UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x

Check the appropriate box:

o Preliminary Proxy Statement

o Confidential, For Use of the Commission Only (as permitted by Rule 14a–6(e)(2))

x Definitive Proxy Statement

o Definitive Additional Materials

o Soliciting Material Under Rule 14a-12

WILSHIRE ENTERPRISES, INC.

_________________________________________________________________________________________

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

o Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11.

(1) Title of each class of securities to which transaction applies:

(2) Aggregate number of securities to which transaction applies:

(3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

o (4) Proposed maximum aggregate value of transaction:

o (5) Total fee paid:

o Fee paid previously with preliminary materials:

o Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing.

(1) Amount previously paid:

(2) Form, Schedule or Registration Statement No.:

(3) Filing Party:

(4) Date Filed:

WILSHIRE ENTERPRISES, INC.

100 EAGLE ROCK AVENUE

EAST HANOVER, NEW JERSEY 07936

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD FEBRUARY 25, 2011

To the Stockholders:

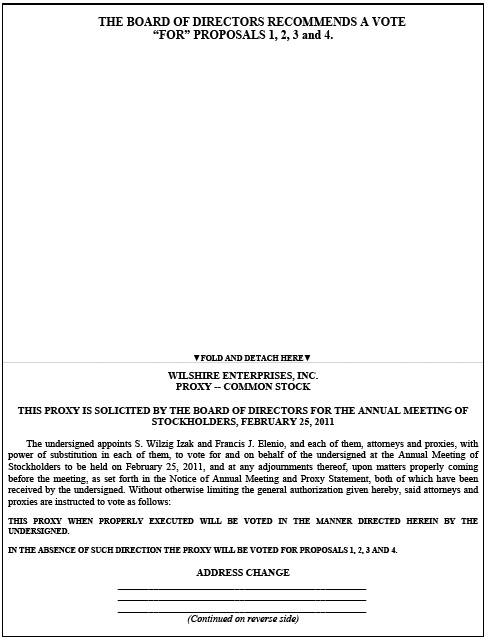

NOTICE IS HEREBY GIVEN that an Annual Meeting of Stockholders of Wilshire Enterprises, Inc., a Delaware corporation (the “Company”), will be held at the Doubletree Hotel Wilmington Downtown, 700 N. King Street, Wilmington, DE, 19801 on February 25, 2011, at 1:00 p.m. Eastern Time (the “Meeting”) for the following purposes:

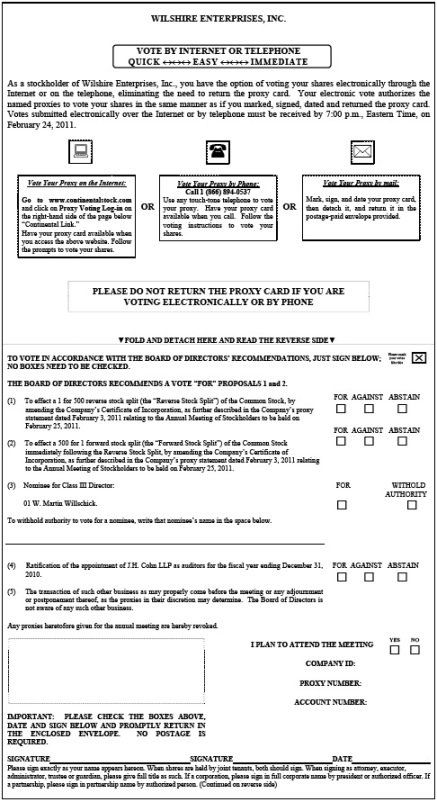

1. To consider and vote upon a proposal to amend the Company’s Certificate of Incorporation, as amended to date (the “Certificate of Incorporation”), to effect a 1-for-500 reverse stock split (the “Reverse Stock Split”) of the Company’s common stock, par value $1.00 per share (the “Common Stock”), which, if approved, would enable the Company to cease its periodic reporting obligations under the Securities Exchange Act of 1934, as amended, and thereby forgo many of the expenses associated with operating as a public company subject to Securities and Exchange Commission reporting obligations. A copy of the proposed amendment to the Certificate of Incorporation for the Reverse Stock Split is attached as Annex A to the accompanying proxy statement.

2. To consider and vote upon a proposal to amend the Certificate of Incorporation to effect a 500-for-1 forward stock split (the “Forward Stock Split” and, together with the Reverse Stock Split, the “Transaction”) of the Common Stock immediately following the Reverse Stock Split of the Common Stock, also by amending the Certificate of Incorporation. A copy of the proposed amendment to the Certificate of Incorporation for the Forward Stock Split is attached as Annex B to the accompanying proxy statement.

As a result of these proposed amendments, (a) each share of Common Stock held of record by a stockholder owning fewer than 500 shares immediately prior to the effective time of the Reverse Stock Split will be converted into the right to receive $1.00 in cash (subject to any applicable U.S. federal, state and local withholding tax), without interest, per pre-split share, and (b) each share of Common Stock held by a stockholder of record owning 500 shares or more immediately prior to the effective time of the Reverse Stock Split will continue to represent one share of Common Stock after completion of the Transaction. Although both the Reverse Stock Split and the Forward Stock Split will be voted on separately, the Company will not effect either the Reverse Stock Split or the Forward Stock Split unless both are approved by the Company’s stockholders.

3. To elect one director of the Company to serve until the 2013 Annual Meeting of Stockholders and until his successor has been elected and qualified or until his earlier resignation or removal.

4. To ratify the appointment of J.H. Cohn LLP as the Company’s independent auditors for the fiscal year ending December 31, 2010.

5. To transact such other business as may properly come before the Meeting or any adjournment thereof.

The foregoing items of business are more fully described in the Proxy Statement accompanying this notice. Only stockholders of record at the close of business on January 19, 2011, are entitled to notice of and to vote at the Meeting. A list of stockholders entitled to vote at the Meeting will be open to the examination of any stockholder, his agent or attorney for any purpose germane to the Meeting upon written notice, and the list will be available for inspection at the Meeting by any stockholder that is present.

Important Notice Regarding the Internet Availability of Proxy Materials for the Annual Meeting of Stockholders to be held on February 25 , 2011: This proxy statement and our Annual Report for the fiscal year ended December 31, 2009 are available to stockholders at http://www.wilshireenterprisesinc.com.

|

BY ORDER OF THE BOARD OF DIRECTORS

|

|

|

By: /s/ S. Wilzig Izak

|

|

|

S. WILZIG IZAK

|

|

|

Chairman of the Board and Chief Executive Officer

|

Dated: February 3 , 2011

THE TRANSACTION HAS NOT BEEN APPROVED OR DISAPPROVED BY THE SECURITIES AND EXCHANGE COMMISSION OR ANY STATE SECURITIES COMMISSION, NOR HAS THE SECURITIES AND EXCHANGE COMMISSION OR ANY STATE SECURITIES COMMISSION PASSED UPON THE FAIRNESS OR MERITS OF THE TRANSACTION OR UPON THE ACCURACY OR ADEQUACY OF THE INFORMATION CONTAINED IN THIS DOCUMENT. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

ALL STOCKHOLDERS ARE CORDIALLY INVITED TO ATTEND THE MEETING. WHETHER OR NOT YOU PLAN TO ATTEND, PLEASE PROMPTLY SUBMIT A PROXY FOR YOUR SHARES ELECTRONICALLY ON THE INTERNET, BY TELEPHONE OR BY SIGNING, DATING AND RETURNING THE ENCLOSED PROXY CARD TO ENSURE THAT YOUR SHARES WILL BE REPRESENTED AT THE MEETING. IF YOU ATTEND THE ANNUAL MEETING, YOU MAY WITHDRAW YOUR PROXY, IF YOU WISH, AND VOTE IN PERSON. YOUR PROXY IS REVOCABLE IN ACCORDANCE WITH THE PROCEDURES SET FORTH IN THE PROXY STATEMENT.

TABLE OF CONTENTS

|

SUMMARY TERM SHEET

|

1

|

|

The Transaction

|

1

|

|

Purposes of and Reasons for the Transaction

|

1

|

|

Effects of the Transaction

|

2

|

|

Fairness of the Transaction

|

3

|

|

Advantages of the Transaction

|

4

|

|

Disadvantages of the Transaction

|

5

|

|

Voting Information

|

6

|

|

Effectiveness of the Transaction

|

6

|

|

Material U.S. Federal Income Tax Consequences of the Transaction

|

6

|

|

No Appraisal or Dissenters’ Rights

|

6

|

|

Termination of Transaction

|

6

|

|

QUESTIONS AND ANSWERS ABOUT THE TRANSACTION AND THE MEETING

|

7

|

|

Where and when is the Meeting?

|

7

|

|

What am I being asked to vote on at the Meeting?

|

7

|

|

How does the Board recommend that I vote on the proposals?

|

7

|

|

What is the purpose of the Transaction?

|

7

|

|

What does the deregistration of our Common Stock mean?

|

8

|

|

How will the Transaction affect the day to day operations of the Company?

|

8

|

|

What is the Pink Sheets?

|

8

|

|

What will I receive in the Transaction?

|

8

|

|

What potential conflicts of interest are posed by the Transaction?

|

8

|

|

Why are we proposing to carry out the Forward Stock Split following the Reverse Stock Split?

|

9

|

|

What if I hold fewer than 500 shares of Common Stock and hold all of my shares in street name?

|

9

|

|

What happens if I own a total of 500 or more shares of Common Stock beneficially through multiple brokerage firms in street name, or through a combination of record ownership in my name and one or more brokerage firms in street name?

|

9

|

|

If I own fewer than 500 shares of Common Stock, is there any way I can continue to be a stockholder of the Company after the Transaction?

|

10

|

|

Is there anything I can do if I own 500 or more shares of Common Stock, but would like to take advantage of the opportunity to receive cash for my shares as a result of the Transaction?

|

10

|

|

Who is entitled to vote at the Meeting?

|

10

|

|

How many shares were outstanding on the Record Date?

|

10

|

|

What is a “quorum” for purposes of the Meeting?

|

10

|

|

What vote is required to approve the proposals?

|

10

|

|

What is a “broker non-vote”?

|

11

|

|

How are broker non-votes counted?

|

11

|

|

How are abstentions counted?

|

11

|

|

What will happen if the Transaction is approved by our stockholders?

|

11

|

|

What will happen if the Transaction is not approved?

|

12

|

|

If the Transaction is approved by the stockholders, can the Board determine not to proceed with the Transaction?

|

12

|

|

What are the material U.S. federal income tax consequences of the Transaction?

|

12

|

|

Should I send in my stock certificates now?

|

12

|

|

What is the total cost of the Transaction to the Company?

|

12

|

|

Am I entitled to appraisal rights in connection with the Transaction?

|

12

|

|

How do I vote?

|

13

|

|

Can I change my vote?

|

13

|

|

What does it mean if I receive more than one proxy card?

|

13

|

|

SPECIAL FACTORS

|

13

|

|

Purposes of and Reasons for the Transaction

|

13

|

| Background of the Transaction | 16 |

|

Fairness of the Transaction

|

21

|

-i-

|

Alternatives Considered

|

26

|

|

Effects of the Transaction

|

27

|

|

Opinion of TM Capital

|

31

|

|

Certain Financial Forecasts

|

40

|

|

Conduct of Our Business After the Transaction

|

41

|

|

Material U.S. Federal Income Tax Consequences of the Transaction

|

41

|

|

Potential Conflicts of Interests of Officers, Directors and Certain Affiliated Persons

|

45

|

|

Sources of Funds and Expenses

|

46

|

|

Stockholder Approval

|

47

|

|

Effective Date

|

47

|

|

Termination of Transaction

|

47

|

|

Process for Payment for Fractional Shares

|

48

|

|

No Appraisal or Dissenters’ Rights

|

49

|

|

Escheat Laws

|

49

|

|

Regulatory Approvals

|

49

|

|

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

|

49

|

|

PROPOSAL NO. 1: REVERSE STOCK SPLIT

|

50

|

|

Annex Relating to Proposal No. 1

|

51

|

|

Vote Required for Approval of Proposal No. 1

|

51

|

|

Recommendation of our Board of Directors

|

51

|

|

PROPOSAL NO. 2: FORWARD STOCK SPLIT

|

51

|

|

Annex Relating to Proposal No. 2

|

51

|

|

Vote Required for Approval of Proposal No. 2

|

51

|

|

Recommendation of our Board of Directors

|

51

|

|

INFORMATION ABOUT THE COMPANY

|

52

|

|

Name and Address

|

52

|

|

Market Price of Common Stock; Dividends

|

52

|

|

Stockholders

|

52

|

|

Prior Public Offerings

|

52

|

|

Stock Purchases

|

53

|

|

Certain Information Concerning the Filing Persons

|

54

|

|

PROPOSAL NO. 3: ELECTION OF DIRECTORS

|

54

|

|

Director Profiles

|

55

|

|

Vote Required for Approval of Proposal No. 3

|

55

|

|

Recommendation of our Board of Directors

|

56

|

|

Relationships Among Directors or Executive Officers

|

56

|

|

Section 16(a) Beneficial Ownership Reporting Compliance

|

56

|

|

Certain Relationships and Related Transactions

|

56

|

|

BOARD OF DIRECTORS AND ITS COMMITTEES

|

56

|

|

Independence

|

56

|

|

Board of Directors’ Meetings

|

57

|

|

Risk Oversight

|

57

|

|

Leadership Structure

|

57

|

|

Executive Committee

|

57

|

|

The Audit Committee

|

57

|

|

Compensation Committee

|

58

|

|

Nominating Committee

|

58

|

|

Additional Nominating Committee Matters

|

58

|

|

Strategic Planning Committee

|

59

|

|

Code of Ethics

|

59

|

|

Stockholder Communications with the Board

|

59

|

|

Related Party Transactions Policy and Procedure

|

60

|

|

EXECUTIVE OFFICERS OF THE COMPANY

|

60

|

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

|

61

|

|

EXECUTIVE COMPENSATION

|

62

|

|

Summary of Cash and Certain other Compensation

|

62

|

| Grants of Plan Based Awards | 63 |

-ii-

|

Outstanding Equity Awards at December 31, 2009

|

64

|

|

Options Exercised and Stock Awards Vested

|

64

|

|

Employment Agreements and Other Arrangements with Executive Officers

|

64

|

|

Compensation of Directors

|

64

|

|

Compensation Committee Interlocks and Insider Participation

|

66

|

|

Compensation Committee Report

|

66

|

|

Other Compensation Committee Matters

|

66

|

|

Other Audit Committee Matters

|

66

|

|

PROPOSAL NO. 4: APPOINTMENT OF J.H. COHN LLP AS THE COMPANY’S INDEPENDENT AUDITORS FOR THE FISCAL YEAR ENDING DECEMBER 31, 2010

|

67

|

|

Votes Required for Approval of Proposal No. 4

|

67

|

|

Recommendation of the Board of Directors

|

67

|

|

Audit Fees and Related Matters

|

67

|

|

Other Matters

|

68

|

|

MEETING AND VOTING INFORMATION

|

68

|

|

Outstanding Voting Securities and Voting Rights

|

68

|

|

Information Concerning Proxies; Revocation of Proxies

|

69

|

|

Solicitation of Proxies

|

69

|

|

Quorum

|

69

|

|

Required Votes

|

69

|

|

How to Vote

|

70

|

|

Adjournment or Postponement

|

71

|

|

FINANCIAL INFORMATION

|

71

|

|

Summary Historical Financial Information

|

71

|

|

Pro Forma Consolidated Financial Statements (Unaudited)

|

72

|

|

STOCKHOLDER PROPOSALS FOR THE COMPANY’S 2011 ANNUAL MEETING

|

76

|

|

Stockholder Proposals for Inclusion in the Proxy Statement for the Company’s 2011 Annual Meeting

|

76

|

|

Other Requirements for Stockholder Proposals for Presentation at the 2011 Annual Meeting

|

76

|

|

PROXY MATERIALS DELIVERED TO A SHARED ADDRESS

|

76

|

|

WHERE YOU CAN FIND MORE INFORMATION

|

76

|

|

INCORPORATION OF CERTAIN DOCUMENTS BY REFERENCE

|

77

|

|

OTHER BUSINESS

|

77

|

ANNEX A – PROPOSED FORM OF AMENDMENT TO CERTIFICATE OF INCORPORATION TO EFFECT REVERSE STOCK SPLIT

ANNEX B – PROPOSED FORM OF AMENDMENT TO CERTIFICATE OF INCORPORATION TO EFFECT FORWARD STOCK SPLIT

ANNEX C – FAIRNESS OPINION OF TM CAPITAL, DATED DECEMBER 2, 2010

ANNEX D – WILSHIRE ENTERPRISES, INC. NOMINATING COMMITTEE CHARTER

ANNEX E – WILSHIRE ENTERPRISES, INC. COMPENSATION COMMITTEE CHARTER

ANNEX F – WILSHIRE ENTERPRISES, INC. AUDIT COMMITTEE CHARTER

-iii-

WILSHIRE ENTERPRISES, INC.

100 EAGLE ROCK AVENUE, EAST HANOVER, NEW JERSEY 07936

PROXY STATEMENT

This Proxy Statement is furnished to stockholders of Wilshire Enterprises, Inc., a Delaware corporation (the “Company,” “we,” “our,” “ours,” and “us”), in connection with the solicitation by the Board of Directors of the Company (the “Board of Directors” or the “Board”) of proxies for use at the Annual Meeting of Stockholders (the “Meeting”) scheduled to be held on February 25, 2011, at 1:00 p.m. Eastern Time at the Doubletree Hotel Wilmington Downtown, 700 N. King Street, Wilmington, DE, 19801, and at any and all adjournments or postponements thereof. This Proxy Statement and the accompanying form of proxy initially will be mailed or made available electronically to stockholders on or about February 4, 2011.

SUMMARY TERM SHEET

The following summary term sheet, together with the Questions and Answers section that follows, highlights certain information about the proposed Transaction (as defined below), but may not contain all of the information that is important to you. For a more complete description of the Transaction, we urge you to carefully read this proxy statement and all of its annexes before you vote. For your convenience, we have directed your attention to the location in this proxy statement where you can find a more complete discussion of the items listed below.

|

The Transaction

|

A special committee of the Board of Directors comprised solely of independent directors (the “Special Committee”) has reviewed and recommended to the Board of Directors, and the Board of Directors has authorized and recommended that the shareholders approve a 1-for-500 reverse stock split (the “Reverse Stock Split”) of our common stock, par value $1.00 per share (“Common Stock”), followed immediately by a 500-for-1 forward stock split (the “Forward Stock Split” and, together with the Reverse Stock Split, the “Transaction”).

As a result of the Transaction:

|

·

|

each share of Common Stock held of record by a stockholder owning fewer than 500 shares immediately prior to the effective time of the Reverse Stock Split (a “Fractional Stockholder”) will be converted into the right to receive $1.00 in cash (subject to any applicable U.S. federal, state and local withholding tax), without interest, per pre-split share; and

|

|

·

|

each share of Common Stock held by a stockholder of record owning 500 shares or more immediately prior to the effective time of the Reverse Stock Split (a “Continuing Stockholder”) will continue to represent one share of Common Stock after completion of the Transaction.

|

At the meeting, stockholders are being asked to consider and vote upon proposals to amend our Certificate of Incorporation, as amended to date (the “Certificate of Incorporation”), to effect the Reverse Stock Split and the Forward Stock Split. Copies of the proposed amendments to our Certificate of Incorporation for the Reverse Stock Split and the Forward Stock Split are attached as Annexes A and B, respectively. Although both the Reverse Stock Split and the Forward Stock Split will be voted on separately, the Company will not effect either the Reverse Stock Split or the Forward Stock Split unless both are approved by the Company’s stockholders.

See “Special Factors—Purposes of and Reasons for the Transaction” beginning on page 13.

|

Purposes of and Reasons for the Transaction

|

The Board of Directors has decided that the costs of being a Securities and Exchange Commission (the “SEC”) reporting company currently outweigh the benefits and, thus, it is no longer in our best interests or the best interests of our stockholders, including our unaffiliated stockholders, for us to remain an SEC reporting company. The Transaction will enable us to terminate the registration of our Common Stock under the Securities Exchange Act of

1934, as amended (the “Exchange Act”), if, after the Transaction, there are fewer than 300 record holders of our Common Stock and we make the necessary filings with the SEC. Our reasons for proposing the Transaction include the following:

|

·

|

Management believes that we will be able to realize significant cost savings by the elimination of most of the expenses related to the disclosure, reporting and compliance requirements of the Exchange Act and the Sarbanes-Oxley Act of 2002, as amended (the “Sarbanes-Oxley Act”), and other accounting, legal, printing and other miscellaneous costs associated with being a publicly traded company, which we estimate will be a minimum of approximately $657,000 per year. In addition, if we were to remain a publicly reporting company, the Dodd-Frank Wall Street Reform and Consumer Protection Act, enacted in July 2010, is expected to result in increased compliance costs for us due to new executive compensation requirements, though the extent of these costs and disclosures are still not known.

|

|

·

|

The ability of our management to focus on long-term growth without an undue emphasis on short-term financial results.

|

|

·

|

The fact that the public trading volume and liquidity of our Common Stock is already very limited and we believe will not be significantly affected if we become a non-publicly reporting company.

|

|

·

|

The ability of our small stockholders (those holding fewer than 500 shares) to liquidate their holdings in us and receive a premium over market prices prevailing at the time of our public announcement of the Transaction, without incurring brokerage commissions.

|

See “Special Factors—Purposes of and Reasons for the Transaction” beginning on page 13.

|

Effects of the Transaction

|

As a result of the Transaction:

|

·

|

We expect that the number of our stockholders of record will be reduced below 300, which will allow us to terminate the registration of our Common Stock under the Exchange Act. Effective on, and following the termination of the registration of our Common Stock under the Exchange Act, we will no longer be subject to any reporting requirements under the Exchange Act or the rules of the SEC applicable to SEC reporting companies and will be able to eliminate most of the expenses related to the disclosure, reporting and compliance requirements of the Sarbanes-Oxley Act, .

|

|

·

|

Each share of Common Stock held of record by a stockholder owning fewer than 500 shares immediately prior to the effective time of the Reverse Stock Split will be converted into the right to receive $1.00 in cash (subject to any applicable U.S. federal, state and local withholding tax), without interest, per pre-split share.

|

|

·

|

Each share of Common Stock held by a stockholder of record owning 500 shares or more immediately prior to the effective time of the Reverse Stock Split will continue to represent one share of Common Stock after completion of the Transaction.

|

|

·

|

The Board of Directors anticipates that we will continue to have our Common Stock quoted on the Pink Sheets; however, liquidity is likely to be limited due to the fact that we will no longer file the reports required by the Exchange Act.

|

|

·

|

Our officers, directors and 10% stockholders will no longer be subject to the reporting requirements of Section 16 of the Exchange Act or be subject to the prohibitions against retaining short-swing profits in our shares of Common Stock.

|

|

·

|

Persons acquiring more than 5% of our Common Stock will no longer be required to report their beneficial ownership under the Exchange Act.

|

-2-

|

·

|

Options evidencing rights to purchase shares of our Common Stock will be unaffected by the Transaction because the options will, after the effective date of the Transaction, be exercisable for the same number of shares of our Common Stock as they were before the Transaction.

|

|

·

|

Since our obligation to file periodic and other filings with the SEC will be suspended, our continuing stockholders will have access to less information about us and our business, operations and financial performance.

|

|

·

|

Upon the effectiveness of the Transaction and as a result of the reduction of the number of shares of Common Stock outstanding by approximately 204,357 shares, we estimate that the ownership percentage of our shares of Common Stock held by our directors, executive officers and 10% stockholders will increase from 61.3% to 64.2%. The increase in the ownership percentage of our shares of Common Stock held by directors, executive officers and 10% stockholders and the reduction in the number of shares outstanding following the completion of the Transaction is based upon information we received as of November 10, 2010 from our transfer agent, Continental Stock Transfer & Trust Company, as to our record holders, and information we have received regarding the holdings of beneficial owners of our Common Stock held in street name. The ownership percentage and the reduction in the number of shares outstanding following the Transaction may increase or decrease depending on purchases, sales and other transfers of our shares of Common Stock by our stockholders prior to the effective time of the Transaction, and the number of street name shares that are actually cashed-out in the Transaction. The ownership percentage of our shares of Common Stock held by directors, executive officers and 10% stockholders and the ownership percentage of the continuing stockholders will proportionally increase or decrease as a result of such purchases, sales and other transfers of our shares of Common Stock by our stockholders prior to the effective time of the Transaction, and depending on the number of street name shares that are actually cashed-out in the Transaction.

|

See “Special Factors—Effects of the Transaction” beginning on page 27, “Special Factors—Alternatives Considered” beginning on page 26, “Special Factors—Fairness of the Transaction” beginning on page 21 and “Special Factors—Potential Conflicts of Interests of Officers, Directors and Certain Affiliated Persons” beginning on page 45.

|

Fairness of the Transaction

|

The Special Committee and the Board of Directors fully considered and reviewed the terms, purposes, alternatives and effects of the proposed Transaction. Based on its review, the Special Committee and the Board of Directors unanimously determined that the Transaction is procedurally and substantively fair to our unaffiliated stockholders, including the unaffiliated stockholders who will receive cash consideration in the Transaction and unaffiliated stockholders who will continue as our stockholders.

The Special Committee and the Board of Directors considered a number of factors in reaching its determinations, including:

|

·

|

the fairness opinion prepared by TM Capital dated December 2, 2010, to the effect that, as of the date and based upon the assumptions made, matters considered and limits of review set forth in TM Capital’s written opinion, the consideration to be received by stockholders owning fewer than 500 shares of Common Stock immediately prior to the effective time of the Reverse Stock Split pursuant to the Transaction is fair, from a financial point of view, to the Fractional Stockholders;

|

|

·

|

anticipated significant cost savings due to the elimination of most of the expenses related to the disclosure, reporting and compliance requirements of the Exchange Act and the Sarbanes-Oxley Act, and other accounting, legal, printing and other miscellaneous costs associated with being a publicly traded company, which we estimate will be a minimum of approximately $657,000 per year;

|

|

·

|

the limited trading volume and liquidity of our shares of Common Stock, the fact that becoming a non-publicly reporting company will likely not significantly further limit the trading volume and liquidity of our Common Stock and the opportunity the Transaction affords our smallest stockholders to obtain cash for

|

-3-

their shares in a relatively limited trading market and at a premium over market prices prevailing at the time of our public announcement of the Transaction without incurring brokerage commissions;

|

·

|

the $1.00 cash out price represents an approximately 177.8% premium over the average share price for the 30-day period ended November 29, 2010, which was prior to the Board of Directors’ initial approval of the Transaction, an approximately 170.3% premium over the average share price for the 60-day period ended November 29, 2010, an approximately 143.9% premium over the average share price for the 90-day period ended November 29, 2010, an approximately 112.8% premium over the average share price for the 120-day period ended November 29, 2010 and an approximately 185.7% premium over the $0.35 closing sales price of Common Stock on December 9, 2010 (the day immediately prior to our announcement of the Transaction);

|

|

·

|

the Transaction will treat no differently our directors, executive officers and stockholders who own more than 10% of our outstanding Common Stock, which we refer to in this proxy statement as our “affiliates,” than stockholders who are not directors, executive officers or 10% stockholders, which we refer to in this proxy statement as our “unaffiliated stockholders,” including unaffiliated cashed-out stockholders and unaffiliated continuing stockholders;

|

|

·

|

stockholders that desire to retain their equity interest in us after the Transaction can increase the number of shares they hold to 500 shares or more prior to the effective date of the Reverse Stock Split, thereby avoiding being cashed-out; however, given the historically limited liquidity in our stock, there can be no assurance that any shares will be available for purchase and thus there can be no assurance that a stockholder will be able to acquire sufficient shares to meet or exceed the required 500 shares prior to the effective time of the Transaction.

|

See “Special Factors—Fairness of the Transaction” beginning on page 21 and “Special Factors—Opinion of TM Capital” beginning on page 31.

|

Advantages of the Transaction

|

If the Transaction occurs, there will be certain advantages to stockholders, including the following:

|

·

|

We expect to realize significant cost savings by the elimination of most of the expenses related to the disclosure, reporting and compliance requirements of the Exchange Act and the Sarbanes-Oxley Act, and other accounting, legal, printing and other miscellaneous costs associated with being a publicly traded company, which we estimate will be a minimum of approximately $657,000 per year. In addition, if we were to remain a publicly reporting company, the Dodd-Frank Wall Street Reform and Consumer Protection Act, enacted in July 2010, is expected to result in increased compliance costs for us due to new executive compensation requirements, though the extent of these costs and disclosures are still not known.

|

|

·

|

There is a relatively illiquid and limited trading market in our shares. Our smallest stockholders will have the opportunity to obtain cash for their shares at a premium over closing prices for our shares of Common Stock at the time of our announcement of the Transaction, without incurring brokerage commissions.

|

|

·

|

Our affiliated stockholders will be treated no differently than our unaffiliated stockholders. The sole determining factor as to whether a stockholder will be a continuing stockholder after the Transaction is the number of shares of our Common Stock that they own on the effective date of the Reverse Stock Split.

|

|

·

|

Stockholders that desire to retain their equity interest in us after the Transaction can increase the number of shares they hold to 500 shares or more prior to the effective date of the Reverse Stock Split, thereby avoiding being cashed-out; however, given the historically limited liquidity in our stock, there can be no assurance that any shares will be available for purchase and thus there can be no assurance that a stockholder will be able to acquire sufficient shares to meet or exceed the required 500 shares prior to the effective time of the Transaction.

|

See “Special Factors—Purposes of and Reasons for the Transaction” beginning on page 13 and “Special Factors—Fairness of the Transaction” beginning on page 21.

-4-

|

Disadvantages of the Transaction

|

If the Transaction occurs, there will be certain disadvantages to stockholders, including the following:

|

·

|

Stockholders cashed-out in the Transaction will no longer have any ownership interest in us and will no longer participate in any future earnings and growth.

|

|

·

|

We will cease to file annual, quarterly, current, and other reports and documents with the SEC, and stockholders will cease to receive annual reports and proxy statements as required under the Exchange Act. While we intend to continue to prepare audited annual financial statements and to make those financial statements available to shareholders through our company website, we will not be under any continuing obligation to do so and may elect in our discretion at any time to not make such information available to shareholders. We will not be providing periodic reports in the format currently required of us under the provisions of the Exchange Act and, as a result, continuing stockholders will have access to less information about us and our business, operations, and financial performance.

|

|

·

|

We will no longer be subject to the provisions of the Sarbanes-Oxley Act or the liability provisions of the Exchange Act (other than the general anti-fraud provisions thereof).

|

|

·

|

While we anticipate that our Common Stock will continue to be quoted on the Pink Sheets, due to the possible limited liquidity for our Common Stock, the suspension of our obligation to publicly disclose financial and other information following the Transaction and the deregistration of our Common Stock under the Exchange Act, continuing stockholders may potentially experience a significant decrease in the value of their Common Stock.

|

|

·

|

Our executive officers, directors and 10% stockholders will no longer be required to file reports relating to their transactions in our Common Stock with the SEC. In addition, our executive officers, directors and 10% stockholders will no longer be subject to the recovery of short-swing profits provision of the Exchange Act, and persons acquiring more than 5% of our Common Stock will no longer be required to report their beneficial ownership under the Exchange Act.

|

|

·

|

We estimate that the cost of payment to Fractional Stockholders, professional fees and other expenses of the Transaction will total approximately $450,000. As a result, immediately after the Transaction, our cash balances on hand will be reduced by the costs incurred in the Transaction.

|

|

·

|

The Transaction will result in the suspension, and not the termination, of our filing obligations under the Exchange Act. If on the first day of any fiscal year after the suspension of our filing obligations we have more than 300 stockholders of record, then we must resume reporting pursuant to Section 15(d) of the Exchange Act, which would result in our once again incurring many of the expenses that we expect to save by virtue of the Transaction.

|

|

·

|

Under Delaware law, our Certificate of Incorporation and our bylaws, no appraisal or dissenters’ rights are available to our stockholders who dissent from the Transaction.

|

|

·

|

The lack of liquidity provided by a ready market may result in fewer opportunities to utilize equity-based incentive compensation tools to recruit and retain top executive talent.

|

|

·

|

Our Common Stock may be a less attractive acquisition currency as an acquirer of illiquid securities of a privately held company must depend on liquidity either via negotiated buy-out or buy-back arrangements, or a liquidity event by the Company that is generally outside of his/her control.

|

|

·

|

Following the Transaction, since we will no longer be registered with the SEC and will not be filing the periodic reports and proxy statements required under the Exchange Act, it will likely be more costly and time consuming for us to raise equity capital from public or private sources.

|

|

·

|

Companies that lose status as a public company may risk losing prestige in the eyes of the public, the investment community and key constituencies.

|

-5-

See “Special Factors—Fairness of the Transaction” beginning on page 21.

|

Voting Information

|

|

·

|

The affirmative vote of a majority of all shares of Common Stock issued and outstanding and entitled to vote at the Meeting will be required to approve the proposed amendments to the Certificate of Incorporation to effect the Reverse Stock Split and the Forward Stock Split. The affirmative vote of a plurality of the votes cast at the Meeting is required for the election of directors. The affirmative vote of the holders of a majority of the shares of Common Stock represented at the Meeting in person or by proxy and entitled to vote at the Meeting will be required to ratify the appointment of J.H. Cohn LLP as the Company’s independent auditors for the fiscal year ending December 31, 2010. Our directors and executive officers have indicated that they intend to vote their shares of our Common Stock (876,257 shares, or approximately 21.2% of our issued and outstanding shares eligible to vote at the Meeting) “FOR” the Transaction.

|

See “Special Factors—Stockholder Approval” beginning on page 47 and “Meeting and Voting Information—Quorum” beginning on page 69.

|

Effectiveness of the Transaction

|

|

·

|

We anticipate that the Transaction will be effected as soon as possible after the date of the Meeting. Following the effective date of the Transaction, transmittal materials will be sent to those stockholders entitled to a cash payment that will describe how to turn in their share certificates and receive the cash payments. Those stockholders entitled to a cash payment should not turn in their share certificates at this time.

|

See “Special Factors—Effective Date” beginning on page 47.

|

Material U.S. Federal Income Tax Consequences of the Transaction

|

|

·

|

The receipt of cash by a Fractional Stockholder in exchange for Common Stock in the Transaction generally will be taxable for U.S. federal income tax purposes. The transfer agent will withhold 30% of any gross payments made to a Non-U.S. Holder (as defined below) with respect to the Transaction, unless such holder properly demonstrates that a reduced rate of U.S. federal income tax withholding or an exemption from such withholding is applicable. In general, neither the Company nor any continuing stockholder who does not receive cash in the Transaction should be subject to U.S. federal income taxation with respect to the Transaction.

|

See “Special Factors—Material U.S. Federal Income Tax Consequences of the Transaction” beginning on page 41.

|

No Appraisal or Dissenters’ Rights

|

|

·

|

Under Delaware law, our Certificate of Incorporation and our bylaws, no appraisal or dissenters’ rights are available to our stockholders who dissent from the Transaction.

|

See “Special Factors—No Appraisal and Dissenters’ Rights” beginning on page 49.

|

Termination of Transaction

|

|

·

|

The Board of Directors has reserved the right to abandon the Transaction if it believes the Transaction is no longer in our best interests, and the Board of Directors has retained authority, in its discretion, to withdraw the Transaction from the agenda of the Meeting prior to any vote. In addition, even if the Transaction is approved by stockholders at the Meeting, the Board of Directors may determine not to implement the Transaction if it subsequently determines that the Transaction is not in our best interests.

|

See “Special Factors—Termination of Transaction” beginning on page 47.

-6-

QUESTIONS AND ANSWERS ABOUT THE TRANSACTION AND THE MEETING

The following questions and answers are intended to briefly address potential questions regarding the Transaction and the Meeting. These questions and answers may not address all questions that may be important to you as a stockholder. Please refer to the more detailed information contained elsewhere in this Proxy Statement, the annexes to this Proxy Statement and any information and documents referred to or incorporated by reference in this Proxy Statement.

|

Where and when is the Meeting?

|

The Meeting will be held at the Doubletree Hotel Wilmington Downtown, 700 N. King Street, Wilmington, DE, 19801 on February 25, 2011, at 1:00 p.m. Eastern Time.

|

What am I being asked to vote on at the Meeting?

|

Our stockholders will consider and vote upon the following proposals:

|

·

|

a proposal to amend the Certificate of Incorporation to effect the Reverse Stock Split

|

|

·

|

a proposal to amend the Certificate of Incorporation to effect the Forward Stock Split

|

|

·

|

the election of one director of the Company to serve until the 2013 Annual Meeting of Stockholders and until his successor has been elected and qualified or until his earlier resignation or removal

|

|

·

|

the ratification of the appointment of J.H. Cohn LLP as the Company’s independent auditors for the fiscal year ending December 31, 2010

|

|

How does the Board recommend that I vote on the proposals?

|

The Board unanimously recommends that you vote as follows:

|

·

|

“FOR” the proposal to amend the Certificate of Incorporation to effect the Reverse Stock Split

|

|

·

|

“FOR” the proposal to amend the Certificate of Incorporation to effect the Forward Stock Split

|

|

·

|

“FOR” the election of one director of the Company to serve until the 2013 Annual Meeting of Stockholders and until his successor has been elected and qualified or until his earlier resignation or removal

|

|

·

|

“FOR” the ratification of the appointment of J.H. Cohn LLP as the Company’s independent auditors for the fiscal year ending December 31, 2010

|

|

What is the purpose of the Transaction?

|

The Board of Directors has decided that the costs of being an SEC reporting company currently outweigh the benefits and, thus, it is no longer in our best interests or the best interests of our stockholders, including our unaffiliated stockholders, for us to remain an SEC reporting company. The Transaction will enable us to terminate the registration of our Common Stock under the Exchange Act if, after the Transaction, there are fewer than 300 record holders of our Common Stock and we make the necessary filings with the SEC.

Our reasons for proposing the Transaction include:

|

·

|

Management believes that we will be able to realize significant cost savings by the elimination of most of the expenses related to the disclosure, reporting and compliance requirements of the Exchange Act and the Sarbanes-Oxley Act of 2002, as amended (the “Sarbanes-Oxley Act”), and other accounting, legal, printing and other miscellaneous costs associated with being a publicly traded company, which we estimate will be a minimum of approximately $657,000 per year.

|

-7-

|

·

|

The fact that the public trading volume and liquidity of our Common Stock is already very limited and we believe will not be significantly affected if we become a non-publicly reporting company.

|

|

·

|

The ability of our management to focus on long-term growth without an undue emphasis on short-term financial results.

|

|

·

|

The ability of our small stockholders (those holding fewer than 500 shares) to liquidate their holdings in us and receive a premium over market prices prevailing at the time of our public announcement of the Transaction, without incurring brokerage commissions.

|

|

What does the deregistration of our Common Stock mean?

|

Following the Transaction, we expect that we will have fewer than 300 stockholders of record, which will enable us to terminate the registration of our Common Stock under the Exchange Act. Effective on and following the termination of the registration of our Common Stock under the Exchange Act, we will no longer be required to file annual, quarterly and other reports with the SEC and our executive officers, directors and 10% stockholders will no longer be required to file reports relating to their transactions in our Common Stock. Any trading in our Common Stock will continue, if at all, in privately negotiated sales or in the Pink Sheets. However, trading opportunities in the Pink Sheets will be dependent upon whether any broker-dealers commit to make a market for our Common Stock, and we cannot guarantee or anticipate whether our Common Stock will be quoted on the Pink Sheets.

|

How will the Transaction affect the day to day operations of the Company?

|

Though the Transaction will have very little effect on the Company’s business and operations, it will reduce management time spent on compliance and disclosure matters attributable to our Exchange Act filings, and may therefore enable management to increase its focus on managing our business and growing stockholder value.

|

What is the Pink Sheets?

|

The Pink Sheets offers limited information about issuers of securities, like our Common Stock, and collects and publishes quotes of market makers for over-the-counter securities through its website at www.otcmarkets.com.

|

What will I receive in the Transaction?

|

If you own fewer than 500 shares of our Common Stock immediately prior to the effective time of the Reverse Stock Split, you will receive $1.00 in cash per share (subject to any applicable U.S. federal, state and local withholding tax), without interest, from us for each pre-Reverse Stock Split share that you own. If you own 500 shares or more of our Common Stock immediately prior to the effective time of the Reverse Stock Split, you will not receive any cash payment for your shares in connection with the Transaction and will continue to hold the same number of shares of our Common Stock as you did before the Reverse Stock Split.

|

What potential conflicts of interest are posed by the Transaction?

|

Our directors, officers and 10% stockholders may have interests in the Transaction that are different from your interests as a stockholder, and have relationships that may present conflicts of interest. While our Board of Directors recommends a vote “FOR” the Transaction, to the Company’s knowledge, none of the Company’s affiliates has made a recommendation, in their individual capacities, either in support of or opposed to the Transaction. Our directors and executive officers have indicated that they intend to vote their shares of our Common Stock (876,257 shares, or approximately 21.2% of our issued and outstanding shares eligible to vote at the Meeting) “FOR” the Transaction.

Upon the effectiveness of the Transaction, the aggregate number of shares of our Common Stock owned by our directors, executive officers and 10% stockholders will remain the same and the ownership percentage of the shares of our Common Stock held by our directors, executive officers and 10% stockholders will increase by approximately 2.9% from 61.3% to 64.2% as a result of the reduction of the number of shares of our Common Stock outstanding.

-8-

Each of our directors and executive officers will continue to own our Common Stock and will continue to serve as a director or executive officer after the Transaction. However, because we will terminate the registration of our common stock under the Exchange Act and our common stock may continue to only be quoted on the Pink Sheets, the liquidity of our Common Stock is likely to be limited due to the fact that we will no longer file the reports required by the Exchange Act and our directors and executive officers cannot be assured of any established market in which to sell shares of our Common Stock following the Transaction. In addition, each member of the Board and certain of our executive officers, holds options to acquire shares of our Common Stock. The Transaction will not affect these stock options and they will remain outstanding after the Transaction. However, these stock options may become less valuable if they cannot be turned into cash quickly and easily once earned because of the lack of a ready market and a decline in the price of our Common Stock. Directors, executive officers and any stockholders who own more than 10% of our outstanding Common Stock will experience certain advantages after the Transaction in that they will be relieved of certain SEC reporting requirements and “short-swing profit” trading provisions under Section 16 of the Exchange Act. Information regarding our officers’ and directors’ compensation and stock ownership will no longer be publicly available and persons acquiring more than 5% of our Common Stock will no longer be required to report their beneficial ownership under the Exchange Act. In addition, by deregistering the Common Stock under the Exchange Act subsequent to the consummation of the Transaction, we will no longer be prohibited, pursuant to Section 402 of the Sarbanes-Oxley Act, from making personal loans to our directors or executive officers, although no such loans currently are contemplated.

|

Why are we proposing to carry out the Forward Stock Split following the Reverse Stock Split?

|

The Forward Stock Split is not necessary for us to reduce the number of holders of record of our shares of Common Stock and to deregister our shares of Common Stock under the Exchange Act. However, we have decided that it is in the best interests of our stockholders to effect the Forward Stock Split to avoid an unusually high stock price after the effective date of the Reverse Stock Split, to facilitate trading of the shares of continuing stockholders either in private transactions or in the Pink Sheets, to mitigate any loss of liquidity in our shares of Common Stock that may result from the Reverse Stock Split portion of the Transaction, to avoid the administrative burden of having fractional shares outstanding and to permit outstanding convertible and exercisable securities, such as stock options, to be unaffected by the Transaction.

|

What if I hold fewer than 500 shares of Common Stock and hold all of my shares in street name?

|

If you hold fewer than 500 shares of our Common Stock in street name, your broker, bank or other nominee is considered the stockholder of record with respect to those shares and not you. It is possible that the bank, broker or other nominee also holds shares for other beneficial owners of our Common Stock and that it may hold 500 or more total shares. Therefore, depending upon their procedures, they may not be obligated to treat the Reverse Stock Split as affecting beneficial holders’ shares. It is our desire to treat stockholders holding fewer than 500 shares of our Common Stock in street name through a nominee (such as a bank or broker) in the same manner as stockholders whose shares are registered in their name. However, we or our transfer agent, Continental Stock Transfer & Trust Company, may not have the necessary information to compare your record holdings with any shares that you may hold in street name in a brokerage account and these banks, brokers and other nominees may have different procedures for processing the Reverse Stock Split. Accordingly, if you hold your shares of our Common Stock in street name, we encourage you to contact your bank, broker or other nominee.

|

What happens if I own a total of 500 or more shares of Common Stock beneficially through multiple brokerage firms in street name, or through a combination of record ownership in my name and one or more brokerage firms in street name?

|

We may not have the information to compare your record holdings and your ownership through a brokerage firm or to compare your holdings in two or more different brokerage firms. As a result, if you hold more than the minimum number of shares, you may nevertheless have your shares cashed-out if you hold them in a combination of record and street name or through accounts in several brokerage firms. If you are in this situation and desire to remain our stockholder after the Transaction, we recommend that you combine your holdings in one brokerage account or transfer any shares held through a brokerage firm into record name prior to the effective time of the Transaction. You should be able to determine whether your shares will be cashed-out by examining your brokerage account statements to see if you hold more than the minimum number of shares in any one account. To determine

-9-

the Transaction’s effect on any shares you hold in street name (and possible payment of the cash consideration), you should contact your broker, bank or other nominee.

|

If I own fewer than 500 shares of Common Stock, is there any way I can continue to be a stockholder of the Company after the Transaction?

|

If you own fewer than 500 shares of our Common Stock before the Transaction, the only way you can continue to be our stockholder after the Transaction is to acquire, prior to the effective time of the Transaction, sufficient additional shares to cause you to own a minimum of 500 shares at the effective time of the Transaction. However, given the historically limited liquidity in our stock, we cannot assure you that any shares will be available for purchase and thus there can be no assurance that you will be able to acquire sufficient shares to meet or exceed the required 500 shares. In such an instance, you would no longer remain a stockholder after the effective time of the Transaction.

|

Is there anything I can do if I own 500 or more shares of Common Stock, but would like to take advantage of the opportunity to receive cash for my shares as a result of the Transaction?

|

If you own 500 or more shares of our Common Stock before the Transaction, you can only receive cash for all of your shares if, prior to the effective time of the Transaction, you reduce your stock ownership to fewer than 500 shares by selling or otherwise transferring shares. However, there can be no assurance that any purchaser for your shares will be available.

|

Who is entitled to vote at the Meeting?

|

Only holders of record of our Common Stock as of the close of business on January 19, 2011 (the “Record Date”), are entitled to notice of, and to vote at, the Meeting.

|

How many shares were outstanding on the Record Date?

|

At the close of business on the Record Date, there were 4,141,099 shares outstanding. Only shares of Common Stock outstanding on the Record Date will be eligible to vote on the Transaction. At the Meeting, each of those shares of Common Stock will be entitled to one vote.

|

What is a “quorum” for purposes of the Meeting?

|

In order to conduct business at the Meeting, a quorum of stockholders is necessary to hold a valid meeting. A quorum will be present if stockholders holding at least a majority of the outstanding shares are present at the meeting in person or represented by proxy. On the close of business on the Record Date, there were 4,141,099 shares outstanding and entitled to vote and, accordingly, the presence, in person or by proxy, of at least 2,070,550 shares is necessary to meet the quorum requirement.

Your shares will be counted towards the quorum only if you submit a valid proxy (or one is submitted on your behalf by your broker, bank or other nominee) or if you vote in person at the meeting. Abstentions and broker non-votes will be counted towards the quorum requirement.

|

What vote is required to approve the proposals?

|

Once a quorum has been established, the following votes are required to approve the proposals to be voted upon at the Meeting:

|

·

|

the proposal to amend the Certificate of Incorporation to effect the Reverse Stock Split

|

|

·

|

The affirmative vote of a majority of all of the shares outstanding and entitled to vote on this matter will be required for approval

|

|

·

|

the proposal to amend the Certificate of Incorporation to effect the Forward Stock Split

|

-10-

|

·

|

The affirmative vote of a majority of all of the shares outstanding and entitled to vote on this matter will be required for approval

|

|

·

|

the election of one director of the Company to serve until the 2013 Annual Meeting of Stockholders and until his successor has been elected and qualified or until his earlier resignation or removal

|

|

·

|

The affirmative vote of a plurality of the votes cast at the Meeting is required for the election of directors. A properly executed proxy marked “WITHHELD” with respect to the election of the director will not be voted with respect to the director indicated, although it will be counted for purposes of determining whether there is a quorum. Thus, the director with the most affirmative votes will be elected at the Meeting.

|

|

·

|

the ratification of the appointment of J.H. Cohn LLP as the Company’s independent auditors for the fiscal year ending December 31, 2010

|

|

·

|

The affirmative vote of a majority of the votes cast at the Meeting will be required for approval.

|

|

What is a “broker non-vote”?

|

Broker non-notes generally occur when shares held by a broker nominee for a beneficial owner are not voted with respect to a proposal because the nominee has not received voting instructions from the beneficial owner and lacks discretionary authority to vote the shares. Brokers normally have discretion to vote on “routine matters,” such as the ratification of independent registered public accounting firms, but not on non-routine matters, such as amendments to charter document and the election of directors.

|

How are broker non-votes counted?

|

Broker non-votes will be counted for the purpose of determining the presence or absence of a quorum, but will not be counted for the purpose of determining the number of shares entitled to vote on a specific proposal.

Accordingly, a broker non-vote will have the effect of:

|

·

|

a vote against the Reverse Stock Split proposal and a vote against the Forward Stock Split Proposal; and

|

|

·

|

no effect on the proposal regarding the election of directors and ratification of our Audit Committee’s appointment of J.H. Cohn LLP.

|

|

How are abstentions counted?

|

A properly executed proxy marked “ABSTAIN” with respect to any such matter will be counted for purposes of determining whether there is a quorum. However, under Delaware law, a proxy marked “ABSTAIN” is not considered a vote cast.

Accordingly, an abstention will have the effect of:

|

·

|

a vote against the Reverse Stock Split proposal and a vote against the Forward Stock Split Proposal; and

|

|

·

|

no effect on the proposal regarding the election of directors and ratification of our Audit Committee’s appointment of J.H. Cohn LLP.

|

|

What will happen if the Transaction is approved by our stockholders?

|

Assuming that we have fewer than 300 record holders of our Common Stock after the Transaction, we will file applicable forms with the SEC to deregister our shares of Common Stock under the federal securities laws. Upon the effectiveness of those filings, we would no longer be subject to the reporting and related requirements under the Exchange Act that are applicable to public companies. We will also no longer be subject to the provisions of the

-11-

Sarbanes-Oxley Act. Also, any trading in our Common Stock will occur, if at all, in privately negotiated sales or in the Pink Sheets.

|

What will happen if the Transaction is not approved?

|

If the Transaction is not approved by our stockholders, we will continue to operate our business, and we will continue to incur the costs involved with being a public company. We also may decide to evaluate and explore available alternatives, although the Board has not yet made a determination that any of those alternatives are feasible or advisable.

|

If the Transaction is approved by the stockholders, can the Board determine not to proceed with the Transaction?

|

If the Transaction is approved by the stockholders, the Board may determine not to proceed with the Transaction if it believes that proceeding with the Transaction is not in our best interests or in the best interests of our stockholders, including all unaffiliated stockholders. If the Board determines not to proceed with the Transaction we will continue to operate our business as presently conducted.

|

What are the material U.S. federal income tax consequences of the Transaction?

|

The receipt of cash by a Fractional Stockholder in exchange for Common Stock in the Transaction generally will be taxable for U.S. federal income tax purposes. The transfer agent will withhold 30% of any gross payments made to a Non-U.S. Holder (as defined below) with respect to the Transaction, unless such holder properly demonstrates that a reduced rate of U.S. federal income tax withholding or an exemption from such withholding is applicable. In general, neither the Company nor any continuing stockholder who does not receive cash in the Transaction should be subject to U.S. federal income taxation with respect to the Transaction. To review the material U.S. federal income tax consequences of the Transaction in greater detail, see “Special Factors—Material U.S. Federal Income Tax Consequences of the Transaction” beginning on page 41. We urge you to consult with your personal tax advisor regarding the tax consequences to you of the Transaction.

|

Should I send in my stock certificates now?

|

No. After the Transaction is completed, we will send instructions on how to receive any cash payments to which you may be entitled.

|

What is the total cost of the Transaction to the Company?

|

Since we do not know how many record and beneficial holders of our Common Stock will receive cash for their shares in the Transaction, we do not know the exact cost of the Transaction. However, based on information that we have received as of November 10, 2010 from our transfer agent, Continental Stock Transfer & Trust Company, with regard to the size of holdings of those of you who may hold shares in street name, as well as our estimates of other Transaction expenses, we believe that the total cash requirement of the Transaction to us will be approximately $450,000. This amount includes approximately $205,000 needed to cash-out fractional shares, approximately $185,000 of legal, accounting and financial advisory fees, approximately $10,000 for transfer agent costs and approximately $50,000 of other costs, including costs of printing and mailing, to effect the Transaction. This total amount could be larger or smaller depending on, among other things, the number of fractional shares that will be outstanding after the Reverse Stock Split as a result of purchases, sales and other transfers of our shares of Common Stock by our stockholders.

|

Am I entitled to appraisal rights in connection with the Transaction?

|

No. Under Delaware law, our Certificate of Incorporation and our bylaws, no appraisal or dissenters’ rights are available to our stockholders who dissent from the Transaction.

-12-

|

How do I vote?

|

Your shares may be voted by one of the following methods:

|

·

|

submitting a proxy via the Internet;

|

|

·

|

submitting a proxy on the telephone;

|

|

·

|

signing and returning a traditional paper proxy card; or

|

|

·

|

attending the annual meeting and voting in person.

|

Whether or not you plan to attend the annual meeting, please take a moment to read the instructions, choose the way to submit a proxy that you find most convenient and submit your proxy as soon as possible.

|

Can I change my vote?

|

Yes. You may change your proxy instructions at any time before the final vote at the Meeting. If you are the record holder of your shares, you may revoke your proxy in any one of three ways:

|

·

|

You may submit another proxy electronically on the internet, by telephone or by signing, dating and returning a completed proxy card with a later date.

|

|

·

|

You may send a timely written notice that you are revoking your proxy to the Company’s Secretary at 100 Eagle Rock Avenue, East Hanover, New Jersey 07936.

|

|

·

|

You may attend the Meeting and vote in person. Simply attending the meeting will not, by itself, revoke your proxy.

|

If your shares are held by your broker or bank as a nominee or agent, you should follow the instructions provided by your broker or bank.

|

What does it mean if I receive more than one proxy card?

|

If you receive more than one proxy card, your shares are registered in more than one name or are registered in different accounts. Please complete, sign and return each proxy card to ensure that all of your shares are voted.

SPECIAL FACTORS

|

Purposes of and Reasons for the Transaction

|

Our Board of Directors has decided that the costs of being an SEC reporting company currently outweigh the benefits and, thus, it is no longer in our best interests or the best interests of our stockholders, including our unaffiliated stockholders, for us to remain an SEC reporting company. Therefore, our Board of Directors has unanimously authorized a 1-for-500 reverse stock split (the “Reverse Stock Split”) of our Common Stock, followed immediately by a 500-for-1 forward stock split (the “Forward Stock Split” and, together with the Reverse Stock Split, the “Transaction”). At the meeting, stockholders are being asked to consider and vote upon proposals to amend our Certificate of Incorporation to effect the Reverse Stock Split and the Forward Stock Split. Copies of the proposed amendments to our Certificate of Incorporation for the Reverse Stock Split and the Forward Stock Split are attached as Annexes A and B, respectively. Although both the Reverse Stock Split and the Forward Stock Split will be voted on separately, the Company will not effect either the Reverse Stock Split or the Forward Stock Split unless both are approved by the Company’s stockholders.

The Transaction will enable us to terminate the registration of our Common Stock under the Exchange Act if, after the Transaction, there are fewer than 300 record holders of our Common Stock and we make the necessary filings with the SEC. Management believes that we will be able to realize significant cost savings by the elimination of most of the expenses related to the disclosure, reporting and compliance requirements of the Exchange Act, the

-13-

Sarbanes-Oxley Act, and other securities laws and regulations. The costs associated with these obligations constitute a significant overhead expense. These costs include professional fees for our auditors and corporate counsel, costs related to our Director and Officer insurance policy, printing and mailing costs, internal compliance costs and transfer agent costs. In addition, if we were to remain a publicly reporting company, the Dodd-Frank Wall Street Reform and Consumer Protection Act, enacted in July 2010, is expected to result in increased compliance costs for us due to new executive compensation requirements, though the extent of these costs and disclosures are still not known.

As a result of the Transaction, (i) each share of Common Stock held of record by a stockholder owning fewer than 500 shares immediately prior to the effective time of the Reverse Stock Split will be converted into the right to receive $1.00 in cash (subject to any applicable U.S. federal, state and local withholding tax), without interest, per pre-split share and (ii) each share of Common Stock held by a stockholder of record owning 500 shares or more immediately prior to the effective time of the Reverse Stock Split will continue to represent one share of Common Stock after completion of the Transaction. The shares of Common Stock acquired by the Company as a result of the Reverse Stock Split will be restored to the status of authorized but unissued shares, which will reduce the number of outstanding shares. The Forward Stock Split is not necessary for us to reduce the number of holders of record of our shares of Common Stock and to deregister our shares of Common Stock under the Exchange Act. However, we have decided that it is in the best interests of our stockholders to effect the Forward Stock Split to avoid an unusually high stock price after the effective date of the Reverse Stock Split, to facilitate trading of the shares of continuing stockholders either in private transactions or in the Pink Sheets, to mitigate any loss of liquidity in our shares of Common Stock that may result from the Reverse Stock Split portion of the Transaction, to avoid the administrative burden of having fractional shares outstanding and to permit outstanding derivative securities, such as stock options, to be unaffected by the Transaction.

In determining whether the number of our stockholders of record falls below 300 as a result of the Transaction, we must count stockholders of record in accordance with Rule 12g5-1 under the Exchange Act. Rule 12g5-1 provides, with certain exceptions, that in determining whether issuers, including the Company, are subject to the registration provisions of the Exchange Act, securities are considered to be “held of record” by each person who is identified as the owner of such securities on the respective records of security holders maintained by or on behalf of the issuers. However, institutional custodians such as Cede & Co. and other commercial depositories are not considered a single holder of record for purposes of these provisions. Rather, each depository’s accounts are treated as the record holder of shares.

As a result of the Transaction and the repurchase of shares from Fractional Stockholders, we expect to have approximately 217 record holders of our shares, which would enable us to terminate the registration of our shares under the Exchange Act. If the Transaction is completed, we intend to file with the SEC a Form 15 to deregister our shares. Upon the filing of the Form 15, our obligation to file periodic and current reports under the Exchange Act will be immediately suspended. Deregistration of our shares will be effective 90 days after filing of the Form 15. Upon deregistration of our shares, our obligation to comply with the requirements of the proxy rules and to file proxy statements under Section 14 of the Exchange Act will also be suspended. We will not be required to file periodic and current reports with the SEC in the future unless we subsequently file another registration statement under the Securities Act of 1933, as amended, or again have record holders of common shares in excess of 300.

It is anticipated that our shares of Common Stock will continue to be quoted on the Pink Sheets following the Transaction. The Pink Sheets is a centralized quotation service that collects and publishes market maker quotes for securities. The Pink Sheets categorizes all securities trading over-the-counter into easily identifiable tiers – the Company intends for our shares of Common Stock to be quoted on either the Pink Sheets limited information tier or no information tier. The limited information tier covers issuers that have provided limited information with respect to the preceding six months, including quarterly financial reports that include, at a minimum, balance sheet, income statement and total shares outstanding for a period within the preceding six months. The no information tier covers issuers that have provided financial reports that are more than six months old.

Although we anticipate that a broker-dealer will quote our shares on the Pink Sheets, there can be no assurance that any broker-dealer will be willing to continue to act as a market maker in our shares after the Transaction.

-14-

Our reasons for proposing the Transaction include the following:

Regulatory Requirements. We believe that we will be able to realize significant cost savings by the elimination of most of the expenses related to the disclosure, reporting and compliance requirements of the Exchange Act and the Sarbanes-Oxley Act, and other accounting, legal, printing and other miscellaneous costs associated with being a publicly traded company. We estimate that the external costs associated with our public reports and other filing obligations, as well as other external costs relating to public company status, comprise a significant overhead expense, made up principally of the following costs:

|

Fiscal Year Ended

|

2010 (est.)

|

2009

|

2008

|

|

Audit, Audit Related Fees, and Tax

|

$195,000

|

$242,000

|

$255,000

|

|

Sarbanes-Oxley Act and Other SEC Compliance

|

$80,000

|

$206,000

|

$267,000

|

|

Transfer Agent, D&O, Legal Fees and Annual Meeting Costs

|

$382,000

|

$392,000

|

$528,000

|

|

Totals

|

$657,000

|

$840,000

|

$1,050,000

|