Use these links to rapidly review the document

TABLE OF CONTENTS

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

|

|

Filed by the Registrant |

|

Filed by a Party other than the Registrant |

| | Check the appropriate box: | | ||||||

|

|

Preliminary Proxy Statement | |||||||

|

|

CONFIDENTIAL, FOR USE OF THE COMMISSION ONLY (AS PERMITTED BY RULE 14a-6(e)(2)) | |||||||

|

|

Definitive Proxy Statement | |||||||

|

|

Definitive Additional Materials | |||||||

|

|

Soliciting Material under §.240.14a-12 | |||||||

Diversified Healthcare Trust

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| | Payment of Filing Fee (Check the appropriate box): | | ||||||

|

|

No fee required. | |||||||

|

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||||||

| | | | | | | | | |

| (1) Title of each class of securities to which transaction applies: | ||||||||

| | | | | | | | | |

| (2) Aggregate number of securities to which transaction applies: | ||||||||

| | | | | | | | | |

| (3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined) : | ||||||||

| | | | | | | | | |

| (4) Proposed maximum aggregate value of transaction: | ||||||||

| | | | | | | | | |

| (5) Total fee paid: | ||||||||

|

|

Fee paid previously with preliminary materials. | |||||||

|

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||||||

| | | | | | | | | |

| (1) Amount Previously Paid: | ||||||||

| | | | | | | | | |

| (2) Form, Schedule or Registration Statement No.: | ||||||||

| | | | | | | | | |

| (3) Filing Party: | ||||||||

| | | | | | | | | |

| (4) Date Filed: | ||||||||

Notice of 2021 Annual Meeting

of Shareholders and Proxy Statement

Thursday, June 3, 2021 at 9:30 a.m., Eastern time

Live Webcast Accessible at

https://www.viewproxy.com/DiversifiedHealthcareTrust/2021/

LETTER TO OUR SHAREHOLDERS FROM

YOUR BOARD OF TRUSTEES

Dear Fellow Shareholders:

Please join us for our 2021 Annual Meeting of Shareholders, which will be held virtually at 9:30 a.m. on Thursday, June 3, 2021. The business to be conducted at the meeting is explained in the attached Notice of Meeting and Proxy Statement. We believe furnishing these materials over the internet expedites your receipt of these important materials while reducing the cost and environmental impact of our annual meeting.

2020 was a particularly challenging year for the senior housing industry and our portfolio was no exception. Our senior housing operating portfolio ("SHOP") manager, Five Star Senior Living Inc., worked tirelessly to keep residents and team members safe, while trying to control operating costs and stabilize occupancy. Vaccine clinics have now been held at all of our communities. With more than 83% of our residents fully vaccinated as of March 27, 2021, we are optimistic that the performance of our SHOP segment will rebound in the second half of this year. Despite the industry challenges resulting from the COVID-19 pandemic, we are proud to report that in 2020, U.S. News and World Report, the global authority in health care rankings, recognized 30 communities within our SHOP segment in its annual list of "Best Nursing Homes." The list of the country's best short-term rehabilitation and long-term care facilities reflects comprehensive information about care, health inspections and staffing, as well as other factors, including COVID-19 management, flu and pneumonia vaccination rates and infection control protocols.

Despite the COVID-19 pandemic, we continued shifting our portfolio mix toward high quality medical office and life science properties, with net operating income from this segment, at the end of the fourth quarter, now making up 75.1% of our total net operating income. We also continued to successfully execute on our three building life science campus redevelopment in the Torrey Pines submarket of San Diego, California, and other redevelopment projects in Tempe, Arizona, and Lexington, Massachusetts.

During 2020, we raised $1.0 billion of unsecured senior notes and worked with our lenders to amend the terms of our credit and term loan facility agreements to ensure we have sufficient liquidity to meet the unique challenges presented by the COVID-19 pandemic and to continue investing in our portfolio of high quality healthcare real estate.

We continue to monitor changing events and circumstances with an eye to managing for the global good, mitigating the negative impact on our business and best positioning us for stability and recovery when the COVID-19 pandemic is behind us. We take seriously our role in the oversight of our Company's long term business strategy, which we believe is the best path to long term value creation for our shareholders.

We thank you for your investment in our Company and for the confidence you put in this Board to oversee your interests in our business.

March 30, 2021

|

| Jennifer B. Clark | | Daniel F. LePage |

|

| John L. Harrington | | Adam D. Portnoy |

|

| Lisa Harris Jones | | Jeffrey P. Somers |

NOTICE OF 2021 ANNUAL MEETING OF SHAREHOLDERS OF DIVERSIFIED HEALTHCARE TRUST

Location: |

Agenda:

• Elect the Trustee nominees identified in the accompanying Proxy Statement to our Board of Trustees;

• Advisory vote to approve executive compensation;

• Ratify the appointment of Deloitte & Touche LLP as our independent auditors to serve for the 2021 fiscal year; and

• Transact such other business as may properly come before the meeting and at any postponements or adjournments of the meeting. |

|

|

Record Date: You can vote if you were a shareholder of record as of the close of business on March 24, 2021. Attending Our 2021 Annual Meeting: Due to the public health impact of the COVID-19 pandemic and to protect the health and well-being of our shareholders and other stakeholders, our 2021 Annual Meeting will be a completely virtual meeting of shareholders, which will be conducted exclusively by webcast. No physical meeting will be held.

• Record Owners: If you are a shareholder as of the record date who holds shares directly, you may participate in our 2021 Annual Meeting via internet webcast by visiting the following website and following the registration and participation instructions contained therein: https://www.viewproxy.com/DiversifiedHealthcareTrust/2021/. Please have the control number located on your proxy card or voting information form available.

• Beneficial Owners: If you are a shareholder as of the record date who holds shares indirectly through a brokerage firm, bank or other nominee, you must register in advance to attend our 2021 Annual Meeting. You will need to present evidence of your beneficial ownership of shares. You will not be able to vote your shares at our 2021 Annual Meeting without a legal proxy. Beneficial owners should complete the registration process at least three days in advance of our 2021 Annual Meeting to ensure that all documentation and verifications are in order. Please see the accompanying Proxy Statement for additional information. By Order of our Board of Trustees,

March 30, 2021 |

The Board of Trustees (our "Board") of Diversified Healthcare Trust (the "Company," "we," "us" or "our") is furnishing this proxy statement and accompanying proxy card (or voting instruction form) to you in connection with the solicitation of proxies by our Board for our 2021 annual meeting of shareholders. Due to the public health impact of the COVID-19 pandemic and to protect the health and well-being of our shareholders and other stakeholders, our annual meeting will be held virtually via live webcast on Thursday, June 3, 2021, at 9:30 a.m., Eastern time, subject to any adjournments or postponements thereof (the "2021 Annual Meeting"). We are first making these proxy materials available to shareholders on or about March 30, 2021.

Only owners of record of our common shares of beneficial interest ("Common Shares") as of the close of business on March 24, 2021, the record date for our 2021 Annual Meeting, are entitled to notice of, and to vote at, the meeting and at any postponements or adjournments of the meeting. Holders of Common Shares are entitled to one vote for each Common Share held on the record date. Our Common Shares are listed on The Nasdaq Stock Market LLC ("Nasdaq"). On March 24, 2021, there were approximately 238,268,478 Common Shares issued and outstanding.

The mailing address of our principal executive office is Two Newton Place, 255 Washington Street, Suite 300, Newton, Massachusetts 02458.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR OUR 2021 ANNUAL MEETING TO BE HELD ON THURSDAY, JUNE 3, 2021.

The Notice of 2021 Annual Meeting, Proxy Statement and Annual Report to Shareholders for the fiscal year ended December 31, 2020 are available at www.proxyvote.com.

Please vote to play a part in our future. Nasdaq rules do not allow a broker, bank or other nominee who holds shares on your behalf to vote on nondiscretionary matters without your instructions.

PROPOSALS THAT REQUIRE YOUR VOTE

| PROPOSAL |

| MORE INFORMATION |

| BOARD RECOMMENDATION |

| VOTES REQUIRED FOR APPROVAL |

||

|---|---|---|---|---|---|---|---|---|

| | | | | | | | | |

| 1 | | Election of Trustees | | Page 21 | | ✓ FOR | | Plurality of all votes cast* |

| 2 | | Advisory vote to approve executive compensation** | | Page 35 | | ✓ FOR | | Majority of all votes cast |

| 3 | | Ratification of independent auditors** | | Page 46 | | ✓ FOR | | Majority of all votes cast |

| | | | | | | | | |

- *

- Our Board has adopted a resignation policy pursuant to which an incumbent Trustee who fails to receive a majority of votes cast in an uncontested election will offer to resign from our Board and, in such circumstance, our Board will decide whether to accept or reject the resignation offer.

- **

- Non-binding advisory vote.

You can vote in advance in one of three ways:

via the internet

|

Visit www.proxyvote.com and enter your 16 digit control number provided in your Notice Regarding the Availability of Proxy Materials, proxy card or voting instruction form before 11:59 p.m., Eastern time, on June 2, 2021 to authorize a proxy VIA THE INTERNET. | |

by phone |

Call 1-800-690-6903 if you are a shareholder of record and 1-800-454-8683 if you are a beneficial owner before 11:59 p.m., Eastern time, on June 2, 2021 to authorize a proxy BY TELEPHONE. You will need the 16 digit control number provided on your Notice Regarding the Availability of Proxy Materials, proxy card or voting instruction form. |

|

by mail

|

Sign, date and return your proxy card if you are a shareholder of record or voting instruction form if you are a beneficial owner to authorize a proxy BY MAIL. |

If the meeting is postponed or adjourned, these times will be extended to 11:59 p.m., Eastern time, on the day before the reconvened meeting.

PLEASE VISIT: www.proxyvote.com

- •

- To review and download easy to read versions of our Proxy Statement and Annual Report.

- •

- To sign up for future electronic delivery to reduce the impact on the environment.

![]() 2021 Proxy

Statement 1

2021 Proxy

Statement 1

This proxy summary highlights information which may be provided elsewhere in this Proxy Statement. This summary does not contain all of the information that you should consider, and you should read the entire Proxy Statement carefully before voting. Page references are supplied to help you find further information in this Proxy Statement.

ELIGIBILITY TO VOTE

You can vote if you were a shareholder of record at the close of business on March 24, 2021, the record date for our 2021 Annual Meeting.

HOW TO CAST YOUR VOTE (Page 50)

You can vote by any of the following methods:

- •

- By Telephone or Internet. All shareholders of

record can authorize a proxy to vote their shares by touchtone telephone by calling 1-800-690-6903, or through the internet at www.proxyvote.com, using the procedures and instructions described in

your Notice Regarding the Availability of Proxy Materials or proxy card.

- •

- By Written Proxy. All shareholders of record

also can submit voting instructions by written proxy card. If you are a shareholder of record and receive a Notice Regarding the Availability of Proxy Materials, you may request a written proxy card

by following the instructions included in the notice.

- •

- Electronically at our 2021 Annual Meeting. All shareholders of record may vote electronically at the meeting. Beneficial owners may vote electronically at our 2021 Annual Meeting if they have a legal proxy.

CORPORATE GOVERNANCE PRINCIPLES (Page 4)

We pride ourselves on continuing to observe and implement best practices in our corporate governance.

SUSTAINABILITY (Page 7)

We have a long-standing commitment to our shareholders and stakeholders to conduct our business in an environmentally and socially responsible manner.

VOTING (Pages 1, 21, 35 and 46)

| PROPOSAL |

| BOARD RECOMMENDATION |

| VOTES REQUIRED FOR APPROVAL |

||

|---|---|---|---|---|---|---|

| | | | | | | |

| 1 | | Election of Trustees | | ✓ FOR | | Plurality of all votes cast* |

| 2 | | Advisory vote to approve executive compensation** | | ✓ FOR | | Majority of all votes cast |

| 3 | | Ratification of independent auditors** | | ✓ FOR | | Majority of all votes cast |

| | | | | | | |

- *

- Our Board has adopted a resignation policy pursuant to which an incumbent Trustee who fails to receive a majority of votes cast in an uncontested election will offer to resign from our Board and, in such circumstance, our Board will decide whether to accept or reject the resignation offer.

- **

- Non-binding advisory vote.

2

![]() 2021 Proxy Statement

2021 Proxy Statement

PROPOSAL 1: ELECTION OF TRUSTEES (Page 21)

Upon the recommendation of our Nominating and Governance Committee, our Board has nominated Lisa Harris Jones as an Independent Trustee and Jennifer F. Francis (Mintzer) ("Jennifer F. Francis") as a Managing Trustee. Presented below is the expected composition of our Board immediately following our 2021 Annual Meeting, assuming the election of Jennifer F. Francis and Lisa Harris Jones and the expiration of Jennifer B. Clark's term as a Trustee.

| NAME OF TRUSTEES |

| INDEPENDENT |

| COMMITTEE MEMBERSHIP |

|---|---|---|---|---|

| | | | | |

| Jennifer F. Francis | | | |

None |

| John L. Harrington | | ✓ | | Audit (Chair) Compensation Nominating and Governance |

| Lisa Harris Jones | | ✓ | |

Audit Compensation Nominating and Governance (Chair) |

| Daniel F. LePage | | ✓ | | Audit Compensation Nominating and Governance |

| Adam D. Portnoy | | | |

None |

| Jeffrey P. Somers | | ✓ | | Audit Compensation (Chair) Nominating and Governance |

| | | | | |

PROPOSAL 2: ADVISORY VOTE TO APPROVE EXECUTIVE COMPENSATION (Page 35)

COMPENSATION DISCUSSION AND ANALYSIS (Page 36)

Our compensation structure is unique because of our relationship with our manager, The RMR Group LLC ("RMR LLC"). Our business management agreement with RMR LLC is designed to incentivize RMR LLC to provide the highest quality services to us. Our Compensation Committee believes that our executive compensation program is appropriately designed to incentivize strong performance over the long term.

PROPOSAL 3: RATIFICATION OF THE APPOINTMENT OF DELOITTE & TOUCHE LLP AS INDEPENDENT AUDITORS (Page 46)

![]() 2021 Proxy

Statement 3

2021 Proxy

Statement 3

CORPORATE GOVERNANCE PRINCIPLES

AND BOARD MATTERS

Review of Corporate Governance Policies and Shareholder Engagement |

Our Board is committed to upholding the values of good corporate governance. In recognition of the relationship between corporate governance and long term performance, and as a result of our ongoing engagement with our shareholders, our Board continues to proactively evaluate our corporate governance principles. Based on these principles, last year our Board:

- •

- amended our Declaration of Trust to declassify our Board so that all of our Trustees will stand for election annually

beginning with our 2023 annual meeting of shareholders, a measure which was supported by more than 71% of our shareholders;

- •

- conducted a shareholder outreach to all of our shareholders who hold 1% or more of our common shares;

- •

- retained Korn Ferry, a leading executive search and consulting firm, to identify and vet candidates to expand and refresh our

Board; and

- •

- enhanced our compensation and sustainability disclosure and reporting in response to shareholder feedback.

This year, our Board continued to engage with Korn Ferry regarding board refreshment and expansion and conducted another shareholder outreach to all of our shareholders who hold 1% or more of our common shares.

As our Board continues on the path to enhanced governance practices, we appreciate your support of our Board and these initiatives.

Board Composition, Expansion and Refreshment |

We are currently governed by a six member Board of Trustees, including four Independent Trustees and two Managing Trustees, and our Board is currently divided into three classes. In 2020, with the support of more than 71% of our shareholders, our Board amended our Declaration of Trust to declassify our Board. Beginning with our 2021 Annual Meeting, the Trustees whose terms expire at an annual meeting will stand for election at the meeting for one-year terms and all Trustees will stand for election at the 2023 annual meeting of shareholders and, thereafter, for one-year terms.

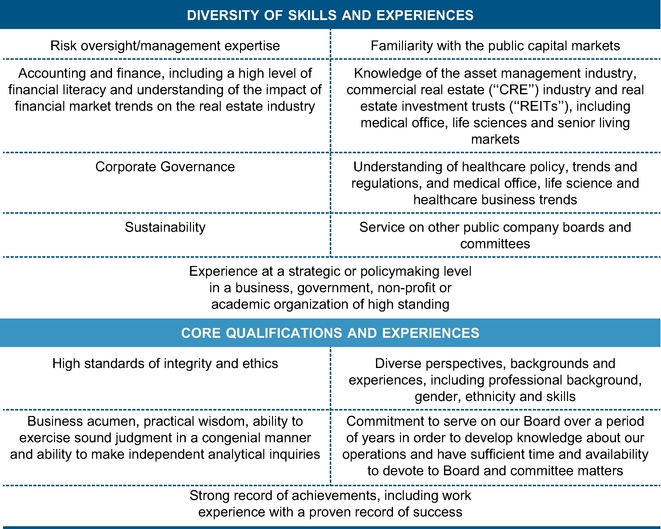

Ensuring our Board is comprised of Trustees who bring diverse viewpoints and perspectives, exhibit a variety of skills, professional experience and backgrounds and effectively represent the long term interests of shareholders is a top priority of our Board and our Nominating and Governance Committee. Our Board continues to actively evaluate its composition. Our Board's expansion and refreshment activities have increased the ratio of Independent Trustees to Managing Trustees, created more skill mix and diversity and ensured a smooth transition as Trustees retire from our Board. Our Nominating and Governance Committee and our Board have an ongoing engagement with Korn Ferry, a leading executive search and consulting firm, to act as an advisor and to assist our Nominating and Governance Committee in:

- •

- identifying and evaluating potential trustee candidates;

- •

- creating an even playing field among candidates identified regardless of source;

- •

- using the criteria, evaluations and references to prioritize candidates for consideration regardless of source; and

- •

- assisting in attracting and vetting candidates.

4

![]() 2021 Proxy Statement

2021 Proxy Statement

Process for Selecting Trustees |

Our Nominating and Governance Committee screens and recommends candidates for nomination by our full Board. Our Nominating and Governance Committee is assisted with its recruitment efforts by its ongoing engagement with Korn Ferry, which recommends candidates that satisfy our Board's criteria. They also provide research and pertinent information regarding candidates, as requested.

ISG Corporate Governance Framework |

We follow the Investor Stewardship Group's ("ISG") Corporate Governance Framework for U.S. Listed Companies, as summarized below:

| ISG Principle | Our Practice | |

| | | |

|

Principle 1: Boards are accountable to shareholders. |

• We amended our Declaration of Trust to declassify our Board. Beginning in 2023, all of our Trustees will stand for election annually.

• We adopted a proxy access bylaw.

• We have a resignation policy pursuant to which an incumbent Trustee who fails to receive a majority of votes cast in an uncontested election will offer to resign from our Board and, in such circumstance, our Board will decide whether to accept or reject the resignation offer. |

|

| | | |

|

Principle 2: Shareholders should be entitled to voting rights in proportion to their economic interest. |

• We do not have a dual class structure; each shareholder gets one vote per share. |

|

| | | |

|

Principle 3: Boards should be responsive to shareholders and be proactive in order to understand their perspectives. |

• In 2020, our proactive shareholder outreach extended to all of our shareholders who hold 1% or more of our common shares.

• Our engagement topics included the impact of the COVID-19 pandemic on our business, governance reform priorities, sustainability and social strategy, Board composition, leadership and refreshment, succession planning and executive compensation program disclosure. |

|

| | | |

![]() 2021 Proxy

Statement 5

2021 Proxy

Statement 5

| ISG Principle | Our Practice | |

| | | |

|

Principle 4: Boards should have a strong, independent leadership structure. |

• We have a Lead Independent Trustee with clearly defined duties and responsibilities that are disclosed to shareholders.

• Our Board considers the appropriateness of its leadership structure at least annually.

• We have strong Independent Committee Chairs. |

|

| | | |

|

Principle 5: Boards should adopt structures and practices that enhance their effectiveness. |

• 66.7% of Board members are independent.

• Our Board includes members of underrepresented communities and is comprised of 33.3% women and 16.7% African American.

• We have an active Board refreshment plan, including an ongoing engagement with an executive search and consulting firm to identify and evaluate candidates to expand and refresh our Board; four new Board members will have joined our Board in the last five years if Ms. Francis is elected as a Managing Trustee by our shareholders at our 2021 Annual Meeting.

• Our Trustees then in office attended at least 75% of all Board and applicable committee meetings in 2020, and each of our Trustees then in office attended the 2020 annual meeting of shareholders. |

|

| | | |

|

Principle 6: Boards should develop management incentive structures that are aligned with the long term strategy of the company. |

• Our Compensation Committee annually reviews and approves incentive compensation program design, goals and objectives for alignment with compensation and business strategies.

• Although we do not pay any cash compensation directly to our officers and have no employees, we have adopted the 2012 Equity Compensation Plan (the "Share Award Plan") to reward our named executive officers and other employees of RMR LLC who provide services to us and to align their interests with those of our shareholders. |

6

![]() 2021 Proxy Statement

2021 Proxy Statement

Sustainability |

Overview. Our business strategy for our life science and medical office portfolio (our "office portfolio" incorporates a focus on sustainable approaches to operating these properties in a manner that benefits our shareholders, tenants and the communities in which we are located. We seek to operate those properties in ways that improve the economic performance of their operations, while simultaneously ensuring tenant comfort and safety, managing energy and water consumption, as well as greenhouse gas emissions.

Our strategy for our senior housing operated portfolio ("SHOP") is to work with our SHOP manager, Five Star Senior Living Inc. ("FVE"), to prioritize the safety and well being of our residents and FVE's team members, particularly during the COVID 19 pandemic, while also seeking to maximize the operating efficiencies of our senior living communities.

Our environmental, social and governance initiatives for our office portfolio are primarily implemented by our manager, RMR LLC, and for our SHOP portfolio, by FVE, and focus on a complementary set of objectives, including the following:

- •

- Responsible Investment: We seek to invest

capital in our properties that both improves environmental performance and enhances asset value. During the acquisition of properties, RMR LLC assesses, among other things, environmental

sustainability opportunities and climate related risks as part of the due diligence process.

- •

- Environmental Stewardship: We seek to improve

the environmental footprint of our properties, including by reducing energy consumption and water usage, especially when doing so may reduce operating costs and enhance the properties' competitive

position. As a result of these ongoing efforts RMR LLC has helped in generating the following portfolio-wide achievements for our office portfolio:

- o

- Certifying more than 1.5 million square feet across thirteen

properties through the Environmental Protection Agency's ("EPA") ENERGY STAR® program, which nearly doubles the certified square feet and number of properties compared to 2019;

- o

- Benchmarking 3.6 million square feet across

38 properties, using the EPA's ENERGY STAR® portfolio manager tool; and

- o

- Owning 1.2 million square feet of Leadership in Energy and

Environmental Design ("LEED") Gold certified properties, a certification program by the U.S. Green Building Council that recognizes performance in location and planning, sustainable site development,

water savings, energy efficiency, materials selection, waste reduction, indoor environmental quality, innovative strategies and attention to priority regional issues.

- •

- Quality of the Resident Experience in our SHOP

Portfolio:

- o

- FVE provides comprehensive resident programming, including Lifestyle

360™, its signature resident enrichment program, and Bridge to Rediscovery™, its award-winning memory care program designed to provide our memory care residents fulfilling

lives and positive experiences at our communities.

- o

- FVE's culinary experience offers exceptional and creative chef

crafted meals focusing on nutritional health and seasonal variety, and social engagement.

- o

- In response to the COVID-19 Pandemic FVE has enhanced the resident

experience by:

- §

- Implementing new group activities that allow for engagement while

maintaining social distancing.

- §

- Continuing to provide devices and connectivity options for

interaction with family members, as well as virtual programming opportunities and distance learning.

- §

- Frequent COVID-19 testing provided to residents as necessary and free of charge.

![]() 2021 Proxy

Statement 7

2021 Proxy

Statement 7

- §

- Vaccination clinics for both doses of the COVID-19 vaccine provided

at substantially all our communities.

- §

- Complimentary counseling and support services for residents.

- •

- Investments in Human Capital: We rely on our managers to hire, train, and develop a workforce that meets the needs of our business, contributes positively to our society and helps reduce our impact on the natural environment.

- o

- Leadership Development

Program: This two-year rotational program prepares newly hired graduates holding a Master of Business Administration degree for future leadership roles by providing an

expansive view into all RMR LLC's client companies.

- o

- LiveWell Employee Wellness

Program: RMR LLC's LiveWell program provides resources and incentives to enhance employees' physical, emotional and financial wellness.

- o

- Managing with Impact:

RMR LLC utilizes Managing with Impact workshops for managers throughout the company to expand their perspectives and increase their confidence as a new manager. Within their first year,

managers complete the workshop and learn how to effectively delegate, solve problems and give meaningful performance feedback.

- o

- Tuition Reimbursement

Program: RMR LLC offers up to $20,000 in annual tuition assistance for work-related education from accredited colleges and universities in order to deepen employees'

skillsets and support personal enrichment.

- o

- Engineering Development

Program: Given the increasing challenges within the real estate industry of attracting qualified engineers, RMR LLC made it a strategic focus to develop the next

generation of qualified building engineers. Over the last year, it launched a program to standardize the recruitment and development of engineering candidates to prepare them for open positions and to

plan for future engineering needs. RMR LLC recruited from various trade schools and job fairs to identify candidates for the two-year program. The curriculum includes specific training in

electrical, HVAC, or plumbing trades and covers a range of essential engineering staff development topics.

- o

- Industry Associations & Credentials: In order to further their professional development, many of RMR LLC's employees seek out credentials and association memberships, with any membership costs reimbursed by RMR LLC. Examples of credentials and association memberships include: Building Owners and Managers Association Membership and Event Participation, Certified Property Manager, Certified Public Accountant and National Association of Industrial and Office Properties.

RMR LLC

RMR LLC employs approximately 600 real estate professionals across the United States. In 2020, RMR LLC was recognized by The Boston Globe as a "Top Place to Work", by Fortune magazine as one of the "100 Fastest Growing Companies", by the EPA as an "ENERGY STAR Partner of the Year", by the Boston Business Journal as the "Fastest Growing Middle Market Company in Massachusetts," and it ranked 9th on Commercial Property Executive's Top Commercial Property Management Companies. Last year, RMR LLC also received the Real Estate Management Excellence Award for Employee & Leadership Development from the Institute of Real Estate Management.

RMR LLC's recruiting programs, on-boarding, retention programs and its development and training programs currently include the following:

FVE

FVE had approximately 19,000 team members, including approximately 12,000 full time and 7,000 part-time. FVE's team member engagement initiatives align with its goal of being an employer of choice with a thriving workforce that encourages career enrichment and positions it for growth.

8

![]() 2021 Proxy Statement

2021 Proxy Statement

- o

- Team Member

Engagement: Management reviews team member engagement and satisfaction surveys to monitor employee morale and receive feedback on a variety of issues.

- o

- Rewards: FVE rewards

team members for innovation and productivity. It has several recognition programs for team members at various levels of the organization.

- o

- Tuition Reimbursement Program: FVE offers tuition assistance for work-related education from accredited colleges and universities in order to deepen team members' skill sets and support personal enrichment.

- o

- Training and

Development: FVE offers a robust learning management platform to provide training and development opportunities to all team members. In 2020, team members took an average of

approximately 17 hours of training assignments per year. In addition, new hires are assigned 16 hours of general orientation training.

- o

- Industry Associations &

Credentials: In order to further their professional development, many of FVE's team members seek out credentials or hold professional licenses and association memberships.

Examples of credentials, professional licenses and association memberships include: Medical Licenses, Licensed Practical Nurses, Registered Nurses, Certified Medical Assistants, Certified Physical and

Occupational Therapists, Speech-Language Pathologists, Certified Fitness Trainers, Cardiopulmonary resuscitation certifications (CPR), First Aid Certifications, Law Licenses and Certified Public

Accountant accreditations.

- •

- Corporate Citizenship: We seek to be a

responsible corporate citizen and to strengthen the communities in which we own properties. Our managers regularly encourage their employees to engage in a variety of charitable and community

programs, including participation in a company-wide service day and a charitable giving matching program.

- •

- Diversity & Inclusion: We value a diversity of backgrounds, experience and perspectives. Our Board is comprised of 33.3% women and 16.7% members of underrepresented communities. Our managers are equal opportunity employers with all qualified applicants receiving consideration for employment without regard to race, color, religion, sex, sexual orientation, gender identity, national origin, disability or protected veteran status. Our managers are committed to racial equality and fostering a culture of diversity and inclusion. As of September 30, 2020, 34% and 27% of RMR LLC's employees were female and members of underrepresented communities, respectively. As of December 31, 2020, approximately 77% and 42% of FVE's approximately 19,500 team members were female and members of underrepresented communities, respectively.

FVE's recruiting programs, on-boarding and retention programs and development and ongoing training programs currently include the following:

FVE also prioritizes ongoing education and training for all team members across the organization as follows:

To learn more about RMR LLC's and our sustainability initiatives, visit www.rmrgroup.com/corporate-sustainability.

Sustainability Accounting Metrics. The following disclosures are informed by the guidance of the Sustainability Accounting Standards Board ("SASB") Standards for Real Estate. To the extent an accounting metric, as defined by the SASB Standard, is not applicable to our portfolio or data to report on the applicable accounting metric is not available to us, we have not made any disclosure.

For the following SASB disclosures, the information presented is as of December 31, 2020 and relates to our office portfolio, inclusive of life science ("Life Science") and medical office buildings ("MOB"), and those Same Property senior housing communities that we own and which are operated by FVE. "Same Property" information includes properties owned continuously since January 1, 2019. Where applicable, the information presents DHC properties on consolidated basis, including two life science properties containing 1.1 million square feet that is owned in a joint venture arrangement in which DHC owns a 55% equity interest.

![]() 2021 Proxy

Statement 9

2021 Proxy

Statement 9

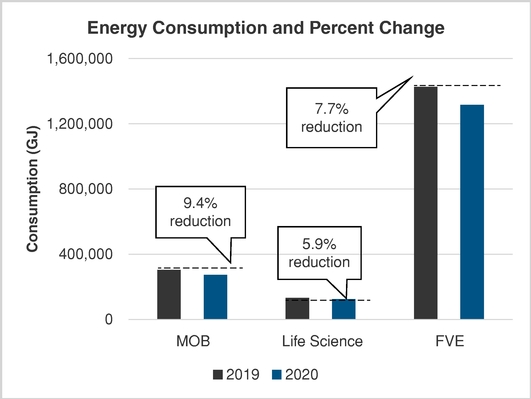

In 2020, the COVID-19 pandemic, along with local, state and Federal social distancing recommendations, created an environment of reduced building utilization. This lower property utilization is evident in the presented sustainability metrics below. It is our expectation that, in a post-pandemic environment as businesses return to normal and our property utilization improves, the energy and water consumption of our properties will increase above 2020 levels.

- I.

- Energy management integration discussion (SASB Accounting Metric Code: IF-RE-130a.5):

- •

- Centralized utility bill processing and payment system;

- •

- ENERGY STAR® benchmarking;

- •

- Real-time energy monitoring;

- •

- Daytime and nighttime energy audits;

- •

- Light Emitting Diodes (LED) lighting upgrades;

- •

- Annual energy engagement competitions;

- •

- Energy performance training for property operations teams;

- •

- Energy performance review for end-of-life heating, ventilation and air conditioning (HVAC) equipment replacements; and

- •

- Capital deployment dedicated to generating returns on energy efficiency upgrades.

RMR LLC deploys on our behalf energy management best practices at our office portfolio, which include:

As a result of these energy management efforts, we have reduced energy and water usage helping to generate both economic and environmental benefits.

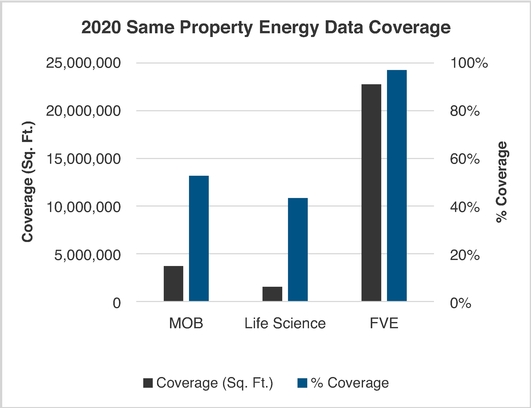

- II.

- Sections II, III and IV below provide SASB-aligned energy-related metrics. Energy consumption data coverage in square feet and as a percentage of Same Property floor area (SASB Accounting Metric Code: IF-RE-130a.1):

The following illustrates Same Property energy data available as compared to the total population of Same Property assets.

10

![]() 2021 Proxy Statement

2021 Proxy Statement

- III.

- Total energy consumption and change in energy consumption for covered Same Property area (SASB Accounting Metric Codes: IF-RE-130a.2 and IF-RE-130a.3):

- IV.

- Percentage of eligible portfolio that (i) has obtained an energy rating and (ii) is certified to ENERGY STAR® (SASB Accounting Metric Code: IF-RE-130a.4):

Medical office and life science properties are not currently eligible to earn certification through the EPA's ENERGY STAR® program. However, we have thirteen properties with operating characteristics similar to traditional office properties, which makes them eligible for certification. All of these eligible properties are certified.

![]() 2021 Proxy

Statement 11

2021 Proxy

Statement 11

- V.

- Water management integration discussion (SASB Accounting Metric Code: IF-RE-140a.4):

On our behalf, RMR LLC supports water management practices at our office portfolio that reduce operating costs as well as our impact on the consumption of natural resources. Water usage is managed by benchmarking water performance to establish a baseline and to measure performance improvements resulting from conservation measures. Benchmarking is performed through the EPA's ENERGY STAR® Portfolio Manager online platform.

Some cities and states in which we own properties require annual whole-building energy and water use disclosure. In these jurisdictions, RMR LLC engages with tenants to collect and report any direct tenant-paid energy and water consumption for our office portfolio.

RMR LLC also routinely implements water efficiency and water use reduction projects at our office portfolio, which include upgrades to indoor plumbing fixtures, low-flow water closets and urinals, low-flow flush valves, low-flow automatic faucet controls, low-flow faucet aerators and shower heads, water-efficient landscaping and cooling tower water management.

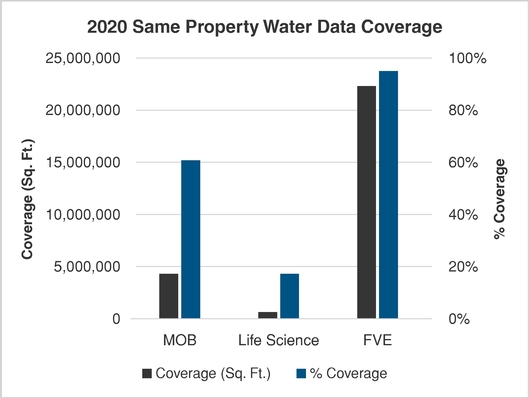

Sections VI and VII below provide SASB-aligned water-related metrics.

- VI.

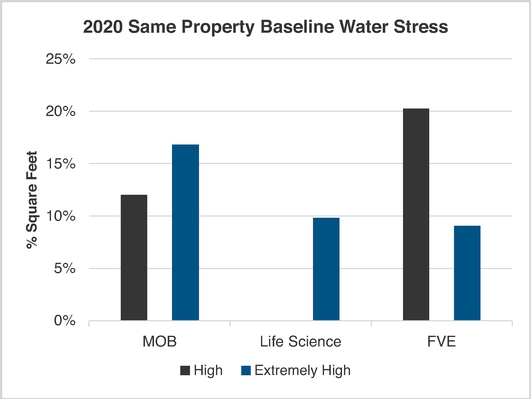

- Water withdrawal data coverage in square feet and as a percentage of Same Property floor area and percentage in regions with High or Extremely High Baseline Water Stress (SASB Accounting Metric Codes: IF-RE-140a.1):

12

![]() 2021 Proxy Statement

2021 Proxy Statement

Baseline Water Stress measures total annual water withdrawals (municipal, industrial, and agricultural) expressed as a percent of the total annual available flow. Higher values indicate more users are competing for limited water supplies.

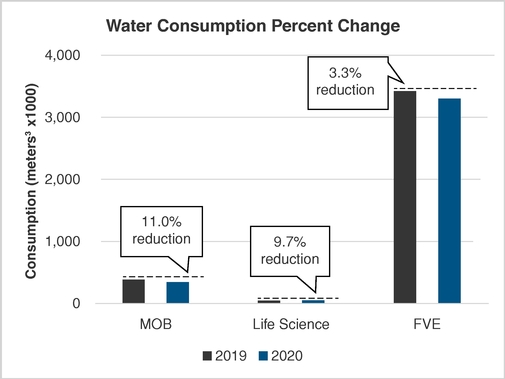

- VII.

- Total water withdrawn and percent change for Same Property area with data coverage (SASB Accounting Metric Codes: IF-RE-140a.2 and IF-RE-140a.3):

![]() 2021 Proxy

Statement 13

2021 Proxy

Statement 13

- VIII.

- Description of approach to measuring, incentivizing, and improving sustainability impacts of tenants (SASB Accounting Metric Code: IF-RE-410a.3):

On our behalf, RMR LLC seeks to provide best-in-class property operations and healthy, efficient environments for our tenants and encourage continual engagement that promotes long-lasting relationships and sustainable behaviors.

RMR LLC has internal policies that govern environmentally responsible property operations. We also utilize green lease language, where possible, to promote mutual commitment to environmentally friendly practices and operational efficiencies with our tenants.

RMR LLC prioritizes LEED certification and recertification projects by reviewing a variety of sustainability and leasing criteria such as high ENERGY STAR® scores and access to public transportation and near-by amenities. We believe that taking the initiative to submit for and attain LEED certification adds value to our properties and enhances tenant satisfaction, which reflects our commitment to environmental sustainability.

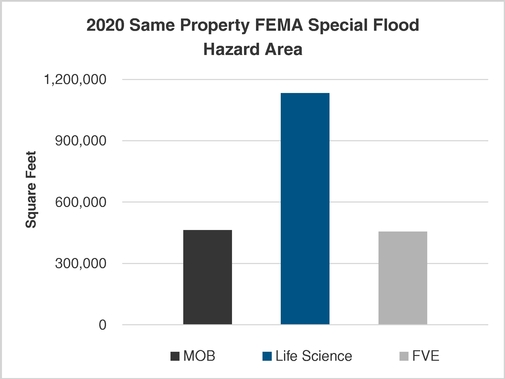

- IX.

- Area of properties located in FEMA Special Flood Hazard Areas or foreign equivalent, by property subsector (SASB Accounting Metric Code: IF-RE-450a.1):

- X.

- Description of climate change risk exposure analysis, degree of systematic portfolio exposure, and strategies for mitigating risks (SASB Accounting Metric Code: IF-RE-450a.2):

We define climate change resilience as our ability to anticipate, prepare for and recover from adverse physical climate activity such as increased severity of acute weather events and chronic changes to weather patterns as well as identify and plan for climate-related transitional activities such as changes in policy and market-driven expectations.

In preparation for and in response to property-level natural hazards, our manager, RMR LLC, utilizes dynamic geographic mapping tools which allows them to quickly assess the risk to our office portfolio from the rapidly changing natural hazards related to coastal and river flooding.

In advance of a natural hazard event, RMR LLC directs resources to our office portfolio identified as potentially impacted through these mapping tools. The resources made available include access to senior management and mobilization of equipment and personnel. Rapid response personnel may also be directed to properties after a weather event has occurred.

14

![]() 2021 Proxy Statement

2021 Proxy Statement

Properties susceptible to inundation from flood waters are evaluated routinely. The evaluation may include implementing tenant and local agency coordination protocols, property incident response plan reviews, insurance provider assessments and the implementation of physical protection elements, such as flood protection barriers.

We routinely utilize technology to evaluate our properties for energy and water performance. Such activities support lower operating expenses, improve comfort for our tenants and reduce our exposure to impacts from policies targeting greenhouse gas emissions.

Our portfolio strategy includes the development of hazard and vulnerability assessments of our existing properties and scenario planning and economic risk reviews of property development opportunities over long- term ownership periods.

Key Responsibilities of Our Board |

| Oversight of Strategy | Oversight of Risk | Succession Planning | ||||||||||

| | | | | | | | | | | | | |

✓ Our Board oversees and monitors strategic planning.

✓ Our Board oversees risk management. ✓ Our Board oversees succession planning and talent development for senior executive positions. |

✓ Business strategy is a key focus of our Board and embedded in the work of Board committees.

✓ Board committees, which meet regularly and report back to our full Board, play significant roles in carrying out the risk oversight function. ✓ Our Nominating and Governance Committee makes an annual report to our Board on succession planning. |

✓ Company management is charged with executing business strategy and provides regular performance updates to our Board.

✓ Company management is charged with managing risk, through robust internal processes and effective internal controls. ✓ In the event of a succession, our entire Board may work with our Nominating and Governance Committee, or the Independent Trustees, as applicable, to nominate and evaluate potential successors. |

||||||||||

| | | | | | | | | | | | | |

Our Board's Role in Oversight of Risk Management |

Our Board is elected by our shareholders to oversee our business and long term strategy. As part of fulfilling its responsibilities, our Board oversees the safeguarding of our assets, the maintenance of appropriate financial and other internal controls and our compliance with applicable laws and regulations. Inherent in these responsibilities is our Board's understanding and oversight of the various risks we face. Our Board considers that risks should not be viewed in isolation and should be considered in virtually every business decision and as part of our business strategy.

Our Board oversees risk as part of its general oversight of our Company. Oversight of risk is addressed as part of various Board and Board committee activities and through regular and special Board and Board committee meetings. Our day to day business is conducted by our manager, RMR LLC, and RMR LLC and our officers and Director of Internal Audit are responsible for incorporating risk management in their activities. Our Director of Internal Audit reports to our Audit Committee and provides us with advice and assistance with our risk management function.

![]() 2021 Proxy

Statement 15

2021 Proxy

Statement 15

In discharging their oversight responsibilities, our Board and Board committees review regularly a wide range of reports provided by RMR LLC and other service providers, including:

- •

- reports on market and industry conditions;

- •

- reports on the impact of the COVID-19 pandemic on our business;

- •

- operating and regulatory compliance reports;

- •

- financial reports;

- •

- reports on risk management and our Environmental, Social and Governance activities and initiatives;

- •

- regulatory and legislative updates that may impact us;

- •

- reports on the security of our information technology processes and our data; and

- •

- legal proceedings updates and reports on other business related matters.

Our Board and Board committees discuss these matters among themselves and with representatives of RMR LLC, our officers, our Director of Internal Audit, legal counsel, our independent auditors and other professionals, as appropriate.

Our Audit Committee takes a leading role in helping our Board fulfill its responsibilities for oversight of our financial reporting, internal audit function, risk management, including cybersecurity, and our compliance with legal and regulatory requirements. Our Board and Audit Committee review periodic reports from our independent auditors regarding potential risks, including risks related to our internal control over financial reporting. Our Audit Committee also reviews, approves and oversees an internal audit plan developed by our Director of Internal Audit with the goal of helping us systematically evaluate the effectiveness of our risk management, control and governance processes on an annual basis. Our Audit Committee meets at least quarterly and reports its findings to our Board. Our Audit Committee also meets periodically with our Director of Internal Audit to review the results of our internal audits, and directs or recommends to our Board actions or changes it determines appropriate to enhance or improve the effectiveness of our risk management.

Our Audit Committee considers risks related to cybersecurity and receives regular reports from our management regarding cybersecurity risks and countermeasures being undertaken or considered by us, including updates on the internal and external cybersecurity landscape and relevant technical developments.

Our Compensation Committee whose duties are detailed in its charter, among other duties, evaluates the performance of our Director of Internal Audit and RMR LLC's performance under our business and property management agreements, including any perceived risks created by compensation arrangements. Also, our Compensation Committee and our Board consider that we have a share award program that requires share awards to executive officers to vest over a period of years. We believe that the use of share awards vesting over time rather than stock options mitigates the incentives for our management to undertake undue risks and encourages management to make long term and appropriately risk balanced decisions.

It is not possible to identify all of the risks that may affect us or to develop processes and controls to eliminate all risks and their possible effects, and processes and controls employed to address risks may be limited in their effectiveness. Moreover, it is necessary for us to bear certain risks to achieve our objectives. As a result of the foregoing and other factors, our ability to manage risk is subject to substantial limitations.

To learn more about the risks we face, you can review the matters discussed in Part I, "Item 1A. Risk Factors" and "Warning Concerning Forward-Looking Statements" in our Annual Report to Shareholders for the fiscal year ended December 31, 2020 (the "Annual Report"). The risks described in the Annual Report are not the only risks we face. Additional risks and uncertainties not currently known or that may currently be deemed to be immaterial also may materially adversely affect our business, financial condition or results of operations in future periods.

16

![]() 2021 Proxy Statement

2021 Proxy Statement

Trustee Independence |

Under the corporate governance listing standards of the Nasdaq and our governing documents, our Board must consist of a majority of Independent Trustees. Under our governing documents, Independent Trustees are Trustees who are not employees of RMR LLC, are not involved in our day to day activities and who meet the qualifications for independence under the applicable rules of the Nasdaq and the Securities and Exchange Commission (the "SEC").

Our Board affirmatively determines whether Trustees have a direct or indirect material relationship with us, including our subsidiaries, other than serving as our Trustees or trustees or directors of our subsidiaries. In making independence determinations, our Board observes the Nasdaq and SEC criteria, as well as the criteria set forth in our governing documents. When assessing a Trustee's relationship with us, our Board considers all relevant facts and circumstances, not merely from the Trustee's standpoint, but also from that of the persons or organizations with which the Trustee has an affiliation. Based on this review, our Board has determined that John L. Harrington, Lisa Harris Jones, Daniel F. LePage and Jeffrey P. Somers currently qualify as independent trustees under applicable Nasdaq and SEC criteria and as Independent Trustees under our governing documents. In making these independence determinations, our Board reviewed and discussed additional information provided by us and the Trustees with regard to each of the Trustees' relationships with us, RMR LLC or The RMR Group Inc. ("RMR Inc."), the managing member of RMR LLC, and the other companies to which RMR LLC or its subsidiaries provide management services. Our Board has concluded that none of these four Trustees possessed or currently possesses any relationship that could impair his, her or their judgment in connection with his, her or their duties and responsibilities as a Trustee or that could otherwise be a direct or indirect material relationship under applicable Nasdaq and SEC standards.

Executive Sessions of Independent Trustees |

Pursuant to our Governance Guidelines, our Independent Trustees are expected to meet at least twice per year in regularly scheduled meetings at which only Independent Trustees are present. Our Independent Trustees also meet separately with our officers, with our Director of Internal Audit and with our independent auditors. The presiding Trustee for purposes of leading Independent Trustee sessions will be the Lead Independent Trustee, unless the Independent Trustees determine otherwise.

Board Leadership Structure |

All Trustees play an active role in overseeing our business both at our Board and committee levels. As set forth in our Governance Guidelines, the core responsibility of our Trustees is to exercise sound, informed and independent business judgment in overseeing our Company and our strategic direction. Our Trustees are skilled and experienced leaders and currently serve or have served as members of senior management in public and private for profit organizations and law firms, and have also served in academia. Our Trustees may be called upon to provide solutions to various complex issues and are expected to, and do, ask hard questions of our officers and advisers. Our Board is small, which facilitates informal discussions and communication from management to our Board and among Trustees.

Adam D. Portnoy serves as Chair of our Board. Our Board believes that Mr. Portnoy's leadership of RMR LLC and extensive familiarity with our day to day business provide valuable insight for our Board.

Four of our Trustees, including one of our Trustee nominees for election at our 2021 Annual Meeting, are independent under the applicable Nasdaq and SEC criteria and our governing documents. All of the members of our Audit Committee, Nominating and Governance Committee and Compensation Committee are independent under the applicable listing requirements and rules of the Nasdaq and other applicable laws, rules and regulations, including those of the SEC. As set forth in our governing documents, two of our Trustees are Managing Trustees, persons who have been employees, officers or directors of RMR LLC or who have been involved in our day to day activities for at least one year prior to his, her or their election as Trustees.

![]() 2021 Proxy

Statement 17

2021 Proxy

Statement 17

Lead Independent Trustee |

We have a Lead Independent Trustee who is selected annually by the vote of a majority of our Independent Trustees. Currently, Ms. Harris Jones serves as our Lead Independent Trustee. Our Lead Independent Trustee has well-defined, substantive responsibilities that include:

- •

- presiding at all meetings of our Board at which the Chair or a Managing Trustee is not present;

- •

- presiding at all meetings and executive sessions of the Independent Trustees;

- •

- having the authority to call meetings of the Independent Trustees or executive sessions of the Independent Trustees;

- •

- serving as the principal liaison between the Independent Trustees and the senior management team;

- •

- arranging, together with the Chair of our Board, for appropriate information (including quality and quantity) to be timely

provided to our Board and the Independent Trustees;

- •

- assisting our Compensation Committee in its annual evaluation of the performance of our management and of our manager,

RMR LLC;

- •

- assisting with setting Board meeting agendas and arranging meeting schedules, including to ensure that there is sufficient

time for discussion of all agenda items;

- •

- considering suggestions for meeting agenda items from other Independent Trustees;

- •

- authorizing the retention of advisors and consultants who report directly to the Independent Trustees when appropriate; and

- •

- if requested, and in coordination with the Chair of our Board and our management, being reasonably available for consultation and direct communication with shareholders.

Code of Business Conduct and Ethics and Committee Governance |

Our Board is committed to corporate governance that promotes the long term interests of our shareholders. Our Board has established Governance Guidelines that provide a framework for effective governance. Our Board regularly reviews developments in corporate governance and updates our Governance Guidelines and other governance materials as it deems necessary and appropriate.

We have also adopted a Code of Business Conduct and Ethics (the "Code") to, among other things, provide guidance to our and RMR LLC's (and its subsidiaries') board members, officers and in the case of RMR LLC, employees, and ensure compliance with applicable laws and regulations.

Our Board has an Audit Committee, Compensation Committee and Nominating and Governance Committee. Our Audit Committee, Compensation Committee and Nominating and Governance Committee each have adopted a written charter, and each Board committee reviews its written charter on an annual basis to consider whether any changes are required.

Our corporate governance materials are available for review in the governance section of our website, including our Governance Guidelines, the charter for each Board committee, the Code, information about how to report concerns or complaints about accounting, internal accounting controls or auditing matters and any violations or possible violations of the Code, and how to communicate with our Trustees. To access these documents on our website visit www.dhcreit.com.

Trustee Resignation Policy |

Our Governance Guidelines provide that if an incumbent Trustee does not receive a majority of the votes cast in an uncontested election, the Trustee will submit an offer to resign from our Board. In such circumstance, our Nominating and Governance Committee will make a recommendation to our Board on whether to accept or reject the resignation offer, or whether other action should be taken. Our Board will

18

![]() 2021 Proxy Statement

2021 Proxy Statement

act on the resignation offer taking into account the recommendation of our Nominating and Governance Committee and make its decision within 90 days following the certification of the election results.

Prohibition on Hedging |

Our Insider Trading Policies and Procedures expressly prohibit members of our Board and our officers from engaging in hedging transactions involving our securities and those of RMR Inc. or any other public company to which RMR LLC or its affiliates provide management services.

Nominations for Trustees |

Shareholders who would like to recommend a Trustee nominee should submit their recommendations in writing by mail to the Chair of our Nominating and Governance Committee, c/o Diversified Healthcare Trust, Secretary, at Two Newton Place, 255 Washington Street, Suite 300, Newton, Massachusetts 02458 or by email to secretary@dhcreit.com. Any such recommendation should include a description of the candidate's qualifications for Board service, the candidate's written consent to be considered for nomination and to serve if nominated and elected, as well as the addresses and telephone numbers for contacting the shareholder and the candidate for more information. Our Nominating and Governance Committee may request additional information about the shareholder recommended nominee or about the shareholder recommending the nominee. Recommendations by shareholders will be considered by our Nominating and Governance Committee in its discretion using the same criteria as other candidates it considers.

A shareholder, or a group of up to 20 shareholders, owning at least three percent of the outstanding Common Shares continuously for at least three years may utilize our proxy access bylaw to nominate and include in our proxy materials Trustee candidate(s) for election at an annual meeting of shareholders provided that the shareholder(s) and the nominee(s) satisfy the informational, documentation and other requirements specified by Section 2.18 of our Bylaws.

Shareholders seeking to nominate one or more individuals as a Trustee candidate without relying on our proxy access bylaw must comply with the advance notice requirements for shareholder nominations set forth in Section 2.14 of our Bylaws, which include, among other things, requirements as to the proposing shareholder's timely delivery of advance notice, continuous requisite ownership of Common Shares and submission of specified documentation and information.

Communications with Our Board |

Our Board has established a process to facilitate communication by shareholders and other stakeholders with our Trustees. Communications should be addressed to Trustees in care of the Secretary, Diversified Healthcare Trust, Two Newton Place, 255 Washington Street, Suite 300, Newton, Massachusetts 02458 or by email to secretary@dhcreit.com.

Shareholder Nominations and Other Proposals |

Deadline to Submit Proposals pursuant to Rule 14a-8 for the 2022 Annual Meeting of Shareholders: Shareholder proposals pursuant to Rule 14a-8 under the Securities Exchange Act of 1934, as amended (the "Exchange Act"), must be received at our principal executive office on or before November 30, 2021 in order to be eligible to be included in the proxy statement for the 2022 annual meeting of shareholders; provided, that, if the date of the 2022 annual meeting of shareholders is more than 30 days before or after June 3, 2022, such a proposal must be submitted within a reasonable time before we begin to print our proxy materials. Under Rule 14a-8, we are not required to include shareholder proposals in our proxy materials in certain circumstances or if conditions specified in the rule are not met.

Deadline to Submit Trustee Proxy Access Nominations for the 2022 Annual Meeting of Shareholders: Under our proxy access bylaw, a shareholder or a group of up to 20 shareholders owning at least three

![]() 2021 Proxy

Statement 19

2021 Proxy

Statement 19

percent of our outstanding Common Shares continuously for at least three years may nominate and include in our proxy materials for the 2022 annual meeting of shareholders Trustee nominees constituting up to the greater of two nominees or 20% of the number of Trustees on our Board that holders of our Common Shares are entitled to elect; provided that, as we declassify our Board, such number of Trustee nominees will be reduced so that for the 2022 annual meeting of shareholders it does not exceed one-half of the number of Trustees to be elected at the 2022 annual meeting of shareholders as noticed by us (so long as our Board consists of less than nine Trustees) rounded down to the nearest whole number (but not rounded down as a result of this proviso to less than one). In addition, the shareholder(s) and nominee(s) must satisfy the informational, documentation and other requirements specified by Section 2.18 of our Bylaws. Notice of a proxy access nomination for consideration at our 2022 annual meeting of shareholders must be received at our principal executive office not later than 5:00 p.m., Eastern time, on November 30, 2021 and not earlier than October 31, 2021.

Deadline to Submit Other Nominations and Proposals for the 2022 Annual Meeting of Shareholders under our Bylaws: To be timely, shareholder nominations and proposals intended to be made outside of Rule 14a-8 under the Exchange Act and outside of the proxy access bylaw at the 2022 annual meeting of shareholders must be received by our Secretary at our principal executive office, in accordance with the requirements of our Declaration of Trust and Bylaws, not later than 5:00 p.m., Eastern time, on November 30, 2021 and not earlier than October 31, 2021; provided, that, if the date of the 2022 annual meeting of shareholders is more than 30 days earlier or later than June 3, 2022, then a shareholder's notice must be so delivered not later than 5:00 p.m., Eastern time, on the tenth day following the earlier of the day on which (i) notice of the date of the 2022 annual meeting of shareholders is mailed or otherwise made available or (ii) public announcement of the date of the 2022 annual meeting of shareholders is first made by us. Shareholders making such a nomination or proposal must comply with the advance notice and other requirements set forth in our Declaration of Trust and Bylaws, which include, among other things, requirements as to the shareholder's timely delivery of advance notice, continuous requisite ownership of Common Shares, holding of a share certificate for such shares at the time of the advance notice and submission of specified information.

The foregoing description of the deadlines and other requirements for shareholders to submit a nomination for election to our Board or a proposal of other business for consideration at an annual meeting of shareholders is only a summary and is not a complete listing of all requirements. Copies of our Declaration of Trust and Bylaws, including the requirements for proxy access or other shareholder nominations and other shareholder proposals, may be obtained by writing to our Secretary at Diversified Healthcare Trust, Two Newton Place, 255 Washington Street, Suite 300, Newton, Massachusetts 02458, or from the SEC's website, www.sec.gov. Any shareholder considering making a nomination or proposal should carefully review and comply with those provisions.

20

![]() 2021 Proxy Statement

2021 Proxy Statement

PROPOSAL 1: ELECTION OF TRUSTEES

Upon the recommendation of our Nominating and Governance Committee, our Board has nominated Lisa Harris Jones as an Independent Trustee and Jennifer F. Francis as a Managing Trustee. Ms. Harris Jones currently serves on our Board, and Ms. Francis currently serves as our President and Chief Operating Officer. On February 24, 2021, Ms. Clark notified our Board of her decision to not seek re-election as a Managing Trustee upon the expiration of her current term. Ms. Clark's decision to not seek re-election to our Board was not due to any disagreement with us relating to our operations, policies or practices. Our Nominating and Governance Committee and our Board voted to nominate Ms. Francis for election as a Managing Trustee to fill the vacancy created by Ms. Clark's decision not to seek re-election.

If elected, each nominee would serve until our 2022 annual meeting of shareholders and until her successor is duly elected and qualifies, subject to her earlier death, resignation, retirement, disqualification or removal.

We expect that each nominee for election as a Trustee will be able to serve if elected. However, if a nominee should become unable or unwilling to serve, proxies may be voted for the election of a substitute nominee designated by our Board.

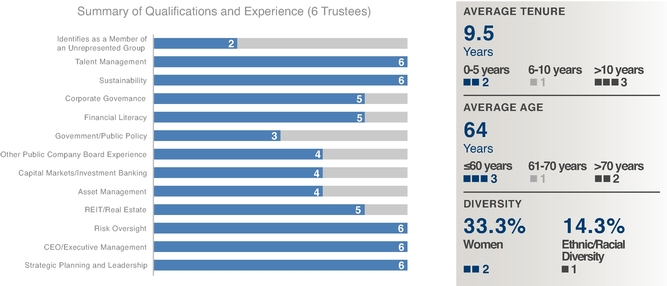

Board of Trustees' Qualifications and Experience

Our Trustees have a great diversity of experience and bring to our Board a wide variety of skills, qualifications, viewpoints and backgrounds that strengthen their ability to carry out their oversight role on behalf of our shareholders.

![]() 2021 Proxy

Statement 21

2021 Proxy

Statement 21

Diversity is an important factor in our |

OUR BOARD OF TRUSTEES |

|

Our Nominating and Governance Committee considers a number of demographics and other factors, including race, gender identity, ethnicity, sexual orientation, culture, nationality and work experiences (including military service), seeking to develop a board that, as a whole, reflects diverse viewpoints, backgrounds, skills, experiences and expertise. Among the factors our Nominating and Governance Committee considers in identifying and evaluating a potential trustee candidate is the extent to which the candidate would add to the diversity of our Board. Our Nominating and Governance Committee considers the same factors in determining whether to re-nominate an incumbent Trustee. Diversity is also considered as part of our annual Board evaluation. |

2 Managing 4 Independent 2 Women 1 African American |

Snapshot of 2021 Board Nominees

Presented below is a snapshot of the expected composition of our Board immediately following our 2021 Annual Meeting, assuming the election of Jennifer F. Francis and Lisa Harris Jones and the expiration of Jennifer B. Clark's term as a Trustee. Our Board of Trustees believes that, collectively, our Trustees exhibit an effective mix of qualifications, experience and diversity.

A plurality of all the votes cast is required to elect a Trustee at our 2021 Annual Meeting.

The names, principal occupations and certain other information regarding the Trustee nominees that led our Nominating and Governance Committee and our Board to conclude that such persons are currently qualified to serve as Trustees are set forth on the following pages.

Our Board of Trustees recommends a vote "FOR" the election of both Trustee nominees.

22

![]() 2021 Proxy Statement

2021 Proxy Statement

Trustee Nominees to be Elected at Our 2021 Annual Meeting |

| |

|

|

Jennifer F. Francis Age: 56 President and Chief Operating Officer since 2018 Expected Term: Annual term expiring at the 2022 annual meeting of shareholders |

| | Board Committees: None | | |

Other RMR Managed Public Company Boards(1): None Other Non-RMR Managed Public Company Boards: None |

| ||||

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | Ms. Francis joined RMR LLC in 2006 and became a senior vice president of RMR LLC in 2014 and an executive vice president of RMR LLC in 2020. Ms. Francis is responsible for the asset management function of RMR LLC, which includes asset management and leasing activities at all RMR LLC managed properties as well as asset management for the senior living and hotel properties owned by RMR LLC's managed REITs. Prior to joining RMR LLC, Ms. Francis was a partner at CBRE/NE Partners, where she performed brokerage and corporate advisory services for numerous large corporate clients on their national commercial real estate portfolios. Previously, Ms. Francis was a vice president at The Gunwyn Company where she was responsible for the asset management of a portfolio of commercial, retail and residential assets. Ms. Francis has over 30 years of experience working in the commercial real estate industry. She is on the executive board of the American Seniors Housing Association (ASHA), a member of the National Association of Industrial and Office Properties (NAIOP), a member of the Commercial Real Estate Women (CREW) and serves on Nareit's 2021 Advisory Board of Governors. | | |

Specific Qualifications, Attributes, Skills and Experience: • Professional skills and experience in real estate matters • Leadership position with RMR LLC and demonstrated management ability • Extensive experience in, and knowledge of, the CRE industry and REITs • Institutional knowledge earned through prior service as an officer of our Company and in leadership positions with RMR LLC • Identifies as Caucasian and female • Qualifying as a Managing Trustee in accordance with the requirements of our governing documents

|

| |||||||||

- (1)

- In addition to our Company, RMR LLC or its subsidiaries currently provide management services to seven other public companies, including the following five public companies that do not have any employees of their own: Industrial Logistics Properties Trust (Nasdaq: ILPT), Office Properties Income Trust (Nasdaq: OPI), Service Properties Trust (Nasdaq: SVC), Tremont Mortgage Trust (Nasdaq: TRMT) and RMR Mortgage Trust (Nasdaq: RMRM). For us and these other companies with no employees, RMR LLC or its subsidiaries provide all business operations and functions pursuant to the terms of the applicable management agreements. RMR LLC also provides business management services to two public operating companies, Five Star Senior Living Inc. (Nasdaq: FVE) and TravelCenters of America Inc. (Nasdaq: TA), both of which have their own employees but some members of the senior leadership of these companies are also RMR LLC employees.

![]() 2021 Proxy

Statement 23

2021 Proxy

Statement 23

| |

|

|

Lisa Harris Jones Age: 53 Independent Trustee since 2015 Lead Independent Trustee since 2018 Expected Term: Annual term expiring at the 2022 annual meeting of shareholders |

| |

Board Committees: • Audit • Compensation • Nominating and Governance (Chair) |

| |

Other RMR Managed Public Company Boards(1): • TravelCenters of America Inc. (since 2013) • Industrial Logistics Properties Trust (since 2018) Other Non-RMR Managed Public Company Boards: None |

| ||||

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | Ms. Harris Jones is the founding member of Harris Jones & Malone, LLC, a law firm based in Maryland. Since founding Harris Jones & Malone, LLC in 2000, Ms. Harris Jones has represented a wide range of clients, focusing her practice in government relations and procurement at both the state and local levels. Prior to founding Harris Jones & Malone, LLC, Ms. Harris Jones was associated with other Maryland law firms from 1993 to 1999, and she has represented the City of Baltimore and many of its agencies and related quasi-public entities in various real estate development and financing transactions. In addition to her professional accomplishments, Ms. Harris Jones has held leadership positions in many community service and civic organizations for which she has received recognitions and awards, including being the recipient of the YWCA Greater Baltimore Special Leadership Award in 2012. | | |

Specific Qualifications, Attributes, Skills and Experience: • Professional skills and experience in legal and business finance matters • Experience in public policy matters • Experience in real estate matters • Demonstrated leadership capability as an entrepreneur and founding member of a law firm • Work on public company boards and board committees • Institutional knowledge earned through prior service on our Board • Identifies as African American and as female • Qualifying as an Independent Trustee in accordance with the requirements of the Nasdaq, the SEC and our governing documents |

| |||||||||

24

![]() 2021 Proxy Statement

2021 Proxy Statement

Continuing Trustees |

| |

|

|

Daniel F. LePage Age: 66 Independent Trustee since 2020 Term: Term expiring at the 2023 annual meeting of shareholders |

| |

Board Committees: • Audit • Compensation • Nominating and Governance |

| |

Other RMR Managed Public Company Boards(1): None Other Non-RMR Managed Public Company Boards: None |

| ||||

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | Mr. LePage is the founder and managing partner of DFL Capital LLC, a New York based real estate investment firm formed in April 2019. He was a managing director and head of the U.S. real estate corporate banking group at RBC Capital Markets from 2006 to 2019. Prior to his involvement with RBC Capital Markets and its affiliates, Mr. LePage held senior leadership positions in commercial real estate lending at Emigrant Savings Bank and Citigroup, Inc. | | |

Specific Qualifications, Attributes, Skills and Experience: • Professional skills and experience in business finance matters • Experience in and knowledge of finance and capital markets • Demonstrated leadership and management abilities • Experience in real estate matters • Experience in capital raising and strategic business transactions • Identifies as Caucasian and as male • Qualifying as an Independent Trustee in accordance with the requirements of the Nasdaq, the SEC and our governing documents |

| |||||||||

| |

|

|

John L. Harrington Age: 84 Independent Trustee since 1999 Term: Term expiring at the 2022 annual meeting of shareholders |

| |

Board Committees: • Audit (Chair) • Compensation • Nominating and Governance |

| |

Other RMR Managed Public Company Boards(1): • Service Properties Trust (since 1995) • RMR Mortgage Trust, including its predecessor funds (formerly known as RMR Real Estate Income Fund, since 2003) • Office Properties Income Trust (since 2009) • Tremont Mortgage Trust (since 2017) Other Non-RMR Managed Public Company Boards: None |

| ||||

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |