles, a corporate policy reviewed and approved annually by the Board and available at https://www.umpquabank.com/investor-relations, describes the qualifications that the Company looks for in its nominees to the Board. The independent Nominating and Governance Committee has responsibility for recommending to the Board a slate of nominees to be presented to the shareholders for election at each annual meeting.

The Statement of Governance Principles provides that:

•Directors should possess the highest personal and professional ethics, integrity and values and should be committed to representing the long-term interests of our shareholders.

•On an overall basis, the Board should have policymaking experience in all of the major business activities of the Company and its subsidiaries.

•To the extent practical, the Board should be representative of the major markets in which the Company operates.

•The Board values diversity and the highest professional qualifications in its members.

The Board has considered and will continue to consider the gender, ethnicity, background and professional experiences of current and prospective directors and seeks a diverse group of directors.

The Nominating and Governance Committee considers skills that will add value to the Board and those that will be lost upon the departure of a director. Directors must be willing to devote sufficient time to effectively carry out their duties and responsibilities. Nominees should not serve on more than three Boards of public companies in addition to the Company’s Board.

Shareholder Recommendations

A shareholder may recommend a candidate for nomination to the Board and that recommendation will be reviewed and evaluated by the Nominating and Governance Committee of our Board. The Committee will use the same procedures and criteria for evaluating nominees recommended by shareholders as it does for nominees recommended by the Committee. Shareholder recommendations for Board candidates should be submitted to the Company’s corporate Secretary, Andrew Ognall, One SW Columbia Street, Suite 1200, Portland, OR 97204. Shareholders may nominate Board candidates only by following the procedures set forth in our bylaws.

In 2019, we did not receive any recommendations of potential nominees, or any nominations of Board candidates, from shareholders.

Changes in Nomination Procedures

There have been no material changes to the procedures by which shareholders may recommend nominees to our Board of Directors since our procedures were disclosed in the proxy statement for the 2019 annual meeting.

22

Shareholder Communications

Our directors are active in their respective communities and they receive comments, suggestions, recommendations and questions from shareholders, customers and other interested parties on an ongoing basis. Our directors are encouraged to share those questions, comments and concerns with other directors and with our CEO.

Our investor relations team regularly attends industry investor conferences and provides updates to directors on questions asked by investors. Our annual shareholder outreach program is described in the Proxy Summary section above.

Director Attendance at Annual Meetings

The Company conducts the annual meeting in Portland, Oregon on the day before, or day of, a regular meeting of the Board. The Board expects all nominated directors to attend the annual meeting. All of the directors nominated for election at the 2020 annual meeting attended the 2019 annual meeting.

Communicating with Directors

Comments and questions may be directed to our Board by submitting them in writing to the Company’s corporate Secretary, Andrew Ognall, One SW Columbia Street, Suite 1200, Portland, OR 97204. These comments or summaries of the comments will be communicated to the Board at its next regular meeting. No communications of this type were received from shareholders in 2019. The investor relations section of our website,

https://www.umpquabank.com/investor-relations, provides shareholders the option of:

•requesting information or submitting questions and comments; and

•signing up for e-mail notification of corporate events, the Company’s SEC filings and press releases.

Annual Board Evaluations

Each year, our Board evaluates the performance of its committees and its members. This evaluation process occurs in two stages. First, each Board member answers a questionnaire designed to rate the performance of each Board committee on which that director serves, with respect to a number of components relevant to that committee’s functions. The answers and comments are compiled anonymously and reviewed by the respective committee, as a whole, and reported to the full Board. The Nominating and Governance Committee then reviews those results and considers whether to recommend changes in committee structure, membership and function to the full Board. The Nominating and Governance Committee’s practice is to rotate directors through the various Board committees to broaden their exposure to the Company’s operations and to take advantage of each director’s skills.

Second, each Board member fills out a confidential evaluation of his or her own performance, which is delivered to the Board Chair. The Board Chair then solicits input from the Nominating and Governance Committee (which is comprised of the committee Chairs) with respect to the Board member’s performance and reviews that information with the Board member. The Nominating and Governance Committee considers this information when recommending a slate of candidates to be nominated by the full Board and in making committee membership decisions.

Succession Planning

Succession planning for the CEO and other named executive officer positions is one of the Board’s most important duties. Each year, the CEO presents his succession plan to the Board. This plan describes the process by which the executive management of the Company will continue if and when the current CEO is unwilling or unable to serve; the process for selecting the CEO’s successor, if necessary; and the process for selecting and naming a successor during the period leading up to the announcement of the CEO’s retirement. At least annually, the CEO reviews with the Nominating and Governance Committee up to three internal candidates who should be considered to replace him and his recommendation as to which, if any, internal candidate should be considered to replace him in the event he cannot serve. Under the current plan, any internal candidate selected on an interim basis will have the opportunity to compete for the position with other candidates that come forward in an internal and external search. Each of the other named executive officers has a written succession plan that is reviewed with the CEO annually.

23

Meetings and Committees of the Board of Directors

The Board met five times during 2019, including a three-day strategic planning retreat. At the retreat, the Board and executive management focused on how to best sustain and enhance shareholder value, and advance the Company’s Human + Digital Banking and Next Gen strategy. All Board committees have regularly scheduled meetings and meet at least quarterly. Board committee Chairs call for additional regular and special meetings of their committees, as they deem appropriate. In 2019, each director attended at least 75% of the meetings of the Board and the committees on which the director served. In addition, Mr. O’Haver invited directors to participate in regular conference calls to provide updates and answer questions.

The Board and each of our Board committees regularly meet in executive session in which only independent directors are present.