fy17-10k.htm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-K

[x] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended: April 30, 2017

OR

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934 (FEE REQUIRED)

For the transition period from to

Commission file number 001-11507

JOHN WILEY & SONS, INC.

(Exact name of Registrant as specified in its charter)

|

NEW YORK

|

|

13-5593032

|

|

State or other jurisdiction of incorporation or organization

|

|

I.R.S. Employer Identification No.

|

| |

|

|

| |

|

|

|

111 River Street, Hoboken, NJ

|

|

07030

|

|

Address of principal executive offices

|

|

Zip Code

|

| |

|

|

| |

|

|

| |

(201) 748-6000

|

|

| |

Registrant’s telephone number including area code

|

|

| |

|

|

| |

|

|

|

Securities registered pursuant to Section 12(b) of the Act: Title of each class

|

|

Name of each exchange on which registered

|

|

Class A Common Stock, par value $1.00 per share

|

|

New York Stock Exchange

|

|

Class B Common Stock, par value $1.00 per share

|

|

New York Stock Exchange

|

| |

|

|

| |

Securities registered pursuant to Section 12(g) of the Act:

|

|

| |

None

|

|

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes |X| No | |

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act.

Yes | | No |X |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes |X| No | |

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes |X| No | |

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. | |

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” ”accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer |X| Accelerated filer | | Non-accelerated filer | | Smaller reporting company | |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes | | No |X|

The aggregate market value of the voting stock held by non-affiliates of the registrant, computed by reference to the closing price as of the last business day of the registrant’s most recently completed second fiscal quarter, October 31, 2016, was approximately $2,337.0 million. The registrant has no non-voting common stock.

The number of shares outstanding of the registrant’s Class A and Class B Common Stock as of May 31, 2017 was 48,026,741 and 9,173,093 respectively.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive proxy statement for use in connection with its annual meeting of stockholders scheduled to be held on September 28, 2017, are incorporated by reference into Part III of this Form 10-K.

JOHN WILEY AND SONS, INC. AND SUBSIDIARIES

FORM 10-K

FOR THE FISCAL YEAR ENDED APRIL 30, 2017

INDEX

|

PART I

|

|

PAGE

|

|

ITEM 1.

|

|

4

|

|

ITEM 1A.

|

|

4-12

|

|

ITEM 1B.

|

|

12

|

|

ITEM 2.

|

|

13

|

|

ITEM 3.

|

|

14

|

|

ITEM 4

|

|

14

|

| |

|

14-16

|

| |

|

|

|

PART II

|

|

|

|

ITEM 5.

|

|

17

|

|

ITEM 6.

|

|

18

|

|

ITEM 7.

|

|

19-57

|

|

ITEM 7A.

|

|

57-59

|

|

ITEM 8.

|

|

60-100

|

|

ITEM 9.

|

|

101

|

|

ITEM 9A.

|

|

101

|

|

ITEM 9B.

|

|

101

|

| |

|

|

|

PART III

|

|

|

|

ITEM 10.

|

|

101-102

|

|

ITEM 11.

|

|

102

|

|

ITEM 12.

|

|

102

|

|

ITEM 13.

|

|

103

|

|

ITEM 14.

|

|

103

|

| |

|

|

|

PART IV

|

|

|

|

ITEM 15.

|

|

104-106

|

| |

|

|

|

SIGNATURES

|

|

|

PART I

The Company, founded in 1807, was incorporated in the state of New York on January 15, 1904. As used herein the term “Company” means John Wiley & Sons, Inc., and its subsidiaries and affiliated companies, unless the context indicates otherwise.

The Company is a global research and learning company. Through the Research segment, the Company provides scientific, technical, medical, and scholarly journals, as well as related content and services, to academic, corporate, and government libraries, learned societies, and individual researchers and other professionals. The Publishing segment provides scientific, professional, and education books and related content in print and digital formats, as well as test preparation services and course workflow tools, to libraries, corporations, students, professionals, and researchers. The Solutions segment provides online program management services for higher education institutions and learning, development, and assessment services for businesses and professionals. The Company’s operations are primarily located in the United States (“U.S.”), Canada, United Kingdom (“U.K.”), Germany, Singapore and Australia.

Further description of the Company’s business is incorporated herein by reference in the Management’s Discussion and Analysis section of this 10-K.

Employees

As of April 30, 2017, the Company employed approximately 5,100 persons on a full-time equivalent basis worldwide.

Financial Information About Business Segments

The note entitled “Segment Information” of the Notes to Consolidated Financial Statements and pages 18 through 55 of the Management’s Discussion and Analysis section of this Form 10-K are incorporated herein by reference.

Financial Information About Foreign and Domestic Operations and Export Sales

The note entitled “Segment Information” of the Notes to Consolidated Financial Statements and pages 18 and 55 of the Management’s Discussion and Analysis section of this Form 10-K are incorporated herein by reference.

You should carefully consider all of the information set forth in this Form 10-K, including the following risk factors, before deciding to invest in any of the Company’s securities. The risks below are not the only ones the Company faces. Additional risks not currently known to the Company or that the Company presently deems immaterial may also impair its business operations. The Company’s business, financial condition, results of operations or prospects could be materially adversely affected by any of these risks.

Cautionary Statement Under the Private Securities Litigation Reform Act of 1995:

This Form 10-K for the year ended April 30, 2017 contains certain forward-looking statements concerning the Company’s operations, performance and financial condition. In addition, the Company provides forward-looking statements in other materials released to the public as well as oral forward-looking information. Statements which contain the words anticipate, expect, believes, estimate, project, forecast, plan, outlook, intend and similar expressions constitute forward-looking statements that involve risk and uncertainties. Reliance should not be placed on forward-looking statements, as actual results may differ materially from those in any forward-looking statements.

Any such forward-looking statements are based upon a number of assumptions and estimates that are inherently subject to uncertainties and contingencies, many of which are beyond the control of the Company, and are subject to change based on many important factors. Such factors include, but are not limited to (i) the level of investment in new technologies and products; (ii) subscriber renewal rates for the Company’s journals; (iii) the financial stability and liquidity of journal subscription agents; (iv) the consolidation of book wholesalers and retail accounts; (v) the market position and financial stability of key retailers; (vi) the seasonal nature of the Company’s education business and the impact of the used-book market; (vii) worldwide economic and political conditions; (viii) the Company’s ability to protect its copyrights and other intellectual property worldwide; (ix) the ability of the Company to successfully integrate acquired operations and realize expected opportunities and (x) other factors detailed from time to time in the Company’s filings with the Securities and Exchange Commission. The Company undertakes no obligation to update or revise any such forward-looking statements to reflect subsequent events or circumstances.

Employment Costs and Expenses

The Company has a significant investment in its employee base around the world. The Company offers competitive salaries and benefits in order to attract and retain the highly skilled workforce needed to sustain and develop new products and services required for growth. Employment and benefit costs are affected by competitive market conditions for qualified individuals, and factors such as healthcare and retirement benefit costs.

Protection of Intellectual Property Rights

A substantial portion of the Company’s publications are protected by copyright, held either in the Company’s name, in the name of the author of the work, or in the name of a sponsoring professional society. Such copyrights protect the Company’s exclusive right to publish the work in many countries abroad for specified periods, in most cases the author’s life plus 70 years, but in any event a minimum of 50 years for works published after 1978. The ability of the Company to continue to achieve its expected results depends, in part, upon the Company’s ability to protect its intellectual property rights. The Company’s results may be adversely affected by lack of legal and/or technological protections for its intellectual property in some jurisdictions and markets.

Maintaining the Company’s Reputation

The Company’s professional customers worldwide rely upon many of the Company’s publications to perform their jobs. It is imperative that the Company consistently demonstrates its ability to maintain the integrity of the information included in its publications. Adverse publicity, whether or not valid, may reduce demand for the Company’s publications.

Trade Concentration and Credit Risk

In the journal publishing business, subscriptions are primarily sourced through journal subscription agents who, acting as agents for library customers, facilitate ordering by consolidating the subscription orders/billings of each subscriber with various publishers. Cash is generally collected in advance from subscribers by the subscription agents and is principally remitted to the Company between the months of December and April. Although at fiscal year-end the Company had minimal credit risk exposure to these agents, future calendar-year subscription receipts from these agents are highly dependent on their financial condition and liquidity. Subscription agents account for approximately 22% of total annual consolidated revenue and no one agent accounts for more than 10% of total annual consolidated revenue.

The Company’s book business is not dependent upon a single customer; however, the industry is concentrated in national, regional, and online bookstore chains. Although no one book customer accounts for more than 8% of total consolidated revenue and 15% of accounts receivable at April 30, 2017, the top 10 book customers account for approximately 14% of total consolidated revenue and approximately 28% of accounts receivable at April 30, 2017. The Company maintains approximately $25 million of trade credit insurance, subject to certain limitations, covering balances due from certain named customers which expires in May 2018.

Changes in Laws and Regulations That Could Adversely Affect the Company’s Business

The Company maintains operations in Asia, Australia, Canada, Europe and the United States. The conduct of our business, including the sourcing of content, distribution, sales, marketing and advertising is subject to various laws and regulations administered by governments around the world. Changes in laws, regulations or government policies, including tax regulations and accounting standards, may adversely affect the Company’s future financial results.

The scientific research publishing industry generates much of its revenue from paid customer subscriptions to online and print journal content. There is debate within government, academic and library communities whether such journal content should be made available for free, immediately or following a period of embargo after publication, referred to as “open access”. For instance, certain governments and privately held funding bodies have implemented mandates that require journal articles derived from government-funded research to be made available to the public at no cost after an embargo period. Open access can be achieved in two ways: Green, which enables authors to publish articles in subscription based journals and self–archive the author accepted version of the article for free public use after an embargo period, and Gold, which enables authors to publish their articles in journals that provide immediate free access to the final version of the article on the publisher’s website, and elsewhere under permissive licensing terms, following payment of an Article Publication Charge (“APC”). These mandates have the potential to put pressure on subscription-based publications. If such regulations are widely implemented the Company’s operating results could be adversely affected. To date, the majority of governments that have taken a position on open access have favored the green model and have generally specified embargo periods of twelve months. The publishing community generally takes the view that this period should be sufficient to protect subscription revenues provided that publishers’ platforms offer sufficient added value to the article. Governments in Europe have been more supportive of the gold model, which thus far is generating incremental revenue for publishers with active open access programs. A number of European administrations are showing interest in a business model which combines the purchasing of subscription content with the purchase of open access publishing for authors in their country. This development removes an element of risk by fixing revenues from that market, provided that the terms, price, and rate of transition negotiated are acceptable.

Business Transformation and Restructuring

The Company continues to transform its business from a traditional publishing model to being a global provider of content-enabled solutions with a focus on digital products and services. The acquisitions of Deltak.edu, LLC (“Deltak”), Inscape Holdings, Inc. (“Inscape”), Profiles International (“Profiles”) and CrossKnowledge Group Limited (“CrossKnowledge”), comprise the Company’s Solutions reporting segment and, along with Atypon Systems, Inc. (“Atypon”) in our Research segment, which was acquired in September 2016, represent examples of strategic initiatives that were implemented as part of the Company’s business transformation. The Company will continue to explore opportunities to develop new business models and enhance the efficiency of its organizational structure. The rapid pace and scope of change increases the risk that not all of our strategic initiatives will deliver the expected benefits within the anticipated timeframes. In addition, these efforts may somewhat disrupt the Company’s business activities which could adversely affect its operating results.

The Company continues to restructure and realign its cost base with current and anticipated future market conditions. Significant risks associated with these actions that may impair the Company’s ability to achieve the anticipated cost reductions or that may disrupt its business include delays in the implementation of anticipated workforce reductions in highly regulated locations outside of the U.S.; decreases in employee morale; the failure to meet operational targets due to the loss of key employees; and disruptions of third parties to whom we have outsourced business functions. In addition, the Company’s ability to achieve the anticipated cost savings and other benefits from these actions within the expected timeframe is subject to many estimates and assumptions. These estimates and assumptions are subject to significant economic, competitive and other uncertainties, some of which are beyond our control. If these estimates and assumptions are incorrect, if we experience delays, or if other unforeseen events occur, our business and results of operations could be adversely affected.

Outsourcing of Business Processes

The Company has outsourced certain business functions, principally in technology, content management; printing; manufacturing; warehousing; fulfillment; distribution; returns processing; and certain other transactional processing functions, to third-party service providers to achieve cost savings and efficiencies. If these third-party service providers do not perform effectively, the Company may not be able to achieve the expected cost savings and depending on the function involved, may experience business disruption or processing inefficiencies, all with potential adverse effects on the Company’s operating results.

Introduction of New Technologies, Products and Services

The Company must continue to invest in technology and other innovations to adapt and add value to its products and services to remain competitive. This is particularly true in the current environment where investment in new technology is ongoing and there are rapid changes in the products competitors are offering, the products our customers are seeking and our sales and distribution channels. In some cases, investments will take the form of internal development; in others, they may take the form of an acquisition. There are uncertainties whenever developing or acquiring new products and services, and it is often possible that such new products and services may not be launched or if launched, may not be profitable or as profitable as existing products and services.

Demand for Digital and Lower Cost Books

A common trend facing each of the Company’s businesses is the digitization of content and proliferation of distribution channels through the internet and other electronic means, which are replacing traditional print formats. The trend to digital content has also created contraction in the print book retail market which increases the risk of bankruptcy for certain retail customers, potentially leading to the disruption of short-term product supply to consumers as well as potential bad debt write-offs. New distribution channels, such as digital formats, the internet, online retailers and growing delivery platforms (e.g. tablets and e-readers), combined with the concentration of retailer power, present both threats and opportunities to the Company’s traditional publishing models, potentially impacting both sales volumes and pricing.

As the market has shifted to digital products, customer expectations for lower priced products has increased due to customer awareness of reductions in production costs and the availability of free or low-cost digital content and products. As a result, there has been pressure to sell digital versions of products at prices below their print versions. Increased customer demand for lower prices could reduce the Company’s revenue.

The Company publishes educational content for undergraduate, graduate and advanced placement students, lifelong learners and in Australia secondary school students. Due to growing student demand for less expensive textbooks, many college bookstores, online retailers and other entities offer used or rental textbooks to students at lower prices than new textbooks. The internet has made the used and rental textbook markets more efficient and has significantly increased student access to used and rental books. Further expansion of the used and rental book markets could further adversely affect the Company’s sales of print textbooks, adversely affecting its results of operations and financial condition.

Factors that Reduce Enrollment at Colleges and Universities

Enrollment in U.S. colleges and universities can be adversely affected by many factors, including changes in government and private student loan and grant programs, uncertainty about current and future economic conditions, general decreases in family income and net worth and a perception of uncertain job prospects for recent graduates. In addition, enrollment levels at colleges and universities outside the United States are influenced by the global and local economic climate, local political conditions and other factors that make predicting foreign enrollment levels difficult. Reductions in expected levels of enrollment at colleges and universities both within and outside the United States could adversely affect demand for our higher education products.

Information Technology Risks

Information technology is a key part of the Company’s business strategy and operations. As a business strategy, Wiley’s technology enables the Company to provide customers with new and enhanced products and services and is critical to the Company’s success in migrating from print to digital business models. Information technology is also a fundamental component of all our business processes; collecting and reporting business data; and communicating internally and externally with customers, suppliers, employees and others.

We are continually improving and upgrading our computer systems and software. We are in the process of implementing a new Enterprise Resource Planning (“ERP”) system as part of a multi-year plan to integrate and upgrade our operational and financial systems and processes. As of April 30, 2017, we have completed the implementation of record-to-report, purchase-to-pay and several other business processes within all locations and will continue to roll out additional processes and functionality of the ERP in phases over the next three years. Implementation of a new ERP system involves risks and uncertainties. Any disruptions, delays, or deficiencies in the design or implementation of a new system, could result in increased costs, disruptions in operations or delays in the collection of cash from our customers, as well as have an adverse effect on our ability to timely report our financial results, all of which could materially adversely affect our business, financial condition, and results of operations.

Information technology system failures, network disruptions and breaches of data security could significantly disrupt the operations of the Company. Management has designed and implemented policies, processes and controls to mitigate risks of information technology failure and to provide security from unauthorized access to our systems. In addition, the Company has in place disaster recovery plans to maintain business continuity. The size and complexity of our information technology and information security systems, and those of our third-party vendors with whom we contract, make such systems potentially vulnerable to cyber-attacks common to most industries from inadvertent or intentional actions by employees, vendors, or malicious third-parties. Such attacks are of ever-increasing levels of sophistication and are made by groups and individuals with a wide range of motives. While the Company has taken steps to address these risks, there can be no assurance that a system failure, disruption or data security breach would not adversely affect the Company’s business and operating results.

Competition for Market Share and Author and Society Relationships

The Company operates in highly competitive markets. Success and continued growth depends greatly on developing new products and the means to deliver them in an environment of rapid technological change. Attracting new authors and professional societies, while retaining our existing business relationships, are critical to our success.

Interest Rate and Foreign Exchange Risk

Non-U.S. revenues, as well as our substantial non-U.S. net assets, expose the Company’s results to foreign currency exchange rate volatility. The percentage of Consolidated Revenue for fiscal year 2017 recognized in the following currencies (on an equivalent U.S. dollar basis) were: approximately 54% U.S. dollar; 29% British pound sterling; 8% euro and 9% other currencies. In addition, our interest-bearing loans and borrowings are subject to risk from changes in interest rates. These risks and the measures we have taken to help contain them are discussed in the Market Risk section of this 10-K. The Company from time-to-time uses derivative instruments to hedge such risks. Notwithstanding our efforts to foresee and mitigate the effects of changes in fiscal circumstances, we cannot predict with certainty changes in currency and interest rates, inflation or other related factors affecting our business.

Changes in Tax Laws

The Company is subject to tax laws within the jurisdictions in which it does business. Changes in tax laws could have a material impact on the Company’s financial results. There have been proposals to reform U.S. tax laws that would significantly impact the taxation of non-US earnings and cash of U.S. multinational corporations. This could have a material impact on the Company’s financial results as most of the Company’s income is earned outside the U.S. There has also been legislation and further proposals in other countries where the Company does business which could impact the Company’s financial results. In addition, the Company is subject to audit by tax authorities and is regularly audited by various tax authorities. Although we believe our tax estimates are reasonable, the final determination of tax audits could be materially different from our historical income tax provisions and accruals and could have a material impact on the Company’s net income, cash flow and financial position.

Business Risk in Developing, Emerging and Other Foreign Markets

The Company sells its products to customers in certain sanctioned and previously sanctioned developing markets where it does not have operating subsidiaries. The Company does not own any assets or liabilities in these markets except for trade receivables. Challenges and uncertainties associated with operating in developing markets has a higher relative risk due to political instability, economic volatility, crime, terrorism, corruption, social and ethnic unrest, and other factors. In fiscal year 2017, the Company recorded revenue and net profits of $3.8 million and $0.6 million, respectively, related to sales to Cuba, Sudan, Syria and Iran. While sales in these markets are not material to the Company’s business results, adverse developments related to the risks associated with these markets may cause actual results to differ from historical and forecasted future operating results.

The Company has certain technology development operations in Russia related to software development and architecture, digital content production and system testing services. Due to the political instability within the region, there is the potential for future government embargos and sanctions which could disrupt the Company’s operations in the area. While the Company has developed business continuity plans to address these issues, further adverse developments in the region could have a material impact on the Company’s business and operating results.

Approximately 15% of Research journal articles are sourced from authors in China. Any restrictions on exporting intellectual property could adversely affect the company’s business and operating results.

Liquidity and Global Economic Conditions

Changes in global financial markets have not had, nor do we anticipate they will have, a significant impact on our liquidity. Due to our significant operating cash flow, financial assets, access to capital markets and available lines of credit and revolving credit agreements, we continue to believe that we have the ability to meet our financing needs for the foreseeable future. As market conditions change, we will continue to monitor our liquidity position. However, there can be no assurance that our liquidity or our results of operations will not be affected by possible future changes in global financial markets and global economic conditions. Unprecedented market conditions including illiquid credit markets, volatile equity markets, dramatic fluctuations in foreign currency rates and economic recession could affect future results.

Effects of Increases in Pension Costs and Funding Requirements

The Company provides defined benefit pension plans for certain employees worldwide. The Company’s Board of Directors approved amendments to the U.S., Canada and U.K. defined benefit plans that froze the future accumulation of benefits effective June 30, 2013, December 31, 2015 and April 30, 2015, respectively. The funding requirements and costs of these plans are dependent upon various factors, including the actual return on plan assets, discount rates, plan participant population demographics and changes in pension regulations. Changes in these factors affect the Company’s plan funding, cash flow and results of operations.

The Company announced a voluntary, limited-time opportunity for terminated vested employees who are participants in the U.S. Employees’ Retirement Plan of John Wiley & Sons, Inc. (the “Pension Plan”) to request early payment of their entire Pension Plan benefit in the form of a single lump sum payment. Eligible participants who wished to receive the lump sum payment were required to make an election by August 29, 2016. Approximately 780 eligible participants made the election to receive the lump sum totaling $28.3 million which was paid from pension plan assets in October 2016. Settlement accounting rules were applied, which resulted in a plan remeasurement and recognition of a pro-rata portion of unamortized net actuarial loss of $8.8 million which was recorded in Operating and Administrative Expenses in the Consolidated Statements of Income.

Effects of Inflation and Cost Increases

The Company, from time to time, experiences cost increases reflecting, in part, general inflationary factors. There is no guarantee that the Company can increase selling prices or reduce costs to fully mitigate the effect of inflation on company costs.

Ability to Successfully Integrate Key Acquisitions

The Company’s growth strategy includes title, imprint and other business acquisitions, including knowledge-enabled services which complement the Company’s existing businesses. Acquisitions may have a substantial impact on the Company’s revenues, costs, cash flows, and financial position. Acquisitions involve risks and uncertainties, including difficulties in integrating acquired operations and in realizing expected opportunities; diversions of management resources and loss of key employees; challenges with respect to operating new businesses; debt incurred in financing such acquisitions; and other unanticipated problems and liabilities.

Valuation of Goodwill and Intangible Assets

At April 30, 2017, the Company had $982.1 million of goodwill and $828.1 million of intangible assets on its balance sheet. The intangible assets are principally comprised of content and publishing rights, customer relationships, and brands and trademarks. Failure to achieve business objectives and financial projections could result in an asset impairment charge, which would result in a non-cash charge to operating expenses. Goodwill and intangible assets with indefinite lives are tested for impairment on an annual basis and also when events or changes in circumstances indicate that impairment may have occurred. Intangible assets with determinable lives are tested for impairment only when events or changes in circumstances indicate that an impairment may have occurred. Determining whether an impairment exists can be difficult as a result of increased uncertainty and current market dynamics, and requires significant management estimates and judgment. In addition, the potential for goodwill impairment is increased during periods of economic uncertainty. An asset impairment charge could have a material adverse effect on the Company’s business, operating results and financial condition.

Attracting and Retaining Key Employees

The Company is highly dependent on the continued services of its Chief Executive Officer, Chief Financial Officer and other senior officers and key employees. The loss of the services of skilled personnel for any reason and the Company’s inability to replace them with suitable candidates quickly or at all, as well as any negative market perception resulting from such loss, could have a material adverse effect on the Company’s business, operating results and financial condition. In addition, we are dependent upon our ability to continue to attract new employees with key skills to support business growth.

None

The Company occupies office, warehouse, and distribution facilities in various parts of the world, as listed below (excluding those locations with less than 10,000 square feet of floor area, none of which is considered material property). All of the buildings and the equipment owned or leased are believed to be in good operating condition and are suitable for the conduct of its business.

| |

Location

|

Purpose

|

Owned or Leased

|

Approx. Sq. Ft.

|

| |

|

|

|

|

| |

United States:

|

|

|

|

| |

|

|

|

|

| |

New Jersey

|

Corporate Headquarters

|

Leased

|

401,000

|

| |

|

Office & Warehouse

|

Leased

|

185,000

|

| |

|

|

|

|

| |

Indiana

|

Office

|

Leased

|

123,000

|

| |

|

|

|

|

| |

California

|

Office

|

Leased

|

29,000

|

| |

|

|

|

|

| |

Massachusetts

|

Office

|

Leased

|

26,000

|

| |

|

|

|

|

| |

Illinois

|

Office

|

Leased

|

52,000

|

| |

|

|

|

|

| |

Florida

|

Office

|

Leased

|

58,000

|

| |

|

|

|

|

| |

Minnesota

|

Offices

|

Leased

|

22,000

|

| |

|

|

|

|

| |

Texas

|

Offices

|

Leased

|

13,000

|

| |

|

|

|

|

| |

Colorado

|

Office

|

Leased

|

15,000

|

| |

|

|

|

|

| |

International:

|

|

|

|

| |

|

|

|

|

| |

Australia

|

Offices

|

Leased

|

48,000

|

| |

|

|

|

|

| |

Canada

|

Office

|

Leased

|

12,000

|

| |

|

|

|

|

| |

England

|

Warehouses

|

Leased

|

297,000

|

| |

|

Offices

|

Leased

|

80,000

|

| |

|

Offices

|

Owned

|

70,000

|

| |

|

|

|

|

| |

France

|

Office

|

Leased

|

32,000

|

| |

|

|

|

|

| |

Germany

|

Office

|

Owned

|

104,000

|

| |

|

Office

|

Leased

|

24,000

|

| |

|

|

|

|

| |

Jordan

|

Office

|

Leased

|

24,000

|

| |

|

|

|

|

| |

Singapore

|

Offices

|

Leased

|

44,000

|

| |

|

|

|

|

| |

Russia

|

Office

|

Leased

|

18,000

|

| |

|

|

|

|

| |

China

|

Office

|

Leased

|

14,000

|

The Company is involved in routine litigation in the ordinary course of its business. In the opinion of management, the ultimate resolution of all pending litigation will not have a material effect upon the financial condition or results of operations of the Company.

Over the past few years, the Company has from time to time faced claims from photographers or agencies that the Company has used photographs without licenses or beyond licensed permissions. The Company has insurance coverage for a significant portion of such claims. The Company does not believe that its exposure to such claims either individually or in the aggregate is material.

Set forth below are the executive officers of the Company as of April 30, 2017. Each of the officers listed will serve until the next organizational meetings of the Board of Directors of the Company and until each of the respective successors are duly elected and qualified.

MATTHEW S. KISSNER – 63 (succeeded Mark J. Allin as Interim - CEO effective May 8th, 2017)

|

|

October 2015 - Chairman of the Board, John Wiley and Sons, Inc. (Director since 2003)

|

MARK J. ALLIN – 56 (succeeded by Matthew S. Kissner effective May 8th, 2017)

|

|

June 2015 - President and Chief Executive Officer and Director, John Wiley and Sons, Inc.

|

|

|

February 2015- Executive Vice President and Chief Operating Officer- responsible for strategy and operations for all of Wiley’s businesses. (succeeded Steve Smith as President and Chief Executive Officer, effective June 1, 2015.)

|

|

|

September 2014 – Executive Vice President, Professional Development

|

|

|

August 2010 - Senior Vice President, Professional Development – responsible for leading the Company’s global Professional Development business.

|

JOHN A. KRITZMACHER – 56

|

|

July 2013 – Chief Financial Officer and Executive Vice President, Technology and Operations, John Wiley & Sons Inc.

|

|

|

October 2012 - Senior Vice President of Business Operations, Organizational Planning & Structure at WebMD Health Corp

|

|

|

October 2008 - Chief Financial Officer and Executive Vice President of Global Crossing Ltd

|

ARCHANA SINGH - 47

|

|

2016 – Executive Vice President and Chief Human Resources Officer

|

|

|

2014 – Chief Human Resources Officer, Hay Group - responsible for aligning HR strategies and initiatives to support the organization into its’ next stage of growth. Leading all aspects of Human Resources with a strong focus on talent management, culture alignment and integration.

|

|

|

2012 – Vice President, Human Resources, Computer Science Corporation - Human Resources Leader for CSC’s enterprise business (technology consulting, application software, services and regions)

|

GARY M. RINCK – 63

|

|

September 2014 – Executive Vice President, General Counsel

|

|

|

2004 – Senior Vice President, General Counsel – responsible for all of the Company’s legal and corporate governance functions at Wiley.

|

JUDY VERSES – 60

|

|

October 2016 – Executive Vice President, Research

|

|

|

October 2011 – President – Global Enterprise and Education, Rosetta Stone Inc.

|

CHRISTOPHER CARIDI – 50 (succeeded Edward J. Melando effective March 20, 2017)

March 2017 – Senior Vice President, Corporate Controller and Chief Accounting Officer

March 2014 – VP Finance, Thomson Reuters

September 2009 – VP, Controller/Global Head of Accounting Operations, Thomson Reuters

EDWARD J. MELANDO – 61 (succeeded by Christopher Caridi effective March 20, 2017)

|

|

Mach 2017 – Senior Vice President, Corporate Controller

|

|

|

January 2013 – Senior Vice President, Corporate Controller– and Chief Accounting Officer – responsible for Financial Reporting, Taxes, and Financial Shared Services.

|

|

|

2002 - Vice President, Corporate Controller– responsible for Financial Reporting, Taxes and the Financial Shared Services.

|

VINCENT MARZANO – 54

|

|

September 2014 – Senior Vice President, Treasurer

|

|

|

September 2006 - Vice President, Treasurer – responsible for global treasury operations, insurable risk management, accounts receivable, and credit and collections.

|

REED ELFENBEIN – 63

|

|

May 2015 – Executive Vice President, International Development and Global Research Sales

|

|

|

May 2014 - Senior Vice President, International Development and Global Research Sales

|

|

|

October 2012 – Senior Vice President, International Development and STMS – leads team responsible for increasing market share in growing and emerging markets and leads the worldwide Research sales team.

|

|

|

February 2007 – Vice President and Managing Director, Sales and Marketing – responsible for leading the domestic and international sales and marketing teams.

|

CLAY E. STOBAUGH – 59

|

|

September 2014 – Executive Vice President & Chief Marketing Officer

|

|

|

October 2013 - Senior Vice President & Chief Marketing Officer

|

|

|

August 2011 – Senior Vice President, Corporate Marketing – responsible for strategic marketing and customer relationship management.

|

JOHN W. SEMEL – 46

|

|

May 2015- Executive Vice President and Chief Strategy Officer- responsible for developing, prioritizing, and implementing strategies that drive business growth.

|

|

|

February 2009 – Senior Vice President, Planning and Development – responsible for global acquisitions and divestitures, strategic investments, strategic planning, corporate alliances and business development.

|

JOAN O’NEIL - 54

|

|

November 2015 – Executive Vice President, Publishing – responsible for leading the Company’s global Publishing business

|

|

|

September 2014 – Senior Vice President and Managing Director, Knowledge Services, Professional Development – responsible for leading the Knowledge Services business within the Professional Development business

|

|

|

May 2013 – Vice President and Managing Director, Business, Finance & Accounting, Professional Development – responsible for leading the global business, finance and accounting programs within Professional Development

|

|

|

January 2011 – Vice President & Group Executive Publisher, Professional/Trade – responsible for the finance and accounting programs within the Professional/Trade business

|

JEFFREY L. SUGERMAN - 61

|

|

May 2015 – Executive Vice President, Talent Solutions and Education Services Group – responsible for leading Wiley’s combined Talent Solutions and Education Services (i.e. CrossKnowledge, Deltak, Profiles International and Inscape Publishing) in the corporate learning and higher education marketplaces.

|

|

|

February 2012 – Senior Vice President, Venture Development – responsible for leading execution and integration of Wiley’s talent solutions business acquisition including Inscape Publishing, CrossKnowledge and Profiles International.

|

PART II

The Company’s Class A and Class B shares are listed on the New York Stock Exchange under the symbols JWa and JWb, respectively. Dividends per share and the market price range (based on daily closing prices) by fiscal quarter for the past two fiscal years were as follows:

| |

|

Class A Common Stock

|

Class B Common Stock

|

| |

|

|

Market Price

|

|

Market Price

|

| |

|

Dividends

|

High

|

Low

|

Dividends

|

High

|

Low

|

| |

2017

|

|

|

|

|

|

|

| |

First Quarter

|

$0.31

|

$57.78

|

$47.68

|

$0.31

|

$57.41

|

$47.92

|

| |

Second Quarter

|

0.31

|

58.86

|

48.40

|

0.31

|

58.99

|

49.66

|

| |

Third Quarter

|

0.31

|

57.75

|

49.45

|

0.31

|

57.69

|

52.68

|

| |

Fourth Quarter

|

0.31

|

57.35

|

49.00

|

0.31

|

57.14

|

46.53

|

| |

2016

|

|

|

|

|

|

|

| |

First Quarter

|

$0.30

|

$58.66

|

$51.68

|

$0.30

|

$58.74

|

$52.54

|

| |

Second Quarter

|

0.30

|

53.18

|

48.16

|

0.30

|

52.93

|

48.25

|

| |

Third Quarter

|

0.30

|

54.29

|

40.29

|

0.30

|

53.80

|

41.25

|

| |

Fourth Quarter

|

0.30

|

50.74

|

40.21

|

0.30

|

50.85

|

40.18

|

On a quarterly basis, the Board of Directors considers the payment of cash dividends based upon its review of earnings, the financial position of the Company, and other relevant factors. As of May 31, 2017, the approximate number of holders of the Company’s Class A and Class B Common Stock were 808 and 64 respectively, based on the holders of record.

During the fourth quarter of fiscal year 2017, the Company made the following purchases of Class A Common Stock under its stock repurchase program.

| |

|

Total Number

of Shares Purchased

|

|

Average Price

Paid Per Share

|

|

Total Number

of Shares Purchased

as part of a Publicly Announced Program

|

|

Maximum Number

of Shares that

May be Purchased

Under the Program

|

| |

February 2017

|

-

|

|

-

|

|

-

|

|

4,076,376

|

| |

March 2017

|

156,097

|

|

$53.15

|

|

156,097

|

|

3,920,276

|

| |

April 2017

|

126,631

|

|

$52.60

|

|

126,631

|

|

3,793,648

|

| |

Total

|

282,728

|

|

$52.88

|

|

282,728

|

|

|

|

For the Years Ended April 30,

|

|

Dollars in millions (except per share data)

|

2017

|

2016

|

2015

|

2014

|

2013

|

|

Revenue

|

$1,718.5

|

$1,727.0

|

$1,822.4

|

$1,775.2

|

$1,760.8

|

|

Operating Income (a-c)

|

206.2

|

188.1

|

237.7

|

206.7

|

199.4

|

|

Net Income (a-d)

|

113.6

|

145.8

|

176.9

|

160.5

|

144.2

|

|

Working Capital (e)

|

(428.1)

|

(111.1)

|

(62.8)

|

60.1

|

(32.2)

|

|

Deferred Revenue in Working Capital (e)

|

(436.2)

|

(426.5)

|

(372.1)

|

(385.7)

|

(363.0)

|

|

Total Assets

|

2,606.2

|

2,921.1

|

3,004.2

|

3,077.4

|

2,806.4

|

|

Long-Term Debt

|

365.0

|

605.0

|

650.1

|

700.1

|

673.0

|

|

Shareholders’ Equity

|

1,003.1

|

1,037.1

|

1,055.0

|

1,182.2

|

988.4

|

|

Per Share Data

|

|

|

|

|

|

|

Earnings Per Share (a-c)

|

|

|

|

|

|

|

Diluted

|

$1.95

|

$2.48

|

$2.97

|

$2.70

|

$2.39

|

|

Basic

|

$1.98

|

$2.51

|

$3.01

|

$2.73

|

$2.43

|

|

Cash Dividends

|

|

|

|

|

|

|

Class A Common

|

$1.24

|

$1.20

|

$1.16

|

$1.00

|

$0.96

|

|

Class B Common

|

$1.24

|

$1.20

|

$1.16

|

$1.00

|

$0.96

|

|

a)

|

In fiscal years 2017, 2016, 2015, 2014 and 2013, the Company recorded restructuring charges of $13.4 million ($0.15 per share), $28.6 million ($0.32 per share), $28.8 million ($0.34 per share), $42.7 million ($0.48 per share) and $29.3 million ($0.33 per share), respectively, and related impairment charges in fiscal years 2014 and 2013 of $4.8 million ($0.06 per share) and $30.7 million ($0.35 per share), respectively.

|

|

b)

|

In fiscal year 2017, the Company recorded a one-time pension settlement of $8.8 million ($0.09 per share) for terminated vested employees who elected to receive lump sum payments of accumulated benefits.

|

|

c)

|

In fiscal year 2013, the Company recorded a gain, net of losses, on the sale of certain consumer publishing programs of $6.0 million ($0.04 per share).

|

|

d)

|

Certain tax benefits and charges included in fiscal year results are as follows:

|

|

·

|

Fiscal year 2017 includes an unfavorable tax settlement of $49.1 million ($0.85 per share) related to an unfavorable tax ruling in Germany.

|

|

·

|

Fiscal years 2017, 2016, 2014 and 2013, include tax benefits of $2.6 million ($0.04 per share), $5.9 million ($0.10 per share), $10.6 million ($0.18 per share) and $8.4 million ($0.14 per share), respectively, principally associated with consecutive tax legislation enacted in the United Kingdom that reduced the U.K. corporate income tax rates.

|

|

·

|

Fiscal year 2015 includes a non-recurring tax benefit of $3.1 million ($0.05 per share) related to tax deductions claimed on the write-up of certain foreign tax assets to fair market value.

|

|

e)

|

The primary driver of the negative working capital is unearned deferred revenue related to subscriptions for which cash has been collected in advance. Cash received in advance for subscriptions is used by the Company for a number of purposes including acquisitions; debt repayments; funding operations; dividend payments; and purchasing treasury shares. The deferred revenue will be recognized in income over the term of the subscription; when the related issue is shipped or made available online, or the service is rendered.

|

The Company is a global research and learning company. Through the Research segment, the Company provides scientific, technical, medical, and scholarly journals, as well as related content and services, to academic, corporate, and government libraries, learned societies, and individual researchers and other professionals. The Publishing segment provides scientific, professional, and education books and related content in print and digital formats, as well as test preparation services and course workflow tools, to libraries, corporations, students, professionals, and researchers. The Solutions segment provides online program management services for higher education institutions and learning, development, and assessment services for businesses and professionals. The Company’s operations are primarily located in the United States, Canada, United Kingdom, Germany, Singapore and Australia.

Business growth strategies include driving pricing and volume growth from existing journal and book brands and titles, as well as learning services related to education and professional development; the development of new journal titles or through publishing partnerships; technology and content acquisitions which complement the Company’s existing businesses; designing and implementing new methods of delivering products to our customers; and the development of new products and services.

Business Segments

Research:

Research’s mission is to support researchers, professionals and learners in the discovery and use of research knowledge to help them achieve their goals in research, learning and practice. Research provides scientific, technical, medical, and scholarly journals, as well as related content and services, to academic, corporate, and government libraries, learned societies, and individual researchers and other professionals. Journal publishing areas include the physical sciences and engineering, health sciences, social science and humanities and life sciences. Research also includes the Company’s recent acquisition of Atypon Systems, Inc. (“Atypon”), a publishing software and service provider that enables scholarly and professional societies and publishers to deliver, host, enhance, market and manage their content on the web. Research customers include academic, corporate, government, and public libraries; funders of research; researchers; scientists; clinicians; engineers and technologists; scholarly and professional societies; and students and professors. The Company’s Research products are sold and distributed globally in digital and print formats through multiple channels, including research libraries and library consortia, independent subscription agents, direct sales to professional society members and other customers. Publishing centers include Australia, China, Germany, India, the United Kingdom and the United States. Research accounted for approximately 50% of total Company revenue in fiscal year 2017.

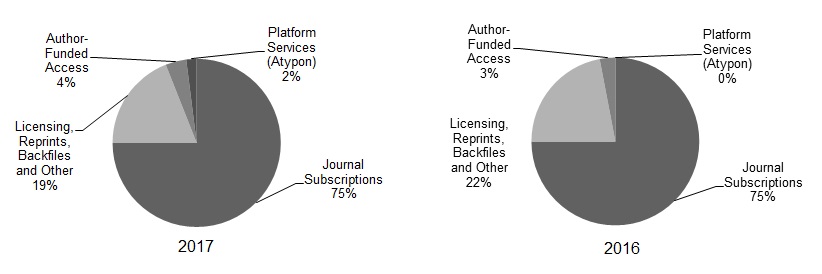

Research revenue by product type includes: Journal Subscriptions; Author-Funded Access; Licensing, Reprints, Backfiles, and Other; and Platform Services (Atypon). The graphs below present Research revenue by product type for fiscal years 2017 and 2016:

Key growth strategies for the Research business include evolving and developing new licensing models for the Company’s institutional customers; developing new open access products and revenue streams; focusing resources on high-growth and emerging markets; and developing new digital products, services and workflow solutions to meet the needs of researchers, authors, societies and corporate customers.

Journals Subscriptions

The Company publishes approximately 1,700 academic research journals. The Company sells journal subscriptions directly through Company sales representatives; indirectly through independent subscription agents; through promotional campaigns; and through memberships in professional societies for those journals that are sponsored by societies. Journal subscriptions, making up approximately 37% of the Company’s consolidated fiscal year 2017 revenue, are primarily licensed through contracts for digital content delivered through the Company’s online platform, Wiley Online Library. Contracts are negotiated by the Company directly with customers or their subscription agents. Licenses range from one to three years in duration and typically cover calendar years. Print journals are generally mailed to subscribers directly from independent printers. The Company does not own or manage printing facilities. Subscription revenue is generally collected in advance, and deferred until the Company has fulfilled its obligation to the customer at which time the revenue is earned.

Approximately 50% of Journal Subscription revenue is derived from publishing rights owned by the Company. Publishing alliances also play a major role in Research’s success. Approximately 50% of Journal Subscription revenue is derived from publication rights which are owned by professional societies and published by the Company pursuant to a long-term contract (generally 5-10 years) or owned jointly with a professional society. These society alliances bring mutual benefit, with the societies gaining Wiley’s publishing, marketing, sales and distribution expertise, while Wiley benefits from being affiliated with prestigious societies and their members. Societies that sponsor or own such journals generally receive a royalty and/or other financial consideration. The Company may procure editorial services from such societies on a pre-negotiated fee basis. The Company also enters into agreements with outside independent editors of journals that define the duties of the editors, and the fees and expenses for their services. Contributors of articles to the Company’s journal portfolio transfer publication rights to the Company or a professional society, as applicable. The Company publishes the journals of many prestigious societies, including the American Cancer Society, the American Heart Association, the British Journal of Surgery Society, the European Molecular Biology Organization, the American Anthropological Association, the American Geophysical Union and the German Chemical Society.

Wiley Online Library, the online publishing platform for the Company’s Research segment, delivers integrated access to over 7 million articles from 1,700 journals, as well as 19,000 online books and hundreds of multi-volume reference works, laboratory protocols and databases. Wiley Online Library provides the user with intuitive navigation, enhanced discoverability, expanded functionality and a range of personalization options. Access to abstracts is free; full content is accessible through licensing agreements or as individual article purchases. Large portions of the content are provided free or at nominal cost to nations in the developing world through partnerships with certain non-profit organizations. The Company has announced that it will be migrating from the Wiley Online Library platform to Atypon’s Literatum platform, which it acquired in fiscal year 2017. Literatum will replace Wiley Online Library starting in calendar year 2018. The Company’s online publishing platforms provide revenue growth opportunities through new applications and business models, online advertising, deeper market penetration and individual sales and pay-per-view options.

The Company transitioned from issue-based to time-based digital journal subscription agreements for calendar year 2016. Under this new model, the Company provides access to all journal content published within a calendar year and recognizes revenue on a straight-line basis over the calendar year. Under the Company’s previous licensing model, a customer subscribed to a discrete number of online journal issues and revenue was recognized as each issue was made available online. The Company made these changes to simplify the contracting and administration of digital journal subscriptions. The change shifted approximately $34 million of revenue from fiscal year 2016 to the remainder of calendar year 2016 (fiscal year 2017). The change had no impact on free cash flow.

Author-Funded Access

Under the Author-Funded Access business model, accepted research articles are published subject to payment of an APC. All Author-Funded Access articles are immediately free to access online. Contributors of Author-Funded Access articles retain many rights and typically license their work under terms that permit re-use.

Author-Funded Access offers authors choices in how to share and disseminate their work, and it serves the needs of researchers who may be required by their research funder to make articles freely accessible without embargo. APCs are typically paid by the individual author or by the author’s funder, and payments are often mediated by the author’s institution. The Company provides specific workflows and infrastructure to authors, funders and institutions to support the requirements of the Author-Funded Access model.

The Company offers two Author-Funded Access publishing models. The first of these is Hybrid Open Access where authors publishing in the majority of the Company’s paid subscription journals are offered, after article acceptance, the opportunity to make their individual research article openly available through the OnlineOpen service upon payment of an APC.

The second Author-Funded Access model offered by the Company is a growing portfolio of fully open access journals, also known as Gold Open Access Journals, in which all accepted articles are published subject to receipt of an APC. All Author-Funded Access articles are subject to the same rigorous peer-review process applied to the Company’s subscription based journals. As with the Company’s subscription portfolio, a number of the Gold Open Access Journals are published under contract for or in partnership with prestigious societies, including the American Geophysical Union, American Heart Association, the European Molecular Biology Organization and the British Ecological Society. The Author-Funded Access portfolio spans life, physical, medical and social sciences and includes a choice of high impact journals and broad scope titles that offer a responsive, author-centred service.

Licensing, Reprints, Backfiles, and Other

Licensing, Reprints, Backfiles, and Other includes advertising, backfile sales, the licensing of publishing rights, journal and article reprints, and individual article sales. The Company generates advertising revenue from print and online journal subscription products; its online publishing platform, Wiley Online Library; online events such as webinars and virtual conferences; community interest websites such as spectroscopyNOW.com and websites. A backfile license provides access to a historical collection of Wiley journals, generally for a one-time fee. The Company also engages with international publishers and receives licensing revenue from photocopies, reproductions, translations, and digital uses of its content. Journal and article reprints are primarily used by pharmaceutical companies and other industries for marketing and promotional purposes. Through the Article Select and PayPerView programs, the Company provides fee-based access to non-subscribed journal articles, content, book chapters and major reference work articles. The Company’s Research business is also a provider of content and services in evidence-based medicine (“EBM”). Through the Company’s alliance with The Cochrane Collaboration, the Company publishes The Cochrane Library, a premier source of high-quality independent evidence to inform healthcare decision-making. EBM facilitates the effective management of patients through clinical expertise informed by best practice evidence that is derived from medical literature.

Platform Services (Atypon)

On September 30, 2016, the Company acquired the net assets of Atypon Systems Inc. (“Atypon”), a Silicon Valley-based publishing-software company, for approximately $121 million in cash, net of cash acquired. Atypon’s Literatum publishing platform serves the scientific, technical, medical and scholarly industry, giving publishers and societies direct control over how their content is displayed, promoted and monetized on the web. Literatum hosts nearly 9,000 journals, 13 million journal articles (accounting for a third of the world’s English-language scholarly articles), and more than 1,800 publication web sites for over 1,500 societies and publishers. The Literatum platform will accelerate Wiley’s technology roadmap and replace Wiley Online Library starting in calendar year 2018. Atypon generated over $31 million in calendar year 2015 revenue.

Publishing:

The Company’s Publishing segment acquires, develops and publishes scientific, professional and education books and related content, as well as test preparation services and course workflow tools, to libraries, corporations, students, professionals and researchers. Communities served include business, finance, accounting, workplace learning, management, leadership, technology, behavioral health, engineering/ architecture, science and medicine, and education. Products are developed in print and digitally for worldwide distribution through multiple channels, including chain and online booksellers, libraries, colleges and universities, corporations, direct to consumer, websites, distributor networks and other online applications. Publishing centers include Australia, Germany, India, the United Kingdom and the United States. Publishing accounted for approximately 37% of total Company revenue in fiscal year 2017.

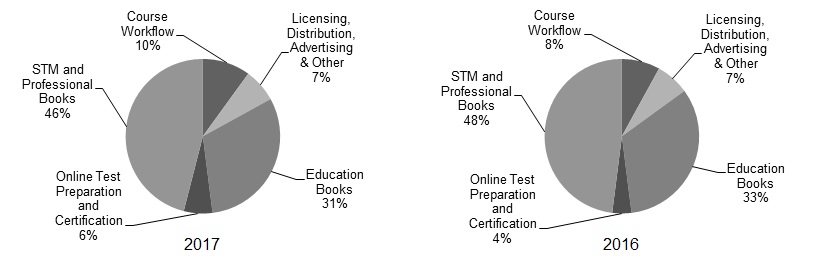

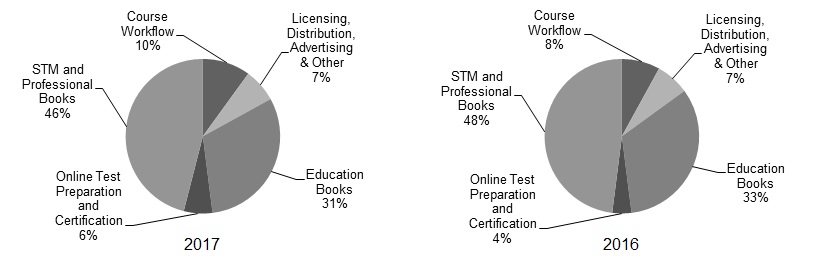

Publishing revenue by product type includes: STM and Professional Books; Education Books; Online Test Preparation and Certification; Course Workflow; and Licensing, Distribution, Advertising and Other. The graphs below present Publishing revenue by product type for fiscal years 2017 and 2016:

Key growth strategies for the Publishing business include developing and acquiring products and services to drive corporate development and professional career development; developing leading brands and franchises; executing strategic acquisitions and partnerships; and innovating digital book formats while expanding their global discoverability and distribution. The Company continues to implement strategies to manage declines in print revenue through cost improvement initiatives and focusing its efforts on growing its digital lines of business. The Company is performing portfolio reviews and workforce realignment, restructuring and operational excellence initiatives. In certain areas, the Company will explore new formats or promote digital only and in other areas the Company may rationalize its portfolio. The Company’s approach is to continue to realign its cost structure to help mitigate the revenue decline, sharpen its focus on high performing areas and digital opportunities, and improve operating efficiency.

Books

Book products accounted for approximately 28% of the Company’s consolidated fiscal year 2017 revenue. Categories include STM (Scientific, Technical, and Medical), Professional and Education Books.

STM books are sold and distributed globally in digital and print formats through multiple channels, including research libraries and library consortia, independent subscription agents, direct sales to professional society members, bookstores, online booksellers and other customers.

Professional books, which include business and finance, technology, and other professional categories, as well as the For Dummies brand, are sold to bookstores and online booksellers serving the general public; wholesalers who supply such bookstores; warehouse clubs; college bookstores; individual practitioners; industrial organizations, and government agencies. The Company employs sales representatives who call upon independent bookstores, national and regional chain bookstores and wholesalers. Sales of professional books also result from direct mail campaigns, telemarketing, online access, advertising and reviews in periodicals.

Education textbooks and related supplementary material and digital products are sold primarily to bookstores and online booksellers, serving both for-profit, nonprofit educational institutions (primarily colleges and universities) and direct-to-students. The Company employs sales representatives who call on faculty responsible for selecting books to be used in courses, and on the bookstores that serve such institutions and their students. The textbook business is seasonal, with the majority of textbook sales occurring during the June through August and November through January periods. There are active used and rental textbook markets, which adversely affect the sale of new textbooks.

Book sales are generally made on a returnable basis with certain restrictions. The Company provides for estimated future returns on sales made during the year based on historical return experience and current market trends.

Materials for book publications are obtained from authors throughout most of the world through the efforts of an editorial staff, outside editorial advisors, and advisory boards. Most materials are originated by the authors themselves or as a result of suggestion or solicitations by editors and advisors. The Company enters into agreements with authors that state the terms and conditions under which the materials will be published, the name in which the copyright will be registered, the basis for any royalties, and other matters. Most of the authors are compensated with royalties, which vary depending on the nature of the product. The Company may make advance payments against future royalties to authors of certain publications. Royalty advances are reviewed for recoverability and a reserve for loss is maintained, if appropriate.

The Company continues to add new titles, revise existing titles, and discontinue the sale of others in the normal course of its business, and also creates adaptations of original content for specific markets based on customer demand. The Company’s general practice is to revise its textbooks approximately every three years, if warranted, and to revise other titles as appropriate. Subscription-based products are updated on a more frequent basis.

The Company generally contracts with independent printers and binderies globally for their services. Management believes that adequate printing and binding facilities, sources of paper and other required materials are available to it, and that it is not dependent upon any single supplier.

In fiscal year 2016, the Company entered into an agreement to outsource its US-based book distribution operations to Cengage Learning, with the continued aim of improving efficiency in its distribution activities and to move to a more variable cost model. As of April 30, 2017, the Company has only one global warehousing and distribution facility remaining which is in the United Kingdom.

The Company develops content in a digital format that can be used for both digital and print products, resulting in productivity and efficiency savings, and enabling print-on-demand delivery. Book content is available online through Wiley Online Library, WileyPLUS, Wiley Custom Select and other proprietary platforms. Digital books are delivered to intermediaries including Amazon, Apple and Google, for re-sale to individuals in various industry-standard formats, which are now the preferred deliverable for licensees of all types, including foreign language publishers. Digital books are also licensed to libraries through aggregators. Specialized formats for digital textbooks go to distributors servicing the academic market, and digital book collections are sold by subscription through independent third-party aggregators servicing distinct communities. Custom deliverables are provided to corporations, institutions and associations to educate their employees, generate leads for their products, and extend their brands. Content from digital books is also used to create online articles, mobile apps, newsletters and promotional collateral. This continual re-use of content improves margins, speeds delivery and helps satisfy a wide range of customer needs. The Company’s online presence not only enables it to deliver content online, but also to sell more books. The growth of online booksellers benefits the Company because they provide unlimited virtual “shelf space” for the Company’s entire backlist.

Publishing alliances and franchise products are important to the Company’s strategy. Professional publishing alliance partners include Bloomberg Press, the American Institute of Architects, the Leader to Leader Institute, Fisher Investments, the CFA Institute, ACT (American College Test), Autodesk and many others. Education publishing alliance partners include Microsoft®, Blackboard, Canvas, Snapwiz and the Culinary Institute of America. The ability to join Wiley’s product development, sales, marketing, distribution and technology with a partner’s content, technology and/or brand name has contributed to the Company’s success.

The Company also promotes active and growing custom professional and education publishing programs. The Company’s custom professional publications are used by professional organizations for internal promotional or incentive programs and include digital and print books written specifically for a customer and customizations of existing publications to include custom cover art, such as imprints, messages and slogans. Of special note are customized For Dummies publications, which leverage the power of this well-known brand to meet the specific information needs of a wide range of organizations around the world. The Company’s custom education publishing program offers an array of tools and services designed to put the creation of customized content in instructors’ hands to create high-quality, affordable education solutions tailored to meet individual classroom needs. Through Wiley Custom Select, an online custom textbook system, instructors can easily build print and digital materials tailored to their specific course needs and add their own content to create a customized solution.

Course Workflow

The Company offers high-quality online learning solutions including WileyPLUS, a research-based, online environment for effective teaching and learning that is integrated with a complete digital textbook. WileyPLUS improves student learning through instant feedback, personalized learning plans, and self-evaluation tools as well as a full range of course-oriented activities, including online planning, presentations, study, homework and testing. In selected courses, WileyPLUS includes a personalized adaptive learning component, Orion, which is based on cognitive science. Orion helps to build student proficiency on topics while improving the effectiveness of their study time. It assists educators in identifying areas that need reinforcement and measures student engagement and proficiency throughout the course. WileyPLUS revenue is deferred and recognized over the timeframe that each student is enrolled in the online course.

Online Test Preparation and Certification

The Online Test Preparation business represents learning solutions and training activities that are delivered to customers directly through online digital delivery platforms. Products include CPAExcel, a modular, digital platform comprised of online self-study, videos, mobile apps, and sophisticated planning tools to help professionals prepare for the CPA exam, and test preparation products for the CFA®; CMA; CIA®; CMT®; FRN®; FINRA; Banking; and PMP® exams. Revenue for these products and services are deferred until the Company’s obligation has been performed, typically when an online training program has been completed or over the timeframe covered by a license to use the online training and study materials.

Licensing, Distribution, Advertising and Other

Marketing and distribution services are made available to other publishers under agency arrangements. The Company also engages in co-publishing titles with international publishers and receives licensing revenue from photocopies, reproductions, translations, and digital uses of its content. Wiley also realizes advertising revenue from branded websites (e.g. Dummies.com, etc.) and online applications.

Solutions: