000010714004-302020FY0.60.40.100001071402019-05-012020-04-3000001071402019-10-310000107140jwa:ClassBCommonStockParValue100PerShareMember2020-05-310000107140jwa:ClassACommonStockParValue100PerShareMember2020-05-310000107140jwa:ClassACommonStockParValue100PerShareMember2019-05-012020-04-300000107140jwa:ClassBCommonStockParValue100PerShareMember2019-05-012020-04-3000001071402019-04-3000001071402020-04-300000107140us-gaap:CommonClassBMember2019-04-300000107140us-gaap:CommonClassAMember2020-04-300000107140us-gaap:CommonClassBMember2020-04-300000107140us-gaap:CommonClassAMember2019-04-3000001071402018-05-012019-04-3000001071402017-05-012018-04-3000001071402018-04-3000001071402017-04-300000107140jwa:TheLearningHouseIncMemberjwa:AdditionalPaidInCapitalAttributableToWarrantMember2018-05-012019-04-300000107140jwa:TheLearningHouseIncMemberjwa:AdditionalPaidInCapitalAttributableToWarrantMember2017-05-012018-04-300000107140jwa:TheLearningHouseIncMemberjwa:AdditionalPaidInCapitalAttributableToWarrantMember2019-05-012020-04-300000107140us-gaap:TreasuryStockMember2017-04-300000107140us-gaap:AdditionalPaidInCapitalMember2017-04-300000107140us-gaap:AccumulatedOtherComprehensiveIncomeMember2017-04-300000107140us-gaap:CommonStockMemberus-gaap:CommonClassBMember2017-04-300000107140us-gaap:CommonStockMemberus-gaap:CommonClassAMember2017-04-300000107140us-gaap:RetainedEarningsMember2017-04-300000107140us-gaap:AccumulatedOtherComprehensiveIncomeMember2017-05-012018-04-300000107140us-gaap:RetainedEarningsMember2019-05-012020-04-300000107140us-gaap:CommonStockMemberus-gaap:CommonClassAMember2017-05-012018-04-300000107140us-gaap:AdditionalPaidInCapitalMember2018-05-012019-04-300000107140us-gaap:RetainedEarningsMember2017-05-012018-04-300000107140us-gaap:TreasuryStockMember2019-05-012020-04-300000107140us-gaap:CommonStockMemberus-gaap:CommonClassBMember2019-05-012020-04-300000107140us-gaap:CommonClassAMemberus-gaap:CommonStockMember2018-05-012019-04-300000107140us-gaap:AdditionalPaidInCapitalMember2017-05-012018-04-300000107140us-gaap:AccumulatedOtherComprehensiveIncomeMember2018-05-012019-04-300000107140us-gaap:TreasuryStockMember2017-05-012018-04-300000107140us-gaap:TreasuryStockMember2018-05-012019-04-300000107140us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-05-012020-04-300000107140us-gaap:CommonStockMemberus-gaap:CommonClassAMember2019-05-012020-04-300000107140us-gaap:AdditionalPaidInCapitalMember2019-05-012020-04-300000107140us-gaap:CommonClassBMemberus-gaap:CommonStockMember2017-05-012018-04-300000107140us-gaap:RetainedEarningsMember2018-05-012019-04-300000107140us-gaap:CommonStockMemberus-gaap:CommonClassBMember2018-05-012019-04-300000107140us-gaap:CommonClassBMemberus-gaap:AdditionalPaidInCapitalMember2017-05-012018-04-300000107140us-gaap:CommonClassAMemberus-gaap:TreasuryStockMember2019-05-012020-04-300000107140us-gaap:RetainedEarningsMemberus-gaap:CommonClassBMember2019-05-012020-04-300000107140us-gaap:AdditionalPaidInCapitalMemberus-gaap:CommonClassBMember2019-05-012020-04-300000107140us-gaap:TreasuryStockMemberus-gaap:CommonClassAMember2018-05-012019-04-300000107140us-gaap:CommonClassBMemberus-gaap:AccumulatedOtherComprehensiveIncomeMember2018-05-012019-04-300000107140us-gaap:AccumulatedOtherComprehensiveIncomeMemberus-gaap:CommonClassBMember2019-05-012020-04-300000107140us-gaap:CommonClassBMemberus-gaap:AccumulatedOtherComprehensiveIncomeMember2017-05-012018-04-300000107140us-gaap:CommonClassAMemberus-gaap:AdditionalPaidInCapitalMember2018-05-012019-04-300000107140us-gaap:RetainedEarningsMemberus-gaap:CommonClassBMember2018-05-012019-04-300000107140us-gaap:CommonClassAMember2019-05-012020-04-300000107140us-gaap:CommonClassBMemberus-gaap:TreasuryStockMember2019-05-012020-04-300000107140us-gaap:RetainedEarningsMemberus-gaap:CommonClassAMember2019-05-012020-04-300000107140us-gaap:AccumulatedOtherComprehensiveIncomeMemberus-gaap:CommonClassAMember2017-05-012018-04-300000107140us-gaap:TreasuryStockMemberus-gaap:CommonClassBMember2018-05-012019-04-300000107140us-gaap:CommonClassAMemberus-gaap:TreasuryStockMember2017-05-012018-04-300000107140us-gaap:CommonClassAMemberus-gaap:AccumulatedOtherComprehensiveIncomeMember2018-05-012019-04-300000107140us-gaap:CommonClassBMember2017-05-012018-04-300000107140us-gaap:RetainedEarningsMemberus-gaap:CommonClassAMember2017-05-012018-04-300000107140us-gaap:CommonClassBMemberus-gaap:TreasuryStockMember2017-05-012018-04-300000107140us-gaap:RetainedEarningsMemberus-gaap:CommonClassBMember2017-05-012018-04-300000107140us-gaap:RetainedEarningsMemberus-gaap:CommonClassAMember2018-05-012019-04-300000107140us-gaap:CommonClassAMemberus-gaap:AdditionalPaidInCapitalMember2017-05-012018-04-300000107140us-gaap:CommonClassBMember2018-05-012019-04-300000107140us-gaap:CommonClassAMemberus-gaap:AdditionalPaidInCapitalMember2019-05-012020-04-300000107140us-gaap:CommonClassBMember2019-05-012020-04-300000107140us-gaap:CommonClassAMember2018-05-012019-04-300000107140us-gaap:CommonClassAMemberus-gaap:AccumulatedOtherComprehensiveIncomeMember2019-05-012020-04-300000107140us-gaap:CommonClassBMemberus-gaap:AdditionalPaidInCapitalMember2018-05-012019-04-300000107140us-gaap:CommonClassAMember2017-05-012018-04-300000107140us-gaap:AdditionalPaidInCapitalMember2020-04-300000107140us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-04-300000107140us-gaap:TreasuryStockMember2018-04-300000107140us-gaap:CommonClassAMemberus-gaap:CommonStockMember2020-04-300000107140us-gaap:CommonStockMemberus-gaap:CommonClassAMember2019-04-300000107140us-gaap:RetainedEarningsMember2019-04-300000107140us-gaap:AccountingStandardsUpdate201409Membersrt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2018-04-300000107140us-gaap:TreasuryStockMember2020-04-300000107140us-gaap:CommonStockMemberus-gaap:CommonClassBMember2020-04-300000107140us-gaap:AccountingStandardsUpdate201409Membersrt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberus-gaap:AdditionalPaidInCapitalMember2018-04-300000107140us-gaap:CommonClassBMemberus-gaap:CommonStockMember2018-04-300000107140us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-04-300000107140us-gaap:TreasuryStockMember2019-04-300000107140srt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberus-gaap:AccountingStandardsUpdate201409Memberus-gaap:AccumulatedOtherComprehensiveIncomeMember2018-04-300000107140us-gaap:AdditionalPaidInCapitalMember2019-04-300000107140us-gaap:RetainedEarningsMember2020-04-300000107140us-gaap:AccumulatedOtherComprehensiveIncomeMember2018-04-300000107140us-gaap:AccountingStandardsUpdate201409Memberus-gaap:TreasuryStockMembersrt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2018-04-300000107140us-gaap:CommonClassAMembersrt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberus-gaap:AccountingStandardsUpdate201409Memberus-gaap:CommonStockMember2018-04-300000107140us-gaap:RetainedEarningsMember2018-04-300000107140us-gaap:RetainedEarningsMembersrt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberus-gaap:AccountingStandardsUpdate201409Member2018-04-300000107140us-gaap:CommonStockMemberus-gaap:CommonClassAMember2018-04-300000107140us-gaap:AdditionalPaidInCapitalMember2018-04-300000107140us-gaap:CommonStockMemberus-gaap:CommonClassBMember2019-04-300000107140us-gaap:CommonClassBMembersrt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberus-gaap:CommonStockMemberus-gaap:AccountingStandardsUpdate201409Member2018-04-300000107140jwa:TheLearningHouseIncMember2019-05-012020-04-300000107140jwa:MthreeMember2019-05-012020-04-300000107140jwa:ZyanteMember2019-05-012020-04-300000107140jwa:RestructuringAndReinvestmentProgramMember2019-05-012020-04-300000107140jwa:BusinessOptimizationProgramMember2019-05-012020-04-300000107140jwa:CorrectionInPresentationOfCertainConsiderationReceivedForServicesNotYetPerformedMembersrt:RestatementAdjustmentMember2018-05-012019-04-300000107140us-gaap:ShippingAndHandlingMember2017-05-012018-04-300000107140us-gaap:ShippingAndHandlingMember2018-05-012019-04-300000107140us-gaap:ShippingAndHandlingMember2019-05-012020-04-300000107140us-gaap:InventoriesMember2020-04-300000107140jwa:RoyaltiesPayableMember2019-04-300000107140jwa:RoyaltiesPayableMember2020-04-300000107140us-gaap:InventoriesMember2019-04-300000107140jwa:ContractLiabilityDeferredRevenueMember2019-04-300000107140jwa:ContractLiabilityDeferredRevenueMember2020-04-300000107140us-gaap:CostOfSalesMember2019-05-012020-04-300000107140us-gaap:GeneralAndAdministrativeExpenseMember2018-05-012019-04-300000107140us-gaap:GeneralAndAdministrativeExpenseMember2019-05-012020-04-300000107140us-gaap:CostOfSalesMember2018-05-012019-04-300000107140us-gaap:GeneralAndAdministrativeExpenseMember2017-05-012018-04-300000107140us-gaap:CostOfSalesMember2017-05-012018-04-300000107140srt:MinimumMemberus-gaap:SoftwareAndSoftwareDevelopmentCostsMember2019-05-012020-04-300000107140jwa:BuildingAndLeaseholdImprovementsMembersrt:MaximumMember2019-05-012020-04-300000107140srt:MinimumMemberus-gaap:ComputerEquipmentMember2019-05-012020-04-300000107140srt:MaximumMemberus-gaap:SoftwareAndSoftwareDevelopmentCostsMember2019-05-012020-04-300000107140us-gaap:SoftwareDevelopmentMembersrt:MaximumMember2019-05-012020-04-300000107140jwa:BookCompositionCostsMembersrt:MinimumMember2019-05-012020-04-300000107140srt:MinimumMemberjwa:FurnitureFixturesAndWarehouseEquipmentMember2019-05-012020-04-300000107140srt:WeightedAverageMemberjwa:OtherProductDevelopmentCostsMember2019-05-012020-04-300000107140jwa:EnterpriseResourcePlanningAndRelatedSystemsMember2019-05-012020-04-300000107140srt:MaximumMemberjwa:FurnitureFixturesAndWarehouseEquipmentMember2019-05-012020-04-300000107140us-gaap:ComputerEquipmentMembersrt:MaximumMember2019-05-012020-04-300000107140srt:MinimumMemberus-gaap:SoftwareDevelopmentMember2019-05-012020-04-300000107140srt:MaximumMemberjwa:BookCompositionCostsMember2019-05-012020-04-300000107140us-gaap:ArtisticRelatedIntangibleAssetsMembersrt:WeightedAverageMember2019-05-012020-04-300000107140srt:WeightedAverageMemberus-gaap:NoncompeteAgreementsMember2019-05-012020-04-300000107140us-gaap:TradeNamesMembersrt:WeightedAverageMember2019-05-012020-04-300000107140us-gaap:CustomerRelationshipsMembersrt:WeightedAverageMember2019-05-012020-04-300000107140us-gaap:DevelopedTechnologyRightsMembersrt:WeightedAverageMember2019-05-012020-04-300000107140srt:WeightedAverageMemberus-gaap:TrademarksMember2019-05-012020-04-300000107140us-gaap:PerformanceSharesMember2019-05-012020-04-300000107140srt:MinimumMemberus-gaap:AccountingStandardsUpdate201602Member2020-04-300000107140jwa:ProfessionalLearningMemberjwa:AcademicAndProfessionalLearningSegmentMember2018-05-012019-04-300000107140jwa:AcademicAndProfessionalLearningSegmentMemberjwa:EducationPublishingMember2019-05-012020-04-300000107140jwa:AcademicAndProfessionalLearningSegmentMember2017-05-012018-04-300000107140jwa:ResearchPublishingMemberjwa:ResearchPublishingAndPlatformsSegmentMember2018-05-012019-04-300000107140jwa:ResearchPublishingAndPlatformsSegmentMember2019-05-012020-04-300000107140jwa:EducationServicesSegmentMemberjwa:MthreeMember2019-05-012020-04-300000107140jwa:EducationServicesSegmentMember2019-05-012020-04-300000107140jwa:ResearchPlatformsMemberjwa:ResearchPublishingAndPlatformsSegmentMember2018-05-012019-04-300000107140jwa:EducationServicesSegmentMemberjwa:MthreeMember2018-05-012019-04-300000107140jwa:ResearchPlatformsMemberjwa:ResearchPublishingAndPlatformsSegmentMember2017-05-012018-04-300000107140jwa:ProfessionalLearningMemberjwa:AcademicAndProfessionalLearningSegmentMember2017-05-012018-04-300000107140jwa:EducationServicesSegmentMemberjwa:MthreeMember2017-05-012018-04-300000107140jwa:ProfessionalLearningMemberjwa:AcademicAndProfessionalLearningSegmentMember2019-05-012020-04-300000107140jwa:ResearchPublishingMemberjwa:ResearchPublishingAndPlatformsSegmentMember2019-05-012020-04-300000107140jwa:EducationServicesSegmentMember2018-05-012019-04-300000107140jwa:OnlineProgramManagementDeltakMemberjwa:EducationServicesSegmentMember2017-05-012018-04-300000107140jwa:OnlineProgramManagementDeltakMemberjwa:EducationServicesSegmentMember2019-05-012020-04-300000107140jwa:AcademicAndProfessionalLearningSegmentMember2019-05-012020-04-300000107140jwa:EducationPublishingMemberjwa:AcademicAndProfessionalLearningSegmentMember2018-05-012019-04-300000107140jwa:ResearchPublishingMemberjwa:ResearchPublishingAndPlatformsSegmentMember2017-05-012018-04-300000107140jwa:ResearchPlatformsMemberjwa:ResearchPublishingAndPlatformsSegmentMember2019-05-012020-04-300000107140jwa:AcademicAndProfessionalLearningSegmentMember2018-05-012019-04-300000107140jwa:EducationServicesSegmentMember2017-05-012018-04-300000107140jwa:EducationServicesSegmentMemberjwa:OnlineProgramManagementDeltakMember2018-05-012019-04-300000107140jwa:ResearchPublishingAndPlatformsSegmentMember2018-05-012019-04-300000107140jwa:AcademicAndProfessionalLearningSegmentMemberjwa:EducationPublishingMember2017-05-012018-04-300000107140jwa:ResearchPublishingAndPlatformsSegmentMember2017-05-012018-04-300000107140jwa:JournalRevenueMember2019-05-012020-04-300000107140jwa:ProfessionalAssessmentMember2019-05-012020-04-300000107140srt:MaximumMemberjwa:OnlineProgramManagementDeltakMember2019-05-012020-04-300000107140jwa:OnlineProgramManagementDeltakMembersrt:MinimumMember2019-05-012020-04-300000107140srt:MaximumMemberjwa:PublishingTechnologyServicesAtyponMember2019-05-012020-04-300000107140jwa:TestPreparationAndCertificationMember2019-05-012020-04-300000107140jwa:PublishingTechnologyServicesAtyponMembersrt:MinimumMember2019-05-012020-04-3000001071402020-05-012020-04-3000001071402021-05-012020-04-300000107140jwa:MthreeMember2020-01-012020-01-010000107140jwa:TheLearningHouseIncMember2018-11-012018-11-010000107140jwa:AcademicAndProfessionalLearningSegmentMemberjwa:ZyanteMember2019-07-012019-07-010000107140jwa:OtherAcquistionsMember2019-05-012020-04-300000107140jwa:EducationServicesSegmentMemberjwa:MthreeMember2019-05-012020-04-300000107140jwa:ZyanteMemberjwa:AcademicAndProfessionalLearningSegmentMember2018-05-012019-04-300000107140jwa:EducationServicesSegmentMemberjwa:TheLearningHouseIncMember2018-05-012019-04-300000107140jwa:AcademicAndProfessionalLearningSegmentMemberjwa:ZyanteMember2019-07-010000107140jwa:MthreeMember2020-01-010000107140jwa:ZyanteMember2019-07-012019-07-010000107140jwa:ZyanteMember2019-07-010000107140jwa:TheLearningHouseIncMember2018-10-310000107140jwa:AcademicAndProfessionalLearningSegmentMemberjwa:OtherAcquistionsMember2020-04-300000107140jwa:OtherAcquistionsMemberjwa:ResearchPublishingAndPlatformsSegmentMember2020-04-300000107140jwa:OtherAcquistionsMember2020-04-300000107140jwa:CourseContentMemberjwa:MthreeMember2020-01-012020-01-010000107140jwa:ZyanteMemberus-gaap:TrademarksMember2019-07-012019-07-010000107140jwa:ZyanteMemberus-gaap:CustomerRelationshipsMember2019-07-012019-07-010000107140us-gaap:CustomerRelationshipsMemberjwa:MthreeMember2020-01-012020-01-010000107140jwa:TheLearningHouseIncMemberus-gaap:CustomerRelationshipsMember2019-05-012020-04-300000107140jwa:CourseContentMemberjwa:TheLearningHouseIncMember2019-05-012020-04-300000107140jwa:MthreeMemberus-gaap:TrademarksMember2020-01-012020-01-010000107140us-gaap:DevelopedTechnologyRightsMemberjwa:ZyanteMember2019-07-012019-07-010000107140jwa:CourseContentMemberjwa:ZyanteMember2019-07-012019-07-010000107140jwa:OtherAcquistionsMemberjwa:CourseContentMember2019-05-012020-04-300000107140jwa:OtherAcquistionsMemberus-gaap:DevelopedTechnologyRightsMember2019-05-012020-04-300000107140jwa:OtherAcquistionsMemberus-gaap:CustomerRelationshipsMember2019-05-012020-04-300000107140jwa:OtherAcquistionsMemberjwa:EducationServicesSegmentMember2020-02-012020-04-300000107140jwa:AcademicAndProfessionalLearningSegmentMemberjwa:OtherAcquistionsMember2019-08-012019-10-310000107140jwa:OtherAcquistionsMemberjwa:ResearchPublishingAndPlatformsSegmentMember2019-05-012019-07-310000107140jwa:TheLearningHouseIncMemberjwa:AdditionalPaidInCapitalAttributableToWarrantMember2018-10-310000107140jwa:AdditionalPaidInCapitalAttributableToWarrantMemberjwa:TheLearningHouseIncMember2018-11-012018-11-010000107140jwa:AdditionalPaidInCapitalAttributableToWarrantMemberus-gaap:CommonClassAMemberjwa:TheLearningHouseIncMember2018-10-310000107140us-gaap:CommonClassAMemberus-gaap:EmployeeStockOptionMember2018-05-012019-04-300000107140jwa:AdditionalPaidInCapitalAttributableToWarrantMemberus-gaap:CommonClassAMember2019-05-012020-04-300000107140us-gaap:CommonClassAMemberjwa:AdditionalPaidInCapitalAttributableToWarrantMember2017-05-012018-04-300000107140us-gaap:EmployeeStockOptionMemberus-gaap:CommonClassAMember2017-05-012018-04-300000107140us-gaap:RestrictedStockMember2019-05-012020-04-300000107140us-gaap:RestrictedStockMember2018-05-012019-04-300000107140us-gaap:CommonClassAMemberus-gaap:EmployeeStockOptionMember2019-05-012020-04-300000107140us-gaap:RestrictedStockMember2017-05-012018-04-300000107140us-gaap:CommonClassAMemberjwa:AdditionalPaidInCapitalAttributableToWarrantMember2018-05-012019-04-300000107140us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2017-04-300000107140us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetUnamortizedGainLossMember2017-04-300000107140us-gaap:AccumulatedTranslationAdjustmentMember2017-04-300000107140us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2017-05-012018-04-300000107140us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetUnamortizedGainLossMember2017-05-012018-04-300000107140us-gaap:AccumulatedTranslationAdjustmentMember2017-05-012018-04-300000107140us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetUnamortizedGainLossMember2019-05-012020-04-300000107140us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetUnamortizedGainLossMember2018-05-012019-04-300000107140us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2019-05-012020-04-300000107140us-gaap:AccumulatedTranslationAdjustmentMember2018-05-012019-04-300000107140us-gaap:AccumulatedTranslationAdjustmentMember2019-05-012020-04-300000107140us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2018-05-012019-04-300000107140us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2018-04-300000107140us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetUnamortizedGainLossMember2018-04-300000107140us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2020-04-300000107140us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetUnamortizedGainLossMember2019-04-300000107140us-gaap:AccumulatedTranslationAdjustmentMember2019-04-300000107140us-gaap:AccumulatedTranslationAdjustmentMember2020-04-300000107140us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2019-04-300000107140us-gaap:AccumulatedTranslationAdjustmentMember2018-04-300000107140us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetUnamortizedGainLossMember2020-04-300000107140us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2017-05-012018-04-300000107140us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2019-05-012020-04-300000107140us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2018-05-012019-04-300000107140jwa:BusinessOptimizationProgramMemberus-gaap:EmployeeSeveranceMember2019-05-012020-04-300000107140jwa:RestructuringAndReinvestmentProgramMemberus-gaap:ContractTerminationMember2017-05-012018-04-300000107140jwa:EducationServicesSegmentMemberjwa:RestructuringAndReinvestmentProgramMember2017-05-012018-04-300000107140jwa:RestructuringAndReinvestmentProgramMemberjwa:AcademicAndProfessionalLearningSegmentMember2018-05-012019-04-300000107140us-gaap:EmployeeSeveranceMemberjwa:RestructuringAndReinvestmentProgramMember2019-05-012020-04-300000107140jwa:ResearchPublishingAndPlatformsSegmentMemberjwa:RestructuringAndReinvestmentProgramMember2017-05-012018-04-300000107140us-gaap:CorporateMemberjwa:RestructuringAndReinvestmentProgramMember2018-05-012019-04-300000107140jwa:RestructuringAndReinvestmentProgramMemberjwa:AcademicAndProfessionalLearningSegmentMember2017-05-012018-04-300000107140jwa:RestructuringAndReinvestmentProgramMember2018-05-012019-04-300000107140jwa:BusinessOptimizationProgramMemberjwa:AcademicAndProfessionalLearningSegmentMember2019-05-012020-04-300000107140jwa:RestructuringAndReinvestmentProgramMemberus-gaap:CorporateMember2019-05-012020-04-300000107140us-gaap:OtherRestructuringMemberjwa:RestructuringAndReinvestmentProgramMember2019-05-012020-04-300000107140jwa:BusinessOptimizationProgramMemberus-gaap:FacilityClosingMember2019-05-012020-04-300000107140jwa:RestructuringAndReinvestmentProgramMemberus-gaap:CorporateMember2017-05-012018-04-300000107140jwa:RestructuringAndReinvestmentProgramMemberus-gaap:EmployeeSeveranceMember2018-05-012019-04-300000107140us-gaap:OtherRestructuringMemberjwa:RestructuringAndReinvestmentProgramMember2017-05-012018-04-300000107140jwa:RestructuringAndReinvestmentProgramMemberus-gaap:EmployeeSeveranceMember2017-05-012018-04-300000107140us-gaap:OtherRestructuringMemberjwa:RestructuringAndReinvestmentProgramMember2018-05-012019-04-300000107140jwa:EducationServicesSegmentMemberjwa:RestructuringAndReinvestmentProgramMember2019-05-012020-04-300000107140jwa:BusinessOptimizationProgramMemberus-gaap:CorporateNonSegmentMember2019-05-012020-04-300000107140us-gaap:ContractTerminationMemberjwa:RestructuringAndReinvestmentProgramMember2019-05-012020-04-300000107140jwa:BusinessOptimizationProgramMemberjwa:EducationServicesSegmentMember2019-05-012020-04-300000107140jwa:RestructuringAndReinvestmentProgramMemberjwa:EducationServicesSegmentMember2018-05-012019-04-300000107140us-gaap:OtherRestructuringMemberjwa:BusinessOptimizationProgramMember2019-05-012020-04-300000107140jwa:ResearchPublishingAndPlatformsSegmentMemberjwa:RestructuringAndReinvestmentProgramMember2019-05-012020-04-300000107140jwa:ResearchPublishingAndPlatformsSegmentMemberjwa:RestructuringAndReinvestmentProgramMember2018-05-012019-04-300000107140jwa:BusinessOptimizationProgramMemberjwa:ResearchPublishingAndPlatformsSegmentMember2019-05-012020-04-300000107140us-gaap:ContractTerminationMemberjwa:RestructuringAndReinvestmentProgramMember2018-05-012019-04-300000107140jwa:RestructuringAndReinvestmentProgramMember2017-05-012018-04-300000107140jwa:RestructuringAndReinvestmentProgramMemberjwa:AcademicAndProfessionalLearningSegmentMember2019-05-012020-04-300000107140jwa:BusinessOptimizationProgramMemberjwa:OperatingLeaseRightOfUseAssetImpairmentMember2019-05-012020-04-300000107140jwa:RestructuringAndReinvestmentProgramMemberjwa:EducationServicesSegmentMember2020-04-300000107140jwa:ResearchPublishingAndPlatformsSegmentMemberjwa:RestructuringAndReinvestmentProgramMember2020-04-300000107140jwa:RestructuringAndReinvestmentProgramMember2020-04-300000107140jwa:RestructuringAndReinvestmentProgramMemberjwa:AcademicAndProfessionalLearningSegmentMember2020-04-300000107140us-gaap:ContractTerminationMemberjwa:RestructuringAndReinvestmentProgramMember2020-04-300000107140jwa:RestructuringAndReinvestmentProgramMemberus-gaap:CorporateMember2020-04-300000107140us-gaap:EmployeeSeveranceMemberjwa:RestructuringAndReinvestmentProgramMember2020-04-300000107140us-gaap:OtherRestructuringMemberjwa:RestructuringAndReinvestmentProgramMember2020-04-300000107140us-gaap:EmployeeSeveranceMemberjwa:RestructuringAndReinvestmentProgramMember2019-04-300000107140jwa:BusinessOptimizationProgramMember2019-04-300000107140jwa:RestructuringAndReinvestmentProgramMember2019-04-300000107140jwa:RestructuringAndReinvestmentProgramMemberus-gaap:ContractTerminationMember2019-04-300000107140jwa:RestructuringAndReinvestmentProgramMemberus-gaap:OtherRestructuringMember2019-04-300000107140us-gaap:EmployeeSeveranceMemberjwa:BusinessOptimizationProgramMember2019-04-300000107140jwa:BusinessOptimizationProgramMemberus-gaap:OtherRestructuringMember2019-04-300000107140jwa:BusinessOptimizationProgramMember2020-04-300000107140jwa:BusinessOptimizationProgramMemberjwa:EmployeeRelatedLiabilitiesCurrentMember2020-04-300000107140us-gaap:OtherRestructuringMemberjwa:BusinessOptimizationProgramMember2020-04-300000107140jwa:BusinessOptimizationProgramMemberus-gaap:EmployeeSeveranceMember2020-04-300000107140us-gaap:OtherNoncurrentLiabilitiesMemberjwa:BusinessOptimizationProgramMember2020-04-300000107140jwa:SoftwareCostsMember2020-04-300000107140jwa:SoftwareCostsMember2019-04-300000107140jwa:BookCompositionCostsMember2019-04-300000107140jwa:ContentDevelopmentCostsMember2020-04-300000107140jwa:ContentDevelopmentCostsMember2019-04-300000107140jwa:BookCompositionCostsMember2020-04-300000107140us-gaap:SoftwareDevelopmentMember2019-04-300000107140us-gaap:LandAndLandImprovementsMember2020-04-300000107140us-gaap:ComputerEquipmentMember2020-04-300000107140jwa:FurnitureFixturesAndWarehouseEquipmentMember2020-04-300000107140jwa:BuildingAndLeaseholdImprovementsMember2020-04-300000107140us-gaap:SoftwareDevelopmentMember2020-04-300000107140jwa:BuildingAndLeaseholdImprovementsMember2019-04-300000107140us-gaap:ComputerEquipmentMember2019-04-300000107140us-gaap:LandAndLandImprovementsMember2019-04-300000107140jwa:FurnitureFixturesAndWarehouseEquipmentMember2019-04-300000107140jwa:EducationServicesSegmentMember2019-04-300000107140jwa:ResearchPublishingAndPlatformsSegmentMember2019-04-300000107140jwa:AcademicAndProfessionalLearningSegmentMember2019-04-300000107140jwa:ResearchPublishingAndPlatformsSegmentMember2020-04-300000107140jwa:EducationServicesSegmentMember2020-04-300000107140jwa:AcademicAndProfessionalLearningSegmentMember2020-04-300000107140us-gaap:TrademarksAndTradeNamesMember2020-04-300000107140us-gaap:DevelopedTechnologyRightsMember2019-04-300000107140us-gaap:TrademarksAndTradeNamesMember2019-04-300000107140us-gaap:NoncompeteAgreementsMember2020-04-300000107140us-gaap:ArtisticRelatedIntangibleAssetsMember2019-04-300000107140us-gaap:NoncompeteAgreementsMember2019-04-300000107140us-gaap:ArtisticRelatedIntangibleAssetsMember2020-04-300000107140us-gaap:CustomerRelationshipsMember2020-04-300000107140us-gaap:DevelopedTechnologyRightsMember2020-04-300000107140us-gaap:CustomerRelationshipsMember2019-04-300000107140jwa:BrandsMember2018-05-012018-07-310000107140us-gaap:ArtisticRelatedIntangibleAssetsMember2019-04-300000107140us-gaap:ArtisticRelatedIntangibleAssetsMember2020-04-300000107140us-gaap:TrademarksAndTradeNamesMember2020-04-300000107140us-gaap:TrademarksAndTradeNamesMember2019-04-300000107140jwa:BrandsMember2018-05-012018-07-310000107140jwa:BrandsMember2019-05-012020-04-300000107140us-gaap:DevelopedTechnologyRightsMember2019-05-012020-04-300000107140jwa:BrandsMember2018-07-310000107140us-gaap:StateAndLocalJurisdictionMember2020-04-300000107140us-gaap:StateAndLocalJurisdictionMember2019-05-012020-04-300000107140srt:MinimumMemberus-gaap:StateAndLocalJurisdictionMember2019-05-012020-04-300000107140srt:MaximumMemberus-gaap:StateAndLocalJurisdictionMember2019-05-012020-04-300000107140us-gaap:ForeignCountryMember2020-04-300000107140us-gaap:LineOfCreditMemberjwa:OtherCreditFacilitiesMember2019-04-300000107140us-gaap:RevolvingCreditFacilityMember2019-04-300000107140us-gaap:RevolvingCreditFacilityMemberjwa:AmendedAndExtendedRevolvingCreditFacilityMember2020-04-300000107140jwa:OtherCreditFacilitiesMemberus-gaap:LineOfCreditMember2020-04-300000107140jwa:TermLoanAFacilityMember2020-04-300000107140us-gaap:LineOfCreditMember2020-04-300000107140us-gaap:RevolvingCreditFacilityMember2020-04-300000107140us-gaap:RevolvingCreditFacilityMember2019-05-300000107140us-gaap:RevolvingCreditFacilityMember2019-05-012020-04-300000107140jwa:TermLoanAFacilityMember2019-05-012020-04-300000107140jwa:TermLoanAFacilityMember2019-05-300000107140jwa:AmendedAndExtendedRevolvingCreditFacilityMember2020-04-300000107140jwa:AmendedAndExtendedRevolvingCreditFacilityMember2019-05-012020-04-300000107140us-gaap:RevolvingCreditFacilityMemberjwa:SyndicateBankGroupMemberus-gaap:BaseRateMembersrt:MinimumMember2019-05-012020-04-300000107140us-gaap:LondonInterbankOfferedRateLIBORMemberjwa:SyndicateBankGroupMembersrt:MaximumMemberus-gaap:RevolvingCreditFacilityMember2019-05-012020-04-300000107140us-gaap:RevolvingCreditFacilityMemberjwa:SyndicateBankGroupMembersrt:MaximumMemberus-gaap:BaseRateMember2019-05-012020-04-300000107140srt:MinimumMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:LondonInterbankOfferedRateLIBORMemberjwa:SyndicateBankGroupMember2019-05-012020-04-300000107140jwa:SyndicateBankGroupMemberus-gaap:EurodollarMemberus-gaap:RevolvingCreditFacilityMember2019-05-012020-04-300000107140us-gaap:FederalFundsEffectiveSwapRateMemberjwa:SyndicateBankGroupMemberus-gaap:RevolvingCreditFacilityMember2019-05-012020-04-300000107140jwa:SyndicateBankGroupMembersrt:MaximumMemberus-gaap:RevolvingCreditFacilityMember2019-05-012020-04-300000107140us-gaap:RevolvingCreditFacilityMemberjwa:SyndicateBankGroupMembersrt:MinimumMember2019-05-012020-04-300000107140jwa:SyndicateBankGroupMemberus-gaap:RevolvingCreditFacilityMember2020-04-300000107140us-gaap:LineOfCreditMember2019-05-012020-04-300000107140us-gaap:LineOfCreditMember2018-05-012019-04-300000107140us-gaap:LineOfCreditMember2019-04-300000107140us-gaap:LondonInterbankOfferedRateLIBORMemberus-gaap:InterestRateSwapMemberjwa:February2020InterestRateSwapVariableRateLoansMember2019-05-012020-04-300000107140us-gaap:LondonInterbankOfferedRateLIBORMemberjwa:April2016InterestRateSwapVariableRateLoansMemberus-gaap:InterestRateSwapMember2019-05-012020-04-300000107140us-gaap:LondonInterbankOfferedRateLIBORMemberus-gaap:InterestRateSwapMemberjwa:August2019InterestRateSwapVariableRateLoansMember2019-05-012020-04-300000107140us-gaap:InterestRateSwapMemberus-gaap:LondonInterbankOfferedRateLIBORMemberjwa:June2019InterestRateSwapVariableRateLoansMember2019-05-012020-04-300000107140us-gaap:InterestRateSwapMemberus-gaap:LondonInterbankOfferedRateLIBORMemberjwa:February2020InterestRateSwapVariableRateLoansMember2020-04-300000107140jwa:April2016InterestRateSwapVariableRateLoansMemberus-gaap:InterestRateSwapMemberus-gaap:LondonInterbankOfferedRateLIBORMember2020-04-300000107140us-gaap:LondonInterbankOfferedRateLIBORMemberus-gaap:InterestRateSwapMemberjwa:August2019InterestRateSwapVariableRateLoansMember2020-04-300000107140us-gaap:InterestRateSwapMemberus-gaap:LondonInterbankOfferedRateLIBORMemberjwa:June2019InterestRateSwapVariableRateLoansMember2020-04-300000107140us-gaap:CashFlowHedgingMemberus-gaap:InterestRateSwapMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:DesignatedAsHedgingInstrumentMember2019-04-300000107140us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CashFlowHedgingMemberus-gaap:InterestRateSwapMember2020-04-300000107140us-gaap:CashFlowHedgingMemberus-gaap:InterestRateSwapMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:InterestExpenseMember2017-05-012018-04-300000107140us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:InterestExpenseMemberus-gaap:CashFlowHedgingMemberus-gaap:InterestRateSwapMember2018-05-012019-04-300000107140us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:InterestRateSwapMemberus-gaap:InterestExpenseMemberus-gaap:CashFlowHedgingMember2019-05-012020-04-300000107140us-gaap:InterestRateSwapMemberus-gaap:CashFlowHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMember2020-04-300000107140srt:MaximumMember2019-05-012020-04-300000107140srt:MinimumMember2019-05-012020-04-300000107140us-gaap:SupplementalEmployeeRetirementPlanDefinedBenefitMember2019-05-012020-04-300000107140us-gaap:DefinedBenefitPlanEquitySecuritiesMember2020-04-300000107140jwa:FixedIncomeSecuritiesAndCashMember2020-04-300000107140us-gaap:ForeignPlanMemberus-gaap:DefinedBenefitPlanCashAndCashEquivalentsMember2019-04-300000107140us-gaap:ForeignPlanMemberus-gaap:DefinedBenefitPlanCashAndCashEquivalentsMember2020-04-300000107140us-gaap:ForeignPlanMemberus-gaap:DefinedBenefitPlanCashAndCashEquivalentsMemberus-gaap:FairValueInputsLevel2Member2019-04-300000107140us-gaap:FairValueInputsLevel2Memberus-gaap:DefinedBenefitPlanCashAndCashEquivalentsMemberus-gaap:ForeignPlanMember2020-04-300000107140us-gaap:DefinedBenefitPlanCashAndCashEquivalentsMemberus-gaap:FairValueInputsLevel1Memberus-gaap:ForeignPlanMember2020-04-300000107140us-gaap:FairValueInputsLevel1Member2019-04-300000107140us-gaap:FairValueInputsLevel2Member2019-04-300000107140us-gaap:ForeignPlanMemberus-gaap:DefinedBenefitPlanCashAndCashEquivalentsMemberus-gaap:FairValueInputsLevel1Member2019-04-300000107140us-gaap:FairValueInputsLevel2Member2020-04-300000107140us-gaap:FairValueInputsLevel1Member2020-04-300000107140us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2019-04-300000107140us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2020-04-300000107140us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2019-05-012020-04-300000107140us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2018-05-012019-04-300000107140us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2017-05-012018-04-300000107140us-gaap:CommonClassAMemberjwa:KeyEmployeeStockPlan2014Member2020-04-300000107140srt:MinimumMemberus-gaap:EmployeeStockOptionMember2020-04-300000107140srt:MaximumMemberus-gaap:EmployeeStockOptionMember2019-05-012020-04-300000107140us-gaap:EmployeeStockOptionMemberus-gaap:ShareBasedCompensationAwardTrancheTwoMember2014-05-012015-04-300000107140jwa:ShareBasedCompensationAwardTrancheFiveMemberus-gaap:EmployeeStockOptionMember2015-05-012016-04-300000107140us-gaap:EmployeeStockOptionMemberus-gaap:ShareBasedCompensationAwardTrancheOneMember2014-05-012015-04-300000107140us-gaap:EmployeeStockOptionMember2015-05-012016-04-300000107140us-gaap:EmployeeStockOptionMember2017-04-300000107140us-gaap:EmployeeStockOptionMember2019-04-300000107140us-gaap:EmployeeStockOptionMember2018-04-300000107140us-gaap:EmployeeStockOptionMember2017-05-012018-04-300000107140us-gaap:EmployeeStockOptionMember2018-05-012019-04-300000107140us-gaap:EmployeeStockOptionMember2019-05-012020-04-300000107140us-gaap:EmployeeStockOptionMember2016-05-012017-04-300000107140us-gaap:EmployeeStockOptionMember2020-04-300000107140jwa:ExercisePriceRange2Member2019-05-012020-04-300000107140jwa:ExercisePriceRange3Member2019-05-012020-04-300000107140jwa:ExercisePriceRange4Member2019-05-012020-04-300000107140jwa:ExercisePriceRange2Member2020-04-300000107140jwa:ExercisePriceRange3Member2020-04-300000107140jwa:ExercisePriceRange4Member2020-04-300000107140us-gaap:RestrictedStockMemberjwa:ShareBasedCompensationAwardTrancheThirteenMemberjwa:KeyEmployeesMember2017-05-012018-04-300000107140us-gaap:ShareBasedCompensationAwardTrancheThreeMemberus-gaap:PerformanceSharesMember2014-05-012015-04-300000107140us-gaap:RestrictedStockMemberjwa:KeyEmployeesMemberjwa:ShareBasedCompensationAwardTrancheThirteenMember2019-05-012020-04-300000107140us-gaap:PerformanceSharesMemberjwa:ShareBasedCompensationAwardTrancheSevenMember2015-05-012016-04-300000107140us-gaap:PerformanceSharesMemberjwa:ShareBasedCompensationAwardTrancheFourMember2014-05-012015-04-300000107140jwa:ShareBasedCompensationAwardTrancheThirteenMemberus-gaap:RestrictedStockMemberjwa:KeyEmployeesMember2018-05-012019-04-300000107140jwa:ShareBasedCompensationAwardTrancheSixMemberus-gaap:PerformanceSharesMember2016-05-012017-04-300000107140us-gaap:PerformanceSharesMemberjwa:ShareBasedCompensationAwardTrancheSevenMember2016-05-012017-04-300000107140jwa:KeyEmployeesMemberus-gaap:ShareBasedCompensationAwardTrancheOneMemberus-gaap:RestrictedStockMember2014-05-012015-04-300000107140us-gaap:RestrictedStockMemberjwa:KeyEmployeesMemberjwa:ShareBasedCompensationAwardTrancheEightMember2015-05-012016-04-300000107140us-gaap:PerformanceSharesMemberjwa:ShareBasedCompensationAwardTrancheSixMember2015-05-012016-04-300000107140us-gaap:ShareBasedCompensationAwardTrancheTwoMemberjwa:KeyEmployeesMemberus-gaap:RestrictedStockMember2014-05-012015-04-300000107140us-gaap:RestrictedStockMember2019-04-300000107140us-gaap:RestrictedStockMember2018-04-300000107140us-gaap:RestrictedStockMember2017-04-300000107140us-gaap:RestrictedStockMember2017-05-012018-04-300000107140us-gaap:RestrictedStockMember2018-05-012019-04-300000107140us-gaap:RestrictedStockMember2019-05-012020-04-300000107140us-gaap:RestrictedStockMember2020-04-300000107140jwa:ExecutiveLongTermIncentiveProgramMember2019-05-012020-04-300000107140jwa:ExecutiveLongTermIncentiveProgramMemberus-gaap:PerformanceSharesMember2019-05-012020-04-300000107140us-gaap:RestrictedStockUnitsRSUMemberjwa:ExecutiveLongTermIncentiveProgramMember2019-05-012020-04-300000107140us-gaap:RestrictedStockUnitsRSUMemberjwa:ExecutiveLongTermIncentiveProgramMember2020-04-300000107140us-gaap:PerformanceSharesMemberjwa:ExecutiveLongTermIncentiveProgramMember2020-04-300000107140us-gaap:RestrictedStockUnitsRSUMemberjwa:SignOnGrantMember2020-04-300000107140us-gaap:RestrictedStockUnitsRSUMemberjwa:SignOnGrantMember2019-05-012020-04-300000107140jwa:ExecutiveLongTermIncentiveProgramMemberjwa:ShareBasedCompensationAwardTrancheElevenMemberus-gaap:RestrictedStockUnitsRSUMember2019-05-012020-04-300000107140jwa:ShareBasedCompensationAwardTrancheNineMemberus-gaap:RestrictedStockUnitsRSUMemberjwa:ExecutiveLongTermIncentiveProgramMember2019-05-012020-04-300000107140jwa:ShareBasedCompensationAwardTrancheTenMemberus-gaap:RestrictedStockUnitsRSUMemberjwa:ExecutiveLongTermIncentiveProgramMember2019-05-012020-04-300000107140us-gaap:RestrictedStockUnitsRSUMemberjwa:ExecutiveLongTermIncentiveProgramMemberjwa:ShareBasedCompensationAwardTrancheTwelveMember2019-05-012020-04-300000107140jwa:DirectorStockPlanMembersrt:DirectorMemberus-gaap:CommonClassAMember2019-05-012020-04-300000107140srt:DirectorMemberjwa:DirectorStockPlanMemberus-gaap:CommonClassAMember2018-05-012019-04-300000107140srt:DirectorMemberjwa:DirectorStockPlanMemberus-gaap:CommonClassAMember2017-05-012018-04-300000107140jwa:ShareRepurchaseProgramIn2017Member2017-04-300000107140jwa:ShareRepurchaseProgramIn2020Member2020-04-300000107140jwa:ShareRepurchaseProgramIn2017Member2020-04-300000107140jwa:ShareRepurchaseProgramIn2020Member2019-05-012020-04-300000107140us-gaap:CommonClassAMember2018-04-300000107140us-gaap:CommonClassBMember2018-04-300000107140us-gaap:CommonClassBMember2017-04-300000107140us-gaap:CommonClassAMember2017-04-300000107140us-gaap:CommonClassAMemberjwa:NonPerformanceSharesMember2018-05-012019-04-300000107140jwa:NonPerformanceSharesMemberus-gaap:CommonClassAMember2017-05-012018-04-300000107140us-gaap:CommonClassAMemberjwa:NonPerformanceSharesMember2019-05-012020-04-300000107140us-gaap:PerformanceSharesMemberus-gaap:CommonClassAMember2019-05-012020-04-300000107140us-gaap:CommonClassAMemberus-gaap:PerformanceSharesMember2018-05-012019-04-300000107140us-gaap:CommonClassAMemberus-gaap:PerformanceSharesMember2017-05-012018-04-300000107140us-gaap:CommonClassBMemberjwa:DividendDeclaredInCurrentYearQ2Member2019-05-012020-04-300000107140jwa:DividendDeclaredInCurrentYearQ3Memberus-gaap:CommonClassBMember2019-05-012020-04-300000107140jwa:DividendDeclaredInCurrentYearQ4Memberus-gaap:CommonClassBMember2019-05-012020-04-300000107140jwa:DividendDeclaredInCurrentYearQ3Memberus-gaap:CommonClassAMember2019-05-012020-04-300000107140us-gaap:CommonClassBMemberjwa:DividendDeclaredInCurrentYearQ1Member2019-05-012020-04-300000107140us-gaap:CommonClassAMemberjwa:DividendDeclaredInCurrentYearQ4Member2019-05-012020-04-300000107140us-gaap:CommonClassAMemberjwa:DividendDeclaredInCurrentYearQ1Member2019-05-012020-04-300000107140us-gaap:CommonClassAMemberjwa:DividendDeclaredInCurrentYearQ2Member2019-05-012020-04-300000107140us-gaap:CommonClassAMemberjwa:DividendDeclaredInCurrentYearQ3Member2018-12-192018-12-190000107140us-gaap:CommonClassAMemberjwa:DividendDeclaredInCurrentYearQ2Member2018-09-262018-09-260000107140us-gaap:CommonClassBMemberjwa:DividendDeclaredInCurrentYearQ1Member2018-06-212018-06-210000107140jwa:DividendDeclaredInCurrentYearQ2Memberus-gaap:CommonClassBMember2018-09-262018-09-260000107140us-gaap:CommonClassAMemberjwa:DividendDeclaredInCurrentYearQ1Member2018-06-212018-06-210000107140jwa:DividendDeclaredInCurrentYearQ4Memberus-gaap:CommonClassAMember2019-03-202019-03-200000107140us-gaap:CommonClassBMemberjwa:DividendDeclaredInCurrentYearQ4Member2019-03-202019-03-200000107140jwa:DividendDeclaredInCurrentYearQ3Memberus-gaap:CommonClassBMember2018-12-192018-12-1900001071402018-10-242018-10-2400001071402019-04-172019-04-1700001071402018-07-182018-07-1800001071402019-01-162019-01-160000107140us-gaap:OperatingSegmentsMember2017-05-012018-04-300000107140us-gaap:OperatingSegmentsMemberjwa:AcademicAndProfessionalLearningSegmentMember2017-05-012018-04-300000107140us-gaap:OperatingSegmentsMemberjwa:ResearchPublishingAndPlatformsSegmentMember2019-05-012020-04-300000107140jwa:EducationServicesSegmentMemberus-gaap:OperatingSegmentsMember2018-05-012019-04-300000107140jwa:AcademicAndProfessionalLearningSegmentMemberus-gaap:OperatingSegmentsMember2018-05-012019-04-300000107140jwa:EducationServicesSegmentMemberus-gaap:OperatingSegmentsMember2019-05-012020-04-300000107140jwa:AcademicAndProfessionalLearningSegmentMemberus-gaap:OperatingSegmentsMember2019-05-012020-04-300000107140us-gaap:OperatingSegmentsMemberjwa:ResearchPublishingAndPlatformsSegmentMember2017-05-012018-04-300000107140jwa:ResearchPublishingAndPlatformsSegmentMemberus-gaap:OperatingSegmentsMember2018-05-012019-04-300000107140jwa:EducationServicesSegmentMemberus-gaap:OperatingSegmentsMember2017-05-012018-04-300000107140us-gaap:OperatingSegmentsMember2019-05-012020-04-300000107140us-gaap:OperatingSegmentsMember2018-05-012019-04-300000107140us-gaap:CorporateNonSegmentMember2019-05-012020-04-300000107140us-gaap:CorporateNonSegmentMember2017-05-012018-04-300000107140us-gaap:CorporateNonSegmentMember2018-05-012019-04-300000107140us-gaap:OperatingSegmentsMemberjwa:EducationServicesSegmentMember2020-04-300000107140us-gaap:OperatingSegmentsMemberjwa:ResearchPublishingAndPlatformsSegmentMember2019-04-300000107140us-gaap:OperatingSegmentsMemberjwa:EducationServicesSegmentMember2018-04-300000107140us-gaap:OperatingSegmentsMemberjwa:AcademicAndProfessionalLearningSegmentMember2018-04-300000107140us-gaap:OperatingSegmentsMemberjwa:AcademicAndProfessionalLearningSegmentMember2019-04-300000107140us-gaap:CorporateNonSegmentMember2019-04-300000107140us-gaap:CorporateNonSegmentMember2020-04-300000107140us-gaap:OperatingSegmentsMemberjwa:AcademicAndProfessionalLearningSegmentMember2020-04-300000107140us-gaap:CorporateNonSegmentMember2018-04-300000107140us-gaap:OperatingSegmentsMemberjwa:EducationServicesSegmentMember2019-04-300000107140jwa:ResearchPublishingAndPlatformsSegmentMemberus-gaap:OperatingSegmentsMember2020-04-300000107140jwa:ResearchPublishingAndPlatformsSegmentMemberus-gaap:OperatingSegmentsMember2018-04-300000107140country:USsrt:ReportableGeographicalComponentsMember2018-05-012019-04-300000107140srt:ReportableGeographicalComponentsMembercountry:DE2019-05-012020-04-300000107140srt:ReportableGeographicalComponentsMembercountry:CA2018-05-012019-04-300000107140srt:ReportableGeographicalComponentsMemberjwa:OtherCountriesMember2017-05-012018-04-300000107140srt:ReportableGeographicalComponentsMembercountry:US2017-05-012018-04-300000107140country:FRsrt:ReportableGeographicalComponentsMember2019-05-012020-04-300000107140srt:ReportableGeographicalComponentsMembercountry:GB2018-05-012019-04-300000107140srt:ReportableGeographicalComponentsMembercountry:GB2019-05-012020-04-300000107140srt:ReportableGeographicalComponentsMembercountry:FR2017-05-012018-04-300000107140srt:ReportableGeographicalComponentsMembercountry:JP2017-05-012018-04-300000107140srt:ReportableGeographicalComponentsMembercountry:JP2018-05-012019-04-300000107140srt:ReportableGeographicalComponentsMemberjwa:OtherCountriesMember2019-05-012020-04-300000107140country:CNsrt:ReportableGeographicalComponentsMember2017-05-012018-04-300000107140country:CNsrt:ReportableGeographicalComponentsMember2018-05-012019-04-300000107140srt:ReportableGeographicalComponentsMembercountry:GB2017-05-012018-04-300000107140jwa:ScandinaviaMembersrt:ReportableGeographicalComponentsMember2018-05-012019-04-300000107140srt:ReportableGeographicalComponentsMembercountry:CN2019-05-012020-04-300000107140country:AUsrt:ReportableGeographicalComponentsMember2018-05-012019-04-300000107140srt:ReportableGeographicalComponentsMemberjwa:OtherCountriesMember2018-05-012019-04-300000107140srt:ReportableGeographicalComponentsMembercountry:CA2017-05-012018-04-300000107140srt:ReportableGeographicalComponentsMembercountry:CA2019-05-012020-04-300000107140country:FRsrt:ReportableGeographicalComponentsMember2018-05-012019-04-300000107140country:DEsrt:ReportableGeographicalComponentsMember2017-05-012018-04-300000107140srt:ReportableGeographicalComponentsMembercountry:JP2019-05-012020-04-300000107140srt:ReportableGeographicalComponentsMembercountry:AU2019-05-012020-04-300000107140srt:ReportableGeographicalComponentsMemberjwa:ScandinaviaMember2019-05-012020-04-300000107140country:AUsrt:ReportableGeographicalComponentsMember2017-05-012018-04-300000107140srt:ReportableGeographicalComponentsMembercountry:DE2018-05-012019-04-300000107140srt:ReportableGeographicalComponentsMembercountry:US2019-05-012020-04-300000107140jwa:ScandinaviaMembersrt:ReportableGeographicalComponentsMember2017-05-012018-04-300000107140country:CNsrt:ReportableGeographicalComponentsMember2018-04-300000107140country:FRsrt:ReportableGeographicalComponentsMember2019-04-300000107140country:JPsrt:ReportableGeographicalComponentsMember2020-04-300000107140srt:ReportableGeographicalComponentsMembercountry:CN2019-04-300000107140srt:ReportableGeographicalComponentsMembercountry:FR2018-04-300000107140srt:ReportableGeographicalComponentsMembercountry:US2020-04-300000107140srt:ReportableGeographicalComponentsMembercountry:JP2018-04-300000107140srt:ReportableGeographicalComponentsMemberjwa:ScandinaviaMember2018-04-300000107140jwa:OtherCountriesMembersrt:ReportableGeographicalComponentsMember2019-04-300000107140jwa:ScandinaviaMembersrt:ReportableGeographicalComponentsMember2019-04-300000107140country:GBsrt:ReportableGeographicalComponentsMember2020-04-300000107140srt:ReportableGeographicalComponentsMembercountry:DE2020-04-300000107140country:CAsrt:ReportableGeographicalComponentsMember2020-04-300000107140country:AUsrt:ReportableGeographicalComponentsMember2018-04-300000107140srt:ReportableGeographicalComponentsMemberjwa:ScandinaviaMember2020-04-300000107140srt:ReportableGeographicalComponentsMembercountry:GB2019-04-300000107140country:DEsrt:ReportableGeographicalComponentsMember2019-04-300000107140country:DEsrt:ReportableGeographicalComponentsMember2018-04-300000107140jwa:OtherCountriesMembersrt:ReportableGeographicalComponentsMember2018-04-300000107140country:CNsrt:ReportableGeographicalComponentsMember2020-04-300000107140country:AUsrt:ReportableGeographicalComponentsMember2020-04-300000107140country:CAsrt:ReportableGeographicalComponentsMember2019-04-300000107140srt:ReportableGeographicalComponentsMembercountry:JP2019-04-300000107140srt:ReportableGeographicalComponentsMemberjwa:OtherCountriesMember2020-04-300000107140country:FRsrt:ReportableGeographicalComponentsMember2020-04-300000107140country:CAsrt:ReportableGeographicalComponentsMember2018-04-300000107140srt:ReportableGeographicalComponentsMembercountry:US2019-04-300000107140country:GBsrt:ReportableGeographicalComponentsMember2018-04-300000107140srt:ReportableGeographicalComponentsMembercountry:US2018-04-300000107140srt:ReportableGeographicalComponentsMembercountry:AU2019-04-3000001071402019-02-012019-04-3000001071402018-05-012018-07-3100001071402020-02-012020-04-3000001071402019-08-012019-10-3100001071402018-08-012018-10-3100001071402019-05-012019-07-3100001071402019-11-012020-01-3100001071402018-11-012019-01-310000107140us-gaap:CommonClassAMemberjwa:DividendDeclaredInNextYearQ1Memberus-gaap:SubsequentEventMember2020-06-252020-06-250000107140us-gaap:CommonClassBMemberus-gaap:SubsequentEventMemberjwa:DividendDeclaredInNextYearQ1Member2020-06-252020-06-250000107140jwa:DividendDeclaredInNextYearQ1Memberus-gaap:SubsequentEventMember2020-06-252020-06-250000107140us-gaap:AllowanceForCreditLossMember2019-04-300000107140us-gaap:InventoryValuationReserveMember2017-04-300000107140us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2018-04-300000107140us-gaap:InventoryValuationReserveMember2018-04-300000107140us-gaap:SalesReturnsAndAllowancesMember2019-04-300000107140us-gaap:InventoryValuationReserveMember2019-04-300000107140us-gaap:SalesReturnsAndAllowancesMember2018-04-300000107140us-gaap:AllowanceForCreditLossMember2018-04-300000107140us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2017-04-300000107140us-gaap:SalesReturnsAndAllowancesMember2017-04-300000107140us-gaap:AllowanceForCreditLossMember2017-04-300000107140us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2019-04-300000107140us-gaap:AllowanceForCreditLossMember2018-05-012019-04-300000107140us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2018-05-012019-04-300000107140us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2019-05-012020-04-300000107140us-gaap:SalesReturnsAndAllowancesMember2017-05-012018-04-300000107140us-gaap:SalesReturnsAndAllowancesMember2019-05-012020-04-300000107140us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2017-05-012018-04-300000107140us-gaap:InventoryValuationReserveMember2019-05-012020-04-300000107140us-gaap:AllowanceForCreditLossMember2017-05-012018-04-300000107140us-gaap:InventoryValuationReserveMember2018-05-012019-04-300000107140us-gaap:SalesReturnsAndAllowancesMember2018-05-012019-04-300000107140us-gaap:InventoryValuationReserveMember2017-05-012018-04-300000107140us-gaap:AllowanceForCreditLossMember2019-05-012020-04-300000107140us-gaap:AllowanceForCreditLossMember2020-04-300000107140us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2020-04-300000107140us-gaap:SalesReturnsAndAllowancesMember2020-04-300000107140us-gaap:InventoryValuationReserveMember2020-04-30iso4217:USDxbrli:sharesiso4217:USDxbrli:sharesjwa:Performanceobligationjwa:Institutioniso4217:EURjwa:Businessxbrli:purejwa:Installmentjwa:Vote

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-K

(Mark One)

| ☒ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended: April 30, 2020

OR

| ☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _________ to _________

Commission file number 001-11507

JOHN WILEY & SONS, INC.

(Exact name of Registrant as specified in its charter)

New York |

|

13-5593032 |

State or other jurisdiction of incorporation or organization |

|

I.R.S. Employer Identification No. |

| |

|

|

111 River Street, Hoboken, NJ |

|

07030 |

Address of principal executive offices |

|

Zip Code |

(201) 748-6000 |

Registrant’s telephone number including area code |

Securities registered pursuant to Section 12(b) of the Act: Title of each class |

Trading Symbol |

Name of each exchange on which registered |

Class A Common Stock, par value $1.00 per share |

JW.A |

New York Stock Exchange |

Class B Common Stock, par value $1.00 per share |

JW.B |

New York Stock Exchange |

| |

Securities registered pursuant to Section 12(g) of the Act: |

|

| |

None |

|

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ☒ |

Accelerated filer ☐ |

Non-accelerated filer ☐ |

Smaller reporting company ☐ |

| |

Emerging growth company ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

The aggregate market value of the voting stock held by non-affiliates of the registrant, computed by reference to the closing price as of the last business day of the registrant’s most recently completed second fiscal quarter, October 31, 2019, was approximately $2,040 million. The registrant has no non-voting common stock.

The number of shares outstanding of the registrant’s Class A and Class B Common Stock as of May 31, 2020 was 46,767,784 and 9,094,674 respectively.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive proxy statement for use in connection with its annual meeting of stockholders scheduled to be held on September 24, 2020, are incorporated by reference into Part III of this Form 10-K.

JOHN WILEY & SONS, INC. AND SUBSIDIARIES

FORM 10-K

FOR THE FISCAL YEAR ENDED APRIL 30, 2020

PART I |

|

PAGE |

|

Business |

4 |

|

Risk Factors |

13 |

|

Unresolved Staff Comments |

20 |

|

Properties |

21 |

|

Legal Proceedings |

21 |

|

Mine Safety Disclosures |

21 |

| |

|

22 |

| |

|

|

PART II |

|

|

|

Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

23 |

|

Selected Financial Data |

24 |

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

25 |

|

Quantitative and Qualitative Disclosures About Market Risk |

45 |

|

Financial Statements and Supplementary Data |

47 |

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

99 |

|

Controls and Procedures |

99 |

|

Other Information |

99 |

| |

|

|

PART III |

|

|

|

Directors, Executive Officers and Corporate Governance |

100 |

|

Executive Compensation |

100 |

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

100 |

|

Certain Relationships and Related Transactions, and Director Independence |

101 |

|

Principal Accounting Fees and Services |

101 |

| |

|

|

PART IV |

|

|

|

Exhibits, Financial Statement Schedules |

102 |

|

Form 10-K Summary |

103 |

| |

|

|

|

|

105 |

Cautionary Notice Regarding Forward-Looking Statements “Safe Harbor” Statement under the Private Securities Litigation Reform Act of 1995:

This report contains “forward-looking statements” within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 concerning our business, consolidated financial condition and results of operations. The Securities and Exchange Commission (“SEC”) encourages companies to disclose forward-looking information so that investors can better understand a company’s prospects and make informed investment decisions. Forward-looking statements are subject to risks and uncertainties, many of which are outside our control, which could cause actual results to differ materially from these statements. Therefore, you should not rely on any of these forward-looking statements. Forward-looking statements can be identified by such words as “anticipates,” “believes,” “plan,” “assumes,” “could,” “should,” “estimates,” “expects,” “intends,” “potential,” “seek,” “predict,” “may,” “will” and similar references to future periods. All statements other than statements of historical facts included in this report regarding our strategies, prospects, financial condition, operations, costs, plans and objectives are forward-looking statements. Examples of forward-looking statements include, among others, statements we make regarding our fiscal year 2021 outlook, the anticipated impact on the ability of our employees, contractors, customers and other business partners to perform our and their respective responsibilities and obligations relative to the conduct of our business in the future due to the current coronavirus (COVID-19) outbreak, anticipated restructuring charges and savings, operations, performance, and financial condition. Reliance should not be placed on forward-looking statements, as actual results may differ materially from those in any forward-looking statements. Any such forward-looking statements are based upon many assumptions and estimates that are inherently subject to uncertainties and contingencies, many of which are beyond our control, and are subject to change based on many important factors. Such factors include, but are not limited to (i) the level of investment in new technologies and products; (ii) subscriber renewal rates for our journals; (iii) the financial stability and liquidity of journal subscription agents; (iv) the consolidation of book wholesalers and retail accounts; (v) the market position and financial stability of key retailers; (vi) the seasonal nature of our educational business and the impact of the used book market; (vii) worldwide economic and political conditions; (viii) our ability to protect our copyrights and other intellectual property worldwide; (ix) our ability to successfully integrate acquired operations and realize expected opportunities; (x) the ability to realize operating savings over time and in fiscal year 2021 in connection with our multi-year Business Optimization Program; and (xi) other factors detailed from time to time in our filings with the SEC. We undertake no obligation to update or revise any such forward-looking statements to reflect subsequent events or circumstances.

Please refer to Part I, Item 1A, “Risk Factors,” of our Annual Report on Form 10-K for important factors that we believe could cause actual results to differ materially from those in our forward-looking statements. Any forward-looking statement made by us in this report is based only on information currently available to us and speaks only as of the date on which it is made. We undertake no obligation to publicly update any forward-looking statement, whether written or oral, that may be made from time to time, whether as a result of new information, future developments or otherwise.

Non-GAAP Financial Measures:

We present financial information that conforms to Generally Accepted Accounting Principles in the United States of America (“U.S. GAAP”). We also present financial information that does not conform to U.S. GAAP, which we refer to as non-GAAP.

In this report, we may present the following non-GAAP performance measures:

• |

Adjusted Earnings Per Share “(Adjusted EPS)”; |

• |

Free Cash Flow less Product Development Spending; |

• |

Adjusted Operating Income and margin; |

• |

Adjusted Contribution to Profit and margin; |

• |

EBITDA and Adjusted EBITDA and margin; |

• |

Results on a constant currency basis. |

Management uses these non-GAAP performance measures as supplemental indicators of our operating performance and financial position as well for internal reporting and forecasting purposes, when publicly providing our outlook, to evaluate our performance and calculate incentive compensation. We present these non-GAAP performance measures in addition to U.S. GAAP financial results because we believe that these non-GAAP performance measures provide useful information to certain investors and financial analysts for operational trends and comparisons over time. The use of these non-GAAP performance measures may also provide a consistent basis to evaluate operating profitability and performance trends by excluding items that we do not consider to be controllable activities for this purpose.

For example:

• |

Adjusted EPS, Adjusted Revenue, Adjusted Operating Income, Adjusted Contribution to Profit, Adjusted EBITDA, and organic revenue provide a more comparable basis to analyze operating results and earnings and are measures commonly used by shareholders to measure our performance. |

• |

Free Cash Flow less Product Development Spending helps assess our ability, over the long term, to create value for our shareholders as it represents cash available to repay debt, pay common stock dividends and fund share repurchases and acquisitions. |

• |

Results on a constant currency basis removes distortion from the effects of foreign currency movements to provide better comparability of our business trends from period to period. We measure our performance before the impact of foreign currency (or at “constant currency”), which means that we apply the same foreign currency exchange rates for the current and equivalent prior period. |

In addition, we have historically provided these or similar non-GAAP performance measures and understand that some investors and financial analysts find this information helpful in analyzing our operating margins, and net income and comparing our financial performance to that of our peer companies and competitors. Based on interactions with investors, we also believe that our non-GAAP performance measures are regarded as useful to our investors as supplemental to our U.S. GAAP financial results, and that there is no confusion regarding the adjustments or our operating performance to our investors due to the comprehensive nature of our disclosures. We have not provided our 2021 outlook for the most directly comparable U.S. GAAP financial measures, as they are not available without unreasonable effort due to the high variability, complexity, and low visibility with respect to certain items, including restructuring charges and credits, gains and losses on foreign currency, and other gains and losses. These items are uncertain, depend on various factors, and could be material to our consolidated results computed in accordance with U.S. GAAP.

Non-GAAP performance measures do not have standardized meanings prescribed by U.S. GAAP and therefore may not be comparable to the calculation of similar measures used by other companies and should not be viewed as alternatives to measures of financial results under U.S. GAAP. The adjusted metrics have limitations as analytical tools and should not be considered in isolation from or as a substitute for U.S. GAAP information. It does not purport to represent any similarly titled U.S. GAAP information and is not an indicator of our performance under U.S. GAAP. Non-U.S. GAAP financial metrics that we present may not be comparable with similarly titled measures used by others. Investors are cautioned against placing undue reliance on these non-U.S. GAAP measures.

PART I

The Company, founded in 1807, was incorporated in the state of New York on January 15, 1904. Throughout this report, when we refer to “Wiley,” the “Company,” “we,” “our,” or “us,” we are referring to John Wiley & Sons, Inc. and all of our subsidiaries, except where the context indicates otherwise.

Please refer to Part II, Item 8, “Financial Statements and Supplementary Data,” for financial information about the Company and its subsidiaries, which is incorporated herein by reference. Also, when we cross reference to a “Note,” we are referring to our “Notes to Consolidated Financial Statements,” unless the context indicates otherwise.

As previously announced, we have changed our segment reporting structure to align with our strategic focus areas: (1) Research Publishing & Platforms, which continues to include the Research publishing and Atypon businesses, (2) Academic & Professional Learning, which is the former “Publishing” segment combined with our corporate training businesses – previously noted as Professional Assessment and Corporate Learning; and (3) Education Services, which includes our Online Program Management and mthree training, upskilling and talent placement services for professionals and businesses. Prior period segment results have been revised to the new segment presentation. There were no changes to our consolidated financial results.

Wiley drives the world forward with research and education. Through publishing, platforms and services, we help researchers, professionals, students, universities, and corporations to achieve their goals in an ever-changing world. Through the Research Publishing & Platforms segment, we provide scientific, technical, medical, and scholarly journals, as well as related content and services, to academic, corporate, and government libraries, learned societies, and individual researchers and other professionals. The Academic & Professional Learning segment provides scientific, professional, and education books in print and digital formats, digital courseware, and test preparation services, to students, libraries, corporations, professionals, and researchers, as well as learning, development, and assessment services for businesses and professionals. The Education Services segment provides online program management services for higher education institutions and mthree talent placement services for professionals and businesses. Our operations are primarily located in the United States (“U.S.”), United Kingdom (“U.K.”), Germany, Russia, Sri Lanka, Canada, Jordan, and France. In the year ended April 30, 2020, approximately 44% of our consolidated revenue was from outside the U.S.

Our business growth strategies include:

• |

driving volume growth from existing journal and book brands and titles, as well as learning services related to education and professional development; |

• |

developing new journal titles or through publishing partnerships; |

• |

developing new products and services for existing university partners, as well as signing new online program management partners; |

• |

making technology and content acquisitions that complement our existing businesses; |

• |

designing and implementing new methods of delivering products to our customers; and |

• |

the development of new products and services. |

Business Segments

We report our segment information in accordance with the provisions of Financial Accounting Standards Board Accounting Standards Codification Topic 280, “Segment Reporting” (“FASB ASC Topic 280”). Our segment reporting structure consists of three reportable segments, which are listed below, and a Corporate category:

|

• |

Research Publishing & Platforms; |

|

• |

Academic & Professional Learning; and |

Research Publishing & Platforms:

Research Publishing & Platforms’ mission is to support researchers, professionals and learners in the discovery and use of research knowledge to help them achieve their goals. Research provides scientific, technical, medical, and scholarly journals, as well as related content and services, to academic, corporate, and government libraries, learned societies, and individual researchers and other professionals. Journal publishing areas include the physical sciences and engineering, health sciences, social sciences and humanities and life sciences. Research Publishing & Platforms also includes Atypon Systems, Inc. (“Atypon”), a publishing software and service provider that enables scholarly and professional societies and publishers to deliver, host, enhance, market, and manage their content on the web through the Literatum™ platform. Research Publishing & Platforms’ customers include academic, corporate, government, and public libraries, funders of research, researchers, scientists, clinicians, engineers and technologists, scholarly and professional societies, and students and professors. Research Publishing & Platforms products are sold and distributed globally in digital and print formats through multiple channels, including research libraries and library consortia, independent subscription agents, direct sales to professional society members, and other customers. Publishing centers include Australia, China, Germany, India, the United Kingdom, and the United States. Research Publishing & Platforms’ revenue accounted for approximately 52% of our consolidated revenue in the year ended April 30, 2020, with a 35.3% Adjusted EBITDA margin.

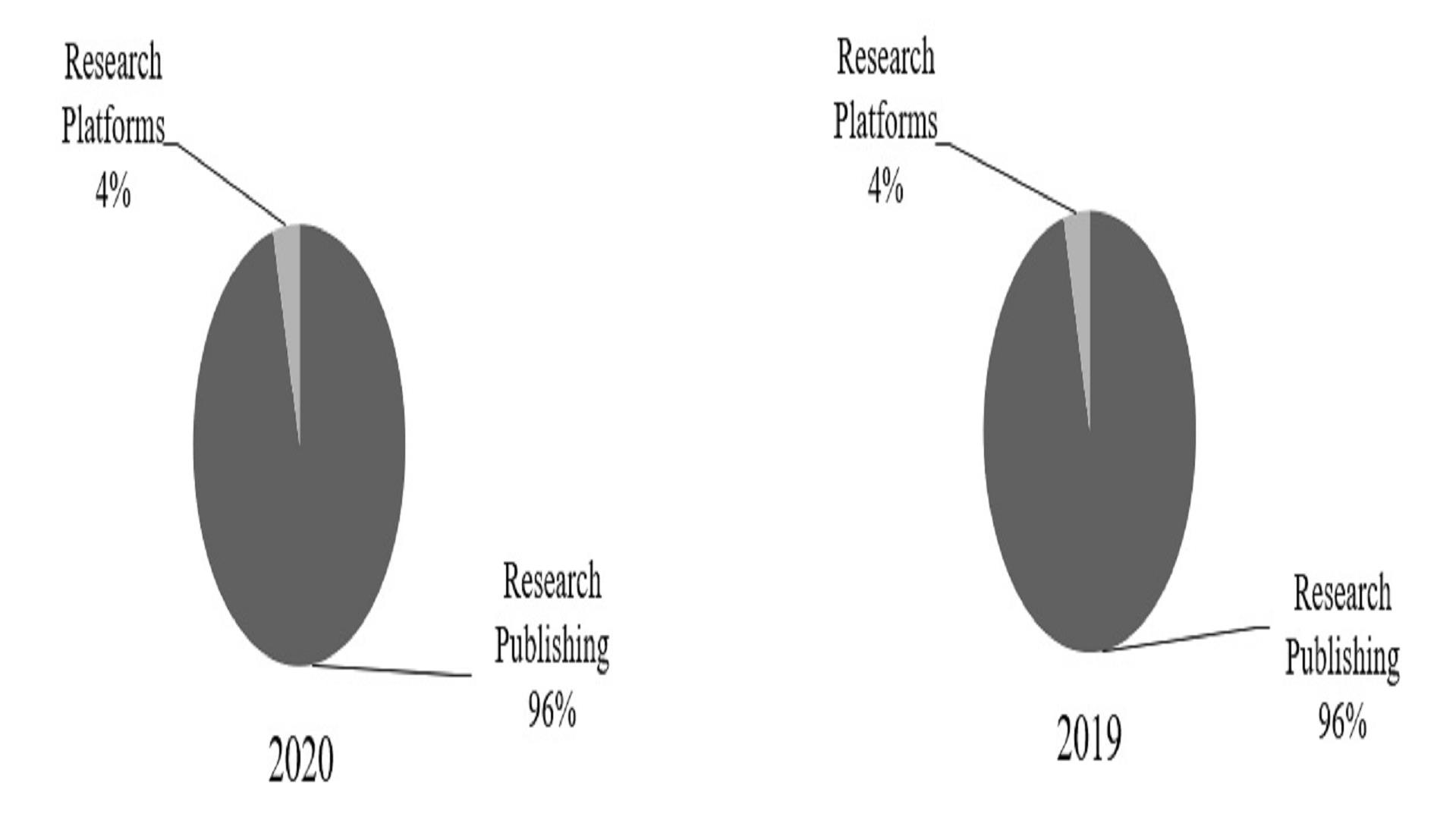

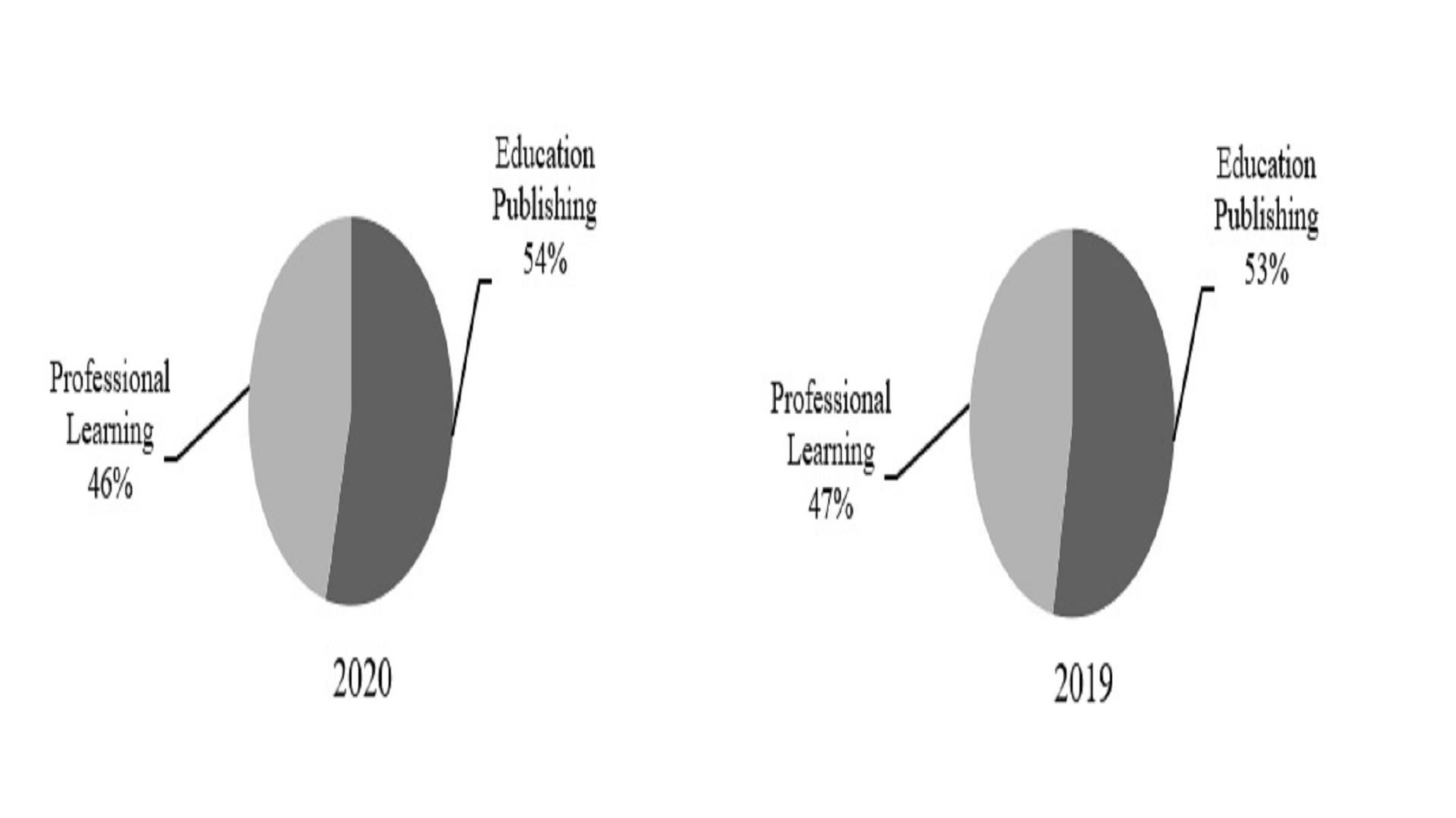

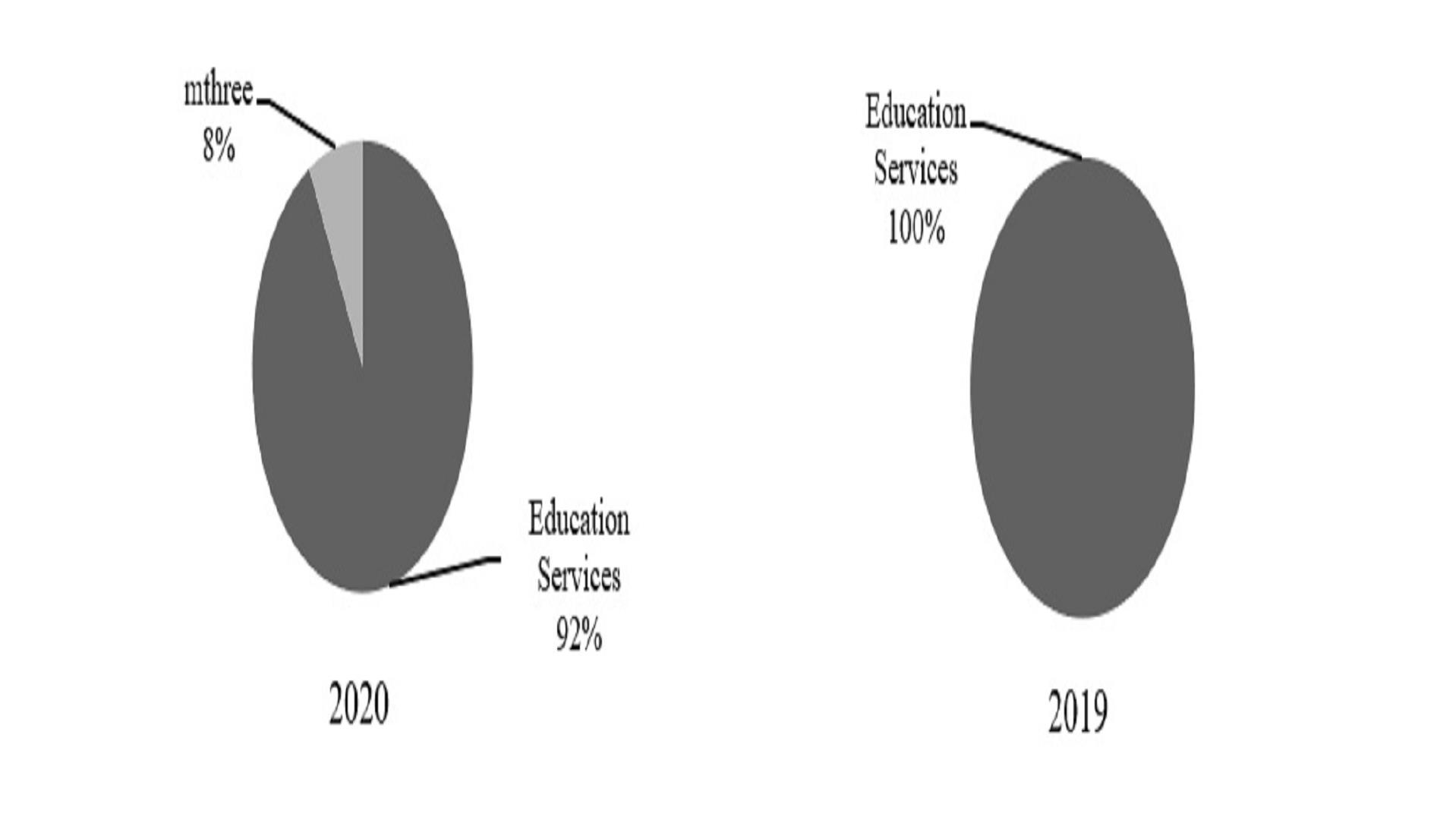

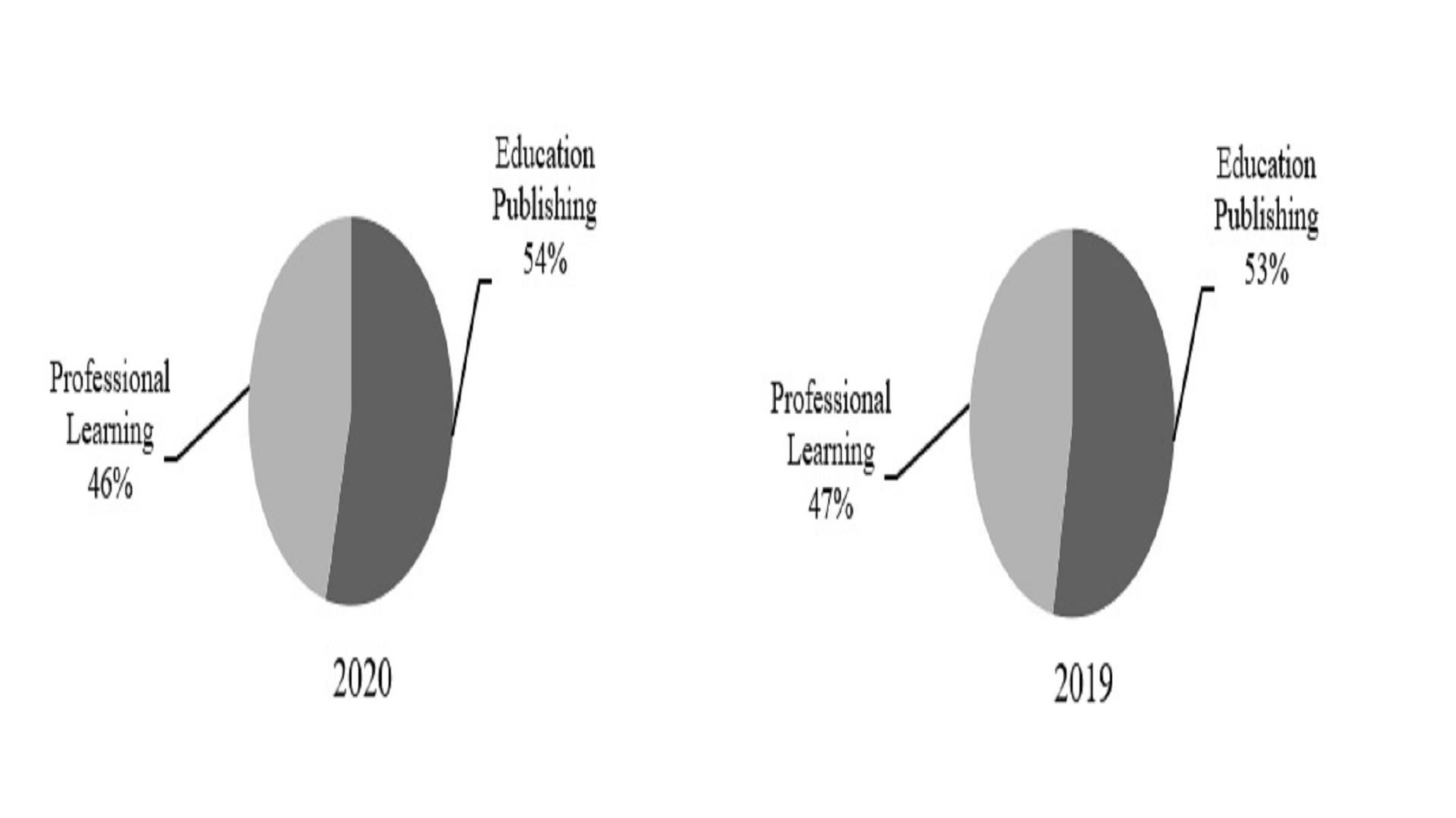

Research Publishing & Platforms revenue by product type includes Research Publishing and Research Platforms. The graphs below present revenue by product type for the years ended April 30, 2020 and 2019:

Key growth strategies for the Research Publishing & Platforms segment include evolving and developing new licensing models for our institutional customers (“pay to read and publish”), developing new open access products and revenue streams (“pay to publish”), focusing resources on high-growth and emerging markets, and developing new digital products, services, and workflow solutions to meet the needs of researchers, authors, societies, and corporate customers.

Research Publishing

Research Publishing generates the majority of its revenue from contracts with its customers for the following revenue streams:

• |

Licensing, Reprints, Backfiles and Other; and |

• |

Open Access and Comprehensive Agreements |

Journal Subscriptions

We publish approximately 1,675 academic research journals. We sell journal subscriptions directly through our sales representatives, indirectly through independent subscription agents, through promotional campaigns, and through memberships in professional societies for those journals that are sponsored by societies. Journal subscriptions are primarily licensed through contracts for digital content available online through Wiley Online Library, which is delivered through our Literatum platform. Contracts are negotiated by us directly with customers or their subscription agents. Subscription periods typically cover calendar years. Print journals are generally mailed to subscribers directly from independent printers. We do not own or manage printing facilities. Subscription revenue is generally collected in advance.

Approximately 50% of Journal Subscription revenue is derived from publishing rights owned by us. Publishing alliances also play a major role in Research Publishing’s success. Approximately 50% of Journal Subscription revenue is derived from publication rights that are owned by professional societies and published by us pursuant to a long-term contract (generally 5–10 years) or owned jointly with a professional society. These society alliances bring mutual benefit, with the societies gaining Wiley’s publishing, marketing, sales, and distribution expertise, while Wiley benefits from being affiliated with prestigious societies and their members. Societies that sponsor or own such journals generally receive a royalty and/or other financial consideration. We may procure editorial services from such societies on a pre-negotiated fee basis. We also enter into agreements with outside independent editors of journals that define the duties of the editors and the fees and expenses for their services. Contributors of articles to our journal portfolio transfer publication rights to us or a professional society, as applicable. We publish the journals of many prestigious societies, including the American Cancer Society, the American Heart Association, the British Journal of Surgery Society, the European Molecular Biology Organization, the American Anthropological Association, the American Geophysical Union, and the German Chemical Society.

Literatum, our online publishing platform for Research Publishing, delivers integrated access to over 9 million articles from approximately 1,675 journals, as well as 22,000 online books and hundreds of multi-volume reference works, laboratory protocols and databases. Wiley Online Library, which is delivered through our Literatum platform, provides the user with intuitive navigation, enhanced discoverability, expanded functionality, and a range of personalization options. Access to abstracts is free and full content is accessible through licensing agreements or as individual article purchases. Large portions of the content are provided free or at nominal cost to nations in the developing world through partnerships with certain non-profit organizations. Our online publishing platforms provide revenue growth opportunities through new applications and business models, online advertising, deeper market penetration, and individual sales and pay-per-view options. The Literatum platform hosts over 40% of the world’s English language journals.

Wiley’s performance in the 2018 release of Clarivate Analytics’ Journal Citation Reports (JCR) remains strong, maintaining its position as #3 in terms of the number of titles indexed, articles published, and citations received. Wiley saw a 9.5% increase in JCR articles, giving it 9.7% overall share (+0.6%) – its biggest increase since 2008.

A total of 1,223 Wiley journals were included in the reports, 58% of these were society publications – reaffirming Wiley’s position as the world’s leading society publishing partner. Wiley journals ranked #1 in 27 categories across 25 titles and achieved 349 top-10 category rankings.

The annual Journal Citation Reports (JCR) are one of the most widely-used sources of citation metrics used to analyze the performance of peer-reviewed journals. The most famous of these metrics, the Impact Factor, is based on the frequency with which an average article is cited in the JCR report year. Alongside other metrics, this makes it an important tool for evaluating a journal’s impact on ongoing research.

Licensing, Reprints, Backfiles, and Other

Licensing, Reprints, Backfiles, and Other includes advertising, backfile sales, the licensing of publishing rights, journal and article reprints, and individual article sales. We generate advertising revenue from print and online journal subscription products, our online publishing platform, Literatum, online events such as webinars and virtual conferences, community interest Web sites such as spectroscopyNOW.com, and other Web sites. A backfile license provides access to a historical collection of Wiley journals, generally for a one-time fee. We also engage with international publishers and receive licensing revenue from photocopies, reproductions, translations, and other digital uses of our content. Journal and article reprints are primarily used by pharmaceutical companies and other industries for marketing and promotional purposes. Through the Article Select and PayPerView programs, we provide fee-based access to non-subscribed journal articles, content, book chapters, and major reference work articles. The Research Publishing business is also a provider of content and services in evidence-based medicine (“EBM”). Through our alliance with The Cochrane Collaboration, we publish The Cochrane Library, a premier source of high-quality independent evidence to inform healthcare decision-making. EBM facilitates the effective management of patients through clinical expertise informed by best practice evidence that is derived from medical literature.

Open Access and Comprehensive Agreements

Under the Author-Funded Access business model, accepted research articles are published subject to payment of Article Publication Charges ("APCs"). After payment to Wiley, all Author-Funded articles are immediately free to access online. Contributors of Author-Funded Access articles retain many rights and typically license their work under terms that permit re-use.

Author-Funded Access offers authors choices in how to share and disseminate their work, and it serves the needs of researchers who may be required by their research funder to make articles freely accessible without embargo. APCs are typically paid by the individual author or by the author’s funder, and payments are often mediated by the author’s institution. We provide specific workflows and infrastructure to authors, funders, and institutions to support the requirements of the Author-Funded Access model.

We offer two Open Access publishing models. The first of these is Hybrid Open Access where, upon payment of an APC, authors publishing in the majority of our paid subscription journals are offered, after article acceptance, the opportunity to make their individual research article openly available through the OnlineOpen service.

The second offering of the Open Access model is a growing portfolio of fully open access journals, also known as Gold Open Access Journals, in which all accepted articles are published subject to receipt of an APC. All Open Access articles are subject to the same rigorous peer-review process applied to our subscription-based journals. As with our subscription portfolio, a number of the Gold Open Access Journals are published under contract for, or in partnership with, prestigious societies, including the American Geophysical Union, the American Heart Association, the European Molecular Biology Organization and the British Ecological Society. The Open Access portfolio spans life, physical, medical and social sciences and includes a choice of high impact journals and broad-scope titles that offer a responsive, author-centered service.