Exhibit 99.1 – Annual Information Form

GOLD RESERVE INC.

ANNUAL INFORMATION FORM

For the Year Ended December 31, 2020

As filed on April 8, 2021

| 1 |

TABLE OF CONTENTS

The Company 3

General Development of the Business 4

Description of the Business 5

Cautionary Statement Regarding Forward-Looking Statements and Information 7

Properties 10

Dividends and Distributions 34

Description of Capital Structure 35

Directors and Officers 36

Audit Committee Information 39

Conflicts of Interest 41

Legal Proceedings and Regulatory Actions 41

Interest of Management and Others in Material Transactions 41

Transfer Agents and Registrars 42

Material Contracts 42

Interests of Experts 42

Additional Information 43

| 2 |

The Company

In this Annual Information Form, the terms "Gold Reserve", the "Company" "we," "us," or "our," refer to Gold Reserve Inc. and its consolidated subsidiaries and affiliates, unless the context requires otherwise. When appropriate, capitalized terms are defined herein.

Gold Reserve, an exploration stage company, is engaged in the business of acquiring, exploring and developing mining projects. We were incorporated in 1998 under the laws of the Yukon Territory, Canada and continued to Alberta, Canada in September 2014. We are the successor issuer to Gold Reserve Corporation, which was incorporated in 1956. We have only one operating segment, the exploration and development of mineral properties. We employed eight individuals as of December 31, 2020. Our Class A common shares (the "Class A Shares") are listed for trading on the TSX Venture Exchange (the "TSXV") and quoted on the OTCQX under the symbol GRZ and GDRZF, respectively.

We have no commercial production at this time. Historically we have financed our operations through the issuance of common stock, other equity securities and debt and more recently in 2018, from payments made by the Bolivarian Republic of Venezuela ("Venezuela") pursuant to the Settlement Agreement (as defined herein). Funds necessary for ongoing corporate activities, including the development of the Siembra Minera Project (as defined herein), which is subject to Sanctions (as defined herein), or other future investments and/or transactions if any, cannot be determined at this time and are subject to available cash, any future payments under the Settlement Agreement and/or collection of the unpaid Award (as defined herein) in the courts or future financings.

Our registered office is located at the office of Norton Rose Fulbright Canada LLP, 400 3rd Avenue SW, Suite 3700, Calgary, Alberta T2P 4H2, Canada. Telephone and fax numbers for our registered agent are 403.267.8222 and 403.264.5973, respectively. Our administrative office is located at 999 West Riverside Avenue, Suite 401, Spokane, WA 99201, U.S.A. and our telephone and fax numbers are 509.623.1500 and 509.623.1634, respectively. The Company's website address is www.goldreserveinc.com.

We conduct our business primarily through our wholly-owned subsidiaries. The following table lists the names of our significant subsidiaries, our ownership in each subsidiary and each subsidiary's jurisdiction of incorporation or organization.

| Subsidiary | Ownership | Domicile |

| Gold Reserve Corporation | 100% | Montana, USA |

| GR Mining (Barbados) Inc. | 100% | Barbados |

| GR Procurement (Barbados) Inc. | 100% | Barbados |

| GR Mining Group (Barbados) Inc. | 100% | Barbados |

In October 2016, together with an affiliate of the government of Venezuela, we established Siembra Minera (as defined herein), a company formed to develop the Siembra Minera Project (as defined herein). Siembra Minera is owned 45% by the Company and 55% by a Venezuelan state-owned entity. Our investment in Siembra Minera, which is held by GR Mining (Barbados) Inc., is accounted for as an equity investment.

We maintain our accounts in U.S. dollars and prepare our financial statements in accordance with accounting principles generally accepted in the United States. Our audited consolidated financial statements as at December 31, 2020 and 2019 and for the years ended December 31, 2020 and 2019 are available for review at www.sedar.com and www.sec.gov. All information in this Annual Information Form is as of April 8, 2021, unless otherwise noted. However, we undertake no duty to update or revise any of this information, whether as a result of future events, or otherwise, except to the extent required by law.

Unless otherwise indicated, all references to "$", "U.S. $" or "U.S. dollars" in this Annual Information Form refer to U.S. dollars and references to "Cdn$" or "Canadian dollars" refer to Canadian dollars. The 12-month average rate of exchange for one Canadian dollar, expressed in U.S. dollars, for each of the last two calendar years equaled 0.7455 and 0.7537, respectively, and the exchange rate at the end of each such period equaled 0.7841 and 0.7715, respectively.

| 3 |

General Development of the Business

Venezuela's Political, Economic and Social Conditions

Venezuela continues to experience substantial social, political and economic turmoil. The country's overall infrastructure, social services network and economy have generally collapsed. Further, certain non-Venezuelan countries (including the United States and Canada) currently recognize a presidency and government led by Juan Guaidó, instead of Nicolás Maduro, resulting in a "dual" government. In addition, in March 2020, the U.S. government indicted Venezuelan President Nicolás Maduro and a number of key associates for human rights abuses and drug trafficking.

The existing conditions in Venezuela, along with the Sanctions (as defined herein), are expected to continue in the foreseeable future, adversely impacting our ability to collect the remaining amount owed to us by Venezuela pursuant to the Settlement Agreement and/or Award and hinder our ability to develop certain gold, copper, silver and other strategic mineral rights contained within Bolivar State comprising what is known as the Siembra Minera project (the "Siembra Minera Project").

U.S. and Canadian Sanctions

The U.S. and Canadian governments have imposed various sanctions which, in aggregate, essentially prevent any dealings with Venezuelan government entities and prohibit the Company and its directors, management and employees from dealing with certain Venezuelan individuals or entering into certain transactions (the "Sanctions"). The cumulative impact of the Sanctions continues to restrict the Company from working with those Venezuelan government officials responsible for the payment and transfer of funds associated with the Settlement Agreement and those responsible for the operation of Siembra Minera and the development of the Siembra Minera Project (See "Description of the Business- U.S. and Canadian Sanctions").

On June 4, 2020, our Board of Directors (the "Board") created a special committee of its members (the “Special Committee”), for the purposes of making all decisions and taking all actions for and on behalf of the Board and the Company, and so binding the Company with respect to all matters related to or arising from the business of the Company, that are not permitted to be done by “U.S. Persons” (as defined in 31 C.F.R. § 591.312) pursuant primarily to Executive Orders 13884 and 13850 (“U.S. Sanctions”). The Special Committee is currently comprised of three individuals: two of whom are directors, Mr. Coleman and Mr. Gagnon, along with a former director, Mr. J.C. Potvin, who serves as an advisor to the Special Committee. None of these three members of the Special Committee are considered U.S. Persons.

Settlement of Arbitration Award

In July 2016, we signed a settlement agreement whereby Venezuela agreed to pay us the Award (as defined herein) including interest, and purchase our Mining Data (both as defined herein) (the "Settlement Agreement"). Under the terms of the Settlement Agreement (as amended) Venezuela agreed to pay the Company approximately $1.032 billion in a series of monthly payments ending on or before June 15, 2019. (See "Description of the Business - Arbitral Award, Settlement Agreement and Mining Data Sale"). On a cumulative basis, the Company has received payments of approximately $254 million pursuant to the Settlement Agreement. The remaining unpaid amount due from Venezuela, which is delinquent, totals approximately $900 million (including interest of approximately $122 million) as of December 31, 2020 (See "Description of the Business- U.S. and Canadian Sanctions"). Venezuela has not made the required payments pursuant to the terms of the Settlement Agreement and has not fulfilled remaining commitments associated with the formation of Siembra Minera and as a result is in breach of those agreements. Due to the complexity of Venezuela's political, economic and social situation and the obstacles presented by Sanctions we have concluded that, at this time, the best course of action is to continue to try to resolve the outstanding issues through continued dialog as allowed by Sanctions and the current conditions in Venezuela. (See "General Development of the Business- Empresa Mixta Ecosocialista Siembra Minera, S.A.").

| 4 |

Empresa Mixta Ecosocialista Siembra Minera, S.A.

In October 2016, Empresa Mixta Ecosocialista Siembra Minera, S.A. ("Siembra Minera") was established, which is beneficially owned 55% by a Venezuelan government-controlled corporation, and 45% by Gold Reserve (See "Properties– Siembra Minera Project"). Siembra Minera holds certain gold, copper, silver and other strategic mineral rights contained within Bolivar State comprising the Siembra Minera Project and is, among other things, authorized to carry on its business via existing or pending Presidential Decrees and Ministerial Resolutions. In March 2018, the Company announced the completion of a preliminary economic assessment (the "PEA") for the Siembra Minera Project in accordance with Canadian National Instrument 43-101 ̶ Standards of Disclosure for Mineral Projects ("NI 43-101"), which included, among other information, resource estimates, pit design, mine plan, flowsheet design, design criteria, project layout, infrastructure requirements, capital and operating estimates (See "Properties ̶ Siembra Minera Project ̶ Preliminary Economic Assessment").

Siembra Minera has no operations at this time. As a result, the Company has directly incurred cumulative costs through December 31, 2020 totaling approximately $21.0 million associated with the Siembra Minera Project (See "Properties ̶ Siembra Minera Project", "Description of the Business ̶ U.S. and Canadian Sanctions" and "Cautionary Statement Regarding Forward-Looking Statements and Information").

Description of the Business

Arbitral Award, Settlement Agreement and Mining Data Sale

Our primary business activities at this time are the collection of the remaining amounts owed to us by Venezuela and the advancement of the Siembra Minera Project (See "Properties ̶ Siembra Minera Project").

In October 2009, we initiated a claim (the "Brisas Arbitration") under the Additional Facility Rules of the International Centre for the Settlement of Investment Disputes ("ICSID") to obtain compensation for the losses caused by the actions of Venezuela that terminated our Brisas Project (as herein defined) in violation of the terms of the Treaty between the Government of Canada and the Government of Venezuela for the Promotion and Protection of Investments. In September 2014, the ICSID Tribunal granted us an Arbitral Award (the "Award") totaling $740.3 million. The Award (less legal costs and expenses) currently accrues post-award interest at a rate of LIBOR plus 2%, compounded annually.

Under the terms of the July 2016 Settlement Agreement (as amended) Venezuela agreed to pay the Company $792 million to satisfy the Award and $240 million for the purchase of our technical mining data (the "Mining Data") associated with our previous mining project in Venezuela (the "Brisas Project") for a total of approximately $1.032 billion in a series of monthly payments ending on or before June 15, 2019. As agreed, the first $240 million received by Gold Reserve from Venezuela has been recognized as proceeds from the sale of the Mining Data.

The terms of the Settlement Agreement included the Company's agreement to suspend the legal enforcement of the Award until final payment is made by Venezuela and Venezuela's agreement to irrevocably waive its right to appeal the February 2017 judgment issued by the Cour d'appel de Paris dismissing the annulment applications filed by Venezuela in respect of the Award and to terminate all other proceedings seeking annulment of the Award.

As of the date of this Annual Information Form, the Company had received payments of approximately $254 million pursuant to the Settlement Agreement. The remaining unpaid amount due from Venezuela pursuant to the Settlement Agreement, which is delinquent, totals approximately $900 million (including interest of approximately $122 million) as of December 31, 2020.

The interest rate provided for on any unpaid amounts pursuant to the Award is specified as LIBOR plus two percent. In 2017, U.K.’s Financial Conduct Authority announced that LIBOR will be phased out of existence as a dependable index for variable interest rates no later than December 31, 2021. Working groups assembled by the U.S. Federal Reserve have identified the Secured Overnight Funding Rate ("SOFR") as the preferred replacement for LIBOR. SOFR reflects the cost of borrowing in dollars in the daily overnight treasury repo market. If and when it is possible to engage with the Venezuelan government, we expect that we will either come to an agreement with Venezuela as to an appropriate replacement or, alternatively, petition the court responsible for the enforcement of our Award judgement to rule on a new interest rate benchmark. There is no assurance that we will be successful.

| 5 |

The terms of the Settlement Agreement also included Venezuela's obligation to make available to an escrow agent negotiable financial instruments, with a face value of at least $350 million, partially guaranteeing the payment obligations to the Company as well as the obligation to advance approximately $110 million to Siembra Minera to facilitate the early startup of the pre-operation and construction activities. As of the date of this Annual Information Form, Venezuela has not yet taken steps to provide such collateral or the early funding and it is unclear if and when Venezuela will comply with these particular obligations contained in the Settlement Agreement (See "Description of the Business- U.S. and Canadian Sanctions" and "Cautionary Statement Regarding Forward-Looking Statements and Information").

U.S. and Canadian Sanctions

The Sanctions, in aggregate, essentially prevent any dealings with Venezuelan government entities and prohibit the Company and its directors, management and employees from dealing with certain Venezuelan individuals or entering into certain transactions.

The Sanctions implemented by the U.S. government generally block all property of the Venezuelan government and state-owned/controlled entities such as Siembra Minera. In addition, U.S. Sanctions prohibit U.S. persons (as defined by U.S. Sanctions statutes) from dealing with Specially Designated Nationals ("SDNs") and targets corruption in, among other identified sectors, the gold sector of the Venezuelan economy.

The Sanctions implemented by the Canadian government generally include asset freezes and impose prohibitions on dealings, by Canadian entities and/or individuals as well as other individuals located in Canada, with certain named Venezuelan officials under the Special Economic Measures (Venezuela) Regulations of the Special Economic Measures Act and the Justice for Victims of Corrupt Foreign Officials Regulations of the Justice for Victims of Corrupt Foreign Officials Act (Sergei Magnitsky Law).

On June 4, 2020, the Board created the Special Committee, for the purposes of making all decisions and taking all actions for and on behalf of the Board and the Company, and so binding the Company with respect to all matters related to or arising from the business of the Company, that are not permitted to be done by “U.S. Persons” (as defined in 31 C.F.R. § 591.312) pursuant primarily to U.S. Sanctions. This is part of the Company’s efforts to ensure compliance with applicable laws, including, without limitation, U.S. Sanctions, the Special Economic Measures (Venezuela) Regulations enacted pursuant to the Special Economic Measures Act and the Justice for Victims of Corrupt Foreign Officials Regulations of the Justice for Victims of Corrupt Foreign Officials Act (Sergei Magnitsky Law). The Special Committee will also ensure that the Company’s actions that it directs are in compliance with applicable laws. The Special Committee is currently comprised of three individuals: two of whom are directors, Mr. Coleman and Mr. Gagnon, along with a former director, Mr. J.C. Potvin who serves as an advisor to the Special Committee. None of these three members of the Special Committee are considered U.S. Persons.

The cumulative impact of the Sanctions restricts the Company from working with those Venezuelan government officials responsible for the payment and transfer of funds associated with the Settlement Agreement and those responsible for the operation of Siembra Minera and the development of the Siembra Minera Project which adversely impacts our ability to collect the remaining amount due pursuant to the Settlement Agreement and/or the Award from Venezuela and, until Sanctions are lifted, obstructs our ability to develop the Siembra Minera Project as originally planned.

Obligations Due Upon Collection of the Award and Sale of Mining Data

Pursuant to a 2012 restructuring of convertible notes, we issued Contingent Value Rights ("CVRs") that entitle the holders to an aggregate of 5.466% of certain proceeds from Venezuela associated with the collection of the Award and/or sale of Mining Data or an enterprise sale (the "Proceeds"), less amounts sufficient to pay or reserve for applicable taxes payable, certain associated professional fees and expenses not to exceed $10 million, any accrued operating expenses as of the date of the receipt of the Proceeds not to exceed $1 million and the balance of any remaining Notes (as defined in the Agreement) and accrued interest thereon (the "Net Proceeds"). We have been advised by a CVR holder that it believes that the Company's 45% interest in Siembra Minera represents "Proceeds" for purposes of the CVRs and as such it believes the CVR holders are entitled to the value of 5.466% of that interest on the date of its acquisition. For a variety of reasons, the Company does not agree with that position and believes it is inconsistent with the CVRs and the terms and manner upon which we reached settlement as to the Award with the Venezuelan government. This matter has not been resolved as of the date of this Annual Information Form and it is not possible at this time to determine its outcome. As of December 31, 2020, the total cumulative estimated obligation due pursuant to the terms of the CVR from the sale of the Mining Data and collection of the Award was approximately $10.0 million, of which approximately $60 thousand remains payable to CVR holders.

| 6 |

The Board approved a bonus plan (the "Bonus Plan") in May 2012, which was intended to compensate the participants, including executive officers, employees, directors and consultants for their contributions related to: the development of the Brisas Project; the manner in which the development effort was carried out allowing the Company to present a strong defense of its arbitration claim; the support of the Company's execution of the Brisas Arbitration; and the ongoing efforts to assist with positioning the Company in the collection of the Award, sale of the Mining Data or enterprise sale. The bonus pool under the Bonus Plan is comprised of the gross proceeds collected or the fair value of any consideration realized less applicable taxes multiplied by 1.28% of the first $200 million and 6.4% thereafter. The Bonus Plan is administered by a committee of independent directors who selected the individual participants in the Bonus Plan and fixed the relative percentage of the total pool to be distributed to each participant. Participation in the Bonus Plan by existing participants isfixed, subject to voluntary termination of employment or termination for cause. Participants who reach age 65 and retire are fully vested and continue to participate in future distributions under the Bonus Plan. As of December 31, 2020, the total cumulative estimated obligation pursuant to the terms of the Bonus Plan from the sale of the Mining Data and collection of the Award was approximately $4.4 million, of which approximately $70 thousand remains payable to Bonus Plan participants.

In March 2020, the U.S. Congress passed legislation which allows companies to carryback net operating losses incurred in 2018, 2019 and 2020 to offset income earned in prior years. In response to this legislation, management reduced its estimate of the U.S. related income tax due on amounts received in 2018 from the sale of Mining Data. The effect of this change in estimate was to increase the net proceeds subject to the CVR and the Bonus Plan, and as a result, the Company recorded an increase in its obligation to the CVR holders and Bonus Plan participants by approximately $60 thousand and $70 thousand, respectively.

Distribution of Funds to Shareholders and Intention to Distribute Funds Received in Connection with the Award in the Future

In June 2019, the Company completed a distribution of approximately $76 million or $0.76 per share to holders of Class A Shares as a return of capital (the "Return of Capital"). The Return of Capital was completed pursuant to a plan of arrangement under the Business Corporations Act (Alberta) (the "ABCA") which required approval by the Alberta Court of Queen's Bench (the "Court") and at least two-thirds of the votes cast by shareholders of the Company ("Shareholders") in respect of a special resolution. Full details of the Return of Capital are described in the Company's management proxy circular dated April 30, 2019 and other related materials filed with applicable Canadian securities regulatory authorities and made available at www.sedar.com or www.sec.gov, and posted on the Company's website at www.goldreserveinc.com.

Following the receipt, if any, of additional funds associated with the Settlement Agreement and/or Award and after applicable payments of Net Proceeds to holders of our CVRs and participants under our Bonus Plan, we expect to distribute to our Shareholders a substantial majority of any remaining proceeds, subject to applicable regulatory requirements and retaining sufficient reserves for operating expenses, contractual obligations, accounts payable and income taxes, and any obligations arising as a result of the future collection of the remaining amounts owed by Venezuela.

Cautionary Statement Regarding Forward-Looking Statements and Information

The information presented or incorporated by reference in this Annual Information Form contains both historical information and "forward-looking statements" (within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act) or "forward-looking information" (within the meaning of applicable Canadian securities laws) (collectively referred to herein as "forward-looking statements") that may state our intentions, hopes, beliefs, expectations or predictions for the future.

Forward-looking statements are necessarily based upon a number of estimates and assumptions that, while considered reasonable by us at this time, are inherently subject to significant business, economic and competitive uncertainties and contingencies that may cause our actual financial results, performance or achievements to be materially different from those expressed or implied herein, many of which are outside our control.

Forward-looking statements involve risks and uncertainties, as well as assumptions, including those set out herein, that may never materialize, prove incorrect or materialize other than as currently contemplated which could cause our results to differ materially from those expressed or implied by such forward-looking statements. The words "believe," "anticipate," "expect," "intend," "estimate," "plan," "may," "could" and other similar expressions that are predictions of or indicate future events and future trends, which do not relate to historical matters, identify forward-looking statements, although not all forward-looking statements contain these words. Any such forward-looking statements are not intended to provide any assurances as to future results.

| 7 |

Numerous factors could cause actual results to differ materially from those described in the forward-looking statements, including, without limitation:

| ● | risks associated with the substantial concentration of our activities and assets in Venezuela which are and will continue to be subject to risks specific to Venezuela, including the effects of political, economic and social developments, social instability and unrest; international response to Venezuelan domestic and international policies; Sanctions by the U.S. or Canadian governments or other jurisdictions and potential invalidation, confiscation, expropriation or rescission of governmental orders, permits, agreements or property rights either by the existing or a future administration or power, de jure or de facto; |

| ● | risks associated with the Sanctions: |

| - | Sanctions imposed by the U.S. government generally block all property of the government of Venezuela and prohibit the Company and its directors, management and employees (who are considered U.S. Persons as defined by U.S. Sanction statutes) from dealing with the Venezuelan government and/or state-owned/controlled entities, entering into certain transactions or dealing with SDNs and target corruption in, among other identified sectors, the gold sector of the Venezuelan economy, |

| - | Sanctions imposed by the Canadian government include asset freezes and prohibitions on dealings, by Canadian entities and/or citizens as well as other individuals in Canada, with certain named Venezuelan officials under the Special Economic Measures (Venezuela) Regulations of the Special Economic Measures Act and the Justice for Victims of Corrupt Foreign Officials Regulations of the Justice for Victims of Corrupt Foreign Officials Act (Sergei Magnitsky Law), |

| - | Sanctions have adversely impacted our ability to collect the remaining funds owed by Venezuela and our ability to finance, develop and operate the Siembra Minera Project, which is expected to continue for an indeterminate period of time; |

| ● | risks that U.S. and Canadian government agencies that enforce Sanctions may not issue licenses that the Company may request in the future to engage in certain Venezuela-related transactions; |

| ● | risks associated with the continued failure by Venezuela to honor its remaining commitments under the Settlement Agreement. As of the date of this report, Venezuela still owes the Company an estimated $900 million (including interest of approximately $122 million) related to the original settlement obligation of approximately $1.032 billion, which was payable in a series of monthly payments ending on or before June 15, 2019; |

| ● | risks associated with our ability to resume our efforts to enforce and collect the Award" including the associated costs of enforcement and collection efforts and the timing and success of that effort, if Venezuela ultimately fails to honor its commitments pursuant to the Settlement Agreement, it is terminated and further efforts related to executing the Settlement Agreement are abandoned; |

| ● | risks associated with the announced phase out of the LIBOR in December 2021 and our ability, if and when it is possible to engage with the Venezuelan government, to either agree with Venezuela on a new interest benchmark or, alternatively, petition the court responsible for the enforcement of our Award judgement to rule on a new benchmark; |

| ● | risks associated with Venezuela's failure to honor its remaining commitments associated with the formation and operation of Siembra Minera (a company formed to develop the Siembra Minera Project which is comprised of certain gold, copper, silver and other strategic mineral rights located in Bolivar State, Venezuela); |

| ● | risks associated with the ability of the Company and Venezuela to (i) successfully overcome legal or regulatory obstacles to operate Siembra Minera for the purpose of developing the Siembra Minera Project, (ii) complete any additional definitive documentation and finalize remaining governmental approvals and (iii) obtain financing to fund the capital costs of the Siembra Minera Project; |

| ● | risks associated with filing a claim, if warranted, for damages against Venezuela in the event they breach the terms of the underlying agreements governing the formation of Siembra Minera and the future development of the Siembra Minera Project. The cost of prosecuting such a claim over a number of years could be substantial, and there is no assurance that we would be successful in our claim or, if successful, could collect any compensation from the Venezuelan government. If we are unable to prevail, in the event we filed a claim against the Venezuelan government related to our stake in the Siembra Minera Project or were unable to collect compensation in respect of our claim, the Company would be adversely affected; |

| 8 |

| ● | risks associated with the existence of "dual" governments in Venezuela as a result of certain non-Venezuelan countries (including the United States and Canada) recognizing a presidency and government led by Juan Guaidó, instead of Nicolás Maduro, including associated challenges as to governing and decision-making authority related thereto, and the U.S. government's previous indictment of Venezuelan President Nicolás Maduro and a number of key associates for human rights abuses and drug trafficking; |

| ● | risks that any future Venezuelan administration or power, de jure or de facto, will fail to respect the agreements entered into by Gold Reserve and Venezuela, including past or future actions of any branch of Government challenging the formation of Siembra Minera and Presidential Decree No. 2.248 creating the National Strategic Development Zone Mining Arc of the Orinoco; |

| ● | the risk that the conclusions of management and its qualified consultants contained in the Preliminary Economic Assessment of the Siembra Minera Project in accordance with NI 43-101 may not be realized in the future; |

| ● | risks associated with exploration, delineation of sufficient reserves, regulatory and permitting obstacles and other risks associated with the development of the Siembra Minera Project; |

| ● | risks associated with our ability to service outstanding obligations as they come due and access future additional funding, when required, for ongoing liquidity and capital resources, pending the receipt of payments under the Settlement Agreement or collection of the Award in the courts; |

| ● | risks associated with our prospects in general for the identification, exploration and development of mining projects and other risks normally incident to the exploration, development and operation of mining properties, including our ability to achieve revenue producing operations in the future; |

| ● | risks that estimates and/or assumptions required to be made by management in the course of preparing our financial statements are determined to be inaccurate, resulting in a negative impact on the reported amounts of assets and liabilities, disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period; |

| ● | risks associated with shareholder dilution resulting from the future sale of additional equity, if required; |

| ● | risks associated with the value realized, if any, from the disposition of the assets related to our previous mining project in Venezuela known as the "Brisas Project"; |

| ● | risks associated with the abilities of and continued participation by certain employees; |

| ● | risks associated with the impact of current or future U.S., Canadian and/or other jurisdiction's tax laws to which we are or may be subject; and |

| ● | risks associated with the impact of new diseases, epidemics and pandemics, including the effects and potential effects of the global coronavirus disease 2019 ("COVID-19") pandemic. |

This list is not exhaustive of the factors that may affect any of our forward-looking statements. See "Risk Factors" in Management's Discussion and Analysis for the fiscal year ended December 31, 2020 which has been filed on SEDAR and is available for review at www.sedar.com.

Investors are cautioned not to put undue reliance on forward-looking statements, and investors should not infer that there has been no change in our affairs since the date of this Annual Information Form that would warrant any modification of any forward-looking statement made in this document, other documents periodically filed with the Ontario Securities Commission, U.S. Securities and Exchange Commission (the "SEC") or other securities regulators or presented on the Company's website. Forward-looking statements speak only as of the date made. All subsequent written and oral forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by this notice. We disclaim any intent or obligation to update publicly or otherwise revise any forward-looking statements or the foregoing list of assumptions or factors, whether as a result of new information, future events or otherwise, subject to our disclosure obligations under applicable U.S. and Canadian securities regulations. Investors are urged to read the Company's filings with Canadian and U.S. securities regulatory agencies, which can be viewed online at www.sedar.com and www.sec.gov, respectively. The forward-looking information contained herein is presented for the purpose of assisting investors in understanding the Company’s expected financial and operational performance and results as at and for the periods ended on the dates presented in the Company’s plans and objectives and may not be appropriate for other purposes.

| 9 |

The terms "mineral resource," "measured mineral resource," "indicated mineral resource" and "inferred mineral resource" are defined in and required to be disclosed by NI 43-101. However, these terms are not defined terms under SEC Industry Guide 7 and normally are not permitted to be used in reports and registration statements filed with the SEC. Investors are cautioned not to assume that any part or all of the mineral deposits in these categories will ever be converted into reserves. "Inferred mineral resources" have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an inferred mineral resource will ever be upgraded to a higher category. Under Canadian rules, estimates of inferred mineral resources may not form the basis of feasibility or pre-feasibility studies, except in rare cases, and such estimates are not part of the SEC industry Guide 7.

Properties

SIEMBRA MINERA PROJECT

Overview

In August 2016, we executed the Contract for the Incorporation and Administration of the Mixed Company with the government of Venezuela (the "Mixed Company Formation Document") to form a jointly owned company and in October 2016, together with an affiliate of the government of Venezuela, we established Siembra Minera, the entity whose purpose is to develop the Siembra Minera Project. Siembra Minera is beneficially owned 55% by Corporacion Venezolana de Mineria, S.A., a Venezuelan government corporation, and 45% by Gold Reserve. Although Venezuela is not current with its obligations outlined in the Settlement Agreement, the parties retain their respective interests in Siembra Minera.

Siembra Minera holds certain gold, copper, silver and other strategic mineral rights within Bolivar State comprising approximately 18,950 hectares in an area located in the Km 88 gold mining district of southeast Bolivar State which includes the historical Brisas and Cristinas areas. The mineral rights held by Siembra Minera have a 20-year term with two 10-year extensions.

Gold Reserve, under a yet to be completed Technical Services Agreement, would provide engineering, procurement and construction services to Siembra Minera for a fee of 5% over all costs of construction and development and, thereafter, for a fee of 5% over operating costs during operations. Venezuela is obligated to use its best efforts to grant to Siembra Minera similar terms that would apply to the Siembra Minera Project in the event Venezuela enters into an agreement with a third party for the incorporation of a Mixed Company (as defined herein) to perform similar activities with terms and conditions that are more favorable than the tax and fiscal incentives contemplated in the Mixed Company Formation Document and is obligated to indemnify us and our affiliates against any future legal actions related to property ownership associated with the Siembra Minera Project.

There are significant provisions related to the formation of Siembra Minera and the development and operation of the Siembra Minera Project, as provided in the Mixed Company Formation Document, some of which are still pending completion. There are a number of pending authorizations and/or still to be completed obligations on the part of the Venezuelan government that are critical to the financing and future operation of the Siembra Minera Project.

Venezuela agreed to certain Presidential Decrees, within the legal framework of the "Orinoco Mining Arc" (created on February 24, 2016 under Presidential Decree No. 2.248 as an area for national strategic development Official Gazette No. 40.855), that will or have been issued to provide for tax and fiscal incentives for companies owned jointly with the government ("Mixed Companies") operating in that area that include exemption from value added tax, stamp tax, municipal taxes and any taxes arising from the contribution of tangible or intangible assets, if any, to the Mixed Companies by the parties and the same cost of electricity, diesel and gasoline as that incurred by the government or related entities.

Siembra Minera is obligated to pay to the government a special advantage of 3% of gross sales and a net smelter return royalty ("NSR") on the sale of gold, copper, silver and any other strategic minerals of 5% for the first ten years of commercial production and 6% for the next ten years. The parties also agreed to participate in the price of gold in accordance with a formula resulting in specified respective percentages based on the sales price of gold per ounce. For sales up to $1,600 per ounce, net profits will be allocated 55% to Venezuela and 45% to us. For sales greater than $1,600 per ounce, the incremental amount will be allocated 70% to Venezuela and 30% to us. For example, with sales at $1,600 and $3,500 per ounce, net profits will be allocated 55.0% - 45.0% and 60.5% - 39.5%, respectively.

Venezuela is obligated to advance $110.2 million to Siembra Minera to facilitate the early startup of the pre-operation and construction activities, but has not yet taken steps to provide such funding and Siembra Minera is obligated, with Venezuela's support, to undertake initiatives to secure financing(s) to fund the anticipated capital costs of the Siembra Minera Project, which are estimated to be in excess of $2 billion. To date, no verifiable financing alternatives have been identified.

| 10 |

The Mixed Company Formation Documents provide for Siembra Minera, pursuant to Presidential Decrees or other authorizations, to be subject to an income tax rate of 14% for years one to five, 19% for years six to ten, 24% for years eleven to fifteen, 29% for years sixteen to twenty and 34% thereafter; to be authorized to export and sell concentrate and doré containing gold, copper, silver and other strategic minerals outside of Venezuela and maintain foreign currency balances associated with sales proceeds; to hold funds associated with future capital cost financings and sale of gold, copper and silver offshore in U.S. dollar accounts with dividend and profit distributions, if any, paid directly to Siembra Minera shareholders; to convert all funds into local currency at the same exchange rate offered by Venezuela to other similar entities, as required to pay Venezuela income taxes and annual operating and capital costs denominated in Bolivars for the Siembra Minera Project. As of the date of this Annual Information Form, Venezuela has not yet taken steps to formally provide such authorizations via Presidential Decree or otherwise.

On October 8, 2020, the Venezuelan National Constituent Assembly approved an “anti-blockade” law, published in Special Official Gazette Nº 6.583 of October 12th, 2020 (the "Law"). The Law is reportedly part of the Maduro administration's strategy to overcome the financial, economic and commercial consequences of U.S. Sanctions. The Law, which according to its own terms ranks as a constitutional law, was passed to provide President Maduro the tools to mitigate the effects of U.S. Sanctions on Venezuela. The Law, in part, allows the Venezuelan government to implement programs to foster investments in projects or alliances in strategic sectors, including the power to sell State assets, lower or increase State interest in mixed companies and suspend legal and sublegal norms that it considers counterproductive due to sanctions. The Law provides strict provisions of confidentiality that would exclude from public scrutiny transactions that are permitted thereunder. Members of the opposition government and academic and professional associations in Venezuela have questioned the constitutionality of the Law. Additionally, they claim that the Law will lead to a lack of transparency and accountability. It is unclear if the Law will have any current or future impact on the Company's operations.

While it is difficult to predict, it is possible that if there were to be a change of government in Venezuela that gives control to the opposition, the new government may challenge the Maduro administration's 2016 formation of Siembra Minera and Presidential Decree No, 2.248 which created the National Strategic Development Zone Mining Arc of the Orinoco where the Siembra Minera Project is located. The impact of recent or future actions by an opposition controlled government could adversely affect the Company's ownership interest in Siembra Minera or its future operations in Venezuela.

Siembra Minera Project Completed Activities

The Company completed a number of social programs to improve the health care in the Siembra Minera Project area including addressing the malaria problem with medicine and preventive measures as well as the completion of an estimated $6 million works program to build new facilities and rehabilitate existing facilities at the four largest schools, a church and recreational and sport facilities for the students and the community. The Company also established a facility to house a radio station at one school to improve local communications and generated preliminary engineering assessments for potential future upgrades to the local communities' water supply and sewage system infrastructure.

Prior to the implementation of the Sanctions, the Company's development activities included the following, much of which were completed prior to 2019: published the results of the PEA in accordance with NI 43-101; completed the preliminary design and engineering on the small scale Phase I oxide saprolite process plant and the Phase 2 larger hard rock process plant; completed the preliminary design work for a Phase 1 and Phase 2 Tailings Dam design; completed and obtained approval of a Venezuelan Environmental Impact Statement; subsequently received the environmental permit to affect the Area for the early works (the "Permit to Affect"); collected and transported a surface saprolite material sample to the U.S. for future metallurgical testing; validated, with the assistance of Empresa Nacional Forestal (a state owned company affiliated with the Ministry of Environment), the forest inventory for the Siembra Minera Project area; assisted with the preparation of budgets for Siembra Minera according to parameters set forth by the Venezuelan budgeting agency; obtained, the "Initiation Act", pursuant to the Permit to Affect, allowing Siembra Minera to initiate the authorized preliminary/early works on the Siembra Minera Project; completed in March 2019 the Environmental Supervision Plan for the permitted (early or preliminary) works; hosted two community events for the granting of the Permit to Affect and the granting of the Initiation Act; worked with Mission Piar (Small Miner Program affiliated with the Ministry of Mines) to complete an initial survey and census of small miners located in the Siembra Minera Project area, which included cataloging identities, locations, infrastructure and health status; completed a feasibility study for a rock quarry in March 2019 as part of the opening of the quarry needed for the "early works" and during both Phases I and II of the Siembra Minera Project; and assisted small miner alliances, with the support of the Ministry of Mines, to obtain mining rights to property north of the Siembra Minera Project – with the purpose of relocating small miners from the Siembra Minera Project area.

Siembra Minera has no operations at this time. As a result, the Company has directly incurred cumulative costs through December 31, 2020 associated with the Siembra Minera Project, totaling approximately $21.0 million. (See "Description of the Business ̶ U.S. and Canadian Sanctions" and "Cautionary Statement Regarding Forward-Looking Statements and Information").

| 11 |

Siembra Minera Project Development

We have considered initial plans for various on-site activities such as site clearing, construction of a temporary camp and warehouse facilities, drilling of dewatering and development drill holes, access roads on the property, opening of the quarry for construction aggregates and initial construction activities. We have evaluated initial proposals for a drilling program in support of the overall project development activities, water management wells, and test areas where additional resource potential is evident. Various geotechnical studies as well as environmental and social studies to augment and update previous work on the property have been considered which could support the generation of a pre-feasibility study for the small and large plant and generate Environmental & Social Impact Assessments ("ESIA") for the support of the various operating and environmental permits that will be required for the Siembra Minera Project. The next phase of the Siembra Minera Project's development is envisioned to include detail design work for the small cyanidation plant and related facilities along with the metallurgical testing to support the metallurgical process used in the plant.

The Sanctions severely obstruct our ability to develop the Siembra Minera Project and, until such time as Sanctions are lifted, we expect our activities in Venezuela will be limited. It is unclear to management if any new Venezuelan administration or power, de jure or de facto, in the future will respect the agreements of the prior administration (See "Description of the Business - U.S. and Canadian Sanctions").

Preliminary Economic Assessment

Set forth below is the summary section of the March 16, 2018 technical report for the PEA of the Siembra Minera Project Report prepared in compliance with NI 43-101. The scientific and technical information contained therein, including resource estimates, pit design, mine plan, flowsheet design, design criteria, project layout, infrastructure requirements, capital and operating estimates was prepared by Roscoe Postle Associates, Inc. ("RPA"), Samuel Engineering Inc., Tierra Group International, Ltd. and AATA International, Inc. The Qualified Persons (as defined in NI 43-101) in respect of the PEA who have reviewed, verified and approved such information are Richard J. Lambert, P.E., P.Eng., José Texidor Carlsson, P.Geo., Grant A. Malensek, P.Eng., Hugo Miranda, C.P. and Kathleen A. Altman, Ph.D., P.E., each of whom is independent of the Company. The PEA was filed on SEDAR on April 6, 2018 and is available at www.sedar.com. The following information is of a summary nature only and reference is made to the detailed disclosure contained in the PEA, which is incorporated herein by reference. Note that, subsequent to the publication of the PEA discussed below, GR Engineering (Barbados) Inc. changed its name to GR Procurement (Barbados) Inc.

All information contained in the PEA is as of March 16, 2018. The information and conclusions contained in the PEA do not consider the impact of Sanctions nor consider the effects of the current Venezuelan political climate, economic conditions, deteriorated infrastructure and social instability or the impact of the world-wide pandemic on Venezuela since its completion. These issues and other negative factors could adversely affect the assumptions underlying the economic analysis contained in the PEA (See Cautionary Statement Regarding Forward-Looking Statements and Information). The full text of the PEA can be found on our website at www.goldreserveinc.com, as well as, www.sedar.com or www.sec.gov.

The PEA is preliminary in nature and includes inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves. The PEA only demonstrates potential viability and there is no certainty that the PEA will be realized, or that any production will be realized from the Siembra Minera Project. Mineral resources are not mineral reserves and do not have demonstrated economic viability. The potential viability of the mineral resources at the Siembra Minera Project have not yet been supported by a pre-feasibility or a feasibility study. The terms "mineralised material" and "material" are used in this summary to denote mineralised material above an economic cut-off grade on which the proposed mining and processing activities are designed to operate. It does not imply that mineral reserves have been estimated.

The terms "mineral resource," "measured mineral resource," "indicated mineral resource" and "inferred mineral resource" are defined in and required to be disclosed by NI 43-101. However, these terms are not defined terms under SEC Industry Guide 7 and normally are not permitted to be used in reports and registration statements filed with the SEC. Investors are cautioned not to assume that any part or all of the mineral deposits in these categories will ever be converted into reserves. "Inferred mineral resources" have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an inferred mineral resource will ever be upgraded to a higher category. Under Canadian rules, estimates of inferred mineral resources may not form the basis of feasibility or pre-feasibility studies, except in rare cases, and such estimates are not part of the SEC Industry Guide 7.

| 12 |

Summary of March 16, 2018 PEA on the Siembra Minera Project

Executive Summary

Roscoe Postle Associates Inc. ("RPA") was retained by Gold Reserve, and its wholly owned subsidiary GR Engineering Barbados, Inc. ("GRE") to prepare an independent Technical Report on the Siembra Minera Project, located in Bolivar State, Venezuela. The operating company, Siembra Minera, which holds the rights to the Siembra Minera Project, is a mixed capital company with 55% being owned by a Venezuelan state entity Corporación Venezolana de Minería ("CVM"), and 45% by GR Mining Barbados, Inc. ("GRM"), a wholly-owned subsidiary of Gold Reserve. GRE has been set up to perform engineering, procurement, construction, and operation of the Siembra Minera Project.

The Project is a combination of the Brisas and Cristinas properties into a single project now called the Siembra Minera Project. The purpose of this report is to provide Gold Reserve and GRE with an initial assessment of the Siembra Minera Project including a resource estimate, conceptual mine plan, and a preliminary economic review. This Technical Report conforms to NI 43-101 Standards of Disclosure for Mineral Projects. RPA visited the Siembra Minera Project on September 19, 2017.

The Siembra Minera Project is a gold-copper deposit located in the Kilometre 88 mining district of Bolivar State in southeast Venezuela. Local owners and illegal miners have worked the property for many years. Shallow pitting and hydraulic methods were used to mine the upper saprolite zone, and coarse gold was recovered by gravity concentration and amalgamation with mercury. Most of the large-scale exploration work at Cristinas was performed by Placer Dome Inc. ("Placer"), which worked on the property from 1991 to 2001. At Brisas, Gold Reserve carried out the exploration program on the concession from 1992 to 2005. The most recent Technical Report for Cristinas is dated November 7, 2007, which is based on a feasibility study and includes historic mineral reserves. The most recent Technical Report for Brisas is dated March 31, 2008, which is also based on a feasibility study and includes historic mineral reserves.

RPA has relied on data derived from work completed by previous owners on the Cristinas concessions and by Gold Reserve on the Brisas concessions. The current resources for Cristinas were estimated by RPA based on the drill hole data supplied by Corporación Venezolana de Guayana ("CVG") to Gold Reserve in 2002. The database had 1,174 drill holes and 108 trenches which were included in the Cristinas database. Hard copies of the assay data sheets were not available, however, GEOLOG data files from Placer were provided including assay data, geological descriptions, structural data, geotechnical data, and check sample data. The current resources for Brisas were estimated by RPA based on drill hole data supplied by Gold Reserve in Geovia GEMS format which formed the basis of the last Technical Report by Pincock Allen & Holt ("PAH") in 2008.

This report is considered by RPA to meet the requirements of a "Preliminary Economic Assessment" as defined in NI 43-101. The mine plan and economic analysis contained in the PEA are based, in part, on Inferred Mineral Resources, and are preliminary in nature. Inferred Mineral Resources are considered too geologically speculative to have mining and economic considerations applied to them that would enable them to be categorized as Mineral Reserves. There is no certainty that economic forecasts on which the PEA is based will be realized.

Conclusions

RPA offers the following conclusions by area.

Geology and Mineral Resources

| · | A number of exploration programs completed by Placer and Gold Reserve were successful in locating and defining the extents of the various mineralized zones on each of their respective property holdings. The recently established Siembra Minera Economic Zone has unified the land tenure. |

| · | The geology of the deposit is well understood in general. RPA is of the opinion that the distribution of high grade areas in the Main Zone should be studied in more detail. In the southern two-thirds of the Cristinas concessions and the entirety of the Brisas concessions, the mineralization occurs in a large tabular body, which strikes approximately north-south and dips moderately to the west. In the northern third of the Cristinas concessions, the mineralization can occur as pipe-shaped forms and as thinner tabular forms with sub-vertical dips and strikes to the southeast. |

| 13 |

| · | The large tabular, strataform mineralized zone (referred to herein as the Main Zone) forms most of the Mineral Resource. The Main Zone has a minimum thickness of 10 m at the south end and reaches a maximum thickness of 350 m. The average thickness is approximately 200 m. While the southern limits of the Main Zone have been outlined by the existing drilling pattern with a reasonable degree of confidence, the down-dip limits have not been defined by drilling. The northern limits of the Main Zone are also reasonably well defined by the existing drilling pattern. |

| · | The drill hole information collected by Placer and Gold Reserve was merged into one master database that was then used to prepare the Mineral Resource estimate. Additional drill hole information collected by Crystallex International Corporation (Crystallex) on the Cristinas concessions could not be used to prepare the current estimate of the Mineral Resources, as the detailed information required was not available. The drill hole data from Placer contained drilling information and analytical results up to 1997 while the drill hole data from Gold Reserve included information up to 2006. |

| · | In RPA's opinion, the drill hole data is adequate for use in the preparation of Mineral Resource estimates. |

| · | The outline of the gold mineralization was created by drawing wireframes using approximately a 0.20 g/t Au cut-off grade and the copper mineralization was outlined using broad wireframes based on approximately a 0.04% Cu cut-off grade. A total of 24 wireframes were constructed to represent the gold mineralization zones and six wireframes to represent the copper mineralization zones. RPA also prepared wireframe surfaces to represent the three main weathering profiles for the mineralized zones: oxide saprolite, sulphide saprolite, and hard rock. |

| · | RPA applied variable capping values for gold and copper grades for each of the mineralized wireframe domains. The capped assay values were composited into three metre lengths. The composites were then used to estimate the gold and copper grades into a grade-block model that used block sizes of 10 m by 10 m by 6 m. Gold and copper grades were estimated into blocks using inverse distance squared and dynamic anisotropy with the Surpac v.6.8 software package. The estimated gold and copper grades were used to calculate Net Smelter Return (NSR) values for each mineralized block. |

| · | Mineral Resources were prepared using an NSR cut-off value of US$7.20/t for the oxide saprolite and US$5.00/t for the sulphide saprolite and fresh rock. An open pit shell was created using the Whittle software package to constrain reporting of the Mineral Resources. |

| · | The Mineral Resource estimate conforms to Canadian Institute of Mining, Metallurgy and Petroleum ("CIM") Definition Standards for Mineral Resources and Mineral Reserves dated May 10, 2014. |

| · | The Mineral Resources are estimated at 10 million tonnes at an average grade of 1.02 g/t Au and 0.18% Cu containing 318,000 ounces of gold and 17,000 tonnes of copper in the Measured category, 1.17 billion tonnes at an average grade of 0.70 g/t Au and 0.10% Cu containing 26.5 million ounces of gold and 1.2 million tonnes of copper in the Indicated category. Mineral Resources in the Inferred category are estimated at 1.30 billion tonnes at an average grade of 0.61 g/t Au and 0.08% Cu containing 25.4 million ounces of gold and 1.0 million tonnes of copper. |

Mining

| · | Mine production is scheduled to be carried out at a maximum mining rate ranging from 330 ktpd to 380 ktpd of total material. |

| · | Stripping ratios are expected to average 1.16 over the Life of Mine ("LoM") plan |

| · | A separate equipment fleet of smaller excavators and articulated dump trucks is included in the mining capital for saprolite mining in the first 10 years. Typically, undisturbed saprolite material can be difficult to mine as the moisture creates operation problems. As the Siembra Minera Project area has essentially been disturbed, RPA has assumed most saprolite is handled by the larger equipment fleet. The larger mine fleet is more productive and prior experience at Cristinas shows that rigid frame trucks can operate in the saprolite. |

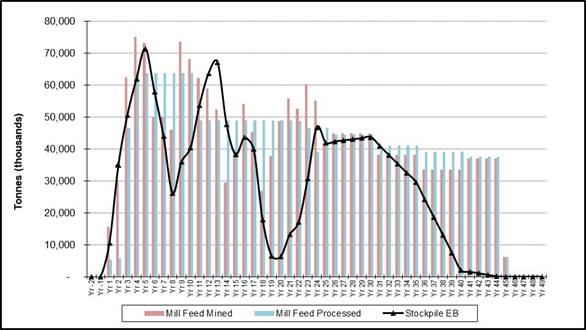

| · | Stockpiles are required for blending the process feed to achieve sufficient copper grades in flotation to produce a copper concentrate above 20%. Stockpiles fluctuate year to year, but achieve maximum capacity of just over 70 million tonnes. |

Mineral Processing

| · | Both Brisas and Cristinas were developed to the feasibility-level stage and beyond in 2006 to 2007 so the quantity of information available is greater than would typically be available at the PEA stage of a project. |

| · | The material to be mined from Siembra Minera is demonstrated to be amenable to both cyanide leaching and to sulphide flotation. For materials that contain lower concentrations of copper, cyanide leaching is more cost effective and for material that contains higher concentrations of copper, sulphide flotation is more cost effective. |

| 14 |

| · | The prior metallurgical test work met industry standards at the time the studies were completed, however, technology has progressed in the subsequent ten plus years and industry standards have evolved. Current standards include testing of a large number of variability samples and development of geometallurgical models, as opposed to testing composite samples to represent "average" material to be processed, which was the emphasis for the Brisas test program. |

Environment

| · | GRE is in the process of preparing environmental reports and programs to meet municipal, provincial, and national regulatory requirements, as well as generally accepted international standards. |

| · | Two separate but parallel Environmental and Social Impact Assessments (ESIA) are being prepared for the Siembra Minera Project, one that meets Venezuelan regulatory requirements and one that meets international standards and guidelines. |

| · | A conceptual plan for small-scale mining management is in place. The conceptual plan includes relocation of the artisanal miners away from the active, large scale mining operations and establishment of an oxide saprolite processing and stockpile area with concrete tailings ponds that collect and transport tailings from the artisanal mining operations to the Siembra Minera Project tailings management facility (TMF). |

Recommendations

Given the positive economic results presented in this report, RPA recommends that the Siembra Minera Project be advanced to the next stage of engineering study and permitting. RPA offers the following recommendations.

Geology and Mineral Resources

| · | Acquire new topographic data. |

| · | Drill approximately 150 to 200 drill holes totaling approximately 75 km to 100 km. This drilling would have a number of objectives including: |

| o | Conversion of Inferred Mineral Resources to Indicated with priority set on Inferred Mineral Resources situated in the 5 and 10-year pit shells. |

| o | Drilling to determine the extent of mineralization at depth in the Main Zone as this will determine the limits of the largest possible pit and help with the location of features such as dumps and roads. |

| o | Better definition of the copper mineralization in the Main Zone footwall. |

| o | Improving preliminary artisanal mining sterilization assumptions. |

| o | Condemnation drilling of proposed waste rock storage sites. |

| o | Closer spaced drilling in the El Potaso area between Brisas and Cristinas concession areas. |

| o | Drilling on the northwest extensions of the mineralization in the Morrocoy and Cordova areas. |

| o | Drilling on the Cristinas Main Zone for density measurements. |

| · | Improve understanding of the geological and structural controls on the shapes and local trends of high grade lenses in the Main Zone. Northwest striking cross-faults need to be identified and modelled and structural sub-domains built to improve future variography studies and dynamic anisotropy trend surfaces. This will improve the local accuracy of future gold and copper grade models. |

| · | Carry out additional 3D mineralization trend analysis studies, domain modelling, and variography work for the gold and copper mineralization. This will also assist in evaluating if additional 5-spot drill holes are needed to support the Indicated classification in some areas with more complex geology. |

| · | Depending on the outcome of new variography work, build gold and copper models using ordinary kriging. |

| · | Develop a new lithology model once new drill holes have been drilled so that an improved material densities model can be created. |

| · | Build a structural model. |

| · | For the proposed drilling, implement field and coarse duplicate sampling programs at Siembra Minera at a rate of approximately 1 in 50. |

| · | Acquire three or four matrix-matched certified reference materials that approximate the cut-off grade, average grade, and high grades and insert them in all future drill programs at the Siembra Minera Project at a rate of approximately 1 in 25. |

| · | Implement external laboratory check assays at a rate of approximately 1 in 20. |

| 15 |

Mining

| · | RPA is of the opinion that one of the most important factors influencing mining will be the amount of water entering the pit. RPA recommends contracting a groundwater hydrologist to evaluate the combined Project based on past work. |

| · | A LoM schedule should be generated for the mining and processing of the Siembra Minera mineralized material. This study should include optimization and blending of the materials to achieve a sufficiently high copper grade to produce a copper concentrate grade above 20%. |

| · | A trade-off study should be completed for the backfilling of the open pit with waste rock and/or neutralized tailings. |

| · | A geotechnical investigation program should be carried out to confirm the subsurface conditions under the proposed new open pit, waste dump locations, and stability analysis undertaken to verify design recommendations. |

Mineral Processing

| · | Every effort should be made to acquire access to the detailed metallurgical and plant data for Cristinas. In the absence of that data, detailed metallurgical sampling and testing are required to provide the information required to design the oxide leaching plant. |

| · | Additional test work should be conducted for the flotation plant using variability samples taken from throughout the deposits with particular emphasis on Cristinas where limited variability testing was done using the flotation flowsheet. Currently, industry standard emphasizes the use of variability samples as opposed to the composite samples that were predominantly used in previous flotation testing. |

| · | RPA is of the opinion that there is considerable potential for optimization of the flowsheet of the Siembra Minera Project. Examples include: |

| o | Increased efficiency if larger equipment sizes are utilized in the design. Due to cost savings and enhanced performance, the sizes for grinding mills and flotation cells have increased substantially. As examples, semi-autogenous grinding mills that are now available are as large as 12.2 m diameter by 8.8 m long as opposed to the 11.6 m by 6.7 m that are in the current design and flotation cells now have capacities of 600 m3 instead of the 160 m3 that are in the current design. The larger pieces of equipment result in a reduced footprint and fewer pieces of equipment and, therefore, lower installed costs. |

| o | The use of an adsorption desorption recovery ("ADR") that is designed for the combined Project will probably result in less cost than merely doubling the size of the current design. In addition to this, consolidating the ADR from the oxide leach plant into a plant that can later be expanded to process the doré from the flotation plant has the potential to not only cut costs but also reduce security concerns and efforts. |

| · | RPA is of the opinion that the current conceptual design for the oxide leach plant does not include the best options for Siembra Minera. Areas that require detailed evaluations include: |

| o | Use of carbon-in-leach ("CIL") instead of carbon-in-pulp ("CIP") particularly since the plant designs for both Cristinas and Brisas were changed to CIL from CIP during previous studies. |

| o | Investigate elimination of the copper circuits. Data from the Cristinas feasibility study shows that copper is only soluble in the sulphide saprolite and that it is not soluble in material that has lower copper concentrations. Therefore, the copper circuit should not be needed as the sulphide saprolite that contains higher concentrations of copper will be processed in the flotation plant and not in the oxide leach plant. |

| o | Changes to the gravity separation circuit. The use of continuous centrifugal concentrators instead of batch units to eliminate manual labour and reduce potential for theft. Use intensive cyanide leaching to process the gravity gold concentrate instead of shaking tables. Prior studies showed that intensive cyanide leaching was preferable for treatment of the gravity concentrate for both Brisas and Cristinas. |

| o | Selection of designs that are appropriate for processing clay-like saprolitic material, including: |

| § | Appropriate tank sizing using slurry densities that are consistent with the material that has a low specific gravity and is viscous in nature |

| § | Proper agitator selection |

| § | Selection of pumps and design of piping |

| · | Design of the TMF for the combined Project is preliminary. Further detailed geotechnical work is required to complete a design for the final tailings. Preliminary plans are to use the feasibility level design from the SNC-Lavalin 2007 study as Stage 1 of construction with the final tailings inundating the Stage 1 structure. |

Environment

| · | Gold Reserve has held discussions with the small miners, indigenous groups, and local people. RPA recommends continuing discussions with these groups. |

| 16 |

| · | Due to the increase in mineral resources, additional work is required for the increased waste rock dump ("WRD") and TMF, and redesign/update of the acid rock drainage ("ARD") mitigation measures. |

| · | A new ESIA will be required for the combined project with an updated project plan and in conjunction with detail design and feasibility study. |

Costs and Economics

| · | After the designs are complete for the Siembra Minera Project, a new capital and operating cost estimate should be completed. |

| · | An updated copper concentrate marketing study should be completed. Recent changes in the world copper concentrate supply have reduced treatment and refining charges for copper and reduced participation charges. |

Proposed Program and Budget

RPA's proposed program for the next stage of study is summarized in Table 1-1.

Table 1-1 Proposed Program

GR Engineering (Barbados), Inc. – Siembra Minera Project

|

Description |

Cost (US$ M) |

| Drilling to upgrade Inferred Mineral Resources – 150 to 200 holes | 20 |

| Geotechnical Studies | 2 |

| Hydrogeology Study | 1 |

| Metallurgical Studies | 2 |

| Pre-feasibility/Feasibility Study | 5 |

| ESIA and Permitting | 2 |

| Total | 32 |

Economic Analysis

The economic analysis contained in this report is based, in part, on Inferred Mineral Resources, and is preliminary in nature. Inferred Mineral Resources are considered too geologically speculative to have mining and economic considerations applied to them that would enable them to be categorized as Mineral Reserves. There is no certainty that economic forecasts on which this PEA is based will be realized.

A Cash Flow Projection has been generated from the LoM production schedule and capital and operating cost estimates, and is summarized in Table 1-4. All currency is in US dollars (US$ or $). A summary of the key criteria is provided below.

Economic Criteria

Production

| · | The LoM production plan assumes that leach plant detailed engineering/early earthworks will commence in Q1 of Year -2. |

| · | The LoM production plan assumes concentrator plant detailed engineering will commence in Q1 of Year -2. |

| · | A 2-year pre-production period for the leach plant, 2 additional years for completion of the flotation concentrator, and a 45-year overall mine life. |

| · | The leach plant has nameplate capacity of 15,000 tpd from year 1 through year 10, which increases in year 11 to 35,000 tpd through year 45 "EoM" (5.8 Mtpa to 12.25 Mtpa, respectively). |

| · | The concentrator plant has nameplate capacity of 140,000 tpd from year 3 through year 10, which decreases in year 11 to 105,000 tpd through year 45 EoM (58 Mtpa to 36.75 Mtpa, respectively). |

| · | Total combined leach and concentrator production is 2.0 billion tonnes, at a grade of 0.70 g/t Au, 0.50 g/t Ag, and 0.090% Cu. |

| · | The copper head grades in the mine plan are 302 Mt at 0.017% Cu and 1,703 Mt at 0.106% Cu for the leach and concentrator plants, respectively. However, the leach plant does not recover copper, thus the overall average copper head grade in the total mill feed is 2,005 Mt at 0.090% Cu. |

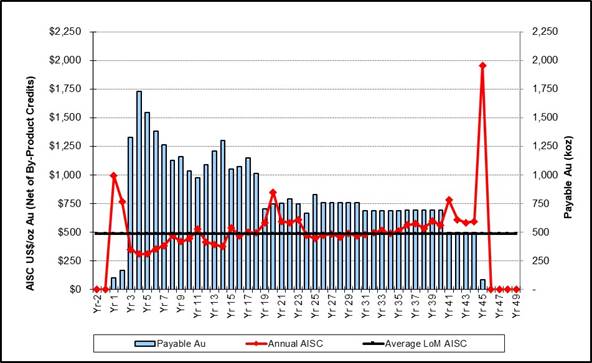

| · | Average overall metal recovery of 84% Au, 53% Ag, and 84% Cu. |

| 17 |

| · | Total recovered metal of 38.1 Moz Au, 17.1 Moz Ag, and 3.3 billion lb Cu. |

| · | Average LoM annual recovered metal production of 847 koz Au, 380 koz Ag, and 78 million lb Cu. |

| · | Average annual recovered metal production in Years 3 through 18 of 1,229 koz Au, 469 koz Ag, and 77 million lb Cu. |

| · | Average annual recovered metal production in Years 19 through 45 EoM of 674 koz Au, 353 koz Ag, and 78 million lb Cu. |

Revenue

| · | Doré payable factors at refinery are 99.9% Au and 98% Ag. |

| · | Copper concentrate average payable factors at smelter are 98% Au, 97% Ag, and 95.8% Cu. |

| · | Payable metal sales for the Siemba Minera Project total 37.6 Moz Au, 16.6 Moz Ag, and 3.2 billion lb Cu split as follows: |

| o | From Doré: 14.4 Moz Au and 4.1 Moz Ag. |

| o | From Concentrate: 23.2 Moz Au, 12.5 Moz Ag, and 3.2 billion lb Cu. |

| · | Metal prices: US$1,300 per troy ounce Au; US$17 per troy ounce Ag and US$3.00 per pound Cu. |

| · | NSR for doré includes transport and refining costs of $0.50 per ounce doré and $6 per ounce gold/$0.40 per ounce silver, respectively. |

| · | NSR for copper concentrate includes: |

| o | Cost Insurance and Freight charge of $103 per wet tonne concentrate (8% moisture content) consisting of: |

| § | Road Transport (350 km one way): $11/t |

| § | Port Charges (Puerto Ordaz): $17/t |

| § | Ocean Transport (Europe): $75/t. |

| o | Smelter treatment charge of $95 per dry tonne concentrate. |

| o | Smelter refining charges of $0.095/lb Cu, $6/oz Au, and $0.40/oz Ag. |

| o | Copper price participation is not included. |

Costs

| · | Pre-production period to CIP plant First Production: 24 months (January Year -2 to December Year -1). |

| · | Pre-production period to concentrator First Production: 48 months (January Year -2 to December Year 2). |

| · | Project development capital totals $2.57 billion, including $459 million in contingency (22% of direct and indirect capital). |

| · | Sustaining capital of $1.42 billion. |

| · | Average unit operating costs in $/t milled over the mine life: |

Mine ($1.36/t mined): 2.89

Process: 4.93

G&A: 1.32

Other Infrastructure: 0.14

Direct Operating Costs 9.29

Concentrate Freight 0.36

Off-site Costs 0.54

Total $10.19

Royalties and Government Payments

Royalties and other government payments

total $5.6 billion, or $2.77/t milled, over the LoM as shown in

Table 1-2.

| 18 |

Table 1-2 Royalties and Government Payments

GR Engineering (Barbados), Inc. – Siembra Minera Project

| Item | US$ M | US$/t milled |

| NSR Royalty | 3,262.8 | 1.63 |

| Special Advantages Tax | 1,710.0 | 0.85 |

| Science, Technology and Innovation Contributions | 588.1 | 0.29 |

| Total | 5,560.9 | 2.77 |

The Project will pay an annual NSR royalty to Venezuela on the sale of gold, copper, and silver and any other strategic minerals of 5% for the first ten years of commercial production and 6% thereafter.

The Project is subject to an additional 3% NSR annual royalty called Special Advantages Tax which is a national social welfare fund.

The Project is subject to a 1% gross revenue levy as part of the Science, Technology and Innovation Contributions fund (LOCTI).

Customs duties and Value Added Taxes are assumed to be waived for the Siembra Minera Project.

Income Taxes, Working Capital, and Other

Income taxes/contributions, upfront working capital and reclamation/closure costs total $8.3 billion as shown in Table 1-3. Withholding taxes on corporate dividends and interest payments are not incorporated into the Siembra Minera Project economic analysis.

Table 1-3 Income Taxes, Working Capital, and Other

GR Engineering (Barbados), Inc. – Siembra Minera Project

| Item | US$ M |

| Anti-Drug Contributions | 283.9 |

| Sports Contributions | 283.9 |

| Corp. Income Taxes Paid | 7,373.8 |

| Upfront Working Capital (Yrs 1-4) | 195.4 |

| Reclamation and Closure | 150.0 |

| Salvage Value | 0.0 |

| Total | 8,286.9 |

Anti-drug and Sport Contributions

These profit-based taxes are assessed at 1% of current year and previous year operating income, respectively. The annual operating margin is calculated by taking annual gross revenues and deducting all operating costs and depreciation/amortization allowances.

Corporate Income Tax