☐ |

Preliminary Proxy Statement | |||

☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||

☒ |

Definitive Proxy Statement | |||

☐ |

Definitive Additional Materials | |||

☐ |

Soliciting Material under §240.14a-12 | |||

(Name of Registrant as Specified In Its Charter) | ||||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

| Payment of Filing Fee (Check the appropriate box): | ||||

☒ |

No fee required. | |||

☐ |

Fee paid previously with preliminary materials. | |||

☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 | |||

| Chair and CEO Letter |

MARCH 20, 2024

|

Dear Fellow Williams Stockholder,

|

|

We are extremely proud of the company’s exceptional track record of safely, reliably and responsibly delivering natural gas, which has become an essential element in keeping America’s economy strong, our lights on and our homes warm. Every day, our growing, large-scale pipeline network moves a third of the nation’s natural gas to where it’s needed most as we continue to develop infrastructure to keep up with the fast-growing demand for low-carbon and affordable energy solutions.

Our natural gas-focused strategy delivered excellent financial results in 2023 with contracted transmission capacity, gathering volumes and Adjusted EBITDA surpassing previous highs, once again demonstrating our ability to grow despite low natural gas prices. We maintained a strong balance sheet and returned $2.179 billion (without buybacks) in attractive dividends to shareholders while also executing on $130 million of opportunistic share buybacks within our repurchase program. Our latest increase in the dividend and expected five-year compounded annual growth rate of 6% places Williams at the top quartile within the S&P 500 – and worth noting that 2024 marks the 50th consecutive year of dividend payments.

Our continued strong financial performance speaks for itself, but we are even more excited about the future as we invest in high-return growth opportunities to serve America’s growing demand for clean energy, while doubling down on our responsibilities as an energy industry leader. Most notably, we:

| • | Reported GAAP EPS growth of 60% in 2023 versus 2022 and delivered Adjusted EPS CAGR of 19% over the past five years, all while maintaining our strong credit metrics. |

| • | Reached record gathering volumes and record gas transmission capacity, which grew 6% and 32% respectively. |

| • | Advanced 10 FERC-regulated expansion projects through the permitting process and won contracts for the largest economic expansion ever on Transco, already the nation’s largest gas transmission network. |

| • | Integrated MountainWest Pipeline, adding approximately 8 billion cubic feet per day of transmission capacity, as well as storage, to our portfolio and enhancing access to the Rockies and West Coast markets. |

| • | Acquired a strategically located natural gas storage portfolio on the Gulf Coast with 115 billion cubic feet of capacity and direct access to growing natural gas and LNG markets. |

| • | Completed two strategic transactions that dramatically grew our position in the DJ Basin, consistent with the company’s strategy of maintaining a top position in its areas of operation. |

| • | Recognized by S&P Global, Sustainalytics, MSCI and Dow Jones Sustainability Index for our commitment to transparency, strong governance and environmental performance; achieved an upgraded ‘A-’ score on the 2023 CDP Climate Change Questionnaire, exceeding the sector and regional averages of a ‘C’. |

While proud of what we have accomplished, we know we have more to do as a midstream leader. Mark our words, we are committed to continually improving our understanding of the needs and priorities of the people who our business touches, including customers, employees and communities where we operate, and shareholders like you.

To that end, on behalf of Williams and the Board of Directors, we cordially invite you to our annual meeting of Stockholders on April 30, 2024, at 2 p.m. Central Daylight Time. During the virtual meeting where all are welcome, we’ll cover the items of business described in the pages that follow as well as provide a company update and question-and-answer session. We thank you for your investment and support of Williams.

Sincerely,

|

| |

| Alan S. Armstrong | Stephen W. Bergstrom | |

| Chief Executive Officer | Chairman of the Board |

Notice of the 2024 Annual Meeting of Stockholders

|

Date & Time Tuesday, April 30, 2024 at 2:00 p.m. CDT

Place & How to Attend This year’s annual meeting of stockholders (“Annual Meeting”) will be conducted online via live, audio webcast at www.meetnow.global/MA5CYUJ. There will be no in-person meeting.

If you are (i) a stockholder of record or (ii) a beneficial holder who has obtained a control number from Computershare (each of (i) and (ii) is a “Voting Eligible Party”), then select “Join Meeting Now,” enter your control number located on the Notice of Internet Availability of Proxy Materials, your proxy card, or received from Computershare and enter your first and last name and your email address. If you are not a Voting Eligible Party, select “Guest,” enter your first and last name, and enter your email address.

Record Date March 7, 2024. Stockholders of record at the close of business on this date are entitled to receive notice of and to participate and vote at the Annual Meeting or any adjournments or postponements.

|

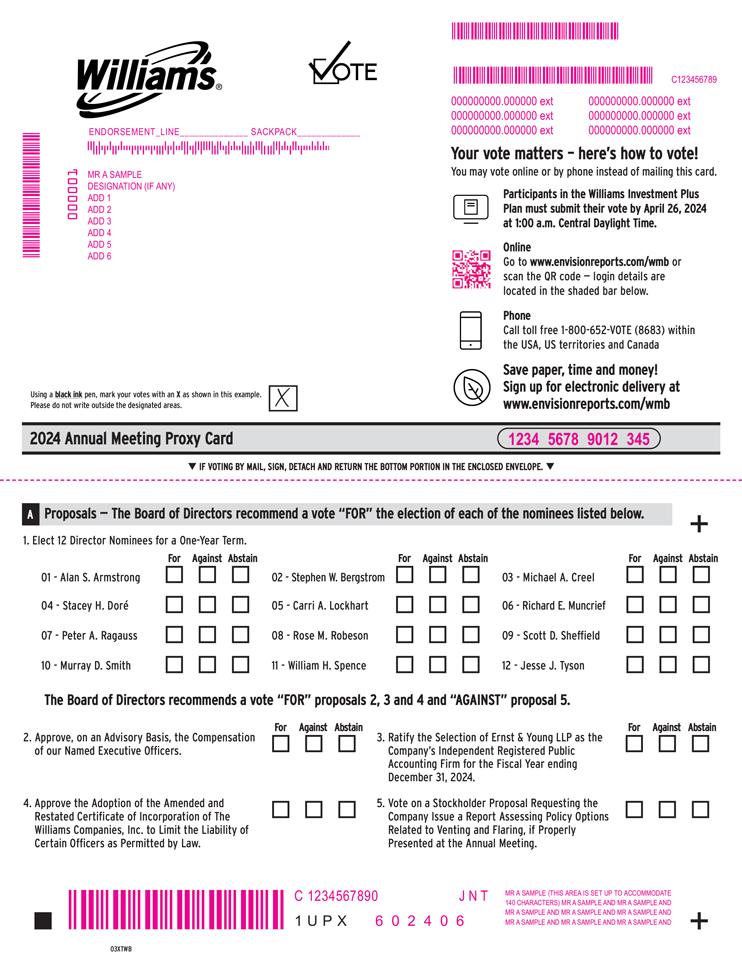

Agenda |

|||||||||||||||

| PROPOSAL

|

|

BOARD

|

|

|

PAGE

|

| ||||||||||

| BOARD PROPOSALS |

||||||||||||||||

| 1. |

Elect 12 Director Nominees for a One-year Term. |

|

FOR each nominee

|

|

10 | |||||||||||

| 2. |

Approve, on an Advisory Basis, the Compensation of our Named Executive Officers. |

|

FOR

|

|

59 | |||||||||||

| 3. |

Ratify the Selection of Ernst & Young LLP as the Company’s Independent Registered Public Accounting Firm for the Fiscal Year ending December 31, 2024.

|

|

FOR

|

|

96 | |||||||||||

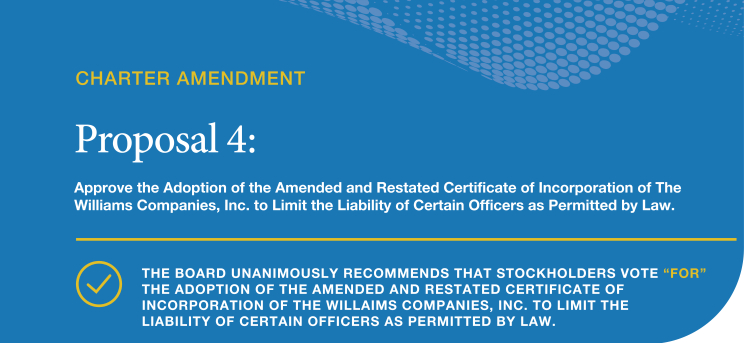

| 4. |

Approve the Adoption of the Amended and Restated Certificate of Incorporation of The Williams Companies, Inc. to Limit the Liability of Certain Officers as Permitted by Law.

|

|

FOR

|

|

99 | |||||||||||

|

STOCKHOLDER PROPOSAL |

||||||||||||||||

| 5. |

Vote on a Stockholder Proposal Requesting the Company Issue a Report Assessing Policy Options Related to Venting and Flaring, if Properly Presented at the Annual Meeting.

|

|

AGAINST

|

|

101 | |||||||||||

| 6.

|

Transact such other business as may properly come before the Annual Meeting or any adjournments or postponements thereof.

|

|

— |

|

|

— |

| |||||||||

How to Vote

|

|

|

|

| ||||

|

By Internet Vote via the Internet at www.envisionreports.

|

By Mail If you received a printed version of the proxy materials, mark, sign, date, and return the proxy card in the enclosed postage-paid envelope. |

By Phone Call toll-free 1-800- Canada. |

Attend the Virtual Meeting

Attend the virtual Annual Meeting (steps above) and click on the “Vote” bar. |

Scan QR Code Scan the QR code on your proxy card. |

For further instructions on voting, please see the “Questions and Answers about the Annual Meeting and Voting” section of the proxy statement, refer to the Notice of Annual Meeting you received in the mail, or, if you received a printed version of the proxy materials by mail, refer to the enclosed proxy card. Please refer to the proxy statement for a detailed explanation of the matters being submitted to a vote of the stockholders.

By Order of the Board of Directors,

|

Robert E. Riley, Jr. Vice President and Assistant General Counsel – Corporate Secretary and Corporate Strategic Development March 20, 2024 |

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON APRIL 30, 2024

We encourage you to access and review all of the important information contained in the proxy materials before voting. The Notice of Annual Meeting, 2024 proxy statement, and 2023 Annual Report, which includes a copy of our annual report on Form 10-K for the fiscal year ended December 31, 2023 (“2023 Annual Report”), are available at www.edocumentview.com/wmb. |

| Williams Companies | 2024 Proxy Statement |

| Table of Contents |

|

|

Environmental, Social and Governance (“ESG”) Topics

| ||||||||

| Board Diversity | 3 | |||||||

| Climate Commitment | 51 | |||||||

| Code of Conduct for Suppliers and Contractors | 37 | |||||||

| Cybersecurity | 47 | |||||||

| Diversity and Inclusion | 56 | |||||||

| EEO-1 Survey Data | 56 | |||||||

| Human Rights Policy and Statement | 37 | |||||||

| Our Compensation Best Practices | 8 | |||||||

| Our Governance Best Practices | 6 | |||||||

| Political Advocacy and Contributions | 46 | |||||||

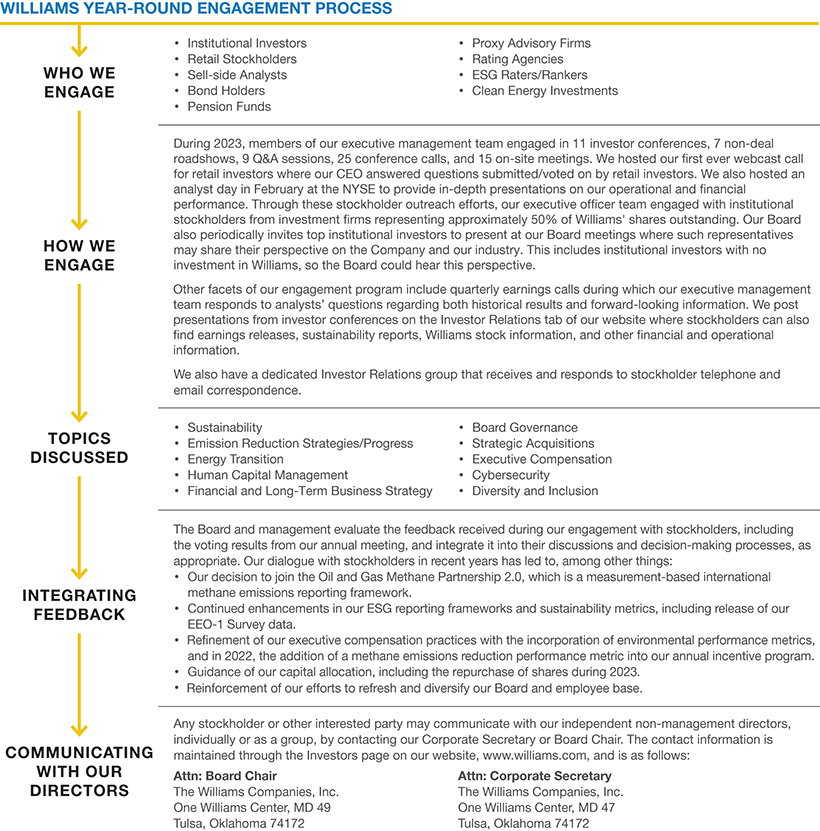

| Stockholder Engagement | 45 | |||||||

| Sustainability Report | 58 | |||||||

The Williams Companies, Inc. (“Williams”) is an energy company committed to being the leader in providing the best transport, storage, and delivery solutions to reliably fuel the clean energy economy.

|

Handling

~one-third

of the natural gas in the United States, serving more than 700 customers.

Operating

>33,000 miles

of pipeline in 24 states in 12 supply areas.

Running

35

natural gas processing facilities and 9 natural gas liquids (“NGLs”) fractionation facilities.

Managing

405.4 Billion

cubic feet (“Bcf”)

of natural gas storage capacity and approximately 25 million barrels of NGL storage capacity. |

| |||||||

| NATURAL GAS GATHERING

• Gather natural gas from producers’ wells and move volumes to processing.

• Gas gathering capacity is 28.5 Bcf per day (“Bcf/d”).

|

NATURAL GAS PROCESSING

• Process volumes to separate natural gas from NGLs.

• Gas processing capacity is 8.3 Bcf/d.

| |||||||

| NATURAL GAS TRANSMISSION AND STORAGE

• Move post-processed natural gas to growing demand centers, including operating Transco, the nation’s largest natural gas transmission pipeline.

• Total gas transmission capacity is 32.3 million dekatherms per day.

|

NGL SERVICES

• Transport NGLs to fractionators to split out individual products, including ethane, propane, butanes, and natural gasoline.

• Move purity products to end-users via pipeline, truck or rail.

| |||||||

| GAS AND NGL MARKETING SERVICES

• Market gas and NGLs to a wide range of end-users primarily through transportation and storage agreements.

• Gas marketing footprint of over 7 Bcf/d; NGL marketing sales volume of 223 million barrels per day. | ||||||||

*Figures represent 100% capacity for operated assets, including those in which Williams has a share of ownership as of December 31, 2023 and include systems acquired on January 3, 2024.

| Williams Companies | 2024 Proxy Statement | 1 |

2023 Company Highlights

Our strategy continues to involve four areas of focus: (1) maintaining financial strength and stability by delivering reliable earnings, durable cash flow, and a healthy balance sheet; (2) creating long-term stockholder value through a disciplined, returns-based approach to capital allocation; (3) driving growth by investing in high-return growth projects, emissions reduction projects, and renewables; and (4) operating sustainably including leveraging our irreplaceable natural gas infrastructure to help build a clean energy future. Below are select highlights from the execution of this strategy in 2023.

Financial Strength & Stability

| • | Protected long-term health of balance sheet and investment-grade rating. |

| • | Ended the year with 3.58x leverage ratio.(3) |

Focus on Long-Term Stockholder Value

| • | Returned value to stockholders through deleveraging, buybacks, and bolt-on expansions. |

| • | Increased quarterly cash dividends in 2023 by 5.3%. Paid a dividend every quarter since 1974. |

| • | Dividend Coverage Ratio (AFFO Basis) = 2.39x. |

Position of Growth

| • | Increased gathering volumes by 6% and contracted transmission capacity by 32% from 2022. |

| • | Closed the acquisition of MountainWest Pipeline Holdings Company adding nearly 2,000-miles of interstate natural gas pipeline systems primarily across Utah, Wyoming, and Colorado totaling about 8 Bcf/d of transmission capacity and adding 56 Bcf of storage capacity. |

| • | Closed two transactions to position the company as the third largest gatherer in the DJ Basin. |

| • | On Jan. 3, 2024, closed the acquisition of a portfolio of natural gas storage assets with total capacity of 115 Bcf connecting Transco to attractive markets, including LNG markets. |

Sustainable Strategy

| • | Executed an agreement with a Southern Company Gas subsidiary to provide certified, low-emissions NextGen Gas over a 3-year period. |

| • | Selected to participate in the Pacific Northwest Hydrogen and Appalachia Regional Clean Hydrogen Hubs by the United States Department of Energy (“DOE”). |

| • | Joined the Oil and Gas Methane Partnership 2.0 (“OGMP 2.0”) Methane Initiative, a measurement-based international methane emissions reporting framework. |

| • | Received funding from the DOE for a CO2 storage hub in collaboration with the University of Wyoming at our Echo Springs plant. |

| • | Received an upgraded “A-“ score on the 2023 CDP Climate Change Questionnaire. |

(1)Net income amounts are from continuing operations attributable to The Williams Companies, Inc. available to common stockholders. Per share amounts are reported on a diluted basis.

(2)A reconciliation of all non-GAAP financial measures to their nearest GAAP comparable financial measures is included in Appendix A.

(3)Does not represent leverage ratios measured for the Williams credit agreement compliance or leverage ratios as calculated by major credit agencies.

| 2 | Williams Companies | 2024 Proxy Statement |

Executive Summary

Our Corporate Governance

Our Board believes strong corporate governance is key to long-term stockholder value and maintaining the trust and confidence of investors, employees, customers, business partners, regulatory agencies, and other stakeholders. Strong corporate governance starts at the top with our Board elected annually by our stockholders to oversee the selection of the CEO and other officers, strategy, and risk-management. A short summary of our Board composition, refreshment, and skillsets is below followed by detailed biographies for each director candidate and analysis regarding the independence of our Board in the “Election of Directors” section. The “Corporate Governance” section details the Board’s processes for building an effective Board, creating an effective Board structure, and executing on effective corporate governance with specific examples of the Board’s oversight and the Company’s practices related to CEO succession, strategic planning and risk assessment, cybersecurity, political advocacy and contributions, corporate ethics and compliance, and Environmental, Social, and Governance (“ESG”). We also included highlights from our annual Sustainability Report in the “Spotlight on Corporate Sustainability” section showcasing our commitment to do the right thing in everything that we do.

Our Board Composition*

*Reflects the anticipated composition of the Board at the conclusion of the Annual Meeting, assuming stockholders elect all nominees to the Board. Age is calculated as of April 30, 2024.

| Williams Companies | 2024 Proxy Statement | 3 |

Executive Summary

| Our Board* |

| |||||||||||||||||||

| NAME & PRINCIPAL OCCUPATION |

COMMITTEES |

|

||||||||||||||||||

|

|

Alan S. Armstrong President & Chief Executive Officer, The Williams Companies, Inc. |

61 | 2011 | BOK Financial Corporation | ||||||||||||||||

|

|

Stephen W. Bergstrom Retired Board Chair, President & Chief Executive Officer, American Midstream Partners, GP, LLC |

66 | 2016 |

|

|

|

Chair | None | ||||||||||||

|

|

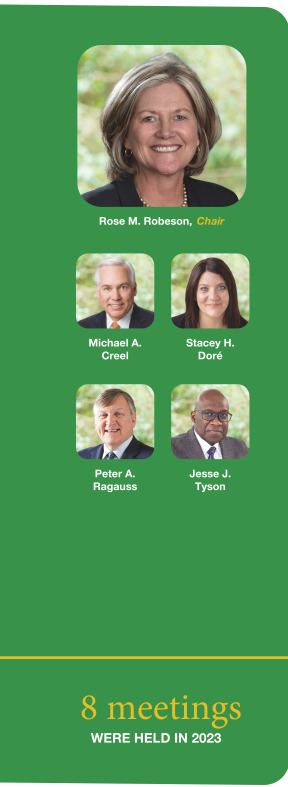

Michael A. Creel Retired Director & Chief Executive Officer, Enterprise Products Partners L.P. |

70 | 2016 |

|

|

Chair | None | |||||||||||||

|

|

Stacey H. Doré Executive Vice President of Public Affairs and Chief Strategy and Sustainability Officer, Vistra Corp. |

51 | 2021 |

|

|

Chair | None | |||||||||||||

|

|

Carri A. Lockhart Retired Executive Vice President, Technology, Digital, and Innovation, Equinor |

52 | 2023 |

|

|

|

Dril-Quip, Inc. | |||||||||||||

|

|

Richard E. Muncrief Director, President & Chief Executive Officer, Devon Energy Corporation |

65 | 2022 |

|

|

|

Devon Energy Corporation | |||||||||||||

|

|

Peter A. Ragauss Retired Senior Vice President & Chief Financial Officer, Baker Hughes Company |

66 | 2016 |

|

|

|

APA Corporation | |||||||||||||

|

|

Rose M. Robeson Retired Group Vice President & Chief Financial Officer, DCP Midstream LLC |

63 | 2020 |

|

Chair |

|

SM Energy Company Newpark Resources, | |||||||||||||

|

|

Scott D. Sheffield Director & Retired Chief Executive Officer, Pioneer Natural Resources Company |

71 | 2016 |

|

|

|

Pioneer Natural Resources Company | |||||||||||||

|

|

Murray D. Smith President of Murray D. Smith and Associates, Former Minister of Energy for Alberta, Canada |

74 | 2012 |

|

|

|

Surge Energy Inc. | |||||||||||||

|

|

William H. Spence Retired Board Chair, President & Chief Executive Officer, PPL Corporation |

67 | 2016 |

|

Chair |

|

Pinnacle West Capital Corporation | |||||||||||||

|

|

Jesse J. Tyson Retired President & Chief Executive Officer, ExxonMobil Inter-Americas |

71 | 2022 |

|

|

|

None | |||||||||||||

|

OF OUR DIRECTORS HAVE ENERGY TRANSITION EXPERIENCE, including through serving as a chief sustainability officer, current or former service |

*Reflects the anticipated composition of the Board at the conclusion of the Annual Meeting, assuming stockholders elect all nominees to the Board. Age is calculated as of April 30, 2024.

| 4 | Williams Companies | 2024 Proxy Statement |

| Williams Companies | 2024 Proxy Statement | 5 |

Executive Summary

Our Governance Best Practices

DIRECTOR INDEPENDENCE AND BOARD LEADERSHIP

| • | Prioritize Board independence. 11 of 12 director nominees are independent. |

| • | Provide that only independent directors may serve on Board committees. |

| • | Conduct regular executive sessions without management. |

| • | Separate the roles of Board Chair and Chief Executive Officer (“CEO”), which were split in 2011. |

ROBUST REFRESHMENT

| • | Seek highly qualified candidates that offer a wide variety of perspectives, including candidates of diverse race, ethnicity, and gender. |

| • | Maintain a policy that provides for retirement at the annual meeting after a director turns 75 years old unless the Board approves an exception. |

| • | Conduct annual performance self-evaluations, including assessing the size, structure, composition, and function of the Board and its committees. |

BOARD AND COMMITTEE OVERSIGHT

| • | Engage in comprehensive senior management succession planning. |

| • | Evaluate, at least annually, our long-term strategy, risks, and opportunities. |

| • | Exercise strategic oversight over Company risk, including our ESG strategy and policies, cybersecurity, political contributions, human capital management, environmental, health and safety (“EH&S”) matters, and our Ethics and Compliance Program. |

GOVERNANCE PRACTICES

| • | Review corporate governance documents annually, including Board committee charters. |

| • | Prohibit pledging, hedging, short sales, and derivative transactions by directors, officers, and employees. |

| • | Maintain stock ownership guidelines for directors and defer all equity granted to directors until retirement from the Board. |

| • | Prohibit director overboarding to prevent a director from serving on more than four public company boards (including our Board) and an Audit Committee member from serving on the audit committee of more than three public companies (including our Audit Committee) without Board approval. |

| • | Present comprehensive director onboarding programs and continuing education opportunities. |

STOCKHOLDER RIGHTS AND ENGAGEMENT

| • | Elect all directors annually by a majority vote for uncontested director elections (plurality voting in contested elections). |

| • | Provide for an annual stockholder advisory vote on executive compensation. |

| • | Allow proxy access so that holders of 3% of our stock for at least three years may include the greater of two nominees or nominees representing 20% of our Board in our proxy statement if they meet the eligibility and notice requirements in our bylaws and charter. |

| • | Provide for the removal of directors with a majority vote, with or without cause. |

| • | Seek robust year-round stockholder engagement. |

|

What’s New

• In 2023, we appointed to our Board Carri A. Lockhart, who was previously the Chief Technology Officer for Equinor.

• Elected women to chair 50% of our standing Board committees (2 of 4) effective February 1, 2023.

• Updated 3 out of 4 Board committee charters in 2022 to formalize existing practices and clarify the delineation of oversight between the Board and the Board committees in several key areas: ESG (including matters related to climate change and energy transition), human capital management, and cybersecurity.

|

| 6 | Williams Companies | 2024 Proxy Statement |

Executive Summary

Our Executive Compensation

2023 Compensation Snapshot

The graphics below demonstrate the mix of fixed (base pay) and variable or at-risk compensation (target short-term and long-term incentives) for our CEO and other named executive officers (“NEOs”). As shown below, the majority of our NEOs’ total compensation is dependent on stock price performance and pre-established performance metrics and targets, which means the compensation they receive will vary every year based on Company and individual performance in accordance with our pay for performance philosophy. A summary of the performance-metrics for the short-term incentives, an annual cash-based incentive, and the performance-based RSUs, an equity-based incentive with potential vesting following a three-year performance period, are set forth below and our entire executive compensation program is described in detail in our “Compensation Discussion and Analysis” section.

What’s New

We made no significant changes to our executive compensation program in 2023 reflecting the strong stockholder support of the executive compensation program design. Annually, we seek stockholder approval for the compensation of our named executive officers. In 2023, 96.2% percent of our stockholders voted in favor of our executive compensation program.

| Williams Companies | 2024 Proxy Statement | 7 |

Executive Summary

Our Compensation Best Practices

Our executive compensation program reflects our pay philosophy used throughout the entire organization to pay for performance and execution of our corporate strategy on an annual and long-term basis. The Board and the Compensation and Management Development Committee oversee the design and administration of the compensation program for our CEO and other NEOs. The tables below highlight the best practices utilized in our compensation process.

What We Don’t Do

|

|

NO EMPLOYMENT AGREEMENTS WITH OUR NEOS EXCEPT STANDARD CHANGE IN CONTROL AGREEMENTS

| |

|

|

NO CASH DIVIDEND EQUIVALENTS ON RSUs UNTIL ELIGIBLE RSUs VEST AND ARE DISTRIBUTED

| |

|

|

NO EXCISE TAX GROSS UP PAYMENTS PROVIDED FOR IN OUR CHANGE IN CONTROL PLAN

| |

|

|

NO EXCESSIVE PERQUISITES

|

|

|

NO REPRICING OR REPLACING UNDERWATER STOCK OPTIONS

| |

|

|

NO PRICING STOCK OPTIONS BELOW GRANT DATE FAIR MARKET VALUE

| |

|

|

NO SHARE RECYCLING FOR STOCK OPTIONS

| |

|

|

NO HEDGING OR PLEDGING OF COMPANY STOCK Our Policy on Securities Trading prohibits our directors, officers, and employees from engaging in hedging activities related to our securities or from pledging our securities as collateral for a loan. |

What We Do

|

|

INDEPENDENT ADMINISTRATION The Compensation and Management Development Committee, which only has independent director members, oversees CEO and NEO pay, including retention of an independent compensation consultant.

| |

|

|

COMPENSATION BENCHMARKS With the assistance of our independent compensation consultant, we annually benchmark our compensation program against a compensation peer group determined based on several factors, including total assets, market capitalization, and enterprise value.

| |

|

|

PRE-ESTABLISHED PERFORMANCE GOALS We align our incentive-compensation to both short-term and long-term Company performance with pre-established performance targets.

| |

|

|

STOCKHOLDER ENGAGEMENT We provide an annual opportunity for stockholders to vote on an advisory basis to approve our NEO compensation and regularly discuss executive compensation with our stockholders.

| |

|

|

MINIMUM THRESHOLDS AND MAXIMUM AWARD CAPS All of our variable compensation plans have minimum thresholds that must be met prior to any payment and have caps on the total amount that we can payout. Our Annual Incentive Program (“AIP”) awards and our performance-based equity awards cap payout at 200% of target.

|

|

|

STOCK AWARD VESTING PERIODS All RSU awards provided to our NEOs vest three years from grant date.

| |

|

“DOUBLE TRIGGERS” FOR EQUITY OR SEVERANCE PAYMENTS FOR A CHANGE IN CONTROL Severance payments and accelerated vesting of equity awards in the event of a change in control require both a change in control and a termination under certain circumstances without cause (“double trigger”), unless the acquiring company does not assume or replace the awards.

| |

|

CLAWBACKS OF EXECUTIVE COMPENSATION The Board may recoup incentive compensation in certain circumstances including for fraud or intentional misconduct and as required by the New York Stock Exchange.

| |

|

ROBUST EQUITY OWNERSHIP GUIDELINES We have established stock ownership guidelines to appropriately align the interests of our executive officers and directors with our stockholders: |

| MULTIPLE OF BASE SALARY/ANNUAL CASH RETAINER | ||

| Directors |

5x | |

| CEO |

6x | |

| Executive and Senior Vice Presidents |

3x | |

| 8 | Williams Companies | 2024 Proxy Statement |

Executive Summary

Voting Roadmap

Board Proposals

|

Proposal 1: Elect 12 Director Nominees for a One-Year Term.

| ||||||

|

|

THE BOARD UNANIMOUSLY RECOMMENDS THAT STOCKHOLDERS VOTE “FOR” EACH OF THE LISTED DIRECTOR NOMINEES FOR A ONE-YEAR TERM. |

PAGE 10

| ||||

|

Proposal 2: Approve, on an Advisory Basis, the Compensation of our Named Executive Officers.

| ||||||

|

|

THE BOARD UNANIMOUSLY RECOMMENDS THAT STOCKHOLDERS VOTE “FOR” THIS ITEM. |

PAGE 59

| ||||

|

Proposal 3: Ratify the selection of Ernst & Young LLP as the Company’s Independent Registered Public Accounting Firm for the Fiscal Year ending December 31, 2024.

| ||||||

|

|

THE BOARD UNANIMOUSLY RECOMMENDS THAT STOCKHOLDERS VOTE “FOR” THIS ITEM.

|

PAGE 96

| ||||

|

Proposal 4: Approve the Adoption of the Amended and Restated Certificate of Incorporation of The Williams Companies, Inc. to Limit the Liability of Certain Officers as Permitted by Law.

| ||||||

|

|

THE BOARD UNANIMOUSLY RECOMMENDS THAT STOCKHOLDERS VOTE “FOR” THIS ITEM.

|

PAGE 99

| ||||

Stockholder Proposal

|

Proposal 5: Stockholder Proposal Requesting the Company Issue a Report Assessing Policy Options Related to Venting and Flaring, if Properly Presented at the Annual Meeting.

| ||||||

|

|

THE BOARD UNANIMOUSLY RECOMMENDS THAT STOCKHOLDERS VOTE “AGAINST” THE STOCKHOLDER PROPOSAL. |

PAGE 101

| ||||

| Williams Companies | 2024 Proxy Statement | 9 |

The Board has nominated 12 director candidates to serve as directors of the Company for one-year terms expiring at the 2025 annual meeting of stockholders as follows: Alan S. Armstrong, Stephen W. Bergstrom, Michael A. Creel, Stacey H. Doré, Carri A. Lockhart, Richard E. Muncrief, Peter A. Ragauss, Rose M. Robeson, Scott D. Sheffield, Murray D. Smith, William H. Spence, and Jesse J. Tyson. Each nominee was previously elected to our Board at our annual meeting of stockholders on April 25, 2023.

Our By-laws provide for a majority voting standard in uncontested director elections. In other words, assuming the presence of a quorum, a director nominee will be elected to our Board if the votes cast for such nominee’s election exceed the votes cast against such nominee’s election. Each of our directors execute an irrevocable resignation that will become effective if (1) he or she fails to receive a majority of the votes cast in an uncontested election and (2) the Board accepts such resignation. If a director fails to receive the required votes for election, the Governance and Sustainability Committee will make a recommendation to the Board, and the Board will determine whether to accept the resignation. To make the determination, the Governance and Sustainability Committee and the Board may consider any factors they deem relevant. The director whose tendered resignation is under consideration abstains from participating. The Board will publicly disclose its decision within 90 days of the date the election results are certified. If the Board accepts a director’s resignation, the Governance and Sustainability Committee will recommend, and the Board will determine, whether to fill such vacancy or reduce the Board size.

Unless otherwise instructed, the individuals designated by the Board as proxies will vote the proxies received for the director candidates nominated by the Board. Each of the director nominees has consented to serve on the Board, and the Board has no reason to believe any nominees will be unable or unwilling to serve if elected. If a nominee is unable to or unwilling to stand for election as a director, either the designated proxies will vote to elect another nominee recommended by the Board, or the Board may choose to reduce its size. The biographical information for the director nominees is set forth in the remainder of this section.

| 10 | Williams Companies | 2024 Proxy Statement |

Election of Directors

Director Nominee Skills, Experience, and Attributes*

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| BOARD SKILLS MATRIX | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Corporate Governance and Public Company Board: Provides knowledge of public company board practices or perspectives from other public company boards, including current or prior experience. |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||

| Energy Industry: Provides industry perspective and understanding of challenges and opportunities we face. |

|

|

|

|

|

|

|

|

|

|

|

| ||||||||||||||||||||||||||||||||||||||||||||||||

| Energy Transition: Provides experience in sustainability or transitioning to alternative non-hydrocarbon energy sources. |

|

|

|

|

|

|

|

| ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Engineering and Construction: Provides technical knowledge related to our business operations that aids in risk oversight. |

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Environmental: Provides experience in regulatory schemes and best practices to enhance our environmental stewardship. |

|

|

|

|

|

|

|

| ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Executive Leadership: Provides judgment and experience as a “C-Level” executive of a publicly traded entity or large private company. |

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||||||||||||||||||||||||||||

| Financial and Accounting: Provides experience in assessing our financial performance and monitoring the integrity of our financial reporting process. |

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Human Capital Management: Provides experience in human resources and best practices to enhance our talent acquisition, retention, and development. |

|

|

|

|

|

|

|

|

|

| ||||||||||||||||||||||||||||||||||||||||||||||||||

| Information Technology: Provides understanding of data management, the technology utilized in our business, and cybersecurity. |

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||

| Legal: Provides insight in assessing legal risk. |

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Marketplace Knowledge: Provides perspectives of the marketplace in which we operate. |

|

|

|

|

|

|

|

|

|

|

|

| ||||||||||||||||||||||||||||||||||||||||||||||||

| Mergers and Acquisitions: Provides experience in assessment and execution of potential acquisitions. |

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||||||||||||||||||||||||||||

| Operations: Provides operational knowledge related to our business to aid in managing risk. |

|

|

|

|

|

|

|

| ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Public Policy and Government: Provides understanding on public policy affecting our business and federal and state regulatory experience, including with the Federal Energy Regulatory Commission. |

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Securities and Capital Markets: Provides experience evaluating our capital structure, capital market transactions, and other finance-related strategies. |

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Strategy Development/Risk Management: Provides experience in risk management to help oversee the identification and assessment of risks and experience developing short-and-long-term company strategies. |

|

|

|

|

|

|

|

|

|

| ||||||||||||||||||||||||||||||||||||||||||||||||||

| Age |

61 | 66 | 70 | 51 | 52 | 65 | 66 | 63 | 71 | 74 | 67 | 71 | ||||||||||||||||||||||||||||||||||||||||||||||||

| Gender |

M | M | M | F | F | M | M | F | M | M | M | M | ||||||||||||||||||||||||||||||||||||||||||||||||

|

Black or African-American |

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

*Reflects the anticipated composition of the Board at the conclusion of the Annual Meeting, assuming stockholders elect all nominees to the Board. Age is calculated as of April 30, 2024.

| Williams Companies | 2024 Proxy Statement | 11 |

Election of Directors

Director Biographies

Below is the biographical information as of April 30, 2024, for each director nominee.

| Alan S. Armstrong

President and Chief Executive Officer, The Williams Companies, Inc.

| ||||

|

DIRECTOR SINCE: 2011

MANDATORY RETIREMENT YEAR: 2038

|

EDUCATION:

• BS, Civil Engineering, | |||

|

QUALIFICATIONS

Mr. Armstrong has served as Director, President, and Chief Executive Officer of the Company since 2011. During his tenure, Williams has expanded its reach, currently handling about one-third of all U.S. natural gas volumes through gathering, processing, transportation, and storage services. In addition, Mr. Armstrong also served as Chairman of the Board and Chief Executive Officer of the general partner of Williams Partners L.P. (“WPZ”), the master limited partnership, that prior to its 2018 merger with Williams, owned most of Williams’ gas pipeline and domestic midstream assets. Prior to being named CEO, Mr. Armstrong led the Company’s North American midstream and olefins businesses as Senior Vice President — Midstream. Previously, Mr. Armstrong served as Vice President of Gathering and Processing from 1999 to 2002; Vice President of Commercial Development from 1998 to 1999; Vice President of Retail Energy Services from 1997 to 1998; and Director of Commercial Operations for the Company’s midstream business in the Gulf Coast region from 1995 to 1997. He joined Williams in 1986 as an engineer.

Mr. Armstrong serves as the Chair of the National Petroleum Council and is a member of the President’s National Infrastructure Advisory Council. He also serves on the Board of the American Petroleum Institute. Mr. Armstrong also serves on the board of several education-focused organizations, including Chair of the Junior Achievement National Board and Chair of the Investment Committee for the University of Oklahoma Foundation.

COMMITTEES

None

CURRENT PUBLIC COMPANY DIRECTORSHIPS

BOK Financial Corporation

• Credit Committee

PRIOR PUBLIC COMPANY DIRECTORSHIPS

(within the last 5 years) None |

SKILLS AND EXPERIENCE

| |||||||

|

| |||||||

|

Corporate Governance & Public Company Board |

Information | |||||||

|

|

| |||||||

|

Energy Industry |

Marketplace Knowledge | |||||||

|

|

| |||||||

|

Energy Transition |

Mergers & | |||||||

|

|

| |||||||

|

Engineering & |

Operations | |||||||

|

|

| |||||||

|

Environmental |

Public Policy | |||||||

|

|

| |||||||

|

Executive |

Strategy | |||||||

|

|

||||||||

|

Human Capital |

||||||||

|

|

||||||||

| 12 | Williams Companies | 2024 Proxy Statement |

Election of Directors

| Stephen W. Bergstrom

Retired Board Chair, President, and Chief Executive Officer,

American Midstream Partners, GP, LLC

| ||||

|

DIRECTOR SINCE: 2016

MANDATORY RETIREMENT YEAR: 2033

|

EDUCATION:

• BS, Industrial Administration, Iowa State University | |||

| QUALIFICATIONS

Mr. Bergstrom brings to our Board 43 years of experience with natural gas midstream operations and electric utilities as well as prior board experience. He was a director on the Board of American Midstream Partners GP, LLC, a natural gas gathering, processing, and transporting company until it merged with ArcLight Capital Partners, LLC in July 2019. From 2013 to 2015, he served as Executive Board Chair, President, and Chief Executive Officer of American Midstream Partners’ general partner. Mr. Bergstrom acted as an exclusive consultant to ArcLight Capital Partners, an energy-focused investment firm, from 2003 to 2015, assisting ArcLight in connection with its energy investments. From 1986 to 2002, Mr. Bergstrom served in several leadership roles for Natural Gas Clearinghouse, which became Dynegy, Inc., a major electric utility company. Mr. Bergstrom acted in various capacities at Dynegy, ultimately serving as President and Chief Operating Officer. Mr. Bergstrom began his career with Transco Energy Company, Inc. in 1980.

NON-EXECUTIVE BOARD CHAIR

COMMITTEES • Compensation & Management Development • Governance & Sustainability

CURRENT PUBLIC COMPANY DIRECTORSHIPS

None

PRIOR PUBLIC COMPANY DIRECTORSHIPS

(within the last 5 years)

None |

SKILLS AND EXPERIENCE

| |||||||

|

| |||||||

|

Corporate Governance & Public Company Board |

Human Capital Management | |||||||

|

|

| |||||||

|

Energy Industry |

Marketplace Knowledge | |||||||

|

|

| |||||||

|

Engineering & Construction |

Mergers & Acquisitions | |||||||

|

|

| |||||||

|

Environmental |

Operations | |||||||

|

|

| |||||||

|

Executive Leadership |

Strategy Development/ Risk Management | |||||||

| Williams Companies | 2024 Proxy Statement | 13 |

Election of Directors

| Michael A. Creel

Retired Director and Chief Executive Officer, Enterprise Products Partners L.P.

| ||||

|

DIRECTOR SINCE: 2016

MANDATORY RETIREMENT YEAR: 2029

|

EDUCATION:

• BS, Accounting, McNeese State University • Certified Public Accountant | |||

| QUALIFICATIONS

Mr. Creel is an executive with 44 years of energy experience, including 19 years on large public company boards and 8 years at the helm of a large publicly-traded energy infrastructure company. Mr. Creel previously served as director and Chief Executive Officer of Enterprise Products Partners L.P. from 2007 until his retirement in 2015. Earlier, he served in positions of increasing responsibility with the company since 1999. He was also Group Vice Chairman at EPCO, Inc., and Executive Vice President and Chief Financial Officer at Duncan Energy Partners, L.P., a company engaged in natural gas liquids transportation, fractionation, marketing and storage, and petrochemical product transportation, gathering and marketing. He was also President and Chief Executive Officer at the general partner of Enterprise GP Holdings L.P. and held a number of executive management positions with Shell affiliates Tejas Energy and NorAm Energy Corp.

COMMITTEES

• Audit • Environmental, Health & Safety (Chair)

CURRENT PUBLIC COMPANY DIRECTORSHIPS

None

PRIOR PUBLIC COMPANY DIRECTORSHIPS

(within the last 5 years)

None

|

SKILLS AND EXPERIENCE

| |||||||

|

| |||||||

|

Corporate Governance & Public Company Board |

Information Technology | |||||||

|

|

| |||||||

|

Energy Industry |

Marketplace Knowledge | |||||||

|

|

| |||||||

|

Environmental |

Mergers & Acquisitions | |||||||

|

|

| |||||||

|

Executive Leadership |

Securities & Capital Markets | |||||||

|

|

| |||||||

|

Financial & Accounting |

Strategy Development/ Risk Management | |||||||

|

|

||||||||

|

Human Capital Management |

||||||||

| 14 | Williams Companies | 2024 Proxy Statement |

Election of Directors

| Stacey H. Doré

Executive Vice President of Public Affairs and Chief Strategy and

| ||||

|

DIRECTOR SINCE: 2021

MANDATORY RETIREMENT YEAR: 2048

|

EDUCATION:

• JD, Harvard Law School • BA, Journalism, University of Southwestern Louisiana | |||

| QUALIFICATIONS

Ms. Doré brings to our Board 26 years of experience in energy and law as well as frontline perspective from her current role in corporate strategy, public affairs and sustainability. She has been working in the power sector on transitioning away from coal and reducing carbon footprint for more than a decade. In August 2022, she was named Executive Vice President of Public Affairs and was named the first Chief Strategy and Sustainability Officer for Vistra Corp., the largest competitive integrated power generation and retail company in the United States. Ms. Doré previously served as President and Chief Executive Officer of Sharyland Utilities, LLC, a regulated Texas-based electric transmission utility. She also served as Senior Vice President of Utility and Power Operations for Hunt Energy, a diversified global company that invests in oil and gas exploration and production, refining, and electric power projects. Prior to this, she served as Senior Vice President and General Counsel of InfraREIT, Inc. until its sale in 2019. Ms. Doré previously held leadership positions of increasing responsibility with Energy Future Holdings, a privately held company with a portfolio of competitive and regulated energy companies, eventually serving as Executive Vice President, General Counsel, and Co-Chief Restructuring Officer. Before her entry into the energy industry, Ms. Doré practiced law for more than a decade with Vinson & Elkins.

COMMITTEES

• Audit • Governance & Sustainability (Chair)

CURRENT PUBLIC COMPANY DIRECTORSHIPS

None

PRIOR PUBLIC COMPANY DIRECTORSHIPS

(within the last 5 years)

None

|

SKILLS AND EXPERIENCE

| |||||||

|

|

| |||||||

|

Corporate Governance & Public Company Board |

Legal | |||||||

|

|

| |||||||

|

Energy Industry |

Marketplace Knowledge | |||||||

|

|

| |||||||

|

Energy |

Mergers & Acquisitions | |||||||

|

|

| |||||||

|

Executive Leadership |

Operations | |||||||

|

|

| |||||||

|

Financial & Accounting |

Public Policy & Government | |||||||

|

|

| |||||||

|

Human Capital Management |

Strategy/ Development/ Risk Management | |||||||

|

|

||||||||

|

Information Technology |

||||||||

| Williams Companies | 2024 Proxy Statement | 15 |

Election of Directors

| Carri A. Lockhart

Former Executive Vice President, Technology,

| ||||

|

AGE: 52

DIRECTOR SINCE: 2023

MANDATORY RETIREMENT

|

EDUCATION: • BS, Petroleum Engineering, Montana College of Mineral Science Technology | |||

| QUALIFICATIONS

With over two decades of experience in the international energy industry, Ms. Lockhart has a broad background in production operations, facility management, and business development. Additionally, she has experience as the Chief Technology Officer for an energy company where she was responsible for developing technology to progress renewables and the energy transition, leading the information technology organization, and driving the digital agenda. Ms. Lockhart formerly served as Equinor’s (formerly known as Statoil, the Norwegian state oil company) Executive Vice President, Technology, Digital & Innovation in Oslo, Norway. Previously, she served as Equinor’s Senior Vice President Portfolio & Partner Operated in Development & Production International. Prior to this, she was Senior Vice President for Equinor’s U.S. Offshore business. Ms. Lockhart joined Equinor in 2016 and held a variety of leadership roles with experience in offshore, onshore conventional and unconventional assets, field supervision, facilities construction and operations, international country management, strategic planning, and business development. Prior to joining Equinor, she was with Marathon Oil Corporation where she started her career as a reservoir and production/operations engineer in Anchorage, Alaska before going on to senior leadership positions including Director of Business Development—the Americas, Alaska Regional General Manager, Vice President UK – North Sea, Vice President Bakken, and Vice President Eagle Ford.

She also brings perspective to our Board from service on two other energy industry boards: Dril-Quip, Inc., a public traded energy services provider, and Ascent Resources LLC, a private exploration and production company operating in the Utica Shale region.

COMMITTEES

• Compensation & Management Development • Environmental, Health & Safety

CURRENT PUBLIC COMPANY DIRECTORSHIPS

Dril-Quip, Inc., • Audit • Nominating and Governance • Compensation

PRIOR PUBLIC COMPANY DIRECTORSHIPS

(within the last 5 years)

None |

SKILLS AND EXPERIENCE

| |||||||

|

|

| |||||||

|

Corporate Governance & Public Company Board |

Human Capital Management | |||||||

|

|

| |||||||

|

Energy Industry |

Information | |||||||

|

|

| |||||||

|

Energy Transition |

Marketplace Knowledge | |||||||

|

|

| |||||||

|

Engineering & Construction |

Mergers & | |||||||

|

|

| |||||||

|

Environmental |

Operations | |||||||

|

|

| |||||||

|

Executive |

Strategy | |||||||

|

|

||||||||

| 16 | Williams Companies | 2024 Proxy Statement |

Election of Directors

| Richard E. Muncrief

Director, President, and Chief Executive Officer, | ||||

|

AGE: 65

DIRECTOR SINCE: 2022

MANDATORY RETIREMENT YEAR: 2034

|

EDUCATION:

• BS, Petroleum Engineering Technology, Oklahoma State University | |||

|

QUALIFICATIONS

Mr. Muncrief has more than 43 years of experience in the oil and gas industry, including a strong background in operations, mergers and acquisitions, and as an active CEO for a publicly traded exploration and production company. He has served as President and Chief Executive Officer of Devon Energy Corporation since January 2021 following the merger of Devon Energy Corporation and WPX Energy, Inc. Prior to that, he served as Chief Executive Officer and Board Chair of WPX Energy, Inc. since 2014. He previously served as Senior Vice President, Operations and Resource Development of Continental Resources, Inc. Earlier in his career, Mr. Muncrief served as Corporate Business Manager at Resource Production Company from August 2008 through May 2009. From September 2007 to August 2008, he served as President, Chief Operating Officer and as a Director of Quest Midstream Partners, LP. From 1980 to 2007, he served in various managerial capacities with ConocoPhillips and its predecessor companies Burlington Resources, Meridian Oil, and El Paso Exploration.

COMMITTEES

• Compensation & Management Development • Environmental, Health & Safety

CURRENT PUBLIC COMPANY DIRECTORSHIPS

Devon Energy Corporation

PRIOR PUBLIC COMPANY DIRECTORSHIPS

(within the last 5 years) WPX Energy, Inc. |

SKILLS AND EXPERIENCE

| |||||||

|

|

| |||||||

|

Corporate Governance & Public Company Board |

Human Capital | |||||||

|

|

| |||||||

|

Energy Industry |

Information | |||||||

|

|

| |||||||

|

Energy Transition |

Marketplace Knowledge | |||||||

|

|

| |||||||

|

Engineering & |

Mergers & | |||||||

|

|

| |||||||

|

Environmental |

Operations | |||||||

|

|

| |||||||

|

Executive |

Strategy | |||||||

| Williams Companies | 2024 Proxy Statement | 17 |

Election of Directors

| Peter A. Ragauss

Retired Senior Vice President and Chief Financial Officer,

| ||||

|

AGE: 66

DIRECTOR SINCE: 2016

MANDATORY RETIREMENT YEAR: 2033

|

EDUCATION: • MBA, Harvard Business School • BS, Mechanical Engineering, Michigan State University | |||

| QUALIFICATIONS

Mr. Ragauss brings to our Board extensive finance and accounting expertise specific to the energy industry. He retired from Baker Hughes Company, an oilfield services company, in November 2014, after serving eight years as Senior Vice President and Chief Financial Officer. From 2003 to 2006, prior to joining Baker Hughes, Mr. Ragauss was Controller, Refining and Marketing for BP Plc. From 2000 to 2003, he was Chief Executive Officer for Air BP. From 1998 to 2000, he was Assistant to Group Chief Executive for BP Amoco. He was Vice President of Finance and Portfolio Management for Amoco Energy International when Amoco Corporation merged with BP Plc. in 1998. Earlier in his career, from 1996 to 1998, Mr. Ragauss served as Vice President of Finance for El Paso Energy International. He held positions of increasing responsibility at Tenneco Inc. from 1993 to 1996 and Kidder, Peabody & Co. Incorporated from 1987 to 1993. He currently serves as a director of Skulte LNG, a private energy company in Latvia.

COMMITTEES

• Audit • Governance & Sustainability

CURRENT PUBLIC COMPANY DIRECTORSHIPS

APA Corporation • Audit

PRIOR PUBLIC COMPANY DIRECTORSHIPS

(within the last 5 years) None |

SKILLS AND EXPERIENCE

| |||||||

|

| |||||||

|

Corporate Governance & Public Company Board |

Information | |||||||

|

|

| |||||||

|

Energy Industry |

Marketplace | |||||||

|

|

| |||||||

|

Executive |

Mergers & | |||||||

|

|

| |||||||

|

Financial & |

Securities & | |||||||

|

|

||||||||

|

|

||||||||

| 18 | Williams Companies | 2024 Proxy Statement |

Election of Directors

| Rose M. Robeson

Retired Group Vice President and Chief Financial Officer, DCP Midstream LLC

| ||||

|

AGE: 63

DIRECTOR SINCE: 2020

MANDATORY RETIREMENT YEAR: 2036

|

EDUCATION: • BS, Accounting, Northwest Missouri State University • Certified Public Accountant (inactive) | |||

| QUALIFICATIONS

Ms. Robeson brings over 40 years of experience in accounting and finance expertise as well as experience from other public company boards in the energy industry. She currently serves on the board for an exploration and production company and an energy infrastructure company, where she transitioned to board chair from audit committee chair in 2023.

She served as Chief Financial Officer of DCP Midstream LLC from January 2002 to May 2012. She also served as the Chief Financial Officer of DCP Midstream GP LLC, the general partner of DCP Midstream Partners, LP, from May 2012 until January 2014. Prior to joining DCP Midstream LLC, Ms. Robeson served as Vice President and Treasurer with Kinder Morgan, Inc. Prior to that, she previously held positions of increasing responsibility with Total Petroleum, Inc. and Ernst & Young and was recognized to the “Top Women in Energy — 2014” by the Denver Business Journal. From 2014 to 2016, she served as a director of American Midstream GP, LLC, the general partner of American Midstream Partners, LP. From 2017 to 2019, she served as a director of AMGP GP LLC, the general partner of Antero Midstream GP LP, a publicly traded limited partnership. In March 2019, when Antero Midstream Corporation was formed, she continued to serve as a director until 2022. She served as a director of Tesco Corporation until its acquisition by Nabors Industries Ltd. in 2017.

COMMITTEES

• Audit (Chair) • Environmental, Health & Safety

CURRENT PUBLIC COMPANY DIRECTORSHIPS

SM Energy Company • Environmental, Social and Governance • Compensation

Newpark Resources, Inc. • Board Chair, effective May 2023 • Prior to May 2023, Audit (Chair), Compensation, and Environmental, Social and Governance

PRIOR PUBLIC COMPANY DIRECTORSHIPS

(within the last 5 years) Antero Midstream Corporation AMGP GP LP |

SKILLS AND EXPERIENCE

| |||||||

|

| |||||||

|

Corporate Governance & Public Company Board |

Information | |||||||

|

|

| |||||||

|

Energy Industry |

Marketplace | |||||||

|

|

| |||||||

|

Executive |

Mergers & | |||||||

|

|

| |||||||

|

Financial & |

Securities & | |||||||

|

|

| |||||||

|

Human Capital |

Strategy | |||||||

|

|

||||||||

| Williams Companies | 2024 Proxy Statement | 19 |

Election of Directors

| Scott D. Sheffield

Director and Retired Chief Executive Officer, Pioneer Natural Resources Company

| ||||

|

AGE: 71

DIRECTOR SINCE: 2016

MANDATORY RETIREMENT YEAR: 2028

|

EDUCATION: • BS, Petroleum Engineering, The University of Texas | |||

| QUALIFICATIONS

Mr. Sheffield has more than 49 years of experience in the energy industry, including building a company into a top tier exploration and production company that was acquired by Exxon Mobil Corporation in a transaction that is expected to close mid-2024. From 2019 until December 31, 2023, he served as a director and Chief Executive Officer of Pioneer Natural Resources Company (“Pioneer”), a large domestic upstream oil and gas company. He retired on December 31, 2023 as CEO and remains as a director. Mr. Sheffield served as the founding Chief Executive Officer of Pioneer from August 1997 until his retirement in December 2016, and he also served as board chair from 1999 until 2019 when he returned as the CEO. Mr. Sheffield was the CEO of Parker and Parsley Petroleum Company, a predecessor company of Pioneer, from 1985 until it merged with MESA, Inc. to form Pioneer in 1997. Mr. Sheffield joined Parker and Parsley as a petroleum engineer in 1979, was promoted to Vice President of Engineering in 1981, was elected President and a director in 1985, and became board chair and Chief Executive Officer in 1989. Mr. Sheffield served as a director of Santos Limited, an Australian exploration and production company, from 2014 to 2017. He previously served as a director from 1996 to 2004 on the board of Evergreen Resources, Inc., an independent natural gas energy company.

COMMITTEES

• Compensation & Management Development • Environmental, Health & Safety

CURRENT PUBLIC COMPANY DIRECTORSHIPS

Pioneer Natural Resources Company

PRIOR PUBLIC COMPANY DIRECTORSHIPS

(within the last 5 years) None |

SKILLS AND EXPERIENCE

| |||||||

|

| |||||||

|

Corporate Governance & Public Company Board |

Information | |||||||

|

|

| |||||||

|

Energy Industry |

Marketplace Knowledge | |||||||

|

|

| |||||||

|

Energy Transition |

Mergers & | |||||||

|

|

| |||||||

|

Engineering & |

Operations | |||||||

|

|

| |||||||

|

Environmental |

Securities & Capital Markets | |||||||

|

|

| |||||||

|

Executive |

Strategy | |||||||

|

|

||||||||

|

Human Capital |

||||||||

|

|

||||||||

| 20 | Williams Companies | 2024 Proxy Statement |

Election of Directors

| Murray D. Smith

President, Murray D. Smith and Associates and Former Minister of Energy for Alberta, Canada | ||||

|

AGE: 74

DIRECTOR SINCE: 2012

MANDATORY RETIREMENT YEAR: 2025

|

EDUCATION: • BA, Economics & Political Science, University of Calgary Notre Dame College, Saskatchewan • London Business School, Senior Executive Programme | |||

| QUALIFICATIONS

Mr. Smith brings international energy and public affairs experience to our Board. He is currently President of Murray D. Smith and Associates, an energy consulting firm. Previously, he held various positions in the Canadian government. As an elected member of the Legislative Assembly of Alberta, Canada, Mr. Smith served in four different cabinet portfolios between 1993 and 2004. As Minister of Energy of Alberta from 2001 to 2004, Mr. Smith oversaw the transformation of the electricity sector into a competitive wholesale generation market and initiated the largest industrial tax reduction in the province’s history. Mr. Smith served as Representative of the Province of Alberta to the United States of America in Washington, D.C., from 2005 to 2007. Prior to becoming an elected official, Mr. Smith was an independent businessman, owning a number of Alberta-based energy services companies.

He also brings perspective from service on the board of Surge Energy, Inc., a publicly traded Canadian exploration and production company and service on the board of Cold Bore Technology, Inc., a private oilfield technology company.

COMMITTEES

• Compensation & Management Development • Environmental, Health & Safety

CURRENT PUBLIC COMPANY DIRECTORSHIPS

Surge Energy Inc. • Compensation, Nominating & Corporate Governance (Chair) • Environment, Health and Safety

PRIOR PUBLIC COMPANY DIRECTORSHIPS

(within the past 5 years) None |

SKILLS AND EXPERIENCE

| |||||||

|

| |||||||

|

Corporate Governance & Public Company Board |

Marketplace Knowledge | |||||||

|

|

| |||||||

|

Energy Industry |

Public Policy & Government | |||||||

|

|

||||||||

|

Energy Transition |

||||||||

|

|

||||||||

| Williams Companies | 2024 Proxy Statement | 21 |

Election of Directors

| William H. Spence

Retired Board Chair, President, and Chief Executive Officer, PPL Corporation | ||||

|

AGE: 67

DIRECTOR SINCE: 2016

MANDATORY RETIREMENT YEAR: 2032

|

EDUCATION: • MBA, Bentley College • BS, Petroleum & Natural Gas Engineering, Pennsylvania State University • Executive Development Program, University of Pennsylvania; Nuclear Technology Program, Massachusetts Institute of Technology

| |||

|

QUALIFICATIONS

Mr. Spence brings to our Board experience with electric utilities and natural gas as well as alternative energy sources, including nuclear energy. He is the retired chair of the board of PPL Corporation. At the time of his retirement, the PPL family of companies held assets of more than $40 billion, delivering electricity and natural gas to about 10 million customers in the United States and the United Kingdom. Mr. Spence was named PPL President and Chief Executive Officer in 2011 and elected Chair in 2012. Previously, he had 19 years of service with Pepco Holdings, Inc., where he held a number of senior management positions. He currently serves on the board of Pinnacle West Capital Corporation, who provides solar power and battery storage. Additionally, Mr. Spence has served on various industry boards, including the Edison Electric Institute, which is the association representing all United States investor-owned electric companies, and the Electric Power Research Institute, which is an independent research organization related to emerging technologies. As part of his service on industry boards, he has participated in, and lead initiatives, related to cyber and physical security, the environment, and electric reliability.

COMMITTEES

• Compensation & Management Development (Chair) • Governance & Sustainability

CURRENT PUBLIC COMPANY DIRECTORSHIPS

Pinnacle West Capital Corporation • Finance • Corporate Governance and Public Responsibility • Nuclear and Operating (Chair)

PRIOR PUBLIC COMPANY DIRECTORSHIPS

(within the last 5 years) PPL Corporation |

SKILLS AND EXPERIENCE

| |||||||

|

| |||||||

|

Corporate Governance & Public Company Board |

Human Capital Management | |||||||

|

|

| |||||||

|

Energy Industry |

Information Technology | |||||||

|

|

| |||||||

|

Energy Transition |

Marketplace Knowledge | |||||||

|

|

| |||||||

|

Engineering & Construction |

Mergers & Acquisitions | |||||||

|

|

| |||||||

|

Environmental |

Operations | |||||||

|

|

| |||||||

|

Executive Leadership |

Strategy Development/ | |||||||

|

|

||||||||

|

Financial & Accounting

|

||||||||

|

|

||||||||

| 22 | Williams Companies | 2024 Proxy Statement |

Election of Directors

| Jesse J. Tyson

Retired President and Chief Executive Officer, ExxonMobil Inter-Americas

| ||||

|

DIRECTOR SINCE: 2022

MANDATORY RETIREMENT YEAR: 2028

|

EDUCATION:

• MBA, The Ohio State University • BA, Economics, | |||

| QUALIFICATIONS

Mr. Tyson brings 36 years of experience in the energy industry from his longstanding career with ExxonMobil Corporation. Early/mid-career, he developed Exxon’s US affiliate’s annual financial plan. In addition, he provided oversight of their US fuel distribution operations. He served as Global Aviation Director from October 2008 to March 2011, President and Chief Executive Officer of Exxon Mobil Inter-Americas from October 2002 to October 2008, and Global Customer Service & Logistics Manager from January 2000 to October 2002. He led the global call center consolidation for ExxonMobil. Previously, he held numerous management positions with ExxonMobil. Upon retirement from ExxonMobil in 2011, he became President and Chief Executive Officer of the National Black MBA Association from January 2012 to June 2018. Currently, he owns the majority interest in T&S Food Services, II, LLC, which has a stake in various restaurants and hotels.

COMMITTEES

• Audit • Governance & Sustainability

CURRENT PUBLIC COMPANY BOARDS

None

PRIOR PUBLIC COMPANY BOARDS

(within the past 5 years) None |

SKILLS AND EXPERIENCE

| |||||||

|

|

| |||||||

| Energy Industry |

Marketplace Knowledge | |||||||

|

|

| |||||||

|

Energy Transition |

Mergers & Acquisitions | |||||||

|

|

| |||||||

|

Environmental |

Operations | |||||||

|

|

| |||||||

|

Executive Leadership |

Strategy Development/ Risk Management | |||||||

|

|

||||||||

|

Human Capital Management |

||||||||

| Williams Companies | 2024 Proxy Statement | 23 |

Election of Directors

Director Independence

Our Corporate Governance Guidelines require that all members of the Board, except our CEO, be “independent” as defined by the NYSE Listed Company Manual, and that the Board assess director independence annually. The NYSE’s Listed Company Manual defines independence by providing that the Board affirmatively determine that a director has no material relationship with the Company, either directly or as a partner, shareholder, or officer of an organization that has a relationship with the Company. Material relationships can include commercial, industrial, banking, consulting, legal, accounting, charitable, and familial relationships. In evaluating independence, the NYSE Listed Company Manual provides that a board should broadly consider all relevant facts and circumstances and further provides that a director is not independent if he or she meets certain criteria, including specified dollar and percentage threshold amounts.

Our Governance and Sustainability Committee oversees our director nomination process and conducts a review of director independence to make recommendations to the Board. Our Board makes the final determination of independence. Based on the evaluations performed and recommendations made by the Governance and Sustainability Committee, in January 2024, the Board affirmatively determined that each of Mr. Bergstrom, Mr. Creel, Ms. Doré, Ms. Lockhart, Mr. Muncrief, Mr. Ragauss, Ms. Robeson, Mr. Sheffield, Mr. Smith, Mr. Spence, and Mr. Tyson are independent as defined by the NYSE’s Listed Company Manual. In January 2023, the Governance and Sustainability Committee and Board determined Nacy K. Buese was independent as defined by the NYSE’s Listed Company Manual prior to her resignation from the Board in February 2023. Mr. Armstrong is not independent because of his role as the Company’s CEO.

As part of the independence evaluation and determination, the Governance and Sustainability Committee considered the below matters. The Board determined the matters described below occurred in the ordinary course of business, and, where applicable, fell below the relevant thresholds for independence as set forth in the NYSE’s Listed Company Manual. Additionally, none of these matters qualified as related party transactions as defined in Item 404(a) of Regulation S-K under the Securities Act of 1933, as amended, (the “Securities Act”) and the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

| DIRECTOR |

MATTERS CONSIDERED | |

| Nancy K. Buese |

Ordinary course business transactions with Newmont Mining Corporation and Baker Hughes Company. | |

| Stacey H. Doré |

Ordinary course business transactions with Vistra Corp. | |

| Carri A. Lockhart |

Ordinary course business transactions with Ascent Resources LLC. | |

| Richard E. Muncrief |

Ordinary course business transactions with Devon Energy Corporation; ongoing continuing indemnification obligations between Williams and Devon Energy Corporation arising from the Company’s spin off of WPX Energy, Inc. | |

| Peter A. Ragauss |

Ordinary course business transactions with APA Corporation. | |

| Rose M. Robeson |

Ordinary course business transactions with Newpark Resources, Inc. and SM Energy Company. | |

| Scott D. Sheffield |

Ordinary course business transactions with Exxon Mobil Corporation and Pioneer Natural Resources Company. | |

In addition to the NYSE’s independence requirements, in January 2024, the Board determined that all the current members of our Audit Committee and our Compensation and Management Development Committee satisfy the heightened independence requirements imposed by the NYSE and the Securities Exchange Commission (“SEC”) applicable to members of such committees.

No related party transactions required review or approval by the Governance and Sustainability Committee, its Chair, or the Board in 2023. For a description of our process for the review of related party transactions, see the “Executing on Effective Corporate Governance” section.

| 24 | Williams Companies | 2024 Proxy Statement |

Election of Directors

Director Compensation

All non-employee directors receive both an annual cash retainer and an annual grant of time-based RSUs for their service on the Board totaling $290,000. The below table sets forth the breakdown of payments to our non-employee directors as follows:

| TYPE OF PAYMENT |

AMOUNT |

TERMS OF PAYMENT | ||||

| Annual Cash Retainer |

$ | 115,000 | Paid in quarterly installments. | |||

| Annual Equity Retainer (RSU) |

$ | 175,000 | Paid annually on the date of the annual meeting and deferred until the director’s retirement from the Board. Dividend equivalents on the RSUs are reinvested until distribution. | |||

Directors who perform additional leadership roles receive the following compensation:

| LEADERSHIP ROLE |

TYPE OF PAYMENT |

AMOUNT |

TERMS OF PAYMENT | |||

| Non-Executive Board Chair |

Annual Equity Retainer (RSU) |

$200,000 | Paid annually on the date of the annual meeting and deferred until the director’s retirement from the Board. Dividend equivalents on the RSUs are reinvested until distribution. | |||

| Audit Committee Chair |

Annual Cash Retainer |

$30,000 | Paid in quarterly installments. | |||

| Compensation & Management Development Committee Chair |

Annual Cash Retainer |

$20,000 | Paid in quarterly installments. | |||

| Environmental, Health & Safety Committee Chair |

Annual Cash Retainer |

$20,000 | Paid in quarterly installments. | |||

| Governance and Sustainability Committee Chair |

Annual Cash Retainer |

$20,000 | Paid in quarterly installments. | |||

The annual retainer increased from $275,000 to $290,000 for the 2022-2023 fiscal year to align to the median of market. The annual cash retainer was increased from $110,000 to $115,000 and the annual equity retainer was increased from $165,000 to $175,000. Prior to this, the annual retainers for the non-employee director compensation program had not changed since 2017. It’s important to emphasize the annual equity retainer is deferred until the director’s retirement from the Board.

Non-employee directors generally receive their compensation for a fiscal year beginning on the date of the annual stockholders meeting. The following table shows how compensation is paid to individuals who become non-employee directors after the annual meeting. In this case, the equity retainer would be paid the first of the month following appointment and the cash retainers will be paid on the scheduled quarterly payment dates.

| AN INDIVIDUAL WHO BECAME A NON-EMPLOYEE DIRECTOR |

BUT BEFORE | WILL RECEIVE | ||

| after the annual meeting | August 1 | full compensation | ||

| on or after August 1 | the next annual meeting | pro-rated compensation | ||

Non-employee directors are reimbursed for expenses (including costs of travel, food, and lodging) incurred in attending Board, committee, and stockholder meetings. Directors are also reimbursed for reasonable expenses associated with other business activities, including participation in director education programs. In addition, Williams pays premiums on directors’ and officers’ liability insurance policies.

Like all Williams employees, directors are eligible to participate in the Williams Matching Grant Program for eligible charitable organizations and the United Way Program. The maximum matching contribution in any calendar year is $10,000 for a participant in the Matching Grant Program and $25,000 for a participant in the United Way Program.

| Williams Companies | 2024 Proxy Statement | 25 |

Election of Directors

Director Compensation for Fiscal Year 2023

The compensation earned by each director for 2023 service is outlined in the following table:

| NAME |

FEES EARNED OR PAID IN CASH (1) |

FEES EARNED OR PAID IN STOCK (2) |

OPTION AWARDS |

NON-EQUITY INCENTIVE PLAN COMPENSATION |

CHANGE IN PENSION VALUE AND NONQUALIFIED DEFERRED COMPENSATION EARNINGS |

ALL OTHER COMPENSATION (3) |

TOTAL | |||||||||||||||||||||

| Stephen W. Bergstrom |

$ | 115,000 | $ | 374,993 | $ | — | $ | — | $ | — | $ | 25,000 | $ | 514,993 | ||||||||||||||

| Nancy K. Buese (4) |

28,750 | — | — | — | — | — | 28,750 | |||||||||||||||||||||

| Michael A. Creel |

130,000 | 175,001 | — | — | — | 10,000 | 315,001 | |||||||||||||||||||||

| Stacey H. Doré |

130,000 | 175,001 | — | — | — | — | 305,001 | |||||||||||||||||||||

| Carri A. Lockhart (5) |

115,000 | 218,743 | — | — | — | — | 333,743 | |||||||||||||||||||||

| Richard E. Muncrief |

115,000 | 175,001 | — | — | — | 10,000 | 300,001 | |||||||||||||||||||||

| Peter A. Ragauss |

122,500 | 175,001 | — | — | — | — | 297,501 | |||||||||||||||||||||

| Rose M. Robeson |

137,500 | 175,001 | — | — | — | — | 312,501 | |||||||||||||||||||||

| Scott D. Sheffield |

120,000 | 175,001 | — | — | — | — | 295,001 | |||||||||||||||||||||

| Murray D. Smith |

120,000 | 175,001 | — | — | — | — | 295,001 | |||||||||||||||||||||

| William H. Spence |

135,000 | 175,001 | — | — | — | 35,000 | 345,001 | |||||||||||||||||||||

| Jesse J. Tyson |

115,000 | 175,001 | — | — | — | — | 290,001 | |||||||||||||||||||||

| (1) | The fees paid in cash are itemized in the following chart: |

| NAME |

ANNUAL CASH RETAINER INCLUDING SERVICE ON TWO COMMITTEES |

AUDIT COMMITTEE CHAIR RETAINER |

COMPENSATION & MANAGEMENT DEVELOPMENT COMMITTEE CHAIR RETAINER |

GOVERNANCE & SUSTAINABILITY COMMITTEE CHAIR RETAINER |

ENVIRONMENTAL, HEALTH, & SAFETY COMMITTEE CHAIR RETAINER |

TOTAL | ||||||||||||||||||

| Bergstrom |

$ | 115,000 | $ | — | $ | — | $ | — | $ | — | $ | 115,000 | ||||||||||||

| Buese (4) |

28,750 | — | — | — | — | 28,750 | ||||||||||||||||||

| Creel |

115,000 | — | — | — | 15,000 | 130,000 | ||||||||||||||||||

| Doré |

115,000 | — | — | 15,000 | — | 130,000 | ||||||||||||||||||

| Lockhart |

115,000 | — | — | — | — | 115,000 | ||||||||||||||||||

| Muncrief |

115,000 | — | — | — | — | 115,000 | ||||||||||||||||||

| Ragauss |

115,000 | 7,500 | — | — | — | 122,500 | ||||||||||||||||||

| Robeson |