Exhibit 99.1

|

GERDAU S.A. and subsidiaries |

Feb 21, 2013 |

|

Mission

To create value for our customers, shareholders, employees and communities by operating as a sustainable steel business.

Vision

To be a global organization and a benchmark in any business we conduct.

Values

Be the Customer’s choice

SAFETY above all

Respected, engaged and fulfilled EMPLOYEES

Pursuing EXCELLENCE with SIMPLICITY

Focus on RESULTS

INTEGRITY with all stakeholders

Economic, social and environmental SUSTAINABILITY

Gerdau is a leading producer of long steel in the Americas and one of the largest suppliers of special steel in the world. With over 45,000 employees, it has industrial operations in 14 countries - in the Americas, Europe and Asia - which together represent an installed capacity of over 25 million metric tons of steel per year. It is the largest recycler in Latin America and around the world it transforms, each year, millions of metric tons of scrap into steel, reinforcing its commitment to sustainable development in the regions where it operates. With more than 140,000 shareholders, the Company is listed on the stock exchanges of São Paulo, New York and Madrid.

Highlights in the Fourth Quarter of 2012

|

|

|

4th Quarter |

|

4th Quarter |

|

Variation |

|

3rd Quarter |

|

Variation |

|

Fiscal Year |

|

Fiscal Year |

|

Variation |

|

|

Key Information |

|

2012 |

|

2011 |

|

4Q12/4Q11 |

|

2012 |

|

4Q12/3Q12 |

|

2012 |

|

2011 |

|

2012/2011 |

|

|

Production (1,000 t) Crude Steel (slabs/blooms/billets) |

|

4,186 |

|

4,732 |

|

-12 |

% |

4,747 |

|

-12 |

% |

18,920 |

|

19,623 |

|

-4 |

% |

|

Shipments (1,000 t) |

|

4,317 |

|

4,709 |

|

-8 |

% |

4,774 |

|

-10 |

% |

18,594 |

|

19,164 |

|

-3 |

% |

|

Net Sales (R$ million) |

|

8,988 |

|

9,066 |

|

-1 |

% |

9,819 |

|

-8 |

% |

37,982 |

|

35,407 |

|

7 |

% |

|

EBITDA (R$ million) |

|

891 |

|

1,025 |

|

-13 |

% |

1,033 |

|

-14 |

% |

4,176 |

|

4,651 |

|

-10 |

% |

|

Net Income (R$ million) |

|

143 |

|

472 |

|

-70 |

% |

408 |

|

-65 |

% |

1,496 |

|

2,098 |

|

-29 |

% |

|

Gross margin |

|

11 |

% |

13 |

% |

|

|

12 |

% |

|

|

13 |

% |

14 |

% |

|

|

|

EBITDA Margin |

|

10 |

% |

11 |

% |

|

|

11 |

% |

|

|

11 |

% |

13 |

% |

|

|

|

Shareholders’ equity (R$ million) |

|

28,798 |

|

26,520 |

|

|

|

28,886 |

|

|

|

28,798 |

|

26,520 |

|

|

|

|

Total Assets (R$ million) |

|

53,093 |

|

49,982 |

|

|

|

53,599 |

|

|

|

53,093 |

|

49,982 |

|

|

|

|

Gross debt / Total capitalization (1) |

|

34 |

% |

34 |

% |

|

|

34 |

% |

|

|

34 |

% |

34 |

% |

|

|

|

Net debt / Total capitalization (2) |

|

30 |

% |

25 |

% |

|

|

29 |

% |

|

|

30 |

% |

25 |

% |

|

|

|

Gross debt / EBITDA (3) |

|

3,5x |

|

2,9x |

|

|

|

3,5x |

|

|

|

3,5x |

|

2,9x |

|

|

|

|

Net debt / EBITDA (3) |

|

2,9x |

|

2,0x |

|

|

|

2,8x |

|

|

|

2,9x |

|

2,0x |

|

|

|

(1) Total capitalization = shareholders’ equity + gross debt

(2) Total capitalization = shareholders’ equity + net debt

(3) EBITDA in the last 12 months

World Steel Market

|

Steel Industry Production |

|

4th Quarter |

|

4th Quarter |

|

Variation |

|

3rd Quarter |

|

Variation |

|

Fiscal Year |

|

Fiscal Year |

|

Variation |

|

|

(Million tons) |

|

2012 |

|

2011 |

|

4Q12/4Q11 |

|

2012 |

|

4Q12/3Q12 |

|

2012 |

|

2011 |

|

2012/2011 |

|

|

Crude Steel |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Brazil |

|

8.6 |

|

8.4 |

|

2 |

% |

8.7 |

|

-1 |

% |

34.7 |

|

35.2 |

|

-1 |

% |

|

North America (except Mexico) |

|

24.1 |

|

24.8 |

|

-3 |

% |

25.1 |

|

-4 |

% |

102.3 |

|

99.4 |

|

3 |

% |

|

Latin America (except Brazil) |

|

8.7 |

|

7.8 |

|

12 |

% |

7.7 |

|

13 |

% |

32.2 |

|

32.4 |

|

-1 |

% |

|

China |

|

174.2 |

|

161.5 |

|

8 |

% |

185.1 |

|

-6 |

% |

716.5 |

|

694.8 |

|

3 |

% |

|

Others |

|

152.9 |

|

155.3 |

|

-2 |

% |

156.0 |

|

-2 |

% |

632.2 |

|

638.5 |

|

-1 |

% |

|

Total(1) |

|

368.5 |

|

357.8 |

|

3 |

% |

382.6 |

|

-4 |

% |

1,517.9 |

|

1,500.3 |

|

1 |

% |

Source: worldsteel and Gerdau

(1) Figures represent approximately 98% of total production in 62 countries.

· In 4Q12, world steel production grew in relation to 4Q11 (see table above), led by China, which recorded the highest growth in crude steel production in the comparison period. The regions where Gerdau operates presented distinct performances. In Brazil and Latin America, production registered increases, led by Mexico. In North America, however, production decreased, mainly due to the uncertainty over fiscal policy and the more severe winter. In 2012, China and North America registered growth in production compared to the previous year, driven by the gradual recovery in steel demand. China remained an important player in the international market, accounting for 47% of world steel production. Average capacity utilization in the world steel industry stood at 79% in 2012.

· On October 11, 2012, World Steel Association released its latest Short Range Outlook containing forecasts for global apparent steel consumption in 2013, in which it estimated growth at 3.2%. Compared to the outlook published in April 2012, the forecasts for world steel consumption in 2013 were revised downward, mainly due to the economic crisis in Europe and the slower-than-expected growth in China. For 2013, Worldsteel estimates growth in apparent steel consumption in developing economies of 3.7%, while developed economies should grow by 1.9%. Meanwhile, the NAFTA region is expected to register growth of 3.6% in apparent steel consumption in 2013.

Gerdau’s performance in the fourth quarter of 2012

The Consolidated Financial Statements of Gerdau S.A. are presented in accordance with the International Financial Reporting Standards (IFRS) issued by the International Accounting Standards Board (IASB) and the accounting practices adopted in Brazil, which are fully aligned with the international accounting standards issued by the Accounting Pronouncement Committee (CPC).

The information in this report does not include data for jointly controlled entities and associate companies, except where stated otherwise.

Business operations

The information in this report is presented in accordance with Gerdau’s corporate governance, as follows:

· Brazil (Brazil BO) — includes the operations in Brazil (except special steel) and the metallurgical and coking coal operation in Colombia;

· North America (North America BO) — includes all North American operations, except Mexico and special steel;

· Latin America (Latin America BO) — includes all Latin American operations, except the operations in Brazil and the metallurgical and coking coal operation in Colombia;

· Special Steel (Special Steel BO) — includes the special steel operations in Brazil, Spain, United States and India.

Crude steel production

|

Production |

|

4th Quarter |

|

4th Quarter |

|

Variation |

|

3rd Quarter |

|

Variation |

|

Fiscal Year |

|

Fiscal Year |

|

Variation |

|

|

(1,000 tons) |

|

2012 |

|

2011 |

|

4Q12/4Q11 |

|

2012 |

|

4Q12/3Q12 |

|

2012 |

|

2011 |

|

2012/2011 |

|

|

Crude Steel (slabs/blooms/billets) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Brazil |

|

1,702 |

|

1,874 |

|

-9 |

% |

1,925 |

|

-12 |

% |

7,204 |

|

7,573 |

|

-5 |

% |

|

North America |

|

1,425 |

|

1,670 |

|

-15 |

% |

1,734 |

|

-18 |

% |

6,900 |

|

6,968 |

|

-1 |

% |

|

Latin America |

|

408 |

|

414 |

|

-1 |

% |

444 |

|

-8 |

% |

1,840 |

|

1,718 |

|

7 |

% |

|

Special Steel |

|

651 |

|

774 |

|

-16 |

% |

644 |

|

1 |

% |

2,976 |

|

3,364 |

|

-12 |

% |

|

Total |

|

4,186 |

|

4,732 |

|

-12 |

% |

4,747 |

|

-12 |

% |

18,920 |

|

19,623 |

|

-4 |

% |

· On a consolidated basis, the reduction in crude steel production in 4Q12 compared to 4Q11 was due to adaptation levels of demand in each region where Gerdau has operations. Regarding 3Q12, there were adaptation levels of demand and also inventory adjustments to reduce working capital.

Crude Steel Production

(in thousands of tonnes)

Shipments

|

Consolidated Shipments (1) |

|

4th Quarter |

|

4th Quarter |

|

Variation |

|

3rd Quarter |

|

Variation |

|

Fiscal Year |

|

Fiscal Year |

|

Variation |

|

|

(1,000 tons) |

|

2012 |

|

2011 |

|

4Q12/4Q11 |

|

2012 |

|

4Q12/3Q12 |

|

2012 |

|

2011 |

|

2012/2011 |

|

|

Brazil (2) |

|

1,814 |

|

1,940 |

|

-6 |

% |

1,791 |

|

1 |

% |

7,299 |

|

7,649 |

|

-5 |

% |

|

Domestic Market |

|

1,294 |

|

1,242 |

|

4 |

% |

1,339 |

|

-3 |

% |

5,320 |

|

5,082 |

|

5 |

% |

|

Exports |

|

520 |

|

698 |

|

-26 |

% |

452 |

|

15 |

% |

1,979 |

|

2,567 |

|

-23 |

% |

|

North America |

|

1,359 |

|

1,607 |

|

-15 |

% |

1,768 |

|

-23 |

% |

6,472 |

|

6,564 |

|

-1 |

% |

|

Latin America |

|

647 |

|

649 |

|

0 |

% |

705 |

|

-8 |

% |

2,707 |

|

2,641 |

|

2 |

% |

|

Special Steel |

|

603 |

|

692 |

|

-13 |

% |

625 |

|

-4 |

% |

2,657 |

|

2,964 |

|

-10 |

% |

|

Eliminations and Adjustments |

|

(106 |

) |

(179 |

) |

|

|

(115 |

) |

|

|

(541 |

) |

(654 |

) |

|

|

|

Total |

|

4,317 |

|

4,709 |

|

-8 |

% |

4,774 |

|

-10 |

% |

18,594 |

|

19,164 |

|

-3 |

% |

(1) - Excludes shipments to subsidiaries.

(2) - Does not consider coking coal and coke shipments.

· Consolidated shipments in 4Q12 compared to 4Q11 registered decreases of varying amounts in each business operation, with the exception of the Latin America BO, which remained flat in the period. At the Brazil BO, the decrease is mainly explained by the reduction in exports due to the

lower international prices and resulting lower profitability. In the domestic market, the recovery in Gerdau’s shipments to the industrial sector in 4Q12 supported positive growth in shipments in the period. In the Special Steel BO, the reduction in shipments occurred primarily at the units in Brazil and Spain. In Brazil, shipments continued to be impacted by the bringing forward of heavy vehicle production that occurred in late 2011, ahead of the new Euro 5 regulations for diesel engines that took effect in 2012. In Spain, the lower special steel shipments reflected the effects from Europe’s economic crisis. In the North America BO, the reduction in shipments reflected the uncertainty over fiscal policy in the United States that led the country to record negative GDP growth in 4Q12 and the more severe winter in 4Q12 compared to 4Q11.

· Compared to 3Q12, consolidated shipments decreased due to seasonal effects, except for the Brazil BO, where the growth in exports boosted shipments in the period. At the North America BO specifically, the reduction in shipments was caused by the uncertainty over fiscal policy and the seasonal effects due to winter, which is typically marked by a slowdown in construction activity.

· In 2012, consolidated shipments registered a slight decrease compared to 2011, which was mitigated by the higher shipments to the domestic market in the Brazil BO, where the construction segment and industrial sector served by Gerdau registered healthy demand.

Consolidated Shipments

(BO Participation)

Net sales

|

Net Sales |

|

4th Quarter |

|

4th Quarter |

|

Variation |

|

3rd Quarter |

|

Variation |

|

Fiscal Year |

|

Fiscal Year |

|

Variation |

|

|

(R$ million) |

|

2012 |

|

2011 |

|

4Q12/4Q11 |

|

2012 |

|

4Q12/3Q12 |

|

2012 |

|

2011 |

|

2012/2011 |

|

|

Brazil |

|

3,589 |

|

3,558 |

|

1 |

% |

3,567 |

|

1 |

% |

14,100 |

|

13,932 |

|

1 |

% |

|

Domestic Market |

|

2,975 |

|

2,629 |

|

13 |

% |

3,053 |

|

-3 |

% |

11,841 |

|

10,561 |

|

12 |

% |

|

Exports (1) |

|

614 |

|

929 |

|

-34 |

% |

514 |

|

19 |

% |

2,259 |

|

3,371 |

|

-33 |

% |

|

North America |

|

2,709 |

|

2,817 |

|

-4 |

% |

3,415 |

|

-21 |

% |

12,450 |

|

10,811 |

|

15 |

% |

|

Latin America |

|

1,219 |

|

1,068 |

|

14 |

% |

1,322 |

|

-8 |

% |

4,964 |

|

4,015 |

|

24 |

% |

|

Special Steel |

|

1,713 |

|

1,863 |

|

-8 |

% |

1,750 |

|

-2 |

% |

7,389 |

|

7,517 |

|

-2 |

% |

|

Eliminations and Adjustments |

|

(242 |

) |

(240 |

) |

|

|

(235 |

) |

|

|

(921 |

) |

(868 |

) |

|

|

|

Total |

|

8,988 |

|

9,066 |

|

-1 |

% |

9,819 |

|

-8 |

% |

37,982 |

|

35,407 |

|

7 |

% |

(1) - Includes coking coal and coke net sales.

· In 4Q12, consolidated net sales were nearly flat compared to 4Q11, since the reduction in shipments was fully offset by the higher net sales per tonne shipped. At the Brazil BO, the higher net sales reflected the increases in net sales per tonne shipped and in shipments to the domestic market, which more than offset the reduction in exports in terms of both shipments and price. In the North America and Special Steel BOs, the lower net sales were due to the reduction in shipments, despite the increase in net sales per tonne shipped. In the Latin America BO, net sales growth was due to the increase in net sales per tonne shipped.

· Compared to 3Q12, consolidated net sales decreased due to the lower shipments, except at the Brazil BO, where the growth in exports led to a slight increase in net sales.

· In 2012 compared to 2011, the growth in net sales was driven by the increase in net sales per tonne shipped at all business operations, despite the lower shipments. In absolute terms, the BOs North America and Latin America were the highlights for the growth of net sales in 2012 compared to 2011, as a result, mainly, of the higher net sales per tonne shipped, influenced by the exchange variation of the period. In Brazil BO, although net sales remained virtually flat, the individual markets served performed differently. In the domestic market, increases in shipments and net sales per tonne shipped contributed to the higher net sales, while exports decreased both shipments and prices.

Cost of goods sold and gross margin

|

|

|

|

|

4th Quarter |

|

4th Quarter |

|

Variation |

|

3rd Quarter |

|

Variation |

|

Fiscal Year |

|

Fiscal Year |

|

Variation |

|

|

Cost of Goods Sold and Gross Margin |

|

2012 |

|

2011 |

|

4Q12/4Q11 |

|

2012 |

|

4Q12/3Q12 |

|

2012 |

|

2011 |

|

2012/2011 |

| ||

|

Brazil |

|

Net sales (R$million) |

|

3,589 |

|

3,558 |

|

1 |

% |

3,567 |

|

1 |

% |

14,100 |

|

13,932 |

|

1 |

% |

|

|

|

Cost of goods sold (R$million) |

|

(2,872 |

) |

(2,995 |

) |

-4 |

% |

(2,851 |

) |

1 |

% |

(11,630 |

) |

(11,624 |

) |

0 |

% |

|

|

|

Gross profit (R$million) |

|

717 |

|

563 |

|

27 |

% |

716 |

|

0 |

% |

2,470 |

|

2,308 |

|

7 |

% |

|

|

|

Gross margin (%) |

|

20 |

% |

16 |

% |

|

|

20 |

% |

|

|

18 |

% |

17 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

North America |

|

Net sales (R$million) |

|

2,709 |

|

2,817 |

|

-4 |

% |

3,415 |

|

-21 |

% |

12,450 |

|

10,811 |

|

15 |

% |

|

|

|

Cost of goods sold (R$million) |

|

(2,621 |

) |

(2,601 |

) |

1 |

% |

(3,192 |

) |

-18 |

% |

(11,453 |

) |

(9,682 |

) |

18 |

% |

|

|

|

Gross profit (R$million) |

|

88 |

|

216 |

|

-59 |

% |

223 |

|

-61 |

% |

997 |

|

1,129 |

|

-12 |

% |

|

|

|

Gross margin (%) |

|

3 |

% |

8 |

% |

|

|

7 |

% |

|

|

8 |

% |

10 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Latin America |

|

Net sales (R$million) |

|

1,219 |

|

1,068 |

|

14 |

% |

1,322 |

|

-8 |

% |

4,964 |

|

4,015 |

|

24 |

% |

|

|

|

Cost of goods sold (R$million) |

|

(1,175 |

) |

(923 |

) |

27 |

% |

(1,264 |

) |

-7 |

% |

(4,635 |

) |

(3,505 |

) |

32 |

% |

|

|

|

Gross profit (R$million) |

|

44 |

|

145 |

|

-70 |

% |

58 |

|

-24 |

% |

329 |

|

510 |

|

-35 |

% |

|

|

|

Gross margin (%) |

|

4 |

% |

14 |

% |

|

|

4 |

% |

|

|

7 |

% |

13 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Special Steel |

|

Net sales (R$million) |

|

1,713 |

|

1,863 |

|

-8 |

% |

1,750 |

|

-2 |

% |

7,389 |

|

7,517 |

|

-2 |

% |

|

|

|

Cost of goods sold (R$million) |

|

(1,528 |

) |

(1,616 |

) |

-5 |

% |

(1,544 |

) |

-1 |

% |

(6,421 |

) |

(6,371 |

) |

1 |

% |

|

|

|

Gross profit (R$million) |

|

185 |

|

247 |

|

-25 |

% |

206 |

|

-10 |

% |

968 |

|

1,146 |

|

-16 |

% |

|

|

|

Gross margin (%) |

|

11 |

% |

13 |

% |

|

|

12 |

% |

|

|

13 |

% |

15 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Eliminations |

|

Net sales (R$million) |

|

(242 |

) |

(240 |

) |

|

|

(235 |

) |

|

|

(921 |

) |

(868 |

) |

|

|

|

and Adjustments |

|

Cost of goods sold (R$million) |

|

227 |

|

270 |

|

|

|

230 |

|

|

|

905 |

|

884 |

|

|

|

|

|

|

Gross profit (R$million) |

|

(15 |

) |

30 |

|

|

|

(5 |

) |

|

|

(16 |

) |

16 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Consolidated |

|

Net sales (R$million) |

|

8,988 |

|

9,066 |

|

-1 |

% |

9,819 |

|

-8 |

% |

37,982 |

|

35,407 |

|

7 |

% |

|

|

|

Cost of goods sold (R$million) |

|

(7,969 |

) |

(7,865 |

) |

1 |

% |

(8,621 |

) |

-8 |

% |

(33,234 |

) |

(30,298 |

) |

10 |

% |

|

|

|

Gross profit (R$million) |

|

1,019 |

|

1,201 |

|

-15 |

% |

1,198 |

|

-15 |

% |

4,748 |

|

5,109 |

|

-7 |

% |

|

|

|

Gross margin (%) |

|

11 |

% |

13 |

% |

|

|

12 |

% |

|

|

13 |

% |

14 |

% |

|

|

· In 4Q12 compared to 4Q11, on a consolidated basis, the increase in selling costs was mainly due to the reduction in production and shipments and the subsequent lower dilution of fixed costs, which was partially offset by the better performance of the Brazil BO. The lower shipments led to a decrease in consolidated gross margin. In the North America and Special Steels BOs, gross margin contraction was due to the reduction in shipments and the subsequent lower dilution of fixed costs. In the Latin America BO, gross margin contraction was due to the higher selling costs resulting from the increase in raw material costs and the write down of certain input prices. In the Brazil BO, in contrast to the other operations, gross margin expanded due to the growth in shipments to the domestic market and to the higher net sales per tonne shipped in this market.

· On a consolidated basis, gross margin reduced in 4Q12 compared to 3Q12, mainly due to the lower gross margin in the North America BO.

· The increase in cost of sales in 2012 compared to 2011, on a consolidated basis, was the result of rising prices of key raw materials was higher than the growth in net sales per tonne shipped, resulting in a lower gross margin. In Brazil BO, on the other hand, there was an improvement in gross margin due to higher net sales per tonne shipped and higher sales volumes focused on the domestic market.

Selling, general and administrative expenses

|

SG&A |

|

4th Quarter |

|

4th Quarter |

|

Variation |

|

3rd Quarter |

|

Variation |

|

Fiscal Year |

|

Fiscal Year |

|

Variation |

|

|

(R$ million) |

|

2012 |

|

2011 |

|

4Q12/4Q11 |

|

2012 |

|

4Q12/3Q12 |

|

2012 |

|

2011 |

|

2012/2011 |

|

|

Selling expenses |

|

156 |

|

158 |

|

-1 |

% |

150 |

|

4 |

% |

587 |

|

604 |

|

-3 |

% |

|

General and administrative expenses |

|

450 |

|

484 |

|

-7 |

% |

480 |

|

-6 |

% |

1,884 |

|

1,798 |

|

5 |

% |

|

Total |

|

606 |

|

642 |

|

-6 |

% |

630 |

|

-4 |

% |

2,471 |

|

2,402 |

|

3 |

% |

|

Net Sales |

|

8,988 |

|

9,066 |

|

-1 |

% |

9,819 |

|

-8 |

% |

37,982 |

|

35,407 |

|

7 |

% |

|

% of net sales |

|

7 |

% |

7 |

% |

|

|

6 |

% |

|

|

7 |

% |

7 |

% |

|

|

· Selling, general and administrative expenses as a ratio of net sales remained flat in 4Q12 compared to same period last year. The same trend was observed in fiscal year 2012 compared to 2011.

Equity income

· The jointly controlled entities and associate companies, whose results are calculated using the equity method, recorded steel shipments of 264,000 tonnes in 4Q12, based on their respective equity interests, for net sales of R$ 420 million.

· Based on the performance of jointly controlled entities and associate companies, equity income was negative R$ 6 million in 4Q12, compared to negative R$ 22 million in 4Q11 and negative R$ 3 million in 3Q12. Note that as of 3Q12, the India operation is no longer recorded using the equity accounting method, being fully consolidated.

· In 2012, the equity income was positive R$ 8 million compared to R$ 63 million in 2011.

EBITDA

|

Breakdown of Consolidated EBITDA (1) |

|

4th Quarter |

|

4th Quarter |

|

Variation |

|

3rd Quarter |

|

Variation |

|

Fiscal Year |

|

Fiscal Year |

|

Variation |

|

|

(R$ million) |

|

2012 |

|

2011 |

|

4Q12/4Q11 |

|

2012 |

|

4Q12/3Q12 |

|

2012 |

|

2011 |

|

2012/2011 |

|

|

Net income |

|

143 |

|

472 |

|

-70 |

% |

408 |

|

-65 |

% |

1,496 |

|

2,098 |

|

-29 |

% |

|

Net financial result |

|

222 |

|

82 |

|

171 |

% |

134 |

|

66 |

% |

789 |

|

528 |

|

49 |

% |

|

Provision for income and social contribution taxes |

|

60 |

|

15 |

|

300 |

% |

26 |

|

131 |

% |

63 |

|

253 |

|

-75 |

% |

|

Depreciation and amortization |

|

466 |

|

456 |

|

2 |

% |

465 |

|

0 |

% |

1,828 |

|

1,772 |

|

3 |

% |

|

EBITDA |

|

891 |

|

1,025 |

|

-13 |

% |

1,033 |

|

-14 |

% |

4,176 |

|

4,651 |

|

-10 |

% |

|

EBITDA Margin |

|

10 |

% |

11 |

% |

|

|

11 |

% |

|

|

11 |

% |

13 |

% |

|

|

(1) Includes the results from jointly controlled entities and associate companies based on the equity income method.

Note: EBITDA is not a method used in accounting practices, does not represent cash flow for the periods in question and should not be considered an alternative to cash flow as an indicator of liquidity. The Company’s EBITDA is already calculated pursuant to Instruction 527 of the CVM.

|

Conciliation of Consolidated EBITDA |

|

4th Quarter |

|

4th Quarter |

|

3rd Quarter |

|

Fiscal Year |

|

Fiscal Year |

|

|

(R$ million) |

|

2012 |

|

2011 |

|

2012 |

|

2012 |

|

2011 |

|

|

EBITDA (1) |

|

891 |

|

1,025 |

|

1,033 |

|

4,176 |

|

4,651 |

|

|

Depreciation and amortization |

|

(466 |

) |

(456 |

) |

(465 |

) |

(1,828 |

) |

(1,772 |

) |

|

OPERATING INCOME BEFORE FINANCIAL RESULT AND TAXES(2) |

|

425 |

|

569 |

|

568 |

|

2,348 |

|

2,879 |

|

(1) Non-accounting measurement adopted by the Company.

(2) Accounting measurement disclosed in consolidated Statements of Income.

|

EBITDA |

EBITDA Margin |

|

|

|

|

|

|

|

|

|

|

|

4th Quarter |

|

4th Quarter |

|

Variation |

|

3rd Quarter |

|

Variation |

|

Fiscal Year |

|

Fiscal Year |

|

Variation |

|

|

EBITDA by Business Operation |

|

2012 |

|

2011 |

|

4Q12/4Q11 |

|

2012 |

|

4Q12/3Q12 |

|

2012 |

|

2011 |

|

2012/2011 |

| ||

|

Brazil |

|

EBITDA (R$million) |

|

703 |

|

531 |

|

32 |

% |

691 |

|

2 |

% |

2,395 |

|

2,219 |

|

8 |

% |

|

|

|

EBITDA margin (%) |

|

20 |

% |

15 |

% |

|

|

19 |

% |

|

|

17 |

% |

16 |

% |

|

|

|

North America |

|

EBITDA (R$million) |

|

59 |

|

187 |

|

-68 |

% |

205 |

|

-71 |

% |

922 |

|

1,176 |

|

-22 |

% |

|

|

|

EBITDA margin (%) |

|

2 |

% |

7 |

% |

|

|

6 |

% |

|

|

7 |

% |

11 |

% |

|

|

|

Latin America |

|

EBITDA (R$million) |

|

21 |

|

96 |

|

-78 |

% |

(3 |

) |

— |

|

180 |

|

412 |

|

-56 |

% |

|

|

|

EBITDA margin (%) |

|

2 |

% |

9 |

% |

|

|

0 |

% |

|

|

4 |

% |

10 |

% |

|

|

|

Special Steel |

|

EBITDA (R$million) |

|

218 |

|

246 |

|

-11 |

% |

233 |

|

-6 |

% |

1,073 |

|

1,159 |

|

-7 |

% |

|

|

|

EBITDA margin (%) |

|

13 |

% |

13 |

% |

|

|

13 |

% |

|

|

15 |

% |

15 |

% |

|

|

|

Eliminations and Adjustments |

|

EBITDA (R$million) |

|

(110 |

) |

(35 |

) |

|

|

(93 |

) |

|

|

(394 |

) |

(315 |

) |

|

|

|

Consolidated |

|

EBITDA (R$million) |

|

891 |

|

1,025 |

|

-13 |

% |

1,033 |

|

-14 |

% |

4,176 |

|

4,651 |

|

-10 |

% |

|

|

|

EBITDA margin (%) |

|

10 |

% |

11 |

% |

|

|

11 |

% |

|

|

11 |

% |

13 |

% |

|

|

· Consolidated EBITDA (earnings before interest, tax, depreciation and amortization) and EBITDA margin decreased in 4Q12 compared to 4Q11 due to the reduction in consolidated gross profit. The North America BO, which accounted for 6% of EBITDA, registered contraction in EBITDA Margin due to the lower dilution of fixed costs. In the Special Steel BO, which accounted for 22% of EBITDA in 4Q12, EBITDA margin was unchanged. In the Brazil BO, which accounted for 70% of EBITDA, the higher volume of shipments to the domestic market and the increase in net sales per tonne shipped in this market supported increases in both EBITDA and EBITDA Margin.

· In 4Q12 compared to 3Q12, consolidated EBITDA and EBITDA margin decreased, impacted by the weaker operating performance in the North America BO. In the other business operations, EBITDA margin either expanded or remained flat.

· In 2012, the consolidated EBITDA, registered a reduction compared to 2011, accompanied by a contraction in EBITDA margin. This decrease can be mainly explained by the lower gross profit (see explanation in “Cost of goods sold and gross margin”) and lower equity income. On the other hand, in Brazil BO, which represented 52% of consolidated EBITDA in 2012, there was an improvement in EBITDA margin due to higher net sales per tonne shipped and higher shipments focused on the domestic market.

Financial result

|

Financial Result |

|

4th Quarter |

|

4th Quarter |

|

Variation |

|

3rd Quarter |

|

Variation |

|

Fiscal Year |

|

Fiscal Year |

|

Variation |

|

|

(R$ million) |

|

2012 |

|

2011 |

|

4Q12/4Q11 |

|

2012 |

|

4Q12/3Q12 |

|

2012 |

|

2011 |

|

2012/2011 |

|

|

Financial income |

|

69 |

|

132 |

|

-48 |

% |

66 |

|

5 |

% |

317 |

|

456 |

|

-30 |

% |

|

Financial expenses |

|

(272 |

) |

(231 |

) |

18 |

% |

(217 |

) |

25 |

% |

(953 |

) |

(971 |

) |

-2 |

% |

|

Exchange variation, net |

|

(14 |

) |

14 |

|

— |

|

21 |

|

— |

|

(134 |

) |

52 |

|

— |

|

|

Exchange variation on net investment hedge |

|

(11 |

) |

— |

|

— |

|

(8 |

) |

38 |

% |

(176 |

) |

— |

|

— |

|

|

Exchange variation - other lines |

|

(3 |

) |

14 |

|

— |

|

29 |

|

— |

|

42 |

|

52 |

|

-19 |

% |

|

Gains (losses) on financial instruments, net |

|

(5 |

) |

3 |

|

— |

|

(4 |

) |

25 |

% |

(19 |

) |

(65 |

) |

-71 |

% |

|

Financial Result |

|

(222 |

) |

(82 |

) |

171 |

% |

(134 |

) |

66 |

% |

(789 |

) |

(528 |

) |

49 |

% |

· In accordance with IFRS, the Company has designated the bulk of its debt in foreign currency contracted by companies in Brazil as a hedge for a portion of the net investments in subsidiaries located abroad. As a result, the effects from exchange variation gains or losses on this debt were fully recognized in shareholders’ equity, while the tax effects (income tax and social contribution) were recognized in income. As of 2Q12, to neutralize the volatility in net income, given that income tax is levied on the total exchange variation of the debt as from Brazil, the Company opted to change the amount of this debt designated as hedge. Therefore, the exchange variation on the amount of US$ 2.4 billion continues to be recognized in shareholders’ equity, while the exchange variation on the portion of US$ 0.8 billion is now recognized in income.

· In 4Q12 compared to 4Q11, the higher negative financial result was mainly due to the decrease in financial income, which in the previous period benefitted from the higher cash position resulting from the public share offering, and to the increase in financial expenses resulting from the higher gross debt. Compared to 3Q12, the higher negative financial result was mainly due to the additional financial expenses arising from the prepayment of debt in 4Q12 and to the exchange variation loss in 4Q12, compared to the gain in 3Q12.

· In 2012, the higher negative financial result compared with the previous year is due to lower financial income and the negative exchange variation on net investment hedge.

Net income

|

Net Income |

|

4th Quarter |

|

4th Quarter |

|

Variation |

|

3rd Quarter |

|

Variation |

|

Fiscal Year |

|

Fiscal Year |

|

Variation |

|

|

(R$ million) |

|

2012 |

|

2011 |

|

4Q12/4Q11 |

|

2012 |

|

4Q12/3Q12 |

|

2012 |

|

2011 |

|

2012/2011 |

|

|

Income before taxes (1) |

|

203 |

|

487 |

|

-58 |

% |

434 |

|

-53 |

% |

1,559 |

|

2,351 |

|

-34 |

% |

|

Income and social contribution taxes (IR/CS) |

|

(60 |

) |

(15 |

) |

300 |

% |

(26 |

) |

131 |

% |

(63 |

) |

(253 |

) |

-75 |

% |

|

IR/CS on net investment hedge |

|

11 |

|

17 |

|

-35 |

% |

8 |

|

38 |

% |

134 |

|

164 |

|

-18 |

% |

|

IR/CS - other lines |

|

(71 |

) |

(32 |

) |

122 |

% |

(34 |

) |

109 |

% |

(197 |

) |

(417 |

) |

-53 |

% |

|

Consolidated Net Income (1) |

|

143 |

|

472 |

|

-70 |

% |

408 |

|

-65 |

% |

1,496 |

|

2,098 |

|

-29 |

% |

(1) Includes the results from jointly controlled entities and associate companies based on the equity income method.

· Consolidated net income in 4Q12 decreased in relation to both 4Q11 and 3Q12, reflecting the lower operating and financial income in the period. The same trend was observed in fiscal year 2012 compared to 2011.

Dividends

· The companies Metalúrgica Gerdau S.A. and Gerdau S.A. approved, based on the results recorded in 4Q12, the payment of the minimum mandatory dividend for fiscal year 2012, as shown below:

· Payment date: March 14th, 2013

· Record date: shareholder position on March 4th, 2013

· Ex-dividend date: March 5th, 2013

· Metalúrgica Gerdau S.A.

· R$ 8 million (R$ 0.02 per share)

· Gerdau S.A.

· R$ 34 million (R$ 0.02 per share)

· In 2012, Metalúrgica Gerdau S.A. and Gerdau S.A. deliberated R$ 130 million (R$ 0.32 per share) and R$ 408 million (R$ 0.24 per share), respectively, in the form of dividends and/or interests on capital stock.

Investments

· In 4Q12, investments in fixed assets totaled R$ 683 million, bringing investments in the whole of the year to R$ 3.1 billion. Of the total invested in the quarter, 60% was allocated to units in Brazil and the remaining 40% to units in other countries.

· Given the uncertainty in the global economy, Gerdau has been selective in evaluating its future investment projects and has revised its investment plan for the 2013-2017 period to R$ 8.5 billion.

Cash conversion cycle and working capital

· In December 2012, working capital decreased by 4% from September 2012 while net sales decreased by 8%, reflecting the slowdown in operations that typically marks the fourth quarter. As a result, the cash conversion cycle (working capital divided by daily net sales in the quarter) increased by five days in relation to September 2012.

Financial liabilities

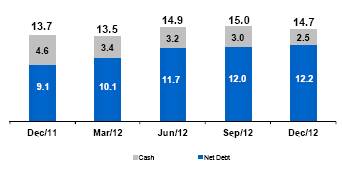

Gross Debt

(R$ billions)

· On December 31, 2012, the composition of gross debt (loans, financing and debentures) was 20% in Brazilian real, 47% in foreign currency contracted by companies in Brazil and 33% in a variety of currencies contracted by subsidiaries abroad. Of this total, 18% was short-term and 82% was long-term debt. Gross debt increased by 7% from December 31, 2011, mainly due to the effects of exchange variation on foreign-denominated debt over the course of 2012 (mainly the 8.9% depreciation of the Brazilian real against the U.S. dollar).

· The decrease in cash (cash, cash equivalents and short-term investments) between December 2011 and December 2012 was mainly due to the debt payments, the higher working capital needs

and investments made during 2012. On December 31, 2012, 35% of this cash was held by Gerdau companies abroad and denominated mainly in U.S. dollar.

· Net debt (gross debt less cash) increased by 34% from December 31, 2011 to December 31, 2012, due to the decrease in cash and the increase in gross debt. Compared to September 30, 2012, when it stood at R$12.0 billion, net debt remained relatively stable.

|

Indebtedness |

|

|

|

|

|

|

|

|

(R$ million) |

|

12.31.2012 |

|

9.30.2012 |

|

12.31.2011 |

|

|

Short Term |

|

2,583 |

|

3,093 |

|

1,757 |

|

|

Local Currency (Brazil) |

|

652 |

|

1,093 |

|

821 |

|

|

Foreign Currency (Brazil) |

|

469 |

|

485 |

|

243 |

|

|

Companies abroad |

|

1,462 |

|

1,515 |

|

693 |

|

|

Long Term |

|

12,086 |

|

11,875 |

|

11,927 |

|

|

Local Currency (Brazil) |

|

2,240 |

|

1,553 |

|

2,383 |

|

|

Foreign Currency (Brazil) |

|

6,422 |

|

6,911 |

|

6,462 |

|

|

Companies abroad |

|

3,424 |

|

3,411 |

|

3,082 |

|

|

Gross Debt |

|

14,669 |

|

14,968 |

|

13,684 |

|

|

Cash, cash equivalents and short-term investments |

|

2,497 |

|

2,999 |

|

4,578 |

|

|

Net Debt |

|

12,172 |

|

11,969 |

|

9,106 |

|

· On December 31, 2012, the nominal weighted average cost of gross debt was 6.1%, with 7.3% for the portion denominated in Brazilian real, 5.9% plus exchange variation for the portion denominated in U.S. dollar contracted by companies in Brazil, and 5.8% for the portion contracted by subsidiaries abroad.

· On December 31, 2012, the gross debt payment schedule was as follows:

|

Short Term |

|

R$ million |

|

|

1st quarter of 2013 |

|

772 |

|

|

2nd quarter of 2013 |

|

1,184 |

|

|

3rd quarter of 2013 |

|

239 |

|

|

4th quarter of 2013 |

|

388 |

|

|

Total |

|

2,583 |

|

|

Long Term |

|

R$ million |

|

|

2014 |

|

1,086 |

|

|

2015 |

|

1,113 |

|

|

2016 |

|

326 |

|

|

2017 and after |

|

9,561 |

|

|

Total |

|

12,086 |

|

· The Company’s main debt indicators are shown below:

|

Indicators |

|

12.31.2012 |

|

9.30.2012 |

|

12.31.2011 |

|

|

Gross debt / Total capitalization (1) |

|

34 |

% |

34 |

% |

34 |

% |

|

Net debt / Total capitalization (2) |

|

30 |

% |

29 |

% |

25 |

% |

|

Gross debt / EBITDA (3) |

|

3,5x |

|

3,5x |

|

2,9x |

|

|

Net debt / EBITDA (3) |

|

2,9x |

|

2,8x |

|

2,0x |

|

|

EBITDA (3) / Financial expenses (3) |

|

3,9x |

|

4,3x |

|

4,3x |

|

|

EBITDA (3) / Net financial expenses (3) |

|

5,6x |

|

6,9x |

|

7,4x |

|

(1) - Total capitalization = shareholders’ equity + gross debt

(2) - Total capitalization = shareholders’ equity + net debt

(3) - Last 12 months

Corporate governance

Corporate Sustainability Index (ISE)

· In November 2012, for the seventh consecutive year, Metalúrgica Gerdau S.A. and Gerdau S.A. were selected as components of the Corporate Sustainability Index (ISE) of the BM&FBOVESPA. Being selected as a component of this index reflects the companies’ best practices in social responsibility and corporate sustainability and places them in the select group of companies that form this important indicator for Brazil’s stock market.

Apimec Meeting

· In November, Gerdau held meetings in the cities of São Paulo and Porto Alegre sponsored by the Capital Market Professionals and Investors Association (Apimec) in which 200 people attended in person and 20 participated via webcast.

THE MANAGEMENT

This document contains forward-looking statements. These statements are based on estimates, information or methods that may be incorrect or inaccurate and that may not occur. These estimates are also subject to risk, uncertainties and assumptions that include, among other factors: general economic, political and commercial conditions in Brazil and in the markets where we operate and existing and future government regulations. Potential investors are cautioned that these forward-looking statements do not constitute guarantees of future performance, given that they involve risks and uncertainties. Gerdau does not undertake and expressly waives any obligation to update any of these forward-looking statements, which are valid only on the date on which they were made.

GERDAU S.A.

CONSOLIDATED BALANCE SHEETS

as of December 31, 2012 and 2011

In thousands of Brazilian reais (R$)

|

|

|

2012 |

|

2011 |

|

|

CURRENT ASSETS |

|

|

|

|

|

|

Cash and cash equivalents |

|

1,437,235 |

|

1,476,599 |

|

|

Short-term investments |

|

|

|

|

|

|

Held for Trading |

|

1,059,605 |

|

3,095,359 |

|

|

Available for sale |

|

— |

|

6,290 |

|

|

Trade accounts receivable - net |

|

3,695,381 |

|

3,602,748 |

|

|

Inventories |

|

9,021,542 |

|

8,059,427 |

|

|

Tax credits |

|

936,748 |

|

815,983 |

|

|

Unrealized gains on derivatives |

|

— |

|

140 |

|

|

Other current assets |

|

259,886 |

|

262,603 |

|

|

|

|

16,410,397 |

|

17,319,149 |

|

|

NON-CURRENT ASSETS |

|

|

|

|

|

|

Available for sale securities |

|

— |

|

— |

|

|

Tax credits |

|

119,582 |

|

389,035 |

|

|

Deferred income taxes |

|

2,210,300 |

|

1,547,967 |

|

|

Related parties |

|

132,478 |

|

111,955 |

|

|

Unrealized gains on derivatives |

|

— |

|

— |

|

|

Judicial deposits |

|

922,578 |

|

713,480 |

|

|

Other non-current assets |

|

214,878 |

|

201,989 |

|

|

Prepaid pension cost |

|

553,095 |

|

533,740 |

|

|

Advance for capital increase in jointly-controlled entity |

|

— |

|

65,254 |

|

|

Investments in associates and jointly-controlled entities |

|

1,425,605 |

|

1,355,291 |

|

|

Other investments |

|

16,252 |

|

19,366 |

|

|

Goodwill |

|

10,033,396 |

|

9,155,789 |

|

|

Other Intangibles |

|

1,364,416 |

|

1,273,708 |

|

|

Property, plant and equipment, net |

|

19,690,181 |

|

17,295,071 |

|

|

|

|

36,682,761 |

|

32,662,645 |

|

|

TOTAL ASSETS |

|

53,093,158 |

|

49,981,794 |

|

GERDAU S.A.

CONSOLIDATED BALANCE SHEETS

as of December 31, 2012 and 2011

In thousands of Brazilian reais (R$)

|

|

|

2012 |

|

2011 |

|

|

CURRENT LIABILITIES |

|

|

|

|

|

|

Trade accounts payable |

|

3,059,684 |

|

3,212,163 |

|

|

Short-term debt |

|

2,324,374 |

|

1,715,305 |

|

|

Debentures |

|

257,979 |

|

41,688 |

|

|

Taxes payable |

|

528,698 |

|

591,983 |

|

|

Payroll and related liabilities |

|

558,634 |

|

617,432 |

|

|

Dividends payable |

|

47,379 |

|

136,391 |

|

|

Employee benefits |

|

53,930 |

|

40,199 |

|

|

Environmental liabilities |

|

24,536 |

|

31,798 |

|

|

Unrealized losses on derivatives |

|

1,535 |

|

314 |

|

|

Put options on non-controlling interests |

|

607,760 |

|

— |

|

|

Other current liabilities |

|

358,673 |

|

389,728 |

|

|

|

|

7,823,182 |

|

6,777,001 |

|

|

NON-CURRENT LIABILITIES |

|

|

|

|

|

|

Long-term debt |

|

11,725,868 |

|

11,182,290 |

|

|

Debentures |

|

360,334 |

|

744,245 |

|

|

Related parties |

|

15 |

|

6 |

|

|

Deferred income taxes |

|

1,795,963 |

|

1,858,725 |

|

|

Unrealized losses on derivatives |

|

6,664 |

|

5,013 |

|

|

Provision for tax, civil and labor liabilities |

|

1,081,381 |

|

907,718 |

|

|

Environmental liabilities |

|

42,395 |

|

36,621 |

|

|

Employee benefits |

|

1,187,621 |

|

1,089,784 |

|

|

Put options on non-controlling interests |

|

— |

|

533,544 |

|

|

Other non-current liabilities |

|

271,818 |

|

327,044 |

|

|

|

|

16,472,059 |

|

16,684,990 |

|

|

EQUITY |

|

|

|

|

|

|

Capital |

|

19,249,181 |

|

19,249,181 |

|

|

Treasury stocks |

|

(290,240 |

) |

(237,199 |

) |

|

Capital reserves |

|

11,597 |

|

11,597 |

|

|

Retained earnings |

|

9,647,587 |

|

8,635,239 |

|

|

Other reserves |

|

(1,372,521 |

) |

(2,661,349 |

) |

|

EQUITY ATTRIBUTABLE TO THE EQUITY HOLDERS OF THE PARENT |

|

27,245,604 |

|

24,997,469 |

|

|

|

|

|

|

|

|

|

NON-CONTROLLING INTERESTS |

|

1,552,313 |

|

1,522,334 |

|

|

|

|

|

|

|

|

|

EQUITY |

|

28,797,917 |

|

26,519,803 |

|

|

|

|

|

|

|

|

|

TOTAL LIABILITIES AND EQUITY |

|

53,093,158 |

|

49,981,794 |

|

GERDAU S.A.

CONSOLIDATED STATEMENTS OF INCOME

In thousands of Brazilian reais (R$)

|

|

|

For the three months period ended on |

|

For the years ended on |

| ||||

|

|

|

December 31, 2012 |

|

December 31, 2011 |

|

December 31, 2012 |

|

December 31, 2011 |

|

|

NET SALES |

|

8,987,704 |

|

9,065,801 |

|

37,981,668 |

|

35,406,780 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of sales |

|

(7,969,258 |

) |

(7,864,563 |

) |

(33,234,102 |

) |

(30,298,232 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

GROSS PROFIT |

|

1,018,446 |

|

1,201,238 |

|

4,747,566 |

|

5,108,548 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling expenses |

|

(156,316 |

) |

(157,910 |

) |

(587,369 |

) |

(603,747 |

) |

|

General and administrative expenses |

|

(450,477 |

) |

(484,163 |

) |

(1,884,306 |

) |

(1,797,937 |

) |

|

Reversal of impairment of assets |

|

— |

|

— |

|

— |

|

— |

|

|

Other operating income |

|

117,983 |

|

35,493 |

|

244,414 |

|

195,015 |

|

|

Other operating expenses |

|

(98,351 |

) |

(3,319 |

) |

(180,453 |

) |

(85,533 |

) |

|

Equity in earnings of unconsolidated companies |

|

(5,834 |

) |

(22,215 |

) |

8,353 |

|

62,662 |

|

|

|

|

|

|

|

|

|

|

|

|

|

NET INCOME BEFORE FINANCIAL INCOME (EXPENSES) AND TAXES |

|

425,451 |

|

569,124 |

|

2,348,205 |

|

2,879,008 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Financial income |

|

68,541 |

|

132,196 |

|

316,611 |

|

455,802 |

|

|

Financial expenses |

|

(271,851 |

) |

(231,119 |

) |

(952,679 |

) |

(970,457 |

) |

|

Exchange variations, net |

|

(14,230 |

) |

14,384 |

|

(134,128 |

) |

51,757 |

|

|

Gain and losses on derivatives, net |

|

(4,836 |

) |

2,556 |

|

(18,547 |

) |

(65,438 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

NET INCOME BEFORE TAXES |

|

203,075 |

|

487,141 |

|

1,559,462 |

|

2,350,672 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Income and social contribution taxes |

|

|

|

|

|

|

|

|

|

|

Current |

|

25,732 |

|

2,185 |

|

(316,271 |

) |

(519,843 |

) |

|

Deferred |

|

(86,146 |

) |

(17,732 |

) |

253,049 |

|

266,747 |

|

|

|

|

|

|

|

|

|

|

|

|

|

NET INCOME |

|

142,661 |

|

471,594 |

|

1,496,240 |

|

2,097,576 |

|

|

|

|

|

|

|

|

|

|

|

|

|

ATTRIBUTED TO: |

|

|

|

|

|

|

|

|

|

|

Owners of the parent |

|

131,022 |

|

438,802 |

|

1,425,633 |

|

2,005,727 |

|

|

Non-controlling interests |

|

11,639 |

|

32,792 |

|

70,607 |

|

91,849 |

|

|

|

|

142,661 |

|

471,594 |

|

1,496,240 |

|

2,097,576 |

|

GERDAU S.A.

CONSOLIDATED STATEMENTS OF CASH FLOW

for the years ended December 31, 2012 and 2011

In thousands of Brazilian reais (R$)

|

|

|

2012 |

|

2011 |

|

|

|

|

|

|

|

|

|

Cash flows from operating activities |

|

|

|

|

|

|

Net income for the year |

|

1,496,240 |

|

2,097,576 |

|

|

Adjustments to reconcile net income for the year to net cash provided by operating activities |

|

|

|

|

|

|

Depreciation and amortization |

|

1,827,499 |

|

1,771,881 |

|

|

(Reversal) Impairment of assets |

|

— |

|

— |

|

|

Equity in earnings of unconsolidated companies |

|

(8,353 |

) |

(62,662 |

) |

|

Exchange variation, net |

|

134,128 |

|

(51,757 |

) |

|

Losses (Gains) on derivatives, net |

|

18,547 |

|

65,438 |

|

|

Post-employment benefits |

|

38,665 |

|

15,882 |

|

|

Stock based remuneration |

|

36,699 |

|

13,974 |

|

|

Income tax |

|

63,222 |

|

253,096 |

|

|

Losses (Gains) on disposal of property, plant and equipment and investments |

|

7,890 |

|

21,006 |

|

|

Gains on available for sale securities |

|

— |

|

(28,073 |

) |

|

Allowance for doubtful accounts |

|

50,084 |

|

42,980 |

|

|

Provision for tax, labor and civil claims |

|

171,264 |

|

261,024 |

|

|

Interest income on investments |

|

(155,638 |

) |

(265,766 |

) |

|

Interest expense on loans |

|

811,416 |

|

828,106 |

|

|

Interest on loans with related parties |

|

(1,594 |

) |

(4,388 |

) |

|

Provision for net realisable value adjustment in inventory |

|

141,121 |

|

56,999 |

|

|

Reversal of net realisable value adjustment in inventory |

|

(86,710 |

) |

(122,877 |

) |

|

|

|

4,544,480 |

|

4,892,439 |

|

|

Changes in assets and liabilities: |

|

|

|

|

|

|

Decrease (Increase) in trade accounts receivable |

|

168,134 |

|

(203,041 |

) |

|

(Increase) Decrease in inventories |

|

(264,366 |

) |

(681,604 |

) |

|

(Decrease) Increase in trade accounts payable |

|

(522,870 |

) |

1,121,433 |

|

|

(Increase) Decrease in other receivables |

|

(664,819 |

) |

(415,192 |

) |

|

Decrease in other payables |

|

(314,906 |

) |

(127,854 |

) |

|

Distributions from jointly-controlled entities |

|

47,667 |

|

61,150 |

|

|

Purchases of trading securities |

|

(2,060,511 |

) |

(6,113,717 |

) |

|

Proceeds from maturities and sales of trading securities |

|

4,444,636 |

|

4,384,832 |

|

|

Cash provided by operating activities |

|

5,377,445 |

|

2,918,446 |

|

|

|

|

|

|

|

|

|

Interest paid on loans and financing |

|

(698,070 |

) |

(726,360 |

) |

|

Income and social contribution taxes paid |

|

(335,328 |

) |

(482,068 |

) |

|

Net cash provided by operating activities |

|

4,344,047 |

|

1,710,018 |

|

|

|

|

|

|

|

|

|

Cash flows from investing activities |

|

|

|

|

|

|

Additions to property, plant and equipment |

|

(3,127,256 |

) |

(1,961,379 |

) |

|

Proceeds from sales of property, plant and equipment, investments and other intangibles |

|

35,334 |

|

11,473 |

|

|

Additions to other intangibles |

|

(156,805 |

) |

(141,666 |

) |

|

Advance for capital increase in jointly-controlled entity |

|

(206,214 |

) |

(74,785 |

) |

|

Payment for business acquisitions, net of cash of acquired entities |

|

— |

|

— |

|

|

Purchases of available for sale securities |

|

— |

|

(723,285 |

) |

|

Proceeds from sales of available for sale securities |

|

— |

|

778,484 |

|

|

Cash and cash equivalents consolidated in business combinations |

|

16,916 |

|

— |

|

|

Net cash used in investing activities |

|

(3,438,025 |

) |

(2,111,158 |

) |

|

|

|

|

|

|

|

|

Cash flows from financing activities |

|

|

|

|

|

|

Capital increase |

|

— |

|

3,874,329 |

|

|

Effects of capital reduction in subsidiary |

|

(116,685 |

) |

— |

|

|

Purchase of treasury shares |

|

(44,932 |

) |

(85,262 |

) |

|

Proceeds from exercise of shares |

|

5,269 |

|

7,168 |

|

|

Dividends and interest on capital paid |

|

(523,076 |

) |

(550,706 |

) |

|

Payment of loans and financing fees |

|

— |

|

(25,530 |

) |

|

Proceeds from loans and financing |

|

1,767,350 |

|

1,378,637 |

|

|

Repayment of loans and financing |

|

(2,105,228 |

) |

(3,781,247 |

) |

|

Intercompany loans, net |

|

(18,992 |

) |

(90,325 |

) |

|

Payment for acquisition of additional interest in subsidiaries |

|

— |

|

— |

|

|

Net cash provided by /(used in) financing activities |

|

(1,036,294 |

) |

727,064 |

|

|

|

|

|

|

|

|

|

Exchange variation on cash and cash equivalents |

|

90,908 |

|

89,641 |

|

|

|

|

|

|

|

|

|

(Decrease) Increase in cash and cash equivalents |

|

(39,364 |

) |

415,565 |

|

|

Cash and cash equivalents at beginning of year |

|

1,476,599 |

|

1,061,034 |

|

|

Cash and cash equivalents at end of year |

|

1,437,235 |

|

1,476,599 |

|