bkng-20231231FY☒☐FALSE20230001075531P1Yhttp://fasb.org/us-gaap/2023#AccruedLiabilitiesCurrenthttp://fasb.org/us-gaap/2023#AccruedLiabilitiesCurrenthttp://fasb.org/us-gaap/2023#PropertyPlantAndEquipmentNethttp://fasb.org/us-gaap/2023#PropertyPlantAndEquipmentNethttp://fasb.org/us-gaap/2023#AccruedLiabilitiesCurrenthttp://fasb.org/us-gaap/2023#AccruedLiabilitiesCurrenthttp://fasb.org/us-gaap/2023#OtherLiabilitiesNoncurrenthttp://fasb.org/us-gaap/2023#OtherLiabilitiesNoncurrenthttp://fasb.org/us-gaap/2023#OtherOperatingIncomeExpenseNet00010755312023-01-012023-12-310001075531us-gaap:CommonStockMember2023-01-012023-12-310001075531bkng:A2.375SeniorNotesDueSeptember2024MemberMember2023-01-012023-12-310001075531bkng:A01SeniorNotesDueMarch2025Member2023-01-012023-12-310001075531bkng:A40SeniorNotesDueNovember2026Member2023-01-012023-12-310001075531bkng:A1.8SeniorNotesDueMarch2027Member2023-01-012023-12-310001075531bkng:A3.625SeniorNotesDue2028Member2023-01-012023-12-310001075531bkng:A05SeniorNotesDueMarch2028Member2023-01-012023-12-310001075531bkng:A425SeniorNotesDueMay2029Member2023-01-012023-12-310001075531bkng:A45SeniorNotesDueNovember2031Member2023-01-012023-12-310001075531bkng:A4.125SeniorNotesDue2033Member2023-01-012023-12-310001075531bkng:A475SeniorNotesDueNovember2034Member2023-01-012023-12-3100010755312023-06-30iso4217:USD00010755312024-02-15xbrli:shares00010755312023-12-3100010755312022-12-310001075531bkng:LongtermInvestmentsMember2022-12-31iso4217:USDxbrli:shares0001075531bkng:MerchantRevenueMember2023-01-012023-12-310001075531bkng:MerchantRevenueMember2022-01-012022-12-310001075531bkng:MerchantRevenueMember2021-01-012021-12-310001075531bkng:AgencyRevenueMember2023-01-012023-12-310001075531bkng:AgencyRevenueMember2022-01-012022-12-310001075531bkng:AgencyRevenueMember2021-01-012021-12-310001075531bkng:AdvertisingandotherrevenuesMember2023-01-012023-12-310001075531bkng:AdvertisingandotherrevenuesMember2022-01-012022-12-310001075531bkng:AdvertisingandotherrevenuesMember2021-01-012021-12-3100010755312022-01-012022-12-3100010755312021-01-012021-12-310001075531us-gaap:CommonStockMember2020-12-310001075531us-gaap:TreasuryStockCommonMember2020-12-310001075531us-gaap:AdditionalPaidInCapitalMember2020-12-310001075531us-gaap:RetainedEarningsMember2020-12-310001075531us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-12-3100010755312020-12-310001075531us-gaap:RetainedEarningsMember2021-01-012021-12-310001075531us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-01-012021-12-310001075531us-gaap:AdditionalPaidInCapitalMember2021-01-012021-12-310001075531us-gaap:CommonStockMember2021-01-012021-12-310001075531us-gaap:TreasuryStockCommonMember2021-01-012021-12-310001075531us-gaap:CommonStockMember2021-12-310001075531us-gaap:TreasuryStockCommonMember2021-12-310001075531us-gaap:AdditionalPaidInCapitalMember2021-12-310001075531us-gaap:RetainedEarningsMember2021-12-310001075531us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-3100010755312021-12-310001075531us-gaap:AdditionalPaidInCapitalMembersrt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2021-12-310001075531us-gaap:RetainedEarningsMembersrt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2021-12-310001075531srt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2021-12-310001075531us-gaap:RetainedEarningsMember2022-01-012022-12-310001075531us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-12-310001075531us-gaap:CommonStockMember2022-01-012022-12-310001075531us-gaap:AdditionalPaidInCapitalMember2022-01-012022-12-310001075531us-gaap:TreasuryStockCommonMember2022-01-012022-12-310001075531us-gaap:CommonStockMember2022-12-310001075531us-gaap:TreasuryStockCommonMember2022-12-310001075531us-gaap:AdditionalPaidInCapitalMember2022-12-310001075531us-gaap:RetainedEarningsMember2022-12-310001075531us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310001075531us-gaap:RetainedEarningsMember2023-01-012023-12-310001075531us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-12-310001075531us-gaap:CommonStockMember2023-01-012023-12-310001075531us-gaap:AdditionalPaidInCapitalMember2023-01-012023-12-310001075531us-gaap:TreasuryStockCommonMember2023-01-012023-12-310001075531us-gaap:CommonStockMember2023-12-310001075531us-gaap:TreasuryStockCommonMember2023-12-310001075531us-gaap:AdditionalPaidInCapitalMember2023-12-310001075531us-gaap:RetainedEarningsMember2023-12-310001075531us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-31bkng:segment0001075531bkng:OnlineTravelReservationServicesMember2023-01-012023-12-310001075531srt:ScenarioPreviouslyReportedMember2022-01-012022-12-310001075531srt:ScenarioPreviouslyReportedMember2021-01-012021-12-310001075531srt:RevisionOfPriorPeriodReclassificationAdjustmentMember2022-01-012022-12-310001075531srt:RevisionOfPriorPeriodReclassificationAdjustmentMember2021-01-012021-12-310001075531bkng:A075SeniorConvertibleNotesDueMay2025Memberus-gaap:ConvertibleDebtMember2021-12-31xbrli:pure0001075531us-gaap:AccountingStandardsUpdate202006Member2021-12-310001075531us-gaap:SalesRevenueNetMemberbkng:OnlineaccommodationreservationservicesMemberus-gaap:ProductConcentrationRiskMember2023-01-012023-12-310001075531us-gaap:SalesRevenueNetMemberbkng:OnlineaccommodationreservationservicesMemberus-gaap:ProductConcentrationRiskMember2022-01-012022-12-310001075531us-gaap:SalesRevenueNetMemberbkng:OnlineaccommodationreservationservicesMemberus-gaap:ProductConcentrationRiskMember2021-01-012021-12-310001075531bkng:OthersourcesofonlinetravelreservationservicesoradvertisingandotherrevenuesMemberus-gaap:SalesRevenueNetMemberus-gaap:ProductConcentrationRiskMembersrt:MaximumMember2021-01-012021-12-310001075531bkng:OthersourcesofonlinetravelreservationservicesoradvertisingandotherrevenuesMemberus-gaap:SalesRevenueNetMemberus-gaap:ProductConcentrationRiskMembersrt:MaximumMember2023-01-012023-12-310001075531bkng:OthersourcesofonlinetravelreservationservicesoradvertisingandotherrevenuesMemberus-gaap:SalesRevenueNetMemberus-gaap:ProductConcentrationRiskMembersrt:MaximumMember2022-01-012022-12-310001075531us-gaap:AccruedLiabilitiesMemberbkng:IncentivesAndLoyaltyProgramsMember2023-12-310001075531us-gaap:AccruedLiabilitiesMemberbkng:IncentivesAndLoyaltyProgramsMember2022-12-310001075531bkng:OmnibusPlan1999Member2023-12-310001075531us-gaap:PerformanceSharesMemberbkng:PerformanceShareUnits2018And2019GrantsMemberbkng:ExecutiveOfficersMember2021-01-012021-12-310001075531us-gaap:RestrictedStockUnitsRSUMembersrt:MinimumMember2023-01-012023-12-310001075531us-gaap:RestrictedStockUnitsRSUMembersrt:MaximumMember2023-01-012023-12-310001075531us-gaap:PerformanceSharesMember2023-01-012023-12-310001075531bkng:AwardsOtherThanOptionsMember2023-12-310001075531bkng:AwardsOtherThanOptionsMember2023-01-012023-12-310001075531us-gaap:RestrictedStockUnitsRSUMember2022-12-310001075531us-gaap:PerformanceSharesMember2022-12-310001075531us-gaap:RestrictedStockUnitsRSUMember2023-01-012023-12-310001075531us-gaap:RestrictedStockUnitsRSUMember2023-12-310001075531us-gaap:PerformanceSharesMember2023-12-310001075531us-gaap:PerformanceSharesMemberbkng:PerformanceShareUnits2021And2022GrantsMember2021-01-012022-12-310001075531us-gaap:PerformanceSharesMemberbkng:PerformanceShareUnits2021And2022GrantsMember2023-01-012023-12-310001075531us-gaap:EmployeeStockOptionMember2022-12-310001075531us-gaap:EmployeeStockOptionMember2022-01-012022-12-310001075531us-gaap:EmployeeStockOptionMember2023-01-012023-12-310001075531us-gaap:EmployeeStockOptionMember2023-12-310001075531us-gaap:ShortTermInvestmentsMemberus-gaap:ForeignGovernmentDebtSecuritiesMember2023-12-310001075531us-gaap:USGovernmentDebtSecuritiesMemberus-gaap:ShortTermInvestmentsMember2023-12-310001075531us-gaap:ShortTermInvestmentsMemberus-gaap:CorporateDebtSecuritiesMember2023-12-310001075531bkng:LongtermInvestmentsMemberus-gaap:EquitySecuritiesMember2023-12-310001075531bkng:LongtermInvestmentsMemberbkng:EquitySecuritiesPrivateCompaniesMember2023-12-310001075531bkng:LongtermInvestmentsMember2023-12-310001075531us-gaap:ShortTermInvestmentsMemberus-gaap:ForeignGovernmentDebtSecuritiesMember2022-12-310001075531us-gaap:USGovernmentDebtSecuritiesMemberus-gaap:ShortTermInvestmentsMember2022-12-310001075531us-gaap:ShortTermInvestmentsMemberus-gaap:CorporateDebtSecuritiesMember2022-12-310001075531bkng:LongtermInvestmentsMemberus-gaap:ForeignGovernmentDebtSecuritiesMember2022-12-310001075531bkng:LongtermInvestmentsMemberus-gaap:USGovernmentDebtSecuritiesMember2022-12-310001075531bkng:LongtermInvestmentsMemberus-gaap:CorporateDebtSecuritiesMember2022-12-310001075531bkng:LongtermInvestmentsMemberus-gaap:EquitySecuritiesMember2022-12-310001075531bkng:LongtermInvestmentsMemberbkng:EquitySecuritiesPrivateCompaniesMember2022-12-310001075531srt:MinimumMember2023-12-310001075531srt:MaximumMember2023-12-310001075531bkng:DiDiGlobalIncMember2023-12-310001075531bkng:GrabHoldingsLimitedMember2023-12-310001075531bkng:GrabHoldingsLimitedMember2022-12-310001075531bkng:DiDiGlobalIncMember2022-12-310001075531bkng:MeituanDianpingMember2022-12-310001075531bkng:MeituanDianpingMember2023-01-012023-12-310001075531bkng:DiDiGlobalIncMember2023-01-012023-12-310001075531bkng:DiDiGlobalIncMember2022-01-012022-12-310001075531bkng:DiDiGlobalIncMember2021-01-012021-12-310001075531bkng:GrabHoldingsLimitedMember2023-01-012023-12-310001075531bkng:GrabHoldingsLimitedMember2022-01-012022-12-310001075531bkng:GrabHoldingsLimitedMember2021-01-012021-12-310001075531bkng:MeituanDianpingMember2022-01-012022-12-310001075531bkng:MeituanDianpingMember2021-01-012021-12-310001075531us-gaap:RedeemableConvertiblePreferredStockMemberbkng:GrabHoldingsLimitedMember2023-01-012023-12-310001075531bkng:GrabHoldingsLimitedMemberus-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2021-01-012021-12-310001075531bkng:EquitySecuritiesPrivateCompaniesMemberbkng:YanoljaCoLtdMember2022-12-310001075531bkng:EquitySecuritiesPrivateCompaniesMemberbkng:YanoljaCoLtdMember2023-12-310001075531bkng:EquitySecuritiesPrivateCompaniesMemberbkng:YanoljaCoLtdMember2021-01-012021-12-310001075531bkng:EquitySecuritiesPrivateCompaniesMemberbkng:YanoljaCoLtdMember2021-12-310001075531bkng:EquitySecuritiesPrivateCompaniesMemberbkng:YanoljaCoLtdMember2023-01-012023-12-310001075531bkng:EquitySecuritiesPrivateCompaniesMemberbkng:YanoljaCoLtdMember2022-01-012022-12-310001075531us-gaap:CashEquivalentsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:MoneyMarketFundsMember2023-12-310001075531us-gaap:CashEquivalentsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:MoneyMarketFundsMember2023-12-310001075531us-gaap:CashEquivalentsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:MoneyMarketFundsMember2023-12-310001075531us-gaap:CashEquivalentsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:MoneyMarketFundsMember2023-12-310001075531us-gaap:CashEquivalentsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:BankTimeDepositsMember2023-12-310001075531us-gaap:CashEquivalentsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:BankTimeDepositsMember2023-12-310001075531us-gaap:CashEquivalentsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:BankTimeDepositsMember2023-12-310001075531us-gaap:CashEquivalentsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:BankTimeDepositsMember2023-12-310001075531us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:ShortTermInvestmentsMemberus-gaap:ForeignGovernmentDebtSecuritiesMember2023-12-310001075531us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:ShortTermInvestmentsMemberus-gaap:ForeignGovernmentDebtSecuritiesMember2023-12-310001075531us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:ShortTermInvestmentsMemberus-gaap:ForeignGovernmentDebtSecuritiesMember2023-12-310001075531us-gaap:FairValueMeasurementsRecurringMemberus-gaap:ShortTermInvestmentsMemberus-gaap:ForeignGovernmentDebtSecuritiesMember2023-12-310001075531us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:USGovernmentDebtSecuritiesMemberus-gaap:ShortTermInvestmentsMember2023-12-310001075531us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:USGovernmentDebtSecuritiesMemberus-gaap:ShortTermInvestmentsMember2023-12-310001075531us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:USGovernmentDebtSecuritiesMemberus-gaap:ShortTermInvestmentsMember2023-12-310001075531us-gaap:FairValueMeasurementsRecurringMemberus-gaap:USGovernmentDebtSecuritiesMemberus-gaap:ShortTermInvestmentsMember2023-12-310001075531us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:ShortTermInvestmentsMemberus-gaap:CorporateDebtSecuritiesMember2023-12-310001075531us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:ShortTermInvestmentsMemberus-gaap:CorporateDebtSecuritiesMember2023-12-310001075531us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:ShortTermInvestmentsMemberus-gaap:CorporateDebtSecuritiesMember2023-12-310001075531us-gaap:FairValueMeasurementsRecurringMemberus-gaap:ShortTermInvestmentsMemberus-gaap:CorporateDebtSecuritiesMember2023-12-310001075531us-gaap:FairValueMeasurementsRecurringMemberus-gaap:EquitySecuritiesMemberus-gaap:FairValueInputsLevel1Memberbkng:LongtermInvestmentsMember2023-12-310001075531us-gaap:FairValueMeasurementsRecurringMemberus-gaap:EquitySecuritiesMemberus-gaap:FairValueInputsLevel2Memberbkng:LongtermInvestmentsMember2023-12-310001075531us-gaap:FairValueMeasurementsRecurringMemberus-gaap:EquitySecuritiesMemberus-gaap:FairValueInputsLevel3Memberbkng:LongtermInvestmentsMember2023-12-310001075531us-gaap:FairValueMeasurementsRecurringMemberus-gaap:EquitySecuritiesMemberbkng:LongtermInvestmentsMember2023-12-310001075531us-gaap:ForwardContractsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:NondesignatedMember2023-12-310001075531us-gaap:ForwardContractsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:NondesignatedMember2023-12-310001075531us-gaap:ForwardContractsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:NondesignatedMember2023-12-310001075531us-gaap:ForwardContractsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:NondesignatedMember2023-12-310001075531us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2023-12-310001075531us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2023-12-310001075531us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2023-12-310001075531us-gaap:FairValueMeasurementsRecurringMember2023-12-310001075531us-gaap:FairValueInputsLevel1Memberbkng:EquitySecuritiesPrivateCompaniesMemberbkng:LongtermInvestmentsMemberus-gaap:FairValueMeasurementsNonrecurringMember2023-12-310001075531us-gaap:FairValueInputsLevel2Memberbkng:EquitySecuritiesPrivateCompaniesMemberbkng:LongtermInvestmentsMemberus-gaap:FairValueMeasurementsNonrecurringMember2023-12-310001075531us-gaap:FairValueInputsLevel3Memberbkng:EquitySecuritiesPrivateCompaniesMemberbkng:LongtermInvestmentsMemberus-gaap:FairValueMeasurementsNonrecurringMember2023-12-310001075531bkng:EquitySecuritiesPrivateCompaniesMemberbkng:LongtermInvestmentsMemberus-gaap:FairValueMeasurementsNonrecurringMember2023-12-310001075531us-gaap:CashEquivalentsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:MoneyMarketFundsMember2022-12-310001075531us-gaap:CashEquivalentsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:MoneyMarketFundsMember2022-12-310001075531us-gaap:CashEquivalentsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:MoneyMarketFundsMember2022-12-310001075531us-gaap:CashEquivalentsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:MoneyMarketFundsMember2022-12-310001075531us-gaap:CashEquivalentsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:BankTimeDepositsMember2022-12-310001075531us-gaap:CashEquivalentsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:BankTimeDepositsMember2022-12-310001075531us-gaap:CashEquivalentsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:BankTimeDepositsMember2022-12-310001075531us-gaap:CashEquivalentsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:BankTimeDepositsMember2022-12-310001075531us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:ShortTermInvestmentsMemberus-gaap:ForeignGovernmentDebtSecuritiesMember2022-12-310001075531us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:ShortTermInvestmentsMemberus-gaap:ForeignGovernmentDebtSecuritiesMember2022-12-310001075531us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:ShortTermInvestmentsMemberus-gaap:ForeignGovernmentDebtSecuritiesMember2022-12-310001075531us-gaap:FairValueMeasurementsRecurringMemberus-gaap:ShortTermInvestmentsMemberus-gaap:ForeignGovernmentDebtSecuritiesMember2022-12-310001075531us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:USGovernmentDebtSecuritiesMemberus-gaap:ShortTermInvestmentsMember2022-12-310001075531us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:USGovernmentDebtSecuritiesMemberus-gaap:ShortTermInvestmentsMember2022-12-310001075531us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:USGovernmentDebtSecuritiesMemberus-gaap:ShortTermInvestmentsMember2022-12-310001075531us-gaap:FairValueMeasurementsRecurringMemberus-gaap:USGovernmentDebtSecuritiesMemberus-gaap:ShortTermInvestmentsMember2022-12-310001075531us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:ShortTermInvestmentsMemberus-gaap:CorporateDebtSecuritiesMember2022-12-310001075531us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:ShortTermInvestmentsMemberus-gaap:CorporateDebtSecuritiesMember2022-12-310001075531us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:ShortTermInvestmentsMemberus-gaap:CorporateDebtSecuritiesMember2022-12-310001075531us-gaap:FairValueMeasurementsRecurringMemberus-gaap:ShortTermInvestmentsMemberus-gaap:CorporateDebtSecuritiesMember2022-12-310001075531us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberbkng:LongtermInvestmentsMemberus-gaap:ForeignGovernmentDebtSecuritiesMember2022-12-310001075531us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberbkng:LongtermInvestmentsMemberus-gaap:ForeignGovernmentDebtSecuritiesMember2022-12-310001075531us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberbkng:LongtermInvestmentsMemberus-gaap:ForeignGovernmentDebtSecuritiesMember2022-12-310001075531us-gaap:FairValueMeasurementsRecurringMemberbkng:LongtermInvestmentsMemberus-gaap:ForeignGovernmentDebtSecuritiesMember2022-12-310001075531us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:USGovernmentDebtSecuritiesMemberbkng:LongtermInvestmentsMember2022-12-310001075531us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:USGovernmentDebtSecuritiesMemberbkng:LongtermInvestmentsMember2022-12-310001075531us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:USGovernmentDebtSecuritiesMemberbkng:LongtermInvestmentsMember2022-12-310001075531us-gaap:FairValueMeasurementsRecurringMemberus-gaap:USGovernmentDebtSecuritiesMemberbkng:LongtermInvestmentsMember2022-12-310001075531us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberbkng:LongtermInvestmentsMemberus-gaap:CorporateDebtSecuritiesMember2022-12-310001075531us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberbkng:LongtermInvestmentsMemberus-gaap:CorporateDebtSecuritiesMember2022-12-310001075531us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberbkng:LongtermInvestmentsMemberus-gaap:CorporateDebtSecuritiesMember2022-12-310001075531us-gaap:FairValueMeasurementsRecurringMemberbkng:LongtermInvestmentsMemberus-gaap:CorporateDebtSecuritiesMember2022-12-310001075531us-gaap:FairValueMeasurementsRecurringMemberus-gaap:EquitySecuritiesMemberus-gaap:FairValueInputsLevel1Memberbkng:LongtermInvestmentsMember2022-12-310001075531us-gaap:FairValueMeasurementsRecurringMemberus-gaap:EquitySecuritiesMemberus-gaap:FairValueInputsLevel2Memberbkng:LongtermInvestmentsMember2022-12-310001075531us-gaap:FairValueMeasurementsRecurringMemberus-gaap:EquitySecuritiesMemberus-gaap:FairValueInputsLevel3Memberbkng:LongtermInvestmentsMember2022-12-310001075531us-gaap:FairValueMeasurementsRecurringMemberus-gaap:EquitySecuritiesMemberbkng:LongtermInvestmentsMember2022-12-310001075531us-gaap:ForwardContractsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:NondesignatedMember2022-12-310001075531us-gaap:ForwardContractsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:NondesignatedMember2022-12-310001075531us-gaap:ForwardContractsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:NondesignatedMember2022-12-310001075531us-gaap:ForwardContractsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:NondesignatedMember2022-12-310001075531us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2022-12-310001075531us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2022-12-310001075531us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2022-12-310001075531us-gaap:FairValueMeasurementsRecurringMember2022-12-310001075531us-gaap:FairValueInputsLevel1Memberbkng:EquitySecuritiesPrivateCompaniesMemberbkng:LongtermInvestmentsMemberus-gaap:FairValueMeasurementsNonrecurringMember2022-12-310001075531us-gaap:FairValueInputsLevel2Memberbkng:EquitySecuritiesPrivateCompaniesMemberbkng:LongtermInvestmentsMemberus-gaap:FairValueMeasurementsNonrecurringMember2022-12-310001075531us-gaap:FairValueInputsLevel3Memberbkng:EquitySecuritiesPrivateCompaniesMemberbkng:LongtermInvestmentsMemberus-gaap:FairValueMeasurementsNonrecurringMember2022-12-310001075531bkng:EquitySecuritiesPrivateCompaniesMemberbkng:LongtermInvestmentsMemberus-gaap:FairValueMeasurementsNonrecurringMember2022-12-310001075531srt:MinimumMemberus-gaap:MeasurementInputDiscountRateMemberus-gaap:IncomeApproachValuationTechniqueMemberbkng:YanoljaCoLtdMember2023-06-300001075531us-gaap:MeasurementInputDiscountRateMemberus-gaap:IncomeApproachValuationTechniqueMembersrt:MaximumMemberbkng:YanoljaCoLtdMember2023-06-300001075531us-gaap:MeasurementInputEbitdaMultipleMembersrt:MinimumMemberus-gaap:IncomeApproachValuationTechniqueMemberbkng:YanoljaCoLtdMember2023-06-300001075531us-gaap:MeasurementInputEbitdaMultipleMemberus-gaap:IncomeApproachValuationTechniqueMembersrt:MaximumMemberbkng:YanoljaCoLtdMember2023-06-300001075531us-gaap:MarketApproachValuationTechniqueMemberbkng:MeasurementInputEbitdaMultipleDecreaseMemberbkng:YanoljaCoLtdMember2022-06-30utr:Y0001075531srt:MinimumMemberus-gaap:MeasurementInputDiscountRateMemberus-gaap:IncomeApproachValuationTechniqueMemberbkng:YanoljaCoLtdMember2022-06-300001075531us-gaap:MeasurementInputDiscountRateMemberus-gaap:IncomeApproachValuationTechniqueMembersrt:MaximumMemberbkng:YanoljaCoLtdMember2022-06-300001075531us-gaap:MeasurementInputEbitdaMultipleMembersrt:MinimumMemberus-gaap:IncomeApproachValuationTechniqueMemberbkng:YanoljaCoLtdMember2022-06-300001075531us-gaap:MeasurementInputEbitdaMultipleMemberus-gaap:IncomeApproachValuationTechniqueMembersrt:MaximumMemberbkng:YanoljaCoLtdMember2022-06-300001075531us-gaap:ForwardContractsMemberus-gaap:NondesignatedMemberbkng:ForeigncurrencypurchasesMember2023-12-310001075531us-gaap:ForwardContractsMemberus-gaap:NondesignatedMemberbkng:ForeigncurrencypurchasesMember2022-12-310001075531us-gaap:ForwardContractsMemberus-gaap:NondesignatedMemberbkng:ForeigncurrencysalesMember2023-12-310001075531us-gaap:ForwardContractsMemberus-gaap:NondesignatedMemberbkng:ForeigncurrencysalesMember2022-12-310001075531us-gaap:TreasuryLockMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:CashFlowHedgingMember2021-03-310001075531us-gaap:TreasuryLockMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:CashFlowHedgingMember2021-03-012021-03-310001075531us-gaap:TreasuryLockMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:CashFlowHedgingMember2021-04-012021-04-300001075531us-gaap:PrepaidExpensesAndOtherCurrentAssetsMember2023-12-310001075531us-gaap:PrepaidExpensesAndOtherCurrentAssetsMember2022-12-310001075531us-gaap:OtherNoncurrentAssetsMember2023-12-310001075531us-gaap:OtherNoncurrentAssetsMember2022-12-310001075531us-gaap:SoftwareDevelopmentMember2023-12-310001075531us-gaap:SoftwareDevelopmentMember2022-12-310001075531srt:MinimumMemberus-gaap:SoftwareDevelopmentMember2023-12-310001075531us-gaap:SoftwareDevelopmentMembersrt:MaximumMember2023-12-310001075531us-gaap:ComputerEquipmentMember2023-12-310001075531us-gaap:ComputerEquipmentMember2022-12-310001075531srt:MinimumMemberus-gaap:ComputerEquipmentMember2023-12-310001075531us-gaap:ComputerEquipmentMembersrt:MaximumMember2023-12-310001075531us-gaap:LeaseholdImprovementsMember2023-12-310001075531us-gaap:LeaseholdImprovementsMember2022-12-310001075531us-gaap:LeaseholdImprovementsMembersrt:MaximumMember2023-12-310001075531bkng:OfficeEquipmentFurnitureFixturesAndLeaseholdImprovementsMember2023-12-310001075531bkng:OfficeEquipmentFurnitureFixturesAndLeaseholdImprovementsMember2022-12-310001075531srt:MinimumMemberbkng:OfficeEquipmentFurnitureFixturesAndLeaseholdImprovementsMember2023-12-310001075531bkng:OfficeEquipmentFurnitureFixturesAndLeaseholdImprovementsMembersrt:MaximumMember2023-12-310001075531us-gaap:SoftwareDevelopmentMember2023-01-012023-12-310001075531us-gaap:SoftwareDevelopmentMember2022-01-012022-12-310001075531us-gaap:SoftwareDevelopmentMember2021-01-012021-12-31bkng:renewal_terms0001075531bkng:GetaroomMember2021-01-012021-12-3100010755312023-01-012023-09-300001075531us-gaap:TradeNamesMember2023-12-310001075531us-gaap:TradeNamesMember2022-12-310001075531srt:MinimumMemberus-gaap:TradeNamesMember2023-12-310001075531us-gaap:TradeNamesMembersrt:MaximumMember2023-12-310001075531us-gaap:DistributionRightsMember2023-12-310001075531us-gaap:DistributionRightsMember2022-12-310001075531srt:MinimumMemberus-gaap:DistributionRightsMember2023-12-310001075531us-gaap:DistributionRightsMembersrt:MaximumMember2023-12-310001075531us-gaap:OtherIntangibleAssetsMember2023-12-310001075531us-gaap:OtherIntangibleAssetsMember2022-12-310001075531us-gaap:OtherIntangibleAssetsMembersrt:MaximumMember2023-12-310001075531us-gaap:RevolvingCreditFacilityMember2023-05-012023-05-310001075531us-gaap:RevolvingCreditFacilityMember2019-08-310001075531us-gaap:LetterOfCreditMember2023-05-310001075531bkng:SwinglineLoansMember2023-05-310001075531us-gaap:RevolvingCreditFacilityMemberus-gaap:BaseRateMembersrt:MinimumMember2023-05-012023-05-310001075531us-gaap:RevolvingCreditFacilityMemberus-gaap:BaseRateMembersrt:MaximumMember2023-05-012023-05-310001075531us-gaap:RevolvingCreditFacilityMember2019-08-012019-08-310001075531us-gaap:RevolvingCreditFacilityMember2023-12-310001075531us-gaap:LetterOfCreditMember2023-12-310001075531us-gaap:RevolvingCreditFacilityMember2022-12-310001075531us-gaap:LetterOfCreditMember2022-12-310001075531bkng:A2.75SeniorNotesDueMarch2023Memberus-gaap:SeniorNotesMember2022-12-310001075531bkng:A2.75SeniorNotesDueMarch2023Memberus-gaap:SeniorNotesMember2023-12-310001075531bkng:A2.75SeniorNotesDueMarch2023Memberus-gaap:SeniorNotesMember2022-12-310001075531bkng:A2375SeniorNotesDueSeptember2024Memberus-gaap:SeniorNotesMember2023-12-31iso4217:EUR0001075531bkng:A2375SeniorNotesDueSeptember2024Memberus-gaap:SeniorNotesMember2022-12-310001075531bkng:A3.65SeniorNotesDueMarch2025Memberus-gaap:SeniorNotesMember2023-12-310001075531bkng:A3.65SeniorNotesDueMarch2025Memberus-gaap:SeniorNotesMember2022-12-310001075531us-gaap:SeniorNotesMemberbkng:A01SeniorNotesDueMarch2025Member2023-12-310001075531us-gaap:SeniorNotesMemberbkng:A01SeniorNotesDueMarch2025Member2022-12-310001075531bkng:A075SeniorConvertibleNotesDueMay2025Memberus-gaap:ConvertibleDebtMember2023-12-310001075531bkng:A075SeniorConvertibleNotesDueMay2025Memberus-gaap:ConvertibleDebtMember2022-12-310001075531bkng:A3.6SeniorNotesDueJune2026Memberus-gaap:SeniorNotesMember2023-12-310001075531bkng:A3.6SeniorNotesDueJune2026Memberus-gaap:SeniorNotesMember2022-12-310001075531bkng:A40SeniorNotesDueNovember2026Memberus-gaap:SeniorNotesMember2023-12-310001075531bkng:A40SeniorNotesDueNovember2026Memberus-gaap:SeniorNotesMember2022-12-310001075531bkng:A1.8SeniorNotesDueMarch2027Memberus-gaap:SeniorNotesMember2023-12-310001075531bkng:A1.8SeniorNotesDueMarch2027Memberus-gaap:SeniorNotesMember2022-12-310001075531us-gaap:SeniorNotesMemberbkng:A3.55SeniorNotesDueMarch2028Member2023-12-310001075531us-gaap:SeniorNotesMemberbkng:A3.55SeniorNotesDueMarch2028Member2022-12-310001075531us-gaap:SeniorNotesMemberbkng:A05SeniorNotesDueMarch2028Member2023-12-310001075531us-gaap:SeniorNotesMemberbkng:A05SeniorNotesDueMarch2028Member2022-12-310001075531us-gaap:SeniorNotesMemberbkng:A3.625SeniorNotesDueNovember2028Member2023-12-310001075531us-gaap:SeniorNotesMemberbkng:A3.625SeniorNotesDueNovember2028Member2022-12-310001075531bkng:A425SeniorNotesDueMay2029Memberus-gaap:SeniorNotesMember2023-12-310001075531bkng:A425SeniorNotesDueMay2029Memberus-gaap:SeniorNotesMember2022-12-310001075531us-gaap:SeniorNotesMemberbkng:A4.625SeniorNotesDueApril2030Member2023-12-310001075531us-gaap:SeniorNotesMemberbkng:A4.625SeniorNotesDueApril2030Member2022-12-310001075531bkng:A45SeniorNotesDueNovember2031Memberus-gaap:SeniorNotesMember2023-12-310001075531bkng:A45SeniorNotesDueNovember2031Memberus-gaap:SeniorNotesMember2022-12-310001075531us-gaap:SeniorNotesMemberbkng:A4125SeniorNotesDueMay2033Member2023-12-310001075531us-gaap:SeniorNotesMemberbkng:A4125SeniorNotesDueMay2033Member2022-12-310001075531bkng:A475SeniorNotesDueNovember2034Memberus-gaap:SeniorNotesMember2023-12-310001075531bkng:A475SeniorNotesDueNovember2034Memberus-gaap:SeniorNotesMember2022-12-310001075531us-gaap:SeniorNotesMember2023-12-310001075531us-gaap:SeniorNotesMember2022-12-310001075531us-gaap:SeniorNotesMember2023-12-310001075531us-gaap:SeniorNotesMember2022-12-310001075531us-gaap:FairValueInputsLevel2Member2023-12-310001075531us-gaap:FairValueInputsLevel2Member2022-12-310001075531bkng:A075SeniorConvertibleNotesDueMay2025Memberus-gaap:ConvertibleDebtMember2020-04-300001075531bkng:A075SeniorConvertibleNotesDueMay2025Memberus-gaap:ConvertibleDebtMember2020-01-012020-12-310001075531bkng:A075SeniorConvertibleNotesDueMay2025Membersrt:MinimumMemberus-gaap:ConvertibleDebtMember2020-04-012020-04-30bkng:day0001075531bkng:A075SeniorConvertibleNotesDueMay2025Memberus-gaap:ConvertibleDebtMembersrt:MaximumMember2020-04-012020-04-300001075531bkng:A075SeniorConvertibleNotesDueMay2025Memberus-gaap:ConvertibleDebtMember2020-04-012020-04-300001075531bkng:A075SeniorConvertibleNotesDueMay2025Memberus-gaap:FairValueInputsLevel2Memberus-gaap:ConvertibleDebtMember2023-12-310001075531bkng:A075SeniorConvertibleNotesDueMay2025Memberus-gaap:FairValueInputsLevel2Memberus-gaap:ConvertibleDebtMember2022-12-310001075531us-gaap:ConvertibleDebtMemberbkng:A0.9SeniorConvertibleNotesDueSeptember2021Member2014-08-310001075531us-gaap:ConvertibleDebtMemberbkng:A0.9SeniorConvertibleNotesDueSeptember2021Member2021-09-012021-09-300001075531us-gaap:AccountingStandardsUpdate202006Member2022-01-012022-12-310001075531us-gaap:ConvertibleDebtMember2021-01-012021-12-310001075531us-gaap:ConvertibleDebtMember2023-01-012023-12-310001075531us-gaap:ConvertibleDebtMember2022-01-012022-12-310001075531us-gaap:SeniorNotesMemberbkng:A2375SeniorNotesDueSeptember2024Member2014-09-300001075531bkng:A3.65SeniorNotesDueMarch2025Memberus-gaap:SeniorNotesMember2015-03-310001075531us-gaap:SeniorNotesMemberbkng:A01SeniorNotesDueMarch2025Member2021-03-310001075531bkng:A3.6SeniorNotesDueJune2026Memberus-gaap:SeniorNotesMember2016-05-310001075531bkng:A40SeniorNotesDueNovember2026Memberus-gaap:SeniorNotesMember2022-11-300001075531bkng:A1.8SeniorNotesDueMarch2027Memberus-gaap:SeniorNotesMember2015-03-310001075531us-gaap:SeniorNotesMemberbkng:A3.55SeniorNotesDueMarch2028Member2017-08-310001075531us-gaap:SeniorNotesMemberbkng:A05SeniorNotesDueMarch2028Member2021-03-310001075531us-gaap:SeniorNotesMemberbkng:A3.625SeniorNotesDueNovember2028Member2023-05-310001075531bkng:A425SeniorNotesDueMay2029Memberus-gaap:SeniorNotesMember2022-11-300001075531us-gaap:SeniorNotesMemberbkng:A4.625SeniorNotesDueApril2030Member2020-04-300001075531bkng:A45SeniorNotesDueNovember2031Memberus-gaap:SeniorNotesMember2022-11-300001075531us-gaap:SeniorNotesMemberbkng:A4125SeniorNotesDueMay2033Member2023-05-310001075531bkng:A475SeniorNotesDueNovember2034Memberus-gaap:SeniorNotesMember2022-11-300001075531bkng:A2.75SeniorNotesDueMarch2023Memberus-gaap:SeniorNotesMember2023-03-012023-03-310001075531bkng:A2.15SeniorNotesDueNovember2022Memberus-gaap:SeniorNotesMember2022-11-012022-11-300001075531bkng:A0.8SeniorNotesDueMarch2022Memberus-gaap:SeniorNotesMember2022-03-012022-03-310001075531bkng:A41SeniorNotesDueApril2025Memberus-gaap:SeniorNotesMember2021-04-012021-04-300001075531us-gaap:SeniorNotesMemberbkng:A4.5SeniorNotesDueApril2027Member2021-04-012021-04-300001075531bkng:A41SeniorNotesDueApril2025And41SeniorNotesDueApril2027Memberus-gaap:SeniorNotesMember2021-01-012021-12-310001075531us-gaap:SeniorNotesMember2023-01-012023-12-310001075531us-gaap:SeniorNotesMember2022-01-012022-12-310001075531us-gaap:SeniorNotesMember2021-01-012021-12-310001075531srt:MinimumMemberus-gaap:DesignatedAsHedgingInstrumentMemberbkng:EuroDenominatedDebtMember2023-01-012023-12-310001075531us-gaap:DesignatedAsHedgingInstrumentMembersrt:MaximumMemberbkng:EuroDenominatedDebtMember2023-01-012023-12-310001075531srt:MinimumMemberus-gaap:DesignatedAsHedgingInstrumentMemberbkng:EuroDenominatedDebtMember2022-01-012022-12-310001075531us-gaap:DesignatedAsHedgingInstrumentMembersrt:MaximumMemberbkng:EuroDenominatedDebtMember2022-01-012022-12-310001075531bkng:A2019ShareRepurchaseProgramMember2022-12-310001075531bkng:A2019ShareRepurchaseProgramMember2019-12-310001075531bkng:A2023ShareRepurchaseProgramMember2023-02-230001075531bkng:A2023ShareRepurchaseProgramMember2023-12-310001075531bkng:CommonStockRepurchaseProgramMember2023-01-012023-12-310001075531bkng:CommonStockRepurchaseProgramMember2022-01-012022-12-310001075531bkng:CommonStockRepurchaseProgramMember2021-01-012021-12-3100010755312023-12-012023-12-3100010755312022-12-012022-12-310001075531us-gaap:SubsequentEventMemberus-gaap:CommonStockMember2024-02-162024-02-160001075531bkng:AccumulatedForeignCurrencyAdjustmentAttributableToParentForeignCurrencyTranslationMember2020-12-310001075531bkng:AccumulatedForeignCurrencyAdjustmentAttributableToParentNetInvestmentHedgesMember2020-12-310001075531us-gaap:AccumulatedTranslationAdjustmentMember2020-12-310001075531us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2020-12-310001075531us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2020-12-310001075531bkng:AccumulatedForeignCurrencyAdjustmentAttributableToParentForeignCurrencyTranslationMember2021-01-012021-12-310001075531bkng:AccumulatedForeignCurrencyAdjustmentAttributableToParentNetInvestmentHedgesMember2021-01-012021-12-310001075531us-gaap:AccumulatedTranslationAdjustmentMember2021-01-012021-12-310001075531us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2021-01-012021-12-310001075531us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2021-01-012021-12-310001075531bkng:AccumulatedForeignCurrencyAdjustmentAttributableToParentForeignCurrencyTranslationMember2021-12-310001075531bkng:AccumulatedForeignCurrencyAdjustmentAttributableToParentNetInvestmentHedgesMember2021-12-310001075531us-gaap:AccumulatedTranslationAdjustmentMember2021-12-310001075531us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2021-12-310001075531us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2021-12-310001075531bkng:AccumulatedForeignCurrencyAdjustmentAttributableToParentForeignCurrencyTranslationMember2022-01-012022-12-310001075531bkng:AccumulatedForeignCurrencyAdjustmentAttributableToParentNetInvestmentHedgesMember2022-01-012022-12-310001075531us-gaap:AccumulatedTranslationAdjustmentMember2022-01-012022-12-310001075531us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2022-01-012022-12-310001075531us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2022-01-012022-12-310001075531bkng:AccumulatedForeignCurrencyAdjustmentAttributableToParentForeignCurrencyTranslationMember2022-12-310001075531bkng:AccumulatedForeignCurrencyAdjustmentAttributableToParentNetInvestmentHedgesMember2022-12-310001075531us-gaap:AccumulatedTranslationAdjustmentMember2022-12-310001075531us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2022-12-310001075531us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2022-12-310001075531bkng:AccumulatedForeignCurrencyAdjustmentAttributableToParentForeignCurrencyTranslationMember2023-01-012023-12-310001075531bkng:AccumulatedForeignCurrencyAdjustmentAttributableToParentNetInvestmentHedgesMember2023-01-012023-12-310001075531us-gaap:AccumulatedTranslationAdjustmentMember2023-01-012023-12-310001075531us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2023-01-012023-12-310001075531us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2023-01-012023-12-310001075531bkng:AccumulatedForeignCurrencyAdjustmentAttributableToParentForeignCurrencyTranslationMember2023-12-310001075531bkng:AccumulatedForeignCurrencyAdjustmentAttributableToParentNetInvestmentHedgesMember2023-12-310001075531us-gaap:AccumulatedTranslationAdjustmentMember2023-12-310001075531us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2023-12-310001075531us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2023-12-310001075531us-gaap:AccumulatedTranslationAdjustmentMemberus-gaap:ForeignExchangeForwardMemberus-gaap:NetInvestmentHedgingMember2021-12-310001075531us-gaap:AccumulatedTranslationAdjustmentMemberus-gaap:ForeignExchangeForwardMemberus-gaap:NetInvestmentHedgingMember2023-12-310001075531us-gaap:AccumulatedTranslationAdjustmentMemberus-gaap:ForeignExchangeForwardMemberus-gaap:NetInvestmentHedgingMember2022-12-310001075531us-gaap:AccumulatedTranslationAdjustmentMemberus-gaap:ForeignExchangeForwardMemberus-gaap:NetInvestmentHedgingMember2020-12-310001075531bkng:Trip.comGroupMemberus-gaap:AccumulatedNetUnrealizedInvestmentGainLossMemberus-gaap:ConvertibleDebtSecuritiesMember2021-01-012021-12-310001075531bkng:Trip.comGroupMemberus-gaap:ConvertibleDebtSecuritiesMember2021-12-310001075531bkng:GrabHoldingsMemberus-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2021-01-012021-12-310001075531us-gaap:AccruedLiabilitiesMember2023-12-310001075531us-gaap:AccruedLiabilitiesMember2022-12-310001075531us-gaap:DomesticCountryMember2023-01-012023-12-310001075531us-gaap:DomesticCountryMember2023-12-310001075531us-gaap:StateAndLocalJurisdictionMember2023-12-310001075531us-gaap:ForeignCountryMember2023-12-310001075531us-gaap:DomesticCountryMemberbkng:ResearchTaxCreditAndForeignTaxCreditCarryforwardsMember2023-12-310001075531us-gaap:ForeignCountryMember2022-12-310001075531us-gaap:DomesticCountryMember2022-12-310001075531us-gaap:TaxAndCustomsAdministrationNetherlandsMember2023-01-012023-12-310001075531us-gaap:TaxAndCustomsAdministrationNetherlandsMember2022-01-012022-12-310001075531us-gaap:TaxAndCustomsAdministrationNetherlandsMember2021-01-012021-12-310001075531us-gaap:SubsequentEventMemberus-gaap:UnfavorableRegulatoryActionMember2024-01-310001075531us-gaap:UnfavorableRegulatoryActionMember2023-12-310001075531bkng:ItalianTaxAuditMemberbkng:TaxYear20132018Member2018-12-012021-08-310001075531bkng:ItalianTaxAuditMember2023-12-310001075531bkng:ItalianTaxAuditMember2023-01-012023-12-310001075531bkng:ItalianTaxAuditMemberus-gaap:TaxYear2013Member2023-01-012023-12-310001075531bkng:ItalianTaxAuditMemberbkng:TaxYears2013Through2019Member2021-06-012021-06-300001075531bkng:ItalianTaxAuditMemberbkng:TaxYears2013Through2019Member2023-07-012023-07-310001075531bkng:FrenchTaxAuditMemberbkng:TaxYears2006Through2018Member2022-12-310001075531bkng:PensionrelatedlitigationMember2023-12-310001075531country:US2023-01-012023-12-310001075531country:NL2023-01-012023-12-310001075531bkng:OtherCountriesMember2023-01-012023-12-310001075531country:US2022-01-012022-12-310001075531country:NL2022-01-012022-12-310001075531bkng:OtherCountriesMember2022-01-012022-12-310001075531country:US2021-01-012021-12-310001075531country:NL2021-01-012021-12-310001075531bkng:OtherCountriesMember2021-01-012021-12-310001075531country:US2023-12-310001075531country:NL2023-12-310001075531country:GB2023-12-310001075531bkng:OtherCountriesMember2023-12-310001075531country:US2022-12-310001075531country:NL2022-12-310001075531country:GB2022-12-310001075531bkng:OtherCountriesMember2022-12-310001075531bkng:GetaroomMember2021-12-012021-12-310001075531bkng:GetaroomMember2021-12-310001075531bkng:GetaroomMemberus-gaap:DistributionRightsMember2021-12-310001075531bkng:GetaroomMemberus-gaap:DistributionRightsMember2021-01-012021-12-310001075531us-gaap:TechnologyBasedIntangibleAssetsMemberbkng:GetaroomMember2021-12-310001075531us-gaap:TechnologyBasedIntangibleAssetsMemberbkng:GetaroomMember2021-01-012021-12-310001075531bkng:GetaroomMemberus-gaap:TradeNamesMember2021-12-310001075531bkng:GetaroomMemberus-gaap:TradeNamesMember2021-01-012021-12-310001075531us-gaap:OtherIntangibleAssetsMemberbkng:GetaroomMember2021-12-310001075531us-gaap:OtherIntangibleAssetsMemberbkng:GetaroomMember2021-01-012021-12-310001075531bkng:TravelTransactionRelatedTaxesMemberbkng:GetaroomMember2021-12-310001075531bkng:COVID19Member2020-01-012021-03-310001075531bkng:COVID19Member2021-01-012021-12-310001075531bkng:EtraveliGroupMember2023-09-012023-09-300001075531srt:ScenarioPreviouslyReportedMember2023-01-012023-03-310001075531srt:ScenarioPreviouslyReportedMember2023-04-012023-06-300001075531srt:ScenarioPreviouslyReportedMember2023-07-012023-09-300001075531srt:ScenarioPreviouslyReportedMember2023-10-012023-12-310001075531srt:ScenarioPreviouslyReportedMember2023-01-012023-12-310001075531srt:RevisionOfPriorPeriodReclassificationAdjustmentMember2023-01-012023-03-310001075531srt:RevisionOfPriorPeriodReclassificationAdjustmentMember2023-04-012023-06-300001075531srt:RevisionOfPriorPeriodReclassificationAdjustmentMember2023-07-012023-09-300001075531srt:RevisionOfPriorPeriodReclassificationAdjustmentMember2023-10-012023-12-310001075531srt:RevisionOfPriorPeriodReclassificationAdjustmentMember2023-01-012023-12-3100010755312023-01-012023-03-3100010755312023-04-012023-06-3000010755312023-07-012023-09-3000010755312023-10-012023-12-310001075531srt:ScenarioPreviouslyReportedMember2022-01-012022-03-310001075531srt:ScenarioPreviouslyReportedMember2022-04-012022-06-300001075531srt:ScenarioPreviouslyReportedMember2022-07-012022-09-300001075531srt:ScenarioPreviouslyReportedMember2022-10-012022-12-310001075531srt:RevisionOfPriorPeriodReclassificationAdjustmentMember2022-01-012022-03-310001075531srt:RevisionOfPriorPeriodReclassificationAdjustmentMember2022-04-012022-06-300001075531srt:RevisionOfPriorPeriodReclassificationAdjustmentMember2022-07-012022-09-300001075531srt:RevisionOfPriorPeriodReclassificationAdjustmentMember2022-10-012022-12-3100010755312022-01-012022-03-3100010755312022-04-012022-06-3000010755312022-07-012022-09-3000010755312022-10-012022-12-310001075531srt:ParentCompanyMember2023-12-310001075531srt:ParentCompanyMember2022-12-310001075531srt:ParentCompanyMember2023-01-012023-12-310001075531srt:ParentCompanyMember2022-01-012022-12-310001075531srt:ParentCompanyMember2021-01-012021-12-310001075531srt:ParentCompanyMember2021-12-310001075531srt:ParentCompanyMember2020-12-310001075531us-gaap:ParentMember2023-01-012023-12-310001075531us-gaap:ParentMember2022-01-012022-12-310001075531us-gaap:ParentMember2021-01-012021-12-310001075531us-gaap:ParentMember2023-12-310001075531us-gaap:ParentMember2022-12-31

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________________________________________________________________________________

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

_____________________________________________________________________________________________

For the fiscal year ended: December 31, 2023

Commission File No.: 1-36691

Booking Holdings Inc.

(Exact name of Registrant as specified in its charter)

| | | | | |

| Delaware | 06-1528493 |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification Number) |

800 Connecticut Avenue

Norwalk, Connecticut 06854

(address of principal executive offices)

Registrant's telephone number, including area code: (203) 299-8000

_____________________________________________________________________________________________

Securities Registered Pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | | |

| Title of Each Class: | | Trading Symbol | | Name of Each Exchange on which Registered: | |

| Common Stock par value $0.008 per share | | BKNG | | The NASDAQ Global Select Market | |

| | | | | |

| | | | | |

| 2.375% Senior Notes Due 2024 | | BKNG 24 | | The NASDAQ Stock Market LLC | |

| 0.100% Senior Notes Due 2025 | | BKNG 25 | | The NASDAQ Stock Market LLC | |

| 4.000% Senior Notes Due 2026 | | BKNG 26 | | The NASDAQ Stock Market LLC | |

| 1.800% Senior Notes Due 2027 | | BKNG 27 | | The NASDAQ Stock Market LLC | |

| 3.625% Senior Notes Due 2028 | | BKNG 28A | | The NASDAQ Stock Market LLC | |

| 0.500% Senior Notes Due 2028 | | BKNG 28 | | The NASDAQ Stock Market LLC | |

| 4.250% Senior Notes Due 2029 | | BKNG 29 | | The NASDAQ Stock Market LLC | |

| 4.500% Senior Notes Due 2031 | | BKNG 31 | | The NASDAQ Stock Market LLC | |

| 4.125% Senior Notes Due 2033 | | BKNG 33 | | The NASDAQ Stock Market LLC | |

| 4.750% Senior Notes Due 2034 | | BKNG 34 | | The NASDAQ Stock Market LLC | |

Securities Registered Pursuant to Section 12(g) of the Act: None.

_____________________________________________________________________________________________

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act: | | | | | | | | | | | | | | | | | |

| Large accelerated filer | ☒ | Accelerated filer | ☐ | Non-accelerated filer | ☐ |

| Smaller reporting company | ☐ | Emerging growth company | ☐ | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management's assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or

issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant's executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

The aggregate market value of common stock held by non-affiliates of Booking Holdings Inc. at June 30, 2023 was approximately $97.2 billion based upon the closing price reported for such date on the NASDAQ Global Select Market. For purposes of this disclosure, shares of common stock held by executive officers and directors of Booking Holdings Inc. on June 30, 2023 have been excluded because such persons may be deemed to be affiliates of Booking Holdings Inc. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

The number of outstanding shares of Booking Holdings Inc.'s common stock was 34,171,027 at February 15, 2024.

DOCUMENTS INCORPORATED BY REFERENCE

The information required by Part III of this Annual Report on Form 10-K, to the extent not set forth in this Form 10-K, is incorporated herein by reference from Booking Holdings Inc.'s definitive proxy statement relating to its annual meeting of stockholders to be held on June 4, 2024, to be filed with the Securities and Exchange Commission within 120 days after the end of Booking Holdings Inc.'s fiscal year ended December 31, 2023.

Booking Holdings Inc. Annual Report on Form 10-K for the Year Ended December 31, 2023 Index

Special Note Regarding Forward-Looking Statements

This Annual Report on Form 10-K, including "Management's Discussion and Analysis of Financial Condition and Results of Operation" in Part II, Item 7, and the documents incorporated by reference contain forward-looking statements. These statements reflect our views regarding current expectations and projections about future events and conditions and are based on currently available information. They are not guarantees of future performance and are subject to risks, uncertainties, and assumptions that are difficult to predict, including the Risk Factors identified in Part I, Item 1A of this Annual Report. Our actual results could differ materially from those expressed or implied in any such statements. Expressions of future goals and expectations and similar expressions, including "may," "will," "should," "could," "aims," "seeks," "expects," "plans," "anticipates," "intends," "believes," "estimates," "predicts," "potential," "targets," and "continue," reflecting something other than historical fact are intended to identify forward-looking statements. Unless required by law, we undertake no obligation to update publicly any forward-looking statements, whether as a result of new information, future events, or otherwise. However, readers should carefully review the reports and documents we file or furnish from time to time with the Securities and Exchange Commission (the "SEC" or the "Commission").

PART I

Item 1. Business

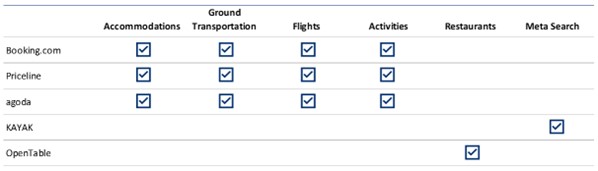

Our mission is to make it easier for everyone to experience the world. We aim to provide consumers with a best-in-class experience offering the travel choices they want, with tailored language, payment, and other options, seamlessly connecting them with our travel service provider partners. We offer these services through five primary consumer-facing brands: Booking.com, Priceline, Agoda, KAYAK, and OpenTable:

We are proud that, despite challenges to our global community such as the wars in Ukraine and the Middle East and the impact of inflation, we continued our efforts to make our brands the most trusted and convenient platforms for consumers and partners, including:

•achieving record annual room nights in 2023;

•continuing to increase room nights and brand awareness in key markets such as the U.S.;

•strongly growing our alternative accommodations offering;

•improving our loyalty programs, particularly the Genius program at Booking.com, and increasing our focus on value for our consumers;

•further integrating artificial intelligence ("AI") technology into our offerings;

•improving and expanding our flight offering at Booking.com and extending our partnership with Etraveli Group through at least 2028; and

•increasing adoption of our payments platform and capabilities.

Our common stock is listed on the NASDAQ Global Select Market under the symbol "BKNG." We refer to our company and all of our subsidiaries and brands collectively as "Booking Holdings," the "Company," "we," "our," or "us."

Our Business Model

We derive substantially all of our revenues from providing online travel reservation services, which facilitate online travel purchases between travel service providers and travelers (which we generally refer to as "partners" and "consumers," respectively). We also earn revenues from advertising services, restaurant reservations, and various other services, such as travel-related insurance and restaurant management services.

For the year ended December 31, 2023, we had revenues of $21.4 billion, which we classify as "merchant" revenues, "agency" revenues, and "advertising and other" revenues.

•Merchant revenues are derived from transactions where we facilitate payments from travelers for the services provided, generally at the time of booking. Merchant revenues include travel reservation commissions and transaction net revenues (i.e., the amount charged to travelers, including the impact of merchandising, less the amount owed to travel service providers); credit card processing rebates and customer processing fees; and ancillary fees, including travel-related insurance revenues. The majority of our merchant revenue is from Booking.com's accommodation reservations.

•Agency revenues are derived from travel-related transactions where we do not facilitate payments from travelers for the services provided. Agency revenues consist almost entirely of travel reservation commissions from our reservation services. Substantially all of our agency revenue is from Booking.com's accommodation reservations.

•Advertising and other revenues are derived primarily from (a) revenues earned by KAYAK for sending referrals to online travel companies ("OTCs") and travel service providers and for advertising placements on its platforms and (b) revenues earned by OpenTable for its restaurant reservation services and subscription fees for restaurant management services.

Our Strategy

We aim to demonstrate global leadership in online travel bookings and related services by:

•making it easy for people to find, book, pay for, and experience travel;

•providing consumers with the most comprehensive choices and value on any device;

•offering platforms, tools, and insights to our business partners to help them be successful; and

•operating our business sustainably and supporting sustainable travel choices by our consumers and partners.

We focus on relentless innovation and execution and a commitment to serve both consumers and partners with unmatched service and best-in-class technology. We believe that global travel bookings will generally continue to grow while shifting from traditional offline methods to online channels like ours. We expect to benefit from this growth in travel and the continued shift to online channels as we work to expand our service offerings and increase our presence in key geographies. In particular, we seek to (a) leverage technology to provide consumers with the best experience, (b) partner with travel service providers and restaurants to our mutual benefit, (c) operate multiple brands that collaborate with each other, and (d) invest in profitable and sustainable growth.

Provide the best consumer experience. We focus on providing consumers with: (a) personalized and easy-to-use online travel services; (b) a comprehensive selection of travel and payment options; (c) informative and useful content; (d) excellent customer service; and (e) value through competitive prices and loyalty programs.

We continue to innovate to meet the needs of our consumers and partners through intuitive, easy-to-use websites and mobile apps. An increasing percentage of our room nights are booked on our mobile apps. We believe that our development of payments capabilities across the Company removes friction from the booking process and delivers additional value for travelers. We continue to execute against our long-term strategy to create an ideal traveler experience, offering our customers relevant options and connections at the times and in the language they want them, making trips booked with us seamless, easy, and valuable. We refer to this as the "Connected Trip." The goal of our Connected Trip vision is to offer a differentiated and personalized online travel planning, booking, payment, and in-trip experience for each trip, enhanced by a robust loyalty program that provides value to travelers and partners across all trips. In the near term, we are focused on providing consumers the ability to build a complete travel itinerary on our platforms by, for example, enabling them to book convenient ground transportation to coincide with their flight arrival or attractions near their accommodation, and developing a generative AI assisted trip planner. We also continue to grow verticals such as our flight offering, with 2023 flight ticket growth across the

Company of 58% year-over-year. We endeavor to provide excellent customer service, including through call centers and online platforms and the use of chatbots and other technologies.

Partner with travel service providers and restaurants. We aim to establish mutually beneficial relationships with our partners around the world. We believe they benefit from participating in our services by increasing their distribution channels, demand, profile and reputation, and inventory utilization in an efficient and cost-effective manner. They also benefit from our trusted brands and marketing efforts, expertise in offering an excellent consumer experience, and ability to offer their inventory in markets and to consumers that they may otherwise be unable or unlikely to reach, for instance due to language or payments services we can offer on their behalf.

Operate multiple brands. We operate multiple brands, which allows us to provide numerous service offerings, appeal to different consumers, pursue distinct marketing and business strategies, encourage experimentation and innovation, and focus on specific markets or geographies. We continue to optimize collaboration among our brands to provide consumers with the most comprehensive and value-oriented services, sharing resources and technological innovations among our brands and co-developing new services. We invest to support growth by our brands, whether through increased marketing, geographic expansion, technological innovation, or increased access to travel service offerings.

Invest in profitable and sustainable growth. We seek to offer online services that meet the needs and the expectations of consumers and partners and that we believe will result in mutual long-term profitability and growth. We have made significant investments in people, technology, marketing, and added or expanded travel offerings. In 2023, we expanded our commercial partnership with Etraveli Group to strengthen and accelerate our efforts to build a frictionless global flights offering, and we increased our investments in generative AI functionalities both for internal productivity and in consumer-facing initiatives. We also regularly evaluate, and may pursue, potential strategic acquisitions, partnerships, joint ventures, or investments as part of our long-term business strategy.

Service Offerings

Booking.com. Booking.com is the world's leading brand for booking online accommodation reservations, based on room nights booked, with operations worldwide and headquarters in the Netherlands. At December 31, 2023, Booking.com offered accommodation reservation services for approximately 3.4 million properties in over 220 countries and territories and in over 40 languages, consisting of over 475,000 hotels, motels, and resorts and over 2.9 million homes, apartments, and other unique places to stay.

In 2023, Booking.com offered flights in 55 markets and in-destination tours and activities in 1,300 cities around the world. Booking.com offers online rental car reservation services in approximately 42,000 locations throughout the world and ground transportation services at over 1,900 airports throughout the world, with customer support in over 40 languages.

Priceline. Priceline is a leader in the discount travel reservation business, offering online travel reservation services primarily in North America, with headquarters in Norwalk, Connecticut. Priceline offers consumers hotel, flight, activity, and rental car reservation services, as well as vacation packages, cruises, and hotel distribution services for partners and affiliates.

Agoda. Agoda is a leading online accommodation reservation service catering primarily to consumers in the Asia-Pacific region, with headquarters in Singapore and operations in Bangkok, Thailand, and elsewhere. Agoda also offers flight, ground transportation, and activities reservation services.

KAYAK. KAYAK, headquartered in Stamford, Connecticut, provides online meta-search services that allow consumers to easily search and compare travel itineraries and prices from hundreds of online travel platforms at once. KAYAK offers its services in over 60 countries and territories, with its largest market in the United States, through various websites including momondo, Cheapflights, and HotelsCombined.

OpenTable. OpenTable is a leading brand for booking online restaurant reservations. With significant operations in San Francisco, California, OpenTable provides online restaurant reservation services to consumers and reservation management services to restaurants, primarily in the United States.

Marketing and Brand Awareness

We have established widely used and recognized e-commerce brands through marketing campaigns and strategic use of performance marketing spend. We invest in marketing and other brand building to preserve and enhance consumer awareness of our brands.

Competition

We compete globally with both online and traditional travel and restaurant reservation and related services. The markets for the services we offer are intensely competitive and constantly evolving. Current and new competitors launch new services at a relatively low cost. Some of our current and potential competitors include the largest global technology companies, which have significantly more customers or users, consumer data, and resources than we do, and may be able to leverage other aspects of their businesses (e.g., search or mobile device businesses, or generative AI capabilities) to compete more effectively with us. For example, Google's online travel offerings have grown rapidly in this area by linking travel search services to its dominant search functionality through flight, hotel, and alternative accommodations meta-search products, and by integrating such products into its Google Maps app.

We currently, or may in the future, compete with a variety of companies, including:

•online travel or restaurant reservation services and meta-search services;

•large online search, social networking, and marketplace companies;

•travel service providers (e.g., accommodations, rental car companies, or airlines);

•traditional travel agencies, travel management companies, wholesalers, and tour operators; and

•companies offering technology services and software solutions to travel service providers.

For more information regarding current and potential competitors and the competitive nature of the markets in which we operate, see Part I, Item 1A, Risk Factors - "Intense competition could reduce our market share and harm our financial performance."

Government Regulation

Our ability to provide our services and any future services is affected by legal regulations of governments and regulatory authorities around the world, many of which are evolving and subject to revised interpretations. Violations of any laws or regulations could result in fines, penalties, and criminal sanctions against us, our officers or employees, and prohibitions on how or where we conduct our business, which could damage our reputation, brands, global expansion efforts, ability to attract and retain employees and business partners, business, and operating results. Even if we comply with these laws and regulations, doing business in certain jurisdictions or violations of these laws and regulations by the parties with which we conduct business runs the risk of harming our reputation and our brands. Regulations that impact our business or our industry include:

•Data Protection and Privacy: We have policies and a global governance framework to comply with privacy laws that apply to our business, meet evolving stakeholder expectations, and support business innovation and growth. In the European Union, the General Data Protection Regulation (the "GDPR") imposes significant compliance obligations and costs. In the United States, the California Consumer Privacy Act (the "CCPA") and the California Privacy Rights Act ("CPRA") impose privacy requirements and rights for consumers in California that will result in additional compliance complexity, risks, and costs. Other U.S. states and jurisdictions globally have adopted or may adopt similar data protection regulations. Some data protection and privacy laws afford consumers a private right of action against companies like ours for certain statutory violations.

•Competition, Consumer Protection and Online Commerce: Competition and consumer protection authorities are increasingly focused on large technology companies, including in relation to the regulation of digital platforms. The Digital Markets Act ("DMA") and Digital Services Act ("DSA") give regulators in the EU more instruments to investigate and regulate digital businesses and impose new rules and requirements on platforms designated as "gatekeepers" under the DMA and online platforms more generally, with separate rules for "Very Large Online Platforms" ("VLOPs") under the DSA. In 2023, Booking.com received a VLOP designation notice from the European Commission. The Company has met the quantitative notification criteria set forth in the DMA and expects to notify the European Commission of that fact within the required deadline.

•Regulation of the Travel Industry: Our business is impacted by travel-related regulations such as local regulation of the use of alternative accommodations. Local jurisdictions around the world have instituted a variety of measures to address the issues of "overtourism" and the impact of tourism on the climate. As our business evolves, we expect to become subject to existing and new regulations. For example, some parts of our business are already subject to certain requirements of the EU Package Travel Directive (the "Package Directive"), and as our offerings continue to diversify and expand, we may become subject to additional requirements of the Package Directive.

•Payments: As we expand our payments services to consumers and business partners, we are subject to additional regulations, such as financial services regulations and license requirements, which has resulted in increased compliance costs and complexities, including those associated with the implementation of new or advanced internal controls. We are also subject to payment card association rules and obligations under our contracts with payment card processors, including the Payment Card Industry Data Security Standard, compliance with which is complex and costly.

For further discussion of these regulations and how other global regulations may impact our business, see Part I, Item 1A, Risk Factors - "Information Security, Cybersecurity, and Data Privacy Risks" and "Legal, Regulatory, Compliance, and Reputational Risks ."

Technology

Our business is supported by multiple systems and platforms designed with an emphasis on scalability, performance, redundancy, and security. Our systems connect us with vendors and partners. We are modernizing our technology by building new applications with modern development tools and application programming interfaces, and we increasingly rely upon public cloud infrastructure. Our applications utilize digital certificates and other security technologies to help us conduct secure communications and transactions, as appropriate. The systems infrastructure and web and database servers of our worldwide operations are hosted in data centers in Europe, Asia, and North America, and each provides services and support typical of hosted data centers. For discussion of risks relating to our technology, see Part I, Item 1A, Risk Factors - "Information Security, Cybersecurity, and Data Privacy Risks."

Intellectual Property

The protection of our intellectual property is important to our success. We rely on intellectual property such as trademarks, copyrights, patents, and trade secrets to support our business as well as domain names or other intangible rights or property secured through purchase, licensing, or other agreements with employees, travel service providers, vendors, and other parties. We have filed applications for protection of certain aspects of our intellectual property in the United States and other jurisdictions, and we currently hold a number of issued patents in several jurisdictions. See Part I, Item 1A, Risk Factors - "We face risks related to our intellectual property."

Seasonality and Other Timing Factors

In 2023, our gross bookings were generally similar in the first three quarters of the year and higher than in the fourth quarter. We generally recognize our marketing activities as the expense is incurred, which is typically in the quarter when the gross bookings for the associated reservations are recognized. However, we would generally recognize revenue from these bookings when the travel begins (at "check-in"), and accommodation check-ins in Europe and North America are generally highest in the third quarter during those regions' peak summer travel season and lowest in the first quarter. As a result of this timing difference between when we record marketing expenses and when we generally recognize associated revenues, we typically experience our highest levels of profitability in the third quarter and our lowest level of profitability in the first quarter. In addition to the typical seasonality effects on our business, our quarterly results and quarterly year-over-year growth rates can be impacted by:

•The length of the booking window (the average time between the booking of a travel reservation and when the travel begins), which impacts the relationship between our gross bookings (recognized at the time of booking) and our revenues (recognized at the time of check-in). In 2023, the booking window was longer than we experienced in 2022 as an increased percentage of bookings were made for travel that was to occur further out from the time of booking;

•The level of acceleration or deceleration in the gross bookings growth rate. For example, our operating margins are typically negatively impacted in the near term from gross bookings and related variable marketing expense growth acceleration, as revenue growth is typically less impacted by accelerating gross bookings growth in the near term. Any such acceleration would positively impact revenue growth in subsequent periods as a portion of the revenue

recognized from such gross bookings will occur in future quarters. Conversely, in periods where our gross bookings growth rate substantially decelerates, our operating margins typically benefit; and

•The date on which certain holidays (e.g., Easter and Ramadan) fall.

Human Capital Resources

Our employees are fundamental to delivering on our mission to make it easier for everyone to experience the world. Our goal is to attract, develop, and retain highly-skilled talent with a significant focus on a diverse workforce operating in an equitable and inclusive environment. We are committed to engaging with our employees across our Company and maintaining a productive workforce that is proud to work for Booking Holdings.

Workforce

Our Board of Directors and the Talent and Compensation Committee have oversight of our human capital management. As a result of our operating structure with multiple distinct brands, our approach to human capital management can vary by brand.

At December 31, 2023, we employed approximately 23,600 employees, of which approximately 3,100 were based in the United States, and approximately 20,500 were based outside the United States. Approximately 99% of our employees are full-time employees. We also retain independent contractors, including to support our customer service, website content translation, and system support functions.

Employees by Geography (as of December 31, 2023)

Diversity, Equity, and Inclusion

Our commitment to diversity, equity, and inclusion means honoring all experiences, valuing all voices, and leading with empathy on our journey to become a more inclusive company. We believe that a diverse workforce operating in an inclusive environment is critical to leveraging our human capital to achieve our long-term strategic goals. We strive for our leadership and workforce to reflect the broad spectrum of people we work with throughout the world because we believe this is the best way for us to connect with the viewpoints, backgrounds, and experiences of our customers and partners. We are committed to creating workplaces that embrace and celebrate the different cultures and practices of our employees and we prohibit unlawful discrimination of any type.

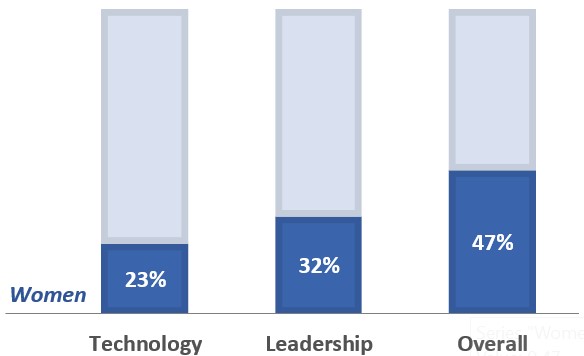

As of December 31, 2023, approximately 47% of our employees were women, approximately 23% of our technology positions were filled by women, and approximately 32% of leadership (which includes vice presidents and above for all brands except Booking.com, which includes senior directors and above due to a greater number of employees) were women. We are committed to pay equity, regardless of gender, race, or ethnicity. With the help of an independent compensation consultant, we conduct pay equity studies every other year, and in the off years, we work on remediation plans to address outliers.

Gender Diversity of Employees (as of December 31, 2023)

While a significant percentage of our workforce is located in jurisdictions that may present challenges to tracking employee racial or ethnic demographics for legal reasons, we seek other ways to assess our employees' experience of inclusion. For example, all of our brands include diversity and inclusion questions in annual employee engagement surveys to gauge our inclusivity progress. We also publish our consolidated EEO-1 report for employees in the United States, although as of December 31, 2023, this represents only approximately 13% of our workforce.

We encourage equality and inclusivity across our workforce through various initiatives. As part of our recruitment efforts to ensure that candidate slates are diverse, we use diversity-focused sourcing platforms, we apply an inclusive language tool to job descriptions to attract candidates of all backgrounds, and we hold recruiters accountable for presenting multicultural candidates by tying it to their performance goals. In addition, we provide training to ensure interviewers consider all candidates objectively.

We have invested in a robust inclusive leadership training program and unconscious bias training for our leaders and we continue to cascade these initiatives further into the organization to ensure that these tenets contribute to our strategy. Additionally, we are entering our eighth year of operating our Women in Leadership program, which is a Company-wide initiative designed to support the advancement and development of high-performing women within our company with the goal of building and enabling gender diversity in our executive pipeline. We sponsor various employee resource groups, including those that support the LGBTQ community and its allies, employees with differing physical and mental abilities, the Black and persons-of-color (POC) community, veteran employees, and gender equality, among others. We are proud of the progress we have made in this space, while recognizing the need for continuous improvement.

Attraction, Development, and Retention

We work diligently to attract the best and most innovative talent from a wide range of sources to grow our business and achieve our long term strategic goals. We believe that we offer a rich culture where employees feel empowered to do their best work with opportunities to grow as well as competitive compensation and benefits. For example, while the specifics can vary by brand, in the United States our employee benefit plans generally include: coverage for fertility treatments, gender reassignment surgery, gender-neutral domestic partner benefits, and paid leave for new parents and grandparents, those caring for a loved one, or bereavement.

We create opportunities for employees to grow and build their careers through training and development programs. These include offering tailored learning opportunities to enable employees to upskill while at work and driving frequent career conversations between employees and their managers, as well as executive succession planning.