UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 20-F

|

o |

REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

|

|

|

OR | |

|

|

|

|

x |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

|

|

|

OR | |

|

|

|

|

o |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

|

|

|

OR | |

|

|

|

|

o |

SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number 1-14878

|

GERDAU S.A. |

|

(Exact name of Registrant as specified in its charter) |

|

|

|

N/A |

|

(Translation of Registrant’s name into English) |

|

|

|

Federative Republic of Brazil |

|

(Jurisdiction of incorporation or organization) |

|

|

|

Av. das Nações Unidas, 8,501 – 8° andar |

|

(Address of principal executive offices) (Zip code) |

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class |

|

Name of each exchange in which registered |

|

Preferred Shares, no par value per share, each represented by American Depositary Shares |

|

New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

The total number of issued shares of each class of stock of GERDAU S.A. as of December 31, 2017 was:

|

|

573,627,483 Common Shares, no par value per share |

|

|

1,146,031,245 Preferred Shares, no par value per share |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

x Yes o No

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

o Yes x No

Note — Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their obligations under those Sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

x Yes o No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

o Yes o No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer x |

|

Accelerated filer o |

|

Non-accelerated filer o |

|

Emerging growth company o |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act. o

†The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

|

U.S. GAAP o |

|

International Financial Reporting Standards as issued |

|

Other o |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

o Item 17 o Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

o Yes x No

|

|

|

Page |

|

|

|

|

|

2 | ||

|

|

|

|

|

|

4 | |

|

|

|

|

|

4 | ||

|

4 | ||

|

4 | ||

|

21 | ||

|

53 | ||

|

54 | ||

|

82 | ||

|

94 | ||

|

97 | ||

|

102 | ||

|

108 | ||

|

QUANTITATIVE AND QUALITATIVE DISCLOSURES REGARDING MARKET RISK |

123 | |

|

124 | ||

|

|

|

|

|

|

125 | |

|

|

|

|

|

125 | ||

|

MATERIAL MODIFICATIONS TO THE RIGHTS OF SECURITY HOLDERS AND USE OF PROCEEDS |

125 | |

|

125 | ||

|

126 | ||

|

126 | ||

|

126 | ||

|

127 | ||

|

127 | ||

|

PURCHASES OF EQUITY SECURITIES BY THE ISSUER AND AFFILIATED PURCHASERS |

128 | |

|

128 | ||

|

128 | ||

|

129 | ||

|

|

|

|

|

|

129 | |

|

|

|

|

|

129 | ||

|

129 | ||

|

129 | ||

Unless otherwise indicated, all references herein to:

(i) the “Company”, “Gerdau”, “we” or “us” are references to Gerdau S.A., a corporation organized under the laws of the Federative Republic of Brazil (“Brazil”) and its consolidated subsidiaries;

(ii) “Açominas” is a reference to Aço Minas Gerais S.A. — Açominas prior to November 2003 whose business was to operate the Ouro Branco steel mill. In November 2003 the company underwent a corporate reorganization, receiving all of Gerdau’s Brazilian operating assets and liabilities and being renamed Gerdau Açominas S.A.;

(iii) “Gerdau Açominas” is a reference to Gerdau Açominas S.A. after November 2003 and to Açominas before such date. In July 2005, certain assets and liabilities of Gerdau Açominas were spun-off to four other newly created entities: Gerdau Aços Longos, Gerdau Aços Especiais and Gerdau América do Sul Participações. As a result of such spin-off, as from July 2005, the activities of Gerdau Açominas only comprise the operation of the Açominas steel mill;

(iv) “Preferred Shares” and “Common Shares” refer to the Company’s authorized and outstanding preferred stock and common stock, designated as ações preferenciais and ações ordinárias, respectively, all without par value. All references herein to the “real”, “reais” or “R$” are to the Brazilian real, the official currency of Brazil. All references to (i) “U.S. dollars”, “dollars”, “U.S.$” or “$” are to the official currency of the United States, (ii) “Euro” or “€” are to the official currency of members of the European Union, (iii) “billions” are to thousands of millions, (iv) “km” are to kilometers, and (vi) “tonnes” are to metric tonnes;

(v) “Installed capacity” means the annual projected capacity for a particular facility (excluding the portion that is not attributable to our participation in a facility owned by a joint venture), calculated based upon operations for 24 hours each day of a year and deducting scheduled downtime for regular maintenance;

(vi) “Tonne” means a metric tonne, which is equal to 1,000 kilograms or 2,204.62 pounds;

(vii) “Consolidated shipments” means the combined volumes shipped from all our operations in Brazil, South America, North America and Asia, excluding our joint ventures and associate companies;

(viii) “Worldsteel” means World Steel Association, “IABr” means Brazilian Steel Institute (Instituto Aço Brasil) and “AISI” means American Iron and Steel Institute;

(ix) “CPI” means consumer price index, “CDI” means Interbanking Deposit Rates (Certificados de Depósito Interfinanceiro), “IGP-M” means Consumer Prices Index (Índice Geral de Preços do Mercado), measured by FGV (Fundação Getulio Vargas), “LIBOR” means London Interbank Offered Rate, “GDP” means Gross Domestic Product;

(x) “Brazil BD” means Brazil Business Division, “North America BD” means North America Business Division, “South America BD” means South America Business Division and “Special Steel BD” means Special Steel Business Division.

(xi) “proven or probable mineral reserves” has the meaning defined by SEC in Industry Guide 7.

The Company has prepared the Consolidated Financial Statements included herein in accordance with International Financial Reporting Standards (IFRS) as issued by the International Accounting Standards Board (IASB). The following investments are accounted following the equity method: Bradley Steel Processor and MRM Guide Rail, all in North America, of which Gerdau Ameristeel holds 50% of the total capital, the investment in the holding company Gerdau Metaldom Corp., in which the Company holds a 45% stake, in the Dominican Republic, the investment in the holding company Corsa Controladora, S.A. de C.V., in which the Company holds a 49% stake, which in turn holds the capital stock of Aceros Corsa S.A. de C.V., in Mexico, the investment in Gerdau Corsa S.A.P.I. de C.V., in Mexico, in which the Company holds a 50% stake and the investment in Dona Francisca Energética S.A, in Brazil, in which the Company holds a 51.82% stake, the investment in the Diaco S.A., in which the Company holds a 49.87% stake, in Colombia and the investment in Gerdau Summit Aços Fundidos e Forjados S.A., in Brazil, in which the Company holds a 58.73% stake.

Unless otherwise indicated, all information in this Annual Report is stated as of December 31, 2017. Subsequent developments are discussed in Item 8.B—Financial Information—Significant Changes.

CAUTIONARY STATEMENT WITH RESPECT TO FORWARD-LOOKING STATEMENTS

This Annual Report contains forward-looking statements within the meaning of the Private Securities Litigation Act of 1995. These statements relate to our future prospects, developments and business strategies.

Statements that are predictive in nature, that depend upon or refer to future events or conditions or that include words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “estimates” and similar expressions are forward-looking statements. Although we believe that these forward-looking statements are based upon reasonable assumptions, these statements are subject to several risks and uncertainties and are made in light of information currently available to us.

It is possible that our future performance may differ materially from our current assessments due to a number of factors, including the following:

· general economic, political and business conditions in our markets, both in Brazil and abroad, including demand and prices for steel products;

· interest rate fluctuations, inflation and exchange rate movements of the real in relation to the U.S. dollar and other currencies in which we sell a significant portion of our products or in which our assets and liabilities are denominated;

· our ability to obtain financing on satisfactory terms;

· prices and availability of raw materials;

· changes in international trade;

· changes in laws and regulations;

· electric energy shortages and government responses to them;

· the performance of the Brazilian and the global steel industries and markets;

· global, national and regional competition in the steel market;

· protectionist measures imposed by steel-importing countries; and

· other factors identified or discussed under “Risk Factors.”

Our forward-looking statements are not guarantees of future performance, and actual results or developments may differ materially from the expectations expressed in the forward-looking statements. As for the forward-looking statements that relate to future financial results and other projections, actual results will be different due to the inherent uncertainty of estimates, forecasts and projections. Because of these uncertainties, potential investors should not rely on these forward-looking statements.

We undertake no obligation to publicly update any forward-looking statement, whether as a result of new information, future events or otherwise.

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

Not applicable, as the Company is filing this Form 20-F as an annual report.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable, as the Company is filing this Form 20-F as an annual report.

A. SELECTED FINANCIAL DATA

The selected financial information for the Company included in the following tables should be read in conjunction with the IFRS financial statements of the Company, appearing elsewhere in this Annual Report, and section “Operating and Financial Review and Prospects”. The consolidated financial data of the Company as of and for each of the years ended on December 31, 2017, 2016, 2015, 2014 and 2013 are derived from the financial statements prepared in accordance with IFRS and presented in Brazilian Reais.

IFRS Summary Financial and Operating Data

|

|

|

(Expressed in thousands of Brazilian Reais- |

| ||||||||

|

|

|

2017 |

|

2016 |

|

2015 |

|

2014 |

|

2013 |

|

|

NET SALES |

|

36,917,619 |

|

37,651,667 |

|

43,581,241 |

|

42,546,339 |

|

39,863,037 |

|

|

Cost of sales |

|

(33,312,995 |

) |

(34,187,941 |

) |

(39,290,526 |

) |

(37,406,328 |

) |

(34,728,460 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GROSS PROFIT |

|

3,604,624 |

|

3,463,726 |

|

4,290,715 |

|

5,140,011 |

|

5,134,577 |

|

|

Selling expenses |

|

(524,965 |

) |

(710,766 |

) |

(785,002 |

) |

(691,021 |

) |

(658,862 |

) |

|

General and administrative expenses |

|

(1,129,943 |

) |

(1,528,262 |

) |

(1,797,483 |

) |

(2,036,926 |

) |

(1,953,014 |

) |

|

Impairment of assets |

|

(1,114,807 |

) |

(2,917,911 |

) |

(4,996,240 |

) |

(339,374 |

) |

— |

|

|

Gains and losses on assets held for sale and sales of interest in subsidiaries and associate company |

|

(721,682 |

) |

(58,223 |

) |

— |

|

636,528 |

|

— |

|

|

Other operating income |

|

260,618 |

|

242,077 |

|

213,431 |

|

238,435 |

|

318,256 |

|

|

Other operating expenses |

|

(168,887 |

) |

(114,230 |

) |

(116,431 |

) |

(150,542 |

) |

(140,535 |

) |

|

Reversal of contingent liabilities, net |

|

929,711 |

|

— |

|

— |

|

— |

|

— |

|

|

Equity in earnings (losses) of unconsolidated companies |

|

(34,597 |

) |

(12,771 |

) |

(24,502 |

) |

101,875 |

|

54,001 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

INCOME (LOSS) BEFORE FINANCIAL INCOME (EXPENSES) AND TAXES |

|

1,100,072 |

|

(1,636,360 |

) |

(3,215,512 |

) |

2,898,986 |

|

2,754,423 |

|

|

Financial income |

|

226,615 |

|

252,045 |

|

378,402 |

|

276,249 |

|

292,910 |

|

|

Financial expenses |

|

(1,726,284 |

) |

(2,010,005 |

) |

(1,780,366 |

) |

(1,397,375 |

) |

(1,053,385 |

) |

|

Exchange variations, net |

|

(4,057 |

) |

851,635 |

|

(1,564,017 |

) |

(476,367 |

) |

(544,156 |

) |

|

Reversal of monetary update of contingent liabilities, net |

|

369,819 |

|

— |

|

— |

|

— |

|

— |

|

|

Gains and losses on financial instruments, net |

|

(9,441 |

) |

(38,930 |

) |

87,085 |

|

36,491 |

|

(2,854 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

INCOME (LOSS) BEFORE TAXES |

|

(43,276 |

) |

(2,581,615 |

) |

(6,094,408 |

) |

1,337,984 |

|

1,452,646 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current |

|

(313,758 |

) |

(110,511 |

) |

(158,450 |

) |

(571,926 |

) |

(318,422 |

) |

|

Deferred |

|

18,367 |

|

(193,803 |

) |

1,656,872 |

|

722,315 |

|

559,478 |

|

|

Income and social contribution taxes |

|

(295,391 |

) |

(304,314 |

) |

1,498,422 |

|

150,389 |

|

241,056 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NET INCOME (LOSS) |

|

(338,667 |

) |

(2,885,929 |

) |

(4,595,986 |

) |

1,488,373 |

|

1,693,702 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ATTRIBUTABLE TO: |

|

|

|

|

|

|

|

|

|

|

|

|

Owners of the parent |

|

(359,360 |

) |

(2,890,811 |

) |

(4,551,438 |

) |

1,402,873 |

|

1,583,731 |

|

|

Non-controlling interests |

|

20,693 |

|

4,882 |

|

(44,548 |

) |

85,500 |

|

109,971 |

|

|

|

|

(338,667 |

) |

(2,885,929 |

) |

(4,595,986 |

) |

1,488,373 |

|

1,693,702 |

|

|

|

|

(Expressed in thousands of Brazilian Reais- |

| ||||||||

|

|

|

2017 |

|

2016 |

|

2015 |

|

2014 |

|

2013 |

|

|

Basic earnings (loss) per share — in R$ |

|

|

|

|

|

|

|

|

|

|

|

|

Common |

|

(0.21 |

) |

(1.70 |

) |

(2.69 |

) |

0.82 |

|

0.93 |

|

|

Preferred |

|

(0.21 |

) |

(1.70 |

) |

(2.69 |

) |

0.82 |

|

0.93 |

|

|

Diluted earnings (loss) per share — in R$ |

|

|

|

|

|

|

|

|

|

|

|

|

Common |

|

(0.21 |

) |

(1.70 |

) |

(2.69 |

) |

0.82 |

|

0.93 |

|

|

Preferred |

|

(0.21 |

) |

(1.70 |

) |

(2.69 |

) |

0.82 |

|

0.93 |

|

|

Cash dividends declared per share — in R$ |

|

|

|

|

|

|

|

|

|

|

|

|

Common |

|

0.08 |

|

0.05 |

|

0.15 |

|

0.25 |

|

0.28 |

|

|

Preferred |

|

0.08 |

|

0.05 |

|

0.15 |

|

0.25 |

|

0.28 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average Common Shares outstanding during the year (1) |

|

571,929,945 |

|

571,929,945 |

|

571,929,945 |

|

571,929,945 |

|

571,929,945 |

|

|

Weighted average Preferred Shares outstanding during the year (1) |

|

1,137,012,265 |

|

1,132,626,373 |

|

1,117,034,926 |

|

1,132,483,383 |

|

1,129,184,775 |

|

|

Number of Common Shares outstanding at year end (2) |

|

571,929,945 |

|

571,929,945 |

|

571,929,945 |

|

571,929,945 |

|

571,929,945 |

|

|

Number of Preferred Shares outstanding at year end (2) |

|

1,137,327,184 |

|

1,137,018,570 |

|

1,114,744,538 |

|

1,132,613,562 |

|

1,132,285,402 |

|

(1) The information on the numbers of shares presented above corresponds to the weighted average quantity during each year.

(2) The information on the numbers of shares presented above corresponds to the shares at the end of the year.

|

|

|

On December 31, |

| ||||||||

|

|

|

2017 |

|

2016 |

|

2015 |

|

2014 |

|

2013 |

|

|

|

|

(Expressed in thousands of Brazilian Reais - R$) |

| ||||||||

|

Balance sheet selected information |

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

2,555,338 |

|

5,063,383 |

|

5,648,080 |

|

3,049,971 |

|

2,099,224 |

|

|

Short-term investments (1) |

|

821,518 |

|

1,024,411 |

|

1,270,760 |

|

2,798,834 |

|

2,123,168 |

|

|

Current assets |

|

17,982,113 |

|

17,796,740 |

|

22,177,498 |

|

20,682,739 |

|

18,177,222 |

|

|

Current liabilities |

|

7,714,120 |

|

8,621,509 |

|

7,863,031 |

|

7,772,796 |

|

7,236,630 |

|

|

Net working capital (2) |

|

10,267,993 |

|

9,175,231 |

|

14,314,467 |

|

12,909,943 |

|

10,940,592 |

|

|

Property, plant and equipment, net |

|

16,443,742 |

|

19,351,891 |

|

22,784,326 |

|

22,131,789 |

|

21,419,074 |

|

|

Net assets (3) |

|

23,893,941 |

|

24,274,653 |

|

31,970,383 |

|

33,254,534 |

|

32,020,757 |

|

|

Total assets |

|

50,301,761 |

|

54,635,141 |

|

70,094,709 |

|

63,042,330 |

|

58,215,040 |

|

|

Short-term debt (including “Current Portion of Long-Term Debt”) |

|

2,004,341 |

|

4,458,220 |

|

2,387,237 |

|

2,037,869 |

|

1,810,783 |

|

|

Long-term debt, less current portion |

|

14,457,315 |

|

15,959,590 |

|

23,826,758 |

|

17,148,580 |

|

14,481,497 |

|

|

Debentures - short term |

|

— |

|

— |

|

— |

|

— |

|

27,584 |

|

|

Debentures - long term |

|

47,928 |

|

165,423 |

|

246,862 |

|

335,036 |

|

386,911 |

|

|

Equity |

|

23,893,941 |

|

24,274,653 |

|

31,970,383 |

|

33,254,534 |

|

32,020,757 |

|

|

Capital |

|

19,249,181 |

|

19,249,181 |

|

19,249,181 |

|

19,249,181 |

|

19,249,181 |

|

(1) Includes held for trading.

(2) Total current assets less total current liabilities.

(3) Total assets less total current liabilities and less total non-current liabilities.

Exchange rates between the United States Dollar and Brazilian Reais

The following table presents the exchange rates, according to the Brazilian Central Bank, for the periods indicated between the United States dollar and the Brazilian real which is the currency in which we prepare our financial statements included in this Annual Report on Form 20-F.

Exchange rates from U.S. dollars to Brazilian reais

|

Period |

|

Period- |

|

Average |

|

High |

|

Low |

|

|

March 2018 (through March 29) |

|

3.3238 |

|

3.2792 |

|

3.3338 |

|

3.2246 |

|

|

February 2018 |

|

3.2598 |

|

3.2419 |

|

3.2821 |

|

3.1730 |

|

|

January 2018 |

|

3.1624 |

|

3.2106 |

|

3.2697 |

|

3.1391 |

|

|

December 2017 |

|

3.3080 |

|

3.2919 |

|

3.3332 |

|

3.2322 |

|

|

November 2017 |

|

3.2616 |

|

3.2593 |

|

3.2920 |

|

3.2136 |

|

|

October 2017 |

|

3.2769 |

|

3.1912 |

|

3.2801 |

|

3.1315 |

|

|

September 2017 |

|

3.1680 |

|

3.1347 |

|

3.1932 |

|

3.0852 |

|

|

2017 |

|

3.3080 |

|

3.1925 |

|

3.8707 |

|

3.0510 |

|

|

2016 |

|

3.2591 |

|

3.4833 |

|

4.1558 |

|

3.1193 |

|

|

2015 |

|

3.9048 |

|

3.3399 |

|

4.1949 |

|

2.5754 |

|

|

2014 |

|

2.6562 |

|

2.3547 |

|

2.7403 |

|

2.1974 |

|

|

2013 |

|

2.3426 |

|

2.1601 |

|

2.4457 |

|

1.9528 |

|

Dividends

The Company’s total authorized capital stock is composed of common and preferred shares. As of December 31, 2017, the Company had 571,929,945 common shares and 1,137,327,184 non-voting preferred shares outstanding (excluding treasury stock).

The following table details dividends and interest on equity paid to holders of common and preferred stock since 2013. The figures are expressed in Brazilian reais and U.S. dollars. The exchange rate used for conversion to U.S. dollars was based on the date of the resolution approving the dividend.

Dividends per share information has been computed by dividing dividends and interest on equity by the number of shares outstanding, which excludes treasury stock. The table below presents the quarterly dividends paid per share, except where stated otherwise:

|

Period |

|

Date of |

|

R$ per Share |

|

$ per Share |

|

|

|

|

|

|

|

|

|

|

|

1st Quarter 2013 |

|

05/07/2013 |

|

0.0200 |

|

0.0099 |

|

|

2nd Quarter 2013 (1) |

|

08/01/2013 |

|

0.0700 |

|

0.0305 |

|

|

3rd Quarter 2013 (1) |

|

10/31/2013 |

|

0.1200 |

|

0.0545 |

|

|

4th Quarter 2013 |

|

02/21/2014 |

|

0.0700 |

|

0.0296 |

|

|

1st Quarter 2014 (1) |

|

05/07/2014 |

|

0.0700 |

|

0.0312 |

|

|

2nd Quarter 2014 |

|

07/30/2014 |

|

0.0600 |

|

0.0265 |

|

|

3rd Quarter 2014 (1) |

|

11/05/2014 |

|

0.0500 |

|

0.0199 |

|

|

4th Quarter 2014 |

|

03/04/2015 |

|

0.0700 |

|

0.0235 |

|

|

1st Quarter 2015 (1) |

|

06/05/2015 |

|

0.0600 |

|

0.0197 |

|

|

2nd Quarter 2015 (1) |

|

08/12/2015 |

|

0.0500 |

|

0.0144 |

|

|

3rd Quarter 2015 |

|

10/29/2015 |

|

0.0400 |

|

0.0102 |

|

|

2nd Quarter 2016 |

|

08/10/2016 |

|

0.0300 |

|

0.0096 |

|

|

3rd Quarter 2016 |

|

11/04/2016 |

|

0.0200 |

|

0.0062 |

|

|

2nd Quarter 2017 |

|

08/08/2017 |

|

0.0200 |

|

0.0064 |

|

|

3rd Quarter 2017 |

|

11/07/2017 |

|

0.0300 |

|

0.0092 |

|

|

4rd Quarter 2017 |

|

27/02/2018 |

|

0.0300 |

|

0.0092 |

|

(1) Payment of interest on equity.

Brazilian Law 9,249 of December 1995 provides that a company may, at its sole discretion, pay interest on equity in addition to or instead of dividends (See Item 8 — “Financial Information - Interest on Equity”). A Brazilian corporation is entitled to pay its shareholders interest on equity up to the limit based on the application of the TJLP rate (Long-Term Interest Rate) to its shareholders’ equity or 50% of the net income in the fiscal year, whichever is higher. This payment is considered part of the mandatory dividend required by Brazilian Corporation Law for each fiscal year. The payment of interest on equity described herein is subject to a 15% withholding tax. See Item 10. “Additional Information — Taxation”.

Gerdau has a Dividend Reinvestment Plan (DRIP), a program that allows the holders of Gerdau ADRs to reinvest dividends to purchase additional ADRs in the Company, with no issuance of new shares. Gerdau also provides its shareholders with a similar program in Brazil that allows the reinvestment of dividends in additional shares, with no issuance of new shares.

B. CAPITALIZATION AND INDEBTEDNESS

Not required, as the Company is filing this Form 20-F as an annual report.

C. REASONS FOR THE OFFER AND USE OF PROCEEDS

Not required, as the Company is filing this Form 20-F as an annual report.

D. RISK FACTORS

We are subject to various risks and uncertainties resulting from changing competitive, economic, political and social conditions that could harm our business, results of operations or financial condition. The risks described below could adversely affect our business, consolidated financial position, results of operations or cash flows. These risks are not the only ones we face. Other risks that we do not presently know about or that we presently believe are not material could also adversely affect us.

Risks Relating to our Business and the Steel Industry

Demand for steel is cyclical and a reduction in prevailing world prices for steel could adversely affect the Company’s results of operations.

The steel industry is highly cyclical. Consequently, the Company is exposed to substantial swings in the demand for steel products, which in turn causes volatility in the prices of most of its products and eventually could cause write-downs of its inventories. In addition, the demand for steel products, and hence the financial condition and results of operations of companies in the steel industry, including the Company itself, are generally affected by macroeconomic changes in the world economy and in the domestic economies of steel-producing countries, including general trends in the steel, construction and automotive industries. Since 2003, demand for steel products from developing countries (particularly China), the strong euro compared to U.S. dollar and world economic growth have contributed to a historically high level of prices for the Company’s steel products. However, since the second half of 2008, and especially in the beginning of 2009, the U.S. and European economies experienced a significant slowdown, in turn affecting many other countries. Slow growth in steel consumption was not accompanied by a corresponding slowdown in capacity expansion over the last few years, resulting in an even greater excess of global steel capacity. Since then, the price has experienced a high volatility. A material decrease in demand for steel or exports by countries not able to consume their production could have a significant adverse effect on the Company’s financial condition and results of operations.

Global crises and subsequent economic slowdowns may adversely affect global steel demand. As a result, the Company’s financial condition and results of operations may be adversely affected.

Historically, the steel industry has been highly cyclical and deeply impacted by economic conditions in general, such as world production capacity and fluctuations in steel imports/exports and the respective import duties. After a steady period of growth between 2004 and 2008, the marked drop in demand resulting from the global economic crisis of 2008-2009 once again demonstrated the vulnerability of the steel market to volatility of international steel prices and raw materials. That crisis was caused by the dramatic increase of high risk real of estate financing defaults and foreclosures in the United States, with serious consequences for bank and financial markets throughout the world. Developed markets, such as North America and Europe, experienced a strong recession due to the collapse of real estate financings and the shortage of global credit. As a result, the demand for steel products suffered a decline in 2009, but since 2010 has been experiencing a gradual recovery, principally in the developing economies. The steel sector is experiencing challenges mainly due to excess global steel capacity, the Chinese economic slowdown, and the entry of imported steel into countries with more open economies.

The economic downturn and turbulence in the global economy can negatively impact the consuming markets, affecting the business environment with respect to the following:

· Decrease in international steel prices;

· Slump in international steel trading volumes;

· Crisis in automotive industry and infrastructure sectors; and

· Lack of liquidity in the international market.

If the Company is not able to remain competitive in these shifting markets, our profitability, margins and income may be negatively affected. A decline in this trend could result in a decrease in the Company’s shipments and revenues. As a result, the Company’s financial condition and results of operations may be adversely affected.

Our results and financial condition are affected by global and local market conditions that we do not control and cannot predict.

We are subject to the risks arising from adverse changes in domestic and global economic and political conditions. Our industry is cyclical by nature and fluctuates with economic cycles, including the current global economic instability. The global financial markets experienced significant disruptions in 2008 and the United States, Europe and other economies went into recession. The recovery from the lows of 2008 and 2009 was uneven and is facing new challenges, including the escalation of the European sovereign debt crisis since 2011, the United Kingdom’s decision to withdraw from the European Union and increasing political uncertainty in a number of countries. It is unclear whether the European sovereign debt crisis will be contained and what effects it and the United Kingdom’s decision to withdraw from the European Union may have. In addition, on January 20, 2017, Donald Trump became the President of the United States. We cannot predict the effects of Donald Trump’s administration or its trade and other policies. There is considerable uncertainty over the long-term effects of the expansionary monetary and fiscal policies that have been adopted by the central banks and financial authorities of some of the world’s leading economies, including China. These policies may have a negative impact on the global and local economy, and consequently our business, financial condition and results of operations. We cannot predict if the actions taken in the United States, Europe, China and elsewhere in the world to address this situation will be successful in reducing the duration and impact of the economic instability and political uncertainty. Global economic weakness may prompt banks to limit or deny lending to us or to our customers, which could have a material adverse effect on our liquidity, on our operations and on our ability to carry out our announced capital investment programs and may prompt our customers to slow down or reduce the purchase of our products. We may experience longer sales cycles, difficulty in collecting sales proceeds and lower prices for our products. We cannot provide any assurance that any of these events will not have a material adverse effect on market conditions, the prices of our securities, our ability to obtain financing and our results of operations and financial condition.

Gerdau faces significant competition in relation to their steel products, including with regard to prices of other domestic and foreign producers, which may adversely affect its profitability and market share.

The global steel industry is highly competitive with respect to price, quality of products and customer service, as well as in relation to technological advances that allow the reduction of production costs. Brazilian exports of steel products are influenced by several factors, including protectionist policies of other countries, foreign exchange policy of the Brazilian government and growth rate of the world economy. Moreover, continuous advances in material sciences and the resulting technologies facilitate the improvement of products such as plastic, aluminum, ceramics and glass, allowing them to replace steel.

Due to the high initial investment costs, the operation of a steel plant on a continuous basis may encourage mill operators to maintain high production levels, even in periods of low demand, which would increase the pressure on industry profit margins. A competitive pressure that forces the fall in steel prices can also affect the profitability of Gerdau.

The steel industry has historically suffered from excess production capacity, which has recently worsened due to a substantial increase in production capacity in emerging countries, particularly China and India and other emerging markets. China is currently the largest global steel producer. In addition, China and certain steel exporting countries have favorable conditions (excess steel capacity, devalued currency or high market prices for steel products in markets outside these countries) which may significantly impact the price of steel in other markets. If Gerdau is unable to remain competitive with China and other steel-producing countries, its financial condition and results of operations may be adversely affected in the future.

An increase in China’s steelmaking capacity or a slowdown in China’s steel consumption could have a material adverse effect on domestic and global steel pricing and could result in increased steel imports into the markets in which the Company operates.

One significant factor in the global steel market has been China’s high steel production capacity, which has been exceeding its domestic consumption needs. This has made China a net exporter of steel products, increasing its importance in different countries of the transoceanic market and consequently pushing down international steel prices. Moreover, China’s lower growth rate has resulted in a slower pace of steel consumption in the country, consequently reducing demand for imported raw materials and putting pressure on global commodity prices. Any intensification of these factors could adversely affect the Company’s exports, results of operations and financial condition.

Higher steel scrap prices or a reduction in supply could adversely affect production costs and operating margins.

The main metal input for the Company’s mini-mills, which mills accounted for 78.0% of total crude steel output as of and for the year ended on December 31, 2017, is steel scrap. Although international steel scrap prices are determined essentially by scrap prices in the U.S. local market, because the United States is the main scrap exporter, scrap prices in the Brazilian market are set by domestic suppliers and demand. The price of steel scrap in Brazil varies from region to region and reflects demand and transportation costs. Should scrap prices increase significantly without a corresponding increase in finished steel selling prices, the Company’s profits and margins could be adversely affected. An increase in steel scrap prices or a shortage in the supply of scrap to its units would affect production costs and potentially reduce operating margins and revenues. As a result, the Company’s financial condition and results of operations may be adversely affected.

Increases in iron ore and coal prices, or reductions in market supply, could adversely affect the Company’s operations.

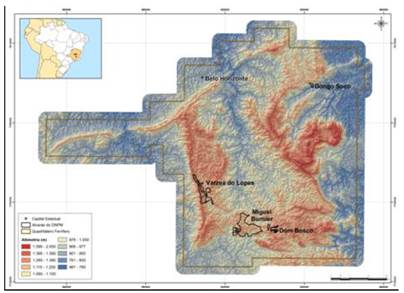

When the prices of raw materials, particularly iron ore and coking coal, increase, and the Company needs to produce steel in its integrated facilities, the production costs in its integrated facilities also increase. The Company uses iron ore to produce hot pig iron at its Ouro Branco, Barão de Cocais and Divinópolis mills located in the state of Minas Gerais.

The Ouro Branco mill is the Company’s largest mill in Brazil, and its main metal input for the production of steel is iron ore. This unit represented 48.8% of the total crude steel output (in volume) of the Brazil Business Division. A shortage of iron ore in the domestic market may adversely affect the steel producing capacity of the Brazilian units, and an increase in iron ore prices could reduce profit margins.

The Company has iron ore mines in the Brazilian state of Minas Gerais. To mitigate its exposure to the volatility in iron ore prices, the Company invested in expanding the production capacity of these mines, which, commencing in 2012, met 100% of iron ore demand from the Ouro Branco Mill.

All of the Company’s coking coal requirements for its Brazilian units are imported due to the low quality of Brazilian coal. Coking coal is the main energy input at the Ouro Branco mill and is used at the coking facility. Although this mill is not dependent on coke supplies, a contraction in the supply of coking coal could adversely affect the integrated operations at this site. The coking coal used in this mill is imported from Canada, the United States, Australia, Mozambique, Peru, Russia and Colombia. Although the market for the supply of coking coal is relatively balanced at the moment, and we have entered into long-term contracts with negotiable prices periodically to minimize the risks of shortages, a shortage of coking coal in the international market would adversely affect the steel producing capacity of the Ouro Branco mill. In addition, an increase in prices could reduce profit margins. Another related risk is the currency depreciation to which the Ouro Branco Mill is exposed, since all coking coal consumed by the operation is imported.

As a result, the Company’s financial condition and results of operations may be adversely affected.

Risks Relating to our Operations

The Company’s projects are subject to risks that may result in increased costs or delay or prevent their successful implementation.

The Company invested to further increase productivity of its operations. These projects are subject to a number of risks that may adversely affect the Company’s growth prospects and profitability, including the following:

· the Company may encounter delays, availability problems or higher than expected costs in obtaining the necessary equipment, services and materials to build and operate a project;

· the Company’s efforts to develop projects according to schedule may be hampered by a lack of infrastructure, including availability of overburden and waste disposal areas as well as reliable power and water supplies;

· the Company may fail to obtain, lose, or experience delays or higher than expected costs in obtaining or renewing the required permits, authorizations, licenses, concessions and/or regulatory approvals to build or continue a project; and

· changes in market conditions, laws or regulations may make a project less profitable than expected or economically or otherwise unfeasible.

Any one or a combination of the factors described above may materially and adversely affect the Company’s financial condition and results of operations.

Unexpected equipment failures may lead to production curtailments or shutdowns.

Unexpected interruptions in the production capabilities at Gerdau’s principal sites and installations would increase production costs, reducing shipments and earnings for the affected period. These interruptions result from: (i) unpredictable/periodic equipment failures, which are essential to the development of the production processes of Gerdau, such as steelmaking equipment, such as its electric arc furnaces, continuous casters, gas-fired reheat furnaces, rolling mills and electrical equipment, including high-output transformers; and/or (ii) unanticipated events such as fires, explosions or violent weather conditions. As a result, Gerdau has experienced and may in the future experience material plant shutdowns or periods of reduced production. Unexpected interruptions in production capabilities would adversely affect Gerdau’s productivity and results of operations. Moreover, any interruption in production capability may require Gerdau to make additions to fixed assets to remedy the problem, which would reduce the amount of cash available for operations. Gerdau’s insurance may not cover the losses. In addition, long-term business disruption could harm the Company’s reputation and result in a loss of customers, which could adversely affect the business, results of operations, cash flows and financial condition.

Failure to obtain the necessary permits and licenses could adversely affect our operations.

We depend on the issuance of permits and licenses from governmental agencies in order to undertake certain of our activities. In order to obtain licenses activities that are expected to have a significant environmental impact, certain investments in conservation are required to offset any such impact. The operational licenses require, among other things, that we periodically report our compliance with emissions standards set by environmental agencies. Failure to obtain, renew or comply with our operating licenses may cause delays in our deployment of new activities, increased costs, monetary fines or even suspension of the affected activity, which may materially adversely affect us.

Climate change may negatively affect our business, financial condition, results of operations and cash flows.

A significant number of scientists, environmentalists, international organizations, regulators and other commentators sustain that global climate change has contributed, and will continue to contribute, to the increasing unpredictability, frequency and severity of natural disasters (including, but not limited to, hurricanes, droughts, tornadoes, freezes, other storms and fires) in certain parts of the world. As a result, a number of legal and regulatory measures as well as social initiatives have been introduced in numerous countries in an effort to reduce carbon dioxide and other greenhouse gas emissions and combat global climate change. Such reductions in greenhouse gas emissions could result in increased energy, transportation and raw material costs and may require us to make additional investments in facilities and equipment. Although we cannot predict the impact of changing global climate conditions, if any, or if legal, regulatory and social responses to concerns about global climate change, any such occurrences may negatively affect our business, financial condition, results of operations and cash flows.

The Company’s operations are energy-intensive, and energy shortages or higher energy prices could have an adverse effect.

Crude steel production is an energy-intensive process, especially in melt shops with electric arc furnaces. Electricity represents an important production component at these units, as also does natural gas, although to a lesser extent. Electricity cannot be replaced at Gerdau’s mills and power rationing or shortages could adversely affect production at those units. As a result, the Company’s financial condition and results of operations may be adversely affected.

Layoffs in the Company’s labor force could generate costs or negatively affect the Company’s operations.

A substantial number of our employees are represented by labor unions and are covered by collective bargaining or other labor agreements, which are subject to periodic negotiation. Strikes or work stoppages have occurred in the past and could reoccur in connection with negotiations of new labor agreements or during other periods for other reasons, including the risk of layoffs during a

down cycle that could generate severance costs. Moreover, the Company could be adversely affected by labor disruptions involving unrelated parties that may provide goods or services to the Company. Strikes and other labor disruptions at any of the Company operations could adversely affect the operation of facilities and the timing of completion and the cost of capital of our projects.

We could be harmed by a failure or interruption of our information technology systems or automated machinery.

We rely on our information technology systems and automated machinery to effectively manage our production processes and operate our business. Advanced technology systems and machinery are nonetheless subject to defects, interruptions and breakdowns. Any failure of our information technology systems and automated machinery to perform as we anticipate could disrupt our business and result in production errors, processing inefficiencies and the loss of sales and customers, which in turn could result in decreased revenue, increased overhead costs and excess or out-of-stock inventory levels resulting in a material adverse effect on our business results. Although we have procedures in place to prevent and minimize the impact of a potential failure, including a disaster recovery system, a back-up site for our management systems, 24/7 monitoring of our servers and a cybersecurity program, there is no assurance that these will work properly or that there will not be an impact on our results of operations or financial condition.

In addition, our information technology systems and automated machinery may be vulnerable to damage or interruption from circumstances beyond our control, including fire, natural disasters, systems failures, viruses, cyber-attacks and other security breaches, including breaches of our production processing systems that could result in damage to our automated machinery, production interruptions or access to our confidential financial, operational or customer data. Any such damage or interruption could have a material adverse effect on our business results, including as a result of our facing significant fines, customer notice obligations or costly litigation, harming our reputation with our customers or requiring us to expend significant time and expense developing, repairing or upgrading our information technology systems and automated machinery.

Further, while we have some backup data-processing systems that could be used in the event of a catastrophe or a failure of our primary systems, we do not yet have an integrated disaster recovery plan or a backup data center that covers all of our units. While we endeavor to prepare for failures of our network by providing backup systems and procedures, we cannot guarantee that our current backup systems and procedures will operate satisfactorily in the event of a regional emergency. Any substantial failure of our backup systems to respond effectively or on a timely basis could have a material adverse effect on our business and results of operations.

We are subject to information technology risks related to breaches of security pertaining to sensitive company, customer, employee and vendor information as well as breaches in the technology used to manage operations and other business processes.

Our business operations rely upon secure information technology systems for data capture, processing, storage and reporting. Despite careful security and controls design, implementation, updating and independent third party verification, our information technology systems, and those of our third party providers, could become subject to employee error or malfeasance, cyber-attacks, or natural disasters. Network, system, application and data breaches could result in operational disruptions or information misappropriation. Access to internal applications required to plan our operations, source materials, manufacture and goods and account for orders could be denied or misused. Theft of intellectual property or trade secrets, and inappropriate disclosure of confidential company, employee, customer or vendor information, could stem from such incidents. Any of these operational disruptions and/or misappropriation of information could result in lost sales, business delays, negative publicity and could have a material effect on our business.

Risks Relating to our Mining Operations

Our mineral resource estimates are based in interpretations and premises and may materially differ from mineral quantities that we may be able to actually extract.

Our mining resources are estimated quantities of ore and minerals. There are numerous uncertainties inherent in estimating quantities of resources, including many factors beyond our control. Reserve engineering involves estimating deposits of minerals that cannot be measured in an exact manner, and the accuracy of any reserve estimate is a function of the quality of available data, engineering and geological interpretation and judgment. In addition, estimates of different engineers may vary. As a result, no assurance can be given that the amount of mining resources will be extracted or that they can be extracted at commercially viable rates, which could adversely affect the financial situation of the Company.

Moreover, when making determinations about whether to advance any projects to development, Gerdau relies upon estimated calculations as to the mineralized material on its properties. Since Gerdau has not conducted a feasibility study demonstrating proven or probable reserves, estimates of mineralized material presented are less certain than would be the case if the estimates were made in accordance with the SEC-recognized definition of proven and probable reserves. Furthermore, until ore is actually mined and processed, any mineral reserves and grades of mineralization must be considered as estimates only. These estimates are imprecise and

depend on geological interpretation and statistical inferences drawn from drilling and sampling analysis, which may prove to be unreliable. We cannot assure that these mineralized material estimates will be accurate or that this mineralized material can be mined or processed profitably and any decision to move forward with development is inherently risky. Further, there can be no assurance that any minerals recovered in small scale tests will be duplicated in large scale tests under on-site conditions or production scale. Any material changes in estimates of mineralized material will affect the economic viability of placing a property into production and such property’s return on capital. As a result, the Company’s financial condition and results of operations may be adversely affected.

The Company has no proven or probable reserves, and the Company’s decision to commence industrial production, in order to supply its steelmaking works as well as sell any surplus volume, is not based on a study demonstrating economical recovery of any mineral reserves and is therefore inherently risky. Any funds spent by the Company on exploration or development could be lost.

The Company has not established any proven or probable mineral reserves at any of its properties. All exploration activities are supported based on mineral resources classified as mineralized materials, as they are not compliant with the definitions established by the SEC of proven or probable reserves. The Company is conducting a comprehensive exploration study to establish, in accordance with SEC definitions, the amount of mineralized material that could be transformed to proven or probable reserves. Thus, part of the volume of mineralized materials informed discussed herein may never reach the development or production stage.

In order to demonstrate the existence of proven or probable reserves, it would be necessary for Company to perform additional exploration to demonstrate the existence of sufficient mineralized material with satisfactory continuity and obtain a positive feasibility study which demonstrates with reasonable certainty that the deposit can be economically and legally extracted and produced. The absence of proven or probable reserves makes it more likely that the Company’s properties may cease to be profitable and that the money spent on exploration and development may never be recovered, which could adversely affect the financial condition and results of operations of the Company.

Drilling and production risks could adversely affect the mining process.

Once mineral deposits are discovered, it can take a number of years from the initial phases of drilling until production is possible, during which time the economic feasibility of production may change. Substantial time and expenditures are required to:

· establish mineral reserves through drilling;

· determine appropriate mining and metallurgical processes for optimizing the recovery of metal contained in ore;

· obtain environmental and other licenses;

· construct mining, processing facilities and infrastructure required for greenfield properties; and

· obtain the ore or extract the minerals from the ore.

If a mining project proves not to be economically feasible by the time we are able to profit from it, the Company may incur substantial losses and be obliged to take write-offs. In addition, potential changes or complications involving metallurgical and other technological processes arising during the life of a project may result in delays and cost overruns that may render the project not economically feasible and could adversely affect the financial condition and results of operations of the Company.

The Company has two mining tailing dams and any accident or defect affecting the structural integrity of either of them could affect its image, results of operations, cash flows and financial condition.

Gerdau has two mining tailing dams in the state of Minas Gerais. The Bocaina Dam has been inactive since 2011 and is practically dry, which is a factor that minimizes the risk. It is periodically monitored and its instrumentation data are within the safety limits. Meanwhile, the Alemães Dam is currently operating at its maximum capacity and is regularly monitored. The instrumentation data are within the safety limits.

Both dams are classified as Class C (low risk) in accordance with the National Mining Dam Registry available on the website of the National Department of Mineral Production (DNPM).

Gerdau adopts rigorous standards of engineering control and environmental supervision and conducts an annual Geotechnical Stability Audit to ensure the stability of the two dams. Gerdau has a Mining Dam Emergency Action Plan for each of the dams and both documents are filed at the regulatory agencies, as required by governing law.

An accident involving a dam could result in serious adverse consequences, including:

· Temporary/permanent shutdown of mining activities and consequently the need to buy iron ore to supply mills;

· Large expenditures on contingencies and on recovering the regions and people affected;

· High investments to resume operations;

· Payment of fines and damages;

· Potential environmental impacts.

Any one or more of these consequences could have a material adverse impact on our results of operations, cash flow and financial condition.

Financial Risks

Any downgrade in the Company’s credit ratings could adversely affect the availability of new financing and increase its cost of capital.

In 2007, the international rating agencies, Fitch Ratings and Standard & Poor’s, classified the Company’s credit risk as “investment grade”, enabling the Company to access more attractive borrowing rates. In December 2011, Moody’s assigned the investment grade rating “Baa3” for all of Gerdau’s ratings. With the deterioration of the Brazilian economy, S&P, Fitch and Moody’s downgraded Brazil’s sovereign rating. Despite the loss of Brazil’s investment grade rating in 2015, the Company maintained its investment grade rating by Fitch and Standard & Poor’s. However, the Company lost its investment grade rating by Moody’s.

The loss of any more of Gerdau’s investment grade ratings could increase its cost of capital, impair its ability to obtain capital and adversely affect its financial condition and results of operations.

The Company’s level of indebtedness could adversely affect its ability to raise additional capital to fund operations, limit the ability to react to changes in the economy or the industry and prevent it from meeting its obligations under its debt agreements.

The Company’s degree of leverage, together with the change in rating by the credit rating agencies, could have important consequences, including the following:

· It may limit the ability to obtain additional financing for working capital, additions to fixed assets, product development, debt service requirements, acquisitions and general corporate or other purposes;

· It may limit the ability to declare dividends on its shares;

· A portion of the cash flows from operations must be dedicated to the payment of interest on existing indebtedness and is not available for other purposes, including operations, additions to fixed assets and future business opportunities;

· It may limit the ability to adjust to changing market conditions and place the Company at a competitive disadvantage compared to its competitors that have less debt;

· The Company may be vulnerable in a downturn in general economic conditions;

· The Company may be required to adjust the level of funds available for additions to fixed assets; and

As a result, the Company’s financial condition and results of operations may be adversely affected.

In September 2015, the Company concluded the process of eliminating financial covenants in all of its contracts. Since October 2015, only financial transactions with BNDES include covenants relating to the Company’s indebtedness ratios, but with distinct characteristics in relation to those contained in the contracts with commercial banks (for more information, see Item 5.B.—Liquidity and Capital Resources — Indebtedness Ratios). In the event of a failure to satisfy the annual tests, the Company would have a grace period and a subsequent renegotiation of the security for the financing, and an event of default would not occur.

Variations in the foreign exchange rates between the U.S. dollar and the currencies of countries in which the Company operates may increase the cost of servicing its debt denominated in foreign currency and adversely affect its overall financial performance.

The Company’s results of operations are affected by fluctuations in the foreign exchange rates between the Brazilian real, the currency in which the Company prepares its financial statements, and the currencies of the countries in which it operates.

For example, the North America Business Division reports its results in U.S. dollars. Therefore, fluctuations in the exchange rate between the U.S. dollar and the Brazilian real could affect its results of operations. The same occurs with all other businesses located outside Brazil with respect to the exchange rate between the local currency of the respective subsidiary and the Brazilian real.

Export revenue and margins are also affected by fluctuations in the exchange rate of the U.S. dollar and other local currencies of the countries where the Company produces in relation to the Brazilian real. The Company’s production costs are denominated in local currency but its export sales are generally denominated in U.S. dollars. Revenues generated by exports denominated in U.S. dollars are reduced when they are translated into Brazilian real in periods during which the Brazilian currency appreciates in relation to the U.S. dollar.

The Brazilian real depreciated against the U.S. dollar by 47.0% in 2015, appreciated by 16.5% in 2016 and depreciated by 1.5% in 2017.

The Company held debt denominated in foreign currency, mainly U.S. dollars, in an aggregate amount of R$13.3 billion at December 31, 2017, representing 81.0% of its consolidated gross debt (loans, financings, and debentures). Significant further depreciation in the Brazilian real in relation to the U.S. dollar or other currencies could reduce the Company’s ability to service its obligations denominated in foreign currencies, particularly since a significant part of its net sales revenue is denominated in Brazilian reais. As a result, the Company’s financial condition and results of operations may be adversely affected.

We are subject to LIBOR-based risks.

On July 27, 2017, the head of the Financial Conduct Authority, or the FCA, announced the desire to phase out the use of LIBOR by the end of 2021. Because the statements made by the head of the FCA are recent in nature, there is no definitive information regarding the future utilization of LIBOR or of any particular replacement rate. As such, the potential effect of any such event on our net investment income cannot yet be determined and, at this time, it is not possible to predict the effect of any establishment of alternative reference rates or any other reforms to LIBOR that may be enacted in the United Kingdom or elsewhere. Uncertainty as to the nature of such potential changes, alternative reference rates or other reforms may have a material adverse effect on our business, financial condition and results of operations.

Unfavorable outcomes in judicial, administrative and regulatory litigation may negatively affect our results of operations, cash flows and financial condition.

We are involved in several tax, civil and labor disputes involving significant monetary claims.

The principal litigations are described more fully in “Legal Proceedings.” Among the material matters for which no reserve has been established are the following:

· The Company and its subsidiary Gerdau Aços Longos S.A. and Gerdau Açominas S.A., have other lawsuits related to the ICMS (state VAT) which are mostly related to credit rights and rate differences, whose demands totaled R$ 443,137 thousands.

· The Company and certain of its subsidiaries in Brazil are parties to claims related to: (i) Imposto sobre Produtos Industrializados - IPI, substantially related to IPI credit on inputs, whose demands total the updated amount of R$ 309,581 thousands; (ii) PIS and COFINS, substantially related to non-approval of compensation of credits on inputs totaling R$ 438,843, (iii) social security contributions in the total of R$ 76,866 thousands and (iv) other taxes, which updated total amount is currently R$ 370,175 thousands.

· Subsidiary Gerdau Aços Longos S.A. is a party to an administrative proceeding relating to Withholding Income Tax, in the amount of R$ 122,029 thousands, assessed on the remittance abroad of interest charged on export financings under Export Prepayment or Export Advance Agreements. The Company submitted an administrative claim challenging the tax assessment on January 13, 2017, which was rejected by the Brazilian Federal Revenue Judgment Office (Delegacia de Julgamento da Receita Federal do Brasil), on June 5, 2017, reason for which the Company submitted a voluntary appeal, on July 4, 2017, which is currently pending on the Brazilian Board of Tax Appeals (Conselho Administrativo de Recursos Fiscais — “CARF”, administrative body of the Ministry of Finance of Brazil).

· The Company (as successor of Gerdau Aços Especiais S.A.) and its subsidiary Gerdau Internacional Empreendimentos Ltda., are parties to administrative and judicial proceedings relating to IRPJ — Corporate Income Tax and CSLL — Social Contribution Tax, in the current amount of R$ 1,488,989 thousands. Said proceedings relate to profits generated abroad, of which (i) R$ 1,317,381 thousands correspond to two proceedings involving Gerdau Internacional Empreendimentos Ltda., of which (i.a.) R$ 951,736 thousands relate to a proceeding that is no longer subject to appeal in CARF and was referred for judicial collection, which collection is being challenged in the competent judicial lower court; and (i.b) R$ 365,645 thousands relate to a voluntary appeal which was partially granted in the lower tribunal of the Brazilian Board of Tax Appeals (Conselho Administrativo de Recursos Fiscais — “CARF”, administrative body of the Ministry of Finance of Brazil), and was subject to special appeal which was partially granted in CARF’s superior tribunal with the publication of the judgment on May 25, 2017, and is currently awaiting due diligence by the Internal Revenue Service, as determined by the CARF decision, and new appeals may be filed after the conclusion of such procedure; and (ii) R$ 171,608 thousands correspond to a proceeding involving the Company, whose voluntary appeal in CARF’s lower tribunal was dismissed, for which a special appeal was filed, and currently awaits judgment in CARF’s superior tribunal.

· The Company (as successor of Gerdau Aços Especiais S.A.) and its subsidiaries Gerdau Aços Longos S.A. and Gerdau Açominas S.A. are parties to administrative proceedings relating to the disallowance of the deductibility of goodwill generated in accordance with Article 7 and 8 of Law 9,532/97 — as a result of a corporate restructuring carried out in 2004/2005 — from the tax base of the Corporate Income tax - IRPJ and Social Contribution on Net Income - CSLL. The total updated amount of the proceedings is R$ 6,217,810 thousands, of which (i) R$ 4,963,398 thousands correspond to four proceedings involving the Company and its subsidiaries Gerdau Aços Longos S.A. and Gerdau Açominas S.A., for which administrative discussions already ended and are currently in the administrative collection stage; and the Companies obtained injunctive relief to permit it to offer a judicial guarantee using a liability insurance policy, for judicial discussions on Motion to Stay Execution by the subsidiary Gerdau Aços Longos S.A. were initiated, in their respective proceedings, which total the amount of R$ 3,195,379 thousands, and also by the Company, in its respective lawsuit, which amounts to R$ 364,370 thousands; (ii) R$ 600,101 thousands correspond to two proceedings involving Gerdau Aços Longos S.A., whose voluntary appeal is currently pending in CARF’s lower tribunal; (iii) R$ 531,138 thousands correspond to two proceeding involving the subsidiary Gerdau Aços Longos S.A., whose voluntary appeal was dismissed in CARF’s lower tribunal and having been presented Request for Clarification against those decisions, which are pending of judgment; and (iv) R$ 123,172 thousands correspond to one proceeding involving the Company (as successor of Gerdau Aços Especiais S.A.), whose Request for Clarification, which was filed against a decision that dismissed its Voluntary Appeal, was rejected on December 7, 2017, then the Company became aware of that on December 12, 2017 and it is opposing the appropriate appeal.

Some of the decisions obtained at the CARF related to those proceedings along with other matters involving the Company included in the scope of the so-called Operation Zelotes (the “Operation”) are being investigated by Brazilian federal authorities including the Judiciary Branch, with the purpose of verifying the occurrence or not of alleged illegal acts.

Considering the involvement of Gerdau’s name in press reports concerning the Operation, the Board of Directors decided to engage outside counsel, which report to a Special Committee of the Board, to conduct an investigation to determine, among other things: (i) whether, in light of current knowledge, proper protocol was followed in the relationship of the Company with governmental authorities, including CARF, and in the hiring of firms representing the Company in cases before CARF; (ii) whether such firms have remained within the scope of their work/hiring; (iii) whether the engagement terms for such firms included clauses intended to prevent activity that violates ethical codes or laws currently in force; (iv) whether the engagement terms for such firms included the establishment of sanctions for any violations (whether contractual breaches or otherwise); and (v) if there is any evidence of fraud, deceit, bad faith, or any expression of an intent to commit an illegal act on the part of directors and/or officers of the Company in the relationship of the Company with governmental authorities, including CARF, in the negotiation, signing or carrying out of the aforementioned contracts (the “Internal Investigation”).

The Internal Investigation is ongoing, and as of the date of the approval of these interim financial statements, the Company believes it is not possible to predict either the duration or the outcome of the Operation or of the Internal Investigation. Additionally, the Company believes that currently there is not enough information to determine whether a provision for losses is required or disclose any contingency.

The Company’s legal advisors confirm that the procedures adopted by the Company with respect to the tax treatment of profits abroad and the deductibility of goodwill were strictly legal, and, therefore, the likelihood of loss with respect to said proceedings is possible (but not likely).

The failure to pay by our clients or the non-receipt, by the Company, of the credits held before financial institutions and originated from financial investments could adversely affect the Company’s revenues.

Gerdau may suffer losses from the default of our clients. Gerdau has a broad base of active clients and, in the case of default of a group of clients, Gerdau may suffer an adverse effect on its business, financial condition, results of operations and cash flows.

This risk arises from the possibility of the Company not receiving the amounts due to it from sales transactions or credits payable by financial institutions, which originated from our financial investments, which could also have an adverse effect on the business, financial condition, results of operations and cash flows of Gerdau.

Regulatory Risks

Restrictive measures on trade in steel products may affect the Company’s business by increasing the price of its products or reducing its ability to export.

Gerdau is a steel producer that supplies both the domestic market in Brazil and a number of international markets. The Company’s exports face competition from other steel producers, as well as restrictions imposed by importing countries in the form of quotas, ad valorem taxes, tariffs or increases in import duties, any of which could increase the costs of products and make them less competitive or prevent Gerdau from selling in these markets. There are no assurances that importing countries will not impose quotas, ad valorem taxes, tariffs or increase import duties, which could adversely affect the Company’s financial condition and results of operations.

Costs related to compliance with environmental regulations could increase if requirements become stricter, which could have a negative effect on the Company’s results of operations.

The Company’s industrial units and other activities must comply with a series of federal, state and municipal laws and regulations regarding the environment and the operation of plants in the countries in which they operate. These regulations include procedures relating to control of air emissions, disposal of liquid effluents and the handling, processing, storage, disposal and reuse of solid waste, hazardous or not, as well as other controls necessary for a steel company.