UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

[X] | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) |

OF THE SECURITIES EXCHANGE ACT OF 1934 | |

For the fiscal year ended June 30, 2013 | |

[ ] | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) |

OF THE SECURITIES EXCHANGE ACT OF 1934 | |

For the transition period from to | |

Commission file number 001-16317

CONTANGO OIL & GAS COMPANY

(Exact name of registrant as specified in its charter)

Delaware | 95-4079863 | |

(State or other jurisdiction of incorporation or organization) | (IRS Employer Identification No.) | |

3700 Buffalo Speedway, Suite 960

Houston, Texas 77098

(Address of principal executive offices)

(713) 960-1901

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Common Stock, Par Value $0.04 per share | NYSE MKT | |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [ ] No [X]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes [ ] No [X]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [X] No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [X]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer [X] Accelerated filer [ ] Non-accelerated filer [ ] Smaller reporting company [ ]

(Do not check if smaller reporting company)

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes [ ] No [X]

At December 31, 2012, the aggregate market value of the registrant’s common stock held by non-affiliates (based upon the closing sale price of shares of such common stock as reported on the NYSE MKT was $559,355,116. As of August 26, 2013, there were 15,194,952 shares of the registrant’s common stock outstanding.

Documents Incorporated by Reference

Items 10, 11, 12, 13 and 14 of Part III have been omitted from this report since registrant will file with the Securities and Exchange Commission, not later than 120 days after the close of its fiscal year, a definitive proxy statement, pursuant to Regulation 14A. The information required by Items 10, 11, 12, 13 and 14 of this report, which will appear in the definitive proxy statement, is incorporated by reference into this Form 10-K.

CONTANGO OIL & GAS COMPANY AND SUBSIDIARIES

ANNUAL REPORT ON FORM 10-K FOR THE FISCAL YEAR ENDED JUNE 30, 2013

TABLE OF CONTENTS

Page | ||

PART I | ||

PART II | ||

i

PART III | ||

PART IV | ||

ii

CAUTIONARY STATEMENT ABOUT FORWARD-LOOKING STATEMENTS

Some of the statements made in this report may contain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, and Section 21E of the Securities Exchange Act of 1934, as amended. The words and phrases “should be”, “will be”, “believe”, “expect”, “anticipate”, “estimate”, “forecast”, “goal” and similar expressions identify forward-looking statements and express our expectations about future events. These include such matters as:

• | Our financial position |

• | Business strategy, including outsourcing |

• | Meeting our forecasts and budgets |

• | Anticipated capital expenditures |

• | Drilling of wells |

• | Natural gas and oil production and reserves |

• | Timing and amount of future discoveries (if any) and production of natural gas and oil |

• | Operating costs and other expenses |

• | Cash flow and anticipated liquidity |

• | Prospect development |

• | Property acquisitions and sales |

• | New governmental laws and regulations |

• | Expectations regarding oil and gas markets in the United States |

Although we believe the expectations reflected in such forward-looking statements are reasonable, such expectations may not occur. These forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from actual future results expressed or implied by the forward-looking statements. These factors include among others:

• | Low and/or declining prices for natural gas and oil |

• | Natural gas and oil price volatility |

• | Operational constraints, start-up delays and production shut-ins at both operated and non-operated production platforms, pipelines and gas processing facilities |

• | The risks associated with acting as the operator in drilling deep high pressure and temperature wells in the Gulf of Mexico, including well blowouts and explosions |

• | The risks associated with exploration, including cost overruns and the drilling of non-economic wells or dry holes, especially in prospects in which the Company has made a large capital commitment relative to the size of the Company’s capitalization structure |

• | The timing and successful drilling and completion of natural gas and oil wells |

• | Availability of capital and the ability to repay indebtedness when due |

• | Availability of rigs and other operating equipment |

• | Ability to receive Bureau of Safety and Environmental Enforcement permits on a time schedule that permits the Company to operate efficiently |

• | Ability to raise capital to fund capital expenditures |

• | Timely and full receipt of sale proceeds from the sale of our production |

• | The ability to find, acquire, market, develop and produce new natural gas and oil properties |

• | Interest rate volatility |

• | Zero or near-zero interest rates |

• | Uncertainties in the estimation of proved reserves and in the projection of future rates of production and timing of development expenditures |

• | Operating hazards attendant to the natural gas and oil business |

• | Downhole drilling and completion risks that are generally not recoverable from third parties or insurance |

• | Potential mechanical failure or under-performance of significant wells, production facilities, processing plants or pipeline mishaps |

• | Weather |

• | Availability and cost of material and equipment |

• | Delays in anticipated start-up dates |

• | Actions or inactions of third-party operators of our properties |

• | Actions or inactions of third-party operators of pipelines or processing facilities |

• | The ability to find and retain skilled personnel |

• | Strength and financial resources of competitors |

• | Federal and state regulatory developments and approvals |

• | Environmental risks |

• | Worldwide economic conditions |

• | The ability to construct and operate offshore infrastructure, including pipeline and production facilities |

• | The continued compliance by the Company with various pipeline and gas processing plant specifications for the gas and condensate produced by the Company |

• | Drilling and operating costs, production rates and ultimate reserve recoveries in our Eugene Island 10 (“Dutch”) and state of Louisiana (“Mary Rose”) acreage |

• | Restrictions on permitting activities |

• | Expanded rigorous monitoring and testing requirements |

• | Legislation that may regulate drilling activities and increase or remove liability caps for claims of damages from oil spills |

• | Ability to obtain insurance coverage on commercially reasonable terms |

• | Accidental spills, blowouts and pipeline ruptures |

• | Impact of new and potential legislative and regulatory changes on Gulf of Mexico operating and safety standards |

You should not unduly rely on these forward-looking statements in this report, as they speak only as of the date of this report. Except as required by law, we undertake no obligation to publicly release any revisions to these forward-looking statements to reflect events or circumstances occurring after the date of this report or to reflect the occurrence of unanticipated events. See the information under the heading “Risk Factors” referred to on page 13 of this report for some of the important factors that could affect our financial performance or could cause actual results to differ materially from estimates contained in forward-looking statements.

All references in this Form 10-K to the “Company”, “Contango”, “we”, “us” or “our” are to Contango Oil & Gas Company and wholly-owned Subsidiaries. Unless otherwise noted, all information in this Form 10-K relating to natural gas and oil reserves and the estimated future net cash flows attributable to those reserves are based on estimates prepared by independent engineers and are net to our interest.

iii

PART I

Item 1. Business

Overview

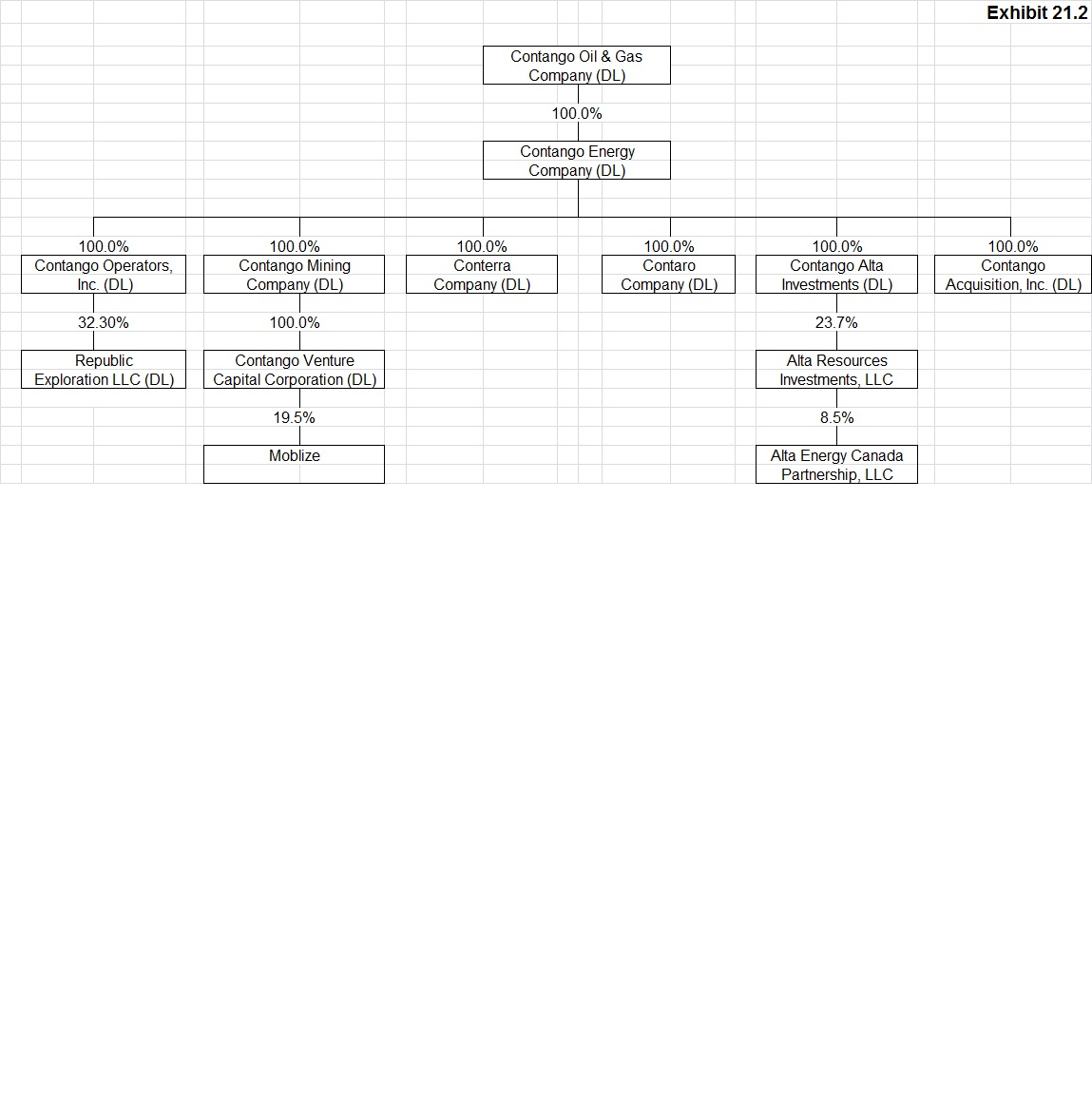

Contango is a Houston, Texas based, independent natural gas and oil company. The Company's core business is to explore, develop, produce and acquire natural gas and oil properties offshore in the shallow waters of the Gulf of Mexico. Contango Operators, Inc. (“COI”), our wholly-owned subsidiary, acts as operator of our offshore properties. Contango has additional onshore investments in i) Alta Resources Investments, LLC ("Alta"), whose primary area of focus is the liquids-rich Kaybob Duvernay in Alberta, Canada; ii) Exaro Energy III LLC ("Exaro"), which is primarily focused on the development of proved natural gas reserves in the Jonah Field in Wyoming; and iii) the Tuscaloosa Marine Shale ("TMS") where we own approximately 24,000 acres.

On April 19, 2013, the Company's founder and former Chairman, President and Chief Executive Officer, Mr. Kenneth R. Peak, passed away at the age of 67. The Company held a $10 million life insurance policy for Mr. Peak and received the proceeds of such policy in early May 2013.

On April 30, 2013, the Company announced that it had signed a merger agreement (the "Merger Agreement") with Crimson Exploration Inc. ("Crimson"), for an all-stock transaction pursuant to which Crimson will become a wholly owned subsidiary of Contango (the "Merger"). Upon consummation of the Merger, each share of Crimson stock will be converted into 0.08288 shares of Contango stock resulting in Crimson stockholders owning 20.3% of the post-merger Contango. This transaction is subject to shareholder approval of both Contango and Crimson and is expected to close in October 2013, subject to satisfaction of a number of closing conditions.

Crimson is a Houston, Texas-based independent energy company engaged in the exploitation, exploration, development and acquisition of crude oil and natural gas, primarily in the onshore Gulf Coast regions of the United States. Crimson currently owns approximately 95,000 net acres onshore in Texas, Louisiana, Colorado and Mississippi. Crimson refers to its four corporate areas as (i) Southeast Texas, focusing on the Woodbine, Eagle Ford and Georgetown formations, (ii) South Texas, focusing on the Eagle Ford and Buda formations, (iii) East Texas, focusing on the Haynesville, Mid-Bossier and James Lime formations, and (iv) Rockies and Other, focusing on the Niobrara and D&J Sand formations. Crimson’s strategy is to continue to increase crude oil and liquids-rich reserves and production from an extensive inventory of drilling prospects, de-risk unproved prospects in core operating areas, and opportunistically grow reserves through acquisitions complementary to its existing asset base.

As of June 30, 2013, Crimson had estimated proved reserves of 117.1 billion cubic feet equivalent ("Bcfe") of natural gas equivalents, based on SEC reporting guidelines. For the quarter ended June 30, 2013, Crimson’s average production was approximately 44.2 million cubic feet equivalent per day ("Mmcfed"). Crimson’s common stock is traded on the NASDAQ under the symbol “CXPO.”

On August 5, 2013, the Company announced that Alta had agreed to sell its interest in over 67,000 acres in the Kaybob Duvernay in Alberta, Canada. Proceeds from the sale are expected to be approximately $29 million, net to the Company. The sale is expected to close by October 2013 after satisfaction of a number of closing conditions.

On July 30, 2013, we spud our South Timbalier 17 prospect with the Hercules 202 rig, and on August 22, 2013 we announced a successful well. Estimated costs net to Contango to drill, complete and bring this well to full production status are $12.5 million.

Our Strategy

Our exploration strategy is predicated upon the belief that the only competitive advantage in the commodity-based natural gas and oil business is to be among the lowest cost producers.

We depend primarily upon our alliance partner, Juneau Exploration, L.P. (“JEX”), for prospect generation expertise and to review prospects submitted by third parties. JEX is experienced and has a successful track record in exploration.

We have concentrated our risk investment capital in the exploration of i) offshore Gulf of Mexico prospects and ii) conventional and unconventional onshore plays. Exploration prospects are inherently risky as they require large amounts of capital with no guarantee of success. COI drills and operates our offshore prospects. Should we be successful in any of our

1

offshore prospects, we will have the opportunity to spend significantly more capital to complete development and bring the discovery to producing status.

Exploration Alliance with JEX

JEX is a private company formed for the purpose of generating offshore and onshore domestic natural gas and oil prospects. Additionally, JEX can generate offshore prospects through our 32.3% owned affiliated company, Republic Exploration LLC ("REX"). In addition to generating new prospects, JEX occasionally evaluates offshore and onshore exploration prospects generated by third-party independent companies for us to purchase. Once we have purchased a prospect from JEX, REX or a third-party, we have historically entered into participation agreements and joint operating agreements, which specify each participant’s working interest, net revenue interest, and describe when such interests are earned, as well as allocate an overriding royalty interest of up to 3.33% to benefit employees of JEX. See Note 13 - Related Party Transactions for a detailed description of our transactions with JEX and REX.

Offshore Gulf of Mexico Activities

Contango, through its wholly-owned subsidiary, COI and its partially-owned affiliate, REX, conducts exploration activities in the Gulf of Mexico. COI drills and operates our wells in the Gulf of Mexico, as well as attends lease sales and acquires leasehold acreage. Additionally, COI may acquire significant working interests in offshore exploration and development opportunities in the Gulf of Mexico, under farm-out agreements, or similar agreements, with REX, JEX and/or other third parties.

As of June 30, 2013, the Company's offshore production was approximately 64.6 Mmcfed, net to Contango, which consists mainly of seven federal and five state of Louisiana wells in the shallow waters of the Gulf of Mexico. These 12 operated wells produce via the following three platforms:

Eugene Island 11 Platform

Our Company-owned and operated production platform at Eugene Island 11 was designed with a capacity of 500 million cubic feet per day ("Mmcfd") and 6,000 barrels of oil per day ("bopd"). In September 2010 the Company installed a companion platform and two pipelines adjacent to the Eugene Island 11 platform to be able to access alternate markets. These platforms service production from the Company’s five Dutch wells in federal waters and five Mary Rose wells in state of Louisiana waters. From these platforms, gas and condensate can flow to our Eugene Island 63 auxiliary platform via our 20” pipeline, which has been designed with a capacity of 330 Mmcfd and 6,000 bopd, and from there to third-party owned and operated on-shore processing facilities near Patterson, Louisiana, via an ANR pipeline.

Alternatively, gas can flow to the American Midstream pipeline via our 8” pipeline, which has been designed with a capacity of 80 Mmcfed, and from there to a third-party owned and operated on-shore processing facility at Burns Point, Louisiana. Condensate can also flow via an ExxonMobil pipeline to on-shore markets and multiple refineries. As of June 30, 2013, we were producing approximately 54.4 Mmcfed, net to Contango, from these platforms.

Based on current production and decline rates, the Company has determined the need to place its Mary Rose wells on compression in mid-2014, and place its Dutch wells on compression in late-2015. The Company is in the process of designing and building a large turbine type compressor for the platform at an estimated cost of $9.1 million, net to Contango. This compressor will be of sufficient capacity to service all ten of the Company's Dutch and Mary Rose wells. As of June 30, 2013, the Company had incurred approximately $8.3 million to design and build the compressor.

In late-2012, the Company suspended production to the Eugene Island 24 Platform, after installing auxiliary flowlines to enable the Company to redirect its Dutch #1, #2, and #3 wells to Eugene Island 11. In June 2013, the Company removed all remaining flowlines connected to the Eugene Island 24 Platform.

Ship Shoal 263 Platform

Our Company-owned and operated production platform at Ship Shoal 263 was designed with a capacity of 40 Mmcfd and 5,000 bopd. This platform services natural gas and condensate production from our Ship Shoal 263 well, which flows via the Transcontinental Gas Pipeline to onshore processing plants. As of June 30, 2013, we were producing approximately 0.7 Mmcfed, net to Contango, from this platform. We believe this well may be fully depleted in the next twelve months. The well reached payout during fiscal year 2012. We will continue producing this well as long as it is economical.

In March 2013, due to the decline in production and high water levels from our Ship Shoal 263 well, our reservoir engineer revised his estimated net proved natural gas and oil reserves from this well. As a result, the net book value of our Ship

2

Shoal 263 well exceeded the future undiscounted cash flows associated with its reserves. Accordingly, the Company recognized an impairment expense of approximately $12.0 million for the fiscal year ended June 30, 2013 for this well.

Should we have a discovery at our upcoming Ship Shoal 255 prospect, we will transport the new production through this platform. We have currently classified the platform as unproved properties, as its cost is expected to be recovered through Ship Shoal 255.

Vermilion 170 Platform

Our Company-owned and operated production platform at Vermilion 170 was designed with a capacity of 60 Mmcfd and 2,000 bopd. This platform services natural gas and condensate production from our Vermilion 170 well, which flow via the Sea Robin Pipeline to onshore processing plants. Based on current production and decline rates, the Company has determined the need to place its Vermilion 170 well on compression in early-2014, at a cost of $1.4 million, net to Contango. As of June 30, 2013, the Company had incurred all of the $1.4 million to design, build and install the compressor. As of June 30, 2013, we were producing approximately 9.5 Mmcfed, net to Contango, from this platform.

In January 2013, we identified sustained casing pressure between the production tubing and the production casing at our Vermilion 170 well. Diagnostic tests revealed that the production tubing had parted downhole requiring a workover of the well. Well production was shut-in and the original tubing and completion assembly were successfully removed. Operations were conducted to replace the tubing and restore the well, which resumed production in June 2013. For the fiscal year ended June 30, 2013, we expended approximately $12.0 million on these workover operations, net to the Company.

Other Activities

On July 30, 2013, we spud our South Timbalier 17 prospect in state of Louisiana waters with the Hercules 202 rig, and on August 22, 2013 we announced a successful well. The well was drilled to a total measured depth of approximately 11,400 feet and the wireline logs of the well indicate the presence of hydrocarbons. Estimated reserves and production rates will be dependent upon the liquids content of the formation, which will be better defined once we complete and test the well. We are proceeding with development, including securing production facilities. Estimated costs net to Contango to drill, complete and bring this well to full production status are $12.5 million. Contango has a 75% working interest (53.25% net revenue interest) before payout of all costs, and a 59.3% working interest (42.1% net revenue interest) after payout.

In June 2013, the Company was awarded Eugene Island 23 by the Bureau of Ocean Energy Management ("BOEM"), which was bid at the Central Gulf of Mexico Lease Sale 227 held on March 20, 2013. In July 2013, the Company was awarded Ship Shoal 52 and Ship Shoal 59, representing one prospect, bid at the same Lease Sale 227. The Company bid a total of approximately $1.7 million on these three blocks. We have begun the permitting process and are hopeful to drill these new prospects in the second and third quarter of calendar year 2014.

In July 2012, we spud our Ship Shoal 134 prospect ("Eagle"). On October 19, 2012, we announced that we had reached total depth on Eagle and no commercial hydrocarbons were found. The Company has plugged and abandoned this well. For the fiscal year ended June 30, 2013, we incurred approximately $28.9 million to drill, plug and abandon this well, including approximately $6.3 million in leasehold costs. During the fiscal year ended 2013, we released two leases related to this prospect.

In July 2012, we spud our South Timbalier 75 prospect ("Fang"). On October 30, 2012, we announced that we had reached total depth on Fang and no commercial hydrocarbons were found. The Company has plugged and abandoned this well. For the fiscal year ended June 30, 2013, we incurred approximately $21.1 million to drill, plug and abandon this well, including approximately $0.3 million in leasehold costs. This prospect was a farm-in and the lease was never earned as a result of the dry hole.

Prior Year Activities

In June 2012, the Company successfully acquired six leases at the Central Gulf of Mexico Lease Sale 216/222. The Company bid an aggregate amount of approximately $11 million on East Cameron 124, Eugene Island 31, Eugene Island 260, Ship Shoal 83, Ship Shoal 255 and South Timbalier 110. The Company will have a 100% working interest in these prospects, subject to back-ins if successful. We have submitted an exploration permit for the first of these blocks, Ship Shoal 255, and have budgeted to spud this well in late-2013 at an estimated cost of $22.5 million, net to Contango.

In March 2012, the Company was awarded Brazos Area 543 by the BOEM, which was bid on at the Western Gulf of Mexico Lease Sale No. 218 held on December 14, 2011. As of June 30, 2013, the Company had invested approximately $0.5

3

million in Brazos Area 543, which includes seismic and leasehold costs. During the year ended June 30, 2013, we recognized an impairment expense of $0.2 million related to this lease.

In June 2011, we completed a workover of our Eloise North well at a cost of approximately $1.8 million, net to Contango, which enabled us to continue producing from the lower Rob-L sands. In October 2011, we commenced a workover of our Eloise North well to recomplete the well in the upper Rob-L sands. During the workover, the Company experienced difficulties and unexpected delays due to malfunctioning production tree valves, coiled tubing equipment failures, weather delays, and stuck equipment in the tubing. As a result, the Company plugged the Rob-L sands in January 2012 and recompleted uphole in the Cib-Op sands as our Mary Rose #5 well, at a cost of approximately $0.5 million, net to Contango, based on the new higher ownership percentage and inclusive of a required well cost adjustment. The Mary Rose #5 well began producing on January 26, 2012 and by mid-March 2012 had stopped again. We are currently flowing the well intermittently until we can install compression in 2015.

On December 21, 2011, the Company purchased an additional 3.66% working interest (2.67% net revenue interest) in

Mary Rose #5 (previously Eloise North) for approximately $0.2 million from an existing partner. This purchase brings the Company’s working interest and net revenue interest in Mary Rose #5 to 37.80% and 27.59%, respectively.

In July 2011, we recompleted our Eloise South well uphole in the Cib-Op sands as our Dutch #5 well, at a cost of approximately $5.7 million, net to Contango. The Company has a 47.05% working interest (38.1% net revenue interest) in Dutch #5. In addition to this $5.7 million, the Dutch #5 well owners purchased the Eloise South well bore from the Eloise South well owners (the “Well Cost Adjustment”). The Company invested a net of approximately $2.3 million related to this Well Cost Adjustment.

In September 2010, we drilled our Galveston Area 277L prospect, a wildcat exploration well in the Gulf of Mexico, and determined it was a dry hole. The Company invested approximately $9.5 million, including leasehold costs, to drill, plug and abandon this well.

Republic Exploration LLC

In his capacity as sole manager of the general partner of JEX, Mr. Brad Juneau controls the activities of REX, an entity owned 34.4% by JEX, 32.3% by Contango, and 33.3% by a third party. REX generates and evaluates offshore exploration prospects and has historically participated with the Company in the drilling and development of certain prospects through participation agreements and joint operating agreements, which specify each participant’s working interest, net revenue interest, and describe when such interests are earned, as well as allocate an overriding royalty interest ("ORRI") of up to 3.33% to benefit the employees of JEX. The Company proportionately consolidates the results of REX in its consolidated financial statements. In April 2013, REX sold its 25% working interest in West Delta 36 to another partner in that well.

Offshore Properties

Contango, through its wholly-owned subsidiary Contango Operators, Inc. ("COI"), and its partially-owned subsidiary REX, conducts exploration activities in the shallow waters of the Gulf of Mexico. As of June 30, 2013, Contango, through COI and REX, had an interest in 19 offshore leases.

During the fiscal year ended June 30, 2013, the Company acquired nine lease blocks at two Central Gulf of Mexico lease sales, acquired one lease block from an independent oil and gas company, relinquished four lease blocks to the BOEM, and allowed two additional lease blocks to expire in accordance with their terms. During the fiscal year ended June 30, 2012, the Company acquired one lease block at federal lease sale and allowed one lease block to expire. During the fiscal year ended June 30, 2011, the Company purchased one lease block from an independent oil and gas company, relinquished 12 lease blocks to the BOEM, and allowed two additional lease blocks to expire in accordance with their terms.

Producing Properties. The following table sets forth the interests owned by Contango through its affiliated entities in the Gulf of Mexico which were capable of producing natural gas or oil as of June 30, 2013:

4

Area/Block | WI | NRI | Status | |||

Eugene Island 10 #D-1 (Dutch #1) | 47.05% | 38.1% | Producing | |||

Eugene Island 10 #E-1 (Dutch #2) | 47.05% | 38.1% | Producing | |||

Eugene Island 10 #F-1 (Dutch #3) | 47.05% | 38.1% | Producing | |||

Eugene Island 10 #G-1 (Dutch #4) | 47.05% | 38.1% | Producing | |||

Eugene Island 10 #I-1 (Dutch #5) | 47.05% | 38.1% | Producing | |||

S-L 18640 #1 (Mary Rose #1) | 53.21% | 40.5% | Producing | |||

S-L 19266 #1 (Mary Rose #2) | 53.21% | 38.7% | Producing | |||

S-L 19266 #2 (Mary Rose #3) | 53.21% | 38.7% | Producing | |||

S-L 18860 #1 (Mary Rose #4) | 34.58% | 25.5% | Producing | |||

S-L 19266 #3 and S-L 19261 (Mary Rose #5) | 37.80% | 27.6% | Intermittent | |||

Ship Shoal 263 | 100.00% | 80.0% | Producing | |||

Vermilion 170 | 87.24% | 68.0% | Producing | |||

Leases. The following table sets forth the interests owned by Contango through its related entities in leases in the Gulf of Mexico as of June 30, 2013:

Area/Block | WI | Lease Date | Expiration Date | |||

East Breaks 369 (Dry Hole) | (1) | Dec-03 | Dec-13 | |||

South Timbalier 17 | 75.00% | (2) | (2) | |||

Brazos Area 543 | 100.00% | Mar-12 | Mar-17 | |||

East Cameron 124 | 100.00% | Sept-12 | Sept-17 | |||

Eugene Island 31 | 100.00% | Oct-12 | Oct-17 | |||

Ship Shoal 83 | 100.00% | Oct-12 | (3) | |||

South Timbalier 110 | 100.00% | Oct-12 | Oct-17 | |||

Eugene Island 260 | 100.00% | Nov-12 | Nov-17 | |||

Ship Shoal 255 | 100.00% | Dec-12 | Dec-17 | |||

Eugene Island 23 | 100.00% | Jun-13 | Jun-18 | |||

Ship Shoal 52 | 100.00% | Jul-13 | Jul-18 | |||

Ship Shoal 59 | 100.00% | Jul-13 | Jul-18 | |||

(1) | Farm-out. COI retains a 2.41% ORRI |

(2) | Successful exploration well. Lease will be held by production. |

(3) Submitted paperwork to relinquish in August 2013.

The Company's Eugene Island 11 block expired in December 2012. This will not impact our ability to operate our facilities located on that block. Operators in the Gulf of Mexico may place platforms and facilities on any location without having to own the lease, provided that permission and proper permits from the Bureau of Safety and Environmental Enforcement (“BSEE”) have been obtained, and Contango obtained such permission and permits. We installed our facilities at Eugene Island 11 because that was the optimal gathering location in proximity to our wells and marketing pipelines, but we were not required to purchase the Eugene Island 11 block to place our facilities at this location.

Onshore Exploration and Properties

Kaybob Duvernay - Alberta, Canada

In April 2011, the Company committed to invest up to $20 million in Alta, a venture that was formed to acquire, explore, develop and operate onshore unconventional oil and natural gas shale assets in North America. As of June 30, 2013, we had invested approximately $14.9 million in Alta to lease over 67,000 acres in the Kaybob Duvernay, a liquids rich shale play in Alberta, Canada. In July 2013, we invested an additional approximately $0.3 million in Alta.

In August 2013, Alta signed a contract to sell its interest in the Kaybob Duvernay. Proceeds from the sale are expected to be approximately $29 million, net to Contango. The sale is expected to close by October after satisfaction of a number of closing conditions. Contango has a 2% interest in Alta and a 5% interest in the Kaybob Duvernay project.

5

Jonah Field - Sublette County, Wyoming

In April 2012, the Company, through its wholly-owned subsidiary, Contaro Company, entered into a Limited Liability Company Agreement (as amended, the “LLC Agreement”) in connection with the formation of Exaro Energy III LLC (“Exaro”). Pursuant to the LLC Agreement, the Company has committed to invest up to $82.5 million in cash in Exaro over the next five years together with other parties for an aggregate commitment of $182.5 million, or a 45% ownership interest in Exaro.

In August 2012, one of the other investors in Exaro exercised its right to assume $15 million of the Company's commitment, which lowered the Company's commitment to $67.5 million and its ownership interest to 37%. As of June 30, 2013, the Company had invested approximately $46.9 million in Exaro.

Exaro has entered into an Earning and Development Agreement with Encana Oil & Gas (USA) Inc. (“Encana”) to provide funding of up to $380 million to continue the development drilling program in a defined area of Encana's Jonah Field asset located in Sublette County, Wyoming. This funding will be comprised of the $182.5 million investment described above, debt, and cash flow from operations. Encana will continue to be the operator of the field and upon investing the full amount of the $380 million, Exaro will have earned 32.5% of Encana's working interest in a defined joint venture area that comprises approximately 5,760 gross acres.

As of June 30, 2013, the Company had invested approximately $46.9 million in Exaro, including $13.1 million that was invested during the fiscal year ended June 30, 2013. As of June 30, 2013, the Exaro-Encana venture had 55 new wells on production, producing at a rate of approximately 10.7 Mmcfed, net to Contango, plus an additional five wells that are either in the completion or fracture stimulation phase. Exaro continues to have three drilling rigs running on this project. For the fiscal year ended June 30, 2013, the Company recognized a gain of approximately $1.2 million, net of tax benefits, as a result of its investment in Exaro. See Note 7 - Investment in Exaro Energy III LLC for a detailed description of our financial condition as a result of this investment.

Tuscaloosa Marine Shale

In October 2012, the Company purchased a 25% non-operating working interest in the Crosby 12H-1 well in Wilkinson County, Mississippi, targeting the Tuscaloosa Marine Shale ("TMS"), an oil-focused shale play in central Louisiana and Mississippi. As of June 30, 2013, we had invested approximately $5.8 million in this well, including leasehold costs. This well is operated by Goodrich Petroleum Company LLC ("Goodrich"). For evaluation purposes, we drilled a pilot well, performed an open-hole evaluation and obtained a conventional core over the TMS interval. As of June 30, 2013, the Crosby 12H-1 well was producing at an 8/8ths rate of approximately 350 barrels of oil per day, with cumulative production of approximately 74,000 barrels of oil through June 30, 2013. This well has approximately 6,700 feet of usable lateral and was fracked with 25 stages.

As of June 30, 2013, the Company had invested approximately $9.1 million to lease approximately 24,000 additional acres in the TMS. In July 2013, we elected to participate with less than a 1% working interest in the CMR/Foster Creek 20-7H #1 well, which is operated by Goodrich, as a result of our acreage being pooled into a unit. In August 2013, we elected to participate with approximately a 3% working interest in the Huff 18-7H #1 well, which is also operated by Goodrich, as a result of our acreage being pooled into a unit. We plan to continue to participate in third-party operated wells with a small working interest prior to initiating an operated, high interest drilling program. The data we obtain from these wells will assist us to evaluate our TMS acreage and to develop a plan for drilling and operating future wells.

Jim Hogg County, Texas

During the fiscal year ended June 30, 2013, we expended approximately $1.4 million in an exploration program with a large south Texas mineral owner involving acreage in Jim Hogg County, Texas. We have determined this program to be unsuccessful and will not invest additional funds.

Discontinued Operations

Joint Venture Assets

In October 2009, the Company entered into a joint venture with Patara Oil & Gas LLC ("Patara") to develop Cotton Valley gas reserves in Panola County, Texas. B.A. Berilgen, a member of the Company’s board of directors, was the Chief Executive Officer of Patara at the time. In May 2011, the Company sold to Patara its 90% interest and 5% overriding royalty interest in the 21 wells drilled under this joint venture for approximately $36.2 million and recognized a pre-tax loss of

6

approximately $0.7 million. These 21 wells had proved reserves of approximately 16.7 Bcfe, net to Contango. The Company accounted for this sale as discontinued operations as of June 30, 2011 and has included the results of the joint venture operations in discontinued operations for all periods presented.

Rexer Assets

In May 2011, the Company sold to Patara its 100% interest in Rexer #1 and 75% interest in Rexer-Tusa #2 for approximately $2.5 million and recognized a pre-tax loss of approximately $0.3 million. The Rexer #1 well had proved reserves of approximately 0.5 Bcfe, net to Contango, while the Rexer-Tusa #2 had not been spud at the time of sale.

The remaining 25% working interest in Rexer-Tusa #2 was sold to Patara in October 2011 for $10,000. The Company has accounted for the sale of Rexer #1 and Rexer-Tusa #2 as discontinued operations as of June 30, 2012 and has included the results of these operations in discontinued operations for all periods presented.

Contango Mining Company

Contango Mining Company (“Contango Mining”), a wholly-owned subsidiary of the Company and the predecessor to Contango ORE, Inc. (“CORE”), was initially formed on October 15, 2009 as a Delaware corporation registered to do business in Alaska for the purpose of engaging in exploration in the State of Alaska for (i) gold and associated minerals and (ii) rare earth elements. Contango Mining held leasehold interests in approximately 675,000 acres from the Tetlin Village Council, the council formed by the governing body for the Native Village of Tetlin, an Alaska Native Tribe, as well as additional acres in unpatented Federal and State of Alaska mining claims for the exploration of gold deposits and associated minerals and rare earth elements (collectively, the “Properties”).

On November 29, 2010, CORE, then another wholly-owned subsidiary of the Company, acquired the assets and assumed the obligations of Contango Mining, including the Properties, in exchange for its common stock which was subsequently distributed to the Company’s stockholders of record as of October 15, 2010 on the basis of one share of common stock for each ten shares of the Company’s common stock then outstanding. No fractional shares were issued, but a cash payment was made to shareholders with less than ten shares based upon the value established for CORE. The Company also contributed $3.5 million in cash to CORE immediately prior to the distribution. The Company no longer has an ownership in CORE and has included its results of operations and gain on disposition in discontinued operations for all periods presented.

Marketing and Pricing

The Company currently derives its revenue principally from the sale of natural gas and oil. As a result, the Company’s revenues are determined, to a large degree, by prevailing natural gas and oil prices. The Company currently sells its natural gas and oil on the open market at prevailing market prices. Major purchasers of our natural gas, oil and natural gas liquids for the fiscal year ended June 30, 2013 were ConocoPhillips Company (53%), Shell Trading US Company (21%), Enterprise Products Operating LLC (9%) and Exxon Mobil Oil Corporation (8%). Market prices are dictated by supply and demand, and the Company cannot predict or control the price it receives for its natural gas and oil. The Company has outsourced the marketing of its offshore natural gas and oil production volume to a privately-held third party marketing firm.

Price decreases would adversely affect our revenues, profits and the value of our proved reserves. Historically, the prices received for natural gas and oil have fluctuated widely. Among the factors that can cause these fluctuations are:

• | The domestic and foreign supply of natural gas and oil |

• | Overall economic conditions |

• | The level of consumer product demand |

• | Adverse weather conditions and natural disasters |

• | The price and availability of competitive fuels such as heating oil and coal |

• | Political conditions in the Middle East and other natural gas and oil producing regions |

• | The level of LNG imports |

• | Domestic and foreign governmental regulations |

• | Special taxes on production |

• | The loss of tax credits and deductions |

Competition

The Company competes with numerous other companies in all facets of its business. Our competitors in the exploration, development, acquisition and production business include major integrated oil and gas companies as well as numerous independents, including many that have significantly greater financial resources and in-house technical expertise.

7

Governmental Regulations

Federal Income Tax. Federal income tax laws significantly affect the Company’s operations. The principal provisions affecting the Company are those that permit the Company, subject to certain limitations, to deduct as incurred, rather than to capitalize and amortize, its domestic “intangible drilling and development costs” and to claim depletion on a portion of its domestic natural gas and oil properties and to claim a manufacturing deduction based on qualified production activities.

Environmental Matters. Domestic natural gas and oil operations are subject to extensive federal regulation and, with respect to federal leases, to interruption or termination by governmental authorities on account of environmental and other considerations such as the Comprehensive Environmental Response, Compensation and Liability Act (“CERCLA”) also known as the “Super Fund Law”. The trend towards stricter standards in environmental legislation and regulation could increase costs to the Company and others in the industry. Natural gas and oil lessees are subject to liability for the costs of clean-up of pollution resulting from a lessee’s operations, and may also be subject to liability for pollution damages. The Company maintains insurance against costs of clean-up operations, but is not fully insured against all such risks. A serious incident of pollution may also result in the Department of the Interior requiring lessees under federal leases to suspend or cease operation in the affected area.

The Oil Pollution Act of 1990 (the “OPA”) and regulations thereunder impose a variety of regulations on “responsible parties” related to the prevention of oil spills and liability for damages resulting from such spills in U.S. waters. The OPA assigns liability to each responsible party for oil removal costs and a variety of public and private damages. While liability limits apply in some circumstances, a party cannot take advantage of liability limits if the spill was caused by gross negligence or willful misconduct or resulted from violation of federal safety, construction or operating regulations. Few defenses exist to the liability imposed by the OPA. In addition, to the extent the Company’s offshore lease operations affect state waters, the Company may be subject to additional state and local clean-up requirements or incur liability under state and local laws. The OPA also imposes ongoing requirements on responsible parties, including proof of financial responsibility to cover at least some costs in a potential spill. The Company believes that it currently has established adequate proof of financial responsibility for its offshore facilities. However, the Company cannot predict whether financial responsibility requirements under any OPA amendments will result in the imposition of substantial additional annual costs to the Company in the future or otherwise materially adversely affect the Company. The impact, however, should not be any more adverse to the Company than it will be to other similarly situated or less capitalized owners or operators in the Gulf of Mexico.

The Company’s operations are subject to numerous federal, state and local laws and regulations controlling the discharge of materials into the environment or otherwise relating to the protection of the environment. Such laws and regulations, among other things, impose absolute liability on the lessee for the cost of clean-up of pollution resulting from a lessee’s operations, subject the lessee to liability for pollution damages, may require suspension or cessation of operations in affected areas, and impose restrictions on the injection of liquids into subsurface aquifers that may contaminate groundwater. Such laws could have a significant impact on the operating costs of the Company, as well as the natural gas and oil industry in general. Federal, state and local initiatives to further regulate the disposal of natural gas and oil wastes are also pending in certain jurisdictions, and these initiatives could have a similar impact on the Company. The Company’s operations are also subject to additional federal, state and local laws and regulations relating to protection of human health, natural resources, and the environment pursuant to which the Company may incur compliance costs or other liabilities.

Impact of Deepwater Horizon Incident. In 2010, the US Department of the Interior issued new rules designed to improve drilling and workplace safety, and various Congressional committees began pursuing legislation to greater regulate drilling activities and increase liability, in response to the Deepwater Horizon Incident. In January 2011, various legislative committees released their reports, recommending that the federal government require additional regulation and an increase in liability caps.

Additional regulatory review, slower permitting processes and increased oversight have resulted in longer development cycle time for our Gulf of Mexico projects. Cycle time is the length of time it takes for a project to progress from developing a prospect to beginning production, and longer development cycle times could result in lower rates of return on our investments.

Increased regulation impacting our activities in the Gulf of Mexico could result in extensive efforts to ensure compliance and incremental compliance costs. A significant delay or cancellation of our planned Gulf of Mexico exploratory activities will reduce our longer term ability to replace reserves, resulting in a negative impact on production over time. To the extent current exploration activities are significantly delayed, a gap could occur in our long-term production profile with a negative impact on our operating results and cash flows.

8

Additional legislation or regulation is being discussed which could require each company doing business in the Gulf of Mexico to establish and maintain a higher level of financial responsibility under its Certificate of Financial Responsibility ("COFR"), a certificate required under the Oil Pollution Act of 1990 which evidences a company’s financial ability to pay for cleanup and damages caused by oil spills. There have also been discussions regarding the establishment of a new industry mutual fund in which companies would be required to participate and which would be available to pay for consequential damages arising from an oil spill. These and/or other legislative or regulatory changes could require us to maintain a certain level of financial strength and may reduce our financial flexibility.

Future legislation or regulation is also likely to result in substantial increases in civil or criminal fines or sanctions. Such fines or sanctions could well exceed the actual cost of containment and cleanup associated with a well incident or spill.

Other Laws and Regulations. Various laws and regulations often require permits for drilling wells and also cover spacing of wells, the prevention of waste of natural gas and oil including maintenance of certain gas/oil ratios, rates of production and other matters. The effect of these laws and regulations, as well as other regulations that could be promulgated by the jurisdictions in which the Company has production, could be to limit the number of wells that could be drilled on the Company’s properties and to limit the allowable production from the successful wells completed on the Company’s properties, thereby limiting the Company’s revenues.

The BOEM administers the natural gas and oil leases held by the Company on federal onshore lands and offshore tracts in the Outer Continental Shelf. The BOEM holds a royalty interest in these federal leases on behalf of the federal government. While the royalty interest percentage is fixed at the time that the lease is entered into, from time to time the BOEM changes or reinterprets the applicable regulations governing its royalty interests, and such action can indirectly affect the actual royalty obligation that the Company is required to pay. However, the Company believes that the regulations generally do not impact the Company to any greater extent than other similarly situated producers. At the end of lease operations, oil and gas lessees must plug and abandon wells, remove platforms and other facilities, and clear the lease site sea floor. The BOEM requires companies operating on the Outer Continental Shelf to obtain surety bonds to ensure performance of these obligations. As an operator, the Company is required to obtain surety bonds of $200,000 per lease for exploration and $500,000 per lease for developmental activities.

The Federal Energy Regulatory Commission (the “FERC”) has embarked on wide-ranging regulatory initiatives relating to natural gas transportation rates and services, including the availability of market-based and other alternative rate mechanisms to pipelines for transmission and storage services. In addition, the FERC has announced and implemented a policy allowing pipelines and transportation customers to negotiate rates above the otherwise applicable maximum lawful cost-based rates on the condition that the pipelines alternatively offer so-called recourse rates equal to the maximum lawful cost-based rates. With respect to gathering services, the FERC has issued orders declaring that certain facilities owned by interstate pipelines primarily perform a gathering function, and may be transferred to affiliated and non-affiliated entities that are not subject to the FERC’s rate jurisdiction. The Company cannot predict the ultimate outcome of these developments, or the effect of these developments on transportation rates. Inasmuch as the rates for these pipeline services can affect the natural gas prices received by the Company for the sale of its production, the FERC’s actions may have an impact on the Company. However, the impact should not be substantially different for the Company than it would be for other similarly situated natural gas producers and sellers.

Risk and Insurance Program

In accordance with industry practice, we maintain insurance against many, but not all, potential perils confronting our operations and in coverage amounts and deductible levels that we believe to be economic. Consistent with that profile, our insurance program is structured to provide us financial protection from significant losses resulting from damages to, or the loss of, physical assets or loss of human life, and liability claims of third parties, including such occurrences as well blowouts and weather events that result in oil spills and damage to our wells and/or platforms. Our goal is to balance the cost of insurance with our assessment of the potential risk of an adverse event. We maintain insurance at levels that we believe are appropriate and consistent with industry practice and we regularly review our risks of loss and the cost and availability of insurance and revise our insurance program accordingly.

We expect the future availability and cost of insurance to be impacted by the Deepwater Horizon Incident. Impacts could include: tighter underwriting standards, limitations on scope and amount of coverage, and higher premiums, and will depend, in part, on future changes in laws and regulations regarding exploration and production activities in the Gulf of Mexico, including possible increases in liability caps for claims of damages from oil spills. We will continue to monitor the expected regulatory and legislative response and its impact on the insurance market and our overall risk profile, and adjust our risk and insurance program to provide protection at a level that we can afford considering the cost of insurance, against the potential and magnitude of disruption to our operations and cash flows.

9

We carry insurance protection for our net share of any potential financial losses occurring as a result of events such as the Deepwater Horizon Incident. As a result of the incident, we have increased our well control coverage to $100 million on certain wells, which covers control of well, pollution cleanup and consequential damages. We have increased our general liability coverage to $150 million, which covers pollution cleanup, consequential damages coverage, and third party personal injury and death. We have also increased our Oil Spill Financial Responsibility coverage to $150 million, which covers additional pollution cleanup and third party claims coverage.

Health, Safety and Environmental Program. The Company’s Health, Safety and Environmental (“HS&E”) Program is supervised by an operating committee of senior management to insure compliance with all state and federal regulations. In addition, to support the operating committee, we have contracted with J. Connors Consulting (“JCC”) to manage our regulatory process. JCC is a regulatory consulting firm specializing in the offshore Gulf of Mexico regulatory process, preparation of incident response plans, safety and environmental services and facilitation of comprehensive oil spill response training and drills to oil and gas companies and pipeline operators.

For our Gulf of Mexico operations, we have a Regional Oil Spill Plan in place with the BOEM. Our response team is trained annually and is tested through annual spill drills given by the BOEM. In addition, we have in place a contract with O’Brien’s Response Management (“O’Brien’s”). O’Brien’s maintains a 24/7 manned incident command center located in Slidell, LA. Upon the occurrence of an oil spill, the Company’s spill program is initiated by notifying O’Brien’s that we have an emergency. While the Company would focus on source control of the spill, O’Brien’s would handle all communication with state and federal agencies as well as U.S. Coast Guard notifications.

If a spill were to occur, we have contracted with Clean Gulf Associates (“CGA”) to assist with equipment and personnel needs. CGA specializes in onsite control and cleanup and is on 24 hour alert with equipment currently stored at six bases (Ingleside and Galveston, TX and Lake Charles, Houma, Venice and Pascagoula, LA), and is opening new sites in Leeville, Morgan City and Harvey, LA. The CGA equipment stockpile is available to serve member oil spill response needs including blowouts; open seas, near shore and shallow water skimming; open seas and shoreline booming; communications; dispersants; boat spray systems to apply dispersants; wildlife rehabilitation; and a forward command center. CGA has retainers with an aerial dispersant company and a company that provides mechanical recovery equipment for spill responses.

In addition to being a member of CGA, the Company has contracted with Wild Well Control for source control at the wellhead, if required. Wild Well Control is one of the world’s leading providers of firefighting, well control, engineering, and training services.

Safety and Environmental Management System. The Company has developed and implemented a Safety and Environmental Management System (“SEMS”) to address oil and gas operations in the Outer Continental Shelf (“OCS”), as required by the BSEE. Our SEMS program identifies, addresses, and manages safety, environmental hazards, and its impacts during the design, construction, start-up, operation, inspection, and maintenance of all new and existing facilities. The Company has established goals, performance measures, training, accountability for its implementation, and provides necessary resources for an effective SEMS, as well as reviews the adequacy and effectiveness of the SEMS program. Facilities must be designed, constructed, maintained, monitored, and operated in a manner compatible with industry codes, consensus standards, and all applicable governmental regulations. We have contracted with Island Technologies Inc. to manage our SEMS program for production operations.

The BSEE enforces the SEMS requirements through regular audits. Failure of an audit may force us to shut-in our Gulf of Mexico operations.

Employees

We have ten employees, all of whom are full time. The Company outsources its human resources function to Insperity, Inc. and all of the Company’s employees are co-employees of Insperity, Inc. In addition to our employees, we use the services of independent consultants and contractors to perform various professional services, including reservoir engineering, land, legal, environmental and tax services. We are dependent on JEX for prospect generation, evaluation and prospect leasing. As a working interest owner, we rely on outside operators to drill, produce and market our natural gas and oil for our onshore prospects and certain offshore prospects where we are a non-operator. In the offshore prospects where we are the operator, we currently rely on drilling contractors to drill and rely on independent contractors to produce and market our natural gas and oil. In addition, we utilize the services of independent contractors to perform field and on-site drilling and production operation services and independent third party engineering firms to evaluate our reserves.

10

Directors and Executive Officers

The following table sets forth the names, ages and positions of our directors and executive officers:

Name | Age | Position | |||

Joseph J. Romano | 60 | Chairman, President and Chief Executive Officer | |||

Sergio Castro | 44 | Vice President, Chief Financial Officer, Treasurer and Secretary | |||

Yaroslava Makalskaya | 44 | Vice President, Chief Accounting Officer and Controller | |||

Marc L. Duncan | 60 | Senior Vice President - Engineering | |||

Charles A. Cambron (1) | 46 | Vice President - Drilling | |||

Michael J. Autin | 54 | Vice President - Production | |||

B.A. Berilgen | 65 | Director | |||

Jay D. Brehmer | 48 | Director | |||

Brad Juneau | 53 | Director | |||

Charles M. Reimer | 68 | Director | |||

Steven L. Schoonover | 68 | Director | |||

(1) Resigned effective August 22, 2013

Joseph J. Romano. Mr. Romano was elected Director, President and Chief Executive Officer of Contango in November 2012, a few months after the Company's founder, Mr. Kenneth R. Peak, received a medical leave of absence. Upon Mr. Peak's passing in April 2013, Mr. Romano was also elected Chairman. Mr. Romano assisted Mr. Peak in founding the Company in 1999. Mr. Romano has worked in the energy industry since 1977. Mr. Romano served as Senior Vice President and Chief Financial Officer of Zilkha Energy Company until its sale in 1998 and served as President and Chief Executive Officer of Zilkha Renewable Company until its sale in 2005. He currently also serves in various capacities in Zilkha-affiliated companies. He has been President and Chief Executive Officer of Olympic Energy Partners since 2005, which owns working interests in Contango's Dutch and Mary Rose fields, has been President and Chief Executive Officer of ZZ Biotech since 2006, and has been Vice President and Director of Laetitia Vineyards and Winery since 2000. Mr. Romano also served as Chief Financial Officer, Treasurer and Controller of Texas International Company from 1986 through 1988 and its Treasurer and Controller from 1982 through 1985. Prior to 1982, Mr. Romano spent five years working in the Worldwide Energy Group of the First National Bank of Chicago. He earned his BA in Economics from the University of Wisconsin in Eau Claire and an MBA from the University of Northern Illinois.

Sergio Castro. Mr. Castro joined Contango in March 2006 as Treasurer and was appointed Vice President, Treasurer and Secretary in April 2006 and Chief Financial Officer in June 2010. Prior to joining Contango, Mr. Castro spent two years (April 2004 to March 2006) as a consultant for UHY Advisors TX, LP. From January 2001 to April 2004, Mr. Castro was a lead credit analyst for Dynegy Inc. From August 1997 to January 2001, Mr. Castro worked as an auditor for Arthur Andersen LLP, where he specialized in energy companies. Mr. Castro was honorably discharged from the U.S. Navy in 1993 as an E-6, where he served onboard a nuclear powered submarine. Mr. Castro received a BBA in Accounting in 1997 from the University of Houston, graduating summa cum laude. Mr. Castro is a CPA and a Certified Fraud Examiner.

Yaroslava Makalskaya. Ms. Makalskaya joined Contango in March 2010 and was appointed Vice President, Chief Accounting Officer and Controller in June 2010. Ms. Makalskaya has over 20 years of experience in accounting and finance, including 13 years in public accounting. Prior to joining Contango, Ms. Makalskaya was a director in the Transaction Services practice at PricewaterhouseCoopers, where she assisted clients with M&A transactions as well as advised clients with complex accounting and financial reporting issues. Prior to July 2008 Ms. Makalskaya was a Senior Manager in the audit practices of PricewaterhouseCoopers and Arthur Andersen, where her clients included many US and international companies in energy, utilities, mining and other sectors. Ms. Makalskaya holds a MS degree in Economics from Novosibirsk State University in Russia. Ms. Makalskaya is a CPA.

Marc L. Duncan. Mr. Duncan joined Contango in June 2005 as President and Chief Operating Officer of Contango Operators, Inc. and was appointed President and Chief Operating Officer of Contango Oil & Gas Company in October 2006 until December 2010. In December 2010 Mr. Duncan was appointed as the Company’s Safety, Environmental and Regulatory Compliance Officer (“SEARCO”) and Vice Chairman of the Operating Committee. In December 2012, Mr. Duncan was appointed Senior Vice President - Engineering. Mr. Duncan has approximately 40 years of experience in the energy industry and has held a variety of domestic and international engineering and senior-level operations management positions relating to

11

natural gas and oil exploration, project development, and drilling and production operations. Prior to joining Contango, Mr. Duncan served as Chief Operating Officer of USENCO International, Inc. and its subsidiaries and affiliates in China and Ukraine from February 2000 to July 2004 and as a senior project and drilling engineer for Hunt Oil Company from July 2004 to June 2005. He holds an MBA in Engineering Management from the University of Dallas, an MEd from the University of North Texas and a BS in Science and Education from Stephen F. Austin University.

Charles A. Cambron. Mr. Cambron joined Contango in August 2010 as Vice President of Drilling. Mr. Cambron has over 20 years of experience in the Gulf of Mexico oil and gas industry. Most recently he was employed by Applied Drilling Technology, Inc. (ADTI) as an Operations Manager from August 1995 until August 2010. He also held various positions in engineering and offshore supervision over a 15 year period. Prior to ADTI, Mr. Cambron began his career with Rowan Petroleum, Inc. as a Drilling Engineer working in both the Gulf of Mexico and North Sea. Mr. Cambron received a BS degree in Petroleum Engineering from the University of Oklahoma in 1991.

Michael J. Autin. Mr. Autin joined Contango in May 2012 as Vice President of Production. Mr. Autin has approximately 35 years of experience in the petroleum industry including the Gulf of Mexico and U.S onshore shale. He has held various positions including Production Manager, HSE Manager and Offshore Installation Manager. Prior to joining Contango, Mr. Autin was employed by BHP Billiton since October 2000, where most recently he was Gulf of Mexico Operations Manager, Field Manager and Operations Advisor. Mr. Autin attended Nicholls State University where he studied petroleum, safety and business. He received a BS degree in 1986.

B.A. Berilgen. Mr. Berilgen was appointed a director of Contango in July 2007. Mr. Berilgen has served in a variety of senior positions during his 40 year career. In February 2013 he became the managing director Most recently, he became Chief Executive Officer of Patara Oil & Gas LLC in April 2008. Prior to that he was Chairman, Chief Executive Officer and President of Rosetta Resources Inc., a company he founded in June 2005, until his resignation in July 2007, and then he was an independent consultant from July 2007 through April 2008. Mr. Berilgen was also previously the Executive Vice President of Calpine Corp. and President of Calpine Natural Gas L.P. from October 1999 through June 2005. In June 1997, Mr. Berilgen joined Sheridan Energy, a public oil and gas company, as its President and Chief Executive Officer. Mr. Berilgen attended the University of Oklahoma, receiving a BS in Petroleum Engineering in 1970 and a MS in Industrial Engineering / Management Science.

Jay D. Brehmer. Mr. Brehmer has been a director of Contango since October 2000. Mr. Brehmer is a co-founding partner of Southplace, LLC, a provider of private-company middle-market corporate finance advisory services. Mr. Brehmer founded Southplace, LLC in November 2002. In August 2004, Mr. Brehmer became Managing Director of Houston Capital Advisors LP, a boutique financial advisory, merger and acquisition investment bank, while still retaining his membership in Southplace, LLC. Mr. Brehmer resigned from Houston Capital Advisors LP in January 2008 and is currently associated with Southplace, LLC in a full-time capacity. From May 1998 until November 2002, Mr. Brehmer was responsible for structured-finance energy related transactions at Aquila Energy Capital Corporation. Prior to joining Aquila, Mr. Brehmer founded Capital Financial Services, which provided mid-cap companies with strategic merger and acquisition advice coupled with prudent financial capitalization structures. Mr. Brehmer holds a BBA from Drake University in Des Moines, Iowa.

Brad Juneau. Mr. Juneau, was elected a director of the Company in April 2012. Mr. Juneau is the sole manager of the general partner of JEX. Prior to forming JEX in 1998, Mr. Juneau served as senior vice president of exploration for Zilkha Energy Company from 1987 to 1998. Prior to joining Zilkha Energy Company, Mr. Juneau served as staff petroleum engineer with Texas International Company for three years, where his principal responsibilities included reservoir engineering, as well as acquisitions and evaluations. Prior to that, he was a production engineer with Enserch Corporation in Oklahoma City. Additionally, as a co-founder of CORE, Mr. Juneau was elected President and Chief Executive Officer of CORE in December 2012, and appointed Chairman of CORE in April 2013. Mr. Juneau holds a BS degree in petroleum engineering from Louisiana State University.

Charles M. Reimer. Mr. Reimer was elected a director of Contango in November 2005. Mr. Reimer is President of Freeport LNG Development, L.P., and has experience in exploration, production, liquefied natural gas (“LNG”) and business development ventures, both domestically and abroad. From 1986 until 1998, Mr. Reimer served as the senior executive responsible for the VICO joint venture that operated in Indonesia, and provided LNG technical support to P. T. Badak. Additionally, during these years he served, along with Pertamina executives, on the board of directors of the P.T. Badak LNG plant in Bontang, Indonesia. Mr. Reimer began his career with Exxon Company USA in 1967 and held various professional and management positions in Texas and Louisiana. Mr. Reimer was named President of Phoenix Resources Company in 1985 and relocated to Cairo, Egypt, to begin eight years of international assignments in both Egypt and Indonesia. Prior to joining Freeport LNG Development, L.P. in December 2002, Mr. Reimer was President and Chief Executive Officer of Cheniere Energy, Inc.

12

Steven L. Schoonover. Mr. Schoonover was elected a director of Contango in November 2005. Mr. Schoonover was most recently Chief Executive Officer of Cellxion, L.L.C., a company he founded in September 1996 and sold in September 2007, which specialized in construction and installation of telecommunication buildings and towers, as well as the installation of high-tech telecommunication equipment. Since the sale in September 2007, Mr. Schoonover continues to serve as a consultant to the current management team of Cellxion, L.L.C. From 1990 until its sale in November 1997 to Telephone Data Systems, Inc., Mr. Schoonover served as President of Blue Ridge Cellular, Inc., a full-service cellular telephone company he co-founded. From 1983 to 1996, he served in various positions, including President and Chief Executive Officer, with Fibrebond Corporation, a construction firm involved in cellular telecommunications buildings, site development and tower construction. Mr. Schoonover has been awarded, on two occasions with two different companies, Entrepreneur of the Year, sponsored by Ernst & Young, Inc Magazine and USA Today.

Mr. Kenneth R. Peak, the Company's founder, was Chairman of the Board, Chief Executive Officer and a director of the Company since its inception in 1999. In August 2012, Mr. Peak received a medical leave of absence from his responsibilities at the Company. Mr. Peak passed away in April 2013. Mr. Peak also co-founded Contango ORE, Inc. in 2010, and from its inception until August 2012 was its Chairman and Chief Executive Officer. Mr. Peak entered the energy industry in 1973 as a commercial banker and held a variety of financial and executive positions in the oil and gas industry prior to founding Contango in 1999. Mr. Peak served as an officer in the U.S. Navy from 1968 to 1971. Mr. Peak received a BS in physics from Ohio University in 1967, and an MBA from Columbia University in 1972. He was also a director of Patterson-UTI Energy, Inc., a provider of onshore contract drilling services to exploration and production companies in North America.

Directors of Contango serve as members of the board of directors until the next annual stockholders meeting, until successors are elected and qualified or until their earlier resignation or removal. Officers of Contango are elected by the board of directors and hold office until their successors are chosen and qualified, until their death or until they resign or have been removed from office. All corporate officers serve at the discretion of the board of directors. Each non-employee director of the Company receives a quarterly retainer of $28,000 payable in cash, with no stock option or common stock grants. There are no additional payments for meetings attended or being chairman of a committee. During fiscal year 2011, each outside director of the Company received a quarterly retainer of $20,000 payable in cash, with no stock option or common stock grants. There were no additional payments for meetings attended or being chairman of a committee. There are no family relationships between any of our directors or executive officers.

Corporate Offices

We lease our corporate offices at 3700 Buffalo Speedway, Suite 960, Houston, Texas 77098. In November 2010, the Company expanded its office space and extended its office lease agreement through February 29, 2016.

Code of Ethics

We adopted a Code of Ethics for senior management in December 2002, which was updated and adopted by the Company's Board of Directors in May 2012. A copy of our Code of Ethics is filed as an exhibit to this Form 10-K and is also available on our website at www.contango.com.

Available Information

You may read and copy all or any portion of this annual report on Form 10-K, our quarterly reports on Form 10-Q and current reports on Form 8-K, as well as any amendments and exhibits to those reports, without charge at the office of the Securities and Exchange Commission (the “SEC”) in Public Reference Room, 100 F Street NE, Washington, DC, 20549. Information regarding the operation of the public reference rooms may be obtained by calling the SEC at 1-800-SEC-0330. In addition, filings made with the SEC electronically are publicly available through the SEC's website at http://www.sec.gov, and at our website at http://www.contango.com. This annual report on Form 10-K, including all exhibits and amendments, has been filed electronically with the SEC.

Item 1A. Risk Factors

In addition to the other information set forth elsewhere in this Form 10-K, you should carefully consider the following factors when evaluating the Company. An investment in the Company is subject to risks inherent in our business. The trading price of the shares of the Company is affected by the performance of our business relative to, among other things, competition, market conditions and general economic and industry conditions. The value of an investment in the Company may decrease, resulting in a loss.

13

RISK FACTORS RELATING TO CONTANGO

We have no ability to control the market price for natural gas and oil. Natural gas and oil prices fluctuate widely, and a substantial or extended decline in natural gas and oil prices would adversely affect our revenues, profitability and growth and could have a material adverse effect on the business, the results of operations and financial condition of the Company.

Our revenues, profitability and future growth depend significantly on natural gas and crude oil prices. Prices received affect the amount of future cash flow available for capital expenditures and repayment of indebtedness and our ability to raise additional capital. We do not expect to hedge our production to protect against price decreases. Lower prices may also affect the amount of natural gas and oil that we can economically produce. Factors that can cause price fluctuations include:

• Overall economic conditions.

• The domestic and foreign supply of natural gas and oil.

• The level of consumer product demand.

• Adverse weather conditions and natural disasters.

• The price and availability of competitive fuels such as LNG, heating oil and coal.

• Political conditions in the Middle East and other natural gas and oil producing regions.

• The level of LNG imports and any LNG exports.

• Domestic and foreign governmental regulations.

• Special taxes on production.

• Access to pipelines and gas processing plants.

• The loss of tax credits and deductions.

A substantial or extended decline in natural gas and oil prices could have a material adverse effect on our access to capital and the quantities of natural gas and oil that may be economically produced by us. A significant decrease in price levels for an extended period would negatively affect us.

Our ability to successfully execute our business plan is dependent on our ability to obtain adequate financing.

Our business plan, which includes participation in 3-D seismic shoots, lease acquisitions, the drilling of exploration prospects and producing property acquisitions, has required and is expected to continue to require substantial capital expenditures. We may require additional financing to fund our planned growth. Our ability to raise additional capital will depend on the results of our operations and the status of various capital and industry markets at the time we seek such capital. Accordingly, additional financing may not be available to us on acceptable terms, if at all. In the event additional capital resources are unavailable, we may be required to curtail our exploration and development activities or be forced to sell some of our assets in an untimely fashion or on less than favorable terms.

It is difficult to quantify the amount of financing we may need to fund our planned growth. The amount of funding we may need in the future depends on various factors such as:

• Our financial condition.

• The prevailing market price of natural gas and oil.

• The type of projects in which we are engaging.

• The lead time required to bring any discoveries to production.

We assume additional risk as operator in drilling high pressure and high temperature wells in the Gulf of Mexico.

COI, a wholly-owned subsidiary of the Company, was formed for the purpose of drilling and operating exploration wells in the Gulf of Mexico. Drilling activities are subject to numerous risks, including the significant risk that no commercially productive hydrocarbon reserves will be encountered. The cost of drilling, completing and operating wells and of installing production facilities and pipelines is often uncertain. Drilling costs could be significantly higher if we encounter difficulty in drilling offshore exploration wells. The Company’s drilling operations may be curtailed, delayed, canceled or negatively impacted as a result of numerous factors, including title problems, weather conditions, compliance with governmental requirements and shortages or delays in the delivery or availability of material, equipment and fabrication yards. In periods of increased drilling activity resulting from high commodity prices, demand exceeds availability for drilling rigs,