UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

| þ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2012

OR

| £ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ________________ to ________________

Commission file number: 001-15643

SKYSTAR BIO-PHARMACEUTICAL COMPANY

(Exact name of registrant as specified in its charter)

| Nevada | 33-0901534 | |

| (State or other jurisdiction of incorporation or | (I.R.S. Employer Identification No.) | |

| organization) | ||

| 4/F, Building B, Chuangye Square, No. 48 Keji Rd | ||

| Gaoxin District, Xi’an, Shaanxi Province, P.R. | ||

| China | N/A | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number: (8629) 8819-3188

Securities registered pursuant to Section 12(b) of the Act:

| Common Stock $0.001 Par Value | NASDAQ Capital Market | |

| (Title of Each Class) | (Name of Each Exchange on Which Registered ) |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period than the registrant was required to submit and post such files). Yes þ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained herein, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ¨ | Accelerated filer ¨ | |

| Non-accelerated filer ¨ | Smaller reporting company þ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No þ

As of June 29, 2012, the last day of the registrant’s most recently completed second fiscal quarter, the aggregate market value of the voting stock held by non-affiliates of the registrant was approximately $13.3 million based on a closing price of $2.20 per share of common stock as reported on the NASDAQ Stock Market on such date.

On March 27, 2013, we had 7,604,800 shares of common stock issued and outstanding.

TABLE OF CONTENTS

TO ANNUAL REPORT ON FORM 10-K

FOR YEAR ENDED DECEMBER 31, 2012

| Page | ||||

| CAUTION REGARDING FORWARD-LOOKING INFORMATION | ||||

| PART I | ||||

| Item 1. | Business | 2 | ||

| Item 1A. | Risk Factors | 10 | ||

| Item 1B. | Unresolved Staff Comments | 19 | ||

| Item 2. | Properties | 19 | ||

| Item 3. | Legal Proceedings | 20 | ||

| Item 4. | Mine Safety Disclosures | 21 | ||

| PART II | ||||

| Item 5. | Market Price for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 21 | ||

| Item 7. | Management’s Discussion and Analysis of Financial Conditions and Results of Operations | 22 | ||

| Item 8. | Financial Statements | 28 | ||

| Item 9. | Changes in and Disagreements With Accountants on Accounting and Financial Disclosure | 28 | ||

| Item 9A. | Controls and Procedures | 29 | ||

| Item 9B. | Other Information | 30 | ||

| PART III | ||||

| Item 10. | Directors, Executive Officers and Corporate Governance | 31 | ||

| Item 11. | Executive Compensation | 33 | ||

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 36 | ||

| Item 13. | Certain Relationships and Related Transactions, and Director Independence | 38 | ||

| Item 14. | Principal Accountant Fees and Services | 39 | ||

| PART IV | ||||

| Item 15. | Exhibits and Financial Statement Schedules | 40 | ||

| SIGNATURES | 44 | |||

| 1 |

CAUTIONARY NOTE REGARDING FORWARD-LOOKING INFORMATION

This Report contains forward-looking statements. All forward-looking statements are inherently uncertain as they are based on current expectations and assumptions concerning future events or future performance of the Company. Readers are cautioned not to place undue reliance on these forward-looking statements, which are only predictions and speak only as of the date hereof. Forward-looking statements usually contain the words “estimate,” “anticipate,” “believe,” “expect,” or similar expressions, and are subject to numerous known and unknown risks and uncertainties. In evaluating such statements, prospective investors should carefully review various risks and uncertainties identified in this Annual Report on Form 10-K, including the matters set forth under the captions “Risk Factors” and in our other SEC filings. These risks and uncertainties could cause our actual results to differ materially from those indicated in the forward-looking statements. We undertake no obligation to update or publicly announce revisions to any forward-looking statements to reflect future events or developments.

Although forward-looking statements in this Annual Report on Form 10-K reflect the good faith judgment of our management, such statements can only be based on facts and factors currently known by us. Consequently, forward-looking statements are inherently subject to risks and uncertainties, and actual results and outcomes may differ materially from the results and outcomes discussed in or anticipated by the forward-looking statements. Factors that could cause or contribute to such differences in results and outcomes include, without limitation, the matters described in this report generally. Readers are urged not to place undue reliance on these forward-looking statements, which speak only as of the date of this report.

We file reports with the Securities and Exchange Commission (SEC or Commission). We make available on our website free of charge our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports as soon as reasonably practicable after we electronically file such materials with or furnish them to the SEC. Information appearing at our website is not a part of this Annual Report on Form 10-K. You can also read and copy any materials we file with the Commission at its Public Reference Room at 100 F Street, NE, Washington, DC 20549. You can obtain additional information about the operation of the Public Reference Room by calling the Commission at 1-800-SEC-0330. In addition, the Commission maintains an Internet site (www.sec.gov) that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the Commission.

Our fiscal year begins on January 1, and ends on December 31, and any references herein to "Fiscal 2012" mean the year ended December 31, 2012, and references to other "Fiscal" years mean the year ending December 31, of the year indicated.

We obtained statistical data, market data and other industry data and forecasts used in this Form 10-K from publicly available information. While we believe that the statistical data, industry data, forecasts and market research are reliable, we have not independently verified the data, and we do not make any representation as to the accuracy of that information.

When used in this Annual Report, the terms the “Company,” “Skystar,” “we,” “us,” “our,” and similar terms refer to Skystar Bio-Pharmaceutical Company, a Nevada corporation, and our subsidiaries and variable interest entity.

PART I

ITEM 1. BUSINESS

Overview and Corporate History

Skystar Bio-Pharmaceutical Company (“Skystar” or the “Company”) was incorporated in Nevada on September 24, 1998. Since its acquisition on November 7, 2005 of Skystar Bio-Pharmaceutical (Cayman) Holdings Co., Ltd. (“Skystar Cayman”), a Cayman Islands company, the Company has been engaged in the research, development, production, marketing, and sales of veterinary healthcare and medical care products. All current operations of the Company are in the People’s Republic of China (“China” or the “PRC”).

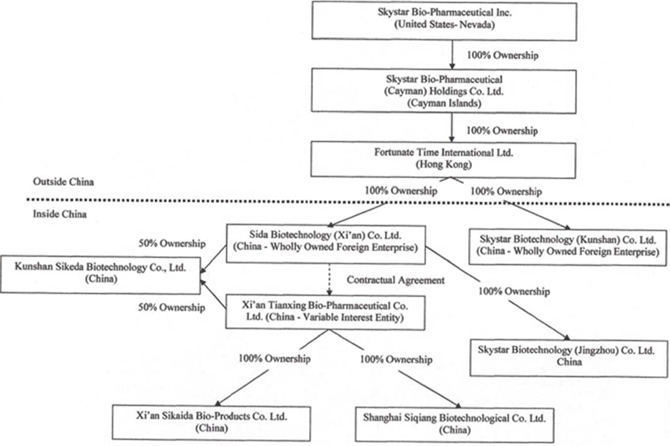

All of the Company’s operations are carried out by our subsidiaries in China and Xi’an Tianxing Bio-Pharmaceutical Co., Limited (“Xi’an Tianxing”), a PRC joint stock company that the Company controls through contractual arrangements originally between Skystar Cayman and Xi’an Tianxing. On March 10, 2008, the Company entered into a series of agreements transferring all of the rights and obligations of Skystar Cayman under the contractual arrangements to Sida Biotechnology (Xi’an) Co., Ltd. (“Sida”), a PRC company. Sida is the wholly owned subsidiary of Fortunate Time International Limited (“Fortunate Time”), a Hong Kong company and wholly owned subsidiary of Skystar Cayman. Xi’an Tianxing also has a wholly owned subsidiary, Shanghai Siqiang Biotechnological Co., Ltd. (“Shanghai Siqiang”), a PRC company.

On September 18, 2009, Skystar Bio-Pharmaceutical Inc. (“Skystar California”) was incorporated in California and became a wholly owned subsidiary of Skystar. On December 20, 2010, we dissolved Skystar California.

On April 21, 2010, Kunshan Sikeda Biotechnology Co., Ltd. (“Kunshan Sikeda”) was incorporated in Kunshan, Jiangsu Province, China with a registered capital of $73,970 (RMB 500,000), of which Xi’an Tianxing and Sida each contributed $36,985 (RMB 250,000). Kunshan Sikeda is jointly owned by Xi’an Tianxing and Sida.

| 2 |

On May 7, 2010, Fortunate Time formed Skystar Biotechnology (Kunshan) Co., Limited (“Skystar Kunshan”) in Kunshan, Jiangsu Province, China with a registered capital of $15,000,000, of which $2,250,000 was paid by Fortunate Time in cash, and of which the remaining $12,750,000 is required to be invested in the future. On July 25, 2012, the Company received the approval of extension for payment of the remaining registered capital but a new due date has not been specified by the government. We intend to apply for another extension in 2013 with the government to invest the remaining registered capital or request the government to reduce the total registered capital for this facility. Kunshan was formed in connection with an acquisition of assets to meet part of the registered capital requirements, and was intended to be a micro-organism manufacturing facility for the Company once the acquisition was complete. The asset acquisition was completed in September 2011, and the Company is also in the process of transferring the assets acquired to meet part of the registered capital requirements.

On August 11, 2010, Sida became the parent company of Skystar Biotechnology (Jingzhou) Co., Limited (“Skystar Jingzhou”), a company established in Jingzhou, Hubei Province, China on February 5, 2010, with a registered capital of approximately $4.1 million (RMB 26,000,000), of which approximately $3.7 million (RMB 23,480,000) was paid. On July 5, 2012, Sida paid up the remaining capital of $0.4 million (RMB 2,520,000).

On March 15, 2011, Xi’an Tianxing formed Xi’an Sikaida Bio-products Co., Ltd. (“Xi’an Sikaida”) with registered capital of approximately $1,587,000 (RMB 10,000,000) paid by Xi’an Tianxing.

Hereinafter, Skystar, Skystar Cayman, Fortunate Time, Sida, Xi’an Tianxing, Skystar Kunshan, Kunshan Sikeda, Skystar Jingzhou, Shanghai Siqiang, and Xi’an Sikaida are collectively referred to as the “Company.”

Our current organizational structure is as follows (the percentages depict the current equity interests):

Nasdaq Listing Compliance Matters

On January 12, 2012, we received staff determination from the Nasdaq Stock Market (“Exchange”) indicating that since we did not hold our 2010 annual shareholder meeting by December 31, 2011, we were not in compliance with Nasdaq Listing Rule 5620(a) and (b) relating to the time frame of and proxy solicitation in connection with annual shareholder meetings and, therefore, the Exchange staff determined to initiate proceedings to delist our securities from Nasdaq at the open of business on January 23, 2012. On March 26, 2012, following our presentation at an oral hearing before the Nasdaq Listing Qualifications Panel, we received a letter informing the Company that the Panel had granted our request to remain listed on the Exchange, subject to the condition that by April 28, 2012, we provided evidence that we held our 2011Annual Meeting of Shareholders. On April 27, 2012, we held our 2011 Annual Meeting of Shareholders, at which our shareholders elected all members of our Board and ratified the engagement of Crowe Horwath LLP as our independent registered public accounting firm. On May 1, 2012, the Exchange confirmed that we had met the requirements of the Panel’s decision dated March 26, 2012, and was in compliance with all other applicable requirements for continued listing on Nasdaq. The matter is now closed.

| 3 |

Our Products

We have four major product lines:

| 1. | Our micro-organism products line includes over 16 products and accounted for 45.7% of our revenue in 2012. |

| 2. | Our veterinary medicine line for poultry and livestock includes over 233 products and accounted for 31.7% of our revenue in 2012. |

| 3. | Our feed additives line includes over 16 products and accounted for 12.0% of our revenue in 2012. |

| 4. | Our bio-pharmaceutical veterinary vaccine line includes over 10 products and accounted for 10.6% of our revenue in 2012. |

| 4 |

Industry and Market Overview

China has one of the largest economic animal husbandry industries in the world. According to the Central Government’s 12th 5-year (2011-2015) national livestock development plan, by 2015, the proportion of China's animal husbandry output value will account for 36% of the total output value of agriculture, forestry, animal husbandry and fisheries as compared to 30% in 2010. With continued development of the livestock sector of the national economy, the veterinary medicines, feed additives and veterinary vaccine industry is expected to maintain a sustained and rapid development for the years to come.

Since 2000, with the steady development of animal husbandry in China, China's veterinary medicine industry has entered a fast-growing period. Especially since 2005, annual output value of veterinary medicines grew at a compound annual growth rate of 15%. In recent years, the veterinary medicine industry has been strongly supported by the national industrial policy. The government particularly encourages the development of new green veterinary medicines. In September 2011, the Ministry of Agriculture issued its 12th 5-year feed industry development plan. According to the plan, China's feed production in 2015 is expected to reach 200 million tons; the quality pass rate of feed products will be more than 95%; and the quality and safety of feed products will be further improved. In January 2012, the Ministry of Agriculture and Ministry of Finance developed a national animal disease compulsory vaccination plan, which requires compulsory immunization for certain kinds of animal diseases. In the same month, the State Council issued the modern agriculture development plan (2011-2015). During the 12th 5-year’s period, the state will continue to the increase animal compulsory vaccination subsidy level.

At present, China has become the second largest market after the United States for consumption of animal health products and China’s animal health products industry is expected to continue to maintain sustained growth in the future. However, the growth of China's animal health products industry is largely attached to the development of China's animal husbandry industry. Although the overall trend of development of animal husbandry in China is progressive and promising, there were some unstable periods during recent years due to the impact of food prices, labor costs, land supply, disease hazards, distribution cost, safety of animal products and many other factors and this phenomenon could continue to exist for a long period of time.

Distribution Methods of Our Products and Our Customers

As of December 31, 2012, we had over 3,964 customers in 29 provinces in China, including 2,859 distributors and 1,105 direct customers. Of the 2,859 distributors, 360 are physical stores that have outer signage with our logo and sell products from our four product lines exclusively that are known as “franchise distributors.”

We recognize the importance of branding as well as packaging. All of our products have uniform branding while being specifically designed to also differentiate our four product lines.

We conduct promotional marketing activities within the provinces we operate to publicize and enhance our image as well as to reinforce the recognition of our brand name, including:

| • | sending sales team to rural and urban areas to promote awareness of poultry and livestock conventional disease, educate farmers about prevention and treatment of diseases, and provide demonstrations in the field to them to promote our products; |

| •· | participating in various meetings, seminars, symposiums, exhibitions for bio-pharmaceutical and other related industries; |

| • | organizing cooperative promotional activities with distributors; and |

| • | sending direct mailing to major customers. |

None of our customers accounted for 10% or more of our total revenues in 2012.

Competition

Before the implementation of Good Manufacturing Practices (GMP) Standard in 2005, there were more than 2,600 veterinary drug companies in China. At present, there are approximately 2000 GMP certified veterinary drug manufacturers in China, of which the majority are privately held small businesses with annual output less than $8 million (RMB 50 million) each. We are one of the leading providers and distributors of veterinary healthcare and medical care products in China. In general, we have two major competitors in China – Qilu Animal Health Production Co., Ltd. and China Animal Husbandry Industry Co. Ltd . Each of them has more assets and a larger market share. Individually, Qilu Animal Health Production Co., Ltd. China Animal Husbandry Industry Co. Ltd and Guangdong VTR Bio-Tech Co., Ltd are our primary competitors in the sectors of micro-organism and feed additives products. Qilu Animal Health Production Co., Ltd. and China Animal Husbandry Industry Co. Ltd. are our primary competitors in the sector of veterinary medicine products. Xinjiang Tecon Animal Husbandry Bio-technology Co., Ltd. and Inner Mongolia Jinyu Group Stock Company are our primary competitors in the sector of veterinary vaccine products. We believe we are able to compete with these competitors because of our quick response to market demand, a full range of product offerings, quality customer service, and competitive prices. Other than these named competitors, most of our other competitors are privately held and vary greatly in terms of scale of operations.

| 5 |

Sources and Availability of Raw Materials and Our Principal Suppliers

Xi’an Zhongsen Pharmaceuticals., Ltd, Xi’an Yanghua Chemical Co., Ltd., Xi’an Fandike Chemical Technology Co., Ltd., Xi’an Nanchen Trading Co., Ltd., and Xi’an Chenyue Trading Co., collectively supplied over 85% of the raw materials we used to manufacture our products in 2012. We design, create prototypes for, and manufacture our products at our facilities located at Xi’an city, Shaanxi Province, China and Jingzhou, Hubei Province, China. Our principal raw materials include various chemical compounds including praziquantel, dexamethasone sodium phosphate, stachyose, zeolite, and yeast. We also use Chinese herbs such as Huanglian (Chinese Goldthread) as raw materials, which are supplied to us by Xi'an Wan Shou Bei Lu Longkui Chinese Medicine Store. Our raw materials generally are not scarce and are readily available from a wide range of sources. Accordingly, we do not have any continuing or long-term supply agreements with any of these suppliers, and purchase our raw materials from them on a per purchase order basis. The prices for these raw materials are nevertheless subject to market forces largely beyond our control, including energy costs, organic chemical feedstock, market demand, and freight costs. The prices for these raw materials have varied significantly in the past and may vary significantly in the future.

As a result of our research and development efforts in 2007 in cooperation with research institutes including Shaanxi Microbial Research Institute, Jiangsu Microbial Research Institute, China Northwestern University, and China Northwest A&F University, we now also internally produce microbial strains, which are key components of our micro-organism products. Our ability to produce microbial strains has translated into a significant cost reduction for these raw materials.

Intellectual Property and Licenses

We rely on a combination of trademark, copyright and trade secret protection laws in China and other jurisdictions, as well as confidentiality procedures and contractual provisions to protect our intellectual property and our brand.

We intend to seek other licenses or apply for exclusivity as necessary in order to protect our rights, and we also enter into confidentiality, non-compete and invention assignment agreements with our employees and consultants and nondisclosure agreements with third parties. Skywing, Stardove and the Chinese characters that transliterate as “Jia Teng Jun,” “Hao Shou Yi,” “Lan Yuan Kang”, “Bao Li Jian”, “Bi Ke Ting” are our registered trademarks in the PRC.

Bio-pharmaceutical companies are at times involved in litigation based on allegations of infringement or other violations of intellectual property rights. Furthermore, the application of laws governing intellectual property rights in China and abroad is uncertain and evolving and could involve substantial risks to us.

Approved Drugs and Veterinary Products – Xi’an Tianxing

Xi’an Tianxing is approved by the Chinese Ministry of Agriculture to manufacture and distribute veterinary drugs. Such approvals certify Xi’an Tianxing’s products as conforming to government-mandated standards. The approvals are issued for a period of 5 years and may be renewed 6 months prior to their expiration date. The veterinary drugs and their approval numbers are listed below:

| Veterinary Drug Products | Approval Number | |

| Diclazuril Premix (0.2%) | Veterinary Drug (2007) 270261140 | |

| Metamizole Sodium Injection | Veterinary Drug (2007) 270261152 | |

| Antondine Injection | Veterinary Drug (2007) 270261160 | |

| Mequindox Injection (10ml:0.5g) | Veterinary Drug (2007) 270264645 | |

| Praziquantel Tablets | Veterinary Drug (2007) 270261174 | |

| Amoxicillin Soluble Powder | Veterinary Drug (2007) 270261199 | |

| Kanamycin Sulfate Injection | Veterinary Drug (2007) 270261211 | |

| Salinomycin Sodium Premix | Veterinary Drug (2007) 270261379 | |

| Vitamin B1 Injection | Veterinary Drug (2007) 270261389 | |

| Erythromycin Thiocyanate Soluble Powder | Veterinary Drug (2007) 270261492 | |

| Gentamycin Sulfate Injection | Veterinary Drug (2007) 270261507 | |

| Compound Sulfamethoxydiazine Sodium Injection | Veterinary Drug (2007) 270261608 | |

| Compound Sulfamethoxazole Tablets | Veterinary Drug (2007) 270261612 | |

| Sulfamonomethoxine Sodium Injection | Veterinary Drug (2007) 270261616 | |

| Sulfadiazine Sodium Injection | Veterinary Drug (2007) 270261634 | |

| Pefloxacin Mesylate Granules | Veterinary Drug (2007) 270262042 | |

| Avermectin Powder | Veterinary Drug (2007) 270262066 | |

| Compound Amoxicillin Powder | Veterinary Drug (2007) 270262092 | |

| Florfenicol Powder | Veterinary Drug (2007) 270262110 | |

| Ofloxacin Tablets | Veterinary Drug (2007) 270262123 | |

| Ofloxacin Soluble Powder | Veterinary Drug (2007) 270262124 | |

| Ofloxacin Injection | Veterinary Drug (2007) 270262126 | |

| Ciprofloxacin Hydrochloride Soluble Powder | Veterinary Drug (2007) 270262159 | |

| Ciprofloxacin Hydrochloride Injection | Veterinary Drug (2007) 270262160 | |

| Enrofloxacin Injection | Veterinary Drug (2007) 270262518 | |

| Diclazuril Premix (5%) | Veterinary Drug (2007) 270262528 |

| 6 |

| Dexamethasone Sodium Phosphate Injection | Veterinary Drug (2007) 270262530 | |

| Norfloxacin Nicotinate Injection | Veterinary Drug (2007) 270262593 | |

| Spectinomycin Hydrochloride and Lincomycin Hydrochloride Soluble Powder | Veterinary Drug (2007) 270262602 | |

| Lincomycin Hydrochloride Injection (10ml:0.3g) | Veterinary Drug (2007) 270262614 | |

| Lincomycin Hydrochloride Injection (10ml:1.5g) | Veterinary Drug (2007) 270262616 | |

| Thiamphenicol Powder | Veterinary Drug (2007) 270262722 | |

| Apramycin Sulfate Soluble Powder | Veterinary Drug (2007) 270262745 | |

| Gentamycin Micronomicin Sulfate Injection (10 ml:100,000 parts) | Veterinary Drug (2007) 270262751 | |

| Gentamycin Micronomicin Sulfate Injection (10ml: 200,000 parts) | Veterinary Drug (2007) 270262752 | |

| Neomycin Sulfate Soluble Powder | Veterinary Drug (2007) 270262755 | |

| Colistin Sulfate Soluble Powder | Veterinary Drug (2007) 270262758 | |

| Vitamin C Injection | Veterinary Drug (2007) 270262795 | |

| Compoumd Vitamin B Injection | Veterinary Drug (2007) 270264572 | |

| Mequindox Injection (10ml:0.2g) | Veterinary Drug (2007) 270264644 | |

| Gongying San | Veterinary Drug (2007) 270265028 | |

| Mubin Xiaohuang San | Veterinary Drug (2007) 270265035 | |

| Zhili San | Veterinary Drug (2007) 270265037 | |

| Baitouweng San | Veterinary Drug (2007) 270265053 | |

| Fuzheng Jiedu San | Veterinary Drug (2007) 270265076 | |

| Quchong San | Veterinary Drug (2007) 270265089 | |

| Feizhucai | Veterinary Drug (2007) 270265100 | |

| Yujin San | Veterinary Drug (2007) 270265102 | |

| Baotai Wuyou San | Veterinary Drug (2007) 270265111 | |

| Jingfang Baidu San | Veterinary Drug (2007) 270265127 | |

| Jianji San | Veterinary Drug (2007) 270265133 | |

| Jianwei San | Veterinary Drug (2007) 270265134 | |

| Xiaoji San | Veterinary Drug (2007) 270265146 | |

| Yimu Shenghua San | Veterinary Drug (2007) 270265148 | |

| Tongru San | Veterinary Drug (2007) 270265156 | |

| Qingfei Zhike San | Veterinary Drug (2007) 270265157 | |

| Qingshu San | Veterinary Drug (2007) 270265162 | |

| Qingwen Baidu San | Veterinary Drug (2007) 270265165 | |

| Danjibao | Veterinary Drug (2007) 270265171 | |

| Huanglian Jiedu San | Veterinary Drug (2007) 270265178 | |

| Houyanjing San | Veterinary Drug (2007) 270265179 | |

| Chulijing | Veterinary Drug (2007) 270265192 | |

| Fenbendazole Powder | Veterinary Drug (2008) 270261189 | |

| Enrofloxacin Injection (10ml:250mg) | Veterinary Drug (2008) 270261295 | |

| Gentamycin Sulfate Injection (10ml:0.2g) | Veterinary Drug (2008) 270261506 | |

| Sulfaquinoxaline Sodium Soluble Powder (10%) | Veterinary Drug (2008) 270261624 | |

| Sulfathiazole Sodium Injection | Veterinary Drug (2008) 270261645 | |

| Danofloxacin Mesylate Injection | Veterinary Drug (2008) 270262033 | |

| Danofloxacin Mesylate Powder | Veterinary Drug (2008) 270262036 | |

| Pefloxacin Mesylate Soluble Powder | Veterinary Drug (2008) 270262040 | |

| Kitasamycin Premix | Veterinary Drug (2008) 270262043 | |

| Ciprofloxacin Lactate Soluble Powder | Veterinary Drug (2008) 270262073 | |

| Lomefloxacin Hydrochloride Soluble Powder | Veterinary Drug (2008) 270262166 | |

| Lomefloxacin Hydrochloride Injection | Veterinary Drug (2008) 270262169 | |

| Norfloxacin Nicotinic Soluble Powder | Veterinary Drug (2008) 270262178 | |

| Florfenicol Injection | Veterinary Drug (2008) 270262546 | |

| Sulfaquinoxaline Sodium Soluble Powder (5%) | Veterinary Drug (2008) 270262580 | |

| Lincomycin Hydrochloride Soluble Powder | Veterinary Drug (2008) 270262620 | |

| Pefloxacin Mesylate Injection | Veterinary Drug (2008) 270262665 | |

| Sulfachloropyrazin Sodium Soluble Powder | Veterinary Drug (2008) 270262703 | |

| Tylosin Tartrate Soluble Powder | Veterinary Drug (2008) 270262731 | |

| Berberine Sulfate Injection | Veterinary Drug (2008) 270264595 | |

| Xiaochaihu San | Veterinary Drug (2008) 270265018 | |

| Shengru San | Veterinary Drug (2008) 270265051 | |

| Bailong San | Veterinary Drug (2008) 270265055 | |

| Longdan Xiegan San | Veterinary Drug (2008) 270265057 | |

| Qumai San | Veterinary Drug (2008) 270265067 | |

| Fangji San | Veterinary Drug (2008) 270265072 | |

| Buzhong Yiqi San | Veterinary Drug (2008) 270265082 | |

| Shenling Baishu San | Veterinary Drug (2008) 270265093 | |

| Xiaoshi Pingwei San | Veterinary Drug (2008) 270265145 |

| 7 |

| Yinqiao San | Veterinary Drug (2008) 270265172 | |

| Maxing Shigan San | Veterinary Drug (2008) 270265174 | |

| Cuiqing San | Veterinary Drug (2008) 270265188 | |

| HuoXi’ang Zhengqi San | Veterinary Drug (2008) 270265200 | |

| Qibu San | Veterinary Drug (2008) 270265220 | |

| Ivermectin Premix | Veterinary Drug (2009) 270263059 | |

| Feizhu San | Veterinary Drug (2009) 270265101 | |

| Tilmicosin Premix | Veterinary Drug (2010) 270262263 | |

| Promethazine Hydrochloride Injection (10ml: 0.25g) | Veterinary Drug (2009) 270261360 | |

| Ciprofloxacin hydrochloride soluble powder (5%) | Veterinary Drug (2010) 270262605 | |

| Pefloxacin mesylate soluble powder (10%) | Veterinary Drug (2010) 270262727 | |

| Ivica bacteria injection (10ml: 10 million units) | Veterinary Drug (2010) 270262646 | |

| Ivica bacteria injection (5ml: 0.05g) | Veterinary Drug (2010) 270261126 | |

| Erythromycin thiocyanate soluble powder (2.5%) | Veterinary Drug (2010) 270262740 | |

| The sulfa chloropyrazine sodium soluble powder (30%) | Veterinary Drug (2010) 270261628 | |

| Ciprofloxacin Lactate Soluble Powder (5%) | Veterinary Drug (2010) 270262772 | |

| Alexander Huang at the end | Veterinary Drug (2010) 270265019 | |

| Stimulated egg powder | Veterinary Drug (2010) 270265197 | |

| Wulingsan | Veterinary Drug (2010) 270265026 | |

| Iron dextran injection (10ml: 0.5g) | Veterinary Drug (2010) 270261064 | |

| Iron dextran injection (10ml: 1g) | Veterinary Drug (2010) 270261065 |

Approved Drugs and Veterinary Products - Skystar Jingzhou

Skystar Jingzhou is approved by the Chinese Ministry of Agriculture to manufacture and distribute veterinary drugs. Such approvals certify Skystar Jingzhou’s products as conforming to government-mandated standards. The approvals are issued for a period of 5 years and may be renewed 6 months prior to their expiration date. The veterinary drugs and their approval numbers are listed below:

| Veterinary Drug Products | Approval Number | |

| Povidone-iodine solution | Veterinary Drug (2012)170141575 | |

| Povidone-iodine solution | Veterinary Drug (2012)170141577 | |

| Sulfaquinoxaline sodium soluble powder | Veterinary Drug (2012)170141624 | |

| The sulfa chloropyrazine sodium soluble powder | Veterinary Drug (2012)170141628 | |

| Ciprofloxacin hydrochloride soluble powder | Veterinary Drug (2012)170142159 | |

| Enrofloxacin solution | Veterinary Drug (2012)170141297 | |

| Jing anti-sepsis scattered | Veterinary Drug (2012)170145127 | |

| The multi flavor stomach scattered | Veterinary Drug (2012)170145063 | |

| Aphrodisiac scattered | Veterinary Drug (2012)170145188 | |

| Qingwenbaiduyin scattered | Veterinary Drug (2012)170145165 | |

| Pulsatilla scattered | Veterinary Drug (2012)170145053 | |

| Albendazole tablets | Veterinary Drug (2012)170141194 | |

| Concentrated glutaraldehyde solution | Veterinary Drug (2012)170149073 | |

| Enrofloxacin powder | Veterinary Drug (2012)170149107 | |

| Norfloxacin powder | Veterinary Drug (2012)170149096 | |

| Florfenicol powder | Veterinary Drug (2012)170149014 | |

| Florfenicol powder | Veterinary Drug (2012)170142538 | |

| Vitamin B complex powder | Veterinary Drug (2012)170146071 | |

| Fuzhengjiedu scattered | Veterinary Drug (2012)170145076 | |

| Huanglianjiedu scattered | Veterinary Drug (2012)170145178 | |

| Deworming scattered | Veterinary Drug (2012)170145089 | |

| Heat dispersion | Veterinary Drug (2012)170145161 | |

| Praziquantel tablets | Veterinary Drug (2012)170141174 | |

| Addition and subtraction eliminate yellow scattered | Veterinary Drug (2012)170149240 | |

| Benzalkonium bromide solution | Veterinary Drug (2012)170149004 |

Skystar Jingzhou is currently waiting for the Ministry of Agriculture to renew the approvals of its veterinary products for manufacturing and distribution. The product names that were submitted to Ministry of Agriculture for renewal are listed below and their approval numbers are to be determined.

| Veterinary Drug Products | ||

| Benzalkonium bromide solution | ||

| Albendazole powder |

| 8 |

Skystar Jingzhou is also waiting for the Ministry of Agriculture to approve its application for manufacturing and distribution of its new veterinary products. The product names that were submitted to Ministry of Agriculture for approval are listed below and their approval numbers are to be determined.

| Veterinary Drug Products | ||

| Hydrochloride doxycycline soluble powder | ||

| Of colistin sulfate soluble powder | ||

| Spectinomycin hydrochloride lincomycin hydrochloride soluble powder | ||

| Florfenicol powder | ||

| Tylosin tartrate soluble powder | ||

| Compound amoxicillin powder | ||

| Oral rehydration salts | ||

| Doxycycline injection | ||

| Lincomycin Hydrochloride Injection | ||

| Florfenicol Injection | ||

| Sulfamethoxazole injection of sodium methoxy pyrimidine | ||

| Enrofloxacin Injection | ||

| The size of the sulfuric acid celebrate Connaught mycophenolate injection | ||

| Difloxacin hydrochloride injection | ||

| Composite phenolic | ||

| Longdanxiegan scattered | ||

| Andrographis scattered four flavor | ||

| Of Robenidine powder hydrochloride | ||

| Menadione Sodium bisulfite powder | ||

| Omphalia betel nut powder | ||

| Board yellow powder | ||

| Hepatobiliary Unicorn Powder | ||

| Yinqiao Banlangen scattered | ||

| The green board Treats scattered | ||

| Sodium periodate solution | ||

| Compound iodine |

Government Approval and Regulation of our Principal Products or Services

Government approval is required for the production of bio-pharmaceutical products. The Chinese Ministry of Agriculture has granted Xi’an Tianxing three government permits to produce the following products: Forage Additive Products, Additive and Mixed Forage Products, and Veterinary Medicine Products. For the production of the veterinary medicine, there is a national standard known as the Good Manufacturing Practice (“GMP”) standard. A company must establish its facility according to GMP standards, including both the facility and the production process. After establishing such facility, the company files an application to operate the facility with the PRC Ministry of Agriculture, which then sends a team of specialists to conduct an on-site inspection of the facility. A company cannot start production at the facility until it receives approval from the Ministry of Agriculture to begin operations. The Chinese Ministry of Agriculture has also granted Skystar Jingzhou the government permit to produce veterinary medicine products. As of December 31, 2012, both Xi’an Tianxing and Skystar Jingzhou have the requisite approvals and licenses from the Ministry of Agriculture in order to operate our production facilities.

Research and Development

We place great emphasis on product research and development, and we work closely with two research institutes in the veterinary science field.

With Shanghai Poultry Verminosis Institute, which is a part of the Chinese Academy of Agricultural Sciences, we jointly established the Skystar Research and Development Center in Shanghai. We are currently working on the following project at this research center:

| · | Culture isolation and purification of various livestock and poultry common pathogen species. |

We also established an R&D center located on our premises in Huxian with the Shaanxi Microbial Institute, the only microbial research institute in northwest China. We provide for the running and operation of the research center, including research equipment and materials. In exchange, we have exclusive rights to any technology derived from any research project that we solely fund. We and the Shaanxi Microbial Institute mutually staff research personnel at, and joint-appointment of the director for, the research center. The Institute, however, is not obligated to us with respect to a specific amount of time or a specific project. We are currently working on the following projects at this research center:

| 9 |

| · | Development of common fish, livestock, poultry pathogen immunodiagnostic reagents, therapeutic agents and preventive reagents. We have developed a new immunodiagnostic kit and are currently conducting farm field experiments. |

| · | Development of fish, livestock, and poultry disease multi-specific transfer factor. |

| · | Development of mononuclear vaccine biological agents. |

During the first quarter of 2008, Xi’an Tianxing contracted with Northwestern Agricultural Technology University to jointly work on an R&D project concerning the application of nano-technology in the prevention of major milk cow disease. The project reached trial stage in March 2009 and remains in progress as of December 31, 2012. We have submitted an application to obtain veterinary permits for the new product. In 2009, Xi’an Tianxing contracted with the Fourth Military Medical University to jointly work on fish diseases linked immunosorbent detection kit and fish diseases multi-linked monoclonal antibody therapeutic agents. The project remains in progress as of December 31, 2012

On September 23, 2009, we purchased an exclusive aquaculture vaccine technology from and signed a collaborative research and development agreement with China’s Fourth Military Medical University (“FMMU”) for approximately $1.2 million (RMB 8 million), granting the Company exclusive rights to sell and market the patented aquaculture vaccine through 2020. Under this patented technology, and in collaboration with FMMU, we will produce the first vaccine in China designed to safely prevent and treat certain bacterial infection and diseases in marine life without causing harmful side effects. Based on its first-to-market status, the Chinese Ministry of Agriculture has issued a Grade I Veterinary Certificate for our vaccine.

During the first quarter of 2011, Xi’an Tianxing contracted with the Fourth Military Medical University to jointly work on new treatment and diagnosis method for Mycoplasmal pneumonia of swine. During the second quarter of 2011, Xi’an Tianxing launched four in-house R&D projects to develop ceftiofur sodium for injection (powder for injection), a sulfuric acid injection neostigmine, dexamethasone sodium phosphate injection, and houttuynia preparation of compound application in weaning piglets. As of December 31, 2012, Xi’an Tianxing had completed these four in-house R&D projects.

During the second quarter of 2012, Xi’an Tianxing contracted with the Fourth Military Medical University to jointly work on an R&D project of ring disease and pseudo-rabies specific transfer factor and blue-ear disease and Mycoplasma pneumoniae disease specific transfer factor to enhance the livestock and poultry's own immuneforce and prevent the onset of conventional disease. The project is currently in clinical research stage. During the fourth quarter of 2012, Xi’an Tianxing launched eight in-house R&D projects to develop oral liquid product, powder for injection product, Vitamin E injection product, anthelmintic product, three disease grams product, premixes class product, bulk powder product and livestock and fish diseases immunoassay kit. All eight projects remain in progress as of December 31, 2012

In addition, the Company also launched various in house R&D projects in 2011 and 2012 on veterinary products formula adjustment, pet drug development and fermentation engineering design and development.

In 2012, we spent $2,154,241, or approximately 6.4%, of our revenue on R&D. In 2011, we spent $2,814,328, or approximately 5.3%, of our revenue on R&D.

Employees

As of December 31, 2012, we have 317 employees, of which 134 employees are production personnel, 72 employees are sales personnel, 24 employees are research and development personnel, and 87 employees are administrative personnel. None of our employees are covered by collective bargaining agreements. We consider our relationships with our employees to be good. We also employ consultants on an as needed basis.

ITEM 1A. RISK FACTORS

Our business involves a number of risks, many of which are beyond our control. The risks and uncertainties described below could individually or collectively have a material adverse effect on our business, assets, profitability or prospects. While these are not the only risks and uncertainties we face, management believes that the more significant risks and uncertainties are as follows:

Risks Relating to Our Business

Our relatively limited operating history makes it difficult to evaluate our future prospects and results of operations.

We have a relatively limited operating history. Xi’an Tianxing, the variable interest entity through which we operate the majority of our business, commenced operations in 1997 and first achieved profitability in the quarter ended September 30, 1999. We acquired the Jingzhou plant and related assets through bankruptcy court and started production in the third quarter of 2010 and the asset acquisition was completed in August of 2010. We completed Kunshan micro-organism plant’s asset acquisition in September 2011. The facility renovation construction was completed in 2012, and the related inspection was completed and accepted in March 2013. However, the equipment installation, tooling and testing has only partially been completed; thus this facility is not operational at this point. Accordingly, you should consider our future prospects in light of the risks and uncertainties typically experienced by companies such as ours in evolving industries such as the bio-pharmaceutical industry in China. Some of these risks and uncertainties relate to our ability to:

| • | offer new and innovative products to attract and retain a larger customer base; | |

| • | attract additional customers and increase spending per customer; |

| 10 |

| • | increase awareness of our brand and continue to develop user and customer loyalty; | |

| • | raise sufficient capital to sustain and expand our business; |

| • | maintain effective control of our costs and expenses; | |

| • | respond to changes in our regulatory environment; |

| • | respond to competitive market conditions; | |

| • | manage risks associated with intellectual property rights; |

| • | attract, retain and motivate qualified personnel; | |

| • | upgrade our technology to support additional research and development of new products; and |

| • | maintain or improve our position as one of the market leaders in China. |

If we are unsuccessful in addressing any of these risks and uncertainties, our business may be materially and adversely affected.

If we fail to obtain additional financing we may be unable to execute our business plan.

Despite our current financing from banks, we may need additional funds to build new production facilities; pursue further research and development; obtain regulatory approvals; file, prosecute, defend and enforce our intellectual property rights; and market our products. Should such needs arise, we intend to seek additional funds through public or private equity or debt financing, strategic transactions and/or from other sources.

There are no assurances that future funding will be available on favorable terms or at all. If additional funding is not obtained, we may need to reduce, defer or cancel development programs, planned initiatives or overhead expenditures, to the extent necessary. The failure to fund our capital requirements would have a material adverse effect on our business, financial condition and results of operations.

Our business will be materially and adversely affected if our collaborative partners, licensees and other third parties over whom we are very dependent fail to perform as expected.

Due to the complexity of the process of developing bio-pharmaceuticals, our core business depends on arrangements with bio-pharmaceutical institutes, corporate and academic collaborators, licensors, licensees and others for the research, development, clinical testing, technology rights, manufacturing, marketing and commercialization of our products. We have various research collaborations and outsource other business functions. Our license agreements could obligate us to diligently bring potential products to market, make substantial milestone payments and royalties and incur the costs of filing and prosecuting patent applications. There are no assurances that we will be able to establish or maintain collaborations that are important to our business on favorable terms, or at all. We could enter into collaborative arrangements for the development of particular products that may lead to our relinquishing some or all rights to the related technology or products. A number of risks arise from our dependence on collaborative agreements with third parties. Product development and commercialization efforts could be adversely affected if any collaborative partner:

| • | terminates or suspends its agreement or arrangement with us; | |

| • | causes delays; | |

| • | fails to timely develop or manufacture in adequate quantities a substance needed in order to conduct clinical trials; | |

| • | fails to adequately perform clinical trials; | |

| • | determines not to develop, manufacture or commercialize a product to which it has rights; or |

| • | otherwise fails to meet its contractual obligations. |

Our collaborative partners could pursue other technologies or develop alternative products that could compete with the products we are developing.

Our products will be adversely affected if we are unable to protect proprietary rights or operate without infringing the proprietary rights of others.

The profitability of our products will depend in part on our ability to obtain and maintain patents and licenses and preserve trade secrets, and the period our intellectual property remains exclusive. We must also operate without infringing the proprietary rights of third parties and without third parties circumventing our rights. The patent positions of bio-pharmaceutical and biotechnology enterprises, including ours, are uncertain and involve complex legal and factual questions for which important legal principles are largely unresolved. In addition, the scope of the originally claimed subject matter in a patent application can be significantly reduced before a patent is issued. The biotechnology patent situation outside the U.S. is uncertain, is currently undergoing review and revision in many countries, and may not protect our intellectual property rights to the same extent as the laws of the U.S. Because patent applications are maintained in secrecy in some cases, we cannot be certain that we or our licensors are the first creators of inventions described in our pending patent applications or patents or the first to file patent applications for such inventions.

Other companies may independently develop similar products and design around any patented products we develop. We cannot assure you that:

| • | any of our patent applications will result in the issuance of patents; | |

| • | we will develop additional patentable products; |

| • | patents we have been issued will provide us with any competitive advantages; | |

| • | the patents of others will not impede our ability to do business; or |

| 11 |

| • | third parties will not be able to circumvent our patents. |

A number of pharmaceutical, biotechnology, research and academic companies and institutions have developed technologies, filed patent applications or received patents on technologies that may relate to our business. If these technologies, applications or patents conflict with ours, the scope of our current or future patents could be limited or our patent applications could be denied. Our business may be adversely affected if competitors independently develop competing technologies, especially if we do not obtain, or obtain only narrow, patent protection. If patents that cover our activities are issued to other companies, we may not be able to obtain licenses at a reasonable cost, or at all; develop our technology; or introduce, manufacture or sell the products we have planned.

Patent litigation is becoming widespread in the biotechnology industry. Such litigation may affect our efforts to form collaborations, to conduct research or development, to conduct clinical testing or to manufacture or market any products under development. There are no assurances that our patents would be held valid or enforceable by a court or that a competitor’s technology or product would be found to infringe our patents in the event of patent litigation. Our business could be materially affected by an adverse outcome to such litigation. Similarly, we may need to participate in interference proceedings declared by the U.S. Patent and Trademark Office or equivalent international authorities to determine priority of invention. We could incur substantial costs and devote significant management resources to defend our patent position or to seek a declaration that another company’s patents are invalid.

Much of our know-how and technology may not be patentable, though it may constitute trade secrets. There are no assurances that we will be able to meaningfully protect our trade secrets. We cannot assure you that any of our existing confidentiality agreements with employees, consultants, advisors or collaborators will provide meaningful protection for our trade secrets, know-how or other proprietary information in the event of any unauthorized use or disclosure. Collaborators, advisors or consultants may dispute the ownership of proprietary rights to our technology, for example by asserting that they developed the technology independently.

Difficulties in manufacturing our products could have a material adverse effect on our profitability.

Before our products can be profitable, they must be produced in commercial quantities in a cost-effective manufacturing process that complies with regulatory requirements, including China’s Good Manufacturing Practice (GMP), production and quality control regulations. If we cannot arrange for or maintain commercial-scale manufacturing on acceptable terms, or if there are delays or difficulties in the manufacturing process, we may not be able to conduct clinical trials, obtain regulatory approval or meet demand for our products.

Failure or delays in obtaining an adequate amount of raw material or other supplies would materially and adversely affect our revenue.

Production of our products could require raw materials which are scarce or which can be obtained only from a limited number of sources. If we are unable to obtain adequate supplies of such raw materials, the development, regulatory approval and marketing of our products could be delayed.

Our ability to generate more revenue would be adversely affected if we need more clinical trials or take more time to complete our clinical trials than we have planned.

Clinical trials vary in design by factors including dosage, end points, length, and controls. We may need to conduct a series of trials to demonstrate the safety and efficacy of our products. The results of these trials may not demonstrate safety or efficacy sufficiently for regulatory authorities to approve our products. Further, the actual schedules for our clinical trials could vary dramatically from the forecasted schedules due to factors including changes in trial design, conflicts with the schedules of participating clinicians and clinical institutions, and changes affecting product supplies for clinical trials.

We rely on collaborators, including academic institutions, governmental agencies and clinical research organizations, to conduct, supervise, monitor and design some or all aspects of clinical trials involving our products. Since these trials depend on governmental participation and funding, we have less control over their timing and design than trials we sponsor. Delays in or failure to commence or complete any planned clinical trials could delay the ultimate timelines for our product releases. Such delays could reduce investors’ confidence in our ability to develop products, likely causing the price of our common stock to decrease.

If we are unable to obtain the regulatory approvals or clearances that are necessary to commercialize our products, we will have less revenue than expected.

China and other countries impose significant statutory and regulatory obligations upon the manufacture and sale of bio-pharmaceutical products. Each regulatory authority typically has a lengthy approval process in which it examines pre-clinical and clinical data and the facilities in which the product is manufactured. Regulatory submissions must meet complex criteria to demonstrate the safety and efficacy of the ultimate products. Addressing these criteria requires considerable data collection, verification and analysis. We may spend time and money preparing regulatory submissions or applications without assurances as to whether they will be approved on a timely basis or at all.

Our product candidates, some of which are currently in the early stages of development, will require significant additional development and pre-clinical and clinical testing prior to their commercialization. These steps and the process of obtaining required approvals and clearances can be costly and time-consuming. If our potential products are not successfully developed, cannot be proven to be safe and effective through clinical trials, or do not receive applicable regulatory approvals and clearances, or if there are delays in the process:

| 12 |

| • | the commercialization of our products could be adversely affected; | |

| • | any competitive advantages of the products could be diminished; and |

| • | revenues or collaborative milestones from the products could be reduced or delayed. |

Governmental and regulatory authorities may approve a product candidate for fewer indications or narrower circumstances than requested or may condition approval on the performance of post-marketing studies for a product candidate. Even if a product receives regulatory approval and clearance, it may later exhibit adverse side effects that limit or prevent its widespread use or that force us to withdraw the product from the market.

Any marketed product and its manufacturer, including us, will continue to be subject to strict regulation after approval. Results of post-marketing programs may limit or expand the further marketing of products. Unforeseen problems with an approved product or any violation of regulations could result in restrictions on the product, including its withdrawal from the market and possible civil actions.

In manufacturing our products we will be required to comply with applicable good manufacturing practices regulations, which include requirements relating to quality control and quality assurance, as well as the maintenance of records and documentation. If we cannot comply with regulatory requirements, including applicable good manufacturing practice requirements, we may not be allowed to develop or market the product candidates. If we or our manufacturers fail to comply with applicable regulatory requirements at any stage during the regulatory process, we may be subject to sanctions, including fines, product recalls or seizures, injunctions, refusal of regulatory agencies to review pending market approval applications or supplements to approve applications, total or partial suspension of production, civil penalties, withdrawals of previously approved marketing applications and criminal prosecution.

Competitors may develop and market bio-pharmaceutical products that are less expensive, more effective or safer, making our products obsolete or uncompetitive.

Some of our competitors and potential competitors have greater product development capabilities and financial, scientific, marketing and human resources than we do. Technological competition from biopharmaceutical companies and biotechnology companies is intense and is expected to increase. Other companies have developed technologies that could be the basis for competitive products. Some of these products have an entirely different approach or means of accomplishing the desired curative effect than products we are developing. Alternative products may be developed that are more effective, work faster and are less costly than our products. Competitors may succeed in developing products earlier than us, obtaining approvals and clearances for such products more rapidly than us, or developing products that are more effective than ours. In addition, other forms of treatment may be competitive with our products. Over time, our technology or products may become obsolete or uncompetitive.

Our revenue will be materially and adversely affected if our products are unable to gain market acceptance.

Our products may not gain market acceptance in the agricultural community. The degree of market acceptance of any product depends on a number of factors, including establishment and demonstration of clinical efficacy and safety, cost-effectiveness, clinical advantages over alternative products, and marketing and distribution support for the products. Limited information regarding these factors is available in connection with our products or products that may compete with ours.

To directly market and distribute our bio-pharmaceutical products, we or our collaborators require a marketing and sales force with appropriate technical expertise and supporting distribution capabilities. We may not be able to further establish sales, marketing and distribution capabilities or enter into arrangements with third parties on acceptable terms. If we or our partners cannot successfully market and sell our products, our ability to generate revenue will be limited.

Our operations and the use of our products could subject us to damages relating to injuries or accidental contamination and thus reduce our earnings or increase our losses.

Our research and development processes involve the controlled use of hazardous materials. We are subject to federal, provincial and local laws and regulations governing the use, manufacture, storage, handling and disposal of such materials and waste products. The risk of accidental contamination or injury from handling and disposing of such materials cannot be completely eliminated. In the event of an accident involving hazardous materials, we could be held liable for resulting damages. We are not insured with respect to this liability. Such liability could exceed our resources. In the future we could incur significant costs to comply with environmental laws and regulations.

If we were sued for product liability, we could face substantial liabilities that may exceed our resources.

We may be held liable if any product we develop, or any product which is made using our technologies, causes injury or is found unsuitable during product testing, manufacturing, marketing, sale or use. These risks are inherent in the development of agricultural and bio-pharmaceutical products. We currently do not have product liability insurance. If we cannot obtain sufficient insurance coverage at an acceptable cost or otherwise protect against potential product liability claims, the commercialization of products that we develop may be prevented or inhibited. If we are sued for any injury caused by our products, our liability could exceed our total assets, whether or not we are successful.

| 13 |

We have no business liability or disruption insurance coverage and therefore we are susceptible to catastrophic or other events that may disrupt our business.

The insurance industry in China is still at an early stage of development. Insurance companies in China offer limited business insurance products. We do not have any business liability or disruption insurance coverage for our operations in China. Any business disruption, litigation or natural disaster may result in our incurring substantial costs and the diversion of our resources.

We will be unsuccessful if we fail to attract and retain qualified personnel.

We depend on a core management and scientific team. The loss of any of these individuals could prevent us from achieving our business objective of commercializing our product candidates. Our future success will depend in large part on our continued ability to attract and retain other highly qualified scientific, technical and management personnel, as well as personnel with expertise in clinical testing and government regulation. We face competition for personnel from other companies, universities, public and private research institutions, government entities and other organizations. If our recruitment and retention efforts are unsuccessful, our business operations could suffer.

Downturn in the global economy may slow domestic growth in China, which in turn may affect our business.

Due to the slowing of global economy, China may not be able to maintain its recent growth rates mainly due to the lack of demand of exports to countries that are in recessions. Although we do not presently export any of our products, our earnings may become unstable if China’s domestic growth slows significantly and the demand for meats and poultry declines.

Risks Related to Our Corporate Structure

Chinese laws and regulations governing our businesses and the validity of certain of our contractual arrangements are uncertain. If we are found to be in violation, we could be subject to sanctions. In addition, changes in such Chinese laws and regulations may materially and adversely affect our business.

There are substantial uncertainties regarding the interpretation and application of Chinese laws and regulations, including, but not limited to, the laws and regulations governing our business, or the enforcement and performance of our contractual arrangements with our affiliated Chinese entity, Xi’an Tianxing, and its stockholders. We are considered a foreign person or foreign invested enterprise under Chinese law. As a result, we are subject to Chinese law limitations on foreign ownership of Chinese companies. These laws and regulations are relatively new and may be subject to change, and their official interpretation and enforcement may involve substantial uncertainty. The effectiveness of newly enacted laws, regulations or amendments may be delayed, resulting in detrimental reliance by foreign investors. New laws and regulations that affect existing and proposed future businesses may also be applied retroactively.

The Chinese government has broad discretion in dealing with violations of laws and regulations, including levying fines, revoking business and other licenses and requiring actions necessary for compliance. In particular, licenses and permits issued or granted to us by relevant governmental bodies may be revoked at a later time by higher regulatory bodies. We cannot predict the effect of the interpretation of existing or new Chinese laws or regulations on our businesses. We cannot assure you that our current ownership and operating structure would not be found in violation of any current or future Chinese laws or regulations. As a result, we may be subject to sanctions, including fines, and could be required to restructure our operations or cease to provide certain services. Any of these or similar actions could significantly disrupt our business operations or restrict us from conducting a substantial portion of our business operations, which could materially and adversely affect our business, financial condition and results of operations.

We may be adversely affected by complexity, uncertainties and changes in Chinese regulation of bio-pharmaceutical business and companies, including limitations on our ability to own key assets.

The Chinese government regulates the bio-pharmaceutical industry including foreign ownership of, and the licensing and permit requirements pertaining to, companies in the bio-pharmaceutical industry. These laws and regulations are relatively new and evolving, and their interpretation and enforcement involve significant uncertainty. As a result, in certain circumstances it may be difficult to determine what actions or omissions may be deemed to be a violation of applicable laws and regulations. Issues, risks and uncertainties relating to Chinese government regulation of the bio-pharmaceutical industry include the following:

| • | we only have contractual control over Xi’an Tianxing. We do not own it due to the restriction of foreign investment in Chinese businesses; and | |

| • | uncertainties relating to the regulation of the bio-pharmaceutical business in China, including evolving licensing practices, means that permits, licenses or operations at our company may be subject to challenge. This may disrupt our business, or subject us to sanctions, requirements to increase capital or other conditions or enforcement, or compromise enforceability of related contractual arrangements, or have other harmful effects on us. |

The interpretation and application of existing Chinese laws, regulations and policies and possible new laws, regulations or policies have created substantial uncertainties regarding the legality of existing and future foreign investments in, and the businesses and activities of, bio-pharmaceutical businesses in China, including our business.

| 14 |

In order to comply with Chinese laws limiting foreign ownership of Chinese bio-pharmaceutical companies, we conduct our bio-pharmaceutical business primarily through Xi’an Tianxing by means of contractual arrangements. If the Chinese government determines that these contractual arrangements do not comply with applicable regulations, our business could be adversely affected.

The Chinese government restricts foreign investment in bio-pharmaceutical businesses in China. Accordingly, we operate our business in China primarily through Xi’an Tianxing, a Chinese joint stock company. Xi’an Tianxing holds the licenses and approvals necessary to operate our bio-pharmaceutical business in China. We have contractual arrangements with Xi’an Tianxing and its stockholders that allow us to substantially control Xi’an Tianxing. We cannot assure you, however, that we will be able to enforce these contracts.

Although we believe we comply with current Chinese regulations, we cannot assure you that the Chinese government would agree that these operating arrangements comply with Chinese licensing, registration or other regulatory requirements, with existing policies or with requirements or policies that may be adopted in the future. If the Chinese government determines that we do not comply with applicable law, it could revoke our business and operating licenses, require us to discontinue or restrict our operations, restrict our right to collect revenues, require us to restructure our operations, impose additional conditions or requirements with which we may not be able to comply, impose restrictions on our business operations or on our customers, or take other regulatory or enforcement actions against us that could be harmful to our business.

Our contractual arrangements with Xi’an Tianxing and its stockholders may not be as effective in providing control over these entities as direct ownership.

Since Chinese law limits foreign equity ownership in bio-pharmaceutical companies in China, we operate our business through Xi’an Tianxing. We have no equity ownership interest in Xi’an Tianxing and rely on contractual arrangements to control and operate such businesses. These contractual arrangements may not be as effective in providing control over Xi’an Tianxing as direct ownership. For example, Xi’an Tianxing could fail to take actions required for our business despite its contractual obligation to do so. If Xi’an Tianxing fails to perform under their agreements with us, we may have to rely on legal remedies under Chinese law, which may not be effective. In addition, we cannot assure you that either of Xi’an Tianxing’s stockholders will act in our best interests.

Because we rely on the consulting services agreement with Xi’an Tianxing for the majority of our revenue, the termination of this agreement will severely and detrimentally affect our continuing business viability under our current corporate structure.

We are a holding company and do not have any assets or conduct any business operations. As a result, our revenues are primarily dependent on dividend payments from Sida after it receives payments from Xi’an Tianxing pursuant to the consulting services agreement which forms a part of the contractual arrangements between Sida and Xi’an Tianxing. The consulting services agreement may be terminated by written notice of Sida or Xi’an Tianxing in the event that: (a) one party causes a material breach of the agreement, provided that if the breach does not relate to a financial obligation of the breaching party, that party may attempt to remedy the breach within 14 days following the receipt of the written notice; (b) one party becomes bankrupt, insolvent, is the subject of proceedings or arrangements for liquidation or dissolution, ceases to carry on business, or becomes unable to pay its debts as they become due; (c) Sida terminates its operations; (d) Xi’an Tianxing’s business license or any other license or approval for its business operations is terminated, cancelled or revoked; or (e) circumstances arise which would materially and adversely affect the performance or the objectives of the agreement. Additionally, Sida may terminate the consulting services agreement without cause. Because neither we nor our direct and indirect subsidiaries own equity interests of Xi’an Tianxing, the termination of the consulting services agreement would sever our ability to continue receiving payments from Xi’an Tianxing under our current holding company structure. While we are currently not aware of any event or reason that may cause the consulting services agreement to terminate, we cannot assure you that such an event or reason will not occur in the future. In the event that the consulting services agreement is terminated, this may have a severe and detrimental effect on our continuing business viability under our current corporate structure, which in turn may affect the value of your investment.

Members of Xi’an Tianxing’s management have potential conflicts of interest with us, which may adversely affect our business and your ability for recourse.

Weibing Lu, our Chief Executive Officer, is also the Chief Executive Officer and Chairman of the Board of Directors of Xi’an Tianxing. Mr. Wei Wen, who is Xi’an Tianxing’s Vice-General Manager and Director, is a member of Skystar’s board of directors. Conflicts of interests between their respective duties to our company and Xi’an Tianxing may arise. As our directors and executive officer (in the case of Mr. Lu), they have a duty of loyalty and care to us under U.S. and Cayman Islands law when there are any potential conflicts of interests between our company and Xi’an Tianxing. We cannot assure you, however, that when conflicts of interest arise, every one of them will act completely in our interests or that conflicts of interests will be resolved in our favor. For example, they may determine that it is in Xi’an Tianxing’s interests to sever the contractual arrangements with Sida, irrespective of the effect such action may have on us. In addition, any one of them could violate his or her legal duties by diverting business opportunities from us to others, thereby affecting the amount of payment Xi’an Tianxing is obligated to remit to us under the consulting services agreement.

Our board of directors is comprised of a majority of independent directors. These independent directors may be in a position to deter and counteract the actions of our officers or non-independent directors that are against our interests, as the independent directors do not have any position with, or interests in, our affiliate entities, and should therefore not have any conflicts of interests such as those potentially of our officers and directors who are management members of Xi’an Tianxing. Additionally, the independent directors have fiduciary duties to act in our best interests, and failure on their part to do so may subject them to personal liabilities for breach of such duties. We cannot, however, give any assurance as to how the independent directors will act. Further, if we or the independent directors cannot resolve any conflicts of interest between us and those of our officers and directors who are management members of Xi’an Tianxing, we would have to rely on legal proceedings, which could result in the disruption of our business.

| 15 |

In the event that you believe that your rights have been infringed under the securities laws or otherwise as a result of any one of the circumstances described above, it may be difficult or impossible for you to bring an action against Xi’an Tianxing or our officers or directors who are members of its management, the majority of whom reside within China. Even if you are successful in bringing an action, the laws of China may render you unable to enforce a judgment against the assets of Xi’an Tianxing and its management, all of which are located in China.

Risks Related to Doing Business in China

Adverse changes in economic and political policies of the Chinese government could have a material adverse effect on the overall economic growth of China, which could adversely affect our business.

Substantially all of our business operations are conducted in China. Accordingly, our results of operations, financial condition and prospects are subject to a significant degree to economic, political and legal developments in China. China’s economy differs from the economies of most developed countries in many respects, including with respect to the amount of government involvement, level of development, growth rate, control of foreign exchange and allocation of resources. While the Chinese economy has experienced significant growth in the past 20 years, growth has been uneven across different regions and among various economic sectors of China. The Chinese government has implemented various measures to encourage economic development and guide the allocation of resources. Some of these measures benefit the overall Chinese economy, but may also have a negative effect on us. For example, our financial condition and results of operations may be adversely affected by government control over capital investments or changes in tax regulations that are applicable to us. Since early 2004, the Chinese government has implemented certain measures to control the pace of economic growth. Such measures may cause a decrease in the level of economic activity in China, which in turn could adversely affect our results of operations and financial condition.

If Chinese law were to phase out the preferential tax benefits currently being extended to foreign invested enterprises and “new or high-technology enterprises” located in a high-tech zone, we would have to pay more taxes, which could have a material and adverse effect on our financial condition and results of operations.

Under Chinese laws and regulations, a foreign invested enterprise may enjoy preferential tax benefits if it is registered in a high-tech zone and also qualifies as “new or high-technology enterprise”. As a foreign invested enterprise as well as a certified “new or high-technology enterprise” located in a high-tech zone in Xian, Xi’an Tianxing has been approved as a new technology enterprise for a period of three years until October 2015 and thus under Chinese Income Tax Laws, it is entitled to a preferential tax rate of 15%. If the Chinese law were to phase out preferential tax benefits currently granted to “new or high-technology enterprises” and technology consulting services, we would be subject to the standard statutory tax rate, which currently is 25%, and we would be unable to obtain business tax refunds for our provision of technology consulting services. Loss of these preferential tax treatments could have a material and adverse effect on our financial condition and results of operations.