0001071255DEF 14AFALSE00010712552023-01-012023-12-31iso4217:USD00010712552022-01-012022-12-3100010712552021-01-012021-12-3100010712552020-01-012020-12-310001071255ecd:PeoMembergden:EquityAwardsReportedValueMember2023-01-012023-12-310001071255gden:EquityValueAdjustmentsMemberecd:PeoMember2023-01-012023-12-310001071255ecd:PeoMembergden:EquityAwardsReportedValueMember2022-01-012022-12-310001071255gden:EquityValueAdjustmentsMemberecd:PeoMember2022-01-012022-12-310001071255ecd:PeoMembergden:EquityAwardsReportedValueMember2021-01-012021-12-310001071255gden:EquityValueAdjustmentsMemberecd:PeoMember2021-01-012021-12-310001071255ecd:PeoMembergden:EquityAwardsReportedValueMember2020-01-012020-12-310001071255gden:EquityValueAdjustmentsMemberecd:PeoMember2020-01-012020-12-310001071255gden:EquityAwardsReportedValueMemberecd:NonPeoNeoMember2023-01-012023-12-310001071255gden:EquityValueAdjustmentsMemberecd:NonPeoNeoMember2023-01-012023-12-310001071255gden:EquityAwardsReportedValueMemberecd:NonPeoNeoMember2022-01-012022-12-310001071255gden:EquityValueAdjustmentsMemberecd:NonPeoNeoMember2022-01-012022-12-310001071255gden:EquityAwardsReportedValueMemberecd:NonPeoNeoMember2021-01-012021-12-310001071255gden:EquityValueAdjustmentsMemberecd:NonPeoNeoMember2021-01-012021-12-310001071255gden:EquityAwardsReportedValueMemberecd:NonPeoNeoMember2020-01-012020-12-310001071255gden:EquityValueAdjustmentsMemberecd:NonPeoNeoMember2020-01-012020-12-310001071255gden:EquityAwardsGrantedDuringTheYearUnvestedMemberecd:PeoMember2023-01-012023-12-310001071255gden:EquityAwardsGrantedInPriorYearsUnvestedMemberecd:PeoMember2023-01-012023-12-310001071255gden:EquityAwardsGrantedDuringTheYearVestedMemberecd:PeoMember2023-01-012023-12-310001071255gden:EquityAwardsGrantedInPriorYearsVestedMemberecd:PeoMember2023-01-012023-12-310001071255gden:EquityAwardsGrantedDuringTheYearUnvestedMemberecd:PeoMember2022-01-012022-12-310001071255gden:EquityAwardsGrantedInPriorYearsUnvestedMemberecd:PeoMember2022-01-012022-12-310001071255gden:EquityAwardsGrantedDuringTheYearVestedMemberecd:PeoMember2022-01-012022-12-310001071255gden:EquityAwardsGrantedInPriorYearsVestedMemberecd:PeoMember2022-01-012022-12-310001071255gden:EquityAwardsGrantedDuringTheYearUnvestedMemberecd:PeoMember2021-01-012021-12-310001071255gden:EquityAwardsGrantedInPriorYearsUnvestedMemberecd:PeoMember2021-01-012021-12-310001071255gden:EquityAwardsGrantedDuringTheYearVestedMemberecd:PeoMember2021-01-012021-12-310001071255gden:EquityAwardsGrantedInPriorYearsVestedMemberecd:PeoMember2021-01-012021-12-310001071255gden:EquityAwardsGrantedDuringTheYearUnvestedMemberecd:PeoMember2020-01-012020-12-310001071255gden:EquityAwardsGrantedInPriorYearsUnvestedMemberecd:PeoMember2020-01-012020-12-310001071255gden:EquityAwardsGrantedDuringTheYearVestedMemberecd:PeoMember2020-01-012020-12-310001071255gden:EquityAwardsGrantedInPriorYearsVestedMemberecd:PeoMember2020-01-012020-12-310001071255gden:EquityAwardsGrantedDuringTheYearUnvestedMemberecd:NonPeoNeoMember2023-01-012023-12-310001071255gden:EquityAwardsGrantedInPriorYearsUnvestedMemberecd:NonPeoNeoMember2023-01-012023-12-310001071255gden:EquityAwardsGrantedDuringTheYearVestedMemberecd:NonPeoNeoMember2023-01-012023-12-310001071255gden:EquityAwardsGrantedInPriorYearsVestedMemberecd:NonPeoNeoMember2023-01-012023-12-310001071255gden:EquityAwardsGrantedDuringTheYearUnvestedMemberecd:NonPeoNeoMember2022-01-012022-12-310001071255gden:EquityAwardsGrantedInPriorYearsUnvestedMemberecd:NonPeoNeoMember2022-01-012022-12-310001071255gden:EquityAwardsGrantedDuringTheYearVestedMemberecd:NonPeoNeoMember2022-01-012022-12-310001071255gden:EquityAwardsGrantedInPriorYearsVestedMemberecd:NonPeoNeoMember2022-01-012022-12-310001071255gden:EquityAwardsGrantedDuringTheYearUnvestedMemberecd:NonPeoNeoMember2021-01-012021-12-310001071255gden:EquityAwardsGrantedInPriorYearsUnvestedMemberecd:NonPeoNeoMember2021-01-012021-12-310001071255gden:EquityAwardsGrantedDuringTheYearVestedMemberecd:NonPeoNeoMember2021-01-012021-12-310001071255gden:EquityAwardsGrantedInPriorYearsVestedMemberecd:NonPeoNeoMember2021-01-012021-12-310001071255gden:EquityAwardsGrantedDuringTheYearUnvestedMemberecd:NonPeoNeoMember2020-01-012020-12-310001071255gden:EquityAwardsGrantedInPriorYearsUnvestedMemberecd:NonPeoNeoMember2020-01-012020-12-310001071255gden:EquityAwardsGrantedDuringTheYearVestedMemberecd:NonPeoNeoMember2020-01-012020-12-310001071255gden:EquityAwardsGrantedInPriorYearsVestedMemberecd:NonPeoNeoMember2020-01-012020-12-3100010712552023-12-31xbrli:pure000107125512023-01-012023-12-31

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

________________________________________

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

(Amendment No. )

________________________________________

Filed by the Registrant þ

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | | | | |

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| þ | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

________________________________________

GOLDEN ENTERTAINMENT, INC.

(Exact name of registrant as specified in its charter)

________________________________________

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | | |

| þ | No fee required. |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

6595 S. Jones Boulevard

Las Vegas, Nevada 89118

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

May 23, 2024

To the Shareholders of Golden Entertainment, Inc.:

You are cordially invited to attend the 2024 annual meeting of shareholders of Golden Entertainment, Inc. (“Annual Meeting”) to be held virtually via live webcast at proxydocs.com/GDEN at 4:00 p.m. Pacific Time on Thursday, May 23, 2024, for the following purposes:

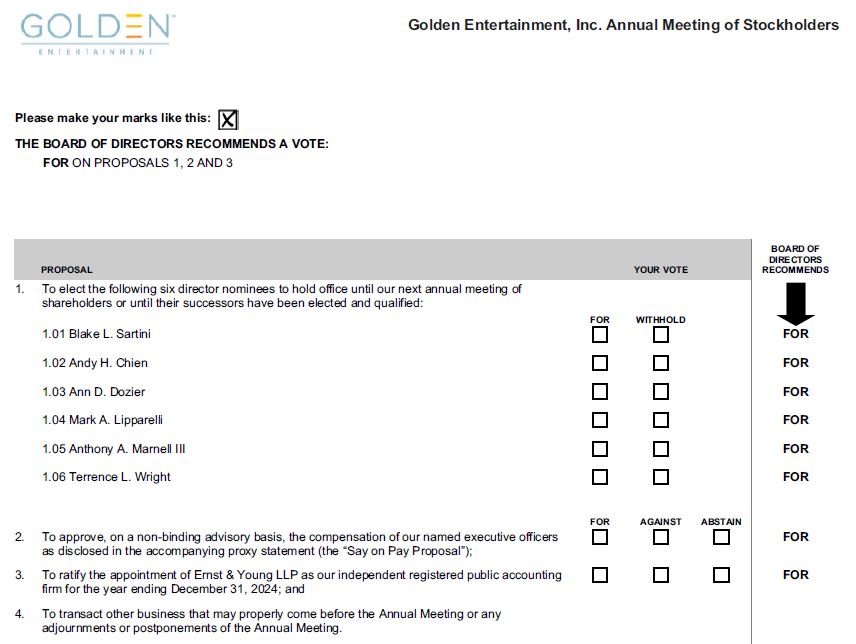

1.To elect the following six director nominees to hold office until our next annual meeting of shareholders or until their successors have been elected and qualified: Blake L. Sartini, Andy H. Chien, Ann D. Dozier, Mark A. Lipparelli, Anthony A. Marnell III, and Terrence L. Wright;

2.To approve, on a non-binding advisory basis, the compensation of our named executive officers as disclosed in the accompanying proxy statement (the “Say on Pay Proposal”);

3.To ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the year ending December 31, 2024; and

4.To transact other business that may properly come before the Annual Meeting or any adjournments or postponements of the Annual Meeting.

We are hosting a virtual Annual Meeting conducted exclusively online via live webcast. You will be able to attend the Annual Meeting and vote and submit questions during the Annual Meeting via the live webcast. In order to attend, you must register in advance at proxydocs.com/GDEN prior to the deadline of May 21, 2024 at 2:00 p.m. Pacific Time. Upon completing registration, you will receive further instructions via email, including a unique link to allow you access to the Annual Meeting. Please be sure to follow the instructions found on your Proxy Card and subsequent instructions that will be delivered to you via email.

Only shareholders of record at the close of business on March 28, 2024, the record date, are entitled to receive notice of, and to vote at, the Annual Meeting or any adjournments or postponements of the Annual Meeting. Your vote is very important. Whether or not you expect to attend the Annual Meeting via the live webcast, please sign, date and return the enclosed proxy card as soon as possible to ensure that your shares are represented at the Annual Meeting. If your shares are held in “street name,” which means your shares are held of record by a broker, bank or other financial institution, you must provide your broker, bank or financial institution with instructions on how to vote your shares.

| | |

| By Order of the Board of Directors |

|

| Blake L. Sartini |

| Chairman of the Board and Chief Executive Officer |

April 10, 2024

GOLDEN ENTERTAINMENT, INC.

6595 S. Jones Boulevard

Las Vegas, Nevada 89118

PROXY STATEMENT

Annual Meeting of Shareholders to be Held

May 23, 2024

This proxy statement is furnished in connection with the solicitation of proxies by the Board of Directors of Golden Entertainment, Inc. to be used at our 2024 annual meeting of shareholders (“Annual Meeting”) to be held at 4:00 p.m. Pacific Time on Thursday, May 23, 2024, for the purposes set forth in the Notice of Annual Meeting of Shareholders. The Annual Meeting will be completely virtual. You may attend the meeting, vote your shares and submit questions electronically during the meeting via live webcast at proxydocs.com/GDEN. The approximate date on which this proxy statement and the accompanying proxy are first being furnished or sent to our shareholders of record entitled to vote at the Annual Meeting is on or about April 10, 2024. As used in this proxy statement, the terms “Golden,” “we,” “us,” “our,” “ours” and the “Company” refer to Golden Entertainment, Inc. and its wholly owned subsidiaries.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE 2024 ANNUAL MEETING OF SHAREHOLDERS TO BE HELD ON MAY 23, 2024:

The proxy materials for the Annual Meeting, including this proxy statement and our 2023 annual report to shareholders, are available over the internet at www.proxydocs.com/GDEN.

GENERAL INFORMATION

ABOUT THE ANNUAL MEETING AND VOTING

You are being sent this proxy statement and the enclosed proxy card because our Board of Directors is soliciting your proxy to vote at the Annual Meeting. This proxy statement summarizes the information you need to know to vote at the Annual Meeting. All shareholders who find it convenient to do so are cordially invited to attend the Annual Meeting via the live webcast.

However, you do not need to attend the Annual Meeting to vote your shares. Instead, you may vote using one of the options below:

In accordance with the “notice and access” rules and regulations adopted by the Securities and Exchange Commission (the “SEC”), instead of mailing a printed copy of our proxy materials to each shareholder of record (the “full set delivery” option), we are furnishing proxy materials to our shareholders over the internet (the “notice only” option). A company may use either option, “notice only” or “full set delivery,” for all of its shareholders or may use one method for some shareholders and the other method for others. We believe the “notice only” process expedites shareholders’ receipt of proxy materials and reduces the costs and environmental impact of the Annual Meeting.

In order to attend the Annual Meeting via the live webcast, you must register in advance at proxydocs.com/GDEN prior to the deadline of May 21, 2024 at 2:00 p.m. Pacific Time. Upon completing registration, you will receive further instructions via email, including a unique link to allow you access to the Annual Meeting. Please be sure to follow the instructions found on your Proxy Card and subsequent instructions that will be delivered to you via email.

Only shareholders of record at the close of business on March 28, 2024 (the “Record Date” for the Annual Meeting) will be entitled to notice of, and to vote at, the Annual Meeting or any adjournments or postponements of the Annual Meeting. There were 28,948,741 shares of our common stock outstanding at the close of business on the Record Date, which is the only class of our capital stock outstanding and entitled to vote. Each share of our common stock is entitled to one vote upon each matter to be presented at the Annual Meeting.

If you are a beneficial owner of shares held by a broker, bank or other nominee, your shares are held in “street name,” and the organization holding your shares is considered to be the shareholder of record for purposes of voting at the Annual Meeting. As the beneficial owner, you have the right to direct your broker, bank or other nominee regarding how to vote your shares. Although you may attend the Annual Meeting via the live webcast, since you are not the shareholder of record you may not vote in the Annual Meeting unless you provide a legal proxy from the record holder of your shares (your broker, bank or other nominee) authorizing you to vote at the Annual Meeting.

You are entitled to attend the Annual Meeting or any adjournments or postponements thereof only if you were a Golden shareholder at the close of business on the Record Date or if you hold a valid proxy to vote at the meeting.

A quorum is necessary for the transaction of business at the Annual Meeting. A quorum exists when holders of a majority of the total number of outstanding shares of our common stock entitled to vote at the Annual Meeting are present via the live webcast or represented by proxy.

In the election of directors, the six nominees for director who receive the highest number of affirmative votes will be elected as directors. The ratification of the appointment of our independent registered public accounting firm requires the affirmative vote of the holders of a majority of votes cast by holders of shares of common stock present or represented by proxy at the Annual Meeting. The vote on the Say on Pay Proposal is a non-binding advisory vote. The Board of Directors will consider our executive compensation to have been approved by shareholders if the Say on Pay Proposal receives more votes “For” than “Against.”

At the Annual Meeting, the inspector of election appointed for the Annual Meeting will determine the presence of a quorum and tabulate the results of the voting by shareholders. The inspector of election will separately tabulate affirmative and negative votes, abstentions and broker non-votes.

Generally, a “broker non-vote” occurs when your shares are held by a broker, bank or other nominee and are not voted with

respect to a particular proposal because the organization that holds your shares has discretionary voting power with respect to routine matters but cannot vote on non-routine matters. Only the proposal for the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for the year ending December 31, 2024 will be considered a routine matter under applicable rules. Therefore, unless you provide voting instructions to the broker, bank or other nominee holding shares on your behalf, they will not have discretionary authority to vote your shares on any of the proposals described in this proxy statement other than the ratification of our independent registered public accounting firm. Please vote your proxy or provide voting instructions to the broker, bank or other nominee holding your shares so your vote on these matters will be counted.

Broker non-votes and abstentions will be counted for the purpose of determining whether a quorum is present, but will not be counted as votes cast on any matter, and therefore will not affect the outcome of any vote at the Annual Meeting.

Our Board of Directors unanimously recommends that you vote “FOR” the election of all nominees for the Board of Directors named in this proxy statement, “FOR” the Say on Pay Proposal, and “FOR” the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for the year ending December 31, 2024.

Your vote is important. Whether or not you plan to attend the Annual Meeting via the webcast, we urge you to sign, date and return the enclosed proxy card as soon as possible to ensure that your vote is recorded promptly. Returning the proxy card will not affect your right to attend the Annual Meeting or vote your shares during the Annual Meeting. If you complete, sign and submit your proxy card, the persons named as proxies will vote your shares in accordance with your instructions. If you sign and submit a proxy card but do not fill out the voting instructions on the proxy card, your shares will be voted as recommended by our Board of Directors. If any other matters are properly presented for voting at the Annual Meeting, or any adjournments or postponements of the Annual Meeting, the proxy card will confer discretionary authority on the individuals named as proxies to vote your shares in accordance with their best judgment. As of the date of this proxy statement, we have not received notice of other matters that may properly be presented for voting at the Annual Meeting.

You may revoke your proxy at any time before your proxy is voted at the Annual Meeting by taking any of the following actions: (i) submitting another proxy card bearing a later date, (ii) delivering written notice of revocation to our Secretary at our principal executive offices at Golden Entertainment, Inc., 6595 S. Jones Boulevard, Las Vegas, Nevada 89118, Attn: Secretary, or (iii) attending and voting during the Annual Meeting, although attendance at the Annual Meeting will not, by itself, revoke a proxy. If your shares are held in “street name,” you must contact your broker, bank or other nominee to revoke any prior instructions.

| | | | | |

| ELECTION OF DIRECTORS |

| (Proposal One) |

Our Board of Directors currently consists of six directors. All of the current directors have been nominated by our Board of Directors for re-election at the Annual Meeting. If elected, each nominee will hold office until the earliest of (i) our next annual meeting of shareholders, (ii) the date his or her successor has been elected and qualified, or (iii) his or her resignation, death or removal. All nominees have consented to be named and have indicated their intention to serve as members of our Board of Directors, if elected.

Board Qualifications, Skills, Expertise, Diversity & Inclusion

All of our nominees bring significant leadership, expertise and diverse backgrounds and perspectives to our Board of Directors as a result of their professional experience and service as executives and/or board members of other companies. The process undertaken by our Corporate Governance Committee in recommending director candidates is described below and under “Corporate Governance — Committees — Corporate Governance Committee.” We evaluate the nominees based on qualification and attributes, such as demonstrated industry experience and expertise in the context of the needs of the Board of Directors. We consider self-identified characteristics, such as gender and ethnic/racial diversity to be a benefit to our Board of Directors, bringing a unique combination of perspectives, professional experiences and backgrounds. Our Board of Directors understands and takes into consideration the importance of having a diverse Board of Directors and is committed to maintaining a balance amongst its members. Board composition diversity may include, but is not limited to, business experience, age, gender, race, ethnicity, nationality, and country of origin. We value the different perspectives and points of view, ensuring we benefit from promoting Board diversity and corporate governance.

The following Board Diversity Matrix presents the diversity statistics for our Board of Directors as of April 10, 2024, in accordance with Nasdaq Rule 5606(f), as self-disclosed by our directors:

| | | | | | | | | | | | | | |

| Board Diversity Matrix (as of April 10, 2024) |

| Total Number of Directors | 6 |

| Female | Male | Non-Binary | Did Not Disclose Gender |

| Part I: Gender Identity |

| Directors | 1 | 5 | 0 | 0 |

| Part II: Self-Identified Demographic Background |

| African American or Black | 0 | 0 | 0 | 0 |

| Alaskan Native or Native American | 0 | 0 | 0 | 0 |

| Asian | 0 | 1 | 0 | 0 |

| Hispanic or Latinx | 0 | 0 | 0 | 0 |

| Native Hawaiian or Pacific Islander | 0 | 0 | 0 | 0 |

| White | 1 | 4 | 0 | 0 |

| Two or More Races or Ethnicities | 0 | 0 | 0 | 0 |

| LGBTQ+ | 0 |

| Did Not Disclose Demographic Background | 0 |

Board Qualifications and Expertise Matrix

The table below summarizes the qualifications and expertise areas of our Board of Directors. We believe that the collective key set of skills of our Board of Directors obtained through the years of industry and other relevant experiences help us to achieve the performance goals and guide us to a long-term operational success.

| | | | | | | | | | | | | | | | | | | | |

| Qualifications & Expertise | Blake L. Sartini | Andy H. Chien | Ann D. Dozier | Mark A. Lipparelli | Anthony A. Marnell | Terrence L. Wright |

| Public Company | ü | ü | ü | ü | | ü |

| International Business | | ü | ü | ü | ü | |

| Corporate Governance | ü | | ü | ü | | ü |

| Capital Allocation/ Corporate Financing | ü | ü | | ü | | ü |

| Financial Literacy | ü | ü | ü | ü | ü | ü |

| Information Services and Technology | | | ü | ü | ü | |

| Legal/ Regulatory/ Public Policy | | | | ü | ü | ü |

| Marketing/ Sales/ Business Development | ü | | ü | ü | ü | ü |

| Risk Management | | | ü | ü | ü | ü |

| Strategic Planning | ü | ü | ü | ü | ü | |

| Human Resources, Executive Compensation, and Talent Management | ü | | ü | ü | ü | ü |

| Senior Leadership | ü | ü | | ü | ü | ü |

| Cybersecurity/ Data Privacy | | | ü | ü | | |

| ESG and Climate Risks | | | ü | | | |

| Industry Experience | ü | ü | | ü | ü | ü |

| Shareholders Advocacy | ü | ü | | ü | | ü |

| Age/Tenure | | | | | | |

| Age | 65 | 48 | 56 | 58 | 50 | 74 |

| Tenure | 8 | 2 | 4 | 8 | 5 | 8 |

Set forth below is biographical information for each person nominated as a director, including a description of certain experience, qualifications and skills that led our Corporate Governance Committee and our Board of Directors to determine that these individuals should serve as our directors.

| | | | | | | | |

| Name and Age of Director | | Biographical Information |

Blake L. Sartini

| | Mr. Sartini joined Golden as Chairman of the Board and Chief Executive Officer in July 2015 in connection with the merger with Sartini Gaming, Inc. (the “Sartini Gaming Merger”) and served as the President of Golden from that time until August 2019. Prior to the merger, Mr. Sartini served as the President and Chief Executive Officer of Sartini Gaming from its formation in January 2012, and as the founder and Chief Executive Officer of Golden Gaming, LLC (“Golden Gaming”), which he established in 2001. Prior to Golden Gaming, Mr. Sartini served in various management and executive positions with Stations Casinos, Inc. (“Station Casinos”) from 1985 to 2001, including as Executive Vice President and Chief Operating Officer upon the company’s public offering in 1993. Additionally, he served as a director of Station Casinos from 1993 until 2001. In 1986, Mr. Sartini founded Southwest Services, Inc. (the predecessor to Golden Gaming) and served as its President beginning in 1993. Before joining Station Casinos, he held key operational positions with the El Cortez Hotel and Casino, as well as the Barbary Coast Hotel and Casino. Mr. Sartini is a member of the University of Nevada, Las Vegas Foundation’s Board of Trustees and was appointed to the Nevada Gaming Policy Committee in March 2014 by Governor Sandoval. Mr. Sartini received a bachelor of science degree in business administration from the University of Nevada, Las Vegas. Mr. Sartini’s position as our Chairman and Chief Executive Officer, together with his deep knowledge of our business as a founder of Golden Gaming and his extensive executive management and industry experience gained over more than 30 years in the gaming industry, makes him a highly qualified and valuable member of our Board of Directors. |

| | |

| | | | | | | | |

| Name and Age of Director | | Biographical Information |

Andy H. Chien

| | Mr. Chien most recently served as the Chief Financial Officer and Treasurer of MGM Growth Properties LLC (NYSE:MGP), a position he held since its initial public offering in April 2016 until its sale to VICI Properties in April 2022. From 2009 to 2016, Mr. Chien held various roles at Greenhill & Co., a boutique investment banking firm, most recently serving as a Managing Director responsible for the firm’s REIT, gaming, lodging and leisure clients. Prior to that, Mr. Chien worked in the investment banking departments at UBS Investment Bank and Citigroup/Salomon Smith Barney. He has also held various positions at Commerce One and Intel Corporation. Mr. Chien received a master of business administration degree in finance and real estate from the UCLA Anderson School of Management, and a bachelor of science degree in electrical engineering, summa cum laude, from the University of Michigan. We believe Mr. Chien’s qualifications to sit on our Board of Directors include his business, leadership and investment banking experience and his familiarity with the gaming, entertainment and real estate markets in which we operate. |

Ann D. Dozier

| | Ms. Dozier currently serves as Senior Vice President, Chief Information and Technology Officer for Southern Glazer’s Wine and Spirits, LLC, a wine and spirits distributor, a position she has held since July 2016, when Southern Wine and Spirits, LLC and Glazer’s Beer and Beverage, LLC were merged. Prior to the merger, Ms. Dozier served as the Senior Vice President, Chief Information Officer of Southern Wine and Spirits, LLC since 2015. Ms. Dozier also has prior experience in both technical and commercial roles at The Coca-Cola Company, Inc., Coca-Cola Enterprises, Inc., Dean Foods and Colgate Palmolive. From 2012 to 2019, Ms. Dozier served on the board of iControl Holdings, LLC, a private technology company focused on delivering services and solutions that automate the retail value chain. She also serves on several community boards and national councils including the Advisory Board of the University of Miami Business School’s Management Science and Business Analytics program, the Business Solutions Committee of the United Way of Miami, South Florida CIO, the Consumer Goods Technology Executive Council, the Wall Street Journal CIO Council, and the Gartner Research Board. Ms. Dozier received a bachelor of science degree in economics from the University of Georgia and attended the Harvard Business School’s Executive Management Program. Ms. Dozier is highly qualified to sit on our Board of Directors due to her extensive experience as an executive in the food and beverage industry, with particular strengths in technology, cybersecurity, business operations, food and beverage, and retail sales. Furthermore, Ms. Dozier possesses in-depth knowledge of information security matters, including experience with identifying and mitigating information security risks, and leads various community efforts focused on creating a more diverse and inclusive workforce, including IT Women, Network of Executive Women, Kearney’s Women@Digital, Women of the Vine & Spirits, and Southern Glazer’s Wine and Spirits Cheers to Diversity. In 2023, Ms. Dozier received the Woman of Wonder award from IT Women for her support of STEM scholarships for young women. Ms. Dozier’s expertise and focus on diversity make her a valuable member of our Board of Directors. |

| | | | | | | | |

| Name and Age of Director | | Biographical Information |

Mark A. Lipparelli

| | Mr. Lipparelli currently serves as the Managing Member and Chief Executive Officer of GVII, LLC, a Nevada gaming licensee that manages the Westgate Resort Las Vegas; the Managing Member of CAMS, LLC, a technology services company to the online gaming industry; Chairman and Managing Member of SBOpco, LLC, a sportsbook company operating as SuperBook; and Chairman of the Board of Directors for Galaxy Gaming, Inc., a company that develops, manufactures and distributes innovative proprietary table games, state-of-the-art electronic wagering platforms and enhanced bonusing systems to land-based, riverboat, cruise ship and online casinos worldwide. Additionally, Mr. Lipparelli serves as an advisor to various operating and investment entities through his role as Managing Member of GVIII, LLC and serves as a member of the Board of Directors of the General Commercial Gaming Regulatory Authority. Mr. Lipparelli also formerly represented State Senate District 6 in the Nevada Legislature, having been appointed to the post in December 2014, and served on a number of Senate committees. Mr. Lipparelli has also twice been an appointee to the Nevada Gaming Policy Committee. Between 2009 and 2012, Mr. Lipparelli served as a Board Member and Chairman of the Nevada Gaming Control Board. Between 2002 and 2007, Mr. Lipparelli served in various executive management positions at Bally Technologies, Inc., a gaming technology supply company listed on the NYSE, including as Executive Vice President of Operations. Prior to joining Bally Technologies, Inc., Mr. Lipparelli served as Executive Vice President and then President of Shuffle Master, Inc., a publicly traded gaming supply company, from 2001 to 2003; as Chief Financial Officer of Camco, Inc., a retail chain holding company, from 2000 to 2001; as Senior Vice President of Entertainment Systems for Bally Gaming, Inc. (a subsidiary of publicly traded Alliance Gaming Corporation), from 1998 to 2000; and various management positions including Vice President of Finance for publicly traded Casino Data Systems from 1993 to 1998. Mr. Lipparelli is a Board Trustee Emeritus of the University of Nevada Foundation, Board Member of the International Center for Responsible Gaming, member of the International Association of Gaming Advisors and a member of the International Masters of Gaming Law. Mr. Lipparelli holds a bachelor’s degree in finance and a master’s degree in economics from the University of Nevada, Reno. Among other qualifications, Mr. Lipparelli brings over 25 years of experience in the gaming industry, including his service as Chief Executive Officer of a strategic advisory and product development firm and various executive management positions at companies serving the gaming industry. He also provides information security expertise to our Board of Directors through his leadership positions with technology services companies, and contributes his legislative experience with the State Senate and past roles with the Nevada Gaming Control Board. |

| | | | | | | | |

| Name and Age of Director | | Biographical Information |

| Anthony A. Marnell III | | Mr. Marnell serves as the Chairman, Chief Executive Officer and Manager of Marnell Gaming, LLC, a company he founded in 2006, which owned and operated the Nugget Casino Resort in Sparks, Nevada prior to its sale in April 2023, as well the Edgewater Hotel & Casino Resort and the Colorado Belle Hotel & Casino Resort in Laughlin, Nevada prior to their acquisition by Golden in January 2019. He also serves as a Board member and Vice President of Global Strategies of Marnell Corrao Associates, a company that designs and develops hotel and casino resorts, positions he has held since 1997. Mr. Marnell previously developed M Resort Spa Casino, a locals-oriented casino property in Las Vegas, Nevada, serving as Chairman and Chief Executive Officer from 2006 to 2011, and (following the casino’s acquisition by Penn National Gaming, Inc.) as President of the casino property from 2011 to 2015. He also served as a strategy consultant to Penn National Gaming, Inc. from 2015 to 2016. Mr. Marnell served as Manager of MG Investors LLC, which operated the Saddle West Hotel Casino & RV Resort in Pahrump, Nevada, from 2005 to 2006, as Manager of Siren Gaming, LLC, a tribal gaming management company, from 2002 to 2005, as Founder, Chairman, President and Chief Executive Officer of TRIRIGA, Inc., a technology company from 2000 to 2011, as Vice President, VIP Marketing at Harrah’s Entertainment, Inc., a leading casino gaming company, from 1999 to 2000, and as Vice President, Corporate Marketing, at Rio Suite Hotel & Casino from 1996 to 1998. He also serves as a Commissioner of the Nevada State Athletic Commission and previously served as its Chairman. He previously served as a Board member of the Nevada State Board of Equalization from 2009 to 2013. He currently serves as a Board member of the Tuscany Research Institute and Henderson Boys and Girls Club, and served as a Board member for the Henderson Special Budget Ad Hoc Committee from 2013 to 2014. Mr. Marnell received a bachelor of science degree in hotel administration from the University of Nevada Las Vegas. We believe Mr. Marnell’s qualifications to sit on our Board of Directors include his over 20 years of experience in the casino industry, including extensive casino development and operational experience in each of the Nevada markets in which we own resort casino properties, and his particular strengths in casino development, operations and marketing. |

| Terrence L. Wright | | Mr. Wright serves as a Board Member of Westcor Land Title Insurance Company, a company he founded in 1991 and which is licensed to issue policies of title insurance throughout the United States. Mr. Wright is an emeritus member of and past Chairman of the University of Nevada Las Vegas Foundation Board, served on the Board of Directors of Southwest Gas Holdings, Inc. (NYSE:SWX) until May 2017, and is the past Chairman for the Nevada Development Authority, the Nevada Land Title Association and the Nevada Chapter of the Young Presidents’ Organization. He has also served as Board member for the Las Vegas Monorail, Pioneer Citizens Bank, First Interstate Bank, Service First Bank of Nevada and the Boy Scouts of America. Mr. Wright received a bachelor’s degree in business administration and a juris doctor from DePaul University, Chicago, and is a member of the California and Illinois bar associations. We believe Mr. Wright’s qualifications to sit on our Board of Directors include his business and leadership experience (including serving as Chairman of the Board of Westcor Land Title Insurance Company), his service as a director of other public companies, and his familiarity with the residential and commercial real estate markets in which we operate. |

In the election of directors, the six nominees for director who receive the highest number of affirmative votes will be elected as directors. Shares represented by executed proxies will be voted, if authority to do so is not withheld, for the election of the six nominees named above. In the event that any nominee should be unavailable for election as a result of an unexpected occurrence, such shares will be voted for the election of such substitute nominee as our Board of Directors may propose.

The Board of Directors recommends that you vote “FOR” the election of all nominees for the Board of Directors named above.

CORPORATE GOVERNANCE

Board of Directors

Our Board of Directors is currently comprised of six members and has the following three standing committees: the Audit Committee, the Compensation Committee and the Corporate Governance Committee. The membership and functions of each standing committee are described below. Each standing committee operates under a written charter which, along with our Code of Business Conduct and Ethics, can be found in the Governance section of our website at https://goldenent.com/governance.html. The information on our website is not part of this proxy statement or any other report or registration statement that we furnish to or file with the SEC. In addition, the Board of Directors has formed a Compliance Committee, the membership and functions of which are described below.

Board Meetings

During the year ended December 31, 2023, our Board of Directors held four meetings, including telephonic meetings. During this period, all of the directors attended or participated in at least 75% of the aggregate of the total number of meetings of the Board and the total number of meetings held by all committees of the Board on which each such director served during the period in which such director served. The independent directors met without management present at each of the regular quarterly meetings of the Board of Directors in 2023.

Director Attendance at Annual Meetings of Shareholders

Although we do not have a formal policy regarding attendance by members of our Board of Directors at our annual meetings of shareholders, we encourage our Board members to attend such meetings. All of our directors attended last year’s annual meeting of shareholders held on May 25, 2023.

Director Independence

Our Board of Directors affirmatively determined that each nominee for election to our Board of Directors is an independent director, as defined by the Nasdaq Stock Market listing standards, other than Mr. Sartini. Mr. Sartini is not considered independent because he is employed by Golden as our Chief Executive Officer. In making these determinations, the Board of Directors has considered information provided by the directors and management with regard to the business and personal activities, relationships and related party transactions of each director.

Enhanced Board Leadership Structure

The Board leadership structure is currently comprised of (1) a combined Chairman of the Board and Chief Executive Officer and (2) a Lead Independent Director. Mr. Sartini, our Chief Executive Officer, also serves as the Chairman of our Board of Directors. Mr. Wright currently serves in the role of Lead Independent Director, which provides strong independent leadership for our Board of Directors and a balance to our combined Chairman and Chief Executive Officer structure. The Lead Independent Director’s responsibilities include presiding over all meetings of the Board of Directors at which the Chairman is not present, calling meetings of independent directors and functioning as a liaison with our Chairman of the Board. Mr. Wright is an active and engaged director, who is well positioned to work collaboratively with Mr. Sartini, while providing strong independent oversight over our Board of Directors.

Our Board of Directors regularly evaluates its leadership structure and currently believes that the use of a Lead Independent Director, coupled with the combined Chairman and Chief Executive Officer positions, provides the most efficient and effective leadership model for Golden. As the individual primarily responsible for the day-to-day management of our business operations, our Chief Executive Officer is best positioned to provide clear insight and direction of business strategies and plans to both our Board of Directors and management. Our Board of Directors believes that a single person, acting in the capacities of Chairman as well as Chief Executive Officer, promotes unity of vision and leadership, which allows for a single, clear focus for management to execute our business strategies and plans. Coupled with a Lead Independent Director, this leadership structure allows our Board of Directors to exercise independent oversight while enabling the Board of Directors to have direct access to information related to the day-to-day management of our business operations. Moreover, we believe that the combined Chairman and Chief Executive Officer role is appropriately counterbalanced and enhanced by sound corporate governance principles, the leadership of the Lead Independent Director, the effective oversight of management by non-employee directors and the strength of our independent directors.

Ability of Shareholders to Communicate with our Board of Directors

We have established several means for shareholders and others to communicate with our Board of Directors. If a shareholder

has a concern regarding our financial statements, accounting practices or internal controls, the concern should be submitted in writing to the Chair of the Audit Committee in care of our Secretary at our corporate office address. If the concern relates to our governance practices, business ethics or corporate conduct, the concern should be submitted in writing to a member of the Corporate Governance Committee in care of our Secretary at our corporate office address. If a shareholder is unsure as to which category the concern relates, the shareholder may communicate it to any one of the independent directors in care of our Secretary at our corporate office address. All such shareholder communications will be forwarded to the applicable director(s), unless such communications are considered, in the reasonable judgment of our Secretary, to be improper for submission to the intended recipient(s). Examples of shareholder communications that would be considered improper for submission include, without limitation, customer complaints, solicitations, communications that do not relate directly or indirectly to Golden or its business, or communications that relate to improper or irrelevant topics. Any such improper communication will be made available to any non-employee director upon request.

Committees

Our Board of Directors has four standing committees, comprised of independent directors: the Audit Committee, the Compensation Committee, the Corporate Governance Committee and the Compliance Committee.

| | | | | | | | | | | | | | | | | | | | |

| Blake L. Sartini | Andy H. Chien | Ann D. Dozier | Mark A. Lipparelli | Anthony A. Marnell | Terrence L. Wright |

| Audit Committee | | ü | ü | Chair | | |

| Compensation Committee | | ü | | | ü | Chair |

| Corporate Governance Committee | | | Chair | | ü | ü |

| Compliance Committee | | ü | | Chair | | |

| Independent Director | | ü | ü | ü | ü | ü |

| Chairman of the Board | ü | | | | | |

Audit Committee

Our Audit Committee currently consists of Mr. Lipparelli (Chair), Mr. Chien and Ms. Dozier. Each current and proposed member of the Audit Committee is an independent director, as defined by the Nasdaq Stock Market listing standards, and meets the independence criteria of Rule 10A-3 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Our Board of Directors has determined that Mr. Lipparelli qualifies as an “audit committee financial expert,” as that term is defined in the rules and regulations established by the SEC. In addition, Ms. Dozier has extensive experience in information security matters.

The Audit Committee operates under an amended and restated written charter adopted by the Board of Directors. The primary duties and responsibilities of the Audit Committee are to (i) serve as an independent and objective party to monitor our financial reporting process and internal control system; (ii) monitor management’s efforts related to the information security matters and review management’s approach to identifying and mitigating information security risks; (iii) review and appraise the audit performed by our independent auditors, who report directly to the Committee; and (iv) provide an open avenue of communication among the independent auditors, financial and senior management and the Board of Directors. The Audit Committee is also charged with oversight of our policies regarding risk assessment and management, including our policies regarding management of financial and information security risk exposure and review of related party transactions (as described in the section captioned “Certain Relationships and Related Transactions”), and our management also briefs the Audit Committee on information security risk matters quarterly, or as often as needed. The charter also requires the Audit Committee (or designated members of the Audit Committee) to review and pre-approve the annual engagement letter and the performance of all audit and non-audit accounting services to be performed by our independent registered public accounting firm (independent auditors), other than certain de minimis exceptions permitted by Section 202 of the Sarbanes-Oxley Act of 2002. The Audit Committee also reviews the independence of our independent auditors and is directly responsible for the appointment, compensation, retention and oversight of our independent registered public accounting firm. The responsibilities and activities of the Audit Committee are described in greater detail in the report included in this proxy statement under the caption “Report of the Audit Committee.” The Audit Committee held four meetings during the year ended December 31, 2023. The Audit Committee also held executive sessions on several occasions during the year with company management not present.

Compensation Committee

Our Compensation Committee currently consists of Mr. Wright (Chair), Mr. Chien and Mr. Marnell. Each current and proposed member of the Compensation Committee is an independent director, as defined by the Nasdaq Stock Market listing standards. All members of our Compensation Committee are also “non-employee directors” as defined by Rule 16b-3 under the Exchange Act.

The Compensation Committee operates under a written amended and restated charter adopted by the Board of Directors. The Compensation Committee is responsible for reviewing periodically our compensation plans, philosophy and programs, and overseeing the evaluation and compensation of our executive officers. The Compensation Committee also administers our incentive compensation plans, including our 2015 Incentive Award Plan (the “2015 Plan”), and our clawback policy. Under the Compensation Committee charter, our Chief Executive Officer has been delegated the authority to grant awards under our equity compensation plans to persons who are employees of Golden at or below the senior vice president level who are not serving as executive officers of Golden nor deemed to be a “named executive officer” of Golden within the meaning of SEC rules and regulations, provided that no such grant for any one individual may exceed 10,000 shares and all such grants after April 1, 2018 may not exceed 100,000 shares in the aggregate, in each case without the prior approval of the Compensation Committee. Under the 2015 Plan, the Compensation Committee may delegate its duties and responsibilities to subcommittees of our directors and/or officers for awards to certain non-executive employees, subject to certain limitations that may be imposed under applicable law or regulation, including Section 16 of the Exchange Act, and/or stock exchange rules, as applicable.

The Compensation Committee has the authority, to the extent it deems necessary or appropriate, to retain a compensation consultant to assist in the evaluation of executive officer compensation. The Compensation Committee also has the sole authority to approve the consultant’s fees and other retention terms. The Compensation Committee also has the authority, to the extent it deems necessary or appropriate, to retain other advisors. Golden will provide appropriate funding, as determined by the Compensation Committee, for payment of compensation to any consulting firm or other advisors hired by the Compensation Committee.

The Compensation Committee held four meetings during the year ended December 31, 2023. Our Chief Executive Officer does not participate in deliberations concerning, and was not present for the vote on, his compensation arrangements. Additional information regarding the Compensation Committee’s processes and procedures for establishing and overseeing executive compensation is disclosed under the heading “Executive Compensation — Compensation Discussion and Analysis.” Corporate Governance Committee

Our Corporate Governance Committee currently consists of Ms. Dozier (Chair), Mr. Marnell and Mr. Wright. Each current and proposed member of the Corporate Governance Committee is an independent director, as defined by the Nasdaq Stock Market listing standards.

The Corporate Governance Committee operates under a written amended and restated charter adopted by the Board of Directors. The primary role of the Corporate Governance Committee is to (i) review and periodically reassess the overall corporate governance guidelines and policies for Golden; (ii) consider and make recommendations to the full Board of Directors concerning the appropriate size, organization, function and needs of the Board of Directors, including establishing criteria for Board of Directors membership and considering, recruiting and recommending candidates (including those recommended by shareholders) to fill new Board of Directors positions; (iii) annually reviewing performance of the current members of the Board of Directors; and (iv) recommending a slate of nominees to the Board of Directors to be considered for election or re-election at our annual meeting of shareholders. The Corporate Governance Committee is also responsible for reviewing and evaluating the performance of the Board of Directors, including overseeing the annual self-evaluation process for the Board of Directors and each of our standing committees, and ensuring that the Board of Directors receives periodic briefings and education on core concepts and trends that impact our industry, business and communities we operate in.

The Corporate Governance Committee also has oversight over Environmental, Social and Governance (“ESG”) initiatives, including human capital matters, and is committed to incorporating environmentally sustainable and socially responsible practices into our business operations, with an ongoing focus on environmental excellence, sustainability governance and social impact. The Committee reviews ESG matters, as they pertain to the Company’s business and long-term value creation for the Company and its shareholders, and make recommendations to the Board regarding these issues.

The Corporate Governance Committee also reviews candidates for director and executive officer positions and presents qualified candidates to the full Board of Directors for nomination. Qualified candidates will be considered without regard to race, color, religion, gender, ancestry, national origin or disability. The Corporate Governance Committee will consider each

candidate’s general business and industry experience, his or her ability to act on behalf of shareholders, potential concerns regarding director independence or conflicts of interest and other factors relevant in evaluating director nominees and executive officer candidates. Additionally, the Board of Directors will consider whether or not the candidate would be found suitable to be issued a gaming license. This is a requirement of continued Board of Directors membership and executive officer positions, as our directors and executive officers are subject to a variety of regulatory and licensing requirements in the various jurisdictions in which we operate gaming facilities. If any gaming authority with jurisdiction over our business were to find any of our directors or executive officers unsuitable for licensing or unsuitable to continue having a relationship with us, we would have to sever our relationship with that person. If the Corporate Governance Committee approves a new candidate for further review following an initial screening, the Corporate Governance Committee will establish an interview process for the candidate. Generally, the candidate will meet with the members of the Corporate Governance Committee, along with our Chief Executive Officer, and President and Chief Financial Officer. Contemporaneously with the interview process, the Corporate Governance Committee will conduct a comprehensive conflicts-of-interest assessment of the new candidate. The Corporate Governance Committee will consider reports of the interviews and the conflicts-of-interest assessment to determine whether to recommend the candidate to the full Board of Directors. The Corporate Governance Committee will also take into consideration the candidate’s personal attributes, including, without limitation, personal integrity, loyalty to us and concern for our success and welfare, willingness to apply sound and independent business judgment, awareness of a director’s vital part in good corporate citizenship and image, time available for meetings and consultation on company matters, and willingness to assume fiduciary responsibility.

Recommendations for candidates to be considered for election to the Board of Directors at our annual shareholder meetings may be submitted to the Corporate Governance Committee by our shareholders. Candidates recommended by our shareholders will be considered under the same standards as candidates that are identified by the Corporate Governance Committee. In order to make such a recommendation, a shareholder must submit the recommendation in writing to the Corporate Governance Committee, in care of our Secretary at our corporate office address, at least 120 days prior to the mailing date of the previous year’s Annual Meeting proxy statement. To enable the Committee to evaluate the candidate’s qualifications, shareholder recommendations must include the following information:

•The name and address of the nominating shareholder and of the director candidate;

•A representation that the nominating shareholder is a holder of record of our common stock and entitled to vote at the current year’s Annual Meeting;

•A description of any arrangements or understandings between the nominating shareholder and the director candidate or candidates being recommended pursuant to which the nomination or nominations are to be made by the shareholder;

•A resume or biographical information detailing the educational, professional and other information necessary to determine if the nominee is qualified to hold a Board of Directors position;

•Such other information regarding each nominee proposed by such shareholder as would have been required to be included in a proxy statement filed pursuant to the proxy rules of the SEC had such nominee been nominated by the Board of Directors; and

•The consent of each nominee to serve as a director if so elected.

The Corporate Governance Committee held four meetings during the year ended December 31, 2023.

Compliance Committee

Our Compliance Committee currently consists of: Mr. Lipparelli (Chair) and Mr. Chien (each of whom is a director of Golden), and Charles H. Protell, our President, Chief Financial Officer and Treasurer. In addition, the Nevada Gaming Control Board requires all non-restricted casino licensees in Nevada to include an independent committee member on its Compliance Committee and we therefore have engaged Thomas Jingoli, Executive Vice President and Chief Operating Officer for Konami Gaming, Inc., to serve in that role.

The Compliance Committee was formed by the Board of Directors. The primary purpose of the Compliance Committee is to oversee the proper implementation of our Gaming Compliance and Reporting Plan (the “Compliance Plan”) that is required by our order of registration with the Nevada Gaming Commission. Among other things, the role of the Compliance Committee is to: (i) ensure the effective implementation of the Compliance Plan; (ii) review and reassess periodically the adequacy of the Compliance Plan and the applicable reporting system utilized by our corporate compliance officer, and recommend any changes as deemed appropriate; (iii) identify and bring to the attention of the Board of Directors current and emerging corporate gaming and regulatory compliance trends and issues that may affect our business operations, performance, public image or compliance with applicable local, state and federal laws; (iv) provide oversight and periodic review of our regulatory

compliance policies, programs and systems; and (v) generally make recommendations to the Board of Directors on gaming and regulatory compliance matters.

The Compliance Committee held four meetings during the year ended December 31, 2023.

Compensation Committee Interlocks and Insider Participation

The current members of the Compensation Committee are Mr. Wright (Chair), Mr. Chien and Mr. Marnell. There were no relationships among members of the Compensation Committee, members of our Board of Directors or executive officers of Golden who served during the year ended December 31, 2023 that require disclosure under Item 407(e) of Regulation S-K promulgated under the Exchange Act.

Board of Directors’ Role in Risk Oversight

Our Board of Directors has an active role, as a whole and at the committee level, in overseeing management of our exposure to risk. The Board of Directors is regularly updated regarding risks that we face, including information security risks and risks that may impact our financial and operational performance, our credit and liquidity profile and other elements of our strategic plans. The Audit Committee assists our Board of Directors in this function and is charged with oversight of our policies regarding risk assessment and management, including our policies regarding management of financial and information security risk exposure and review of related party transactions. The Compensation Committee is responsible for overseeing the management of risks relating to executive compensation plans and arrangements. The Corporate Governance Committee manages risks associated with the independence of the Board, including considering whether any director nominees have relationships or potential conflicts of interest that could affect their independence. The Corporate Governance Committee is also responsible for assessing and reviewing risks related to ESG matters, including those related to climate change, as well as human capital related matters. The Corporate Governance Committee controls and monitors the processes related to such risks through obtaining regular quarterly updates from the ESG Committee and identifies, manages and mitigates such risks through shifting the Company’s long-term strategic goals.

While each committee is responsible for evaluating certain risks and overseeing the management of such risks, the entire Board of Directors is informed of risks we face through reports from our committees and management.

Environmental Stewardship

Climate Change Risk Strategy and Mitigation

Most of our operations are located in areas classified as extreme weather locations, which puts our business at potential risk from natural disasters such as floods, flash floods, droughts, and high winds. We understand potential risks arising from climate change and are committed to contributing to mitigation of those risks. In 2023, we strengthened our data collection process to monitor our impact on the environment and potentially reduce our impact on energy and water consumption in our operations.

Water and Energy Efficiency

We are focused on enhancing our environmental leadership and are committed to preserving water resources by regularly reevaluating our water management program and expanding energy efficient technologies.

We incorporate energy efficiency in our business practices and prioritize installation of high-efficiency devices across our casino properties and branded tavern locations. We plan to increase our investment in smart technologies to track our usage of utilities more efficiently. Our ongoing efforts include converting to LED lighting throughout our properties and retrofitting the existing HVAC systems with higher-efficiency options. We extended our partnership with Energy Star, which delivers cost-saving energy efficiency solutions that protect climate and public health and improve air quality. Partnership with Energy Star provides us with measured information to rely on to make well-informed decisions to improve our energy management and efficiency.

We practice xeriscaping as an environmental design choice, which allows for a reduction in our water usage and maintenance costs associated with commercial landscaping and allows us to adapt to the current pressures around monitoring and minimizing water usage. We plan to increase our investment in smart technologies that allow us to track our usage of utilities more efficiently and to prioritize budgeting for water-efficient equipment and appliances.

The ESG Committee is responsible for leading sustainability practices and strategy, while facilities teams are responsible for maintaining, monitoring and reviewing our current levels of water and energy usage, with the ultimate goal of optimizing and

reducing our overall water and energy consumption. Our current water and energy policies are in compliance with federal, state and local regulations.

Recycling and Waste Management

We continue highlighting the importance of waste reduction. We partner with multiple recycling companies and take an active part in landfill diversion initiatives. We recycle through third-party services and our efforts include recycling plastic, paper, cardboard, linens and vegetable oil. We initiated an “all-shred” program, partnering with a paper recycling company. We contribute to food recovery by sending food scraps from our properties to be used as livestock feed. Our team members participate in community cleanup days alongside the local organizations. In addition, we partner with The Blind Center of Nevada, a local non-profit organization in Las Vegas, Nevada, by participating in the e-waste management program through donation of used laptops and computers with an estimated device count of 150-200 per quarter.

Social Responsibility

We believe that our organization’s social goals as well as our team members’ involvement have a positive impact on the communities we serve. We are proud to be involved in various charitable events, including an annual fundraiser for amyotrophic lateral sclerosis (ALS), the Keep Memory Alive foundation for brain disorders, Scale The STRAT for the American Lung Association, and others. We have been contributing to the AAA Scholarship fund since 2018 and donate $0.2 million each year. We support food security programs, including but not limited to, Feed a Family, Meals for Christmas and Thanksgiving, and Meals for the Nevada Housing Authority, and our team members volunteer in food banks. In addition, we participate in “adopt the school” programs in each community we operate in and support local schools through both charitable donations and supply drives.

In 2023, we updated our social disclosures by formalizing our policies and statements (published at https://www.goldenent.com/our-policies.html), and issuing our first ESG fact sheet entailing various aspects of ESG topics and matters (which can be located at https://www.goldenent.com/our-policies/ESG2023.pdf).

Responsible Gaming, Marketing and Advertising

We are committed to promoting responsible gaming and a healthy gaming experience throughout our properties and branded tavern locations, which is an important part of our overall marketing strategy. We engage in responsible gaming practices and are committed to promoting such practices and providing responsible gaming information to our customers. We are a member of the Nevada Council on Problem Gaming and have contributed nearly $400,000 to the organization since 2015.

Our marketing practices adhere to legal and regulatory requirements, and we put a significant emphasis on raising awareness about our commitment to responsible gaming. We strictly prohibit any marketing and advertisements directed toward underage persons or high-risk individuals. Our patrons have an opportunity to be removed from any promotional mailings and gambling on site by requesting to be a part of our exclusion program. We include a toll-free help number and responsible gaming messaging at all of our properties and branded tavern locations.

We regularly train our team members on ways to detect and prevent minors from gambling and consuming alcohol or loitering in designated gaming areas. This training is required to be taken by all team members upon hire.

Human Capital Management

We are committed to recruiting, developing and retaining a diverse and superior workforce. We have a long history and deep cultural commitment to service and authenticity. Our human capital management is overseen by our Senior Vice President of Human Resources who provides quarterly updates on human capital related matters to the Corporate Governance Committee.

As of December 31, 2023, we employed over 5,800 team members and over 1,400 of our team members were covered by various collective bargaining agreements.

Recruiting

We recruit applicants by utilizing various recruitment platforms and sources in an effort to secure a diverse pool of applicants and ensure sustainability of our talent pipeline. We offer referral and retention incentives to remain competitive in a limited labor market. In 2023, we continued our relationships with various local non-profit organizations to connect job seekers with employment opportunities within Golden and attended numerous career fairs throughout the year. We continue partnering with University of Nevada - Las Vegas (“UNLV”), offering internship opportunities to students within our Finance and

Accounting, Hospitality, Marketing and Information Technology departments, and providing gaming-specific lecturing both at UNLV and at our properties. We enhanced job skills training initiatives so that those with a skills gap or no prior experience could receive training enabling them to perform job duties. Further, we provide behavioral interviewing training to support investment in our top talent. Our number one applicant and new hire source is Indeed, followed by our company site, and team member referrals.

Mission and Values

In 2023, we continued to emphasize our organizational mission and values. Our mission is to provide exceptional service, founded on our commitment to accountability and integrity in every guest experience. We share and uphold our organization’s values by empowering our team members and implementing standards to promote diversity, equity and inclusion, strong ethical conduct and community involvement.

Team Member Benefits and Well-Being

We engage with a nationally recognized compensation and benefits consulting firm to independently evaluate the effectiveness and competitiveness of our benefits program within the industry. As an organization with a diverse workforce across our casino properties and branded taverns, we offer our team members several options for annual benefits enrollment, including enrollment by telephone, online or through an app, and we support multi-lingual options. Our comprehensive benefits program provides our team members with the flexibility to choose their preferred medical, dental and vision plans. In addition, we offer telemedicine, flexible spending and health savings accounts, life insurance and a retirement plan that provides an annual discretionary match. We also offer a variety of optional benefits to promote the health and security of our employees and their families, including disability insurance and expanded life insurance coverage, critical illness and accident insurance, legal, identity theft, auto and home insurance, and pet insurance. We view mental health services as a fundamental part of our benefits program and offer a comprehensive suite of related benefits, including online mental health counseling through our team member assistance program. Additionally, we offer extended benefits to employees with disabilities and chronic health conditions, including no cost Medicare and Medicaid assistance programs and prescription savings solutions for team members with chronic health conditions.

We continue to offer a number of on-site health clinics to ensure the health and well-being of our team members. Such clinics

are offered free of charge and include, but are not limited to, dental exams, preventative care health screenings, and mental health awareness and support. We also offer free seminars to educate our team members on financial wellness, retirement planning, and other matters. We are committed to promoting and building a workplace where our team members feel safe and secure. Team members are required to complete specific safety training courses based on their job duties and potential hazards at hire and then on an annual basis.

Training, Employee Retention and Development

We consider employee training, retention, and development to be an important part of our overall employee professional development policy, as such initiatives also lead to a higher level of team member engagement and job satisfaction.

In 2023, we enhanced our learning management system by adding 35 learning opportunities. All safety and compliance training, except certain required hands-on certifications, are part of the online curriculum. Certifications have been assigned to manage reoccurring safety and compliance requirements. The training catalog includes multiple courses for leadership and management processes, as well as options to improve technical skills. Additionally, we have expanded department level training and development initiatives with leadership facilitated instructor training. We have also invested in resources to make online training more accessible to our team members, which resulted in over 76,000 training courses completed in 2023.

Our investment in our team members’ talent and ongoing development is one of the key aspects of our employee retention efforts, as we believe that creating an involved environment for our team members sets us apart from our competitors and makes us an attractive employer. We consider employee retention to be an integral part of our overall employment strategy and invest in the continuous development of our team members and their growth within the company.

Affinity Groups and Mentoring

In 2022, we launched our Golden Women’s Group (“GWG”), a women’s leadership development program dedicated to the workplace advancement of women. The mission of the GWG is to promote a support network among its members and to provide mentoring and professional education for established and emerging women leaders within our organization. The focus of this program is to build leadership skills and strategies that will positively impact the GWG class members by

enhancing their professional skill set and relationships. We have successfully completed the second year of the program with over 30 GWG graduates.

In 2023, as part of our GWG program, we launched a mentoring program designed to enhance career development opportunities for the GWG participants. We strongly believe that mentoring improves performance, job satisfaction and retention, advances skill-building, encourages growth, and helps team members to stay connected and expand their networking circles. Mentoring aids the personal and professional development of the mentee and increases mentors’ influence and impact at work for mentors by supporting the organization and developing talent.

Diversity, Equity and Inclusion

As of December 31, 2023, our organizational makeup was 50.5% female and 49.5% male with approximately 45% of management roles held by women. Average rate of pay for female salaried employees falls within 10% of the overall average pay for male employees in the same category.

As of December 31, 2023, the ethnic distribution of the overall workforce was 50% Caucasian, 18% Hispanic, 11% two or more races, 10% Asian, 9% Black, followed by 2% other races (including American Indian, Alaskan Native, Native Hawaiian, and Pacific Islander). The breakdown for salaried team members was 64% Caucasian and 36% non-Caucasian (all other races) with 30% of management roles held by non-Caucasian team members.

Among the overall workforce, as of December 31, 2023, 32% were under the age of 40 and 68% were over the age of 40, 12% of which were 65 and older. Individuals over the age of 40 represented 73% of the salaried workforce.

We strongly believe in attracting, developing and retaining diverse talent. We ensure equal access to opportunities for all of our team members. We foster an inclusive culture and workplace environment, promote tolerance, mutual respect and a sense of belonging. Our team members are required to complete a mandatory human trafficking training, with the scope and frequency of training being based on the team members’ job duties.

Community Involvement and Charities

Our commitment is to serve and strengthen the communities we operate in. Each of our properties and our team members donate to various organizations, participate in community-related charities, drives and events, and provide in-kind and other donations and volunteering hours.

Cybersecurity

Maintaining and improving our cybersecurity capabilities is a high priority for our business. Our Board of Directors considers cybersecurity risk as part of its risk oversight function and has delegated to the Audit Committee of our Board of Directors oversight of cybersecurity and another information technology risks. The Audit Committee oversees management’s implementation of our cybersecurity risk management program and receives semi-annual reports from our General Counsel and Chief Technology Officer on our cybersecurity risks and the implementation of our cybersecurity risk management program. In addition, management updates the Audit Committee, as necessary, regarding any material cybersecurity incidents, as well as any incidents with lesser impact potential.

The Audit Committee reports to our Board of Directors regarding its activities, including those related to cybersecurity. Our Board of Directors also receives briefings from management on our cyber risk management program, including presentations on cybersecurity topics from our Chief Technology Officer, internal security staff or external experts as part of the Board’s continuing education on topics that impact public companies.

Our management team has formed a dedicated group, including our General Counsel, Chief Technology Officer, and key information technology team members from our information technology security, compliance, vendor management office and our project management office, that is responsible for assessing and managing our material risks from cybersecurity threats. This group meets on a monthly basis to discuss the results of our cybersecurity and privacy matters and to evaluate new technologies from a security, operational, and regulatory perspective prior to their implementation. Their findings are summarized in a comprehensive report that is reviewed by our Audit Committee. Our Chief Technology Officer has over 30 years of experience in cybersecurity related to infrastructure (on-premise and cloud based), security (managed both internally

and by third-party providers), and development (agile and waterfall methodologies). Our Chief Technology Officer is supported by a team of information security and compliance professionals and third-party partners.

Our management team supervises efforts to prevent, detect, mitigate, and remediate cybersecurity risks and incidents through various means, which may include briefings from internal security personnel; threat intelligence and other

information obtained from governmental, public or private sources, including external consultants engaged by us; and alerts and reports produced by security tools deployed in the IT environment.

Throughout our organization, we maintain cybersecurity awareness and training programs through our learning management platform as well as through our internal policies and certifications, which are subject to review and oversight by our management and our Board of Directors. These programs and certifications cover computer acceptable-use practices, phishing education and awareness, and general security and privacy awareness regarding how to detect possible threats and obtain assistance from company cybersecurity experts. All newly hired team members are required to take training courses with particular focus on the acceptable use of technology and related cybersecurity risks. E-mail phishing training and testing is performed routinely throughout the year.

Corporate Policies and Procedures

Our Board of Directors reviews our corporate practices and organizational policies on an ongoing basis. We are committed to maintaining a strong and effective corporate governance structure. We have developed and regularly update our corporate governance documents located at https://www.goldenent.com/governance.html. Our corporate policies that were updated in 2023 and published on our corporate website at https://www.goldenent.com/our-policies.html are listed below:

| | | |

| Our Policies | |

| Anti-Human Trafficking and Anti-Modern Slavery Policy | |

| Non-Discrimination, Non-Harassment and Non-Retaliation Policy | |

| Responsible Gaming and Marketing Policy | |

| Anti-Bribery, Anti-Corruption and Anti-Money Laundering Policy | |

| Gaming Compliance Plan | |

| Human Rights Statement | |

| Community Impact Statement | |

| Diversity, Equity and Inclusion Statement | |

| Supplier Code of Conduct | |

ESG Committee

In 2023, we created a management ESG Committee, which is comprised of Legal, Finance and Human Resource team members. The ESG Committee meets on a quarterly basis and provides semi-annual reports on ESG related matters to the Corporate Governance Committee. The ESG Committee assists the Corporate Governance Committee in (i) developing, reviewing and evaluating the Company-wide polices, related to ESG and other issues; (ii) working with the Company’s executives and management in developing strategies and goals by integrating sustainability into the strategic business activities and analyzing potential future risks for the Company; (iii) advising the Company’s executives and management on disclosures pertaining to the Company’s business and its stakeholders. The Corporate Governance Committee is responsible for the oversight of the Company’s ESG goals and initiatives.

Corporate Governance