Ron Farnsworth | Bradley Howes |

EVP/Chief Financial Officer | SVP/Director of Investor Relations |

Umpqua Holdings Corporation | Umpqua Holdings Corporation |

503-727-4108 | 503-727-4226 |

ronfarnsworth@umpquabank.com | bradhowes@umpquabank.com |

• | $5.1 million gain related to the fair value change of the MSR asset, compared to $2.0 million gain in the prior quarter and $7.7 million negative adjustment in the same period of the prior year. |

• | $1.1 million gain related to the fair value change of the debt capital market swap derivatives, compared to a gain of $0.2 million in the prior quarter and a negative adjustment of $0.7 million in the same period of the prior year. |

• | $2.5 million of exit or disposal costs, compared to $3.1 million in the prior quarter and $0.5 million in the same period of the prior year. |

• | No loss related to junior subordinated debentures carried at fair value was included in earnings in the first quarter of 2018, as the related fair value adjustments are now included in accumulated other comprehensive income (loss). Net loss on junior subordinated debentures carried at fair value included in earnings was $10.0 million for the prior quarter and $1.6 million for the same period of the prior year. |

• | Net interest income increased by $2.6 million, or 1%, driven primarily by growth in loans and leases and an 8 basis point increase in net interest margin; |

• | Provision for loan and lease losses increased by $0.7 million, driven primarily by continued loan growth and higher net charge-offs, which increased by one basis point to 0.26% of average loans and leases (annualized); |

• | Non-interest income increased by $8.1 million, driven primarily by the change in accounting principle for the junior subordinated debentures carried at fair value (see notable items above), partially offset by lower mortgage banking revenue and lower gains on portfolio loan sales; |

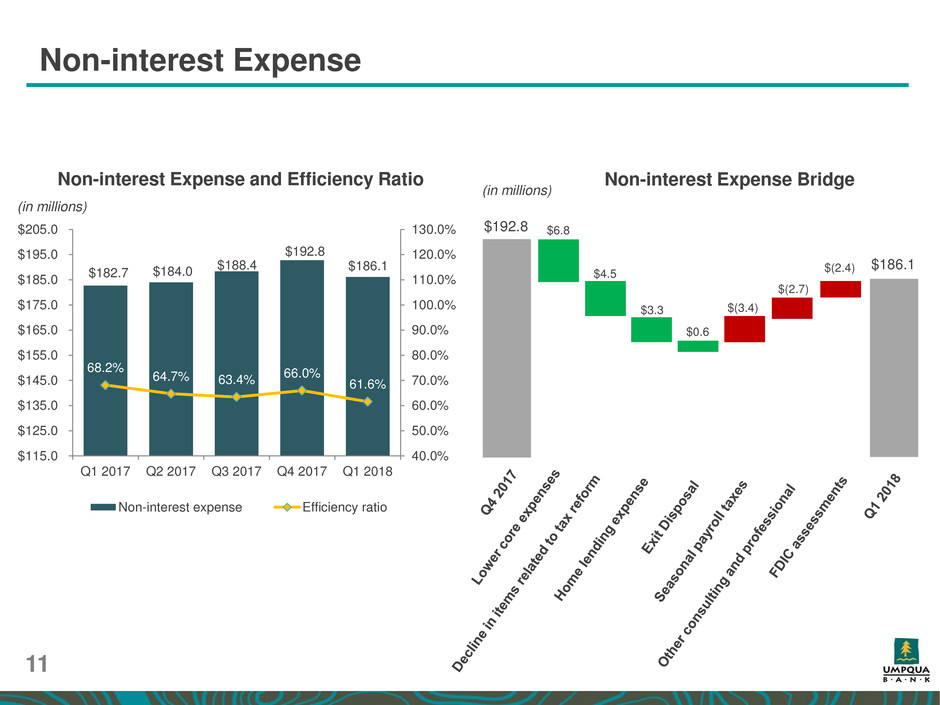

• | Non-interest expense decreased by $6.7 million, driven primarily by lower salaries and benefits expense, partially offset by a linked quarter increase in FDIC assessment expense related to one-time credits recorded in the prior quarter; |

• | Provision for income taxes increased by $20.9 million, reflecting the net benefit received in the fourth quarter of 2017 related to the revaluation of the net deferred tax liability, partially offset by a lower corporate tax rate, both attributable to the Tax Cuts and Jobs Act (“Tax Act”); |

• | Non-performing assets to total assets decreased by four basis points to 0.33%; |

• | Estimated total risk-based capital ratio of 14.0% and estimated Tier 1 common to risk weighted assets ratio of 11.0%; and |

• | Increased the quarterly cash dividend by 11.1% to $0.20 per common share. |

(In thousands, except per share data) | Mar 31, 2018 | Dec 31, 2017 | Sep 30, 2017 | Jun 30, 2017 | Mar 31, 2017 | |||||||||||||||

Total shareholders' equity | $ | 4,013,882 | $ | 4,014,786 | $ | 3,985,260 | $ | 3,958,845 | $ | 3,931,150 | ||||||||||

Subtract: | ||||||||||||||||||||

Goodwill | 1,787,651 | 1,787,651 | 1,787,651 | 1,787,651 | 1,787,651 | |||||||||||||||

Other intangible assets, net | 28,589 | 30,130 | 31,819 | 33,508 | 35,197 | |||||||||||||||

Tangible common shareholders' equity | $ | 2,197,642 | $ | 2,197,005 | $ | 2,165,790 | $ | 2,137,686 | $ | 2,108,302 | ||||||||||

Total assets | $ | 25,875,643 | $ | 25,741,439 | $ | 25,695,663 | $ | 25,257,784 | $ | 24,861,458 | ||||||||||

Subtract: | ||||||||||||||||||||

Goodwill | 1,787,651 | 1,787,651 | 1,787,651 | 1,787,651 | 1,787,651 | |||||||||||||||

Other intangible assets, net | 28,589 | 30,130 | 31,819 | 33,508 | 35,197 | |||||||||||||||

Tangible assets | $ | 24,059,403 | $ | 23,923,658 | $ | 23,876,193 | $ | 23,436,625 | $ | 23,038,610 | ||||||||||

Common shares outstanding at period end | 220,461 | 220,149 | 220,225 | 220,205 | 220,349 | |||||||||||||||

Total shareholders' equity to total assets ratio | 15.51 | % | 15.60 | % | 15.51 | % | 15.67 | % | 15.81 | % | ||||||||||

Tangible common equity ratio | 9.13 | % | 9.18 | % | 9.07 | % | 9.12 | % | 9.15 | % | ||||||||||

Book value per common share | $ | 18.21 | $ | 18.24 | $ | 18.10 | $ | 17.98 | $ | 17.84 | ||||||||||

Tangible book value per common share | $ | 9.97 | $ | 9.98 | $ | 9.83 | $ | 9.71 | $ | 9.57 | ||||||||||

Umpqua Holdings Corporation | ||||||||||||||||||||||||||

Consolidated Statements of Income | ||||||||||||||||||||||||||

(Unaudited) | ||||||||||||||||||||||||||

Quarter Ended | % Change | |||||||||||||||||||||||||

(In thousands, except per share data) | Mar 31, 2018 | Dec 31, 2017 | Sep 30, 2017 | Jun 30, 2017 | Mar 31, 2017 | Seq. Quarter | Year over Year | |||||||||||||||||||

Interest income: | ||||||||||||||||||||||||||

Loans and leases | $ | 227,738 | $ | 223,206 | $ | 223,321 | $ | 212,998 | $ | 205,996 | 2 | % | 11 | % | ||||||||||||

Interest and dividends on investments: | ||||||||||||||||||||||||||

Taxable | 15,699 | 14,857 | 13,979 | 15,220 | 13,931 | 6 | % | 13 | % | |||||||||||||||||

Exempt from federal income tax | 2,128 | 2,121 | 2,125 | 2,237 | 2,242 | 0 | % | (5 | )% | |||||||||||||||||

Dividends | 468 | 386 | 357 | 360 | 388 | 21 | % | 21 | % | |||||||||||||||||

Temporary investments and interest bearing deposits | 1,164 | 1,565 | 934 | 324 | 1,557 | (26 | )% | (25 | )% | |||||||||||||||||

Total interest income | 247,197 | 242,135 | 240,716 | 231,139 | 224,114 | 2 | % | 10 | % | |||||||||||||||||

Interest expense: | ||||||||||||||||||||||||||

Deposits | 15,610 | 13,241 | 12,052 | 10,641 | 9,648 | 18 | % | 62 | % | |||||||||||||||||

Repurchase agreements and federal funds purchased | 63 | 43 | 81 | 321 | 30 | 47 | % | 110 | % | |||||||||||||||||

Term debt | 3,361 | 3,496 | 3,491 | 3,662 | 3,510 | (4 | )% | (4 | )% | |||||||||||||||||

Junior subordinated debentures | 4,932 | 4,734 | 4,628 | 4,437 | 4,201 | 4 | % | 17 | % | |||||||||||||||||

Total interest expense | 23,966 | 21,514 | 20,252 | 19,061 | 17,389 | 11 | % | 38 | % | |||||||||||||||||

Net interest income | 223,231 | 220,621 | 220,464 | 212,078 | 206,725 | 1 | % | 8 | % | |||||||||||||||||

Provision for loan and lease losses | 13,656 | 12,928 | 11,997 | 10,657 | 11,672 | 6 | % | 17 | % | |||||||||||||||||

Non-interest income: | ||||||||||||||||||||||||||

Service charges on deposits | 14,995 | 15,413 | 15,849 | 15,478 | 14,729 | (3 | )% | 2 | % | |||||||||||||||||

Brokerage revenue | 4,194 | 4,226 | 3,832 | 3,903 | 4,122 | (1 | )% | 2 | % | |||||||||||||||||

Residential mortgage banking revenue, net | 38,438 | 42,118 | 33,430 | 33,894 | 26,834 | (9 | )% | 43 | % | |||||||||||||||||

(Loss) gain on investment securities, net | — | — | (6 | ) | 35 | (2 | ) | 0 | % | (100 | )% | |||||||||||||||

Gain on loan sales | 1,230 | 3,688 | 7,969 | 3,310 | 1,754 | (67 | )% | (30 | )% | |||||||||||||||||

Loss on junior subordinated debentures carried at fair value | — | (10,010 | ) | (1,590 | ) | (1,572 | ) | (1,555 | ) | (100 | )% | (100 | )% | |||||||||||||

BOLI income | 2,070 | 2,015 | 2,041 | 2,089 | 2,069 | 3 | % | 0 | % | |||||||||||||||||

Other income | 17,640 | 13,000 | 13,877 | 13,982 | 12,274 | 36 | % | 44 | % | |||||||||||||||||

Total non-interest income | 78,567 | 70,450 | 75,402 | 71,119 | 60,225 | 12 | % | 30 | % | |||||||||||||||||

Non-interest expense: | ||||||||||||||||||||||||||

Salaries and employee benefits | 106,551 | 114,414 | 108,732 | 108,561 | 106,473 | (7 | )% | 0 | % | |||||||||||||||||

Occupancy and equipment, net | 38,661 | 37,269 | 37,648 | 36,955 | 38,673 | 4 | % | 0 | % | |||||||||||||||||

Intangible amortization | 1,541 | 1,689 | 1,689 | 1,689 | 1,689 | (9 | )% | (9 | )% | |||||||||||||||||

FDIC assessments | 4,480 | 2,075 | 4,405 | 4,447 | 4,087 | 116 | % | 10 | % | |||||||||||||||||

(Gain) loss on other real estate owned, net | (38 | ) | (83 | ) | (99 | ) | (457 | ) | 82 | (54 | )% | (146 | )% | |||||||||||||

Merger related expenses | — | — | 6,664 | 1,640 | 1,020 | 0 | % | (100 | )% | |||||||||||||||||

Other expense | 34,918 | 37,422 | 29,315 | 31,186 | 30,690 | (7 | )% | 14 | % | |||||||||||||||||

Total non-interest expense | 186,113 | 192,786 | 188,354 | 184,021 | 182,714 | (3 | )% | 2 | % | |||||||||||||||||

Income before provision for income taxes | 102,029 | 85,357 | 95,515 | 88,519 | 72,564 | 20 | % | 41 | % | |||||||||||||||||

Provision for income taxes | 24,360 | 3,486 | 34,182 | 31,707 | 26,561 | 599 | % | (8 | )% | |||||||||||||||||

Net income | 77,669 | 81,871 | 61,333 | 56,812 | 46,003 | (5 | )% | 69 | % | |||||||||||||||||

Dividends and undistributed earnings allocated to participating securities | 6 | 16 | 14 | 14 | 12 | (63 | )% | (50 | )% | |||||||||||||||||

Net earnings available to common shareholders | $ | 77,663 | $ | 81,855 | $ | 61,319 | $ | 56,798 | $ | 45,991 | (5 | )% | 69 | % | ||||||||||||

Weighted average basic shares outstanding | 220,370 | 220,194 | 220,215 | 220,310 | 220,287 | 0 | % | 0 | % | |||||||||||||||||

Weighted average diluted shares outstanding | 220,825 | 220,873 | 220,755 | 220,753 | 220,779 | 0 | % | 0 | % | |||||||||||||||||

Earnings per common share – basic | $ | 0.35 | $ | 0.37 | $ | 0.28 | $ | 0.26 | $ | 0.21 | (5 | )% | 67 | % | ||||||||||||

Earnings per common share – diluted | $ | 0.35 | $ | 0.37 | $ | 0.28 | $ | 0.26 | $ | 0.21 | (5 | )% | 67 | % | ||||||||||||

Umpqua Holdings Corporation Consolidated Balance Sheets | ||||||||||||||||||||||||||

(Unaudited) | ||||||||||||||||||||||||||

% Change | ||||||||||||||||||||||||||

(In thousands, except per share data) | Mar 31, 2018 | Dec 31, 2017 | Sep 30, 2017 | Jun 30, 2017 | Mar 31, 2017 | Seq. Quarter | Year over Year | |||||||||||||||||||

Assets: | ||||||||||||||||||||||||||

Cash and due from banks | $ | 304,681 | $ | 330,856 | $ | 304,760 | $ | 320,027 | $ | 262,655 | (8 | )% | 16 | % | ||||||||||||

Interest bearing cash and temporary investments | 264,508 | 303,424 | 540,806 | 295,937 | 421,991 | (13 | )% | (37 | )% | |||||||||||||||||

Investment securities: | ||||||||||||||||||||||||||

Trading, at fair value | 12,362 | 12,255 | 11,919 | 11,467 | 11,241 | 1 | % | 10 | % | |||||||||||||||||

Available for sale, at fair value | 2,998,347 | 3,065,769 | 3,047,358 | 3,132,566 | 3,243,408 | (2 | )% | (8 | )% | |||||||||||||||||

Held to maturity, at amortized cost | 3,667 | 3,803 | 3,905 | 4,017 | 4,121 | (4 | )% | (11 | )% | |||||||||||||||||

Loans held for sale | 299,739 | 259,518 | 417,470 | 451,350 | 372,073 | 15 | % | (19 | )% | |||||||||||||||||

Loans and leases | 19,314,589 | 19,080,184 | 18,677,762 | 18,321,142 | 17,829,638 | 1 | % | 8 | % | |||||||||||||||||

Allowance for loan and lease losses | (141,933 | ) | (140,608 | ) | (139,503 | ) | (136,867 | ) | (136,292 | ) | 1 | % | 4 | % | ||||||||||||

Loans and leases, net | 19,172,656 | 18,939,576 | 18,538,259 | 18,184,275 | 17,693,346 | 1 | % | 8 | % | |||||||||||||||||

Restricted equity securities | 43,501 | 43,508 | 45,509 | 45,511 | 45,522 | 0 | % | (4 | )% | |||||||||||||||||

Premises and equipment, net | 259,354 | 269,182 | 276,316 | 288,853 | 293,133 | (4 | )% | (12 | )% | |||||||||||||||||

Goodwill | 1,787,651 | 1,787,651 | 1,787,651 | 1,787,651 | 1,787,651 | 0 | % | 0 | % | |||||||||||||||||

Other intangible assets, net | 28,589 | 30,130 | 31,819 | 33,508 | 35,197 | (5 | )% | (19 | )% | |||||||||||||||||

Residential mortgage servicing rights, at fair value | 164,760 | 153,151 | 141,225 | 141,832 | 142,344 | 8 | % | 16 | % | |||||||||||||||||

Other real estate owned | 13,055 | 11,734 | 4,160 | 4,804 | 6,518 | 11 | % | 100 | % | |||||||||||||||||

Bank owned life insurance | 307,745 | 306,864 | 305,572 | 303,894 | 301,777 | 0 | % | 2 | % | |||||||||||||||||

Deferred tax assets, net | — | — | — | — | 8,464 | 0 | % | (100 | )% | |||||||||||||||||

Other assets | 215,028 | 224,018 | 238,934 | 252,092 | 232,017 | (4 | )% | (7 | )% | |||||||||||||||||

Total assets | $ | 25,875,643 | $ | 25,741,439 | $ | 25,695,663 | $ | 25,257,784 | $ | 24,861,458 | 1 | % | 4 | % | ||||||||||||

Liabilities: | ||||||||||||||||||||||||||

Deposits | $ | 20,106,856 | $ | 19,948,300 | $ | 19,851,910 | $ | 19,459,950 | $ | 19,167,293 | 1 | % | 5 | % | ||||||||||||

Securities sold under agreements to repurchase | 291,984 | 294,299 | 321,542 | 330,189 | 304,280 | (1 | )% | (4 | )% | |||||||||||||||||

Term debt | 801,868 | 802,357 | 852,306 | 852,219 | 852,308 | 0 | % | (6 | )% | |||||||||||||||||

Junior subordinated debentures, at fair value | 278,410 | 277,155 | 266,875 | 265,423 | 263,605 | 0 | % | 6 | % | |||||||||||||||||

Junior subordinated debentures, at amortized cost | 88,895 | 100,609 | 100,690 | 100,770 | 100,851 | (12 | )% | (12 | )% | |||||||||||||||||

Deferred tax liability, net | 39,277 | 37,503 | 51,423 | 34,296 | — | 5 | % | 100 | % | |||||||||||||||||

Other liabilities | 254,471 | 266,430 | 265,657 | 256,092 | 241,971 | (4 | )% | 5 | % | |||||||||||||||||

Total liabilities | 21,861,761 | 21,726,653 | 21,710,403 | 21,298,939 | 20,930,308 | 1 | % | 4 | % | |||||||||||||||||

Shareholders' equity: | ||||||||||||||||||||||||||

Common stock | 3,515,506 | 3,517,258 | 3,516,558 | 3,514,094 | 3,516,537 | 0 | % | 0 | % | |||||||||||||||||

Retained earnings | 546,330 | 522,520 | 476,226 | 454,802 | 433,417 | 5 | % | 26 | % | |||||||||||||||||

Accumulated other comprehensive loss | (47,954 | ) | (24,992 | ) | (7,524 | ) | (10,051 | ) | (18,804 | ) | 92 | % | 155 | % | ||||||||||||

Total shareholders' equity | 4,013,882 | 4,014,786 | 3,985,260 | 3,958,845 | 3,931,150 | 0 | % | 2 | % | |||||||||||||||||

Total liabilities and shareholders' equity | $ | 25,875,643 | $ | 25,741,439 | $ | 25,695,663 | $ | 25,257,784 | $ | 24,861,458 | 1 | % | 4 | % | ||||||||||||

Common shares outstanding at period end | 220,461 | 220,149 | 220,225 | 220,205 | 220,349 | 0 | % | 0 | % | |||||||||||||||||

Book value per common share | $ | 18.21 | $ | 18.24 | $ | 18.10 | $ | 17.98 | $ | 17.84 | 0 | % | 2 | % | ||||||||||||

Tangible book value per common share | $ | 9.97 | $ | 9.98 | $ | 9.83 | $ | 9.71 | $ | 9.57 | 0 | % | 4 | % | ||||||||||||

Tangible equity - common | $ | 2,197,642 | $ | 2,197,005 | $ | 2,165,790 | $ | 2,137,686 | $ | 2,108,302 | 0 | % | 4 | % | ||||||||||||

Tangible common equity to tangible assets | 9.13 | % | 9.18 | % | 9.07 | % | 9.12 | % | 9.15 | % | (0.05 | ) | (0.02 | ) | ||||||||||||

Umpqua Holdings Corporation | ||||||||||||||||||||||||||

Loan and Lease Portfolio | ||||||||||||||||||||||||||

(Unaudited) | ||||||||||||||||||||||||||

(Dollars in thousands) | Mar 31, 2018 | Dec 31, 2017 | Sep 30, 2017 | Jun 30, 2017 | Mar 31, 2017 | % Change | ||||||||||||||||||||

Amount | Amount | Amount | Amount | Amount | Seq. Quarter | Year over Year | ||||||||||||||||||||

Loans and leases: | ||||||||||||||||||||||||||

Commercial real estate: | ||||||||||||||||||||||||||

Non-owner occupied term, net | $ | 3,526,221 | $ | 3,491,137 | $ | 3,475,243 | $ | 3,401,679 | $ | 3,410,914 | 1 | % | 3 | % | ||||||||||||

Owner occupied term, net | 2,476,287 | 2,488,251 | 2,467,995 | 2,593,395 | 2,584,183 | 0 | % | (4 | )% | |||||||||||||||||

Multifamily, net | 3,131,275 | 3,087,792 | 2,993,203 | 2,964,851 | 2,885,164 | 1 | % | 9 | % | |||||||||||||||||

Commercial construction, net | 522,680 | 540,707 | 521,666 | 464,690 | 471,007 | (3 | )% | 11 | % | |||||||||||||||||

Residential development, net | 179,871 | 165,865 | 186,400 | 165,956 | 145,479 | 8 | % | 24 | % | |||||||||||||||||

Commercial: | ||||||||||||||||||||||||||

Term, net | 2,025,213 | 1,944,987 | 1,819,664 | 1,686,597 | 1,620,311 | 4 | % | 25 | % | |||||||||||||||||

Lines of credit and other, net | 1,147,028 | 1,166,173 | 1,134,045 | 1,153,409 | 1,114,160 | (2 | )% | 3 | % | |||||||||||||||||

Leases and equipment finance, net | 1,228,709 | 1,167,503 | 1,137,732 | 1,082,651 | 1,000,376 | 5 | % | 23 | % | |||||||||||||||||

Residential real estate: | ||||||||||||||||||||||||||

Mortgage, net | 3,283,945 | 3,192,185 | 3,094,361 | 3,021,331 | 2,916,924 | 3 | % | 13 | % | |||||||||||||||||

Home equity lines and loans, net | 1,107,822 | 1,103,297 | 1,079,931 | 1,056,848 | 1,015,138 | 0 | % | 9 | % | |||||||||||||||||

Consumer and other, net | 685,538 | 732,287 | 767,522 | 729,735 | 665,982 | (6 | )% | 3 | % | |||||||||||||||||

Total, net of deferred fees and costs | $ | 19,314,589 | $ | 19,080,184 | $ | 18,677,762 | $ | 18,321,142 | $ | 17,829,638 | 1 | % | 8 | % | ||||||||||||

Loan and leases mix: | ||||||||||||||||||||||||||

Commercial real estate: | ||||||||||||||||||||||||||

Non-owner occupied term, net | 18 | % | 18 | % | 19 | % | 19 | % | 19 | % | ||||||||||||||||

Owner occupied term, net | 13 | % | 13 | % | 13 | % | 14 | % | 14 | % | ||||||||||||||||

Multifamily, net | 16 | % | 16 | % | 16 | % | 16 | % | 16 | % | ||||||||||||||||

Commercial construction, net | 3 | % | 3 | % | 3 | % | 3 | % | 3 | % | ||||||||||||||||

Residential development, net | 1 | % | 1 | % | 1 | % | 1 | % | 1 | % | ||||||||||||||||

Commercial: | ||||||||||||||||||||||||||

Term, net | 10 | % | 10 | % | 10 | % | 9 | % | 9 | % | ||||||||||||||||

Lines of credit and other, net | 6 | % | 6 | % | 6 | % | 6 | % | 6 | % | ||||||||||||||||

Leases and equipment finance, net | 6 | % | 6 | % | 6 | % | 6 | % | 6 | % | ||||||||||||||||

Residential real estate: | ||||||||||||||||||||||||||

Mortgage, net | 17 | % | 17 | % | 16 | % | 16 | % | 16 | % | ||||||||||||||||

Home equity lines and loans, net | 6 | % | 6 | % | 6 | % | 6 | % | 6 | % | ||||||||||||||||

Consumer and other, net | 4 | % | 4 | % | 4 | % | 4 | % | 4 | % | ||||||||||||||||

Total | 100 | % | 100 | % | 100 | % | 100 | % | 100 | % | ||||||||||||||||

Umpqua Holdings Corporation | ||||||||||||||||||||||||||

Deposits by Type/Core Deposits | ||||||||||||||||||||||||||

(Unaudited) | ||||||||||||||||||||||||||

(Dollars in thousands) | Mar 31, 2018 | Dec 31, 2017 | Sep 30, 2017 | Jun 30, 2017 | Mar 31, 2017 | % Change | ||||||||||||||||||||

Amount | Amount | Amount | Amount | Amount | Seq. Quarter | Year over Year | ||||||||||||||||||||

Deposits: | ||||||||||||||||||||||||||

Demand, non-interest bearing | $ | 6,699,399 | $ | 6,505,628 | $ | 6,571,471 | $ | 6,112,480 | $ | 6,021,585 | 3 | % | 11 | % | ||||||||||||

Demand, interest bearing | 2,354,873 | 2,384,133 | 2,394,240 | 2,371,386 | 2,327,226 | (1 | )% | 1 | % | |||||||||||||||||

Money market | 6,546,704 | 7,037,891 | 6,700,261 | 6,755,707 | 6,784,442 | (7 | )% | (4 | )% | |||||||||||||||||

Savings | 1,482,560 | 1,446,860 | 1,444,801 | 1,427,677 | 1,400,330 | 2 | % | 6 | % | |||||||||||||||||

Time | 3,023,320 | 2,573,788 | 2,741,137 | 2,792,700 | 2,633,710 | 17 | % | 15 | % | |||||||||||||||||

Total | $ | 20,106,856 | $ | 19,948,300 | $ | 19,851,910 | $ | 19,459,950 | $ | 19,167,293 | 1 | % | 5 | % | ||||||||||||

Total core deposits (1) | $ | 18,007,169 | $ | 18,263,802 | $ | 18,005,730 | $ | 17,561,956 | $ | 17,427,832 | (1 | )% | 3 | % | ||||||||||||

Deposit mix: | ||||||||||||||||||||||||||

Demand, non-interest bearing | 33 | % | 33 | % | 33 | % | 32 | % | 31 | % | ||||||||||||||||

Demand, interest bearing | 12 | % | 12 | % | 12 | % | 12 | % | 12 | % | ||||||||||||||||

Money market | 33 | % | 35 | % | 34 | % | 35 | % | 36 | % | ||||||||||||||||

Savings | 7 | % | 7 | % | 7 | % | 7 | % | 7 | % | ||||||||||||||||

Time | 15 | % | 13 | % | 14 | % | 14 | % | 14 | % | ||||||||||||||||

Total | 100 | % | 100 | % | 100 | % | 100 | % | 100 | % | ||||||||||||||||

Number of open accounts: | ||||||||||||||||||||||||||

Demand, non-interest bearing | 399,721 | 397,427 | 394,755 | 389,767 | 385,859 | |||||||||||||||||||||

Demand, interest bearing | 78,181 | 78,853 | 79,899 | 80,594 | 81,570 | |||||||||||||||||||||

Money market | 54,752 | 55,175 | 55,659 | 55,795 | 55,903 | |||||||||||||||||||||

Savings | 162,841 | 162,453 | 162,556 | 161,369 | 160,323 | |||||||||||||||||||||

Time | 48,529 | 46,861 | 47,129 | 47,339 | 47,365 | |||||||||||||||||||||

Total | 744,024 | 740,769 | 739,998 | 734,864 | 731,020 | |||||||||||||||||||||

Average balance per account: | ||||||||||||||||||||||||||

Demand, non-interest bearing | $ | 16.8 | $ | 16.4 | $ | 16.6 | $ | 15.7 | $ | 15.6 | ||||||||||||||||

Demand, interest bearing | 30.1 | 30.2 | 30.0 | 29.4 | 28.5 | |||||||||||||||||||||

Money market | 119.6 | 127.6 | 120.4 | 121.1 | 121.4 | |||||||||||||||||||||

Savings | 9.1 | 8.9 | 8.9 | 8.8 | 8.7 | |||||||||||||||||||||

Time | 62.3 | 54.9 | 58.2 | 59.0 | 55.6 | |||||||||||||||||||||

Total | $ | 27.0 | $ | 26.9 | $ | 26.8 | $ | 26.5 | $ | 26.2 | ||||||||||||||||

Umpqua Holdings Corporation | ||||||||||||||||||||||||||

Credit Quality – Non-performing Assets | ||||||||||||||||||||||||||

(Unaudited) | ||||||||||||||||||||||||||

Quarter Ended | % Change | |||||||||||||||||||||||||

(Dollars in thousands) | Mar 31, 2018 | Dec 31, 2017 | Sep 30, 2017 | Jun 30, 2017 | Mar 31, 2017 | Seq. Quarter | Year over Year | |||||||||||||||||||

Non-performing assets: | ||||||||||||||||||||||||||

Loans and leases on non-accrual status | $ | 45,775 | $ | 51,465 | $ | 44,573 | $ | 26,566 | $ | 28,915 | (11 | )% | 58 | % | ||||||||||||

Loans and leases past due 90+ days and accruing (1) | 25,478 | 30,994 | 29,073 | 27,252 | 23,421 | (18 | )% | 9 | % | |||||||||||||||||

Total non-performing loans and leases | 71,253 | 82,459 | 73,646 | 53,818 | 52,336 | (14 | )% | 36 | % | |||||||||||||||||

Other real estate owned | 13,055 | 11,734 | 4,160 | 4,804 | 6,518 | 11 | % | 100 | % | |||||||||||||||||

Total non-performing assets | $ | 84,308 | $ | 94,193 | $ | 77,806 | $ | 58,622 | $ | 58,854 | (10 | )% | 43 | % | ||||||||||||

Performing restructured loans and leases | $ | 31,659 | $ | 32,157 | $ | 45,813 | $ | 52,861 | $ | 43,029 | (2 | )% | (26 | )% | ||||||||||||

Loans and leases past due 31-89 days | $ | 38,650 | $ | 43,870 | $ | 32,251 | $ | 31,153 | $ | 49,530 | (12 | )% | (22 | )% | ||||||||||||

Loans and leases past due 31-89 days to total loans and leases | 0.20 | % | 0.23 | % | 0.17 | % | 0.17 | % | 0.28 | % | ||||||||||||||||

Non-performing loans and leases to total loans and leases (1) | 0.37 | % | 0.43 | % | 0.39 | % | 0.29 | % | 0.29 | % | ||||||||||||||||

Non-performing assets to total assets(1) | 0.33 | % | 0.37 | % | 0.30 | % | 0.23 | % | 0.24 | % | ||||||||||||||||

(1) | Excludes non-performing mortgage loans guaranteed by Ginnie Mae, which Umpqua has the unilateral right to repurchase but has not done so, totaling $6.3 million, $12.4 million, $12.3 million, $16.3 million, and $5.3 million at March 31,2018, December 31, 2017, September 30, 2017, June 30, 2017, and March 31, 2017, respectively. |

Umpqua Holdings Corporation | ||||||||||||||||||||||||||

Credit Quality – Allowance for Loan and Lease Losses | ||||||||||||||||||||||||||

(Unaudited) | ||||||||||||||||||||||||||

Quarter Ended | % Change | |||||||||||||||||||||||||

(Dollars in thousands) | Mar 31, 2018 | Dec 31, 2017 | Sep 30, 2017 | Jun 30, 2017 | Mar 31, 2017 | Seq. Quarter | Year over Year | |||||||||||||||||||

Allowance for loan and lease losses: | ||||||||||||||||||||||||||

Balance beginning of period | $ | 140,608 | $ | 139,503 | $ | 136,867 | $ | 136,292 | $ | 133,984 | ||||||||||||||||

Provision for loan and lease losses | 13,656 | 12,928 | 11,997 | 10,657 | 11,672 | 6 | % | 17 | % | |||||||||||||||||

Charge-offs | (15,812 | ) | (15,751 | ) | (13,222 | ) | (13,944 | ) | (13,002 | ) | 0 | % | 22 | % | ||||||||||||

Recoveries | 3,481 | 3,928 | 3,861 | 3,862 | 3,638 | (11 | )% | (4 | )% | |||||||||||||||||

Net charge-offs | (12,331 | ) | (11,823 | ) | (9,361 | ) | (10,082 | ) | (9,364 | ) | 4 | % | 32 | % | ||||||||||||

Total allowance for loan and lease losses | 141,933 | 140,608 | 139,503 | 136,867 | 136,292 | 1 | % | 4 | % | |||||||||||||||||

Reserve for unfunded commitments | 4,129 | 3,963 | 3,932 | 3,816 | 3,495 | 4 | % | 18 | % | |||||||||||||||||

Total allowance for credit losses | $ | 146,062 | $ | 144,571 | $ | 143,435 | $ | 140,683 | $ | 139,787 | 1 | % | 4 | % | ||||||||||||

Net charge-offs to average loans and leases (annualized) | 0.26 | % | 0.25 | % | 0.20 | % | 0.22 | % | 0.22 | % | ||||||||||||||||

Recoveries to gross charge-offs | 22.01 | % | 24.94 | % | 29.20 | % | 27.70 | % | 27.98 | % | ||||||||||||||||

Allowance for loan and lease losses to loans and leases | 0.73 | % | 0.74 | % | 0.75 | % | 0.75 | % | 0.76 | % | ||||||||||||||||

Allowance for credit losses to loans and leases | 0.76 | % | 0.76 | % | 0.77 | % | 0.77 | % | 0.78 | % | ||||||||||||||||

Umpqua Holdings Corporation | |||||||||||||||||||||

Selected Ratios | |||||||||||||||||||||

(Unaudited) | |||||||||||||||||||||

Quarter Ended | % Change | ||||||||||||||||||||

Mar 31, 2018 | Dec 31, 2017 | Sep 30, 2017 | Jun 30, 2017 | Mar 31, 2017 | Seq. Quarter | Year over Year | |||||||||||||||

Average Rates: | |||||||||||||||||||||

Yield on loans and leases | 4.75 | % | 4.65 | % | 4.70 | % | 4.67 | % | 4.65 | % | 0.10 | 0.10 | |||||||||

Yield on loans held for sale | 4.21 | % | 3.99 | % | 3.89 | % | 3.26 | % | 3.86 | % | 0.22 | 0.35 | |||||||||

Yield on taxable investments | 2.31 | % | 2.17 | % | 2.00 | % | 2.07 | % | 2.10 | % | 0.14 | 0.21 | |||||||||

Yield on tax-exempt investments (1) | 3.68 | % | 4.49 | % | 4.59 | % | 4.64 | % | 4.76 | % | (0.81 | ) | (1.08 | ) | |||||||

Yield on interest bearing cash and temporary investments | 1.55 | % | 1.22 | % | 1.47 | % | 1.03 | % | 0.79 | % | 0.33 | 0.76 | |||||||||

Total yield on earning assets (1) | 4.39 | % | 4.26 | % | 4.30 | % | 4.26 | % | 4.18 | % | 0.13 | 0.21 | |||||||||

Cost of interest bearing deposits | 0.47 | % | 0.40 | % | 0.36 | % | 0.33 | % | 0.30 | % | 0.07 | 0.17 | |||||||||

Cost of securities sold under agreements | |||||||||||||||||||||

to repurchase and fed funds purchased | 0.08 | % | 0.06 | % | 0.10 | % | 0.32 | % | 0.04 | % | 0.02 | 0.04 | |||||||||

Cost of term debt | 1.70 | % | 1.67 | % | 1.63 | % | 1.72 | % | 1.67 | % | 0.03 | 0.03 | |||||||||

Cost of junior subordinated debentures | 5.36 | % | 5.11 | % | 5.02 | % | 4.88 | % | 4.70 | % | 0.25 | 0.66 | |||||||||

Total cost of interest bearing liabilities | 0.65 | % | 0.58 | % | 0.55 | % | 0.52 | % | 0.48 | % | 0.07 | 0.17 | |||||||||

Net interest spread (1) | 3.74 | % | 3.68 | % | 3.75 | % | 3.74 | % | 3.70 | % | 0.06 | 0.04 | |||||||||

Net interest margin (1) | 3.96 | % | 3.88 | % | 3.94 | % | 3.91 | % | 3.85 | % | 0.08 | 0.11 | |||||||||

Performance Ratios: | |||||||||||||||||||||

Return on average assets | 1.23 | % | 1.27 | % | 0.96 | % | 0.92 | % | 0.75 | % | (0.04 | ) | 0.48 | ||||||||

Return on average tangible assets | 1.32 | % | 1.36 | % | 1.04 | % | 0.99 | % | 0.81 | % | (0.04 | ) | 0.51 | ||||||||

Return on average common equity | 7.84 | % | 8.12 | % | 6.10 | % | 5.76 | % | 4.74 | % | (0.28 | ) | 3.10 | ||||||||

Return on average tangible common equity | 14.30 | % | 14.90 | % | 11.23 | % | 10.67 | % | 8.83 | % | (0.60 | ) | 5.47 | ||||||||

Efficiency ratio – Consolidated | 61.56 | % | 65.99 | % | 63.43 | % | 64.71 | % | 68.15 | % | (4.43 | ) | (6.59 | ) | |||||||

Efficiency ratio – Bank | 59.58 | % | 62.09 | % | 61.42 | % | 62.45 | % | 65.75 | % | (2.51 | ) | (6.17 | ) | |||||||

Umpqua Holdings Corporation Average Balances | ||||||||||||||||||||||||||

(Unaudited) | ||||||||||||||||||||||||||

Quarter Ended | % Change | |||||||||||||||||||||||||

(Dollars in thousands) | Mar 31, 2018 | Dec 31, 2017 | Sep 30, 2017 | Jun 30, 2017 | Mar 31, 2017 | Seq. Quarter | Year over Year | |||||||||||||||||||

Temporary investments and interest bearing cash | $ | 303,670 | $ | 509,187 | $ | 253,015 | $ | 125,886 | $ | 804,354 | (40 | )% | (62 | )% | ||||||||||||

Investment securities, taxable | 2,793,449 | 2,804,530 | 2,867,292 | 3,008,079 | 2,723,576 | 0 | % | 3 | % | |||||||||||||||||

Investment securities, tax-exempt | 286,603 | 286,345 | 281,139 | 292,553 | 286,444 | 0 | % | 0 | % | |||||||||||||||||

Loans held for sale | 267,231 | 370,564 | 420,282 | 392,183 | 351,570 | (28 | )% | (24 | )% | |||||||||||||||||

Loans and leases | 19,150,315 | 18,765,251 | 18,537,827 | 18,024,651 | 17,598,314 | 2 | % | 9 | % | |||||||||||||||||

Total interest earning assets | 22,801,268 | 22,735,877 | 22,359,555 | 21,843,352 | 21,764,258 | 0 | % | 5 | % | |||||||||||||||||

Goodwill and other intangible assets, net | 1,817,068 | 1,818,730 | 1,820,394 | 1,822,032 | 1,823,799 | 0 | % | 0 | % | |||||||||||||||||

Total assets | 25,686,471 | 25,661,566 | 25,311,994 | 24,792,869 | 24,730,285 | 0 | % | 4 | % | |||||||||||||||||

Non-interest bearing demand deposits | 6,450,364 | 6,611,493 | 6,354,591 | 5,951,670 | 5,883,924 | (2 | )% | 10 | % | |||||||||||||||||

Interest bearing deposits | 13,492,965 | 13,281,502 | 13,155,462 | 13,037,064 | 13,119,736 | 2 | % | 3 | % | |||||||||||||||||

Total deposits | 19,943,329 | 19,892,995 | 19,510,053 | 18,988,734 | 19,003,660 | 0 | % | 5 | % | |||||||||||||||||

Interest bearing liabilities | 14,971,759 | 14,790,883 | 14,705,842 | 14,659,650 | 14,661,558 | 1 | % | 2 | % | |||||||||||||||||

Shareholders’ equity - common | 4,019,822 | 3,998,609 | 3,989,868 | 3,956,777 | 3,936,340 | 1 | % | 2 | % | |||||||||||||||||

Tangible common equity (1) | 2,202,754 | 2,179,879 | 2,166,474 | 2,134,745 | 2,112,541 | 1 | % | 4 | % | |||||||||||||||||

Umpqua Holdings Corporation Residential Mortgage Banking Activity | ||||||||||||||||||||||||||

(unaudited) | ||||||||||||||||||||||||||

Quarter Ended | % Change | |||||||||||||||||||||||||

(Dollars in thousands) | Mar 31, 2018 | Dec 31, 2017 | Sep 30, 2017 | Jun 30, 2017 | Mar 31, 2017 | Seq. Quarter | Year over Year | |||||||||||||||||||

Residential mortgage servicing rights: | ||||||||||||||||||||||||||

Residential mortgage loans serviced for others | $ | 15,442,915 | $ | 15,336,597 | $ | 15,007,942 | $ | 14,797,242 | $ | 14,541,171 | 1 | % | 6 | % | ||||||||||||

MSR asset, at fair value | 164,760 | 153,151 | 141,225 | 141,832 | 142,344 | 8 | % | 16 | % | |||||||||||||||||

MSR as % of serviced portfolio | 1.07 | % | 1.00 | % | 0.94 | % | 0.96 | % | 0.98 | % | 7 | % | 9 | % | ||||||||||||

Residential mortgage banking revenue: | ||||||||||||||||||||||||||

Origination and sale | $ | 22,837 | $ | 29,864 | $ | 32,784 | $ | 32,385 | $ | 24,647 | (24 | )% | (7 | )% | ||||||||||||

Servicing | 10,522 | 10,287 | 9,879 | 9,839 | 9,858 | 2 | % | 7 | % | |||||||||||||||||

Change in fair value of MSR asset | 5,079 | 1,967 | (9,233 | ) | (8,330 | ) | (7,671 | ) | 158 | % | (166 | )% | ||||||||||||||

Total | $ | 38,438 | $ | 42,118 | $ | 33,430 | $ | 33,894 | $ | 26,834 | (9 | )% | 43 | % | ||||||||||||

Closed loan volume: | ||||||||||||||||||||||||||

Closed loan volume - portfolio | $ | 237,783 | $ | 265,718 | $ | 336,362 | $ | 312,022 | $ | 245,334 | (11 | )% | (3 | )% | ||||||||||||

Closed loan volume - for-sale | 687,226 | 850,453 | 891,063 | 918,200 | 754,715 | (19 | )% | (9 | )% | |||||||||||||||||

Closed loan volume - total | $ | 925,009 | $ | 1,116,171 | $ | 1,227,425 | $ | 1,230,222 | $ | 1,000,049 | (17 | )% | (8 | )% | ||||||||||||

Gain on sale margin: | ||||||||||||||||||||||||||

Based on for-sale volume | 3.32 | % | 3.51 | % | 3.68 | % | 3.53 | % | 3.27 | % | (0.19 | ) | 0.05 | |||||||||||||