EXHIBIT 99.1

Contacts:

Ron Farnsworth | Bradley Howes |

EVP/Chief Financial Officer | SVP/Director of Investor Relations |

Umpqua Holdings Corporation | Umpqua Holdings Corporation |

503-727-4108 | 503-727-4226 |

ronfarnsworth@umpquabank.com | bradhowes@umpquabank.com |

UMPQUA REPORTS SECOND QUARTER 2018 RESULTS

Net earnings of $67.8 million, or $0.31 per common share

Quarterly loan and lease growth of $379.4 million, or 8% annualized, and deposit growth of $637.7 million, or 13% annualized

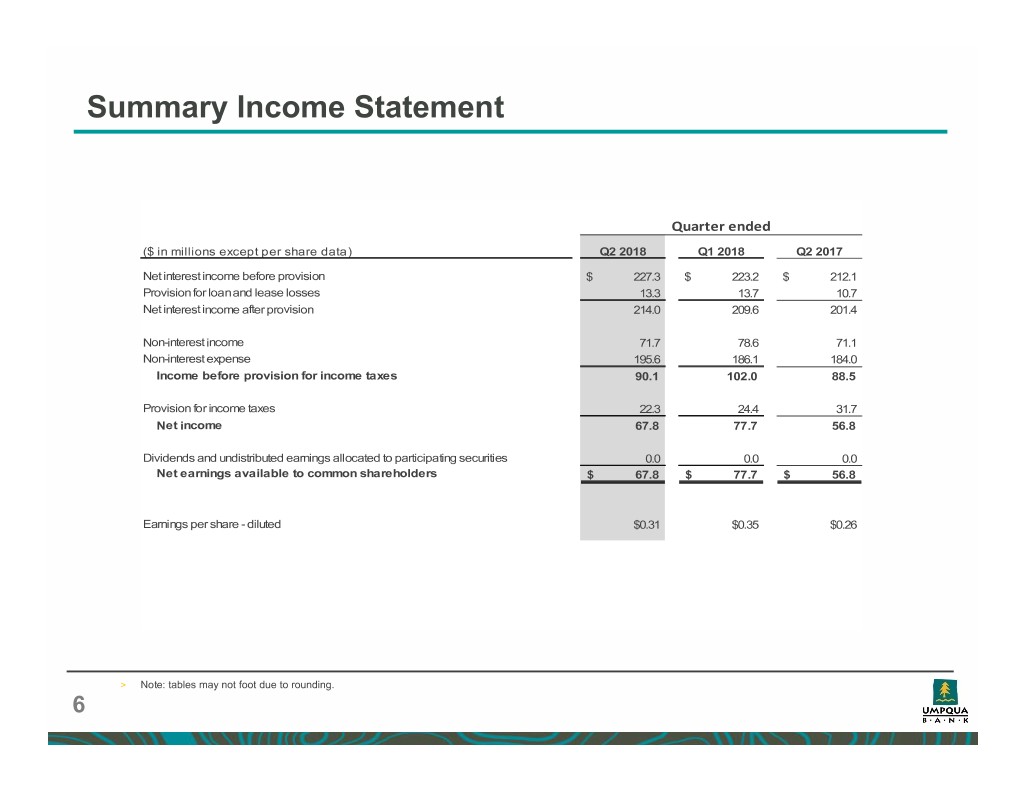

Organization simplification and design complete, results include pre-tax restructuring charges of $8.2 million

PORTLAND, Ore. – July 18, 2018 – Umpqua Holdings Corporation (NASDAQ: UMPQ) (the “Company”) reported net earnings available to common shareholders of $67.8 million for the second quarter of 2018, compared to $77.7 million for the first quarter of 2018 and $56.8 million for the second quarter of 2017. Earnings per diluted common share were $0.31 for the second quarter of 2018, compared to $0.35 for the first quarter of 2018 and $0.26 for the second quarter of 2017.

“Our second quarter results were highlighted by strong growth in loans and deposits, higher net interest income and stable credit quality,” said Cort O'Haver, president and CEO of Umpqua Holdings Corporation. “Building on the foundation of Umpqua Next Gen, during the second quarter we completed important elements of our operational excellence initiative, including organizational simplification and design phases, while advancing our human digital strategy. We are starting to see good traction from these Phase I levers, and remain on pace to deliver on the previously announced $18 to $24 million in annual savings.”

Notable items that impacted the second quarter 2018 financial results included:

• | $8.2 million in restructuring charges related to the organization simplification and design and procurement phases of Umpqua Next Gen, including $4.1 million in severance-related expense and $4.1 million in professional fees. This compares to $0.8 million in severance-related expense and $2.7 in professional fees in the prior quarter. |

• | $5.4 million negative adjustment related to the fair value change of the MSR asset, compared to $5.1 million gain in the prior quarter and $8.3 million negative adjustment in the same period of the prior year. |

• | $0.3 million gain related to the fair value change of the debt capital market swap derivatives, compared to a gain of $1.1 million in the prior quarter and a loss of $0.8 million in the same period of the prior year. |

• | $2.6 million of exit or disposal costs, compared to $2.5 million in the prior quarter and $0.7 million in the same period of the prior year. |

• | $1.4 million unrealized holding loss on equity securities, compared to no gain or loss recorded in the prior quarters. |

Umpqua Reports Second Quarter 2018 Results

July 18, 2018

Page 2

Second Quarter 2018 Highlights (compared to prior quarter):

• | Net interest income increased by $4.1 million, or 2%, attributable to the strong growth in loans and leases and the benefit from increases in short-term interest rates; |

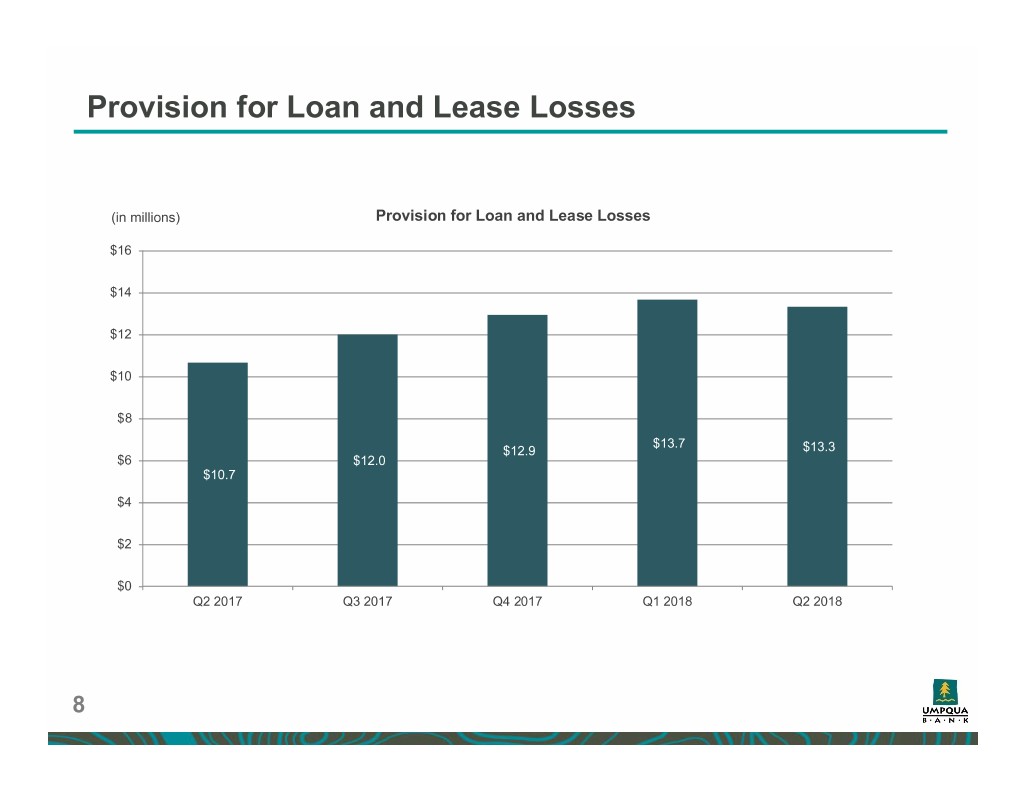

• | Provision for loan and lease losses decreased by $0.3 million, driven primarily by lower net charge-offs, which decreased by four basis points to 0.22% of average loans and leases (annualized); |

• | Non-interest income decreased by $6.9 million, reflecting the $10.5 million linked quarter change in fair value of the MSR asset (see notable items above), partially offset by higher net revenue from the origination and sale of residential mortgages; |

• | Non-interest expense increased by $9.5 million, driven primarily by higher restructuring charges (see notable items above) and higher mortgage banking-related expense, consistent with the increase in mortgage originations; |

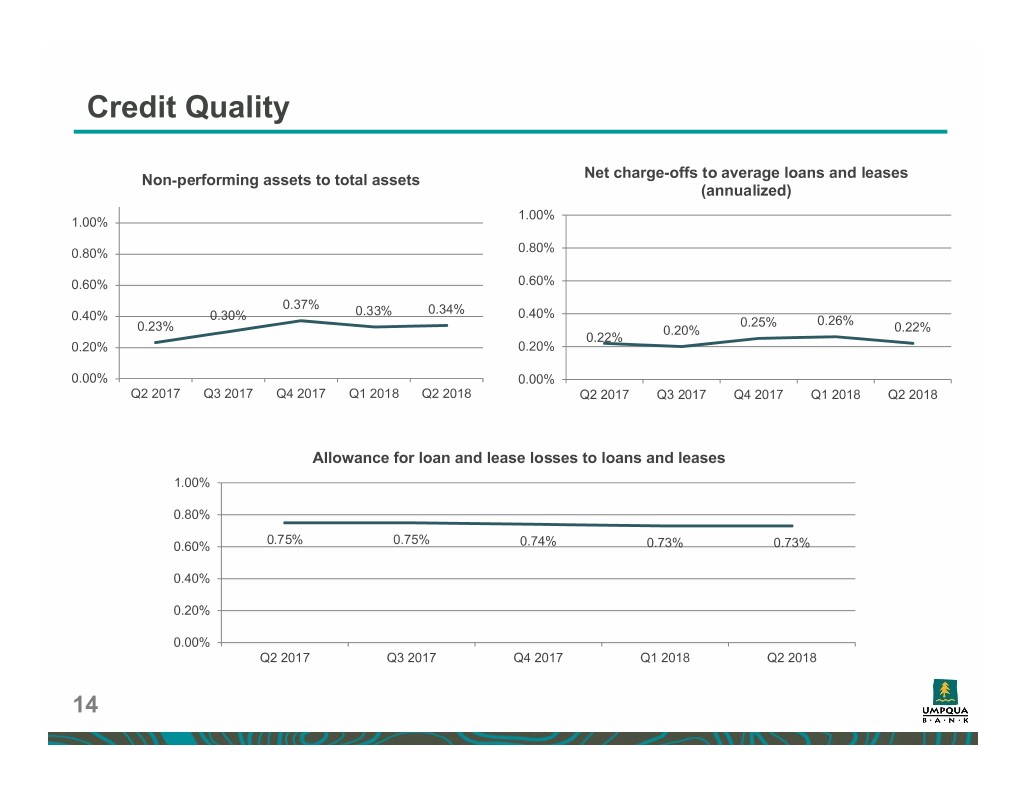

• | Non-performing assets to total assets increased by one basis point to 0.34%; |

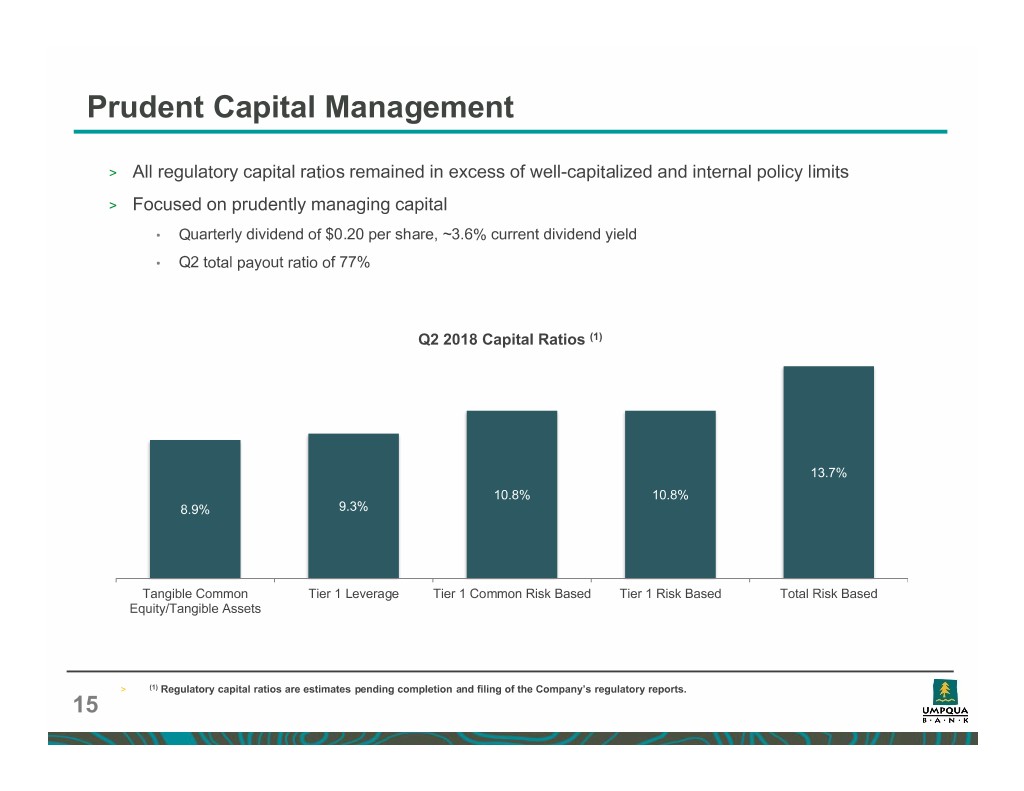

• | Estimated total risk-based capital ratio of 13.7% and estimated Tier 1 common to risk weighted assets ratio of 10.8%; |

• | Declared quarterly cash dividend of $0.20 per common share; and |

• | Repurchased 327,000 shares of common stock for $8.0 million. |

Balance Sheet

Total consolidated assets were $26.5 billion as of June 30, 2018, compared to $25.9 billion as of March 31, 2018 and $25.3 billion as of June 30, 2017. Including secured off-balance sheet lines of credit, total available liquidity was $10.4 billion as of June 30, 2018, representing 39% of total assets and 50% of total deposits.

Gross loans and leases were $19.7 billion as of June 30, 2018, an increase of $379.4 million, or 8% annualized, from $19.3 billion as of March 31, 2018. This increase reflects balanced growth within the commercial term, leasing, multifamily, and residential mortgage loan portfolios, partially offset by a decline in consumer loans attributable to the Company's decision to wind down its indirect auto loan business.

Total deposits were $20.7 billion as of June 30, 2018, an increase of $637.7 million, or 13% annualized, from $20.1 billion as of March 31, 2018. This increase was attributable to higher balances of time and non-interest bearing deposits, partially offset by lower money market deposits.

Net Interest Income

Net interest income was $227.3 million for the second quarter of 2018, up $4.1 million from the prior quarter. This increase reflects higher average loans and leases, driven by strong growth during the quarter, as well as higher average yields on earning assets from the short-term rate increases. Accretion of the credit discount recorded on acquired loans from Sterling Financial Corporation (“Sterling”) increased by $1.7 million from the prior quarter level, driven by a higher level of accretion on credit impaired loans associated with higher pay-offs.

The Company’s net interest margin was 3.93% for the second quarter of 2018, down 3 basis points from 3.96% for the first quarter of 2018, reflecting an increase in the cost of interest bearing liabilities and a higher average balance of interest-bearing cash, partially offset by higher average yields on interest-earning assets. The increase in the cost of interest-bearing liabilities was attributable to an increase in average rates paid on interest-bearing deposits, as well as a higher percentage mix of time deposits, relative to the prior quarter.

Credit Quality

The allowance for loan and lease losses was $144.6 million, or 0.73% of loans and leases, as of June 30, 2018. During the second quarter of 2018, the Company recorded $6.0 million of accretion related to the credit discount on acquired loans from Sterling, compared to $4.3 million in the prior quarter. As of June 30, 2018, the Sterling purchased non-credit impaired loans had approximately $19.3 million of remaining credit discount that will accrete into interest income over the life of the loans, and the Sterling purchased credit impaired loan pools had approximately $21.6 million of remaining total discount.

Umpqua Reports Second Quarter 2018 Results

July 18, 2018

Page 3

The provision for loan and lease losses was $13.3 million for the second quarter of 2018, a decrease of $0.3 million from the prior quarter level, driven primarily by lower net charge-offs, which decreased by four basis points to 0.22% of average loans and leases (annualized). As of June 30, 2018, non-performing assets were 0.34% of total assets, compared to 0.33% as of March 31, 2018 and 0.23% as of June 30, 2017.

Non-interest Income

Non-interest income was $71.7 million for the second quarter of 2018, down $6.9 million from the prior quarter, reflecting the negative linked quarter fair value change on the MSR asset (see notable items above), partially offset by an increase in net revenue from the origination and sale of residential mortgages.

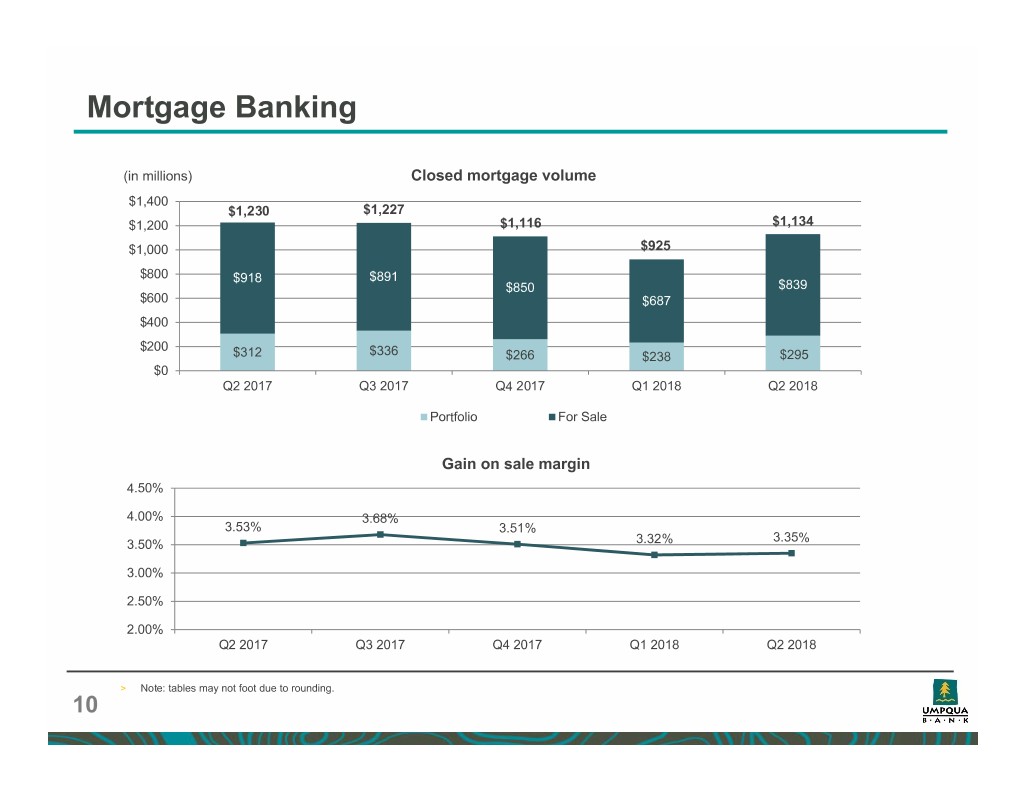

Net revenue from the origination and sale of residential mortgages was $28.2 million for the second quarter of 2018, up $5.3 million from the prior quarter, reflecting stronger seasonal purchase activity. For-sale mortgage origination volume increased by 22% from the prior quarter, and the home lending gain on sale margin increased by 3 basis points to 3.35% for the second quarter of 2018. Of the current quarter’s mortgage production, 81% related to purchase activity, compared to 68% for the prior quarter and 77% for the same period of the prior year.

Non-interest Expense

Non-interest expense was $195.6 million for the second quarter of 2018, and included $8.2 million in restructuring charges related to the organization simplification and design and procurement phases of Umpqua Next Gen. Excluding the impact of restructuring charges, non-interest expense increased by $4.7 million from the prior quarter. This increase included $2.6 million in higher mortgage banking-related expense, reflecting the increase in mortgage originations, and $1.3 million in higher marketing expense.

Capital

As of June 30, 2018, the Company’s tangible book value per common share1 was $10.02, compared to $9.97 in the prior quarter and $9.71 in the same period of the prior year. During the second quarter of 2018, the Company repurchased 327,000 shares of common stock for $8.0 million.

The Company’s estimated total risk-based capital ratio was 13.7% and its estimated Tier 1 common to risk weighted

assets ratio was 10.8% as of June 30, 2018. The Company remains above current “well-capitalized” regulatory minimums. The regulatory capital ratios as of June 30, 2018 are estimates, pending completion and filing of the Company’s regulatory reports.

1 "Non-GAAP" financial measure. More information regarding this measurement and a reconciliation to the comparable GAAP measurement is provided

under the heading Non-GAAP Financial Measures below.

Umpqua Reports Second Quarter 2018 Results

July 18, 2018

Page 4

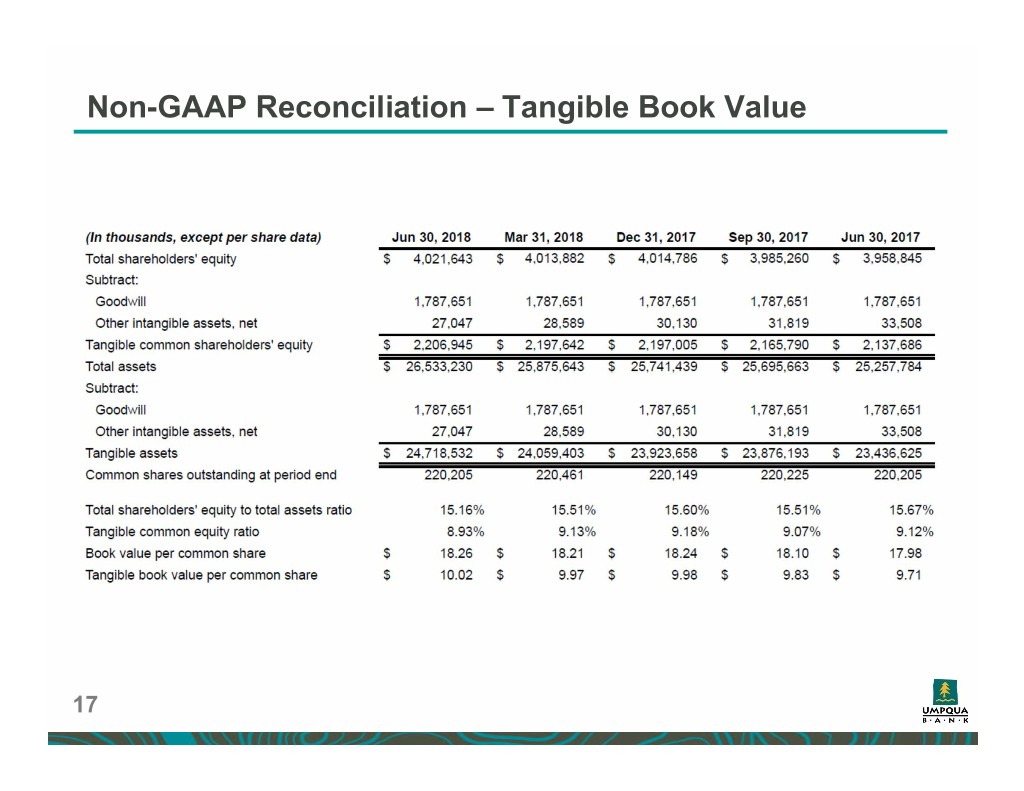

Non-GAAP Financial Measures

In addition to results presented in accordance with generally accepted accounting principles in the United States of America (GAAP), this press release contains certain non-GAAP financial measures. The Company believes that these non-GAAP financial measures provide investors with information useful in understanding the Company’s financial performance; however, readers of this document are urged to review these non-GAAP financial measures in conjunction with the GAAP results as reported.

Management believes tangible common equity and the tangible common equity ratio are useful measures of capital adequacy because they provide a meaningful base for period-to-period and company-to-company comparisons, which management believes will assist investors in assessing the capital of the Company and the ability to absorb potential losses. Tangible common equity is calculated as total shareholders' equity less goodwill and other intangible assets, net (excluding MSRs). Tangible assets are total assets less goodwill and other intangible assets, net (excluding MSRs). The tangible common equity ratio is calculated as tangible common shareholders’ equity divided by tangible assets.

The following table provides reconciliations of ending shareholders’ equity (GAAP) to ending tangible common equity (non-GAAP), and ending assets (GAAP) to ending tangible assets (non-GAAP).

(In thousands, except per share data) | Jun 30, 2018 | Mar 31, 2018 | Dec 31, 2017 | Sep 30, 2017 | Jun 30, 2017 | |||||||||||||||

Total shareholders' equity | $ | 4,021,643 | $ | 4,013,882 | $ | 4,014,786 | $ | 3,985,260 | $ | 3,958,845 | ||||||||||

Subtract: | ||||||||||||||||||||

Goodwill | 1,787,651 | 1,787,651 | 1,787,651 | 1,787,651 | 1,787,651 | |||||||||||||||

Other intangible assets, net | 27,047 | 28,589 | 30,130 | 31,819 | 33,508 | |||||||||||||||

Tangible common shareholders' equity | $ | 2,206,945 | $ | 2,197,642 | $ | 2,197,005 | $ | 2,165,790 | $ | 2,137,686 | ||||||||||

Total assets | $ | 26,533,230 | $ | 25,875,643 | $ | 25,741,439 | $ | 25,695,663 | $ | 25,257,784 | ||||||||||

Subtract: | ||||||||||||||||||||

Goodwill | 1,787,651 | 1,787,651 | 1,787,651 | 1,787,651 | 1,787,651 | |||||||||||||||

Other intangible assets, net | 27,047 | 28,589 | 30,130 | 31,819 | 33,508 | |||||||||||||||

Tangible assets | $ | 24,718,532 | $ | 24,059,403 | $ | 23,923,658 | $ | 23,876,193 | $ | 23,436,625 | ||||||||||

Common shares outstanding at period end | 220,205 | 220,461 | 220,149 | 220,225 | 220,205 | |||||||||||||||

Total shareholders' equity to total assets ratio | 15.16 | % | 15.51 | % | 15.60 | % | 15.51 | % | 15.67 | % | ||||||||||

Tangible common equity ratio | 8.93 | % | 9.13 | % | 9.18 | % | 9.07 | % | 9.12 | % | ||||||||||

Book value per common share | $ | 18.26 | $ | 18.21 | $ | 18.24 | $ | 18.10 | $ | 17.98 | ||||||||||

Tangible book value per common share | $ | 10.02 | $ | 9.97 | $ | 9.98 | $ | 9.83 | $ | 9.71 | ||||||||||

Umpqua Reports Second Quarter 2018 Results

July 18, 2018

Page 5

About Umpqua Holdings Corporation

Umpqua Holdings Corporation (NASDAQ: UMPQ) is the parent company of Umpqua Bank, an Oregon-based community bank recognized for its entrepreneurial approach, innovative customer experience, and distinctive banking solutions. Umpqua Bank has locations across Oregon, Washington, California, Idaho and Nevada. Umpqua Holdings also owns a retail brokerage subsidiary, Umpqua Investments, Inc., which has locations in Umpqua Bank stores and in dedicated offices in Oregon, and Pivotus Ventures, an enterprise software and innovation company headquartered in Silicon Valley. Umpqua Holdings Corporation is headquartered in Portland, Oregon. For more information, visit umpquabank.com.

Earnings Conference Call Information

The Company will host its second quarter 2018 earnings conference call on Thursday, July 19, 2018, at 10:00 a.m. PDT (1:00 p.m. EDT). During the call, the Company will provide an update on recent activities and discuss its second quarter 2018 financial results. There will be a live question-and-answer session following the presentation. To join the call, please dial (888) 505-4378 ten minutes prior to the start time and enter conference ID: 5308253. A re-broadcast will be available approximately two hours after the call by dialing (888) 203-1112 and entering conference ID 5308253. The earnings conference call will also be available as an audiocast, which can be accessed on the Company’s investor relations page at umpquabank.com.

Forward-Looking Statements

This press release includes forward-looking statements within the meaning of the “Safe-Harbor” provisions of the Private Securities Litigation Reform Act of 1995, which management believes are a benefit to shareholders. These statements are necessarily subject to risk and uncertainty and actual results could differ materially due to various risk factors, including those set forth from time to time in our filings with the SEC. You should not place undue reliance on forward-looking statements and we undertake no obligation to update any such statements. In this press release we make forward-looking statements about corporate initiatives and related cost savings. Risks that could cause results to differ from forward-looking statements we make are set forth in our filings with the SEC and include, without limitation, prolonged low interest rate environment; the effect of interest rate increases on the cost of deposits; unanticipated weakness in loan demand or loan pricing; deterioration in the economy; lack of strategic growth opportunities or our failure to execute on those opportunities; our ability to effectively manage problem credits; our ability to successfully implement efficiency and operational excellence initiatives on time and in amounts projected; our ability to successfully develop and market new products and technology; and changes in laws or regulations.

Umpqua Reports Second Quarter 2018 Results

July 18, 2018

Page 6

Umpqua Holdings Corporation | ||||||||||||||||||||||||||

Consolidated Statements of Income | ||||||||||||||||||||||||||

(Unaudited) | ||||||||||||||||||||||||||

Quarter Ended | % Change | |||||||||||||||||||||||||

(In thousands, except per share data) | Jun 30, 2018 | Mar 31, 2018 | Dec 31, 2017 | Sep 30, 2017 | Jun 30, 2017 | Seq. Quarter | Year over Year | |||||||||||||||||||

Interest income: | ||||||||||||||||||||||||||

Loans and leases | $ | 237,343 | $ | 227,738 | $ | 223,206 | $ | 223,321 | $ | 212,998 | 4 | % | 11 | % | ||||||||||||

Interest and dividends on investments: | ||||||||||||||||||||||||||

Taxable | 15,678 | 15,699 | 14,857 | 13,979 | 15,220 | 0 | % | 3 | % | |||||||||||||||||

Exempt from federal income tax | 2,057 | 2,128 | 2,121 | 2,125 | 2,237 | (3 | )% | (8 | )% | |||||||||||||||||

Dividends | 433 | 468 | 386 | 357 | 360 | (7 | )% | 20 | % | |||||||||||||||||

Temporary investments and interest bearing deposits | 2,080 | 1,164 | 1,565 | 934 | 324 | 79 | % | 542 | % | |||||||||||||||||

Total interest income | 257,591 | 247,197 | 242,135 | 240,716 | 231,139 | 4 | % | 11 | % | |||||||||||||||||

Interest expense: | ||||||||||||||||||||||||||

Deposits | 21,259 | 15,610 | 13,241 | 12,052 | 10,641 | 36 | % | 100 | % | |||||||||||||||||

Securities sold under agreement to repurchase and federal funds purchased | 155 | 63 | 43 | 81 | 321 | 146 | % | (52 | )% | |||||||||||||||||

Term debt | 3,478 | 3,361 | 3,496 | 3,491 | 3,662 | 3 | % | (5 | )% | |||||||||||||||||

Junior subordinated debentures | 5,400 | 4,932 | 4,734 | 4,628 | 4,437 | 9 | % | 22 | % | |||||||||||||||||

Total interest expense | 30,292 | 23,966 | 21,514 | 20,252 | 19,061 | 26 | % | 59 | % | |||||||||||||||||

Net interest income | 227,299 | 223,231 | 220,621 | 220,464 | 212,078 | 2 | % | 7 | % | |||||||||||||||||

Provision for loan and lease losses | 13,319 | 13,656 | 12,928 | 11,997 | 10,657 | (2 | )% | 25 | % | |||||||||||||||||

Non-interest income: | ||||||||||||||||||||||||||

Service charges on deposits | 15,520 | 14,995 | 15,413 | 15,849 | 15,478 | 4 | % | 0 | % | |||||||||||||||||

Brokerage revenue | 4,161 | 4,194 | 4,226 | 3,832 | 3,903 | (1 | )% | 7 | % | |||||||||||||||||

Residential mortgage banking revenue, net | 33,163 | 38,438 | 42,118 | 33,430 | 33,894 | (14 | )% | (2 | )% | |||||||||||||||||

Gain (loss) on sale of investment securities, net | 14 | — | — | (6 | ) | 35 | nm | (60 | )% | |||||||||||||||||

Unrealized holding losses on equity securities not held for trading | (1,432 | ) | — | — | — | — | nm | nm | ||||||||||||||||||

Gain on loan sales, net | 1,348 | 1,230 | 3,688 | 7,969 | 3,310 | 10 | % | (59 | )% | |||||||||||||||||

Loss on junior subordinated debentures carried at fair value | — | — | (10,010 | ) | (1,590 | ) | (1,572 | ) | 0 | % | (100 | )% | ||||||||||||||

BOLI income | 2,060 | 2,070 | 2,015 | 2,041 | 2,089 | 0 | % | (1 | )% | |||||||||||||||||

Other income | 16,817 | 17,640 | 13,000 | 13,877 | 13,982 | (5 | )% | 20 | % | |||||||||||||||||

Total non-interest income | 71,651 | 78,567 | 70,450 | 75,402 | 71,119 | (9 | )% | 1 | % | |||||||||||||||||

Non-interest expense: | ||||||||||||||||||||||||||

Salaries and employee benefits | 113,340 | 106,551 | 114,414 | 108,732 | 108,561 | 6 | % | 4 | % | |||||||||||||||||

Occupancy and equipment, net | 37,584 | 38,661 | 37,269 | 37,648 | 36,955 | (3 | )% | 2 | % | |||||||||||||||||

Intangible amortization | 1,542 | 1,541 | 1,689 | 1,689 | 1,689 | 0 | % | (9 | )% | |||||||||||||||||

FDIC assessments | 4,692 | 4,480 | 2,075 | 4,405 | 4,447 | 5 | % | 6 | % | |||||||||||||||||

Gain on other real estate owned, net | (92 | ) | (38 | ) | (83 | ) | (99 | ) | (457 | ) | 142 | % | (80 | )% | ||||||||||||

Merger related expenses | — | — | — | 6,664 | 1,640 | 0 | % | (100 | )% | |||||||||||||||||

Other expenses | 38,506 | 34,918 | 37,422 | 29,315 | 31,186 | 10 | % | 23 | % | |||||||||||||||||

Total non-interest expense | 195,572 | 186,113 | 192,786 | 188,354 | 184,021 | 5 | % | 6 | % | |||||||||||||||||

Income before provision for income taxes | 90,059 | 102,029 | 85,357 | 95,515 | 88,519 | (12 | )% | 2 | % | |||||||||||||||||

Provision for income taxes | 22,273 | 24,360 | 3,486 | 34,182 | 31,707 | (9 | )% | (30 | )% | |||||||||||||||||

Net income | 67,786 | 77,669 | 81,871 | 61,333 | 56,812 | (13 | )% | 19 | % | |||||||||||||||||

Dividends and undistributed earnings allocated to participating securities | 4 | 6 | 16 | 14 | 14 | (33 | )% | (71 | )% | |||||||||||||||||

Net earnings available to common shareholders | $ | 67,782 | $ | 77,663 | $ | 81,855 | $ | 61,319 | $ | 56,798 | (13 | )% | 19 | % | ||||||||||||

Weighted average basic shares outstanding | 220,283 | 220,370 | 220,194 | 220,215 | 220,310 | 0 | % | 0 | % | |||||||||||||||||

Weighted average diluted shares outstanding | 220,647 | 220,825 | 220,873 | 220,755 | 220,753 | 0 | % | 0 | % | |||||||||||||||||

Earnings per common share – basic | $ | 0.31 | $ | 0.35 | $ | 0.37 | $ | 0.28 | $ | 0.26 | (11 | )% | 19 | % | ||||||||||||

Earnings per common share – diluted | $ | 0.31 | $ | 0.35 | $ | 0.37 | $ | 0.28 | $ | 0.26 | (11 | )% | 19 | % | ||||||||||||

nm = not meaningful | ||||||||||||||||||||||||||

Umpqua Reports Second Quarter 2018 Results

July 18, 2018

Page 7

Umpqua Holdings Corporation | |||||||||||

Consolidated Statements of Income | |||||||||||

(Unaudited) | |||||||||||

Six Months Ended | % Change | ||||||||||

(In thousands, except per share data) | Jun 30, 2018 | Jun 30, 2017 | Year over Year | ||||||||

Interest income | |||||||||||

Loans and leases | $ | 465,081 | $ | 418,994 | 11 | % | |||||

Interest and dividends on investments: | |||||||||||

Taxable | 31,377 | 29,151 | 8 | % | |||||||

Exempt from federal income tax | 4,185 | 4,479 | (7 | )% | |||||||

Dividends | 901 | 748 | 20 | % | |||||||

Temporary investments and interest bearing deposits | 3,244 | 1,881 | 72 | % | |||||||

Total interest income | 504,788 | 455,253 | 11 | % | |||||||

Interest expense | |||||||||||

Deposits | 36,869 | 20,289 | 82 | % | |||||||

Securities sold under agreement to repurchase and federal funds purchased | 218 | 351 | (38 | )% | |||||||

Term debt | 6,839 | 7,172 | (5 | )% | |||||||

Junior subordinated debentures | 10,332 | 8,638 | 20 | % | |||||||

Total interest expense | 54,258 | 36,450 | 49 | % | |||||||

Net interest income | 450,530 | 418,803 | 8 | % | |||||||

Provision for loan and lease losses | 26,975 | 22,329 | 21 | % | |||||||

Non-interest income | |||||||||||

Service charges on deposits | 30,515 | 30,207 | 1 | % | |||||||

Brokerage revenue | 8,355 | 8,025 | 4 | % | |||||||

Residential mortgage banking revenue, net | 71,601 | 60,728 | 18 | % | |||||||

Gain on sale of investment securities, net | 14 | 33 | (58 | )% | |||||||

Unrealized holding losses on equity securities not held for trading | (1,432 | ) | — | nm | |||||||

Gain on loan sales, net | 2,578 | 5,064 | (49 | )% | |||||||

Loss on junior subordinated debentures carried at fair value | — | (3,127 | ) | (100 | )% | ||||||

BOLI income | 4,130 | 4,158 | (1 | )% | |||||||

Other income | 34,457 | 26,256 | 31 | % | |||||||

Total non-interest income | 150,218 | 131,344 | 14 | % | |||||||

Non-interest expense | |||||||||||

Salaries and employee benefits | 219,891 | 215,034 | 2 | % | |||||||

Occupancy and equipment, net | 76,245 | 75,628 | 1 | % | |||||||

Intangible amortization | 3,083 | 3,378 | (9 | )% | |||||||

FDIC assessments | 9,172 | 8,534 | 7 | % | |||||||

Gain on other real estate owned, net | (130 | ) | (375 | ) | (65 | )% | |||||

Merger related expenses | — | 2,660 | (100 | )% | |||||||

Other expenses | 73,424 | 61,876 | 19 | % | |||||||

Total non-interest expense | 381,685 | 366,735 | 4 | % | |||||||

Income before provision for income taxes | 192,088 | 161,083 | 19 | % | |||||||

Provision for income taxes | 46,633 | 58,268 | (20 | )% | |||||||

Net income | 145,455 | 102,815 | 41 | % | |||||||

Dividends and undistributed earnings allocated to participating securities | 10 | 26 | (62 | )% | |||||||

Net earnings available to common shareholders | $ | 145,445 | $ | 102,789 | 41 | % | |||||

Weighted average basic shares outstanding | 220,326 | 220,298 | 0 | % | |||||||

Weighted average diluted shares outstanding | 220,760 | 220,790 | 0 | % | |||||||

Earnings per common share – basic | $ | 0.66 | $ | 0.47 | 40 | % | |||||

Earnings per common share – diluted | $ | 0.66 | $ | 0.47 | 40 | % | |||||

nm = not meaningful | |||||||||||

Umpqua Reports Second Quarter 2018 Results

July 18, 2018

Page 8

Umpqua Holdings Corporation Consolidated Balance Sheets | ||||||||||||||||||||||||||

(Unaudited) | ||||||||||||||||||||||||||

% Change | ||||||||||||||||||||||||||

(In thousands, except per share data) | Jun 30, 2018 | Mar 31, 2018 | Dec 31, 2017 | Sep 30, 2017 | Jun 30, 2017 | Seq. Quarter | Year over Year | |||||||||||||||||||

Assets: | ||||||||||||||||||||||||||

Cash and due from banks | $ | 314,513 | $ | 304,681 | $ | 330,856 | $ | 304,760 | $ | 320,027 | 3 | % | (2 | )% | ||||||||||||

Interest bearing cash and temporary investments | 488,499 | 264,508 | 303,424 | 540,806 | 295,937 | 85 | % | 65 | % | |||||||||||||||||

Investment securities: | ||||||||||||||||||||||||||

Equity and other, at fair value | 64,297 | 63,295 | 12,255 | 11,919 | 11,467 | 2 | % | 461 | % | |||||||||||||||||

Available for sale, at fair value | 2,854,398 | 2,947,414 | 3,065,769 | 3,047,358 | 3,132,566 | (3 | )% | (9 | )% | |||||||||||||||||

Held to maturity, at amortized cost | 3,586 | 3,667 | 3,803 | 3,905 | 4,017 | (2 | )% | (11 | )% | |||||||||||||||||

Loans held for sale, at fair value | 432,642 | 299,739 | 259,518 | 417,470 | 451,350 | 44 | % | (4 | )% | |||||||||||||||||

Loans and leases | 19,693,955 | 19,314,589 | 19,080,184 | 18,677,762 | 18,321,142 | 2 | % | 7 | % | |||||||||||||||||

Allowance for loan and lease losses | (144,556 | ) | (141,933 | ) | (140,608 | ) | (139,503 | ) | (136,867 | ) | 2 | % | 6 | % | ||||||||||||

Loans and leases, net | 19,549,399 | 19,172,656 | 18,939,576 | 18,538,259 | 18,184,275 | 2 | % | 8 | % | |||||||||||||||||

Restricted equity securities | 42,320 | 43,501 | 43,508 | 45,509 | 45,511 | (3 | )% | (7 | )% | |||||||||||||||||

Premises and equipment, net | 245,954 | 259,354 | 269,182 | 276,316 | 288,853 | (5 | )% | (15 | )% | |||||||||||||||||

Goodwill | 1,787,651 | 1,787,651 | 1,787,651 | 1,787,651 | 1,787,651 | 0 | % | 0 | % | |||||||||||||||||

Other intangible assets, net | 27,047 | 28,589 | 30,130 | 31,819 | 33,508 | (5 | )% | (19 | )% | |||||||||||||||||

Residential mortgage servicing rights, at fair value | 166,217 | 164,760 | 153,151 | 141,225 | 141,832 | 1 | % | 17 | % | |||||||||||||||||

Other real estate owned | 12,101 | 13,055 | 11,734 | 4,160 | 4,804 | (7 | )% | 152 | % | |||||||||||||||||

Bank owned life insurance | 309,844 | 307,745 | 306,864 | 305,572 | 303,894 | 1 | % | 2 | % | |||||||||||||||||

Other assets | 234,762 | 215,028 | 224,018 | 238,934 | 252,092 | 9 | % | (7 | )% | |||||||||||||||||

Total assets | $ | 26,533,230 | $ | 25,875,643 | $ | 25,741,439 | $ | 25,695,663 | $ | 25,257,784 | 3 | % | 5 | % | ||||||||||||

Liabilities: | ||||||||||||||||||||||||||

Deposits | $ | 20,744,526 | $ | 20,106,856 | $ | 19,948,300 | $ | 19,851,910 | $ | 19,459,950 | 3 | % | 7 | % | ||||||||||||

Securities sold under agreements to repurchase | 273,666 | 291,984 | 294,299 | 321,542 | 330,189 | (6 | )% | (17 | )% | |||||||||||||||||

Term debt | 801,739 | 801,868 | 802,357 | 852,306 | 852,219 | 0 | % | (6 | )% | |||||||||||||||||

Junior subordinated debentures, at fair value | 280,669 | 278,410 | 277,155 | 266,875 | 265,423 | 1 | % | 6 | % | |||||||||||||||||

Junior subordinated debentures, at amortized cost | 88,838 | 88,895 | 100,609 | 100,690 | 100,770 | 0 | % | (12 | )% | |||||||||||||||||

Deferred tax liability, net | 39,328 | 39,277 | 37,503 | 51,423 | 34,296 | 0 | % | 15 | % | |||||||||||||||||

Other liabilities | 282,821 | 254,471 | 266,430 | 265,657 | 256,092 | 11 | % | 10 | % | |||||||||||||||||

Total liabilities | 22,511,587 | 21,861,761 | 21,726,653 | 21,710,403 | 21,298,939 | 3 | % | 6 | % | |||||||||||||||||

Shareholders' equity: | ||||||||||||||||||||||||||

Common stock | 3,509,146 | 3,515,506 | 3,517,258 | 3,516,558 | 3,514,094 | 0 | % | 0 | % | |||||||||||||||||

Retained earnings | 569,933 | 546,330 | 522,520 | 476,226 | 454,802 | 4 | % | 25 | % | |||||||||||||||||

Accumulated other comprehensive loss | (57,436 | ) | (47,954 | ) | (24,992 | ) | (7,524 | ) | (10,051 | ) | 20 | % | 471 | % | ||||||||||||

Total shareholders' equity | 4,021,643 | 4,013,882 | 4,014,786 | 3,985,260 | 3,958,845 | 0 | % | 2 | % | |||||||||||||||||

Total liabilities and shareholders' equity | $ | 26,533,230 | $ | 25,875,643 | $ | 25,741,439 | $ | 25,695,663 | $ | 25,257,784 | 3 | % | 5 | % | ||||||||||||

Common shares outstanding at period end | 220,205 | 220,461 | 220,149 | 220,225 | 220,205 | 0 | % | 0 | % | |||||||||||||||||

Book value per common share | $ | 18.26 | $ | 18.21 | $ | 18.24 | $ | 18.10 | $ | 17.98 | 0 | % | 2 | % | ||||||||||||

Tangible book value per common share | $ | 10.02 | $ | 9.97 | $ | 9.98 | $ | 9.83 | $ | 9.71 | 1 | % | 3 | % | ||||||||||||

Tangible equity - common | $ | 2,206,945 | $ | 2,197,642 | $ | 2,197,005 | $ | 2,165,790 | $ | 2,137,686 | 0 | % | 3 | % | ||||||||||||

Tangible common equity to tangible assets | 8.93 | % | 9.13 | % | 9.18 | % | 9.07 | % | 9.12 | % | (0.20 | ) | (0.19 | ) | ||||||||||||

Umpqua Reports Second Quarter 2018 Results

July 18, 2018

Page 9

Umpqua Holdings Corporation | ||||||||||||||||||||||||||

Loan and Lease Portfolio | ||||||||||||||||||||||||||

(Unaudited) | ||||||||||||||||||||||||||

(Dollars in thousands) | Jun 30, 2018 | Mar 31, 2018 | Dec 31, 2017 | Sep 30, 2017 | Jun 30, 2017 | % Change | ||||||||||||||||||||

Amount | Amount | Amount | Amount | Amount | Seq. Quarter | Year over Year | ||||||||||||||||||||

Loans and leases: | ||||||||||||||||||||||||||

Commercial real estate: | ||||||||||||||||||||||||||

Non-owner occupied term, net | $ | 3,525,001 | $ | 3,526,221 | $ | 3,491,137 | $ | 3,475,243 | $ | 3,401,679 | 0 | % | 4 | % | ||||||||||||

Owner occupied term, net | 2,484,960 | 2,476,287 | 2,488,251 | 2,467,995 | 2,593,395 | 0 | % | (4 | )% | |||||||||||||||||

Multifamily, net | 3,210,796 | 3,131,275 | 3,087,792 | 2,993,203 | 2,964,851 | 3 | % | 8 | % | |||||||||||||||||

Construction & development, net | 568,572 | 522,680 | 540,707 | 521,666 | 464,690 | 9 | % | 22 | % | |||||||||||||||||

Residential development, net | 183,114 | 179,871 | 165,865 | 186,400 | 165,956 | 2 | % | 10 | % | |||||||||||||||||

Commercial: | ||||||||||||||||||||||||||

Term, net | 2,106,804 | 2,025,213 | 1,944,987 | 1,819,664 | 1,686,597 | 4 | % | 25 | % | |||||||||||||||||

Lines of credit & other, net | 1,152,841 | 1,147,028 | 1,166,173 | 1,134,045 | 1,153,409 | 1 | % | 0 | % | |||||||||||||||||

Leases & equipment finance, net | 1,265,843 | 1,228,709 | 1,167,503 | 1,137,732 | 1,082,651 | 3 | % | 17 | % | |||||||||||||||||

Residential real estate: | ||||||||||||||||||||||||||

Mortgage, net | 3,414,216 | 3,283,945 | 3,192,185 | 3,094,361 | 3,021,331 | 4 | % | 13 | % | |||||||||||||||||

Home equity loans & lines, net | 1,136,378 | 1,107,822 | 1,103,297 | 1,079,931 | 1,056,848 | 3 | % | 8 | % | |||||||||||||||||

Consumer & other, net | 645,430 | 685,538 | 732,287 | 767,522 | 729,735 | (6 | )% | (12 | )% | |||||||||||||||||

Total, net of deferred fees and costs | $ | 19,693,955 | $ | 19,314,589 | $ | 19,080,184 | $ | 18,677,762 | $ | 18,321,142 | 2 | % | 7 | % | ||||||||||||

Loan and leases mix: | ||||||||||||||||||||||||||

Commercial real estate: | ||||||||||||||||||||||||||

Non-owner occupied term, net | 18 | % | 18 | % | 18 | % | 19 | % | 19 | % | ||||||||||||||||

Owner occupied term, net | 13 | % | 13 | % | 13 | % | 13 | % | 14 | % | ||||||||||||||||

Multifamily, net | 16 | % | 16 | % | 16 | % | 16 | % | 16 | % | ||||||||||||||||

Construction & development, net | 3 | % | 3 | % | 3 | % | 3 | % | 3 | % | ||||||||||||||||

Residential development, net | 1 | % | 1 | % | 1 | % | 1 | % | 1 | % | ||||||||||||||||

Commercial: | ||||||||||||||||||||||||||

Term, net | 11 | % | 10 | % | 10 | % | 10 | % | 9 | % | ||||||||||||||||

Lines of credit & other, net | 6 | % | 6 | % | 6 | % | 6 | % | 6 | % | ||||||||||||||||

Leases & equipment finance, net | 6 | % | 6 | % | 6 | % | 6 | % | 6 | % | ||||||||||||||||

Residential real estate: | ||||||||||||||||||||||||||

Mortgage, net | 17 | % | 17 | % | 17 | % | 16 | % | 16 | % | ||||||||||||||||

Home equity loans & lines, net | 6 | % | 6 | % | 6 | % | 6 | % | 6 | % | ||||||||||||||||

Consumer & other, net | 3 | % | 4 | % | 4 | % | 4 | % | 4 | % | ||||||||||||||||

Total | 100 | % | 100 | % | 100 | % | 100 | % | 100 | % | ||||||||||||||||

Umpqua Reports Second Quarter 2018 Results

July 18, 2018

Page 10

Umpqua Holdings Corporation | ||||||||||||||||||||||||||

Deposits by Type/Core Deposits | ||||||||||||||||||||||||||

(Unaudited) | ||||||||||||||||||||||||||

(Dollars in thousands) | Jun 30, 2018 | Mar 31, 2018 | Dec 31, 2017 | Sep 30, 2017 | Jun 30, 2017 | % Change | ||||||||||||||||||||

Amount | Amount | Amount | Amount | Amount | Seq. Quarter | Year over Year | ||||||||||||||||||||

Deposits: | ||||||||||||||||||||||||||

Demand, non-interest bearing | $ | 6,819,325 | $ | 6,699,399 | $ | 6,505,628 | $ | 6,571,471 | $ | 6,112,480 | 2 | % | 12 | % | ||||||||||||

Demand, interest bearing | 2,321,691 | 2,354,873 | 2,384,133 | 2,394,240 | 2,371,386 | (1 | )% | (2 | )% | |||||||||||||||||

Money market | 6,161,907 | 6,546,704 | 7,037,891 | 6,700,261 | 6,755,707 | (6 | )% | (9 | )% | |||||||||||||||||

Savings | 1,465,154 | 1,482,560 | 1,446,860 | 1,444,801 | 1,427,677 | (1 | )% | 3 | % | |||||||||||||||||

Time | 3,976,449 | 3,023,320 | 2,573,788 | 2,741,137 | 2,792,700 | 32 | % | 42 | % | |||||||||||||||||

Total | $ | 20,744,526 | $ | 20,106,856 | $ | 19,948,300 | $ | 19,851,910 | $ | 19,459,950 | 3 | % | 7 | % | ||||||||||||

Total core deposits (1) | $ | 17,743,888 | $ | 18,007,169 | $ | 18,263,802 | $ | 18,005,730 | $ | 17,561,956 | (1 | )% | 1 | % | ||||||||||||

Deposit mix: | ||||||||||||||||||||||||||

Demand, non-interest bearing | 33 | % | 33 | % | 33 | % | 33 | % | 32 | % | ||||||||||||||||

Demand, interest bearing | 11 | % | 12 | % | 12 | % | 12 | % | 12 | % | ||||||||||||||||

Money market | 30 | % | 33 | % | 35 | % | 34 | % | 35 | % | ||||||||||||||||

Savings | 7 | % | 7 | % | 7 | % | 7 | % | 7 | % | ||||||||||||||||

Time | 19 | % | 15 | % | 13 | % | 14 | % | 14 | % | ||||||||||||||||

Total | 100 | % | 100 | % | 100 | % | 100 | % | 100 | % | ||||||||||||||||

Number of open accounts: | ||||||||||||||||||||||||||

Demand, non-interest bearing | 402,771 | 399,721 | 397,427 | 394,755 | 389,767 | |||||||||||||||||||||

Demand, interest bearing | 77,918 | 78,181 | 78,853 | 79,899 | 80,594 | |||||||||||||||||||||

Money market | 55,393 | 54,752 | 55,175 | 55,659 | 55,795 | |||||||||||||||||||||

Savings | 162,414 | 162,841 | 162,453 | 162,556 | 161,369 | |||||||||||||||||||||

Time | 51,073 | 48,529 | 46,861 | 47,129 | 47,339 | |||||||||||||||||||||

Total | 749,569 | 744,024 | 740,769 | 739,998 | 734,864 | |||||||||||||||||||||

Average balance per account: | ||||||||||||||||||||||||||

Demand, non-interest bearing | $ | 16.9 | $ | 16.8 | $ | 16.4 | $ | 16.6 | $ | 15.7 | ||||||||||||||||

Demand, interest bearing | 29.8 | 30.1 | 30.2 | 30.0 | 29.4 | |||||||||||||||||||||

Money market | 111.2 | 119.6 | 127.6 | 120.4 | 121.1 | |||||||||||||||||||||

Savings | 9.0 | 9.1 | 8.9 | 8.9 | 8.8 | |||||||||||||||||||||

Time | 77.9 | 62.3 | 54.9 | 58.2 | 59.0 | |||||||||||||||||||||

Total | $ | 27.7 | $ | 27.0 | $ | 26.9 | $ | 26.8 | $ | 26.5 | ||||||||||||||||

(1) Core deposits are defined as total deposits less time deposits greater than $100,000.

Umpqua Reports Second Quarter 2018 Results

July 18, 2018

Page 11

Umpqua Holdings Corporation | ||||||||||||||||||||||||||

Credit Quality – Non-performing Assets | ||||||||||||||||||||||||||

(Unaudited) | ||||||||||||||||||||||||||

Quarter Ended | % Change | |||||||||||||||||||||||||

(Dollars in thousands) | Jun 30, 2018 | Mar 31, 2018 | Dec 31, 2017 | Sep 30, 2017 | Jun 30, 2017 | Seq. Quarter | Year over Year | |||||||||||||||||||

Non-performing assets: | ||||||||||||||||||||||||||

Loans and leases on non-accrual status | $ | 43,485 | $ | 45,775 | $ | 51,465 | $ | 44,573 | $ | 26,566 | (5 | )% | 64 | % | ||||||||||||

Loans and leases past due 90+ days and accruing (1) | 34,494 | 25,478 | 30,994 | 29,073 | 27,252 | 35 | % | 27 | % | |||||||||||||||||

Total non-performing loans and leases | 77,979 | 71,253 | 82,459 | 73,646 | 53,818 | 9 | % | 45 | % | |||||||||||||||||

Other real estate owned | 12,101 | 13,055 | 11,734 | 4,160 | 4,804 | (7 | )% | 152 | % | |||||||||||||||||

Total non-performing assets | $ | 90,080 | $ | 84,308 | $ | 94,193 | $ | 77,806 | $ | 58,622 | 7 | % | 54 | % | ||||||||||||

Performing restructured loans and leases | $ | 27,144 | $ | 31,659 | $ | 32,157 | $ | 45,813 | $ | 52,861 | (14 | )% | (49 | )% | ||||||||||||

Loans and leases past due 31-89 days | $ | 45,114 | $ | 38,650 | $ | 43,870 | $ | 32,251 | $ | 31,153 | 17 | % | 45 | % | ||||||||||||

Loans and leases past due 31-89 days to total loans and leases | 0.23 | % | 0.20 | % | 0.23 | % | 0.17 | % | 0.17 | % | ||||||||||||||||

Non-performing loans and leases to total loans and leases (1) | 0.40 | % | 0.37 | % | 0.43 | % | 0.39 | % | 0.29 | % | ||||||||||||||||

Non-performing assets to total assets(1) | 0.34 | % | 0.33 | % | 0.37 | % | 0.30 | % | 0.23 | % | ||||||||||||||||

(1) | Excludes non-performing mortgage loans guaranteed by Ginnie Mae, which Umpqua has the unilateral right to repurchase but has not done so, totaling $9.2 million, $6.3 million, $12.4 million, $12.3 million, and $16.3 million at June 30, 2018, March 31, 2018, December 31, 2017, September 30, 2017, and June 30, 2017, respectively. |

Umpqua Reports Second Quarter 2018 Results

July 18, 2018

Page 12

Umpqua Holdings Corporation | ||||||||||||||||||||||||||

Credit Quality – Allowance for Loan and Lease Losses | ||||||||||||||||||||||||||

(Unaudited) | ||||||||||||||||||||||||||

Quarter Ended | % Change | |||||||||||||||||||||||||

(Dollars in thousands) | Jun 30, 2018 | Mar 31, 2018 | Dec 31, 2017 | Sep 30, 2017 | Jun 30, 2017 | Seq. Quarter | Year over Year | |||||||||||||||||||

Allowance for loan and lease losses: | ||||||||||||||||||||||||||

Balance beginning of period | $ | 141,933 | $ | 140,608 | $ | 139,503 | $ | 136,867 | $ | 136,292 | ||||||||||||||||

Provision for loan and lease losses | 13,319 | 13,656 | 12,928 | 11,997 | 10,657 | (2 | )% | 25 | % | |||||||||||||||||

Charge-offs | (14,815 | ) | (15,812 | ) | (15,751 | ) | (13,222 | ) | (13,944 | ) | (6 | )% | 6 | % | ||||||||||||

Recoveries | 4,119 | 3,481 | 3,928 | 3,861 | 3,862 | 18 | % | 7 | % | |||||||||||||||||

Net charge-offs | (10,696 | ) | (12,331 | ) | (11,823 | ) | (9,361 | ) | (10,082 | ) | (13 | )% | 6 | % | ||||||||||||

Total allowance for loan and lease losses | 144,556 | 141,933 | 140,608 | 139,503 | 136,867 | 2 | % | 6 | % | |||||||||||||||||

Reserve for unfunded commitments | 4,130 | 4,129 | 3,963 | 3,932 | 3,816 | 0 | % | 8 | % | |||||||||||||||||

Total allowance for credit losses | $ | 148,686 | $ | 146,062 | $ | 144,571 | $ | 143,435 | $ | 140,683 | 2 | % | 6 | % | ||||||||||||

Net charge-offs to average loans and leases (annualized) | 0.22 | % | 0.26 | % | 0.25 | % | 0.20 | % | 0.22 | % | ||||||||||||||||

Recoveries to gross charge-offs | 27.80 | % | 22.01 | % | 24.94 | % | 29.20 | % | 27.70 | % | ||||||||||||||||

Allowance for loan and lease losses to loans and leases | 0.73 | % | 0.73 | % | 0.74 | % | 0.75 | % | 0.75 | % | ||||||||||||||||

Allowance for credit losses to loans and leases | 0.75 | % | 0.76 | % | 0.76 | % | 0.77 | % | 0.77 | % | ||||||||||||||||

Umpqua Holdings Corporation | |||||||||||

Credit Quality – Allowance for Loan and Lease Losses | |||||||||||

(Unaudited) | |||||||||||

Six Months Ended | % Change | ||||||||||

(Dollars in thousands) | Jun 30, 2018 | Jun 30, 2017 | Year over Year | ||||||||

Allowance for loan and lease losses: | |||||||||||

Balance beginning of period | $ | 140,608 | $ | 133,984 | |||||||

Provision for loan and lease losses | 26,975 | 22,329 | 21 | % | |||||||

Charge-offs | (30,627 | ) | (26,946 | ) | 14 | % | |||||

Recoveries | 7,600 | 7,500 | 1 | % | |||||||

Net charge-offs | (23,027 | ) | (19,446 | ) | 18 | % | |||||

Total allowance for loan and lease losses | 144,556 | 136,867 | 6 | % | |||||||

Reserve for unfunded commitments | 4,130 | 3,816 | 8 | % | |||||||

Total allowance for credit losses | $ | 148,686 | $ | 140,683 | 6 | % | |||||

Net charge-offs to average loans and leases (annualized) | 0.24 | % | 0.22 | % | |||||||

Recoveries to gross charge-offs | 24.81 | % | 27.83 | % | |||||||

Umpqua Reports Second Quarter 2018 Results

July 18, 2018

Page 13

Umpqua Holdings Corporation | |||||||||||||||||||||

Selected Ratios | |||||||||||||||||||||

(Unaudited) | |||||||||||||||||||||

Quarter Ended | % Change | ||||||||||||||||||||

Jun 30, 2018 | Mar 31, 2018 | Dec 31, 2017 | Sep 30, 2017 | Jun 30, 2017 | Seq. Quarter | Year over Year | |||||||||||||||

Average Rates: | |||||||||||||||||||||

Yield on loans and leases | 4.81 | % | 4.75 | % | 4.65 | % | 4.70 | % | 4.67 | % | 0.06 | 0.14 | |||||||||

Yield on loans held for sale | 4.86 | % | 4.21 | % | 3.99 | % | 3.89 | % | 3.26 | % | 0.65 | 1.60 | |||||||||

Yield on taxable investments | 2.37 | % | 2.31 | % | 2.17 | % | 2.00 | % | 2.07 | % | 0.06 | 0.30 | |||||||||

Yield on tax-exempt investments (1) | 3.64 | % | 3.68 | % | 4.49 | % | 4.59 | % | 4.64 | % | (0.04 | ) | (1.00 | ) | |||||||

Yield on interest bearing cash and temporary investments | 1.82 | % | 1.55 | % | 1.22 | % | 1.47 | % | 1.03 | % | 0.27 | 0.79 | |||||||||

Total yield on earning assets (1) | 4.45 | % | 4.39 | % | 4.26 | % | 4.30 | % | 4.26 | % | 0.06 | 0.19 | |||||||||

Cost of interest bearing deposits | 0.62 | % | 0.47 | % | 0.40 | % | 0.36 | % | 0.33 | % | 0.15 | 0.29 | |||||||||

Cost of securities sold under agreements | |||||||||||||||||||||

to repurchase and fed funds purchased | 0.22 | % | 0.08 | % | 0.06 | % | 0.10 | % | 0.32 | % | 0.14 | (0.10 | ) | ||||||||

Cost of term debt | 1.74 | % | 1.70 | % | 1.67 | % | 1.63 | % | 1.72 | % | 0.04 | 0.02 | |||||||||

Cost of junior subordinated debentures | 5.89 | % | 5.36 | % | 5.11 | % | 5.02 | % | 4.88 | % | 0.53 | 1.01 | |||||||||

Total cost of interest bearing liabilities | 0.80 | % | 0.65 | % | 0.58 | % | 0.55 | % | 0.52 | % | 0.15 | 0.28 | |||||||||

Net interest spread (1) | 3.65 | % | 3.74 | % | 3.68 | % | 3.75 | % | 3.74 | % | (0.09 | ) | (0.09 | ) | |||||||

Net interest margin (1) | 3.93 | % | 3.96 | % | 3.88 | % | 3.94 | % | 3.91 | % | (0.03 | ) | 0.02 | ||||||||

Performance Ratios: | |||||||||||||||||||||

Return on average assets | 1.04 | % | 1.23 | % | 1.27 | % | 0.96 | % | 0.92 | % | (0.19 | ) | 0.12 | ||||||||

Return on average tangible assets | 1.12 | % | 1.32 | % | 1.36 | % | 1.04 | % | 0.99 | % | (0.20 | ) | 0.13 | ||||||||

Return on average common equity | 6.74 | % | 7.84 | % | 8.12 | % | 6.10 | % | 5.76 | % | (1.10 | ) | 0.98 | ||||||||

Return on average tangible common equity | 12.27 | % | 14.30 | % | 14.90 | % | 11.23 | % | 10.67 | % | (2.03 | ) | 1.60 | ||||||||

Efficiency ratio – Consolidated | 65.31 | % | 61.56 | % | 65.99 | % | 63.43 | % | 64.71 | % | 3.75 | 0.60 | |||||||||

Efficiency ratio – Bank | 62.53 | % | 59.58 | % | 62.09 | % | 61.42 | % | 62.45 | % | 2.95 | 0.08 | |||||||||

(1) Tax exempt interest has been adjusted to a taxable equivalent basis using a 21% tax rate for 2018 and a 35% tax rate for 2017.

Umpqua Reports Second Quarter 2018 Results

July 18, 2018

Page 14

Umpqua Holdings Corporation | |||||||||

Selected Ratios | |||||||||

(Unaudited) | |||||||||

Six Months Ended | % Change | ||||||||

Jun 30, 2018 | Jun 30, 2017 | Year over Year | |||||||

Average Rates: | |||||||||

Yield on loans and leases | 4.78 | % | 4.66 | % | 0.12 | ||||

Yield on loans held for sale | 4.57 | % | 3.54 | % | 1.03 | ||||

Yield on taxable investments | 2.34 | % | 2.09 | % | 0.25 | ||||

Yield on tax-exempt investments (1) | 3.66 | % | 4.70 | % | (1.04 | ) | |||

Yield on interest bearing cash and temporary investments | 1.72 | % | 0.82 | % | 0.90 | ||||

Total yield on earning assets (1) | 4.43 | % | 4.23 | % | 0.20 | ||||

Cost of interest bearing deposits | 0.55 | % | 0.31 | % | 0.24 | ||||

Cost of securities sold under agreements | |||||||||

to repurchase and fed funds purchased | 0.15 | % | 0.19 | % | (0.04 | ) | |||

Cost of term debt | 1.72 | % | 1.70 | % | 0.02 | ||||

Cost of junior subordinated debentures | 5.62 | % | 4.79 | % | 0.83 | ||||

Total cost of interest bearing liabilities | 0.73 | % | 0.50 | % | 0.23 | ||||

Net interest spread (1) | 3.70 | % | 3.73 | % | (0.03 | ) | |||

Net interest margin (1) | 3.96 | % | 3.89 | % | 0.07 | ||||

Performance Ratios: | |||||||||

Return on average assets | 1.13 | % | 0.84 | % | 0.29 | ||||

Return on average tangible assets | 1.22 | % | 0.90 | % | 0.32 | ||||

Return on average common equity | 7.29 | % | 5.25 | % | 2.04 | ||||

Return on average tangible common equity | 13.28 | % | 9.76 | % | 3.52 | ||||

Efficiency ratio – Consolidated | 63.43 | % | 66.38 | % | (2.95 | ) | |||

Efficiency ratio – Bank | 61.06 | % | 64.05 | % | (2.99 | ) | |||

(1) Tax exempt interest has been adjusted to a taxable equivalent basis using a 21% tax rate for 2018 and a 35% tax rate for 2017.

Umpqua Reports Second Quarter 2018 Results

July 18, 2018

Page 15

Umpqua Holdings Corporation Average Balances | ||||||||||||||||||||||||||

(Unaudited) | ||||||||||||||||||||||||||

Quarter Ended | % Change | |||||||||||||||||||||||||

(Dollars in thousands) | Jun 30, 2018 | Mar 31, 2018 | Dec 31, 2017 | Sep 30, 2017 | Jun 30, 2017 | Seq. Quarter | Year over Year | |||||||||||||||||||

Temporary investments and interest bearing cash | $ | 458,133 | $ | 303,670 | $ | 509,187 | $ | 253,015 | $ | 125,886 | 51 | % | 264 | % | ||||||||||||

Investment securities, taxable | 2,723,406 | 2,793,449 | 2,804,530 | 2,867,292 | 3,008,079 | (3 | )% | (9 | )% | |||||||||||||||||

Investment securities, tax-exempt | 279,158 | 286,603 | 286,345 | 281,139 | 292,553 | (3 | )% | (5 | )% | |||||||||||||||||

Loans held for sale | 326,427 | 267,231 | 370,564 | 420,282 | 392,183 | 22 | % | (17 | )% | |||||||||||||||||

Loans and leases | 19,444,890 | 19,150,315 | 18,765,251 | 18,537,827 | 18,024,651 | 2 | % | 8 | % | |||||||||||||||||

Total interest earning assets | 23,232,014 | 22,801,268 | 22,735,877 | 22,359,555 | 21,843,352 | 2 | % | 6 | % | |||||||||||||||||

Goodwill and other intangible assets, net | 1,815,529 | 1,817,068 | 1,818,730 | 1,820,394 | 1,822,032 | 0 | % | 0 | % | |||||||||||||||||

Total assets | 26,127,935 | 25,686,471 | 25,661,566 | 25,311,994 | 24,792,869 | 2 | % | 5 | % | |||||||||||||||||

Non-interest bearing demand deposits | 6,645,689 | 6,450,364 | 6,611,493 | 6,354,591 | 5,951,670 | 3 | % | 12 | % | |||||||||||||||||

Interest bearing deposits | 13,745,089 | 13,492,965 | 13,281,502 | 13,155,462 | 13,037,064 | 2 | % | 5 | % | |||||||||||||||||

Total deposits | 20,390,778 | 19,943,329 | 19,892,995 | 19,510,053 | 18,988,734 | 2 | % | 7 | % | |||||||||||||||||

Interest bearing liabilities | 15,199,900 | 14,971,759 | 14,790,883 | 14,705,842 | 14,659,650 | 2 | % | 4 | % | |||||||||||||||||

Shareholders’ equity - common | 4,031,253 | 4,019,822 | 3,998,609 | 3,989,868 | 3,956,777 | 0 | % | 2 | % | |||||||||||||||||

Tangible common equity (1) | 2,215,724 | 2,202,754 | 2,179,879 | 2,166,474 | 2,134,745 | 1 | % | 4 | % | |||||||||||||||||

Umpqua Holdings Corporation Average Balances | |||||||||||

(Unaudited) | |||||||||||

Six Months Ended | % Change | ||||||||||

(Dollars in thousands) | Jun 30, 2018 | Jun 30, 2017 | Year over Year | ||||||||

Temporary investments and interest bearing cash | $ | 381,328 | $ | 463,245 | (18 | )% | |||||

Investment securities, taxable | 2,758,235 | 2,866,614 | (4 | )% | |||||||

Investment securities, tax-exempt | 282,860 | 289,515 | (2 | )% | |||||||

Loans held for sale | 296,992 | 371,989 | (20 | )% | |||||||

Loans and leases | 19,298,416 | 17,812,660 | 8 | % | |||||||

Total interest earning assets | 23,017,831 | 21,804,023 | 6 | % | |||||||

Goodwill and other intangible assets, net | 1,816,294 | 1,822,910 | 0 | % | |||||||

Total assets | 25,908,423 | 24,761,749 | 5 | % | |||||||

Non-interest bearing demand deposits | 6,548,566 | 5,917,984 | 11 | % | |||||||

Interest bearing deposits | 13,619,723 | 13,078,171 | 4 | % | |||||||

Total deposits | 20,168,289 | 18,996,155 | 6 | % | |||||||

Interest bearing liabilities | 15,086,460 | 14,660,598 | 3 | % | |||||||

Shareholders’ equity - common | 4,025,569 | 3,946,615 | 2 | % | |||||||

Tangible common equity (1) | 2,209,275 | 2,123,705 | 4 | % | |||||||

(1) Average tangible common equity is a non-GAAP financial measure. Average tangible common equity is calculated as average common shareholders’ equity less average goodwill and other intangible assets, net (excluding MSRs).

Umpqua Reports Second Quarter 2018 Results

July 18, 2018

Page 16

Umpqua Holdings Corporation Average Rates and Balances | ||||||||||||||||||||||||||||||||

(unaudited) | ||||||||||||||||||||||||||||||||

(dollars in thousands) | Quarter Ended | |||||||||||||||||||||||||||||||

June 30, 2018 | March 31, 2018 | June 30, 2017 | ||||||||||||||||||||||||||||||

Average Balance | Interest Income or Expense | Average Yields or Rates | Average Balance | Interest Income or Expense | Average Yields or Rates | Average Balance | Interest Income or Expense | Average Yields or Rates | ||||||||||||||||||||||||

INTEREST-EARNING ASSETS: | ||||||||||||||||||||||||||||||||

Loans held for sale | $ | 326,427 | $ | 3,967 | 4.86 | % | $ | 267,231 | $ | 2,815 | 4.21 | % | $ | 392,183 | $ | 3,193 | 3.26 | % | ||||||||||||||

Loans and leases (1) | 19,444,890 | 233,376 | 4.81 | % | 19,150,315 | 224,923 | 4.75 | % | 18,024,651 | 209,805 | 4.67 | % | ||||||||||||||||||||

Taxable securities | 2,723,406 | 16,111 | 2.37 | % | 2,793,449 | 16,167 | 2.31 | % | 3,008,079 | 15,580 | 2.07 | % | ||||||||||||||||||||

Non-taxable securities (2) | 279,158 | 2,539 | 3.64 | % | 286,603 | 2,640 | 3.68 | % | 292,553 | 3,397 | 4.64 | % | ||||||||||||||||||||

Temporary investments and interest-bearing cash | 458,133 | 2,080 | 1.82 | % | 303,670 | 1,164 | 1.55 | % | 125,886 | 324 | 1.03 | % | ||||||||||||||||||||

Total interest-earning assets | 23,232,014 | $ | 258,073 | 4.45 | % | 22,801,268 | 247,709 | 4.39 | % | 21,843,352 | $ | 232,299 | 4.26 | % | ||||||||||||||||||

Allowance for loan and lease losses | (144,598 | ) | (142,409 | ) | (137,445 | ) | ||||||||||||||||||||||||||

Other assets | 3,040,519 | 3,027,612 | 3,086,962 | |||||||||||||||||||||||||||||

Total assets | $ | 26,127,935 | $ | 25,686,471 | $ | 24,792,869 | ||||||||||||||||||||||||||

INTEREST-BEARING LIABILITIES: | ||||||||||||||||||||||||||||||||

Interest-bearing demand deposits | $ | 2,322,359 | $ | 1,565 | 0.27 | % | $ | 2,323,232 | $ | 1,210 | 0.21 | % | $ | 2,311,555 | $ | 798 | 0.14 | % | ||||||||||||||

Money market deposits | 6,332,372 | 5,896 | 0.37 | % | 6,908,067 | 5,713 | 0.34 | % | 6,682,937 | 2,975 | 0.18 | % | ||||||||||||||||||||

Savings deposits | 1,456,625 | 252 | 0.07 | % | 1,463,058 | 163 | 0.05 | % | 1,401,238 | 146 | 0.04 | % | ||||||||||||||||||||

Time deposits | 3,633,733 | 13,546 | 1.50 | % | 2,798,608 | 8,524 | 1.24 | % | 2,641,334 | 6,722 | 1.02 | % | ||||||||||||||||||||

Total interest-bearing deposits | 13,745,089 | 21,259 | 0.62 | % | 13,492,965 | 15,610 | 0.47 | % | 13,037,064 | 10,641 | 0.33 | % | ||||||||||||||||||||

Repurchase agreements and federal funds purchased | 285,338 | 155 | 0.22 | % | 303,059 | 63 | 0.08 | % | 405,892 | 321 | 0.32 | % | ||||||||||||||||||||

Term debt | 801,768 | 3,478 | 1.74 | % | 802,297 | 3,361 | 1.70 | % | 852,254 | 3,662 | 1.72 | % | ||||||||||||||||||||

Junior subordinated debentures | 367,705 | 5,400 | 5.89 | % | 373,438 | 4,932 | 5.36 | % | 364,440 | 4,437 | 4.88 | % | ||||||||||||||||||||

Total interest-bearing liabilities | 15,199,900 | $ | 30,292 | 0.80 | % | 14,971,759 | $ | 23,966 | 0.65 | % | 14,659,650 | $ | 19,061 | 0.52 | % | |||||||||||||||||

Non-interest-bearing deposits | 6,645,689 | 6,450,364 | 5,951,670 | |||||||||||||||||||||||||||||

Other liabilities | 251,093 | 244,526 | 224,772 | |||||||||||||||||||||||||||||

Total liabilities | 22,096,682 | 21,666,649 | 20,836,092 | |||||||||||||||||||||||||||||

Common equity | 4,031,253 | 4,019,822 | 3,956,777 | |||||||||||||||||||||||||||||

Total liabilities and shareholders' equity | $ | 26,127,935 | $ | 25,686,471 | $ | 24,792,869 | ||||||||||||||||||||||||||

NET INTEREST INCOME | $ | 227,781 | $ | 223,743 | $ | 213,238 | ||||||||||||||||||||||||||

NET INTEREST SPREAD | 3.65 | % | 3.74 | % | 3.74 | % | ||||||||||||||||||||||||||

AVERAGE YIELD ON EARNING ASSETS (1), (2) | 4.45 | % | 4.39 | % | 4.26 | % | ||||||||||||||||||||||||||

INTEREST EXPENSE TO EARNING ASSETS | 0.52 | % | 0.43 | % | 0.35 | % | ||||||||||||||||||||||||||

NET INTEREST INCOME TO EARNING ASSETS OR NET INTEREST MARGIN (1), (2) | 3.93 | % | 3.96 | % | 3.91 | % | ||||||||||||||||||||||||||

(1) | Non-accrual loans and leases are included in the average balance. |

(2) | Tax-exempt income has been adjusted to a tax equivalent basis at a 21% tax rate for 2018 and a 35% tax rate for 2017. The amount of such adjustment was an addition to recorded income of approximately $482,000 for the three months ended June 30, 2018 as compared to $512,000 for March 31, 2018 and $1.2 million for June 30, 2017. |

Umpqua Reports Second Quarter 2018 Results

July 18, 2018

Page 17

Umpqua Holdings Corporation Average Rates and Balances | |||||||||||||||||||||

(unaudited) | |||||||||||||||||||||

(dollars in thousands) | Six Months Ended | ||||||||||||||||||||

June 30, 2018 | June 30, 2017 | ||||||||||||||||||||

Average Balance | Interest Income or Expense | Average Yields or Rates | Average Balance | Interest Income or Expense | Average Yields or Rates | ||||||||||||||||

INTEREST-EARNING ASSETS: | |||||||||||||||||||||

Loans held for sale | $ | 296,992 | $ | 6,782 | 4.57 | % | $ | 371,989 | $ | 6,588 | 3.54 | % | |||||||||

Loans and leases (1) | 19,298,416 | 458,299 | 4.78 | % | 17,812,660 | 412,406 | 4.66 | % | |||||||||||||

Taxable securities | 2,758,235 | 32,278 | 2.34 | % | 2,866,614 | 29,899 | 2.09 | % | |||||||||||||

Non-taxable securities (2) | 282,860 | 5,179 | 3.66 | % | 289,515 | 6,806 | 4.70 | % | |||||||||||||

Temporary investments and interest-bearing cash | 381,328 | 3,244 | 1.72 | % | 463,245 | 1,881 | 0.82 | % | |||||||||||||

Total interest-earning assets | 23,017,831 | $ | 505,782 | 4.43 | % | 21,804,023 | $ | 457,580 | 4.23 | % | |||||||||||

Allowance for loan and lease losses | (143,509 | ) | (136,834 | ) | |||||||||||||||||

Other assets | 3,034,101 | 3,094,560 | |||||||||||||||||||

Total assets | $ | 25,908,423 | $ | 24,761,749 | |||||||||||||||||

INTEREST-BEARING LIABILITIES: | |||||||||||||||||||||

Interest-bearing demand deposits | $ | 2,322,793 | $ | 2,775 | 0.24 | % | $ | 2,288,870 | $ | 1,443 | 0.13 | % | |||||||||

Money market deposits | 6,618,629 | 11,609 | 0.35 | % | 6,776,705 | 5,644 | 0.17 | % | |||||||||||||

Savings deposits | 1,459,824 | 414 | 0.06 | % | 1,383,124 | 274 | 0.04 | % | |||||||||||||

Time deposits | 3,218,477 | 22,071 | 1.38 | % | 2,629,472 | 12,928 | 0.99 | % | |||||||||||||

Total interest-bearing deposits | 13,619,723 | 36,869 | 0.55 | % | 13,078,171 | 20,289 | 0.31 | % | |||||||||||||

Repurchase agreements and federal funds purchased | 294,150 | 218 | 0.15 | % | 366,498 | 351 | 0.19 | % | |||||||||||||

Term debt | 802,031 | 6,839 | 1.72 | % | 852,302 | 7,172 | 1.70 | % | |||||||||||||

Junior subordinated debentures | 370,556 | 10,332 | 5.62 | % | 363,627 | 8,638 | 4.79 | % | |||||||||||||

Total interest-bearing liabilities | 15,086,460 | $ | 54,258 | 0.73 | % | 14,660,598 | $ | 36,450 | 0.50 | % | |||||||||||

Non-interest-bearing deposits | 6,548,566 | 5,917,984 | |||||||||||||||||||

Other liabilities | 247,828 | 236,552 | |||||||||||||||||||

Total liabilities | 21,882,854 | 20,815,134 | |||||||||||||||||||

Common equity | 4,025,569 | 3,946,615 | |||||||||||||||||||

Total liabilities and shareholders' equity | $ | 25,908,423 | $ | 24,761,749 | |||||||||||||||||

NET INTEREST INCOME | $ | 451,524 | $ | 421,130 | |||||||||||||||||

NET INTEREST SPREAD | 3.70 | % | 3.73 | % | |||||||||||||||||

AVERAGE YIELD ON EARNING ASSETS (1), (2) | 4.43 | % | 4.23 | % | |||||||||||||||||

INTEREST EXPENSE TO EARNING ASSETS | 0.47 | % | 0.34 | % | |||||||||||||||||

NET INTEREST INCOME TO EARNING ASSETS OR NET INTEREST MARGIN (1), (2) | 3.96 | % | 3.89 | % | |||||||||||||||||

(1) | Non-accrual loans and leases are included in the average balance. |

(2) | Tax-exempt income has been adjusted to a tax equivalent basis at a 21% tax rate for 2018 and a 35% tax rate for 2017. The amount of such adjustment was an addition to recorded income of approximately $1.0 million for the six months ended June 30, 2018 as compared to $2.3 million for the same period in 2017. |

Umpqua Reports Second Quarter 2018 Results

July 18, 2018

Page 18

Umpqua Holdings Corporation Residential Mortgage Banking Activity | ||||||||||||||||||||||||||

(unaudited) | ||||||||||||||||||||||||||

Quarter Ended | % Change | |||||||||||||||||||||||||

(Dollars in thousands) | Jun 30, 2018 | Mar 31, 2018 | Dec 31, 2017 | Sep 30, 2017 | Jun 30, 2017 | Seq. Quarter | Year over Year | |||||||||||||||||||

Residential mortgage servicing rights: | ||||||||||||||||||||||||||

Residential mortgage loans serviced for others | $ | 15,508,182 | $ | 15,442,915 | $ | 15,336,597 | $ | 15,007,942 | $ | 14,797,242 | 0 | % | 5 | % | ||||||||||||

MSR asset, at fair value | 166,217 | 164,760 | 153,151 | 141,225 | 141,832 | 1 | % | 17 | % | |||||||||||||||||

MSR as % of serviced portfolio | 1.07 | % | 1.07 | % | 1.00 | % | 0.94 | % | 0.96 | % | 0 | % | 11 | % | ||||||||||||

Residential mortgage banking revenue: | ||||||||||||||||||||||||||

Origination and sale | $ | 28,159 | $ | 22,837 | $ | 29,864 | $ | 32,784 | $ | 32,385 | 23 | % | (13 | )% | ||||||||||||

Servicing | 10,407 | 10,522 | 10,287 | 9,879 | 9,839 | (1 | )% | 6 | % | |||||||||||||||||

Change in fair value of MSR asset | (5,403 | ) | 5,079 | 1,967 | (9,233 | ) | (8,330 | ) | (206 | )% | (35 | )% | ||||||||||||||

Total | $ | 33,163 | $ | 38,438 | $ | 42,118 | $ | 33,430 | $ | 33,894 | (14 | )% | (2 | )% | ||||||||||||

Closed loan volume: | ||||||||||||||||||||||||||

Closed loan volume - portfolio | $ | 294,581 | $ | 237,783 | $ | 265,718 | $ | 336,362 | $ | 312,022 | 24 | % | (6 | )% | ||||||||||||

Closed loan volume - for-sale | 839,489 | 687,226 | 850,453 | 891,063 | 918,200 | 22 | % | (9 | )% | |||||||||||||||||

Closed loan volume - total | $ | 1,134,070 | $ | 925,009 | $ | 1,116,171 | $ | 1,227,425 | $ | 1,230,222 | 23 | % | (8 | )% | ||||||||||||

Gain on sale margin: | ||||||||||||||||||||||||||

Based on for-sale volume | 3.35 | % | 3.32 | % | 3.51 | % | 3.68 | % | 3.53 | % | 0.03 | (0.18 | ) | |||||||||||||

Six Months Ended | % Change | |||||||||||||||||||||||||

(Dollars in thousands) | Jun 30, 2018 | Jun 30, 2017 | Year over Year | |||||||||||||||||||||||

Residential mortgage banking revenue: | ||||||||||||||||||||||||||

Origination and sale | $ | 50,996 | $ | 57,032 | (11 | )% | ||||||||||||||||||||

Servicing | 20,929 | 19,697 | 6 | % | ||||||||||||||||||||||

Change in fair value of MSR asset | (324 | ) | (16,001 | ) | (98 | )% | ||||||||||||||||||||

Total | $ | 71,601 | $ | 60,728 | 18 | % | ||||||||||||||||||||

Closed loan volume: | ||||||||||||||||||||||||||

Closed loan volume - portfolio | $ | 532,364 | $ | 557,356 | (4 | )% | ||||||||||||||||||||

Closed loan volume - for-sale | 1,526,715 | 1,672,915 | (9 | )% | ||||||||||||||||||||||

Closed loan volume - total | $ | 2,059,079 | $ | 2,230,271 | (8 | )% | ||||||||||||||||||||

Gain on sale margin: | ||||||||||||||||||||||||||

Based on for-sale volume | 3.34 | % | 3.41 | % | (0.07 | ) | ||||||||||||||||||||

###