UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☑

Filed by a Party other than the Registrant ☐

Check the appropriate box:

|

☐ |

Preliminary Proxy Statement |

|

☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

☑ |

Definitive Proxy Statement |

|

☐ |

Definitive Additional Materials |

|

☐ |

Soliciting Material Pursuant to §240.14a-12 |

GOLDEN ENTERTAINMENT, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

☑ |

No fee required. |

|

☐ |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

|

|

(1) |

Title of each class of securities to which transaction applies: |

|

|

(2) |

Aggregate number of securities to which transaction applies: |

|

|

(3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

|

|

(4) |

Proposed maximum aggregate value of transaction: |

|

|

(5) |

Total fee paid: |

|

☐ |

Fee paid previously with preliminary materials. |

|

☐ |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

Amount Previously Paid: |

|

|

(2) |

Form, Schedule or Registration Statement No.: |

|

|

(3) |

Filing Party: |

|

|

(4) |

Date Filed: |

6595 S. Jones Boulevard

Las Vegas, Nevada 89118

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

June 5, 2019

To the Shareholders of Golden Entertainment, Inc.:

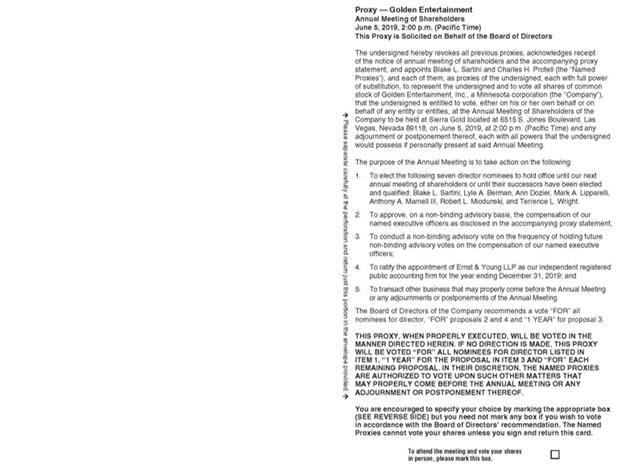

You are cordially invited to attend the 2019 annual meeting of shareholders of Golden Entertainment, Inc. (“Annual Meeting”) to be held at Sierra Gold located at 6515 S. Jones Boulevard, Las Vegas, Nevada 89118 at 2:00 p.m. Pacific Time on June 5, 2019, for the following purposes:

|

|

1. |

To elect the following seven director nominees to hold office until our next annual meeting of shareholders or until their successors have been elected and qualified: Blake L. Sartini, Lyle A. Berman, Ann Dozier, Mark A. Lipparelli, Anthony A. Marnell III, Robert L. Miodunski and Terrence L. Wright; |

|

|

2. |

To approve, on a non-binding advisory basis, the compensation of our named executive officers as disclosed in the accompanying proxy statement (the “Say on Pay Proposal”); |

|

|

3. |

To conduct a non-binding advisory vote on the frequency of holding future non-binding advisory votes on the compensation of our named executive officers (the “Say on Frequency Proposal”); |

|

|

4. |

To ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the year ending December 31, 2019; and |

|

|

5. |

To transact other business that may properly come before the Annual Meeting or any adjournments or postponements of the Annual Meeting. |

Only shareholders of record at the close of business on April 12, 2019, the record date, are entitled to receive notice of, and to vote at, the Annual Meeting or any adjournments or postponements of the Annual Meeting. Your vote is very important. Whether or not you expect to attend the Annual Meeting in person, please sign, date and return the enclosed proxy card as soon as possible to ensure that your shares are represented at the Annual Meeting. If your shares are held in “street name,” which means your shares are held of record by a broker, bank or other financial institution, you must provide your broker, bank or financial institution with instructions on how to vote your shares.

|

|

By Order of the Board of Directors |

|

|

|

|

|

|

|

|

Blake L. Sartini Chairman of the Board, President and Chief Executive Officer |

April 26, 2019

|

|

1 |

|

|

|

1 |

|

|

|

3 |

|

|

|

8 |

|

|

|

8 |

|

|

|

8 |

|

|

|

8 |

|

|

|

8 |

|

|

|

8 |

|

|

Ability of Shareholders to Communicate with our Board of Directors |

|

8 |

|

|

9 |

|

|

|

11 |

|

|

|

12 |

|

|

|

14 |

|

|

|

16 |

|

|

Security Ownership of Certain Beneficial Owners and Management |

|

16 |

|

|

17 |

|

|

|

18 |

|

|

|

18 |

|

|

|

28 |

|

|

|

29 |

|

|

|

31 |

|

|

|

32 |

|

|

|

33 |

|

|

|

34 |

|

|

|

34 |

|

|

|

34 |

|

|

|

36 |

|

|

|

36 |

|

|

|

37 |

|

|

|

39 |

|

|

Proposal 2—Non-binding Advisory Vote on Executive Compensation |

|

40 |

|

|

41 |

|

|

Proposal 4—Ratification of the Appointment of Independent Registered Public Accounting Firm |

|

42 |

|

|

43 |

|

|

|

43 |

|

|

|

43 |

|

|

|

44 |

|

|

|

45 |

|

|

|

45 |

|

|

|

45 |

|

|

|

47 |

|

|

|

47 |

|

|

|

47 |

|

|

|

48 |

|

|

|

48 |

GOLDEN ENTERTAINMENT, INC.

6595 S. Jones Boulevard

Las Vegas, Nevada 89118

Annual Meeting of Shareholders to be Held

June 5, 2019

This proxy statement is furnished in connection with the solicitation of proxies by the Board of Directors of Golden Entertainment, Inc. to be used at our 2018 annual meeting of shareholders (“Annual Meeting”) to be held at Sierra Gold located at 6515 S. Jones Boulevard, Las Vegas, Nevada 89118 at 2:00 p.m. Pacific Time on Tuesday, June 5, 2019, for the purposes set forth in the Notice of Annual Meeting of Shareholders. The approximate date on which this proxy statement and the accompanying proxy are first being furnished or sent to our shareholders of record entitled to vote at the Annual Meeting is on or about April 26, 2019. As used in this proxy statement, the terms “Golden” “we,” “us,” “our,” “ours” and the “Company” refer to Golden Entertainment, Inc. and its wholly owned subsidiaries.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS

FOR THE 2019 ANNUAL MEETING OF SHAREHOLDERS TO BE HELD ON JUNE 5, 2019:

The proxy materials for the Annual Meeting, including this proxy statement and our 2018 annual report to shareholders, are available over the internet at www.proxydocs.com/GDEN.

ABOUT THE ANNUAL MEETING AND VOTING

You are being sent this proxy statement and the enclosed proxy card because our Board of Directors is soliciting your proxy to vote at the Annual Meeting. This proxy statement summarizes the information you need to know to vote at the Annual Meeting. All shareholders who find it convenient to do so are cordially invited to attend the Annual Meeting in person. However, you do not need to attend the Annual Meeting to vote your shares. Instead, you may simply sign, date and return the enclosed proxy card so that it is received by 11:59 p.m. Eastern Time the day before the meeting date.

Only shareholders of record at the close of business on April 12, 2019 (the “Record Date” for the Annual Meeting) will be entitled to notice of, and to vote at, the Annual Meeting or any adjournments or postponements of the Annual Meeting. There were 27,742,627 shares of our common stock outstanding at the close of business on the Record Date, which is the only class of our capital stock outstanding and entitled to vote. Each share of our common stock is entitled to one vote upon each matter to be presented at the Annual Meeting.

If you are a beneficial owner of shares held by a broker, bank or other nominee, your shares are held in “street name” and the organization holding your shares is considered to be the shareholder of record for purposes of voting at the Annual Meeting. As the beneficial owner, you have the right to direct your broker, bank or other nominee regarding how to vote your shares. However, since you are not the shareholder of record, you may not vote in person at the Annual Meeting unless you bring to the Annual Meeting a legal proxy from the record holder of the shares (your broker, bank or other nominee) authorizing you to vote at the Annual Meeting.

You are entitled to attend the Annual Meeting or any adjournments or postponements thereof only if you were a Golden shareholder at the close of business on the Record Date or if you hold a valid proxy to vote at the meeting. You should be prepared to present photo identification to be admitted to the meeting.

1

A quorum is necessary for the transaction of business at the Annual Meeting. A quorum exists when holders of a majority of the total number of outstanding shares of our common stock entitled to vote at the Annual Meeting are present in person or represented by proxy.

In the election of directors, the seven nominees for director who receive the highest number of affirmative votes will be elected as directors. The ratification of the appointment of our independent registered public accounting firm requires the affirmative vote of the holders of a majority of the shares of common stock present in person or represented by proxy and entitled to vote at the Annual Meeting. The votes on the Say on Pay Proposal and the Say on Frequency Proposal are non-binding advisory votes. The Board of Directors will consider our executive compensation to have been approved by shareholders if the Say on Pay Proposal receives more votes “For” than “Against”. The Board of Directors will consider shareholders to have selected the Say on Frequency that receives the greatest number of votes.

At the Annual Meeting, the inspector of election appointed for the Annual Meeting will determine the presence of a quorum and tabulate the results of the voting by shareholders. The inspector of election will separately tabulate affirmative and negative votes, abstentions and broker non-votes.

Generally, a “broker non-vote” occurs when your shares are held by a broker, bank or other nominee and are not voted with respect to a particular proposal because the organization that holds your shares has discretionary voting power with respect to routine matters but cannot vote on non-routine matters. Only the proposal for the ratification of the appointment of Ernst & Young LLP, as our independent registered public accounting firm for the year ending December 31, 2019 will be considered a routine matter under applicable rules. Therefore, unless you provide voting instructions to the broker, bank or other nominee holding shares on your behalf, they will not have discretionary authority to vote your shares on any of the proposals described in this proxy statement other than the ratification of our independent registered public accounting firm. Broker non-votes will be counted for the purpose of determining whether a quorum is present, but will not be counted as shares entitled to vote and will therefore have no effect on the result of any vote. Please vote your proxy or provide voting instructions to the broker, bank or other nominee holding your shares so your vote on these matters will be counted.

Abstentions will be counted for the purpose of determining whether a quorum is present, but will not be counted as votes cast on any matter, and thus, for all proposals other than the election of directors, abstentions will have the same effect as a negative vote.

Our Board of Directors unanimously recommends that you vote “FOR” the election of all nominees for the Board of Directors named in this proxy statement, “FOR” the Say on Pay Proposal, “ONE YEAR” for the Say on Frequency Proposal and “FOR” the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for the year ending December 31, 2019.

Your vote is important. Whether or not you plan to attend the Annual Meeting in person, we urge you to sign, date and return the enclosed proxy card as soon as possible to ensure that your vote is recorded promptly. Returning the proxy card will not affect your right to attend the Annual Meeting or vote your shares in person. If you complete, sign and submit your proxy card, the persons named as proxies will vote your shares in accordance with your instructions. If you sign and submit a proxy card but do not fill out the voting instructions on the proxy card, your shares will be voted as recommended by our Board of Directors. If any other matters are properly presented for voting at the Annual Meeting, or any adjournments or postponements of the Annual Meeting, the proxy card will confer discretionary authority on the individuals named as proxies to vote your shares in accordance with their best judgment. As of the date of this proxy statement, we have not received notice of other matters that may properly be presented for voting at the Annual Meeting.

You may revoke your proxy at any time before your proxy is voted at the Annual Meeting by taking any of the following actions: (1) submitting another proxy card bearing a later date, (2) delivering written notice of revocation to our Secretary at our principal executive offices at Golden Entertainment, Inc., 6595 S. Jones Boulevard, Las Vegas, Nevada 89118, Attn: Secretary, or (3) attending the Annual Meeting and voting in person, although attendance at the Annual Meeting will not, by itself, revoke a proxy. If your shares are held in “street name,” you must contact your broker, bank or other nominee to revoke any prior instructions.

2

(Proposal One)

Our Board of Directors currently consists of seven directors. Timothy J. Cope and Neil I. Sell, who currently serve on our Board of Directors, will not be standing for re-election as directors at the Annual Meeting. Ann Dozier and Anthony A. Marnell III have been nominated by our Board of Directors for election as their replacements. In addition, existing directors Blake L. Sartini, Lyle A. Berman, Mark A. Lipparelli, Robert L. Miodunski and Terrence L. Wright have been nominated by our Board of Directors for re-election at the Annual Meeting. If elected, each nominee will hold office until the earliest of (a) our next annual meeting of shareholders, (b) the date his or her successor has been elected and qualified, or (c) his or her resignation, death or removal. All nominees have consented to be named and have indicated their intention to serve as members of our Board of Directors, if elected. In accordance with our Fifth Amended and Restated Bylaws, our Board of Directors has set the number of members constituting our Board of Directors at seven.

All of our nominees bring significant leadership, expertise and diverse backgrounds and perspectives to our Board of Directors as a result of their professional experience and service as executives and/or board members of other companies. The process undertaken by our Corporate Governance Committee in recommending director candidates is described below and under “Corporate Governance — Standing Committees — Corporate Governance Committee.”

The nomination by the Board of Directors of Mr. Marnell was made in accordance with an agreement to which Golden is a party regarding director nominations. In January 2019, we acquired two casino resort properties in Laughlin, Nevada, the Edgewater Hotel & Casino Resort and the Colorado Belle Hotel & Casino Resort, from Marnell Gaming, LLC (“Marnell”). In connection with the acquisition, we entered into a shareholders agreement with such assignees in which we agreed to nominate Mr. Marnell for election to the Board of Directors at our 2019 annual meeting. In addition, Messrs. Sartini, Lipparelli, Miodunski and Wright were previously nominated for election to the Board of Directors under a shareholders agreement entered into by Golden in connection with the Sartini Gaming, Inc. merger in July 2015. This shareholders agreement expired in August 2018.

3

Set forth below is biographical information for each person nominated as a director, including a description of certain experience, qualifications and skills that led our Corporate Governance Committee and our Board of Directors to determine that these individuals should serve as our directors.

|

Name and Age of Director |

|

Biographical Information |

|

Director Since |

|

|

|

|

|

|

|

Blake L. Sartini Age 60 |

|

Mr. Sartini joined Golden as Chairman of the Board, President and Chief Executive Officer in July 2015 in connection with the Sartini Gaming merger. Prior to the merger, Mr. Sartini served as the President and Chief Executive Officer of Sartini Gaming from its formation in January 2012, and as the founder and Chief Executive Officer of Golden Gaming, LLC (“Golden Gaming”), which he established in 2001. Prior to Golden Gaming, Mr. Sartini served in various management and executive positions with Stations Casinos, Inc. (“Station Casinos”) from 1985 to 2001, including as Executive Vice President and Chief Operating Officer upon the company’s public offering in 1993. Additionally, he served as a director of Station Casinos from 1993 until 2001. In 1986, Mr. Sartini founded Southwest Services, Inc. (the predecessor to Golden Gaming) and served as its President beginning in 1993. Before joining Station Casinos, he held key operational positions with the El Cortez Hotel and Casino, as well as the Barbary Coast Hotel and Casino. Mr. Sartini is a member of the University of Nevada, Las Vegas Foundation’s Board of Trustees and was appointed to the Nevada Gaming Policy Committee in March 2014 by Governor Sandoval. Mr. Sartini received a bachelor of science degree in business administration from the University of Nevada, Las Vegas. Mr. Sartini’s position as our Chairman, President and Chief Executive Officer, together with his deep knowledge of our business as a founder of Golden Gaming and his extensive executive management and industry experience gained over more than 30 years in the gaming industry, makes him a highly qualified and valuable member of our Board of Directors. |

|

2015 |

|

|

|

|

|

|

|

Lyle A. Berman Age 77 |

|

Mr. Berman previously served as our Chairman of the Board and Chief Executive Officer from our formation in December 1998 until the Sartini Gaming merger in July 2015, and as Chairman of the Board of Directors of Grand Casinos, Inc. (our predecessor) from October 1991 through December 1998. Mr. Berman also served as Chief Executive Officer and Chairman of the Board of Rainforest Café, Inc. from 1994 until December 2000. Mr. Berman served as the Executive Chairman of the Board of WPT Enterprises, Inc. (now known as Emerald Oil, Inc.) from its inception in February 2002 until July 2013. Mr. Berman also served as a director of PokerTek, Inc. from January 2005 until October 2014, including serving as Chairman of the Board from January 2005 until October 2011. Mr. Berman currently serves on the boards of directors of various private companies, including Augeo Affinity Marketing, Inc., Black Ridge Oil & Gas, Inc., Black Ridge Acquisition Corp., LubeZone, Inc., Mille City Ventures, Ltd, Poker52, LLC and Redstone American Grill, Inc. We believe Mr. Berman’s qualifications to sit on our Board of Directors include his over 30 years of experience in the casino industry, including serving as our Chairman and Chief Executive Officer between 1998 and July 2015, his extensive executive management experience, and his particular strengths in strategic operations and strategy, food and beverage, and retail sales. |

|

1998 |

4

|

Name and Age of Director |

|

Biographical Information |

|

Director Since |

|

|

|

|

|

|

|

Ann Dozier Age 51 |

|

Ms. Dozier currently serves as Senior Vice President, Chief Information Officer for Southern Glazer's Wine and Spirits, LLC, a wine and spirits distributor, a position she has held since July 2016, when Southern Wine and Spirits, LLC and Glazer's Beer and Beverage, LLC were merged. Prior to the merger, Ms. Dozier served as the Senior Vice President, Chief Information Officer of Southern Wine and Spirits, LLC since 2015. Ms. Dozier also has prior experience in both technical and commercial roles at The Coca-Cola Company, Inc., Coca-Cola Enterprises, Inc., Dean Foods and Colgate Palmolive. Mrs. Dozier has served on the board of iControl Holdings, LLC, a private technology company focused on delivering services and solutions that automate the retail value chain, since 2012. She also serves on several community boards and national councils including the Advisory Board of the University of Miami Business School's Management Science and Business Analytics program, the Advisory Board of A.T. Kearney's Women@Digital, the Consumer Goods Technology Executive Council, the Wall Street Journal CIO Council, and the Gartner Research Board. Mrs. Dozier received a bachelor of science degree in economics from the University of Georgia and attended the Harvard Business School's Executive Management Program. We believe Ms. Dozier’s qualifications to sit on our Board of Directors include her over 30 years of experience as an executive in the food and beverage industry, with particular strengths in operations, food and beverage, and retail sales. |

|

N/A |

|

|

|

|

|

|

|

Mark A. Lipparelli Age 53 |

|

Mr. Lipparelli currently serves as the Chief Executive Officer of Gioco Ventures, a strategic advisory and product development firm serving the gaming, investment, technology and entertainment industries around the globe, a position he has held since 2007. Mr. Lipparelli also formerly represented State Senate District 6 in the Nevada Legislature, having been appointed to the post in December 2014, and served on various Senate committees. Mr. Lipparelli has also been an appointee to the Nevada Gaming Policy Committee. Between 2002 and 2007, Mr. Lipparelli served in various executive management positions at Bally Technologies, Inc., a gaming technology supply company listed on the NYSE, including as Executive Vice President of Operations. Prior to joining Bally, Mr. Lipparelli served as Executive Vice President and then President of Shuffle Master, Inc., a publicly traded gaming supply company, from 2001 to 2003; as Chief Financial Officer of Camco, Inc., a retail chain holding company, from 2000 to 2001; as Senior Vice President of Entertainment Systems for Bally Gaming, Inc. (a subsidiary of publicly traded Alliance Gaming Corporation), from 1998 to 2000; and various management positions including Vice President of Finance for publicly traded Casino Data Systems from 1993 to 1998. Between 2009 and 2012, Mr. Lipparelli served as a Board Member and Chairman of the Nevada State Gaming Control Board. Mr. Lipparelli currently serves as Chairman of the Board of Galaxy Gaming, Inc. (GLXZ), a position he has held since July 2017. He is also a Board Trustee Emeritus of the University of Nevada Foundation, Board Member of the National Center for Responsible Gaming, and member of the International Association of Gaming Advisors and of the International Masters of Gaming Law. Mr. Lipparelli received a bachelor’s degree in finance (1987) and a master’s degree in economics (1993) from the University of Nevada, Reno. We believe Mr. Lipparelli’s qualifications to sit on our Board of Directors include his over 20 years of experience in the gaming industry (including serving as Chief Executive Officer of Gioco Ventures from 2007 until the present, and various executive management positions at Bally Technologies, Inc. between 2002 and 2007), his legislative experience with the State Senate and past roles with the Nevada State Gaming Control Board. |

|

2015 |

5

|

Name and Age of Director |

|

Biographical Information |

|

Director Since |

|

|

|

|

|

|

|

Anthony A. Marnell III Age 45 |

|

Mr. Marnell serves as the Chairman, Chief Executive Officer and Manager of Marnell Gaming, LLC, a company he founded in 2006, which owns and operates the Nugget Casino Resort in Sparks, Nevada and previously owned and operated the Edgewater Hotel & Casino Resort and the Colorado Belle Hotel & Casino Resort in Laughlin, Nevada prior to their acquisition by Golden in January 2019. He also serves as a Board member and Vice President of Global Strategies of Marnell Corrao Associates, a company that designs and develops hotel and casino resorts, positions he has held since 1997. Mr. Marnell previously developed M Resort Spa Casino, a locals-oriented casino property in Las Vegas, Nevada, serving as Chairman and Chief Executive Officer from 2006 to 2011, and (following the casino’s acquisition by Penn National Gaming, Inc.) as President of the casino property from 2011 to 2015. He also served as a strategy consultant to Penn National Gaming, Inc. from 2015 to 2016. Mr. Marnell served as Manager of MG Investors LLC, which operated the Saddle West Hotel Casino & RV Resort in Pahrump, Nevada, from 2005 to 2006, as Manager of Siren Gaming, LLC, a tribal gaming management company, from 2002 to 2005, as Founder, Chairman, President and Chief Executive Officer of TRIRIGA, Inc., a technology company from 2000 to 2011, as Vice President, VIP Marketing at Harrah’s Entertainment, Inc., a leading casino gaming company, from 1999 to 2000, and as Vice President, Corporate Marketing, at Rio Suite Hotel & Casino from 1996 to 1998. He is also Chairman of the Nevada State Athletic Commission, and previously served as a Board member of the Nevada State Board of Equalization from 2009 to 2013. He currently serves as a Board member of the Tuscany Research Institute and Henderson Boys and Girls Club, and served as a Board member for the Henderson Special Budget Ad Hoc Committee from 2013 to 2014. Mr. Marnell received a bachelor of science degree in hotel administration from the University of Nevada Las Vegas. We believe Mr. Marnell’s qualifications to sit on our Board of Directors include his over 20 years of experience in the casino industry, including extensive casino development and operational experience in each of the Nevada markets in which we own resort casino properties, and his particular strengths in casino development, operations and marketing. |

|

N/A |

|

|

|

|

|

|

6

In the election of directors, the seven nominees for director who receive the highest number of affirmative votes will be elected as directors. Shares represented by executed proxies will be voted, if authority to do so is not withheld, for the election of the seven nominees named above. In the event that any nominee should be unavailable for election as a result of an unexpected occurrence, such shares will be voted for the election of such substitute nominee as our Board of Directors may propose.

The Board of Directors recommends that you vote “FOR” the election of all nominees for

the Board of Directors named above.

7

Our Board of Directors is currently comprised of seven members and has the following three standing committees: the Audit Committee, the Compensation Committee and the Corporate Governance Committee. The membership and functions of each standing committee are described below. Each standing committee operates under a written charter which, along with our Code of Business Conduct and Ethics, can be found on the Governance section of our website at https://goldenent.com/governance.html. The information on our website is not part of this proxy statement or any other report or registration statement that we furnish to or file with Securities and Exchange Commission (the “SEC”). In addition, the Board of Directors has formed a Compliance Committee, the membership and functions of which are described below.

During the year ended December 31, 2018, our Board of Directors held six meetings, including telephonic meetings. During this period, all of the directors attended or participated in at least 75% of the aggregate of the total number of meetings of the Board and the total number of meetings held by all committees of the Board on which each such director served. The independent directors met without management present at each of the regular quarterly meetings of the Board of Directors in 2018.

Director Attendance at Annual Meetings of Shareholders

Although we do not have a formal policy regarding attendance by members of our Board of Directors at our annual meetings of shareholders, we encourage our Board members to attend such meetings. All of our directors attended last year’s annual meeting of shareholders held on June 5, 2018.

Our Board of Directors affirmatively determined that each nominee for election to our Board of Directors is an independent director, as defined by the Nasdaq Stock Market listing standards, other than Messrs. Sartini and Berman. Mr. Sartini is not considered independent because he is employed by Golden as our President and Chief Executive Officer. Mr. Berman is not considered independent because he received more than $120,000 in compensation from the Company during a twelve-month period within the past three years.

Blake L. Sartini, our President and Chief Executive Officer, also serves as the Chairman of our Board of Directors. Our Board of Directors has considered this leadership structure and believes it currently provides the most efficient and effective leadership model for Golden by enhancing both the Chairman’s and the President and Chief Executive Officer’s ability to provide clear insight and direction of business strategies and plans to both our Board of Directors and management. Our Board of Directors believes that a single person, acting in the capacities of Chairman as well as President and Chief Executive Officer, promotes unity of vision and leadership, which allows for a single, clear focus for management to execute the Company’s business strategies and plans. Our Board of Directors has not appointed a lead independent director.

Ability of Shareholders to Communicate with our Board of Directors

We have established several means for shareholders and others to communicate with our Board of Directors. If a shareholder has a concern regarding our financial statements, accounting practices or internal controls, the concern should be submitted in writing to the Chair of the Audit Committee in care of our Secretary at our corporate office address. If the concern relates to our governance practices, business ethics or corporate conduct, the concern should be submitted in writing to a member of the Corporate Governance Committee in care of our Secretary at our corporate office address. If a shareholder is unsure as to which category the concern relates, the shareholder may communicate it to any one of the independent directors in care of our Secretary at our corporate office address. All such shareholder communications will be forwarded to the applicable director(s), unless such communications are considered, in the reasonable judgment of our Secretary, to be improper for submission to the

8

intended recipient(s). Examples of shareholder communications that would be considered improper for submission include, without limitation, customer complaints, solicitations, communications that do not relate directly or indirectly to Golden or its business, or communications that relate to improper or irrelevant topics. Any such improper communication will be made available to any non-employee director upon request.

Our Board of Directors has an Audit Committee, a Compensation Committee and a Corporate Governance Committee.

Audit Committee

Our Audit Committee currently consists of Mr. Lipparelli (Chair), Mr. Sell and Mr. Wright. Mr. Sell will stand down as a member of the Audit Committee at the Annual Meeting. Each current and proposed member of the Audit Committee is an independent director, as defined by the Nasdaq Stock Market listing standards, and meets the independence criteria of Rule 10A-3 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Our Board of Directors has determined that Mr. Lipparelli qualifies as an “audit committee financial expert,” as that term is defined in the rules and regulations established by the SEC.

The Audit Committee operates under an amended and restated written charter adopted by the Board of Directors. The primary duties and responsibilities of the Audit Committee are to (1) serve as an independent and objective party to monitor our financial reporting process and internal control system, (2) review and appraise the audit performed by our independent auditors, who report directly to the Committee, and (3) provide an open avenue of communication among the independent auditors, financial and senior management and the Board of Directors. The charter also requires the Audit Committee (or designated members of the Audit Committee) to review and pre-approve the annual engagement letter and the performance of all audit and non-audit accounting services to be performed by our independent registered public accounting firm (independent auditors), other than certain de minimis exceptions permitted by Section 202 of the Sarbanes-Oxley Act of 2002. The Audit Committee also reviews the independence of our independent auditors and is directly responsible for the appointment, compensation, retention and oversight of our independent registered public accounting firm. The responsibilities and activities of the Audit Committee are described in greater detail in the report included in this proxy statement under the caption “Report of the Audit Committee.”

The Audit Committee held eight meetings during the year ended December 31, 2018. The Audit Committee also held executive sessions on several occasions during the year with company management not present.

Compensation Committee

Our Compensation Committee currently consists of Mr. Miodunski (Chair), Mr. Lipparelli and Mr. Sell. Mr. Sell will stand down as a member of the Compensation Committee at the Annual Meeting. Each current and proposed member of the Compensation Committee is an independent director, as defined by the Nasdaq Stock Market listing standards. All members of our Compensation Committee are also “non-employee directors” as defined by Rule 16b-3 under the Exchange Act.

The Compensation Committee operates under a written amended and restated charter adopted by the Board of Directors. The Compensation Committee is responsible for reviewing periodically our compensation plans, philosophy and programs, and overseeing the evaluation and compensation of our executive officers. The Compensation Committee also administers our incentive compensation plans, including our 2015 Incentive Award Plan (the “2015 Plan”). Under the Compensation Committee charter, our Chief Executive Officer has been delegated the authority to grant awards under the Company’s equity compensation plans to persons who are employees of the Company at or below the senior vice president level who are not serving as executive officers of the Company nor deemed to be a “named executive officer” of the Company within the meaning of SEC rules and regulations, provided that no such grant for any one individual may exceed 10,000 shares and all such grants after April 1, 2018 may not exceed 100,000 shares in the aggregate, in each case without the prior approval of the Compensation Committee. Under the 2015 Plan, the Compensation Committee may delegate its duties and responsibilities to subcommittees of our directors and/or officers for awards to certain non-executive employees,

9

subject to certain limitations that may be imposed under applicable law or regulation, including Section 16 of the Exchange Act, and/or stock exchange rules, as applicable.

The Compensation Committee has the authority, to the extent it deems necessary or appropriate, to retain a compensation consultant to assist in the evaluation of executive officer compensation. The Compensation Committee also has the sole authority to approve the consultant’s fees and other retention terms. The Compensation Committee also has the authority, to the extent it deems necessary or appropriate, to retain other advisors. Golden will provide appropriate funding, as determined by the Compensation Committee, for payment of compensation to any consulting firm or other advisors hired by the Compensation Committee.

The Compensation Committee held ten meetings during the year ended December 31, 2018. Our President and Chief Executive Officer does not participate in deliberations concerning, and was not present for the vote on, his compensation arrangements. Additional information regarding the Compensation Committee’s processes and procedures for establishing and overseeing executive compensation is disclosed under the heading “Executive Compensation — Compensation Discussion and Analysis.”

Corporate Governance Committee

Our Corporate Governance Committee currently consists of Mr. Wright (Chair), Mr. Miodunski and Mr. Sell. Mr. Sell will stand down as a member of the Corporate Governance Committee at the Annual Meeting. Each current and proposed member of the Corporate Governance Committee is an independent director, as defined by the Nasdaq Stock Market listing standards.

The Corporate Governance Committee operates under a written amended and restated charter adopted by the Board of Directors. The primary role of the Corporate Governance Committee is to (1) review and periodically reassess the overall corporate governance guidelines and policies for Golden, (2) consider and make recommendations to the full Board of Directors concerning the appropriate size, organization, function and needs of the Board of Directors, including establishing criteria for Board of Directors membership and considering, recruiting and recommending candidates (including those recommended by shareholders) to fill new Board of Directors positions, and (3) annually recommending a slate of nominees to the Board of Directors to be considered for election or re-election at the Company’s annual meeting of shareholders.

The Corporate Governance Committee will review director candidates and present qualified candidates to the full Board of Directors for nomination. Qualified candidates will be considered without regard to race, color, religion, gender, ancestry, national origin or disability. The Corporate Governance Committee will consider each candidate’s general business and industry experience, his or her ability to act on behalf of shareholders, potential concerns regarding independence or conflicts of interest and other factors relevant in evaluating Board of Directors nominees. Additionally, the Board of Directors will consider whether or not the candidate would be found suitable to be issued a gaming license. This is a requirement of continued Board of Directors membership. If the Corporate Governance Committee approves a new candidate for further review following an initial screening, the Corporate Governance Committee will establish an interview process for the candidate. Generally, the candidate will meet with the members of the Corporate Governance Committee, along with our President and Chief Executive Officer. Contemporaneously with the interview process, the Corporate Governance Committee will conduct a comprehensive conflicts-of-interest assessment of the new candidate. The Corporate Governance Committee will consider reports of the interviews and the conflicts-of-interest assessment to determine whether to recommend the candidate to the full Board of Directors. The Corporate Governance Committee will also take into consideration the candidate’s personal attributes, including, without limitation, personal integrity, loyalty to us and concern for our success and welfare, willingness to apply sound and independent business judgment, awareness of a director’s vital part in good corporate citizenship and image, time available for meetings and consultation on company matters, and willingness to assume fiduciary responsibility.

Recommendations for candidates to be considered for election to the Board of Directors at our annual shareholder meetings may be submitted to the Corporate Governance Committee by our shareholders. Candidates recommended by our shareholders will be considered under the same standards as candidates that are identified by the Corporate Governance Committee. In order to make such a recommendation, a shareholder must submit the recommendation in writing to the Corporate Governance Committee, in care of our Secretary at our corporate office address, at least 120 days prior to the mailing date of the previous year’s Annual Meeting

10

proxy statement. To enable the Committee to evaluate the candidate’s qualifications, shareholder recommendations must include the following information:

|

|

• |

The name and address of the nominating shareholder and of the director candidate; |

|

|

• |

A representation that the nominating shareholder is a holder of record of our common stock and entitled to vote at the current year’s Annual Meeting; |

|

|

• |

A description of any arrangements or understandings between the nominating shareholder and the director candidate or candidates being recommended pursuant to which the nomination or nominations are to be made by the shareholder; |

|

|

• |

A resume or biographical information detailing the educational, professional and other information necessary to determine if the nominee is qualified to hold a Board of Directors position; |

|

|

• |

Such other information regarding each nominee proposed by such shareholder as would have been required to be included in a proxy statement filed pursuant to the proxy rules of the SEC had such nominee been nominated by the Board of Directors; and |

|

|

• |

The consent of each nominee to serve as a director if so elected. |

The Corporate Governance Committee held four meetings during the year ended December 31, 2018.

Compliance Committee

Our Compliance Committee currently consists of: Mr. Lipparelli (Chair), Mr. Cope and Mr. Wright (each of whom is a director of the Golden); Sean T. Higgins, our Executive Vice President of Compliance and Government Affairs and Chief Legal Officer; and Mr. Tom Jingoli, a gaming industry executive who is an independent, non-employee member of our Compliance Committee. Mr. Cope will stand down as a member of the Compliance Committee at the Annual Meeting.

The Compliance Committee was formed by the Board of Directors and operates under a written charter adopted by the Board of Directors. Previously, our compliance committee was an administrative committee established and operated by our management in accordance with applicable gaming laws. The primary purpose of the Compliance Committee is to oversee the proper implementation of our Gaming Compliance and Reporting Plan (the “Compliance Plan”) that is required by our order of registration with the Nevada Gaming Commission. Among other things, the role of the Compliance Committee is to: (1) ensure the effective implementation of the Compliance Plan; (2) review and reassess periodically the adequacy of the Compliance Plan and the applicable reporting system utilized by our corporate compliance officer, and recommend any changes as deemed appropriate; (3) identify and bring to the attention of the Board of Directors current and emerging corporate gaming and regulatory compliance trends and issues that may affect our business operations, performance, public image or compliance with applicable local, state and federal laws; (4) provide oversight and periodic review of our regulatory compliance policies, programs and systems; and (5) generally make recommendations to the Board of Directors on gaming and regulatory compliance matters.

The Compliance Committee held four meetings during the year ended December 31, 2018.

Board of Directors’ Role in Risk Oversight

Our Board of Directors has an active role, as a whole and at the committee level, in overseeing management of our exposure to risk. The Board of Directors is regularly updated regarding risks that we face, including those that may impact our financial and operational performance, our credit and liquidity profile and other elements of our strategic plans. The Audit Committee assists our Board of Directors in this function and is charged with oversight of our policies regarding risk assessment and management, including our policies regarding management of financial risk exposure and review of related party transactions. Our other standing committees also have responsibilities with respect to risk oversight. The Compensation Committee is responsible for overseeing the management of risks relating to executive compensation plans and arrangements. The Corporate Governance Committee manages risks associated with the independence of the Board, including considering whether any director nominees have relationships or potential conflicts of interest that could affect their independence. While each committee is responsible for evaluating certain risks and overseeing the management of such risks, the entire Board of Directors is informed of risks we face through reports from our committees and management.

11

Mr. Sartini is not paid any fees or other compensation for services as a member of our Board of Directors.

Under our non-employee director compensation program in place during 2018 prior to June 5, 2018, non-employee members of our Board of Directors received an annual cash retainer of $55,000 for their service on our Board of Directors, payable in arrears in quarterly installments. Members of the Audit Committee, Compensation Committee, Corporate Governance Committee and Compliance Committee of our Board of Directors received additional annual cash retainers for such service in the following amounts, also payable in arrears in quarterly installments: $20,000 for the Chairman of the Audit Committee, $10,000 for each other member of the Audit Committee, $16,000 for the Chairman of the Compensation Committee, $8,000 for each other member of the Compensation Committee, $8,000 for the Chairman of the Corporate Governance Committee, $4,000 for each other member of the Corporate Governance Committee, and $8,000 for each member of the Compliance Committee. In addition, under our prior non-employee director compensation program, non-employee members of our Board of Directors were entitled to receive an initial stock option award under the 2015 Plan of options to purchase 30,000 shares of the Company’s common stock upon their initial election or appointment to our Board of Directors and an annual stock option award under the 2015 Plan of options to purchase 20,000 shares of the Company’s common stock on the date of each annual meeting of shareholders (which annual award was prorated for the first year if a non-employee director’s initial election or appointment did not occur at an annual meeting), in each case with an exercise price equal to the fair market value of the Company’s common stock on the date of grant. Each such stock option has a ten-year term. Each initial stock option award vests in substantially equal installments on each of the first three anniversaries of the grant date, and each subsequent stock option award vests in full on the first anniversary of the grant date. All such stock option awards vest in full in the event of a “Change in Control” (as defined in the 2015 Plan) or the director’s termination of service due to death or disability.

With assistance from the Compensation Committee of the Board of Directors and its independent compensation consultant, the Board of Directors evaluated the competitiveness of our non-employee director compensation program in early 2018 and made adjustments to the program, including substituting awards of time-based restricted stock units ("RSUs") for some or all of the future awards of stock options that had been contemplated by the program. Under the amended non-employee director compensation program adopted by the Board of Directors on June 5, 2018, non-employee members of our Board of Directors receive an annual cash retainer of $60,000 for their service on our Board of Directors, payable in arrears in quarterly installments. Members of the Audit Committee, Compensation Committee, Corporate Governance Committee and Compliance Committee of our Board of Directors received additional annual cash retainers for such service in the following amounts, also payable in arrears in quarterly installments: $25,000 for the Chairman of the Audit Committee, $12,500 for each other member of the Audit Committee, $20,000 for the Chairman of the Compensation Committee, $10,000 for each other member of the Compensation Committee, $15,000 for the Chairman of the Corporate Governance Committee, $7,500 for each other member of the Corporate Governance Committee, $20,000 for the Chairman of the Compliance Committee, and $10,000 for each other member of the Compliance Committee. In addition, commencing with the 2018 annual meeting, non-employee members of our Board of Directors receive an annual RSU award under the 2015 Plan of such number of units as is equal to $162,500 divided by the 20-day trailing average closing price of our common stock for the 20-calendar day period preceding the date of grant. Each annual award vests in full on the first anniversary of the grant date. All such awards vest in full in the event of a “Change in Control” (as defined in the 2015 Plan) or the director’s termination of service due to death or disability.

Also, in March 2018, the Board of Directors adopted Stock Ownership Guidelines applicable to our non-employee directors. Under the Stock Ownership Guidelines, non-employee directors are expected to own Golden common stock with a market value equal to five times the value of the non-employee director’s annual cash retainer (excluding any annual cash retainer for committee membership or chairmanship), which is currently $60,000 per year, for as long as he or she remains a non-employee director. Under the Stock Ownership Guidelines, applicable ownership of common stock includes: shares held of record or beneficially by the non-employee director, by his or her spouse, or by trusts for the benefit of the non-employee director, his or her spouse, or members of his or her immediate family; shares held in a 401(k) or deferred compensation plan for the benefit of the non-employee director; the after-tax value of RSUs held by the non-employee director,

12

whether vested or unvested; the after-tax value of “earned” performance-based shares or performance-based restricted stock units (“PSUs”) held by the non-employee director, whether or vested or unvested; and the after-tax value of vested, in-the-money stock options held by the non-employee director. Each non-employee director is expected to meet the requirements set forth in the Stock Ownership Guidelines by the fifth anniversary of his or her first appointment or election as a non-employee director.

Director Compensation During 2018

The following table sets forth a summary of the compensation paid to our non-employee directors pursuant to the Company’s compensation policies for the year ended December 31, 2018.

|

|

|

Fees |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Earned |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

or Paid in |

|

|

Stock |

|

|

All Other |

|

|

|

|

|

|||

|

|

|

Cash |

|

|

Awards |

|

|

Compensation |

|

|

Total |

|

||||

|

Name |

|

($) |

|

|

($)(1) |

|

|

($)(2) |

|

|

($) |

|

||||

|

Lyle A. Berman |

|

|

57,500 |

|

|

|

171,302 |

|

|

|

131,017 |

|

|

|

359,819 |

|

|

Timothy J. Cope |

|

|

73,833 |

|

|

|

171,302 |

|

|

|

— |

|

|

|

245,135 |

|

|

Mark A. Lipparelli |

|

|

99,976 |

|

|

|

171,302 |

|

|

|

— |

|

|

|

271,278 |

|

|

Robert L. Miodunski |

|

|

81,250 |

|

|

|

171,302 |

|

|

|

— |

|

|

|

252,552 |

|

|

Neil I. Sell |

|

|

87,360 |

|

|

|

171,302 |

|

|

|

— |

|

|

|

258,662 |

|

|

Terrence L. Wright |

|

|

90,446 |

|

|

|

171,302 |

|

|

|

— |

|

|

|

261,748 |

|

|

(1) |

Represents full grant date fair value of the awards granted to the non-employee directors in 2018 under Accounting Standards Codification Topic 718. The full grant date fair value is the amount Golden will expense over the awards’ vesting period. The amounts do not reflect the actual amounts that may be realized by the non-employee directors. A discussion of the assumptions used in calculating the stock option award amounts may be found in note 9 to the audited financial statements in our Annual Report on Form 10-K for the year ended December 31, 2018. As of December 31, 2018, our non-employee directors held the following outstanding stock options and RSUs: Mr. Berman, 50,000 stock options and 5,452 RSUs; Mr. Cope, 120,000 stock options and 5,452 RSUs; Mr. Lipparelli, 49,474 stock options and 5,452 RSUs; Mr. Miodunski, 50,000 stock options and 5,452 RSUs; Mr. Sell, 68,265 stock options and 5,452 RSUs; and Mr. Wright, 50,000 stock options and 5,452 RSUs. |

|

(2) |

Amounts shown include consulting fees paid to Mr. Berman of $116,669. In connection with the Sartini Gaming merger, Mr. Berman entered into a three-year consulting agreement with Golden which expired on July 31, 2018 that paid his wholly owned consulting firm, Berman Consulting Corporation, $200,000 annually, plus reimbursements for certain health insurance, administrative assistant and office costs. |

13

Biographical information for the executive officers of Golden as of the date of this proxy statement (other than our Chairman of the Board, President and Chief Executive Officer, Blake L. Sartini, whose biographical information is provided above under “Election of Directors”) is set forth below. Executive officers serve at the discretion of our Board of Directors and until their successors have been duly elected and qualified, unless sooner removed by our Board of Directors. There are no family relationships between our directors and executive officers, other than Blake L. Sartini, II, our Senior Vice President of Distributed Gaming, who is the son of Blake L. Sartini.

Executive Officers:

|

Name |

|

Age |

|

Position |

|

Blake L. Sartini |

|

60 |

|

Chairman of the Board, President and Chief Executive Officer |

|

Stephen A. Arcana |

|

54 |

|

Executive Vice President and Chief Operating Officer |

|

Charles H. Protell |

|

44 |

|

Executive Vice President, Chief Strategy Officer and Chief Financial Officer |

|

Thomas E. Haas |

|

58 |

|

Senior Vice President of Accounting |

|

Sean T. Higgins |

|

55 |

|

Executive Vice President of Compliance and Government Affairs and Chief Legal Officer |

|

Blake L. Sartini, II |

|

33 |

|

Senior Vice President of Distributed Gaming |

Stephen A. Arcana joined Golden as Executive Vice President and Chief Operating Officer in July 2015 in connection with the Sartini Gaming merger. Prior to the merger, Mr. Arcana served as the chief operating officer for Golden Gaming from August 2003 to July 2015. From November 1995 to March 2003, Mr. Arcana held several executive positions with Station Casinos, LLC. Prior to joining Station Casinos, LLC, Mr. Arcana held a variety of hotel operations and food and beverage positions over a ten-year period with the Sands Hotel in Atlantic City, New Jersey. Mr. Arcana received a bachelor of science degree in hotel and restaurant management from Widener University School of Hotel and Restaurant Management in Chester, Pennsylvania.

Charles H. Protell joined Golden as Executive Vice President, Chief Strategy Officer and Chief Financial Officer in November 2016. Prior to joining Golden, Mr. Protell served as managing director at Macquarie Capital’s investment banking group since May 2011, and as co-founder and a managing director at REGAL Capital Advisors from January 2009 until its acquisition by Macquarie Capital in May 2011. Prior to co-founding REGAL Capital Advisors, Mr. Protell held various investment banking roles at Credit Suisse, Deutsche Bank and CIBC World Markets. Mr. Protell received a bachelor of science degree in commerce from the University of Virginia.

Thomas E. Haas joined Golden in October 2017 in connection with the acquisition of American Casino & Entertainment Properties LLC (“American”) and was appointed as Senior Vice President of Accounting in March 2018. Mr. Haas had served as senior vice president of finance and principal accounting officer of American since August 2015, and continued to serve in that role following the American acquisition until his promotion to Senior Vice President of Accounting of Golden. Mr. Haas joined American in April 2004 as the director of compliance and was promoted to vice president finance in August 2006. Prior to joining American, Mr. Haas held financial and accounting management positions with Mikohn Gaming, Inc. and GES Exposition Services. Mr. Haas started his career with Deloitte & Touche. Mr. Haas earned a BSBA in accounting and finance from the University of Arizona.

Sean T. Higgins joined Golden as Senior Vice President of Government Affairs and Business Development in March 2016 and was promoted to Executive Vice President of Governmental Affairs and Business Development and Chief Legal Officer in October 2016. Mr. Higgins currently serves as our Executive Vice President of Compliance and Government Affairs and Chief Legal Officer. Prior to joining Golden, Mr. Higgins served as principal of STH Strategies, a firm he founded in early 2015. From August 2011 to January 2015, Mr. Higgins was managing principal of Porter Gordon Silver Communications, a full-service government affairs and business strategic consulting firm. From July 2010 to January 2015, Mr. Higgins was a partner in the law firm of Gordon Silver. Prior to that, Mr. Higgins spent 17 years as general counsel and head of government

14

affairs for a multijurisdictional gaming company. Mr. Higgins received his law degree from Santa Clara University School of Law and his undergraduate degree in business administration from Southern Methodist University. He is licensed to practice law in the state of Nevada.

Blake L. Sartini II joined Golden as Senior Vice President of Distributed Gaming in July 2015 in connection with the Sartini Gaming merger. In his current position, he oversees all distributed gaming operations in Nevada and Montana, as well as the Nevada tavern locations operating under the brand names PT’s, Sierra Gold, SG Bar and Sean Patrick’s. From January 2010 until the merger, Mr. Sartini II served in various roles with Sartini Gaming, including as Vice President of Operations for Golden Route Operations, LLC (“GRO”), a subsidiary of Sartini Gaming, from September 2014, as assistant director for GRO from January 2012 to September 2014, and as a marketing manager from January 2010 to January 2012. Prior to joining Sartini Gaming, Mr. Sartini II served as senior business associate with the Ultimate Fighting Championship for its international event operations and talent relations in the United Kingdom. Mr. Sartini II received a bachelor of science degree in business administration from Chapman University in Orange, California.

15

Security Ownership of Certain Beneficial Owners and Management

The following table contains information about the beneficial ownership of our common stock as of April 1, 2019 for (i) each shareholder known by us to beneficially own more than 5% of our common stock, (ii) each of our current directors, (iii) each of our named executive officers and (iv) all of our directors and executive officers as a group. The percentage of ownership indicated in the following table is based on 27,742,627 shares of our common stock outstanding on April 1, 2019.

Information with respect to beneficial ownership has been furnished by each director and executive officer, and with respect to beneficial owners of more than 5% of our common stock, by Schedules 13D and 13G filed with the SEC by them. Beneficial ownership is determined in accordance with the rules of the SEC. Except as indicated by footnote and subject to community property laws where applicable, to our knowledge, the persons named in the table below have sole voting and investment power with respect to all shares of common stock shown as beneficially owned by them. In computing the number of shares beneficially owned by a person and the percentage ownership of that person, shares of common stock subject to options or warrants held by that person that are currently exercisable or will become exercisable within 60 days after April 1, 2019 are deemed outstanding, as well as any shares of common stock that such person has the right to acquire upon the vesting of restricted stock units within 60 days after April 1, 2019, while such shares are not deemed outstanding for purposes of computing the percentage ownership of any other person. Except as otherwise indicated, the mailing address of each shareholder is c/o Golden Entertainment, Inc., 6595 S. Jones Boulevard, Las Vegas, Nevada 89118.

|

Directors and Executive Officers |

|

Number of Shares |

|

|

Percentage |

|

||

|

Blake L. Sartini(1) |

|

|

7,006,288 |

|

|

|

24.6 |

% |

|

Lyle A. Berman(2) |

|

|

1,311,124 |

|

|

|

4.7 |

% |

|

Timothy J. Cope(3) |

|

|

183,820 |

|

|

* |

|

|

|

Mark A. Lipparelli(4) |

|

|

49,474 |

|

|

* |

|

|

|

Robert L. Miodunski(5) |

|

|

50,000 |

|

|

* |

|

|

|

Neil I. Sell(6) |

|

|

438,729 |

|

|

|

1.6 |

% |

|

Terrence L. Wright(7) |

|

|

50,000 |

|

|

* |

|

|

|

Stephen A. Arcana(8) |

|

|

311,350 |

|

|

1.1% |

|

|

|

Charles H. Protell(9) |

|

|

299,475 |

|

|

1.1% |

|

|

|

Sean T. Higgins(10) |

|

|

144,600 |

|

|

* |

|

|

|

Blake L. Sartini, II(11) |

|

|

944,125 |

|

|

|

3.4 |

% |

|

All directors and executive officers as a group (12 persons) |

|

|

10,792,546 |

|

|

|

36.4 |

% |

|

* |

Represents beneficial ownership of less than 1.0% of the outstanding shares of common stock |

|

|

(1) |

Includes (a) 6,292,887 shares of common stock held by The Blake L. Sartini and Delise F. Sartini Family Trust (the “Sartini Trust”), of which Mr. Sartini is a co-trustee. Mr. Sartini shares the power to vote and dispose of such shares with his spouse, Delise F. Sartini, who is also a co-trustee of the Sartini Trust, (b) options to purchase 702,333 shares of common stock that may be exercised within 60 days of April 1, 2019, and (c) 11,068 shares of common stock held by Mr. Sartini. Excludes 750,000 shares of common stock held by D’Oro Holdings, LLC, for which the Sartini Trust and Mr. and Mrs. Sartini have disclaimed any beneficial ownership. Blake L. Sartini, II, the adult son of Mr. and Mrs. Sartini, is the sole manager of D’Oro Holdings, LLC (“D’Oro Holdings”) with sole power to vote and dispose of such shares. |

|

|

(2) |

Includes (a) 892,841 shares of common stock held by the Lyle A. Berman Revocable Trust, all of which have been pledged as collateral as described below, (b) options to purchase 50,000 shares of common stock that may be exercised within 60 days of April 1, 2019, (c) 211,403 shares of common stock held by Berman Consulting Corporation, a corporation wholly owned by Mr. Berman, and (d) 156,880 shares of common stock held by the Lyle A. Berman Roth IRA. |

16

|

|

(4) |

Includes options to purchase 49,474 shares of common stock that may be exercised within 60 days of April 1, 2019. |

|

|

(5) |

Includes options to purchase 50,000 shares of common stock that may be exercised within 60 days of April 1, 2019. |

|

|

(6) |

Includes (a) options to purchase 68,265 shares of common stock that may be exercised within 60 days of April 1, 2019, (b) 6,699 shares of common stock held by Mr. Sell, (c) 146,925 shares of common stock held by the Julie Berman Irrevocable Trust, of which Mr. Sell is the co-trustee, and in such capacity shares the power to vote and dispose of such shares, (d) 105,672 shares of common stock held by the Amy Berman Irrevocable Trust, of which Mr. Sell is the co-trustee, and in such capacity shares the power to vote and dispose of such shares, (e) 105,672 shares of common stock held by the Jessie Lynn Berman Irrevocable Trust, of which Mr. Sell is the co-trustee, and in such capacity shares the power to vote and dispose of such shares, and (f) 5,496 shares of common stock held by the Theresa Berman 2012 Irrevocable Trust for the benefit of Lyle A. Berman, of which Mr. Sell is sole trustee, and in such capacity has the sole power to vote and dispose of such shares. Mr. Sell disclaims beneficial ownership of the shares held by the, Julie Berman Irrevocable Trust, Amy Berman Irrevocable Trust, Jessie Lynn Berman Irrevocable Trust and Theresa Berman 2012 Irrevocable Trust. |

|

|

(7) |

Includes options to purchase 50,000 shares of common stock that may be exercised within 60 days of April 1, 2019. |

|

|

(8) |

Includes (a) options to purchase 306,667 shares of common stock that may be exercised within 60 days of April 1, 2019, and (b) 4,683 shares of common stock held by Mr. Arcana. |

|

|

(9) |

Includes (a) options to purchase 169,792 shares of common stock that may be exercised within 60 days of April 1, 2019, and (b) 129,683 shares of common stock held by Mr. Protell. |

|

|

(10) |

Includes (a) options to purchase 142,187 shares of common stock that may be exercised within 60 days of April 1, 2019, and (b) 2,413 shares of common stock held by Mr. Higgins. |

|

|

(11) |

Includes (a) options to purchase 191,875 shares of common stock that may be exercised within 60 days of April 1, 2019, (b) 2,250 shares of common stock held by Mr. Sartini II, and (c) 750,000 shares of common stock held by D’Oro Holdings, of which Mr. Sartini, II is sole manager with sole power to vote and dispose of such shares. Certain family trusts, of which Mr. Sartini II is the trustee, are the sole members of D’Oro Holdings. Mr. Sartini II disclaims beneficial ownership of the shares held by D’Oro Holdings except to the extent of his pecuniary interest therein. |

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires our directors, executive officers and holders of more than 10% of our common stock to file reports of ownership and changes in ownership with the SEC. These persons are required to furnish us with copies of all Section 16(a) forms they file. Based solely on our review of the Section 16(a) forms furnished to us, or in reliance upon written representations from our directors and executive officers, we believe that all of our directors, executive officers and greater than 10% shareholders complied with all applicable filing requirements under Section 16(a) of the Exchange Act during the year ended December 31, 2018.

17

Compensation Discussion and Analysis

Introduction

Golden owns and operates a diversified entertainment platform, consisting of a portfolio of gaming assets that focus on resort casino operations and distributed gaming (including tavern gaming in our wholly-owned taverns). We conduct our business through two reportable operating segments: Casinos and Distributed Gaming. In our Casinos segment, we own and operate ten resort casinos, nine in Nevada and one in Maryland. Four of our Nevada resort casino properties (including The STRAT Casino, Hotel & SkyPod) were added to our casino portfolio in October 2017 as a result of our acquisition of American, and we acquired two additional resort casino properties in Laughlin, Nevada in January 2019. Our Distributed Gaming segment involves the installation, maintenance and operation of slots and amusement devices in non-casino locations such as restaurants, bars, taverns, convenience stores, liquor stores and grocery stores in Nevada and Montana, and the operation of branded taverns targeting local patrons located primarily in the greater Las Vegas, Nevada metropolitan area.

The information contained in this Compensation Discussion and Analysis (“CD&A”) and the executive compensation disclosures below is provided for the individuals who were our named executive officers for 2018, who we refer to collectively as the “NEOs”:

|

|

• |

Blake L. Sartini, President, Chief Executive Officer and Chairman of the Board of Directors; |

|

|

• |

Stephen A. Arcana, Executive Vice President and Chief Operating Officer; |

|

|

• |

Charles H. Protell, Executive Vice President, Chief Strategy Officer and Chief Financial Officer; |

|

|

• |

Sean T. Higgins, Executive Vice President of Compliance and Government Affairs and Chief Legal Officer; and |

|

|

• |

Blake L. Sartini, II, Senior Vice President of Distributed Gaming. |

Executive Summary—Golden Executive Compensation Program

The Compensation Committee has designed our compensation programs and practices to drive financial performance and senior management focus on our business strategy. Our compensation programs and practices are intended to reward superior corporate performance and provide long-term incentives to employees in roles critical to our future.

Our Compensation Committee has adopted a number of practices and policies designed for a company our size and the marketplace in which we compete for executive talent, all to create an executive compensation program that places a significant emphasis on “pay-for-performance.” Our Compensation Committee selects and engages its own independent advisor, and engaged Aon to serve as its independent compensation consultant for 2018. The Compensation Committee reviewed external market data and peer group data with its independent consultant, and designed our executive compensation program to link executive pay to company performance and to shareholder interests, by weighting total target compensation to the achievement of corporate performance metrics and strong stock price performance.

Long-Term Incentive Awards. In connection with the annual executive compensation review conducted with Aon, the Compensation Committee approved a new long-term equity incentive structure for the Company’s NEOs in 2018, approving awards of restricted stock units to the NEOs in lieu of grants of stock options. Specifically, the Compensation Committee awarded 50% of each executive’s target long-term incentive value in the form of time-based restricted stock units (“RSUs”) (which vest over three years in equal installments) and 50% of such value in the form of PSUs for a “target” number of shares (of which between 0%-200% of such “target” number of shares may be earned based on the Company’s attainment of performance goals set (or to be set) by the Compensation Committee for each of 2018 and 2019. The percentage achievement for each year

18

relative to the performance objectives for such year will be averaged at the end of the two-year period and applied to the “target” number of shares, and will be subject to a potential 15% reduction based on the Company’s average net debt-to-Adjusted EBITDA ratio for each of fiscal year 2018 and 2019. The number of “earned” shares will be then be subject to one additional year of time-based vesting, with such shares vesting on the third anniversary of grant. For additional information regarding the Company’s 2018 long-term equity incentive structure, please see "--2018 Executive Compensation Decisions--2018 Long-Term Equity Incentive Awards "below.

Annual Incentive Bonuses. In early 2018, our Compensation Committee adopted a performance-based annual incentive program for 2018 under the 2015 Plan (the “2018 Annual Incentive Program”) and established performance goals and target incentive opportunities for the NEOs that were consistent with competitive market levels. Our NEOs’ annual incentives for 2018 were tied to our Adjusted EBITDA performance (as defined below), with various performance levels corresponding to the executives’ incentive payouts. At maximum performance, our NEOs were eligible to earn an annual incentive of 200% of their respective target bonuses. Because we achieved Adjusted EBITDA of below the threshold level of performance needed for payouts under the 2018 Annual Incentive Program, no annual bonuses were paid to our NEOs for 2018.

Executive Employment Agreements. We have entered into employment agreements with each of our NEOs. These agreements do not have “single trigger” severance payments owing solely on account of the occurrence of a change in control event, nor do they provide tax gross-ups for “excess parachute payments.” See “—Executive Employment Agreements” below.

Stock Ownership Guidelines. In March 2018, our Compensation Committee adopted Stock Ownership Guidelines applicable to our executive officers and senior vice presidents. Under the Stock Ownership Guidelines, our executive officers and senior vice presidents are expected to own shares of our common stock with a market value equal to: for the Chief Executive Officer, six times his annual base salary; for each of the Chief Operating Officer and the Chief Financial Officer, three times his annual base salary; for each of the Chief Legal Officer and the Chief Administrative Officer, two times his annual base salary; and for other executives, one times his or her annual base salary. For a description of the Stock Ownership Guidelines, including the treatment of outstanding equity awards under the ownership criteria in the Stock Ownership Guidelines, please see “—Stock Ownership Guidelines” below.

Executive Compensation Program Objectives

The primary objectives of our executive compensation program are: (1) our executive compensation program should be competitive with compensation paid by companies in the same market in which we compete for executive talent; (2) our compensation program should align executive compensation with our corporate strategies, business objectives and the interests of our shareholders by rewarding successful execution of our business plan and key corporate objectives; and (3) the majority of executives’ total compensation should be in the form of variable compensation, comprised of annual cash incentive awards and long-term equity incentive awards, with compensation dependent upon corporate performance results and the creation of long-term shareholder value.

Setting Executive Compensation

Role of the Compensation Committee

The Compensation Committee operates under a written amended and restated charter adopted by the Board of Directors. The Compensation Committee is responsible for reviewing periodically our compensation plans, philosophy and programs, and overseeing the evaluation and compensation of our executive officers. The Compensation Committee also administers our incentive compensation plans.