| · | Overview – a brief discussion of our business; |

| · | Results of Operations – a comparison of our current and prior period results; |

| · | Liquidity and Capital Resources – a discussion of our cash flow and debt; |

| · | Outlook – our current financial outlook for 2013; |

| · | Related Party Transactions – a discussion of transactions with our principal and controlling shareholder, The Woodbridge Company Limited (Woodbridge), and others; |

| · | Subsequent Events – a discussion of material events occurring after June 30, 2013 and through the date of this management’s discussion and analysis; |

| · | Changes in Accounting Policies – a discussion of changes in our accounting policies and recent accounting pronouncements; |

| · | Critical Accounting Estimates and Judgments – a discussion of critical estimates and judgments made by our management in applying accounting policies; |

| · | Additional Information – other required disclosures; and |

| · | Appendices – supplemental information and discussion. |

| · | General economic conditions and market trends and their anticipated effects on our business; |

| · | Our 2013 financial outlook; |

| · | Investments that we have made and plan to make and the timing for businesses that we expect to sell; and |

| · | Our liquidity and capital resources available to us to fund our ongoing operations, investments and returns to shareholders. |

|

KEY HIGHLIGHTS

|

||

|

|

|

|

|

Our second quarter performance was consistent with full-year expectations. We are pleased with the progress that we continue to make despite challenging market conditions, particularly in the banking and legal sectors.

|

||

|

|

|

|

|

In the second quarter of 2013, revenues from ongoing businesses increased 2% before currency(1). This performance reflected 6% combined growth from our Legal, Tax & Accounting and Intellectual Property & Science businesses, which was partially offset by a 1% decline in Financial & Risk’s revenues. The 2% increase in revenues from ongoing businesses before currency reflected a 3% contribution from acquisitions, which was offset by a 1% decline in existing businesses.

|

||

|

|

|

|

|

|

·

|

Financial & Risk’s revenues decreased 1%. As we have previously stated, we do not believe that Financial & Risk will achieve revenue improvement in 2013 compared to 2012, due to the subscription nature of its business and the lag effect of negative net sales from 2012. The revenue decrease reflected a 2% contribution from acquisitions which was offset by a 3% decline in existing businesses. Although Financial & Risk’s overall net sales remained negative in the second quarter, the trend continues to improve driven by an increase in Eikon users. The business also continued to make tangible progress to reduce its cost structure.

|

|

|

|

|

|

|

·

|

Legal’s revenues rose 5% primarily driven by a 4% contribution from acquisitions, notably Practical Law Company (PLC). Revenues from existing businesses grew 1%, as 2% subscription revenue growth was offset by a 7% decline in print revenues.

|

|

|

|

|

|

|

·

|

Tax & Accounting revenues increased 7%, of which 3% was from existing businesses. The increase was driven by continued growth in subscription revenues and strong performance across all of Tax & Accounting’s business segments, except for Government.

|

|

|

|

|

|

|

·

|

Intellectual Property & Science revenues increased 9% due to a 10% contribution from acquisitions, while revenues from existing businesses declined 1% due to the timing of several contracts.

|

|

|

|

|

|

|

·

|

Our Global Growth & Operations (GGO) unit, which works across our businesses to combine our global capabilities, increased revenues 14%, of which 7% was from existing businesses. On an annualized basis, GGO comprises about $1 billion of our company’s total revenues.

|

|

|

|

|

|

Despite a 1% revenue decline from existing businesses, adjusted EBITDA(1) increased 3% and the related margin was up 40bp to 27.6%, reflecting our ongoing cost reduction efforts. Underlying operating profit(1) increased slightly, but the related margin declined 10bp due to higher depreciation and amortization expense. Adjusted EPS(1) was unchanged at $0.48 per share, as higher depreciation and amortization and interest expense were offset by an improvement in adjusted EBITDA and a lower tax rate.

|

||

|

|

|

|

|

On July 30, 2013, we reaffirmed our 2013 full-year business outlook that we originally communicated in February. For 2013, we continue to expect low single digit revenue growth(1), underlying operating profit margin(1) between 16.5% and 17.5%, adjusted EBITDA margin(1) between 26% and 27% and free cash flow(1) between $1.7 billion and $1.8 billion. Additional information is provided in the “Outlook” section of this management’s discussion and analysis.

|

||

|

|

|

|

|

We remain focused on achieving our key priorities for 2013, which are:

|

||

|

|

|

|

|

|

·

|

Driving for growth organically as well as through tactical acquisitions, including by shifting more of our revenue mix and investments to higher growth businesses and geographic areas;

|

|

|

|

|

|

|

·

|

Focusing on streamlining our costs and increasing free cash flow through improvements to our infrastructure; and

|

|

|

|

|

|

|

·

|

Simplifying our systems and processes across the organization.

|

|

|

|

|

|

(1)

|

Refer to Appendix A for additional information on non-IFRS financial measures.

|

|

| · | Revenues from ongoing businesses; |

| · | Revenues at constant currency (before currency or revenues excluding the effects of foreign currency); |

| · | Underlying operating profit and the related margin; |

| · | Adjusted EBITDA and the related margin; |

| · | Adjusted EBITDA less capital expenditures and the related margin; |

| · | Adjusted earnings and adjusted earnings per share; |

| · | Net debt; |

| · | Free cash flow; and |

| · | Free cash flow from ongoing businesses. |

| · | Corporate & Other includes expenses for corporate functions, certain share-based compensation costs and the Reuters News business, which is comprised of the Reuters News Agency and consumer publishing. |

| · | Other Businesses is an aggregation of businesses that have been or are expected to be exited through sale or closure that did not qualify for discontinued operations classification. The results of Other Businesses are not comparable from period to period as the composition of businesses changes due to the timing of completed divestitures. |

|

|

Three months ended

June 30,

|

Six months ended

June 30,

|

||||||||||||||||||||||

|

(millions of U.S. dollars, except per share amounts)

|

2013

|

2012

|

Change

|

2013

|

2012

|

Change

|

||||||||||||||||||

|

IFRS Financial Measures

|

||||||||||||||||||||||||

|

Revenues

|

3,163

|

3,272

|

(3

|

%)

|

6,338

|

6,587

|

(4

|

%)

|

||||||||||||||||

|

Operating profit

|

597

|

1,297

|

(54

|

%)

|

987

|

1,661

|

(41

|

%)

|

||||||||||||||||

|

Diluted earnings per share

|

$

|

0.30

|

$

|

1.08

|

(72

|

%)

|

$

|

0.26

|

$

|

1.44

|

(82

|

%)

|

||||||||||||

|

|

||||||||||||||||||||||||

|

Non-IFRS Financial Measures

|

||||||||||||||||||||||||

|

Revenues from ongoing businesses

|

3,108

|

3,074

|

1

|

%

|

6,205

|

6,146

|

1

|

%

|

||||||||||||||||

|

Adjusted EBITDA

|

858

|

836

|

3

|

%

|

1,615

|

1,608

|

-

|

|||||||||||||||||

|

Adjusted EBITDA margin

|

27.6

|

%

|

27.2

|

%

|

40

|

bp

|

26.0

|

%

|

26.2

|

%

|

(20

|

)bp

|

||||||||||||

|

Adjusted EBITDA less capital expenditures

|

670

|

635

|

6

|

%

|

1,077

|

1,135

|

(5

|

%)

|

||||||||||||||||

|

Adjusted EBITDA less capital expenditures margin

|

21.6

|

%

|

20.7

|

%

|

90

|

bp

|

17.4

|

%

|

18.5

|

%

|

(110

|

)bp

|

||||||||||||

|

Underlying operating profit

|

569

|

567

|

-

|

1,031

|

1,064

|

(3

|

%)

|

|||||||||||||||||

|

Underlying operating profit margin

|

18.3

|

%

|

18.4

|

%

|

(10

|

)bp

|

16.6

|

%

|

17.3

|

%

|

(70

|

)bp

|

||||||||||||

|

Adjusted earnings per share

|

$

|

0.48

|

$

|

0.48

|

-

|

$

|

0.86

|

$

|

0.87

|

(1

|

%)

|

|||||||||||||

|

|

Three months ended

June 30,

|

Percentage change:

|

||||||||||||||||||||||||

|

(millions of U.S. dollars)

|

2013

|

2012

|

Existing

businesses

|

Acquired

businesses

|

Constant

currency

|

Foreign

currency

|

Total

|

|||||||||||||||||||

|

Revenues from ongoing businesses

|

3,108

|

3,074

|

(1%)

|

|

3%

|

|

2%

|

|

(1%)

|

|

1%

|

|

||||||||||||||

|

Other Businesses

|

55

|

198

|

n/m

|

|

n/m

|

|

n/m

|

|

n/m

|

|

n/m

|

|

||||||||||||||

|

Revenues

|

3,163

|

3,272

|

n/m

|

|

n/m

|

|

n/m

|

|

n/m

|

|

(3%)

|

|

||||||||||||||

|

|

Six months ended

June 30,

|

Percentage change:

|

||||||||||||||||||||||||

|

(millions of U.S. dollars)

|

2013

|

2012

|

Existing

businesses

|

Acquired

businesses

|

Constant

currency

|

Foreign

currency

|

Total

|

|||||||||||||||||||

|

Revenues from ongoing businesses

|

6,205

|

6,146

|

(1%)

|

|

3%

|

|

2%

|

|

(1%)

|

|

1%

|

|

||||||||||||||

|

Other Businesses

|

133

|

441

|

n/m

|

|

n/m

|

|

n/m

|

|

n/m

|

|

n/m

|

|

||||||||||||||

|

Revenues

|

6,338

|

6,587

|

n/m

|

|

n/m

|

|

n/m

|

|

n/m

|

|

(4%)

|

|

||||||||||||||

|

|

Three months ended

June 30,

|

Six months ended

June 30,

|

||||||||||||||||||||||

|

(millions of U.S. dollars)

|

2013

|

2012

|

Change

|

2013

|

2012

|

Change

|

||||||||||||||||||

|

Operating profit

|

597

|

1,297

|

(54

|

%)

|

987

|

1,661

|

(41

|

%)

|

||||||||||||||||

|

Adjustments to remove:

|

||||||||||||||||||||||||

|

Amortization of other identifiable intangible assets

|

157

|

149

|

317

|

301

|

||||||||||||||||||||

|

Fair value adjustments

|

(29

|

)

|

(43

|

)

|

(91

|

)

|

(13

|

)

|

||||||||||||||||

|

Other operating gains, net

|

(136

|

)

|

(798

|

)

|

(130

|

)

|

(820

|

)

|

||||||||||||||||

|

Operating profit from Other Businesses

|

(20

|

)

|

(38

|

)

|

(52

|

)

|

(65

|

)

|

||||||||||||||||

|

Underlying operating profit

|

569

|

567

|

-

|

1,031

|

1,064

|

(3

|

%)

|

|||||||||||||||||

|

Remove: depreciation and amortization of computer software (excluding Other Businesses)

|

289

|

269

|

584

|

544

|

||||||||||||||||||||

|

Adjusted EBITDA(1)

|

858

|

836

|

3

|

%

|

1,615

|

1,608

|

-

|

|||||||||||||||||

|

Remove: capital expenditures, less proceeds from disposals (excluding Other Businesses)

|

188

|

201

|

538

|

473

|

||||||||||||||||||||

|

Adjusted EBITDA less capital expenditures(1)

|

670

|

635

|

6

|

%

|

1,077

|

1,135

|

(5

|

%)

|

||||||||||||||||

|

|

||||||||||||||||||||||||

|

Underlying operating profit margin

|

18.3

|

%

|

18.4

|

%

|

(10

|

)bp

|

16.6

|

%

|

17.3

|

%

|

(70

|

)bp

|

||||||||||||

|

Adjusted EBITDA margin

|

27.6

|

%

|

27.2

|

%

|

40

|

bp

|

26.0

|

%

|

26.2

|

%

|

(20

|

)bp

|

||||||||||||

|

Adjusted EBITDA less capital expenditures margin

|

21.6

|

%

|

20.7

|

%

|

90

|

bp

|

17.4

|

%

|

18.5

|

%

|

(110

|

)bp

|

||||||||||||

| (1) | See Appendix B for a reconciliation of earnings from continuing operations to adjusted EBITDA and adjusted EBITDA less capital expenditures. |

|

|

Three months ended

June 30,

|

Six months ended

June 30,

|

||||||||||||||||||||||

|

(millions of U.S. dollars)

|

2013

|

2012

|

Change

|

2013

|

2012

|

Change

|

||||||||||||||||||

|

Operating expenses

|

2,256

|

2,351

|

(4

|

%)

|

4,580

|

4,891

|

(6

|

%)

|

||||||||||||||||

|

Adjustments to remove:

|

||||||||||||||||||||||||

|

Fair value adjustments(1)

|

29

|

43

|

91

|

13

|

||||||||||||||||||||

|

Other Businesses

|

(35

|

)

|

(156

|

)

|

(81

|

)

|

(366

|

)

|

||||||||||||||||

|

Operating expenses, excluding fair value adjustments and Other Businesses

|

2,250

|

2,238

|

1

|

%

|

4,590

|

4,538

|

1

|

%

|

||||||||||||||||

| (1) | Fair value adjustments primarily represent non-cash accounting adjustments from the revaluation of embedded foreign exchange derivatives within certain customer contracts due to fluctuations in foreign exchange rates and mark-to-market adjustments from certain share-based awards. |

|

|

Three months ended

June 30,

|

Six months ended

June 30,

|

||||||||||||||||||||||

|

(millions of U.S. dollars)

|

2013

|

2012

|

Change

|

2013

|

2012

|

Change

|

||||||||||||||||||

|

Depreciation

|

101

|

108

|

(6

|

%)

|

208

|

217

|

(4

|

%)

|

||||||||||||||||

|

Amortization of computer software

|

188

|

165

|

14

|

%

|

376

|

337

|

12

|

%

|

||||||||||||||||

|

Subtotal

|

289

|

273

|

6

|

%

|

584

|

554

|

5

|

%

|

||||||||||||||||

|

Amortization of other identifiable intangible assets

|

157

|

149

|

5

|

%

|

317

|

301

|

5

|

%

|

||||||||||||||||

| · | Depreciation and amortization of computer software on a combined basis increased in both periods reflecting investments in products such as Thomson Reuters Eikon, and amortization of assets from recently acquired businesses. |

| · | Amortization of other identifiable intangible assets increased in both periods due to amortization from newly-acquired assets which more than offset decreases from the completion of amortization for certain identifiable assets acquired in previous years. |

|

|

Three months ended

June 30,

|

Six months ended

June 30,

|

||||||||||||||

|

(millions of U.S. dollars)

|

2013

|

2012

|

2013

|

2012

|

||||||||||||

|

Other operating gains, net

|

136

|

798

|

130

|

820

|

||||||||||||

|

|

Three months ended

June 30,

|

Six months ended

June 30,

|

||||||||||||||||||||||

|

(millions of U.S. dollars)

|

2013

|

2012

|

Change

|

2013

|

2012

|

Change

|

||||||||||||||||||

|

Net interest expense

|

124

|

107

|

16

|

%

|

239

|

236

|

1

|

%

|

||||||||||||||||

|

|

Three months ended

June 30,

|

Six months ended

June 30,

|

||||||||||||||

|

(millions of U.S. dollars)

|

2013

|

2012

|

2013

|

2012

|

||||||||||||

|

Other finance (costs) income

|

(17

|

)

|

(16

|

)

|

(72

|

)

|

14

|

|||||||||

|

|

Three months ended

June 30,

|

Six months ended

June 30,

|

||||||||||||||

|

(millions of U.S. dollars)

|

2013

|

2012

|

2013

|

2012

|

||||||||||||

|

Share of post-tax earnings in equity method investments

|

9

|

12

|

19

|

15

|

||||||||||||

|

|

Three months ended

June 30,

|

Six months ended

June 30,

|

||||||||||||||

|

(millions of U.S. dollars)

|

2013

|

2012

|

2013

|

2012

|

||||||||||||

|

Tax expense

|

209

|

270

|

456

|

230

|

||||||||||||

|

(Expense) benefit

|

Three months ended

June 30,

|

Six months ended

June 30,

|

||||||||||||||

|

(millions of U.S. dollars)

|

2013

|

2012

|

2013

|

2012

|

||||||||||||

|

Discrete tax items:

|

||||||||||||||||

|

Consolidation of technology and content assets(1)

|

(161

|

)

|

-

|

(396

|

)

|

-

|

||||||||||

|

Uncertain tax positions(2)

|

-

|

80

|

2

|

84

|

||||||||||||

|

Corporate tax rates(3)

|

-

|

-

|

1

|

14

|

||||||||||||

|

Other(4)

|

10

|

3

|

21

|

11

|

||||||||||||

|

Subtotal

|

(151

|

)

|

83

|

(372

|

)

|

109

|

||||||||||

|

|

||||||||||||||||

|

Tax related to:

|

||||||||||||||||

|

Sale of businesses(5)

|

(15

|

)

|

(238

|

)

|

(23

|

)

|

(184

|

)

|

||||||||

|

Operating profit of Other Businesses

|

(5

|

)

|

(9

|

)

|

(13

|

)

|

(16

|

)

|

||||||||

|

Fair value adjustments

|

(14

|

)

|

(14

|

)

|

(23

|

)

|

(6

|

)

|

||||||||

|

Other items

|

(2

|

)

|

(2

|

)

|

1

|

(2

|

)

|

|||||||||

|

Subtotal

|

(36

|

)

|

(263

|

)

|

(58

|

)

|

(208

|

)

|

||||||||

|

Total

|

(187

|

)

|

(180

|

)

|

(430

|

)

|

(99

|

)

|

||||||||

| (1) | Relates to the consolidation of the ownership and management of our technology and content assets. |

| (2) | Relates to the reversal of tax reserves in connection with favorable developments regarding tax disputes. |

| (3) | Relates to the reduction of deferred tax liabilities due to lower corporate tax rates that were substantively enacted in certain jurisdictions outside the U.S. |

| (4) | Primarily relates to the recognition of deferred tax benefits in connection with acquisitions and disposals. |

| (5) | In 2013, primarily relates to the sale of the Corporate Services business which was comprised of the Investor Relations, Public Relations and Multimedia Solutions businesses; in 2012, primarily relates to the sale of the Healthcare business and the Trade and Risk Management business. |

|

(Expense) benefit

|

Three months ended

June 30,

|

Six months ended

June 30,

|

||||||||||||||

|

(millions of U.S. dollars)

|

2013

|

2012

|

2013

|

2012

|

||||||||||||

|

Tax expense

|

(209

|

)

|

(270

|

)

|

(456

|

)

|

(230

|

)

|

||||||||

|

Remove: Items from above impacting comparability

|

187

|

180

|

430

|

99

|

||||||||||||

|

Other adjustments:

|

||||||||||||||||

|

Interim period effective tax rate normalization

|

19

|

46

|

12

|

52

|

||||||||||||

|

Tax charge amortization(1)

|

(24

|

)

|

-

|

(32

|

)

|

-

|

||||||||||

|

Total tax expense on adjusted earnings

|

(27

|

)

|

(44

|

)

|

(46

|

)

|

(79

|

)

|

||||||||

| (1) | Relates to tax charges associated with the consolidation of the ownership and management of our technology and content assets. Both periods include a $12 million charge related to amounts payable in 2013 and amortization of the remaining cumulative tax charge of $384 million on a straight line basis over seven years, the period over which the tax is expected to be paid. |

|

|

Three months ended

June 30,

|

Six months ended

June 30,

|

||||||||||||||||||||||

|

(millions of U.S. dollars, except per share amounts)

|

2013

|

2012

|

Change

|

2013

|

2012

|

Change

|

||||||||||||||||||

|

Net earnings

|

262

|

915

|

(71

|

%)

|

245

|

1,221

|

(80

|

%)

|

||||||||||||||||

|

Diluted earnings per share

|

$

|

0.30

|

$

|

1.08

|

(72

|

%)

|

$

|

0.26

|

$

|

1.44

|

(82

|

%)

|

||||||||||||

|

|

Three months ended

June 30,

|

Six months ended

June 30,

|

||||||||||||||||||||||

|

(millions of U.S. dollars, except per share amounts and share data)

|

2013

|

2012

|

Change

|

2013

|

2012

|

Change

|

||||||||||||||||||

|

Earnings attributable to common shareholders

|

248

|

902

|

(73

|

%)

|

217

|

1,196

|

(82

|

%)

|

||||||||||||||||

|

Adjustments to remove:

|

||||||||||||||||||||||||

|

Operating profit from Other Businesses

|

(20

|

)

|

(38

|

)

|

(52

|

)

|

(65

|

)

|

||||||||||||||||

|

Fair value adjustments

|

(29

|

)

|

(43

|

)

|

(91

|

)

|

(13

|

)

|

||||||||||||||||

|

Other operating gains, net

|

(136

|

)

|

(798

|

)

|

(130

|

)

|

(820

|

)

|

||||||||||||||||

|

Other finance costs (income)

|

17

|

16

|

72

|

(14

|

)

|

|||||||||||||||||||

|

Share of post-tax earnings in equity method investments

|

(9

|

)

|

(12

|

)

|

(19

|

)

|

(15

|

)

|

||||||||||||||||

|

Tax on above items

|

36

|

263

|

58

|

208

|

||||||||||||||||||||

|

Discrete tax items(1)

|

151

|

(83

|

)

|

372

|

(109

|

)

|

||||||||||||||||||

|

Amortization of other identifiable intangible assets

|

157

|

149

|

317

|

301

|

||||||||||||||||||||

|

Discontinued operations

|

(6

|

)

|

1

|

(6

|

)

|

3

|

||||||||||||||||||

|

Interim period effective tax rate normalization

|

19

|

46

|

12

|

52

|

||||||||||||||||||||

|

Tax charge amortization(2)

|

(24

|

)

|

-

|

(32

|

)

|

-

|

||||||||||||||||||

|

Dividends declared on preference shares

|

(1

|

)

|

(1

|

)

|

(2

|

)

|

(2

|

)

|

||||||||||||||||

|

Adjusted earnings

|

403

|

402

|

-

|

716

|

722

|

(1

|

%)

|

|||||||||||||||||

|

Adjusted earnings per share (adjusted EPS)

|

$

|

0.48

|

$

|

0.48

|

-

|

$

|

0.86

|

$

|

0.87

|

(1

|

%)

|

|||||||||||||

|

Diluted weighted-average common shares (millions)

|

832.5

|

830.7

|

831.5

|

830.5

|

||||||||||||||||||||

| (1) | See the “Tax expense” section above. |

| (2) | Reflects amortization of tax charges associated with the consolidation of technology and content assets. See the “Tax expense” section above. |

| · | Results from the Reuters News business and Other Businesses are excluded from our reportable segments as they do not qualify as a component of our four reportable segments, nor as a separate reportable segment. |

| · | We use segment operating profit to measure the operating performance of our reportable segments. |

| o | The costs of centralized support services such as technology, news, real estate, accounting, procurement, legal, human resources and strategy are allocated to each segment based on usage or other applicable measures. |

| o | We define segment operating profit as operating profit before (i) amortization of other identifiable intangible assets; (ii) other operating gains and losses; (iii) certain asset impairment charges; and (iv) corporate-related items (including corporate expense and fair value adjustments). We use this measure because we do not consider these excluded items to be controllable operating activities for purposes of assessing the current performance of our reportable segments. |

| o | We also use segment operating profit margin, which we define as segment operating profit as a percentage of revenues. |

| o | Our definition of segment operating profit may not be comparable to that of other companies. |

| · | As a supplemental measure of segment operating performance, we add back depreciation and amortization of computer software to segment operating profit to arrive at each segment’s EBITDA and the related margin as a percentage of revenues. Refer to Appendix B for additional information. |

|

|

Three months ended

June 30,

|

Percentage change:

|

||||||||||||||||||||||||

|

(millions of U.S. dollars)

|

2013

|

2012

|

Existing

businesses

|

Acquired

businesses

|

Constant

currency

|

Foreign

currency

|

Total

|

|||||||||||||||||||

|

Trading

|

616

|

662

|

(6

|

%)

|

-

|

(6

|

%)

|

(1

|

%)

|

(7

|

%)

|

|||||||||||||||

|

Investors

|

534

|

545

|

(2

|

%)

|

1

|

%

|

(1

|

%)

|

(1

|

%)

|

(2

|

%)

|

||||||||||||||

|

Marketplaces

|

451

|

434

|

(1

|

%)

|

7

|

%

|

6

|

%

|

(2

|

%)

|

4

|

%

|

||||||||||||||

|

Governance, Risk & Compliance (GRC)

|

59

|

52

|

11

|

%

|

2

|

%

|

13

|

%

|

-

|

13

|

%

|

|||||||||||||||

|

Revenues

|

1,660

|

1,693

|

(3

|

%)

|

2

|

%

|

(1

|

%)

|

(1

|

%)

|

(2

|

%)

|

||||||||||||||

|

EBITDA

|

420

|

421

|

-

|

|||||||||||||||||||||||

|

EBITDA margin

|

25.3

|

%

|

24.9

|

%

|

40

|

bp

|

||||||||||||||||||||

|

Segment operating profit

|

260

|

273

|

(5

|

%)

|

||||||||||||||||||||||

|

Segment operating profit margin

|

15.7

|

%

|

16.1

|

%

|

(40

|

)bp

|

||||||||||||||||||||

|

|

Six months ended

June 30,

|

Percentage change:

|

||||||||||||||||||||||||

|

(millions of U.S. dollars)

|

2013

|

2012

|

Existing

businesses

|

Acquired

businesses

|

Constant

currency

|

Foreign

currency

|

Total

|

|||||||||||||||||||

|

Trading

|

1,246

|

1,340

|

(6

|

%)

|

-

|

(6

|

%)

|

(1

|

%)

|

(7

|

%)

|

|||||||||||||||

|

Investors

|

1,068

|

1,087

|

(1

|

%)

|

-

|

(1

|

%)

|

(1

|

%)

|

(2

|

%)

|

|||||||||||||||

|

Marketplaces

|

907

|

876

|

(2

|

%)

|

7

|

%

|

5

|

%

|

(1

|

%)

|

4

|

%

|

||||||||||||||

|

Governance, Risk & Compliance (GRC)

|

114

|

103

|

9

|

%

|

2

|

%

|

11

|

%

|

-

|

11

|

%

|

|||||||||||||||

|

Revenues

|

3,335

|

3,406

|

(3

|

%)

|

2

|

%

|

(1

|

%)

|

(1

|

%)

|

(2

|

%)

|

||||||||||||||

|

EBITDA

|

780

|

844

|

(8

|

%)

|

||||||||||||||||||||||

|

EBITDA margin

|

23.4

|

%

|

24.8

|

%

|

(140

|

)bp

|

||||||||||||||||||||

|

Segment operating profit

|

460

|

543

|

(15

|

%)

|

||||||||||||||||||||||

|

Segment operating profit margin

|

13.8

|

%

|

15.9

|

%

|

(210

|

)bp

|

||||||||||||||||||||

|

Results by revenue type were:

· Subscription revenues declined 3% in the three and six-month periods reflecting negative, but improving net sales. At the end of the second quarter of 2013, Thomson Reuters Eikon desktop users grew to nearly 61,000, which represented a 30% increase from the end of the first quarter.

· Recoveries revenues (low-margin revenues that we collect and largely pass-through to a third party provider, such as stock exchange fees) decreased 4% in the three and six-month periods due to declines in desktops as well as third party providers continuing to move to direct billing of customers.

· Transaction revenues increased 22% and 20% for the three and six-month periods, respectively, driven by the 2012 acquisition of FXall. Revenues from existing businesses grew 5% and 3% for the three and six-month periods, respectively, due to higher volumes at Tradeweb.

· Outright revenues, which are primarily discrete sales of software and services, represented a small portion of Financial & Risk’s revenues and increased 2% in the three and six-month periods.

|

|

|

|

|

|

| · | Trading revenues decreased 6% in both periods, all from existing businesses, as desktop cancellations in Equities and Fixed Income associated with negative net sales over the past 12 months were partly offset by growth from Elektron Managed Services. |

| · | Investors revenues declined 1% in both periods, primarily from existing businesses. In the three-month period, 9% growth in Enterprise Content, driven by demand for pricing and reference data, was offset by a 4% decline in Investment Management. Revenues in the Banking and Research and Wealth Management businesses were essentially unchanged. |

| · | Marketplaces revenues increased 6% and 5% in the three and six-month periods, respectively, driven by the acquisition of FXall. Revenues from existing businesses decreased 1% in the second quarter as 5% growth at Tradeweb was more than offset by a revenue decline from desktop cancellations. Revenues from existing businesses decreased 2% in the six-month period and reflected the same dynamics as the second quarter. |

| · | GRC revenues increased 13% and 11% in the three month and six-month periods, respectively, due to strong sales growth and continued strong demand. |

|

|

Three months ended

June 30,

|

Percentage change:

|

||||||||||||||||||||||||

|

(millions of U.S. dollars)

|

2013

|

2012

|

Existing

businesses

|

Acquired

businesses

|

Constant

currency

|

Foreign

currency

|

Total

|

|||||||||||||||||||

|

Revenues

|

846

|

812

|

1

|

%

|

4

|

%

|

5

|

%

|

(1

|

%)

|

4

|

%

|

||||||||||||||

|

EBITDA

|

326

|

319

|

2

|

%

|

||||||||||||||||||||||

|

EBITDA margin

|

38.5

|

%

|

39.3

|

%

|

(80

|

)bp

|

||||||||||||||||||||

|

Segment operating profit

|

255

|

251

|

2

|

%

|

||||||||||||||||||||||

|

Segment operating profit margin

|

30.1

|

%

|

30.9

|

%

|

(80

|

)bp

|

||||||||||||||||||||

|

|

Six months ended

June 30,

|

Percentage change:

|

||||||||||||||||||||||||

|

(millions of U.S. dollars)

|

2013

|

2012

|

Existing

businesses

|

Acquired

businesses

|

Constant

currency

|

Foreign

currency

|

Total

|

|||||||||||||||||||

|

Revenues

|

1,640

|

1,583

|

-

|

4

|

%

|

4

|

%

|

-

|

4

|

%

|

||||||||||||||||

|

EBITDA

|

602

|

589

|

2

|

%

|

||||||||||||||||||||||

|

EBITDA margin

|

36.7

|

%

|

37.2

|

%

|

(50

|

)bp

|

||||||||||||||||||||

|

Segment operating profit

|

456

|

452

|

1

|

%

|

||||||||||||||||||||||

|

Segment operating profit margin

|

27.8

|

%

|

28.6

|

%

|

(80

|

)bp

|

||||||||||||||||||||

|

Results by revenue type were:

· Subscription revenues increased 8% for the three and six-month periods, led by growth from the acquisition of Practical Law Company (PLC). Growth from existing businesses was 2% for the three and six-month periods reflecting the mix of a challenging core legal research market sector offset by expanding sales in our newer lines of business;

· Transaction revenues in the three-month period increased 4%, primarily from existing businesses. This reflected an improvement from a 7% decline in the first quarter due to timing of our software and services revenues. Revenues declined 1% (3% from existing businesses) for the six-month period; and

· U.S. print revenues declined 7% and 5% for the three and six-month periods, respectively, as customers continued to cut discretionary spending. Print revenues are often impacted by seasonal factors and publication schedules relating to content availability. In the third quarter, we anticipate that print revenues will decline about 10% compared to the third quarter of last year for these reasons. We expect print revenues in the fourth quarter and in the full year to decrease mid-single digits.

|

|

|

|

|

|

Results by line of business were:

|

|

|

· U.S. Law Firm Solutions revenues (52% of segment revenues) increased 1% primarily from the PLC acquisition. Revenues from the Business of Law sub-segment increased 7%, while research-related revenues decreased 1%. Revenues for the six-month period were essentially unchanged and reflected the same drivers as the second quarter;

· Corporate, Government & Academic revenues (25% of segment revenues) decreased 1% in the three-month period, reflecting a 5% decline in Government revenues primarily related to print cancellations as governments contend with cost pressures, partly offset by a 6% increase in Corporate revenues. Revenues increased 1% for the six-month period; and

· Global revenues (23% of segment revenues) increased primarily from the acquisition of PLC. Revenues from existing businesses grew 4%, driven by growth in Latin America. Revenues grew 20% for the six-month period (3% from existing businesses).

|

|

|

|

Three months ended

June 30,

|

Percentage change:

|

||||||||||||||||||||||||

|

(millions of U.S. dollars)

|

2013

|

2012

|

Existing

businesses

|

Acquired

businesses

|

Constant

currency

|

Foreign

currency

|

Total

|

|||||||||||||||||||

|

Revenues

|

288

|

273

|

3

|

%

|

4

|

%

|

7

|

%

|

(2

|

%)

|

5

|

%

|

||||||||||||||

|

EBITDA

|

87

|

79

|

10

|

%

|

||||||||||||||||||||||

|

EBITDA margin

|

30.2

|

%

|

28.9

|

%

|

130

|

bp

|

||||||||||||||||||||

|

Segment operating profit

|

57

|

51

|

12

|

%

|

||||||||||||||||||||||

|

Segment operating profit margin

|

19.8

|

%

|

18.7

|

%

|

110

|

bp

|

||||||||||||||||||||

|

|

Six months ended

June 30,

|

Percentage change:

|

||||||||||||||||||||||||

|

(millions of U.S. dollars)

|

2013

|

2012

|

Existing

businesses

|

Acquired

businesses

|

Constant

currency

|

Foreign

currency

|

Total

|

|||||||||||||||||||

|

Revenues

|

605

|

572

|

4

|

%

|

3

|

%

|

7

|

%

|

(1

|

%)

|

6

|

%

|

||||||||||||||

|

EBITDA

|

185

|

170

|

9

|

%

|

||||||||||||||||||||||

|

EBITDA margin

|

30.6

|

%

|

29.7

|

%

|

90

|

bp

|

||||||||||||||||||||

|

Segment operating profit

|

126

|

114

|

11

|

%

|

||||||||||||||||||||||

|

Segment operating profit margin

|

20.8

|

%

|

19.9

|

%

|

90

|

bp

|

||||||||||||||||||||

|

Results by line of business were:

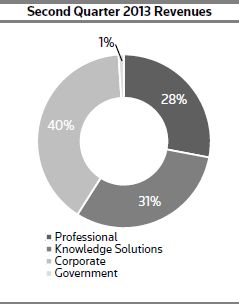

· Professional revenues from small, medium and large accounting firms increased 13% and 9%, all from existing businesses, during the three and six-month periods, respectively;

· Knowledge Solutions revenues increased 4% (3% from existing businesses) for the three-month period and 5% (4% from existing businesses) for the six-month period primarily from growth in our U.S. Checkpoint business;

· Corporate revenues increased 20% (9% from existing businesses) for the three-month period and 17% (9% from existing businesses) for the six-month period primarily from ONESOURCE software and services and strong growth in solutions revenues in Latin America; and

· Government, which represents approximately 5% of Tax & Accounting revenues on an annual basis, continued to experience weak performance during the second quarter. Over the long term, we continue to believe this is an attractive market sector and that it will have less of a negative impact on the segment’s results going forward.

|

|

|

|

|

Three months ended

June 30,

|

Percentage change:

|

||||||||||||||||||||||||

|

(millions of U.S. dollars)

|

2013

|

2012

|

Existing

businesses

|

Acquired

businesses

|

Constant

currency

|

Foreign

currency

|

Total

|

|||||||||||||||||||

|

Revenues

|

234

|

216

|

(1

|

%)

|

10

|

%

|

9

|

%

|

(1

|

%)

|

8

|

%

|

||||||||||||||

|

EBITDA

|

79

|

75

|

5

|

%

|

||||||||||||||||||||||

|

EBITDA margin

|

33.8

|

%

|

34.7

|

%

|

(90

|

)bp

|

||||||||||||||||||||

|

Segment operating profit

|

59

|

59

|

-

|

|||||||||||||||||||||||

|

Segment operating profit margin

|

25.2

|

%

|

27.3

|

%

|

(210

|

)bp

|

||||||||||||||||||||

|

|

Six months ended

June 30,

|

Percentage change:

|

||||||||||||||||||||||||

|

(millions of U.S. dollars)

|

2013

|

2012

|

Existing

businesses

|

Acquired

businesses

|

Constant

currency

|

Foreign

currency

|

Total

|

|||||||||||||||||||

|

Revenues

|

467

|

425

|

1

|

%

|

10

|

%

|

11

|

%

|

(1

|

%)

|

10

|

%

|

||||||||||||||

|

EBITDA

|

149

|

147

|

1

|

%

|

||||||||||||||||||||||

|

EBITDA margin

|

31.9

|

%

|

34.6

|

%

|

(270

|

)bp

|

||||||||||||||||||||

|

Segment operating profit

|

110

|

114

|

(4

|

%)

|

||||||||||||||||||||||

|

Segment operating profit margin

|

23.6

|

%

|

26.8

|

%

|

(320

|

)bp

|

||||||||||||||||||||

|

Results by line of business were:

· IP Solutions revenues grew 18% and 20% for the three and six-month periods, respectively, due to the acquisition of MarkMonitor. Revenues from existing businesses declined 2% for the three-month period and were essentially unchanged for the six-month period due to lower transactional revenues. The decline in the transactional revenues in the six-month period was mitigated by higher Asset Management and IP Services revenues;

· Scientific & Scholarly Research revenues increased 2% and 3% for the three and six-month periods, respectively, all from existing businesses as higher Web of Knowledge subscription revenues were partly offset by lower transactional revenues due to timing of discrete sales; and

· Life Sciences revenues were essentially unchanged for the three-month period and grew 1% during the six-month period. Both periods reflected the impact of delayed renewals.

|

|

|

|

|

|

|

Three months ended

June 30,

|

Six months ended

June 30,

|

||||||||||||||

|

(millions of U.S. dollars)

|

2013

|

2012

|

2013

|

2012

|

||||||||||||

|

Revenues – Reuters News

|

82

|

83

|

163

|

165

|

||||||||||||

|

|

||||||||||||||||

|

Reuters News

|

1

|

(6

|

)

|

(3

|

)

|

(10

|

)

|

|||||||||

|

Core corporate expenses

|

(63

|

)

|

(61

|

)

|

(118

|

)

|

(149

|

)

|

||||||||

|

Total

|

(62

|

)

|

(67

|

)

|

(121

|

)

|

(159

|

)

|

||||||||

|

|

Three months ended

June 30,

|

Six months ended

June 30,

|

||||||||||||||

|

(millions of U.S. dollars)

|

2013

|

2012

|

2013

|

2012

|

||||||||||||

|

Revenues

|

55

|

198

|

133

|

441

|

||||||||||||

|

Operating profit

|

20

|

38

|

52

|

65

|

||||||||||||

|

Business

|

|

Status

|

Former segment

|

|

Description

|

|

|

Corporate Services

|

|

Sold – Q2 2013

|

Financial & Risk

|

|

A provider of tools and solutions that help companies communicate with investors and media

|

|

|

Healthcare

|

|

Sold – Q2 2012

|

Healthcare & Science

|

|

A provider of data analytics and performance benchmarking solutions and services to companies, government agencies and healthcare professionals

|

|

|

Trade and Risk Management

|

|

Sold – Q1 2012

|

Financial & Risk

|

|

A provider of risk management solutions to financial institutions, including banks, broker-dealers and hedge funds

|

|

|

Portia

|

|

Sold – Q2 2012

|

Financial & Risk

|

|

A provider of portfolio accounting and reporting applications

|

|

|

Property Tax Consulting

|

|

Sold – Q4 2012

|

Tax & Accounting

|

|

A provider of property tax outsourcing and compliance services in the U.S.

|

| · | approximately $1.6 billion of cash on hand; |

| · | an undrawn $2.5 billion credit facility; |

| · | a $2.0 billion commercial paper program under which we issue short-term notes; and |

| · | average long-term debt maturity of approximately seven years with no significant concentration in any one year. |

|

|

As at

|

|||||||

|

(millions of U.S. dollars)

|

June 30, 2013

|

December 31, 2012

|

||||||

|

Current indebtedness

|

1,021

|

1,008

|

||||||

|

Long-term indebtedness

|

6,907

|

6,223

|

||||||

|

Total debt

|

7,928

|

7,231

|

||||||

|

Swaps

|

(96

|

)

|

(242

|

)

|

||||

|

Total debt after swaps

|

7,832

|

6,989

|

||||||

|

Remove fair value adjustments for hedges

|

(45

|

)

|

(54

|

)

|

||||

|

Total debt after hedging arrangements

|

7,787

|

6,935

|

||||||

|

Remove transaction costs and discounts included in the carrying value of debt

|

60

|

50

|

||||||

|

Less: cash and cash equivalents(2)

|

(1,613

|

)

|

(1,283

|

)

|

||||

|

Net debt

|

6,234

|

5,702

|

||||||

| (1) | Net debt is a non-IFRS financial measure, which we define in Appendix A. |

| (2) | Includes cash of $150 million and $148 million at June 30, 2013 and December 31, 2012, respectively, which was held in subsidiaries which have regulatory restrictions, contractual restrictions or operate in countries where exchange controls and other legal restrictions apply and are therefore not available for general use by our company. |

| · | We monitor the financial strength of financial institutions with which we have banking and other commercial relationships, including those that hold our cash and cash equivalents as well as those which are counterparties to derivative financial instruments and other arrangements; |

| · | We expect to continue to have access to funds held by our subsidiaries outside the U.S. in a tax efficient manner to meet our liquidity requirements; |

| · | During the second quarter of 2013, we issued $850 million of long term debt; and |

| · | In the second quarter of 2013, we filed a new debt shelf prospectus in connection with the expiration of our existing prospectus (see “Cash Flow”). |

|

(millions of U.S. dollars)

|

|

|||

|

Balance at December 31, 2012

|

17,498

|

|||

|

Net earnings

|

245

|

|||

|

Share issuances

|

87

|

|||

|

Effect of share-based compensation plans on contributed surplus

|

(27

|

)

|

||

|

Dividends declared on common shares

|

(539

|

)

|

||

|

Dividends declared on preference shares

|

(2

|

)

|

||

|

Change in unrecognized net loss on cash flow hedges

|

20

|

|||

|

Change in foreign currency translation adjustment

|

(369

|

)

|

||

|

Net remeasurement gains on defined benefit pension plans, net of tax

|

154

|

|||

|

Distributions to non-controlling interests

|

(20

|

)

|

||

|

Balance at June 30, 2013

|

17,047

|

|||

|

|

Three months ended

June 30,

|

Six months ended

June 30,

|

||||||||||||||||||||||

|

(millions of U.S. dollars)

|

2013

|

2012

|

Change

|

2013

|

2012

|

Change

|

||||||||||||||||||

|

Net cash provided by operating activities

|

904

|

855

|

49

|

1,020

|

1,122

|

(102

|

)

|

|||||||||||||||||

|

Net cash provided by (used in) investing activities

|

33

|

1,161

|

(1,128

|

)

|

(1,013

|

)

|

1,346

|

(2,359

|

)

|

|||||||||||||||

|

Net cash provided by (used in) financing activities

|

259

|

(678

|

)

|

937

|

340

|

(1,087

|

)

|

1,427

|

||||||||||||||||

|

Translation adjustments on cash and cash equivalents

|

(6

|

)

|

(7

|

)

|

1

|

(17

|

)

|

(3

|

)

|

(14

|

)

|

|||||||||||||

|

Increase in cash and cash equivalents

|

1,190

|

1,331

|

(141

|

)

|

330

|

1,378

|

(1,048

|

)

|

||||||||||||||||

|

Cash and cash equivalents at beginning of period

|

423

|

451

|

(28

|

)

|

1,283

|

404

|

879

|

|||||||||||||||||

|

Cash and cash equivalents at end of period

|

1,613

|

1,782

|

(169

|

)

|

1,613

|

1,782

|

(169

|

)

|

||||||||||||||||

| · | Commercial paper program. Our $2.0 billion commercial paper program provides efficient and flexible short-term funding. We had no commercial paper borrowings outstanding at June 30, 2013. Issuances of commercial paper reached a peak of $0.5 billion during the six-month period of 2013. |

| · | Credit facility. In May 2013, we increased the size of our syndicated credit facility from $2.0 billion to $2.5 billion and extended the maturity date of the facility from August 2016 to May 2018. The facility may be used to provide liquidity for general corporate purposes (including to support our commercial paper program). In the first quarter of 2013, we borrowed and repaid $440 million under the credit facility. There were no outstanding borrowings at June 30, 2013. |

| · | Long-term debt. In May 2013, we filed a new debt shelf prospectus allowing us to issue up to $3.0 billion principal amount of debt securities through June 2015. In the second quarter of 2013, we issued the following debt securities under the new prospectus: |

|

Month/Year

|

Notes issued

|

Principal

Amount

(in millions)

|

|

May 2013

|

0.875% notes due 2016

|

US$500

|

|

May 2013

|

4.50% notes due 2043

|

US$350

|

| · | Credit ratings. Our access to financing depends on, among other things, suitable market conditions and the maintenance of suitable long-term credit ratings. Our credit ratings may be adversely affected by various factors, including increased debt levels, decreased earnings, declines in customer demand, increased competition, a further deterioration in general economic and business conditions and adverse publicity. Any downgrades in our credit ratings may impede our access to the debt markets or raise our borrowing rates. |

|

|

Moody’s

|

Standard & Poor’s

|

DBRS Limited

|

Fitch

|

|

Long-term debt

|

Baa1

|

A-

|

A (low)

|

A-

|

|

Commercial paper

|

-

|

A-1 (low)

|

R-1 (low)

|

F2

|

|

Trend/Outlook

|

Stable

|

Negative

|

Stable

|

Stable

|

| · | Dividends. In February 2013, our board of directors approved a $0.02 per share increase in the annualized dividend rate to $1.30 per common share. We paid the following dividends on our shares in the periods presented: |

|

|

Three months ended

June 30,

|

Six months ended

June 30,

|

||||||||||||||

|

(millions of U.S. dollars)

|

2013

|

2012

|

2013

|

2012

|

||||||||||||

|

Dividends declared

|

270

|

266

|

539

|

531

|

||||||||||||

|

Dividends reinvested

|

(10

|

)

|

(10

|

)

|

(20

|

)

|

(19

|

)

|

||||||||

|

Dividends paid

|

260

|

256

|

519

|

512

|

||||||||||||

| · | Share repurchases. We may buy back shares (and subsequently cancel them) from time to time as part of our capital strategy. In May 2013, we renewed our normal course issuer bid (NCIB) for an additional 12 months. Under the NCIB, we may repurchase up to 15 million common shares (representing less than 2% of our total outstanding shares) between May 22, 2013 and May 21, 2014 in open market transactions on the Toronto Stock Exchange (TSX), the New York Stock Exchange (NYSE) and/or other exchanges or alternative trading systems, if eligible, or by such other means as may be permitted by the TSX. |

|

|

Three months ended

June 30,

|

Six months ended

June 30,

|

||||||||||||||

|

(millions of U.S. dollars)

|

2013

|

2012

|

2013

|

2012

|

||||||||||||

|

Net cash provided by operating activities

|

904

|

855

|

1,020

|

1,122

|

||||||||||||

|

Capital expenditures, less proceeds from disposals

|

(188

|

)

|

(207

|

)

|

(538

|

)

|

(487

|

)

|

||||||||

|

Other investing activities

|

17

|

10

|

21

|

20

|

||||||||||||

|

Dividends paid on preference shares

|

(1

|

)

|

(1

|

)

|

(2

|

)

|

(2

|

)

|

||||||||

|

Free cash flow

|

732

|

657

|

501

|

653

|

||||||||||||

|

Remove: Other Businesses

|

(49

|

)

|

(59

|

)

|

(42

|

)

|

(113

|

)

|

||||||||

|

Free cash flow from ongoing businesses

|

683

|

598

|

459

|

540

|

||||||||||||

|

2013 Outlook

|

|

Material assumptions

|

|

Material risks

|

|

Revenues expected to grow low single digits

|

|

— Improvement in net sales as the year progresses

— Positive gross domestic product (GDP) growth in the countries where we operate, led by rapidly developing economies

— Continued increase in the number of professionals around the world and their demand for high quality information and services

— Continued operational improvement in the Financial & Risk business and the successful execution of ongoing product release programs, our globalization strategy and other growth initiatives

|

|

— Uneven economic growth or recession across the markets we serve may result in reduced spending levels by our customers

— Demand for our products and services could be reduced by changes in customer buying patterns, competitive pressures or our inability to execute on key product or customer support initiatives

— Implementation of regulatory reform, including Dodd-Frank legislation and similar financial services laws around the world, may limit business opportunities for our customers, lowering their demand for our products and services

— Uncertainty regarding the European sovereign debt crisis and the Euro currency could impact demand from our customers as well as their ability to pay us

— Pressure on our customers, in developed markets in particular, to constrain the number of professionals employed due to regulatory and economic uncertainty

|

|

2013 Outlook

|

|

Material assumptions

|

|

Material risks

|

|

Adjusted EBITDA margin expected to be between 26% and 27%

|

|

— Revenues expected to grow low single digits

— Business mix continues to shift to higher-growth lower margin offerings

— Realization of expected benefits from cost control and efficiency initiatives, specifically in our Financial & Risk business relative to reductions in workforce, platform consolidation and operational simplification

|

|

— Refer to the risks above related to the revenue outlook

— Revenues from higher margin businesses may be lower than expected

— The costs of required investments exceed expectations or actual returns are below expectations

· Acquisition and disposal activity may dilute margins

· Cost control initiatives may cost more than expected, be delayed or may not produce the expected level of savings

|

|

Underlying operating profit margin expected to be between 16.5% and 17.5%

|

|

— Adjusted EBITDA margin expected to be between 26% and 27%

— Depreciation and amortization expense expected to represent approximately 9.5% of revenues

— Capital expenditures expected to be approximately 8% of revenues

|

|

— Refer to the risks above related to adjusted EBITDA margin outlook

— Capital expenditures may be higher than currently expected, resulting in higher in-period depreciation and amortization

|

|

Free cash flow is expected to be between $1.7 billion and $1.8 billion

|

|

— Revenues expected to grow low single digits

— Adjusted EBITDA margin expected to be between 26% and 27%

— Capital expenditures expected to be approximately 8% of revenues

|

|

— Refer to the risks above related to the revenue outlook and adjusted EBITDA margin outlook

— A weaker macroeconomic environment and unanticipated disruptions from new order-to-cash applications could negatively impact working capital performance

— Capital expenditures may be higher than currently expected resulting in higher cash outflows

— The timing of completing disposals of businesses may vary from our expectations resulting in actual free cash flow performance below our expectations

· The timing and amount of tax payments to governments may differ from our expectations

· We may decide to make a voluntary contribution to our defined benefit plans

|

|

Non-IFRS Financial Measure

|

|

How We Define It

|

|

Why We Use It and Why It Is Useful to Investors

|

|

Most Directly Comparable IFRS Measure/Reconciliation

|

|

Revenues from ongoing businesses

|

|

Revenues from reportable segments and Corporate & Other (which includes the Reuters News business), less eliminations.

|

|

Provides a measure of our ability to grow our ongoing businesses over the long term.

|

|

Revenues

|

|

Revenues at constant currency (before currency or revenues excluding the effects of foreign currency)

|

|

Revenues applying the same foreign currency exchange rates for the current and equivalent prior period. To calculate the foreign currency impact between periods, we convert the current and equivalent prior period’s local currency revenues using the same foreign currency exchange rate.

|

|

Provides a measure of underlying business trends, without distortion from the effect of foreign currency movements during the period.

Our reporting currency is the U.S. dollar. However, we conduct a significant amount of our activities in currencies other than the U.S. dollar. We manage our operating segments on a constant currency basis, and we manage currency exchange risk at the corporate level.

|

|

Revenues

|

|

Underlying operating profit and underlying operating profit margin

|

|

Operating profit from reportable segments and Corporate & Other. The related margin is expressed as a percentage of revenues from ongoing businesses.

|

|

Provides a basis to evaluate operating profitability and performance trends, excluding the impact of items which distort the performance of our operations.

|

|

Operating profit

|

|

Adjusted EBITDA and adjusted EBITDA margin

|

|

Underlying operating profit excluding the related depreciation and amortization of computer software. The related margin is expressed as a percentage of revenues from ongoing businesses.

|

|

Provides a measure commonly reported and widely used by investors as an indicator of a company’s operating performance and ability to incur and service debt, and as a valuation metric.

|

|

Earnings from continuing operations

|

|

Adjusted EBITDA less capital expenditures and adjusted EBITDA less capital expenditures margin

|

|

Adjusted EBITDA less capital expenditures, less proceeds from disposals (excluding Other Businesses). The related margin is expressed as a percentage of revenues from ongoing businesses.

|

|

Provides a basis for evaluating the operating profitability and capital intensity of a business in a single measure. This measure captures investments regardless of whether they are expensed or capitalized.

|

|

Earnings from continuing operations

|

|

Non-IFRS Financial Measure

|

|

How We Define It

|

|

Why We Use It and Why It Is Useful to Investors

|

|

Most Directly Comparable IFRS Measure/Reconciliation

|

|

Adjusted earnings and adjusted earnings per share

|

|

Earnings attributable to common shareholders and per share excluding:

· the pre-tax impacts of amortization of other identifiable intangible assets;

· the post-tax impacts of fair value adjustments, other operating gains and losses, certain impairment charges, the results of Other Businesses, other net finance costs or income, our share of post-tax earnings or losses in equity method investments, discontinued operations and other items affecting comparability. We also deduct dividends declared on preference shares; and

|

|

Provides a more comparable basis to analyze earnings and is also a measure commonly used by shareholders to measure our performance.

|

|

Earnings attributable to common shareholders and earnings per share attributable to common shareholders

|

|

· amortization of the tax charges associated with the consolidation of ownership and management of technology and content assets. For the non-IFRS measure, the majority of the charges are amortized over seven years, the period over which the tax is expected to be paid.

|

We believe this treatment more accurately reflects our tax position because the tax liability is associated with ongoing tax implications from the consolidation of these assets.

|

|||||

|

This measure is calculated using diluted weighted- average shares.

|

||||||

|

In interim periods, we also adjust our reported earnings and earnings per share to reflect a normalized effective tax rate. Specifically, the normalized effective rate is computed as the estimated full-year effective tax rate applied to adjusted pre-tax earnings of the interim period. The reported effective tax rate is based on separate annual effective income tax rates for each taxing jurisdiction that are applied to each interim period’s pre-tax income.

|

Because the geographical mix of pre-tax profits and losses in interim periods distorts the reported effective tax rate within an interim period, we believe that using the expected full-year effective tax rate provides more comparability among interim periods. The adjustment to normalize the effective tax rate reallocates estimated full-year income taxes between interim periods, but has no effect on full year tax expense or on cash taxes paid.

|

|

Non-IFRS Financial Measure

|

|

How We Define It

|

|

Why We Use It and Why It Is Useful to Investors

|

|

Most Directly Comparable IFRS Measure/Reconciliation

|

|

Net debt

|

|

Total indebtedness, including the associated fair value of hedging instruments on our debt, but excluding unamortized transaction costs and premiums or discounts associated with our debt, less cash and cash equivalents.

|

|

Provides a commonly used measure of a company’s leverage.