EXHIBIT 99.1

THOMSON REUTERS CORPORATION

MANAGEMENT’S DISCUSSION AND ANALYSIS

This management’s discussion and analysis is designed to provide you with a narrative explanation through the eyes of our management of our financial condition and results of operations. We recommend that you read this in conjunction with our interim financial statements for the three months ended March 31 ,2012, our 2011 annual financial statements and our 2011 annual management’s discussion and analysis. This management’s discussion and analysis is dated as of April 30, 2012.

About Thomson Reuters - We are the leading source of intelligent information for businesses and professionals. We combine industry expertise with innovative technology to deliver critical information to leading decision-makers. Through approximately 60,000 employees in over 100 countries, we deliver this must-have insight to the financial and risk, legal, tax and accounting, intellectual property and science and media markets, powered by the world’s most trusted news organization.

We derive the majority of our revenues from selling electronic content and services to professionals, primarily on a subscription basis. Over the years, this has proven to be capital efficient and cash flow generative, and it has enabled us to maintain leading and scalable positions in our chosen markets. Within each of the markets we serve, we bring in-depth understanding of our customers’ needs, flexible technology platforms, proprietary content and scale. We believe our ability to embed our solutions into customers’ workflows is a significant competitive advantage as it leads to strong customer retention.

How this section is organized - We have organized our management’s discussion and analysis in the following key sections:

|

|

·

|

Overview – a brief discussion of our business;

|

|

|

·

|

Results of Operations – a comparison of our current and prior period results;

|

|

|

·

|

Liquidity and Capital Resources – a discussion of our cash flow and debt;

|

|

|

·

|

Outlook – our current financial outlook for 2012;

|

|

|

·

|

Related Party Transactions – a discussion of transactions with our principal and controlling shareholder, The Woodbridge Company Limited (Woodbridge), and others;

|

|

|

·

|

Subsequent Events – a discussion of material events occurring after March 31, 2012 and through the date of this management’s discussion and analysis;

|

|

|

·

|

Changes in Accounting Policies – a discussion of changes in our accounting policies and recent accounting pronouncements;

|

|

|

·

|

Critical Accounting Estimates and Judgments – a discussion of critical estimates and judgments made by our management in applying accounting policies;

|

|

|

·

|

Additional Information – other required disclosures; and

|

|

|

·

|

Appendices – supplemental information and discussion.

|

References in this discussion to “$” and “US$” are to U.S. dollars. In addition, “bp” means “basis points” and “na” and “n/m” refer to “not applicable” and “not meaningful”, respectively. Unless otherwise indicated or the context otherwise requires, references in this discussion to “we,” “our,” “us” and “Thomson Reuters” are to Thomson Reuters Corporation and our subsidiaries.

Forward-looking statements - This management's discussion and analysis also contains forward-looking statements, which are subject to risks and uncertainties that could cause our actual results to differ materially from the forward-looking statements. Forward-looking statements include, but are not limited to, our expectations regarding:

|

|

·

|

General economic conditions and market trends and their anticipated effects on our business;

|

|

|

·

|

Our 2012 financial outlook;

|

|

|

·

|

Investments that we have made and plan to make and the timing for businesses that we expect to sell; and

|

|

|

·

|

Our liquidity and capital resources available to us to fund our ongoing operations, investments and returns to shareholders.

|

For additional information related to forward-looking statements and material risks associated with them, please see the section of this management’s discussion and analysis entitled “Cautionary Note Concerning Factors That May Affect Future Results”.

1

OVERVIEW

KEY HIGHLIGHTS

Our first quarter results met our expectations and we are progressing on our key priorities.

|

|

·

|

4% growth in revenues from ongoing businesses (before currency)(1) was led by our Legal, Tax & Accounting and Intellectual Property & Science segments. Growth from these segments reflected the benefit of our investments in products, adjacent markets and new geographic areas in recent years and favorable market dynamics, particularly in Tax & Accounting. Our Financial & Risk segment made progress on product and customer initiatives to address challenges in the business.

|

|

|

·

|

Adjusted EBITDA margin(1) increased 260 basis points due to the elimination of Reuters integration expenses, as we completed the program last year, and from higher revenues. Underlying operating profit margin(1) decreased 30 basis points due to higher depreciation and amortization associated with investments in products. Adjusted earnings per share(1) of $0.44 increased 19% due to the elimination of integration expenses and higher underlying operating profit.

|

Financial & Risk is simplifying its product strategy and is focused on improving customer experience. We opened a new Thomson Reuters Elektron hosting center in Brazil and we launched several new products including:

|

|

·

|

DataStream Pro, a new product for investment managers, which consolidates 12 legacy desktop products;

|

|

|

·

|

Accelus Compliance Manager in our Governance, Risk & Compliance business unit; and

|

|

|

·

|

Specific versions of Thomson Reuters Eikon for Commodities & Energy and for Wealth Management in Asia and EMEA (Europe, Middle East and Africa).

|

We recently entered into a definitive agreement to sell our Healthcare business for $1.25 billion and we expect the transaction to close in the next few months. We expect to use the proceeds from the sale for tactical acquisitions and investments in existing products and services. We may also use some of the proceeds to repurchase shares of our company.

We recently reaffirmed our 2012 business outlook that we originally communicated in February. Additional information is provided in the “Outlook” section of this management’s discussion and analysis.

|

(1)

|

Refer to Appendix A for additional information on non-IFRS financial measures.

|

OUR ORGANIZATIONAL STRUCTURE

Thomson Reuters is organized as a group of strategic business units: Financial & Risk, Legal, Tax & Accounting and Intellectual Property & Science, supported by a corporate center. This structure became effective January 1, 2012 and is intended to allow us to work better across business units to meet the increasingly complex demands of our customers, capture growth opportunities and achieve efficiencies by building innovative technology platforms that can be shared across the company. We were previously organized as two divisions: Professional (consisting of our legal, tax and accounting and intellectual property and science businesses) and Markets (consisting of our financial and media businesses).

Under our current structure, the new Financial & Risk unit consists of the financial businesses that were previously part of our Markets division and some of the Governance, Risk & Compliance businesses that were previously included within our Legal segment. We also operate a Global Growth & Operations organization which works across our business units to identify opportunities in faster growing geographic areas. Our News organization and Media business, previously part of the Markets division, are managed at our corporate center. See the “Business” section of our 2011 annual report for additional information about our strategic business units.

SEASONALITY

Our revenues and operating profits do not tend to be significantly impacted by seasonality as we record a large portion of our revenues ratably over a contract term and our costs (other than expenses associated with the Reuters integration program that was completed in 2011) are generally incurred evenly throughout the year. However, our non-recurring revenues can cause changes in our performance from quarter to consecutive quarter. Additionally, the release of certain print-based offerings can be seasonal as can certain product releases for the regulatory markets, which tend to be concentrated at the end of the year.

2

USE OF NON-IFRS FINANCIAL MEASURES

In addition to our results reported in accordance with International Financial Reporting Standards (IFRS), we use certain non-IFRS financial measures as supplemental indicators of our operating performance and financial position and for internal planning purposes. These non-IFRS financial measures include:

|

|

·

|

Revenues from ongoing businesses;

|

|

|

·

|

Revenues at constant currency (before currency or revenues excluding the effects of foreign currency);

|

|

|

·

|

Underlying operating profit and underlying operating profit margin;

|

|

|

·

|

Adjusted EBITDA and adjusted EBITDA margin;

|

|

|

·

|

Adjusted earnings and adjusted earnings per share from continuing operations;

|

|

|

·

|

Net debt;

|

|

|

·

|

Free cash flow; and

|

|

|

·

|

Free cash flow from ongoing operations.

|

We have historically reported non-IFRS financial measures as we believe their use provides more insight into our performance. Please see Appendix A of this management’s discussion and analysis for a description of our non-IFRS financial measures, including an explanation of why we believe they are useful measures of our performance, including our ability to generate cash flow. Non-IFRS financial measures are unaudited. Please see the sections of this management’s discussion and analysis entitled “Results of Operations”, “Liquidity and Capital Resources” and Appendix B for reconciliations of these non-IFRS financial measures to the most directly comparable IFRS financial measures.

RESULTS OF OPERATIONS

BASIS OF PRESENTATION

Within this management’s discussion and analysis, we discuss our results of operations on various bases, all of which exclude discontinued operations and include the performance of acquired businesses from the date of their purchase.

Consolidated results

We discuss our consolidated results from continuing operations as reported in our income statement. Additionally, we discuss our consolidated results on a non-IFRS basis which, among other adjustments, excludes “Other businesses”, which is an aggregation of businesses that have been or are expected to be exited through sale or closure that did not qualify for discontinued operations classification.

Segment results

We discuss the results of our four reportable segments as presented in our interim financial statements for the three months ended March 31, 2012: Financial & Risk, Legal, Tax & Accounting and Intellectual Property & Science. Our reportable segments align with our strategic business unit structure and reflect how we manage our company from January 1, 2012 (1).

We also provide information on “Corporate & Other” and “Other businesses”. The items in these categories do not qualify as a component of another reportable segment, nor as a separate reportable segment. Corporate & Other includes expenses for corporate functions and certain share-based compensation costs as well as the results from our Media business.

Note 3 of our interim financial statements for the three months ended March 31, 2012 includes a reconciliation of results from our reportable segments to consolidated results as reported in our income statement.

In analyzing our revenues from ongoing businesses, at both the consolidated and segment levels, we separately measure the effect of foreign currency. We measure the performance of existing businesses and the impact of acquired businesses on a constant currency basis.

|

(1)

|

Prior period amounts have been reclassified to reflect the current presentation. See Appendix C for restated 2011 and 2010 annual information.

|

3

CONSOLIDATED RESULTS

|

Three months ended

March 31,

|

||||||||||||

|

(millions of U.S. dollars, except per share amounts)

|

2012

|

2011

|

Change

|

|||||||||

|

IFRS Financial Measures

|

||||||||||||

|

Revenues

|

3,354 | 3,330 | 1 | % | ||||||||

|

Operating profit

|

386 | 396 | (3 | %) | ||||||||

|

Diluted earnings per share

|

$ | 0.38 | $ | 0.30 | 27 | % | ||||||

|

Non-IFRS Financial Measures

|

||||||||||||

|

Revenues from ongoing businesses

|

3,187 | 3,077 | 4 | % | ||||||||

|

Adjusted EBITDA

|

825 | 717 | 15 | % | ||||||||

|

Adjusted EBITDA margin

|

25.9 | % | 23.3 | % | 260 | bp | ||||||

|

Underlying operating profit

|

545 | 536 | 2 | % | ||||||||

|

Underlying operating profit margin

|

17.1 | % | 17.4 | % | (30 | )bp | ||||||

|

Adjusted earnings per share from continuing operations

|

$ | 0.44 | $ | 0.37 | 19 | % | ||||||

Foreign currency effects. With respect to the average foreign exchange rates that we use to report our results, the U.S. dollar stengthened against the Euro and British pound sterling, but weakened against the Japanese yen in the first quarter of 2012 compared to the same period in 2011. Given our currency mix of revenues and expenses around the world, these fluctuations did not impact our consolidated revenues in U.S. dollars or our underlying operating profit margin.

Revenues.

|

Three months ended

March 31,

|

Percentage change:

|

|||||||||||||||||||||||||||

|

(millions of U.S. dollars)

|

2012

|

2011

|

Existing

businesses

|

Acquired

businesses

|

Constant

currency

|

Foreign

currency

|

Total

|

|||||||||||||||||||||

|

Revenues from ongoing businesses

|

3,187 | 3,077 | 1 | % | 3 | % | 4 | % | - | 4 | % | |||||||||||||||||

|

Other businesses

|

167 | 253 | n/m | n/m | n/m | n/m | n/m | |||||||||||||||||||||

|

Revenues

|

3,354 | 3,330 | n/m | n/m | n/m | n/m | 1 | % | ||||||||||||||||||||

Revenues from ongoing businesses increased on a constant currency basis led by our Legal, Tax & Accounting and Intellectual Property & Science segments and the Marketplaces and Governance, Risk & Compliance business units within our Financial & Risk segment. These increases more than offset decreases from Financial & Risk’s Trading and Investors business units. Acquisitions contributed to revenue growth.

Our Global Growth & Operations organization is focused on supporting our businesses in the following geographic areas: Latin America (and Iberia), the Middle East, Africa, Russia and the Commonwealth of Independent States, China and India. Revenues from these geographic areas represented approximately 7% of our revenues in the first quarter of 2012 and grew 18% on a constant currency basis (7% from existing businesses). Our 2011 acquisition of Mastersaf in Brazil contributed to revenue growth.

4

Operating profit, underlying operating profit and adjusted EBITDA.

|

Three months ended

March 31,

|

||||||||||||

|

(millions of U.S. dollars)

|

2012

|

2011

|

Change

|

|||||||||

|

Operating profit

|

386 | 396 | (3 | %) | ||||||||

|

Adjustments:

|

||||||||||||

|

Amortization of other identifiable intangible assets

|

152 | 144 | ||||||||||

|

Integration programs expenses

|

- | 70 | ||||||||||

|

Fair value adjustments

|

30 | (2 | ) | |||||||||

|

Other operating gains, net

|

(22 | ) | (33 | ) | ||||||||

|

Operating profit from Other businesses

|

(1 | ) | (39 | ) | ||||||||

|

Underlying operating profit

|

545 | 536 | 2 | % | ||||||||

|

Adjustments:

|

||||||||||||

|

Integration programs expenses

|

- | (70 | ) | |||||||||

|

Depreciation and amortization of computer software (excluding Other businesses)

|

280 | 251 | ||||||||||

|

Adjusted EBITDA (1)

|

825 | 717 | 15 | % | ||||||||

|

Underlying operating profit margin

|

17.1 | % | 17.4 | % | (30 | )bp | ||||||

|

Adjusted EBITDA margin

|

25.9 | % | 23.3 | % | 260 | bp | ||||||

|

(1)

|

See Appendix B for a reconciliation of earnings from continuing operations to adjusted EBITDA.

|

Operating profit decreased as the favorable effects from higher revenues, elimination of Reuters integration expenses (as the various programs were completed in 2011) and savings from efficiency initiatives were more than offset by lower results from “Other businesses” (which are businesses that we have or plan to exit through sale or closure), unfavorable fair value adjustments and lower other operating gains, net. The results of other businesses are not comparable from period to period as the composition of businesses changes due to the timing of completed divestitures.

Underlying operating profit increased due to higher revenues and savings from efficiency initiatives. Underlying operating profit margin decreased, reflecting higher depreciation and amortization from prior investments in products. Adjusted EBITDA and the related margin benefited from the elimination of integration programs expenses.

Our results for the first quarter of 2012 included $28 million of severance charges, the majority of which were recorded within Corporate & Other. Our results for the first quarter of 2011 included $39 million of efficiency-related charges, the majority of which were recorded within our Financial & Risk segment as those charges were considered non-integration related.

For the full year, we expect adjusted EBITDA margin to range between 27% and 28% and underlying operating profit margin to range between 18% and 19%. We expect a more pronounced improvement in margins in the fourth quarter of 2012 due to easier comparisons resulting from the elimination of reorganization costs and integration expenses that were incurred in the fourth quarter of last year.

Operating expenses.

|

Three months ended

March 31,

|

||||||||||||

|

(millions of U.S. dollars)

|

2012

|

2011

|

Change

|

|||||||||

|

Operating expenses

|

2,553 | 2,552 | - | % | ||||||||

|

Remove:

|

||||||||||||

|

Fair value adjustments (1)

|

(30 | ) | 2 | |||||||||

|

Other businesses

|

(161 | ) | (194 | ) | ||||||||

|

Operating expenses, excluding fair value adjustments and Other businesses

|

2,362 | 2,360 | - | % | ||||||||

|

(1)

|

Fair value adjustments primarily represent non-cash accounting adjustments from the revaluation of embedded foreign exchange derivatives within certain customer contracts due to fluctuations in foreign exchange rates and mark-to-market adjustments from certain share-based awards.

|

Operating expenses, excluding fair value adjustments and Other businesses, were essentially unchanged. In the three months ended March 31, 2012, savings generated from tight cost controls and efficiency initiatives mitigated increases associated with recent acquisitions and $28 million of severance charges.

In the three months ended March 31, 2011, operating expenses included $39 million of non-integration efficiency-related charges and $70 million of Reuters integration expenses.

5

Depreciation and amortization.

|

Three months ended

March 31,

|

||||||||||||

|

(millions of U.S. dollars)

|

2012

|

2011

|

Change

|

|||||||||

|

Depreciation

|

110 | 107 | 3 | % | ||||||||

|

Amortization of computer software

|

175 | 164 | 7 | % | ||||||||

|

Amortization of other identifiable intangible assets

|

152 | 144 | 6 | % | ||||||||

|

|

·

|

Depreciation and amortization of computer software increased reflecting investments in products such as Thomson Reuters Eikon, new capital expenditures and amortization of assets from recently acquired businesses, particularly in our Tax & Accounting segment.

|

|

|

·

|

Amortization of other identifiable intangible assets increased due to amortization from newly-acquired assets, which more than offset decreases from the completion of amortization for certain identifiable intangible assets acquired in previous years.

|

Other operating gains, net.

|

Three months ended

March 31,

|

||||||||

|

(millions of U.S. dollars)

|

2012

|

2011

|

||||||

|

Other operating gains, net

|

22 | 33 | ||||||

In the three months ended March 31, 2012, other operating gains, net, were primarily comprised of a $37 million gain from the sale of our Trade and Risk Management business, partially offset by transaction-related charges associated with business acquisitions and anticipated divestitures. The prior year period included a gain in connection with the termination of an information technology outsourcing agreement.

Net interest expense.

|

Three months ended

March 31,

|

||||||||||||

|

(millions of U.S. dollars)

|

2012

|

2011

|

Change

|

|||||||||

|

Net interest expense

|

114 | 101 | 13 | % | ||||||||

The increase in net interest expense was attributable to interest associated with certain tax liabilities. Because over 90% of our long-term debt obligations pay interest at fixed rates (after swaps), the balance of interest expense was relatively unchanged.

Other finance income.

|

Three months ended

March 31,

|

||||||||

|

(millions of U.S. dollars)

|

2012

|

2011

|

||||||

|

Other finance income

|

30 | 7 | ||||||

Other finance income included gains or losses realized from changes in foreign currency exchange rates on certain intercompany funding arrangements and gains or losses related to freestanding derivative instruments.

Share of post tax (losses) earnings in equity method investees.

|

Three months ended

March 31,

|

||||||||

|

(millions of U.S. dollars)

|

2012

|

2011

|

||||||

|

Share of post tax (losses) earnings in equity method investees

|

(7 | ) | 5 | |||||

We realized losses from our equity method investees in the first quarter of 2012 compared to earnings in the prior year period.

6

Tax benefit (expense).

|

Three months ended

March 31,

|

||||||||

|

(millions of U.S. dollars)

|

2012

|

2011

|

||||||

|

Tax benefit (expense)

|

33 | (52 | ) | |||||

Tax benefit (expense) for each period presented reflected the mix of taxing jurisdictions in which pre-tax profits and losses were recognized. However, because the geographical mix of pre-tax profits and losses in interim periods may not be reflective of full year results, this distorts our interim period effective tax rate.

The following items were included in tax benefit (expense) for the three months ended March 31, 2012:

|

|

·

|

$87 million of tax benefit from the recognition of a deferred tax asset that we expect to realize in connection with the planned sale of our Healthcare business;

|

|

|

·

|

$26 million of discrete tax benefits, of which $14 million related to lower corporate tax rates that were substantively enacted in certain jurisdictions outside the U.S. The remainder related to the recognition of deferred tax assets and the reversal of provisions for uncertain tax positions; and

|

|

|

·

|

$ 33 million of tax expense related to a gain on the sale of the Trade and Risk Management business.

|

Net earnings and earnings per share.

|

Three months ended

March 31,

|

||||||||

|

(millions of U.S. dollars, except per share amounts)

|

2012

|

2011

|

||||||

|

Net earnings

|

326 | 257 | ||||||

|

Diluted earnings per share

|

$ | 0.38 | $ | 0.30 | ||||

Net earnings and the related per share amounts increased as a result of tax benefits, higher operating profit from our reportable segments and the elimination of integration programs expenses, which more than offset lower operating profit from Other businesses, unfavorable fair value adjustments, losses from our equity method investees and higher net interest expense.

Adjusted earnings and adjusted earnings per share from continuing operations.

|

Three months ended

March 31,

|

||||||||||||

|

(millions of U.S. dollars, except per share amounts and share data)

|

2012

|

2011

|

Change

|

|||||||||

|

Earnings attributable to common shareholders

|

314 | 250 | 26 | % | ||||||||

|

Adjustments:

|

||||||||||||

|

Operating profit from Other businesses

|

(1 | ) | (39 | ) | ||||||||

|

Fair value adjustments

|

30 | (2 | ) | |||||||||

|

Other operating gains, net

|

(22 | ) | (33 | ) | ||||||||

|

Other finance income

|

(30 | ) | (7 | ) | ||||||||

|

Share of post-tax losses (earnings) in equity method investees

|

7 | (5 | ) | |||||||||

|

Tax on above

|

21 | 12 | ||||||||||

|

Interim period effective tax rate normalization

|

6 | (10 | ) | |||||||||

|

Discrete tax items

|

(113 | ) | - | |||||||||

|

Amortization of other identifiable intangible assets

|

152 | 144 | ||||||||||

|

Discontinued operations

|

2 | (2 | ) | |||||||||

|

Dividends declared on preference shares

|

(1 | ) | (1 | ) | ||||||||

|

Adjusted earnings from continuing operations

|

365 | 307 | 19 | % | ||||||||

|

Adjusted earnings per share from continuing operations (adjusted EPS)

|

$ | 0.44 | $ | 0.37 | 19 | % | ||||||

|

Diluted weighted average common shares (millions)

|

830.3 | 839.7 | ||||||||||

Adjusted earnings from continuing operations and the related per share amount increased primarily due to the elimination of integration expenses as the various programs associated with the Reuters acquisition were completed in 2011, but also reflected higher underlying operating profit.

7

SEGMENT RESULTS

A discussion of the operating results of each of our reportable segments follows. By definition, results from the Media business and Other businesses are excluded from our reportable segments as they do not qualify as a component of our four reportable segments, nor as a separate reportable segment. We use segment operating profit to measure the performance of our reportable segments. Our definition of segment operating profit as reflected below may not be comparable to that of other companies. We define segment operating profit as operating profit before (i) amortization of other identifiable intangible assets; (ii) other operating gains and losses; (iii) certain asset impairment charges; and (iv) corporate-related items (including corporate expense, costs associated with the Reuters integration program that was completed in 2011 and fair value adjustments). We use this measure because we do not consider these excluded items to be controllable operating activities for purposes of assessing the current performance of our reportable segments. We also use segment operating profit margin, which we define as segment operating profit as a percentage of revenues. As a supplemental measure of segment performance, we add back depreciation and amortization of computer software to segment operating profit to arrive at each segment’s EBITDA and with the related margin as a percentage of revenues.

Financial & Risk

|

Three months ended

March 31,

|

Percentage change:

|

|||||||||||||||||||||||||||

|

(millions of U.S. dollars)

|

2012

|

2011

|

Existing

businesses

|

Acquired

businesses

|

Constant

currency

|

Foreign

currency

|

Total

|

|||||||||||||||||||||

|

Trading

|

859 | 885 | (2 | %) | - | (2 | %) | (1 | %) | (3 | %) | |||||||||||||||||

|

Investors

|

603 | 623 | (3 | %) | - | (3 | %) | - | (3 | %) | ||||||||||||||||||

|

Marketplaces

|

298 | 273 | 4 | % | 6 | % | 10 | % | (1 | %) | 9 | % | ||||||||||||||||

|

Governance, Risk & Compliance (GRC)

|

51 | 23 | 16 | % | 106 | % | 122 | % | - | 122 | % | |||||||||||||||||

|

Revenues

|

1,811 | 1,804 | (1 | %) | 2 | % | 1 | % | (1 | %) | - | |||||||||||||||||

|

EBITDA

|

459 | 465 | (1 | %) | ||||||||||||||||||||||||

|

EBITDA margin

|

25.3 | % | 25.8 | % | (50 | )bp | ||||||||||||||||||||||

|

Segment operating profit

|

302 | 327 | (8 | %) | ||||||||||||||||||||||||

|

Segment operating profit margin

|

16.7 | % | 18.1 | % | (140 | )bp | ||||||||||||||||||||||

Revenues increased on a constant currency basis led by Marketplaces and GRC. Acquired businesses also contributed to revenue growth, including Rafferty Capital Markets (a U.S. based registered broker-dealer now part of Marketplaces) and World-Check (a provider of financial crime and corruption information in GRC), both acquired in 2011. Revenues from our Trading and Investors business units decreased. Financial & Risk is executing on a more focused strategy to deliver products which address end-user needs and to improve customer experience. Net sales (gross sales, less cancellations) for Financial & Risk improved sequentially from the fourth quarter of last year, but remained negative, as modest improvements in the Americas were offset by the effects of challenging market conditions in Europe. We expect that ongoing product releases and customer support programs will gradually lead to positive net sales by the end of the year.

|

By revenue type:

|

First Quarter 2012 Revenues

|

|

|

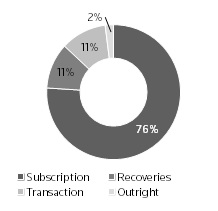

· Subscription revenues increased 1% due to acquisitions and the benefit of a price increase. Excluding acquisitions, revenues decreased 1% due to desktop losses. We continued to make progress with the rollout of Thomson Reuters Eikon and Thomson Reuters Elektron. Thomson Reuters Eikon had more than 16,000 active desktops at the end of the first quarter of 2012, an increase of 30% from year-end 2011, and Thomson Reuters Elektron has 15 hosting centers around the world, including a new center opened in Brazil in April 2012.

· Recoveries revenues (low-margin revenues that we collect and largely pass-through to a third party provider, such as stock exchange fees) increased 2% as a result of a price increase from exchanges.

· Transaction revenues increased 4%, led by higher fixed income volume at Tradeweb. Lower foreign exchange volumes impacted revenues.

· Outright revenues, which are primarily discrete sales of software and services, represented a small portion of Financial & Risk’s revenues and increased 9%.

|

_______________________________

|

8

By geographic area, revenues from Europe, Middle East and Africa (EMEA) increased 2%, Americas increased 1% and Asia were unchanged, as decreases from Japan offset increases across other Asian markets.

The following provides additional information regarding Financial & Risk businesses on a constant currency basis:

|

|

·

|

Trading revenues decreased as growth from Commodities & Energy and Foreign Exchange was offset by desktop cancellations in Exchange Traded Instruments and Fixed Income. Recoveries revenues increased 2%.

|

|

|

·

|

Investors revenues declined as a 16% increase in Enterprise Content, driven by demand for pricing and reference data, was more than offset by a 10% decrease from Investment Management (IM). Prior year cancellations and challenging operating conditions in Europe impacted IM’s performance. While IM’s revenues declined sequentially from the fourth quarter of 2011, net sales, though still negative, improved over the same period. Revenues from Corporate customers increased 1%, Investment Banking was unchanged and Wealth Management decreased 3%.

|

|

|

·

|

Marketplaces revenues increased led by Tradeweb, which benefited from the recent acquisition of Rafferty Capital Markets and also reflected 11% growth from Tradeweb’s existing business. Foreign exchange revenues rose slightly, but were impacted by lower transaction volumes.

|

|

|

·

|

GRC revenues increased significantly as this unit is primarily comprised of recently acquired business. Strong demand for risk and compliance solutions also contributed to revenue growth. Thomson Reuters Accelus Compliance Manager was launched in March 2012.

|

EBITDA, segment operating profit and the related margins were adversely impacted by foreign currency. Foreign currency accounted for the 50 basis points reduction in EBITDA margin and 40 basis points of the unfavorable impact on segment operating profit margin. Excluding foreign currency, EBITDA increased 1% and segment operating profit decreased 4%. Segment operating profit and the related margin also reflected the impact of higher depreciation and amortization charges attributable to investments in products, such as Thomson Reuters Eikon, where we continued to roll out new releases in the first quarter of 2012.

The first quarter of 2011 included $28 million of non-integration severance charges as a result of ongoing opportunities to streamline our operations.

Legal

|

Three months ended

March 31,

|

Percentage change:

|

|||||||||||||||||||||||||||

|

(millions of U.S. dollars)

|

2012

|

2011

|

Existing

businesses

|

Acquired

businesses

|

Constant

currency

|

Foreign

currency

|

Total

|

|||||||||||||||||||||

|

Revenues

|

777 | 754 | 2 | % | 1 | % | 3 | % | - | 3 | % | |||||||||||||||||

|

EBITDA

|

270 | 257 | 5 | % | ||||||||||||||||||||||||

|

EBITDA margin

|

34.7 | % | 34.1 | % | 60 | bp | ||||||||||||||||||||||

|

Segment operating profit

|

200 | 190 | 5 | % | ||||||||||||||||||||||||

|

Segment operating profit margin

|

25.7 | % | 25.2 | % | 50 | bp | ||||||||||||||||||||||

Revenues increased on a constant currency basis reflecting contributions from both existing and acquired businesses. The Legal segment continues to benefit from our investments in products, adjacent markets and new geographic areas in recent years. The legal services market environment improved modestly in the first quarter of 2012, after declining in the fourth quarter of 2011. The improvement was led by higher demand for litigation services, which is the largest legal services sector. WestlawNext continues to gain market acceptance and has been sold to approximately 65% of Westlaw’s revenue base.

By revenue type:

|

|

·

|

Subscription revenues increased 4%, led by client development solutions and global businesses;

|

|

|

·

|

Transaction revenues increased 7%, led by our back office and legal process outsourcing solutions; and

|

|

|

·

|

U.S. print revenues declined 3%.

|

By line of business:

|

|

·

|

U.S. Law Firm Solutions revenues increased 2%, led by a 12% increase in Business of Law revenues (FindLaw and Elite). Core legal research revenues were unchanged;

|

|

|

·

|

Corporate, Government & Academic revenues increased 4%, led by growth in legal process outsourcing;

|

9

|

|

·

|

Global businesses revenues increased 7% (4% from existing businesses) led by growth in Latin America. Global businesses include our operations outside the U.S. in both developed markets such as the U.K., Canada, Australia and New Zealand and higher growth regions such as Latin America and Asia; and

|

|

|

·

|

U.S. Law Firm Solutions, Corporate, Government & Academic and Global businesses represented approximately 55%, 25% and 20% of the Legal segment’s revenues, respectively, in the first quarter of 2012.

|

EBITDA and segment operating profit increased due to the benefits of scale from higher revenues and savings from efficiency initiatives. The prior year period also included a $10 million efficiency-related charge. Unfavorable business mix impacted margins, as our higher-growth business have attractive margins, but still not as high as those in our core legal research business.

Tax & Accounting

|

Three months ended

March 31,

|

Percentage change:

|

|||||||||||||||||||||||||||

|

(millions of U.S. dollars)

|

2012

|

2011

|

Existing

businesses

|

Acquired

businesses

|

Constant

currency

|

Foreign

currency

|

Total

|

|||||||||||||||||||||

|

Revenues

|

310 | 238 | 9 | % | 22 | % | 31 | % | (1 | %) | 30 | % | ||||||||||||||||

|

EBITDA

|

96 | 64 | 50 | % | ||||||||||||||||||||||||

|

EBITDA margin

|

31.0 | % | 26.9 | % | 410 | bp | ||||||||||||||||||||||

|

Segment operating profit

|

68 | 43 | 58 | % | ||||||||||||||||||||||||

|

Segment operating profit margin

|

21.9 | % | 18.1 | % | 380 | bp | ||||||||||||||||||||||

Revenues increased on a constant currency basis reflecting contributions from both existing and acquired businesses. Revenue growth was led by sales to professional accounting firms, our tax information reporting services and our ONESOURCE global tax workstation. U.S. accounting firms continue to hire professionals and we are driving growth through product innovations. ONESOURCE, built through a combination of internal investment and acquired capabilities, continues to be well received by corporate tax departments. Significant acquisitions in 2012 include Dr. Tax Software, a Canadian based developer of income tax software for accounting firms and consumers, and in 2011, Mastersaf, which provided entry into Brazil, and Manatron, which provided entry into the government tax automation market.

EBITDA, segment operating profit and the related margins increased due to the benefits of scale from higher revenues and savings from efficiency initiatives. Segment operating profit margin also included the dilutive effects of software amortization from acquired businesses.

Tax & Accounting is a seasonal business with a significant percentage of its operating profit historically generated in the fourth quarter. Small movements in the timing of expenses can impact quarterly margins. Full-year margins are more reflective of the segment’s performance.

Intellectual Property & Science

|

Three months ended

March 31,

|

Percentage change:

|

|||||||||||||||||||||||||||

|

(millions of U.S. dollars)

|

2012

|

2011

|

Existing

businesses

|

Acquired

businesses

|

Constant

currency

|

Foreign

currency

|

Total

|

|||||||||||||||||||||

|

Revenues

|

209 | 201 | 3 | % | 1 | % | 4 | % | - | 4 | % | |||||||||||||||||

|

EBITDA

|

72 | 66 | 9 | % | ||||||||||||||||||||||||

|

EBITDA margin

|

34.4 | % | 32.8 | % | 160 | bp | ||||||||||||||||||||||

|

Segment operating profit

|

55 | 52 | 6 | % | ||||||||||||||||||||||||

|

Segment operating profit margin

|

26.3 | % | 25.9 | % | 40 | bp | ||||||||||||||||||||||

Revenues increased on a constant currency basis reflecting contributions from both existing and acquired businesses. These increases were driven by growth in the Intellectual Property Solutions and Scientific & Scholarly Research businesses, partly offset by a 1% decline in Life Sciences revenues due to timing of renewals and a challenging prior year comparable that benefited from a discrete sale.

EBITDA, segment operating profit and the related margins increased due to higher revenues. Segment operating profit and the related margin also reflected the impact of higher depreciation and amortization charges attributable to investments in products.

Small movements in the timing of expenses can impact quarterly margins. Full-year margins are more reflective of the segment’s performance.

10

Corporate & Other

|

Three months ended

March 31,

|

||||||||

|

(millions of U.S. dollars)

|

2012

|

2011

|

||||||

|

Revenues – Media

|

82 | 82 | ||||||

|

Media

|

(1 | ) | (1 | ) | ||||

|

Core corporate expenses

|

(79 | ) | (75 | ) | ||||

|

Total

|

(80 | ) | (76 | ) | ||||

Revenues from our Media business were unchanged as an increase in Agency revenues, led by Reuters America, was offset by lower advertising-based revenues and unfavorable foreign currency.

Core corporate expenses were slightly higher as we incurred severance charges which were partially offset by timing of expenses and other savings.

Other businesses

“Other businesses” includes businesses that we plan to sell or close. We provide information on the performance of these Other businesses separately from our reportable segments. The results of Other businesses are not comparable from period to period, as the composition of businesses changes as businesses are identified for sale or closure. Further fluctuations are caused by the timing of the sales or closures.

|

Three months ended

March 31,

|

||||||||

|

(millions of U.S. dollars)

|

2012

|

2011

|

||||||

|

Revenues

|

167 | 253 | ||||||

|

Operating profit

|

1 | 39 | ||||||

The more significant businesses included in this category for the periods presented were:

|

Business

|

Status

|

Former Segment

|

Description

|

|||

|

BARBRI

|

Sold - Q2 2011

|

Legal

|

A provider of bar exam preparatory workshops, courses, software, lectures and other tools in the U.S.

|

|||

|

Healthcare

|

Signed agreement for sale – Q2 2012

|

Healthcare & Science

|

A provider of data, analytics and performance benchmarking solutions and services to companies, government agencies and healthcare professionals

|

|||

|

Property Tax Consulting

|

Held for sale

|

Tax & Accounting

|

A provider of property tax outsourcing and compliance services in the U.S.

|

|||

|

Trade and Risk Management

|

Sold - Q1 2012

|

Financial & Risk

|

A provider of risk management solutions to financial institutions, including banks, broker-dealers and hedge funds

|

We had previously suspended the divestiture process of our Healthcare business in December 2011. The process was resumed in the first quarter of this year and we recently reached agreement to sell this business. We expect the transaction to close in the next few months. See “Subsequent Events”.

LIQUIDITY AND CAPITAL RESOURCES

At March 31, 2012, we had a strong liquidity position with:

|

|

·

|

Approximately $0.5 billion of cash on hand;

|

|

|

·

|

Access through August 2016 to an undrawn $2.0 billion syndicated credit facility;

|

|

|

·

|

The ability to access capital markets as evidenced by our active commercial paper program; and

|

|

|

·

|

No scheduled maturities of long-term debt until 2013.

|

We expect to continue to generate significant free cash flow in 2012 attributable to our strong business model and diversified customer base. We believe that cash on hand, cash provided by our operations, our commercial paper program and borrowings available under our credit facility will be sufficient to fund our expected cash dividends, debt service, capital expenditures, acquisitions in the normal course of business and any opportunistic share repurchases.

11

Proceeds from the closing of previously announced divestitures are also expected to be a source of liquidity in 2012, with $0.6 billion of cash realized in the first quarter and a further $1.0 billion in after tax proceeds anticipated from the planned sale of our Healthcare business, which we expect to close in the next few months. See “Subsequent Events”.

FINANCIAL POSITION

Our total assets were $31.9 billion at March 31, 2012 compared to $32.5 billion at December 31, 2011. Total assets decreased in the first quarter of 2012 as the effects of depreciation and amortization during the period more than offset increases from changes in foreign currency and additions from newly acquired businesses and capital expenditures.

Additional information. At March 31, 2012, the carrying amounts (excluding balances held for sale) of our total current liabilities exceeded the carrying amounts of our total current assets principally because current liabilities include deferred revenue. Deferred revenue does not represent a cash obligation, but rather an obligation to perform services or deliver products in the future. The costs to fulfill these obligations are included in our operating expenses.

Net Debt (1)

|

As at

|

||||||||

|

(millions of U.S. dollars)

|

March 31,

2012

|

December 31,

2011

|

||||||

|

Current indebtedness

|

296 | 434 | ||||||

|

Long-term indebtedness

|

7,210 | 7,160 | ||||||

|

Total debt

|

7,506 | 7,594 | ||||||

|

Swaps

|

(246 | ) | (224 | ) | ||||

|

Total debt after swaps

|

7,260 | 7,370 | ||||||

|

Other derivatives (2)

|

- | (2 | ) | |||||

|

Remove fair value adjustments for hedges

|

(44 | ) | (19 | ) | ||||

|

Total debt after hedging arrangements

|

7,216 | 7,349 | ||||||

|

Remove transaction costs and discounts included in the carrying value of debt

|

58 | 60 | ||||||

|

Less: cash and cash equivalents (3)

|

(467 | ) | (422 | ) | ||||

|

Net debt

|

6,807 | 6,987 | ||||||

|

(1)

|

Net debt is a non-IFRS financial measure, which we define in Appendix A.

|

|

(2)

|

Fair value of derivatives associated with commercial paper borrowings that were not designated as hedges for accounting purposes.

|

|

(3)

|

Includes restricted cash of $131 million and $147 million at March 31, 2012 and December 31, 2011, respectively.

|

The decrease in our net debt was primarily due to repayment of commercial paper borrowings.

The maturity dates for our debt are well balanced with no significant concentration in any one year. Our next scheduled maturity of long-term debt is in July 2013. At March 31, 2012, the average maturity of our long-term debt was approximately eight years at an average interest rate (after swaps) under 6%. Our commercial paper program also provides efficient and flexible short-term funding to balance the timing of completed acquisitions, expected disposal proceeds and debt repayments. At March 31, 2012, the average interest rate for our commercial paper borrowings was under 0.5%.

Our cash and cash equivalents increased $45 million. See “Cash Flow” for additional information.

Additional information.

|

|

·

|

We monitor the financial strength of financial institutions with which we have banking and other commercial relationships, including those that hold our cash and cash equivalents as well as those which are counterparties to derivative financial instruments and other arrangements;

|

|

|

·

|

We expect to continue to have access to funds held by our subsidiaries outside the U.S. in a tax efficient manner to meet our liquidity requirements; and

|

|

|

·

|

We have issued $350 million principal amount of debt securities under our $3.0 billion debt shelf prospectus that expires in May 2013.

|

12

Total Equity

|

(millions of U.S. dollars)

|

||||

|

Balance at December 31, 2011

|

16,750 | |||

|

Net earnings

|

326 | |||

|

Share issuances

|

50 | |||

|

Share repurchases

|

(24 | ) | ||

|

Effect of share-based compensation plans on contributed surplus

|

(8 | ) | ||

|

Dividends declared on common shares

|

(265 | ) | ||

|

Dividends declared on preference shares

|

(1 | ) | ||

|

Change in unrecognized net loss on cash flow hedges

|

(29 | ) | ||

|

Change in foreign currency translation adjustment

|

81 | |||

|

Net actuarial losses on defined benefit pension plans, net of tax

|

(44 | ) | ||

|

Distributions to non-controlling interests

|

(8 | ) | ||

|

Balance at March 31, 2012,

|

16,828 | |||

We returned approximately $0.3 billion to our shareholders through dividends and share repurchases in the three months ended March 31, 2012.

CASH FLOW

Our principal sources of liquidity are cash on hand, cash provided by our operations, our commercial paper program, our credit facility as well as the issuance of public debt. In 2012, proceeds from divestitures are also expected to be a source of liquidity. Our principal uses of cash are for debt servicing costs, debt repayments, dividend payments, capital expenditures, acquisitions and we have recently used cash to repurchase outstanding shares in open market transactions.

Summary of Statement of Cash Flow

|

Three months ended

March 31,

|

||||||||||||

|

(millions of U.S. dollars)

|

2012

|

2011

|

$ Change

|

|||||||||

|

Net cash provided by operating activities

|

273 | 200 | 73 | |||||||||

|

Net cash provided by (used in) investing activities

|

177 | (277 | ) | 454 | ||||||||

|

Net cash used in financing activities

|

(409 | ) | (180 | ) | (229 | ) | ||||||

|

Translation adjustments on cash and cash equivalents

|

4 | 4 | - | |||||||||

|

Increase (decrease) in cash and cash equivalents

|

45 | (253 | ) | 298 | ||||||||

|

Cash and cash equivalents at beginning of period

|

422 | 864 | (442 | ) | ||||||||

|

Cash and cash equivalents at end of period

|

467 | 611 | (144 | ) | ||||||||

Key highlights:

|

|

·

|

Net cash provided by operating activities increased reflecting higher adjusted EBITDA which included a benefit from lower Reuters integration-related costs;

|

|

|

·

|

We realized $614 million in proceeds (within investing activities) principally from the sale of our Trade and Risk Management business; and

|

|

|

·

|

We reduced our short-term borrowings by $136 million and continued to return cash to our shareholders in the current period.

|

Operating activities. The increase in net cash provided by operating activities reflected higher adjusted EBITDA which included a benefit from lower Reuters integration-related costs. This was partially offset by the elimination of operating cash flows from Other businesses due to the timing of completed divestitures.

Investing activities. The increase in net cash provided by investing activities is attributable to proceeds from the sale of our Trade & Risk Management business. During the three months ended March 31, 2012, we also continued to make investments in acquisitions and capital expenditures. Our acquisition spending was principally in our Tax & Accounting segment and capital expenditures were directed at product and infrastructure technology. In particular, we continued to make investments in our Thomson Reuters Eikon platform, with a focus on improving performance and stability, adding functionality and developing future releases.

13

Financing activities. The increase in net cash used by investing activities is principally attributable to repayments of commercial paper borrowings. We also returned more cash to our shareholders through repurchases of shares and an increase in our annualized dividend rate for 2012. Additional information about our debt, dividends and share repurchases is as follows:

|

|

·

|

Commercial paper program. Our $2.0 billion commercial paper program provides efficient and flexible short-term funding to balance the timing of completed acquisitions, expected disposal proceeds and debt repayments. We had commercial paper of $0.3 billion outstanding at March 31, 2012. Issuances of commercial paper reached a peak of $0.6 billion during the three-month period.

|

|

|

·

|

Credit facility. We have a $2.0 billion unsecured syndicated credit facility agreement which we may utilize from time to time to provide liquidity in connection with our commercial paper program and for general corporate purposes. As of March 31, 2012, we had no amounts drawn under the credit facility.

|

Based on our current credit ratings, the cost of borrowing under the agreement is priced at LIBOR/EURIBOR plus 90 basis points. If our long-term debt rating were downgraded by Moody’s or Standard & Poor’s, our facility fee and borrowing costs may increase, although availability would be unaffected. Conversely, an upgrade in our ratings may reduce our facility fees and borrowing costs. We monitor the lenders that are party to our facility and believe they continue to be able to lend to us.

We guarantee borrowings by our subsidiaries under the credit facility agreement. Under the agreement, we must maintain a ratio of net debt as of the last day of each fiscal quarter to EBITDA as defined in the credit agreement (earnings before interest, income taxes, depreciation and amortization and other modifications described in the credit agreement) for the last four quarters ended of not more than 4.5:1. We were in compliance with this covenant at March 31, 2012.

|

|

·

|

Credit ratings. Our access to financing depends on, among other things, suitable market conditions and the maintenance of suitable long-term credit ratings. Our credit ratings may be adversely affected by various factors, including increased debt levels, decreased earnings, declines in customer demand, increased competition, a further deterioration in general economic and business conditions and adverse publicity. Any downgrades in our credit ratings may impede our access to the debt markets or raise our borrowing rates.

|

The following table sets forth the credit ratings that we have received from rating agencies in respect of our outstanding securities as of the date of this management's discussion and analysis:

|

Moody’s

|

Standard & Poor’s

|

DBRS Limited

|

Fitch

|

|

|

Long-term debt

|

Baa1

|

A-

|

A (low)

|

A-

|

|

Commercial paper

|

-

|

A-1 (low)

|

R-1 (low)

|

F2

|

|

Trend/Outlook

|

Stable

|

Stable

|

Stable

|

Stable

|

We are not aware of any changes to our credit ratings being contemplated by rating agencies.

These credit ratings are not recommendations to purchase, hold or sell securities and do not address the market price or suitability of a specific security for a particular investor. Credit ratings may not reflect the potential impact of all risks on the value of securities. We cannot assure you that our credit ratings will not be lowered in the future or that rating agencies will not issue adverse commentaries regarding our securities.

|

·

|

Dividends. Dividends paid on our common shares were as follows for the periods presented:

|

|

Three months ended

March 31,

|

||||||||

|

(millions of U.S. dollars)

|

2012

|

2011

|

||||||

|

Dividends declared

|

265 | 259 | ||||||

|

Dividends reinvested in shares

|

(9 | ) | (42 | ) | ||||

|

Dividends paid

|

256 | 217 | ||||||

In February 2012, our board of directors approved a $0.04 per share increase in the annualized dividend rate to $1.28 per common share.

The decrease in dividends reinvested in shares reflects lower reinvestment by Woodbridge, which had temporarily increased its participation in our dividend reinvestment plan in the first quarter of last year.

14

|

|

·

|

Share repurchases. We may buy back shares (and subsequently cancel them) from time to time as part of our capital management strategy. In May 2011, we renewed our normal course issuer bid (NCIB) for an additional 12-month period. Under the NCIB, we may repurchase up to 15 million common shares (representing less than 2% of the total outstanding shares) in open market transactions on the Toronto Stock Exchange (TSX) or the New York Stock Exchange (NYSE) between May 13, 2011 and May 12, 2012.

|

During the three months ended March 31, 2012, we repurchased 851,200 of our common shares for approximately $24 million. The average price per share was $28.17. We have repurchased 11,607,100 of our common shares under the current NCIB. Decisions regarding any future repurchases will be based on market conditions, share price and other factors including opportunities to invest capital for growth.

Free cash flow and free cash flow from ongoing operations.

|

Three months ended

March 31,

|

||||||||

|

(millions of U.S. dollars)

|

2012

|

2011

|

||||||

|

Net cash provided by operating activities

|

273 | 200 | ||||||

|

Capital expenditures, less proceeds from disposals

|

(283 | ) | (294 | ) | ||||

|

Other investing activities

|

5 | 35 | ||||||

|

Dividends paid on preference shares

|

(1 | ) | (1 | ) | ||||

|

Free cash flow

|

(6 | ) | (60 | ) | ||||

|

Remove: Other businesses

|

(35 | ) | (85 | ) | ||||

|

Free cash flow from ongoing operations

|

(41 | ) | (145 | ) | ||||

Free cash flow and free cash flow from ongoing operations are historically lowest in the first quarter of the year and not indicative of our full year expectations. The year-over-year improvement in these measures was attributable to higher adjusted EBITDA which included a benefit from lower Reuters integration-related costs. Free cash flow was also impacted by the elimination of operating cash flows from Other businesses due to the timing of completed divestitures.

OFF-BALANCE SHEET ARRANGEMENTS, COMMITMENTS AND CONTRACTUAL OBLIGATIONS

For a summary of our other off-balance sheet arrangements, commitments and contractual obligations please see our 2011 annual management’s discussion and analysis. There were no material changes to these arrangements, commitments and contractual obligations outside the ordinary course of business during the three months ended March 31, 2012.

CONTINGENCIES

Lawsuits and Legal Claims

In November 2009, the European Commission initiated an investigation relating to our use of our company’s Reuters Instrument Codes (RIC symbols). RIC symbols are specifically designed to help financial professionals retrieve news and information on financial instruments (such as prices and other data on stocks, bonds, currencies and commodities) from Thomson Reuters financial data services. While we do not believe that we have engaged in any anti-competitive behavior related to RIC symbols, we offered to allow customers to license additional usage rights for RICs and to provide them with information needed to cross reference RICs with other data. As a result of market testing (as prescribed by European Union law), the European Commission advised us that our proposed commitments were insufficient to meet its concerns. We continue to cooperate fully with the European Commission.

In addition to the matter described above, we have engaged in various legal proceedings and claims that have arisen in the ordinary course of business. The outcome of all of the proceedings and claims against us, including the matter described above, is subject to future resolution, including the uncertainties of litigation. Based on information currently known to us and after consultation with outside legal counsel, management believes that the probable ultimate resolution of any such proceedings and claims, individually or in the aggregate, will not have a material adverse effect on our financial condition taken as a whole.

Uncertain Tax Positions

We are subject to taxation in numerous jurisdictions. There are many transactions and calculations during the course of business for which the ultimate tax determination is uncertain. We maintain provisions for uncertain tax positions that we believe appropriately reflect our risk. These provisions are made using the best estimate of the amount expected to be paid based on a qualitative assessment of all relevant factors. We review the adequacy of these provisions at the end of the reporting period. It is possible that at some future date, liabilities in excess of our provisions could result from audits by, or litigation with, the IRS or other relevant taxing authorities. Management believes that such additional liabilities would not have a material adverse impact on our financial condition taken as a whole.

15

OUTLOOK

The information in this section is forward-looking and should be read in conjunction with the section below entitled “Cautionary Note Concerning Factors That May Affect Future Results”.

We recently reaffirmed our business outlook for 2012 that was first communicated in February.

The following table sets forth our current 2012 outlook, the material assumptions related to our outlook and the material risks that may cause actual performance to differ materially from our current expectations.

Our 2012 outlook for revenues, adjusted EBITDA and underlying operating profit excludes the impact of foreign currency and previously announced businesses that have been or are expected to be exited through sale or closure. We provide our outlook for free cash flow both including and excluding businesses that have been or are expected to be exited through sale or closure.

|

2012 Outlook

|

Material assumptions

|

Material risks

|

||

|

Revenues expected to grow low single digits

|

— Improvement in net sales as the year progresses

— Positive gross domestic product (GDP) growth in the countries where we operate, led by rapidly developing economies

— Continued increase in the number of professionals around the world and their demand for high quality information and services

— Successful execution of ongoing product release and customer support programs, globalization strategy and other growth initiatives

|

— Uneven economic growth or recession across the markets we serve may result in reduced spending levels by our customers

— Demand for our products and services could be reduced by changes in customer buying patterns, competitive pressures or our inability to execute on key product or customer support initiatives

— Implementation of regulatory reform, including Dodd-Frank legislation and similar financial services laws around the world, may limit business opportunities for our customers, lowering their demand for our products and services

— Uncertainty regarding the European sovereign debt crisis and the Euro currency could impact demand from our customers as well as their ability to pay us

— Pressure on our customers, in developed markets in particular, to constrain the number of professionals employed due to regulatory and economic uncertainty

|

||

|

Adjusted EBITDA margin expected to be between 27% and 28%

|

— Revenues expected to grow low single digits in 2012

— Business mix continues to shift to higher-growth lower margin offerings

— Realization of expected benefits from efficiency initiatives and 2011 organizational realignments

|

— See the risks above related to the revenue outlook

— Revenues from higher margin businesses may be lower than expected

— The costs of required investments exceed expectations or actual returns are below expectations

|

16

|

2012 Outlook

|

Material assumptions

|

Material risks

|

||

|

Underlying operating profit margin expected to be between 18% and 19%

|

— Adjusted EBITDA margin expected to be between 27% and 28% in 2012

— Depreciation and amortization expense expected to represent 9% of revenues reflecting prior investments

— Capital expenditures expected to be between 7.5% and 8.0% of revenues

|

— See the risks above related to adjusted EBITDA margin outlook

— 2012 capital expenditures may be higher than currently expected, resulting in higher in-period depreciation and amortization

|

|

Free cash flow expected to increase 5% to 10% and free cash flow from ongoing operations expected to grow 15% to 20%

|

— Revenues expected to grow low single digits in 2012

— Adjusted EBITDA margin expected to be between 27% and 28%

— Capital expenditures expected to be between 7.5% to 8.0% of revenues

|

— See the risks above related to the revenue outlook and adjusted EBITDA margin outlook

— A weaker macroeconomic environment and unanticipated disruptions from new order-to-cash applications could negatively impact working capital performance

— 2012 capital expenditures may be higher than currently expected resulting in higher cash outflows

— The timing of completing divestitures may vary from our expectations resulting in actual free cash flow performance below our expectations

|

Additionally, in 2012, we expect interest expense to be $400 million to $425 million, assuming no significant change in our level of indebtedness. We also expect that our 2012 effective tax rate (as a percentage of post-amortization adjusted earnings) will be between 21% to 23%, assuming no material changes in current tax laws or treaties to which we are subject.

17

RELATED PARTY TRANSACTIONS

As of April 30, 2012, Woodbridge beneficially owned approximately 55% of our shares.

TRANSACTIONS WITH WOODBRIDGE

From time to time, in the normal course of business, we enter into transactions with Woodbridge and certain of its affiliates. These transactions involve providing and receiving product and service offerings, are negotiated at arm’s length on standard terms, including price, and are not significant to our results of operations or financial condition either individually or in the aggregate.

In the normal course of business, certain of our subsidiaries charge a Woodbridge owned company fees for various administrative services. In 2011, the total amount charged to Woodbridge for these services was approximately $69,000.

We purchase property and casualty insurance from third party insurers and retain the first $500,000 of each and every claim under the programs via our captive insurance subsidiaries. Woodbridge is included in these programs and pays us a premium commensurate with its exposures. Premiums relating to 2011 were $58,000, which would approximate the premium charged by a third party insurer for such coverage.

We maintained an agreement with Woodbridge until April 17, 2008 (the closing date of the Reuters acquisition) under which Woodbridge agreed to indemnify up to $100 million of liabilities incurred either by our current and former directors and officers or by our company in providing indemnification to these individuals on substantially the same terms and conditions as would apply under an arm’s length, commercial arrangement. We were required to pay Woodbridge an annual fee of $750,000, which was less than the premium that would have been paid for commercial insurance. In 2008, we replaced this agreement with a conventional insurance agreement. We are entitled to seek indemnification from Woodbridge for any claims arising from events prior to April 17, 2008, so long as the claims are made before April 17, 2014.

TRANSACTIONS WITH ASSOCIATES AND JOINT VENTURES

From time to time, we enter into transactions with our investments in associates and joint ventures. These transactions typically involve providing or receiving services and are entered into in the normal course of business and on an arm’s length basis.

We and The Depository Trust & Clearing Corporation (DTCC) each have a 50% interest in Omgeo, a provider of trade management services. Omgeo pays us for use of a facility and technology and other services which were valued at approximately $2 million for the three months ended March 31, 2012.

We and Shin Nippon Hoki Shuppan K.K. each own 50% of Westlaw Japan K.K., a provider of legal information and solutions to the Japanese legal market. We provide the joint venture with technology and other services which were valued at approximately $200,000 for the three months ended March 31, 2012.

In connection with the 2008 acquisition of Reuters, we assumed a lease agreement with 3XSQ Associates, an entity now owned by Thomson Reuters and Rudin Times Square Associates LLC that was formed to build and operate the 3 Times Square property and building in New York, New York that now serves as our corporate headquarters. We follow the equity method of accounting for our investment in 3XSQ Associates. The lease provides us with over 690,000 square feet of office space until 2021 and includes provisions to terminate portions early and various renewal options. Our costs under this lease arrangement for rent, taxes and other expenses were approximately $10 million for the three months ended March 31, 2012.

OTHER TRANSACTIONS

In October 2010, we acquired Serengeti, a provider of electronic billing and matter management systems for corporate legal departments. As a result of a prior investment in a venture lending firm, Peter Thomson, one of our directors, may have the right to receive 10% of the purchase consideration paid by our company. Mr. Thomson did not participate in negotiations related to the acquisition of Serengeti and refrained from deliberating and voting on the acquisition.

SUBSEQUENT EVENTS

DIVESTITURE

In April 2012, we signed a definitive agreement to sell our Healthcare business, a provider of data, analytics and performance benchmarking solutions and services to companies, government agencies and healthcare professionals for $1.25 billion. We expect to record a significant gain on this transaction, which is anticipated to close in the next few months.

18

CHANGES IN ACCOUNTING POLICIES

Please refer to the “Changes in Accounting Policies” section of our 2011 annual management’s discussion and analysis, which is contained in our 2011 annual report, as well as note 2 of our interim financial statements for the three months ended March 31, 2012, for information regarding changes in accounting policies.

CRITICAL ACCOUNTING ESTIMATES AND JUDGMENTS

The preparation of financial statements requires management to make estimates and judgments about the future. Estimates and judgments are continually evaluated and are based on historical experience and other factors, including expectations of future events that are believed to be reasonable under the circumstances. Please refer to the “Critical Accounting Estimates and Judgments” section of our 2011 annual management’s discussion and analysis, which is contained in our 2011 annual report, for additional information. Since the date of our 2011 annual management’s discussion and analysis, there have not been any significant changes to our critical accounting estimates and judgments.

ADDITIONAL INFORMATION

DISCLOSURE CONTROLS AND PROCEDURES

Our Chief Executive Officer and Chief Financial Officer, after evaluating the effectiveness of our disclosure controls and procedures (as defined in applicable U.S. and Canadian securities law) as of the end of the period covered by this management’s discussion and analysis, have concluded that our disclosure controls and procedures are effective to ensure that all information that we are required to disclose in reports that we file or furnish under the U.S. Securities Exchange Act and applicable Canadian securities law is (i) recorded, processed, summarized and reported within the time periods specified in the rules and forms of the SEC and Canadian securities regulatory authorities and (ii) accumulated and communicated to our management, including our Chief Executive Officer and Chief Financial Officer, to allow timely decisions regarding required disclosure.

INTERNAL CONTROL OVER FINANCIAL REPORTING

Our management is responsible for establishing and maintaining adequate internal control over financial reporting to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with IFRS. A multi-year phased implementation of order-to-cash (OTC) applications and related workflow processes is in progress. Key elements of the OTC solutions are order management, billing, cash management and collections functionality. We expect to reduce the number of applications and to streamline processes across our organization through this initiative. We continue to modify the design and documentation of the related internal control processes and procedures as the phased implementation progresses.

Except as described above, there was no change in our internal control over financial reporting during the three months ended March 31, 2012 that materially affected, or is reasonably likely to materially affect, our internal control over financial reporting.

SHARE CAPITAL