UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended

or

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

For the transition period from to |

Commission File Number:

(Exact name of registrant as specified in its charter)

|

|

|

|

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Title of each Class | Trading Symbol | Name of each exchange on which registered |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ◻

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Accelerated filer ◻ | Non-accelerated filer ◻ | Smaller Reporting Company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ◻

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes

The aggregate market value of the common units of the registrant held by non-affiliates as of June 30, 2019 was approximately $

As of February 19, 2020, there were

TC PIPELINES, LP

TABLE OF CONTENTS

All amounts are stated in United States dollars unless otherwise indicated.

TC PipeLines, LP Annual Report 2019 3

DEFINITIONS

The abbreviations, acronyms, and industry terminology used in this annual report are defined as follows:

2013 Term Loan Facility | TC PipeLines, LP’s $500 million term loan credit facility under a term loan agreement as amended on September 29, 2017 |

2015 Term Loan Facility | TC PipeLines, LP’s $170 million term loan credit facility under a term loan agreement as amended on September 29, 2017 |

2017 Acquisition | Partnership’s acquisition of an additional 11.81 percent interest in PNGTS and 49.34 percent in Iroquois on June 1, 2017 |

2017 Great Lakes Settlement | Stipulation and Agreement of Settlement for Great Lakes regarding its rates and terms and conditions of service approved by FERC on February 22, 2018 |

2017 Northern Border Settlement | Stipulation and Agreement of Settlement for Northern Border regarding its rates and terms and conditions of service approved by FERC on February 23, 2018 |

2017 Tax Act | Public Law No. 115-97, commonly known as the Tax Cuts and Jobs Act, enacted on December 22, 2017 |

2018 FERC Actions | FERC’s 2018 issuance of Revised Policy Statement on Treatment of Income Taxes (Revised Policy Statement) and a Final Rule that established a schedule by which interstate pipelines must either (i) file a new uncontested rate settlement or (ii) file a one-time report, called FERC Form No. 501-G, that quantified the rate impact of the 2017 Tax Act on FERC regulated pipelines and the impact of the Revised Policy Statement on pipelines held by an MLP |

2018 GTN Settlement | Stipulation and Agreement of Settlement for GTN regarding its rates and terms and conditions of service approved by FERC on November 30, 2018 |

2019 Iroquois Settlement | An uncontested settlement filed by Iroquois with FERC to address the issues contemplated by the 2017 Tax Act and the 2018 FERC Actions via an amendment to its prior 2016 settlement approved by FERC on May 2, 2019 |

2019 Tuscarora Settlement | An uncontested settlement filed by Tuscarora with FERC to address the issues contemplated by the 2017 Tax Act and the 2018 FERC Actions via an amendment to its prior 2016 settlement approved by FERC on May 2, 2019 |

ADIT | Accumulated Deferred Income Tax |

AFUDC | Allowance for funds used during construction |

ASC | Accounting Standards Codification |

ASU | Accounting Standards Update |

ATM program | At-the-market Equity Issuance Program |

BIA | Bureau of Indian Affairs |

Bison | Bison Pipeline LLC |

C2C Contracts | PNGTS’ Continent-to-Coast Contracts with several shippers for a term of 15 years for approximately 82,000 Dth/day |

Canadian Mainline | TC Energy’s Mainline, a natural gas transmission system extending from the Alberta/Saskatchewan border east to Quebec |

Certificate Policy Statement NOI | FERC Notice of Inquiry issued on April 19, 2018 |

4 TC PipeLines, LP Annual Report 2019

Class B Distribution | Annual distribution to TC Energy based on 30 percent of GTN’s annual distributions as follows: (i) 100 percent of distributions above $20 million through March 31, 2020; and (ii) 25 percent of distributions above $20 million thereafter |

Class B Reduction | Approximately 35 percent reduction applied to the estimated annual Class B Distribution beginning in 2018, which is equivalent to the percentage by which distributions payable to the common units were reduced in 2018. The Class B Reduction will continue to apply for any particular calendar year until distributions payable in respect of common units for such calendar year equal or exceed $3.94 per common unit |

Consolidated Subsidiaries | GTN, Bison, North Baja, Tuscarora and PNGTS |

Delaware Act | Delaware Revised Uniform Limited Partnership Act |

DOT | U.S. Department of Transportation |

Dth/day | Dekatherms per day |

DSUs | Deferred Share Units |

EBITDA | Earnings Before Interest, Tax, Depreciation and Amortization |

EPA | U.S. Environmental Protection Agency |

ExC Project | Iroquois Enhancement by Compression project that involves upgrading its compressor stations along the pipeline and provide approximately 125,000 Dth/day of additional firm transportation service to meet current and future gas supply needs of utility customers |

FASB | Financial Accounting Standards Board |

FERC | Federal Energy Regulatory Commission |

GAAP | U.S. generally accepted accounting principles |

General Partner | TC PipeLines GP, Inc. |

GHG | Greenhouse Gas |

Great Lakes | Great Lakes Gas Transmission Limited Partnership |

GTN | Gas Transmission Northwest LLC |

GTN XPress | GTN project that will both increase the reliability of GTN's existing transportation service and provide up to 250,000 Dth/day of additional firm transportation service on the full path of the GTN system from Kingsgate, British Columbia, Canada to Malin, Oregon |

HCAs | High consequence areas |

IDRs | Incentive Distribution Rights |

ILP Contribution | On December 31, 2018, General Partner contributed its 1.0101 percent general partner interest in each of the Partnership ILPs to the Intermediate GP and received a 1 percent general partner interest in the Partnership in return |

ILPs | Intermediate Limited Partnerships |

Intermediate GP | TC PipeLines Intermediate GP, LLC |

IRS | Internal Revenue Service |

Iroquois | Iroquois Gas Transmission System, L.P. |

Joint Facilities | Pipeline facilities jointly owned with MNE on PNGTS |

TC PipeLines, LP Annual Report 2019 5

KPMG | KPMG LLP |

LDCs | Local Distribution Companies |

LIBOR | London Interbank Offered Rate |

LNG | Liquefied Natural Gas |

MLPs | Master limited partnerships |

MNE | Maritimes and Northeast Pipeline LLC, a subsidiary of Enbridge Inc. |

MNOC | M&N Operating Company, LLC, a wholly owned subsidiary of MNE |

NGA | Natural Gas Act of 1938 |

North Baja | North Baja Pipeline, LLC |

North Baja XPress | North Baja potential project to transport additional volumes of natural gas of approximately 495,000 Dth/day between Ehrenberg, Arizona and Ogilby, California |

Northern Border | Northern Border Pipeline Company |

NYSE | New York Stock Exchange |

Our pipeline systems | Our ownership interests in GTN, Northern Border, Bison, Great Lakes, North Baja, Tuscarora, PNGTS and Iroquois |

Partnership | TC PipeLines, LP including its subsidiaries, as applicable |

Partnership Agreement | Fourth Amended and Restated Agreement of Limited Partnership of the Partnership |

Partnership ILPs | TC PipeLines Intermediate Limited Partnership, TC Tuscarora Intermediate Limited Partnership and TC GL Intermediate Limited Partnership |

PHMSA | U.S. Department of Transportation Pipeline and Hazardous Materials Safety Administration |

PNGTS | Portland Natural Gas Transmission System |

PXP | Portland XPress Project of PNGTS to re-contract certain system capacity set to expire in 2019 as well as construct incremental compression facilities within PNGTS’ existing footprint in Maine |

Revised Policy Statement | FERC's Revised Policy Statement on Treatment of Income Taxes |

ROE | Return on equity |

SEC | Securities and Exchange Commission |

Securities Act | Securities Act of 1933, as amended |

Senior Credit Facility | TC PipeLines, LP’s senior facility under revolving credit agreement as amended and restated, dated September 29, 2017 |

TC Energy | TC Energy Corporation, formerly known as TransCanada Corporation |

TQM | TransQuebec and Maritimes Pipeline |

Tuscarora | Tuscarora Gas Transmission Company |

Tuscarora XPress | Tuscarora's expansion project through additional compression capability at an existing Tuscarora facility and provide up to 15,000 Dth/day of additional firm transportation service |

6 TC PipeLines, LP Annual Report 2019

U.S. | United States of America |

WCSB | Western Canadian Sedimentary Basin |

Westbrook XPress | Westbrook XPress Project of PNGTS that is part of a coordinated offering to transport incremental Western Canadian Sedimentary Basin natural gas supplies to the Northeast U.S. and Atlantic Canada markets through additional compression capability at an existing PNGTS facility |

VIEs | Variable Interest Entities |

Wholly-owned subsidiaries | GTN, Bison, North Baja, and Tuscarora |

Unless the context clearly indicates otherwise, TC PipeLines, LP and its subsidiaries are collectively referred to in this annual report as “we,” “us,” “our” and “the Partnership.” We use “our pipeline systems” and “our pipelines” when referring to the Partnership’s ownership interests in Gas Transmission Northwest LLC (GTN), Northern Border Pipeline Company (Northern Border), Bison Pipeline LLC (Bison), Great Lakes Gas Transmission Limited Partnership (Great Lakes), North Baja Pipeline, LLC (North Baja), Tuscarora Gas Transmission Company (Tuscarora), Portland Natural Gas Transmission System (PNGTS) and Iroquois Gas Transmission System, LP (Iroquois).

TC PipeLines, LP Annual Report 2019 7

PART I

FORWARD-LOOKING STATEMENTS AND CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION

This report includes certain forward-looking statements. Forward-looking statements are identified by words and phrases such as: “anticipate,” “estimate,” “expect,” “project,” “intend,” “plan,” “believe,” “forecast,” “should,” “predict,” “could,” “will,” “may,” and other terms and expressions of similar meaning. The absence of these words, however, does not mean that the statements are not forward-looking. These statements are based on management’s beliefs and assumptions and on currently available information and include, but are not limited to, statements regarding anticipated financial performance, future capital expenditures, liquidity, dropdown opportunities, market or competitive conditions, regulations, organic or strategic growth opportunities, contract renewals and ability to market open capacity, business prospects, outcome of regulatory proceedings and cash distributions to unitholders.

Forward-looking statements involve risks and uncertainties that may cause actual results to differ materially from the results predicted. Factors that could cause actual results and our financial condition to differ materially from those contemplated in forward-looking statements include, but are not limited to:

| ● | the ability of our pipeline systems to sell available capacity on favorable terms and renew expiring contracts which are affected by, among other factors: |

| ● | demand for natural gas; |

| ● | changes in relative cost structures and production levels of natural gas producing basins; |

| ● | natural gas prices and regional differences; |

| ● | weather conditions; |

| ● | availability and location of natural gas supplies in Canada and the United States (U.S.) in relation to our pipeline systems; |

| ● | competition from other pipeline systems; |

| ● | natural gas storage levels; and |

| ● | rates and terms of service; |

| ● | the performance by the shippers of their contractual obligations on our pipeline systems; |

| ● | the outcome and frequency of rate proceedings or settlement negotiations on our pipeline systems; |

| ● | potential changes in the taxation of master limited partnership (MLP) investments by state or federal governments such as elimination of pass-through taxation or tax deferred distributions; |

| ● | increases in operational or compliance costs resulting from changes in laws and governmental regulations affecting our pipeline systems, particularly regulations issued by the Federal Energy Regulatory Commission (FERC), U.S. Environmental Protection Agency (EPA) and U.S. Department of Transportation (DOT); |

| ● | the impact of downward changes in oil and natural gas prices, including the effects on the creditworthiness of our shippers; |

| ● | our ongoing ability to grow distributions through acquisitions, accretive expansions or other growth opportunities, including the timing, structure and closure of further potential acquisitions; |

| ● | potential conflicts of interest between TC PipeLines GP, Inc., our general partner (General Partner), TC Energy Corporation (TC Energy) and us; |

| ● | failure to comply with debt covenants, some of which are beyond our control; |

| ● | the ability to maintain secure operation of our information technology including management of cybersecurity threats, acts of terrorism and related distractions; |

| ● | the implementation of future accounting changes and ultimate outcome of commitments and contingent liabilities (if any); |

| ● | the impact of any impairment charges; |

| ● | changes in the political environment; |

8 TC PipeLines, LP Annual Report 2019

| ● | operating hazards, casualty losses and other matters beyond our control; |

| ● | the overall increase in the allocated management and operational expenses to our pipeline systems for services performed by TC Energy; and |

| ● | the level of our indebtedness, including the indebtedness of our pipeline systems, changes in interest rates, and the availability of capital. |

These and other risks are described in greater detail in Part I, Item 1A. “Risk Factors.” Given these uncertainties, you should not place undue reliance on these forward-looking statements. All forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by these factors. All forward-looking statements are made only as of the date made and except as required by applicable law, we undertake no obligation to update any forward-looking statements to reflect new information, subsequent events or other changes.

Item 1. Business

NARRATIVE DESCRIPTION OF BUSINESS

GENERAL

We are a publicly traded Delaware master limited partnership. Our common units trade on the New York Stock Exchange (NYSE) under the symbol TCP. We were formed by TC Energy and its subsidiaries in 1998 to acquire, own and participate in the management of energy infrastructure businesses in North America. Our pipeline systems transport natural gas in the U.S.

We are managed by our General Partner, which is an indirect, wholly-owned subsidiary of TC Energy. At December 31, 2019, subsidiaries of TC Energy own approximately 24 percent of our common units, 100 percent of our Class B units, 100 percent of our incentive distribution rights (IDRs) and hold a two percent general partner interest in us. See Part II, Item 5. “Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities” for more information regarding TC Energy's ownership in us.

RECENT BUSINESS DEVELOPMENTS

Growth Projects Update:

Below is a summary of our growth projects announced in 2019 and updates to previously announced projects:

PNGTS’ Portland XPress Project - Our estimated $85 million Portland XPress Project or “PXP” was initiated in 2017 in order to expand deliverability on the PNGTS system to Dracut, Massachusetts through re-contracting and construction of incremental compression within PNGTS’ existing footprint in Maine. PXP was designed to be phased in over a three-year time period. Phases I and II were placed into service on November 1, 2018 and November 1, 2019, respectively. Phase III of the project is expected to be in service on November 1, 2020. Beginning in 2021, PXP is expected to generate approximately $50 million in annual revenue for PNGTS. PNGTS filed the required applications with FERC for all three phases of the project in 2018, which included an amendment to its Presidential Permit and an increase in its certificated capacity through the addition of a compressor unit at its jointly owned facility with Maritimes and Northeast Pipeline LLC to bring additional natural gas supply to New England. The total final volume of the project is approximately 183,000 Dth/ day; 40,000 Dth/day from Phase I, 118,400 Dth/day from Phase II, which includes re-contracting and renewal of expiring contracts, and 24,600 Dth/day from Phase III. We continue to advance this project and have received all approvals on filings to date. We expect to file with FERC for approval to proceed with construction of Phase III of the project in early 2020. PXP is secured by long-term agreements and when all phases of the project are in service, PNGTS will be effectively fully contracted until 2032.

Additionally, in connection with PXP, PNGTS entered into an arrangement with TC Energy regarding the construction of certain facilities on the TC Energy system (TransQuebec and Maritimes Pipeline (TQM) and TC Energy’s Canadian Mainline natural gas transmission system (Canadian Mainline)) that will be required to fulfill future PXP contracts on the PNGTS system. In the event the Canadian system expansions terminate prior to their in-service dates, PNGTS could be required to reimburse TC Energy for an amount up to the total outstanding costs incurred to the date of the termination. As a result of TC Energy’s system expansions being commercially in service on November 1, 2019, and PNGTS’ commitments on TC Energy’s upstream pipelines being assigned to the PXP Phase II shippers, PNGTS’ obligation to reimburse the costs for Phase I and II terminated, which was approximately $143 million at the time of termination. Going forward, in the event the Phase III expansion terminates prior to its in-service date, PNGTS will only be obligated to reimburse costs incurred by TC Energy in relation to Phase III, which was $0.6 million at December 31, 2019 and is estimated to be approximately $8.0 million by November 1, 2020, when TC Energy’s facilities associated with the Phase III volumes go into service.

TC PipeLines, LP Annual Report 2019 9

PNGTS' Westbrook XPress Project (Westbrook XPress) - Westbrook XPress is an estimated $125 million multi-phase expansion project that is expected to generate approximately $35 million in revenue for PNGTS on an annualized basis when fully in service. It is part of a coordinated offering to transport incremental Western Canadian Sedimentary Basin (WCSB) natural gas supplies to the Northeast U.S. and Atlantic Canada markets through additional compression capability at an existing PNGTS facility. Westbrook XPress is designed to be phased in over a four-year period which began on November 1, 2019 with Phase I. Phases II and III have estimated in-service dates of November 2021 and 2022, respectively. These three Phases will add incremental capacity of approximately 43,000 Dth/day, 69,000 Dth/day, and 18,000 Dth/day, respectively. Westbrook XPress, together with PXP, will increase PNGTS’ capacity by 90 percent from 210,000 Dth/day to approximately 400,000 Dth/day. The Westbrook XPress contracts expire between 2036 and 2042.

GTN XPress Project (GTN XPress) - On November 1, 2019, we announced that GTN will move forward with the GTN XPress project which will transport approximately 250,000 Dth/day of additional volumes of natural gas enabled by TC Energy’s system expansion upstream. The estimated total project cost of this integrated reliability and expansion project is $335 million. The project’s reliability work is anticipated to be in service by the end of 2021 and will account for more than three quarters of the total project cost. These costs are expected to be recovered in recourse rates. The project’s expansion work is anticipated to be commercially phased into service through November 2023. GTN XPress’ expansion work is 100 percent underpinned by fixed rate negotiated contracts with an average term in excess of 30 years. The incremental capacity is expected to generate approximately $25 million in revenue annually when fully in service.

Tuscarora XPress Project (Tuscarora XPress) - Tuscarora XPress is an estimated $13 million expansion project through additional compression capability at an existing Tuscarora facility. Tuscarora XPress is 100 percent underpinned by a 20-year contract and will transport approximately 15,000 Dth/day of additional volumes when completed in November 2021. Tuscarora XPress is expected to generate approximately $2 million in revenue on an annualized basis when fully in service.

Iroquois Gas Transmission ExC Project (Iroquois ExC Project) - During the second quarter of 2019, Iroquois initiated the “Enhancement by Compression” project (ExC Project) which will optimize the Iroquois system to meet current and future gas supply needs of utility customers while minimizing the environmental impact through enhancements at existing compressor stations along the pipeline. In February 2020, Iroquois filed an application with FERC to authorize the construction of the project. The project’s total design capacity is approximately 125,000 Dth/day with an estimated cost of $250 million and in-service date of November 2023. This project will be 100 percent underpinned with 20-year contracts.

North Baja XPress Project (North Baja XPress) - North Baja XPress is an estimated $90 million potential project to transport additional volumes of natural gas along North Baja’s mainline system. The project was initiated in response to market demand to provide firm transportation service of up to approximately 495,000 Dth/day between Ehrenberg, Arizona and Ogilby, California. The binding open season for the project was concluded in April of 2019. In December 2019, North Baja filed an application with FERC to authorize the construction of this project. The estimated in-service date is November 1, 2022, subject to the satisfaction or waiver of certain conditions precedent, including a positive Final Investment Decision (FID) from Sempra LNG International, LLC.

PHMSA Compliance Regulation

On October 1, 2019, the federal Pipeline and Hazardous Materials Safety Administration (PHMSA) released the first of three anticipated final rulemakings following its issuances in 2016 of an expansive proposed rulemaking (known as the "gas mega rule") revising the regulation of gas transmission and gathering lines. The October 1, 2019 final rule relates specifically to gas transmission pipelines and, among other things, updates reporting and records retention standards for covered pipelines and expands the level of required integrity assessments that must be completed on certain pipeline segments outside of high consequence areas (HCAs). The October 1, 2019 final rule also requires operators to review maximum allowable operating pressure records and perform specific remediation activities where records are not available. We are currently assessing the operational and financial impact related to this ruling which will become effective on July 1, 2020 with a 15-year implementation deadline. The remaining rulemakings comprising the gas mega rule are expected to be issued in 2020. See also Part I, Item 1. “Business- Government Regulation-Pipeline Safety Matters” for more information relating to PHSMA regulation of gas pipelines.

Cash Distributions to Common Units and our General Partner

Our quarterly declared cash distributions in 2019 remained the same as in 2018, which was $0.65 per common unit or $2.60 per common unit in total for the year. Please read Notes 15 within Part IV, Item 15. “Exhibits and Financial Statement Schedules” for more information.

On April 23, 2019, the board of directors of our General Partner declared the Partnership’s first quarter 2019 cash distribution in the amount of $0.65 per common unit, which was paid on May 13, 2019 to unitholders of record as of May 3, 2019. The declared distribution totaled $47 million and was paid in the following manner: $46 million to common unitholders (including $4 million to the General Partner as a holder of 5,797,106 common units and $7 million to another subsidiary of TC Energy as holder of 11,287,725 common units) and $1 million to our General Partner for its two percent general partner interest.

10 TC PipeLines, LP Annual Report 2019

On July 23, 2019, the board of directors of our General Partner declared the Partnership’s second quarter 2019 cash distribution in the amount of $0.65 per common unit, which was paid on August 14, 2019 to unitholders of record as of August 2, 2019. The declared distribution totaled $47 million and was paid in the following manner: $46 million to common unitholders (including $4 million to the General Partner as a holder of 5,797,106 common units and $7 million to another subsidiary of TC Energy as holder of 11,287,725 common units) and $1 million to our General Partner for its two percent general partner interest.

On October 22, 2019, the board of directors of our General Partner declared the Partnership’s third quarter 2019 cash distribution in the amount of $0.65 per common unit, which was paid on November 14, 2019 to unitholders of record as of November 1, 2019. The declared distribution totaled $47 million and was paid in the following manner: $46 million to common unitholders (including $4 million to the General Partner as a holder of 5,797,106 common units and $7 million to another subsidiary of TC Energy as holder of 11,287,725 common units) and $1 million to our General Partner for its two percent general partner interest.

On January 21, 2020, the board of directors of the General Partner declared the Partnership’s fourth quarter 2019 cash distribution in the amount of $0.65 per common unit, which was paid on February 14, 2020 to unitholders of record as of January 31, 2020. The declared distribution totaled $47 million and was paid in the following manner: $46 million to common unitholders (including $4 million to the General Partner as a holder of 5,797,106 common units and $7 million to another subsidiary of TC Energy as a holder of 11,287,725 common units) and $1 million to the General Partner for its two percent general partner interest.

Incentive distributions are paid to our General Partner if quarterly cash distributions on the common units exceed levels specified in the Fourth Amended and Restated Agreement of Limited Partnership of the Partnership (as amended, the Partnership Agreement). The distributions declared during 2019 did not reach the specified levels for any period and, therefore, the General Partner did not receive any distributions in respect of its IDRs in 2019. See Part II, Item 7 “Management’s Discussion and Analysis of Financial Condition and Results of Operations – Cash Distribution Policy of the Partnership” for further information regarding the Partnership’s distributions.

Class B Distributions

On January 21, 2020, the board of directors of our General Partner declared its annual Class B distribution in the amount of $8 million, which was paid on February 14, 2020. In 2019, the Class B distribution paid was $13 million. Please read Notes 11, 14 and 15 within Part IV, Item 15. “Exhibits and Financial Statement Schedules” for more detailed disclosures on the Class B units.

Other Business Developments

Partnership structure - On December 31, 2018, the General Partner contributed its 1.0101 percent general partner interest in each of TC PipeLines Intermediate Limited Partnership, TC Tuscarora Intermediate Limited Partnership and TC GL Intermediate Limited Partnership (together, the Partnership ILPs) to TC PipeLines Intermediate GP, LLC (the Intermediate GP), a wholly-owned subsidiary of the Partnership, and received a one percent general partner interest in the Partnership in return (the ILP Contribution). This resulted in a simplification of the General Partner’s effective two percent general interest in the Partnership previously held through its directly-held one percent and indirectly-held 1.0101 percent general partner interests in the Partnership and Partnership ILPs, respectively, to a directly-held two percent general partner interest in the Partnership. The Partnership subsequently held 100 percent of the Partnership ILPs’ limited and general partner interests, with the general partner interest being held through the Intermediate GP.

During the fourth quarter of 2019, the Partnership initiated the dissolution of the Partnership ILPs and Intermediate GP. Effective October 31, 2019, the Intermediate GP and Partnership ILPs transferred 100 percent of the ownership of their pipeline assets to the Partnership, and the process of dissolving and unwinding the entities was completed in January 2020. Accordingly, the Partnership now owns its pipeline assets directly, which creates a more efficient partnership structure and aligns more closely with other MLP structures existing today, with no economic impact to the general and limited partners of the Partnership.

Financing

Partnership’s 2013 $500 Million Term Loan Facility - In June 2019, the Partnership repaid $50 million of outstanding borrowings under its 2013 $500 million Term Loan Facility using the proceeds received from the Northern Border distribution on the same date. Additionally, the Partnership terminated an equivalent amount in interest rate swaps that were used to hedge this facility at a rate of 2.81%.

Partnership’s Senior Credit Facility and Overall Debt Level - We continue to deleverage our balance sheet. At December 31, 2019, there was no outstanding balance under the Partnership's Senior Credit Facility. Additionally, the Partnership's overall consolidated debt was reduced by $106 million from $2,118 million at December 31, 2018 to $2,012 million at December 31, 2019 as a result of the (a) $40 million net repayment from cash flow of the outstanding balance under the Partnership's Senior Credit facility; (b) $50 million partial repayment of the Partnership's 2013 $500 Million Term Loan

TC PipeLines, LP Annual Report 2019 11

Facility; (c) the repayment of $35 million due upon the maturity of GTN's $75 million Unsecured Term Loan Facility; and (d) $1 million scheduled payment on Tuscarora's Unsecured Term Loan offset by $20 million of additional borrowings on PNGTS' revolving credit facility. See Part II, Item 7. "Management’s Discussion and Analysis of Financial Condition and Result of Operations-Liquidity and Capital Resources" for more information.

Credit Rating Upgrade - On July 23, 2019, Standard & Poor's (S&P) upgraded the Partnership’s credit rating to BBB/Stable from BBB-/Stable primarily due to the improvement in our financial risk profile resulting from our ongoing deleveraging efforts.

Financing – Unconsolidated Subsidiaries

Northern Border - In June 2019, Northern Border borrowed an additional $100 million under its $200 million revolving credit facility to finance a $100 million cash distribution, of which $50 million was received by the Partnership. Northern Border's outstanding balance under this facility amounted to $115 million at December 31, 2019.

Iroquois Financing - On May 9, 2019, Iroquois refinanced $140 million of 6.63% Senior Notes due 2019 and $150 million of 4.84% Senior Notes due in 2020 by issuing $140 million of new 15-year 4.12% Senior Notes and $150 million of new 10-year 4.07% Senior Notes. The debt covenants require Iroquois to maintain a debt to capitalization ratio below 75 percent and a debt service coverage ratio of at least 1.25 times for the four preceding quarters and are unchanged from those governing the refinanced Senior Notes.

Business Strategies

| ● | Our strategy is focused on generating long-term, steady and predictable distributions to our unitholders by investing in long-life critical energy infrastructure that provides reliable delivery of energy to customers. |

| ● | Our investment approach is to develop or acquire assets that provide stable cash distributions and opportunities for new capital additions, while maintaining a low-risk profile. We are opportunistic and disciplined in our approach when identifying new investments. |

| ● | Our goal is to maximize distributable cash flows over the long term through efficient utilization of our pipeline systems and appropriate business strategies, while maintaining a commitment to safe and reliable operations. |

Understanding the Natural Gas Infrastructure Business

Natural gas infrastructure moves natural gas from major sources of supply or upstream gathering facilities to downstream locations or markets that use natural gas to meet their energy needs. Infrastructure systems include meter stations that record how much natural gas comes on to the pipeline and how much exits at the delivery locations; compressor stations that act like pumps to move the large volumes of natural gas along the pipeline; and the pipelines themselves that transport natural gas under high pressure.

Regulation, rates and cost recovery

Interstate natural gas pipelines are regulated by FERC. FERC approves the construction of new facilities and regulates aspects of our business including the maximum rates that are allowed to be charged. Maximum rates are based on operating costs, which include allowances for operating and maintenance costs, income and property taxes, interest on debt, depreciation expense to recover invested capital and a return on the capital invested. During 2018, FERC issued a revised policy statement that changed its long-standing policy on the treatment of income taxes for rate-making purposes for MLP-owned pipelines. The revised policy statement had a significant impact on MLPs in general and on their respective natural gas pipeline assets. (See also Part I, Item 1. “Business- Government Regulation- 2018 FERC Actions for” more information).

Although FERC regulates maximum rates for services, interstate natural gas pipelines frequently face competition and therefore may choose to discount their services in order to compete.

Because FERC rate reviews are periodic and not annual, actual revenues and costs typically vary from those projected during a rate case. If revenues no longer provide a reasonable opportunity to recover costs, a pipeline can file with FERC for a determination of new rates, subject to any moratoriums in effect. FERC also has the authority to initiate a review to determine whether a pipeline’s rates of return are just and reasonable. In some cases, a settlement or agreement with the pipeline’s shippers is achieved, precluding the need for FERC to conduct a rate case, which may include mutually beneficial performance incentives. A settlement is ultimately subject to FERC approval.

Contracting

New infrastructure projects are typically supported by long-term contracts. The term of the contracts is dependent on the individual developer’s appetite for risk and is a function of expected rates of return, stability and certainty of returns. Transportation contracts expire at varying times and underpin varying amounts of capacity. As existing contracts

12 TC PipeLines, LP Annual Report 2019

approach their expiration dates, efforts are made to extend and/or renew the contracts. If market conditions are not favorable at the time of renewal, transportation capacity may remain uncontracted, be contracted at lower rates or be contracted on a shorter-term basis. Unsold capacity may be recontracted if and when market conditions become more favorable. The ability to extend and/or renew expiring contracts and the terms of such subsequent contracts will depend upon the overall commercial environment for natural gas transportation and consumption in the region in which the pipeline is situated.

Business environment

The North American natural gas infrastructure network has been developed to connect supply to market. Use and growth of the systems are affected by changes in the location, relative cost of natural gas supply and changing market demand.

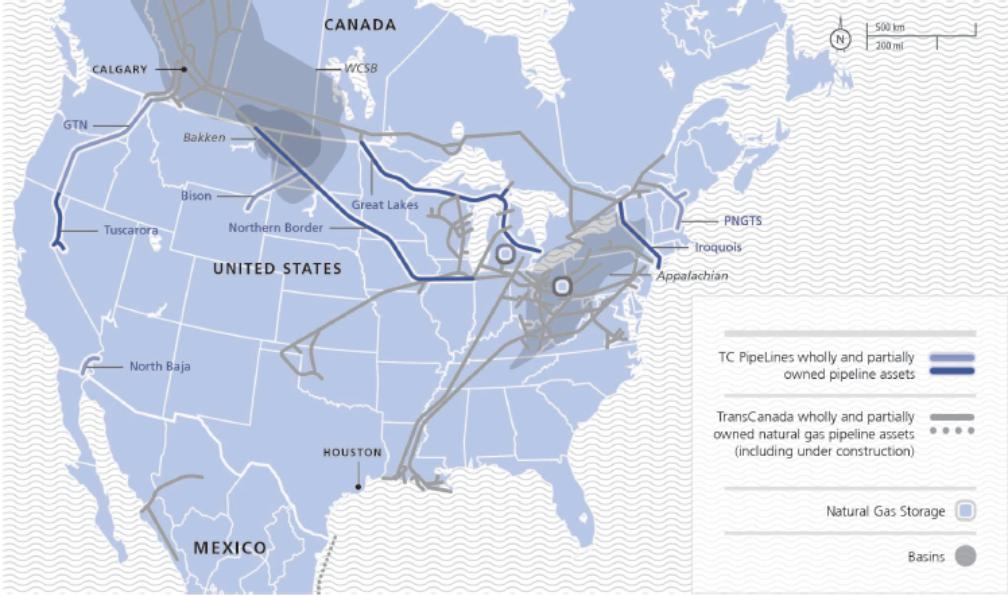

The map below shows the location of certain North American basins in relation to our systems together with those of our General Partner and TC Energy.

Supply

Natural gas is primarily transported from producing regions and, in limited circumstances, from liquefied natural gas (LNG) import facilities to market hubs or interconnects for distribution to natural gas consumers. The ongoing development of shale and other unconventional gas reserves has resulted in increases in overall North American natural gas production and economically recoverable reserves.

There has been an increase in production from the development of shale gas reserves that are located close to traditional markets, particularly in the Northeastern U.S. This has increased the number of supply choices for natural gas consumers and has contributed to the decline of higher-cost sources of supply (such as certain offshore gas production from Atlantic Canada) resulting in changes to historical natural gas pipeline flow patterns.

The supply of natural gas in North America is expected to continue increasing over the next decade and over the long-term for a number of reasons, including the following:

| ● | use of technology, including horizontal drilling in combination with multi-stage hydraulic fracturing, is allowing companies to access unconventional resources economically. This is increasing the technically accessible resource base of existing and emerging gas basins; and |

| ● | application of these technologies to existing oil fields where further recovery of the existing resource is now possible. There is often associated natural gas discovered in the exploration and production of liquids-rich |

TC PipeLines, LP Annual Report 2019 13

| hydrocarbons (for example the Bakken oil fields), which also contributes to an increase in the overall natural gas supply for North America. |

Other factors that can influence the overall level of natural gas supply in North America include:

| ● | the price of natural gas – low prices in North America may increase demand but reduce drilling activities that in turn diminish production levels, particularly in dry natural gas fields where the extra revenue generated from the associated liquids is not available. High natural gas prices may encourage higher drilling activities but may decrease the level of demand; |

| ● | producer portfolio diversification – large producers often diversify their portfolios by developing several basins, but this is influenced by actual costs to develop the resource as well as economic access to markets and cost of pipeline transportation services. Basin-on-basin competition impacts the extent and timing of a resource development that, in turn, drives changing dynamics for pipeline capacity demand; and |

| ● | regulatory and public scrutiny – changes in regulations that apply to natural gas production and consumption could impact the cost and pace of development of natural gas in North America. |

Demand

The natural gas pipeline business ultimately depends on a shipper’s demand for pipeline capacity and the price paid for that capacity. Demand for pipeline capacity is influenced by, among other things, supply and market competition, economic activity, weather conditions, natural gas pipeline and storage competition and the price of alternative fuels.

The growing supply of natural gas has resulted in relatively low natural gas prices in North America which has supported increased demand for natural gas particularly in the following areas:

| ● | natural gas-fired power generation; |

| ● | petrochemical and industrial facilities; |

| ● | the production of the Marcellus, Alberta’s oil sands, and the Bakken and shale deposits, although new greenfield projects that have not begun construction may be delayed in the current oil price environment; |

| ● | exports to Mexico to fuel electric power generation facilities; and |

| ● | exports from North America to global markets through a number of proposed LNG export facilities. |

Commodity Prices

In general, the profitability of the natural gas pipelines business is not directly tied to commodity prices given we are a transporter of the commodity and the transportation costs are not tied to the price of natural gas. However, the cyclical supply and demand nature of commodities and its price impact can have a secondary impact on our business where our shippers may choose to accelerate or delay certain projects. This can impact the timing for the demand of transportation services and/or new gas pipeline infrastructure.

Competition

Competition among natural gas pipelines is based primarily on transportation rates and proximity to natural gas supply areas and consuming markets. Changes in supply locations and regional demand have resulted in changes to pipeline flow dynamics. Where pipelines historically transported natural gas from one or two supply sources to their markets under long-term contracts, today many pipelines transport gas in multiple directions and under shorter contract terms. Some pipelines have even reversed their flows in order to adapt to changing sources of supply. Competition among pipelines to attract supply and new or existing markets to their systems has also increased across North America.

Our Natural Gas Infrastructure

We have ownership interests in eight natural gas interstate pipeline systems that are collectively designed to transport approximately 10.9 billion cubic feet per day of natural gas from producing regions and import facilities to market hubs and consuming markets primarily in the Western, Midwestern and Eastern U.S. All our pipeline systems, except Iroquois and the pipeline facilities jointly owned with MNE on PNGTS (Joint Facilities), are operated by subsidiaries of TC Energy. The Iroquois pipeline system is operated by Iroquois Pipeline Operating Company, a wholly owned subsidiary of Iroquois. The Joint Facilities are operated by M&N Operating Company, LLC (MNOC), a subsidiary of Maritimes and Northeast Pipeline LLC (MNE). MNE is a subsidiary of Enbridge Inc.

14 TC PipeLines, LP Annual Report 2019

Our pipeline systems include:

Pipeline |

| Length |

| Description |

| Ownership |

GTN | 1,377 miles | Extends from an interconnection near Kingsgate, British Columbia, Canada at the Canadian border to a point near Malin, Oregon at the California border and delivers natural gas to the Pacific Northwest and to California. | 100 percent | |||

Bison | 303 miles | Extends from a location near Gillette, Wyoming to Northern Border’s pipeline system in North Dakota. Bison can, but does not currently, transport natural gas from the Powder River Basin to Midwest markets. | 100 percent | |||

North Baja | 86 miles | Extends from an interconnection with the El Paso Natural Gas Company pipeline near Ehrenberg, Arizona to an interconnection with a natural gas pipeline near Ogilby, California on the Mexican border transporting natural gas in the southwest. North Baja is a bi-directional pipeline. | 100 percent | |||

Tuscarora | 305 miles | Extends from the terminus of the GTN pipeline near Malin, Oregon to its terminus near Reno, Nevada and delivers natural gas in northeastern California and northwestern Nevada. | 100 percent | |||

Northern Border | 1,412 miles | Extends from the Canadian border near Port of Morgan, Montana to a terminus near North Hayden, Indiana, south of Chicago. Northern Border is capable of receiving natural gas from Canada, the Bakken, the Williston Basin and the Rocky Mountain area for deliveries to the Midwest. ONEOK Northern Border Pipeline Company Holdings LLC owns the remaining 50 percent of Northern Border. | 50 percent | |||

PNGTS | 295 miles | Connects with the TQM pipeline at the Canadian border to deliver natural gas to customers in the U.S. northeast. Northern New England Investment Company, Inc. owns the remaining 38.29 percent of PNGTS. The 295-mile pipeline includes 107 miles of jointly owned pipeline facilities (the Joint Facilities) with MNE. The Joint Facilities extend from Westbrook, Maine to Dracut, Massachusetts and PNGTS owns approximately 32 percent of the Joint Facilities. | 61.71 percent | |||

Great Lakes | 2,115 miles | Connects with the TC Energy Mainline at the Canadian border points near Emerson, Manitoba, Canada and St. Clair, Michigan, near Detroit. Great Lakes is a bi-directional pipeline that can receive and deliver natural gas at multiple points along its system. TC Energy owns the remaining 53.55 percent of Great Lakes. | 46.45 percent | |||

Iroquois | 416 miles | Extends from the TC Energy Mainline system near Waddington, New York to deliver natural gas to customers in the U.S. northeast. The remaining 50.66 percent is owned by: TC Energy (0.66 percent), Dominion Energy, Inc. (Dominion Energy) (50 percent) | 49.34 percent |

TC PipeLines, LP Annual Report 2019 15

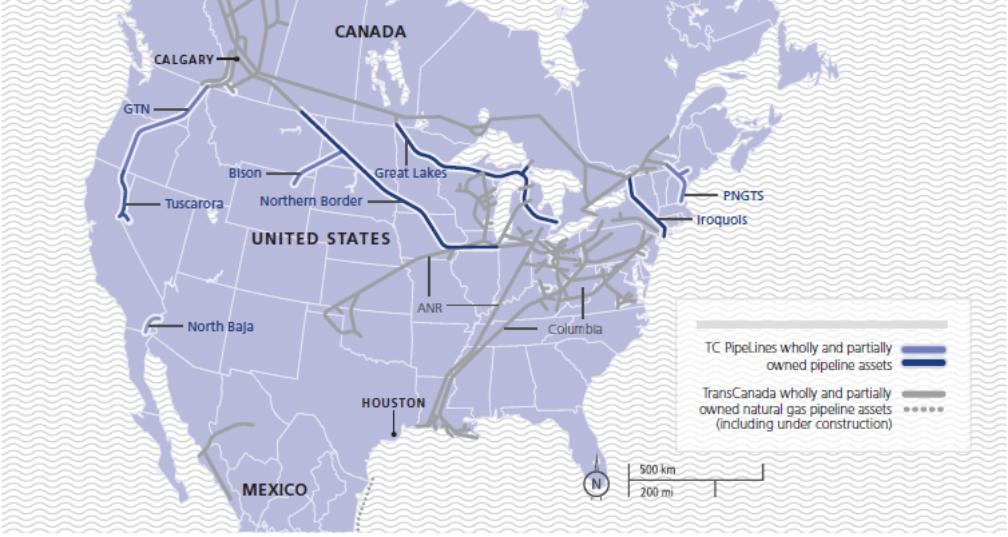

The map below shows the location of our pipeline systems.

Customers, Contracting and Demand

Our customers are generally large utilities, Local Distribution Companies (LDCs), major natural gas marketers, producing companies and other interstate pipelines, including affiliates. Our systems generate revenue by charging rates for transporting natural gas. Natural gas transportation service is provided pursuant to long-term and short-term contracts on a firm or interruptible basis. The majority of our pipeline systems' natural gas transportation services are provided through firm service transportation contracts with a reservation or demand charge that reserves pipeline capacity, regardless of use, for the term of the contract. The revenues associated with capacity reserved under firm service transportation contracts are not subject to fluctuations caused by changing supply and demand conditions, competition or customers. Customers with interruptible service transportation agreements may utilize available capacity after firm service transportation requests are satisfied.

Our pipeline systems actively market their available capacity and work closely with customers, including natural gas producers, LDCs, marketers and end users, to ensure our pipelines are offering attractive services and competitive rates. Approximately 70 percent of our long-term contract revenues are with customers who have an investment grade rating or who have provided guarantees from investment grade parties. We have obtained financial assurances as permitted by FERC and our tariffs for the remaining long-term contracts. See Part I, Item 1A. “Risk Factors.”

Transactions with our major customers that are at least 10 percent of our consolidated revenues can be found under Note 17-Transactions with major customers within Part IV, Item 15. “Exhibits and Financial Statement Schedules," which information is incorporated herein by reference. Additionally, our equity investee Great Lakes earns a significant portion of its revenue from TC Energy and its affiliates as disclosed under Note 18-Related party transactions within Part IV, Item 15. “Exhibits and Financial Statement Schedules,” which information is incorporated herein by reference.

GTN – GTN’s revenues are substantially supported by long-term contracts through the end of 2023 with its remaining contracts extending between 2024 and 2045. These contracts, which have historically been renewed on a long-term basis upon expiration, are primarily held by residential and commercial LDCs and power generators that use a diversified portfolio of transportation options to serve their long-term markets and marketers under a variety of contract terms. A small portion of our contract portfolio is contracted by industrial shippers and producers. We expect GTN to continue to be an important transportation component of these diversified portfolios. Incremental transportation opportunities are based on the difference in value between Western Canadian natural gas supplies and deliveries to Northern California.

In 2018, GTN benefitted from an increase in the quantity of natural gas it transports as debottlenecking activities occurred on upstream pipeline systems which deliver natural gas to GTN. These upstream activities are continuing and, as a result, we have signed over 700,000 Dth/day in long-term contracts starting between 2018 and 2020, of which 348,000 Dth/day resulted in additional quantity flowing onto GTN mid-2018, and 114,000 Dth/day in the fourth quarter of 2019. The

16 TC PipeLines, LP Annual Report 2019

remaining quantity is expected to begin to flow in mid-2020. The majority of these contracts have terms of at least 15 years.

On January 29, 2019, GTN’s largest customer, Pacific Gas and Electric Company (Pacific Gas), filed for Chapter 11 bankruptcy protection. Pacific Gas accounted for approximately seven percent of the Partnership’s consolidated revenues in 2019 (2018 - six percent). As a utility company, Pacific Gas serves residential and industrial customers in the state of California and has an ongoing obligation to serve its customers. We have not experienced collection issues in 2019 and we do not expect the bankruptcy of Pacific Gas to have a material impact on our future cash flows and results of operations.

During the fourth quarter of 2019, we announced the GTN XPress project, our largest organic opportunity in TCP’s 20-year history. This project includes a horsepower replacement program and a brownfield expansion. The reliability work will enable increased firm natural gas transportation on GTN, which together with the growth component of the project, will sum to 250,000 Dth/d in additional long-term contracts on the pipeline system. See Part I, Item 1. “Business- Recent Business Developments-Growth Projects” for more information.

Northern Border – Northern Border is a highly competitive pipeline system with a weighted average remaining contract length of approximately 4 years. Northern Border contracts that include renewal rights and expiring contracts have typically been renewed for terms of five years. A significant portion of Northern Border’s contract portfolio is contracted by utilities, marketers and industrial load. In addition, Northern Border sells seasonal transportation services which have traditionally been strongest during peak winter months to serve heating demand and peak spring/summer months to serve electric cooling demand and storage injection.

Great Lakes – Great Lakes' revenue is derived from both short-haul and long-haul transportation services. The majority of its contracts are with TC Energy and affiliates on multiple paths across its system. Great Lakes' ability to sell its available and future capacity will depend on future market conditions which are impacted by a number of factors including weather, levels of natural gas in storage, the capacity of upstream and downstream pipelines and the availability and pricing of natural gas supplies. Demand for Great Lakes' services has historically been highest in the summer to fill the natural gas storage complexes in Ontario and Michigan in advance of the upcoming winter season. During the winter, Great Lakes serves peak heating requirements for customers in Minnesota, Wisconsin, Michigan and the upper Midwest of the U.S.

A significant portion of Great Lakes’ total contract portfolio is contracted by its affiliates including its long-term transportation agreement with TC Energy’s Canadian Mainline that commenced on November 1, 2017 for a ten-year period that allows TC Energy to transport up to 0.711 billion cubic feet (equivalent to about 722,000 Dth/day) of natural gas per day on the Great Lakes system. This contract, which contains volume reduction options up to full contract quantity until November 1, 2020, was a direct benefit from TC Energy’s long-term fixed price service on its Canadian Mainline that was launched in 2017. TC Energy’s long-term fixed price service provides long-term capacity to TC Energy’s shippers for the transportation of WCSB natural gas to markets in Eastern Canada and the U.S.

During the second quarter of 2018, Great Lakes reached an agreement on the terms of new long-term transportation capacity contracts with its affiliate, ANR Pipeline Company. The contracts are for a term of 15 years from November 2021 to October 31, 2036 with a total contract value of approximately $1.3 billion on 0.9 billion of cubic feet (equivalent to about 913,000 Dth/day) capacity. The contracts contain reduction options (i) at any time on or before April 1, 2020 for any reason and (ii) any time before April 2021, if TC Energy is not able to secure the required regulatory approval related to anticipated expansion projects. During the first quarter of 2019, Great Lakes reached an agreement to amend a volume reduction “for any reason” option by extending the period “on or before” April 1, 2019 to “on or before” April 1, 2020. All the other terms remained the same.

PNGTS – PNGTS’ revenues are primarily generated from transportation agreements with LDCs throughout New England and Canada’s Atlantic provinces. The majority of PNGTS’ current revenue stream is supported by long-term contracts entered into via a series of open seasons for long-term capacity held by PNGTS in recent years. Long-term contract commitments of approximately 82,000 Dth/day from PNGTS’ Continent-to-Coast Contracts with several shippers for a term of 15 years (the C2C Contracts) open season began December 1, 2017, necessitating an increase in PNGTS’ certificated capacity up to approximately 210,000 Dth/day. The C2C Contracts mature in 2032.

In addition to the C2C Contracts, in 2017, as a result of its PXP open season, PNGTS executed 20-year precedent agreements with several LDCs in New England and Atlantic Canada to re-contract certain system capacity set to expire in 2019 as well as expand the PNGTS system. PXP Phases I and II were placed into service on November 1, 2018 and November 1, 2019, respectively. Phase III of the project is expected to be in service on November 1, 2020. The total final volume of the project is approximately 183,000 Dth/ day: 40,000 Dth/day from Phase I, 118,400 Dth/day from Phase II, which includes re-contracting and renewal of expiring contracts, and 24,600 Dth/day from Phase III. PXP, together with the C2C expansion brings additional, natural gas supply options to markets in New England and Atlantic Canada in response to the growing need for natural gas transportation capacity in the region.

PXP is fully subscribed with no uncontracted firm capacity to meet incremental market demand in this region. In response, PNGTS developed a second expansion project. In early 2019, PNGTS announced the Westbrook XPress project which is

TC PipeLines, LP Annual Report 2019 17

an independent project that is designed to be phased in over a four-year period beginning November 1, 2019 with Phase I. Phases II and III have estimated in-service dates of November 2021 and 2022, respectively. Westbrook XPress will add incremental capacity of approximately 43,000 Dth/day, 69,000 Dth/day, and 18,000 Dth/day, respectively. Westbrook XPress, together with PXP, will increase PNGTS’ capacity by 90 percent from 210,000 Dth/day to approximately 400,000 Dth/day. PNGTS signed precedent agreements for Phases II and III of Westbrook XPress, pending receipt of various regulatory and corporate approvals. The Westbrook XPress contracts expire between 2036 and 2042. See Part I, Item 1. “Business- Recent Business Developments-Growth Projects” for more information about PXP and Westbrook XPress.

Iroquois – Iroquois transports natural gas under long-term contracts that expire between 2019 and 2026 and extends from TC Energy’s Canadian Mainline system at the U.S. border near Waddington, New York to markets in the U.S. northeast, including New York City, Long Island and Connecticut. Iroquois provides service to local gas distribution companies, electric utilities and electric power generators, as well as marketers and other end users, directly or indirectly, through interconnecting pipelines and exchanges throughout the northeastern U.S. Iroquois also earns discretionary transportation service revenues which can have a significant earnings impact. Discretionary transportation service revenues include short-term firm transportation service contracts with less than one-year terms as well as standard interruptible transportation service contracts. In 2019, Iroquois earned approximately 12 percent of its revenues from discretionary services.

During the second quarter of 2019, Iroquois initiated the ExC Project to meet current and future gas supply needs of utility customers by upgrading its compressor stations along the pipeline. This project will be 100 percent underpinned with 20-year contracts and is subject to necessary permits and approvals. This project has an estimated in-service date of November 2023. See Part I, Item 1. “Business- Recent Business Developments-Growth Projects” for more information.

North Baja – The North Baja pipeline system is an 86-mile bi-directional natural gas pipeline transporting gas between Arizona, California and the Mexican border since 2002. North Baja’s historical steady financial performance is due to its strong contracting levels, having a weighted average remaining firm contract length of about 7 years. North Baja currently has a design capacity of 500 mcf/d of southbound transportation and is capable of transporting 600 mcf/d in a northbound direction.

In April 2019, we concluded a successful binding open season for North Baja XPress project to transport additional volumes of natural gas along North Baja’s mainline system between Arizona and California. The estimated in-service date of the project is November 2022, subject to the satisfaction or waiver of certain conditions precedent including positive FID from Sempra LNG International, LLC. See Part I, Item 1. “Business- Recent Business Developments-Growth Projects” for more information.

Bison – As previously disclosed, natural gas is not flowing on the Bison system in response to the recent relative cost advantage of WCSB and Bakken sourced gas versus Rockies production. From its in-service date in 2011 up to the fourth quarter of 2018, Bison was fully contracted on a ship-or-pay basis. During the fourth quarter of 2018, through a Permanent Capacity Release Agreement, Tenaska Marketing Ventures (Tenaska) assumed Anadarko Energy Services Company’s (Anadarko) ship-or-pay contract obligation on Bison, the largest contract on Bison. After assuming the transportation obligation, Bison accepted an offer from Tenaska to terminate this contract. Following the amendment of its tariff to enable this transaction, another customer executed a similar agreement to terminate its contract on Bison. At the completion of the contracts, Bison was released from performing any future services with the two customers and as such, the amounts received were recorded in revenue in 2018.

The two customers represented approximately 60 percent of Bison’s revenue and accordingly, in 2019, Bison’s revenue was reduced by approximately $47 million. Its remaining contracts in the system expire in January 2021. Bison will therefore be approximately 40 percent contracted on a ship-or-pay basis in 2020 and is expected to generate approximately $30 million in revenue, similar to 2019.

Based on this development and other qualitative factors, the Partnership evaluated the remaining carrying value of Bison’s property, plant and equipment at December 31, 2018 and concluded that the entire amount was no longer recoverable, resulting in a non-cash impairment charge during the fourth quarter of 2018. We continue to explore alternative transportation-related options for Bison and we believe commercial potential exists to reverse the direction of natural gas flow on Bison for deliveries onto third party pipelines and ultimately connect into the Cheyenne hub. See also Part II, Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations - Critical Accounting Estimates” for more information.

Tuscarora – Tuscarora’s revenues are substantially supported by long-term contracts with a weighted average remaining contract length of approximately 5 years. We expect Tuscarora to continue be fully contracted on a long-term basis when its current contracts expire.

During the fourth quarter of 2019, we announced that we are proceeding with the Tuscarora XPress project, an expansion project through additional compression capability at an existing Tuscarora facility that is expected to increase capacity by approximately 7 percent by November 2021. Tuscarora XPress is 100 percent underpinned by a 20-year contract. See Part I, Item 1. “Business- Recent Business Developments-Growth Projects” for more information.

18 TC PipeLines, LP Annual Report 2019

Competition

Overall, our pipeline systems generate a substantial portion of their cash flow from long-term firm contracts for transportation services and are therefore insulated from competitive factors during the terms of the contracts. If these long-term contracts are not renewed at their expiration, our pipeline systems face competitive pressures which influence contract renewals and rates charged for transportation services.

GTN and Northern Border, through their respective connections with TC Energy's Foothills systems, and Great Lakes and Iroquois, through their respective connections with TC Energy's Canadian Mainline, compete with each other for WCSB natural gas supply as well as with other pipelines, including the Alliance pipeline and the Westcoast pipeline. Northern Border and Great Lakes compete in their respective market areas for natural gas supplies from other basins as well, such as the Bakken, Rocky Mountain area, Mid-Continent, Gulf Coast, Utica and Marcellus basins. GTN primarily competes with pipelines supplying natural gas into California and Pacific Northwest markets.

Bison competes for deliveries with other pipelines that transport natural gas supplies within and away from the Rocky Mountain area, and gas from the Rocky Mountains that is delivered into the Midwest must compete with gas sourced from the Bakken and Western Canada.

North Baja’s southbound pipeline capacity competes with deliveries of LNG received at the Costa Azul terminal in Mexico. If LNG shipments are received at Costa Azul, North Baja’s northbound capacity competes with pipelines that deliver Rocky Mountain area, Permian and San Juan basin natural gas into the southern California area.

Tuscarora competes for deliveries primarily into the northern Nevada natural gas market with natural gas from the Rocky Mountain area.

PNGTS connects with the TQM pipeline at the Canadian border and shares facilities with the MNE from Westbrook, Maine to a connection with the Tennessee Gas Pipeline System near Boston, Massachusetts. PNGTS competes with LNG supplies and gas flows from Canada and with LNG delivered into Boston. Tennessee Gas Pipeline and Algonquin Gas Transmission also compete with PNGTS for gas deliveries into New England markets.

As noted above, Iroquois, through its connection with TC Energy’s Canadian Mainline System, competes for WCSB natural gas supply with other pipelines. Iroquois connects at five locations with three interstate pipelines (Tennessee Gas, CNG Gas Transmission and Algonquin Gas Transmission) and TC Energy’s Canadian Mainline System near Waddington, New York and provides a link between WCSB natural gas deliveries to markets in the states of Connecticut, Massachusetts, New Hampshire, New Jersey, New York, and Rhode Island.

Additionally, our pipeline assets face competition from other pipeline companies seeking opportunities to invest in greenfield natural gas pipeline development opportunities. This competition could result in fewer projects being available that meet our pipeline systems’ investment hurdles or projects that proceed with lower overall financial returns.

Relationship with TC Energy

TC Energy is the indirect parent of our General Partner and at December 31, 2019, owns, through its subsidiaries, approximately 24 percent of our common units, 100 percent of our Class B units, 100 percent of our IDRs and has a two percent general partner interest in us. TC Energy is a major energy infrastructure company, listed on the Toronto Stock Exchange and NYSE, with more than 65 years of experience in the responsible development and reliable operation of energy infrastructure in North America. TC Energy’s business is primarily focused on natural gas and liquids transmission and power generation services, delivering the energy millions of people rely on to power their lives in a sustainable way. TC Energy consists of investments in 57,900 miles of natural gas pipelines, approximately 3,000 miles of liquids pipelines and 653 billion cubic feet of natural gas storage capacity. TC Energy also owns or has interests in approximately 6,000 megawatts of power generation. TC Energy operates most of our pipeline systems and, in some cases, contracts for pipeline capacity.

See also Part III, Item 13. “Certain Relationships and Related Transactions, and Director Independence” for more information on our relationship with TC Energy.

Government Regulation

Federal Energy Regulatory Commission

All of our pipeline systems are regulated by FERC under the Natural Gas Act of 1938 (NGA) and Energy Policy Act of 2005, which gives FERC jurisdiction to regulate effectively all aspects of our business, including:

| ● | transportation of natural gas in interstate commerce; |

| ● | rates and charges; |

TC PipeLines, LP Annual Report 2019 19

| ● | terms of service and service contracts with customers, including counterparty credit support requirements; |

| ● | certification and construction of new facilities; |

| ● | extension or abandonment of service and facilities; |

| ● | accounts and records; |

| ● | depreciation and amortization policies; |

| ● | acquisition and disposition of facilities; |

| ● | initiation and discontinuation of services; and |

| ● | standards of conduct for business relations with certain affiliates. |

Our pipeline systems’ operating revenues are determined based on rate options stated in our tariffs which are approved by FERC. Tariffs specify the general terms and conditions for pipeline transportation service including the rates that may be charged. FERC, either through hearing a rate case or as a result of approving a negotiated rate settlement, approves the maximum rates permissible for transportation service on a pipeline system which are designed to recover the pipeline’s cost-based investment, operating expenses and a reasonable return for its investors. Once maximum rates are set, a pipeline system is not permitted to adjust the maximum rates to reflect changes in costs or contract demand until new rates are approved by FERC. Pipelines are permitted to charge rates lower than the maximum tariff rates in order to compete. As a result, earnings and cash flows of each pipeline system depend on a number of factors including costs incurred, contracted capacity and transportation path, the volume of natural gas transported, and rates charged.

2018 FERC Actions

Background:

During the latter part of 2018, the Partnership completed its regulatory filings to address the issues contemplated by Public Law No. 115-97, commonly known as the Tax Cuts and Jobs Act (2017 Tax Act) and certain FERC actions that began in March of 2018, namely FERC’s Revised Policy Statement on Treatment of Income Taxes (Revised Policy Statement) and a Final Rule that established a schedule by which interstate pipelines must either (i) file a new uncontested rate settlement or (ii) file a one-time report, called FERC Form No. 501-G, that quantified the rate impact of the 2017 Tax Act on FERC-regulated pipelines and the impact of the Revised Policy Statement on pipelines held by MLPs (collectively, the 2018 FERC Actions).

Pipelines filing FERC Form No. 501-G had four options:

| ● | Option 1: make a limited NGA Section 4 filing to reduce its rates by the reduction in its cost of service shown in its FERC Form No. 501-G. For any pipeline electing this option, FERC guaranteed a three-year moratorium on NGA Section 5 rate investigations if the pipeline’s FERC Form 501-G showed the pipeline’s estimated return on equity (ROE) as being 12 percent or less. Under the Final Rule and notwithstanding the Revised Policy Statement, a pipeline organized as an MLP is not required to eliminate its income tax allowance, but instead can reduce its rates to reflect the reduction in the maximum corporate tax rate. Alternatively, the MLP pipeline can eliminate its tax allowance, along with its Accumulated Deferred Income Tax (ADIT) used for rate-making purposes. In situations where the ADIT balance is a liability, this elimination would have the effect of increasing the pipeline’s rate base used for rate-making purposes; |

| ● | Option 2: commit to file either a pre-packaged uncontested rate settlement or a general Section 4 rate case if it believed that using the limited Section 4 option would not result in just and reasonable rates. If the pipeline committed to file by December 31, 2018, FERC would not initiate a Section 5 investigation of its rates prior to that date; |

| ● | Option 3: file a statement explaining its rationale for why it did not believe the pipeline's rates must change; or |

| ● | Option 4: take no action. FERC would then consider whether to initiate a Section 5 investigation of any pipeline that had not submitted a limited Section 4 rate filing or committed to file a general Section 4 rate case. |

Impact of the 2018 FERC Actions to the Partnership:

The 2018 FERC Actions directly addressed two components of our pipeline systems’ cost-of-service based rates: the allowance for income taxes and the inclusion of ADIT in their rate base. The 2018 FERC Actions also noted that precise treatment of entities with more ambiguous ownership structures must be separately resolved on a case-by-case basis, such as those partially owned by corporations including Great Lakes, Northern Border, Iroquois and PNGTS. Additionally, any FERC-mandated rate reduction did not affect negotiated rate contracts.

20 TC PipeLines, LP Annual Report 2019

Prior to the 2018 FERC Actions, none of the Partnership’s pipeline systems had a requirement to file or adjust their rates earlier than 2022 as a result of their existing rate settlements. However, several of our pipeline systems accelerated such adjustments as a result of the 2018 FERC Actions. The actions taken by our pipelines are outlined below:

| Form 501-G Filing Option |

| Impact on Maximum Rates |

| Moratorium, Mandatory | |

Great Lakes | Option 1; reflected an elimination of income tax allowance and ADIT; Limited Section 4 accepted by FERC; 501-G Docket remains open | 2.0% rate reduction effective February 1, 2019 | No moratorium in effect; comeback provision with new rates to be effective by October 1, 2022 | |||

GTN | Settlement approved by FERC on November 30, 2018 eliminated the requirement to file Form 501-G | A refund of $10 million to its firm customers in 2018; 10.0% rate reduction effective January 1, 2019; additional rate reduction of 6.6% effective January 1, 2020 through December 31, 2021; these reductions will replace the 8.3% rate reduction in 2020 agreed to as part of the last settlement in 2015 | Moratorium on rate changes until December 31, 2021; comeback provision with new rates to be effective by January 1, 2022; Settlement agreement reflected an elimination of income tax allowance and ADIT | |||

Northern Border | Option 1; reflected an elimination of income tax allowance and ADIT; subsequent settlement approved by FERC on May 24, 2019; 501-G docket closed | 2.0% rate reduction effective February 1, 2019 to December 31, 2019 extended until July 1, 2024 unless superseded by a subsequent rate case or settlement | No moratorium in effect; comeback provision with new rates to be effective by July 1, 2024 | |||

Bison | Option 3; reflected an elimination of income tax allowance and ADIT; accepted by FERC; 501-G docket closed | No rate changes proposed | No moratorium or comeback provisions | |||

Iroquois | Option 3; reflected an elimination of income tax allowance and ADIT; subsequent settlement approved by FERC on May 2, 2019; 501-G docket closed | 3.25% rate reduction effective March 1, 2019; additional 3.25% rate reduction effective April 1, 2020 | Moratorium on rate changes until September 1, 2020; comeback provision with new rates to be effective by March 1, 2023 | |||

PNGTS | Option 3; reflected an elimination of income tax allowance and ADIT; accepted by FERC; 501-G docket closed | No rate changes | No moratorium or comeback provisions | |||

North Baja | Option 1; reflected an elimination of income tax allowance and ADIT; accepted by FERC; 501-G docket closed | 10.8% rate reduction effective December 1, 2018 | No moratorium or comeback provisions; approximately 90 percent of North Baja’s contracts are negotiated; 10.8% reduction is on maximum rate contracts only | |||

Tuscarora | Option 1; reflected an elimination of income tax allowance and ADIT; subsequent settlement approved by FERC on May 2, 2019; 501-G docket closed | 1.7% rate reduction effective February 1, 2019; additional rate reduction of 10.8% effective August 1, 2019 | Moratorium on rate changes until January 31, 2023; comeback provision with new rates to be effective by February 1, 2023; Settlement agreement reflected an elimination of income tax allowance and ADIT |

The Final Rule allowed pipelines owned by MLPs and other pass through entities to remove the ADIT liability from their rate bases, and thus increase the net recoverable rate base, partially or in some cases wholly mitigated the loss of the tax allowance in cost-of-service based rates. Following the elimination of the tax allowance and the ADIT liability from rate base, rate settlements and related filings of all pipelines held wholly or in part by the Partnership summarized above, the estimated impact of the tax-related changes to our revenue and cash flow is a reduction of approximately $30 million per year on an annualized basis beginning in 2019.

In 2019, the estimated impact of the tax-related changes to our revenue and cashflow have been largely mitigated by additional revenue generated from continued strong natural gas flows mainly out of WCSB and from solid contracting levels across the Partnership pipeline assets. See Part II, Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations” for more information.

TC PipeLines, LP Annual Report 2019 21

Filings required by the Final Rule and Rate Settlements:

GTN

On October 16, 2018, GTN filed an uncontested settlement with FERC to address the changes proposed by the 2018 FERC Actions on its rates via an amendment to its prior 2015 settlement (the 2018 GTN Settlement). The 2018 GTN Settlement reflects an elimination of the tax allowance previously recovered in rates along with ADIT for rate-making purposes (see details of the 2018 GTN Settlement in the table above).

Tuscarora

On December 6, 2018, Tuscarora elected to make a limited NGA Section 4 filing to reduce its maximum rates by approximately 1.7 percent and eliminate its deferred income tax balances previously used for rate setting (Option 1). On March 15, 2019, Tuscarora filed an uncontested settlement with FERC to address the issues contemplated by the 2017 Tax Act and 2018 FERC Actions via an amendment to its prior 2016 settlement (the 2019 Tuscarora Settlement).