|

Exhibit 99.1

|

||

|

|

|

Michael D. Bluhm, Chief Financial Officer 240.744.5110 Gee Lingberg, Senior Vice President 240.744.5275

|

NEWS RELEASE

HOST HOTELS & RESORTS, INC. REPORTS RESULTS FOR THE FIRST QUARTER 2019

BETHESDA, MD; May 1, 2019 – Host Hotels & Resorts, Inc. (NYSE: HST) (“Host Hotels” or the “Company”), the nation’s largest lodging real estate investment trust (“REIT”), today announced results for the first quarter of 2019.

Operating Results 1

(unaudited, in millions, except per share and hotel statistics)

|

|

Quarter ended March 31, |

|

|

Percent |

|

||||||

|

|

2019 |

|

|

2018 |

|

|

Change |

|

|||

|

Total revenues |

$ |

1,390 |

|

|

$ |

1,346 |

|

|

|

3.3 |

% |

|

Comparable hotel revenues (1) |

|

1,184 |

|

|

|

1,182 |

|

|

|

0.2 |

% |

|

Net income |

|

189 |

|

|

|

256 |

|

|

|

(26.2 |

)% |

|

EBITDAre and Adjusted EBITDAre (1) |

|

406 |

|

|

|

370 |

|

|

|

9.7 |

% |

|

Change in comparable hotel RevPAR: |

|

|

|

|

|

|

|

|

|

|

|

|

Domestic properties |

|

(1.2 |

) |

|

|

|

|

|

|

|

|

|

International properties - Constant US$ |

|

11.4 |

|

|

|

|

|

|

|

|

|

|

Total - Constant US$ |

|

(1.0 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted earnings per common share |

|

0.25 |

|

|

|

0.34 |

|

|

|

(26.5 |

)% |

|

NAREIT FFO and Adjusted FFO per diluted share (1) |

|

0.48 |

|

|

|

0.43 |

|

|

|

11.6 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

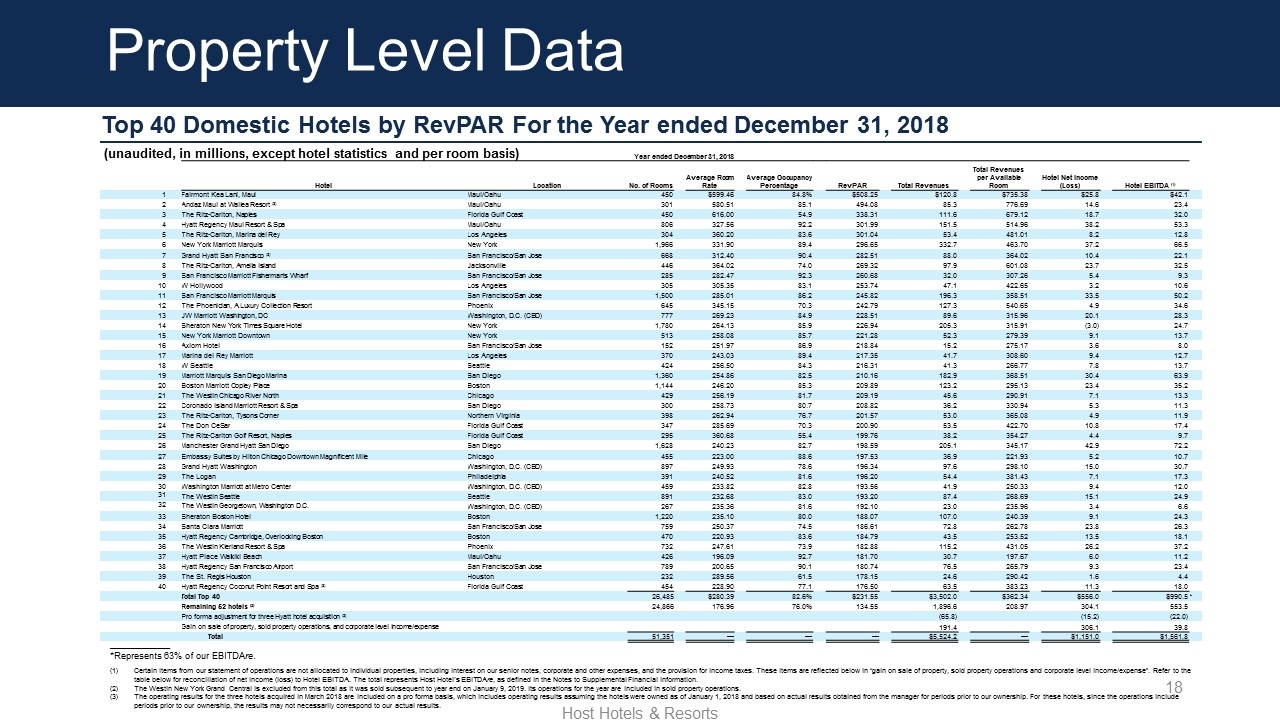

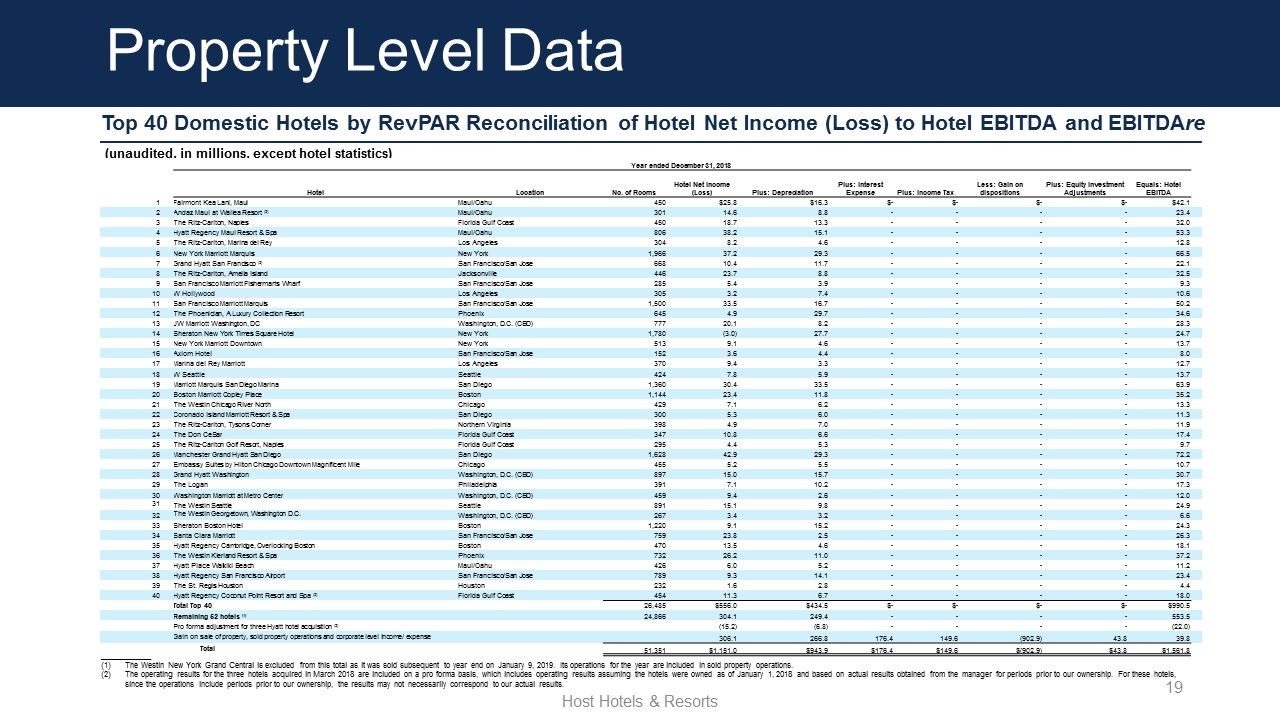

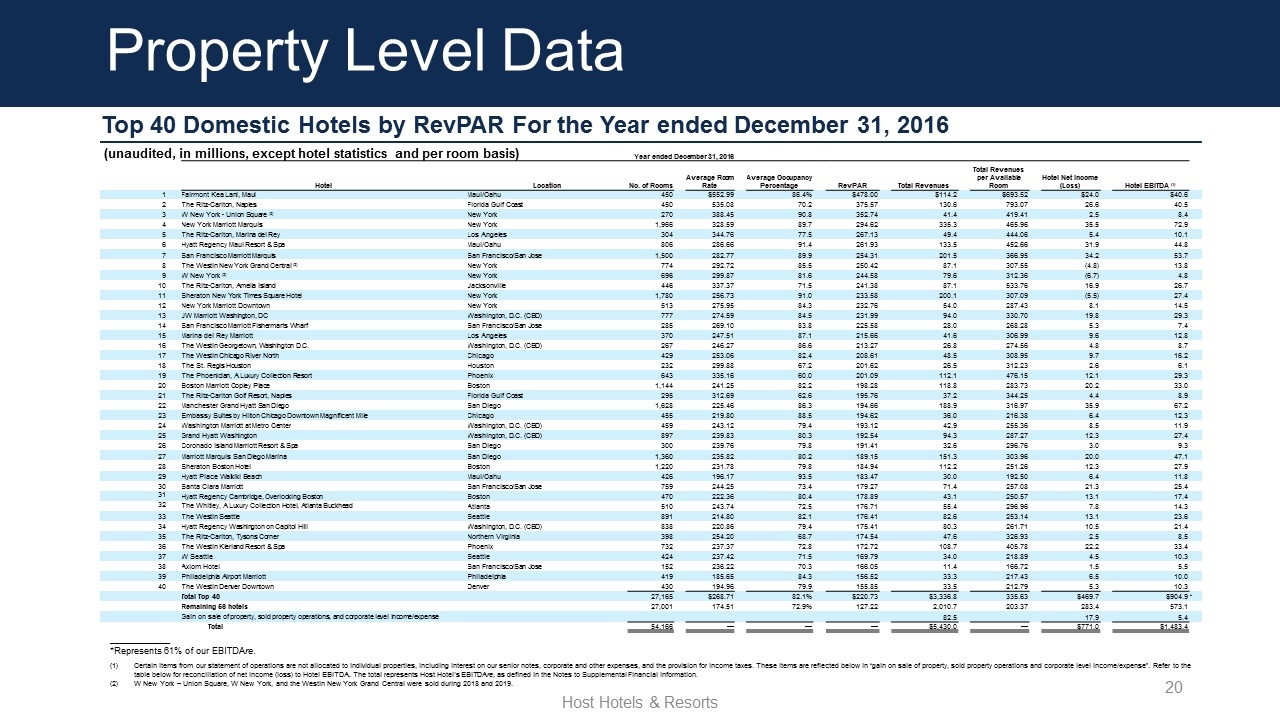

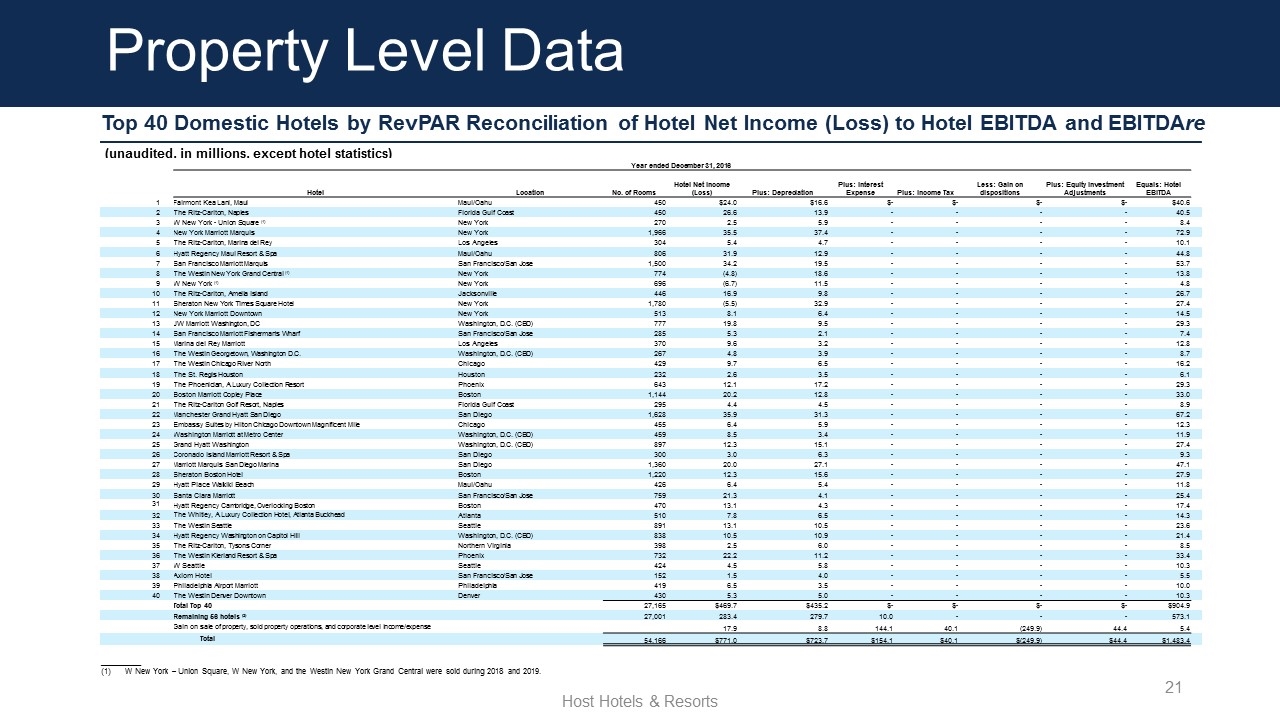

*Additional detail on the Company’s results, including data for 22 domestic markets and top 40 hotels by RevPAR, is available in the First Quarter 2019 Supplemental Financial Information available on the Company’s website at www.hosthotels.com.

Highlights

|

|

• |

Total revenues improved 3.3% for the quarter, driven by the acquisitions of four premier hotels since March 2018. Also helping drive the improvement in revenues was a 30 basis point increase in comparable Total RevPAR to $274 for the quarter, which includes all hotel-level revenues per available room. |

|

|

• |

The Company increased its overall profitability, despite a comparable hotel RevPAR decline of 1.0% for the quarter on a constant dollar basis. The decline in RevPAR was primarily driven by the Marriott transformational capital program and the effect of the government shutdown. |

|

|

• |

Net income and earnings per share of $189 million and $0.25, respectively, were affected by a reduction in gains on sales of assets compared to the first quarter of 2018. However, the Company experienced strong growth in Adjusted EBITDAre of 9.7% to $406 million and Adjusted FFO per share of 11.6% to $0.48 per share. |

James F. Risoleo, President and Chief Executive Officer, said, “Our first quarter results reflect our proven ability to drive operational outperformance as well as the scale and strength of Host Hotels’ integrated investment platform. Our margin

|

|

(1) |

NAREIT Funds From Operations (“FFO”) per diluted share, Adjusted FFO per diluted share, EBITDAre, Adjusted EBITDAre and comparable hotel results are non-GAAP (U.S. generally accepted accounting principles) financial measures within the meaning of the rules of the Securities and Exchange Commission (“SEC”). See the Notes to Financial Information on why the Company believes these supplemental measures are useful, reconciliations to the most directly comparable GAAP measure, and the limitations on the use of these supplemental measures. |

performance for the quarter is nothing short of remarkable. We are very pleased to report a beat and raise quarter and to raise net income, Adjusted EBITDAre and Adjusted FFO per share guidance for the full year. Our disciplined and strategic capital allocation decisions have significantly enhanced the quality of our portfolio and we remain focused on value-enhancing growth opportunities to complement our collection of iconic and irreplaceable assets. As discussed last quarter, we have nearly $2.5 billion of investment capacity that can be comfortably deployed while maintaining our commitment to our investment-grade balance sheet. We do not intend to move higher than our targeted leverage range, nor do we intend to invest beyond that capacity.”

Operating Performance

GAAP Metrics

|

|

• |

The improvement in total revenues of 3.3% for the quarter was due to the operations of the 1 Hotel South Beach acquired in February and the Hyatt hotel portfolio acquired in 2018, partially offset by the disposition of five hotels in 2019 and 2018. |

|

|

• |

GAAP operating profit margin increased 280 basis points for the quarter, due to higher margins at hotels acquired in 2019 and 2018 and items that affected comparable margins discussed below. |

|

|

• |

Net income decreased by $67 million to $189 million for the quarter, primarily due to a decrease in gain on sale of assets, partially offset by the improvement in operating profit. |

|

|

• |

Diluted earnings per common share decreased 26.5% for the quarter. |

Other Metrics

|

|

• |

Comparable RevPAR on a constant dollar basis declined 1.0% for the quarter, due to a 180 basis point decrease in occupancy, partially offset by a 1.3% increase in average room rate. The decline in RevPAR was primarily the result of an estimated 40 basis point decrease for the comparable hotels in the Marriott transformational capital program and an estimated 30 basis point decrease related to the government shutdown primarily affecting Washington, D.C. and San Diego. |

|

|

• |

Comparable hotel revenues increased 0.2% for the quarter. |

|

|

• |

Comparable hotel EBITDA increased by $7 million, or 1.9%, for the quarter. |

|

|

• |

Comparable hotel EBITDA margins improved 50 basis points for the quarter due to several factors, including: |

|

|

o |

an increase in average room rates; |

|

|

o |

improvement in rooms and food and beverage productivity and a decrease in other operating expenses resulting from Company initiatives; |

|

|

o |

an increase in ancillary revenues; |

|

|

o |

benefits from synergies of the Marriott International merger with Starwood Hotels; and |

|

|

o |

the receipt of operating profit guarantees provided by Marriott related to transformational capital projects. |

|

|

• |

Adjusted EBITDAre increased by $36 million, or 9.7%, for the quarter. |

|

|

• |

Adjusted FFO per diluted share increased 11.6% for the quarter. |

Acquisitions and Dispositions

During the first quarter, the Company acquired the 1 Hotel South Beach for $610 million and sold The Westin New York Grand Central for $302 million, including approximately $20 million of FF&E funds. On April 2, the Company sold The Westin Mission Hills Golf Resort & Spa for $27 million.

Capital Allocation

During the quarter, the Company invested approximately $110 million in capital expenditures, of which $52 million were return on investment (“ROI”) capital expenditures and $58 million were on renewal and replacement projects.

For 2019, the Company expects capital expenditures of between $550 million and $625 million. This comprises between $315 million and $350 million in ROI projects and between $235 million and $275 million in renewal and replacement projects. The ROI projects include approximately $225 million that are part of the previously announced agreement with Marriott International.

The Company paid a regular quarterly cash dividend of $0.20 per share on its common stock on April 15, 2019 to stockholders of record as of March 29, 2019. All future dividends, including any special dividends, are subject to approval by the Company’s Board of Directors.

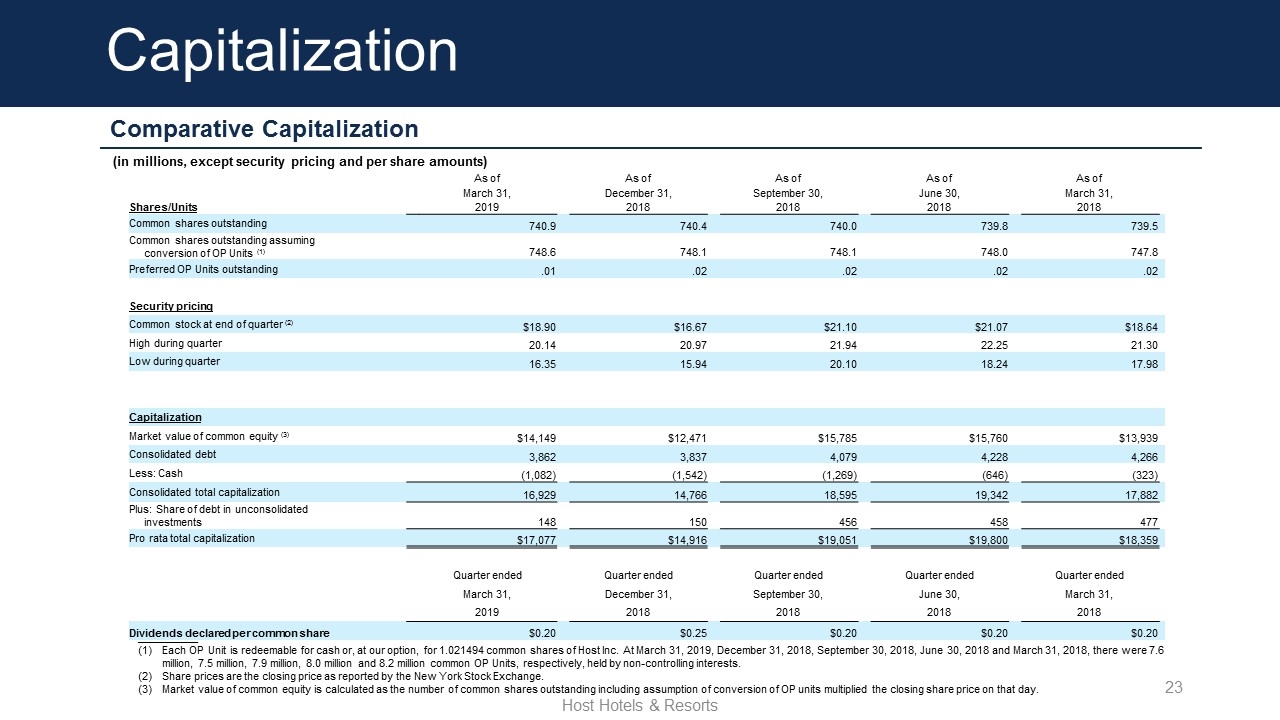

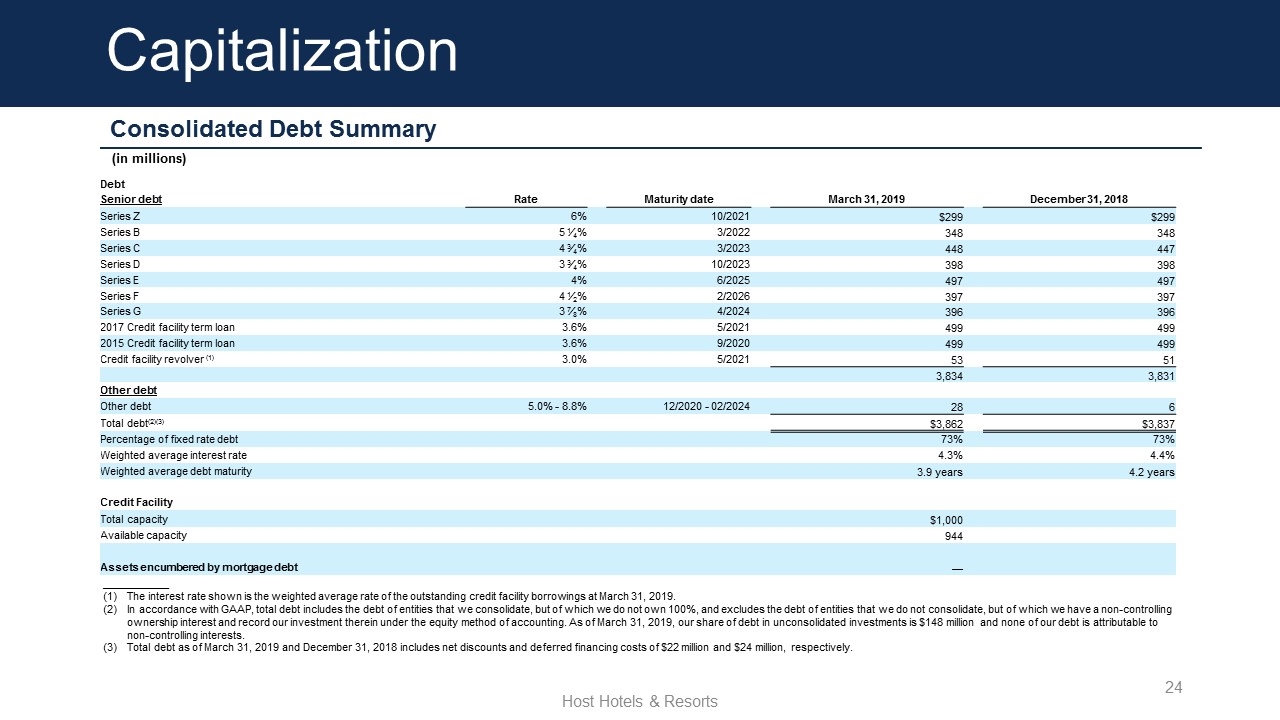

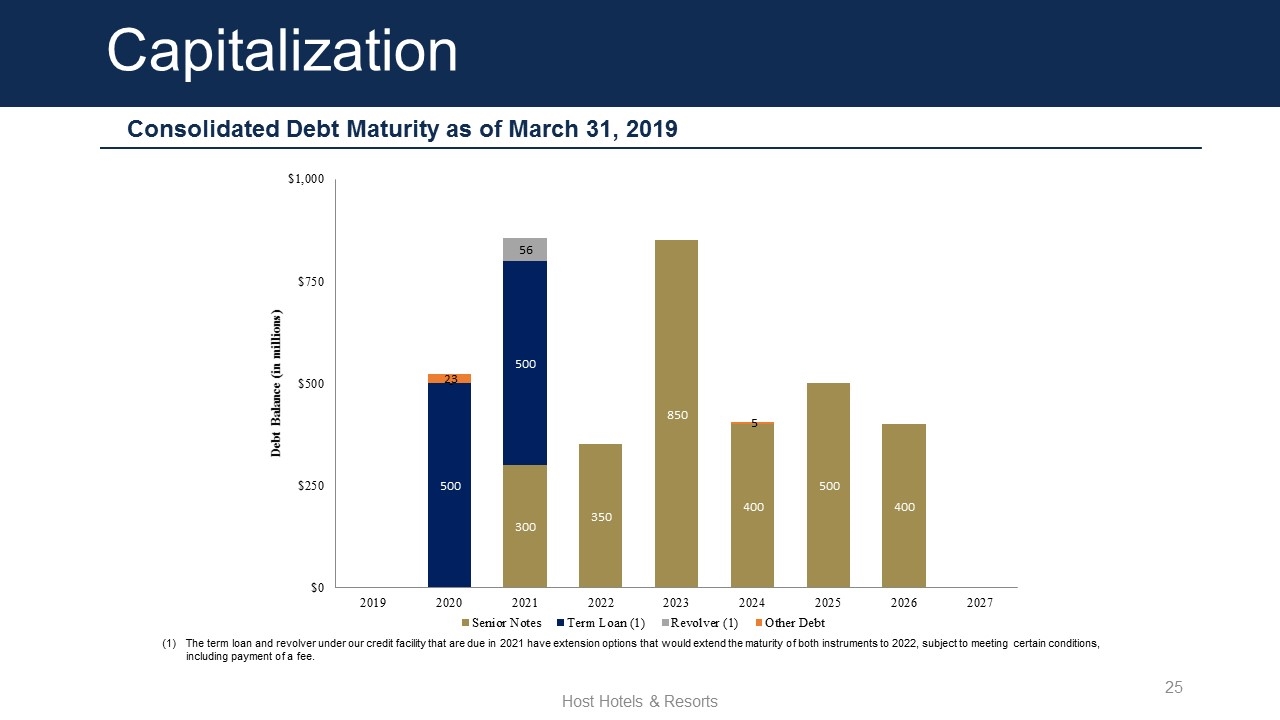

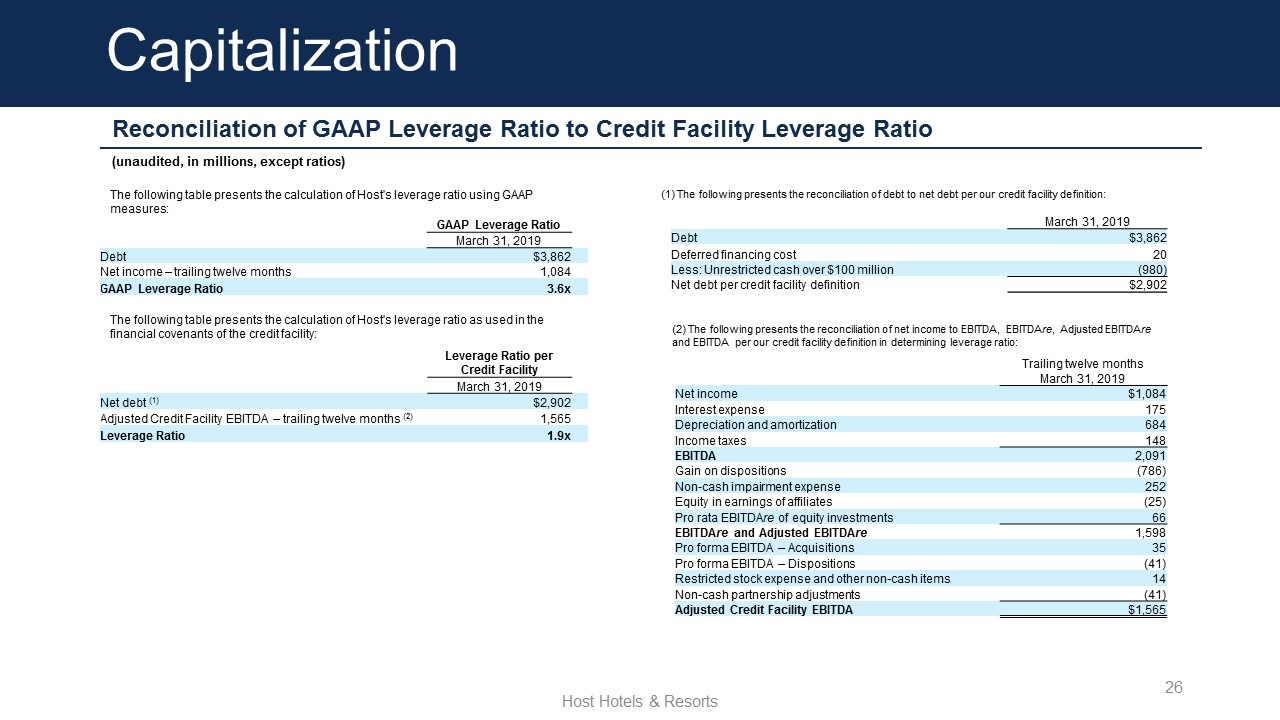

Balance Sheet

At March 31, 2019, the Company had approximately $1,082 million of unrestricted cash, not including $191 million in the FF&E escrow reserves, and $944 million of available capacity under the revolver portion of its credit facility. Total debt was $3.9 billion, with an average maturity of 3.9 years and an average interest rate of 4.3%. The Company has no debt maturities until 2020.

As previously announced, the Company has $500 million of capacity available under its current common share repurchase program. No shares were repurchased in the first quarter of 2019. As previously announced, the Company has a distribution agreement in place under which it may issue and sell, from time to time, shares of common stock having an aggregate offering price of up to $500 million in “at the market” offerings. No shares were issued in the first quarter of 2019.

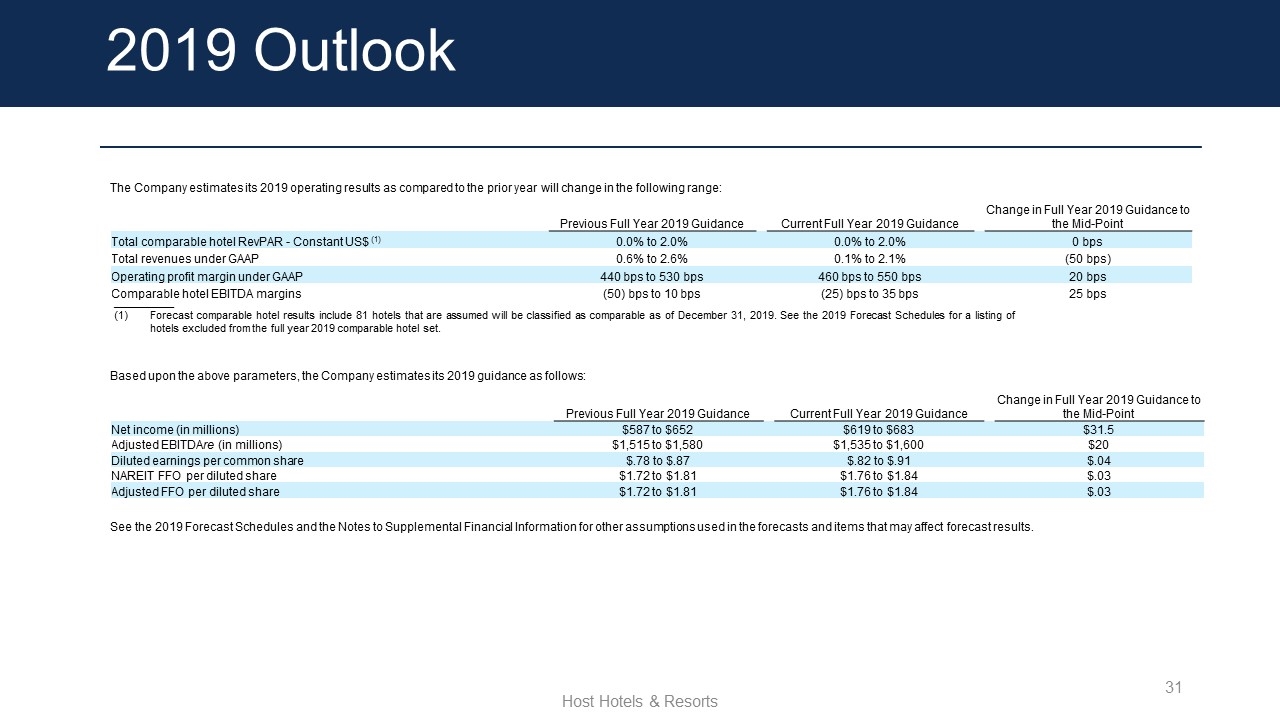

2019 Outlook

For 2019, the Company’s forecast for comparable hotel RevPAR growth is 0% to 2.0%. The RevPAR guidance reflects an estimated 45 basis points of disruption impact from the incremental capital expenditures associated with the Marriott transformational capital program. However, the estimated effect to earnings caused by these expenditures is offset by the operating profit guarantees provided by Marriott. The Company expects to receive $23 million of operating profit guarantees in 2019, of which $10 million is included in comparable hotel EBITDA, to offset the disruption to operations caused by the incremental spend on those properties. The Company estimates its 2019 operating results as compared to the prior year will change in the following range:

|

|

|

Previous Full Year 2019 Guidance |

|

Current Full Year 2019 Guidance |

|

Change in Full Year 2019 Guidance to the Mid-Point |

|

Total comparable hotel RevPAR - Constant US$ (1) |

|

0.0% to 2.0% |

|

0.0% to 2.0% |

|

0 bps |

|

Total revenues under GAAP |

|

0.6% to 2.6% |

|

0.1% to 2.1% |

|

(50 bps) |

|

Operating profit margin under GAAP |

|

440 bps to 530 bps |

|

460 bps to 550 bps |

|

20 bps |

|

Comparable hotel EBITDA margins |

|

(50) bps to 10 bps |

|

(25) bps to 35 bps |

|

25 bps |

__________

|

(1) |

Forecast comparable hotel results include 81 hotels that are assumed will be classified as comparable as of December 31, 2019. See the 2019 Forecast Schedules for a listing of hotels excluded from the full year 2019 comparable hotel set. |

Based upon the above parameters, the Company estimates its 2019 guidance as follows:

|

|

|

Previous Full Year 2019 Guidance |

|

Current Full Year 2019 Guidance |

|

Change in Full Year 2019 Guidance to the Mid-Point |

||

|

Net income (in millions) |

|

$587 to $652 |

|

$619 to $683 |

|

$31.5 |

||

|

Adjusted EBITDAre (in millions) |

|

$1,515 to $1,580 |

|

$1,535 to $1,600 |

|

$20 |

||

|

Diluted earnings per common share |

|

$.78 to $.87 |

|

$.82 to $.91 |

|

$.04 |

||

|

NAREIT FFO per diluted share |

|

$1.72 to $1.81 |

|

$1.76 to $1.84 |

|

$.03 |

||

|

Adjusted FFO per diluted share |

|

$1.72 to $1.81 |

|

$1.76 to $1.84 |

|

$.03 |

||

See the 2019 Forecast Schedules and the Notes to Financial Information for other assumptions used in the forecasts and items that may affect forecast results.

About Host Hotels & Resorts

Host Hotels & Resorts, Inc. is an S&P 500 company and is the largest lodging real estate investment trust and one of the largest owners of luxury and upper-upscale hotels. The Company currently owns 87 properties in the United States and five properties internationally totaling approximately 51,500 rooms. The Company also holds non-controlling interests in six domestic and one international joint ventures. Guided by a disciplined approach to capital allocation and aggressive asset management, the Company partners with premium brands such as Marriott®, Ritz-Carlton®, Westin®, Sheraton®, W®, St. Regis®, The Luxury Collection®, Hyatt®, Fairmont®, Hilton®, Swissôtel®, ibis® and Novotel®, as well as independent brands in the operation of properties in over 50 major markets. For additional information, please visit the Company’s website at www.hosthotels.com.

Note: This press release contains forward-looking statements within the meaning of federal securities regulations. These forward-looking statements include forecast results and are identified by their use of terms and phrases such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “should,” “plan,” “predict,” “project,” “will,” “continue” and other similar terms and phrases, including references to assumptions and forecasts of future results. Forward-looking statements are not guarantees of future performance and involve known

and unknown risks, uncertainties and other factors which may cause the actual results to differ materially from those anticipated at the time the forward-looking statements are made. These risks include, but are not limited to: changes in national and local economic and business conditions and other factors such as natural disasters, pandemics and weather that will affect occupancy rates at our hotels and the demand for hotel products and services; the impact of geopolitical developments outside the U.S. on lodging demand; volatility in global financial and credit markets; operating risks associated with the hotel business; risks and limitations in our operating flexibility associated with the level of our indebtedness and our ability to meet covenants in our debt agreements; risks associated with our relationships with property managers and joint venture partners; our ability to maintain our properties in a first-class manner, including meeting capital expenditure requirements; the effects of hotel renovations on our hotel occupancy and financial results; our ability to compete effectively in areas such as access, location, quality of accommodations and room rate structures; risks associated with our ability to complete acquisitions and dispositions and develop new properties and the risks that acquisitions and new developments may not perform in accordance with our expectations; our ability to continue to satisfy complex rules in order for us to remain a REIT for federal income tax purposes; risks associated with our ability to effectuate our dividend policy, including factors such as operating results and the economic outlook influencing our board’s decision whether to pay further dividends at levels previously disclosed or to use available cash to make special dividends; and other risks and uncertainties associated with our business described in the Company’s annual report on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K filed with the SEC. Although the Company believes the expectations reflected in such forward-looking statements are based upon reasonable assumptions, it can give no assurance that the expectations will be attained or that any deviation will not be material. All information in this release is as of May 1, 2019, and the Company undertakes no obligation to update any forward-looking statement to conform the statement to actual results or changes in the Company’s expectations.

|

* |

This press release contains registered trademarks that are the exclusive property of their respective owners. None of the owners of these trademarks has any responsibility or liability for any information contained in this press release. |

*** Tables to Follow ***

Host Hotels & Resorts, Inc., herein referred to as “we” or “Host Inc.,” is a self-managed and self-administered real estate investment trust that owns hotel properties. We conduct our operations as an umbrella partnership REIT through an operating partnership, Host Hotels & Resorts, L.P. (“Host LP”), of which we are the sole general partner. When distinguishing between Host Inc. and Host LP, the primary difference is approximately 1% of the partnership interests in Host LP held by outside partners as of March 31, 2019, which is non-controlling interests in Host LP in our consolidated balance sheets and is included in net income attributable to non-controlling interests in our consolidated statements of operations. Readers are encouraged to find further detail regarding our organizational structure in our annual report on Form 10-K.

|

2019 OPERATING RESULTS |

|

PAGE NO. |

|

Condensed Consolidated Balance Sheets (unaudited) March 31, 2019 and December 31, 2018 |

|

6 |

|

Condensed Consolidated Statements of Operations (unaudited) Quarter Ended March 31, 2019 and 2018 |

|

7 |

|

Earnings per Common Share (unaudited) Quarter Ended March 31, 2019 and 2018 |

|

8 |

|

Hotel Operating Data |

|

|

|

Hotel Operating Data for Consolidated Hotels (by Location) |

|

9 |

|

|

|

|

|

Schedule of Comparable Hotel Results |

|

10 |

|

Reconciliation of Net Income to EBITDA, EBITDAre and Adjusted EBITDAre |

|

11 |

|

Reconciliation of Diluted Earnings per Common Share to NAREIT and Adjusted Funds From Operations per Diluted Share |

|

12 |

|

2019 FORECAST INFORMATION |

|

|

|

Reconciliation of Net Income to EBITDA, EBITDAre, and Adjusted EBITDAre and Diluted Earnings per Common Share to NAREIT and Adjusted Funds From Operations per Diluted Share for 2019 Forecasts |

|

13 |

|

Schedule of Comparable Hotel Results for 2019 Forecasts |

|

14 |

|

Notes to Financial Information |

|

16 |

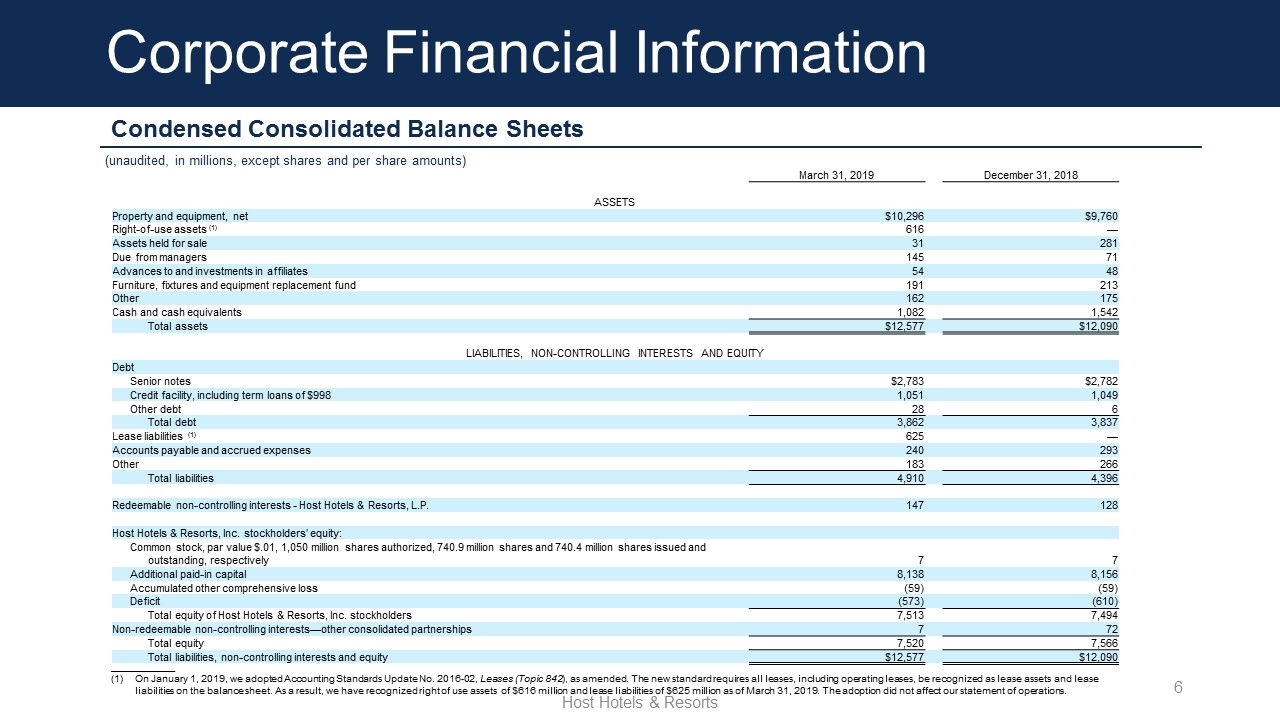

Condensed Consolidated Balance Sheets

(unaudited, in millions, except shares and per share amounts)

|

|

|

March 31, 2019 |

|

|

December 31, 2018 |

|

||

|

|

|

|

|

|

|

|

|

|

|

ASSETS |

|

|||||||

|

Property and equipment, net |

|

$ |

10,296 |

|

|

$ |

9,760 |

|

|

Right-of-use assets(1) |

|

|

616 |

|

|

|

— |

|

|

Assets held for sale |

|

|

31 |

|

|

|

281 |

|

|

Due from managers |

|

|

145 |

|

|

|

71 |

|

|

Advances to and investments in affiliates |

|

|

54 |

|

|

|

48 |

|

|

Furniture, fixtures and equipment replacement fund |

|

|

191 |

|

|

|

213 |

|

|

Other |

|

|

162 |

|

|

|

175 |

|

|

Cash and cash equivalents |

|

|

1,082 |

|

|

|

1,542 |

|

|

Total assets |

|

$ |

12,577 |

|

|

$ |

12,090 |

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES, NON-CONTROLLING INTERESTS AND EQUITY |

|

|||||||

|

Debt (2) |

|

|

|

|

|

|

|

|

|

Senior notes |

|

$ |

2,783 |

|

|

$ |

2,782 |

|

|

Credit facility, including the term loans of $998 |

|

|

1,051 |

|

|

|

1,049 |

|

|

Other debt |

|

|

28 |

|

|

|

6 |

|

|

Total debt |

|

|

3,862 |

|

|

|

3,837 |

|

|

Lease liabilities(1) |

|

|

625 |

|

|

|

— |

|

|

Accounts payable and accrued expenses |

|

|

240 |

|

|

|

293 |

|

|

Other |

|

|

183 |

|

|

|

266 |

|

|

Total liabilities |

|

|

4,910 |

|

|

|

4,396 |

|

|

|

|

|

|

|

|

|

|

|

|

Redeemable non-controlling interests - Host Hotels & Resorts, L.P. |

|

|

147 |

|

|

|

128 |

|

|

|

|

|

|

|

|

|

|

|

|

Host Hotels & Resorts, Inc. stockholders’ equity: |

|

|

|

|

|

|

|

|

|

Common stock, par value $.01, 1,050 million shares authorized, 740.9 million shares and 740.4 million shares issued and outstanding, respectively |

|

|

7 |

|

|

|

7 |

|

|

Additional paid-in capital |

|

|

8,138 |

|

|

|

8,156 |

|

|

Accumulated other comprehensive loss |

|

|

(59 |

) |

|

|

(59 |

) |

|

Deficit |

|

|

(573 |

) |

|

|

(610 |

) |

|

Total equity of Host Hotels & Resorts, Inc. stockholders |

|

|

7,513 |

|

|

|

7,494 |

|

|

Non-redeemable non-controlling interests—other consolidated partnerships |

|

|

7 |

|

|

|

72 |

|

|

Total equity |

|

|

7,520 |

|

|

|

7,566 |

|

|

Total liabilities, non-controlling interests and equity |

|

$ |

12,577 |

|

|

$ |

12,090 |

|

|

___________ |

|

|

|

|

|

|

|

|

|

(1) |

On January 1, 2019, we adopted Accounting Standard Update No. 2016-02, Leases (Topic 842), as amended. The new standard requires that all leases, including operating leases, be recognized as lease assets and lease liabilities on the balance sheet. As a result, we have recognized right of use assets of $616 million and lease liabilities of $625 million as of March 31, 2019. The adoption did not affect our statement of operations. |

|

(2) |

Please see our First Quarter 2019 Supplemental Financial Information for more detail on our debt balances. |

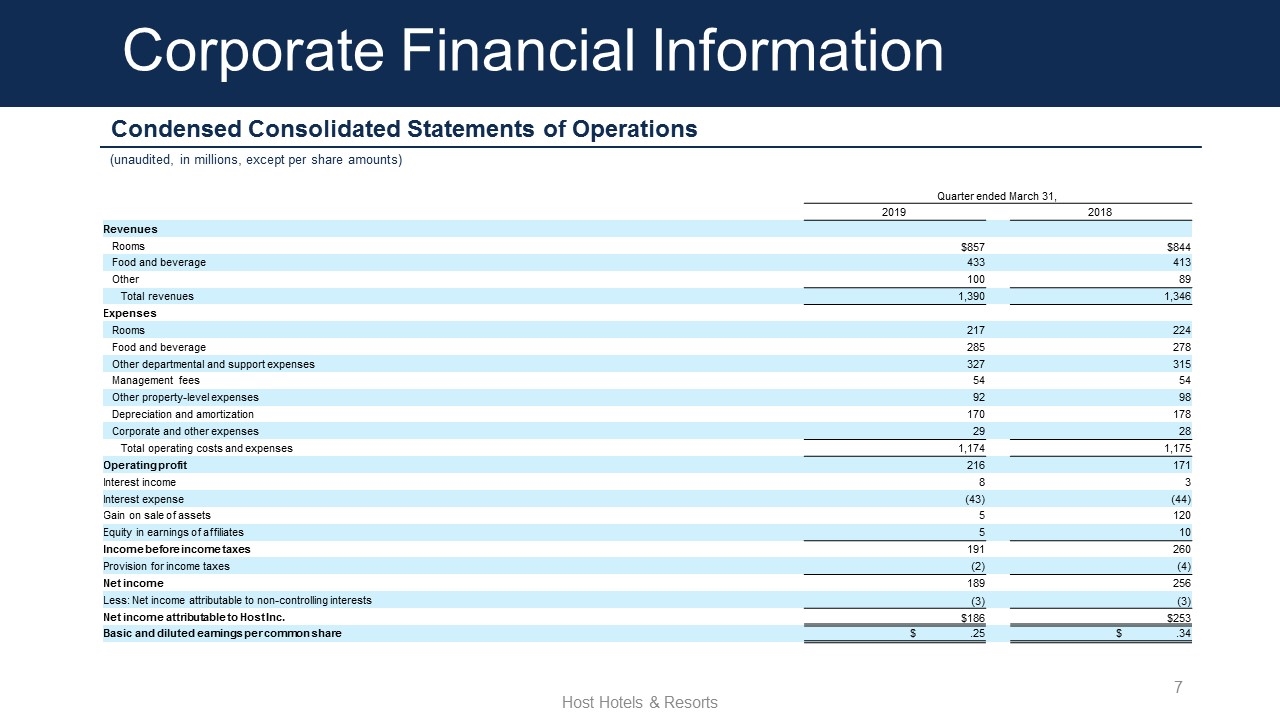

HOST HOTELS & RESORTS, INC.

Condensed Consolidated Statements of Operations

(unaudited, in millions, except per share amounts)

|

|

|

Quarter ended March 31, |

|

|||||

|

|

|

2019 |

|

|

2018 |

|

||

|

Revenues |

|

|

|

|

|

|

|

|

|

Rooms |

|

$ |

857 |

|

|

$ |

844 |

|

|

Food and beverage |

|

|

433 |

|

|

|

413 |

|

|

Other |

|

|

100 |

|

|

|

89 |

|

|

Total revenues |

|

|

1,390 |

|

|

|

1,346 |

|

|

Expenses |

|

|

|

|

|

|

|

|

|

Rooms |

|

|

217 |

|

|

|

224 |

|

|

Food and beverage |

|

|

285 |

|

|

|

278 |

|

|

Other departmental and support expenses |

|

|

327 |

|

|

|

315 |

|

|

Management fees |

|

|

54 |

|

|

|

54 |

|

|

Other property-level expenses |

|

|

92 |

|

|

|

98 |

|

|

Depreciation and amortization |

|

|

170 |

|

|

|

178 |

|

|

Corporate and other expenses(1) |

|

|

29 |

|

|

|

28 |

|

|

Total operating costs and expenses |

|

|

1,174 |

|

|

|

1,175 |

|

|

Operating profit |

|

|

216 |

|

|

|

171 |

|

|

Interest income |

|

|

8 |

|

|

|

3 |

|

|

Interest expense |

|

|

(43 |

) |

|

|

(44 |

) |

|

Gain on sale of assets |

|

|

5 |

|

|

|

120 |

|

|

Equity in earnings of affiliates |

|

|

5 |

|

|

|

10 |

|

|

Income before income taxes |

|

|

191 |

|

|

|

260 |

|

|

Provision for income taxes |

|

|

(2 |

) |

|

|

(4 |

) |

|

Net income |

|

|

189 |

|

|

|

256 |

|

|

Less: Net income attributable to non-controlling interests |

|

|

(3 |

) |

|

|

(3 |

) |

|

Net income attributable to Host Inc. |

|

$ |

186 |

|

|

$ |

253 |

|

|

Basic and diluted earnings per common share |

|

$ |

.25 |

|

|

$ |

.34 |

|

|

___________ |

|

|

|

|

|

|

|

|

|

(1) |

Corporate and other expenses include the following items: |

|

|

|

Quarter ended March 31, |

|

|||||

|

|

2019 |

|

|

2018 |

|

|||

|

General and administrative costs |

|

$ |

25 |

|

|

$ |

25 |

|

|

Non-cash stock-based compensation expense |

|

|

4 |

|

|

|

3 |

|

|

Total |

|

$ |

29 |

|

|

$ |

28 |

|

|

|

|

|

|

|

|

|

|

|

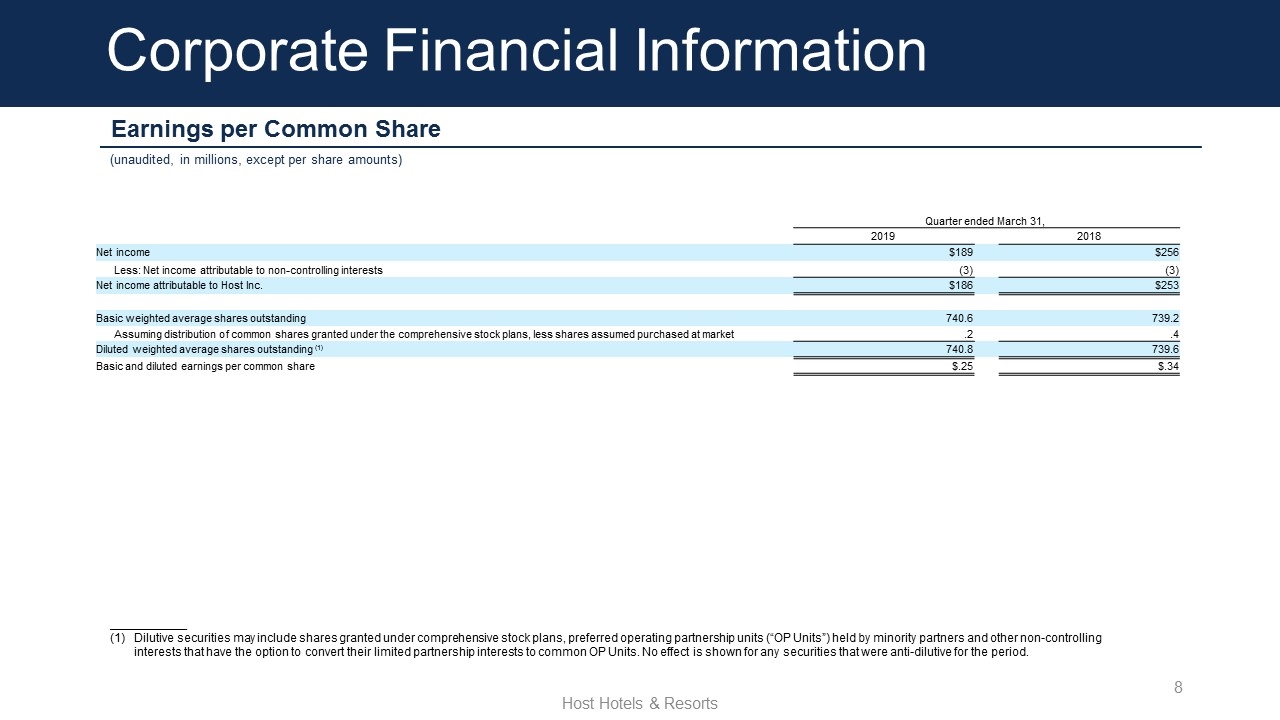

HOST HOTELS & RESORTS, INC.

Earnings per Common Share

(unaudited, in millions, except per share amounts)

|

|

|

Quarter ended March 31, |

|

|||||

|

|

|

2019 |

|

|

2018 |

|

||

|

Net income |

|

$ |

189 |

|

|

$ |

256 |

|

|

Less: Net income attributable to non-controlling interests |

|

|

(3 |

) |

|

|

(3 |

) |

|

Net income attributable to Host Inc. |

|

$ |

186 |

|

|

$ |

253 |

|

|

|

|

|

|

|

|

|

|

|

|

Basic weighted average shares outstanding |

|

|

740.6 |

|

|

|

739.2 |

|

|

Assuming distribution of common shares granted under the comprehensive stock plans, less shares assumed purchased at market |

|

|

.2 |

|

|

|

.4 |

|

|

Diluted weighted average shares outstanding (1) |

|

|

740.8 |

|

|

|

739.6 |

|

|

Basic and diluted earnings per common share |

|

$ |

.25 |

|

|

$ |

.34 |

|

|

___________ |

|

|

|

|

|

|

|

|

|

(1) |

Dilutive securities may include shares granted under comprehensive stock plans, preferred operating partnership units (“OP Units”) held by minority partners and other non-controlling interests that have the option to convert their limited partnership interests to common OP Units. No effect is shown for any securities that were anti-dilutive for the period. |

HOST HOTELS & RESORTS, INC.

Hotel Operating Data for Consolidated Hotels (1)

Comparable Hotels by Location in Constant US$

|

|

|

As of March 31, 2019 |

|

|

Quarter ended March 31, 2019 |

|

|

Quarter ended March 31, 2018 |

|

|

|

|

|

|||||||||||||||||||||||

|

Location |

|

No. of Properties |

|

|

No. of Rooms |

|

|

Average Room Rate |

|

|

Average Occupancy Percentage |

|

|

RevPAR |

|

|

Average Room Rate |

|

|

Average Occupancy Percentage |

|

|

RevPAR |

|

|

Percent Change in RevPAR |

|

|||||||||

|

Maui/Oahu |

|

|

3 |

|

|

|

1,682 |

|

|

$ |

399.24 |

|

|

|

89.2 |

% |

|

$ |

356.00 |

|

|

$ |

396.73 |

|

|

|

91.4 |

% |

|

$ |

362.47 |

|

|

|

(1.8 |

)% |

|

Jacksonville |

|

|

1 |

|

|

|

446 |

|

|

|

367.78 |

|

|

|

78.6 |

|

|

|

289.04 |

|

|

|

355.15 |

|

|

|

71.3 |

|

|

|

253.14 |

|

|

|

14.2 |

|

|

Phoenix |

|

|

5 |

|

|

|

2,163 |

|

|

|

339.86 |

|

|

|

84.1 |

|

|

|

285.90 |

|

|

|

317.94 |

|

|

|

83.7 |

|

|

|

266.02 |

|

|

|

7.5 |

|

|

Florida Gulf Coast |

|

|

3 |

|

|

|

940 |

|

|

|

328.81 |

|

|

|

85.0 |

|

|

|

279.47 |

|

|

|

323.19 |

|

|

|

84.6 |

|

|

|

273.36 |

|

|

|

2.2 |

|

|

Los Angeles |

|

|

4 |

|

|

|

1,726 |

|

|

|

223.86 |

|

|

|

86.5 |

|

|

|

193.59 |

|

|

|

230.25 |

|

|

|

89.2 |

|

|

|

205.41 |

|

|

|

(5.8 |

) |

|

San Francisco/San Jose |

|

|

5 |

|

|

|

2,353 |

|

|

|

252.45 |

|

|

|

76.0 |

|

|

|

191.79 |

|

|

|

225.49 |

|

|

|

80.2 |

|

|

|

180.76 |

|

|

|

6.1 |

|

|

Miami |

|

|

2 |

|

|

|

843 |

|

|

|

210.99 |

|

|

|

86.9 |

|

|

|

183.31 |

|

|

|

207.22 |

|

|

|

88.5 |

|

|

|

183.36 |

|

|

|

— |

|

|

San Diego |

|

|

4 |

|

|

|

4,341 |

|

|

|

235.04 |

|

|

|

77.4 |

|

|

|

181.93 |

|

|

|

231.83 |

|

|

|

81.9 |

|

|

|

189.78 |

|

|

|

(4.1 |

) |

|

Washington, D.C. (CBD) |

|

|

5 |

|

|

|

3,238 |

|

|

|

247.89 |

|

|

|

73.3 |

|

|

|

181.79 |

|

|

|

250.33 |

|

|

|

71.8 |

|

|

|

179.63 |

|

|

|

1.2 |

|

|

Atlanta |

|

|

5 |

|

|

|

1,936 |

|

|

|

224.73 |

|

|

|

77.9 |

|

|

|

175.00 |

|

|

|

192.08 |

|

|

|

78.7 |

|

|

|

151.15 |

|

|

|

15.8 |

|

|

New Orleans |

|

|

1 |

|

|

|

1,333 |

|

|

|

209.79 |

|

|

|

81.6 |

|

|

|

171.18 |

|

|

|

197.38 |

|

|

|

82.7 |

|

|

|

163.21 |

|

|

|

4.9 |

|

|

New York |

|

|

3 |

|

|

|

4,259 |

|

|

|

236.38 |

|

|

|

72.0 |

|

|

|

170.27 |

|

|

|

252.47 |

|

|

|

77.7 |

|

|

|

196.18 |

|

|

|

(13.2 |

) |

|

Orlando |

|

|

1 |

|

|

|

2,004 |

|

|

|

208.20 |

|

|

|

79.0 |

|

|

|

164.41 |

|

|

|

210.77 |

|

|

|

81.6 |

|

|

|

172.05 |

|

|

|

(4.4 |

) |

|

San Antonio |

|

|

2 |

|

|

|

1,513 |

|

|

|

196.01 |

|

|

|

77.4 |

|

|

|

151.75 |

|

|

|

198.26 |

|

|

|

75.7 |

|

|

|

150.18 |

|

|

|

1.0 |

|

|

Orange County |

|

|

4 |

|

|

|

1,432 |

|

|

|

193.05 |

|

|

|

78.2 |

|

|

|

150.88 |

|

|

|

192.00 |

|

|

|

76.3 |

|

|

|

146.53 |

|

|

|

3.0 |

|

|

Seattle |

|

|

2 |

|

|

|

1,315 |

|

|

|

194.12 |

|

|

|

77.4 |

|

|

|

150.15 |

|

|

|

201.47 |

|

|

|

75.1 |

|

|

|

151.30 |

|

|

|

(0.8 |

) |

|

Philadelphia |

|

|

2 |

|

|

|

810 |

|

|

|

190.16 |

|

|

|

78.1 |

|

|

|

148.48 |

|

|

|

192.13 |

|

|

|

83.5 |

|

|

|

160.48 |

|

|

|

(7.5 |

) |

|

Houston |

|

|

4 |

|

|

|

1,716 |

|

|

|

182.60 |

|

|

|

75.8 |

|

|

|

138.36 |

|

|

|

178.84 |

|

|

|

76.5 |

|

|

|

136.75 |

|

|

|

1.2 |

|

|

Northern Virginia |

|

|

5 |

|

|

|

1,919 |

|

|

|

189.73 |

|

|

|

69.6 |

|

|

|

132.13 |

|

|

|

186.56 |

|

|

|

71.7 |

|

|

|

133.83 |

|

|

|

(1.3 |

) |

|

Boston |

|

|

4 |

|

|

|

3,185 |

|

|

|

185.32 |

|

|

|

68.3 |

|

|

|

126.54 |

|

|

|

183.76 |

|

|

|

70.7 |

|

|

|

129.97 |

|

|

|

(2.6 |

) |

|

Denver |

|

|

3 |

|

|

|

1,340 |

|

|

|

161.82 |

|

|

|

64.7 |

|

|

|

104.75 |

|

|

|

152.93 |

|

|

|

67.5 |

|

|

|

103.26 |

|

|

|

1.4 |

|

|

Chicago |

|

|

6 |

|

|

|

2,393 |

|

|

|

141.59 |

|

|

|

62.4 |

|

|

|

88.30 |

|

|

|

148.46 |

|

|

|

67.2 |

|

|

|

99.80 |

|

|

|

(11.5 |

) |

|

Other |

|

|

8 |

|

|

|

3,596 |

|

|

|

174.04 |

|

|

|

70.4 |

|

|

|

122.54 |

|

|

|

176.71 |

|

|

|

72.2 |

|

|

|

127.59 |

|

|

|

(4.0 |

) |

|

Domestic |

|

|

82 |

|

|

|

46,483 |

|

|

|

227.85 |

|

|

|

75.5 |

|

|

|

172.07 |

|

|

|

224.59 |

|

|

|

77.5 |

|

|

|

174.11 |

|

|

|

(1.2 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

International |

|

|

5 |

|

|

|

1,499 |

|

|

|

143.88 |

|

|

|

67.6 |

|

|

|

97.32 |

|

|

|

141.14 |

|

|

|

61.9 |

|

|

|

87.35 |

|

|

|

11.4 |

|

|

All Locations - Constant US$ |

|

|

87 |

|

|

|

47,982 |

|

|

|

225.49 |

|

|

|

75.3 |

|

|

|

169.74 |

|

|

|

222.50 |

|

|

|

77.0 |

|

|

|

171.40 |

|

|

|

(1.0 |

) |

All Owned Hotels in Constant US$ (2)

|

|

|

As of March 31, 2019 |

|

|

Quarter ended March 31, 2019 |

|

|

Quarter ended March 31, 2018 |

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

No. of Properties |

|

|

No. of Rooms |

|

|

Average Room Rate |

|

|

Average Occupancy Percentage |

|

|

RevPAR |

|

|

Average Room Rate |

|

|

Average Occupancy Percentage |

|

|

RevPAR |

|

|

Percent Change in RevPAR |

|

|||||||||

|

Comparable Hotels |

|

|

87 |

|

|

|

47,982 |

|

|

$ |

225.49 |

|

|

|

75.3 |

% |

|

$ |

169.74 |

|

|

$ |

222.50 |

|

|

|

77.0 |

% |

|

$ |

171.40 |

|

|

|

(1.0 |

)% |

|

Non-comparable Hotels (Pro forma) |

|

|

6 |

|

|

|

3,803 |

|

|

|

486.08 |

|

|

|

80.7 |

|

|

|

392.36 |

|

|

|

446.16 |

|

|

|

88.2 |

|

|

|

393.42 |

|

|

|

(0.3 |

) |

|

All Hotels |

|

|

93 |

|

|

|

51,785 |

|

|

|

246.13 |

|

|

|

75.7 |

|

|

|

186.27 |

|

|

|

241.31 |

|

|

|

77.9 |

|

|

|

187.89 |

|

|

|

(0.9 |

) |

Comparable Hotels in Nominal US$

|

|

|

As of March 31, 2019 |

|

|

Quarter ended March 31, 2019 |

|

|

Quarter ended March 31, 2018 |

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

No. of Properties |

|

|

No. of Rooms |

|

|

Average Room Rate |

|

|

Average Occupancy Percentage |

|

|

RevPAR |

|

|

Average Room Rate |

|

|

Average Occupancy Percentage |

|

|

RevPAR |

|

|

Percent Change in RevPAR |

|

|||||||||

|

International |

|

|

5 |

|

|

|

1,499 |

|

|

$ |

143.88 |

|

|

|

67.6 |

% |

|

$ |

97.32 |

|

|

$ |

153.01 |

|

|

|

61.9 |

% |

|

$ |

94.70 |

|

|

|

2.8 |

% |

|

Domestic |

|

|

82 |

|

|

|

46,483 |

|

|

|

227.85 |

|

|

|

75.5 |

|

|

|

172.07 |

|

|

|

224.59 |

|

|

|

77.5 |

|

|

|

174.11 |

|

|

|

(1.2 |

) |

|

All Locations |

|

|

87 |

|

|

|

47,982 |

|

|

|

225.49 |

|

|

|

75.3 |

|

|

|

169.74 |

|

|

|

222.79 |

|

|

|

77.0 |

|

|

|

171.63 |

|

|

|

(1.1 |

) |

|

(1) |

See the Notes to Financial Information for a discussion of comparable hotel operating statistics and constant US$ presentation. Nominal US$ results include the effect of currency fluctuations, consistent with our financial statement presentation. CBD of a location refers to the central business district. |

|

(2) |

Operating statistics are presented for all consolidated properties owned as of March 31, 2019 and do not include the results of operations for properties sold in 2019 or 2018. Additionally, all owned hotel operating statistics include hotels that we did not own for the entirety of the periods presented and properties that are undergoing large-scale capital projects during the periods presented and, therefore, are not considered comparable hotel information upon which we usually evaluate our performance. Specifically, comparable RevPAR is calculated as room revenues divided by the available room nights, which will rarely vary on a year-over-year basis. Conversely, the available room nights included in the non-comparable RevPAR statistic will vary widely based on the timing of hotel closings, the scope of a capital project, or the development of a new property. Comparable Total RevPAR is calculated as rooms, food and beverage and other revenues by the available room nights. See the Notes to Financial Information – Comparable Hotel Operating Statistics for further information on these pro forma statistics and the limitations on their use. |

|

|

• |

Non-comparable hotels (pro forma) - This represents two hotels under significant renovations in 2018 and 2019, and four hotels acquired in 2018 and 2019, which are presented on a pro forma basis assuming we owned the hotels as of January 1, 2018 and includes historical operating data for periods prior to our ownership. As a result, the RevPAR decrease of 0.3% for the quarter for these six hotels is considered non-comparable. |

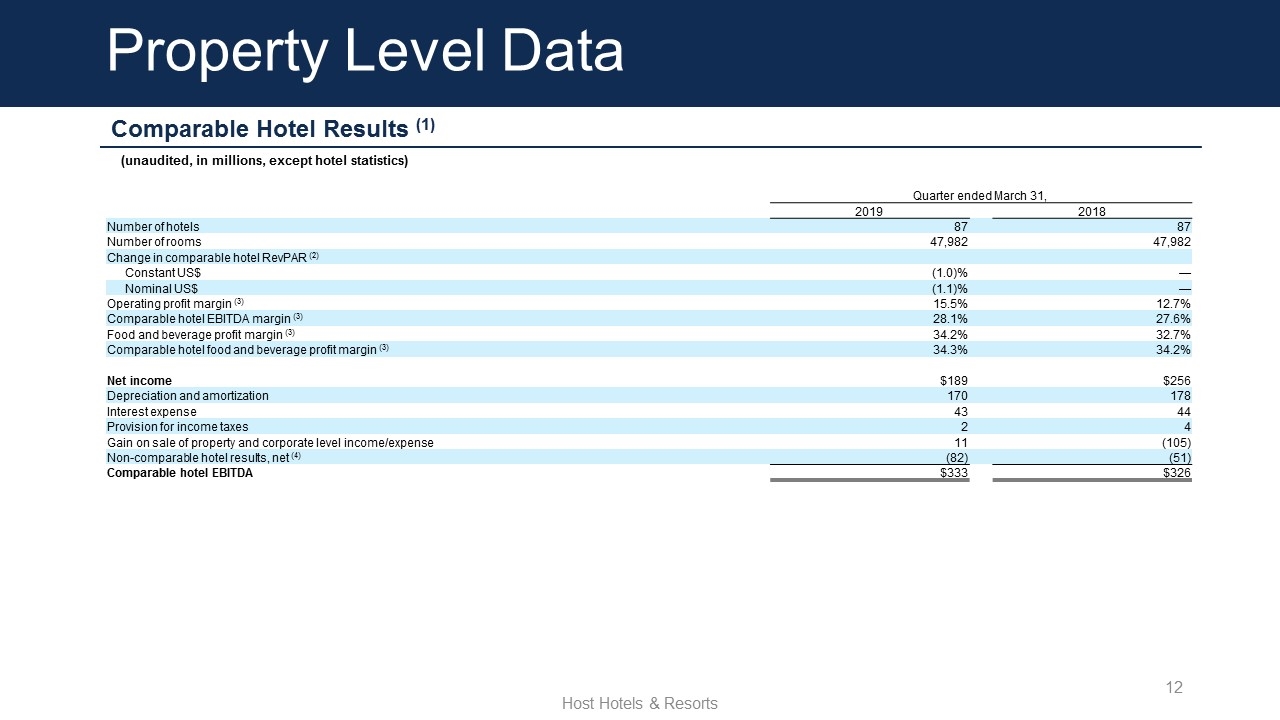

Schedule of Comparable Hotel Results (1)

(unaudited, in millions, except hotel statistics)

|

|

|

Quarter ended March 31, |

|

|||||

|

|

|

2019 |

|

|

2018 |

|

||

|

Number of hotels |

|

|

87 |

|

|

|

87 |

|

|

Number of rooms |

|

|

47,982 |

|

|

|

47,982 |

|

|

Change in comparable hotel RevPAR - |

|

|

|

|

|

|

|

|

|

Constant US$ |

|

|

(1.0 |

)% |

|

|

— |

|

|

Nominal US$ |

|

|

(1.1 |

)% |

|

|

— |

|

|

Operating profit margin (2) |

|

|

15.5 |

% |

|

|

12.7 |

% |

|

Comparable hotel EBITDA margin (2) |

|

|

28.1 |

% |

|

|

27.6 |

% |

|

Food and beverage profit margin (2) |

|

|

34.2 |

% |

|

|

32.7 |

% |

|

Comparable hotel food and beverage profit margin (2) |

|

|

34.3 |

% |

|

|

34.2 |

% |

|

|

|

|

|

|

|

|

|

|

|

Net income |

|

$ |

189 |

|

|

$ |

256 |

|

|

Depreciation and amortization |

|

|

170 |

|

|

|

178 |

|

|

Interest expense |

|

|

43 |

|

|

|

44 |

|

|

Provision for income taxes |

|

|

2 |

|

|

|

4 |

|

|

Gain on sale of property and corporate level income/expense |

|

|

11 |

|

|

|

(105 |

) |

|

Non-comparable hotel results, net (3) |

|

|

(82 |

) |

|

|

(51 |

) |

|

Comparable hotel EBITDA |

|

$ |

333 |

|

|

$ |

326 |

|

|

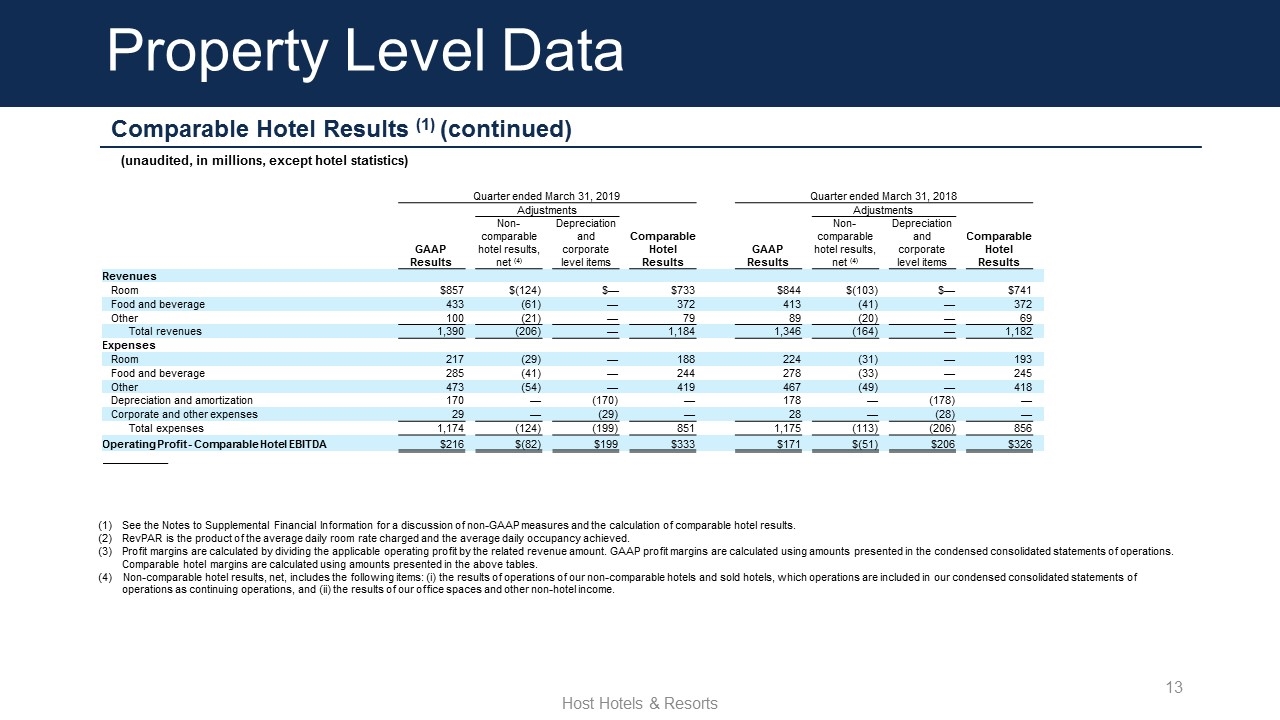

|

|

Quarter ended March 31, 2019 |

|

|

Quarter ended March 31, 2018 |

|

||||||||||||||||||||||||||

|

|

|

|

|

|

|

Adjustments |

|

|

|

|

|

|

|

|

|

|

Adjustments |

|

|

|

|

|

||||||||||

|

|

|

GAAP Results |

|

|

Non-comparable hotel results, net (3) |

|

|

Depreciation and corporate level items |

|

|

Comparable Hotel Results |

|

|

GAAP Results |

|

|

Non-comparable hotel results, net (3) |

|

|

Depreciation and corporate level items |

|

|

Comparable Hotel Results |

|

||||||||

|

Revenues |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Room |

|

$ |

857 |

|

|

$ |

(124 |

) |

|

$ |

— |

|

|

$ |

733 |

|

|

$ |

844 |

|

|

$ |

(103 |

) |

|

$ |

— |

|

|

$ |

741 |

|

|

Food and beverage |

|

|

433 |

|

|

|

(61 |

) |

|

|

— |

|

|

|

372 |

|

|

|

413 |

|

|

|

(41 |

) |

|

|

— |

|

|

|

372 |

|

|

Other |

|

|

100 |

|

|

|

(21 |

) |

|

|

— |

|

|

|

79 |

|

|

|

89 |

|

|

|

(20 |

) |

|

|

— |

|

|

|

69 |

|

|

Total revenues |

|

|

1,390 |

|

|

|

(206 |

) |

|

|

— |

|

|

|

1,184 |

|

|

|

1,346 |

|

|

|

(164 |

) |

|

|

— |

|

|

|

1,182 |

|

|

Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Room |

|

|

217 |

|

|

|

(29 |

) |

|

|

— |

|

|

|

188 |

|

|

|

224 |

|

|

|

(31 |

) |

|

|

— |

|

|

|

193 |

|

|

Food and beverage |

|

|

285 |

|

|

|

(41 |

) |

|

|

— |

|

|

|

244 |

|

|

|

278 |

|

|

|

(33 |

) |

|

|

— |

|

|

|

245 |

|

|

Other |

|

|

473 |

|

|

|

(54 |

) |

|

|

— |

|

|

|

419 |

|

|

|

467 |

|

|

|

(49 |

) |

|

|

— |

|

|

|

418 |

|

|

Depreciation and amortization |

|

|

170 |

|

|

|

— |

|

|

|

(170 |

) |

|

|

— |

|

|

|

178 |

|

|

|

— |

|

|

|

(178 |

) |

|

|

— |

|

|

Corporate and other expenses |

|

|

29 |

|

|

|

— |

|

|

|

(29 |

) |

|

|

— |

|

|

|

28 |

|

|

|

— |

|

|

|

(28 |

) |

|

|

— |

|

|

Total expenses |

|

|

1,174 |

|

|

|

(124 |

) |

|

|

(199 |

) |

|

|

851 |

|

|

|

1,175 |

|

|

|

(113 |

) |

|

|

(206 |

) |

|

|

856 |

|

|

Operating Profit - Comparable Hotel EBITDA |

|

$ |

216 |

|

|

$ |

(82 |

) |

|

$ |

199 |

|

|

$ |

333 |

|

|

$ |

171 |

|

|

$ |

(51 |

) |

|

$ |

206 |

|

|

$ |

326 |

|

|

___________ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) |

See the Notes to Financial Information for a discussion of non-GAAP measures and the calculation of comparable hotel results. For additional information on comparable hotel EBITDA by location, see the First Quarter 2019 Supplemental Financial Information posted on our website. |

|

(2) |

Profit margins are calculated by dividing the applicable operating profit by the related revenue amount. GAAP profit margins are calculated using amounts presented in the condensed consolidated statements of operations. Comparable hotel margins are calculated using amounts presented in the above tables. |

|

(3) |

Non-comparable hotel results, net, includes the following items: (i) the results of operations of our non-comparable hotels and sold hotels, which operations are included in our condensed consolidated statements of operations as continuing operations, and (ii) the results of our office spaces and other non-hotel income. |

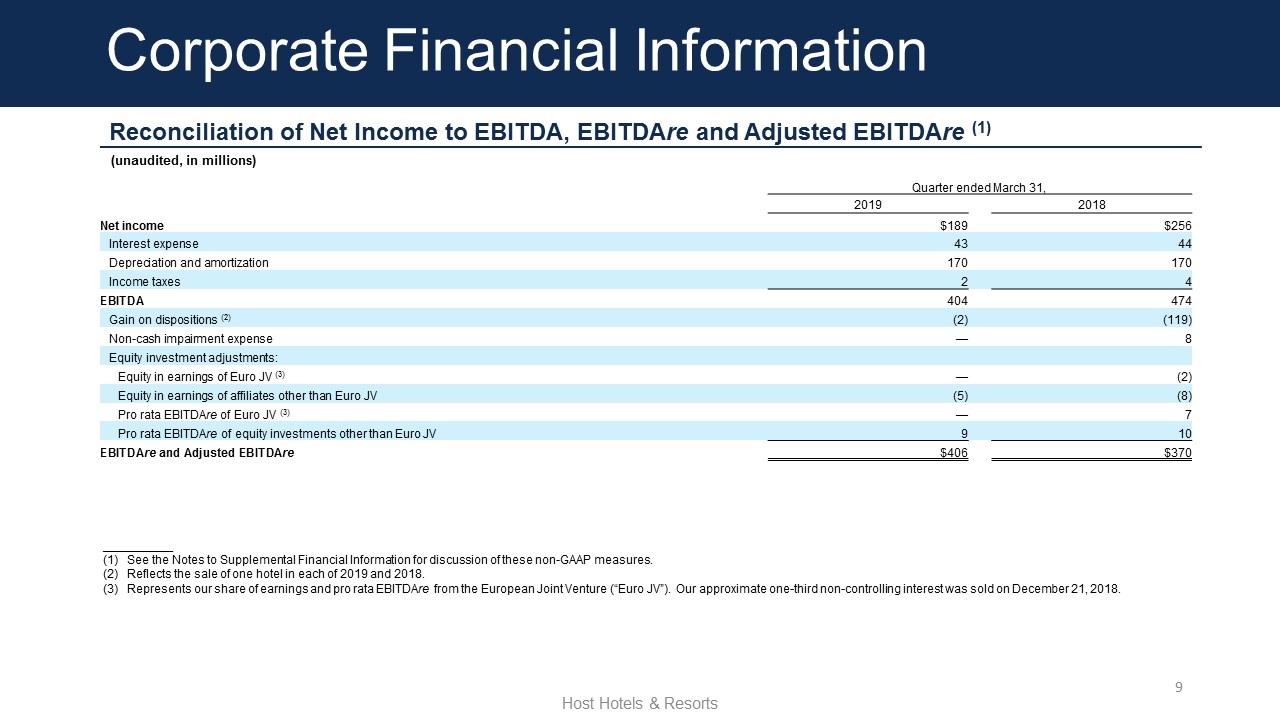

Reconciliation of Net Income to

EBITDA, EBITDAre and Adjusted EBITDAre (1)

(unaudited, in millions)

|

|

|

Quarter ended March 31, |

|

|||||

|

|

|

2019 |

|

|

2018 |

|

||

|

Net income |

|

$ |

189 |

|

|

$ |

256 |

|

|

Interest expense |

|

|

43 |

|

|

|

44 |

|

|

Depreciation and amortization |

|

|

170 |

|

|

|

170 |

|

|

Income taxes |

|

|

2 |

|

|

|

4 |

|

|

EBITDA |

|

|

404 |

|

|

|

474 |

|

|

Gain on dispositions (2) |

|

|

(2 |

) |

|

|

(119 |

) |

|

Non-cash impairment expense |

|

|

— |

|

|

|

8 |

|

|

Equity investment adjustments: |

|

|

|

|

|

|

|

|

|

Equity in earnings of Euro JV (3) |

|

|

— |

|

|

|

(2 |

) |

|

Equity in earnings of affiliates other than Euro JV |

|

|

(5 |

) |

|

|

(8 |

) |

|

Pro rata EBITDAre of Euro JV (3) |

|

|

— |

|

|

|

7 |

|

|

Pro rata EBITDAre of equity investments other than Euro JV |

|

|

9 |

|

|

|

10 |

|

|

EBITDAre and Adjusted EBITDAre |

|

$ |

406 |

|

|

$ |

370 |

|

|

___________ |

|

|

|

|

|

|

|

|

|

(1) |

See the Notes to Financial Information for discussion of non-GAAP measures. |

|

(2) |

Reflects the sale of one hotel in each of 2019 and 2018. |

|

(3) |

Represents our share of earnings and pro rata EBITDAre from the European Joint Venture (“Euro JV”). Our approximate one-third non-controlling interest was sold on December 21, 2018. |

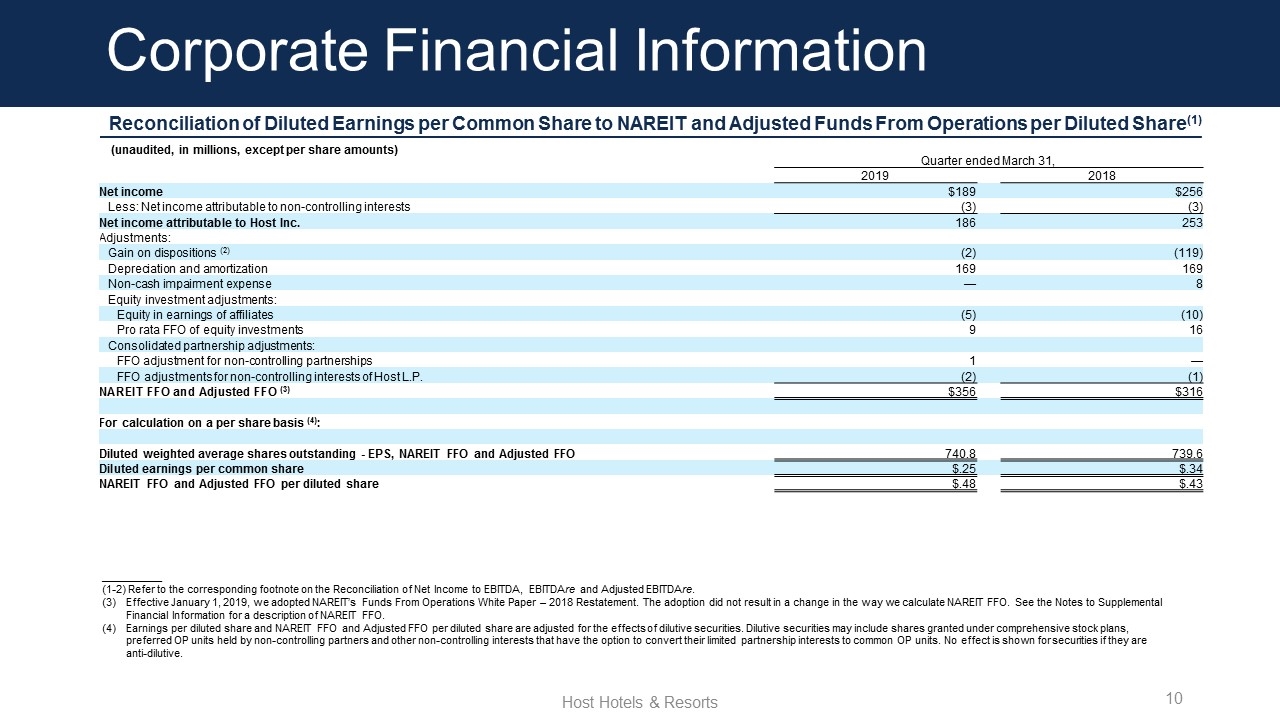

Reconciliation of Diluted Earnings per Common Share to

NAREIT and Adjusted Funds From Operations per Diluted Share (1)

(unaudited, in millions, except per share amounts)

|

|

|

Quarter ended March 31, |

|

|||||

|

|

|

2019 |

|

|

2018 |

|

||

|

Net income |

|

$ |

189 |

|

|

$ |

256 |

|

|

Less: Net income attributable to non-controlling interests |

|

|

(3 |

) |

|

|

(3 |

) |

|

Net income attributable to Host Inc. |

|

|

186 |

|

|

|

253 |

|

|

Adjustments: |

|

|

|

|

|

|

|

|

|

Gain on dispositions (2) |

|

|

(2 |

) |

|

|

(119 |

) |

|

Depreciation and amortization |

|

|

169 |

|

|

|

169 |

|

|

Non-cash impairment expense |

|

|

— |

|

|

|

8 |

|

|

Equity investment adjustments: |

|

|

|

|

|

|

|

|

|

Equity in earnings of affiliates |

|

|

(5 |

) |

|

|

(10 |

) |

|

Pro rata FFO of equity investments |

|

|

9 |

|

|

|

16 |

|

|

Consolidated partnership adjustments: |

|

|

|

|

|

|

|

|

|

FFO adjustment for non-controlling partnerships |

|

|

1 |

|

|

|

— |

|

|

FFO adjustments for non-controlling interests of Host L.P. |

|

|

(2 |

) |

|

|

(1 |

) |

|

NAREIT FFO and Adjusted FFO (3) |

|

$ |

356 |

|

|

$ |

316 |

|

|

|

|

|

|

|

|

|

|

|

|

For calculation on a per share basis (4): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted weighted average shares outstanding - EPS, NAREIT FFO and Adjusted FFO |

|

|

740.8 |

|

|

|

739.6 |

|

|

Diluted earnings per common share |

|

$ |

.25 |

|

|

$ |

.34 |

|

|

NAREIT FFO and Adjusted FFO per diluted share |

|

$ |

.48 |

|

|

$ |

.43 |

|

|

___________ |

|

|

|

|

|

|

|

|

|

(1-2) |

Refer to the corresponding footnote on the Reconciliation of Net Income to EBITDA, EBITDAre and Adjusted EBITDAre. |

|

(3) |

Effective January 1, 2019, we adopted NAREIT’s Funds From Operations White Paper – 2018 Restatement. The adoption did not result in a change in the way we calculate NAREIT FFO. See the Notes to Financial Information for a description of NAREIT FFO. |

|

(4) |

Earnings per diluted share and NAREIT FFO and Adjusted FFO per diluted share are adjusted for the effects of dilutive securities. Dilutive securities may include shares granted under comprehensive stock plans, preferred OP units held by non-controlling partners and other non-controlling interests that have the option to convert their limited partnership interests to common OP units. No effect is shown for securities if they are anti-dilutive. |

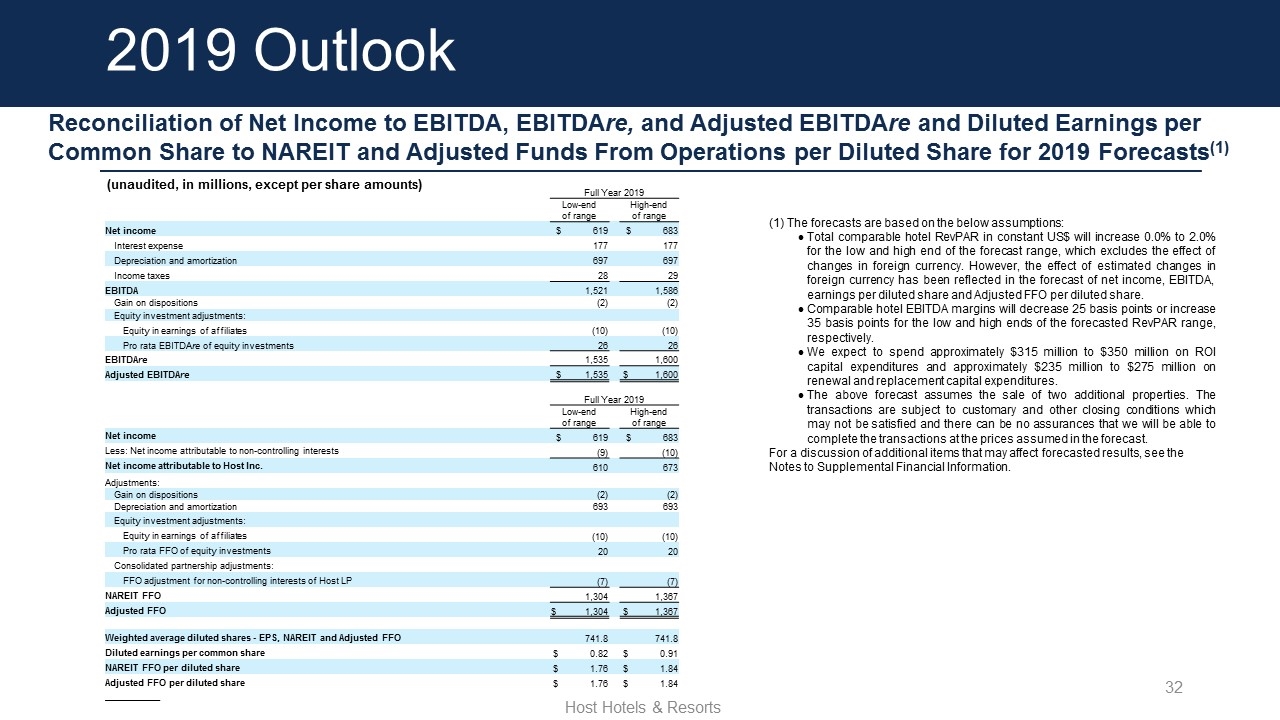

Reconciliation of Net Income to EBITDA, EBITDAre, and Adjusted EBITDAre and

Diluted Earnings per Common Share to NAREIT and Adjusted Funds From Operations per Diluted Share for 2019 Forecasts (1)

(unaudited, in millions, except per share amounts)

|

|

Full Year 2019 |

|

|||||

|

|

Low-end of range |

|

|

High-end of range |

|

||

|

Net income |

$ |

619 |

|

|

$ |

683 |

|

|

Interest expense |

|

177 |

|

|

|

177 |

|

|

Depreciation and amortization |

|

697 |

|

|

|

697 |

|

|

Income taxes |

|

28 |

|

|

|

29 |

|

|

EBITDA |

|

1,521 |

|

|

|

1,586 |

|

|

Gain on dispositions |

|

(2 |

) |

|

|

(2 |

) |

|

Equity investment adjustments: |

|

|

|

|

|

|

|

|

Equity in earnings of affiliates |

|

(10 |

) |

|

|

(10 |

) |

|

Pro rata EBITDAre of equity investments |

|

26 |

|

|

|

26 |

|

|

EBITDAre |

|

1,535 |

|

|

|

1,600 |

|

|

Adjusted EBITDAre |

$ |

1,535 |

|

|

$ |

1,600 |

|

|

|

|

|

|

|

|

|

|

|

|

Full Year 2019 |

|

|||||

|

|

Low-end of range |

|

|

High-end of range |

|

||

|

Net income |

$ |

619 |

|

|

$ |

683 |

|

|

Less: Net income attributable to non-controlling interests |

|

(9 |

) |

|

|

(10 |

) |

|

Net income attributable to Host Inc. |

|

610 |

|

|

|

673 |

|

|

Adjustments: |

|

|

|

|

|

|

|

|

Gain on dispositions |

|

(2 |

) |

|

|

(2 |

) |

|

Depreciation and amortization |

|

693 |

|

|

|

693 |

|

|

Equity investment adjustments: |

|

|

|

|

|

|

|

|

Equity in earnings of affiliates |

|

(10 |

) |

|

|

(10 |

) |

|

Pro rata FFO of equity investments |

|

20 |

|

|

|

20 |

|

|

Consolidated partnership adjustments: |

|

|

|

|

|

|

|

|

FFO adjustment for non-controlling interests of Host LP |

|

(7 |

) |

|

|

(7 |

) |

|

NAREIT FFO |

|

1,304 |

|

|

|

1,367 |

|

|

Adjusted FFO |

$ |

1,304 |

|

|

$ |

1,367 |

|

|

|

|

|

|

|

|

|

|

|

Weighted average diluted shares - EPS, NAREIT and Adjusted FFO |

|

741.8 |

|

|

|

741.8 |

|

|

Diluted earnings per common share |

$ |

0.82 |

|

|

$ |

0.91 |

|

|

NAREIT FFO per diluted share |

$ |

1.76 |

|

|

$ |

1.84 |

|

|

Adjusted FFO per diluted share |

$ |

1.76 |

|

|

$ |

1.84 |

|

|

___________ |

|

|

|

|

|

|

|

|

(1) |

The forecasts are based on the below assumptions: |

|

|

• |

Total comparable hotel RevPAR in constant US$ will increase 0.0% to 2.0% for the low and high end of the forecast range, which excludes the effect of changes in foreign currency. However, the effect of estimated changes in foreign currency has been reflected in the forecast of net income, EBITDA, earnings per diluted share and Adjusted FFO per diluted share. |

|

|

• |

Comparable hotel EBITDA margins will decrease 25 basis points or increase 35 basis points for the low and high ends of the forecasted RevPAR range, respectively. |

|

|

• |

We expect to spend approximately $315 million to $350 million on ROI capital expenditures and approximately $235 million to $275 million on renewal and replacement capital expenditures. |

|

|

• |

The above forecast assumes the sale of two additional properties. The transactions are subject to customary and other closing conditions which may not be satisfied and there can be no assurances that we will be able to complete the transactions at the prices assumed in the forecast. |

For a discussion of additional items that may affect forecasted results, see the Notes to Financial Information.

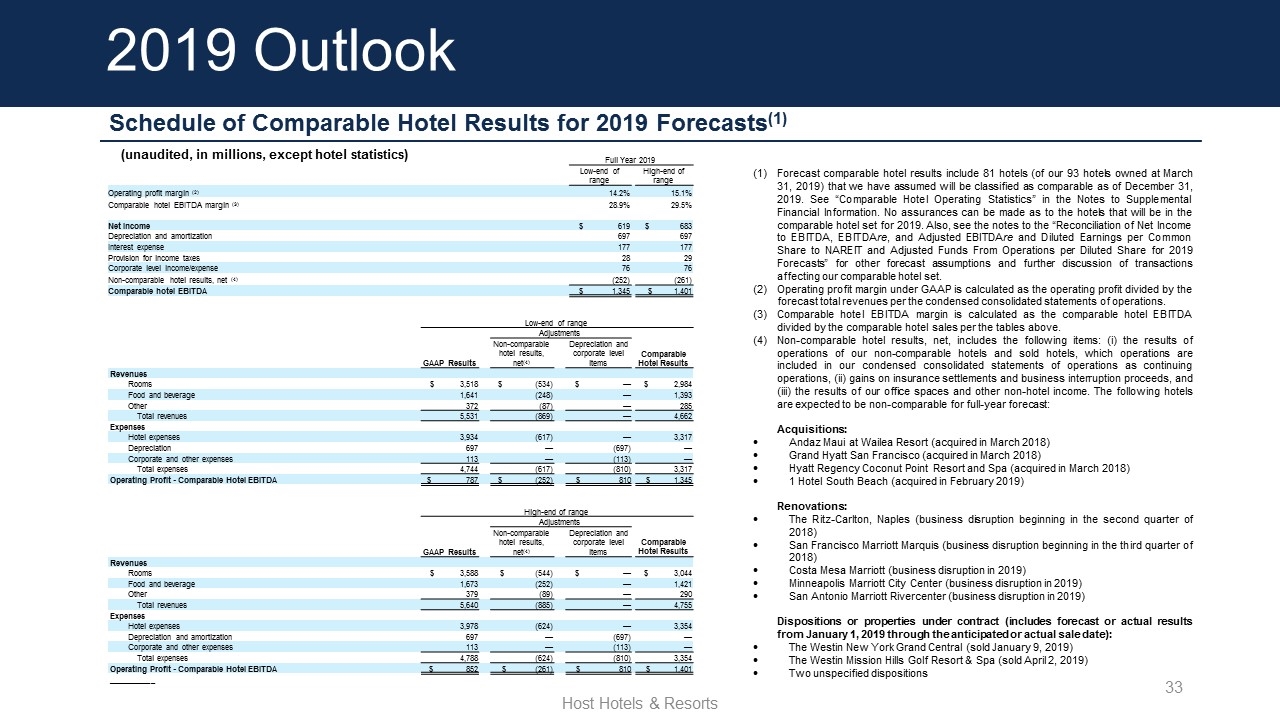

HOST HOTELS & RESORTS, INC.

Schedule of Comparable Hotel Results

for 2019 Forecasts (1)

(unaudited, in millions, except hotel statistics)

|

|

|

|

|

|

|

|

|

|

|

Full Year 2019 |

|

|||||

|

|

|

|

|

|

|

|

|

|

|

Low-end of range |

|

|

High-end of range |

|

||

|

Operating profit margin (2) |

|

|

|

14.2 |

% |

|

|

15.1 |

% |

|||||||

|

Comparable hotel EBITDA margin (3) |

|

|

|

28.9 |

% |

|

|

29.5 |

% |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

Net income |

|

|

$ |

619 |

|

|

$ |

683 |

|

|||||||

|

Depreciation and amortization |

|

|

|

697 |

|

|

|

697 |

|

|||||||

|

Interest expense |

|

|

|

177 |

|

|

|

177 |

|

|||||||

|

Provision for income taxes |

|

|

|

28 |

|

|

|

29 |

|

|||||||

|

Corporate level income/expense |

|

|

|

76 |

|

|

|

76 |

|

|||||||

|

Non-comparable hotel results, net (4) |

|

|

|

(252 |

) |

|

|

(261 |

) |

|||||||

|

Comparable hotel EBITDA |

|

|

$ |

1,345 |

|

|

$ |

1,401 |

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Low-end of range |

|

|||||||||||||

|

|

|

|

|

|

|

Adjustments |

|

|

|

|

|

|||||

|

|

|

GAAP Results |

|

|

Non-comparable hotel results, net (4) |

|

|

Depreciation and corporate level items |

|

|

Comparable Hotel Results |

|

||||

|

Revenues |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Rooms |

|

$ |

3,518 |

|

|

$ |

(534 |

) |

|

$ |

— |

|

|

$ |

2,984 |

|

|

Food and beverage |

|

|

1,641 |

|

|

|

(248 |

) |

|

|

— |

|

|

|

1,393 |

|

|

Other |

|

|

372 |

|

|

|

(87 |

) |

|

|

— |

|

|

|

285 |

|

|

Total revenues |

|

|

5,531 |

|

|

|

(869 |

) |

|

|

— |

|

|

|

4,662 |

|

|

Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Hotel expenses |

|

|

3,934 |

|

|

|

(617 |

) |

|

|

— |

|

|

|

3,317 |

|

|

Depreciation |

|

|

697 |

|

|

|

— |

|

|

|

(697 |

) |

|

|

— |

|

|

Corporate and other expenses |

|

|

113 |

|

|

|

— |

|

|

|

(113 |

) |

|

|

— |

|

|

Total expenses |

|

|

4,744 |

|

|

|

(617 |

) |

|

|

(810 |

) |

|

|

3,317 |

|

|

Operating Profit - Comparable Hotel EBITDA |

|

$ |

787 |

|

|

$ |

(252 |

) |

|

$ |

810 |

|

|

$ |

1,345 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

High-end of range |

|

|||||||||||||

|

|

|

|

|

|

|

Adjustments |

|

|

|

|

|

|||||

|

|

|

GAAP Results |

|

|

Non-comparable hotel results, net (4) |

|

|

Depreciation and corporate level items |

|

|

Comparable Hotel Results |

|

||||

|

Revenues |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Rooms |

|

$ |

3,588 |

|

|

$ |

(544 |

) |

|

$ |

— |

|

|

$ |

3,044 |

|

|

Food and beverage |

|

|

1,673 |

|

|

|

(252 |

) |

|

|

— |

|

|

|

1,421 |

|

|

Other |

|

|

379 |

|

|

|

(89 |

) |

|

|

— |

|

|

|

290 |

|

|

Total revenues |

|

|

5,640 |

|

|

|

(885 |

) |

|

|

— |

|

|

|

4,755 |

|

|

Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Hotel expenses |

|

|

3,978 |

|

|

|

(624 |

) |

|

|

— |

|

|

|

3,354 |

|

|

Depreciation and amortization |

|

|

697 |

|

|

|

— |

|

|

|

(697 |

) |

|

|

— |

|

|

Corporate and other expenses |

|

|

113 |

|

|

|

— |

|

|

|

(113 |

) |

|

|

— |

|

|

Total expenses |

|

|

4,788 |

|

|

|

(624 |

) |

|

|

(810 |

) |

|

|

3,354 |

|

|

Operating Profit - Comparable Hotel EBITDA |

|

$ |

852 |

|

|

$ |

(261 |

) |

|

$ |

810 |

|

|

$ |

1,401 |

|

|

___________ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Schedule of Comparable Hotel Results

for 2019 Forecasts (1) (cont.)

(unaudited, in millions, except hotel statistics)

|

(2) |

Operating profit margin under GAAP is calculated as the operating profit divided by the forecast total revenues per the condensed consolidated statements of operations. |

|

(3) |

Comparable hotel EBITDA margin is calculated as the comparable hotel EBITDA divided by the comparable hotel sales per the tables above. |

|

(4) |

Non-comparable hotel results, net, includes the following items: (i) the results of operations of our non-comparable hotels and sold hotels, which operations are included in our condensed consolidated statements of operations as continuing operations, (ii) gains on insurance settlements and business interruption proceeds, and (iii) the results of our office spaces and other non-hotel income. The following hotels are expected to be non-comparable for full-year forecast: |

|

Acquisitions: |

|

|

• |

Andaz Maui at Wailea Resort (acquired in March 2018) |

|

|

• |

Grand Hyatt San Francisco (acquired in March 2018) |

|

|

• |

Hyatt Regency Coconut Point Resort and Spa (acquired in March 2018) |

|

|

• |

1 Hotel South Beach (acquired in February 2019) |

|

Renovations: |

|

|

• |

The Ritz-Carlton, Naples (business disruption beginning in the second quarter of 2018) |

|

|

• |

San Francisco Marriott Marquis (business disruption beginning in the third quarter of 2018) |

|

|

• |

Costa Mesa Marriott (business disruption in 2019) |

|

|

• |

Minneapolis Marriott City Center (business disruption in 2019) |

|

|

• |

San Antonio Marriott Rivercenter (business disruption in 2019) |

|

Dispositions or properties under contract (includes forecast or actual results from January 1, 2019 through the anticipated or actual sale date): |

|

|

• |

The Westin New York Grand Central (sold January 9, 2019) |

|

|

• |

The Westin Mission Hills Golf Resort & Spa (sold April 2, 2019) |

|

|

• |

Two unspecified dispositions |

HOST HOTELS & RESORTS, INC.

Notes to Financial Information