Exhibit 99.1

THOMSON REUTERS CORPORATION

MANAGEMENT’S DISCUSSION AND ANALYSIS

This management’s discussion and analysis is designed to provide you with a narrative explanation through the eyes of our management of our financial condition and results of operations. We recommend that you read this in conjunction with our interim financial statements for the three months ended March 31, 2013, our 2012 annual financial statements and our 2012 annual management’s discussion and analysis. This management’s discussion and analysis is dated as of April 29, 2013.

About Thomson Reuters - We are the leading source of intelligent information for businesses and professionals. We combine industry expertise with innovative technology to deliver critical information to leading decision-makers. Through approximately 60,000 employees in over 100 countries, we deliver this must-have insight to the financial and risk, legal, tax and accounting, intellectual property and science and media markets, powered by the world’s most trusted news organization.

We derive the majority of our revenues from selling electronic content and services to professionals, primarily on a subscription basis. Over the years, this has proven to be capital efficient and cash flow generative, and it has enabled us to maintain leading and scalable positions in our chosen markets. Within each of the market segments that we serve, we bring in-depth understanding of our customers’ needs, flexible technology platforms, proprietary content and scale. We believe our ability to embed our solutions into customers’ workflows is a significant competitive advantage as it leads to strong customer retention.

Contents - We have organized our management’s discussion and analysis in the following key sections:

|

|

·

|

Overview – a brief discussion of our business;

|

|

|

·

|

Results of Operations – a comparison of our current and prior period results;

|

|

|

·

|

Liquidity and Capital Resources – a discussion of our cash flow and debt;

|

|

|

·

|

Outlook – our current financial outlook for 2013;

|

|

|

·

|

Related Party Transactions – a discussion of transactions with our principal and controlling shareholder, The Woodbridge Company Limited (Woodbridge), and others;

|

|

|

·

|

Subsequent Events – a discussion of material events occurring after March 31, 2013 and through the date of this management’s discussion and analysis;

|

|

|

·

|

Changes in Accounting Policies – a discussion of changes in our accounting policies and recent accounting pronouncements;

|

|

|

·

|

Critical Accounting Estimates and Judgments – a discussion of critical estimates and judgments made by our management in applying accounting policies;

|

|

|

·

|

Additional Information – other required disclosures; and

|

|

|

·

|

Appendices – supplemental information and discussion.

|

We prepare our financial statements in accordance with International Financial Reporting Standards (IFRS), as issued by the International Accounting Standards Board (IASB). This management’s discussion and analysis also includes certain non-IFRS financial measures which we use as supplemental indicators of our operating performance and financial position and for internal planning purposes.

References in this discussion to “$” and “US$” are to U.S. dollars and references to “C$” are to Canadian dollars. In addition, “bp” means “basis points” and “na” and “n/m” refer to “not applicable” and “not meaningful”, respectively. Unless otherwise indicated or the context otherwise requires, references in this discussion to “we,” “our,” “us” and “Thomson Reuters” are to Thomson Reuters Corporation and our subsidiaries.

Forward-looking statements - This management's discussion and analysis also contains forward-looking statements, which are subject to risks and uncertainties that could cause our actual results to differ materially from the forward-looking statements. Forward-looking statements include, but are not limited to, our expectations regarding:

|

|

·

|

General economic conditions and market trends and their anticipated effects on our business;

|

|

|

·

|

Our 2013 financial outlook;

|

|

|

·

|

Investments that we have made and plan to make and the timing for businesses that we expect to sell; and

|

|

|

·

|

Our liquidity and capital resources available to us to fund our ongoing operations, investments and returns to shareholders.

|

For additional information related to forward-looking statements and material risks associated with them, refer to the section of this management’s discussion and analysis entitled “Cautionary Note Concerning Factors That May Affect Future Results”.

1

OVERVIEW

|

KEY HIGHLIGHTS

|

||||

|

Our first quarter performance was consistent with our full-year expectations and we are pleased with the positive trajectory of the business as we begin the year. The external environment continues to be challenging, but we believe that it has improved compared to a year ago.

|

||||

|

In the first quarter of 2013, revenues from ongoing businesses increased 2% before currency(1). This performance reflected good growth from our Legal, Tax & Accounting and Intellectual Property & Science businesses, which was partially offset by a decrease in Financial & Risk’s revenues.

|

||||

| ● |

Financial & Risk’s revenues decreased 1%. While the business continues to make significant progress, we do not believe that Financial & Risk will achieve revenue improvement in 2013 compared to 2012 due to the subscription nature of its business and the lag effect of 2012 negative net sales. However, the trend in Financial & Risk’s net sales performance continues to improve and the business is making tangible progress reducing its cost structure.

|

|||

| ● |

Legal’s revenues rose 4% driven by acquisitions. Revenues from existing businesses were unchanged due to the timing of several contracts and a 2% decrease in print revenues.

|

|||

| ● |

Tax & Accounting revenues increased 7%, of which 5% was from existing businesses. In particular, subscription revenues experienced good growth.

|

|||

| ● |

Intellectual Property & Science revenues increased 13%, of which 4% was from existing businesses.

|

|||

| ● |

Our Global Growth & Operations (GGO) unit increased revenues by 13%, of which 7% was from existing businesses. On an annualized basis, GGO comprises about $1 billion of our revenues.

|

|||

|

Adjusted EBITDA(1) decreased 2% reflecting $78 million of severance charges, primarily to reduce positions in Financial & Risk. Underlying operating profit(1) decreased 7%, primarily due to the severance charges and higher depreciation and amortization. Adjusted EPS(1) was $0.38 per share, which represented a $0.01 decrease compared to the prior-year period. This decrease was primarily attributable to lower underlying operating profit(1) driven by the severance charges, which was partially offset by lower interest expense and a lower tax rate.

|

||||

|

Based on our first quarter performance, we recently reaffirmed our 2013 business outlook that we originally communicated in February. For 2013, we are targeting low single digit revenue growth(1), underlying operating profit(1) between 16.5% and 17.5%, adjusted EBITDA margin(1) between 26% and 27% and free cash flow(1) between $1.7 billion and $1.8 billion. Additional information is provided in the “Outlook” section of this management’s discussion and analysis.

|

||||

|

We remain focused on achieving our key priorities for 2013, which are:

|

||||

| ● |

Driving for growth organically as well as through tactical acquisitions, including by shifting more of our revenue mix and investments to higher growth businesses and geographic areas;

|

|||

| ● |

Focusing on streamlining our costs and increasing free cash flow through improvements to our infrastructure; and

|

|||

| ● |

Simplifying our systems and processes across the organization.

|

|||

| (1) |

Refer to Appendix A for additional information on non-IFRS financial measures.

|

|||

OUR ORGANIZATIONAL STRUCTURE

Thomson Reuters is organized as a group of strategic business units: Financial & Risk, Legal, Tax & Accounting and Intellectual Property & Science, supported by a corporate center. We believe this structure allows us to best meet the complex demands of our customers, capture growth opportunities and achieve efficiencies. We also operate a Global Growth & Operations (GGO) organization which works across our business units to identify opportunities in faster growing geographic areas. We do not report GGO as a separate business unit, but rather include its results within our strategic business units. Our Reuters News business is managed at our corporate center.

2

SEASONALITY

Our revenues and operating profits do not tend to be significantly impacted by seasonality as we record a large portion of our revenues ratably over a contract term and our costs are generally incurred evenly throughout the year. However, our non-recurring revenues can cause changes in our performance from quarter to consecutive quarter. Additionally, the release of certain print-based offerings can be seasonal as can certain product releases for the regulatory markets, which tend to be concentrated at the end of the year.

USE OF NON-IFRS FINANCIAL MEASURES

In addition to our results reported in accordance with IFRS, we use certain non-IFRS financial measures as supplemental indicators of our operating performance and financial position and for internal planning purposes. These non-IFRS financial measures include:

|

|

·

|

Revenues from ongoing businesses;

|

|

|

·

|

Revenues at constant currency (before currency or revenues excluding the effects of foreign currency);

|

|

|

·

|

Underlying operating profit and the related margin;

|

|

|

·

|

Adjusted EBITDA and the related margin;

|

|

|

·

|

Adjusted EBITDA less capital expenditures and the related margin;

|

|

|

·

|

Adjusted earnings and adjusted earnings per share;

|

|

|

·

|

Net debt;

|

|

|

·

|

Free cash flow; and

|

|

|

·

|

Free cash flow from ongoing businesses.

|

We report non-IFRS financial measures as we believe their use provides more insight into and understanding of our performance. Refer to Appendix A of this management’s discussion and analysis for a description of our non-IFRS financial measures, including an explanation of why we believe they are useful measures of our performance, including our ability to generate cash flow. Refer to the sections of this management’s discussion and analysis entitled “Results of Operations”, “Liquidity and Capital Resources” and Appendix B for reconciliations of these non-IFRS financial measures to the most directly comparable IFRS financial measures.

RESULTS OF OPERATIONS

BASIS OF PRESENTATION

Within this management’s discussion and analysis, we discuss our results of operations on both an IFRS and non-IFRS basis. Both bases exclude discontinued operations and include the performance of acquired businesses from the date of purchase. Prior period amounts have been restated to reflect the retrospective application of amendments to IAS 19, Employee Benefits and the adoption of IFRS 11, Joint Arrangements. See note 2 of our interim financial statements for the three months ended March 31, 2013 for information regarding changes in accounting policies.

Consolidated results

We discuss our consolidated results from continuing operations on an IFRS basis, as reported in our income statement. Additionally, we discuss our consolidated results on a non-IFRS basis using the measures described within the “Use of Non-IFRS Financial Measures” section. Among other adjustments, our non-IFRS revenue and profitability measures as well as free cash flow from ongoing businesses exclude Other Businesses, which is an aggregation of businesses that have been or are expected to be exited through sale or closure that did not qualify for discontinued operations classification.

Segment results

We discuss the results of our four reportable segments as presented in our interim financial statements for the three months ended March 31, 2013: Financial & Risk, Legal, Tax & Accounting and Intellectual Property & Science.

We also provide information on “Corporate & Other” and “Other Businesses”. The items in these categories neither qualify as a component of another reportable segment nor as a separate reportable segment.

|

|

·

|

Corporate & Other includes expenses for corporate functions, certain share-based compensation costs and the Reuters News business, which is comprised of the Reuters News Agency and consumer publishing.

|

|

|

·

|

Other Businesses is an aggregation of businesses that have been or are expected to be exited through sale or closure that did not qualify for discontinued operations classification. The results of Other Businesses are not comparable from period to period as the composition of businesses changes due to the timing of completed divestitures.

|

3

Prior-period amounts have been reclassified to reflect the current presentation. Note 3 of our interim financial statements for the three months ended March 31, 2013 includes a reconciliation of results from our reportable segments to consolidated results as reported in our income statement.

In analyzing our revenues from ongoing businesses, at both the consolidated and segment levels, we separately measure the effect of foreign currency changes. We separately measure both the revenue growth of existing businesses and the impact of acquired businesses on our revenue growth, on a constant currency basis.

CONSOLIDATED RESULTS

|

Three months ended

March 31,

|

||||||||||||

|

(millions of U.S. dollars, except per share amounts)

|

2013

|

2012

|

Change

|

|||||||||

|

IFRS Financial Measures

|

||||||||||||

|

Revenues

|

3,175 | 3,315 | (4 | %) | ||||||||

|

Operating profit

|

390 | 364 | 7 | % | ||||||||

|

Diluted (loss) earnings per share

|

$ | (0.04 | ) | $ | 0.35 | n/m | ||||||

|

Non-IFRS Financial Measures

|

||||||||||||

|

Revenues from ongoing businesses

|

3,097 | 3,072 | 1 | % | ||||||||

|

Adjusted EBITDA

|

757 | 772 | (2 | %) | ||||||||

|

Adjusted EBITDA margin

|

24.4 | % | 25.1 | % | (70 | )bp | ||||||

|

Adjusted EBITDA less capital expenditures

|

407 | 500 | (19 | %) | ||||||||

|

Adjusted EBITDA less capital expenditures margin

|

13.1 | % | 16.3 | % | (320 | )bp | ||||||

|

Underlying operating profit

|

462 | 497 | (7 | %) | ||||||||

|

Underlying operating profit margin

|

14.9 | % | 16.2 | % | (130 | )bp | ||||||

|

Adjusted earnings per share

|

$ | 0.38 | $ | 0.39 | (3 | %) | ||||||

Foreign currency effects. With respect to the average foreign exchange rates that we use to report our results, the U.S. dollar strengthened against the British pound sterling and the Japanese yen, but weakened against the Euro in the first quarter of 2013 compared to the same period in 2012. Given our currency mix of revenues and expenses around the world, these fluctuations had a negative impact on our consolidated revenues in U.S. dollars and on our adjusted EBITDA and underlying operating profit margin.

Revenues.

|

Three months ended

March 31,

|

Percentage change:

|

|||||||||||||||||||||||||||

|

(millions of U.S. dollars)

|

2013

|

2012

|

Existing

businesses

|

Acquired

businesses

|

Constant

currency

|

Foreign

currency

|

Total

|

|||||||||||||||||||||

|

Revenues from ongoing businesses

|

3,097 | 3,072 | (1%) | 3% | 2% | (1%) | 1% | |||||||||||||||||||||

|

Other Businesses

|

78 | 243 | n/m | n/m | n/m | n/m | n/m | |||||||||||||||||||||

|

Revenues

|

3,175 | 3,315 | n/m | n/m | n/m | n/m | (4%) | |||||||||||||||||||||

Revenues from ongoing businesses increased on a constant currency basis led by our Legal, Tax & Accounting and Intellectual Property & Science segments and the Marketplaces and Governance, Risk & Compliance business units within our Financial & Risk segment. These increases more than offset a decrease from Financial & Risk’s Trading business. Acquisitions contributed to revenue growth across all segments.

Our Global Growth & Operations organization is focused on supporting our businesses in the following geographic areas: Latin America, China, India, the Middle East, Africa, the Association of Southeast Asian Nations/North Asia, Russia and countries comprising the Commonwealth of Independent States and Turkey. Revenues from these geographic areas represented approximately 8% of our revenues in the first quarter of 2013 and grew 13% on a constant currency basis (7% from existing businesses).

4

Operating profit, underlying operating profit, adjusted EBITDA and adjusted EBITDA less capital expenditures.

|

Three months ended

March 31,

|

||||||||||||

|

(millions of U.S. dollars)

|

2013

|

2012

|

Change

|

|||||||||

|

Operating profit

|

390 | 364 | 7 | % | ||||||||

|

Adjustments to remove:

|

||||||||||||

|

Amortization of other identifiable intangible assets

|

160 | 152 | ||||||||||

|

Fair value adjustments

|

(62 | ) | 30 | |||||||||

|

Other operating losses (gains), net

|

6 | (22 | ) | |||||||||

|

Operating profit from Other Businesses

|

(32 | ) | (27 | ) | ||||||||

|

Underlying operating profit

|

462 | 497 | (7 | %) | ||||||||

|

Remove: depreciation and amortization of computer software (excluding Other Businesses)

|

295 | 275 | ||||||||||

|

Adjusted EBITDA(1)

|

757 | 772 | (2 | %) | ||||||||

|

Remove: capital expenditures, less proceeds from disposals (excluding Other Businesses)

|

350 | 272 | ||||||||||

|

Adjusted EDITDA less capital expenditures

|

407 | 500 | (19 | %) | ||||||||

|

Underlying operating profit margin

|

14.9 | % | 16.2 | % | (130 | )bp | ||||||

|

Adjusted EBITDA margin

|

24.4 | % | 25.1 | % | (70 | )bp | ||||||

|

Adjusted EBITDA less capital expenditures margin

|

13.1 | % | 16.3 | % | (320 | )bp | ||||||

|

(1)

|

See Appendix B for a reconciliation of (loss) earnings from continuing operations to adjusted EBITDA and adjusted EBITDA less capital expenditures.

|

Operating profit increased due to a significant benefit from fair value adjustments that more than offset higher severance costs and lower gains from the sales of businesses.

Adjusted EBITDA and the related margin decreased due to higher severance expenses, lower revenues from existing businesses and the impact of currency, partly offset by lower expenses from reducing our cost structure. The decline in underlying operating profit was also impacted by higher depreciation and amortization from recent product launches and acquisitions. We believe that the first quarter was the low water mark for adjusted EBITDA and underlying operating profit margins for the year.

The decrease in adjusted EBITDA less capital expenditures reflected the same factors as adjusted EBITDA as well as higher capital expenditures due to the timing of payments related to a large multi-year software contract.

Excluding severance charges for the three months ended March 31, 2013 and 2012 of $78 million and $28 million, respectively, adjusted EBITDA in the first quarter of 2013 grew 4% and the related margin expanded 100bp, underlying operating profit grew 3% and the related margin expanded 30bp.

Operating expenses.

|

Three months ended

March 31,

|

||||||||||||

|

(millions of U.S. dollars)

|

2013

|

2012

|

Change

|

|||||||||

|

Operating expenses

|

2,324 | 2,540 | (9 | %) | ||||||||

|

Adjustments to remove:

|

||||||||||||

|

Fair value adjustments(1)

|

62 | (30 | ) | |||||||||

|

Other Businesses

|

(46 | ) | (210 | ) | ||||||||

|

Operating expenses, excluding fair value adjustments and Other Businesses

|

2,340 | 2,300 | 2 | % | ||||||||

|

(1)

|

Fair value adjustments primarily represent non-cash accounting adjustments from the revaluation of embedded foreign exchange derivatives within certain customer contracts due to fluctuations in foreign exchange rates and mark-to-market adjustments from certain share-based awards.

|

Operating expenses, excluding fair value adjustments and Other Businesses, increased primarily due to higher severance charges and expenses from newly acquired businesses. In the three months ended March 31, 2013 and 2012, operating expenses included $78 million and $28 million of severance charges, respectively. In 2013, the charges related primarily to our previously announced intention to reduce Financial & Risk’s workforce. We expect to incur about $100 million in severance charges for the full year 2013. The increase in operating expenses was partly offset by lower expenses from reducing our cost structure.

5

Depreciation and amortization.

|

Three months ended

March 31,

|

||||||||||||

|

(millions of U.S. dollars)

|

2013

|

2012

|

Change

|

|||||||||

|

Depreciation

|

107 | 109 | (2 | %) | ||||||||

|

Amortization of computer software

|

188 | 172 | 9 | % | ||||||||

|

Subtotal

|

295 | 281 | 5 | % | ||||||||

|

Amortization of other identifiable intangible assets

|

160 | 152 | 5 | % | ||||||||

|

|

·

|

Depreciation and amortization of computer software on a combined basis increased reflecting investments in products such as Thomson Reuters Eikon and amortization of assets from recently acquired businesses.

|

|

|

·

|

Amortization of other identifiable intangible assets increased due to amortization from newly-acquired assets, which more than offset decreases from the completion of amortization for certain identifiable intangible assets acquired in previous years.

|

Other operating (losses) gains, net.

|

Three months ended

March 31,

|

||||||||

|

(millions of U.S. dollars)

|

2013

|

2012

|

||||||

|

Other operating (losses) gains, net

|

(6 | ) | 22 | |||||

In the three months ended March 31, 2013, other operating losses, net, were primarily comprised of transaction-related charges associated with business acquisitions and divestitures, partially offset by a gain from the sale of the Law School Publishing business. The prior-year period was primarily comprised of a gain from the sale of the Trade and Risk Management business, partially offset by transaction-related charges associated with business acquisitions and divestitures.

Net interest expense.

|

Three months ended

March 31,

|

||||||||||||

|

(millions of U.S. dollars)

|

2013

|

2012

|

Change

|

|||||||||

|

Net interest expense

|

115 | 129 | (11 | %) | ||||||||

The decrease in net interest expense was primarily attributable to a reduction of interest associated with certain tax liabilities. Because over 90% of our long-term debt obligations pay interest at fixed rates (after swaps) and because our long-term debt remained relatively constant, the balance of interest expense was relatively unchanged.

Other finance (costs) income.

|

Three months ended

March 31,

|

||||||||

|

(millions of U.S. dollars)

|

2013

|

2012

|

||||||

|

Other finance (costs) income

|

(55 | ) | 30 | |||||

In both periods, other finance (costs) income primarily included losses or gains realized from changes in foreign currency exchange rates on certain intercompany funding arrangements, but also included gains from freestanding derivative instruments.

Share of post-tax earnings in equity method investments.

|

Three months ended

March 31,

|

||||||||

|

(millions of U.S. dollars)

|

2013

|

2012

|

||||||

|

Share of post-tax earnings in equity method investments

|

10 | 3 | ||||||

In both periods, our share of post-tax earnings in equity method investments primarily included our joint arrangements with Omgeo, a provider of trade management services. The three months ended March, 31, 2012 included losses from other equity method investments.

6

Tax (expense) benefit.

|

Three months ended

March 31,

|

||||||||

|

(millions of U.S. dollars)

|

2013

|

2012

|

||||||

|

Tax (expense) benefit

|

(247 | ) | 40 | |||||

The comparability of our tax (expense) benefit was impacted by various transactions and accounting adjustments during both periods. Additionally, the tax (expense) benefit in each period reflected the mix of taxing jurisdictions in which pre-tax profits and losses were recognized. Because the geographical mix of pre-tax profits and losses in interim periods distorts the reported effective tax rate, tax expense or benefit in interim periods is not necessarily indicative of tax expense for the full year.

In the three months ended March 31, 2013, we recorded a $235 million tax charge in conjunction with the further consolidation of the ownership and management of our technology and content assets. This tax is expected to be paid over the next seven years, in varying annual amounts. The following table sets forth significant components within our income tax (expense) benefit that impact comparability from period to period.

|

(Expense) benefit

|

Three months ended

March 31,

|

|||||||

|

(millions of U.S. dollars)

|

2013

|

2012

|

||||||

|

Discrete tax items:

|

||||||||

|

Consolidation of technology and content assets(1)

|

(235 | ) | - | |||||

|

Corporate tax rates(2)

|

1 | 14 | ||||||

|

Uncertain tax positions

|

2 | 4 | ||||||

|

Other(3)

|

11 | 8 | ||||||

|

Subtotal

|

(221 | ) | 26 | |||||

|

Tax related to:

|

||||||||

|

Sale of businesses(4)

|

(8 | ) | (33 | ) | ||||

|

Healthcare(5)

|

- | 87 | ||||||

|

Operating profit of Other Businesses

|

(8 | ) | (7 | ) | ||||

|

Fair value adjustments

|

(9 | ) | 8 | |||||

|

Other items

|

3 | - | ||||||

|

Subtotal

|

(22 | ) | 55 | |||||

|

Total

|

(243 | ) | 81 | |||||

|

(1)

|

Relates to the further consolidation of the ownership and management of our technology and content assets.

|

|

(2)

|

In 2012, relates to the reduction of deferred tax liabilities due to lower corporate tax rates that were substantively enacted in certain jurisdictions outside the U.S.

|

|

(3)

|

Primarily relates to the recognition of deferred tax benefits in connection with acquisitions and disposals.

|

|

(4)

|

In 2012, primarily relates to the sale of our Trade and Risk Management business.

|

|

(5)

|

Relates to the recognition of a deferred tax asset in connection with the sale of our Healthcare business in the second quarter of 2012.

|

Because the items described above impact the comparability of our tax expense each period, we remove them from our calculation of adjusted earnings, along with the pre-tax items to which they relate. Accordingly, in our calculation of adjusted earnings, we have removed the impact of the $235 million tax charge associated with the consolidation of technology and content assets. However, we have included a tax charge equivalent to amortizing the $235 million charge on a straight-line basis over the seven-year period in which the tax liability is expected to be paid. We believe this treatment more appropriately reflects our tax position because the tax charge is an actual tax expense that we will have to pay over the next seven years, in varying annual amounts. While we anticipate this transaction will be relatively neutral on a net cash tax basis over the near term, we expect that this transaction will produce ongoing tax benefits to more than offset the tax cost. After removing the items noted above, which impact comparability, and increasing tax expense by $7 million for quarterly tax rate normalization (2012 - $6 million decrease) and $8 million for the amortization of the tax charge associated with the consolidation of technology and content assets, our tax expense on adjusted earnings for the three months ended March 31, 2013 was $19 million (2012 - $35 million). During 2013, we expect to record additional tax charges of approximately $170 million in conjunction with the further consolidation of technology and content assets.

7

Net (loss) earnings and (loss) earnings per share.

|

Three months ended

March 31,

|

||||||||

|

(millions of U.S. dollars, except per share amounts)

|

2013

|

2012

|

||||||

|

Net (loss) earnings

|

(17 | ) | 306 | |||||

|

Diluted (loss) earnings per share

|

$ | (0.04 | ) | $ | 0.35 | |||

Net (loss) earnings and the related per share amounts decreased primarily due to higher tax expense associated with the further consolidation of the ownership and management of our technology and content assets.

Adjusted earnings and adjusted earnings per share.

|

Three months ended

March 31,

|

||||||||||||

|

(millions of U.S. dollars, except per share amounts and share data)

|

2013

|

2012

|

Change

|

|||||||||

|

(Loss) earnings attributable to common shareholders

|

(31 | ) | 294 | n/m | ||||||||

|

Adjustments to remove:

|

||||||||||||

|

Operating profit from Other Businesses

|

(32 | ) | (27 | ) | ||||||||

|

Fair value adjustments

|

(62 | ) | 30 | |||||||||

|

Other operating losses (gains), net

|

6 | (22 | ) | |||||||||

|

Other finance costs (income)

|

55 | (30 | ) | |||||||||

|

Share of post-tax earnings in equity method investments

|

(10 | ) | (3 | ) | ||||||||

|

Tax on above items

|

22 | (55 | ) | |||||||||

|

Discrete tax items(1)

|

221 | (26 | ) | |||||||||

|

Amortization of other identifiable intangible assets

|

160 | 152 | ||||||||||

|

Discontinued operations

|

- | 2 | ||||||||||

|

Interim period effective tax rate normalization

|

(7 | ) | 6 | |||||||||

|

Tax charge amortization(2)

|

(8 | ) | - | |||||||||

|

Dividends declared on preference shares

|

(1 | ) | (1 | ) | ||||||||

|

Adjusted earnings

|

313 | 320 | (2 | %) | ||||||||

|

Adjusted earnings per share (adjusted EPS)

|

$ | 0.38 | $ | 0.39 | (3 | %) | ||||||

|

Diluted weighted average common shares (millions)(3)

|

830.4 | 830.3 | ||||||||||

|

(1)

|

Refer to “Tax (expense) benefit”.

|

|

(2)

|

Reflects amortization of tax charge associated with consolidation of technology and content assets. Refer to “Tax (expense) benefit”.

|

|

(3)

|

Refer to Appendix B for reconciliation of diluted weighted average common shares at March 31, 2013.

|

Adjusted earnings and the related per share amount decreased due to lower underlying operating profit, driven by the severance charge, partly offset by lower interest and taxes. Adjusted earnings per share in the three months ended March 31, 2013 included an $0.08 impact from the severance charge. Adjusted earnings per share reflected a negative impact from foreign currency of $0.03 compared to the prior year.

SEGMENT RESULTS

A discussion of the operating results of each of our reportable segments follows. Results from the Reuters News business and Other Businesses are excluded from our reportable segments as they do not qualify as a component of our four reportable segments, nor as a separate reportable segment. We use segment operating profit to measure the performance of our reportable segments. Our definition of segment operating profit as reflected below may not be comparable to that of other companies. We define segment operating profit as operating profit before (i) amortization of other identifiable intangible assets; (ii) other operating gains and losses; (iii) certain asset impairment charges; and (iv) corporate-related items (including corporate expense and fair value adjustments). We use this measure because we do not consider these excluded items to be controllable operating activities for purposes of assessing the current performance of our reportable segments. We also use segment operating profit margin, which we define as segment operating profit as a percentage of revenues. As a supplemental measure of segment performance, we add back depreciation and amortization of computer software to segment operating profit to arrive at each segment’s EBITDA and the related margin as a percentage of revenues. Refer to Appendix B for additional information.

8

Financial & Risk

|

Three months ended

March 31,

|

Percentage change:

|

|||||||||||||||||||||||||||

|

(millions of U.S. dollars)

|

2013

|

2012

|

Existing

businesses

|

Acquired

businesses

|

Constant

currency

|

Foreign

currency

|

Total

|

|||||||||||||||||||||

|

Trading

|

630 | 678 | (6%) | - | (6%) | (1%) | (7%) | |||||||||||||||||||||

|

Investors

|

534 | 542 | (1%) | 1% | - | (1%) | (1%) | |||||||||||||||||||||

|

Marketplaces

|

456 | 442 | (2%) | 6% | 4% | (1%) | 3% | |||||||||||||||||||||

|

Governance, Risk & Compliance (GRC)

|

55 | 51 | 6% | 2% | 8% | - | 8% | |||||||||||||||||||||

|

Revenues

|

1,675 | 1,713 | (3%) | 2% | (1%) | (1%) | (2%) | |||||||||||||||||||||

|

EBITDA

|

360 | 423 | (15%) | |||||||||||||||||||||||||

|

EBITDA margin

|

21.5 | % | 24.7 | % | (320)bp | |||||||||||||||||||||||

|

Segment operating profit

|

200 | 270 | (26%) | |||||||||||||||||||||||||

|

Segment operating profit margin

|

11.9 | % | 15.8 | % | (390)bp | |||||||||||||||||||||||

Revenues declined on a constant currency basis as growth from acquired businesses was more than offset by a decline in revenues from existing businesses, which reflected the lag effect of negative net sales from 2012. The decline in Trading was partially offset by growth in Marketplaces and GRC. The Investors business was essentially unchanged from the prior year.

Although net sales were negative for the first quarter ended March 31, 2013, the performance represented an improvement over the prior-year period, as well as from the fourth quarter ended December 31, 2012. Accordingly, we continue to target to achieve positive net sales in the second half of the year.

|

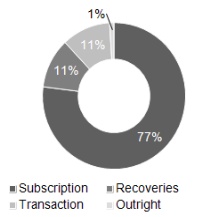

Results by type were:

· Subscription revenues declined 3%, reflecting the impact of negative net sales in 2012. At the end of the first quarter, Thomson Reuters Eikon desktop users grew to nearly 47,000, which represented close to a 40% increase from year-end.

· Recoveries revenues (low-margin revenues that we collect and largely pass-through to a third party provider, such as stock exchange fees) decreased 4% as a result of declines in desktops as well as third party providers continuing to move to direct billing of customers.

· Transaction revenues increased 17%, driven by the 2012 acquisition of FXall. Revenues grew 2% from existing businesses and included higher volumes at Tradeweb.

· Outright revenues, which are primarily discrete sales of software and services, represented a small portion of Financial & Risk’s revenues and increased 4%.

|

First Quarter 2013 Revenues

|

|

|

||

By geographic area, revenues from Europe, Middle East and Africa (EMEA) decreased 3%, Americas increased 2% and Asia decreased 2%, reflecting declines in Japan and Australia.

The following provides additional information regarding Financial & Risk businesses on a constant currency basis:

|

|

·

|

Trading revenues decreased 6%, all from existing businesses, as growth from Data Feeds and Elektron Managed Services was more than offset by desktop cancellations in Equities and Fixed Income associated with negative net sales in 2012 and continued weakness in Europe.

|

|

|

·

|

Investors revenues were essentially unchanged from the prior year as a 6% increase in Enterprise Content, driven by demand for pricing and reference data, was offset by a 3% decline in both the Investment Management, and Banking and Research businesses. Wealth Management revenues were unchanged.

|

|

|

·

|

Marketplaces revenues increased 4% due to the 2012 acquisition of FXall. Revenues from existing businesses decreased 2% due to declines in FX desktops. Tradeweb grew 1% reflecting difficult prior year comparables.

|

|

|

·

|

GRC revenues increased 8% driven by demand for financial crime and reputational risk solutions.

|

EBITDA, segment operating profit and the related margins were adversely impacted by lower revenues and a $65 million severance charge to streamline our cost structure. Excluding severance, EBITDA decreased 1% and the related margin increased 40bp from the prior year, while segment operating profit declined 4% and the related margin declined 30bp. Foreign currency reduced EBITDA and segment operating profit margins by approximately 100bp. The decline in segment operating profit and the related margin reflected higher depreciation and amortization from new product investments, and software amortization from acquired businesses.

9

Legal

|

Three months ended

March 31,

|

Percentage change:

|

|||||||||||||||||||||||||||

|

(millions of U.S. dollars)

|

2013

|

2012

|

Existing

businesses

|

Acquired

businesses

|

Constant

currency

|

Foreign

currency

|

Total

|

|||||||||||||||||||||

|

Revenues

|

794 | 771 | - | 4% | 4% | (1%) | 3% | |||||||||||||||||||||

|

EBITDA

|

276 | 270 | 2% | |||||||||||||||||||||||||

|

EBITDA margin

|

34.8 | % | 35.0 | % | (20)bp | |||||||||||||||||||||||

|

Segment operating profit

|

201 | 201 | - | |||||||||||||||||||||||||

|

Segment operating profit margin

|

25.3 | % | 26.1 | % | (80)bp | |||||||||||||||||||||||

Revenues increased on a constant currency basis reflecting contributions from acquired businesses. Revenues from existing businesses were unchanged, largely due to timing issues within our software and services businesses and a 2% decline in print revenues. We expect revenue growth to improve throughout the balance of the year.

|

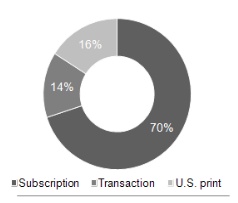

Results by type were:

· Subscription revenues increased 7%, led by growth from the acquisition of Practical Law Company (PLC) and 3% growth from existing businesses;

· Transaction revenues declined 7% which reflected a 9% decline from existing businesses largely attributable to the timing of software and services revenues, primarily from our Elite, Pangea3, and Latin American businesses; and

· U.S. print revenues declined 2% as customers continued to control discretionary spending.

|

First Quarter 2013 Revenues

|

|

|

||

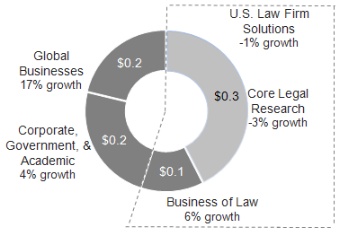

The following chart illustrates the growth dynamics and changing business mix in the Legal segment:

|

Results by line of business were:

· U.S. Law Firm Solutions revenues (55% of segment revenues) declined 1% as growth in Business of Law revenues, led by 9% growth in FindLaw, was more than offset by a decline in research related revenues;

· Corporate, Government & Academic revenues (25% of segment revenues) increased 4% with Corporate up 5% and Government up 3%; and

· Global (20% of segment revenues) businesses revenues increased 17% primarily from the acquisition of PLC. Revenues from existing businesses grew 1%, reflecting timing within several Latin American businesses due to our focus on integrating our recent acquisitions.

|

First Quarter 2013 Legal Revenues

4% constant currency revenue growth

(billions of U.S. dollars)

|

|

|

||

The decline in EBITDA and segment operating profit margins were driven by the expected dilutive impact of the PLC acquisition. For the full year, we expect the PLC acquisition to negatively impact Legal’s EBITDA and segment operating profit margins by a little over 100 basis points.

10

Tax & Accounting

|

Three months ended

March 31,

|

Percentage change:

|

|||||||||||||||||||||||||||

|

(millions of U.S. dollars)

|

2013

|

2012

|

Existing

businesses

|

Acquired

businesses

|

Constant

currency

|

Foreign

currency

|

Total

|

|||||||||||||||||||||

|

Revenues

|

317 | 299 | 5% | 2% | 7% | (1%) | 6% | |||||||||||||||||||||

|

EBITDA

|

98 | 91 | 8% | |||||||||||||||||||||||||

|

EBITDA margin

|

30.9 | % | 30.4 | % | 50bp | |||||||||||||||||||||||

|

Segment operating profit

|

69 | 63 | 10% | |||||||||||||||||||||||||

|

Segment operating profit margin

|

21.8 | % | 21.1 | % | 70bp | |||||||||||||||||||||||

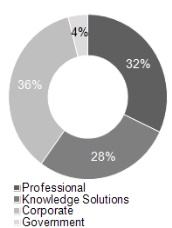

Revenues increased on a constant currency basis reflecting contributions from both existing and acquired businesses. The revenue growth reflected the strength of our product offerings and healthy conditions prevailing in the global tax and accounting market. Subscription revenues, which comprise approximately 65% of our Tax & Accounting business, increased 11%. This was partly offset by a decline in Government revenues, which continues to face headwinds.

|

Results by line of business were:

· Professional revenues from small, medium and large accounting firms increased 6% (5% from existing businesses);

· Knowledge Solutions revenues increased 7% (5% from existing businesses) primarily from growth in our U.S. Checkpoint business;

· Corporate revenues increased 14% (10% from existing businesses) primarily from ONESOURCE software and services and strong growth in solutions revenues in Latin America; and

· Government revenues decreased 29%, all from existing businesses. We expect continued weakness in the government sector during 2013.

|

First Quarter 2013 Revenues

|

|

|

||

EBITDA, segment operating profit and the related margins increased due to higher revenues.

Tax & Accounting is a seasonal business with a significant percentage of its operating profit historically generated in the fourth quarter. Small movements in the timing of revenues and expenses can impact quarterly margins. Full-year margins are more reflective of the segment’s performance.

Intellectual Property & Science

|

Three months ended

March 31,

|

Percentage change:

|

|||||||||||||||||||||||||||

|

(millions of U.S. dollars)

|

2013

|

2012

|

Existing

businesses

|

Acquired

businesses

|

Constant

currency

|

Foreign

currency

|

Total

|

|||||||||||||||||||||

|

Revenues

|

233 | 209 | 4% | 9% | 13% | (2%) | 11% | |||||||||||||||||||||

|

EBITDA

|

70 | 72 | (3%) | |||||||||||||||||||||||||

|

EBITDA margin

|

30.0 | % | 34.4 | % | (440)bp | |||||||||||||||||||||||

|

Segment operating profit

|

51 | 55 | (7%) | |||||||||||||||||||||||||

|

Segment operating profit margin

|

21.9 | % | 26.3 | % | (440)bp | |||||||||||||||||||||||

Revenues increased on a constant currency basis reflecting contributions from existing businesses and the 2012 acquisition of MarkMonitor. Subscription revenues, which represent approximately 75% of Intellectual Property & Science’s business, increased 18% (5% from existing businesses). Transaction revenues were unchanged as lower trademark search revenues and the timing of discrete sales for our Web of Knowledge and Web of Science products were offset by higher professional services.

11

|

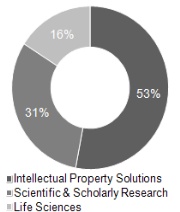

Results by line of business were:

· IP Solutions grew 22%, reflecting the acquisition of MarkMonitor. Revenue grew 3% from existing businesses as growth in Asset Management was partly offset by lower transactional revenues;

· Scientific & Scholarly Research increased 5% from existing business led by the Web of Knowledge as higher subscription revenues were partly offset by lower transactional revenues due to timing; and

· Life Sciences revenues increased 2% from existing businesses reflecting higher professional services revenues.

|

First Quarter 2013 Revenues

|

|

|

||

EBITDA, segment operating profit and the related margins decreased largely from the expected dilutive effect of the MarkMonitor acquisition and severance charges in the three months ended March 31, 2013.

Small movements in the timing of revenues and expenses can impact quarterly margins. Full-year margins are more reflective of the segment’s performance.

Corporate & Other

|

Three months ended

March 31,

|

||||||||

|

(millions of U.S. dollars)

|

2013

|

2012

|

||||||

|

Revenues - Reuters News

|

81 | 82 | ||||||

|

Reuters News

|

(4 | ) | (4 | ) | ||||

|

Core corporate expenses

|

(55 | ) | (88 | ) | ||||

|

Total

|

(59 | ) | (92 | ) | ||||

Revenues from our Reuters News business were essentially unchanged as an increase in Agency revenues, led by growth in the Americas, was offset by lower advertising-based revenues and unfavorable foreign currency. Before currency, revenues from our Reuters News business increased 1%.

Lower core corporate expenses primarily reflected a reduction in severance costs. For the full year 2013, we expect Corporate & Other costs to be roughly in line with the previous year.

Other Businesses

“Other Businesses” is an aggregation of businesses that have been or are expected to be exited through sale or closure that did not qualify for discontinued operations classification. The results of Other Businesses are not comparable from period to period, as the composition of businesses changes as businesses are identified for sale or closure. Further fluctuations are caused by the timing of the sales or closures.

|

Three months ended

March 31,

|

||||||||

|

(millions of U.S. dollars)

|

2013

|

2012

|

||||||

|

Revenues

|

78 | 243 | ||||||

|

Operating profit

|

32 | 27 | ||||||

12

The most significant businesses in Other Businesses for the periods presented were:

|

Business

|

Status

|

Former segment

|

Description

|

||

|

Corporate Services(1)

|

Held for sale

(binding offer accepted)

|

Financial & Risk

|

A provider of tools and solutions that help companies communicate with investors and media

|

||

|

Healthcare

|

Sold – Q2 2012

|

Healthcare & Science

|

A provider of data analytics and performance benchmarking solutions and services to companies, government agencies and healthcare professionals

|

||

|

Trade and Risk Management

|

Sold – Q1 2012

|

Financial & Risk

|

A provider of risk management solutions to financial institutions, including banks, broker-dealers and hedge funds

|

||

|

Portia

|

Sold – Q2 2012

|

Financial & Risk

|

A provider of portfolio accounting and reporting applications

|

||

|

Property Tax Consulting

|

Sold – Q4 2012

|

Tax & Accounting

|

A provider of property tax outsourcing and compliance services in the U.S.

|

|

(1)

|

Comprised of the Investor Relations, Public Relations and Multimedia Solutions businesses.

|

LIQUIDITY AND CAPITAL RESOURCES

At March 31, 2013, we had a strong liquidity position with:

|

|

·

|

approximately $0.4 billion of cash on hand;

|

|

|

·

|

an undrawn $2.0 billion syndicated credit facility;

|

|

|

·

|

a commercial paper program under which we issue short-term notes; and

|

|

|

·

|

average long-term debt maturity of approximately seven years with no significant concentration in any one year.

|

We expect to generate between $1.7 billion and $1.8 billion of free cash flow in 2013. See “Outlook” for additional information. We believe that cash on hand, cash provided by our operations, borrowings available under our credit facility, and our commercial paper program will be sufficient to fund our expected cash dividends, debt service, capital expenditures, acquisitions in the normal course of business and any opportunistic share repurchases in 2013. Additionally, proceeds from the anticipated closing of our Corporate Services business and several smaller divestitures will provide liquidity in 2013.

FINANCIAL POSITION

Our total assets were $32.0 billion at March 31, 2013 compared to $32.5 billion at December 31, 2012. The decrease was due to changes in foreign currency and depreciation and amortization, partly offset by capital expenditures.

Additional information. At March 31, 2013, the carrying amounts of our total current liabilities exceeded the carrying amounts of our total current assets principally because current liabilities include deferred revenue. Deferred revenue does not represent a cash obligation, but rather an obligation to perform services or deliver products in the future. The costs to fulfill these obligations are included in our operating expenses.

Net Debt (1)

|

As at

|

||||||||

|

(millions of U.S. dollars)

|

March 31, 2013

|

December 31, 2012

|

||||||

|

Current indebtedness

|

1,340 | 1,008 | ||||||

|

Long-term indebtedness

|

6,170 | 6,223 | ||||||

|

Total debt

|

7,510 | 7,231 | ||||||

|

Swaps

|

(207 | ) | (242 | ) | ||||

|

Total debt after swaps

|

7,303 | 6,989 | ||||||

|

Remove fair value adjustments for hedges

|

(34 | ) | (54 | ) | ||||

|

Total debt after hedging arrangements

|

7,269 | 6,935 | ||||||

|

Remove transaction costs and discounts included in the carrying value of debt

|

48 | 50 | ||||||

|

Less: cash and cash equivalents(2)

|

(423 | ) | (1,283 | ) | ||||

|

Net debt

|

6,894 | 5,702 | ||||||

|

(1)

|

Net debt is a non-IFRS financial measure, which we define in Appendix A.

|

|

(2)

|

Includes cash of $141 million and $148 million at March 31, 2013 and December 31, 2012, respectively, which is subject to certain contractual and regulatory restrictions.

|

13

The increase in our net debt was primarily due to cash used for acquisitions.

The maturity dates for our long-term debt are well balanced with no significant concentration in any one year. Our only scheduled maturities of long-term debt in 2013 are $1.0 billion aggregate principal amount of notes that will be due in the third quarter. At March 31, 2013, the average maturity of our long-term debt was approximately seven years at an average interest rate (after swaps) of less than 6%. Our commercial paper program also provides efficient and flexible short-term funding to balance the timing of completed acquisitions, expected disposal proceeds, dividend payments and debt repayments. At March 31, 2013, the average interest rate for our outstanding commercial paper borrowings was under 0.5%.

Our cash and cash equivalents as of March 31, 2013 decreased $860 million compared to the total as of December 31, 2012. See “Cash Flow” for additional information.

Additional information.

|

|

·

|

We monitor the financial strength of financial institutions with which we have banking and other commercial relationships, including those that hold our cash and cash equivalents as well as those which are counterparties to derivative financial instruments and other arrangements;

|

|

|

·

|

We expect to continue to have access to funds held by our subsidiaries outside the U.S. in a tax efficient manner to meet our liquidity requirements; and

|

|

|

·

|

We have issued $350 million principal amount of debt securities under our $3.0 billion debt shelf prospectus, which expires in May 2013. None of these debt securities were issued in 2013 or 2012. We expect to file a new debt shelf prospectus in connection with the expiration of our current prospectus.

|

Total Equity

|

(millions of U.S. dollars)

|

||||

|

Balance at December 31, 2012

|

17,498 | |||

|

Net loss

|

(17 | ) | ||

|

Share issuances

|

62 | |||

|

Effect of share-based compensation plans on contributed surplus

|

(31 | ) | ||

|

Dividends declared on common shares

|

(269 | ) | ||

|

Dividends declared on preference shares

|

(1 | ) | ||

|

Change in unrecognized net loss on cash flow hedges

|

14 | |||

|

Change in foreign currency translation adjustment

|

(253 | ) | ||

|

Net remeasurement gains on defined benefit pension plans, net of tax

|

79 | |||

|

Distributions to non-controlling interests

|

(4 | ) | ||

|

Balance at March 31, 2013

|

17,078 | |||

We returned approximately $0.3 billion to our shareholders through dividends in the three months ended March 31, 2013.

CASH FLOW

Our principal sources of liquidity are cash on hand, cash provided by our operations, our commercial paper program, and our credit facility. In 2013, proceeds from the disposals of businesses are also a source of liquidity. From time to time, we also issue debt securities. Our principal uses of cash are for debt servicing costs, debt repayments, dividend payments, capital expenditures and acquisitions. Additionally, we have occasionally used cash to repurchase outstanding shares in open market transactions, though we have not repurchased any shares in 2013.

Summary of Statement of Cash Flow

|

Three months ended March 31,

|

||||||||||||

|

(millions of U.S. dollars)

|

2013

|

2012

|

$ Change

|

|||||||||

|

Net cash provided by operating activities

|

116 | 267 | (151 | ) | ||||||||

|

Net cash (used in) provided by investing activities

|

(1,046 | ) | 185 | (1,231 | ) | |||||||

|

Net cash provided by (used in) financing activities

|

81 | (409 | ) | 490 | ||||||||

|

Translation adjustments on cash and cash equivalents

|

(11 | ) | 4 | (15 | ) | |||||||

|

(Decrease) increase in cash and cash equivalents

|

(860 | ) | 47 | (907 | ) | |||||||

|

Cash and cash equivalents at beginning of period

|

1,283 | 404 | 879 | |||||||||

|

Cash and cash equivalents at end of period

|

423 | 451 | (28 | ) | ||||||||

14

Operating activities. The decrease in net cash provided by operating activities reflected unfavorable working capital movements and the elimination of operating cash flows from Other Businesses, partly offset by lower interest and tax payments, all of which were due to timing. Operating cash flows from Other Businesses were impacted by timing of divestitures.

Investing activities. The increase in net cash used in investing activities reflected higher spending on acquisitions and timing of capital expenditures, which included payments related to a large multi-year software contract. Additionally, the first quarter of 2012 included proceeds from the sale of our Trade and Risk Management business. Our acquisition spending in the first quarter of 2013 was principally for PLC, a provider of practical legal know-how, current awareness and workflow solutions within the Legal segment. Capital expenditures in both periods were primarily directed at product and infrastructure technology.

Financing activities. Net cash provided by financing activities in the first quarter of 2013 was principally attributable to commercial paper borrowings. Net cash used in financing activities in the first quarter of 2012 reflected repayments of commercial paper. In both years, we continued to return cash to our shareholders primarily through dividends. Additional information about our debt, dividends and share repurchases is as follows:

|

|

·

|

Commercial paper program. Our $2.0 billion commercial paper program provides efficient and flexible short-term funding to balance the timing of completed acquisitions, expected disposal proceeds, dividend payments and debt repayments. We had commercial paper borrowings of $0.3 billion outstanding at March 31, 2013.

|

|

|

·

|

Credit facility. We have a $2.0 billion unsecured syndicated credit facility that expires in August 2016 which we may utilize from time to time to provide liquidity in connection with our commercial paper program and for general corporate purposes. In the first quarter of 2013, we borrowed and repaid $440 million. There were no outstanding borrowings at March 31, 2013.

|

Based on our current credit ratings, the cost of borrowing under the agreement is priced at LIBOR/EURIBOR plus 90 basis points. If our long-term debt rating were downgraded by Moody’s or Standard & Poor’s, our facility fee and borrowing costs may increase, although availability would be unaffected. Conversely, an upgrade in our ratings may reduce our facility fees and borrowing costs. We monitor the lenders that are party to our facility and believe they continue to be able to lend to us.

We may request an extension of the maturity date under certain circumstances for up to two additional one-year periods, which the applicable lenders may accept or decline in their sole discretion. We may also request an increase, subject to approval by applicable lenders, in the lenders’ commitments up to a maximum amount of $2.5 billion.

We guarantee borrowings by our subsidiaries under the credit facility. We must also maintain a ratio of net debt as of the last day of each fiscal quarter to EBITDA (earnings before interest, income taxes, depreciation and amortization and other modifications described in the credit agreement) for the last four quarters ended of not more than 4.5:1. We were in compliance with this covenant at March 31, 2013.

|

|

·

|

Credit ratings. Our access to financing depends on, among other things, suitable market conditions and the maintenance of suitable long-term credit ratings. Our credit ratings may be adversely affected by various factors, including increased debt levels, decreased earnings, declines in customer demand, increased competition, a further deterioration in general economic and business conditions and adverse publicity. Any downgrades in our credit ratings may impede our access to the debt markets or raise our borrowing rates.

|

The following table sets forth the credit ratings that we have received from rating agencies in respect of our outstanding securities as of the date of this management's discussion and analysis:

|

Moody’s

|

Standard & Poor’s

|

DBRS Limited

|

Fitch

|

|

|

Long-term debt

|

Baa1

|

A-

|

A (low)

|

A-

|

|

Commercial paper

|

-

|

A-1 (low)

|

R-1 (low)

|

F2

|

|

Trend/Outlook

|

Stable

|

Negative

|

Stable

|

Stable

|

We are not aware of any changes to our credit ratings being contemplated by rating agencies.

These credit ratings are not recommendations to purchase, hold, or sell securities and do not address the market price or suitability of a specific security for a particular investor. Credit ratings may not reflect the potential impact of all risks on the value of securities. We cannot assure you that our credit ratings will not be lowered in the future or that rating agencies will not issue adverse commentaries regarding our securities.

· Dividends. Dividends paid on our common shares were as follows for the periods presented:

|

Three months ended

March 31,

|

||||||||

|

(millions of U.S. dollars)

|

2013

|

2012

|

||||||

|

Dividends declared

|

269 | 265 | ||||||

|

Dividends reinvested

|

(10 | ) | (9 | ) | ||||

|

Dividends paid

|

259 | 256 | ||||||

15

In February 2013, our board of directors approved a $0.02 per share increase in the annualized dividend rate to $1.30 per common share.

|

|

·

|

Share repurchases. We may buy back shares (and subsequently cancel them) from time to time as part of our capital management strategy. Under our normal course issuer bid (NCIB), up to 15 million common shares (representing less than 2% of our total outstanding shares) may be repurchased in open market transactions on the Toronto Stock Exchange (TSX) or the New York Stock Exchange (NYSE) between May 22, 2012 and May 21, 2013.

|

We did not repurchase any shares in the first quarter of 2013. In 2012, we repurchased 4,332,200 shares under the current NCIB. Decisions regarding any future repurchases will be based on market conditions, share price and other factors including opportunities to invest capital for growth.

Free cash flow and free cash flow from ongoing businesses.

|

Three months ended

March 31,

|

||||||||

|

(millions of U.S. dollars)

|

2013

|

2012

|

||||||

|

Net cash provided by operating activities

|

116 | 267 | ||||||

|

Capital expenditures, less proceeds from disposals

|

(350 | ) | (280 | ) | ||||

|

Other investing activities

|

4 | 10 | ||||||

|

Dividends paid on preference shares

|

(1 | ) | (1 | ) | ||||

|

Free cash flow

|

(231 | ) | (4 | ) | ||||

|

Remove: Other Businesses

|

7 | (54 | ) | |||||

|

Free cash flow from ongoing businesses

|

(224 | ) | (58 | ) | ||||

Free cash flow and free cash flow from ongoing operations are historically lowest in the first quarter of the year and are not indicative of our full year expectations of $1.7 billion to $1.8 billion. The decreases in the first quarter of 2013 reflected lower cash from operating activities and higher capital spending for product and infrastructure technology. Free cash flow includes the impact of the elimination of operating cash flows from Other Businesses due to the timing of divestitures.

OFF-BALANCE SHEET ARRANGEMENTS, COMMITMENTS AND CONTRACTUAL OBLIGATIONS

For a summary of our other off-balance sheet arrangements, commitments and contractual obligations please see our 2012 annual management’s discussion and analysis. There were no material changes to these arrangements, commitments and contractual obligations outside the ordinary course of business during the three months ended March 31, 2013.

CONTINGENCIES

Lawsuits and Legal Claims

We are engaged in various legal proceedings, claims, audits and investigations that have arisen in the ordinary course of business. These matters include, but are not limited to, intellectual property infringement claims, employment matters and commercial matters. The outcome of all of the matters against us is subject to future resolution, including the uncertainties of litigation. Based on information currently known to us and after consultation with outside legal counsel, management believes that the probable ultimate resolution of any such matters, individually or in the aggregate, will not have a material adverse effect on our financial condition taken as a whole.

Uncertain Tax Positions

We are subject to taxation in numerous jurisdictions. There are many transactions and calculations during the course of business for which the ultimate tax determination is uncertain. We maintain provisions for uncertain tax positions that we believe appropriately reflect our risk. These provisions are made using the best estimate of the amount expected to be paid based on a qualitative assessment of all relevant factors. We review the adequacy of these provisions at the end of the reporting period. It is possible that at some future date, liabilities in excess of our provisions could result from audits by, or litigation with, relevant taxing authorities. Management believes that such additional liabilities would not have a material adverse impact on our financial condition taken as a whole.

16

OUTLOOK

The information in this section is forward-looking and should be read in conjunction with the section below entitled “Cautionary Note Concerning Factors That May Affect Future Results”.

We recently reaffirmed our business outlook for 2013 that was first communicated in February.

The following table sets forth our current 2013 financial outlook, the material assumptions related to our financial outlook and the material risks that may cause actual performance to differ materially from our current expectations.

Our 2013 outlook for revenues, adjusted EBITDA and underlying operating profit excludes the impact of foreign currency and previously announced businesses that have been or are expected to be exited through sale or closure. In addition, our 2013 outlook should be reviewed in connection with Appendix C (“Supplemental Financial Information”), which contains our revised 2012 full year results, and reflects the retrospective application of the amendments to IAS 19, Employee Benefits and the adoption of IFRS 11, Joint Arrangements.

|

2013 Outlook

|

Material assumptions

|

Material risks

|

||

|

Revenues expected to grow low single digits

|

— Improvement in net sales as the year progresses

— Positive gross domestic product (GDP) growth in the countries where we operate, led by rapidly developing economies

— Continued increase in the number of professionals around the world and their demand for high quality information and services

— Continued operational improvement in the Financial & Risk business and the successful execution of ongoing product release programs, our globalization strategy and other growth initiatives

|

— Uneven economic growth or recession across the markets we serve may result in reduced spending levels by our customers

— Demand for our products and services could be reduced by changes in customer buying patterns, competitive pressures or our inability to execute on key product or customer support initiatives

— Implementation of regulatory reform, including Dodd-Frank legislation and similar financial services laws around the world, may limit business opportunities for our customers, lowering their demand for our products and services

— Uncertainty regarding the European sovereign debt crisis and the Euro currency could impact demand from our customers as well as their ability to pay us

— Pressure on our customers, in developed markets in particular, to constrain the number of professionals employed due to regulatory and economic uncertainty

|

17

|

2013 Outlook

|

Material assumptions

|

Material risks

|

||

|

Adjusted EBITDA margin expected to be between 26% and 27%

|

— Revenues expected to grow low single digits

— Business mix continues to shift to higher-growth lower margin offerings

— Realization of expected benefits from cost control and efficiency initiatives, specifically in our Financial & Risk business relative to reductions in workforce, platform consolidation and operational simplification

|

— Refer to the risks above related to the revenue outlook

— Revenues from higher margin businesses may be lower than expected

— The costs of required investments exceed expectations or actual returns are below expectations

· Acquisition and disposal activity may dilute margins

· Cost control initiatives may cost more than expected, be delayed or may not produce the expected level of savings

|

||

|

Underlying operating profit margin expected to be between 16.5% and 17.5%

|

— Adjusted EBITDA margin expected to be between 26% and 27%

— Depreciation and amortization expense expected to represent approximately 9.5% of revenues

— Capital expenditures expected to be approximately 8% of revenues

|

— Refer to the risks above related to adjusted EBITDA margin outlook

— Capital expenditures may be higher than currently expected, resulting in higher in-period depreciation and amortization

|

||

|

Free cash flow is expected to be between $1.7 billion and $1.8 billion

|

— Revenues expected to grow low single digits

— Adjusted EBITDA margin expected to be between 26% and 27%

— Capital expenditures expected to be approximately 8% of revenues

|

— Refer to the risks above related to the revenue outlook and adjusted EBITDA margin outlook

— A weaker macroeconomic environment and unanticipated disruptions from new order-to-cash applications could negatively impact working capital performance

— Capital expenditures may be higher than currently expected resulting in higher cash outflows

— The timing of completing disposals of businesses may vary from our expectations resulting in actual free cash flow performance below our expectations

· The timing and amount of tax payments to governments may differ from our expectations.

· We may decide to make a voluntary contribution to our defined benefit plans

|

Additionally, in 2013, we expect interest expense to be $470 million to $490 million, assuming no significant change in our level of indebtedness and inclusive of non-cash pension related interest charges of $60 million to $70 million, relating to a new accounting pronouncement. We expect our 2013 effective tax rate (as a percentage of post-amortization adjusted earnings) will be between 11% to 13%, assuming no material changes in current tax laws or treaties to which we are subject.

18

RELATED PARTY TRANSACTIONS

As of April 29, 2013, Woodbridge beneficially owned approximately 55% of our shares.

TRANSACTIONS WITH WOODBRIDGE

From time to time, in the normal course of business, we enter into transactions with Woodbridge and certain of its affiliates. These transactions involve providing and receiving product and service offerings, are negotiated at arm’s length on standard terms, including price, and are not significant to our results of operations or financial condition either individually or in the aggregate.

In May 2012, as part of our efforts to expand our mutual fund data and strategic research capabilities, we acquired a Canadian mutual fund database, fund fact sheet business and mutual fund and equity data feed business for approximately C$9 million from The Globe and Mail (The Globe), which is majority owned by Woodbridge. We paid approximately C$8 million in cash and issued a C$1 million promissory note to The Globe that will be due in May 2016. In connection with the acquisition, we licensed the acquired database to The Globe over a four year term, valued at approximately C$250,000 per year. The Globe issued four promissory notes to us, each for the value of the annual license. Amounts due each year under the notes issued by The Globe will be offset against the note issued by us. Our board of directors’ Corporate Governance Committee approved the transaction.

In the normal course of business, certain of our subsidiaries charge a Woodbridge owned company fees for various administrative services. In 2012, the total amount charged to Woodbridge for these services was approximately $112,000.

We purchase property and casualty insurance from third party insurers and retain the first $500,000 of each and every claim under the programs via our captive insurance subsidiaries. Woodbridge is included in these programs and pays us a premium commensurate with its exposures. Premiums relating to 2012 were $40,000, which would approximate the premium charged by a third party insurer for such coverage.

We maintained an agreement with Woodbridge until April 17, 2008 (the closing date of the Reuters acquisition) under which Woodbridge agreed to indemnify up to $100 million of liabilities incurred either by our current and former directors and officers or by our company in providing indemnification to these individuals on substantially the same terms and conditions as would apply under an arm’s length, commercial arrangement. We were required to pay Woodbridge an annual fee of $750,000, which was less than the premium that would have been paid for commercial insurance. In 2008, we replaced this agreement with a conventional insurance agreement. We are entitled to seek indemnification from Woodbridge for any claims arising from events prior to April 17, 2008, so long as the claims are made before April 17, 2014.

TRANSACTIONS WITH ASSOCIATES AND JOINT VENTURES

From time to time, we enter into transactions with our investments in associates and joint ventures. These transactions typically involve providing or receiving services and are entered into in the normal course of business and on an arm’s length basis.