Table of Contents

| REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered | ||

Ordinary Shares* |

| * | Not for trading, but only in connection with the registration of American Depositary Shares. |

| U.S. GAAP ☐ |

by the International Accounting Standards Board ☒ |

Other ☐ |

1 |

||||||

1 |

||||||

| Item 1. |

1 |

|||||

| Item 2. |

1 |

|||||

| Item 3. |

1 |

|||||

| Item 4. |

11 |

|||||

| Item 4A. |

21 |

|||||

| Item 5. |

21 |

|||||

| Item 6. |

25 |

|||||

| Item 7. |

34 |

|||||

| Item 8. |

35 |

|||||

| Item 9. |

35 |

|||||

| Item 10. |

35 |

|||||

| Item 11. |

46 |

|||||

| Item 12. |

47 |

|||||

48 |

||||||

| Item 13. |

48 |

|||||

| Item 14. |

48 |

|||||

| Item 15. |

48 |

|||||

| Item 16. |

48 |

|||||

| Item 16A. |

48 |

|||||

| Item 16B. |

49 |

|||||

| Item 16C. |

49 |

|||||

| Item 16D. |

49 |

|||||

| Item 16E. |

49 |

|||||

| Item 16F. |

49 |

|||||

| Item 16G. |

50 |

|||||

| Item 16H. |

51 |

|||||

51 |

||||||

| Item 17. |

51 |

|||||

| Item 18. |

51 |

|||||

| Item 19. |

51 |

|||||

Item 1. |

Identity of Directors, Senior Management and Advisors |

Item 2. |

Offer Statistics and Expected Timetable |

Item 3. |

Key Information |

| • | continue our research and clinical development of our product candidates; |

| • | expand the scope of our current clinical studies for our product candidates or initiate additional clinical or other studies for product candidates; |

| • | seek regulatory and marketing approvals for any of our product candidates that successfully complete clinical trials; |

| • | further develop the manufacturing process for our product candidates; |

| • | change or add additional manufacturers or suppliers; |

| • | seek to identify and validate additional product candidates; |

| • | acquire or in-license other product candidates and technologies; |

| • | maintain, protect and expand our intellectual property portfolio; |

| • | create additional infrastructure to support our operations as a public company in the United States and our product development and future commercialization efforts; and |

| • | experience any delays or encounter issues with any of the above. |

| • | successfully initiating and completing clinical trials of our product candidates; |

| • | obtaining regulatory and marketing approvals for product candidates for which we complete clinical trials; |

| • | maintaining, protecting and expanding our intellectual property portfolio, and avoiding infringing on intellectual property of third parties; |

| • | establishing and maintaining successful licenses, collaborations and alliances with third parties; |

| • | developing a sustainable, scalable, reproducible and transferable manufacturing process for our product candidates; |

| • | establishing and maintaining supply and manufacturing relationships with third parties that can provide products and services adequate, in amount and quality, to support clinical development and commercialization of our product candidates, if approved; |

| • | launching and commercializing any product candidates for which we obtain regulatory and marketing approval, either by collaborating with a partner or, if launched independently, by establishing a sales, marketing and distribution infrastructure; |

| • | obtaining market acceptance of any product candidates that receive regulatory approval as viable treatment options; |

| • | obtaining favorable coverage and reimbursement rates for our products from third-party payers; |

| • | addressing any competing technological and market developments; |

| • | identifying and validating new product candidates; and |

| • | negotiating favorable terms in any collaboration, licensing or other arrangements into which we may enter. |

| • | impairment of our business reputation; |

| • | withdrawal of clinical trial participants; |

| • | costs due to related litigation; |

| • | distraction of management’s attention from our primary business; |

| • | substantial monetary awards to patients or other claimants; |

| • | the inability to commercialize our product candidates; |

| • | decreased demand for our product candidates, if approved for commercial sale; and |

| • | increased cost, or impairment of our ability, to obtain or maintain product liability insurance coverage. |

| • | advancements in the treatment of cancer that make our treatments obsolete; |

| • | market exclusivity and competitor products; |

| • | timing of market introduction of the Company’s drugs and competitive drugs; |

| • | actual and perceived efficacy and safety of the Company’s drug candidates; |

| • | prevalence and severity of any side effects; |

| • | potential or perceived advantages or disadvantages over alternative treatments; |

| • | strength of sales, marketing and distribution support; |

| • | price of future products, both in absolute terms and relative to alternative treatments; |

| • | the effect of current and future healthcare laws on the Company’s drug candidates; and |

| • | availability of coverage and reimbursement from government and other third-party payers. |

| • | unacceptable toxicity findings in animals and humans; |

| • | lack of efficacy in human trials at Phase II stage or beyond; |

| • | announcements of technological innovations by the Company and its competitors; |

| • | new products introduced or announced by the Company or its competitors; |

| • | changes in financial estimates by securities analysts; |

| • | actual or anticipated variations in operating results; |

| • | expiration or termination of licenses, research contracts or other collaboration agreements; |

| • | conditions or trends in the regulatory climate in the biotechnology, pharmaceutical and genomics industries; |

| • | changes in the market values of similar companies; |

| • | the liquidity of any market for the Company’s securities; and |

| • | additional sales by the Company of its shares. |

Item 4. |

Information on the Company |

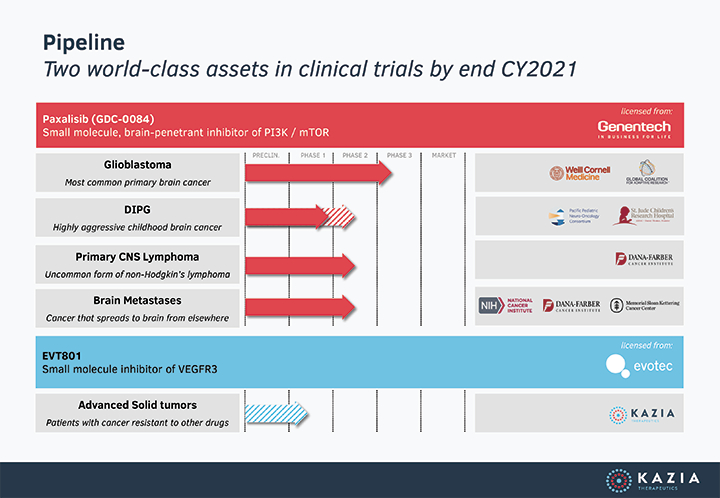

| • | a Kazia-sponsored phase II clinical trial to examine paxalisib in newly diagnosed glioblastoma, the most common and most aggressive form of primary brain tumor in adults; |

| • | a phase II / III adaptive registrational study in glioblastoma, sponsored by the Global Coalition for Adaptive Research; |

| • | a phase I clinical trial being conducted by St Jude Children’s Hospital, examining paxalisib in diffuse intrinsic pontine glioma (DIPG), a rare but very aggressive form of childhood brain cancer; |

| • | a phase II study being conducted at Dana-Farber Cancer Institute, examining HER2+ breast cancer brain metastases – breast cancer which has spread to the brain – in combination with Herceptin (trastuzumab); |

| • | an NCI funded multi-drug study of brain metastases – cancer which has spread to the brain from any primary tumor. This study is a phase II trial and is being conducted by the Alliance for Clinical Trials in Oncology; |

| • | Memorial Sloan Kettering Cancer Center is investigating the potential use of paxalisib in combination with radiotherapy in a phase I clinical trial for cancer which has spread to the brain; |

| • | A phase II clinical trial is being conducted by Weill Cornell Cancer Centre to examine the impact of a ketogenic diet on the use of paxalisib in glioblastoma; |

| • | Dana-Farber Cancer Institute is conducting a phase II trial examining paxalisib in primary CNS lymphoma; |

| • | Pacific Pediatric Neuro-Oncology Consortium is examining paxalisib in DIPG and DMGs (childhood brain cancer) in a phase II study; and |

| • | A human ‘ADME’ study (also called a ‘mass-balance’ study), which is designed to better understand the elimination of paxalisib from the body, and which is required for eventual product approval. |

| • | Final results will be reported from the phase II clinical trial of paxalisib in glioblastoma; |

| • | Interim results will be reported from the phase II clinical trial of paxalisib in combination with trastuzumab in breast cancer metastases; |

| • | Interim results will be reported from the phase II genomically-guided study of paxalisib in brain metastases; |

| • | Interim results will be reported from the phase I study of paxalisib in combination with radiotherapy in brain metastases; |

| • | Final data will be reported from the phase I study of paxalisib in children with diffuse intrinsic pontine glioma (DIPG); |

| • | The phase II study of paxalisib in combination with a ketogenic diet in glioblastoma will commence recruitment; |

| • | The phase II study of paxalisib in combination with ONC-201 in DIPG and DMGs will commence recruitment; and |

| • | The phase I study of EVT801 in patients with advanced solid tumours will commence recruitment. |

| • | pre-clinical laboratory evaluations, including formulation and stability testing, and animal tests performed under the FDA’s Good Laboratory Practices regulations to assess pharmacological activity and toxicity potential; |

| • | submission and approval of an IND Application, including results of pre-clinical studies, clinical experience, manufacturing information, and protocols for clinical tests, which must become effective before clinical trials may begin in the United States; |

| • | obtaining approval of Institutional Review Boards (“IRBs”), to administer the products to human subjects in clinical trials; |

| • | adequate and well-controlled human clinical trials to establish the safety and efficacy of the product for the product’s intended use; |

| • | development of manufacturing processes which conform to FDA current Good Manufacturing Practices (“cGMPs”), as confirmed by FDA inspection; |

| • | submission of results for pre-clinical and clinical studies, and chemistry, manufacture and control information on the product to the FDA in a New Drug Approval (“NDA”) Application; and |

| • | FDA review and approval of an NDA, prior to any commercial sale, promotion or shipment of a product. |

| • | Phase I: |

| • | Phase II: |

| • | Phase III: |

| Name |

Country of incorporation | |

| Kazia Laboratories Pty Ltd | Australia | |

| Kazia Research Pty Ltd | Australia | |

| Kazia Therapeutics Inc. | United States (Delaware) | |

| Glioblast Pty Ltd Kazia Therapeutics (Hong Kong) Limited |

Australia Hong Kong | |

Item 4A. |

Unresolved Staff Comments |

Item 5. |

Operating and Financial Review and Prospects |

For the fiscal year ended June 30, |

||||||||||||

2021 |

2020 |

2019 |

||||||||||

A$’000 |

A$’000 |

A$’000 |

||||||||||

| Revenue |

15,183 | — | — | |||||||||

| Finance income |

42 | 66 | 100 | |||||||||

| Other income: |

||||||||||||

| Net foreign exchange gain |

— | 5 | — | |||||||||

| Payroll tax rebate |

2 | 2 | — | |||||||||

| Reimbursement of expenses |

— | — | 25 | |||||||||

| Research and development rebate |

— | 968 | 1,431 | |||||||||

| Subsidies and grants |

— | 20 | 9 | |||||||||

| |

|

|

|

|

|

|||||||

| Total revenue and other income |

15,227 | 1,061 | 1,565 | |||||||||

| |

|

|

|

|

|

|||||||

(in A$ thousands) |

2021 |

2020 |

2019 |

|||||||||

| Net cash used in operating activities |

(9,110 | ) | (8,809 | ) | (6,714 | ) | ||||||

| Net cash from investing activities |

— | — | 2,359 | |||||||||

| Net cash from financing activities |

28,108 | 12,139 | 3,815 | |||||||||

| • | In October 2018 the Company issued 8,900,001 shares to industry funds and other investors and raised A$3,382,000 before costs. |

| • | In November 2018, the Company issued 2,820,824 shares in relation to a milestone associated with the acquisition of Glioblast Pty Limited. |

| • | In November 2018 the Company issued 2,036,227 shares to qualifying existing shareholders under the Company’s Share Purchase Plan, raising funds of A$773,760 before costs. |

| • | In November 2019, the Company issued 10,000,000 shares to industry funds and other investors and raised A$4,000,000 before costs. |

| • | In April 2020, the Company issued 18,041,667 shares to industry funds and other investors and raised A$7,216,667 before costs. |

| • | In May 2020 the Company issued 4,390,010 shares to qualifying existing shareholders under the Company’s Share Purchase Plan, raising funds of A$1,756,004 before costs. |

| • | In October 2020 the Company issued 31,542,895 shares to industry funds and other investors and raised A$25,234,316 before costs. |

| • | In April 2021 the Company issued 3,037,580 shares to a partner pharmaceutical company for the sum of US$4,000,000. |

| • | In May 2021 the Company issued 2,391,865 shares in satisfaction of a milestone payment relating to the acquisition of paxalisib. |

| • | In August 2020 and March 2021, the Company issued a total of 441,500 shares upon the exercise of options, raising a total of A$273,287. |

| • | expenses incurred under agreements with academic research centres, clinical research organizations and investigative sites that conduct our clinical trials; and |

| • | the cost of acquiring, developing, and manufacturing clinical trial materials. |

| • | the scope, rate of progress, and expense of our ongoing as well as any additional clinical trials and other research and development activities; |

| • | the countries in which trials are conducted; |

| • | future clinical trial results; |

| • | uncertainties in clinical trial enrolment rates or drop-out or discontinuation rates of patients; |

| • | potential additional safety monitoring or other studies requested by regulatory agencies; |

| • | significant and changing government regulation; and |

| • | the timing and receipt of any regulatory approvals. |

| • | While we anticipate that funds will continue to be spent on research and development of our drug candidates, the amounts expended in recent years may not be indicative of the amounts to be expended in future years, because we may have more or fewer drug candidates, they may be at different stages of their lifecycle and the trials deemed suitable for their development may be more or less costly; |

| • | While we generated revenue from licensing transactions in fiscal 2021, Kazia may not generate any revenue in future years, and if it does, the amounts generated in fiscal 2021 may not be representative of any such revenues in future years. This could be as a result of whether any further licensing transactions are entered into, as well as whether any milestones are met in relation to license agreements already in place; |

| • | The quantum of general and administrative expenditure in recent years may not be indicative of the expenditure required in future years; |

Item 6. |

Directors, Senior Management and Employees |

| Iain Ross | Chairman, Non-Executive Director | |

| Bryce Carmine | Non-Executive Director | |

| Steven Coffey | Non-Executive Director | |

| James Garner | Managing Director and Chief Executive Officer | |

| Kate Hill | Company Secretary | |

| Gabrielle Heaton | Director of Finance and Administration |

| Name: | Iain Ross | |

| Title: | Chairman, Non-Executive Director | |

| Experience and expertise: | Iain, based in the UK, is an experienced Director and has served on a number of Australian company boards. He is Chairman of Silence Therapeutics plc (LSE & NASDAQ:SLN), ReNeuron Group plc (LSE:RENE) and BiVitctriX Therapeutics plc (LSE:BVX) as well as unlisted Biomer Technology Limited. He is also a non-executive director of Palla Pharma Limited (ASX:PAL). In his career he has held senior positions in Sandoz AG, Fisons Plc, Hoffmann-La Roche AG and Celltech Group Plc and also undertaken a number of start-ups and turnarounds on behalf of banks and private equity groups. His track record includes multiple financing transactions having raised in excess of £400 million, both publicly and privately, as well as extensive experience of divestments and strategic restructurings and has over 25 years in cross-border management as a Chairman and CEO. He has led and participated in 8 Initial Public Offerings,(5 LSE, 1 ASX, 2 NASDAQ) and has direct experience of mergers and acquisitions transactions in Europe, USA and the Pacific Rim. | |

| Other current directorships: | Silence Therapeutics plc (LSE:SLN), ReNeuron Group plc (LSE:RENE), Palla Pharma Limited (ASX:PAL) and BiVictriX Therapeutics plc (LSE:BVX) | |

| Special responsibilities: | Member of Remuneration and Nomination Committee, Member of the Audit, Risk and Governance Committee. |

| Name: | Bryce Carmine | |

| Title: | Non-Executive Director | |

| Experience and expertise: | Bryce spent 36 years working for Eli Lilly & Co. and retired as Executive Vice President for Eli Lilly & Co, and President, Lilly Bio-Medicines. Prior to this he led the Global Pharmaceutical Sales and Marketing and was a member of the Company’s Executive Committee. Bryce previously held a series of product development portfolio leadership roles culminating when he was named President, Global Pharmaceutical Product Development, with responsibility for the entire late-phase pipeline development across all therapeutic areas for Eli Lilly. During his career with Lilly, Bryce held several country leadership positions including President Eli Lilly Japan, Managing Dir. Australia/NZ & General Manager of a JV for Lilly in Seoul, Korea. Bryce is currently Chairman and CEO of HaemaLogiX Pty Ltd, a Sydney based privately owned biotech. | |

| Other current directorships: | None | |

| Special responsibilities: | Chair of Remuneration and Nomination Committee, member of Audit, Risk and Governance Committee. | |

| Name: | Steven Coffey | |

| Title: | Non-Executive Director | |

| Experience and expertise: | Steven is a Chartered Accountant and registered company auditor and has over 35 years experience in the accounting and finance industry. He has been a partner in the chartered accounting firm Watkins Coffey Martin since 1993. Steven sits on the board of a number of large private family companies and audits a number of large private companies and not-for-profit | |

| Other current directorships: | none | |

| Special responsibilities: | Chair of Audit, Risk and Governance Committee, member of Remuneration and Nomination Committee. | |

| Name: | Dr. James Garner | |

| Title: | Managing Director and Chief Executive Officer | |

| Experience and expertise: | Dr Garner is an experienced life sciences executive who has previously worked with companies ranging from small biotechs to multinational pharmaceutical companies such as Biogen and Takeda. His career has focused on regional and global development of new medicines from preclinical to commercialisation. Dr Garner is a physician by training and holds an MBA from the University of Queensland. He began his career in hospital medicine and worked for a number of years as a corporate strategy consultant with Bain & Company before entering the pharmaceutical industry. Prior to joining Kazia in 2016, he led R&D strategy for Sanofi in Asia-Pacific and was based in Singapore. | |

| Other current directorships: | None | |

| Special responsibilities: | None | |

| Name: | Kate Hill | |

| Title: | Company Secretary | |

| Experience and expertise: | Kate has over 20 years’ experience as an audit partner with Deloitte Touche Tohmatsu, working with ASX listed and privately-owned clients. She has worked extensively in regulated environments including assisting with Initial Public Offerings, capital raising and general compliance, as well as operating in an audit environment. She is a Non-Executive Director of CountPlus Limited (ASX:CUP) and Elmo Software Limited (ASX:ELO) as well as Chair of the Audit and Risk Committee for both of these companies. She is also Chair of Seeing Machines Limited (LSE:SEE). Kate is a member of the Institute of Chartered Accountants in Australia and New Zealand, and a graduate of the Australian Institute of Company Directors. | |

| Name: | Gabrielle Heaton | |

| Title: | Director of Finance and Administration | |

| Experience and expertise: | Gabrielle Heaton has over 30 years of commercial experience in media, property services and healthcare for multinational, ASX listed and overseas companies. She has held a number of senior Finance positions including CFO, Quality Auditor and been responsible for Human Resources and IT. Gabrielle has a Bachelor of Business from the University of Technology and is a member of CPA Australia. | |

| • | fixed remuneration |

| • | short-term performance incentives - cash bonus |

| • | share-based payments - award of options through the ESOP |

| • | Iain Ross - Non-Executive Director, Chairman |

| • | Bryce Carmine - Non-Executive Director |

| • | Steven Coffey - Non-Executive Director |

| • | Dr James Garner - Managing Director, CEO |

| • | Gabrielle Heaton - Director of Finance and Administration |

| • | Kate Hill - Company Secretary |

| Short-term benefits |

Short-term benefits |

Post- employment benefits |

Share-based payments |

|||||||||||||||||||||

| Movements in accrued leave |

||||||||||||||||||||||||

| Cash salary | Cash | Non- | Super- | Equity- | ||||||||||||||||||||

| and fees | Bonus | monetary | annuation | settled options | Total | |||||||||||||||||||

| 2021 | A$ | A$ | A$ | A$ | A$ | A$ | ||||||||||||||||||

| Non-Executive Directors: |

||||||||||||||||||||||||

| I Ross* |

147,436 | 20,000 | — | — | 119,067 | 286,503 | ||||||||||||||||||

| B Carmine |

82,500 | 22,500 | — | 9,975 | 119,067 | 234,042 | ||||||||||||||||||

| S Coffey |

82,500 | 22,500 | — | 9,975 | 119,067 | 234,042 | ||||||||||||||||||

| Executive Directors: |

||||||||||||||||||||||||

| J Garner |

503,000 | 240,000 | 90,400 | 70,585 | 228,651 | 1,132,636 | ||||||||||||||||||

| Other Key Management Personnel: |

||||||||||||||||||||||||

| G Heaton |

204,000 | 25,000 | (241 | ) | 21,755 | 15,069 | 265,583 | |||||||||||||||||

| K Hill |

108,525 | 26,400 | — | — | 15,677 | 155,701 | ||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| 1,127,961 | 356,400 | 90,159 | 112,290 | 616,598 | 2,303,408 | |||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| * | Salary paid in UK pounds, but disclosed in Australian dollars using an annual average rate of 0.5562 |

| Name: Title: Agreement commenced: Term of agreement: Details: |

James Garner Chief Executive Officer, Managing Director February 1, 2016 Full-time employment Base salary to be reviewed annually by the Remuneration and Nomination Committee. James’s appointment with Kazia may be terminated with Kazia giving 6 months’ notice or by James giving 6 months’ notice. Kazia may elect to pay James equal amount to that proportion of his salary equivalent 6 months’ pay in lieu of notice, together with any outstanding entitlements due to him. | |

| The current base salary, as from January 1, 2021, is A$510,000 including an allowance for health benefits. | ||

| Name: Title: Agreement commenced: Term of agreement: Details: |

Gabrielle Heaton Director of Finance and Administration March 13, 2017 Full time employment Base salary to be reviewed annually by the Remuneration and Nomination Committee. Gabrielle’s appointment with Kazia may be terminated with Kazia giving 4 weeks’ notice or by Gabrielle giving 4 weeks’ notice. Kazia may elect to pay Gabrielle equal amount to that proportion of her salary equivalent 4 weeks’ pay in lieu of notice, together with any outstanding entitlements due to her. | |

| The current base salary, from January 1, 2021, is A$208,000. | ||

| Name: Title: Agreement commenced: Term of agreement: Details: |

Kate Hill Company Secretary September 9, 2016 Part-time contractor Base remuneration is based on time worked. Daily rate to be reviewed annually by the Remuneration and Nomination Committee, with monthly rate of A$11,900 for a two-day week, applied from January 1, 2021. The contract is open ended. Kate’s appointment with Kazia may be terminated with Kazia giving 60 days’ notice or by Kate giving 60 days’ notice. | |

| Grant date | No of options |

Vesting date | Expiry date | Exercise price $ |

Fair value at grant date $ |

|||||||||||||||

| 09/11/2020 | 200,000 | 13/01/2021 | 13/01/2025 | $ | 0.881 | $ | 0.450 | |||||||||||||

| 09/11/2020 | 200,000 | 13/01/2022 | 13/01/2025 | $ | 0.881 | $ | 0.490 | |||||||||||||

| 09/11/2020 | 200,000 | 13/01/2023 | 13/01/2025 | $ | 0.881 | $ | 0.520 | |||||||||||||

| 09/11/2020 | 200,000 | 13/01/2024 | 13/01/2025 | $ | 0.881 | $ | 0.550 | |||||||||||||

| 09/11/2020 | 300,000 | 01/01/2021 | 09/11/2024 | $ | 1.132 | $ | 0.379 | |||||||||||||

| 09/11/2020 | 300,000 | 01/07/2021 | 09/11/2024 | $ | 1.132 | $ | 0.403 | |||||||||||||

| 09/11/2020 | 300,000 | 01/01/2022 | 09/11/2024 | $ | 1.132 | $ | 0.425 | |||||||||||||

| 09/11/2020 | 300,000 | 01/07/2022 | 09/11/2024 | $ | 1.132 | $ | 0.446 | |||||||||||||

| 04/01/2021 | 25,000 | 04/01/2022 | 04/01/2025 | $ | 1.690 | $ | 0.520 | |||||||||||||

| 04/01/2021 | 25,000 | 04/01/2023 | 04/01/2025 | $ | 1.690 | $ | 0.576 | |||||||||||||

| 04/01/2021 | 25,000 | 04/01/2024 | 04/01/2025 | $ | 1.690 | $ | 0.627 | |||||||||||||

| 04/01/2021 | 25,000 | 04/01/2025 | 04/01/2025 | $ | 1.690 | $ | 0.671 | |||||||||||||

| |

|

|||||||||||||||||||

| 2,100,000 | ||||||||||||||||||||

| |

|

|||||||||||||||||||

| • | representing and serving the interests of shareholders by overseeing and appraising the strategies, policies and performance of the Company. This includes overviewing the financial and human resources the Company has in place to meet its objectives and the review of management performance; |

| • | protecting and optimising Company performance and building sustainable value for shareholders in accordance with any duties and obligations imposed on the Board by law and the Company’s Constitution and within a framework of prudent and effective controls that enable risk to be assessed and managed; |

| • | responsible for the overall Corporate Governance of Kazia Therapeutics Limited and its subsidiaries, including monitoring the strategic direction of the Company and those entities, formulating goals for management and monitoring the achievement of those goals; |

| • | setting, reviewing and ensuring compliance with the Company’s values (including the establishment and observance of high ethical standards); and |

| • | ensuring shareholders are kept informed of the Company’s performance and major developments affecting its state of affairs. |

| • | selecting, appointing and evaluating from time to time the performance of, determining the remuneration of, and planning for the successor of, the CEO; |

| • | reviewing procedures in place for appointment of senior management and monitoring of its performance, and for succession planning. This includes ratifying the appointment and the removal of the Company Secretary; |

| • | overseeing the Company, including its control and accountability systems; |

| • | input into and final approval of management development of corporate strategy, including setting performance objectives and approving operating budgets; |

| • | reviewing and guiding systems of risk management and internal control and ethical and legal compliance. This includes reviewing procedures in place to identify the main risks associated with the Company’s businesses and the implementation of appropriate systems to manage these risks; |

| • | overseeing and monitoring compliance with the Code of Conduct and other corporate governance policies; |

| • | monitoring corporate performance and implementation of strategy and policy; |

| • | approving major capital expenditure, acquisitions and divestitures, and monitoring capital management; |

| • | monitoring and reviewing management processes in place aimed at ensuring the integrity of financial and other reporting; |

| • | monitoring and reviewing policies and processes in place relating to occupational health and safety, compliance with laws, and the maintenance of high ethical standards; and |

| • | performing such other functions as are prescribed by law or are assigned to the Board. |

| • | appointment of a Chair; |

| • | appointment and removal of the CEO; |

| • | appointment of directors to fill a vacancy or as additional directors; |

| • | establishment of Board committees, their membership and delegated authorities; |

| • | approval of dividends; |

| • | development and review of corporate governance principles and policies; |

| • | approval of major capital expenditure, acquisitions and divestitures in excess of authority levels delegated to management; |

| • | calling of meetings of shareholders; and |

| • | any other specific matters nominated by the Board from time to time. |

Name |

Position |

Year First Appointed |

Current term expires | |||

| Bryce Carmine |

Non-executive Director |

2015 | Nov-23 | |||

| Iain Ross |

Non-executive Director,Chairman |

2014 | Nov-21 | |||

| Steven Coffey |

Non-executive Director |

2012 | Nov-22 | |||

| James Garner |

Managing Director, CEO | 2016 | N/A* | |||

| * | The managing director is exempt from standing for re-election under the Company’s constitution and Australian corporate law. |

| • | the selection, nomination and appointment processes for directors; and |

| • | the remuneration of key management personnel and directors. |

| • | each Committee of the Board will also be required to provide feedback in terms of a review of its own performance; |

| • | feedback will be collected by the chair of the Board, or an external facilitator, and discussed by the Board, with consideration being given as to whether any steps should be taken to improve performance of the Board or its Committees; |

| • | the Chief Executive Officer will also provide feedback from senior management in connection with any issues that may be relevant in the context of Board performance review; and |

| • | where appropriate to facilitate the review process, assistance may be obtained from third party advisors. |

| • | retention and motivation of key executives; |

| • | attraction of high-quality management to the Company and Company; and |

| • | performance incentives that allow executives to share in the success of Kazia Therapeutics Limited. |

Category of Activity |

2021 |

2020 |

2019 |

|||||||||

| Research and Development |

4.6 | 3.6 | 3.6 | |||||||||

| Finance and Administration |

1.7 | 1.7 | 1.7 | |||||||||

| |

|

|

|

|

|

|||||||

| Total |

6.3 |

5.3 |

5.3 |

|||||||||

| |

|

|

|

|

|

|||||||

Geographic Location |

2021 |

2020 |

2019 |

|||||||||

| Australia |

5.3 | 5.3 | 5.3 | |||||||||

| United States |

1 | 0 | 0 | |||||||||

| |

|

|

|

|

|

|||||||

| Total |

6.3 |

5.3 |

5.3 |

|||||||||

| |

|

|

|

|

|

|||||||

Balance at start of year |

Received as part of rem |

Additions |

Disposals |

Balance at end of year |

||||||||||||||||

| Ordinary shares |

||||||||||||||||||||

| B Carmine* |

266,293 | — | 106,400 | — | 372,693 | |||||||||||||||

| S Coffey* |

326,474 | — | 107,791 | — | 434,265 | |||||||||||||||

| J Garner* |

275,000 | — | 155,000 | — | 430,000 | |||||||||||||||

| I Ross* |

800,001 | — | 200,000 | — | 1,000,001 | |||||||||||||||

| K Hill* |

30,000 | — | 265,000 | — | 295,000 | |||||||||||||||

| G Heaton* |

10,000 | — | 103,168 | — | 113,168 | |||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| Total |

1,707,768 | — | 937,359 | — | 2,645,127 | |||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| * | Each Director and Key Management Personnel owns less than 1% of shareholding. |

Balance at the start of the year |

Granted as remuneration |

Expired |

Exercised |

Balance at the end of the year |

||||||||||||||||

| Options over ordinary shares |

||||||||||||||||||||

| J Garner* |

1,200,000 | 800,000 | — | — | 2,000,000 | |||||||||||||||

| K Hill* |

320,000 | 50,000 | — | (245,000 | ) | 125,000 | ||||||||||||||

| G Heaton* |

242,000 | 50,000 | — | (96,500 | ) | 195,500 | ||||||||||||||

| Iain Ross* |

— | 400,000 | — | — | 400,000 | |||||||||||||||

| Bryce Carmine* |

— | 400,000 | — | — | 400,000 | |||||||||||||||

| Steven Coffey* |

— | 400,000 | — | — | 400,000 | |||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| 1,762,000 | 2,100,000 | — | (341,500 | ) | 3,520,500 | |||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| * | Options issued under the Employee Share Option Plan. Unvested options are forfeited upon cessation of employment with the Company. |

Item 7. |

Major Shareholders and Related Party Transactions |

Ordinary shares beneficially owned |

||||||||||||||||||||||||

| 5% or greater shareholders |

September 30, 2021 |

August 14, 2020 |

August 31, 2019 |

|||||||||||||||||||||

Number |

% |

Number |

% |

Number |

% |

|||||||||||||||||||

| Hishenk Pty Limited and associated entities |

18,715,000 | 14.44 | % | 18,570,000 | 16.1 | % | 11,108,792 | 17.9 | % | |||||||||||||||

| Platinum International Healthcare Fund |

7,084,856 | 5.47 | % | 11,356,760 | 9.9 | % | 6,578,948 | 10.6 | % | |||||||||||||||

| Quest Asset Partners Pty Ltd |

11,101,710 | 8.4 | % | 7,215,790 | 6.3 | % | — | 0.0 | % | |||||||||||||||

Item 8. |

Financial Information |

Item 9. |

The Offer and Listing |

Item 10. |

Additional Information |

| • | a special resolution passed at a meeting of members holding shares in that class; or |

| • | the written consent of members with at least 75% of the shares in that class. |

| • | by a foreign person (as defined in the Foreign Takeovers Act) or associated foreign persons that would result in such persons having an interest in 20% or more of the issued shares of, or control of 20% or more of the voting power in, an Australian company; and |

| • | by non-associated foreign persons that would result in such foreign persons having an aggregate interest in 40% or more of the issued shares of, or control of 40% or more of the voting power in, an Australian company, where the Australian company is valued above the monetary threshold prescribed by Foreign Takeovers Act. |

| • | is the holder of the securities or the holder of an ADS over the shares; |

| • | has power to exercise, or control the exercise of, a right to vote attached to the securities; or |

| • | has the power to dispose of, or control the exercise of a power to dispose of, the securities, including any indirect or direct power or control. |

| • | a person has a relevant interest in issued securities; and |

| • | the person has: |

| • | entered or enters into an agreement with another person with respect to the securities; |

| • | given or gives another person an enforceable right, or has been or is given an enforceable right by another person, in relation to the securities (whether the right is enforceable presently or in the future and whether or not on the fulfillment of a condition); or |

| • | granted or grants an option to, or has been or is granted an option by, another person with respect to the securities; and |

| • | the other person would have a relevant interest in the securities if the agreement were performed, the right enforced or the option exercised, |

| • | when the acquisition results from the acceptance of an offer under a formal takeover bid; |

| • | when the acquisition is conducted on market by or on behalf of the bidder during the bid period for a full takeover bid that is unconditional or only conditional on certain ‘prescribed’ matters set out in the Corporations Act, |

| • | when the acquisition has been previously approved by shareholders of Kazia by resolution passed at general meeting; |

| • | an acquisition by a person if, throughout the six months before the acquisition, that person or any other person has had voting power in Kazia of at least 19% and, as a result of the acquisition, none of the relevant persons would have voting power in Kazia more than three percentage points higher than they had six months before the acquisition; |

| • | when the acquisition results from the issue of securities under a pro rata rights issue; |

| • | when the acquisition results from the issue of securities under a dividend reinvestment scheme or bonus share plan; |

| • | when the acquisition results from the issue of securities under certain underwriting arrangements; |

| • | when the acquisition results from the issue of securities through a will or through operation of law; |

| • | an acquisition that arises through the acquisition of a relevant interest in another listed company which is listed on a prescribed financial market or a foreign market approved by ASIC; |

| • | an acquisition arising from an auction of forfeited shares conducted on-market; or |

| • | an acquisition arising through a compromise, arrangement, liquidation or buy-back. |

| • | On August 11, 2016 the Company announced the submission of an IND application. On September 10, 2016, the Company received a letter from the FDA advising the study may proceed. This triggered the conversion of Convertible Notes with a face value of A$500,000 into 20,000,000 ordinary shares. |

| • | on October 31, 2016, the Company announced it had licensed a Phase II ready molecule. This triggered the conversion of Convertible Notes with a face value of A$400,000 into 16,000,000 ordinary shares. |

| • | 75% or more of its gross income for such year is “passive income” which for this purpose generally includes dividends, interest, royalties, rents and gains from commodities and securities transactions and gains from assets that produce passive income; or |

| • | 50% or more of the value of its gross assets (based on an average of the quarterly values of the gross assets) during such year is attributable to assets that produce passive income or are held for the production of passive income. |

Item 11. |

Quantitative and Qualitative Disclosures about Market Risk |

Item 12. |

Description of Securities Other than Equity Securities |

| Persons depositing or withdrawing shares must pay: |

For: | |||

| US$5.00 (or less) per 100 ADSs (or portion of 100 ADSs) | • | Issuance of ADSs, including issuances resulting from a distribution of shares or rights or other property | ||

| • | Cancellation of ADSs for the purpose of withdrawal, including if the deposit agreement terminates | |||

| US$.05 (or less) per ADS | • | Any cash distribution to ADS registered holders | ||

| A fee equivalent to the fee that would be payable if securities distributed to you had been shares and the shares had been deposited for issuance of ADSs | • | Distribution of securities distributed to holders of deposited securities which are distributed by the depositary to ADS registered holders | ||

| US$.05 (or less) per ADSs per calendar year | • | Depositary services | ||

| Registration or transfer fees | • | Transfer and registration of shares on the Company’s share register to or from the name of the depositary or its agent when you deposit or withdraw shares | ||

| Expenses of the depositary | • | Cable, telex and facsimile transmissions (when expressly provided in the deposit agreement) | ||

| • | Converting foreign currency to U.S. dollars | |||

| Taxes and other governmental charges the depositary or the custodian have to pay on any ADS or share underlying an ADS, for example, stock transfer taxes, stamp duty or withholding taxes | • | As necessary | ||

| Any charges incurred by the depositary or its agents for servicing the deposited securities | • | As necessary | ||

Item 13. |

Defaults, Dividend Arrearages and Delinquencies |

Item 14. |

Material Modifications to the Rights of Security Holders and the Use of Proceeds |

Item 15. |

Controls and Procedures |

Item 16. |

[Reserved] |

Item 16A. |

Audit Committee Financial Expert |

Item 16B. |

Code of Ethics |

Item 16C. |

Principal Accounting Fees and Services |

| 2021 A$’000 |

2020 A$’000 |

|||||||

| Audit fees - Grant Thornton Audit Pty Ltd |

151 | 124 | ||||||

| |

|

|

|

|||||

| Total fees |

151 | 124 | ||||||

| |

|

|

|

|||||

Item 16D. |

Exemptions from the Listing Standards for Audit Committees |

Item 16E. |

Purchases of Equity Securities by the Issuer and Affiliated Purchasers |

Item 16F. |

Changes in registrant’s Certifying Accountant |

Item 16G. |

Corporate Governance |

| • | Kazia is exempt from NASDAQ’s requirement that each NASDAQ issuer shall require shareholder approval of a plan or arrangement in connection with the acquisition of the stock or assets of another company if “any director, officer or substantial shareholder of the issuer has a 5 percent or greater interest (or such persons collectively have a 10 percent or greater interest), directly or indirectly, in the company or assets to be acquired or in the consideration to be paid in the transaction or series of related transactions and the present or potential issuance of common stock, or securities convertible into or exercisable for common stock, could result in an increase in outstanding common shares or voting power of 5 percent or more”. Kazia is subject to Chapter 10 of the ASX listing rules, which requires shareholder approval for an acquisition from or disposal to a “related party” (including a director) or “substantial shareholder” (who is entitled to at least 10% of the voting securities) of “substantial assets”. The Australian Corporations Act to which Kazia is also subject generally requires shareholder approval for a transaction with a director or director-controlled entity unless on arm’s length terms. |

| • | Nasdaq requirement under Rule 5620(c) that a quorum consist of holders of 33 1/3% of the outstanding ordinary shares — The ASX Listing Rules do not have an express requirement that each issuer listed on ASX have a quorum of any particular number of the outstanding ordinary shares, but instead allow a listed issuer to establish its own quorum requirements. Our quorum is currently three shareholders. We believe this quorum requirement is consistent with the requirements of the ASX and is appropriate and typical of generally accepted business practices in Australia. |

| • | Nasdaq requirements under Rules 5605(b)(1) and (2) relating to director independence, including the requirements that a majority of the board of directors must be comprised of independent directors and that independent directors must have regularly scheduled meetings at which only independent directors are present — The Nasdaq and ASX definitions of what constitute an independent director are not identical and the requirements relating to the roles and obligations of independent directors are not identical. The ASX, unlike Nasdaq, permits an issuer to establish its own materiality threshold for determining whether a transaction between a director and an issuer affects the director’s status as independent and it does not require that a majority of the issuer’s board of directors be independent, as long as the issuer publicly discloses this fact. In addition, the ASX does not require that the independent directors have regularly scheduled meeting at which only independent directors are present. We believe that our Board composition is consistent with the requirements of the ASX and that it is appropriate and typical of generally accepted business practices in Australia. |

| • | The requirement that our independent directors meet regularly in executive sessions under Nasdaq Listing Rules. The ASX Listing Rules and the Corporations Act do not require the independent directors of an Australian company to have such executive sessions. |

| • | The Nasdaq requirements under Rules 5605(d) and 5605(e) that compensation of an issuer’s officers must be determined, or recommended to the Board for determination, either by a majority of the independent directors, or a compensation committee comprised solely of independent directors, and that director nominees must either be selected, or recommended for the Board’s selection, either by a majority of the independent directors, or a nominations committee comprised solely of independent directors. The Nasdaq compensation committee requirements are not identical to the ASX remuneration and nomination committee requirements. Issuers listed on the ASX are recommended under applicable listing standards to establish a remuneration committee consisting of a majority of independent directors and an independent chairperson, or publicly disclose that it has not done so. Kazia has, and expects to continue to have, a Remuneration and Nomination Committee consisting of three non-executive directors. |

| • | The requirement prescribed by Nasdaq Listing Rules that issuers obtain shareholder approval prior to the issuance of securities in connection with certain acquisitions, private placements of securities, or the establishment or amendment of certain share option, purchase or other compensation plans. Applicable Australian law and the ASX Listing Rules differ from Nasdaq requirements, with the ASX Listing Rules providing generally for prior shareholder approval in numerous circumstances, including (i) issuance of equity securities exceeding 15% (or 25% under certain circumstances) of our issued share capital in any 12-month period (but, in determining the 15% limit, securities issued under an exception to the rule or with shareholder approval are not counted), (ii) issuance of equity securities to related parties (as defined in the ASX Listing Rules) and (iii) issuances of securities to directors or their associates under an employee incentive plan. |

Item 16H. |

Mine Safety Disclosure |

Item 17. |

Financial Statements |

Item 18. |

Financial Statements |

Item 19. |

Exhibits |

| (a) | Exhibits |

| * | Filed herewith |

| ✓ | Certain confidential information in this exhibit was omitted by means of marking such information with brackets (“[***]”) because the identified confidential information is not material and is the type that the registrant treats as private or confidential. |

KAZIA THERAPEUTICS LIMITED |

| /s/ James Garner |

| Dr James Garner |

| Managing Director and Chief Executive Officer |

| Date: October 7, 2021 |

Page |

||||

| Consolidated Financial Statements for June 30, 2021, 2020 and 2019 and the years then ended: |

||||

F-2 |

||||

F-3 |

||||

F-5 |

||||

F-6 |

||||

F-8 |

||||

F-9 |

||||

| • | the Licensing Agreement which grants the Company the right to develop the paxalisib molecule; and |

| • | the Licensing Agreement which grants the Company the right to develop the EVT801 molecule. |

| • | obtaining an understanding of and evaluating management’s process and controls related to the assessment of the existence of impairment indicators; |

| • | testing management’s assessment of the existence of any impairment indicators, including making enquiries of management’s experts; |

| • | considering each of the internal and external factors outlined by IAS 136 and assessing whether any indicators of impairment are present; |

| • | testing management’s assessment of the potential impact of COVID-19 on the performance of the assets; and |

| • | evaluating the adequacy of the relevant disclosures in the financial statements. |

| • | obtaining and testing the license agreement to understand the terms and conditions of the transaction; |

| • | testing management’s assessment of the proposed accounting treatment of the transaction; |

| • | agreeing key terms of agreements utilised in management’s assessment; |

| • | testing key assumptions made by management in its assessment of accounting treatment; |

| • | evaluating management’s method of amortisation; |

| • | making enquiries of management’s experts; and |

| • | evaluating the adequacy of the relevant disclosures within the financial statements. |

| • | On 1 March 2021, the Company entered into an exclusive worldwide license agreement with Oasmia Pharmaceutical AB (Oasmia), granting Oasmia the worldwide rights to develop and commercialise Cantrixil; and |

| • | On 29 March 2021 the Company entered into a licensing agreement with Simcere Pharmaceutical Group Ltd (Simcere), granting Simcere the rights to develop and commercialise Paxalisib, in the Greater China territory. |

| • | obtaining copies of the license agreements to understand the terms and conditions of the transactions; |

| • | evaluating management’s accounting papers documenting the accounting treatments, including in relation to the applicability of IFRS 15; |

| • | agreeing key terms of agreements utilised in management’s assessment; |

| • | testing key assumptions made by management in its assessment of accounting treatments; |

| • | making enquiries of management’s experts; and |

| • | evaluating the adequacy of the relevant disclosures within the financial statements. |

Note |

2021 A$’000 |

2020 A$’000 |

2019 A$’000 |

|||||||||||||

| Revenue from continuing operations |

5 | — | — | |||||||||||||

| Other income |

6 | |||||||||||||||

| Finance income — bank interest |

||||||||||||||||

| Expenses |

||||||||||||||||

| Research and development expense |

( |

) | ( |

) | ( |

) | ||||||||||

| General and administrative expense |

( |

) | ( |

) | ( |

) | ||||||||||

| Loss on disposal of fixed assets |

— | — | ( |

) | ||||||||||||

| Fair value losses on financial assets at fair value through profit or loss |

( |

) | ( |

) | ||||||||||||

| Loss on revaluation of contingent consideratio n |

( |

) | ( |

) | ( |

) | ||||||||||

| |

|

|

|

|

|

|||||||||||

| Loss before income tax expense from continuing operations |

( |

) | ( |

) | ( |

) | ||||||||||

| Income tax benefit |

8 | |||||||||||||||

| |

|

|

|

|

|

|||||||||||

| Loss after income tax expense for the year |

( |

) | ( |

) | ( |

) | ||||||||||

| Other comprehensive income |

||||||||||||||||

| Items that may be reclassified subsequently to profit or loss |

||||||||||||||||

| Net exchange difference on translation of financial statements of foreign controlled entities, net of tax |

( |

) | ( |

) | ||||||||||||

| |

|

|

|

|

|

|||||||||||

| Other comprehensive income for the year, net of tax |

( |

) | ( |

) | ||||||||||||

| Total comprehensive income for the year |

( |

) |

( |

) |

( |

) | ||||||||||

| Loss for the year is attributable to: |

||||||||||||||||

| Owners of Kazia Therapeutics Limited |

( |

) | ( |

) | ( |

) | ||||||||||

| |

|

|

|

|

|

|||||||||||

| Total loss for the year |

( |

) | ( |

) | ( |

) | ||||||||||

| Total comprehensive income for the year is attributable to: |

||||||||||||||||

| Owners of Kazia Therapeutics Limited |

( |

) | ( |

) | ( |

) | ||||||||||

| |

|

|

|

|

|

|||||||||||

| Total comprehensive income for the year |

( |

) |

( |

) |

( |

) | ||||||||||

| |

|

|

|

|

|

|||||||||||

Note |

2021 |

2020 |

2019 |

|||||||||||||

A$ |

A$ |

A$ |

||||||||||||||

Cents |

Cents |

Cents |

||||||||||||||

| Earnings per share for loss from continuing operations attributable to the owners of Kazia Therapeutics Limited |

||||||||||||||||

| Basic earnings per share |

31 | ( |

) | ( |

) | ( |

) | |||||||||

| Diluted earnings per shar e |

31 | ( |

) | ( |

) | ( |

) | |||||||||

2021 |

2020 |

2019 |

||||||||||||||

A$ |

A$ |

A$ |

||||||||||||||

Cents |

Cents |

Cents |

||||||||||||||

| Earnings per share for loss attributable to the owners of Kazia Therapeutics Limited |

||||||||||||||||

| Basic earnings per share |

31 | ( |

) | ( |

) | ( |

) | |||||||||

| Diluted earnings per share |

31 | ( |

) | ( |

) | ( |

) | |||||||||

Note |

2021 A$’000 |

2020 A$’000 |

||||||||||

| Assets |

||||||||||||

| Current assets |

||||||||||||

| Cash and cash equivalents |

9 | |||||||||||

| Trade and other receivables |

10 | |||||||||||

| Other |

11 | |||||||||||

| |

|

|

|

|||||||||

| Total current assets |

||||||||||||

| |

|

|

|

|||||||||

| Non-current assets |

||||||||||||

| Trade and other receivables |

10 | — | ||||||||||

| Intangibles |

12 | |||||||||||

| |

|

|

|

|||||||||

| Total non-current assets |

||||||||||||

| |

|

|

|

|||||||||

| Total assets |

||||||||||||

| |

|

|

|

|||||||||

| Liabilities |

||||||||||||

| Current liabilities |

||||||||||||

| Trade and other payables |

13 | |||||||||||

| Employee benefits |

14 | |||||||||||

| Contingent consideration |

15 | |||||||||||

| |

|

|

|

|||||||||

| Total current liabilities |

||||||||||||

| |

|

|

|

|||||||||

| Non-Current liabilities |

||||||||||||

| Deferred tax |

16 | |||||||||||

| Employee benefits |

14 | — | ||||||||||

| Contingent consideration |

15 | |||||||||||

| |

|

|

|

|||||||||

| Total non-current liabilities |

||||||||||||

| |

|

|

|

|||||||||

| Total liabilities |

||||||||||||

| |

|

|

|

|||||||||

| Net assets |

||||||||||||

| |

|

|

|

|||||||||

| Equity |

||||||||||||

| Contributed equity |

17 | |||||||||||

| Other contributed equit y |

18 | |||||||||||

| Reserves |

19 | |||||||||||

| Accumulated losses |

( |

) | ( |

) | ||||||||

| |

|

|

|

|||||||||

| Equity attributable to the owners of Kazia Therapeutics Limited |

||||||||||||

| |

|

|

|

|||||||||

| |

|

|

|

|||||||||

| Total equity |

||||||||||||

| |

|

|

|

|||||||||

Contributed equity A$’000 |

Other Contributed equity A$’000 |

Reserves A$’000 |

Accumulated Losses A$’000 |

Non- controlling Interest A$’000 |

Total equity A$’000 |

|||||||||||||||||||

Balance at 1 July 2018 |

( |

) | ||||||||||||||||||||||

Adjustment for change in accounting policy |

( |

) | ||||||||||||||||||||||

Balance at 1 July 2018 – restated |

( |

) | ||||||||||||||||||||||

Loss after income tax expense for the year |

( |

) | ( |

) | ||||||||||||||||||||

Other comprehensive income for the year, net of tax |

( |

) | ( |

) | ||||||||||||||||||||

Total comprehensive income for the year |

( |

) | ( |

) | ( |

) | ||||||||||||||||||

Transactions with owners in their capacity as owners: |

||||||||||||||||||||||||

Share issue costs |

( |

) | ( |

) | ||||||||||||||||||||

Transfers |

||||||||||||||||||||||||

Share based payment |

||||||||||||||||||||||||

Issue of shares |

||||||||||||||||||||||||

Balance at 30 June 2019 |

( |

) | ||||||||||||||||||||||

Contributed equity A$’000 |

Other Contributed equity A$’000 |

Reserves A$’000 |

Accumulated Losses A$’000 |

Non- controlling Interest A$’000 |

Total equity A$’000 |

|||||||||||||||||||

Balance at 1 July 2019 |

( |

) | ||||||||||||||||||||||

Loss after income tax expense for the yea r |

( |

) | ( |

) | ||||||||||||||||||||

Other comprehensive income for the year, net of tax |

( |

) | ( |

) | ||||||||||||||||||||

Total comprehensive income for the year |

( |

) | ( |

) | ( |

) | ||||||||||||||||||

Transactions with owners in their capacity as owners: |

||||||||||||||||||||||||

Share issue costs |

( |

) | ( |

) | ||||||||||||||||||||

Transfers |

||||||||||||||||||||||||

Conversion of convertible note |

||||||||||||||||||||||||

Employee share-based payment options |

||||||||||||||||||||||||

Share based payment |

||||||||||||||||||||||||

Issue of shares |

||||||||||||||||||||||||

Expired options |

( |

) | ||||||||||||||||||||||

Balance at 30 June 2020 |

( |

) | ||||||||||||||||||||||

| Contributed equity A$’000 |

Other Contributed equity A$’000 |

Reserves A$’000 |

Accumulated Losses A$’000 |

Non- controlling Interest A$’000 |

Total equity A$’000 |

|||||||||||||||||||

| Balance at 1 July 2020 |

( |

) | ||||||||||||||||||||||

| Loss after income tax expense for the year |

( |

) | ( |

) | ||||||||||||||||||||

| Other comprehensive income for the year, net of tax |

||||||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total comprehensive income for the year |

( |

) | ( |

) | ||||||||||||||||||||

| Transactions with owners in their capacity as owners: |

||||||||||||||||||||||||

| Contributions of equity, net of transaction costs |

||||||||||||||||||||||||

| Share issue costs |

( |

) | ( |

) | ||||||||||||||||||||

| Transfers |

||||||||||||||||||||||||

| Conversion of convertible note |

||||||||||||||||||||||||

| Employee share-based payment option s |

||||||||||||||||||||||||

| Share based payment |

||||||||||||||||||||||||

| Issue of shares |

( |

) | ||||||||||||||||||||||

| Expired options |

( |

) | ||||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Balance at 30 June 2021 |

( |

) | ||||||||||||||||||||||

Note |

2021 A$’000 |

2020 A$’000 |

2019 A$’000 |

|||||||||||||

| Cash flows from operating activities |

||||||||||||||||

| Loss before income tax expense for the year |

( |

) | ( |

) | ( |

) | ||||||||||

| Adjustments for: |

||||||||||||||||

| Depreciation and amortisation |

7 | |||||||||||||||

| Net loss on disposal of non-current assets |

— | — | ||||||||||||||

| Impairment of property, plant and equipment |

||||||||||||||||

| Share-based payments |

||||||||||||||||

| Foreign exchange differences |

||||||||||||||||

| Loss/(gain) on contingent consideration |

15 | |||||||||||||||

| Fair value loss on financial assets |

||||||||||||||||

| |

|

|

|

|

|

|||||||||||

( |

) |

( |

) |

( |

) | |||||||||||

| Change in operating assets and liabilities: |

||||||||||||||||

| Increase in trade and other receivables |

( |

) | ||||||||||||||

| Increase/(decrease) in prepayments |

( |

) | ( |

) | ||||||||||||

| Increase/(decrease) in trade and other payables |

( |

) | ||||||||||||||

| Increase/(decrease) in other provisions |

( |

) | ||||||||||||||

| Decrease in deferred tax liability |

( |

) | ( |

) | ( |

) | ||||||||||

| Increase/(decrease) in accrued revenue |

— | — | ( |

) | ||||||||||||

| |

|

|

|

|

|

|||||||||||

| Net cash used in operating activitie s |

( |

) |

( |

) |

( |

) | ||||||||||

| |

|

|

|

|

|

|||||||||||

| Cash flows from investing activities |

||||||||||||||||

| Proceeds from disposal of shares |

||||||||||||||||

| |

|

|

|

|

|

|||||||||||

| Net cash used in investing activities |

||||||||||||||||

| |

|

|

|

|

|

|||||||||||

| Cash flows from financing activities |

||||||||||||||||

| Proceeds from issue of shares |

17 | |||||||||||||||

| |

|

|

|

|

|

|||||||||||

| Net cash from financing activities |

||||||||||||||||

| |

|

|

|

|

|

|||||||||||

| Net decrease in cash and cash equivalents |

( |

) | ||||||||||||||

| Cash and cash equivalents at the beginning of the financial year |

||||||||||||||||

| Effects of exchange rate changes on cash |

( |

) | ||||||||||||||

| |

|

|

|

|

|

|||||||||||

| Cash and cash equivalents at the end of the financial year |

9 | |||||||||||||||

| |

|

|

|

|

|

|||||||||||

| • | Kazia’s key clinical trials have not been impacted by COVID-19 to date. The GBM Agile study, the pivotal study for paxalisib in glioblastoma, is on track with recruitment running to plan, and no disruption to this schedule is foreseen. The Phase II study of paxalisib in glioblastoma was fully recruited prior to the onset of restrictions and is in wrap up stage at the date of this report. Plans are on track for the commencement of a Phase I trial for EVT801 before the end of 2021; |

| |

|

|

| • | In general, clinical research in advanced cancer is relatively protected from pandemic disruption due to the ongoing and time-critical need for patient care in specialised facilities that cannot easily be repurposed; |

| • | The Company is not reliant on ongoing revenue from customers, and so changes in customer behaviour over the next several years due to public health restrictions and reduced economic activity have little to no impact on its finances; |

| • | The Company was able to secure funding of approximately $ COVID-19 in April 2020, and additional funds of approximately $ |

| • | Based on budgets and forecasts, the Company has sufficient cash to fund the operations for a period of at least 12 months from the date of this report; and |

| • | As a consequence the directors do not foresee any other impacts on the Company’s ability to raise additional funding as a result of COVID-19. |

| • | financial assets at amortised cost |

| • | financial assets at fair value through profit or loss (FVPL) |

| • | The entity’s business model for managing the financial asset |

| • | The contractual cash flow characteristics of the financial assets |

| • | they are held within a business model whose objective is to hold the financial assets and collect its contractual cash flows |

| • | the contractual terms of the financial assets give rise to cash flows that are solely payments of principal and interest on the principal amount outstanding |

| • | financial instruments that have not deteriorated significantly in credit quality since initial recognition or that have low credit risk (‘Stage 1’) and |

| • | financial instruments that have deteriorated significantly in credit quality since initial recognition and whose credit risk is not low (‘Stage 2’). |

| • | When the deferred income tax asset or liability arises from the initial recognition of goodwill or an asset or liability in a transaction that is not a business combination and that, at the time of the transaction, affects neither the accounting nor taxable profits; or |

| • | When the taxable temporary difference is associated with interests in subsidiaries, associates or joint ventures, and the timing of the reversal can be controlled and it is probable that the temporary difference will not reverse in the foreseeable future. |

| • | Right-of-use |

| • | Depreciation on right-of-use |

| • | The total amount of cash paid under lease arrangements is separated into a principal portion (presented within financing activities) and interest (presented within operating activities) in the consolidated cash flow statement. |

| • | during the vesting period, the liability at each reporting date is the fair value of the award at that date multiplied by the expired portion of the vesting period. |

| • | from the end of the vesting period until settlement of the award, the liability is the full fair value of the liability at the reporting date. |

Consolidated |

||||||||||||

| 2021 A$’000 |

2020 A$’000 |

2019 A$’000 |

||||||||||

| Licensing revenue |

||||||||||||

| |

|

|

|

|

|

|||||||

Consolidated |

||||||||||||

| 2021 A$’000 |

2020 A$’000 |

2019 A$’000 |

||||||||||

| Geographical regions |

||||||||||||

| China |

||||||||||||

| Sweden |

||||||||||||

| |

|

|

|

|

|

|||||||

| |

|

|

|

|

|

|||||||

| Timing of revenue recognition |

||||||||||||

| Licensing revenue at a point in time |

||||||||||||

| |

|

|

|

|

|

|||||||

Consolidated |

||||||||||||

| 2021 A$’000 |

2020 A$’000 |

2019 A$’000 |

||||||||||

| Net foreign exchange gain |

||||||||||||

| Payroll tax rebate |

||||||||||||

| Subsidies and grants |

||||||||||||

| Reimbursement of expenses |

||||||||||||

| Research and development rebate |

||||||||||||

| |

|

|

|

|

|

|||||||

| Other income |

||||||||||||

| |

|

|

|

|

|

|||||||

Consolidated |

||||||||||||

2021 |

2020 |

2019 |

||||||||||

A$’000 |

A$’000 |

A$’000 |

||||||||||

| Loss before income tax includes the following specific |

||||||||||||

| Amortisation |

||||||||||||

| Paxalisib licensing agreement |

||||||||||||

| Evotech licensing agreement |

— | — | ||||||||||

| |

|

|

|

|

|

|||||||

| Total amortisation |

||||||||||||

| |

|

|

|

|

|

|||||||

| Net foreign exchange loss |

||||||||||||

| Net foreign exchange loss |

— | |||||||||||

| Rental expense relating to operating leases |

||||||||||||

| Minimum lease payments |

||||||||||||

| Superannuation expense |

||||||||||||

| Defined contribution superannuation expense |

||||||||||||

| Employee benefits expense excluding superannuation |

||||||||||||

| Employee benefits expense excluding superannuation |

||||||||||||

| Other Expenses |

||||||||||||

| Chinese With-Holding Tax incurred on license transaction |

— | — | ||||||||||

| Chinese Value Added Tax incurred on license transaction |

— | — | ||||||||||

| |

|

|

|

|

|

|||||||

| — | — | |||||||||||

| |

|

|

|

|

|

|||||||

2021 |

2020 |

2019 |

||||||||||

A$’000 |

A$’000 |

A$’000 |

||||||||||

| Numerical reconciliation of income tax benefit and tax at the statutory rate |

||||||||||||

| Loss before income tax benefi t |

( |

) | ( |

) | ( |

) | ||||||

| Tax at the statutory tax rate of |

( |

) | ( |

) | ( |

) | ||||||

| Tax effect amounts which are not deductible/(taxable) in calculating taxable income: |

||||||||||||

| Research and Development claim |

— | |||||||||||

| Amortisation of intangibles |

— | |||||||||||

| Employee option plan |

||||||||||||

| Gain/loss on revaluation of contingent consideration |

||||||||||||

| |

|

|

|

|

|

|||||||

| ( |

) | ( |

) | ( |

) | |||||||

| Adjustment to deferred tax balances as a result of change in statutory tax rate |

( |

) | — | — | ||||||||

| Tax losses and timing differences not recognised |

||||||||||||

| |

|

|

|

|

|

|||||||

| Income tax benefit |

( |

) | ( |

) | ( |

) | ||||||

| |

|

|

|

|

|

|||||||

2021 |

2020 |

2019 |

||||||||||

A$’000 |

A$’000 |

A$’000 |

||||||||||

| Tax losses not recognised |

||||||||||||

| Unused tax losses for which no deferred tax asset has been recognised-Australia |

||||||||||||

| Potential tax benefit @ |

||||||||||||

| Unused tax losses for which no deferred tax asset has been recognised-US |

||||||||||||

| Potential tax benefit at statutory tax rates@ |

||||||||||||

2021 |

2020 |

|||||||

A$’000 |

A$’000 |

|||||||

| Cash at bank and on hand |

||||||||

| Short-term deposits |

||||||||

| |

|

|

|

|||||

| |

|

|

|

|||||

2021 |

2020 |

|||||||

A$’000 |

A$’000 |

|||||||

| Current assets |

||||||||

| R&D tax rebate receivable |

— | |||||||

| |

|

|

|

|||||

| — | ||||||||

| |

|

|

|

|||||

| Other receivables |

||||||||

| Deposits held |

||||||||

| Less: Provision for impairment of deposits held |

— | ( |

) | |||||

| |

|

|

|

|||||

| |

|

|

|

|||||

| Non-current assets |

||||||||

| Deposit paid |

||||||||

| |

|

|

|

|||||

| |

|

|

|

|||||

2021 |

2020 |

|||||||

A$’000 |

A$’000 |

|||||||

| Prepayments |

||||||||

| |

|

|

|

|||||

Consolidated |

||||||||

2021 |

2020 |

|||||||

A$’000 |

A$’000 |

|||||||

| Licensing agreement - at acquired fair value |

||||||||

| Less: Accumulated amortisation |

( |

) | ( |

) | ||||

| |

|

|

|

|||||

| |

|

|

|

|||||

| Licensing agreement - at cost |

— | |||||||

| Less: Accumulated amortisation |

( |

) | — | |||||

| |

|

|

|

|||||

| |

|

|

|

|||||

| |

|

|

|

|||||

| EVT801 licensing agreement A$’000 |

Paxalisib licensing agreement A$’000 |

Total A$’000 |

||||||||||

| Balance at 1 July 2019 |

— | |||||||||||

| Additions |

||||||||||||

| Disposals |

||||||||||||

| Amortisation expense |

— | ( |

) | ( |

) | |||||||

| |

|

|

|

|

|

|||||||

| Balance at 30 June 2020 |

— | |||||||||||

| |

|

|

|

|

|

|||||||

| Additions |

||||||||||||

| Amortisation expense |

( |

) | ( |

) | ( |

) | ||||||

| |

|

|

|

|

|

|||||||

| Balance at 30 June 2021 |

||||||||||||

| |

|

|

|

|

|

|||||||

2021 |

2020 |

|||||||

A$’000 |

A$’000 |

|||||||

| Trade payables |

||||||||

| Accrued payables |

||||||||

| |

|

|

|

|||||

| |

|

|

|

|||||

2021 |

2020 |

|||||||

A$’000 |

A$’000 |

|||||||

| Current Liabilities |

||||||||

| Employee benefits |

||||||||

| Non-Current Liabilities |

||||||||

| Long service leave |

— | |||||||

| |

|

|

|

|||||

| |

|

|

|

|||||

| 2021 A$’000 |

2020 A$’000 |

|||||||

| Current Liabilities |

||||||||

| Contingent consideration - paxalisib |

— | |||||||

| Contingent consideration – EVT801 |

— | |||||||

| |

|

|

|

|||||

| |

|

|

|

|||||

| Non-current Liabilities |

||||||||

| Contingent consideration - paxalisib |

||||||||

| Contingent consideration – EVT801 |

— | |||||||

| |

|

|

|

|||||

| |

|

|

|

|||||

| |

|

|

|

|||||

2021 |

2020 |

|||||||

A$’000 |

A$’000 |

|||||||

Non-current Liabilities |

||||||||

Deferred tax liability associated with Licensing Agreement |

||||||||

Consolidated |

||||||||||||||||

2021 Shares |

2020 Shares |

2021 $ |

2020 $ |

|||||||||||||

Ordinary shares - fully paid |

||||||||||||||||

Details |

Date |

Shares |

Issue price |

$ |

||||||||||