UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2014

OR

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

VIEW SYSTEMS, INC.

(Exact name of registrant as specified in its charter)

| Nevada | 59-2928366 | |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

| 1550 Caton Center Drive, Suite E, Baltimore, Maryland | 21227 | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (410) 242-8439

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, $0.001 Par Value

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. [ ] YES [X] NO

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. [ ] YES [X] NO

Note – Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Exchange Act from their obligations under those Sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. [X] YES [ ] NO

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). [X] YES [ ] NO

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in a definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ ] YES [X] NO

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| [ ] | Large accelerated filer | [ ] | Accelerated filer |

| [ ] | Non-accelerated filer | [X] | Smaller reporting company |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). o YES þ NO

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter.

Note. If a determination as to whether a particular person or entity is an affiliate cannot be made without involving unreasonable effort and expense, the aggregate market value of the common stock held by non-affiliates may be calculated on the basis of assumptions reasonable under the circumstances, provided that the assumptions are set forth in this Form.

The aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was sold as of June 30, 2014 was $1,949,590.83.

APPLICABLE ONLY TO REGISTRANTS INVOLVED IN BANKRUPTCY

PROCEEDINGS DURING THE PRECEDING FIVE YEARS:

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Section 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. o YES o NO

(APPLICABLE ONLY TO CORPORATE REGISTRANTS)

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date. 304,855,526 shares of common stock are outstanding as of April 14, 2015.

DOCUMENTS INCORPORATED BY REFERENCE

List hereunder the following documents if incorporated by reference and the Part of the Form 10-K (e.g., Part I, Part II, etc.) into which the document is incorporated: (1) Any annual report to security holders; (2) Any proxy or information statement; and (3) Any prospectus filed pursuant to Rule 424(b) or (c) under the Securities Act of 1933. The listed documents should be clearly described for identification purposes (e.g., annual report to security holders for fiscal year ended December 24, 1980). None

| PART I | ||||

| Item 1. | Business | 4 | ||

| Item 1A. | Risk Factors | 12 | ||

| Item 1B. | Unresolved Staff Comments | 20 | ||

| Item 2. | Properties | 20 | ||

| Item 3. | Legal Proceedings | 21 | ||

| Item 4. | Mine Safety Disclosures | 21 | ||

| PART II | ||||

| Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 21 | ||

| Item 6. | Selected Financial Data | 27 | ||

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 28 | ||

| Item 7A. | Quantitative and Qualitative Disclosures About Market Risk` | 35 | ||

| Item 8. | Financial Statements and Supplementary Data | 36 | ||

| Item 9. | Changes in and Disagreements With Accountants on Accounting and Financial Disclosure | 52 | ||

| Item 9A. | Controls and Procedures | 52 | ||

| Item 9B. | Other Information | 53 | ||

| PART III | ||||

| Item 10. | Directors, Executive Officers and Corporate Governance | 53 | ||

| Item 11. | Executive Compensation | 55 | ||

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 58 | ||

| Item 13. | Certain Relationships and Related Transactions, and Director Independence | 59 | ||

| Item 14. | Principal Accounting Fees and Services | 60 | ||

| PART IV | ||||

| Item 15. | Exhibits, Financial Statement Schedules | 61 | ||

| SIGNATURES | 62 | |||

Safe Harbor Statement Under the Private Securities Litigation Reform Act of 1995

Information included in this Form 10-K contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (“Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (“Exchange Act”). This information may involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of View Systems, Inc. (the “Company”), to be materially different from future results, performance or achievements expressed or implied by any forward-looking statements. Forward-looking statements, which involve assumptions and describe future plans, strategies and expectations of the Company, are generally identifiable by use of the words “may,” “will,” “should,” “expect,” “anticipate,” “estimate,” “believe,” “intend,” or “project” or the negative of these words or other variations on these words or comparable terminology. These forward-looking statements are based on assumptions that may be incorrect, and there can be no assurance that these projections included in these forward-looking statements will come to pass. Actual results of the Company could differ materially from those expressed or implied by the forward-looking statements as a result of various factors. Except as required by applicable laws, the Company has no obligation to update publicly any forward-looking statements for any reason, even if new information becomes available or other events occur in the future.

PART I

ITEM 1. BUSINESS.

In this report, unless the context requires otherwise, references to the "Company", "View Systems", "we", "us" and "our" are to View Systems, Inc.

CORPORATE HISTORY

View Systems was incorporated in Florida on January 25, 1989, as Beneficial Investment Group, Inc. and became active in September 1998 when we began development of our digital video product line and changed the company's name to View Systems, Inc. Starting in 1999 we expanded our business operations through a series of acquisitions of technologies we use in our digital video recorder technology products and in our concealed weapons technology.

On July 25, 2003, View Systems incorporated View Systems, Inc. as a wholly-owned Nevada corporation for the sole purpose of changing the domicile of the company from Florida to Nevada. On July 31, 2003, articles of merger were filed with the states of Florida and Nevada to complete the domicile change.

OUR BUSINESS

View Systems, Inc. develops, produces and markets computer software and hardware systems for security and surveillance applications. In 1998 digital video recorder technology was our first developed product and we enhanced this product line by developing interfaces with other various technologies, such as facial recognition, access control cards and control devices such as magnetic locks, alarms and other common security devices. In 2003 we sold this product to various commercial entities including schools, restaurants, night clubs, car washers and car dealers (license plate recognition was incorporated into these types of installations), ranches and gas stations. In these installations we integrated the digital video recorded technology with other electronic devices, and we gained knowledge of the security needs of a wide range of businesses.

We expanded our product line in 2002 to include a concealed weapons detection system we call ViewScan. We have penetrated four major market segments for this product: correctional facilities, judicial facilities, probation offices and federal facilities in the Mid-Atlantic States, the West Coast and the South. In 2003 we added a hazardous material first response wireless video transmitting system to our product line we refer to as Visual First Responder. The markets for these units are first responder units for agencies such as the National Guard, Coast Guard, Army, state law enforcement agencies, and fire departments. Both of these technologies were licensed from the U.S. Department of Energy's Idaho National Engineering Laboratory ("INEL"). Until 2005 we assembled all of our products in-house, but we currently contract with third party manufacturers to manufacture some components of our products.

Historically, we have relied upon exclusive technology licensing agreements with federal departments to license and distribute the ViewScan technology. In anticipation of the expiration of federal licenses, we developed propriety components and made sufficient engineering design changes to the ViewScan product to lower production costs and to accommodate the price points required by competitive pressures. By redesigning the ViewScan, we offset the impact of the expiration of our license agreements and continued to capitalize on the competitive advantage we had in the markets we had entered. We have a similar strategy for the Visual First Responder, which is now in its third generation.

Letter of Intent

On January 29, 2015, we entered into that certain letter of intent (the "Letter of Intent") with Potomac River Group LLC ("PRG"), regarding the acquisition by PRG of substantially all of the assets and certain specified liabilities of our business (the "Transaction"). In accordance with the terms and provisions of the Letter of Intent: (i) we will transfer substantially all of our assets and certain specified liabilities free and clear of all encumbrances to a newly created wholly-owned limited liability company (the "Merger Sub"); (ii) we will further consolidate all of our outstanding shares into a single class of common stock that will remain publicly traded; and (iii) subsequently, the Merger Sub and PRG will merge with PRG as the survivor and we will change our name to "Potomac River Group Holdings Inc.". In further accordance with the terms and provisions of the Letter of Intent, we will receive approximately 12% of the membership interests of PRG and the then existing members of PRG will receive 88% of the membership interests of PRG, which will be exchangeable into shares our common stock on a one-for-one basis.

Certain conditions must be met before the parties memoralize the final terms in a definitive agreement as follows: (i) PRG's satisfactory completion of due diligence; (ii) renegotiation and execution of certain banking/lending arrangements satisfactory to PRG; (iii) the respective board of directors and shareholders of PRG and us approving the Transaction; (iv) receipt of any regulatory approvals and third party consents; and (v) certain employment agreements entered into, including one with Gunther Than, our current President/Chief Executive Officer.

We have agreed with PRG that until such time as the Letter of Intent has terminated either by execution of a definitive agreement or mutual consent or April 30, 2015, we shall not initiate, solicit or negotiate any proposal or offer from any person/group other than PRG to acquire all or any portion of our assets.

As of the date of this Annual Report, we anticipate presenting the Transaction to our shareholders for approval.

PRODUCTS AND SERVICES

We have three main products, namely the concealed weapons detection system, the visual first responder system and the Viewmaxx digital video system. With regards to the three products as described below, revenue is considered earned when the product is shipped to the customer, installed (if necessary) and accepted by the customer as a completed sale. The concealed weapons detection system and the digital video system each require installation and training. The customer can engage us for installation and training, which is a revenue source separate and apart from the sale of the product. In those cases revenue is recognized at the completion of the installation and training and acceptance by the customer. However, the customer can also self-install or can engage another firm to provide installation and training. Each product has an unconditional 30 day warranty, during which time the product can be returned for a complete refund. Customers can purchase extended warranties, which provide for replacement or repair of the unit beyond the period provided by the unconditional warranty. Warranties can be purchased for various periods but generally they are for one year period that begins after any other warranties expire. See "Item 7. Management's Discussion and Analysis

Our current principal products and services include:

ViewScan Concealed Weapons Detection System

ViewScan, which is also sold under the name “Secure Scan”, is a walk-through concealed weapons detector which uses data sensing technology to accurately pinpoint the location, size and number of concealed weapons. This walk-through portal is controlled by a master processing board and a personal computer based unit which receives magnetic and video information and combines it in a manner that allows the suspected location of the weapon to be stored electronically and referenced. Because ViewScan does not produce a graphic anatomical display of a scanned person, the Company does not believe that ViewScan is susceptible to privacy concerns raised about certain personnel scanners produced by other companies.

ViewScan products are distributed in three basic configurations; stand-alone units, portable units and integrated door systems.

While electromagnetic induction systems of the type described above have been used for decades as concealed weapons detection systems, they are not without their problems. For example, such electromagnetic induction systems are generally sensitive to the overall size, i.e., surface area of the object, including its mass. Consequently, small, compact, but massive objects, such as a small pistol, may not produce a "signature" that is significantly larger than the signature produced by a light weight object of the same or greater size, such as a cell phone or compact camera. Another problem associated with electromagnetic induction systems is related to the fact that electromagnetic systems are sensitive to electrically conductive objects, regardless of whether they are magnetic or non-magnetic. That is, electromagnetic systems tend to detect non-magnetic objects, such as pocket change, just as easily as magnetic objects, such as weapons. Consequently, electromagnetic systems tend to be prone to false alarms. In many circumstances, such false alarms need to be resolved by scanning the suspect with a hand-held detector in order to confirm or deny the presence of a dangerous weapon.

ViewScan is designed to overcome the traditional shortcomings of electromagnetic induction scanners. The ViewScan portal uses an array of advanced magnetic sensors, each with internal digital signal processors. The sensors communicate with the control unit's software which spatially places identified magnetic anomalies and visually places the location of the potential threat object with a red dot that is superimposed over a real time snapshot image of the person walking through the portal. Along with the snapshot, a graph displays the sensor data which automatically scales the signal strength of the individual sensors and cross-references them to the video image. All of this information is brought together on a video screen that displays the image of the person, the location of the weapon(s) and the size of the weapon(s), depending on the intensity of the magnetic signature. The visual image allows the operator to determine what the object is without the need to conduct a personal search to locate the object and look at it.

The ViewScan system operates faster than ordinary metal detectors and can scan as high as 1,200 persons per hour. Since the ViewScan technology does not use transmitters to produce electromagnetic induction, it does not pose a problem for pacemakers. The ViewScan self calibrates and does not need operator intervention or special calibration tools.

In 2004 we introduced the ViewScan product to the venue and stadium market. In February 2005 we tested the ViewScan at the pre-game venues of the Super Bowl football game in Jacksonville, Florida. During that installation, the portal scanned up to 3,000 to 4,000 people and at various times throughput ranged from approximately 600 to 1,200 persons per hour.

During 2005 we contracted with the University of Northern Florida to design new sensor boards for the ViewScan product which has allowed us to reduce the installed sensor cost by a factor of four. The new lower costs allow us to offer price points to the market which compete directly with traditional metal detectors.

In February 2006 we demonstrated a ViewScan product with a precision optical biometric fingerprint terminal. As expected, the demand for biometric interfaces has increased significantly. In addition to

verifying that an individual is not carrying guns, knives and sometimes cameras, the units can perform multi-modal double and triple identity checks, including: fingerprint, facial, iris, driver’s license and employee identification card verification.

Today we sell these units for an average retail price of approximately $9,000 with a one year extended warranty. We feel the new reduced price points and enhanced interface abilities will allow us to be more competitive, along with the advantages of three to four times the throughput rate, non-contact imaging and permanent visual storage, and a log of all individuals scanned. We have been making additional cost reductions through economies of scale and larger scale integration by taking advantage of ongoing computer component improvements.

3D Facial Recognition Technology - Animetrics Inc.

On August 9, 2012, we entered into a partnership with Animetrics Inc. ("Animetrics"), a leading developer of advanced 3D facial recognition and identify management solutions (the "Animetrics Agreement"). In accordance with the terms and provisions of the Animetrics Agreement, we will integrate Animetrics' next-generation 3D facial recognition technology into its concealed weapons detection systems used for security screening at correctional facilities, stadiums, courthouses, schools and other public facilities. Our ViewScan Concealed Weapons Detector is a walk-through portal which uses advanced magnetics technology to accurately pinpoint threat objects on a visual image of the subject. The system is sensitive enough to locate items such as hidden razor blades and cellular phones but will ignore common objects such as coins, keys and belt buckles. The initial objective is to integrate Animetrics' facial identify management software, the FaceR identity management solution (FIMS) onto our ViewScan, incorporating next generation facial recognition and investigative face biometric capabilities into the weapons detection and identification system. We also plan to utilize Animetrics' cloud-based FaceR FIMS and its suite of FaceR facial biometric identify and screening applications, including FaceR Mobile ID, FaceR Credential Me and ForensicaGPS across its entire portfolio of security and surveillance systems and applications.

The FIMS is deployed either via Web server or in a clod-based architecture system. Both configurations provide centralized and scalable management of highly distributed :one-to-many" identity searched in the field. FIMS utilized Animetrics' FACEngine biometric facial recognition technology that converts 2D images to accurate 3D geometrics for enhanced biometric templates. FIMS makes these 3D facial "signatures" for identification purposes available to credentialized users via any mobile or fixed digital device with internet connectivity. This powerful combination with the ViewScan delivers most advanced facial-recognition and comparison technology to personnel in the field providing accurate and fast results.

ViewMaxx Digital Video System

ViewMaxx is a high-resolution, digital video recording and real-time monitoring system. This system can be scaled to meet a specific customer's needs by using anywhere from one camera up to 32 surveillance cameras per each ViewMaxx unit. The system uses a video capture card recording which translates closed-circuit television analog video data (a format normally used by broadcasters for national television programs) to a computer readable digital format to be stored on direct access digital disk devices rather than the conventional television format of video tape.

ViewMaxx offers programmable recording features that can eliminate the unnecessary storage of non-critical image data. This ability allows the user to utilize the digital disk storage more efficiently. The ViewMaxx system can be programmed to satisfy each customer's special requirements, be it coverage which is continuous, or only when events are detected. For example, it can be programmed to begin recording when motion is detected in a surveillance area, or a smaller field of interest within the surveillance area, and can be programmed to notify the user with an alarm or message.

Viewing of the stored digital images can be performed locally on the computer's video display unit or remotely through the customer's existing telecom systems or data network. It also uses a multi-mode search tool to quickly play back files with simple point and click operations. The search mode parameters can be set according to a specific monitoring need, such as: certain times of day, selected areas of interest in the

field of view or breaches of limit areas. These features and abilities avoid the need to review an entire, or many, VCR tapes for a critical event.

Our ViewMaxx products include the following features:

| • | Use any and all forms of telecommunications, such as standard telephone lines; |

| • | Video can be monitored 24 hours a day by a security monitoring center |

| • | Local and remote recording, storage and playback for up to 28 days, with optional additional storage capability; |

| • | The system may be set to automatically review an area in a desired camera sequence; |

| • | Stores the video image according to time or a criteria specified by the customer and retrieves the visual data selectively in a manner that the customer considers valuable or desirable; |

| • | The system may trigger programmed responses to events detected in a surveillance area, such as break-ins or other unauthorized breaches of the secured area; |

| • | Cameras can be concealed in ordinary home devices such as smoke detectors |

| • | The system monitors itself to insure system functionality with alert messages in the event of covert or natural interruption; and |

| • | Modular expansion system configuration allows the user to purchase add-on components at a later date. |

Depending on the features of a particular system the retail price including installation can range from approximately $5,000 up to $50,000.

Additional Applications and Integration of ViewScan and ViewMaxx

We also offer integration of other products with ViewScan or ViewMaxx. Biometric verification is a system for recognizing faces and comparing them to known individuals, such as employees or individuals wanted by law enforcement agencies. This product can be interfaced with ViewScan and/or ViewMaxx to limit individual access to an area. ViewScan and/or ViewMaxx can be coupled with magnetic door locks to restrict access to a particular area. We also offer a central monitoring or video command center for ViewScan or ViewMaxx products.

TRAINING AND SERVICE PROGRAMS

We offer support services for our products which include:

| • | On site consulting/planning with customer architect and engineers, |

| • | Installation and technical support, |

| • | Training and "Train the Trainer" programs, and |

| • | Extended service agreements. |

OUR MARKET

Our family of products offers government and law enforcement agencies, commercial security professionals, private businesses and residential consumers an enhanced surveillance and detection capacity. Management has chosen to avoid the air passenger traffic and civilian airport market for metal detection because we believe that a larger market exists in venues such as sporting events, concerts, race tracks, schools, courthouses, municipal buildings, and law enforcement agencies.

Our ViewScan products and technology can be used where there is a temporary requirement for real-time weapons detection devices in areas where a permanent installation is cost prohibitive or impractical. For example, our ViewScan portal could be set up for special events, concerts, and conventions. Our systems may reduce the need for a large guard force and can provide improved pedestrian traffic flow into an event because individuals can be scanned quickly and false alarms are reduced.

A primary market for our ViewScan portal is federal and state government courthouses, county and municipal buildings, and correctional facilities. We have installed our ViewScan weapons detection products in a variety of court house situations.

The MMV product's market includes National Guard units and first response agencies such as fire, police, SWAT, and homeland security response teams.

The MINI is an easy to use, simple and convenient personal security monitoring device that can be purchased by individuals through an independent website, potentially through retail electronics stores, or through commercial installers of self-contained or centrally monitored security systems. However, at this time we do not have retail agreements in place. Using our technology, individuals could run their own perimeter and interior surveillance systems from their own home computer. Real-time action at home can be monitored remotely through a modem and the Internet. There is also the capability to make real-time monitors wireless. An additional advantage of our technology is that it allows for the storage of information on the home computer and does not require a VCR. This capability may reduce the expense and time of the home installation and may make installation affordable for a majority of homeowners. We are marketing the MINI to large potential users, such as real property managers, as well as retail customers through the www.minicamsim.com website. We have had non-material amounts of revenue from MINI sales thus far, which we attribute to a lack of advertising funds and market awareness.

In March, 2011, we exited the fiber optic installation network and terminated our Network Services Division.

MANUFACTURING

We manufacture the ViewScan portal and the ViewMaxx internally at our facilities in Baltimore, Maryland. Our third party manufacturers create several of the hardware components in our systems and we assemble our systems by combining other commercially available hardware and software together with our proprietary software. We hold licenses for software components that are integrated into our proprietary software and installed in our systems. We believe that we can continue to obtain components for our systems at reasonable prices from a variety of sources. Although we have developed certain proprietary hardware components for use in our products and purchased some components from single source suppliers, we believe similar components can be obtained from alternative suppliers without significant delay.

SALES AND DISTRIBUTION

We are constantly seeking to extend our United States domestic network of manufacturing representatives and dealers for the sale and distribution of our products. We are looking for security consultants, specifiers and distributors of security and surveillance equipment that sell directly to schools, courthouses, and government and commercial buildings.

We use mailings and telephone calls to contact potential representatives in a geographical area with the intent to arrange a demonstration of our products to these persons. We attend region specific trade shows

such as sheriff's conventions, court administrators meetings, civil support team, and state police shows. Then we demonstrate or give trial offers in the area until a sale is completed. Once we have completed a sale in a specific market area, then we expand that market by contacting correctional facilities, courthouses and other municipal buildings. We ship our products to the customer and each product has an unconditional 30 day warranty, during which time the product can be returned for a complete refund.

We have ongoing reseller arrangements with small and medium-sized domestic and international resellers. Our reseller agreements grant a non-exclusive right to the reseller to purchase our products at a discount from the list price and then sell them to others. These agreements are generally for a term of one year and automatically renew for successive one-year terms unless terminated by notice or in the event of breach.

In 2010 we also have experienced international interest from security related resellers and system integrators. Previously, we had chosen not to pursue international markets, but we secured sales in Bangladesh.

Marketing of the MINI can be viral through use of Internet search engine optimization. During 2011 we did not have the financial resources to market the MINI.

MAJOR CUSTOMERS

On October 9, 2012, we were selected for installation of its enhanced and new ViewScan VS-1000 weapons detection and access control product for installation in seventeen Detroit Public Schools. The ViewScan VS-1000 was introduced at the annual ASIS Security Conference and Exposition in Philadelphia in 2011 and has been chosen by multiple companies to be used for access control. The first installations were made in the Detroit Public Schools in September 2011. To date, we have installed out ViewScan systems in the Bayview Electric ESS School, Wiltec Electronic Security Group, Fox Command Center, Detroit Police Department, Harper Woods School, Blueline and have rented equipment to Pinkerton and Harper Woods School. The improved WiewScan VS-1000 system senses the smallest reading without being affected by environmental disturbances and structural elements such as reinforced concrete and metal door frames. Unlike ordinary metal detectors, the ViewScan VS-1000 system can be placed directly next to each other and still function correctly. The ViewScan VS-1000 system was also used at the National Democratic Convention.

During 2011, we had 21 ViewScan systems ordered by correctional facilities and 60 units ordered by domestic schools and police departments. We also received purchase orders for a total of 12 ViewScan units from a customer in Bangladesh.

COMPETITION

The markets for our products are extremely competitive. Competitors include a broad range of companies that develop and market products for the identification and video surveillance markets. In the weapons detection market, we compete with Ranger Security Scanners, Inc. and Garrett Electronics, Inc. in the United States, and an Italian company, CEIA SpA, which has the most sophisticated electromagnetic induction product. In the video surveillance market we compete with numerous VCR suppliers and digital recording suppliers, including, Sensormatic Corporation, NICE Systems, Ltd., and Integral Systems.

TRADEMARK, LICENSES AND INTELLECTUAL PROPERTY

Certain features of our products and documentation are proprietary, and we rely on a combination of patent, contract, copyright, trademark and trade secret laws and other measures to protect our proprietary information. We limit access to, and distribution of, our software, documentation and other proprietary information. As part of our confidentiality procedures, we generally enter into confidentiality and invention assignment agreements with our employees and mutual non-disclosure agreements with our manufacturing representatives, dealers and systems integrators. Notwithstanding such actions, a court considering these provisions may determine not to enforce such provisions or only partially enforce such provisions.

The ViewScan concealed weapons detection technology involves sensing technology and data acquisition/analysis software subsystems that have patents pending or issued to the U.S. Department of Energy. We have not renewed our license, with the INEL to commercialize, manufacture and market the concealed weapons detection technology. View Systems has not filed for patents and has found that the expense and difficulty of patenting this product would be financially prohibitive.

Governmental ownership of the patents is advantageous to us; however, the costs have outweighed the benefits. We have not received improvements, the promised funding or support from our government licensors. We have, however, paid money and spent time to advance the technologies. We have obtained software licensing agreements for software operating systems components, fingerprint identification capabilities to possibly integrate into our proprietary software, and commercially available operating systems software to integrate into our proprietary product software.

Because the software and firmware (software imbedded in hardware) are in a state of continuous development, we have not filed applications to register the copyrights for these items. However, under law, copyright vests upon creation of our software and firmware. Registration is not a prerequisite for the acquisition of copyright rights. We take steps to insure that notices are placed on these items to indicate that they are copyright protected. The copyright protection for our software extends for the 20-year statutory period from the date of first "publication," distribution of copies to the general public, or from the date of creation, whichever occurs first.

We provide software to end-users under non-exclusive "shrink-wrap" licenses, which are automatic licenses executed once the package is opened. This type of license has a perpetual term and is generally nontransferable. Although we do not generally make source code available to end-users, we may, from time to time, enter into source code escrow agreements with certain customers. We have also obtained licenses for certain software from third parties for incorporation into our products.

RESEARCH AND DEVELOPMENT

We outsource improvements or changes when requested by customers and warranted financially. For the years ended December 31, 2014 and December 31, 2013, we have spent approximately $3,626 and $21,977, respectively, on research and development.

REGULATORY ENVIRONMENT

We are not subject to government approval or regulation in the manufacture of our products or the components in our products. However, our products are subject to certain government restrictions on sales to "unfriendly" countries and countries designated as adversarial, which may limit our sales to the international market. In addition, our resellers and end users may be subject to numerous regulations that stem from surveillance activities. We also benefit from the recent "made in America" trade laws where non-United States manufactures must secure waivers in order to sell security and surveillance products to United States domestic end-users.

Security and surveillance systems, including cameras, raise privacy issues and our products involve both video and audio, and added features for facial identification. The regulations regarding the recording and storage of this data are uncertain and evolving. For example, under the Federal wiretapping statute, the audio portion of our surveillance systems may not record a person's conversation without his or her consent. Further, there are state and federal laws associated with recording video in non-public places.

Cost and effect of compliance with environmental laws

The Company has not determined any recognizable cost related to compliance with environmental laws.

EMPLOYEES

As of the date of this Annual Report, we employ approximately five persons, including one sales executive and three office personnel, which includes one customer service engineer. Two persons are part-time and we also contract with five independent contractors who devote a majority of their work to a variety of our projects. Our employees are not presently covered by any collective bargaining agreement. Our relations with our employees are good, and we have not experienced any work stoppages by our employees.

ITEM 1A. RISK FACTORS.

RISK FACTORS

You should carefully consider the risks, uncertainties and other factors described below because they could materially and adversely affect our business, financial condition, operating results and prospects and could negatively affect the market price of our common stock. Also, you should be aware that the risks and uncertainties described below are not the only ones facing us. Additional risks and uncertainties that we do not yet know of, or that we currently believe are immaterial, may also impair our business operations and financial results. Our business, financial condition or results of operations could be harmed by any of these risks. The trading price of our common stock could decline due to any of these risks, and you may lose all or part of your investment.

In assessing these risks you should also refer to the other information contained in or incorporated by reference to this Annual Report on Form 10-K, including our financial statements and the related notes.

WE HAVE EXPERIENCED HISTORICAL LOSSES AND A SUBSTANTIAL ACCUMULATED DEFICIT. IF WE ARE UNABLE TO REVERSE THIS TREND, WE WILL LIKELY BE FORCED TO CEASE OPERATIONS.

We have incurred losses for the past two fiscal years which consists of a net loss of $1,338,145 for 2014 and a net loss of $2,008,101 for 2013. In addition, we had an accumulated deficit of $28,949,191 at December 31, 2014 as compared with $27,611,046 at December 31, 2013. Further, we do not expect positive cash flow from operations in the near term. There is no assurance that actual cash requirements will not exceed our estimates. In particular, additional capital will be required for future periods for: (i) new product development expenses; (ii) potential marketing costs and professional fees; or (iii) we encounter greater costs associated with general and administrative expenses or offering costs. As a result, we are unable to predict whether we will achieve profitability in the future, or at all.

The uncertainty and factors described throughout this section may impede our ability to economically develop, produce, and market our products effectively. As a result, we may not be able to achieve or sustain profitability or positive cash flows from operating activities in the future.

WE HAVE A WORKING CAPITAL DEFICIT AND SIGNIFICANT CAPITAL REQUIREMENTS. SINCE WE WILL CONTINUE TO INCUR LOSSES UNTIL WE ARE ABLE TO GENERATE SUFFICIENT REVENUES TO OFFSET OUR EXPENSES, INVESTORS MAY BE UNABLE TO SELL OUR SHARES AT A PROFIT OR AT ALL.

We had a net loss of $1,338,145 for fiscal year ended December 31, 2014 and net cash used in operations of $172,367 for the fiscal year ended December 31, 2014. Because we have not yet achieved or acquired sufficient operating capital and given these financial results along with our expected cash requirements in 2014, additional capital investment will be necessary to develop and sustain our operations.

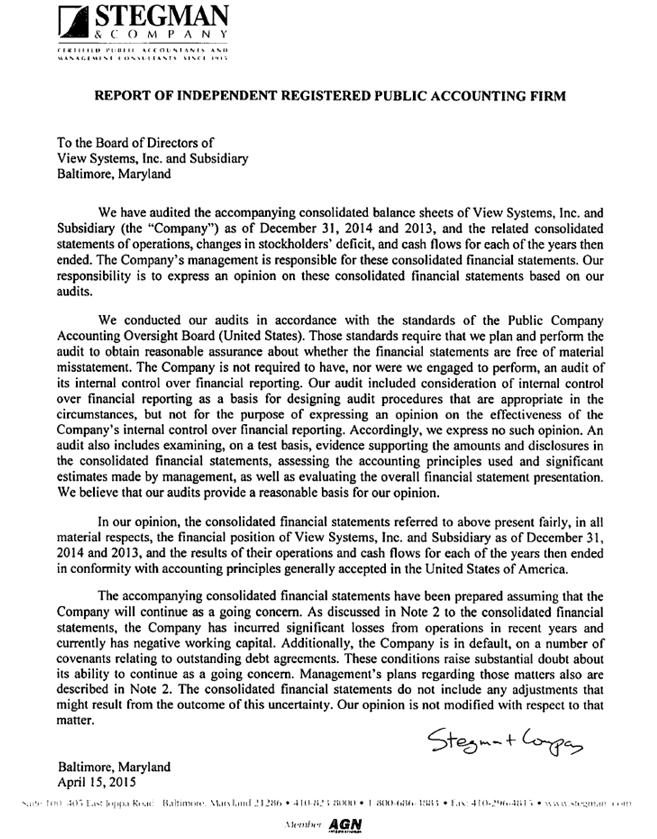

OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM HAS RAISED DOUBT OVER OUR ABILITY TO CONTINUE AS A GOING CONCERN.

The independent registered public accounting firm’s report accompanying our December 31, 2014 and 2013 audited financial statements contains an explanatory paragraph expressing substantial doubt about our ability to continue as a going concern. The financial statements have been prepared "assuming that the Company will continue as a going concern." Our ability to continue as a going concern is dependent on

raising additional capital to fund our operations and ultimately on generating future profitable operations. There can be no assurance that we will be able to raise sufficient additional capital or eventually have positive cash flow from operations to address all of our cash flow needs. If we are not able to find alternative sources of cash or generate positive cash flow from operations, our business and shareholders will be materially and adversely affected

We have incurred substantial operating and net losses, as well as negative operating cash flow and do not have financing commitments in place to meet expected cash requirements for the next twelve months. Our net loss for the year ended December 31, 2014 was $1,338,145 and our net loss for the year ended December 31, 2013 was $2,008,101. Our retained deficit was $28,949,191 at December 31, 2014. We are unable to fund our day-to-day operations through revenues alone, and management believes we will incur operating losses for the near future while we expand our sales channels. While we have expanded our product line and expect to establish new sales channels, we may be unable to increase revenues to the point that we attain and are able to maintain profitability. We have had to rely on private financing to cover cash shortfalls. As a result, we continue to have significant working capital and stockholders' deficits including a substantial accumulated deficit at December 31, 2014. In recognition of such, our independent registered public accounting firms have included an explanatory paragraph in their respective reports on our consolidated financial statements for the fiscal years ended December 31, 2014, and December 31, 2013 that expressed substantial doubt regarding our ability to continue as a going concern.

WE NEED ADDITIONAL EXTERNAL CAPITAL AND IF WE ARE UNABLE TO RAISE SUFFICIENT CAPITAL TO FUND OUR PLANS, WE MAY BE FORCED TO DELAY OR CEASE OPERATIONS.

Based on our current growth plan we believe we may require approximately $1,200,000 in additional financing within the next twelve months to develop our sales channels. Furthermore, if the cost of our development, production and marketing programs are greater than anticipated, we may have to seek additional funds through public or private share offerings or arrangements with corporate partners. There can be no assurance that we will be successful in our efforts to raise these required funds, or on terms satisfactory to us. Our success will depend upon our ability to access equity capital markets and borrow on terms that are financially advantageous to us. However, we may not be able to obtain additional funds on acceptable terms. If we fail to obtain funds on acceptable terms, then we might be forced to delay or abandon some or all of our business plans or may not have sufficient working capital to develop products, finance acquisitions, or pursue business opportunities. If we borrow funds, then we could be forced to use a large portion of our cash reserves, if any, to repay principal and interest on those loans. If we issue our securities for capital, then the interests of investors and stockholders will be diluted. We are attempting to raise at least $1,000,000 through an offering of securities.

WE ARE CURRENTLY DEPENDENT ON THE EFFORTS OF RESELLERS FOR OUR CONTINUED GROWTH AND MUST EXPAND OUR SALES CHANNELS TO INCREASE OUR REVENUES AND FURTHER DEVELOP OUR BUSINESS PLANS. OUR FUTURE GROWTH AND PROFITABILITY MAY DEPEND UPON THE EFFECTIVENESS AND EFFICIENCY OF OUR MARKETING EXPENDITURES IN RECRUITING NEW CUSTOMERS.

We are in the process of developing and expanding our sales channels, but we expect overall sales to remain down as we develop these sales channels. We are actively recruiting additional resellers and dealers and have hired in-house sales personnel for regional and national sales. We must continue to find other methods of distribution to increase our sales. If we are unsuccessful in developing sales channels we may have to abandon our business plan.

Moreover, our future growth and profitability will depend in large part upon the effectiveness and efficiency of our marketing expenditures, including our ability to: (i) create greater awareness of our ViewScan products and band name; (ii) identify the most effective and efficient level of spending in each market, media and specific media vehicle; (iii) determine the appropriate message and media mix for advertising, marketing and promotional expenditures; (iv) effectively manage marketing costs, including creative and media expense in order to generate and maintain acceptable costs; (v) generate leads for sales, including obtaining lists of businesses in a cost-effective manner; and (vi) drive traffic to our website.

WE MAY NOT BE ABLE TO COMPETE SUCCESSFULLY IN OUR MARKET BECAUSE WE HAVE A SMALL MARKET SHARE AND COMPETE WITH LARGE NATIONAL AND INTERNATIONAL COMPANIES.

We estimate that we have less than a 1% market share of the surveillance and weapons detection market. We compete with many companies that have greater brand name recognition and significantly greater financial, technical, marketing, and managerial resources. The position of these competitors in the market may prevent us from capturing more market share. We intend to remain competitive by increasing our existing business through marketing efforts, selectively acquiring complementary technologies or businesses and services, increasing our efficiency, and reducing costs.

WE MUST SUCCESSFULLY INTRODUCE NEW OR ENHANCED PRODUCTS AND MANAGE THE COSTS ASSOCIATED WITH PRODUCING SEVERAL PRODUCT LINES TO BE SUCCESSFUL. WE OPERATE IN A MARKET WHICH IS SUBJECT TO RAPID TECHNOLOGICAL AND OTHER CHANGES AND INCREASING COMPETITION COULD LEAD TO PRICING PRESSURES, REDUCED OPERATING MARGINS, LOSS OF MARKET SHARE AND INCREASED CAPITAL EXPENDITURES.

Our future success depends on our ability to continue to improve our existing products and to develop new products using the latest technology that can satisfy customer needs. For example, our short term success will depend on the continued acceptance of the Multi-Mission Mobil Video and the ViewScan portal product line. We cannot be certain that we will be successful at producing multiple product lines and we may find that the cost of production of multiple product lines inhibits our ability to maintain or improve our gross profit margins. In addition, the failure of our products to gain or maintain market acceptance or our failure to successfully manage our cost of production could adversely affect our financial condition.

The markets for our ViewScan products is highly competitive and we expect increased competition in the future that could adversely affect our revenue and market share. Larger established companies with high brand recognition may develop products and services that are competitive with our core products and services. These competitors may be able to devote greater resources than us to the development, promotion and sale of their products and services and respond more quickly than we can to new technologies or changes. We may not be able to compete effectively with current or future competitors, especially those with significantly greater resources or more established customer bases, which may materially adversely affect our sales and our business.

PROTECTION OF OUR INTELLECTUAL PROPERTY IS LIMITED AND ANY MISUSE OF OUR INTELLECTUAL PROPERTY BY OTHRES COULD HARM OUR BUSINESS, REPUTATION AND COMPETITIVE POSITION.

Our trademarks, copyrights, trade secrets, trade dress and designs are valuable and integral to our success and competitive position. However, we cannot assure you that we will be able to adequately protect our proprietary rights through reliance on a combination of copyrights, trademarks, trade secrets, confidentiality procedures, contractual provisions and technical measures from outside influences.

Protection of trade secrets and other intellectual property rights in the markets in which we operate and compete is highly uncertain and may involve complex legal questions. We cannot completely prevent the unauthorized use or infringement of our intellectual property rights, as such prevention is inherently difficult.

We also expect that the more successful we are, the more likely that competitors will try to illegally use our proprietary information and develop products that are similar to ours, which may infringe on our proprietary rights. In addition, we could potentially lose future trade secret protection for our source code if any unauthorized disclosure of such code occurs. The loss of future trade secret protection could make it

easier for third parties to compete with our products by copying functionality. Any changes in, or unexpected interpretations of, the trade secret and other intellectual property laws in any country in which we operate may compromise our ability to enforce our trade secret and intellectual property rights. Costly and time-consuming litigation could be necessary to enforce and determine the scope of our confidential information and trade secret protection. If we are unable to protect our proprietary rights or if third parties independently develop or gain access to our or similar technologies, our business, service revenue, reputation and competitive position could be materially adversely affected.

THE CONFIDENTIALITY, NON-DISCLOSURE AND OTHER AGREEMENTS WE USE TO PROTECT OUR PRODUCTS, TRADE SECRETS AND PROPRIETARY INFORMATION MAY PROVE UNENFORCEABLE OR INADEQUATE.

We protect our products, trade secrets and proprietary information, in part, by requiring all of our employees and consultants to enter into agreements providing for the maintenance of confidentiality. We also enter into non-disclosure agreements with our technical consultants to protect our confidential and proprietary information. We cannot assure you that our confidentiality agreements with our employees, consultants and other third parties will not be breached, that we will be able to effectively enforce these agreements, that we will have adequate remedies for any breach, or that our trade secrets and other proprietary information will not be disclosed or will otherwise be protected.

WE HAVE NOT REGISTERED COPYRIGHTS FOR OUR VIEWSCAN PRODUCTS, WHICH MAY LIMIT OUR ABILITY TO ENFORCE THEM.

We have not registered our copyrights in all of our materials, website information, designs or other copyrightable works. The United States Copyright Act automatically protects all of our copyrightable works, but without registration we cannot enforce those copyrights against infringers or seek certain statutory remedies for any such infringement. Preventing others from copying our products, written materials and other copyrightable works is important to our overall success in the marketplace. In the event we decide to enforce any of our copyrights against infringers, we will first be required to register the relevant copyrights, and we cannot be sure that all of the material for which we seek copyright registration would be registrable in whole or in part, or that once registered, we would be successful in bringing a copyright claim against any such infringers.

THE SUCCESS OF OUR BUSINESS DEPENDS UPON THE CONTINUING CONTRIBUTION OF OUR KEY PERSONNEL, INCLUDING MR. GUNTHER THAN, OUR CHIEF EXECUTIVE OFFICER, WHOSE KNOWLEDGE OF OUR BUSINESS WOULD BE DIFFICULT TO REPLACE IN THE EVENT WE LOSE HIS SERVICES.

We are dependent on the services of Gunther Than, our Chief Executive Officer, and a member of our Board and our other executive officers and members of our senior management team. For example, the loss of Mr. Than could damage customer relations and could restrict our ability to raise additional working capital if and when needed. There can be no assurance that Mr. Than will continue in his present capacity for any particular period of time. Other than non-compete provisions of limited duration included in employment agreements that we may or will have with certain executives, we do not generally seek non-compete agreements with key personnel, and they may leave and subsequently compete against us. The loss of service of any of our senior management team, particularly those who are not party to employment agreements with us, or our failure to attract and retain other qualified and experienced personnel on acceptable terms, could have a material adverse effect on our business.

WE MAY BE UNABLE TO ATTRACT AND RETAIN THE SKILLED EMPLOYEES NEEDED TO SUSTAIN AND GROW OUR BUSINESS.

Our success to date has largely depended on, and will continue to depend on, the skills, efforts and motivations of our executive team and employees, who generally have significant experience with our Company. Our success also depends largely on our ability to attract and retain highly qualified IT engineers and programmers, to train professionals and sales and marketing managers and corporate management

personnel. We may experience difficulties in locating and hiring qualified personnel and in retaining such personnel once hired, which may materially and adversely affect our business.

OUR DIRECTORS AND OFFICERS ARE ABLE TO EXERCISE SIGNIFICANT INFLUENCE OVER MATTERS REQUIRING STOCKHOLDER APPROVAL.

As of the date of this Annual Report, we have 304,855,526 shares of common stock issued and outstanding and 4,089,647 shares of preferred stock issued and outstanding. Currently, our directors and executive officers collectively hold approximately 18.59% of the voting power of our common and 100% of the preferred stock entitled to vote on any matter brought to a vote of the stockholders. Including the effects of Gunther Than’s, our Chief Executive Officer's voting preferred stock, our directors and officers have the power to vote approximately 32.22% of common shares (based on the assumed effects of conversion of all of Mr. Than’s preferred stock) as of the date of this Annual Report. Pursuant to Nevada law and our bylaws, the holders of a majority of our voting stock may authorize or take corporate action with only a notice provided to our stockholders. A stockholder vote may not be made available to our minority stockholders, and in any event, a stockholder vote would be controlled by the majority stockholders.

OUR OFFICER AND DIRECTORS MAY BE SUBJECT TO CONFLICTS OF INTEREST.

Some of our officers and directors serve only part time and can become subject to conflicts of interest. Some devote part of their working time to other business endeavors, including consulting relationships with other entities, and have responsibilities to these other entities. Such conflicts include deciding how much time to devote to our affairs, as well as what business opportunities should be presented to us. Because of these relationships, our officers and directors could be subject to conflicts of interest. Currently, we have no policy in place to address such conflicts of interest.

NEVADA LAW AND OUR ARTICLES OF INCORPORATION MAY PROTECT OUR DIRECTORS FROM CERTAIN TYPES OF LAWSUITS.

Nevada law provides that our officers and directors will not be liable to us or our stockholders for monetary damages for all but certain types of conduct as officers and directors. Our Bylaws permit us broad indemnification powers to all persons against all damages incurred in connection with our business to the fullest extent provided or allowed by law. The exculpation provisions may have the effect of preventing stockholders from recovering damages against our officers and directors caused by their negligence, poor judgment or other circumstances. The indemnification provisions may require us to use our limited assets to defend our officers and directors against claims, including claims arising out of their negligence, poor judgment, or other circumstances.

WE HAVE IDENTIFIED MATERIAL WEAKNESSES IN OUR INTERNAL CONTROL OVER FINANCIAL REPORTING, AND OUR BUSINESS AND STOCK PRICE MAY BE ADVERSELY AFFECTED IF WE DO NOT ADEQUATELY ADDRESS THOSE WEAKNESSES OR IF WE HAVE OTHER MATERIAL WEAKNESSES OR SIGNIFICANT DEFICIENCIES IN OUR INTERNAL CONTROL OVER FINANCIAL REPORTING.

For fiscal year ended 2014, we did not adequately implement certain internal controls, particularly with respect to revenue reporting, and made certain other accounting errors in our financial statements for the year ended December 31, 2010 and for the interim periods of March 31, 2011, June 30, 2011, and September 30, 2011. Due to accounting errors, we had to restate our financial statements as of and for the period ended December 31, 2010 to reflect the correction of: (i) an understatement of deferred income that resulted from incorrectly allocating the revenue received under extended warranty arrangements over the life of the warranty; (ii) an overstatement of revenue due to recognition of sales prior to the installation of the products, and (iii) the classification of common stock that was issued to the holder of a note payable. As a result of reducing sales revenue there was a corresponding reduction in cost of sales and accounts payable. We had originally recorded the issuance of the stock as a payment in full for the note and related costs. However, after a further review of the legal documents, it was determined that the debt was not satisfied but instead the ultimate resolution of the debt was contingent on events that were still unfolding.

Because of the errors that are being corrected, we have restated our belief that our internal controls over financial reporting were effective to conclude that they were not effective.

Although we have taken steps to correct our identified material weaknesses in our internal controls and have revised our interim financial disclosures for periods in 2011, the existence of these or possibly other material weaknesses or significant deficiencies raises concerns that the prevention of future errors could require the allocation of scarce financial resources at times when such resources may not be available to us. As of the date of this Annual Report, we believe we have corrected any material weaknesses in our internal controls. If we cannot produce reliable financial reports, investors could lose confidence in our reported financial information; the market price of our stock could decline significantly; we may be unable to obtain additional financing to operate and expand our business, and our business and financial condition could be harmed.

For fiscal year ended December 31, 2012, we have remedied our control deficiencies over our revenue recognition. In 2013 and 2014, we identified a material weakness because we did not currently employ a sufficient number of qualified accounting personnel to ensure proper and timely evaluation of complex accounting, tax, and disclosure issues that may arise during the course of our business. We intend to address this material weakness by reviewing our business. We intend to address this material weakness by reviewing our accounting and finance processes to identify any improvements thereto that might enhance our disclosure controls and procedures and our internal control over financial reporting and determine the feasibility of implementing such improvements and by seeking qualified employees and/or outside consultants who possess the knowledge needed to eliminate this weakness. Our ability to remediate this weakness may, however, be delayed or limited by resource constraints, a lack of qualified persons in our market area and/or competition from other employers.

FAILURE TO MAINTAIN EFFECTIVE INTERNAL CONTROLS IN ACCORDANCE WITH SECTION 404 OF THE SARBANES-OXLEY ACT WOULD LEAD TO LOSS OF INVESTOR CONFIDENCE IN OUR REPORTED FINANCIAL INFORMATION.

Pursuant to proposals related to Section 404 of the Sarbanes-Oxley Act of 2002, beginning with our Annual Report on Amendment No. 2 to Form 10-K for the fiscal year ending December 31, 2008, we have been required to furnish a report by our management on our internal control over financial reporting. If we cannot provide reliable financial reports or prevent fraud, then our business and operating results could be harmed, investors could lose confidence in our reported financial information, and the trading price of our stock could drop significantly.

To maintain compliance with Section 404 of the Act, we engage in a process to document and evaluate our internal control over financial reporting, which is both costly and challenging and requires management to dedicate scarce internal resources and to retain outside consultants.

During the course of our testing, we may identify deficiencies which we may not be able to remediate in time for securities disclosure reporting deadlines. In addition, if we fail to maintain the adequacy of our internal controls, as such standards are modified, supplemented or amended from time to time, we may not be able to ensure that we can conclude on an ongoing basis that we have effective internal controls over financial reporting in accordance with Section 404 of the Sarbanes-Oxley Act. Moreover, effective internal controls, particularly those related to revenue recognition, are necessary for us to produce reliable financial reports and are important to helping prevent financial fraud.

THERE IS NO SIGNIFICANT ACTIVE TRADING MARKET FOR OUR SHARES, AND IF AN ACTIVE TRADING MARKET DOES NOT DEVELOP, PURCHASERS OF OUR SHARES MAY BE UNABLE TO SELL THEM PUBLICLY.

There is no significant active trading market for our shares, and we do not know if an active trading market will develop. An active market will not develop unless broker-dealers develop interest in trading our shares, and we may be unable to generate interest in our shares among broker-dealers until we generate meaningful

revenues and profits from operations. Until that time occurs, if it does at all, purchasers of our shares may be unable to sell them publicly. In the absence of an active trading market:

| • | Investors may have difficulty buying and selling our shares or obtaining market quotations; |

| • | Market visibility for our common stock may be limited; and |

| • | A lack of visibility for our common stock may depress the market price for our shares. |

Moreover, the market price for our shares is likely to be highly volatile and subject to wide fluctuations in response to various factors, including the following: (i) actual or anticipated fluctuations in our quarterly operating results and revisions to our expected results; (ii) changes in financial estimates by securities research analysts; (iii) conditions in the market for our products; (iv) changes in the economic performance or market valuations of companies specializing in the defense industries; (v) announcements by us or our competitors of new services, strategic relationships, joint ventures or capital commitments; (vi) addition or departure of key personnel; (vii) litigation related to any intellectual property; and (viii) sales or perceived potential sales of our shares.

In addition, the securities market has from time to time, and to an even greater degree since the last quarter of 2007, experienced significant price and volume fluctuations that are not related to the operating performance of particular companies. These market fluctuations may also have a material adverse effect on the market price of our ordinary shares. Furthermore, in the past, following periods of volatility in the market price of a public company’s securities, shareholders have frequently instituted securities class action litigation against that company. Litigation of this kind could result in substantial costs and a diversion of our management’s attention and resources.

OUR COMMON STOCK IS CONSIDERED TO BE "PENNY STOCK."

Our common stock is considered to be a "penny stock" because it meets one or more of the definitions in Rules 15g-2 through 15g-6 promulgated under Section 15(g) of the Securities Exchange Act of 1934, as amended. These include but are not limited to, the following: (i) the stock trades at a price less than $5.00 per share; (ii) it is not traded on a "recognized" national exchange; (iii) it is not quoted on The NASDAQ Stock Market, or even if quoted, has a price less than $5.00 per share; or (iv) is issued by a company with net tangible assets less than $2.0 million, if in business more than a continuous three years, or with average revenues of less than $6.0 million for the past three years. The principal result or effect of being designated a "penny stock" is that securities broker-dealers cannot recommend the stock but must trade it on an unsolicited basis.

The SEC has adopted rules that regulate broker-dealer practices in connection with transactions in "penny stocks." Penny stocks generally are equity securities with a price of less than $5.00 (other than securities registered on certain national securities exchanges or quoted on the NASDAQ system, provided that current price and volume information with respect to transactions in such securities is provided by the exchange or system). Penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from those rules, to deliver a standardized risk disclosure document prepared by the SEC, which specifies information about penny stocks and the nature and significance of risks of the penny stock market. A broker-dealer must also provide the customer with bid and offer quotations for the penny stock, the compensation of the broker-dealer, and sales person in the transaction, and monthly account statements indicating the market value of each penny stock held in the customer's account. In addition, the penny stock rules require that, prior to a transaction in a penny stock not otherwise exempt from those rules, the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser's written agreement to the transaction. These disclosure requirements may have the effect of reducing the trading activity in the secondary market for stock that becomes subject to those penny stock rules. If a trading market for our common stock develops, our common stock will probably become subject to the penny stock rules, and shareholders may have difficulty in selling their shares.

BROKER-DEALER REQUIREMENTS MAY AFFECT TRADING AND LIQUIDITY.

Section 15(g) of the Securities Exchange Act of 1934, as amended, and Rule 15g-2 promulgated thereunder by the SEC require broker-dealers dealing in penny stocks to provide potential investors with a document disclosing the risks of penny stocks and to obtain a manually signed and dated written receipt of the document before effecting any transaction in a penny stock for the investor's account. Potential investors in our common stock are urged to obtain and read such disclosure carefully before purchasing any shares that are deemed to be "penny stocks." Moreover, Rule 15g-9 requires broker-dealers in penny stocks to approve the account of any investor for transactions in such stocks before selling any penny stock to that investor. This procedure requires the broker-dealer to (i) obtain from the investor information concerning his or her financial situation, investment experience and investment objectives; (ii) reasonably determine, based on that information, that transactions in penny stocks are suitable for the investor and that the investor has sufficient knowledge and experience as to be reasonably capable of evaluating the risks of penny stock transactions; (iii) provide the investor with a written statement setting forth the basis on which the broker-dealer made the determination in (ii) above; and (iv) receive a signed and dated copy of such statement from the investor, confirming that it accurately reflects the investor's financial situation, investment experience and investment objectives. Compliance with these requirements may make it more difficult for holders of our common stock to resell their shares to third parties or to otherwise dispose of them in the market or otherwise.

OUR COMMON STOCK MAY BE VOLATILE, WHICH SUBSTANTIALLY INCREASES THE RISK THAT YOU MAY NOT BE ABLE TO SELL YOUR SHARES AT OR ABOVE THE PRICE THAT YOU MAY PAY FOR THE SHARES.

Because of the limited trading market for our common stock, and because of the possible price volatility, you may not be able to sell your shares of common stock when you desire to do so. The inability to sell your shares in a rapidly declining market may substantially increase your risk of loss because of such illiquidity and because the price for our common stock may suffer greater declines because of its price volatility.

The market price of our common stock may be higher or lower than the price you may pay for your shares. Certain factors, some of which are beyond our control, that may cause our share price to fluctuate significantly include, but are not limited to, the following:

| • | variations in our quarterly operating results; |

| • | loss of a key relationship or failure to complete significant transactions; |

| • | additions or departures of key personnel; and |

| • | fluctuations in stock market price and volume. |

Additionally, in recent years the stock market in general, and the over-the-counter markets in particular, have experienced extreme price and volume fluctuations. In some cases, these fluctuations are unrelated or disproportionate to the operating performance of the underlying company. These market and industry factors may materially and adversely affect our stock price, regardless of our operating performance.

In the past, class action litigation often has been brought against companies following periods of volatility in the market price of those companies' common stock. If we become involved in this type of litigation in the future, it could result in substantial costs and diversion of management attention and resources, which could have a further negative effect on your investment in our stock.

WE HAVE NOT PAID, AND DO NOT INTEND TO PAY, CASH DIVIDENDS IN THE FORESEEABLE FUTURE.

We have not paid any cash dividends on our common stock and do not intend to pay cash dividends in the foreseeable future. We intend to retain future earnings, if any, for reinvestment in the development and expansion of our business. Dividend payments in the future may also be limited by other loan agreements or covenants contained in other securities which we may issue. Any future determination to pay cash

dividends will be at the discretion of our board of directors and depend on our financial condition, results of operations, capital and legal requirements and such other factors as our board of directors deems relevant.

SALES OF OUR COMMON STOCK RELYING UPON RULE 144 MAY DEPRESS PRICES IN THE MARKET FOR OUR COMMON STOCK BY A MATERIAL AMOUNT.

As of the date of this Annual Report, all of our common stock held by non-affiliates that was issued before December 31, 2013 and was either issued in a registered offer for sale or exchange or has been issued and outstanding beyond applicable holding periods imposed by Rule 144 under the Securities Act of 1933, as amended. Thus, with 100% of our common stock issued prior to December 31, 2011 to non-affiliates being freely tradeable, there is a significant risk that sales under Rule 144 or under any other exemption from the Securities Act, if available, or pursuant to registration of shares of Common Stock of present stockholders, may have a depressive effect upon the price of our common stock in the over-the-counter market, especially in situations where a large volume of shares is offered for sale at the same time.

Securities saleable pursuant to the Rule 144 exemption from registration may only be resold, however, if all of the requirements of Rule 144 have been met, including, but not limited to, the requirement that the issuer of the securities have made available all required public information. However, there is no limit on the amount of restricted securities that may be sold by a non-affiliate (i.e., a stockholder who has not been an officer, director or control person for at least 90 consecutive days) after the restricted securities have been held by the owner for a period of at least six months and the other requirements of Rule 144 have been satisfied. Presently shares of restricted Common Stock held by non-affiliates of the Company may be sold, subject to compliance with Rule 144, six months after issuance, provided that our Exchange Act registration remains in effect and we are current in our disclosure reporting obligations.

ITEM 1B. UNRESOLVED STAFF COMMENTS.

As of the date of this Annual Report, there are no unresolved SEC Staff comments.

ITEM 2. DESCRIPTION OF PROPERTY

We lease 3,600 sq. ft. of office and warehouse space at 1550 Caton Center Drive, Suites D and E, Baltimore, Maryland, under a three-year non-cancellable operating lease, which expires December 2014. This location serves as both our principal executive office and the manufacturing and assembly location for our proprietary products.

The original base rent had been $3,077 per month with an annual rent escalator of 3%. The current monthly rent is $3,464. .Rent expense, which includes the Caton Center property as well as some other short-term leases, was $42,582 and $44,652 for the periods ended December 31, 2014 and 2013, respectively.

ITEM 3. LEGAL PROCEEDINGS.

As of the date of this Annual Report, management is not aware of any legal proceedings contemplated by any governmental authority or any other party involving us or our properties. As of the date of this Annual Report, no director, officer or affiliate is (i) a party adverse to us in any legal proceeding, or (ii) has an adverse interest to us in any legal proceedings. Management is not aware of any other legal proceedings pending or that have been threatened against us or our properties.

ITEM 4. MINE SAFETY DISCLOSURES.

Not Applicable.

PART II

ITEM 5. MARKET FOR COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND SMALL BUSINESS ISSUER PURCHASERS OF EQUITY SECURITIES.

MARKET INFORMATION

Our common stock has been quoted on the OTC Bulletin Board under the symbol "VYST.OB" up to October 2008 and from October 17, 2008 under the symbol “VSYM.OB” and is traded over the counter. The following table sets forth the high and low price information of the Company's common stock for the periods indicated.

OTC Bulletin Board (1) (2)

| FISCAL YEAR ENDED DECEMBER 31, 2014: | High | Low | ||||||||||

| Fourth Quarter | $ | 0.013 | $ | 0.01 | ||||||||

| Third Quarter | $ | 0.023 | $ | 0.0033 | ||||||||

| Second Quarter | $ | 0.026 | $ | 0.01 | ||||||||

| First Quarter | $ | 0.03 | $ | 0.016 | ||||||||

| FISCAL YEAR ENDED DECEMBER 31, 2013: | ||||||||||||

| Fourth Quarter | $ | 0.301 | ` | 0.0001 | ||||||||

| Third Quarter | $ | 0.035 | $ | 0.0378 | ||||||||

| Second Quarter | $ | 0.04 | $ | 0.037 | ||||||||

| First Quarter | $ | 0.025 | $ | 0.019 | ||||||||

| (1) | Over-the-counter market quotations reflect inter-dealer prices without retail mark-up, mark-down or commission, and may not represent actual transactions. |

| (2) | Source: www.nasdaq.com |

SHAREHOLDERS OF RECORD

As of April 14, 2015, there were approximately 402 holders of record of our common stock, not including holders who hold their shares in street name.

DIVIDENDS

We have never declared or paid a cash dividend. At this time, we do not anticipate paying dividends in the future. We are under no legal or contractual obligation to declare or to pay dividends, and the timing and amount of any future cash dividends and distributions is at the discretion of our Board of Directors and will depend, among other things, on our future after-tax earnings, operations, capital requirements, borrowing capacity, financial condition and general business conditions. We plan to retain any earnings for use in the operation of our business and to fund future growth. You should not purchase our Shares on the expectation of future dividends.

SECURITIES AUTHORIZED FOR ISSUANCE UNDER EQUITY COMPENSATION PLANS

Equity Compensation Plan Information