GREAT-WEST LIFE & ANNUITY INSURANCE COMPANY Insured: [John Doe] Policy Number: [1234567] A Stock Company [8515 East Orchard Road] [Greenwood Village, CO 80111] [1-877-723-8723] Great-West Life & Annuity Insurance Company (the “Company”) will pay the Death Benefit Proceeds to the Beneficiary subject to the policy provisions, when the Company receives due proof of the Insured’s death. (Payment of such Proceeds will completely discharge the Company’s liability with respect to the amount payable.) The Owner and Beneficiary are as shown in the application unless changed as provided for in this policy. The provisions on the following pages are a part of this policy. Signed for the Company on the Issue Date. [ ] [ ] [Richard Schultz,] [Robert L. Reynolds,] [Secretary] [President and Chief Executive Officer] This policy is a legal contract between the Owner and the Company. PLEASE READ THIS POLICY CAREFULLY. RIGHT TO EXAMINE THERE IS A 10 DAY RIGHT TO EXAMINE. IF THE POLICY IS ISSUED AS A REPLACEMENT OF AN EXISTING POLICY, THE RIGHT TO EXAMINE PERIOD IS EXTENDED TO 30 DAYS FROM THE DATE OF RECEIVING IT. IF YOU ARE NOT SATISFIED WITH THE POLICY, RETURN IT TO THE COMPANY OR AN AGENT OF THE COMPANY. THE POLICY WILL BE VOID FROM THE START, AND THE COMPANY WILL REFUND THE POLICY VALUE ACCOUNT LESS SURRENDERS, WITHDRAWALS, AND DISTRIBUTIONS. DURING THE RIGHT TO EXAMINE PERIOD, THE PREMIUM WILL BE ALLOCATED TO THE INVESTMENT DIVISIONS AS SPECIFIED IN THE APPLICATION. FLEXIBLE PREMIUM VARIABLE UNIVERSAL LIFE INSURANCE Proceeds payable at death are subject to policy provisions. See Death Benefit Provisions. Flexible Premiums payable while the Insured is alive. If no Premiums are paid after the first Premium, or if subsequent Premiums prove to be insufficient, this coverage may cease prior to age 121. ALL PAYMENTS AND VALUES ARE BASED ON THE INVESTMENT EXPERIENCE OF THE SUB-ACCOUNTS AND ARE VARIABLE, MAY INCREASE OR DECREASE ACCORDINGLY, AND ARE NOT GUARANTEED AS TO AMOUNT. Non-Participating. ICC14-J355X

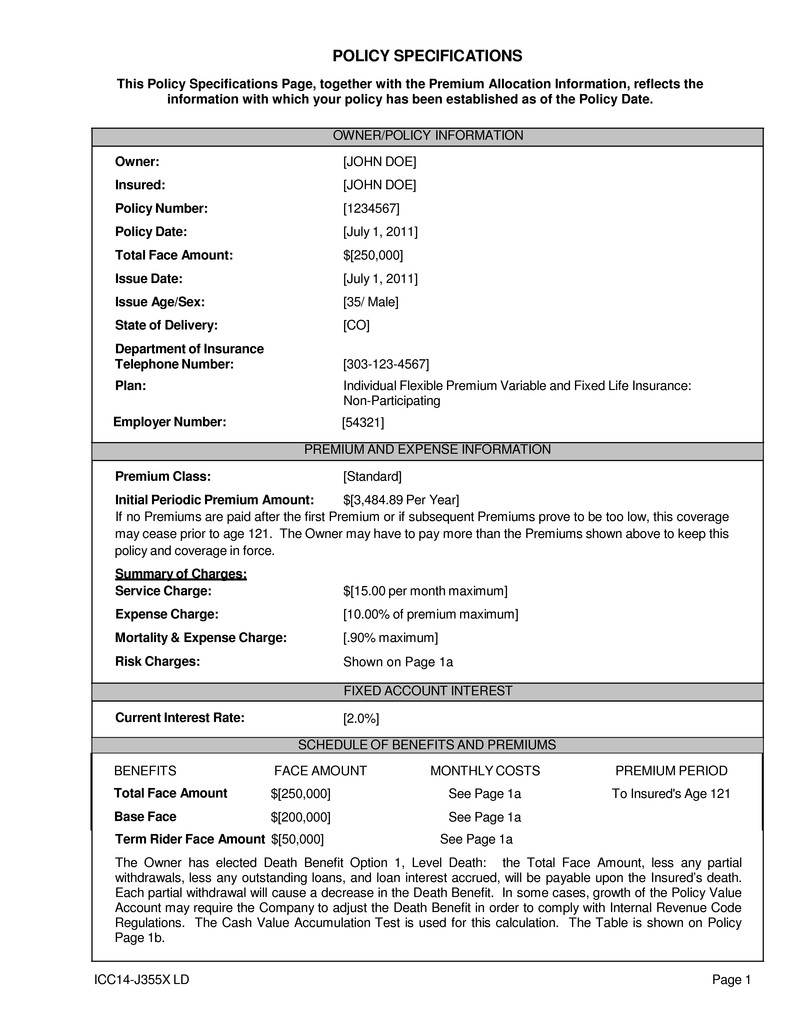

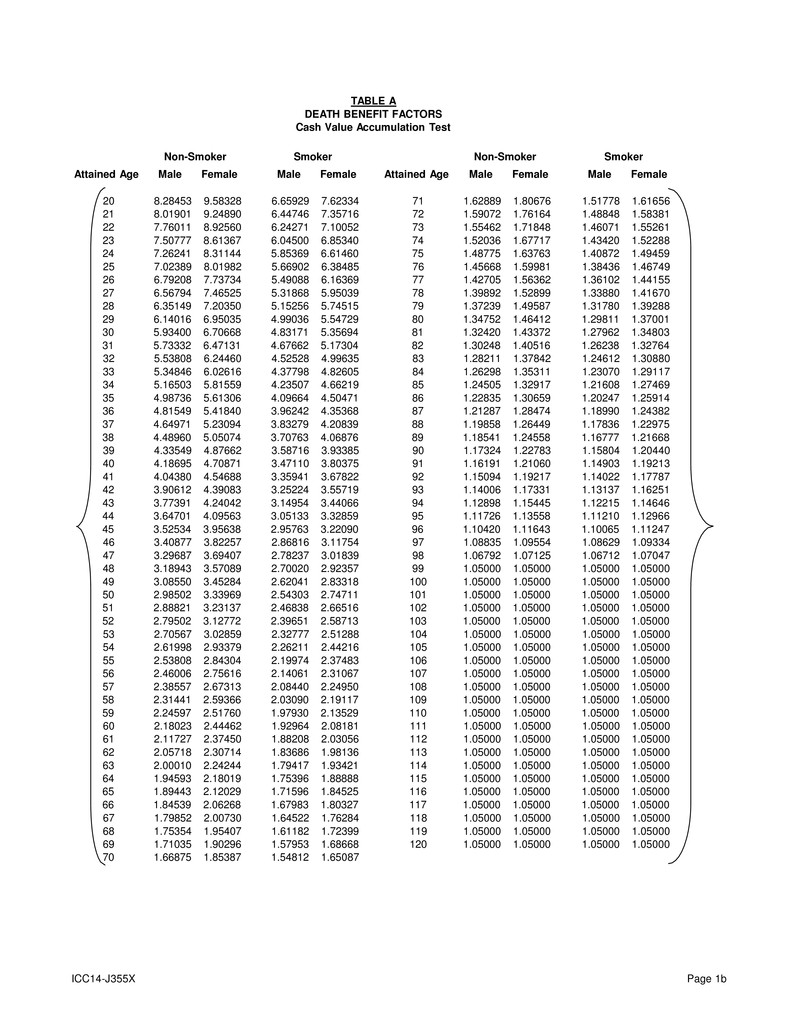

POLICY SPECIFICATIONS This Policy Specifications Page, together with the Premium Allocation Information, reflects the information with which your policy has been established as of the Policy Date. OWNER/POLICY INFORMATION Owner: [JOHN DOE] Insured: [JOHN DOE] Policy Number: [1234567] Policy Date: [July 1, 2011] Total Face Amount: $[250,000] Issue Date: [July 1, 2011] Issue Age/Sex: [35/ Male] State of Delivery: [CO] Department of Insurance Telephone Number: [303-123-4567] Plan: Individual Flexible Premium Variable and Fixed Life Insurance: Non-Participating Employer Number: [54321] PREMIUM AND EXPENSE INFORMATION Premium Class: [Standard] Initial Periodic Premium Amount: $[3,484.89 Per Year] If no Premiums are paid after the first Premium or if subsequent Premiums prove to be too low, this coverage may cease prior to age 121. The Owner may have to pay more than the Premiums shown above to keep this policy and coverage in force. Summary of Charges: Service Charge: $[15.00 per month maximum] Expense Charge: [10.00% of premium maximum] Mortality & Expense Charge: [.90% maximum] Risk Charges: Shown on Page 1a FIXED ACCOUNT INTEREST Current Interest Rate: [2.0%] SCHEDULE OF BENEFITS AND PREMIUMS BENEFITS FACE AMOUNT MONTHLY COSTS PREMIUM PERIOD Total Face Amount $[250,000] See Page 1a To Insured's Age 121 Base Face $[200,000] See Page 1a Term Rider Face Amount $[50,000] See Page 1a The Owner has elected Death Benefit Option 1, Level Death: the Total Face Amount, less any partial withdrawals, less any outstanding loans, and loan interest accrued, will be payable upon the Insured’s death. Each partial withdrawal will cause a decrease in the Death Benefit. In some cases, growth of the Policy Value Account may require the Company to adjust the Death Benefit in order to comply with Internal Revenue Code Regulations. The Cash Value Accumulation Test is used for this calculation. The Table is shown on Policy Page 1b. ICC14-J355X LD Page 1

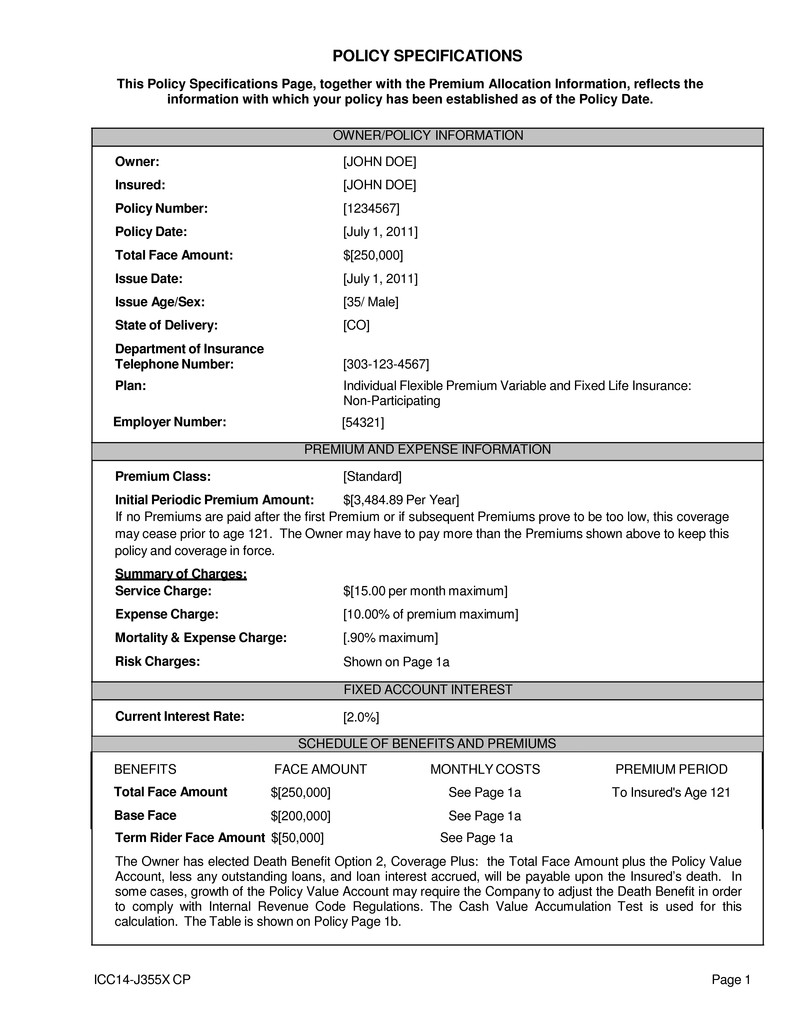

POLICY SPECIFICATIONS This Policy Specifications Page, together with the Premium Allocation Information, reflects the information with which your policy has been established as of the Policy Date. OWNER/POLICY INFORMATION Owner: [JOHN DOE] Insured: [JOHN DOE] Policy Number: [1234567] Policy Date: [July 1, 2011] Total Face Amount: $[250,000] Issue Date: [July 1, 2011] Issue Age/Sex: [35/ Male] State of Delivery: [CO] Department of Insurance Telephone Number: [303-123-4567] Plan: Individual Flexible Premium Variable and Fixed Life Insurance: Non-Participating Employer Number: [54321] PREMIUM AND EXPENSE INFORMATION Premium Class: [Standard] Initial Periodic Premium Amount: $[3,484.89 Per Year] If no Premiums are paid after the first Premium or if subsequent Premiums prove to be too low, this coverage may cease prior to age 121. The Owner may have to pay more than the Premiums shown above to keep this policy and coverage in force. Summary of Charges: Service Charge: $[15.00 per month maximum] Expense Charge: [10.00% of premium maximum] Mortality & Expense Charge: [.90% maximum] Risk Charges: Shown on Page 1a FIXED ACCOUNT INTEREST Current Interest Rate: [2.0%] SCHEDULE OF BENEFITS AND PREMIUMS BENEFITS FACE AMOUNT MONTHLY COSTS PREMIUM PERIOD Total Face Amount $[250,000] See Page 1a To Insured's Age 121 Base Face $[200,000] See Page 1a Term Rider Face Amount $[50,000] See Page 1a The Owner has elected Death Benefit Option 2, Coverage Plus: the Total Face Amount plus the Policy Value Account, less any outstanding loans, and loan interest accrued, will be payable upon the Insured’s death. In some cases, growth of the Policy Value Account may require the Company to adjust the Death Benefit in order to comply with Internal Revenue Code Regulations. The Cash Value Accumulation Test is used for this calculation. The Table is shown on Policy Page 1b. ICC14-J355X CP Page 1

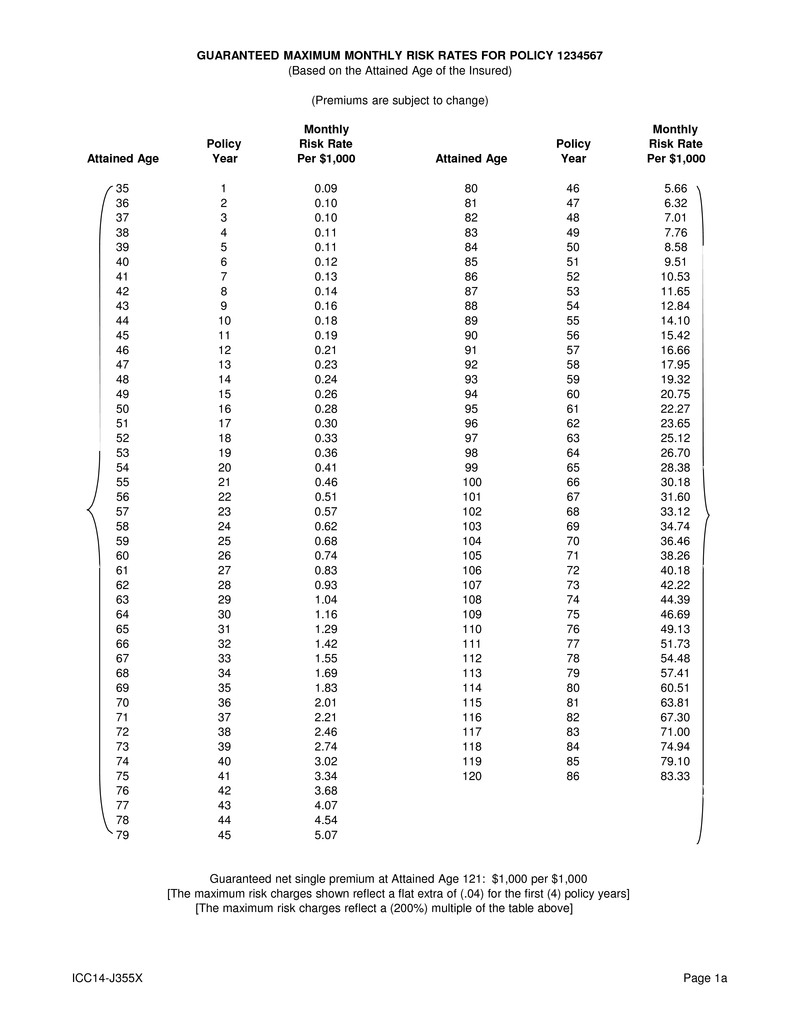

GUARANTEED MAXIMUM MONTHLY RISK RATES FOR POLICY 1234567 (Based on the Attained Age of the Insured) (Premiums are subject to change) Monthly Monthly Policy Risk Rate Policy Risk Rate Attained Age Year Per $1,000 Attained Age Year Per $1,000 35 1 0.09 80 46 5.66 36 2 0.10 81 47 6.32 37 3 0.10 82 48 7.01 38 4 0.11 83 49 7.76 39 5 0.11 84 50 8.58 40 6 0.12 85 51 9.51 41 7 0.13 86 52 10.53 42 8 0.14 87 53 11.65 43 9 0.16 88 54 12.84 44 10 0.18 89 55 14.10 45 11 0.19 90 56 15.42 46 12 0.21 91 57 16.66 47 13 0.23 92 58 17.95 48 14 0.24 93 59 19.32 49 15 0.26 94 60 20.75 50 16 0.28 95 61 22.27 51 17 0.30 96 62 23.65 52 18 0.33 97 63 25.12 53 19 0.36 98 64 26.70 54 20 0.41 99 65 28.38 55 21 0.46 100 66 30.18 56 22 0.51 101 67 31.60 57 23 0.57 102 68 33.12 58 24 0.62 103 69 34.74 59 25 0.68 104 70 36.46 60 26 0.74 105 71 38.26 61 27 0.83 106 72 40.18 62 28 0.93 107 73 42.22 63 29 1.04 108 74 44.39 64 30 1.16 109 75 46.69 65 31 1.29 110 76 49.13 66 32 1.42 111 77 51.73 67 33 1.55 112 78 54.48 68 34 1.69 113 79 57.41 69 35 1.83 114 80 60.51 70 36 2.01 115 81 63.81 71 37 2.21 116 82 67.30 72 38 2.46 117 83 71.00 73 39 2.74 118 84 74.94 74 40 3.02 119 85 79.10 75 41 3.34 120 86 83.33 76 42 3.68 77 43 4.07 78 44 4.54 79 45 5.07 Guaranteed net single premium at Attained Age 121: $1,000 per $1,000 [The maximum risk charges shown reflect a flat extra of (.04) for the first (4) policy years] [The maximum risk charges reflect a (200%) multiple of the table above] ICC14-J355X Page 1a

TABLE A DEATH BENEFIT FACTORS Cash Value Accumulation Test Non-Smoker Smoker Non-Smoker Smoker Attained Age Male Female Male Female Attained Age Male Female Male Female 20 8.28453 9.58328 6.65929 7.62334 71 1.62889 1.80676 1.51778 1.61656 21 8.01901 9.24890 6.44746 7.35716 72 1.59072 1.76164 1.48848 1.58381 22 7.76011 8.92560 6.24271 7.10052 73 1.55462 1.71848 1.46071 1.55261 23 7.50777 8.61367 6.04500 6.85340 74 1.52036 1.67717 1.43420 1.52288 24 7.26241 8.31144 5.85369 6.61460 75 1.48775 1.63763 1.40872 1.49459 25 7.02389 8.01982 5.66902 6.38485 76 1.45668 1.59981 1.38436 1.46749 26 6.79208 7.73734 5.49088 6.16369 77 1.42705 1.56362 1.36102 1.44155 27 6.56794 7.46525 5.31868 5.95039 78 1.39892 1.52899 1.33880 1.41670 28 6.35149 7.20350 5.15256 5.74515 79 1.37239 1.49587 1.31780 1.39288 29 6.14016 6.95035 4.99036 5.54729 80 1.34752 1.46412 1.29811 1.37001 30 5.93400 6.70668 4.83171 5.35694 81 1.32420 1.43372 1.27962 1.34803 31 5.73332 6.47131 4.67662 5.17304 82 1.30248 1.40516 1.26238 1.32764 32 5.53808 6.24460 4.52528 4.99635 83 1.28211 1.37842 1.24612 1.30880 33 5.34846 6.02616 4.37798 4.82605 84 1.26298 1.35311 1.23070 1.29117 34 5.16503 5.81559 4.23507 4.66219 85 1.24505 1.32917 1.21608 1.27469 35 4.98736 5.61306 4.09664 4.50471 86 1.22835 1.30659 1.20247 1.25914 36 4.81549 5.41840 3.96242 4.35368 87 1.21287 1.28474 1.18990 1.24382 37 4.64971 5.23094 3.83279 4.20839 88 1.19858 1.26449 1.17836 1.22975 38 4.48960 5.05074 3.70763 4.06876 89 1.18541 1.24558 1.16777 1.21668 39 4.33549 4.87662 3.58716 3.93385 90 1.17324 1.22783 1.15804 1.20440 40 4.18695 4.70871 3.47110 3.80375 91 1.16191 1.21060 1.14903 1.19213 41 4.04380 4.54688 3.35941 3.67822 92 1.15094 1.19217 1.14022 1.17787 42 3.90612 4.39083 3.25224 3.55719 93 1.14006 1.17331 1.13137 1.16251 43 3.77391 4.24042 3.14954 3.44066 94 1.12898 1.15445 1.12215 1.14646 44 3.64701 4.09563 3.05133 3.32859 95 1.11726 1.13558 1.11210 1.12966 45 3.52534 3.95638 2.95763 3.22090 96 1.10420 1.11643 1.10065 1.11247 46 3.40877 3.82257 2.86816 3.11754 97 1.08835 1.09554 1.08629 1.09334 47 3.29687 3.69407 2.78237 3.01839 98 1.06792 1.07125 1.06712 1.07047 48 3.18943 3.57089 2.70020 2.92357 99 1.05000 1.05000 1.05000 1.05000 49 3.08550 3.45284 2.62041 2.83318 100 1.05000 1.05000 1.05000 1.05000 50 2.98502 3.33969 2.54303 2.74711 101 1.05000 1.05000 1.05000 1.05000 51 2.88821 3.23137 2.46838 2.66516 102 1.05000 1.05000 1.05000 1.05000 52 2.79502 3.12772 2.39651 2.58713 103 1.05000 1.05000 1.05000 1.05000 53 2.70567 3.02859 2.32777 2.51288 104 1.05000 1.05000 1.05000 1.05000 54 2.61998 2.93379 2.26211 2.44216 105 1.05000 1.05000 1.05000 1.05000 55 2.53808 2.84304 2.19974 2.37483 106 1.05000 1.05000 1.05000 1.05000 56 2.46006 2.75616 2.14061 2.31067 107 1.05000 1.05000 1.05000 1.05000 57 2.38557 2.67313 2.08440 2.24950 108 1.05000 1.05000 1.05000 1.05000 58 2.31441 2.59366 2.03090 2.19117 109 1.05000 1.05000 1.05000 1.05000 59 2.24597 2.51760 1.97930 2.13529 110 1.05000 1.05000 1.05000 1.05000 60 2.18023 2.44462 1.92964 2.08181 111 1.05000 1.05000 1.05000 1.05000 61 2.11727 2.37450 1.88208 2.03056 112 1.05000 1.05000 1.05000 1.05000 62 2.05718 2.30714 1.83686 1.98136 113 1.05000 1.05000 1.05000 1.05000 63 2.00010 2.24244 1.79417 1.93421 114 1.05000 1.05000 1.05000 1.05000 64 1.94593 2.18019 1.75396 1.88888 115 1.05000 1.05000 1.05000 1.05000 65 1.89443 2.12029 1.71596 1.84525 116 1.05000 1.05000 1.05000 1.05000 66 1.84539 2.06268 1.67983 1.80327 117 1.05000 1.05000 1.05000 1.05000 67 1.79852 2.00730 1.64522 1.76284 118 1.05000 1.05000 1.05000 1.05000 68 1.75354 1.95407 1.61182 1.72399 119 1.05000 1.05000 1.05000 1.05000 69 1.71035 1.90296 1.57953 1.68668 120 1.05000 1.05000 1.05000 1.05000 70 1.66875 1.85387 1.54812 1.65087 ICC14-J355X Page 1b

THIS PAGE IS INTENTIONALLY LEFT BLANK ICC14-J355X Page 2

Table of Contents DEFINITIONS ...............................................................................................................................5 OWNERSHIP PROVISIONS Assignments/Transfers ..........................................................................................................6 Beneficiary .............................................................................................................................6 Ownership of Series Account ...............................................................................................7 Ownership of Fixed Account ..................................................................................................7 Rights of Owner .....................................................................................................................6 GENERAL PROVISIONS Additional Premium Payments Provision ............................................................................9 Allocation of Premiums ..........................................................................................................8 Annual Statement ..................................................................................................................9 Change of Total Face Amount ............................................................................................. 10 Currency .................................................................................................................................8 Entire Contract .......................................................................................................................7 Grace Period Provision .........................................................................................................9 Illustration of Benefits and Values ..................................................................................... 10 Incontestability Provision ......................................................................................................7 Interstate Insurance Product Regulation Commission ........................................................7 Misstatement of Age and/or Sex ..........................................................................................8 Non-Participating ..................................................................................................................8 Payment of Premiums ..........................................................................................................8 Periodic Premium Amount ....................................................................................................9 Policy Modification ................................................................................................................7 Policy Years and Anniversaries ............................................................................................8 Reinstatement ........................................................................................................................9 Suicide Exclusion ...................................................................................................................8 Voting Rights ..........................................................................................................................8 DEATH BENEFIT PROVISIONS Change of Death Benefit Option .......................................................................................... 11 Death Benefit Payment ....................................................................................................... 11 Death Benefit Options .......................................................................................................... 10 (Continued on following page) ICC14-J355X Page 3

Table of Contents (continued) POLICY VALUES, LOAN AND NONFORFEITURE PROVISIONS Continuation of Insurance ........................................................................................................... 13 Cost of Insurance ........................................................................................................................ 11 Effect of a Loan ........................................................................................................................... 13 Emergency Procedure ................................................................................................................ 15 Expense Charge .......................................................................................................................... 11 Fixed Account Value ................................................................................................................... 12 Fixed Account Interest ................................................................................................................. 13 How Values Are Computed .......................................................................................................... 15 Loan Interest ................................................................................................................................ 13 Loan Interest Rate ....................................................................................................................... 14 Loan Value .................................................................................................................................. 13 Net Investment Factor ................................................................................................................. 13 Paid-Up Life Insurance Provision................................................................................................. 14 Partial Withdrawal Provision ....................................................................................................... 15 Policy Loan .................................................................................................................................. 13 Policy Value Account ................................................................................................................... 12 Postponement ............................................................................................................................. 15 Return of Expense Charge ......................................................................................................... 14 Risk Rate ..................................................................................................................................... 11 Service Charge ............................................................................................................................ 12 Sub-Account Value ...................................................................................................................... 12 Surrender Benefit ........................................................................................................................ 14 Tax Considerations ..................................................................................................................... 14 TRANSFER PROVISIONS Dollar Cost Averaging ................................................................................................................. 16 The Rebalancer Option ............................................................................................................... 16 Transfers ..................................................................................................................................... 15 ICC14-J355X Page 4

Definitions Attained Age - the age of the Insured, nearest birthday, as of the Policy Date and each policy anniversary thereafter. Beneficiary - the person(s) named by the Owner to receive the Death Benefit Proceeds upon the death of the Insured. Cash Surrender Value - is equal to: (a) Policy Value Account on the effective date of the surrender; less (b) outstanding policy loans and accrued loan interest, if any; less (c) any monthly cost of insurance charges. Corporate Headquarters - Great-West Life & Annuity Insurance Company (“the Company”), [8515 East Orchard Road, Greenwood Village, Colorado 80111.] Death Benefit Proceeds - the amount payable upon the Insured’s death. A full description of the Death Benefit is described in the Death Benefit Provision. Effective Date - the date on which the first Premium payment is credited to the policy. Evidence of Insurability - information about an Insured which is used to approve or reinstate this policy or any additional benefit. Fixed Account - A division of our General Account that provides a fixed interest rate. The maximum allowed into the Fixed Account by any Owner may be limited by the Company. General Account - All of our assets other than those held in the Separate Account. Insured - the person named on Page 1 as the Insured. Investment Divisions - the divisions of the Series Account that purchase shares in specific securities. The Company may, at times: • make additional Series Accounts or additional Series Account Investment Divisions available; • eliminate Investment Divisions; • combine two or more Investment Divisions; or • substitute a new portfolio for the portfolio in which an Investment Division invests. Subject to any required regulatory approvals, the Company has the right to transfer assets of a Series Account or of an Investment Division to another Series Account or Investment Division. When permitted by law, the Company may modify the policy to comply with applicable federal and state laws and combine the Series Account with other Series Accounts. Issue Date - the date from which the incontestability and suicide exclusions are measured shown on Page 1. Loan Account - all outstanding loans plus credited loan interest held in the General Account of the Company. The Loan Account is not part of the Series Account. Loan Account Value - the sum of all outstanding loans plus credited loan interest for this policy. Owner – is the person, persons or entity named on the Policy Specifications page as the Owner. The Owner is entitled to all the rights under this policy while the Insured is living. Policy Date - the effective date of coverage under this policy. The policy months, policy years and anniversaries are measured from the Policy Date shown on Page 1. Policy Value Account - the Sub-Account Value plus the Fixed Account Value plus the Loan Account Value. Premiums - amounts received and allocated to the Sub-Account(s) and the Fixed Account prior to any deductions. Request - any instruction in a form, written, telephoned or computerized, satisfactory to the Company and received at the Corporate Headquarters from the Owner or the Owner's assignee (as specified in a form acceptable to the Company) or the Beneficiary, (as applicable) as required by any provision of this policy or as required by the Company. The Request is subject to any action taken or payment made by the Company before it was processed. An Owner may submit a Request for transactions including, but not limited to, the following: • allocations of Premiums or loan repayments; and • Requests for surrenders, partial withdrawals, loans, or Transfers. Series Account - the segregated investment account established by the Company as a separate account under Colorado law named the COLI VUL-2 Series Account. It is registered as a unit investment trust under the Investment Company Act of 1940, as amended. The Company owns the assets in the Series Account. The investments held in the Series Account provide variable life insurance benefits under this policy and the Series Account is used for other purposes permitted by applicable laws and regulations. This account is kept separate from the General Account and other series accounts the Company may have. ICC14-J355X Page 5

Definitions (continued) Sub-Account - sub-division(s) of the Owner’s Policy Value Account containing the value credited to the Owner from the Series Account. Sub-Account Value - the sum of the values of the Sub-Accounts credited to the Owner under the Policy Value Account. The Sub-Account Value is credited with a return based upon the investment experience of the Investment Division(s) selected by the Owner and will increase or decrease accordingly. Transaction Date - the date on which any Premium payment or Request from the Owner will be processed by the Company. Premium payments and Requests received after 4:00 p.m. EST/EDT will be deemed to have been received on the next business day. Requests will be processed and the Sub- Account Value will be valued on each date that the New York Stock Exchange (“NYSE”) is open for trading. Ownership Provisions Transfer - the moving of money from one Sub- Account or the Fixed Account to one or more Sub- Account(s) or the Fixed Account. Underlying Fund - a portfolio of securities managed in accordance with a specified investment objective, or a registered management investment company in which the assets of the Series Account may be invested. Valuation Date - the date on which the net asset value of each Underlying Fund is determined. A Valuation Date is each day that the New York Stock Exchange is open for regular business. The value of an Investment Division's assets is determined at the end of each Valuation Date. To determine the value of an asset on a day that is not a Valuation Date, the value of that asset as of the end of the previous Valuation Date will be used. Valuation Period - the period between two successive Valuation Dates, starting at the close of the NYSE on one Valuation Date and ending at the close of the NYSE on the next succeeding Valuation Date. RIGHTS OF OWNER While the Insured is living, all benefits and rights under this policy belong to the Owner. However, the Owner’s rights are subject to the rights of any assignee or irrevocably named Beneficiary. ASSIGNMENTS/TRANSFERS The Owner may assign this policy while the Insured is living subject to the assignment satisfying applicable laws and regulations. The Company will not recognize an assignment until the original or a certified copy is recorded at the Corporate Headquarters. When filed, the Owner’s rights and those of the Beneficiary are subject to the assignment. The Company is not responsible for the validity of any assignment. When recorded by the Company, a transfer of ownership will revoke any designation of a Secondary Owner. It will not change a Beneficiary. All benefits and rights under this policy will belong to the new Owner, subject to the terms and conditions of the policy and the interest of any recorded assignee. BENEFICIARY While the Insured is living, the Owner may change the Beneficiary by Request unless a previous designation was made irrevocable. An irrevocable Beneficiary designation may not be changed without the written consent of that Beneficiary, except to the extent required by law. Any change is subject to any existing assignment of this policy. A recorded change of Beneficiary will take effect as of the date the notice was signed unless otherwise specified by the Owner. However, the change will not affect any payment made by the Company before it received a Request for a change of Beneficiary. The Company may rely on an affidavit by any responsible person to identify a Beneficiary or verify the non-existence of a Beneficiary not identified by name. ICC14-J355X Page 6

Ownership Provisions (continued) OWNERSHIP OF SERIES ACCOUNT The Company has absolute ownership of the assets of the Series Account. The portion of the assets of the Series Account equal to the reserves and other Contract liabilities with respect to the Series Account are not chargeable with liabilities arising out of any other business the Company may conduct. Income and realized and unrealized gains or losses from the assets in the Series Account are credited to or charged against the account without regard to other income, gains or losses arising out of any other business the Company may conduct. Assets of the Series Account held in or represented by any other separate account of the Company used in connection with this policy, in an amount equal to such other account’s reserves and other contract liabilities shall not be chargeable with the liabilities arising out of any other business the Company may conduct. OWNERSHIP OF FIXED ACCOUNT The Company has absolute ownership of the assets of the Fixed Account. Except as limited by law, the Company has sole control over the investment of the General Account Assets. The Owner does not share in the investment experience of the General Account, but is allowed to allocate and Transfer Policy Value into the Fixed Account. General Provisions ENTIRE CONTRACT This policy, any endorsements, any riders, and the application form the entire contract. A copy of the application is attached. After issue, amendments or changes in writing and agreed to by the Company are part of the contract. All statements in the application, in the absence of fraud, are considered representations and not warranties. Only statements in the application will be used to defend a claim or to cancel the policy for misrepresentation. Only the President, a Vice-President, or the Secretary of the Company have the authority to change or waive any provisions of the policy. No agent or broker has the authority to change any term of this policy or to make any agreements binding to the Company. INTERSTATE INSURANCE PRODUCT REGULATION COMMISSION This Policy was approved under the authority of the Interstate Insurance Product Regulation Commission and issued under the Commission standards. Any provision of the Policy that on the provision’s effective date is in conflict with Interstate Insurance Product Regulation Commission standards for this product type is hereby amended to conform to the Interstate Insurance Product Regulation Commission standards for this product type as of the provision’s effective date. POLICY MODIFICATION The Company may terminate an Investment Division or Underlying Fund. In the event, the Owner, by Request, may change the allocation of the Premium. If no Request is made by the date of termination, future Premium allocations to the terminated Investment Division or Underlying Fund will be allocated to the Money Market Investment Division. Any modification will not affect the terms, provisions or conditions which are, or may be, applicable to Premium payments previously made to any such Investment Division. INCONTESTABILITY PROVISION Except for nonpayment of premium, this policy will not be contested on the basis of misrepresentation after it has been in force during the Insured's lifetime for 2 years from the Issue Date. However, this 2 year limit does not apply to any rider attached to this policy which provides: (a) benefits in the event of disability; or (b) additional insurance in the event of accidental death. If the Total Face Amount is increased, the amount of the increase will in like manner be incontestable after it has been in force during the Insured's lifetime for 2 years from the effective date of the increase. ICC14-J355X Page 7

General Provisions (continued) SUICIDE EXCLUSION If the Insured commits suicide, while sane or insane, within 2 years from the Issue Date (or 2 years within the date of reinstatement, if applicable) the proceeds payable under this policy will be limited to an amount equal to all Premiums paid on this policy less outstanding policy loans, accrued loan interest, partial withdrawals and the cost for riders. Payment will be made to the Beneficiary. If the face amount is increased, and if the Insured commits suicide, while sane or insane, within 2 years from the effective date of any increase, the Company will pay only that portion of the Policy Value Account and the cost of insurance paid for the amount of increase. The face amount of the policy will be reduced to the face amount that was in effect prior to the increase. VOTING RIGHTS The Company will exercise any voting rights associated with the Series Account investments in its sole discretion in accordance with applicable law. CURRENCY All amounts to be paid to or by the Company will be in the currency of the United States of America. NON-PARTICIPATING This policy is non-participating. It is not eligible to share in the Company's divisible surplus. MISSTATEMENT OF AGE AND/OR SEX If the Insured's age and/or sex on the Policy Date has been misstated, the benefits payable under this policy will be the amount of insurance that the cost of insurance (deducted from the Policy Value Account at the beginning of the month in which death occurred) would have purchased for the correct age and/or sex on the Policy Date. If the age and/or sex of the Insured or any other person covered under a rider has been misstated on the Policy Date, the benefits payable under the rider will be the benefit that the amount charged would have purchased for the correct age and/or sex on the Policy Date. If the age is misstated in such a way that the Insured was not eligible for coverage under the policy, the Company’s liability will be limited to a return of the Premiums paid, less any partial withdrawals and outstanding loans and accrued loan interest and the cost for riders. POLICY YEARS AND ANNIVERSARIES Policy years and anniversaries will be measured from the Policy Date shown on Page 1. PAYMENT OF PREMIUMS The first Premium is due on or before the Policy Date shown on Page 1. The Company will mail the Owner a billing notice 30 days in advance of the Premium due date. All Premiums after the first are to be made payable to the Company and will be due on the first day of any Policy Month in which the cost of insurance exceeds the Policy Value Account less any outstanding loans and less any accrued loan interest. Subject to limitations as provided in this policy, Premiums paid after the first may be paid in any amount and at any time before the Paid-Up Life Insurance Provision goes into effect. A premium allocation confirmation will be sent upon receipt of each Premium. ALLOCATION OF PREMIUMS During the right to examine period, Premiums will be allocated effective upon the Transaction Date to one or more of the Investment Division(s) selected on the application. During the right to examine period, the Owner may Transfer all or a portion of the Policy Value Account amount among the Investment Divisions currently being offered by the Company. Any returned policy will be void from the date the Company issued the policy and we will refund your Policy Value Account less surrenders, withdrawals, and distributions. This amount may be higher or lower than the Premiums paid, which means the Owner bears the investment risk during the right to examine period. After the right to examine period, subsequent Premium payments will be allocated in the Policy Value Account as Requested by the Owner. If there are no accompanying instructions, then allocations will be made in accordance with standing instructions. Allocations will be effective upon the Transaction Date. ICC14-J355X Page 8

General Provisions (continued) GRACE PERIOD PROVISION The first day of each Policy Month is the due date for any Premium required to keep the policy in force for that month. Except for the first Premium, if the amount in the Policy Value Account, less any outstanding policy loans and less any accrued loan interest, on the last day of a Policy Month is not sufficient to cover the monthly deduction for the cost of insurance for the next Policy Month, a grace period of 61 days from the due date will be allowed for the payment of an amount sufficient to cover the monthly cost of insurance for the next 2 months. Coverage will remain in force during the grace period. If the Premium due is not paid within the grace period, all coverage under this policy will cease at the end of the 61 day period. Notice of such Premium due will be mailed to the last known address of the Owner and any assignee of record at least 31 days prior to the date coverage will cease. If the Insured dies during the grace period, any cost of insurance charges due and unpaid will be deducted from the Death Benefit Proceeds. PERIODIC PREMIUM AMOUNT The Company may suggest a periodic premium amount. The actual amount of Premiums needed may change, depending on the number of Premium payments made, changes in coverage, investment experience, monthly risk rate, and partial withdrawals made. ADDITIONAL PREMIUM PAYMENTS PROVISION Besides the periodic premium amount, the Owner may make additional Premium payments as described below prior to the date the Paid-Up Life Insurance Provision goes into effect. Additional Premium payments may be limited to amounts that will not exceed tax guidelines and jeopardize the tax status of the policy as life insurance. The minimum additional Premium that will be accepted at one time is $100. The Company reserves the right to restrict or refuse additional Premium payments that exceed the Initial Periodic Premium Amount shown on Page 1. REINSTATEMENT This policy may be reinstated within 3 years after the coverage ceased, unless it has been surrendered. The Company must receive: • A Request from the Owner. • Evidence of Insurability for the Insured and any other person covered by rider, at the Owner's expense. • Payment of the cost of insurance for the grace period. • Payment of an amount equal to 4 months’ cost of insurance. Such payment less the expense charges will be credited to the Policy Value Account as of the date of reinstatement. • Payment or reinstatement of any policy loan which was outstanding as of the date the coverage ceased, including interest thereon. Interest will be 6.00% per year. Interest will be compounded annually to the date of the policy reinstatement. Reinstatement will become effective on the date the application for reinstatement is approved by the Company. ANNUAL STATEMENT Within 30 days after each policy anniversary, the Company will send the Owner a statement showing: • The Policy Value Account; • The Death Benefit • Premiums paid and investment experience since the last statement; • Partial withdrawals and charges since the last statement; • Outstanding policy loans and loan interest paid since the last statement; and • The current allocation in each of the Investment Divisions. ICC14-J355X Page 9

General Provisions (continued) ILLUSTRATION OF BENEFITS AND VALUES The Owner may at any time Request from the Company an illustration of future Death Benefits and Cash Surrender Values. The first illustration provided during a policy year will be at no charge. Each additional illustration during that policy year will be subject to a maximum fee of $50. This illustration will be based on: • The current Policy Value Account; • Assumed investment experience; • Coverage amounts and the Death Benefit option elected; • Recommended periodic premium amounts; and • Current monthly risk rates. Death Benefit Provisions CHANGE OF TOTAL FACE AMOUNT By Request, the Owner may at any time increase or decrease the total face amount provided by this policy, subject to the Company's approval. Any change in total face amount may be limited to amounts that will not exceed tax guidelines and jeopardize the tax status of the policy as life insurance. For a decrease in total face amount: • The Company must receive a Request. • The decrease will become effective on the first day of the Policy Month following approval of the Request. • The decrease will apply first to the most recent increase or increases in total face amount for purposes of the incontestability provision. The minimum decrease amount will be $25,000. The total face amount may not be decreased below $100,000 unless prior approval is obtained from the Company. For an increase in total face amount: • The Company must receive a Request. • The increase will be subject to Evidence of Insurability satisfactory to the Company. • The increase will be effective on the policy anniversary following the approval of the Request for the increase, subject to the deduction of the first month's cost of insurance from the Policy Value Account. The minimum increase amount will be $25,000. DEATH BENEFIT OPTIONS The Death Benefit option for this policy as of the Issue Date is shown on Page 1. The Death Benefit is determined by the option in effect at the Insured's date of death. Option 1: Level Death The Death Benefit will be the greater of: a) the Total Face Amount shown on Page 1, less any partial withdrawals; and b) the Policy Value Account on the Insured’s date of death times the applicable Factor shown in the Table on Page 1b. The Death Benefit will be reduced by the amount of any outstanding loans and loan interest accrued. Option 2: Coverage Plus The Death Benefit will be the greater of: a) the Total Face Amount shown on Page 1, plus the Policy Value Account on the Insured’s date of death; and b) the Policy Value Account on the Insured’s date of death times the applicable Factor shown in the Table on Page 1b. The Death Benefit will be reduced by the amount of any outstanding loans and loan interest accrued. ICC14-J355X Page 10

Death Benefit Provisions (continued) CHANGE OF DEATH BENEFIT OPTION After the first policy year, but not more than once each policy year, the Owner may change the Death Benefit option by Request. Any change will be effective on the first day of the Policy Month following the date the Company approves the Request. A maximum fee of $100 will be deducted from the Policy Value Account for each change. A change in the Death Benefit option is subject to the following conditions: • If the change is from Option 1 to Option 2, the amount payable upon the death of the Insured will remain the same and the new Total Face Amount, at the time of the change, will equal the prior Total Face Amount less the Policy Value Account. Evidence of Insurability may be required. • If the change is from Option 2 to Option 1, the amount payable upon the death of the Insured will remain the same and the new Total Face Amount, at the time of the change, will equal the prior Total Face Amount plus the Policy Value Account. DEATH BENEFIT PAYMENT The Death Benefit payable on the Insured's death will be paid in a lump sum unless the Owner elects to receive all or a portion of the Death Benefit Proceeds under a settlement option that the Company is then offering. The Company will pay interest on the Death Benefit Proceeds from the date of death. The Company will pay interest on the Proceeds at a rate established by the Company for funds left on deposit. Additional interest shall accrue at a rate of 10% annually beginning with the date that is 31 calendar days from the latest of (i), (ii), and (iii) to the date the claim is paid, where: (i) The date that due proof of death is received by the Company; (ii) The date the Company receives sufficient information to determine our liability, the extent of the liability, and the appropriate payee legally entitled to the Proceeds; and (iii) The date that legal impediments to the payment of Death Benefit Proceeds that depend on the action of parties other than the Company are resolved and sufficient evidence of the same is provided to the Company. Legal impediments to payment include, but are not limited to (a) the establishment of guardianships and conservatorships; (b) the appointment and qualification of trustees, executors and administrators; and (c) the submission of information required to satisfy state and federal reporting requirements. Policy Values, Loan and Nonforfeiture Provisions COST OF INSURANCE An amount will be deducted on the first day of each Policy Month from the Policy Value Account to pay the cost of insurance for that Policy Month. The cost of insurance is calculated on the first day of each Policy Month and is equal to: the Death Benefit divided by 1.00327374 less the Policy Value Account on the first day of each Policy Month, multiplied by the current monthly risk rate for the Insured's Attained Age, plus the extra charge for any rated class plus the monthly Service Charge plus the cost of any riders. If there has been an increase or decrease in Death Benefit during the policy year, the cost of insurance calculation will be adjusted accordingly to reflect the change. RISK RATE The maximum monthly risk rate is shown on Page 1a. The Company may charge a lower monthly risk rate. The maximum risk rates shown on Page 1a are based on the Commissioners 2001 Standard Ordinary Smoker-Distinct and Sex-Distinct Mortality Table, age nearest birthday. The Company reserves the right to change the monthly risk rate based on our expectations of future mortality, investment earnings, persistency, capital and reserve requirements, and expenses (including taxes) subject to the maximum risk rates. Any change will be made uniformly by class. EXPENSE CHARGE The maximum expense charge for this policy is shown on Page 1. The charge is a percentage of all Premiums paid. This charge is guaranteed and may not be increased. ICC14-J355X Page 11

Policy Values, Loan and Nonforfeiture Provisions (Continued) The expense charge will be deducted from each Premium paid. This would include any Premium paid to reinstate the policy. SERVICE CHARGE The maximum service charge for this policy is shown on Page 1. This charge is deducted from the Policy Value Account on the first day of each policy month. This charge is guaranteed and may not be increased. POLICY VALUE ACCOUNT The Policy Value Account is equal to the Sub-Account Value plus the Fixed Account Value plus the Loan Account Value. Each Premium less any expense charge will be credited to the Policy Value Account on the date received at the Corporate Headquarters. On the first day of each policy month a deduction will be made from this account for the cost of insurance. SUB-ACCOUNT VALUE The Sub-Account Value is the total dollar amount of all accumulation units under each of the Owner’s Sub- Accounts excluding the Fixed Account. Initially, the value of each Accumulation Unit was set at $10.00. Each Sub-Account’s Value is equal to the sum of: • the value of the Sub-Account at the last Valuation Date; • any Premium, less Expense Charges deducted from Premiums received during the current Valuation Period which is allocated to the Sub- Account; • any loan repayment amount; • all values transferred to the Sub-Account; and • any net investment return allocated to the Sub- Account. MINUS the following: • all values transferred to another Sub-Account and the Loan Account Value taken from the Sub- Account during the current Valuation Period; • all partial withdrawals from the Sub-Account during the current Valuation Period. • an amount representing the mortality and expense risk charge deducted from each Investment Division on a daily basis, equal to an annual rate as a percentage of the daily net asset value of each Investment Division. The actual mortality and expense charge is determined by the company, but may not exceed the annual guaranteed maximum mortality and expense charge of .90% In addition, whenever a Valuation Period includes the monthly anniversary day, value of the Sub- Account at the end of such period is reduced by the portion of the cost of insurance charges allocated to the Sub-Account and any other investment charges specified on Page 1. The Sub-Account Value is expected to change from Valuation Period to Valuation Period, reflecting the investment experience of the selected Investment Division(s) as well as the deductions for charges. Premiums which the Owner allocates to an Investment Division are used to purchase accumulation units in the Investment Division(s) the Owner selects. The number of accumulation units to be credited will be determined by dividing the portion of each Premium allocated to or amount transferred to the Investment Division by the value of an Accumulation Unit determined at the end of the Valuation Period during which the Premium was received or the amount was transferred to the Investment Division. In the case of the initial Premium, accumulation units for that payment will be credited to the Sub-Account Value. In the case of any subsequent Premium, accumulation units for that payment will be credited at the end of the Valuation Period during which we receive the Premium. The value of an Accumulation Unit for each Investment Division for a Valuation Period is established at the end of each Valuation Period and is calculated by multiplying the value of that unit at the end of the prior Valuation Period by the Investment Division's net investment factor for the Valuation Period. FIXED ACCOUNT VALUE The Fixed Account Value is • Premiums, less expense charges, allocated to the Fixed Account; plus • Sub-Account Value transferred to the Fixed Account; plus • Interest credited to the Fixed Account; minus • The portion of any accrued policy fees and charges allocated to the Fixed Account; minus • Partial withdrawals from the Fixed Account including any applicable partial withdrawal charges; minus • Transfers from the Fixed Account, including any applicable Transfer charges. During any policy month the Fixed Account Value will be calculated on a consistent basis. For purposes of crediting interest, policy value deducted, transferred or withdrawn from the Fixed Account is accounted for on a first in first out basis. ICC14-J355X Page 12

Policy Values, Loan and Nonforfeiture Provisions (continued) NET INVESTMENT FACTOR The net investment factor for any Investment Division for any Valuation Period is determined by dividing (a) by (b): (a) is the net result of: (i) the net asset value held in the Investment Division determined as of the end of the current Valuation Period; plus (ii) the amount of any dividend (or, if applicable, capital gain distributions) on assets held in the Investment Division if the "ex-dividend" date occurs during the current Valuation Period; minus or plus (iii) a charge or credit for any taxes incurred by or reserved for in the Investment Division, which is determined by the Company to have resulted from the investment operations of the Investment Division. (b) is the net result of: (i) the net asset value held in the Investment Division determined as of the end of the immediately preceding Valuation Period; minus or plus (ii) the charge or credit for any taxes incurred by or reserved for in the Investment Division for the immediately preceding Valuation Period. The net investment factor may be greater than, less than, or equal to one. Therefore, the accumulation unit value may increase, decrease or remain unchanged. The net asset value includes a deduction for an investment advisory fee. This fee compensates the investment adviser for services provided to the Underlying Fund. The fee may differ between Underlying Funds and may be renegotiated each year. FIXED ACCOUNT INTEREST The interest rate credited to the Policy Value Account in the Fixed Account is set by the Company but is guaranteed to be at least that shown on the Policy Specifications page. We may credit interest at rates higher than the minimum guaranteed rate. We will review the interest rate at least once a year, but at the Company’s discretion. We may reset the interest rate monthly. CONTINUATION OF INSURANCE If Premium payments cease, coverage under this policy or any attached riders will continue until the Policy Value Account, less any outstanding loans, and less loan interest accrued is insufficient to cover the monthly deduction for the cost of insurance. When the amount is insufficient, the Grace Period Provision will go into effect. POLICY LOAN While this policy is in force, the Owner, by Request, may obtain a loan from the Company on the security of the policy. The minimum loan amount is $500. The total amount of loans cannot be more than the maximum described in the Loan Value Provision. EFFECT OF A LOAN When a policy loan is made, funds are transferred out of the Series Account and Fixed Account and into the Loan Account. When a policy loan is repaid, the amount of repayment is added according to current Premium allocations. A loan, whether or not repaid, will have a permanent effect on the Cash Surrender Value and on the Death Benefit, as described in this policy. If not repaid, any indebtedness will reduce the amount of Death Benefit Proceeds and the amount available upon surrender of this policy. A policy loan will not be treated as a taxable distribution under Section 72 unless: • this policy is surrendered or lapsed while there is an outstanding loan; or • this policy is a modified endowment contract. If this policy is a modified endowment contract, a 10% penalty will apply to the amount of the loan included as gross income unless the loan is made after the date the Owner becomes 59½ or becomes disabled. LOAN INTEREST Interest credited on the Loan Account is the loan interest rate less a maximum of .90%. A policy loan will be a first lien on the policy in favor of the Company. The Owner must Request if any part of a Premium is to be applied to repay a policy loan. The expense charge will not apply to repayments of policy loans. Loan amounts will be withdrawn from all the Sub- Accounts and the Fixed Account on a pro rata basis. LOAN VALUE The maximum loan value is equal to: 90% of the Policy Value Account at the time of the loan less the current monthly deductions remaining for the balance of the policy year less interest on the loan to the next policy anniversary date. ICC14-J355X Page 13

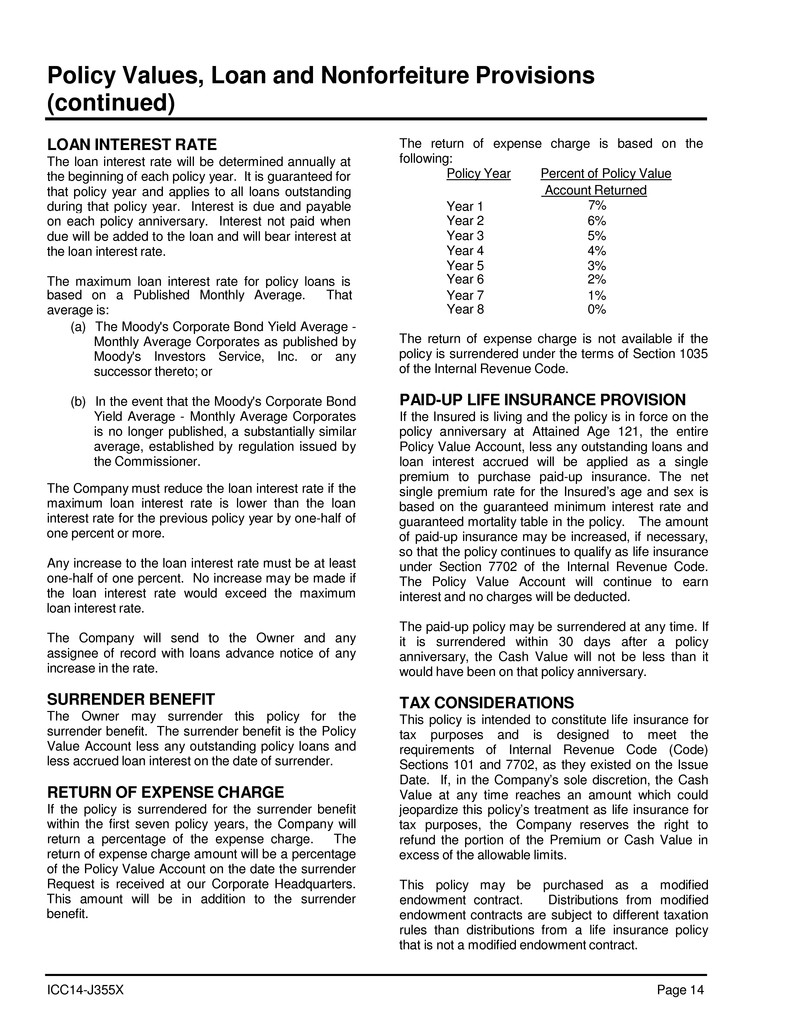

that policy year and applies to all loans outstanding during that policy year. Interest is due and payable Year 1 Account Returned 7% on each policy anniversary. Interest not paid when Year 2 6% due will be added to the loan and will bear interest at Year 3 5% the loan interest rate. Year 4 4% Year 5 3% The maximum loan interest rate for policy loans is Year 6 2% based on a Published Monthly Average. That Year 7 1% average is: Year 8 0% Policy Values, Loan and Nonforfeiture Provisions (continued) LOAN INTEREST RATE The loan interest rate will be determined annually at the beginning of each policy year. It is guaranteed for The return of expense charge is based on the following: Policy Year Percent of Policy Value (a) The Moody's Corporate Bond Yield Average - Monthly Average Corporates as published by Moody's Investors Service, Inc. or any successor thereto; or (b) In the event that the Moody's Corporate Bond Yield Average - Monthly Average Corporates is no longer published, a substantially similar average, established by regulation issued by the Commissioner. The Company must reduce the loan interest rate if the maximum loan interest rate is lower than the loan interest rate for the previous policy year by one-half of one percent or more. Any increase to the loan interest rate must be at least one-half of one percent. No increase may be made if the loan interest rate would exceed the maximum loan interest rate. The Company will send to the Owner and any assignee of record with loans advance notice of any increase in the rate. SURRENDER BENEFIT The Owner may surrender this policy for the surrender benefit. The surrender benefit is the Policy Value Account less any outstanding policy loans and less accrued loan interest on the date of surrender. RETURN OF EXPENSE CHARGE If the policy is surrendered for the surrender benefit within the first seven policy years, the Company will return a percentage of the expense charge. The return of expense charge amount will be a percentage of the Policy Value Account on the date the surrender Request is received at our Corporate Headquarters. This amount will be in addition to the surrender benefit. The return of expense charge is not available if the policy is surrendered under the terms of Section 1035 of the Internal Revenue Code. PAID-UP LIFE INSURANCE PROVISION If the Insured is living and the policy is in force on the policy anniversary at Attained Age 121, the entire Policy Value Account, less any outstanding loans and loan interest accrued will be applied as a single premium to purchase paid-up insurance. The net single premium rate for the Insured’s age and sex is based on the guaranteed minimum interest rate and guaranteed mortality table in the policy. The amount of paid-up insurance may be increased, if necessary, so that the policy continues to qualify as life insurance under Section 7702 of the Internal Revenue Code. The Policy Value Account will continue to earn interest and no charges will be deducted. The paid-up policy may be surrendered at any time. If it is surrendered within 30 days after a policy anniversary, the Cash Value will not be less than it would have been on that policy anniversary. TAX CONSIDERATIONS This policy is intended to constitute life insurance for tax purposes and is designed to meet the requirements of Internal Revenue Code (Code) Sections 101 and 7702, as they existed on the Issue Date. If, in the Company’s sole discretion, the Cash Value at any time reaches an amount which could jeopardize this policy’s treatment as life insurance for tax purposes, the Company reserves the right to refund the portion of the Premium or Cash Value in excess of the allowable limits. This policy may be purchased as a modified endowment contract. Distributions from modified endowment contracts are subject to different taxation rules than distributions from a life insurance policy that is not a modified endowment contract. ICC14-J355X Page 14

Policy Values, Loan and Nonforfeiture Provisions (continued) If the policy is not a modified endowment contract when issued, the payment of excess Premium or a material change in the benefits or terms of the contract as provided in Code Section 7702A will cause the policy to be treated as a new contract and may cause the policy to become a modified endowment contract. It is entirely the Owner’s responsibility to monitor Premium payments and material changes to ensure that the policy does not become a modified endowment contract. Nothing in this policy is to be construed as tax advice, and the Company recommends that the Owner discuss the tax consequences under the policy with a competent tax adviser. PARTIAL WITHDRAWAL PROVISION The Owner may make a partial withdrawal from the Policy Value Account at any time while the policy is in force. The minimum amount per withdrawal is $500. The maximum amount that may be withdrawn is 90% of the Policy Value Account less the Loan Account Value. There is no administrative fee charged for the first partial withdrawal in any policy year. However, a maximum administrative fee of $25 will be deducted from the Policy Value Account for each additional partial withdrawal made in the same policy year. The partial withdrawal will be effective on the Transaction Date. The Policy Value Account will be reduced by the withdrawal amount, which will be taken from all the Sub-Accounts and the Fixed Account on a pro-rata basis. If the policy is in force under Option 1, Level Death Benefit, then the Death Benefit also will be reduced by the amount of each withdrawal. Withdrawals may not be repaid directly into the Policy Value Account. Any payments received will be subject to the Additional Premium Payments Provision. POSTPONEMENT If the Company receives a Request for surrender, partial withdrawal, or a loan, the Company may postpone any payment for up to 7 days. Transfer Provisions For Investment Divisions which are not valued on each business day, the Company may defer until the next Valuation Date: • determination and payment of any surrenders, partial withdrawals or loans; • determination and payment of any death proceeds in excess of the face amount; • reallocation of the Sub-Account value; and • transfers During the postponement period, the Sub-Account Value will continue to be subject to the investment experience (gains or losses) of the Underlying Fund(s) and all applicable charges. EMERGENCY PROCEDURE If the Company cannot value the Investment Divisions due to a national stock exchange closure, with the exception of weekends or holidays, or if trading is restricted due to an existing emergency as defined by the Securities and Exchange Commission (SEC), or as otherwise ordered by the SEC, the Company may postpone all procedures which require valuation of the Investment Divisions until valuation is possible. HOW VALUES ARE COMPUTED All guaranteed calculations are based on the Commissioners 2001 Standard Ordinary Sex-Distinct and Smoker-Distinct Mortality Table, age nearest birthday, at an interest rate of 4% per year. These computations assume that Death Benefits are to be paid at the end of the policy year in which death occurs. Any net single Premium will be computed on the basis of the Insured's Attained Age and Premium class. A detailed statement of the method of computing the values of this policy has been filed with the Interstate Insurance Product Regulation Commission. Any cash values and paid-up non-forfeiture benefits available under the policy are not less than the minimum values and benefits required by or pursuant to the NAIC Variable Life Insurance Regulation, model # 270 using actuarial guidelines XXIV. TRANSFERS The Owner may make Transfers by Request but no more frequently than every 30 days. The following provisions apply: (a) While this policy is in force, the Owner, by Request may Transfer all or a portion of the Sub-Account Value among the Investment Divisions and/or Fixed Account currently offered by the Company. (b) A Transfer out of the Fixed Account may only be made one time during a 365 day period and is limited to the greater of the maximum of 25% of the balance of the Fixed Account or the amount of the Transfer from the previous 365 day period. (c) A Transfer will be effective upon the Transaction Date. ICC14-J355X Page 15

Transfer Provisions (continued) (d) There is no administrative charge for the first twelve Transfers made in a calendar year. There is a maximum $10 administrative fee for each subsequent Transfer. All Transfers made on a single Transaction Date will be aggregated to count as only one Transfer toward the twelve free Transfers; however, if a one time rebalancing Transfer also occurs on the Transaction Date it will be counted as a separate and additional Transfer. (e) A loan and a 1035 exchange will both be considered a Transfer. DOLLAR COST AVERAGING By Request, the Owner may elect dollar cost averaging in order to purchase accumulation units of the Sub-Accounts over a period of time. The Owner may Request to automatically Transfer a predetermined dollar amount, subject to the Company’s minimum, at regular intervals from any one or more designated Sub-Accounts to one or more of the remaining, then available, Sub-Accounts. The unit value will be determined on the dates of the Transfers. The Owner must specify the percentage to be Transferred into each designated Sub-Account. Transfers may be set up on any one of the following frequency periods: monthly, quarterly, semiannually, or annually. The Transfer will be initiated on the Transaction Date one frequency period following the date of the Request. The Company will provide a list of Sub-Accounts eligible for dollar cost averaging which may be modified from time to time. Amounts Transferred through dollar cost averaging are not counted against the twelve free Transfers allowed in a calendar year. The Owner may terminate dollar cost averaging at any time by Request. Dollar cost averaging will terminate automatically when this policy is no longer in force. THE REBALANCER OPTION By Request, the Owner may elect the rebalancer option in order to automatically Transfer among the Sub-Accounts on a periodic basis. This type of automatic Transfer program automatically reallocates the Sub-Account Value to maintain a particular percentage allocation among Sub-Accounts selected by the Owner. The amount allocated to each Sub- Account will increase or decrease at different rates depending on the investment experience of the Sub- Account. The Owner may Request that rebalancing occur one time only, in which case the Transfer will take place on the Transaction Date of the Request. This Transfer will count as one Transfer towards the twelve free Transfers allowed in a calendar year. Rebalancing may also be set up on a quarterly, semiannual, or annual basis, in which case the first Transfer will be initiated on the Transaction Date one frequency period following the date of the Request. On the Transaction Date for the specified Request, assets will be automatically reallocated to the selected funds. Rebalancing will continue on the same Transaction Date for subsequent periods. In order to participate in the rebalancer option, the entire Sub-Account Value must be included. Transfers set up with these frequencies will not count against the twelve free Transfers allowed in a calendar year. The Owner must specify the percentage of Sub- Account Value to be allocated to each Investment Division and the frequency of rebalancing. The Owner may terminate the rebalancer option at any time by Request. The rebalancer option will terminate automatically when this policy is no longer in force. Participation in the rebalancer option and dollar cost averaging at the same time is not allowed. Participation in the rebalancer option does not assure a greater profit, nor will it prevent or necessarily alleviate losses in a declining market. The Company reserves the right to modify, suspend, or terminate the rebalancer option at any time. ICC14-J355X Page 16

ADJUSTABLE DEATH BENEFIT. Proceeds payable at death are subject to policy provisions. See Death Benefit Provisions. Flexible Premiums payable while the Insured is alive. If no Premiums are paid after the first Premium, or if subsequent Premiums prove to be too low, this coverage may cease prior to age 121. ALL PAYMENTS AND VALUES BASED ON THE INVESTMENT EXPERIENCE OF THE INVESTMENT DIVISIONS ARE VARIABLE, MAY INCREASE OR DECREASE ACCORDINGLY, AND ARE NOT GUARANTEED AS TO AMOUNT. Non-Participating. CORPORATE HEADQUARTERS – [Greenwood Village, Colorado] ICC14-J355X