2. By resolution of the board of directors pursuant to a provision in the articles of incorporation this certificate establishes the following regarding the voting powers, designations, preferences, limitations, restrictions and relative rights of the following class or series of stock.

VISUALANT, INCORPORATED

CERTIFICATE OF DESIGNATIONS OF PREFERENCES, POWERS,

RIGHTS AND LIMITATION

OF

SERIES B REDEEMABLE CONVERTIBLE PREFERRED STOCK

The undersigned, Ronald P. Erickson and Mark E. Scott, hereby certify that:

1. The undersigned are the Chief Executive Officer and Chief Financial Officer, respectively, of Visualant, Incorporated, a Nevada corporation (the “Corporation”);

2. The Corporation is authorized to issue 5,000,000 shares of preferred stock, $0.001 par value, of which 23,334 shares are designated as Series A, of which 23,334 are issued and outstanding; and

3. The following resolutions were duly adopted by the Board of Directors:

WHEREAS, the Certificate of Incorporation of the Corporation provides for a class of its authorized stock known as preferred stock, comprised of 5,000,000 shares, $0.001 par value per share (the “Preferred Stock”), issuable from time to time in one or more series;

WHEREAS, the Board of Directors of the Corporation is authorized to fix the dividend rights, dividend rate, powers, voting rights, conversion rights, rights and terms of redemption and liquidation preferences of any wholly unissued series of Preferred Stock and the number of shares constituting any Series and the designation thereof, of any of them;

WHEREAS, it is the desire of the Board of Directors of the Corporation, pursuant to its authority as aforesaid and as set forth in this Certificate of Designations of Preferences, Powers, Rights and Limitations of Series B Redeemable Convertible Preferred Stock, to designate the rights, preferences, restrictions and other matters relating to the Series B Redeemable Convertible Preferred Stock, which will consist of up to 5,000 shares of the Preferred Stock which the Corporation has the authority to issue, as follows:

NOW, THEREFORE, BE IT RESOLVED, that the Board of Directors does hereby provide for the issuance of a series of Preferred Stock for cash, notes or exchange of other securities, rights or property and does hereby fix and determine the powers, rights, preferences, restrictions and other matters relating to such series of Preferred Stock as follows:

I. Terms of Preferred Stock.

A. Designation and Amount. A series of Preferred Stock is hereby designated as the Corporation’s Series B Redeemable Convertible Preferred Stock, par value of $0.001 per share (the “Series B Preferred Stock”), the number of shares of which so designated are 5,000 shares of Series B Preferred Stock; which Series B Preferred Stock will not be subject to increase without any consent of the holders of the Series B Preferred Stock (each a “Holder” and collectively, the “Holders”) that may be required by applicable law.

- 1 -

B. Ranking and Voting.

1. Ranking. The Series B Preferred Stock will, with respect to dividend rights and rights upon liquidation, winding-up or dissolution, rank: (a) senior to the Corporation’s Common Stock, $0.001 par value per share (“Common Stock”); (b) senior, pari passu or junior with respect to any other series of Preferred Stock, as set forth in the Certificate of Designations of Preferences, Powers, Rights and Limitations with respect to such Preferred Stock; and (c) junior to all existing and future indebtedness of the Corporation. Without the prior written consent of the Holders of a majority of the outstanding shares of Series B Preferred Stock (voting separately as a single class), the Corporation may not issue any additional shares of Series B Preferred Stock, or any other Preferred Stock that is pari passu or senior to the Series B Preferred Stock with respect to any rights for a period of 1 year after the earlier of such date (i) a registration statement is effective and available for the resale of all Conversion Shares, or (ii) Securities Act Rule 144 is available for the immediate unrestricted resale of all Conversion Shares.

2. Voting. Except as required by applicable law or as set forth herein, the holders of shares of Series B Preferred Stock will have no right to vote on any matters, questions or proceedings of this Corporation including, without limitation, the election of directors except: (a) during a period where a dividend (or part of a dividend) is in arrears; (b) on a proposal to reduce the Company’s share capital; (c) on a resolution to approve the terms of a buy-back agreement; (d) on a proposal to wind up the Company; (e) on a proposal for the disposal of all or substantially all the Company’s property, business and undertaking; and (f) during the winding-up of the entity.

C. Dividends.

1. Commencing on the date of the issuance of any such shares of Series B Preferred Stock (each respectively an “Issuance Date”), each outstanding share of Series B Preferred Stock will accrue cumulative dividends (“Dividends”), at a rate equal to 7.0% per annum, subject to adjustment as provided in this Certificate of Designations (“Dividend Rate”), of the Face Value. Dividends will be payable with respect to any shares of Series B Preferred Stock upon any of the following: (a) upon redemption of such shares in accordance with Section I.F; (b) upon conversion of such shares in accordance with Section I.G; and (c) when, as and if otherwise declared by the board of directors of the Corporation.

2. Dividends, as well as any applicable Conversion Premium payable hereunder, will be paid: (a) in the Corporation’s sole and absolute discretion, immediately in cash; or (b) if Corporation notifies Holder it will not pay all or any portion in cash, or to the extent cash is not paid and received as soon as practicable, and in any event within 3 Trading Days after the Notice Time for any reason whatsoever, in shares of Common Stock valued at (i) if there has never been a Trigger Event, (A) 90.0% of the average of the 5 lowest individual daily volume weighted average prices of the Common Stock on the Trading Market during the applicable Measurement Period, which may be non-consecutive, less $0.05 per share of Common Stock, not to exceed (B) 100% of the lowest sales price on the last day of such Measurement Period less $0.05 per share of Common Stock (ii) following any Trigger Event, (A) 80.0% of the lowest daily volume weighted average price during any Measurement Period for any conversion by Holder, less $0.10 per share of Common Stock, not to exceed (B) 80.0% of the lowest sales price on the last day of any Measurement Period, less $0.10 per share of Common Stock. In no event will the value of Common Stock pursuant to the foregoing be below the par value per share. All amounts that are required or permitted to be paid in cash pursuant to this Certificate of Designations will be paid by wire transfer of immediately available funds to an account designated by Holder.

- 2 -

3. So long as any shares of Series B Preferred Stock are outstanding, the Company will not repurchase shares of Common Stock other than as payment of the exercise or conversion price of a convertible security or payment of withholding tax, and no dividends or other distributions will be paid, declared or set apart with respect to any Common Stock, except for Purchase Rights.

D. Protective Provision.

1. So long as any shares of Series B Preferred Stock are outstanding, the Corporation will not, without the affirmative approval of the Holders of a majority of the shares of the Series B Preferred Stock then outstanding (voting separately as one class), (i) alter or change adversely the powers, preferences or rights given to the Series B Preferred Stock or alter or amend this Certificate of Designations, (ii) authorize or create any class of stock ranking as to distribution of dividends senior to the Series B Preferred Stock, (iii) amend its certificate of incorporation or other charter documents in breach of any of the provisions hereof, (iv) increase the authorized number of shares of Series B Preferred Stock or (v) enter into any agreement with respect to the foregoing.

2. A “Deemed Liquidation Event” will mean: (a) a merger or consolidation in which the Corporation is a constituent party or a subsidiary of the Corporation is a constituent party and the Corporation issues shares of its capital stock pursuant to such merger or consolidation, except any such merger or consolidation involving the Corporation or a subsidiary in which the shares of capital stock of the Corporation outstanding immediately prior to such merger or consolidation continue to represent, or are converted into or exchanged for shares of capital stock that represent, immediately following such merger or consolidation, at least a majority, by voting power, of the capital stock of the surviving or resulting corporation or if the surviving or resulting corporation is a wholly owned subsidiary of another corporation immediately following such merger or consolidation, the parent corporation of such surviving or resulting corporation; (b) Corporation issues securities that are senior to the Series B Preferred Stock in any respect, (c) Holder does not receive the number of Conversion Shares stated in a Conversion Notice with 5 Trading Days of the Notice Time; (d) trading of the Common Stock is halted or suspended by the Trading Market or any U.S. governmental agency for 5 or more consecutive trading days; (e) the sale, lease, transfer, exclusive license or other disposition, in a single transaction or series of related transactions, by the Corporation or any subsidiary of the Corporation of all or substantially all the assets of the Corporation and its subsidiaries taken as a whole, or the sale or disposition (whether by merger or otherwise) of one or more subsidiaries of the Corporation if substantially all of the assets of the Corporation and its subsidiaries taken as a whole are held by such subsidiary or subsidiaries, except where such sale, lease, transfer, exclusive license or other disposition is to a wholly owned subsidiary of the Corporation.

3. The Corporation will not have the power to close or effect a voluntary Deemed Liquidation Event unless the agreement or plan of merger or consolidation for such transaction provides that the consideration payable to the stockholders of the Corporation will be allocated among the holders of capital stock of the Corporation in accordance with Section I.E, and the required amount is paid to Holder prior to or upon closing, effectuation or occurrence of the Deemed Liquidation Event.

- 3 -

E. Liquidation.

1. Upon any liquidation, dissolution or winding up of the Corporation, whether voluntary or involuntary, after payment or provision for payment of debts and other liabilities of the Corporation, pari passu with any distribution or payment made to the holders of Preferred Stock and Common Stock by reason of their ownership thereof, the Holders of Series B Preferred Stock will be entitled to be paid out of the assets of the Corporation available for distribution to its stockholders an amount with respect to each share of Series B Preferred Stock equal to $10,000.00 (“Face Value”), plus an amount equal to any accrued but unpaid Dividends thereon (collectively with the Face Value, the “Liquidation Value”). If, upon any liquidation, dissolution or winding up of the Corporation, whether voluntary or involuntary, the amounts payable with respect to the shares of Series B Preferred Stock are not paid in full, the holders of shares of Series B Preferred Stock will share equally and ratably with the holders of shares of Preferred Stock and Common Stock in any distribution of assets of the Corporation in proportion to the liquidation preference and an amount equal to all accumulated and unpaid Dividends, if any, to which each such holder is entitled.

2. If, upon any liquidation, dissolution or winding up of the Corporation, the assets of the Corporation will be insufficient to make payment in full to all Holders, then the assets distributable to the Holders will be distributed among the Holders at the time outstanding, ratably in proportion to the full amounts to which they would otherwise be respectively entitled.

F. Redemption.

1. Corporation’s Redemption Option. On the Dividend Maturity Date, the Corporation may redeem any or all shares of Series B Preferred Stock by paying Holder in cash an amount per share equal to 100% of the Liquidation Value for the shares redeemed.

2. Early Redemption. Prior to the Dividend Maturity Date, provided that no Trigger Event has occurred, the Corporation will have the right at any time upon 30 Trading Days’ prior written notice, in its sole and absolute discretion, to redeem all or any portion of the shares of Series B Preferred Stock then outstanding by paying Holder in cash an amount per share of Series B Preferred Stock (the “Early Redemption Price”) equal to the sum of the following: (a) 100% of the Face Value, plus (b) the Conversion Premium, minus (c) any Dividends that have been paid, for each share of Series B Preferred Stock redeemed.

3. Credit Risk Adjustment.

a. The Dividend Rate will adjust downward by an amount equal to the Spread Adjustment for each amount, if any, equal to the Adjustment Factor that the Measuring Metric rises above the Maximum Triggering Level, down to a minimum of 0.0%.

b. The Dividend Rate will adjust upward by an amount equal to the Spread Adjustment for each amount, if any, equal to the Adjustment Factor that the Measuring Metric falls below the Minimum Triggering Level, up to a maximum of 24.95%. In addition, the Dividend Rate will adjust upward by 10.0% following the occurrence of any Trigger Event.

c. The adjusted Dividend Rate used for calculation of the Liquidation Value, Conversion Premium, Early Redemption Price and Dividend, as applicable, and the amount of Dividends owed will be calculated and determined based upon the Measuring Metric at close of the Trading Market immediately prior to the Notice Time.

- 4 -

4. Mandatory Redemption. If the Corporation determines to liquidate, dissolve or wind-up its business and affairs, or upon closing or occurrence of any Deemed Liquidation Event, the Corporation will prior to or concurrently with the closing, effectuation or occurrence any such action, redeem the Series B Preferred Stock for cash, by wire transfer of immediately available funds to an account designated by Holder, at the Early Redemption Price set forth in Section I.F.2 if the event is prior to the Dividend Maturity Date, or at the Liquidation Value if the event is on or after the Dividend Maturity Date.

5. Mechanics of Redemption. In order to redeem any of the Holders’ Series B Preferred Stock then outstanding, the Corporation must deliver written notice (each, a “Redemption Notice”) to each Holder setting forth (a) the number of shares of Series B Preferred Stock that the Corporation is redeeming, (b) the applicable Dividend Rate, Liquidation Value and Early Redemption Price, and (c) the calculation of the amount paid. Upon receipt of payment in cash, each Holder will promptly submit to the Corporation such Holder’s Series B Preferred Stock certificates. In connection with a mandatory redemption, the notice will be delivered as soon as the number of shares can be determined, and in all other instances at least 30 Trading Days prior to payment. For the avoidance of doubt, the delivery of a Redemption Notice shall not affect Holder’s rights under Section I.G until after receipt of cash payment by Holder.

G. Conversion.

1. Mechanics of Conversion.

a. One or more shares of the Series B Preferred Stock may be converted, in part or in whole, into shares of Common Stock, at any time or times after the Issuance Date, in the sole and absolute discretion of Holder or, subject to the terms and conditions hereof, the Corporation; (i) if at the option of Holder, by delivery of one or more written notices to the Corporation or its transfer agent (each, a “Holder Conversion Notice”), of the Holder’s election to convert any or all of its Series B Preferred Stock; or (ii) if at the option of the Corporation, if the Equity Conditions are met, delivery of written notice to Holder (each, a “Corporation Conversion Notice,” with the Holder Conversion Notice, each a “Conversion Notice,” and with the Redemption Notice, each an “Initial Notice”), of the Corporation’s election to convert the Series B Preferred Stock.

b. Each Delivery Notice will set forth the number of shares of Series B Preferred Stock being converted, the minimum number of Conversion Shares and the amount of Dividends and any applicable Conversion Premium due as of the time the Delivery Notice is given (the “Notice Time”), and the calculation thereof.

b. If the Corporation notifies Holder by 10:00 a.m. Eastern time on the Trading Day after the Notice Time that it is paying all or any portion of Dividends or Conversion Premium, and actually pays in cash by the next Trading Day, time being of the essence, the full amount of Dividends and Conversion Premium stated in the Delivery Notice, no further amount will be due with respect thereto.

c. As soon as practicable, and in any event within 1 Trading Day of the Notice Time, time being of the essence, the Corporation will do all of the following: (i) transmit the Delivery Notice by facsimile or electronic mail to the Holder, and to the Corporation’s transfer agent (the “Transfer Agent”) with instructions to comply with the Delivery Notice; (ii) either (A) if the Corporation is approved through The Depository Trust Corporation (“DTC”), authorize and instruct the credit by the Transfer Agent the aggregate number of Conversion Shares set forth in the Delivery Notice, to Holder’s or its designee’s balance account with the DTC Fast Automated Securities Transfer (FAST) Program, through its Deposit/Withdrawal at Custodian (DWAC) system, or (B) only if the Corporation is not approved through DTC, issue and surrender to

- 5 -

a common carrier for overnight delivery to the address as specified in the Delivery Notice a certificate bearing no restrictive legend, registered in the name of Holder or its designee, for the number of Conversion Shares to which Holder is then entitled, as set forth in the Delivery Notice; and (iii) if it contends that the Delivery Notice is in any way incorrect, a through explanation of why and its own calculation, or the Delivery Notice will conclusively be deemed correct for all purposes. The Corporation will at all times diligently take or cause to be taken all actions reasonably necessary to cause the Conversion Shares to be issued as soon as practicable.

d. If during the Measurement Period the Holder is entitled to receive additional Conversion Shares with regard to an Initial Notice, Holder may at any time deliver one or more additional written notices to the Corporation or its transfer agent (each, an “Additional Notice” and with the Initial Notice, each a “Delivery Notice”) setting forth the additional number of Conversion Shares to be delivered, and the calculation thereof.

e. If the Corporation for any reason does not issue or cause to be issued to the Holder within 3 Trading Days after the date of a Delivery Notice, the number of Conversion Shares stated in the Delivery Notice, then, in addition to all other remedies available to the Holder, as liquidated damages and not as a penalty, the Corporation will pay in cash to the Holder on each day after such 3rd Trading Day that the issuance of such Conversion Shares is not timely effected an amount equal to 2% of the product of (i) the aggregate number of Conversion Shares not issued to the Holder on a timely basis and to which the Holder is entitled and (ii) the highest Closing Price of the Common Stock between the date on which the Corporation should have issued such shares to the Holder and the actual date of receipt of Conversion Shares by Holder. It is intended that the foregoing will serve to reasonably compensate Holder for any delay in delivery of Conversion Shares, and not as punishment for any breach by the Corporation. The Corporation acknowledges that the actual damages likely to result from delay in delivery are difficult to estimate and would be difficult for Holder to prove.

f. Notwithstanding any other provision: all of the requirements of Section I.F and this Section I.G are each independent covenants; the Corporation’s obligations to issue and deliver Conversion Shares upon any Delivery Notice are absolute, unconditional and irrevocable; any breach or alleged breach of any representation or agreement, or any violation or alleged violation of any law or regulation, by any party or any other person will not excuse full and timely performance of any of the Corporation’s obligations under these sections; and under no circumstances may the Corporation seek or obtain any temporary, interim or preliminary injunctive or equitable relief to prevent or interfere with any issuance of Conversion Shares to Holder.

g. If for any reason whatsoever Holder does not timely receive the number of Conversion Shares stated in any Delivery Notice, Holder will be entitled to a compulsory remedy of immediate specific performance, temporary, interim and, preliminary and final injunctive relief requiring Corporation and its transfer agent, attorneys, officers and directors to immediately issue and deliver the number of Conversion Shares stated by Holder, which requirement will not be stayed for any reason, without the necessity of posting any bond, and which Corporation may not seek to stay or appeal.

h. No fractional shares of Common Stock are to be issued upon conversion of Series B Preferred Stock, but rather the Corporation will issue to Holder scrip or warrants registered on the books of the Corporation (certificated or uncertificated) which will entitle Holder to receive a full share upon the surrender of such scrip or warrants aggregating a full share. The Holder will not be required to deliver the original certificates for the Series B Preferred Stock in order to effect a conversion hereunder. The Corporation will pay any and all taxes which may be payable with respect to the issuance and delivery of any Conversion Shares.

- 6 -

2. Holder Conversion. In the event of a conversion of any Series B Preferred Stock pursuant to a Holder Conversion Notice, the Corporation will (a) satisfy the payment of Dividends and Conversion Premium as provided in Section I.C.2, and (b) issue to the Holder of such Series B Preferred Stock a number of Conversion Shares equal to (i) the Face Value multiplied by (ii) the number of such Series B Preferred Stock subject to the Holder Conversion Notice divided by (iii) the applicable Conversion Price with respect to such Series B Preferred Stock; all in accordance with the procedures set forth in Section I.G.1.

3. Corporation Conversion. The Corporation will have the right to send the Holder a Corporation Conversion Notice at any time in its sole and absolute discretion, if the Equity Conditions are met as of the time such Corporation Conversion Notice is given. Upon any conversion of any Series B Preferred Stock pursuant to a Corporation Conversion Notice, the Corporation will on the date of such notice (a) satisfy the payment of Dividends and Conversion Premium as provided in Section I.C.2, and (b) issue to the Holder of such Series B Preferred Stock a number of Conversion Shares equal to (i) the Face Value multiplied by (ii) the number of such Series B Preferred Stock subject to the Holder Conversion Notice divided by (iii) the applicable Conversion Price with respect to such Series B Preferred Stock; all in accordance with the procedures set forth in Section I.G.1.

4. Stock Splits. If the Corporation at any time on or after the filing of this Certificate of Designations subdivides (by any stock split, stock dividend, recapitalization or otherwise) one or more classes of its outstanding shares of Common Stock into a greater number of shares, the applicable Conversion Price, Adjustment Factor, Maximum Triggering Level, Minimum Triggering Level, and other share based metrics in effect immediately prior to such subdivision will be proportionately reduced and the number of shares of Common Stock issuable will be proportionately increased. If the Corporation at any time on or after such Issuance Date combines (by combination, reverse stock split or otherwise) one or more classes of its outstanding shares of Common Stock into a smaller number of shares, the applicable Conversion Price, Adjustment Factor, Maximum Triggering Level, Minimum Triggering Level, and other share based metrics in effect immediately prior to such combination will be proportionately increased and the number of Conversion Shares will be proportionately decreased. Any adjustment under this Section will become effective at the close of business on the date the subdivision or combination becomes effective.

5. Rights. In addition to any adjustments pursuant to Section I.G.4, if at any time the Corporation grants, issues or sells any options, convertible securities or rights to purchase stock, warrants, securities or other property pro rata to the record holders of any class of shares of Common Stock (the “Purchase Rights”), then Holder will be entitled to acquire, upon the terms applicable to such Purchase Rights, the aggregate Purchase Rights which Holder could have acquired if Holder had held the number of shares of Common Stock acquirable upon conversion of all Preferred Stock held by Holder immediately before the date on which a record is taken for the grant, issuance or sale of such Purchase Rights, or, if no such record is taken, the date as of which the record holders of shares of Common Stock are to be determined for the grant, issue or sale of such Purchase Rights.

6. Notices. The holders of shares of Series B Preferred Stock are entitled to the same rights as the holders of Common Stock with respect to rights to receive notices, reports and audited accounts from the Company and with respect to attending stockholder meetings.

7. Definitions. The following terms will have the following meanings:

“Adjustment Factor” means $0.25 per share of Common Stock.

- 7 -

“Closing Price” means, for any security as of any date, the last closing bid price for such security on the Trading Market, or, if the Trading Market begins to operate on an extended hours basis and does not designate the closing bid price, then the last bid price of such security prior to 4:00 p.m., Eastern time, or, if the Trading Market is not the principal securities exchange or trading market for such security, the last closing bid price of such security on the principal securities exchange or trading market where such security is listed or traded, or if the foregoing do not apply, the last closing bid price of such security in the over-the-counter market on the electronic bulletin board for such security, or, if no closing bid price is reported for such security, the average of the bid prices of any market makers for such security as reported in the “pink sheets” by Pink Sheets LLC (formerly the National Quotation Bureau, Inc.).

“Conversion Premium” for each share of Series B Preferred Stock means the Face Value, multiplied by the product of (i) the applicable Dividend Rate, and (ii) the number of whole years between the Issuance Date and the Dividend Maturity Date.

“Conversion Price” means a price per share of Common Stock equal to $7.50 per share of Common Stock, subject to adjustment as otherwise provided herein.

“Conversion Shares” means all shares of Common Stock that are required to be or may be issued upon conversion of Series B Preferred Stock.

“Dividend Maturity Date” means the date that is 7 years after the Issuance Date.

“Equity Conditions” means on each day during the Measurement Period, (i) the Common Stock is not under chill or freeze from DTC, the Common Stock is designated for trading on OTCQB or higher market and shall not have been suspended from trading on such market, and delisting or suspension by the Trading Market has not been threatened or pending, either in writing by such market or because Company has fallen below the then effective minimum listing maintenance requirements of such market; (ii) the Corporation has delivered Conversion Shares upon all conversions or redemptions of the Series B Preferred Stock in accordance with their terms to the Holder on a timely basis; (iii) the Corporation will have no knowledge of any fact that would cause both of the following (A) a registration statement not to be effective and available for the resale of all Conversion Shares, and (B) Section 3(a)(9) under the Securities Act of 1933, as amended, not to be available for the issuance of all Conversion Shares, or Securities Act Rule 144 not to be available for the resale of all the Conversion Shares underlying the Series B Preferred Stock without restriction; (iv) there has been a minimum of $5 million, or 10 times the Face Value of Preferred Share being converted, whichever is lower; in aggregate trading volume since the most recent Issuance Date; (v) all shares of Common Stock to which Holder is entitled have been timely received into Holder’s designated account in electronic form fully cleared for trading; (vi) the Corporation otherwise shall have been in compliance with and shall not have breached any provision, covenant, representation or warranty of any Transaction Document; (vii) the Measuring Metric is at least $1.00; and (viii) no Trigger Event shall have occurred.

“Measurement Period” means the period beginning, if no Trigger Event has occurred 30 Trading Days, and if a Trigger Event has occurred 60 Trading Days, before the Notice Date, and ending, if no Trigger Event has occurred 30 Trading Days, and if a Trigger Event has occurred 60 Trading Days, after the number of Conversion Shares stated in the initial Notice have actually been received into Holder’s designated brokerage account in electronic form and fully cleared for trading; provided that for each day during the Measurement Period on which less than all of the conditions set forth in Section I.G.6.h exist, 1 Trading Day will be added to what otherwise would have been the end of the Measurement Period.

- 8 -

“Measuring Metric” means the volume weighted average price of the Common Stock on any Trading Day following the Issuance Date of the Series B Preferred Stock.

“Maximum Triggering Level” means $9.00 per share of Common Stock.

“Minimum Triggering Level” means $6.00 per share of Common Stock.

“Spread Adjustment” means 100 basis points.

“Stock Purchase Agreement” means the Stock Purchase Agreement or other agreement pursuant to which any share of Series B Preferred Stock is issued, including all exhibits thereto and all related Transaction Documents as defined therein.

“Trading Day” means any day on which the Common Stock is traded on the Trading Market.

“Trading Market” means or whatever is at the applicable time, the principal U.S. trading exchange or market for the Common Stock. All Trading Market data will be measured as provided by the appropriate function of the Bloomberg Professional service of Bloomberg Financial Markets or its successor performing similar functions.

7. Issuance Limitation. Notwithstanding any other provision, at no time may the Corporation issue shares of Common Stock to Holder which, when aggregated with all other shares of Common Stock then deemed beneficially owned by Holder, would result in Holder owning more than 4.99% of all Common Stock outstanding immediately after giving effect to such issuance, as determined in accordance with Section 13(d) of the Exchange Act and the rules and regulations promulgated thereunder; provided, however, that Holder may increase such amount to 9.99% upon not less than 61 days’ prior notice to the Corporation. No provision of this paragraph may be waived by Holder or the Corporation.

8. Conversion at Maturity. On the Dividend Maturity Date, all remaining outstanding Series B Preferred Stock will automatically be converted into shares of Common Stock.

H. Trigger Event.

1. Any occurrence of any one or more of the following shall constitute a “Trigger Event”:

(a) Holder does not timely receive the number of Conversion Shares stated in any Conversion Notice for any reason whatsoever, time being of the essence, including without limitation the issuance of restricted shares if counsel for Corporation or Holder provides a legal opinion that shares may be issued without restrictive legend;

(b) Any violation of or failure to timely perform any covenant or provision of this Certificate of Designations, the Stock Purchase Agreement, or any Transaction Document, related to payment of cash, registration or delivery of Conversion Shares, time being of the essence;

(c) Any violation of or failure to perform any covenant or provision of this Certificate of Designations, the Stock Purchase Agreement, or any Transaction Document, which in the case of a default that is curable, is not related to payment of cash, registration or delivery of Conversion Shares, and has not occurred before, is not cured within 5 Trading Days of written notice thereof;

- 9 -

(d) Any representation or warranty made in the Stock Purchase Agreement or any Transaction Document shall be untrue or incorrect in any respect as of the date when made or deemed made;

(e) The occurrence of any default or event of default under any material agreement, lease, document or instrument to which the Corporation or any subsidiary is obligated, including without limitation of an aggregate of at least $100,000 of indebtedness;

(f) While any Registration Statement is required to be maintained effective, the effectiveness of the Registration Statement lapses for any reason, including, without limitation, the issuance of a stop order, or the Registration Statement, or the prospectus contained therein, is unavailable to Holder sale of all Conversion Shares for any 5 or more Trading Days, which may be non-consecutive;

(g) The suspension from trading or the failure of the Common Stock to be trading or listed on the Trading Market;

(h) The Corporation notifies Holder, including without limitation, by way of public announcement or through any of its attorneys, agents or representatives, of its intention not to comply, as required, with a Conversion Notice at any time, including without limitation any objection or instruction to its transfer agent not to comply with any notice from Holder;

(i) Bankruptcy, insolvency, reorganization or liquidation proceedings or other proceedings for the relief of debtors shall be instituted by or against the Corporation or any subsidiary and, if instituted against the Corporation or any subsidiary by a third party, an order for relief is entered or the proceedings are not dismissed within 30 days of their initiation;

(j) The appointment of or taking possession by a custodian, receiver, liquidator, assignee, trustee, or other similar official of the Corporation or any subsidiary or of any substantial part of its property, or the making by it of an assignment for the benefit of creditors, or the execution of a composition of debts, or the occurrence of any other similar federal, state or foreign proceeding, or the admission by it in writing of its inability to pay its debts generally as they become due, the taking of corporate action by the Corporation or any Subsidiary in furtherance of any such action or the taking of any action by any person to commence a foreclosure sale or any other similar action under any applicable law;

(k) A final judgment or judgments for the payment of money aggregating in excess of $100,000 are rendered against the Corporation or any of its subsidiaries and are not stayed or satisfied within 30 days of entry;

(l) The Corporation does not for any reason timely comply with the reporting requirements of the Securities Exchange Act of 1934, as amended, and the regulations promulgated thereunder, including without limitation timely filing when first due all periodic reports;

(m) Any regulatory, administrative or enforcement proceeding is initiated against Corporation or any subsidiary (except to the extent an adverse determination would not have a material adverse effect on the Company’s business, properties, assets, financial condition or results of operations or prevent the performance by the Company of any material obligation under the Transaction Documents); or

- 10 -

(n) Any material provision of this Certificate of Designations shall at any time for any reason, other than pursuant to the express terms thereof, cease to be valid and binding on or enforceable against the parties thereto, or the validity or enforceability thereof shall be contested by any party thereto, or a proceeding shall be commenced by the Corporation or any subsidiary or any governmental authority having jurisdiction over any of them, seeking to establish the invalidity or unenforceability thereof, or the Corporation or any subsidiary denies that it has any liability or obligation purported to be created under this Certificate of Designations.

2. It is intended that all adjustments made following a Trigger Event will serve to reasonably compensate Holder for the consequences and increased risk following a Trigger Event, and not as a penalty or punishment for any breach by the Corporation. The Corporation acknowledges that the actual damages likely to result from a Trigger Event are difficult to estimate and would be difficult for Holder to prove.

I. Stock Register. The Corporation will keep at its principal office, or at the offices of the transfer agent, a register of the Series B Preferred Stock, which will be prima facie indicia of ownership of all outstanding shares of Series B Preferred Stock. Upon the surrender of any certificate representing Series B Preferred Stock at such place, the Corporation, at the request of the record Holder of such certificate, will execute and deliver (at the Corporation’s expense) a new certificate or certificates in exchange therefor representing in the aggregate the number of shares represented by the surrendered certificate. Each such new certificate will be registered in such name and will represent such number of shares as is requested by the Holder of the surrendered certificate and will be substantially identical in form to the surrendered certificate.

II. Miscellaneous.

A. Notices. Any and all notices to the Corporation will be addressed to the Corporation’s Chief Executive Officer at the Corporation’s principal place of business on file with the Secretary of State of the State of Nevada. Any and all notices or other communications or deliveries to be provided by the Corporation to any Holder hereunder will be in writing and delivered personally, by electronic mail or facsimile, sent by a nationally recognized overnight courier service addressed to each Holder at the electronic mail, facsimile telephone number or address of such Holder appearing on the books of the Corporation, or if no such electronic mail, facsimile telephone number or address appears, at the principal place of business of the Holder. Any notice or other communication or deliveries hereunder will be deemed given and effective on the earliest of (1) the date of transmission, if such notice or communication is delivered via facsimile or electronic mail prior to 5:30 p.m. Eastern time, (2) the date after the date of transmission, if such notice or communication is delivered via facsimile or electronic mail later than 5:30 p.m. but prior to 11:59 p.m. Eastern time on such date, (3) the second business day following the date of mailing, if sent by nationally recognized overnight courier service, or (4) upon actual receipt by the party to whom such notice is required to be given, regardless of how sent.

B. Lost or Mutilated Preferred Stock Certificate. Upon receipt of evidence reasonably satisfactory to the Corporation (an affidavit of the registered Holder will be satisfactory) of the ownership and the loss, theft, destruction or mutilation of any certificate evidencing shares of Series B Preferred Stock, and in the case of any such loss, theft or destruction upon receipt of indemnity reasonably satisfactory to the Corporation (provided that if the Holder is a financial institution or other institutional investor its own agreement will be satisfactory) or in the case of any such mutilation upon surrender of such certificate, the Corporation will, at its expense, execute and deliver in lieu of such certificate a new certificate of like kind representing the number of shares of such class represented by such lost, stolen, destroyed or mutilated certificate and dated the date of such lost, stolen, destroyed or mutilated certificate.

- 11 -

C. Headings. The headings contained herein are for convenience only, do not constitute a part of this Certificate of Designations and will not be deemed to limit or affect any of the provisions hereof.

RESOLVED, FURTHER, that the chairman, chief executive officer, chief financial officer, president or any vice-president, and the secretary or any assistant secretary, of the Corporation be and they hereby are authorized and directed to prepare and file a Designation of Preferences, Rights and Limitations of Series B Preferred Stock in accordance with the foregoing resolution and the provisions of Nevada law.

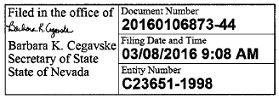

IN WITNESS WHEREOF, the undersigned have executed this Certificate this 8th day of March 2016.

Signed: /s/ Ronald P. Erickson

Name: Ronald P. Erickson

Title: Chief Executive Officer

Signed: /s/ Mark E. Scott

Name: Mark E. Scott

Title: Chief Financial Officer

- 12 -