Market Price and Dividend Information

MARKET PRICE INFORMATION

The Company’s common stock trades on the NASDAQ Global Market (“NASDAQ”) under the symbol “CIZN”. On March 1, 2021, the common stock’s closing price on NASDAQ was $20.00.

On March 1, 2021, shares of the Company’s common stock were held of record by approximately 486 shareholders.

DIVIDENDS

Dividends totaled $0.96 per share for 2020 and 2019.

If funds are available, the Board of Directors of the Company typically declares dividends on a quarterly basis in March, June, September and December with payment following at the end of the month in which the dividend was declared. Funds for the payment by the Company of cash dividends are obtained from dividends, loans or advances received by the Company from the Bank. Accordingly, the declaration and payment of dividends by the Company depend upon the Bank’s earnings and financial condition, general economic conditions, compliance with regulatory requirements, and other factors. The Bank must also receive the approval of the Mississippi Department of Banking and Consumer Finance prior to the payment of a dividend.

108

STOCK PERFORMANCE GRAPH

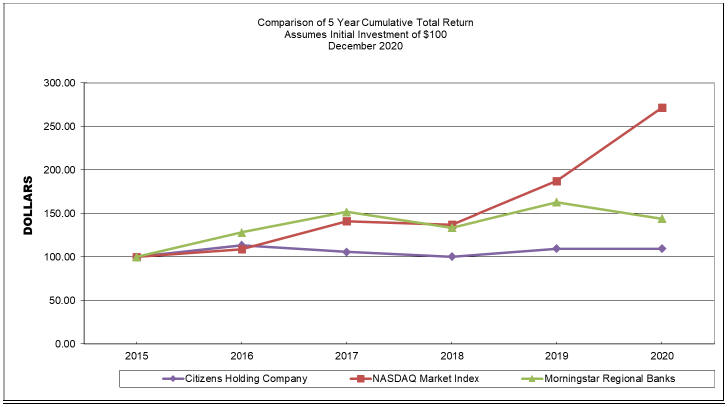

The following performance graph compares the performance of the Company’s common stock to the NASDAQ Composite Index and the Morningstar Regional Bank index (a peer group of other regional bank holding companies) for the Company’s reporting period. The graph assumes that the value of the investment in the Company’s common stock and each index was $100 at December 31, 2015 and that all dividends were reinvested.

Performance Graph

December 31, 2015 - December 31, 2020

| 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | |||||||||||||||||||

| Citizens Holding Company |

100.00 | 113.57 | 105.68 | 100.38 | 109.57 | 109.57 | ||||||||||||||||||

| NASDAQ Market Index |

100.00 | 108.87 | 141.13 | 137.12 | 187.44 | 271.64 | ||||||||||||||||||

| Morningstar Regional Banks |

100.00 | 128.37 | 151.66 | 133.74 | 162.97 | 144.00 | ||||||||||||||||||

There can be no assurance that the Company’s common stock performance will continue in the future with the same or similar trends depicted in the performance graph above. The Company does not and will not make or endorse any predictions as to future stock performance.

109

THE CITIZENS BANK OFFICERS

| Greg McKee President and CEO Phillip R. Branch Senior Vice President, CFO Mark Taylor Senior Vice President, COO, Trust Officer Ray Stone Senior Vice President, Chief Credit Officer Ledale Reynolds Senior Vice President and CIO Liz Owen Senior Vice President, Director of Human Resources, Chief Risk Officer Erdis Chaney Vice President, Senior Deposit Officer Jackie Hester Vice President, Marketing Officer Darrel Bates Vice President, Collections Manager Jean T. Fulton Vice President, Internal Auditor Brad Copeland Vice President, Branch Manager Mark Majure Vice President, Loan Review Officer Bob Posey Vice President Mike Chandler Vice President Stacy Arnold Vice President, Compliance Officer Tabbetha Calvert Vice President, BSA Officer Joshua Sullivan Vice President, Senior Credit Analyst Ashley Peebles Vice President, Director of Deposit Services Sommer Vick Assistant Vice President, Assistant Trust Officer Mitch Peden Assistant Vice President, Information Services Manager |

Pam Garrett Network Services Manager Pat Stokes Assistant Vice President, Operations Officer Scott Lewis Assistant Vice President, Information Security Officer Sam Mars Assistant Vice President, Loan Officer Shon Kirkland Assistant Vice President, Security Officer/ Facilities Manager Charles Wilkerson Assistant Vice President, Loan Operations Officer Greg Jackson Accounting Officer Reaghan Jenkins Accounting Officer Deborah Ladd Item Processing Officer Sandra Curtis Assistant Cashier, Teller Administrator Temika Triplett Assistant Cashier, Electronic Services Officer Grant Comans Assistance Vice President, Branch Manager Jamie Shotts Vice President, Appraisal Review Officer Carthage Branch Billy Cook Vice President Tonya Dorman Deposit Operations Officer Sebastopol Branch Connie Comans Branch President Union and Decatur Branches Susan Brown Deposit Operations Officer Kosciusko Branch Teresa Patterson Vice President, Branch Manager |

110

| Scooba and DeKalb Branches Reggie Moore Assistant Vice President, Branch Manager Jan White Branch Operations Officer Forest Branch Lawanda McCaughn Deposit Operation Officer Louisville Branch Bruce Lee Market President – Winston County Lynn Graham Assistant Vice President, Branch Operations Officer Starkville Branch Rhonda Edmonson Assistant Vice President, Branch Manager Collinsville Branch Mike Shelby Vice President, Branch Manager Meridian Eastgate and Broadmoor Branches Jay Hines Vice President, Regional Commercial Lender Tammara Hopson, Deposit Operations Officer Hattiesburg Branch Chad Hill Vice President, Branch Manager Tammy McAlpin Commercial Loan Portfolio Manager Flowood Branch George Gammon III Metro Jackson President Cory Bass Assistant Vice President, Accounting Officer Ridgeland Branch Daniel Webb Assistance Vice President |

Biloxi Cedar Lake and Lemoyne Branches Travis Moore Vice President, Regional Commercial Lender Brandon Sherwood Regional Commercial Lender Tammy Warren Assistant Vice President, Mortgage Loan Officer Katie Hancock Vice President, Branch Manager Patrick Ricci Vice President, Commercial Lender Mandy Dawson Treasury Management Officer Mortgage Loan Department Charlene Deweese Assistant Vice President, Mortgage Loan Officer Oxford Branch Grant Boone Oxford City President Marion Boyd Vice President, Regional Commercial Lender Meg Smith Branch Operations Officer Pascagoula Branch Gregory E. Cronin Gulf Coast President Ford Kinsey Vice President, Senior Credit Officer Pam Lindsey Vice President, Senior Bank Officer Paulette Roberts Vice President, Senior Operations Officer Amber Thomas Vice President, Commercial Lender Julius Bosco III Loan Compliance Officer Pam Pierce Human Resources Administrator Theresa Jenkins Community Retail Officer |

111

| Ocean Springs Branch Melissa Ceasar Community Retail Officer Sharon Wetzel Vice President, Information Technology Officer Reagan Bridley Vice President, Commercial Lender Thomas Graham Vice President, Mortgage Loan Officer |

112