UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

|

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended

OR

|

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number

(Exact name of registrant as specified in its charter)

|

MARYLAND |

|

|

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

|

|

|

|

|

|

|

(Address of principal executive offices) |

(Zip Code) |

REGISTRANT'S TELEPHONE NUMBER, INCLUDING AREA CODE: (

SECURITIES REGISTERED PURSUANT TO SECTION 12(b) OF THE ACT:

|

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

|

|

|

|

|

|

SECURITIES REGISTERED PURSUANT TO SECTION 12(g) OF THE ACT: NONE

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer", "accelerated filer", "smaller reporting company", and "emerging growth company" in Rule 12b-2 of the Exchange Act.

|

|

☒ |

|

Accelerated filer |

☐ |

|

Non-accelerated filer |

☐ |

|

Smaller reporting company |

|

|

Emerging growth company |

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management's assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes

The aggregate market value of the shares of the registrant's Common Stock held by non-affiliates was approximately $

DOCUMENTS INCORPORATED BY REFERENCE:

Auditor Firm Id: 000

CORECIVIC, INC.

FORM 10-K

For the fiscal year ended December 31, 2021

TABLE OF CONTENTS

|

Item No. |

|

Page |

|

|

|

|

|

|

|

|

|

|

|

|

|

1. |

7 |

|

|

|

7 |

|

|

|

9 |

|

|

|

14 |

|

|

|

18 |

|

|

|

20 |

|

|

|

28 |

|

|

|

33 |

|

|

|

36 |

|

|

|

37 |

|

|

|

38 |

|

|

1A. |

39 |

|

|

1B. |

60 |

|

|

2. |

60 |

|

|

3. |

60 |

|

|

4. |

60 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5. |

61 |

|

|

|

61 |

|

|

|

61 |

|

|

|

61 |

|

|

6. |

61 |

|

|

7. |

Management's Discussion and Analysis of Financial Condition and Results of Operations |

62 |

|

|

62 |

|

|

|

66 |

|

|

|

69 |

|

|

|

84 |

|

|

|

91 |

|

|

|

91 |

|

|

7A. |

91 |

|

|

8. |

92 |

|

|

9. |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

92 |

|

9A. |

92 |

|

|

9B. |

95 |

|

|

9C. |

Disclosure Regarding Foreign Jurisdictions That Prevent Inspections |

95 |

|

|

|

|

|

|

|

|

|

|

|

|

|

10. |

96 |

|

|

11. |

96 |

|

|

12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

96 |

|

13. |

Certain Relationships and Related Party Transactions and Director Independence |

97 |

|

14. |

97 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

15. |

98 |

|

|

16. |

102 |

|

|

|

103 |

2

CAUTIONARY STATEMENT REGARDING

FORWARD-LOOKING INFORMATION

This Annual Report on Form 10-K, or Annual Report, contains statements as to our beliefs and expectations of the outcome of future events that are forward-looking statements as defined within the meaning of the Private Securities Litigation Reform Act of 1995, as amended. All statements other than statements of current or historical fact contained in this Annual Report, including statements regarding our future financial position, business strategy, budgets, projected costs and plans, and objectives of management for future operations, are forward-looking statements. The words "anticipate," "believe," "continue," "could," "estimate," "expect," "intend," "may," "plan," "projects," "will," and similar expressions, as they relate to us, are intended to identify forward-looking statements. These forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially from the statements made in this Annual Report. These include, but are not limited to, the risks and uncertainties associated with:

|

|

• |

changes in government policy (including the United States Department of Justice, or DOJ, not renewing contracts as a result of President Biden’s Executive Order on Reforming Our Incarceration System to Eliminate the Use of Privately Operated Criminal Detention Facilities, or the Private Prison EO) (two agencies of the DOJ, the United States Federal Bureau of Prisons, or BOP, and the United States Marshals Service, or USMS, utilize our services), legislation and regulations that affect utilization of the private sector for corrections, detention, and residential reentry services, in general, or our business, in particular, including, but not limited to, the continued utilization of our correctional and detention facilities by the federal government, and the impact of any changes to immigration reform and sentencing laws (we do not, under longstanding policy, lobby for or against policies or legislation that would determine the basis for, or duration of, an individual's incarceration or detention); |

|

|

• |

our ability to obtain and maintain correctional, detention, and residential reentry facility management contracts because of reasons including, but not limited to, sufficient governmental appropriations, contract compliance, negative publicity and effects of inmate disturbances; |

|

|

• |

changes in the privatization of the corrections and detention industry, the acceptance of our services, the timing of the opening of new facilities and the commencement of new management contracts (including the extent and pace at which new contracts are utilized), as well as our ability to utilize available beds; |

|

|

• |

general economic and market conditions, including, but not limited to, the impact governmental budgets can have on our contract renewals and renegotiations, per diem rates, and occupancy; |

|

|

• |

fluctuations in our operating results because of, among other things, changes in occupancy levels; competition; contract renegotiations or terminations; inflation and other increases in costs of operations, including a continuing rise in labor costs; fluctuations in interest rates and risks of operations; |

|

|

• |

the duration of the federal government's denial of entry at the United States southern border to asylum-seekers and anyone crossing the southern border without proper documentation or authority in an effort to contain the spread of the novel coronavirus and related variants, or COVID-19; |

|

|

• |

government and staff responses to staff or residents testing positive for COVID-19 within public and private correctional, detention and reentry facilities, including the facilities we operate; |

|

|

• |

restrictions associated with COVID-19 that disrupt the criminal justice system, along with government policies on prosecutions and newly ordered legal restrictions that affect the number of people placed in correctional, detention, and reentry facilities, including those associated with a resurgence of COVID-19; |

|

|

• |

whether revoking our real estate investment trust, or REIT, election, effective January 1, 2021, and our revised capital allocation strategy can be implemented in a cost effective manner that provides the expected benefits, including facilitating our planned debt reduction initiative and planned return of capital to shareholders; |

|

|

• |

our ability to successfully identify and consummate future development and acquisition opportunities and realize projected returns resulting therefrom; |

3

|

|

• |

our ability, following our revocation of our REIT election, to identify and initiate service opportunities that were unavailable under the REIT structure; |

|

|

• |

our ability to have met and maintained qualification for taxation as a REIT for the years we elected REIT status; and |

|

|

• |

the availability of debt and equity financing on terms that are favorable to us, or at all. |

Any or all of our forward-looking statements in this Annual Report may turn out to be inaccurate. We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our financial condition, results of operations, business strategy, and financial needs. Our statements can be affected by inaccurate assumptions we might make or by known or unknown risks, uncertainties and assumptions, including the risks, uncertainties, and assumptions described in "Risk Factors" included elsewhere in this Annual Report and in other reports, documents, and other information we file with the Securities and Exchange Commission, or the SEC, from time to time.

In light of these risks, uncertainties and assumptions, the forward-looking events and circumstances discussed in this Annual Report may not occur and actual results could differ materially from those anticipated or implied in the forward-looking statements. When you consider these forward-looking statements, you should keep in mind the risk factors and other cautionary statements in this Annual Report, including in "Management's Discussion and Analysis of Financial Condition and Results of Operations," "Business" and "Risk Factors."

Our forward-looking statements speak only as of the date made. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or circumstances or otherwise, except as required by law. All subsequent written and oral forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the cautionary statements contained in this Annual Report.

4

RISK FACTORS SUMMARY

Our business faces significant risks and uncertainties. If any of the following risks are realized, our business, financial condition and results of operations could be materially and adversely affected. You should carefully review and consider the full discussion of our risk factors in Part I, Item 1A, "Risk Factors" of this Annual Report. Set forth below is a summary list of the principal risk factors as of the date of the filing of this Annual Report.

|

|

• |

Resistance to privatization of correctional, detention, and residential reentry facilities, and negative publicity regarding inmate disturbances or perceived poor operational performance, could result in our inability to obtain new contracts, the loss of existing contracts, or other unforeseen consequences. |

|

|

• |

We are subject to fluctuations in occupancy levels, and a decrease in occupancy levels could cause a decrease in revenues and profitability. |

|

|

• |

We are dependent on government appropriations, and our results of operations may be negatively affected by governmental budgetary challenges or government shutdowns. |

|

|

• |

The COVID-19 pandemic has had, and we expect will continue to have, certain negative effects on our business, and such effects may have a material adverse effect on our results of operations, financial condition and cash flows. |

|

|

• |

Competition may adversely affect the profitability of our business. |

|

|

• |

We are subject to terminations, non-renewals, or competitive re-bids of our government contracts. |

|

|

• |

Our ability to secure new contracts to develop and manage correctional, detention, and residential reentry facilities depends on many factors outside our control. |

|

|

• |

We may face community opposition to facility location, which may adversely affect our ability to obtain new contracts. |

|

|

• |

Providing family residential services increases certain unique risks and difficulties compared to operating our other facilities. |

|

|

• |

We may incur significant start-up and operating costs on new contracts before receiving related revenues, which may impact our cash flows and not be recouped. |

|

|

• |

Government agencies may investigate and audit our contracts and operational performance, and if any deficiencies or improprieties are found, we may be required to cure those deficiencies or improprieties, refund revenues we have received, or forego anticipated revenues, and we may be subject to penalties and sanctions, including contract termination and prohibitions on our bidding in response to Requests for Proposals. |

|

|

• |

Failure to comply with facility contracts or with unique and increased governmental regulation could result in material penalties or non-renewal or termination of noncompliant contracts or our other contracts to provide or manage correctional, detention, and residential reentry facilities. |

|

|

• |

We depend on a limited number of governmental customers for a significant portion of our revenues. |

|

|

• |

As a result of our acquisitions, we have recorded and will continue to record goodwill and other intangible assets. In the future, our goodwill or other intangible assets may become impaired, which could result in non-cash charges to our results of operations. |

|

|

• |

We are dependent upon our senior management and our ability to attract and retain sufficient qualified personnel. |

|

|

• |

We are subject to various types of litigation. |

|

|

• |

We are subject to necessary insurance costs. |

|

|

• |

We may be adversely affected by inflation. |

|

|

• |

Technological changes or negative changes in the level of acceptance of, or resistance to, the use of electronic monitoring products could cause our electronic monitoring products and other technology to become obsolete or require the redesign of our electronic monitoring products, which could have an adverse effect on our business. |

|

|

• |

We depend on a limited number of third parties to manufacture and supply our electronic monitoring products. If our suppliers cannot provide the products or services we require in a timely manner and with such quality as we expect, our ability to market and sell our electronic monitoring products and services could be harmed. |

5

|

|

• |

We may be subject to costly product liability claims from the use of our electronic monitoring products, which could damage our reputation, impair the marketability of our products and services and force us to pay costs and damages that may not be covered by adequate insurance. |

|

|

• |

We are subject to risks associated with ownership of real estate. |

|

|

• |

We may be adversely affected by an increase in costs or difficulty of obtaining adequate levels of surety credit on favorable terms. |

|

|

• |

Interruption, delay or failure of the provision of our technology services or information systems, or the compromise of the security thereof, could adversely affect our business, financial condition or results of operations. |

|

|

• |

We are subject to risks related to corporate social responsibility. |

|

|

• |

As an owner and operator of correctional, detention, and residential reentry facilities, we are subject to risks relating to acts of God, outbreaks of epidemic or pandemic disease, global climate change, terrorist activity and war. |

|

|

• |

Our indebtedness could adversely affect our financial health and prevent us from fulfilling our obligations under our debt securities. |

|

|

• |

Our Credit Agreements, indentures related to our senior notes, and other debt instruments have restrictive covenants that could limit our financial flexibility. |

|

|

• |

Our indebtedness is secured by a substantial portion of our assets. |

|

|

• |

Servicing our indebtedness will require a significant amount of cash or may require us to refinance our indebtedness before it matures. Our ability to generate cash depends on many factors beyond our control and there is no assurance that we will be able to refinance our debt on acceptable terms, or at all. |

|

|

• |

We are required to repurchase all or a portion of our senior notes upon a change of control, and our Credit Agreements are subject to acceleration upon a change of control. |

|

|

• |

Despite current indebtedness levels, we may still incur more debt. |

|

|

• |

Our ability to incur more secured debt has been further limited by the Term Loan B. |

|

|

• |

Our access to capital may be affected by general macroeconomic conditions. |

|

|

• |

Increasing activist resistance to the use of public-private partnerships for correctional, detention, and residential reentry facilities could impact our ability to obtain financing to grow our business or to refinance existing indebtedness, which could have a material adverse effect on our business, financial condition and results of operations. |

|

|

• |

Rising interest rates would increase the cost of our variable rate debt. |

|

|

• |

We may fail to realize the anticipated benefits of revoking our REIT election and becoming a taxable C Corporation effective January 1, 2021, or those benefits may take longer to realize than expected, if at all, or may not offset the costs of revoking our REIT election and becoming a taxable C Corporation. |

|

|

• |

If we failed to remain qualified as a REIT for those years we elected REIT status, we would be subject to corporate income taxes and would not be able to deduct distributions to stockholders when computing our taxable income for those years. |

|

|

• |

Even if we remained qualified as a REIT for those years we elected REIT status, we may owe taxes under certain circumstances. |

|

|

• |

The market price of our equity securities may vary substantially, which may limit our stockholders' ability to liquidate their investment. |

|

|

• |

The number of shares of our common stock available for future sale could adversely affect the market price of our common stock. |

|

|

• |

Future offerings of debt or equity securities ranking senior to our common stock or incurrence of debt (including under our Bank Credit Facility) may adversely affect the market price of our common stock. |

|

|

• |

Our issuance of preferred stock could adversely affect holders of our common stock and discourage a takeover. |

|

|

• |

Our charter and bylaws and Maryland law could make it difficult for a third party to acquire our company. |

6

PART I.

|

ITEM 1. |

BUSINESS. |

Overview

We are a diversified government solutions company with the scale and experience needed to solve tough government challenges in flexible, cost-effective ways. Through three segments, CoreCivic Safety, CoreCivic Community, and CoreCivic Properties, we provide a broad range of solutions to government partners that serve the public good through corrections and detention management, a network of residential reentry centers to help address America's recidivism crisis, and government real estate solutions. We have been a flexible and dependable partner for government for nearly 40 years. Our employees are driven by a deep sense of service, high standards of professionalism and a responsibility to help government better the public good.

We are the nation's largest owner of partnership correctional, detention, and residential reentry facilities and one of the largest prison operators in the United States. We also believe we are the largest private owner of real estate used by government agencies in the U.S. As of December 31, 2021, through our CoreCivic Safety segment, we operated 46 correctional and detention facilities, 41 of which we owned, with a total design capacity of approximately 69,000 beds. Through our CoreCivic Community segment, we owned and operated 26 residential reentry centers with a total design capacity of approximately 5,000 beds. In addition, through our CoreCivic Properties segment, we owned 10 properties for lease to third parties and used by government agencies, totaling 1.8 million square feet.

In addition to providing fundamental residential services, our correctional, detention, and residential reentry facilities offer a variety of rehabilitation and educational programs, including basic education, faith-based services, life skills and employment training, and substance abuse treatment. These services are intended to help reduce recidivism and to prepare offenders for their successful reentry into society upon their release. We also provide or make available to offenders certain health care (including medical, dental, and mental health services), food services, and work and recreational programs.

We are a Maryland corporation formed in 1983. Our principal executive offices are located at 5501 Virginia Way, Brentwood, Tennessee, 37027, and our telephone number at that location is (615) 263-3000. Our website address is www.corecivic.com. We make our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, definitive proxy statements, and amendments to those reports under the Securities Exchange Act of 1934, as amended, or the Exchange Act, available on our website, free of charge, as soon as reasonably practicable after these reports are filed with or furnished to the SEC. Information contained on our website is not part of this Annual Report.

We operated as a REIT from January 1, 2013 through December 31, 2020. As a REIT, we provided services and conducted other business activities through taxable REIT subsidiaries, or TRSs. A TRS is a subsidiary of a REIT that is subject to applicable corporate income tax rates and certain qualification requirements. Our use of TRSs enabled us to comply with REIT qualification requirements while providing correctional services at facilities we own and at facilities owned by our government partners and to engage in certain other business operations.

As a REIT, we generally were not subject to federal income taxes on our REIT taxable income and gains that we distributed to our stockholders, including the income derived from our real estate and dividends we earned from our TRSs. However, our TRSs were required to pay income taxes on their earnings at regular corporate income tax rates. As a REIT, we generally were required to distribute annually to our stockholders at least 90% of our REIT taxable income (determined without regard to the dividends paid deduction and excluding net capital gains). Our REIT taxable income did not typically include income earned by our TRSs except to the extent our TRSs paid dividends to the REIT.

On August 5, 2020, we announced that our Board of Directors, or BOD, unanimously approved a plan to revoke our REIT election and become a taxable C Corporation, effective January 1, 2021. The BOD also voted unanimously to discontinue our quarterly dividend and prioritize allocating our free cash flow to reduce debt levels. As a result, we are no longer required to operate under REIT rules, including the requirement to distribute at least 90% of our taxable income to our stockholders, which provides us with greater flexibility to use our free cash flow. Beginning January 1, 2021, we are subject to federal and state income taxes on our taxable income at applicable tax rates, and

7

are no longer entitled to a tax deduction for dividends paid. However, we believe this conversion will improve our overall credit profile and lower our overall cost of capital. Following our first priority of reducing debt, we expect to allocate a substantial portion of our free cash flow to returning capital to our shareholders and pursuing alternative growth opportunities. This conversion will also provide us with significantly more liquidity, which will enable us to reduce our reliance on the capital markets and reduce the size of our Second Amended and Restated Credit Agreement (which provides for a term loan of an original principal balance of $200.0 million, or Term Loan A, and a revolving credit facility in an aggregate principal amount of up to $800.0 million, or Revolving Credit Facility), or Bank Credit Facility, in the future. We continued to operate as a REIT for the 2020 tax year, and existing REIT requirements and limitations, including those established by our organizational documents, remained in place until January 1, 2021.

Our ongoing operations are organized into three principal business segments:

|

|

• |

CoreCivic Safety segment, consisting of the 46 correctional and detention facilities that are owned, or controlled via a long-term lease, and managed by CoreCivic, as well as those correctional and detention facilities owned by third parties but managed by CoreCivic. CoreCivic Safety also includes the operating results of our subsidiary that provides transportation services to governmental agencies, TransCor America, LLC, or TransCor. |

|

|

• |

CoreCivic Community segment, consisting of the 26 residential reentry centers that are owned, or controlled via a long-term lease, and managed by CoreCivic. CoreCivic Community also includes the operating results of our electronic monitoring and case management services. |

|

|

• |

CoreCivic Properties segment, consisting of the 10 real estate properties owned by CoreCivic for lease to third parties and used by government agencies. |

For the years ended December 31, 2021, 2020, and 2019, our total segment net operating income, which we define as a facility's revenues (including interest income associated with finance leases) less operating expenses, was divided among our three business segments as follows:

|

|

|

For the Years Ended December 31, |

|

|||||||||

|

|

|

2021 |

|

|

2020 |

|

|

2019 |

|

|||

|

Segment: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Safety |

|

|

85.5 |

% |

|

|

82.2 |

% |

|

|

85.2 |

% |

|

Community |

|

|

3.3 |

% |

|

|

3.4 |

% |

|

|

5.0 |

% |

|

Properties |

|

|

11.2 |

% |

|

|

14.4 |

% |

|

|

9.8 |

% |

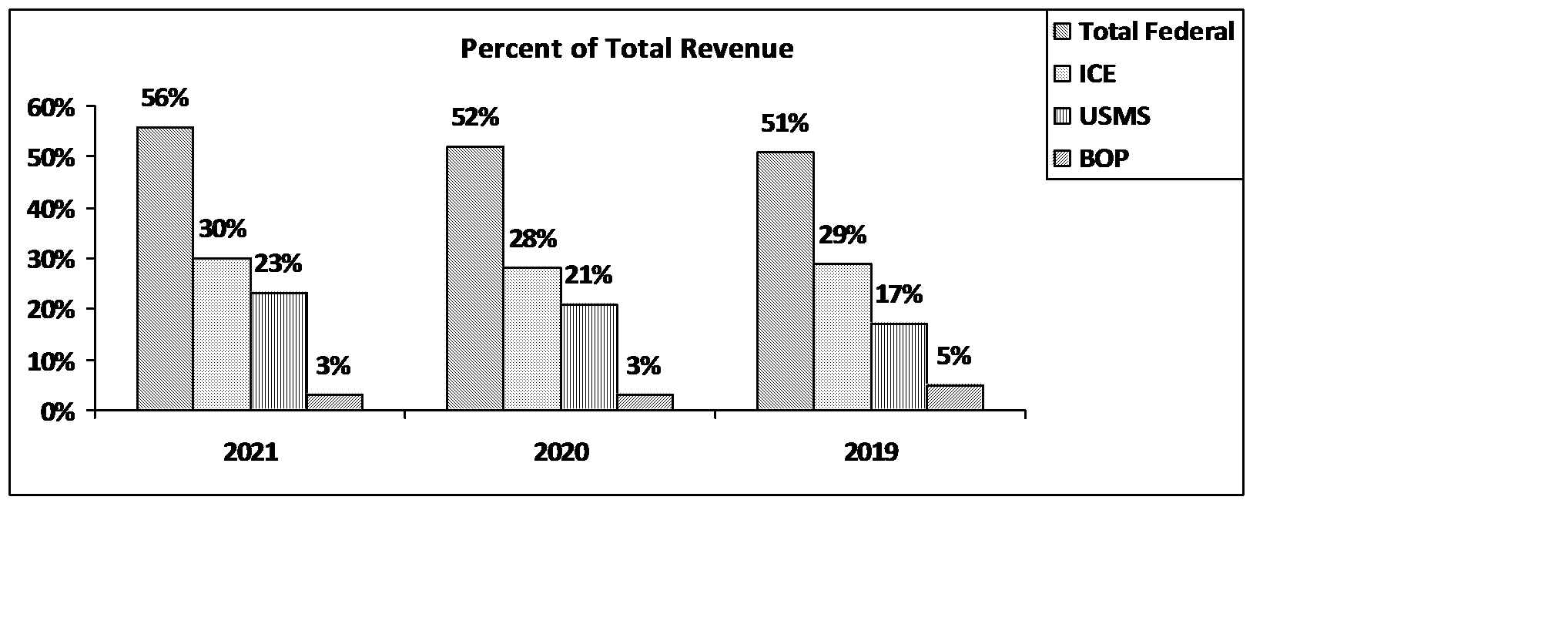

Our customers primarily consist of federal, state, and local government agencies. Federal correctional and detention authorities primarily consist of ICE, the USMS, and the BOP. Payments by federal correctional and detention authorities represented 56%, 52%, and 51% of our total revenue for the years ended December 31, 2021, 2020, and 2019, respectively.

Our customer contracts for providing bed capacity and correctional, detention, and residential reentry services in our CoreCivic Safety and CoreCivic Community segments typically have terms of three to five years and contain multiple renewal options. Most of our facility contracts also contain clauses that allow the government agency to terminate the contract at any time without cause, and our facility contracts are generally subject to annual or bi-annual legislative appropriations of funds. Notwithstanding these termination clauses, the contract renewal rate for properties we owned and operated in these segments was 95% over the five years ended December 31, 2021. The government lease agreements in our CoreCivic Properties segment typically have terms of five to twenty years including renewal options, and generally have more restrictive termination clauses.

8

In our CoreCivic Safety and CoreCivic Community segments, we are compensated for providing bed capacity and correctional, detention, and residential reentry services at a per diem rate based upon actual or minimum guaranteed occupancy levels. Occupancy rates for a particular facility are typically low when first opened or immediately following an expansion. However, beyond the start-up period, which typically ranges from 90 to 180 days, the occupancy rate tends to stabilize. Our occupancy rates have declined since 2019 due to the effects of COVID-19, as further described hereafter. The average compensated occupancy of our correctional, detention, and residential reentry facilities, based on rated capacity was as follows for 2021, 2020, and 2019:

|

|

|

2021 |

|

|

2020 |

|

|

2019 |

|

|||

|

CoreCivic Safety facilities |

|

|

73 |

% |

|

|

75 |

% |

|

|

82 |

% |

|

CoreCivic Community facilities |

|

|

55 |

% |

|

|

62 |

% |

|

|

76 |

% |

|

Total |

|

|

72 |

% |

|

|

74 |

% |

|

|

82 |

% |

The average compensated occupancy of our CoreCivic Safety and CoreCivic Community facilities, excluding idled facilities, was 80%, 82%, and 93% for 2021, 2020, and 2019, respectively.

In our CoreCivic Properties segment, we own properties for lease to third parties and used by government agencies where our occupancy percentage is based on leased square feet rather than bed capacity. The average occupancy of the 10 properties comprising our CoreCivic Properties segment portfolio as of December 31, 2021 was 100%, 99%, and 99% for 2021, 2020, and 2019, respectively.

Operating Procedures and Offender Services for Correctional, Detention, and Residential Reentry Facilities

Pursuant to the terms of our customer contracts, we are responsible for the overall operations of our facilities, including staff recruitment, general administration of the facilities, facility maintenance, security, and supervision of the offenders. We are required by our customer contracts to maintain certain levels of insurance coverage for general liability, workers' compensation, vehicle liability, and property loss or damage. We also are required to indemnify our customers for claims and costs arising out of our operations and, in certain cases, to maintain performance bonds and other collateral requirements.

Reentry programs.

We believe a focus on inmate reentry provides great benefits for our communities – more people living healthy and productive lives and contributing to strong families and local economies. We have committed to evolving our model with an increased focus on reentry services, and we are working hard to equip the men and women in our care with the services, support, and resources they need to be successful upon reentry.

While we remain focused on our commitment, due to COVID-19 and the measures we have implemented to protect the health and safety of our staff and the people in our care, we continued to experience a reduction in the number of individuals who benefited from our reentry and educational programs in 2021 when compared to years prior to 2020. Our efforts to mitigate the spread of COVID-19 have included restricting the movement and interactions of individuals in and around our facilities, which has significantly disrupted our reentry programs. We have worked with our government partners to continue to provide programs in a safe manner, including offering programs where possible through self-study materials, and we expanded the use of tablet technology. We also reduced class sizes to help ensure social distancing and offered special high school equivalency (either GED or HiSet) testing schedules. We intend to work with our government partners and to follow national health standards in reinstating these reentry programs to their full capacity as circumstances permit.

We provide a wide range of evidence-based reentry programs and activities in our facilities. At most of the facilities we manage, offenders have the opportunity to enhance their basic education from literacy through earning a high school equivalency certificate endorsed by their respective state. In some cases, we also provide opportunities for postsecondary educational achievements and chances to participate in college degree programs. A number of our facilities that care for non-U.S. citizens offer adult education curricula recognized by several nations to which these offenders may return, including a curriculum offered in conjunction with the Mexican government. We also provide an Adult Education in Spanish program for offenders with that specific language need.

9

For the offenders who are close to taking their GED/HiSET exam, we have invested in the equipment needed to use the GED/HiSET Academy software program, which is an offline software program providing over 200 hours of individualized lessons up to a 12th grade level. The GED/HiSET Academy incorporates teaching best practices and provides an atmosphere to engage and motivate students to learn everything they need to know to pass the GED/HiSET exam. According to a 2018 study published in the Journal of Experimental Criminology, inmates participating in correctional education programs were 28% less likely to recidivate when compared with inmates who did not participate in correctional education programs.

In addition, we offer a broad spectrum of career/technical education opportunities to help individuals learn marketable job skills. Our trade programs are certified by the National Center for Construction Education and Research, or NCCER. NCCER establishes the curriculum and certification for over 4,000 construction and trade organizations. Graduates of these programs enter the job market with certified skills that significantly enhance employability. According to research conducted by the RAND Corporation published in 2013, inmates who complete vocational training are 28% more likely to find a job after release.

We are proud of the educational programs we offer and intend to maintain and continue to develop such programs. Examples of programs we've recently offered include:

|

|

• |

In 2021, we partnered with Home Builders Institute, or HBI, in opening a Construction Academy at our Crowley County Correctional Facility in Colorado. HBI is a national nonprofit organization that provides training, curriculum development, and job placement services for the building industry. Carpentry is taught at the Construction Academy at our Crowley facility and students can earn a Pre-Apprenticeship Certificate and receive job placement assistance from HBI staff. |

|

|

• |

In 2021, we partnered with Trinity Services Group, a national leader in correctional food service, in opening a Culinary Training Program at our Lake Erie Correctional Institution in Ohio. Through the 10-month program offered at the Lake Erie facility, students can earn a Certified Fundamental Cook Certificate issued by the American Culinary Federation. The program also teaches students restaurant and catering management skills. |

|

|

• |

In 2020, our Lee Adjustment Center in Kentucky implemented "Interview School," a web-based artificial intelligence software for practicing job interviews. Interview School conducts job-specific interviews and provides feedback on tone, confidence, and answer content. We plan to implement Interview School at additional facilities in 2022. |

|

|

• |

In 2019, we partnered with Persevere, a national non-profit organization, to offer offenders at our Trousdale Turner facility in Tennessee an opportunity to learn software coding and job readiness/employability skills specific to the technology field. The partnership with Persevere was expanded to include our Red Rock Correctional Center in 2020 and our Saguaro Correctional Facility in 2021. Both the Red Rock and Saguaro facilities are in Arizona. The instructor-led, self-paced program utilizes both a coding instructor and a Technology Employability Specialist to ensure students are learning the craft and how to obtain and maintain a job in the field, post-incarceration. Additionally, the program is split into two phases that allows students to become certified Front-end Developers (phase 1) and Full Stack Developers (phase 2) upon completion. |

|

|

• |

In 2019, we increased our post-secondary educational offerings by growing our relationship with Ashland University, based in Ohio, to deliver college-level programming to offenders at our Jenkins, Wheeler, and Coffee correctional facilities in Georgia. In 2020, we also began offering the college-level programming at our Northeast Ohio facility in Ohio. This relationship with Ashland University allows enrollees to obtain an Associate's Degree in General Studies or a Bachelor's Degree in Communication Studies or Interdisciplinary Studies at no cost to them through Pell Grant funding. Students access coursework, tests, and interact with their instructors through a secure Learning Management System via a tablet computer. |

10

|

|

• |

In 2018, through a relationship with Fuel Education, a company that specializes in digital learning opportunities, we began offering an online Information Support and Services computer program at our Lee Adjustment Center in Kentucky. This program allows students to enhance their computer knowledge and was developed in coordination with the Commonwealth of Kentucky Department of Corrections, or KYDOC, our government partner at the Lee facility. Students who successfully complete the approximate 10-month program will be awarded a base National Occupational Competency Testing Institute, or NOCTI, credential with the opportunity to earn an advanced NOCTI credential in the future. |

|

|

• |

In 2016, our Coffee and Wheeler facilities in Georgia implemented state-of-the-art Diesel Maintenance and Welding programs in coordination with the Georgia Department of Corrections, or GDOC, enabling students to earn trade certificates from nearby community colleges. |

For those with assessed substance abuse disorders, we offer cognitive behavioral evidence-based treatment programs with proven clinical outcomes, such as the Residential Drug Abuse Program. We offer both therapeutic community models and intensive outpatient programs. We also offer drug and alcohol use education/DWI programs at some of our locations. Our goal in providing substance abuse treatment is to stimulate internal motivation for change and progress through the stages of change so that lasting behavioral change can occur. Our drug and alcohol education programs help participants understand their relationships with drugs and alcohol and the links between drug and alcohol use and crime, as well as equipping participants with information designed to help them make better choices that can lead to healthier relationships in their lives. According to a study by the Florida State University College of Criminology and Criminal Justice, "An Assessment of Substance Abuse Treatment Programs in Florida's Prisons Using a Random Assignment Experimental Design" submitted to the National Institute of Justice, Office of Justice Programs, U.S. Department of Justice, in 2016, inmates who completed addiction treatment in prison have significantly lower recidivism levels regardless of the treatment model used.

Additional program offerings include our Victim Impact Programs, available at a number of our Safety and Community facilities, which seek to educate offenders about the negative effects their criminal conduct can have on others. All of our facility chaplains facilitate diverse and inclusive opportunities for those in our care to engage in the practice of spirituality and to exercise individual religious freedom. In several facilities, we offer faith-based programs with an emphasis on character development, spiritual growth, and successful reentry. Presently, we utilize Threshold, an innovative, evidence-based inter-faith component of comprehensive reentry services.

Our Reentry and Life Skills programs prepare individuals for life after incarceration by teaching them how to successfully conduct a job search, how to manage their budget and financial matters, parenting skills, and relationship and family skills. Equally significant, we offer cognitive behavioral programs aimed at changing anti-social attitudes and behaviors in offenders, with a focus on altering the level of criminal thinking. In 2017, we introduced a comprehensive reentry strategy we call "Go Further," a forward thinking, process approach to reentry. "Go Further" encompasses all facility reentry programs, adds a proprietary cognitive/behavioral curriculum, and encourages staff and offenders to take a collaborative approach to assist in reentry preparation. In 2020, we expanded our offering by completing the first implementation of "Go Further" in one of our community corrections facilities.

In 2021, we opened a "Go Further Release" program in the Denver, Colorado area. Go Further Release is a program we developed that provides stabilization services and reentry coaching to individuals being released from our facilities. The program provides "Reach-in" services during the returning citizen's last 90 days of incarceration which are designed to prepare individuals for release and make a connection with a reentry coach that will provide support to them after release. "Stabilization and Reentry Coaching" services are provided during an individual's first 90 days of release and an ongoing community support group is available as long as needed. All services are free of charge.

Across the country, our dedicated staff, along with the assistance of thousands of volunteers, work to provide guidance, direction, and post-incarceration services to the men and women in our care. We believe these critical reentry programs help fight the serious challenge of recidivism facing the United States.

11

Through our community corrections facilities, we provide an array of services to defendants and offenders who are serving their full sentence, the last portion of their sentence, waiting to be sentenced, or awaiting trial while supervised in a community environment. We offer housing and programs with a key focus on employment, job readiness, life skills and various substance abuse treatment programs, in order to help offenders successfully reenter their communities and reduce the risk of recidivism. In some of our community corrections facilities, we offer housing and program services to parolees who have completed their sentence but lack a viable reentry plan. Through a focus on employment and skill development, we provide a means for these parolees to successfully reintegrate into their communities.

In addition, we provide day-reporting and substance abuse treatment programs at some of our community corrections facilities. These programs, depending on the needs of the offender, can provide cognitive behavioral-based programs to assist in the offender's successful reentry while holding the individual accountable while living in the community.

Lastly, we also provide a number of non-residential correctional alternative services, including electronic monitoring and case management services, under our CoreCivic Community segment. Governmental customers use electronic monitoring products and services to monitor low risk offenders as a way to help reduce overcrowding in correctional facilities, as a monitoring and sanctioning tool, and to promote public safety by imposing restrictions on movement and serving as a deterrent for alcohol usage. Providing these non-residential services is a natural complement to our broad network of residential reentry facilities and can help keep individuals from going back to prison or being incarcerated in the first place.

Ultimately, the work we do is intended to give people the tools to reintegrate with their communities permanently. We are proud of the teachers, counselors, case managers, chaplains, and other offender support service professionals who provide these services to the men and women entrusted in our care.

To further underscore our long-term commitment to reducing recidivism, since October 2017, we have maintained a nationwide initiative to advocate for a range of government policies that will help former offenders successfully reenter society and stay out of prison. As part of this continued initiative, we apply government relations resources and expertise to advocate for the following policies:

|

|

• |

"Ban-the-Box" proposals to help improve former inmates' chances at getting a job; |

|

|

• |

Reduced legal barriers to make it easier and less risky for companies to hire former inmates; |

|

|

• |

Increased funding for reentry programs in areas such as education, addiction treatment, faith-based offerings, victim impact and post-release employment; and |

|

|

• |

Social impact bond pilot programs that tie contractor payments to positive outcomes. |

In 2020, we announced that we will publicly advocate at the federal and state levels for a slate of new policies that will help people succeed in their communities after being released from prison. Specifically, we pledged our support for Pell Grant Restoration, Voting Rights Restoration and Licensure Reform Policies. Also in 2020, we began a partnership with, and continue to invest in, Prison Fellowship, a leading advocate for criminal justice reform serving approximately 550,000 current and formerly incarcerated individuals and their family members each year. Through a network of programming and advocacy efforts, the organization seeks to effect positive change at every level of the criminal justice system. We have committed to a multi-year partnership in Prison Fellowship's Warden Exchange program, a residency and online professional development program that enables wardens to share reentry best practices and problem solve amongst a peer group. We believe that as successful as we may be with our work inside our facilities, offenders still face embedded societal barriers when they return to their communities. Supporting recidivism-reducing policies is one way we can bridge the gap and give the men and women entrusted in our care a better opportunity at never returning to prison.

12

Operating guidelines.

The American Correctional Association, or ACA, is an independent organization comprised of corrections professionals that establishes accreditation standards for correctional and detention facilities around the world. Outside agency standards, such as those established by the ACA, provide us with the industry's most widely accepted operational guidelines. ACA accredited facilities must be audited and re-accredited at least every three years. We have sought and received ACA accreditation for 37, or approximately 95%, of the eligible facilities we operated as of December 31, 2021, excluding our residential reentry facilities. During 2021, 17 of the facilities we manage were newly accredited or re-accredited by the ACA with an average score of 99.6%, making our portfolio average 99.6%.

Beyond the standards provided by the ACA, our facilities are operated in accordance with a variety of company and facility-specific policies and procedures, as well as various contractual requirements. Many of these policies and procedures reflect the high standards generated by a number of sources, including the ACA, the National Commission on Correctional Healthcare, the Occupational Safety and Health Administration, as well as federal, state, and local government codes and regulations and longstanding correctional procedures.

In addition, our facilities are operated in compliance with the Prison Rape Elimination Act, or PREA, standards. All confinement facilities covered under the PREA standards must be audited at least every three years to maintain compliance with the PREA standards. We utilize DOJ certified PREA auditors to help ensure that all facilities operate in compliance with applicable PREA regulations.

Our facilities operate under these established standards, policies, and procedures, and also are subject to annual audits by our Quality Assurance Division, or QAD, which operates under, and reports directly to, our Office of General Counsel and acts independently from our Operations Division. Through the QAD, we have devoted significant resources to ensuring that our facilities meet outside agency and accrediting organization standards and guidelines.

The QAD employs a team of full-time auditors, who are subject matter experts from all major disciplines within institutional operations. Annually, QAD auditors generally conduct unannounced on-site evaluations of each CoreCivic Safety facility we operate using specialized audit tools, typically containing more than 1,300 audit indicators across all major operational areas. In most instances, these audit tools are tailored to facility and partner specific requirements. In 2021, due to the impact of COVID-19, the QAD's annual facility audits were announced and some were conducted through a combination of remote and limited onsite reviews. We expect these remote and hybrid audit practices to continue for at least a portion of 2022. In addition, audit teams provide guidance to facility staff on operational best practices and assist staff with addressing specific areas of need, such as meeting requirements of new partner contracts and providing detailed training on compliance requirements for new departmental managers.

The QAD management team coordinates overall operational auditing and compliance efforts across all correctional, detention, and residential reentry facilities we manage. In conjunction with subject matter experts and other stakeholders having risk management responsibilities, the QAD management team develops performance measurement tools used in facility audits. The QAD management team provides governance of the corrective action plan process for any items of nonconformance identified through internal and external facility reviews. Our QAD also contracts with teams of ACA certified correctional auditors to evaluate compliance with ACA standards at accredited facilities. Similarly, the QAD routinely incorporates a review of facility compliance with key ACA standards and PREA regulations during annual audits of company facilities.

13

In addition to our own internal audit and contract compliance efforts, we are also subject to oversight by our government partners. As part of their standard monitoring and compliance programs, approximately 82% of our federal and state government partners typically conduct formal contract-compliance audits and inspections at least annually at CoreCivic Safety facilities. In addition to these annual audits of our facilities, many partners conduct additional area-specific operational audits and inspections on a more frequent basis, including monthly, quarterly, and semi-annually. Some of these audits and facility inspections by our partners are conducted on an unannounced basis. In 2021, our government partners conducted approximately 200 annual, semi-annual, quarterly, and monthly compliance audits and inspections at our CoreCivic Safety facilities. In addition, the majority of our federal and state government partners employ on-site contract monitors who monitor performance and contract compliance at our facilities on a full- or part-time basis. In 2021, all of the CoreCivic Safety facilities we manage have an assigned contract monitor.

Business Development

We believe we own, or control via a long-term lease, approximately 56% of all privately owned prison beds in the United States, manage nearly 38% of all privately managed prison beds in the United States, and are currently the second largest private owner and provider of community corrections services in the nation. We also believe that we are the largest private owner of real estate used by government agencies in the U.S. Under the direction of our partnership development department, we market our facilities and services to government agencies responsible for federal, state, and local correctional, detention, and residential reentry facilities in the United States. Under the direction of our real estate department, we intend to continue to pursue attractive growth opportunities, including development opportunities, to meet the need to modernize outdated correctional infrastructure across the country and that we believe have favorable investment returns, diversify our cash flows, and increase value to our stockholders. We will also respond to customer demand and may develop or expand correctional and detention facilities when we believe potential long-term returns justify the capital deployment.

We execute cross-departmental efforts to market CoreCivic Safety solutions to government partners that seek corrections and detention management services, CoreCivic Community solutions to government partners seeking residential reentry services, and CoreCivic Properties solutions to customers that need real estate and maintenance services.

As indicated by the following chart, business from our federal customers, including primarily ICE, the USMS, and the BOP, continues to be a significant component of our business, although the source of revenue is derived from many contracts at various types of properties, i.e. correctional, detention, and reentry. ICE and the USMS each accounted for 10% or more of our total revenue during the last three years.

14

Certain of our contracts with federal partners contain clauses that guarantee the federal partner access to a minimum bed capacity in exchange for a fixed monthly payment. However, these contracts also generally provide the government the ability to cancel the contract for non-appropriation of funds or for convenience. The solutions we provide to our federal customers continue to be a significant component of our business. We believe our ability to provide flexible solutions and fulfill emergent needs of our federal customers would be very difficult and costly to replicate in the public sector.

Additionally, on January 26, 2021, President Biden issued the Private Prison EO. The Private Prison EO directs the Attorney General to not renew DOJ contracts with privately operated criminal detention facilities. Two agencies of the DOJ, the BOP and the USMS, utilize our services. The BOP houses inmates who have been convicted, and the USMS is generally responsible for detainees who are awaiting trial. The BOP has experienced a steady decline in inmate populations over the last eight years, a trend that has been accelerated by the COVID-19 pandemic. We currently have one prison contract with the BOP at our 1,978-bed McRae Correctional Facility, accounting for 2% ($40.6 million) of our total revenue for the twelve months ended December 31, 2021, which expires in November 2022. The Private Prison EO only applies to agencies that are part of the DOJ, which includes the BOP and USMS. ICE facilities are not covered by the Private Prison EO, as ICE is an agency of the Department of Homeland Security, not the DOJ, although it is possible that the federal government could choose to take similar action on ICE facilities in the future. For the twelve months ended December 31, 2021, USMS and ICE accounted for 23% ($433.6 million) and 30% ($552.2 million), respectively, of our total revenue.

Unlike the BOP, the USMS does not own detention capacity and relies on the private sector, along with various government agencies, for its detainee population. The USMS has been advised by the Office of the Deputy Attorney General not to renew existing contracts, or enter into new contracts for private detention facilities. During the second quarter of 2021, we had direct contracts with the USMS for up to 992 detainees at our 2016-bed Northeast Ohio Correctional Center and for up to approximately 96 detainees at our 664-bed Crossroads Correctional Center in Montana that expired and were not renewed. On May 28, 2021, we entered into a new three-year contract with Mahoning County, Ohio to utilize up to 990 beds at our Northeast Ohio Correctional Center. Mahoning County is responsible for County inmates and federal detainees, including USMS detainees, and the County is using the Northeast Ohio facility to address its population needs. During the third quarter of 2021, we entered into an amendment to the contract with the state of Montana to utilize all of the capacity at the Crossroads Correctional Center, including the space vacated by the USMS, and to extend the existing contract to June 30, 2023, with additional renewal options by mutual agreement through August 31, 2029. We had a direct contract with the USMS to care for detainees at our 600-bed West Tennessee Detention Facility that expired on September 30, 2021 and was not renewed. In addition, we had a direct contract with the USMS to care for detainees at our 1,033-bed Leavenworth Detention Center that expired on December 31, 2021 and was not renewed. We are actively marketing the West Tennessee and Leavenworth facilities to other government agencies, and in August 2021, we submitted a formal response to a government agency's request for proposal to utilize the West Tennessee facility. We are also currently in discussions with, and have submitted proposals to, other potential government partners to utilize the Leavenworth facility. However, we can provide no assurance that we will be able to reach agreements for the utilization of the West Tennessee or Leavenworth facilities.

We currently have six detention facilities that have separate contracts where the USMS is the primary customer within the facility that all expire at various times over the next several years, with the exception of two contracts that have indefinite terms. As of December 31, 2021, one of the aforementioned six contracts, a contract with a government agency at our 2,672-bed Tallahatchie County Correctional Facility in Mississippi that allows the USMS to utilize available capacity, expires in June 2022. Non-renewal of these contracts, or the expansion of the Private Prison EO to ICE, could have a material adverse effect on our business, financial condition, and results of operations if we are unable to replace the cash flows with new management contracts like we did at our Northeast Ohio and Crossroads facilities.

In March 2020, the World Health Organization declared the outbreak of COVID-19 as a pandemic. As a result, in the first quarter of 2020, the federal government decided to deny entry at the United States southern border to asylum-seekers and anyone crossing the southern border without proper documentation or authority in an effort to contain the spread of COVID-19, a policy known as Title 42, continued by the Biden administration. This policy resulted in a reduction to the number of people ICE detained, including in our detention facilities.

15

In February 2021, President Biden announced plans to allow certain migrants to pursue asylum in the United States while awaiting their proceedings in immigration courts, reversing a policy of the prior administration, known as the Migrant Protection Protocols, or MPP, commonly referred to as the "Remain in Mexico Policy", which required these asylum seekers to wait in Mexico during the pendency of their immigration court proceedings.

Both Title 42 and MPP have been subject to legal challenges. On August 13, 2021, a federal court ordered the Biden administration to reinstate the MPP finding that terminating MPP would be illegal "until the Department of Homeland Security has the capacity and willingness to detain immigrants." On August 24, 2021, the Supreme Court refused to block implementation of that order. On October 29, 2021, Secretary of Homeland Security Alejandro N. Mayorkas issued a memorandum asserting the termination of MPP, which was structured to be implemented if the decision reinstating MPP is vacated. The memorandum also provides that the Biden administration will continue to comply with the injunction requiring the reinstatement and enforcement of MPP until a final judicial decision, if any, to vacate such injunction is issued. In early December 2021, the Department of Homeland Security began the court-ordered re-implementation of the MPP, and on December 13, 2021, a federal appeals court rejected the Biden administration’s attempts to terminate MPP. On December 29, 2021, the Biden administration appealed this decision to the Supreme Court. Separately, on September 16, 2021, a federal judge prohibited the Biden administration from expelling migrant families pursuant to Title 42, finding that public health law does not authorize the expulsion of migrants. On September 30, 2021, a federal appeals court issued a temporary stay on the prohibition on expelling migrant families pursuant to Title 42. On February 4, 2022, the federal government extended Title 42. As a result, the Biden administration has been able to expel migrant families pursuant to public health concerns over the spread of COVID-19 while the litigation of such policy continues. The number of people apprehended by ICE could increase upon the reversal of Title 42, and if the Biden administration prevails in its efforts to terminate MPP.

Federal revenues from contracts at correctional, detention, and residential reentry facilities that we operate increased 5.2% from $999.2 million during 2020 to $1,050.7 million during 2021. The increase in federal revenues resulted from several factors, including new federal contracts and higher average per diems, as further described in Management's Discussion and Analysis of Financial Condition and Results of Operations, or MD&A, partially offset by the effect of one fewer day of operations in 2021 due to a leap year in 2020.

State revenues from contracts at correctional, detention, and residential reentry facilities that we operate constituted 32%, 33%, and 34% of our total revenue during 2021, 2020, and 2019, respectively, and decreased 5.4% from $636.3 million during 2020 to $602.1 million during 2021. Partially offset by several mitigating factors, as further described in MD&A, state revenues primarily decreased in 2021 as a result of the effect of an overall decline in state inmate populations resulting from government actions to help prevent the spread of COVID-19. The decrease in state revenues in 2021 was also a result of one fewer day of operations in 2021 due to a leap year in 2020.

We cannot predict government responses to an increase in staff or residents testing positive for COVID-19 within public and private correctional, detention and reentry facilities, nor can we predict COVID-19 related restrictions on individuals, businesses, and services that disrupt the criminal justice system. Further, we cannot predict government policies on prosecutions and legal restrictions as a result of COVID-19 that affect the number of people placed in correctional, detention, and reentry facilities. In response to COVID-19, we continue to exercise enhanced hygiene practices and provide our employees and those in our care with personal protective equipment, or PPE, including masks and other personal hygiene items. Further, in an effort to mitigate the spread of COVID-19 and at the direction of our government partners, we have significantly reduced the level of movement within our facilities in an effort to reduce the risk of transmitting COVID-19 within our facilities. We intend to continue to work with our government partners and follow national and local health standards in reinstating normal movement within our facilities.

COVID-19 notwithstanding, we believe the long-term growth opportunities of our business remain attractive as government agencies consider their emergent needs (including capacity to help mitigate the spread of infectious disease), as well as the efficiency and offender programming opportunities we provide as flexible solutions to satisfy our partners' needs. Further, although disrupted by the COVID-19 pandemic, several of our existing federal and state partners, as well as prospective state partners, have been experiencing growth in offender populations and overcrowded conditions, as well as an increase in violent crime. Governments are now assessing their need for correctional space in light of COVID-19, and several are considering alternative correctional capacity for their aged

16

or inefficient infrastructure, or are seeking cost savings by utilizing the private sector, which could result in increased future demand for the solutions we provide. For example, in December 2021, the state of Arizona awarded us a new contract for up to 2,706 inmates at our 3,060-bed La Palma Correctional Center in Arizona, which we expect to commence late in the first quarter or early in the second quarter of 2022. We are not aware of a larger prison contract awarded to the private sector by any state in over a decade. Competing budget priorities, which will likely become more challenging because of COVID-19, often impede our customers' ability to construct new prison beds of their own or update their older facilities, which we believe could result in further demand for private sector prison capacity solutions in the long-term. Over the long-term, we would like to see meaningful utilization of our available capacity and better visibility from our customers into their potential future needs before we develop new prison capacity on a speculative basis. We will, however, respond to customer demand and may develop or expand correctional and detention facilities when we believe potential long-term returns justify the capital deployment.

Following our first priorities of debt reduction, which may include the purchase of our outstanding debt in open market transactions, privately negotiated transactions or otherwise, and managing through the COVID-19 pandemic, we believe the revocation of our REIT election and conversion to a taxable C Corporation, effective January 1, 2021, will allow us to allocate a substantial portion of our free cash flow to returning capital to our shareholders and to pursuing attractive growth opportunities. We believe that we can further develop our business by, among other things:

|

|

• |

Maintaining and expanding our existing customer relationships and filling existing capacity within our facilities, while maintaining an adequate inventory of available capacity that we believe provides us with flexibility and a competitive advantage when bidding for new management contracts; |

|

|

• |

Enhancing the terms of our existing contracts and expanding the services we provide under those contracts; |

|

|

• |

Pursuing additional opportunities to lease our facilities to government and other third-party operators in need of correctional, detention, and residential reentry capacity; |

|

|

• |

Pursuing mission-critical real estate solutions for government agencies focused on, but not limited to, corrections and detention real estate assets; |

|

|

• |

Pursuing other asset acquisitions and business combinations through transactions with non-government third parties; |

|

|

• |

Maintaining and expanding our focus on community corrections and reentry programming that align with the needs of our government partners; |

|

|

• |

Exploring potential opportunities to expand the scope of non-residential correctional alternative solutions we provide to government agencies, including those services that were not available to us under the REIT structure; and |

|

|

• |

Establishing relationships with new customers that have either previously not outsourced their correctional facility management needs or have utilized other private enterprises. |

We generally receive inquiries from or on behalf of government agencies that are considering outsourcing the ownership and/or management of certain facilities or that have already decided to contract with a private enterprise. When we receive such an inquiry, we determine whether there is an existing need for our correctional, detention, and residential reentry facilities and/or services and whether the legal and political climate in which the inquiring party operates is conducive to serious consideration of outsourcing. Based on these findings, an initial cost analysis is conducted to further determine project feasibility.

17

Frequently, government agencies responsible for correctional, detention, and residential reentry facilities and services procure space and services through solicitations or competitive procurements. As part of our process of responding to such requests, members of our management team meet with the appropriate personnel from the agency making the request to best determine the agency's needs. If the project fits within our strategy, we submit a written response. A typical solicitation or competitive procurement requires bidders to provide detailed information, including, but not limited to, the space and services to be provided by the bidder, its experience and qualifications, and the price at which the bidder is willing to provide the facility and services (which services may include the purchase, renovation, improvement or expansion of an existing facility or the planning, design and construction of a new facility). The requesting agency selects a provider believed to be able to provide the requested bed capacity, if needed, and most qualified to provide the requested services, and then negotiates the price and terms of the contract with that provider.

2021 Accomplishments

In spite of the continued challenges presented by COVID-19 on our business in 2021, we entered into a number of new contracts, renewed several other significant contracts, and completed numerous other transactions and milestones, including the following:

CoreCivic Safety:

|

|

• |

Partnered with HBI in opening a Construction Academy at our Crowley County Correctional Facility in Colorado. HBI is a national nonprofit organization that provides training, curriculum development, and job placement services for the building industry. Carpentry is taught at the Construction Academy at our Crowley facility and students can earn a Pre-Apprenticeship Certificate and receive job placement assistance from HBI staff. |

|

|

• |

Partnered with Trinity Services Group, a national leader in correctional food service, in opening a Culinary Training Program at our Lake Erie Correctional Institution in Ohio. Through the 10-month program offered at the Lake Erie facility, students can earn a Certified Fundamental Cook Certificate issued by the American Culinary Federation. The program also teaches students restaurant and catering management skills. |

|

|

• |

Expanded our existing contract with the state of Montana at our 664-bed Crossroads Correctional Center by 96 beds to utilize 100% of the facility capacity, and replacing capacity previously utilized by the USMS. |

|

|

• |

Entered into a new contract with Mahoning County, Ohio to utilize up to 990 beds at our 2,016-bed Northeast Ohio Correctional Center to assist in caring for County inmates and federal detainees in their custody, replacing substantially all of our capacity previously utilized by the USMS. |

|

|

• |

Awarded a new contract by the state of Arizona for up to 2,706 inmates at our 3,060-bed La Palma Correctional Center in Arizona, which we expect to commence late in the first quarter or early in the second quarter of 2022. |

CoreCivic Community:

|

|

• |

Activated a new contract with the BOP to provide residential reentry and home confinement services at our previously idled 289-bed Turley Residential Center and at our 494-bed Oklahoma Reentry Opportunity Center, both in Oklahoma. |

18

CoreCivic Properties:

|

|

• |

Completed the sale of two government-leased properties in a single transaction to a third party for an aggregate price of $73.0 million, generating net proceeds of $46.2 million after the repayment of debt associated with one of the properties and other transaction-related costs. |

|

|

• |

Completed the sale of a 541,000 square foot government-leased property to a third-party for a price of $253.0 million, generating net proceeds of $76.4 million after the repayment of the debt related to the property and other transaction related costs. |

|

|

• |

Entered into a three-year lease agreement with the state of New Mexico at our 596-bed Northwest New Mexico Correctional Center. We previously operated the Northwest New Mexico facility in our Safety segment under a contract with the state of New Mexico. The new lease agreement commenced on November 1, 2021 and includes extension options that could extend the term of the lease through October 31, 2041. |

Corporate and Other:

|

|

• |

Completed our plan to revoke our REIT election and become a taxable C Corporation, effective January 1, 2021, providing us with greater financial flexibility. |

|

|

• |

Sold $450.0 million of 8.25% senior unsecured notes at 99% of face value, resulting in an effective yield to maturity of 8.5%. The new notes mature in April 2026. |

|

|

• |

Completed a tack-on offering of $225.0 million of 8.25% senior unsecured notes at an issue price of 102.25% of face value, resulting in an effective yield to maturity of 7.65%. The notes mature in April 2026. |

|

|

• |

Repaid approximately $444.0 million of indebtedness, net of the change in cash, extended our weighted average maturity of recourse debt by approximately one year, and reduced our debt leverage ratio to 2.9x for the year ended December 31, 2021, from 3.7x for the year ended December 31, 2020. |

|

|

• |

Issued our third Environmental, Social and Governance, or ESG, report which summarizes our impacts and aspirational goals across environmental, social, and governance topics. The report details our commitment to reducing the national recidivism crisis through evidence-based practice in our reentry programs and covers progress in our human rights-related goals. |

|

|

• |

Named one of America's Most Responsible Companies by Newsweek, making our inaugural appearance on the 2021 list published in November 2021. |

19

Facility Portfolio

CoreCivic Safety and Community Facilities and Facility Management Contracts