Exhibit 99.1

MANAGEMENT

PROXY CIRCULAR

AND

NOTICE OF ANNUAL

MEETING OF SHAREHOLDERS

MAY 22, 2014

LETTER TO SHAREHOLDERS

To our Shareholders and Stakeholders,

Trust is the foundation of our business. As the accelerating pace of change reshapes global markets before our eyes, our customers are required to react faster than ever before and to sort through an increasingly complex tsunami of information and ever-changing regulation. Against this backdrop, our ability to separate the signal from the noise has never been more important. We are privileged to be trusted for the decisions that matter most. We believe the greatest value we deliver is the ability for our customers to act with confidence in a complex world.

We know that trust must be earned every day. And we dedicate ourselves to that task in everything we do.

2013: Execution and Momentum

Our financial performance in 2013 demonstrated an ability to execute on our strategy in a volatile and shifting global environment. We delivered on our financial outlook for 2013 despite challenges to two of our largest customer groups – large global banks and big U.S. law firms. More importantly, we improved our position with customers, launched new products, continued to reduce operating expenses and announced another dividend increase for our shareholders.

We saw promising growth in many of our business units. Our Intellectual Property & Science unit grew revenues 11%. Our Tax & Accounting unit grew 9%. Our Legal business was up 3%. And our businesses in emerging markets grew by 10% during the year.

While revenues from our Financial business declined 1%, we continued to make tangible progress both from operating and competitive perspectives. It will take more time before this progress translates into positive revenue growth for this business. Eikon is our flagship desktop product for financial professionals, and we were pleased that there were nearly three times as many installed Eikon desktops -- more than 122,000 -- at the end of the year than there were at the beginning. Both customer satisfaction and sales trends improved throughout the year and we expect more of the same through 2014.

2014: Customer-Driven Growth

We enter 2014 on a positive trajectory and in a far stronger competitive position than a year ago. Our Financial business is working closely with our largest customers to help them retool for the competitive challenges ahead. We expect our Legal business to continue to make good progress as it evolves into a solutions business, helping law firms improve productivity, manage their businesses more efficiently and grow more quickly. And we believe that IP & Science and Tax & Accounting will keep building from their strong performances last year. The global markets in which they operate continue to expand and they each hold strong market positions.

Expanding on the progress made in 2013, this year we will sharpen our focus on innovation and driving higher rates of organic growth. We will increasingly work across our internal units to deliver customers the full power of our enterprise. We believe that the breadth and depth of our content, market-moving news, technology platforms, applications, transaction capabilities, cloud-based services and workflow solutions are unrivaled across our competitive set. In fact, our strongest customer relationships today are those where we engage across multiple touch points. By working to reduce internal complexity and simplify our organization, we believe there is a great opportunity to build on those strong foundations.

Moreover, we are unlocking the extraordinary talent of our people through a sweeping culture change program aimed at strengthening accountability, creativity and collaboration at all levels of our organization.

Well Positioned to Capitalize on Global Trends

Today Thomson Reuters stands at the crossroads of information and technology, of regulation and global commerce. It's a busy intersection. While the global trends that are reshaping our customers' worlds are unprecedented and require that we evolve, they also create unprecedented opportunities for us.

In the deluge of data, professionals need content they can trust. They need accurate, timely and relevant information on which they can base critical decisions.

We hold as sacred that role of trusted source. It has been built over generations in each of our markets – in fact over more than 100 years in more than 100 countries around the world. Over those years we have built deep relationships that allow us to connect our customers with opportunities locally and across regions.

The global regulatory environment is not only intense and aggressive, it also is uncoordinated. Our regional strength gives us the ability to monitor across jurisdictions and we also have deep vertical expertise that allows our customers to manage issues and regulations specific to their businesses.

As we continue to evolve into an enterprise that balances vertical and regional expertise with global scale, we look to harness the full power of our assets and expertise to meet customers' rising expectations -- building new and broader partnerships, and empowering our customers to act with confidence in an ever-more complex world.

Thomson Reuters Management Proxy Circular

We believe the steps we are taking to transform Thomson Reuters will result in a more nimble and effective enterprise with deeper customer relationships, higher and more sustainable organic revenue growth, and stronger earnings. We are excited about the journey.

Transforming Our World

In 2013, we made our Corporate Responsibility program more relevant by realigning our focus areas to better align with the mission and values of the organization. We report on our progress in an annual global Corporate Responsibility report.

We are proud of the Thomson Reuters employees who volunteered more than 91,000 hours of community service in 2013, more than doubling the hours recorded in 2012. We recognize and reward employee community service efforts through our Community Champion Awards program with company donations to support personal charitable initiatives across the globe. We continue to develop and enhance our internal philanthropy platform, My Community, which offers employees access to matching gifts, volunteering and employee giving programs. And, importantly, we provide products and services across our business operations which support our Corporate Responsibility focus, as well as our website, sustainability.thomsonreuters.com, which brings together our work advising decision makers in the professional and business communities on sustainability issues.

2013 was also a banner year for The Thomson Reuters Foundation, a not-for-profit organization supported by our company, which leverages skills and expertise across our organization to increase trust in and access to the rule of law, saving lives through the provision of trusted information and improving standards of journalism. We encourage you to read about the Foundation's work in its annual report and on its website, www.trust.org.

Like the solutions, services and platforms which we provide our customers, our philanthropic efforts help to create a more informed, empowered and prosperous world.

Heartfelt Thanks

As always, we are grateful to our customers, employees and shareholders for their trust, and to our Board for their guidance and support.

After many years of distinguished service on our Board, Lawton W. Fitt, Sir Deryck Maughan and John M. Thompson are completing their terms this spring. We cannot thank them enough for the deep insight and wise counsel they have provided over the years.

|

|

|

|

|

|

David Thomson

|

James C. Smith

|

|

Chairman of the Board

|

President & Chief Executive Officer

|

Certain statements in the letter are forward-looking. These forward-looking statements are based on certain assumptions and reflect our current expectations. As a result, forward-looking statements are subject to a number of risks and uncertainties that could cause actual results or events to differ materially from current expectations. Some of the factors that could cause actual results to differ materially from current expectations are discussed in the “Risk Factors” section of our 2013 annual report as well as in other materials that we from time to time file with, or furnish to, the Canadian securities regulatory authorities and the U.S. Securities and Exchange Commission. There is no assurance that any forward-looking statements will materialize. You are cautioned not to place undue reliance on forward-looking statements, which reflect expectations only as of this date. Except as may be required by applicable law, we disclaim any intention or obligation to update or revise any forward-looking statements.

Thomson Reuters Management Proxy Circular

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS OF THOMSON REUTERS CORPORATION

To our Shareholders,

We are pleased to invite you to attend the 2014 Thomson Reuters annual meeting of shareholders on Thursday, May 22, 2014 at 12:00 p.m. (Eastern Daylight Time). The meeting will be held at Roy Thomson Hall, 60 Simcoe Street, Toronto, Ontario, Canada. Following the meeting, a webcast will also be available at www.thomsonreuters.com.

BUSINESS

The business of the meeting will be to:

1. Receive our consolidated financial statements for the year ended December 31, 2013 and the auditor’s report on those statements;

2. Elect directors;

3. Appoint the auditor and authorize the directors to fix the auditor’s remuneration; and

4. Transact any other business properly brought before the meeting and any adjourned or postponed meeting.

These matters are discussed in more detail in the accompanying management proxy circular. At the meeting, you will also have an opportunity to hear about our 2013 performance and our plans for Thomson Reuters going forward. Shareholders in attendance will have an opportunity to ask questions.

RECORD DATE

You are entitled to vote at the meeting, and any adjourned or postponed meeting, if you were a holder of our common shares as of 5:00 p.m. (Eastern Daylight Time) on March 31, 2014.

NOTICE-AND-ACCESS

We are using the “notice-and-access” system for the delivery of our proxy materials through our website, www.thomsonreuters.com, similar to last year’s meeting. Shareholders who receive a notice have the ability to access the proxy materials on our website and to request a paper copy of the proxy materials. Instructions on how to access the proxy materials through our website or to request a paper copy may be found in the notice. Electronic delivery reduces the cost and environmental impact of producing and distributing paper copies of documents in very large quantities. It also provides shareholders with faster access to information about Thomson Reuters.

Shareholders who have already signed up for electronic delivery of proxy materials will continue to receive them by e-mail.

VOTING

Your vote is important. If you’re unable to attend the meeting in person, please vote by proxy. A proxy is a document that authorizes someone else to attend the meeting and cast votes for you. The proxy form contains instructions on how to complete and send your voting instructions. If you hold your shares through a broker or other intermediary, you should follow the procedures provided by your broker or intermediary.

If you’re a registered shareholder, our transfer agent, Computershare Trust Company of Canada, must receive your proxy or voting instructions no later than 5:00 p.m. (Eastern Daylight Time) on Tuesday, May 20, 2014, or if the meeting is adjourned or postponed, no later than 48 hours (excluding Saturdays, Sundays and holidays) before any adjourned or postponed meeting. If you’re a registered shareholder and have any questions or need assistance voting your shares, please call Computershare Trust Company of Canada, toll-free in Canada and the United States, at 1.800.564.6253.

Non-registered/beneficial shareholders will be subject to earlier voting deadlines as specified in their proxy or voting instructions.

The Thomson Reuters board considers all of the proposals described in the enclosed materials to be in the best interests of our company. Accordingly, the board unanimously recommends that you cast your vote “FOR” all of these items of business.

Thank you for your continued support of, and interest in, Thomson Reuters.

Very truly yours,

|

|

|

|

|

|

David Thomson

|

James C. Smith

|

|

Chairman of the Board

|

President & Chief Executive Officer

|

March 31, 2014

Thomson Reuters Management Proxy Circular

MANAGEMENT PROXY CIRCULAR

WHAT’S INSIDE

|

Page

|

|

|

2

|

About this Circular and Related Proxy Materials

|

|

3

|

Business of the Meeting

|

|

4

|

Voting Information

|

|

6

|

Annual and Quarterly Financial Statements and Related MD&A

|

|

6

|

Notice-and-Access

|

|

7

|

Electronic Delivery of Shareholder Communications

|

|

7

|

Principal Shareholder and Share Capital

|

|

8

|

About Our Directors

|

|

10

|

Nominee Information

|

|

15

|

Director Compensation

|

|

18

|

Corporate Governance

|

|

18

|

Board Composition and Responsibilities

|

|

21

|

Controlled Company

|

|

21

|

Committees

|

|

22

|

Audit Committee

|

|

25

|

Corporate Governance Committee

|

|

28

|

HR Committee

|

|

29

|

Succession Planning and Talent Management

|

|

29

|

Director Attendance

|

|

30

|

Transactions Involving Directors or Officers

|

|

30

|

Other/Interlocking Directorships

|

|

30

|

Disclosure and Communications Controls and Procedures

|

|

31

|

Code of Business Conduct and Ethics

|

|

31

|

Trust Principles and Founders Share Company

|

|

33

|

About Our Independent Auditor

|

|

34

|

Advisory Resolution on Executive Compensation (Say on Pay)

|

|

35

|

Compensation Discussion and Analysis

|

|

35

|

Overview of 2013 Compensation

|

|

36

|

Components of 2013 Compensation

|

|

37

|

Designing and Determining Executive Compensation: The Role of the HR Committee, Our Principal Shareholder and Independent Advisors

|

|

39

|

Our Key Compensation Principles

|

|

42

|

2013 Compensation

|

|

45

|

2013 Named Executive Officer Compensation and Key Accomplishments

|

|

53

|

Executive Compensation

|

|

62

|

Indebtedness of Officers, Directors and Employees

|

|

63

|

Directors’ and Officers’ Indemnification and Insurance

|

|

63

|

Additional Information

|

|

64

|

Directors’ Approval

|

|

A-1

|

Appendix A — Plan Descriptions

|

Thomson Reuters Management Proxy Circular

1

FAST FACTS ABOUT THOMSON REUTERS

For more information about our company, visit www.thomsonreuters.com.

|

Who we are and what we do – We are the leading source of intelligent information for businesses and professionals. We combine industry expertise with innovative technology to deliver critical information to leading decision-makers. We deliver this must-have insight to the financial and risk, legal, tax and accounting, intellectual property and science and media markets, powered by the world’s most trusted news organization.

2013 results:

· Revenues – US$12.5 billion

· Adjusted EBITDA margin* - 24.5%

· Underlying operating profit margin* – 15.0%

· Adjusted earnings per share (EPS)* – US$1.54

· Free cash flow* – US$1.2 billion

|

|

Stock exchange listings (Symbol: TRI):

Toronto Stock Exchange (TSX)

New York Stock Exchange (NYSE)

Stock prices (2013):

Closing price (12/31/2013): C$40.17 / US$37.82

High: C$40.70 / US$38.73

Low: C$28.75 / US$29.10

Market capitalization (12/31/2013) – Over US$31.5 billion

Dividend per share (2014 annualized) – $1.32 (representing a 1.5% increase compared to 2013)

*Non-International Financial Reporting Standards (IFRS) financial measures. Please see the note in the “Additional Information” section of this circular.

Front cover photo credit: REUTERS/Kai Pfaffenbach, October 30, 2013.

|

ABOUT THIS CIRCULAR AND RELATED PROXY MATERIALS

We are providing this circular and proxy materials to you in connection with our annual meeting of shareholders to be held on Thursday, May 22, 2014. As a shareholder, you are invited to attend the meeting. If you are unable to attend, you may still vote by completing the enclosed proxy form.

This circular describes the items to be voted on at the meeting and the voting process and contains additional information about executive compensation, corporate governance practices and other matters that will be discussed at the meeting.

Unless otherwise indicated, all dollar amounts in this circular are expressed in U.S. dollars, and information is as of March 25, 2014. In this circular, the terms “we”, “us” and “our” refer to Thomson Reuters Corporation and our consolidated subsidiaries. The term “Woodbridge” refers to The Woodbridge Company Limited and other companies affiliated with it.

Please see the “Voting Information” section of this document for an explanation of how you can vote on the matters to be considered at the meeting, whether or not you decide to attend the meeting.

We are a Canadian company that is considered to be a “foreign private issuer” for U.S. federal securities law purposes. As a result, we have prepared this circular in accordance with applicable Canadian disclosure requirements.

Information contained on our website or any other websites identified in this circular is not part of this circular. All website addresses listed in this circular are intended to be inactive, textual references only. The Thomson Reuters logo and our other trademarks, trade names and service names mentioned in this circular are the property of Thomson Reuters.

Thomson Reuters Management Proxy Circular

2

BUSINESS OF THE MEETING

|

HIGHLIGHTS

|

|

|

|

||

|

|

|

|

|

|

|

|

This year’s meeting will cover the following items of business:

|

|

|

|||

|

|

|

|

|

|

|

|

|

Item of Business

|

Highlights

|

Board Vote Recommendation

|

|

|

|

|

1

|

Financial statements

|

Receipt of our 2013 audited financial statements.

· Our 2013 annual consolidated financial statements are included in our 2013 annual report, which is available in the “Investor Relations” section of our website, www.thomsonreuters.com.

· Shareholders who requested a copy of the 2013 annual report will receive it by mail or e-mail.

· Representatives from Thomson Reuters and our independent auditor, PricewaterhouseCoopers LLP, will be available to discuss any questions about our financial statements at the meeting.

|

N/A

|

|

|

|

|

|

|

|

|

|

|

2

|

Directors

|

At the meeting, 13 individuals are proposed to be elected to our board of directors. All of these individuals are currently directors of our company who were elected at last year’s meeting, except for Sheila Bair, Michael Daniels and P. Thomas Jenkins. Lawton Fitt, Sir Deryck Maughan and John Thompson have decided not to stand for re-election.

· A majority of our directors are independent.

· The roles and responsibilities of the Chairman and the CEO are separate.

· Shareholders vote annually for individual directors.

|

FOR EACH

DIRECTOR

NOMINEE

|

|

|

3

|

Auditor

|

We are proposing to re-appoint PricewaterhouseCoopers LLP as our independent auditor for another year until the 2015 annual meeting of shareholders.

|

FOR

|

||

|

4

|

Advisory resolution on executive compensation

|

In determining 2013 compensation arrangements for our executive team, the Human Resources (HR) Committee of our board created pay packages which are designed to recognize their various levels of experience and contributions. Most of the compensation arrangements are variable or “at risk” and based on our company’s financial performance.

Based on our company’s performance, 2013 annual incentive awards and performance restricted share units (PRSUs) granted as part of 2011-2013 long-term incentive awards each paid out at below target amounts.

We believe that our named executive officers’ compensation is aligned with performance relative to other public companies that we consider to be our peers or comparables.

Please see the “Compensation Discussion and Analysis” section of the circular for additional information.

|

FOR

|

||

|

|

|

|

|

|

|

|

|

5

|

Other business

|

If any other items of business are properly brought before the meeting (or any adjourned or postponed meeting), shareholders will be asked to vote. We are not aware of any other items of business at this time.

|

N/A

|

|

Thomson Reuters Management Proxy Circular

3

VOTING INFORMATION

Who can vote at the meeting?

If you held common shares as of 5:00 p.m. (Eastern Daylight Time) on March 31, 2014 (the record date), then you are entitled to vote at the meeting or any adjourned or postponed meeting. Each share is entitled to one vote. As of March 25, 2014, there were 813,999,450 common shares outstanding.

We also have 6,000,000 Series II preference shares outstanding, but these shares do not have voting rights at the meeting.

How many votes are required for approval?

A simple majority (more than 50%) of votes cast, in person or by proxy, is required to approve each item of business.

How do I vote?

|

You have two choices – you can vote by proxy, or you can attend the meeting and vote in person. The voting process is different for each choice. The voting process also depends on whether you are a registered or non-registered shareholder.

|

You should first determine whether you are a registered or non-registered holder of our common shares. Most of our shareholders are non-registered holders.

| · | You are a registered shareholder if your name appears directly on your share certificates, or if you hold your common shares in book-entry form through the direct registration system (DRS) on the records of our transfer agent, Computershare Trust Company of Canada. |

| · | You are a non-registered shareholder if you own shares indirectly and the shares are registered in the name of an intermediary. For example, you are a non-registered shareholder if: |

| o | your common shares are held in the name of a bank, trust company, securities broker, trustee or custodian; or |

| o | you hold Depositary Interests representing our common shares which are held in the name of Computershare Company Nominees Limited as nominee and custodian. |

Non-registered shareholders are sometimes referred to as “beneficial owners”.

Voting by proxy

If it is not convenient for you to attend the meeting, you may vote by proxy on the matters to be considered at the meeting. A proxy is a document that authorizes someone else to attend the meeting and cast votes for you.

Non-registered shareholders

If you are a non-registered shareholder who receives a proxy form or voting instruction form (VIF), you should follow your intermediary’s instruction for completing the form. Holders of Depositary Interests will receive a voting form of instruction or direction from Computershare Investor Services PLC.

Registered shareholders

| · | You may authorize our directors who are named on the enclosed proxy form to vote your shares as your proxyholder. You may give voting instructions by mail, the Internet or telephone. Please refer to your proxy form for instructions. |

| · | You may appoint another person to attend the meeting on your behalf and vote your shares as your proxyholder. If you choose this option, you can appoint your proxy by mail or through the Internet. If you mail the proxy form, you must print that person’s name in the blank space provided on the back of the enclosed proxy form and you should indicate how you want your shares voted. Sign, date and return the proxy form in the envelope provided. If you vote through the Internet, you may also appoint another person to be your proxyholder. You may choose anyone to be your proxyholder; the person does not have to be another shareholder. You may be able to appoint more than one proxyholder, provided that each proxyholder is entitled to exercise the rights attaching to different shares held by you. If you do appoint more than one proxyholder, you must do so by mail, and please enter the number of shares next to the proxyholder’s name that he or she is entitled to vote. The person you appoint must attend the meeting and vote on your behalf in order for your votes to be counted. Proxyholders should register with representatives of Computershare Trust Company of Canada when they arrive at the meeting. |

Thomson Reuters Management Proxy Circular

4

Voting in person

Non-registered shareholders

You should do one of the following if you plan to attend the meeting:

| · | If you have received a proxy form from your intermediary, insert your own name in the blank space provided on the proxy form to appoint yourself as proxyholder. If the intermediary has not signed the proxy form, you must sign and date it. Follow your intermediary’s instructions for returning the proxy form; or |

| · | If you have received a VIF from your intermediary, follow your intermediary’s instructions for completing the form. |

Registered shareholders

You do not need to do anything except attend the meeting. Do not complete or return your proxy form, as your vote will be taken at the meeting. You should register with representatives of Computershare Trust Company of Canada when you arrive at the meeting. If you wish to vote common shares registered in the name of a legal entity, that entity must submit a properly executed proxy form to Computershare Trust Company of Canada by the proxy cut-off time which appoints you to vote the common shares on its behalf.

Can I vote my shares by filling out and returning the notice?

No. The notice sets forth the items to be voted on at the meeting, but you cannot vote by marking the notice and returning it. The notice provides instructions on how to vote.

What’s the deadline for receiving my proxy or voting instructions?

If you are a registered shareholder, your proxy or voting instructions must be received by 5:00 p.m. (Eastern Daylight Time) on Tuesday, May 20, 2014.

Non-registered shareholders may be subject to earlier deadlines as specified in their proxy or voting instructions.

If the meeting is adjourned or postponed, the proxy cut-off deadline will be no later than 48 hours (excluding Saturdays, Sundays and holidays) before any adjourned or postponed meeting.

How will my shares be voted if I appoint a proxyholder?

Your proxyholder must vote your shares on each matter according to your instructions if you have properly completed and returned a proxy form. If you have not specified how to vote on a particular matter, then your proxyholder can vote your shares as he or she sees fit. If you have appointed our directors named on the enclosed proxy form as your proxyholder, and you have not specified how you want your shares to be voted, your shares will be voted FOR each of the items of business described in this circular.

What happens if any amendments are properly made to the items of business to be considered or if other matters are properly brought before the meeting?

Your proxyholder will have discretionary authority to vote your shares as he or she sees fit. As of the date of this circular, management knows of no such amendment, variation or other matter expected to come before the meeting.

If I change my mind, how do I revoke my proxy or voting instructions?

Non-registered shareholders

You may revoke your proxy or voting instructions by sending written notice to your intermediary, so long as the intermediary receives your notice at least seven days before the meeting (or as otherwise instructed by your intermediary). This gives your intermediary time to submit the revocation to Computershare Trust Company of Canada. If your revocation is not received in time, your intermediary is not required to act on it.

Registered shareholders

You may revoke your proxy or voting instructions in any of the following ways:

| · | By completing and signing a proxy form with a later date than the proxy form you previously returned, and delivering it to Computershare Trust Company of Canada at any time before 5:00 p.m. (Eastern Daylight Time) on Tuesday, May 20, 2014. If the meeting is adjourned or postponed, the deadline will be no later than 48 hours before any adjourned or postponed meeting; |

Thomson Reuters Management Proxy Circular

5

| · | By completing a written statement revoking your instructions, which is signed by you or your attorney authorized in writing, and delivering it: |

| o | To the offices of Computershare Trust Company of Canada at any time before 5:00 p.m. (Eastern Daylight Time) on Wednesday, May 21, 2014. If the meeting is adjourned or postponed, the deadline will be no later than 48 hours before any adjourned or postponed meeting; or |

| o | To the Chair of the meeting before the meeting starts; or |

| o | In any other manner permitted by law. |

Who is soliciting my proxy and distributing proxy-related materials?

Thomson Reuters management and directors may solicit your proxy for use at the meeting and any adjourned or postponed meeting. Our management and directors may solicit proxies by mail and in person. We are paying all costs of solicitation. We are not sending proxy-related materials directly to non-objecting beneficial owners and we plan to have such materials distributed by intermediaries. We are paying for intermediaries to send proxy-related materials to both non-objecting beneficial owners and objecting beneficial owners.

Is my vote confidential?

Yes. Our registrar, Computershare Trust Company of Canada, independently counts and tabulates the proxies to preserve the confidentiality of individual shareholder votes. Proxies are referred to us only in cases where a shareholder clearly intends to communicate with management, in the event of questions as to the validity of a proxy or where it is necessary to do so to meet applicable legal requirements.

|

Voting results

Following the meeting, we will post the voting results in the “Investor Relations” section of our website, www.thomsonreuters.com. We will also file a copy of the results with the Canadian securities regulatory authorities at www.sedar.com and the U.S. Securities and Exchange Commission at www.sec.gov. For more information, see the “Additional Information” section of this circular.

|

ANNUAL AND QUARTERLY FINANCIAL STATEMENTS AND RELATED MD&A

Our annual and quarterly reports and earnings releases are available in the “Investor Relations” section of our website, www.thomsonreuters.com. Please also see the “Electronic Delivery of Shareholder Communications” section below for information about electronic delivery of these reports and other shareholder communications.

NOTICE-AND-ACCESS

Why did I receive a notice in the mail regarding the website availability of this circular and proxy materials?

We are using the “notice-and-access” system for the delivery of our proxy materials through our website, similar to last year’s meeting. Shareholders who receive a notice have the ability to access the proxy materials on our website and to request a paper copy of the proxy materials. Instructions on how to access the proxy materials through our website or to request a paper copy may be found in the notice.

Electronic delivery reduces the cost and environmental impact of producing and distributing paper copies of documents in very large quantities. It also provides shareholders with faster access to information about Thomson Reuters.

Why didn’t I receive a printed notice in the mail about the website availability of the proxy materials?

Shareholders who previously signed up for electronic delivery of our proxy materials will continue to receive them by e-mail and will not receive a printed notice in the mail.

Thomson Reuters Management Proxy Circular

6

How do I vote under the “notice-and-access” system?

The voting process is the same as described in the “Voting Information” section of this circular. You have two choices – you can vote by proxy, or you can attend the meeting and vote in person.

ELECTRONIC DELIVERY OF SHAREHOLDER COMMUNICATIONS

Does Thomson Reuters provide electronic delivery of shareholder communications?

Yes. Electronic delivery is a voluntary program for our shareholders. Under this program, an e-mail notification (with links to the documents posted on our website) is sent to you.

Electronic delivery reduces the cost and environmental impact of producing and distributing paper copies of documents in very large quantities. It also provides shareholders with faster access to information about Thomson Reuters.

How can I enroll for electronic delivery of shareholder communications?

For most non-registered shareholders (other than holders of our Depositary Interests), please go to www.investordelivery.com for more instructions and to register. You will need your Enrollment Number/Control Number. You can find this number on your voting instruction form/proxy form.

If you are a registered shareholder, please go to www.computershare.com/eDelivery and click on “eDelivery Signup”. You will need information from your proxy form to register.

PRINCIPAL SHAREHOLDER AND SHARE CAPITAL

As of March 25, 2014, Woodbridge beneficially owned 455,967,692 of our common shares, or approximately 56% of our outstanding common shares. Woodbridge is the principal and controlling shareholder of Thomson Reuters.

Woodbridge, a private company, is the primary investment vehicle for members of the family of the late Roy H. Thomson, the first Lord Thomson of Fleet. Woodbridge is a professionally managed company that, in addition to its controlling interest in Thomson Reuters, has other substantial investments.

Prior to his passing in 2006, Kenneth R. Thomson controlled our company through Woodbridge. He did so by holding shares of a holding company of Woodbridge, Thomson Investments Limited. Under his estate arrangements, the 2003 TIL Settlement, a trust of which the trust company subsidiary of a Canadian chartered bank is trustee and members of the family of the late first Lord Thomson of Fleet are beneficiaries, holds those holding company shares. Kenneth R. Thomson established these arrangements to provide for long-term stability of the business of Woodbridge. The equity of Woodbridge continues to be owned by members of successive generations of the family of the first Lord Thomson of Fleet.

Under the estate arrangements of Kenneth R. Thomson, the directors and officers of Woodbridge are responsible for its business and operations. In certain limited circumstances, including very substantial dispositions of our company’s common shares by Woodbridge, the estate arrangements provide for approval of the trustee to be obtained.

Note 30 to our 2013 annual consolidated financial statements provides information on certain transactions that we entered into with Woodbridge in 2013 and 2012.

To our knowledge, no other person beneficially owns, directly or indirectly, 10% or more of our common shares.

Thomson Reuters Management Proxy Circular

7

ABOUT OUR DIRECTORS

This section includes the following information:

| · | Profiles for each director nominee; |

| · | Compensation that we paid to our directors in 2013; and |

| · | Our corporate governance structure and practices. |

|

HIGHLIGHTS

· A majority of our directors are independent;

· The roles and responsibilities of the Chairman and the CEO are separate; and

· We are proposing to elect three new directors at the meeting.

|

All of the nominees are currently directors of our company who were elected at last year’s annual meeting of shareholders, except for Sheila Bair, Michael Daniels and P. Thomas Jenkins. Lawton Fitt, Sir Deryck Maughan and John Thompson are not standing for re-election. Ms. Fitt has been a director of our company since 2008 and previously joined the Reuters board in 2004. Sir Deryck Maughan has been a director of our company since 2008 and previously joined the Reuters board in 2005. Mr. Thompson has been a director of our company since 2003. We thank Ms. Fitt, Sir Deryck and Mr. Thompson for their contributions to Thomson Reuters. Ms. Fitt, Sir Deryck and Mr. Thompson will be in attendance at this year’s meeting.

The board unanimously recommends that you vote FOR the election of the following 13 nominees to the Thomson Reuters board of directors: David Thomson, James C. Smith, Sheila C. Bair, Manvinder S. Banga, David W. Binet, Mary Cirillo, Michael E. Daniels, Steven A. Denning, P. Thomas Jenkins, Ken Olisa, OBE, Vance K. Opperman, Peter J. Thomson and Wulf von Schimmelmann.

Voting

You will be asked to vote for each director on an individual basis.

Management does not believe that any of the nominees will be unable to serve as a director but, if this should occur for any reason prior to the meeting, the persons named in the enclosed proxy form may vote for another nominee at their discretion.

Majority voting policy

We have a majority voting policy that applies to the election of directors at the annual meeting of shareholders. This means that if a director receives more “withhold” votes than “for” votes at the meeting, then the director will immediately tender his or her resignation to the Chairman. This would be effective if accepted by the board. The Corporate Governance Committee will consider a director’s offer to resign and make a recommendation to the board as to whether to accept it. The board will accept resignations, except in exceptional circumstances. The board will have 90 days from the annual meeting to make and publicly disclose its decision either to accept or reject the resignation (including reasons for rejecting the resignation, if applicable).

Director qualifications

We believe that all of the director nominees possess character, integrity, judgment, business experience, a record of achievement and other skills and talents which enhance the board and the overall management of the business and affairs of Thomson Reuters. Each director nominee has an understanding of our company’s principal operational and financial objectives, plans and strategies, financial position and performance and the performance of Thomson Reuters relative to our principal competitors. The Corporate Governance Committee considered these qualifications in determining to recommend the director nominees for election. Additional information is provided in the individual director profiles below and in the “Corporate Governance – Corporate Governance Committee” section of this circular.

Independence

A majority of the board is independent. Under the corporate governance guidelines adopted by the board, a director is not considered independent unless the board affirmatively determines that the director has no “material relationship” with Thomson Reuters. In determining the independence of directors, the board considers all relevant facts and circumstances. In March 2014, the board conducted its annual assessment of the independence of each of its current members and determined that 9 of the 13 directors (69%) serving on the board are independent. The board also determined that if the three new director nominees are elected, then 9 of the 13 directors (69%) proposed to be elected at the meeting will be independent. In determining independence, the board examined and relied on the applicable definitions of “independent” in the NYSE listing standards and Canadian Securities Administrators’ National Instrument 58-101. The board also reviewed the results of questionnaires completed by current directors and new director nominees.

Thomson Reuters Management Proxy Circular

8

|

|

Director Independence

|

|||

|

Name of Director

|

Management

|

Independent

|

Not Independent

|

Reason for Non-Independence

|

|

Current directors

|

|

|

|

|

|

David Thomson

|

|

|

P

|

A Chairman of Woodbridge, the principal shareholder of Thomson Reuters

|

|

James C. Smith

|

P

|

|

P

|

President & Chief Executive Officer of Thomson Reuters

|

|

Manvinder S. Banga

|

|

P

|

|

|

|

David W. Binet

|

|

|

P

|

President of Woodbridge, the principal shareholder of Thomson Reuters

|

|

Mary Cirillo

|

|

P

|

|

|

|

Steven A. Denning

|

|

P

|

|

|

|

Lawton W. Fitt*

|

|

P

|

|

|

|

Sir Deryck Maughan*

|

|

P

|

|

|

|

Ken Olisa, OBE

|

|

P

|

|

|

|

Vance K. Opperman

|

|

P

|

|

|

|

John M. Thompson*

|

|

P

|

|

|

|

Peter J. Thomson

|

|

|

P

|

A Chairman of Woodbridge, the principal shareholder of Thomson Reuters

|

|

Wulf von Schimmelmann

|

|

P

|

|

|

|

Total

|

1

|

9

|

4

|

|

|

|

|

|

|

|

|

New director nominees

|

|

|

|

|

|

Sheila C. Bair

|

|

P

|

|

|

|

Michaels E. Daniels

|

|

P

|

|

|

|

P. Thomas Jenkins

|

|

P

|

|

|

|

Total - directors proposed to be elected at the meeting

|

1

|

9

|

4

|

|

* Not standing for re-election at the meeting.

None of Messrs. D. Thomson, Binet or P. Thomson is a member of Thomson Reuters executive management team. With its substantial equity investment in Thomson Reuters, Woodbridge considers that its interests as a shareholder are aligned with those of all other shareholders.

In determining the independence of directors, the board also considers that in the normal course of business, we provide services to, and receive services from, companies with which some of the independent directors are affiliated. Based on the specific facts and circumstances, the board determined in March 2014 that these relationships were immaterial.

Thomson Reuters Management Proxy Circular

9

Nominee Information

The following provides information regarding the 13 director nominees who are proposed to be elected at the meeting.

In the director nominee profiles on the following pages, “securities held” by a director nominee includes common shares over which a director exercised control or direction, and the number of restricted share units (RSUs), deferred share units (DSUs) and options held by, or credited to, each individual as of March 25, 2014. Information regarding common shares beneficially owned does not include shares that may be obtained through the exercise or vesting of options, RSUs or DSUs. Each director nominee provided us with information about how many common shares he or she beneficially owns. The market value of shares beneficially owned is based on the closing price of our common shares on the New York Stock Exchange (NYSE) on March 25, 2014, which was $34.23. The market value of DSUs is also based on the closing price of our common shares on the NYSE on that date. We have also included information about each director nominee’s ownership of Thomson Reuters common shares and DSUs as of March 25, 2014 as a multiple of their annual retainer. Additional information about director share ownership guidelines is provided later in this section.

|

David Thomson1

Age: 56

Toronto, Ontario, Canada

Director since 1988

Non-independent

Areas of expertise:

investment management,

retail, media/publishing

|

David Thomson is Chairman of Thomson Reuters. He is also a Chairman of Woodbridge, the Thomson family investment company, and Chairman of The Globe and Mail Inc., a Canadian media company. Mr. Thomson is an active private investor with a focus on real estate and serves on the boards of several private companies. Mr. Thomson has a MA from Cambridge University.

|

|

Board/committee membership

|

2013 attendance

|

|

Other public company board memberships

|

|

|

Board

|

8 of 8

|

100%

|

–

|

|

|

Total

|

8 of 8

|

100%

|

|

|

Securities held2

|

|

|

|

Total shares

and DSUs

|

Total market value

|

Ownership multiple

of annual

retainer2

|

||||||||||||

|

Common shares

|

RSUs

|

DSUs

|

Options

|

|||||||||||||||

|

-

|

– | 4,486 | – | 4,486 |

$153,556

|

– |

|

1

|

David Thomson and Peter Thomson, both of whom are nominees, are brothers.

|

|

2

|

David Thomson and Peter Thomson are substantial shareholders of our company as members of the family that owns the equity of Woodbridge, our principal shareholder. For additional information, please see the “Principal Shareholder and Share Capital” section of this circular.

|

|

James C. Smith

Age: 54

Stamford, Connecticut,

United States

Director since 2012

Non-independent

Areas of expertise:

operations, international

business and media/publishing

|

James C. Smith has been President & Chief Executive Officer since January 2012. Mr. Smith was Chief Operating Officer of Thomson Reuters from September 2011 to December 2011 and Chief Executive Officer of Thomson Reuters Professional division from April 2008 to September 2011. Prior to the acquisition of Reuters Group PLC (Reuters) by The Thomson Corporation (Thomson) in April 2008, he served as Chief Operating Officer of Thomson and as President and Chief Executive Officer of Thomson Learning’s Academic and Reference Group. Mr. Smith joined the Thomson Newspaper Group in 1987. He held several staff and operating positions, culminating in his role as head of operations for Thomson Newspapers in the U.S. With the sale of the Thomson Newspaper Group in 2000, he joined Thomson in 2001 as Executive Vice President. He began his career as a journalist and held several editorial and general management positions prior to joining Thomson. Mr. Smith received a BA from Marshall University.

|

|

Board/committee membership

|

2013 attendance

|

|

Other public company board memberships

|

|

|

Board

|

8 of 8

|

100%

|

–

|

|

|

Total

|

8 of 8

|

100%

|

|

|

|

Securities held

|

|

|

|

Total shares

and DSUs

|

Total market value

|

Ownership multiple

of base

salary1

|

||||||||||||

|

Common shares

|

RSUs

|

DSUs

|

Options

|

|||||||||||||||

|

216,158

|

26,951 | 155,166 | 2,239,810 | 371,324 |

$12,710,421

|

8.20x | ||||||||||||

|

1

|

Reflects Mr. Smith’s ratio under his executive ownership guidelines, which is based on a multiple of his salary.

|

Thomson Reuters Management Proxy Circular

10

|

Manvinder S. Banga

Age: 59

London, United Kingdom

Director since 2009

Independent

Areas of expertise:

international business,

finance, technology,

operations, marketing

|

Manvinder (Vindi) Banga joined Clayton, Dubilier & Rice, LLC, a private equity investment firm, as an Operating Partner based in London in June 2010. Prior to that, he held a number of senior executive positions over his 33 year career with Unilever, including President, Food, Home & Personal Care of Unilever PLC, Business Group President of Unilever’s Home and Personal Care business in Asia and Chairman and Managing Director of Hindustan Unilever Ltd. Mr. Banga is also a director of B&M Stores Ltd. Mr. Banga is a member of the Prime Minister of India’s Council on Trade & Industry. He is a graduate of the Indian Institute of Technology (IIT), Delhi, where he completed his Bachelor of Technology in Mechanical Engineering and the IIM Ahmedabad where he obtained a post graduate degree in management.

|

|

Board/committee membership

|

2013 attendance

|

|

Other public company board memberships

|

|

|

Board

|

7 of 8

|

88%

|

Marks and Spencer Group plc

|

|

|

HR

|

5 of 5

|

100%

|

||

|

Total

|

12 of 13

|

92%

|

|

|

|

Securities held

|

|

|

|

Total shares

and DSUs

|

Total market value

|

Ownership multiple

of annual

retainer

|

||||||||||||

|

Common shares

|

RSUs

|

DSUs

|

Options

|

|||||||||||||||

|

31,713

|

– | 1,342 | – | 33,055 |

$1,131,473

|

5.66x | ||||||||||||

|

David W. Binet

Age: 56

Toronto, Ontario, Canada

Director since January 2013

Non-independent

Areas of expertise:

legal, media/publishing,

investment management

|

David W. Binet is President and Chief Executive Officer and a director of Woodbridge, the Thomson family investment company. Prior to January 1, 2013, he held a number of senior positions at Woodbridge between 1999 and 2012, including Chief Operating Officer. Mr. Binet is a director of The Globe and Mail Inc., a Canadian media company and of a number of other companies in which Woodbridge is invested. Mr. Binet is also Chairman of the Thomson Reuters Foundation. Prior to joining Woodbridge in 1999, he was a partner at a major law firm. Mr. Binet has a law degree from McGill University, a BA from Queen’s University and a graduate degree in journalism from Northwestern University.

|

|

Board/committee membership

|

2013 attendance

|

|

Other public company board memberships

|

|

|

Board

|

8 of 8

|

100%

|

–

|

|

|

Corporate Governance

|

5 of 5

|

100%

|

||

|

HR

|

5 of 5

|

100%

|

||

|

Total

|

18 of 18

|

100%

|

|

|

|

Securities held

|

|

|

|

Total shares

and DSUs

|

Total market value

|

Ownership multiple

of annual

retainer

|

||||||||||||

|

Common shares

|

RSUs

|

DSUs

|

Options

|

|||||||||||||||

|

262,476

|

– | 1,679 | – | 264,155 |

$9,042,026

|

45.21x | ||||||||||||

|

Mary Cirillo

Age: 66

New York, New York,

United States

Director since 2005

Independent

Areas of expertise:

technology, finance,

operations, international business

|

Mary Cirillo is a corporate director. Ms. Cirillo was Chair and Chief Executive Officer of Opcenter, LLC, an Internet consulting firm, from 2000 to 2003. Prior to that, she was a senior banking executive at Bankers Trust and Citibank for over 20 years. Ms. Cirillo is a member of the Advisory Board of Hudson Venture Partners, L.P., a venture capital firm, and serves on the boards of several cultural and educational organizations. She has a BA from Hunter College.

|

|

Board/committee membership

|

2013 attendance

|

|

Other public company board memberships

|

|

|

Board

|

8 of 8

|

100%

|

Dealer Track Holdings Inc.

|

|

|

Corporate Governance

|

5 of 5

|

100%

|

ACE Ltd.

|

|

|

HR

|

5 of 5

|

100%

|

||

|

Total

|

18 of 18

|

100%

|

|

|

|

Securities held

|

|

|

|

Total shares

and DSUs

|

Total market value

|

Ownership multiple

of annual

retainer

|

||||||||||||

|

Common shares

|

RSUs

|

DSUs

|

Options

|

|||||||||||||||

|

15,594

|

– | 16,419 | – | 32,013 |

$1,095,805

|

4.76x | ||||||||||||

Thomson Reuters Management Proxy Circular

11

|

Steven A. Denning

Age: 65

Greenwich, Connecticut,

United States

Director since 2000

Independent

Areas of expertise:

investment management,

technology, international business

|

Steven Denning is Chairman and a Managing Director of General Atlantic LLC, a global growth private equity firm. Mr. Denning has been with General Atlantic (or its predecessor) since 1980. He serves on the boards of several cultural and educational organizations. He has a BS degree from the Georgia Institute of Technology and an MBA from the Graduate School of Business, Stanford University.

|

|

Board/committee membership

|

2013 attendance

|

|

Other public company board memberships

|

|

|

Board

|

7 of 7

|

88%

|

–

|

|

|

HR

|

5 of 5

|

100%

|

||

|

Total

|

12 of 12

|

92%

|

|

|

|

Securities held

|

|

|

|

Total shares

and DSUs

|

Total market value

|

Ownership multiple

of annual

retainer

|

||||||||||||

|

Common shares

|

RSUs

|

DSUs

|

Options

|

|||||||||||||||

|

39,455

|

– | 23,029 | – | 62,484 |

$2,138,827

|

10.69x | ||||||||||||

|

Ken Olisa, OBE

Age: 62

London, United Kingdom

Director since 2008

Independent

Areas of expertise:

technology, operations,

finance, international business

|

Ken Olisa, OBE, is Founder and Chairman of Restoration Partners, a boutique technology merchant bank advising and investing in IT companies. He joined the board of Reuters in 2004. From 1992 to 2006, Mr. Olisa was Chair and CEO of Interregnum PLC, a technology merchant bank. Prior to that, he was a senior executive for over 20 years at Wang Labs and IBM. From 1995 to 2000, Mr. Olisa was also a director of Open Text Corporation and of Eurasian Natural Resources Corporation from 2007 until 2011. He serves on the boards of several U.K. not-for-profit organizations. He has a MA from Fitzwilliam College, Cambridge.

|

|

Board/committee membership

|

2013 attendance

|

|

Other public company board memberships

|

|

|

Board

|

8 of 8

|

100%

|

–

|

|

|

Audit

|

8 of 8

|

100%

|

||

|

Total

|

16 of 16

|

100%

|

|

|

|

Securities held

|

|

|

|

Total shares

and DSUs

|

Total market value

|

Ownership multiple

of annual

retainer

|

||||||||||||

|

Common shares

|

RSUs

|

DSUs

|

Options

|

|||||||||||||||

|

4,143

|

– | 1,623 | – | 5,766 |

$197,370

|

0.99x | ||||||||||||

|

Vance K. Opperman

Age: 71

Minneapolis, Minnesota,

United States

Director since 1996

Independent

Areas of expertise:

legal, operations, finance,

media/publishing, investment management

|

Vance Opperman is Lead Independent Director of Thomson Reuters. He is also President and Chief Executive Officer of Key Investment, Inc., a private investment company involved in publishing and other activities. Previously, Mr. Opperman was President of West Publishing Company, an information provider of legal and business research which is now owned by Thomson Reuters. He serves as chairman of the board of Blue Cross and Blue Shield of Minnesota and he serves on the board of several educational and not-for-profit organizations. He has a law degree from the University of Minnesota and practiced law for many years.

|

|

Board/committee membership

|

2013 attendance

|

|

Other public company board memberships

|

|

|

Board

|

8 of 8

|

100%

|

TCF Financial Corporation

|

|

|

Audit

|

8 of 8

|

100%

|

||

|

Corporate Governance

|

4 of 4

|

100%

|

||

|

Total

|

20 of 20

|

100%

|

|

|

|

Securities held

|

|

|

|

Total shares

and DSUs

|

Total market value

|

Ownership multiple

of annual

retainer

|

||||||||||||

|

Common shares

|

RSUs

|

DSUs

|

Options

|

|||||||||||||||

|

50,000

|

– | 67,912 | – | 117,912 |

$4,036,128

|

10.62x | ||||||||||||

|

1

|

Mr. Opperman was appointed to the Corporate Governance Committee in March 2013 and as Lead Independent Director in November 2013.

|

Thomson Reuters Management Proxy Circular

12

|

Peter J. Thomson1

Age: 48

Toronto, Ontario, Canada

Director since 1995

Non-independent

Areas of expertise:

investment management,

science, technology

|

Peter J. Thomson is a Chairman of Woodbridge, the Thomson family investment company. Mr. Thomson is an active private equity investor and serves on the boards of several private companies. He has a BA from the University of Western Ontario.

|

|

Board/committee membership

|

2013 attendance

|

|

Other public company board memberships

|

|

|

Board

|

8 of 8

|

88%

|

–

|

|

|

Total

|

8 of 8

|

92%

|

|

|

|

Securities held2

|

|

|

|

Total shares

and DSUs

|

Total market value

|

Ownership multiple

of annual

retainer2

|

||||||||||||

|

Common shares

|

RSUs

|

DSUs

|

Options

|

|||||||||||||||

|

–

|

– | 3,327 | – | 3,327 |

$113,883

|

– |

|

1

|

David Thomson and Peter Thomson, both of whom are nominees, are brothers.

|

|

2

|

David Thomson and Peter Thomson are substantial shareholders of our company as members of the family that owns the equity of Woodbridge, our principal shareholder. For additional information, please see the “Principal Shareholder and Share Capital” section of this circular.

|

|

Wulf von Schimmelmann

Age: 67

Munich, Germany

Director since 2011

Independent

Areas of expertise:

finance, operations,

international business

|

Wulf von Schimmelmann was Chief Executive Officer of Deutsche Postbank AG from 1999 to 2007, where he transformed the organization from a check processing division of Deutsche Post to one of Germany's leading retail banks. Since 2008, he has served as Chairman of the Supervisory Board of Deutsche Post DHL AG, an international leader in mail and logistics services. He also serves as a member of the Supervisory Board of Maxingvest AG and a member of the Supervisory Board of Allianz Deutschland AG. Prior to his lengthy career in banking, he was a partner at McKinsey & Co., working in Switzerland, the US and Germany. Mr. von Schimmelmann was also previously a member of the Supervisory Board of Deutsche Teleknow and Chair of BAWAG P.S.K. Mr. von Schimmelmann received a degree in economic sciences and his Ph.D. in economics from the University of Zurich.

|

|

Board/committee membership

|

2013 attendance

|

|

Other public company board memberships

|

|

|

Board

|

8 of 8

|

100%

|

Accenture plc

|

|

|

Audit

|

7 of 8

|

88%

|

Deutsche Post DHL AG

|

|

|

Total

|

15 of 16

|

94%

|

Western Union Company

|

|

|

Allianz Deutschland AG

|

|

Securities held

|

|

|

|

Total shares

and DSUs

|

Total market value

|

Ownership multiple

of annual

retainer

|

||||||||||||

|

Common shares

|

RSUs

|

DSUs

|

Options

|

|||||||||||||||

|

–

|

– | 14,118 | – | 14,118 |

$483,259

|

2.42x | ||||||||||||

The three individuals below are proposed to be elected to the board at the meeting and do not currently serve as directors of our company. None of these individuals own Thomson Reuters securities at this time.

|

Sheila C. Bair

Age: 59

Washington, D.C.,

United States

Independent

Areas of expertise:

international business,

finance, operations, legal

|

Sheila C. Bair is a Senior Advisor to the Pew Charitable Trusts, an independent non-profit and non-governmental global research and public policy organization. Prior to August 2011, she was the Chair of the Federal Deposit Insurance Corporation, where she served in that capacity from June 2006 to July 2011. From 2002 to 2006, she was the Dean’s Professor of Financial Regulatory Policy for the Isenberg School of Management at the University of Massachusetts-Amherst. She also served as Assistant Secretary for Financial Institutions at the U.S. Department of the Treasury from 2001 to 2002, Senior Vice President for Government Relations of the New York Stock Exchange from 1995 to 2000, Commissioner of the Commodity Futures Trading Commission from 1991 to 1995, and as counsel to Kansas Republican Senate Majority Leader Bob Dole from 1981 to 1988. Ms. Bair has a bachelor’s degree and law degree from the University of Kansas.

Ms. Bair is expected to be appointed to the Audit Committee of the board if elected.

|

|

Other public company board memberships

|

||

|

Host Hotels & Resorts, Inc.

|

|

|

|

Banco Santander, SA

|

|

|

Thomson Reuters Management Proxy Circular

13

|

Michael E. Daniels

Age: 59

Hilton Head Island,

South Carolina, United States

Independent

Areas of expertise:

international business,

finance, operations, technology

|

Michael E. Daniels is a corporate director. In March 2013, Mr. Daniels retired as Senior Vice President and Group Executive IBM Services after 36 years with the company where he directed IBM’s consulting, systems integration, application management, cloud computing and outsourcing services around the globe. Mr. Daniels also held a number of senior leadership positions in his career at IBM, including General Manager of Sales and Distribution Operations of the Americas as well as leading Global Services in the Asia Pacific region. Mr. Daniels has a bachelor’s degree in political science from Holy Cross College and is also a trustee of Holy Cross.

Mr. Daniels is expected to be appointed to the HR Committee of the board if elected.

|

|

Other public company board memberships

|

|

|

|

SS&C Technologies Holdings, Inc.

|

|

|

|

Tyco International Ltd.

|

|

|

|

P. Thomas Jenkins

Age: 54

Canmore, Alberta, Canada

Independent

Areas of expertise:

technology, finance, operations,

international business

|

Paul Thomas Jenkins is Chairman of OpenText Corporation, a multinational enterprise software firm. He has served as a director of OpenText since 1994 and as its Chairman since 1998. From 1994 to 2005, Mr. Jenkins was President and Chief Executive Officer, and then from 2005 to 2013, Executive Chairman and Chief Strategy Officer of OpenText. Prior to that, Mr. Jenkins was employed in technical and managerial capacities at a variety of technology companies dating back to the late 1970s. Mr. Jenkins has an MBA from Schulich School of Business at York University, an M.A.Sc. in electrical engineering from the University of Toronto and a B.Eng. & Mgt. in Engineering Physics and Commerce from McMaster University.

Mr. Jenkins is expected to be appointed to the Audit Committee of the board if elected.

|

|

Other public company board memberships

|

||

|

OpenText Corporation

|

|

|

|

|

||

Thomson Reuters Management Proxy Circular

14

Director Compensation

Our Corporate Governance Committee is responsible for reviewing the adequacy and form of directors’ compensation on an annual basis. In 2013, the Corporate Governance Committee recommended, and the board subsequently approved, an increase in certain elements of director compensation. The factors that led the Corporate Governance Committee to recommend this increase included:

| · | the size, scope and complexity of our organization; |

| · | the time commitment required of directors to serve on the board and one or more board committees, as applicable (including board/committee meetings and travel to and from board/committee meetings and site visits); |

| · | the experience and skills of our directors; |

| · | compensation levels for boards of directors of other large comparable U.S. and Canada-based multinational public companies in order for amounts paid to our directors to be competitive to attract new candidates and to retain existing directors; |

| · | an increasing trend in U.S. and Canadian public company director compensation programs to require a combination of mandatory and optional equity components to further align directors’ interests with shareholders; and |

| · | our desire to have a flat fee structure. |

In benchmarking director compensation, the Corporate Governance Committee evaluated publicly available data related to director compensation paid by U.S. public companies in the S&P 500 index and Canadian public companies in the S&P/TSX 60 index, as our company’s board is primarily comprised of directors from the U.S. and Canada. U.S. board compensation is generally higher than Canadian companies.

Retainers / Mandatory Equity Component

In 2013, director compensation increased for the first time since the formation of Thomson Reuters in 2008. Effective as of May 1, 2013, annual non-management director retainers were increased from $150,000 to $200,000. Prior to May 2013, directors could select cash, common shares or DSUs (or a mix thereof) for their retainers and there was no mandatory equity component. In connection with the retainer increases, a mandatory equity component was added and $50,000 of annual director retainers is now payable in DSUs. Our non-management directors may elect to receive the remaining $150,000 of their $200,000 annual retainer in the form of DSUs, common shares or cash (or a mix thereof).

DSUs

DSUs granted to directors are bookkeeping entries credited to an account maintained for each eligible director. Each DSU has the same value as one common share, though DSUs do not have voting rights. If a director elects to receive DSUs, units representing the value of common shares are credited to the director’s account. DSUs accumulate additional units based on notional equivalents of dividends paid on our common shares. DSUs are only settled (in the form of common shares or cash, at the election of the director) following termination of the director’s board service.

Common Shares

If a director elects to receive common shares, the amount (net of withholding taxes) is used to buy shares in the open market. Payment is made in our common shares or cash (net of withholding taxes), based on the market value of the common shares on the date prior to the payment date.

Committee Fees

Committee chair fees were also increased as of May 2013, as reflected in the table below. Prior to May 2013, committee chairs could also select the type of payment for their committee retainers between cash, common shares and DSUs (or a mix thereof). Effective in May 2013, a mandatory equity component was added for committee chair retainers, which are now payable entirely in DSUs.

Lead Independent Director Retainer

In March 2013, the board created a new Lead Independent Director position. The Lead Independent Director annual retainer is $150,000 and is inclusive of the fee for chairing one committee. The Lead Independent Director also receives the same annual $200,000 retainer paid to non-management directors. Additional information about the Lead Independent Director is provided later in this section of the circular.

Thomson Reuters Management Proxy Circular

15

Components of Director Compensation

The table below sets forth the annual retainers that were payable to our directors in 2013. Directors do not receive separate attendance or meeting fees. Chairs of the Audit Committee and HR Committee currently receive additional fees given their increased responsibilities and workloads.

|

|

January 2013 –

April 2013

|

May 2013 -

December 2013

|

|

|

($)

|

($)

|

|

Non-management directors

|

150,000

|

200,000

($50,000 of which is required to be paid in DSUs)

|

|

Committee chairs

|

|

|

|

Audit

|

20,000

|

30,000

(payable in DSUs)

|

|

Corporate Governance

|

10,000

|

Reflected in Lead Independent Director fee

|

|

HR

|

20,000

|

30,000

(payable in DSUs)

|

|

Chairman of the Board

|

600,000

|

600,000

|

|

Lead Independent Director

|

150,000

(payable in DSUs)

|

150,000

(payable in DSUs)

|

Our board had a Deputy Chairman position through May 2013. The annual retainer for that position was $300,000 in 2013.

Total Director Compensation

The table below reflects compensation earned by our directors in 2013. The fee amounts reflect cash compensation earned. The share-based awards include DSUs and common shares received in lieu of cash. Approximately 57% of 2013 director compensation was paid in DSUs and common shares.

As President and CEO of Thomson Reuters, Mr. Smith does not receive compensation for his service as a director. Information regarding Mr. Smith’s 2013 compensation is set forth in the “Executive Compensation” section of this circular.

|

|

Fees earned ($) |

|

||||||||||||||||||

|

Director

|

Cash

|

DSUs

|

Common Shares

|

All Other

Compensation ($)

|

Total ($)

|

|||||||||||||||

|

David Thomson

|

600,000

|

-

|

-

|

-

|

600,000

|

|||||||||||||||

|

Manvinder S. Banga

|

-

|

33,333

|

150,000

|

-

|

183,333

|

|||||||||||||||

|

W. Geoffrey Beattie(1)

|

105,205

|

-

|

-

|

-

|

105,205

|

|||||||||||||||

|

David W. Binet(2)

|

150,000

|

43,333

|

-

|

-

|

193,333

|

|||||||||||||||

|

Mary Cirillo(2)(3)

|

-

|

43,333

|

176,667

|

-

|

220,000

|

|||||||||||||||

|

Steven A. Denning

|

-

|

33,333

|

150,000

|

-

|

183,333

|

|||||||||||||||

|

Lawton W. Fitt(2)(4)

|

160,000

|

128,000

|

-

|

-

|

288,000

|

|||||||||||||||

|

Roger L. Martin(5)

|

-

|

52,603

|

-

|

-

|

52,603

|

|||||||||||||||

|

Sir Deryck Maughan(2)

|

-

|

193,333

|

-

|

-

|

193,333

|

|||||||||||||||

|

Ken Olisa, OBE

|

120,000

|

33,333

|

30,000

|

-

|

183,333

|

|||||||||||||||

|

Vance K. Opperman(2) (6)

|

-

|

236,005

|

-

|

-

|

236,005

|

|||||||||||||||

|

John M. Thompson(2)

|

-

|

118,333

|

75,000

|

-

|

193,333

|

|||||||||||||||

|

Peter J. Thomson

|

150,000

|

33,333

|

-

|

-

|

183,333

|

|||||||||||||||

|

Wulf von Schimmelmann

|

-

|

183,333

|

-

|

-

|

183,333

|

|||||||||||||||

|

Total

|

1,285,205

|

1,131,605

|

581,667

|

-

|

2,998,477

|

|||||||||||||||

(1) Mr. Beattie’s compensation reflects his service as a director and a Deputy Chairman from January 1, 2013 through our last annual meeting of shareholders held on May 8, 2013, when he retired from the board.

(2) Received an additional $10,000 in DSUs for serving on an ad hoc committee of the board.

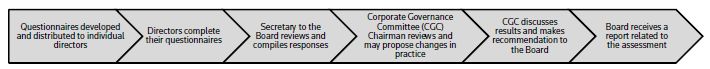

(3) Ms. Cirillo’s compensation includes fees for serving as Chair of the HR Committee.