OR 15D-16 OF THE SECURITIES EXCHANGE ACT OF 1934

For the month of August, 2019

(Commission File No. 1-14862 )

Camacari, Bahia - CEP 42810-000 Brazil

Form 20-F ___X___ Form 40-F ______

in paper as permitted by Regulation S-T Rule 101(b)(1). _____

in paper as permitted by Regulation S-T Rule 101(b)(7). _____

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes ______ No ___X___

Braskem reports consolidated recurring EBITDA of US$ 336 million

1Q19 HIGHLIGHTS:

Braskem – Consolidated:

4 Braskem’s recurring EBITDA was US$ 336 million, down 16% and 60% from 4Q18 and 1Q18, respectively, influenced by lower petrochemical spreads in the international market. Including non-recurring impacts, EBITDA was US$864 million, reflecting the positive impact of US$528 million related to PIS/COFINS tax revenue from overpayments between June 2002 and December 2011; between January 2012 and February 2017 and the reversal of provisioning related to the Energy Development Account11 and to REIQ12.

4 In the period, net income was R$1,363 million1, compared to a net loss of R$78 million in 4Q18, and 29% higher than in 1Q18, corresponding to R$1.71 per common share and class “A” preferred share2.

4 The Company posted free cash generation of R$130 million, down 70% from 4Q18, mainly due to: (i) lower recurring EBITDA and (ii) higher concentration of interest payments on bonds.

4 Financial leverage measured by the ratio of net debt to EBITDA3 in U.S. dollar stood at 2.03x.

4 The recordable and lost-time injury frequency rate, considering both Team Members and Partners per million hours worked, stood at 1.46 in 1Q19, which is 54% below the industry average4.

Braskem – Strategy:

4 Braskem launched two new products in its Wecycle Platform portfolio, which use post-consumer resin and Green PE as feedstock: (i) in partnership with Embalixo, the first line of trash bags with bug-repellent action, called “Embalixo Repelente;” and (ii) “Zero CO2 Emissions Shrink Film,” whose post-consumer resin is derived from the reverse logistics of sacks used in Braskem’s own operations.

4 Construction of the new PP plant in the United States reached 56.2% completion at the end of March 2019, with investment of US$426 million already made.

4 To mitigate risks associated with the safety and reliability of the Neal plant in Kenova, West Virginia, which was built in 1955, Braskem will invest US$43 million to modernize the unit’s power distribution system. With completion programmed for the second half of 2020, in addition to mitigating electrical system risks, the investment will also reduce utility and electricity costs, while supporting productivity gains.

Braskem – Highlights by region:

1 Based on net income attributable to the shareholders of the Company.

2 For the class “B” preferred shares, the amount is R$0.61 per share.

3 Excludes the Project Finance in Mexico.

4 The industry average is 3.15 per million hours worked, according to the American Chemistry Council.

Brazil:

4 Resin demand (PE, PP and PVC) was 1.4 million tons, growing 7.8% and 4.2% from 4Q18 and 1Q18, respectively, driven by restocking activities throughout the production chain in the period.

4 In 1Q19, the crackers operated at an average capacity utilization rate of 88%, up 1 p.p. from 4Q18. Compared to 1Q18, capacity utilization fell 2 p.p., which was adversely affected by plant outages in the period.

4 Resin sales volume came to 878 kton, with the growth of 10% on 4Q18 outpacing the industry average. In this scenario, Braskem’s market share stood at 64% in 1Q19. Compared to 1Q18, resin sales were down 1%. Meanwhile, sales of key chemicals fell 4% and 3% from 4Q18 and 1Q18, respectively, to 689 kton.

4 In 1Q19, the Company exported 356 kton of resins, up 16% from 4Q18, and 194 kton of key chemicals, down 10% from 4Q18, influenced by the lower volume of gasoline exports. Compared to 1Q18, a period affected by power outages at plants located in Brazil’s Northeast, by the lower supply of propylene to the PP plants and by the incident at the chlor-alkali plant in Alagoas, exports of resins and key chemicals increased 11% and 64%, respectively.

4 In the quarter, the units in Brazil and exports posted EBITDA of US$293 million (R$1,104 million), to account for 63% of the Company’s consolidated EBITDA from all segments.

United States & Europe:

4 Domestic PP demand in the U.S. market was lower due to high inventories throughout the chain and the weak performance of the textile fibers segment. In Europe, demand recovered in 1Q19, with the market expanding primarily in anticipation of a series of scheduled shutdowns programmed for the second quarter.

4 Plants in the region operated at a capacity utilization rate of 90%, higher than in 4Q18, due to the normalization of logistics in Europe, but lower than in the year-ago period due to plant outages.

4 In the quarter, the units in the United States and Europe posted EBITDA of US$72 million (R$279 million), representing 16% of the Company’s consolidated EBITDA.

Mexico:

4 PE demand in Mexico came to 504 kton, down 8% and 9% from 1Q18 and 4Q18, respectively, reflecting the decline in public and private-sector investment and by the country’s economic slowdown.

4 In 1Q19, the average utilization rate of the PE plants increased 6 p.p. from 4Q18 to 79%, due to the higher ethane supply in the period. Compared to 1Q18, the average capacity utilization fell by 7 p.p.

4 In the quarter, the Mexico unit posted EBITDA of US$100 million (R$382 million), representing 22% of the Company’s consolidated EBITDA.

Environment, Social Responsibility and Corporate Governance:

4 Environment: Braskem continued to make progress in its global plan to adapt to climate change, with implementation reaching 73%, which enabled the elimination of 10 climate risk scenarios. The plan includes initiatives to mitigate or reduce more significant climate risks to the Company’s operations, such as: (i) intense rainfall and electrical discharges; (ii) water shortage; (iii) hurricanes and tropical cyclones; (iv) energy generation; (v) floods; and (vi) rising sea levels.

4 In line with the initiative to drive engagement among consumers in recycling and recovery programs, in April Braskem launched the program “Recycle & Win,” a pilot project conducted in partnership with the gas station chain Boxter, which added a recycling collection center for recyclable packaging that awards consumers points every time they discard a material, which can then be redeemed for discounts on products sold by Boxter stations. Also aligned with its strategy to promote environmental education, Braskem hosted at the Virada Sustentável sustainability event in Porto Alegre and at the International Plastics Trade Fair (Feiplastic) in São Paulo the project “Recycling is Transforming.” The project uses a modular structure to show the entire process to consumers, from waste picking to conversion into new products, while stressing the importance of proper disposal in the cycle.

2

4 Social Responsibility: Graduation of the first class of Braskem Women Entrepreneurs, an initiative in partnership with the Women Entrepreneur Network, which offers professional training to women living near Braskem’s petrochemical complex in the ABC region of São Paulo. The project is expected to foster local development through higher income and new job creation by improving employability and supporting businesses led by women.

Governance & Compliance:

4 Conclusion of 98% of initiatives under the Compliance Program.

4 Beginning of the third phase of the Independent Monitorship, which includes document analyses, on-site interviews and transaction testing.

4 Conclusion of 5 projects under the Internal Audit: Testing of SOx Controls, Maritime Shipping and Freight, Access and Change Management – IT, Payment of Commissions for Third and Fourth Quarters, and Sales Intermediation.

4 Approval of Plan for Braskem’s Compliance Ambassadors Program.

4 Conclusion of new cycle of declarations for assessing potential conflicts of interest.

4 Revisions of Anticorruption Policy, Global Compliance System Policy and Global Procedure for Business Courtesies.

4 Approval of Third-Party Due Diligence Procedure in Europe and of Client Due Diligence Procedure.

4 Approval of Procedure for Donations and Sponsorships in Europe.

Petrochemical Industry 1Q19:

4 Spreads of key chemicals5 produced by Braskem: decrease explained by lower spreads for (i) propylene, due to an increase in supply given producers’ high utilization rates and elevated inventory levels in the United States, coupled with logistics constraints for exports at the Port of Houston; and (ii) benzene, due to the higher supply in Asia and lower demand from China.

4 Spread of polyolefins6 produced by Braskem in Brazil: lower than in the previous period, explained by the startup of new PE capacities, especially in the USA, and by the slowdown in demand growth in China, which revised downwards its forecasts for GDP growth in 2019.

4 Spread of vinyls7: increase due to higher PVC prices in Asia, mainly at the start of the year, influenced by stronger demand from Southeast Asia and supply constraints caused by scheduled shutdowns and outages in Asia. Caustic soda prices continued to decrease. Despite India’s decision to lift its ban on caustic soda imports into the country, there was no significant effect on prices in the quarter. Furthermore, high inventories in the USA continued to pressure prices in the period.

5 Difference between the prices of key chemicals (15% ethylene, 10% propylene, 35% BTX, 10% butadiene, 5% cumene and 25% fuels, based on the capacity mix of Braskem’s industrial units in Brazil) and the price of naphtha. (Source: external consulting firm.)

6 Difference between the price of PE and PP based on the capacity mix of the industrial units in Brazil and the price of naphtha. (Source: external consulting firm.)

7 International PVC price - (0.48*3.33*ARA Naphtha Price) - (Brent Oil Price)*1.75/1.725 + (0.685 x Caustic Soda Price).

3

4 PP spread in United States8: stable compared to 4Q18, since PP accompanied the decline in propylene prices. In relation to 1Q18, spreads increased, reflecting the higher propylene supply, with DHPs reaching high utilization rates in the period.

4 PP spread in Europe9: increased compared to last quarter, given the lower propylene price, due to the end of logistics constraints on the region’s rivers and the stronger demand for PP due to restocking activities in anticipation of the scheduled shutdown season in 2Q19. Compared to the same period last year, spreads contracted due to weaker demand for PP, reflecting the region’s economic slowdown.

4 PE spread in North America10: declined due to new PE capacities, which continue to come online in the USA, as well as the expectations for lower U.S. demand growth.

OPERATING PERFORMANCE IN 1Q19 BY REGION:

BRAZIL

8 Difference between the U.S. polypropylene price and the U.S. propylene price.

9 Difference between the Europe polypropylene price and the Europe propylene price.

10 Difference between the U.S. polyethylene price and the U.S. ethane price.

4

INTERNATIONAL REFERENCES:

|

COGS: positively influenced by the reversal of provisions for the Energy Development Account (CDE)11 in the amount of US$54 million (R$200 million) and for REIQ while the injunction was in force in the amount of US$30 million (R$117 million)12. Excluding these nonrecurring events, COGS in the quarter was lower compared to 4Q18, explained by the inventory carryover cost formed by lower-priced feedstock, especially naphtha, which offset the higher sales volumes. Compared to 1Q18, the decrease was driven by lower feedstock prices, except for ethane. COGS also benefited from the PIS/COFINS tax credit on feedstock purchases (REIQ) of US$57 million (R$213 million) and by the Reintegra credit of US$0.6 million (R$2.4 million). |

|

11 The Brazilian Association of Large Energy Consumers (ABRACE), of which Braskem is a member, filed lawsuits disputing the charges to fund public policies in the Brazilian electricity industry, known as the Energy Development Account, in 2015 and 2016 (CDE 2015 and CDE 2016), and obtained injunctions suspending the collection of said charges from its members. At the time of the injunctions, due to the uncertainty regarding the final outcome of the lawsuit, the Company started to provision the amount corresponding to the suspended charges. After more than 3 years from the filing of the actions, and after the injunctions were upheld and confirmed by higher courts, the attorneys that represent ABRACE revised the likelihood of success to possible with a favorable inclination, which justified the reversal of the provisioning accrued from October 2015 and June 2018.

12 In August 2018, the Brazilian Chemical Manufacturers' Association (ABIQUIM) filed a lawsuit to declare the right of its members not to be subject to the repeal of the Special Regime for the Chemical Industry (REIQ) implemented through Provisional Presidential Decree (MP) 836/2018, whose effects were valid as from September 1, 2018. As a result, Braskem maintained the application of REIQ in accordance with the legislation prior to the MP and accrued a provision until the lack of its effect, on October 10, 2018, through a temporary court order. Later, after the final and unappealable decision in February 2019, which accepted the claim, Braskem reversed the provision.

5

UNITED STATES & EUROPE13

International references:

|

COGS: decline compared to 4Q18 and 1Q18, explained by the lower propylene price, given: (i) the monomer’s higher supply in the United States from on-purpose producers; (ii) the end of logistics constraints in Europe; and (iii) lower oil prices. |

|

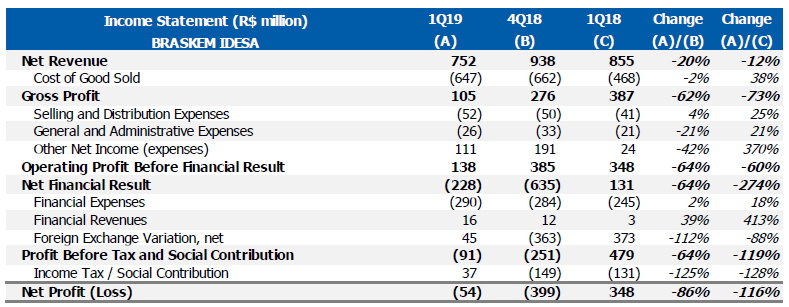

MEXICO (Braskem Idesa)14

13 The segment’s results are formed by six industrial units in the United States and two in Europe, with aggregate production capacity of 2,195 kta, with 1,570 kta in the United States and 625 kta in Europe.

14 The segment comprises an ethane-based cracker, two high-density polyethylene (HDPE) plants and one low-density polyethylene (LDPE) plant with combined PE production capacity of 1,050 kta. This unit includes the results of Braskem Idesa SAPI and of the other subsidiaries of Braskem S.A. in Mexico.

6

International references:

|

COGS: increase compared to 4Q18, explained by sales volume growth and by the higher natural gas price. Compared to 1Q18, the increase was mainly due to higher ethane prices, given the stronger demand following the startup of new gas-based crackers in the United States. |

|

Other Income (Expenses), net: the result in 1Q19 includes income of US$31 million related to the delivery-or-pay clause of the ethane supply agreement, which is explained by: (i) lower supply in 1Q19; (ii) the higher provision in 3Q18 related to the volume not offset by 1Q19; (iii) the increase in the provision of 4Q18.

7

CONSOLIDATED PERFORMANCE 1Q1915

1. EBITDA

2. COGS

3. OTHER INCOME (EXPENSES), NET

In 1Q19, the Company recorded income of R$1,232 million, mainly impacted by the provision in the amount of R$410 million related to the leniency agreement entered into with the Office of the Federal Controller General (CGU) and the Office of the General Counsel for the Federal Government (AGU), which was offset by the recognition of income from overpayment of PIS and COFINS taxes made between June 2002 and December 2011; and between January 2012 and February 2017, of which R$1,708 million were recorded under “Other operating income (expenses),” as shown below, and R$101 million under “Financial income.”

15 Braskem’s consolidated result corresponds to the sum of the results in Brazil, United States & Europe and Mexico, less eliminations from the revenues and costs from the transfers of products among these regions.

8

4. NET FINANCIAL RESULT

Financial expenses: increase of R$147 million compared to 4Q18, mainly explained by adoption of the accounting standard IFRS 16 and the R$118 million in present value adjustment of the leniency agreement due to the change in the adjustment index of the installments payable to the MPF from the IPCA to the Selic.

Financial income: increase compared to 4Q18, mainly due to the R$101 million impact related to the overpayment of PIS and COFINS taxes between June 2002 and December 2011; and between January 2012 and February 2017.

Net exchange variation: compared to 4Q18, this line was affected by effects of the Mexican peso appreciation against the U.S. dollar on the outstanding balance of the loan of Braskem Idesa in the amount of US$ 2,140 million on March 31, 2019, and by the expense with the transition of the hedge accounting of exports, which previously was recorded under shareholders' equity, in the amounts of R$261 million at Braskem and of R$61 million at Braskem Idesa.

5. LIQUIDITY AND CAPITAL RESOURCES

On March 31, 2019, the average debt term was approximately 14 years, while the average weighted cost of the Company’s debt was equivalent to exchange variation + 5.48%.

9

Braskem’s liquidity position of US$1,746 million is sufficient to cover the payment of all obligations maturing over the next 37 months.

In December 2018, the Company signed a new BNDES on lending facility worth R$476 million with maturity in January 2031. On January 30, 2019, Braskem withdrew the first installment under this facility, in the amount of R$266 million, which is in aligned with the Company’s capital expenditures in Brazil.

Risk-rating agencies:

Braskem maintained investment grade ratings above Brazil’s sovereign risk at Standard & Poor's (BBB-) and Fitch Ratings (BBB-) and a stable ratings outlook at the three main agencies. The reports are available on the Investor Relations website (http://www.braskem-ri.com.br/home-en).

10

6. INVESTMENTS & VALUE CREATION16

Of the total investments in 1Q19, 36% were allocated to the construction of the new PP plant in the United States, which reached 56.2% completion, with investment of US$426 million already made.

7. FREE CASH FLOW17

In 1Q19, Braskem’s free cash generation decreased 70% from 4Q18, which is basically explained by the lower recurring EBITDA and by the higher concentration of interest payments on bonds. Compared to 1Q18, free cash generation decreased 93%, mainly due to the lower EBITDA and the negative effect from the weaker local currency on the translation into Brazilian real of interest payments and capital expenditures pegged to the U.S. dollar.

SUSTAINABLE DEVELOPMENT

4 Sustainable Development – Highlights in 1Q19

16 Considers operating investment, maintenance shutdowns and acquisitions of spare parts.

17 Note that the cash flow analysis above does not consider the reclassification of “cash and cash equivalents” to “financial investments” related to financial investments in Brazilian federal government bonds (Brazilian floating-rate (SELIC) government bond - LFT) and floating-rate bonds (LFs) issued by financial institutions, whose original maturities exceed three months, with immediate liquidity and expected realization in the short term, in accordance with Note 4 to the Quarterly Financial Statements as of June 30, 2018. In the cash flow presented, this is recorded as “financial investments” (includes LFTs and LFs), with the following effects from reclassifications: (i) increase in the balance of financial investments by R$100 million in 1Q18; (ii) increase in the balance of financial investments by R$275 million in 4Q18; and (iii) increase in the balance of financial investments by R$640 million in 1Q19.

11

o Braskem Labs: During the Campus Party, Braskem launched the 5th edition of Braskem Labs. At the event, the project received startups that registered for the program’s new edition: Scale, Ignition & Challenge

o RobecoSAM Yearbook: Braskem was included for the fourth consecutive time in the RobecoSAM Sustainability Yearbook.

o World Water Day: Braskem participated in the events of companies that are references in water management at CNI, FIESP, CDP Supply Chain, with the highlight the publication #juntospelaágua of the Brazilian Business Council on Sustainable Development (CEBDS), which highlighted Braskem’s use of treated water from household sewage in the ABC region of Greater São Paulo.

o Solar Power: Installation of 1MWp of the 5MWp of the solar panel project in Sobradinho, developed in partnership with Sunlution and the UNIPAC group, which aims to maintain or increase the power generation capacity of Chesf during prolonged droughts.

o Maxio Resins: Launch of the new grade Maxio DP213A, which accelerates the production of polypropylene extruders, with productivity gains of up to 35% without increasing energy consumption, while reducing costs for clients producing big bags;

o Green EVA: I’m green™ EVA is now the feedstock used to make the first innersole in Latin America produced and marketed using renewable plastics, the so-called green EVA. The inner sole is the product of a partnership with Cofrag and Mais Polímeros.

o OCS/Zero Pellet: Braskem signed a Statement of Commitment to implement the program Operation Clean Sweep (OCS), which was created to help the Brazilian plastics industry and its logistics chain to reduce pellet, flock and powder losses into the environment and to prevent contamination of marine environments.

INDICATORS

12

EXHIBITS LIST:

|

EXHIBIT I: |

Consolidated Statement of Operations |

14 |

|

EXHIBIT II: |

Calculation of Consolidated EBITDA |

14 |

|

EXHIBIT III: |

Consolidated Balance Sheet |

15 |

|

EXHIBIT IV: |

Consolidated Cash Flow |

17 |

|

EXHIBIT V: |

Braskem Idesa Statement of Operations |

18 |

|

EXHIBIT VI: |

Braskem Idesa Balance Sheet |

18 |

|

EXHIBIT VII: |

Braskem Idesa Cash Flow Statement |

19 |

|

EXHIBIT VIII: |

Financial Results Braskem Idesa |

19 |

|

EXHIBIT IX: |

Operating Tables by Segment of Brazil |

20 |

|

EXHIBIT X: |

Consolidated Financial Overview |

22

|

DISCLAIMER

This release contains forward-looking statements. These forward-looking statements are not solely historical data, but rather reflect the targets and expectations of Braskem’s management. Words such as "anticipate," "wish," "expect," "foresee," "intend," "plan," "predict," "project," "aim" and similar terms seek to identify statements that necessarily involve known and unknown risks. Braskem does not undertake any liability for transactions or investment decisions based on the information contained in this document.

13

APPENDIX I

Consolidated Statement of Operations

APPENDIX II

Calculation of Consolidated EBITDA

(i) Represents the accrual and reversal of provisions for the impairment of long-lived assets (investments, property, plant and equipment and intangible assets) that were adjusted to form EBITDA, since there is no expectation of their financial realization and if in fact realized they would be duly recorded on the statement of operations.

(ii) Corresponds to results from equity investments in associated companies and joint ventures.

(iii) Includes effects of IFRS16.

14

APPENDIX III

Consolidated Balance Sheet - Assets

15

Consolidated Balance Sheet - Liabilities18

18 On the reporting date of these quarterly financial statements, i.e. march 31, 2019, certain non-financial contractual obligations were still in unremedied breach. As a result, the entire balance of non-current liabilities, in the amount of R$9,348 million, is still reclassified as current liabilities, in accordance with CPC 26 and its corresponding accounting standard IAS 1 (Presentation of Financial Statements). In accordance with the aforementioned accounting standards, reclassification is required in situations in which the breach of certain contractual obligations entitles creditors to request from Braskem Idesa the settlement of obligations in the short term. In this context, note that none of the creditors requested said prepayment of obligations and that Braskem Idesa has been settling its debt service obligations in accordance with their original maturity schedule.

16

EXHIBIT IV

Consolidated Cash Flow

17

EXHIBIT V

Braskem Idesa Statement of Operations

EXHIBIT VI

Braskem Idesa Balance Sheet18

18

EXHIBIT VII

Braskem Idesa Cash Flow Statement

EXHIBIT VIII

Financial Results Braskem Idesa

19

EXHIBIT IX

Operating Tables by Segment of Brazil

20

21

EXHIBIT X

Consolidated Financial Overview

22

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: August 7, 2019| BRASKEM S.A. | |||

| By: | /s/ Pedro van Langendonck Teixeira de Freitas | ||

|

| |||

| Name: | Pedro van Langendonck Teixeira de Freitas | ||

| Title: | Chief Financial Officer | ||

This press release may contain forward-looking statements. These statements are statements that are not historical facts, and are based on management's current view and estimates offuture economic circumstances, industry conditions, company performance and financial results. The words "anticipates", "believes", "estimates", "expects", "plans" and similar expressions, as they relate to the company, are intended to identify forward-looking statements. Statements regarding the declaration or payment of dividends, the implementation of principal operating and financing strategies and capital expenditure plans, the direction of future operations and the factors or trends affecting financial condition, liquidity or results of operations are examples of forward-looking statements. Such statements reflect the current views of management and are subject to a number of risks and uncertainties. There is no guarantee that the expected events, trends or results will actually occur. The statements are based on many assumptions and factors, including general economic and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors could cause actual results to differ materially from current expectations.