2013.12.31 10-K Exhibit 10.25i - Texas Contract Amendment I

Exhibit 10.25i

EXPLANATORY NOTE: “***” INDICATES THE PORTION OF THIS EXHIBIT THAT HAS BEEN OMITTED AND SEPARATELY FILED WITH THE SECURITIES AND EXCHANGE COMMISSION PURSUANT TO A REQUEST FOR CONFIDENTIAL TREATMENT.

HHSC Contract No. 529-12-0002-00006-I

|

| | |

This Amendment is between the Texas Health and Human Services Commission (HHSC), an administrative agency within the executive department of the State of Texas, having its principal office at 4900 North Lamar Boulevard, Austin, Texas 78751, and Bankers Reserve Life Insurance Company of Wisconsin d.b.a. Superior HealthPlan Network (MCO), an entity organized under the laws of the State of Wisconsin, having its principal place of business at 2100 South IH-35, Suite 202, Austin, Texas 78704. HHSC and MCO may be referred to in this Amendment individually as a “Party” and collectively as the “Parties.”

|

Amendment Effective Date | Contract Expiration Date | Operational Start Date |

February 1, 2014 | August 31, 2015 | March 1, 2012 |

MCO Brand Names |

The MCO will use following brand name(s). The MCO acknowledges that if it requests a change to the brand name(s), it will be responsible for all costs associated with the change(s), including HHSC's costs for modifying its business rules, system identifiers, communications materials, web page, etc. STAR: Superior Health Plan STAR+PLUS: Superior Health Plan CHIP: MRSA: Superior HealthPlan |

Project Managers |

HHSC: Emily Zalkovsky Director, Program Management 11209 Metric Boulevard, Building H Austin, Texas 78758 Phone: 512-491-2078 Fax: 512-491-1972 MCO: Susan Erickson Vice President 2100 South IH-35, Suite 202 Austin, Texas 78704 Phone: 512-692-1465 Ext 22032 Fax: 866-702-4830 E-mail: serickson@centene.com

|

Legal Notice Delivery Addresses |

HHSC: General Counsel 4900 North Lamar Boulevard, 4th Floor Austin, Texas 78751 Fax: 512-424-6586 MCO: Superior HealthPlan 2100 South IH-35, Suite 202 Austin, Texas 78704 Fax: 866-702-4830 |

|

|

|

MCO Programs and Service Areas |

This Amendment applies to the following checked HHSC MCO Programs and Service Areas . All references in the Amendment or the Contract to MCO Programs or Service Areas that are not checked do not apply to the MCO. þ Medicaid STAR MCO Program þ Medicaid STAR + PLUS MCO Program o CHIP MCO Program |

þ Medicaid STAR MCO Program

|

| | | | |

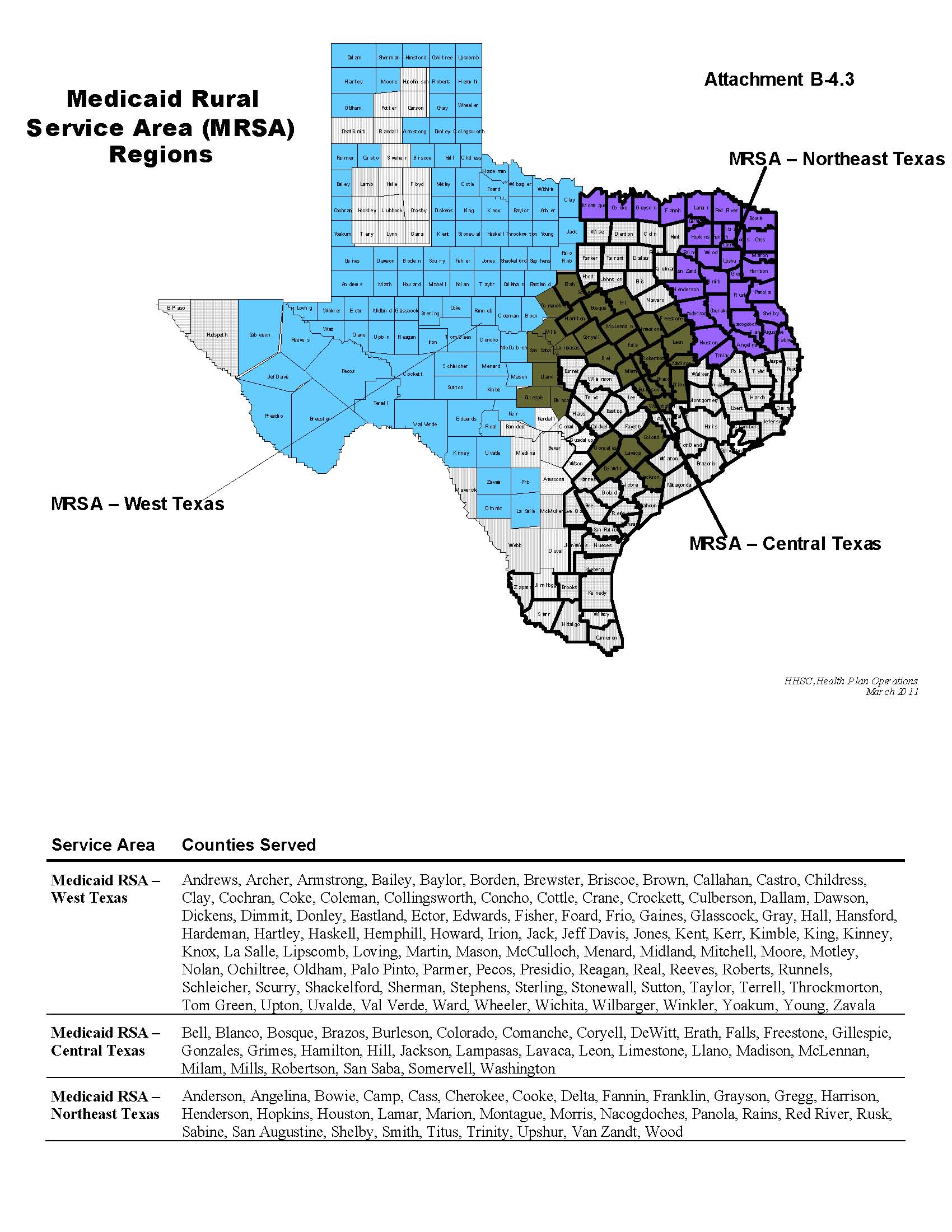

Service Areas: | | o Bexar | | þ Medicaid RSA - Central |

| | o Dallas | | þ Medicaid RSA - Northeast |

| | o El Paso | | þ Medicaid RSA - West |

| | o Harris | | o Nueces |

| | þ Hidalgo | | o Tarrant |

| | o Jefferson | | o Travis |

| | o Lubbock | | |

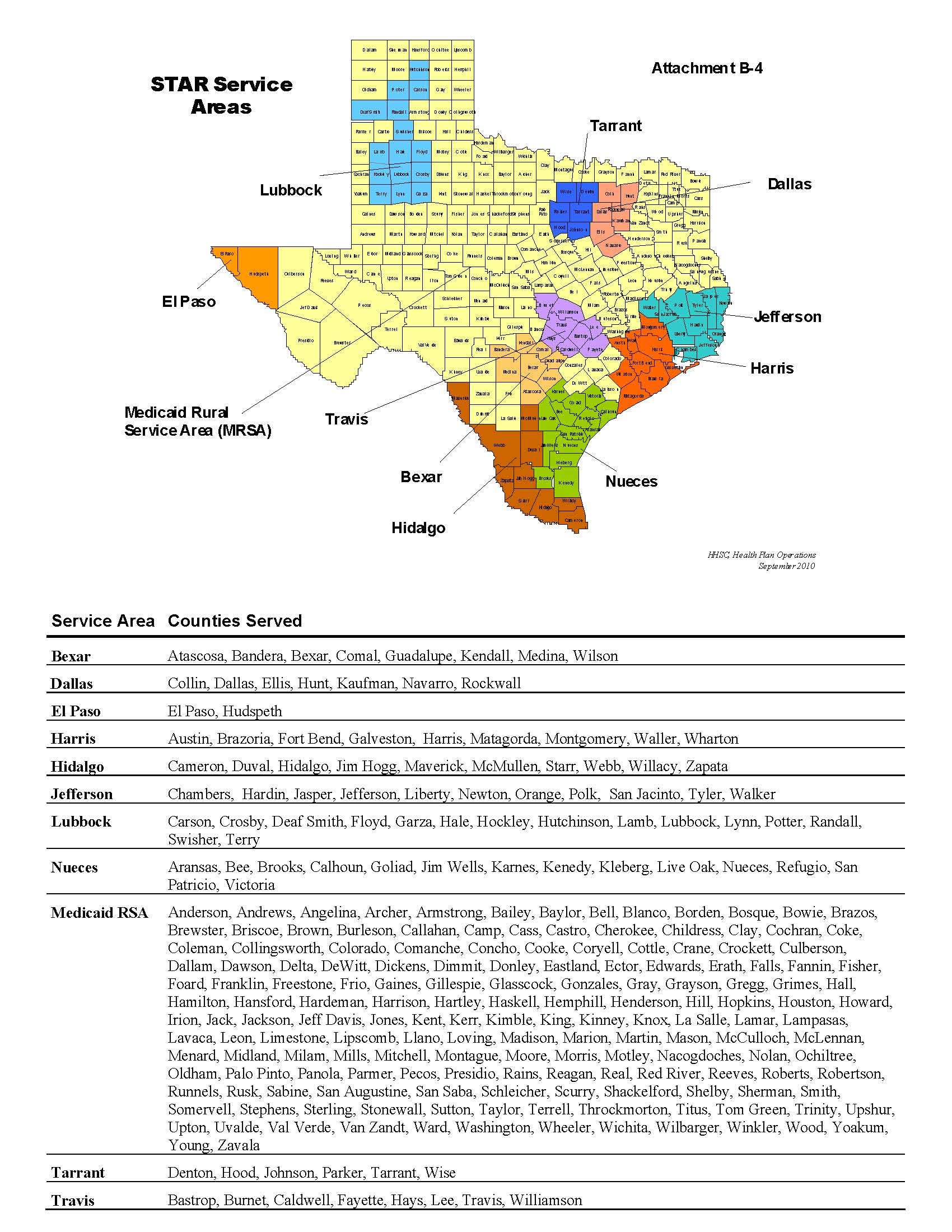

See Contract Attachment B-4, “Map of Counties with MCO Program Service Areas,” for listing of counties included within the STAR Service Areas.

þ Medicaid STAR+PLUS MCO Program

|

| | | | |

Service Areas: | | o Bexar | | o Jefferson |

| | o El Paso | | o Lubbock |

| | o Harris | | o Nueces |

| | þ Hidalgo | | o Travis |

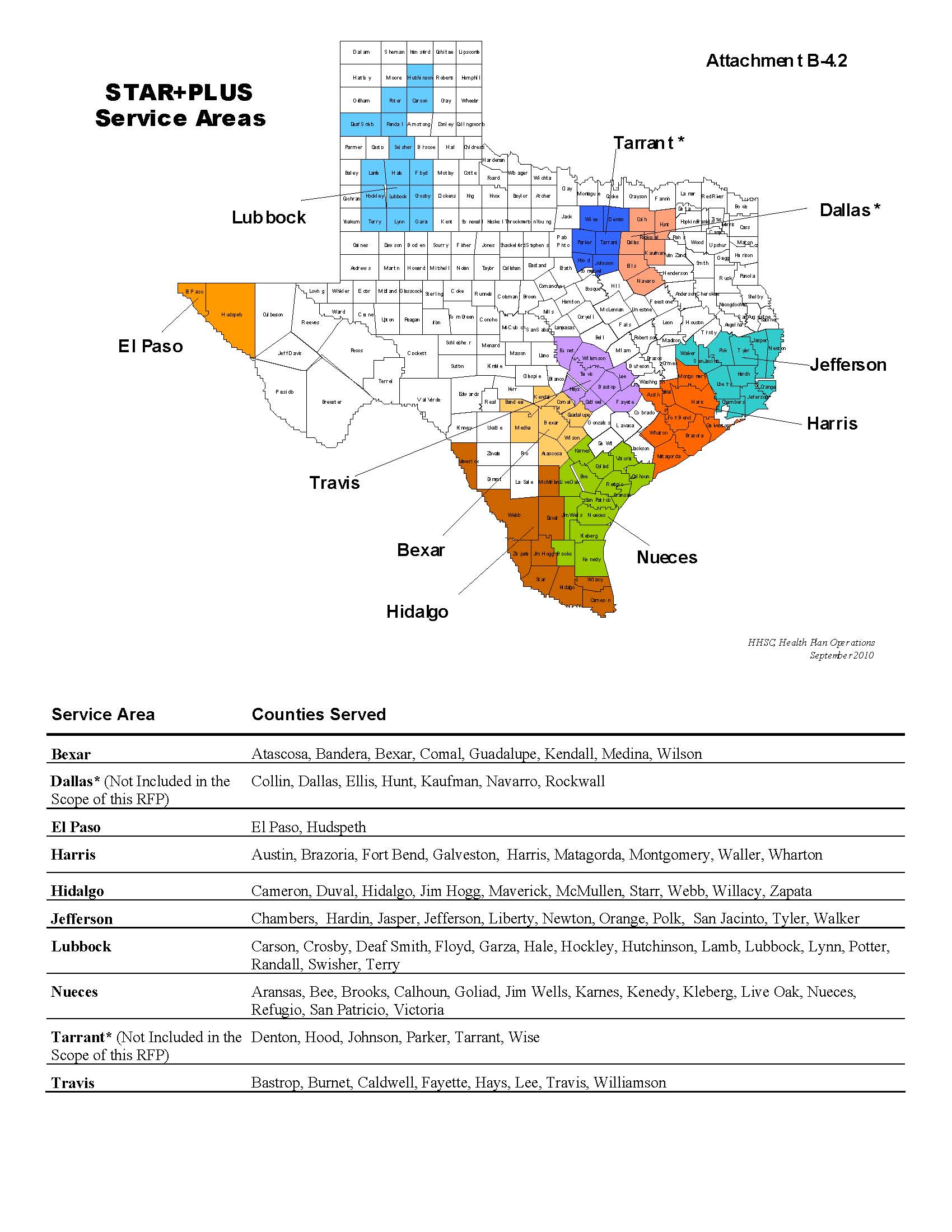

See Contract Attachment B-4.2, “Map of Counties with STAR+PLUS MCO Program Service Areas,” for a list of counties included within the STAR+PLUS Service Areas.

þ Medicaid STAR MCO Program

Capitation: See Attachment A, “Uniform Managed Care Contract Terms and Conditions,” Article 10, for a description of the Capitation Rate-setting methodology and the Capitation Payment requirements for the STAR Program.

|

| | | | | |

Rate Period 2 Capitation Rates |

| Service Area: | Hidalgo | Medicaid Rural Service Area - Central Texas | Medicaid Rural Service Area - Northeast Texas | Medicaid Rural Service Area - West Texas |

| Rate Cell | | | | |

1 | Under Age 1 Child | *** | *** | *** | *** |

2 | Age 1-5 Child | *** | *** | *** | *** |

3 | Age 6-14 Child | *** | *** | *** | *** |

4 | Age 15-18 Child | *** | *** | *** | *** |

5 | Age 19-20 Child | *** | *** | *** | *** |

6 | TANF Adult | *** | *** | *** | *** |

7 | Pregnant Woman | *** | *** | *** | *** |

8 | SSI - Aged, Blind, & Disabled | | *** | *** | *** |

Delivery Supplemental Payment: See Contract Attachment A, "Uniform Managed Care Contract Terms and Conditions," Article 10, for a description of the Delivery Supplemental Payment for the STAR Program. The STAR Delivery Supplemental Payments for the Service Areas covered by this contract are listed below.

|

| |

Service Area | Delivery Supplemental Payment |

Hidalgo | *** |

Medicaid Rural Service Area - Central Texas | *** |

Medicaid Rural Service Area - Northeast Texas | *** |

Medicaid Rural Service Area - West Texas | *** |

þ Medicaid STAR+PLUS MCO Program

Capitation: See Attachment A, “HHSC Uniform Managed Care Contract Terms and Conditions,” Article 10, for a description of the Capitation Rate-setting methodology and the Capitation Payment requirements for the STAR+PLUS Program.

|

| | |

Rate Period 2 Capitation Rates |

| STAR + PLUS Service Area: | Hidalgo |

| Rate Cell | |

1 | Medicaid Only Standard Rate

| *** |

2 | Medicaid Only HCBS STAR+PLUS Waiver Rate - Above Floor

| *** |

3 | Medicaid Only HCBS STAR+PLUS Waiver Rate - Below Floor

| *** |

4 | Dual Eligible Standard Rate | *** |

5 | Dual Eligible HCBS STAR+PLUS Waiver Rate- Above Floor | *** |

6 | Dual Eligible HCBS STAR+PLUS Waiver Rate- Below Floor | *** |

7 | Nursing Facility - Medicaid Only | *** |

8 | Nursing Facility - Dual Eligible | *** |

The parties agree to amend their original contract, HHSC contract number 529-12-0002-00006 (Contract). The Parties agree that the terms of the Contract will remain in effect and continue to govern except to the extent modified in this Amendment.

The Parties execute this Amendment in accordance with the authority granted in HHSC Uniform Managed Care Contract Attachment A , "Uniform Managed Care Contract Terms & Conditions," under Article 8, "Amendments & Modifications."

HHSC Uniform Managed Care Contract Version 2.9 is attached.

|

|

Signatures |

The Parties execute this Amendment in their stated capacities with authority to bind their organizations on the dates in this section. Texas Health and Human Services Commission /s/ Chris Traylor Chris Traylor Chief Deputy Commissioner Office of the Chief Deputy Commissioner Date: 12/23/2013 Bankers Reserve Life Insurance Company of Wisconsin d.b.a. Superior HealthPlan Network /s/ Holly Munin By: Holly Munin Title: CEO Date: 11/14/2013 |

Responsible Office: HHSC Office of General Counsel (OGC)

Subject: Attachment A -- HHSC Uniform Managed Care Contract Terms & Conditions Version 2.9

Texas Health & Human Services Commission

Uniform Managed Care Contract Terms & Conditions

|

| | | | | | | |

DOCUMENT HISTORY LOG |

STATUS1 | | DOCUMENT REVISION2 | | EFFECTIVE DATE | | DESCRIPTION3 |

Baseline | | n/a | | September 1, 2011 | | Initial version of the Attachment A, “Medicaid and CHIP Uniform Managed Care Contract Terms & Conditions.” |

Revision | | 2.1 | | March 1, 2012 | | Definition “1915(c) Nursing Facility Waiver” is modified to correct a cross-reference. Definition for Medically Necessary is modified for clarification. The State has determined that all acute care behavioral health and non-behavioral health services for Medicaid children fall within the scope of Texas Health Steps. Note that for LTSS, such as PCS (PAS) services for children in STAR+PLUS, the functional necessity standard for LTSS also applies (see Attachment B-1, Section 8.3.3). Definition for Rate Period 1 is modified. Section 4.04 is modified to clarify the requirements for Medical Director designees, and to clarify that the provision does not apply to prior authorization determinations made by Texas licensed pharmacists. New Section 4.11 “Prohibition Against Performance Outside of the United States” added. Section 5.02(b) is modified to clarify that MCOs may not sell or transfer their Member base. Section 5.06(a)(2) is modified to clarify the exceptions to enrollment in an MCO during an Inpatient Stay. Section 5.06(a)(3) and (4) are modified to clarify that Members cannot move from FFS to an MCO or from one MCO to another during residential treatment or residential detoxification. References to the PCCM program are removed. In addition, Section 5.06(a)(8) is modified to clarify movement requirements for SSI Members in the MRSA. Section 10.06(b) is modified to remove the Perinate Newborn 0% - 185% rate cell. Section 10.10 is modified to consolidate STAR+PLUS with STAR and CHIP for the Experience Rebate calculation. Section 10.10.1 is deleted in its entirety. Section 10.10.2 is modified to consolidate STAR+PLUS into STAR and CHIP for the Experience Rebate calculation. |

|

| | | | | | | |

Revision | | 2.2 | | June 1, 2012 | | Definition for Consolidated FSR Report or Consolidated Basis is added. Definition for Financial Statistical Report is added. Definitions for FSR Reporting Period, FSR Reporting Period 12/13, and FSR Reporting Period 14 are added. Definition for Material Subcontract is modified. Definition for Net Income Before Taxes is modified. Definition for Pre-tax Income is modified. Definition for Program is added. Definition for Rate Period 1 and Rate Period 2 are modified. Section 10.10 is modified to consolidate the Experience Rebate across all contracts and all programs. Section 10.10.2 is modified to consolidate the Administrative Expense Cap across all contracts and all programs. |

Revision | | 2.3 | | September 1, 2012 | | Definition for Case Management for Children and Pregnant Women is modified to remove the acronym “CPW”. Definition for Community-based Long Term Services and Supports is modified to replace references to “1915(c) Nursing Facility Waiver” with “HCBS STAR+PLUS Waiver”. Definition for “1915(c) Nursing Facility Waiver” is modified to change the name to “HCBS STAR+PLUS. Waiver” and to update references to “Texas Healthcare Transformation and Quality Improvement Program 1115 Waiver” and “HCBS STAR+PLUS Waiver”. Definition for “HHSC MCO Programs or MCO Programs” is modified. Definition for “Medically Necessary” is modified. Definition for “Provider Materials” is added. Section 5.06(a)(4) is modified to clarify responsibility for payment. Section 5.11 is deleted in its entirety. Section 7.02 is modified to clarify that only applicable provisions of the listed laws apply to the contract. Section 10.05 is modified to replace references to “1915(c) Nursing Facility Waiver” with “HCBS STAR+PLUS Waiver”.

|

Revision

| | 2.4 | | March 1, 2013 | | All references to the previous Executive Commissioner Suehs are changed to his successor, Executive Commissioner Janek.

Definition for “Electronic Visit Verification” is added.

Section 5.02(e), Subsections (4) and (5) are modified.

Section 10.16 is added to address supplemental payments to MCOs for wrap-around services for outpatient drugs and biological products for STAR-PLUS Members.

|

|

| | | | | | | |

Revision | | 2.5 | | June 1, 2013 | | Contract amendment did not revise Attachment A, Uniform Managed Care Contract Terms and Conditions. |

Revision | | 2.6 | | September 1, 2013 | | Definition for CAHPS is modified to correct the name to which the acronym refers. Definition for “Community Health Worker” is added. Definition for “Court-Ordered Commitment” is modified. Definition for Default Enrollment is modified to add T.A.C. reference. Definition for “DSM” is modified. Definition for “ECI” is modified. Definition for HEDIS is modified to correct the name to which the acronym refers. Definition for Primary Care Physician is modified to remove the list of provider types as being redundant. Definition for Rate Period is modified to include a third sub-period. Section 5.02(e) is modified to remove the language regarding disenrollment for ESRD and ventilator dependency. Section 5.08 is renamed “Modified Default Enrollment Process” and revised to include a process for all Programs. Section 5.09 is deleted and replaced with Section 5.08. Section 5.10 is deleted and replaced with Section 5.08. Section 7.04 is deleted in its entirety and updated within Section 7.02 Section 9.02 is modified for clarification that records must be provided “at no cost.” Section 9.04 is modified for clarification that records must be provided “at no cost.” Section 10.05(a) is modified to comply with the new STAR Risk Groups. Section 10.10.3 is modified to clarify that the Reinsurance Cap impacts only the Experience Rebate calculation. Section 11.01(c) is modified to add the missing word “may.” Section 13.01 is modified to clarify the required certifications. Section 14.08 is modified to delete outdated language

|

|

| | | | | | | |

Revision | | 2.7 |

| | September 1, 2013 | | Section 10.17 “Pass-through Payments for Provider Rate Increases” is added. |

Revision | | 2.8 |

| | January 1, 2014 | | Definition for Expansion Children is removed.

Definition for Federal Poverty Level is updated.

Definition for Former Foster Care Child (FFCC) Member is added.

Section 5.02 is modified to add requirement for default assignment methodologies.

Section 5.04 is modified to clarify that HHSC or the ASC will enroll or disenroll Members.

Section 5.05 is modified to clarify that HHSC or the ASC will transmit new Member information, to remove the FPL limits, to remove the default assignment language, and to clarify the enrollment process when CHIP Perinate coverage expires.

Section 5.06 is modified to add requirements regarding movement from a STAR Health MCO to a STAR MCO.

Section 10.06(b) is modified to clarify the eligibility thresholds.

Section 10.09 is modified to clarify the eligibility thresholds.

Section 11.01(a) is modified to correct an administrative error.

Section 12.03 is modified to delete subsection (b)(8) Termination for Insolvency and all following subsections are renumbered.

|

|

| | | | | | | |

Revision | | 2.9 |

| | February 1, 2014 | | Definition for Capitation Payment is modified to include associated Administrative Services.

Definition for Child (or Children) with Special Health Care Needs (CSHCN) is clarified.

Definition for Clean Claim is clarified to include Nursing Facility Services.

Definition for Cognitive Rehabilitation Therapy is added.

Definition for Community Services Specialist (CSSP) is added.

Definition for Electronic Visit Verification System is added.

Definition for Employment Assistance is added.

Definition for Family Partner is added.

Definition for Fee-for-Service (FFS) is clarified that payment is made after the service is provided.

Definition for ICF-IID Program is added.

Definition for IDD Waiver is added.

Definition for Licensed Medical Personnel is added.

Definition for Licensed Practitioner of the Healing Arts is added.

Definition for Local IDD Authority is added.

Definition for Local Mental Health Authority is modified to reference the legal citation.

Definition for Material Subcontract is modified to clarify excluded subcontractors.

Definition for MCO Administrative Services is modified to include all required deliverables outside of the Covered Services.

Definition for Medical Home is modified to have the meaning assigned in Gov’t Code 533.0029.

Definition for Member with Special Health Care Needs (MSHCN) is modified.

Definition for Mental Health Rehabilitative Services is added.

Definition for Nursing Facility is added.

Definition for PASRR is added.

Definition for PASRR Level I Screening is added.

Definition for PASRR Level II Evaluation is added.

Definition for PASRR Specialized Services is added.

Definition for Peer Provider is added.

Definition for Population Risk Group or Risk Group is modified to add defined criteria.

Definition for SED is modified to remove the reference to LMHAs.

Definition for SPMI is modified to remove the reference to LMHAs.

Definition for Supported Employment is added.

|

|

| | | | | | | |

Revision | | 2.9 |

| | February 1, 2014 | | Definition for Targeted Case Management is added.

Definition for Texas Medicaid Bulletin is removed.

Definition for Texas Medicaid Provider Procedures Manual is modified to remove the reference to the Texas Medicaid Bulletin.

Section 4.08 is renamed Subcontractors and Agreements with Third Parties and is modified to include language from Section 4.10 Agreements with Third Parties.

Section 4.10 MCO Agreements with Third Parties is deleted in its entirety.

Section 5.06 Span of Coverage is modified to update the requirements effective through August, 31, 2014 and to add requirements effective September 1, 2014.

Section 10.01 is modified to clarify the calculation of the monthly Capitation Payment.

Section 10.02 is modified to include Liquidated Damages due and unpaid including any associated interest.

Section 10.08 is modified to clarify the requirements for adjustments.

Section 10.10 is modified to include Liquidated Damages assessment.

Section 10.10.2 is modified to clarify the data sources and to update the calculation example.

Section 13.02 is modified to include an obligation to comply with 41 U.S.C. § 423. |

1 Status should be represented as “Baseline” for initial issuances, “Revision” for changes to the Baseline version, and “Cancellation” for withdrawn versions 2 Revisions should be numbered in accordance according to the version of the issuance and sequential numbering of the revision—e.g., “1.2” refers to the first version of the document and the second revision. 3 Brief description of the changes to the document made in the revision. |

TABLE OF CONTENTS

Article 1. Introduction ................................................................................................................................... 1

Section 1.01 Purpose. ..................................................................................................................................... 1

Section 1.02 Risk-based contract. .................................................................................................................. 1

Section 1.03 Inducements............................................................................................................................... 1

Section 1.04 Construction of the Contract. ..................................................................................................... 1

Section 1.05 No implied authority. .................................................................................................................. 2

Section 1.06 Legal Authority. .......................................................................................................................... 2

Article 2. Definitions ..................................................................................................................................... 2

Article 3. General Terms & Conditions.......................................................................................................15

Section 3.01 Contract elements. ....................................................................................................................15

Section 3.02 Term of the Contract. ................................................................................................................15

Section 3.03 Funding. ....................................................................................................................................15

Section 3.04 Delegation of authority. .............................................................................................................15

Section 3.05 No waiver of sovereign immunity. .............................................................................................15

Section 3.06 Force Majeure. ..........................................................................................................................15

Section 3.07 Publicity. ....................................................................................................................................16

Section 3.08 Assignment. ..............................................................................................................................16

Section 3.09 Cooperation with other vendors and prospective vendors. .......................................................16

Section 3.10 Renegotiation and reprocurement rights. ..................................................................................16

Section 3.11 RFP errors and omissions. ........................................................................................................16

Section 3.12 Enforcement Costs. ...................................................................................................................17

Section 3.13 Preferences under service contracts. ........................................................................................17

Section 3.14 Time of the essence. .................................................................................................................17

Section 3.15 Notice ........................................................................................................................................17

Article 4. Contract Administration & Management ...................................................................................17

Section 4.01 Qualifications, retention and replacement of MCO employees. ................................................17

Section 4.02 MCO's Key Personnel. ..............................................................................................................17

Section 4.03 Executive Director. ....................................................................................................................18

Section 4.04 Medical Director. .......................................................................................................................18

Section 4.05 Responsibility for MCO personnel and Subcontractors. ............................................................19

Section 4.06 Cooperation with HHSC and state administrative agencies. .....................................................19

Section 4.07 Conduct of MCO personnel and Subcontractors. ......................................................................20

Section 4.08 Subcontractors and Agreements with Third Parties. .................................................................22

Section 4.09 HHSC’s ability to contract with Subcontractors. ........................................................................23

Section 4.10 This Section Intentionally Left Blank ......................................................... ..............................23

Section 4.11 Prohibition Against Performance Outside the United States. ....................................................22

Article 5. Member Eligibility & Enrollment .................................................................................................23

Section 5.01 Eligibility Determination .............................................................................................................23

Section 5.02 Member Enrollment & Disenrollment. ........................................................................................23

Section 5.03 STAR enrollment for pregnant women and infants. ...................................................................24

Section 5.04 CHIP eligibility and enrollment. .................................................................................................24

Section 5.05 CHIP Perinatal eligibility, enrollment, and disenrollment ...........................................................24

Section 5.06 Span of Coverage (Effective through August 31, 2014) ............................................................27

Section 5.06 Span of Coverage (Effective Beginning September 1, 2014) ....................................................31

Section 5.07 Verification of Member Eligibility. ..............................................................................................27

Section 5.08 Modified Default Enrollment Process ........................................................................................27

Section 5.09 This Section Intentionally Left Blank .........................................................................................27

Section 5.10 This Section Intentionally Left Blank .........................................................................................27

Section 5.11 This Section Intentionally Left Blank .........................................................................................27

Article 6. Service Levels & Performance Measurement ...........................................................................27

Section 6.01 Performance measurement. ......................................................................................................27

Article 7. Governing Law & Regulations ....................................................................................................27

Section 7.01 Governing law and venue. ........................................................................................................27

Section 7.02 MCO responsibility for compliance with laws and regulations. ..................................................27

Section 7.03 TDI licensure/ANHC certification and solvency. ........................................................................28

Section 7.04 This Section Intentionally Left Blank .........................................................................................29

Section 7.05 Compliance with state and federal anti-discrimination laws. .....................................................29

Section 7.06 Environmental protection laws. .................................................................................................29

Section 7.07 HIPAA. ......................................................................................................................................30

Section 7.08 Historically Underutilized Business Participation Requirements ...............................................30

Article 8. Amendments & Modifications.....................................................................................................30

Section 8.01 Mutual agreement. ....................................................................................................................30

Section 8.02 Changes in law or contract. .......................................................................................................30

Section 8.03 Modifications as a remedy.........................................................................................................30

Section 8.04 Modification Process. ................................................................................................................31

Section 8.05 Modification of the Uniform Managed Care Manual. .................................................................31

Section 8.06 CMS approval of amendments ..................................................................................................31

Section 8.07 Required compliance with amendment and modification procedures. ......................................31

Article 9. Audit & Financial Compliance ....................................................................................................31

Section 9.01 Record retention and audit. .......................................................................................................31

Section 9.02 Access to records, books, and documents. ...............................................................................31

Section 9.03 Audits of Services, Deliverables and inspections. .....................................................................32

Section 9.04 SAO Audit .................................................................................................................................32

Section 9.05 Response/compliance with audit or inspection findings. ...........................................................32

Section 9.06 Notification of Legal and Other Proceedings, and Related Events. ...........................................33

Article 10. Terms & Conditions of Payment ...............................................................................................33

Section 10.01 Calculation of monthly Capitation Payment. ............................................................................33

Section 10.02 Time and Manner of Payment. ................................................................................................33

Section 10.03 Certification of Capitation Rates. .............................................................................................33

Section 10.04 Modification of Capitation Rates. .............................................................................................34

Section 10.05 STAR and STAR+PLUS Capitation Structure. ........................................................................34

Section 10.06 CHIP Capitation Rates Structure. ............................................................................................35

Section 10.07 MCO input during rate setting process. ...................................................................................35

Section 10.08 Adjustments to Capitation Payments. .....................................................................................36

Section 10.09 Delivery Supplemental Payment for CHIP, CHIP Perinatal and STAR MCOs. .......................36

Section 10.10 Experience Rebate ..................................................................................................................36

Section 10.11 Restriction on assignment of fees. ..........................................................................................41

Section 10.12 Liability for taxes. ....................................................................................................................41

Section 10.13 Liability for employment-related charges and benefits. ...........................................................41

Section 10.14 No additional consideration. ....................................................................................................41

Section 10.15 Federal Disallowance ..............................................................................................................41

Section 10.16 Supplemental Payments for Medicaid Wrap-Around Services for Outpatient Drugs and Biological Products ........................................................................................................................................41

Article 11. Disclosure & Confidentiality of Information ...........................................................................42

Section 11.01 Confidentiality..........................................................................................................................42

Section 11.02 Disclosure of HHSC's Confidential Information. ......................................................................42

Section 11.03 Member Records .....................................................................................................................43

Section 11.04 Requests for public information. ..............................................................................................43

Section 11.05 Privileged Work Product. .........................................................................................................43

Section 11.06 Unauthorized acts. ..................................................................................................................43

Section 11.07 Legal action. ............................................................................................................................44

Section 11.08 Information Security ................................................................................................................44

Article 12. Remedies & Disputes ................................................................................................................44

Section 12.01 Understanding and expectations. ............................................................................................44

Section 12.02 Tailored remedies. ..................................................................................................................44

Section 12.03 Termination by HHSC. ............................................................................................................46

Section 12.04 Termination by MCO. ..............................................................................................................48

Section 12.05 Termination by mutual agreement. ..........................................................................................48

Section 12.06 Effective date of termination. ...................................................................................................48

Section 12.07 Extension of termination effective date. ..................................................................................48

Section 12.08 Payment and other provisions at Contract termination. ...........................................................48

Section 12.09 Modification of Contract in the event of remedies. ..................................................................49

Section 12.10 Turnover assistance. ...............................................................................................................49

Section 12.11 Rights upon termination or expiration of Contract. ..................................................................49

Section 12.12 MCO responsibility for associated costs. ................................................................................49

Section 12.13 Dispute resolution. ..................................................................................................................49

Section 12.14 Liability of MCO. ......................................................................................................................50

Section 12.15 Pre-termination Process. .........................................................................................................50

Article 13. Assurances & Certifications .....................................................................................................50

Section 13.01 Proposal certifications. ............................................................................................................50

Section 13.02 Conflicts of interest. .................................................................................................................50

Section 13.03 Organizational conflicts of interest. .........................................................................................50

Section 13.04 HHSC personnel recruitment prohibition. ................................................................................51

Section 13.05 Anti-kickback provision. ...........................................................................................................51

Section 13.06 Debt or back taxes owed to State of Texas. ............................................................................51

Section 13.07 Outstanding debts and judgments. ..........................................................................................51

Article 14. Representations & Warranties ..................................................................................................51

Section 14.01 Authorization. ..........................................................................................................................51

Section 14.02 Ability to perform. ....................................................................................................................52

Section 14.03 Minimum Net Worth. ...............................................................................................................52

Section 14.04 Insurer solvency. .....................................................................................................................52

Section 14.05 Workmanship and performance. .............................................................................................52

Section 14.06 Warranty of deliverables. ........................................................................................................52

Section 14.07 Compliance with Contract. ......................................................................................................52

Section 14.08 Technology Access .................................................................................................................52

Section 14.09 Electronic & Information Resources Accessibility Standards ..................................................52

Article 15. Intellectual Property ..................................................................................................................54

Section 15.01 Infringement and misappropriation. .........................................................................................54

Section 15.02 Exceptions...............................................................................................................................54

Section 15.03 Ownership and Licenses .........................................................................................................54

Article 16. Liability .......................................................................................................................................55

Section 16.01 Property damage. ....................................................................................................................55

Section 16.02 Risk of Loss.............................................................................................................................55

Section 16.03 Limitation of HHSC's Liability. .................................................................................................55

Article 17. Insurance & Bonding .................................................................................................................56

Section 17.01 Insurance Coverage. ...............................................................................................................56

Section 17.02 Performance Bond. .................................................................................................................57

Section 17.03 TDI Fidelity Bond .....................................................................................................................57

Article 1. Introduction

Section 1.01 Purpose.

The purpose of this Contract is to set forth the terms and conditions for the MCO’s participation as a managed care organization in one (1) or more of the MCO Programs administered by HHSC. Under the terms of this Contract, MCO will provide comprehensive health care services to qualified Program recipients through a managed care delivery system.

Section 1.02 Risk-based contract.

This is a Risk-based contract.

Section 1.03 Inducements.

In making the award of this Contract, HHSC relied on MCO’s assurances of the following:

(1) MCO is a health maintenance organization, Approved Non-Profit Health Corporation (ANHC), or Exclusive Provider Organization that arranges for the delivery of Health Care Services, and is either (1) has received Texas Department of Insurance (TDI) licensure or approval as such an entity and is fully authorized to conduct business in the Service Areas, or (2) will receive TDI licensure or approval as such an entity and be fully authorized to conduct business in all Service Areas no later than 60 calendar days after HHSC executes this Contract;

(2) MCO and the MCO Administrative Service Subcontractors have the skills, qualifications, expertise, financial resources and experience necessary to provide the Services and Deliverables described in the RFP, MCO’s Proposal, and this Contract in an efficient, cost-effective manner, with a high degree of quality and responsiveness, and has performed similar services for other public or private entities;

(3) MCO has thoroughly reviewed, analyzed, and understood the RFP, has timely raised all questions or objections to the RFP, and has had the opportunity to review and fully understand HHSC’s current program and operating environment for the activities that are the subject of the Contract and the needs and requirements of the State during the Contract term;

(4) MCO has had the opportunity to review and understand the State’s stated objectives in entering into this Contract and, based on such review and understanding, MCO currently has the capability to perform in accordance with the terms and conditions of this Contract;

(5) MCO also has reviewed and understands the risks associated with the MCO Programs as described in the RFP, including the risk of non-appropriation of funds.

Accordingly, on the basis of the terms and conditions of this Contract, HHSC desires to engage MCO to perform the Services and provide the Deliverables described in this Contract under the terms and conditions set forth in this Contract.

Section 1.04 Construction of the Contract.

(a) Scope of Introductory Article.

The provisions of any introductory article to the Contract are intended to be a general introduction and are not intended to expand the scope of the Parties’ obligations under the Contract or to alter the plain meaning of the terms and conditions of the Contract.

(b) References to the “State.”

References in the Contract to the “State” must mean the State of Texas unless otherwise specifically indicated and must be interpreted, as appropriate, to mean or include HHSC and other agencies of the State of Texas that may participate in the administration of the MCO Programs, provided, however, that no provision will be interpreted to include any entity other than HHSC as the contracting agency.

(c) Severability.

If any provision of this Contract is construed to be illegal or invalid, such interpretation will not affect the legality or validity of any of its other provisions. The illegal or invalid provision will be deemed stricken and deleted to the same extent and effect as if never incorporated in this Contract, but all other provisions will remain in full force and effect.

(d) Survival of terms.

Termination or expiration of this Contract for any reason will not release either Party from any liabilities or obligations set forth in this Contract that:

(1) The Parties have expressly agreed must survive any such termination or expiration; or

(2) Arose prior to the effective date of termination and remain to be performed or by their nature would be intended to be applicable following any such termination or expiration.

(e) Headings.

The article, section and paragraph headings in this Contract are for reference and convenience only and may not be considered in the interpretation of this Contract.

(f) Global drafting conventions.

(1) The terms “include,” “includes,” and “including” are terms of inclusion, and where used in this Contract, are deemed to be followed by the words “without limitation.”

(2) Any references to “sections,” “appendices,” “exhibits” or “attachments” are deemed to be references to sections, appendices, exhibits or attachments to this Contract.

(3) Any references to laws, rules, regulations, and manuals in this Contract are deemed references to these documents as amended, modified, or supplemented from time to time during the term of this Contract.

Section 1.05 No implied authority.

The authority delegated to MCO by HHSC is limited to the terms of this Contract. HHSC is the state agency designated by the Texas Legislature to administer the MCO Programs, and no other agency of the State grants MCO any authority related to this program unless directed through HHSC. MCO may not rely upon implied authority, and specifically is not delegated authority under this Contract to:

(1) make public policy;

(2) promulgate, amend or disregard administrative regulations or program policy decisions made by State and federal agencies responsible for administration of HHSC Programs; or

(3) unilaterally communicate or negotiate with any federal or state agency or the Texas Legislature on behalf of HHSC regarding the HHSC Programs.

MCO is required to cooperate to the fullest extent possible to assist HHSC in communications and negotiations with state and federal governments and agencies concerning matters relating to the scope of the Contract and the MCO Program(s), as directed by HHSC.

Section 1.06 Legal Authority.

(a) HHSC is authorized to enter into this Contract under Chapters 531 and 533, Texas Government Code; Section 2155.144, Texas Government Code; and/or Chapter 62, Texas Health & Safety Code. MCO is authorized to enter into this Contract pursuant to the authorization of its governing board or controlling owner or officer.

(b) The person or persons signing and executing this Contract on behalf of the Parties, or representing themselves as signing and executing this Contract on behalf of the Parties, warrant and guarantee that he, she, or they have been duly authorized to execute this Contract and to validly and legally bind the Parties to all of its terms, performances, and provisions.

Article 2. Definitions

As used in this Contract, the following terms and conditions must have the meanings assigned below:

1915(c) Nursing Facility Waiver or 1915(c) STAR+PLUS Waiver (SPW) means the HHSC waiver program that provides home and community based services to aged and disabled adults as cost-effective alternatives to institutional care

in nursing homes. Should HHSC begin operating this waiver program under a 1115 Waiver structure, then references to the 1915(c) Nursing Facility Waiver or SPW will mean the home and community based services component of the 1115 Waiver for Members who qualify for the additional services described in Attachment B-2, "STAR+PLUS Covered Services," under the heading “1915(c) STAR+PLUS Waiver Services for those Members who qualify for such services.”

AAP means the American Academy of Pediatrics.

Abuse means provider practices that are inconsistent with sound fiscal, business, or medical practices and result in an unnecessary cost to the Medicaid or CHIP Program, or in reimbursement for services that are not Medically Necessary or that fail to meet professionally recognized standards for health care. It also includes Member practices that result in unnecessary cost to the Medicaid or CHIP Program.

Account Name means the name of the individual who lives with the child(ren) and who applies for the Children’s Health Insurance Program coverage on behalf of the child(ren).

Action (Medicaid only) means:

(1) the denial or limited authorization of a requested Medicaid service, including the type or level of service;

(2) the reduction, suspension, or termination of a previously authorized service;

(3) the denial in whole or in part of payment for service;

(4) the failure to provide services in a timely manner;

(5) the failure of an MCO to act within the timeframes set forth in the Contract and 42 C.F.R. §438.408(b); or

(6) for a resident of a rural area with only one (1) MCO, the denial of a Medicaid Members’ request to obtain services outside of the Network.

An Adverse Determination is one (1) type of Action.

Acute Care means preventive care, primary care, and other medical care provided under the direction of a physician for a condition having a relatively short duration.

Acute Care Hospital means a Hospital that provides Acute Care Services.

Adjudicate means to deny or pay a Clean Claim.

Administrative Services see MCO Administrative Services.

Administrative Services Contractor see HHSC Administrative Services Contractor.

Adverse Determination means a determination by an MCO or Utilization Review agent that the Health Care Services furnished, or proposed to be furnished to a patient, are not Medically Necessary or not appropriate.

Affiliate means any individual or entity that meets any of the following criteria:

(1) owns or holds more than a five percent (5%) interest in the MCO (either directly, or through one (1) or more intermediaries);

(2) in which the MCO owns or holds more than a five percent (5%) interest (either directly, or through one (1) or more intermediaries);

(3) any parent entity or subsidiary entity of the MCO, regardless of the organizational structure of the entity;

(4) any entity that has a common parent with the MCO (either directly, or through one (1) or more intermediaries);

(5) any entity that directly, or indirectly through one (1) or more intermediaries, controls, or is controlled by, or is under common control with, the MCO; or

(6) any entity that would be considered to be an affiliate by any Securities and Exchange Commission (SEC) or Internal Revenue Service (IRS) regulation, Federal Acquisition Regulations (FAR), or by another applicable regulatory body.

Agreement or Contract means this formal, written, and legally enforceable contract and amendments thereto between the Parties.

Allowable Expenses means all expenses related to the Contract between HHSC and the MCO that are incurred during the Contract Period, are not reimbursable or recovered from another source, and that conform with the Uniform Managed Care Manual’s “Cost Principles for Expenses.”

Appeal (CHIP and CHIP Perinatal Program only) means the formal process by which a Utilization Review agent addresses Adverse Determinations.

Appeal (Medicaid only) means the formal process by which a Member or his or her representative request a review of the MCO’s Action, as defined above.

Approved Non-Profit Health Corporation (ANHC) means an organization formed in compliance with Chapter 844 of the Texas Insurance Code and licensed by TDI. See also MCO.

Auxiliary Aids and Services includes:

(1) qualified interpreters or other effective methods of making aurally delivered materials understood by persons with hearing impairments;

(2) taped texts, large print, Braille, or other effective methods to ensure visually delivered materials are available to individuals with visual impairments; and

(3) other effective methods to ensure that materials (delivered both aurally and visually) are available to those with cognitive or other Disabilities affecting communication.

Batch Processing is a billing technique that uses a single program loading to process many individual jobs, tasks, or requests for service. In managed care, batch billing is a technique that allows providers to send billing information all at once in a “batch” rather than in separate individual transactions.

Behavioral Health Services means Covered Services for the treatment of mental, emotional, or chemical dependency disorders.

Benchmark means a target or standard based on historical data or an objective/goal.

Business Continuity Plan or BCP means a plan that provides for a quick and smooth restoration of MIS operations after a disruptive event. BCP includes business impact analysis, BCP development, testing, awareness, training, and maintenance. This is a day-to-day plan.

Business Day means any day other than a Saturday, Sunday, or a state or federal holiday on which HHSC’s offices are closed, unless the context clearly indicates otherwise.

CAHPS means the Consumer Assessment of Healthcare Providers and Systems. This survey is conducted annually by the EQRO.

Call Coverage means arrangements made by a facility or an attending physician with an appropriate level of health care provider who agrees to be available on an as-needed basis to provide medically appropriate services for routine, high risk, or Emergency Medical Conditions or Emergency Behavioral Health Conditions that present without being scheduled at the facility or when the attending physician is unavailable.

Capitation Payment means the aggregate amount paid by HHSC to the MCO on a monthly basis for the provision of Covered Services to enrolled Members (including associated Administrative Services) in accordance with the Capitation Rates in the Contract.

Capitation Payment means the aggregate amount paid by HHSC to the MCO on a monthly basis for the provision of Covered Services to enrolled Members in accordance with the Capitation Rates in the Contract.

Capitation Rate means a fixed predetermined fee paid by HHSC to the MCO each month in accordance with the Contract, for each enrolled Member in a defined Rate Cell, in exchange for the MCO arranging for or providing a defined set of Covered Services to such a Member, regardless of the amount of Covered Services used by the enrolled Member.

Case Head means the head of the household that is applying for Medicaid.

Case Management for Children and Pregnant Women is a Medicaid program for children with a health condition/health risk, birth through 20 years of age and for women with high-risk pregnancies of all ages, in order to help them gain access to medical, social, educational and other health-related services.

C.F.R. means the Code of Federal Regulations.

Chemical Dependency Treatment means treatment provided for a chemical dependency condition by a Chemical Dependency Treatment facility, chemical dependency counselor or Hospital.

Child (or Children) with Special Health Care Needs (CSHCN) means a child (or children) eligible for, and enrolled in, the DSHS CSHCN Program, as further defined in Tex. Health & Safety Code § 35.0022.

Children’s Health Insurance Program or CHIP means the health insurance program authorized and funded pursuant to Title XXI, Social Security Act (42 U.S.C. §§ 1397aa-1397jj) and administered by HHSC. The CHIP Perinatal Program is a subprogram of CHIP.

CHIP MCO Program, or CHIP Program, means the State of Texas program in which HHSC contracts with MCOs to provide, arrange for, and coordinate Covered Services for enrolled CHIP Members.

CHIP MCOs means MCOs participating in the CHIP MCO Program.

CHIP Perinatal MCOs means MCOs participating in the CHIP Perinatal Program, a subprogram of CHIP.

CHIP Perinatal Program means the State of Texas program in which HHSC contracts with MCOs to provide, arrange for, and coordinate Covered Services for enrolled CHIP Perinate and CHIP Perinate Newborn Members. Although the CHIP Perinatal Program is part of the CHIP Program, for Contract administration purposes it is sometimes identified independently in this Contract.

CHIP Perinate means a CHIP Perinatal Program Member identified prior to birth (an unborn child).

CHIP Perinate Newborn means a CHIP Perinate who has been born alive and whose family income meets the criteria for continued participation in the CHIP Perinatal Program (refer to Section 5.04.1 for information concerning eligibility).

Chronic or Complex Condition means a physical, behavioral, or developmental condition which may have no known cure and/or is progressive and/or can be debilitating or fatal if left untreated or under-treated.

Clean Claim means a claim submitted by a physician or provider for health care services rendered to a Member, with the data necessary for the MCO or subcontracted claims processor to adjudicate and accurately report the claim. A Clean Claim other than a Nursing Facility Services Clean Claim must meet all requirements for accurate and complete data as defined in the appropriate claim type encounter guides as follows:

(1) 837 Professional Combined Implementation Guide;

(2) 837 Institutional Combined Implementation Guide;

(3) 837 Professional Companion Guide;

(4) 837 Institutional Companion Guide; or

(5) National Council for Prescription Drug Programs (NCPDP) Companion Guide.

The MCO may not require a physician or provider to submit documentation that conflicts with the requirements of 28 Tex. Admin. Code, Chapter 21, Subchapters C and T.

Claims submitted by a Nursing Facility must meet DADS' criteria for clean claims submission as described in UMCM Chapter 2.3, Nursing Facility Claims Manual.

Clinical Edit means a process for verifying that a Member’s medical condition matches the clinical criteria for dispensing a requested drug. Clinical Edits must be based on evidence-based clinical criteria and nationally recognized peer-reviewed information. If the information about a Member’s medical condition meets the Clinical Edit criteria, the claim can be approved. If a Member's medical condition does not meet the Clinical Edit criteria, then prior authorization is required.

CMS means the Centers for Medicare and Medicaid Services, which is the federal agency responsible for administering Medicare and overseeing state administration of Medicaid and CHIP.

Cognitive Rehabilitation Therapy means an HCBS STAR+PLUS Waiver service that assists a Member in learning or relearning cognitive skills that have been lost or altered as a result of damage to brain cells/chemistry in order to enable the Member to compensate for the lost cognitive functions. Cognitive rehabilitation therapy may be provided when an appropriate professional assesses the Member and determines it is medically necessary. Cognitive rehabilitation therapy it is provided in accordance with the plan of care developed by the assessor, and includes reinforcing, strengthening, or reestablishing previously learned patterns of behavior, or establishing new patterns of cognitive activity or compensatory mechanisms for impaired neurological systems.

COLA means the Cost of Living Adjustment.

Community-based Long Term Services and Supports means services provided to STAR+PLUS Members in their home or other community based settings necessary to provide assistance with activities of daily living to allow the Member to remain in the most integrated setting possible. Community-based Long-term Services and Supports includes services available to all STAR+PLUS Members as well as those services available only to STAR+PLUS Members who qualify for HCBS STAR+PLUS Waiver services.

Community Health Worker: Also called a promotor(a), a community health worker is a trusted member of the community, and has a close understanding of the ethnicity, language, socio-economic status, and life experiences of the community served. A community health worker helps people gain access to needed services, increase health knowledge, and become self-sufficient through outreach, patient navigation and follow-up, community health education and information, informal counseling, social support, advocacy, and more.

Community Resource Coordination Groups

(CRCGs)

means a statewide system of local interagency groups, including both public and private providers, which coordinate services for ”multi-need” children and youth. CRCGs develop individual service plans for children and adolescents whose needs can be met only through interagency cooperation. CRCGs address Complex Needs in a model that promotes local decision-making and ensures that children receive the integrated combination of social, medical and other services needed to address their individual problems.

Community Services Specialist (CSSP) means a Mental Health Rehabilitative Service provider who meets the following minimum requirements: (1) high school diploma or high school equivalency, and (2) three continuous years of documented full-time experience in the provisions of Mental Health Rehabilitative Services and demonstrated competency in the provision and documentation of Mental Health Rehabilitative Services.

Complainant means a Member or a treating provider or other individual designated to act on behalf of the Member who filed the Complaint.

Complaint (CHIP Program only) means any dissatisfaction, expressed by a Complainant, orally or in writing to the MCO, with any aspect of the MCO’s operation, including, but not limited to, dissatisfaction with plan administration, procedures related to review or Appeal of an Adverse Determination, as defined in Texas Insurance Code, Chapter 843, Subchapter G; the denial, reduction, or termination of a service for reasons not related to Medical Necessity; the way a service is provided; or disenrollment decisions. The term does not include misinformation that is resolved promptly by supplying the appropriate information or clearing up the misunderstanding to the satisfaction of the CHIP Member.

Complaint (Medicaid only) means an expression of dissatisfaction expressed by a Complainant, orally or in writing to the MCO, about any matter related to the MCO other than an Action. As provided by 42 C.F.R. §438.400, possible subjects for Complaints include, but are not limited to, the quality of care of services provided, and aspects of interpersonal relationships such as rudeness of a provider or employee, or failure to respect the Medicaid Member’s rights.

Complex Need means a condition or situation resulting in a need for coordination or access to services beyond what a PCP would normally provide, triggering the MCO's determination that Care Coordination is required.

Comprehensive Care Program: see definition for Texas Health Steps.

Confidential Information means any communication or record (whether oral, written, electronically stored or transmitted, or in any other form) consisting of:

(1) Confidential Client information, including HIPAA-defined protected health information;

(2) All non-public budget, expense, payment and other financial information;

(3) All Privileged Work Product;

(4) All information designated by HHSC or any other State agency as confidential, and all information designated as confidential under the Texas Public Information Act;

(5) Information utilized, developed, received, or maintained by HHSC, the MCO, or participating State agencies for the purpose of fulfilling a duty or obligation under this Contract and that has not been disclosed publicly.

Consolidated FSR Report or Consolidated Basis, means FSR reporting results for all Programs and all SDAs operated by the MCO or its Affiliates, including those under separate contracts between the MCO or its Affiliates and HHSC. Consolidated FSR Reporting does not include any of the MCO's or its Affiliates' business outside of the HHSC Programs.

Consumer-Directed Services means the Member or his legal guardian is the employer of and retains control over the hiring, management, and termination of an individual providing personal assistance or respite.

Continuity of Care means care provided to a Member by the same PCP or specialty provider to ensure that the delivery of care to the Member remains stable, and services are consistent and unduplicated.

Contract or Agreement means this formal, written, and legally enforceable contract and amendments thereto between the Parties.

Contract Period or Contract Term means the Initial Contract Period plus any and all Contract extensions.

Contractor or MCO means the MCO that is a party to this Contract and is an insurer licensed or approved by TDI as an HMO, ANHC formed in compliance with Chapter 844 of the Texas Insurance Code, or an EPO with an Exclusive Provider Benefit Plan approved by TDI in accordance with 28 T.A.C. §3.9201-3.9212.

Copayment (CHIP only) means the amount that a Member is required to pay when utilizing certain CHIP Covered Services. Once the copayment is made, further payment is not required by the Member.

Corrective Action Plan means the detailed written plan that may be required by HHSC to correct or resolve a deficiency or event causing the assessment of a remedy or damage against MCO.

Court-Ordered Commitment means a commitment of a Member to an inpatient mental health facility for treatment ordered by a court of law pursuant to Texas Health and Safety Code, Chapters 573 or 574.

Covered Services means Health Care Services the MCO must arrange to provide to Members, including all services required by the Contract and state and federal law, and all Value-added Services negotiated by the Parties (see Attachments B-2, B-2.1, B-2.2 and B-3 of the HHSC Managed Care Contract relating to “Covered Services” and “Value-added Services”).

CPW means Case Management for Children and Pregnant Women; a Medicaid program for children with a health condition/health risk, birth through 20 years of age and to women with high-risk pregnancies of all ages, in order to help them gain access to medical, social, educational and other health-related services.

Credentialing means the process of collecting, assessing, and validating qualifications and other relevant information pertaining to a health care provider to determine eligibility and to deliver Covered Services.

Cultural Competency means the ability of individuals and systems to provide services effectively to people of various cultures, races, ethnic backgrounds, and religions in a manner that recognizes, values, affirms, and respects the worth of the individuals and protects and preserves their dignity.

DADS means the Texas Department of Aging and Disability Services or its successor agency (formerly Department of Human Services).

Date of Disenrollment means the last day of the last month for which MCO receives payment for a Member.

Day means a calendar day unless specified otherwise.

Default Enrollment means the processes established by HHSC to assign an enrollee who has not selected an MCO to an MCO. See 1 Tex. Admin. Code § 353.403 for Medicaid default enrollment processes, and 1 Tex. Admin. Code § 370.303 for CHIP default enrollment processes

Deliverable means a written or recorded work product or data prepared, developed, or procured by MCO as part of the Services under the Contract for the use or benefit of HHSC or the State of Texas.

Delivery Supplemental Payment means a one-time per pregnancy supplemental payment for STAR, CHIP and CHIP Perinatal MCOs.

Designated Provider means a physician, clinical practice or clinical group practice, rural clinic, community heath center, community mental health center, home health agency, or any other entity or provider (including pediatricians, gynecologists, and obstetricians) that are determined by the State and approved by the U.S. Secretary of Health and Human Services to be qualified to be a Health Home for Members with chronic conditions on the basis of documentation that the physician practice or clinic (A) has the systems and infrastructure in place to provide Health Home services and (B) satisfies the qualification standards established by the U.S. Secretary of Health and Human Services.

Diagnostic means assessment that may include gathering of information through interview, observation, examination, and use of specific tests that allows a provider to diagnose existing conditions.

Disabled Person or Person with Disability means a person under 65 years of age, including a child, who qualifies for Medicaid services because of a disability.

Disability means a physical or mental impairment that substantially limits one (1) or more of an individual’s major life activities, such as caring for oneself, performing manual tasks, walking, seeing, hearing, speaking, breathing, learning, and/or working.

Disability-related Access means that facilities are readily accessible to and usable by individuals with disabilities, and that auxiliary aids and services are provided to ensure effective communication, in compliance with Title III of the Americans with Disabilities Act.

Disaster Recovery Plan means the document developed by the MCO that outlines details for the restoration of the MIS in the event of an emergency or disaster.

Discharge means a formal release of a Member from an Inpatient Hospital stay when the need for continued care at an inpatient level has concluded. Movement or Transfer from one (1) Acute Care Hospital or Long Term Care Hospital /facility and readmission to another within 24 hours for continued treatment is not a discharge under this Contract.

Disease Management means a system of coordinated healthcare interventions and communications for populations with conditions in which patient self-care efforts are significant.

Disproportionate Share Hospital (DSH) means a Hospital that serves a higher than average number of Medicaid and other low-income patients and receives additional reimbursement from the State.

DSHS means the Texas Department of State Health Services or its successor agency (formerly Texas Department of Health and Texas Department of Mental Health and Mental Retardation).

DSM means the most current edition of the Diagnostic and Statistical Manual of Mental Disorders, which is the American Psychiatric Association's official classification of behavioral health disorders, or its replacement.

Dual Eligibles means Medicaid recipients who are also eligible for Medicare.

ECI means Early Childhood Intervention, a federally mandated program for infants and toddlers under the age of three with developmental delays or disabilities. See 34 C.F.R. § 303.1 et seq. and 40 Tex. Admin. Code § 108.101 et seq. for further clarification.

EDI means electronic data interchange.

Effective Date means the effective date of this Contract, as specified in the HHSC Managed Care Contract document.

Effective Date of Coverage means the first day of the month for which the MCO has received payment for a Member.

Electronic Visit Verification (EVV) is the electronic verification and documentation of visit data, such as the date and time the provider begins and ends the delivery of services, the attendant, the recipient, and the location of services provided.

Eligibles means individuals residing in one (1) of the Service Areas and eligible to enroll in a STAR, STAR+PLUS, CHIP, or CHIP Perinatal MCO, as applicable.

Emergency Behavioral Health Condition means any condition, without regard to the nature or cause of the condition, which in the opinion of a prudent layperson possessing an average knowledge of health and medicine:

(1) requires immediate intervention and/or medical attention without which Members would present an immediate danger to themselves or others, or

(2) renders Members incapable of controlling, knowing or understanding the consequences of their actions.

Emergency Medical Condition means a medical condition manifesting itself by acute symptoms of recent onset and sufficient severity (including severe pain), such that a prudent layperson, who possesses an average knowledge of health and medicine, could reasonably expect the absence of immediate medical care could result in:

(1) placing the patient’s health in serious jeopardy;

(2) serious impairment to bodily functions;

(3) serious dysfunction of any bodily organ or part;

(4) serious disfigurement; or

(5) in the case of a pregnant women, serious jeopardy to the health of a woman or her unborn child.

Emergency Services means covered inpatient and outpatient services furnished by a provider that is qualified to furnish such services under the Contract and that are needed to evaluate or stabilize an Emergency Medical Condition and/or an Emergency Behavioral Health Condition, including Post-stabilization Care Services.

Employment Assistance means assistance provided as an HCBS STAR+PLUS Waiver service to a Member to help the Member locate paid employment in the community. Employment assistance includes:

identifying an individual's employment preferences, job skills, and requirements for a work setting and work conditions;

locating prospective employers offering employment compatible with an individual's identified preferences, skills, and requirements; and contacting a prospective employer on behalf of an individual and negotiating the individual's employment.

Employment Assistance is not available to Members receiving services through a program funded by the Rehabilitation Act of 1973 or the Individuals with Disabilities Education Act. For any Member receiving one of those waiver services, the MCO must document that the Employment Assistance service is not available to the Member in the Member's record.

Encounter means a Covered Service or group of Covered Services delivered by a Provider to a Member during a visit between the Member and Provider. This also includes Value-added Services.

Encounter Data means data elements from Fee-for-Service claims or capitated services proxy claims that are submitted to HHSC by the MCO in accordance with HHSC’s required format for Medicaid and CHIP MCOs.

Enrollment Report/Enrollment File means the daily or monthly list of Eligibles that are enrolled with an MCO as Members on the day or for the month the report is issued.

EPSDT means the federally mandated Early and Periodic Screening, Diagnosis and Treatment program contained at 42 U.S.C. 1396d(r). The name has been changed to Texas Health Steps in the State of Texas.

Exclusive Provider Organization (EPO) means an insurer with an Exclusive Provider Benefit Plan approved by TDI in accordance with 28 T.A.C. §3.9201-3.9212

Expansion Area means a county or Service Area that has not previously provided healthcare to HHSC’s MCO Program Members utilizing a managed care model.

Expansion Service Areas are the Hidalgo and Medicaid Rural Service Areas for the STAR Program; and the El Paso, Hidalgo, and Lubbock Service Areas for the STAR+PLUS Program.

Expedited Appeal means an appeal to the MCO in which the decision is required quickly based on the Member's health status, and the amount of time necessary to participate in a standard appeal could jeopardize the Member's life or health or ability to attain, maintain, or regain maximum function.

Experience Rebate means the portion of the MCO’s Net Income Before Taxes that is returned to the State in accordance with Section 10.10 for the STAR, CHIP and CHIP Perinatal Programs and 10.10.1 for the STAR+PLUS Program (“Experience Rebate”).

Expiration Date means the expiration date of this Contract, as specified in HHSC’s Managed Care Contract document.

External Quality Review Organization (EQRO) means the entity that contracts with HHSC to provide external review of access to and quality of healthcare provided to Members of HHSC’s MCO Programs.

Fair Hearing means the process adopted and implemented by HHSC in 1 T.A.C. Chapter 357, in compliance with federal regulations and state rules relating to Medicaid Fair Hearings.

Family Partner means a Mental Health Rehabilitative Service provider who meets the following minimum requirements: (1) high school diploma or high school equivalency, and (2) one cumulative year of participating in mental health services as the parent or legally authorized representative of a child receiving mental health services.

Farm Worker Child (FWC) means a child birth through age 20 of a Migrant Farm Worker.

Federal Poverty Level (FPL) means the Federal poverty level updated periodically in the Federal Register by the Secretary of Health and Human Services under the authority of 42 U.S.C. § 9902(2) and as in effect for the applicable budget period used to determine an individual’s eligibility in accordance with 42 C.F.R. § 435.603(h).

Fee-for-Service (FFS) means the traditional Medicaid Health Care Services payment system under which providers receive a payment for each unit of service, after the service is provided, according to rules adopted pursuant to Chapter 32, Texas Human Resources Code.

Financial Statistical Report (see FSR below).

Force Majeure Event means any failure or delay in performance of a duty by a Party under this Contract that is caused by fire, flood, hurricane, tornadoes, earthquake, an act of God, an act of war, riot, civil disorder, or any similar event beyond the reasonable control of such Party and without the fault or negligence of such Party.

Former Foster Care Child (FFCC) Member means a young adult who has aged out of the foster care system and has previously received Medicaid while in foster care. FFCC Members may be enrolled in the STAR or STAR Health Program. The FFCC Member may be enrolled until the last day of the month of his or her 26th birthday.

FPL means the Federal Poverty Level.

FQHC means a Federally Qualified Health Center, certified by CMS to meet the requirements of §1861(aa)(3) of the Social Security Act as a federally qualified health center, that is enrolled as a provider in the Texas Medicaid program.

Fraud means an intentional deception or misrepresentation made by a person with the knowledge that the deception could result in some unauthorized benefit to himself or some other person. It includes any act that constitutes fraud under applicable federal or state law.

FSR means Financial Statistical Report. The FSR is a report designed by HHSC, and submitted to HHSC by the MCO in accordance with Contract requirements. The FSR is a form of modified income statement, subject to audit, and contains revenue, cost, and other data, as defined by the Contract. Not all incurred expenses may be included in the FSR.