0001070732falsePlus accumulated and unpaid dividends. Calculated by subtracting the Trust’s total liabilities (not including the notes payable and preferred shares) from the Trust’s total assets, dividing the result by the sum of the value of the notes payable and liquidation value of the preferred shares, and multiplying the result by the liquidation value of one preferred share. Calculated by subtracting the Trust’s total liabilities (not including the notes payable and preferred shares) from the Trust’s total assets, and dividing the result by the notes payable balance in thousands. Stated as a percentage of average net assets attributable to common shares for the year ended June 30, 2024. As of June 30, 2024, the outstanding borrowings represented approximately 7.66% leverage and the preferred shares represented approximately 23.99% leverage, totaling 31.65% leverage. Interest and fee expense relates to the notes payable. The investment adviser fee paid by the Trust to EVM is based on the average weekly gross assets of the Trust, including all assets attributable to any form of investment leverage that the Trust may utilize. Accordingly, if the Trust were to increase investment leverage in the future, the investment adviser fee will increase as a percentage of net assets. Pursuant to the investment advisory agreement, the investment adviser fee was computed at an annual rate of 0.71% of the Trust’s average weekly gross assets through April 30, 2024 and beginning May 1, 2024, at 0.70% of the Trust’s average weekly gross assets, and is payable monthly. The annual investment adviser fee rate shall be reduced to the following as of the stated date: May 1, 2025: 0.69% and May 1, 2026: 0.55%. You will be charged a $5.00 service charge and pay brokerage charges if you direct the plan agent to sell your common shares held in a dividend reinvestment account. If common shares are sold to or through underwriters, the Prospectus Supplement will set forth any applicable sales load.Eaton Vance Management (“EVM”) will pay the expenses of the offering (other than the applicable commissions); therefore, offering expenses are not included in the Summary of Fund Expenses. Offering expenses generally include, but are not limited to, the preparation, review and filing with the SEC of the Trust’s registration statement (including its current Prospectus Supplement, the accompanying Prospectus and Statement of Additional Information (“SAI”)), the preparation, review and filing of any associated marketing or similar materials, costs associated with the printing, mailing or other distribution of its current Prospectus Supplement, the accompanying Prospectus, SAI and/or marketing materials, associated filing fees, stock exchange listing fees, and legal and auditing fees associated with the offering. 0001070732 2023-07-01 2024-06-30 0001070732 cik0001070732:CommonSharesMember 2023-07-01 2024-06-30 0001070732 cik0001070732:SeriesAOneMember 2023-07-01 2024-06-30 0001070732 cik0001070732:SeriesBOneMember 2023-07-01 2024-06-30 0001070732 cik0001070732:MarketRiskMember 2023-07-01 2024-06-30 0001070732 cik0001070732:IncomeRiskMember 2023-07-01 2024-06-30 0001070732 cik0001070732:RegulatoryRiskMember 2023-07-01 2024-06-30 0001070732 cik0001070732:GeopoliticalRiskMember 2023-07-01 2024-06-30 0001070732 cik0001070732:CybersecurityRiskMember 2023-07-01 2024-06-30 0001070732 cik0001070732:RecentMarketConditionsMember 2023-07-01 2024-06-30 0001070732 cik0001070732:RisksAssociatedWithActiveManagementMember 2023-07-01 2024-06-30 0001070732 cik0001070732:InflationRiskMember 2023-07-01 2024-06-30 0001070732 cik0001070732:DerivativesRiskMember 2023-07-01 2024-06-30 0001070732 cik0001070732:CurrencyRiskMember 2023-07-01 2024-06-30 0001070732 cik0001070732:EmergingMarketsInvestmentRiskMember 2023-07-01 2024-06-30 0001070732 cik0001070732:ForeignInvestmentRiskMember 2023-07-01 2024-06-30 0001070732 cik0001070732:LeverageRiskMember 2023-07-01 2024-06-30 0001070732 cik0001070732:CreditRisksMember 2023-07-01 2024-06-30 0001070732 cik0001070732:MarketDisruptionMember 2023-07-01 2024-06-30 0001070732 cik0001070732:GeneralFundInvestingRisksMember 2023-07-01 2024-06-30 0001070732 cik0001070732:AntiTakeoverProvisionsMember 2023-07-01 2024-06-30 0001070732 cik0001070732:PooledInvestmentVehiclesRiskMember 2023-07-01 2024-06-30 0001070732 cik0001070732:USGovernmentSecuritiesRiskMember 2023-07-01 2024-06-30 0001070732 cik0001070732:IssuerRiskMember 2023-07-01 2024-06-30 0001070732 cik0001070732:PrepaymentRisksMember 2023-07-01 2024-06-30 0001070732 cik0001070732:NonInvestmentGradeBondsRiskMember 2023-07-01 2024-06-30 0001070732 us-gaap:InterestRateRiskMember 2023-07-01 2024-06-30 0001070732 cik0001070732:LowerRatedInvestmentsRiskMember 2023-07-01 2024-06-30 0001070732 cik0001070732:AdditionalRisksOfLoansMember 2023-07-01 2024-06-30 0001070732 cik0001070732:ReinvestmentRiskMember 2023-07-01 2024-06-30 0001070732 cik0001070732:MoneyMarketInstrumentRiskMember 2023-07-01 2024-06-30 0001070732 cik0001070732:MarketDiscountRiskMember 2023-07-01 2024-06-30 0001070732 cik0001070732:LiquidityRiskMember 2023-07-01 2024-06-30 0001070732 cik0001070732:EquitySecuritiesRiskMember 2023-07-01 2024-06-30 0001070732 cik0001070732:SeniorLoansRiskMember 2023-07-01 2024-06-30 0001070732 cik0001070732:PreferredSharesMember 2023-07-01 2024-06-30 0001070732 cik0001070732:OfferingExpensesMember 2023-07-01 2024-06-30 0001070732 cik0001070732:PreferredSharesMember 2022-07-01 2023-06-30 0001070732 cik0001070732:PreferredSharesMember 2021-07-01 2022-06-30 0001070732 cik0001070732:PreferredSharesMember 2014-07-01 2015-06-30 0001070732 cik0001070732:PreferredSharesMember 2015-07-01 2016-06-30 0001070732 cik0001070732:PreferredSharesMember 2016-07-01 2017-06-30 0001070732 cik0001070732:PreferredSharesMember 2017-07-01 2018-06-30 0001070732 cik0001070732:PreferredSharesMember 2018-07-01 2019-06-30 0001070732 cik0001070732:PreferredSharesMember 2019-07-01 2020-06-30 0001070732 cik0001070732:PreferredSharesMember 2020-07-01 2021-06-30 0001070732 cik0001070732:CommonSharesMember 2024-04-01 2024-06-30 0001070732 cik0001070732:CommonSharesMember 2024-01-01 2024-03-31 0001070732 cik0001070732:CommonSharesMember 2023-10-01 2023-12-31 0001070732 cik0001070732:CommonSharesMember 2023-07-01 2023-09-30 0001070732 cik0001070732:CommonSharesMember 2023-04-01 2023-06-30 0001070732 cik0001070732:CommonSharesMember 2022-10-01 2022-12-31 0001070732 cik0001070732:CommonSharesMember 2022-07-01 2022-09-30 0001070732 cik0001070732:CommonSharesMember 2023-01-01 2023-03-31 0001070732 cik0001070732:NotesPayableMember 2024-06-30 0001070732 cik0001070732:PreferredSharesMember 2024-06-30 0001070732 cik0001070732:NotesPayableMember 2023-06-30 0001070732 cik0001070732:PreferredSharesMember 2023-06-30 0001070732 cik0001070732:NotesPayableMember 2022-06-30 0001070732 cik0001070732:PreferredSharesMember 2022-06-30 0001070732 cik0001070732:NotesPayableMember 2021-06-30 0001070732 cik0001070732:PreferredSharesMember 2021-06-30 0001070732 cik0001070732:NotesPayableMember 2020-06-30 0001070732 cik0001070732:PreferredSharesMember 2020-06-30 0001070732 cik0001070732:NotesPayableMember 2019-06-30 0001070732 cik0001070732:PreferredSharesMember 2019-06-30 0001070732 cik0001070732:NotesPayableMember 2018-06-30 0001070732 cik0001070732:PreferredSharesMember 2018-06-30 0001070732 cik0001070732:NotesPayableMember 2017-06-30 0001070732 cik0001070732:PreferredSharesMember 2017-06-30 0001070732 cik0001070732:NotesPayableMember 2016-06-30 0001070732 cik0001070732:PreferredSharesMember 2016-06-30 0001070732 cik0001070732:NotesPayableMember 2015-06-30 0001070732 cik0001070732:PreferredSharesMember 2015-06-30 xbrli:pure iso4217:USD xbrli:shares iso4217:USD xbrli:shares

SECURITIES AND EXCHANGE COMMISSION

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number:

811-09013

Eaton Vance Senior Income Trust

(Exact Name of Registrant as Specified in Charter)

One Post Office Square, Boston, Massachusetts 02109

(Address of Principal Executive Offices)

One Post Office Square, Boston, Massachusetts 02109

(Name and Address of Agent for Services)

(Registrant’s Telephone Number)

Item 1. Reports to Stockholders

Eaton Vance

Senior Income Trust (EVF)

Annual Report

June 30, 2024

Commodity Futures Trading Commission Registration.

The Commodity Futures Trading Commission (“CFTC”) has adopted regulations that subject registered investment companies and advisers to regulation by the CFTC if a fund invests more than a prescribed level of its assets in certain CFTC-regulated instruments (including futures, certain options and swap agreements) or markets itself as providing investment exposure to such instruments. The investment adviser has claimed an exclusion from the definition of “commodity pool operator” under the Commodity Exchange Act with respect to its management of the Fund. Accordingly, neither the Fund nor the adviser with respect to the operation of the Fund is subject to CFTC regulation. Because of its management of other strategies, the Fund's adviser is registered with the CFTC as a commodity pool operator. The adviser is also registered as a commodity trading advisor.

Fund shares are not insured by the FDIC and are not deposits or other obligations of, or guaranteed by, any depository institution. Shares are subject to investment risks, including possible loss of principal invested.

Annual Report

June 30, 2024

Eaton Vance

Senior Income Trust

|

|

| |

2 |

| |

3 |

| |

4 |

| |

5 |

| |

10 |

| |

11 |

| |

12 |

| |

13 |

| |

14 |

| |

43 |

| |

44 |

| |

45 |

| |

47 |

| |

51 |

| |

53 |

| |

56 |

| |

62 |

Eaton Vance

Senior Income Trust

June 30, 2024

Management’s Discussion of Fund Performance

†

Economic and Market Conditions

Amid global concerns over inflation, high interest rates, and wars in Ukraine and the Middle East, senior loans displayed their value as a portfolio diversifier, outperforming most U.S. fixed-income asset classes during the 12-month period ended June 30, 2024.

With senior loans among the few asset classes to benefit from rising interest rates, the Morningstar® LSTA® US Leveraged Loan Index

SM

(the Index), a broad measure of the asset class, returned 11.11% during the period. Senior loans generally outperformed investment-grade corporate bonds, corporate high yield bonds, municipal bonds, and U.S. government bonds during the period.

From the beginning of the period -- July 2023 through September 2023 -- senior loans rallied as fears of a U.S. recession receded. In October, the Index return was virtually flat amid volatility that briefly rattled capital markets worldwide. But the senior loan market showed resilience, capping its second-best calendar year on record with strong performances in November and December 2023, driven by expectations that the U.S. Federal Reserve (the Fed) had ended its interest rate hiking cycle and the American economy was heading for a soft landing.

The senior loan rally continued into 2024. By June 30, the asset class had delivered eight straight months of positive returns, and a 2024 year-to-date performance of 4.40%. Reflecting investors’ increased appetite for risk in a thriving U.S. economy, lower-rated loans generally outperformed higher-rated loans during the period.

Asset class technical factors contributed to senior loan performance. Investor demand outstripped net supply, which helped support floating-rate prices in secondary markets. Meanwhile, new capital formation in structured products reflected strong institutional demand for senior loans. Retail loan funds also experienced increasingly strong demand as the period progressed, particularly in the final three months of the period. Most notably, in May 2024 retail funds posted their largest inflows since the Fed began hiking interest rates in March 2022.

Issuer fundamentals also strengthened during the period. The trailing 12-month default rate fell from 1.71% at the start of the period to 0.90% at period-end -- well below the senior loan market’s 2.70% long-term default average. Loan prices improved from $94.24 at the start of the period to $96.59 at period-end.

For the period as a whole, BBB, BB, B, CCC, and D-rated (defaulted) loans within the Index returned 8.23%, 9.01%, 12.01%, 15.38%, and -20.71%, respectively.

Fund Performance

For the 12-month period ended June 30, 2024, Eaton Vance Senior Income Trust (the Fund) returned 13.22% at net asset value of its common shares (NAV), outperforming its benchmark, the Morningstar® LSTA® US Leveraged Loan Index

SM

(the Index), which returned 11.11%.

The Fund’s use of investment leverage during the period contributed to performance versus the Index, which does not employ leverage. The use of leverage has the effect of achieving additional exposure to the loan market, magnifying exposure to the Fund’s underlying investments in both up-and-down market environments. During this period of strong performance by the senior loan market, leverage amplified the price appreciation and interest income of loans in the Fund’s underlying portfolio, helping Fund performance versus the Index.

Additional contributors to Fund performance relative to the Index included an out-of-Index allocation to debt securities of collateralized loan obligations, which generally outperformed the Index during the period, as well as loan selections within the pharmaceuticals and the health care equipment & supplies industries.

In contrast, detractors from performance versus the Index during the period included loan selections in the health care providers & services industry, and the household durables industry. On an individual loan basis, the largest detractors from Index-relative performance were overweight positions in a struggling mattress maker and a primary care health care company that filed for bankruptcy in early 2024.

See Endnotes and Additional Disclosures in this report.

Past performance is no guarantee of future results. Returns are historical and are calculated net of management fees and other expenses by determining the percentage change in net asset value (NAV) or market price (as applicable) with all distributions reinvested in accordance with the Fund’s Dividend Reinvestment Plan. Furthermore, returns do not reflect the deduction of taxes that shareholders may have to pay on Fund distributions or upon the sale of Fund shares. Performance at market price will differ from performance at NAV due to variations in the Fund’s market price versus NAV, which may reflect factors such as fluctuations in supply and demand for Fund shares, changes in Fund distributions, shifting market expectations for the Fund’s future returns and distribution rates, and other considerations affecting the trading prices of closed-end funds. Investment return and principal value will fluctuate so that shares, when sold, may be worth more or less than their original cost. Performance for periods less than or equal to one year is cumulative. Performance is for the stated time period only; due to market volatility, current Fund performance may be lower or higher than the quoted return. For performance as of the most recent month-end, please refer to eatonvance.com.

Eaton Vance

Senior Income Trust

June 30, 2024

Performance

Portfolio Manager(s)

Andrew N. Sveen, CFA, Catherine C. McDermott, Daniel P. McElaney, CFA and Sarah A. Choi

% Average Annual Total Returns 1,2 |

Inception Date |

One Year |

Five Years |

Ten Years |

| Fund at NAV |

10/30/1998 |

13.22% |

5.73% |

5.60% |

| Fund at Market Price |

— |

30.40 |

9.00 |

6.70 |

|

| Morningstar® LSTA® US Leveraged Loan Index SM |

— |

11.11% |

5.52% |

4.59% |

% Premium/Discount to NAV 3 |

|

| As of period end |

2.92% |

|

|

| Total Distributions per share for the period |

$0.70 |

| Distribution Rate at NAV |

11.88% |

| Distribution Rate at Market Price |

11.55 |

|

|

| Auction Preferred Shares (APS) |

23.99% |

| Borrowings |

7.66 |

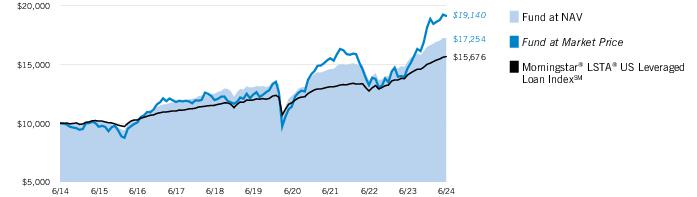

Growth of $10,000

This graph shows the change in value of a hypothetical investment of $10,000 in the Fund for the period indicated. For comparison, the same investment is shown in the indicated index.

See Endnotes and Additional Disclosures in this report.

Past performance is no guarantee of future results. Returns are historical and are calculated net of management fees and other expenses by determining the percentage change in net asset value (NAV) or market price (as applicable) with all distributions reinvested in accordance with the Fund’s Dividend Reinvestment Plan. Furthermore, returns do not reflect the deduction of taxes that shareholders may have to pay on Fund distributions or upon the sale of Fund shares. Performance at market price will differ from performance at NAV due to variations in the Fund’s market price versus NAV, which may reflect factors such as fluctuations in supply and demand for Fund shares, changes in Fund distributions, shifting market expectations for the Fund’s future returns and distribution rates, and other considerations affecting the trading prices of closed-end funds. Investment return and principal value will fluctuate so that shares, when sold, may be worth more or less than their original cost. Performance for periods less than or equal to one year is cumulative. Performance is for the stated time period only; due to market volatility, current Fund performance may be lower or higher than the quoted return. For performance as of the most recent month-end, please refer to eatonvance.com.

Eaton Vance

Senior Income Trust

June 30, 2024

| Top 10 Issuers (% of total investments) 1 |

|

| Cloud Software Group, Inc. |

0.9% |

| UKG, Inc. |

0.8 |

| Mallinckrodt International Finance SA |

0.8 |

| Sophia LP |

0.8 |

| Great Outdoors Group LLC |

0.8 |

| INEOS U.S. Finance LLC |

0.8 |

| INEOS Quattro Holdings U.K. Ltd. |

0.8 |

| Clarios Global LP |

0.7 |

| Drake Software LLC |

0.7 |

| Banff Merger Sub, Inc. |

0.7 |

Total |

7.8% |

| Top 10 Industries (% of total investments) 1 |

| Software |

12.6% |

| Health Care Providers & Services |

6.8 |

| Chemicals |

6.1 |

| Machinery |

5.0 |

| Hotels, Restaurants & Leisure |

4.6 |

| Capital Markets |

3.7 |

| Commercial Services & Supplies |

3.6 |

| Specialty Retail |

3.4 |

| Professional Services |

3.0 |

| IT Services |

2.9 |

Total |

51.7% |

| Credit Quality (% of bonds, loans and asset-backed securities) 2 |

Footnotes:

1 |

Excludes cash and cash equivalents. |

2 |

Credit ratings are categorized using S&P Global Ratings (“S&P”). Ratings, which are subject to change, apply to the creditworthiness of the issuers of the underlying securities and not to the Fund or its shares. Credit ratings measure the quality of a bond based on the issuer’s creditworthiness, with ratings ranging from AAA, being the highest, to D, being the lowest based on S&P’s measures. Ratings of BBB or higher by S&P are considered to be investment-grade quality. Credit ratings are based largely on the ratings agency’s analysis at the time of rating. The rating assigned to any particular security is not necessarily a reflection of the issuer’s current financial condition and does not necessarily reflect its assessment of the volatility of a security’s market value or of the liquidity of an investment in the security. Holdings designated as “Not Rated” (if any) are not rated by S&P. |

Eaton Vance

Senior Income Trust

June 30, 2024

The Fund's Investment Objectives, Principal Strategies and Principal Risks

‡

Investment Objectives.

The Fund’s investment objective is to provide a high level of current income, consistent with the preservation of capital.

Principal Strategies.

The Fund pursues its objective by investing primarily in senior, secured floating-rate loans (“Senior Loans”). Senior Loans typically are secured with specific collateral and have a claim on the assets and/or stock that is senior to subordinated debtholders and stockholders of the borrower. Senior Loans are made to corporations, partnerships and other business entities (“Borrowers”) that operate in various industries and geographical regions. The Senior Loans are loans in which the interest rate paid fluctuates based on a reference rate. The interest rates for the Senior Loans are reset periodically on the basis of a floating base lending rate plus a premium. Senior Loans typically are of below investment grade quality and have below investment grade credit ratings, which ratings are associated with securities having high risk, speculative characteristics.

Under normal market conditions, at least 80% of the Fund’s total assets will be invested in interests in Senior Loans of domestic and foreign borrowers that are denominated in U.S. dollars or in euros, British pounds, Swiss francs, Canadian dollars and Australian dollars (each an “Authorized Foreign Currency”) making payments in such Authorized Foreign Currency. The remaining investment assets of the Fund may include, among other types of investments, equity securities that are acquired in connection with an investment in a Senior Loan. For the purpose of the 80% test, total assets is defined as net assets plus any borrowings for investment purposes, including any outstanding preferred shares. The Fund may invest up to 15% of its net assets in foreign Senior Loans denominated in an Authorized Foreign Currency.

The Fund may invest up to 20% of its total assets in (i) loan interests which have (a) a second lien on collateral (“Second Lien”), (b) no security interest in the collateral, or (c) lower than a senior claim on collateral; (ii) other income-producing securities, such as investment and non-investment grade corporate debt securities and U.S. government and U.S. dollar-denominated foreign government or supranational debt securities; and (iii) warrants and equity securities issued by a Borrower or its affiliates as part of a package of investments in the Borrower or its affiliates. In respect of (ii) above, the Fund may invest in corporate bonds of below investment grade quality (“Non-Investment Grade Bonds”), commonly referred to as “junk bonds,” which are bonds that are rated below investment grade by each of the nationally recognized statistical rating agencies who cover the security, or, if unrated, are determined to be of comparable quality by the Adviser. S&P Global Ratings and Fitch Ratings consider securities rated below BBB- to be below investment grade and Moody’s Investors Service, Inc. considers securities rated below Baa3 to be below investment grade. The Fund’s credit quality policies apply only at the time a security is purchased, and the Fund is not required to dispose of a security in the event of a downgrade of an assessment of credit quality or the withdrawal of a rating. Securities rated in the lowest investment grade rating (BBB- or Baa3) may have certain speculative characteristics. Below investment grade quality securities are considered to be predominantly speculative because of the credit risk of the issuers.

The Fund may invest in individual Senior Loans and other securities of any credit quality.

The Fund may invest up to 15% of net assets in foreign Senior Loans denominated in Authorized Foreign Currencies and may invest in other securities of non-United States issuers. The Fund’s investments may have significant exposure to certain sectors of the economy and thus may react differently to political or economic developments than the market as a whole. The Fund will not invest more than 10% of its assets in securities (including interests in Senior Loans) of any single Borrower.

The Fund may purchase or sell derivative instruments (which derive their value from another instrument, security or index) for risk management purposes, such as hedging against fluctuations in Senior Loans and other securities prices or interest rates. Transactions in derivative instruments may include the purchase or sale of futures contracts on securities, indices and other financial instruments, credit-linked notes, tranches of collateralized loan obligations and/or collateralized debt obligations, options on futures contracts, exchange-traded and over-the-counter options on securities or indices, forward foreign currency exchange contracts, and interest rate, total return and credit default swaps.

The Fund employs leverage to seek opportunities for additional income. Leverage may amplify the effect on the Fund’s net asset value (“NAV”) of any increase or decrease in the value of investments held. There can be no assurance that the use of borrowings will be successful. The Fund has issued preferred shares and borrowed to establish leverage. Investments in derivative instruments may result in economic leverage for the Fund.

Principal Risks

Income Risk.

The income investors receive from the Fund is based primarily on the interest it earns from its investments, which can vary widely over the short and long-term. If prevailing market interest rates drop, investors’ income from the Fund could drop as well. The Fund’s income could also be affected adversely when prevailing short-term interest rates increase and the Fund is utilizing leverage, although this risk is mitigated by the Fund’s investment in Senior Loans, which pay floating-rates of interest.

Market Risk.

The value of investments held by the Fund may increase or decrease in response to social, economic, political, financial, public health crises or other disruptive events (whether real, expected or perceived) in the U.S. and global markets and include events such as war, natural disasters, epidemics and pandemics, terrorism, conflicts and social unrest. These events may negatively impact broad segments of businesses and populations and may exacerbate pre-existing risks to the Fund. The frequency and magnitude of resulting changes in the value of the Fund’s investments cannot be predicted. Certain securities and other investments held by the Fund may experience increased volatility, illiquidity, or other potentially adverse effects in reaction to changing market conditions. Monetary and/or fiscal actions taken by U.S. or foreign governments to stimulate or stabilize the global economy may not be effective and could lead to higher market volatility. No active trading market may exist for certain investments held by the Fund, which may impair the ability of the Fund to sell or to realize the current valuation of such investments in the event of the need to liquidate such assets.

See Endnotes and Additional Disclosures in this report.

5

Eaton Vance

Senior Income Trust

June 30, 2024

The Fund's Investment Objectives, Principal Strategies and Principal Risks

‡

— continued

Senior Loans Risk.

The risks associated with Senior Loans are similar to the risks of Non-Investment Grade Bonds (discussed below), although Senior Loans are typically senior and secured in contrast to Non-Investment Grade Bonds, which are often subordinated and unsecured. Senior Loans’ higher standing has historically resulted in generally higher recoveries in the event of a corporate reorganization or other restructuring. In addition, because their interest rates are adjusted for changes in short-term interest rates, Senior Loans generally have less interest rate risk than Non-Investment Grade Bonds, which are typically fixed rate. The Fund’s investments in Senior Loans are typically below investment grade and are considered speculative because of the credit risk of their issuers. Such companies are more likely to default on their payments of interest and principal owed to the Fund, and such defaults could reduce the Fund’s NAV and income distributions. An economic downturn generally leads to a higher non-payment rate, and a debt obligation may lose significant value before a default occurs. Moreover, any specific collateral used to secure a loan may decline in value or lose all its value or become illiquid, which would adversely affect the loan’s value. “Junior Loans” are secured and unsecured subordinated loans, second lien loans and subordinate bridge loans. Senior Loans and Junior Loans are referred to together herein as “loans.”

Loans and other debt securities are also subject to the risk of price declines and to increases in prevailing interest rates, although floating-rate debt instruments are less exposed to this risk than fixed-rate debt instruments. Interest rate changes may also increase prepayments of debt obligations and require the Fund to invest assets at lower yields.

Loans are traded in a private, unregulated inter-dealer or inter-bank resale market and are generally subject to contractual restrictions that must be satisfied before a loan can be bought or sold. These restrictions may impede the Fund’s ability to buy or sell loans (thus affecting their liquidity) and may negatively impact the transaction price. See also “Market Risk” above. It also may take longer than seven days for transactions in loans to settle. The types of covenants included in loan agreements generally vary depending on market conditions, the creditworthiness of the issuer, the nature of the collateral securing the loan and possibly other factors. Loans with fewer covenants that restrict activities of the borrower may provide the borrower with more flexibility to take actions that may be detrimental to the loan holders and provide fewer investor protections in the event of such actions or if covenants are breached. The Fund may experience relatively greater realized or unrealized losses or delays and expense in enforcing its rights with respect to loans with fewer restrictive covenants. Loans to entities located outside of the U.S. may have substantially different lender protections and covenants as compared to loans to U.S. entities and may involve greater risks. The Fund may have difficulties and incur expense enforcing its rights with respect to non-U.S. loans and such loans could be subject to bankruptcy laws that are materially different than in the U.S. Loans may be structured such that they are not securities under securities law, and in the event of fraud or misrepresentation by a borrower, lenders may not have the protection of the anti-fraud provisions of the federal securities laws. Loans are also subject to risks associated with other types of income investments, including credit risk and risks of lower rated investments.

Credit Risk.

Investments in fixed-income and other debt obligations, including loans, (referred to below as “debt instruments”) are subject to the risk of non-payment of scheduled principal and interest. Changes in economic conditions or other circumstances may reduce the capacity of the party obligated to make principal and interest payments on such instruments and may lead to defaults. Such non-payments and defaults may reduce the value of Fund shares and income distributions. The value of debt instruments also may decline because of concerns about the issuer’s ability to make principal and interest payments. In addition, the credit ratings of debt instruments may be lowered if the financial condition of the party obligated to make payments with respect to such instruments deteriorates. In the event of bankruptcy of the issuer of a debt instrument, the Fund could experience delays or limitations with respect to its ability to realize the benefits of any collateral securing the instrument. In order to enforce its rights in the event of a default, bankruptcy or similar situation, the Fund may be required to retain legal or similar counsel, which may increase the Fund’s operating expenses and adversely affect NAV. Due to their lower place in the borrower’s capital structure, Junior Loans involve a higher degree of overall risk than Senior Loans to the same borrower.

Additional Risks of Loans.

Loans are traded in a private, unregulated inter-dealer or inter-bank resale market and are generally subject to contractual restrictions that must be satisfied before a loan can be bought or sold. These restrictions may impede the Fund’s ability to buy or sell loans (thus affecting their liquidity) and may negatively impact the transaction price. See also “Market Risk” above. It also may take longer than seven days for transactions in loans to settle. The types of covenants included in loan agreements generally vary depending on market conditions, the creditworthiness of the issuer, the nature of the collateral securing the loan and possibly other factors. Loans with fewer covenants that restrict activities of the borrower may provide the borrower with more flexibility to take actions that may be detrimental to the loan holders and provide fewer investor protections in the event of such actions or if covenants are breached. The Fund may experience relatively greater realized or unrealized losses or delays and expense in enforcing its rights with respect to loans with fewer restrictive covenants. Loans to entities located outside of the U.S. may have substantially different lender protections and covenants as compared to loans to U.S. entities and may involve greater risks. The Fund may have difficulties and incur expense enforcing its rights with respect to non-U.S. loans and such loans could be subject to bankruptcy laws that are materially different than in the U.S. Loans may be structured such that they are not securities under securities law, and in the event of fraud or misrepresentation by a borrower, lenders may not have the protection of the anti-fraud provisions of the federal securities laws. Loans are also subject to risks associated with other types of income investments, including credit risk and risks of lower rated investments.

Lower Rated Investments Risk.

Investments rated below investment grade and comparable unrated investments (sometimes referred to as “junk”) are speculative because of increased credit risk relative to other fixed income investments. Changes in economic conditions or other circumstances typically have a greater effect on the ability of issuers of lower rated investments to make principal and interest payments than they do on issuers of higher rated investments. An economic downturn generally leads to a higher non-payment rate, and a lower rated investment may lose significant value before a default occurs. Lower rated investments typically are subject to greater price volatility and illiquidity than higher rated investments.

See Endnotes and Additional Disclosures in this report.

Eaton Vance

Senior Income Trust

June 30, 2024

The Fund's Investment Objectives, Principal Strategies and Principal Risks

‡

— continued

Interest Rate Risk.

In general, the value of income securities will fluctuate based on changes in interest rates. The

value

of these securities is likely to increase when interest rates fall and decline when interest rates rise. Duration measures the time-weighted expected cash flows of a fixed-income security, while maturity refers to the amount of time until a fixed-income

security

matures. Generally, securities with longer durations or maturities are more sensitive to changes in interest rates than securities with shorter durations or maturities, causing them to be more volatile. Conversely, fixed-income securities with shorter durations or maturities will be less volatile but may provide lower returns than fixed-income securities with longer durations or maturities. The impact of interest rate changes is significantly less for floating-rate instruments that have relatively short periodic rate resets (e.g., ninety days or less). In a rising interest rate environment, the duration of income securities that have the ability to be prepaid or called by the issuer may be extended. In a declining interest rate environment, the proceeds from prepaid or maturing instruments may have to be reinvested at a lower interest rate.

Non-Investment Grade Bonds Risk.

The Fund’s investments in Non-Investment Grade Bonds, commonly referred to as “junk bonds,” are predominantly speculative because of the credit risk of their issuers. While offering a greater potential opportunity for capital appreciation and higher yields, Non-Investment Grade Bonds typically entail greater potential price volatility and may be less liquid than higher-rated securities. Issuers of Non-Investment Grade Bonds are more likely to default on their payments of interest and principal owed to the Fund, and such defaults will reduce the Fund’s NAV and income distributions. The prices of these lower rated obligations are more sensitive to negative developments than higher rated securities. Adverse business conditions, such as a decline in the issuer’s revenues or an economic downturn, generally lead to a higher non-payment rate. In addition, a security may lose significant value before a default occurs as the market adjusts to expected higher non-payment rates.

Prepayment Risk.

During periods of declining interest rates or for other purposes, Borrowers may exercise their option to prepay principal earlier than scheduled. For fixed-income securities, such payments often occur during periods of declining interest rates, forcing the Fund to reinvest in lower yielding securities. This is known as call or prepayment risk. Non-Investment Grade Bonds frequently have call features that allow the issuer to redeem the security at dates prior to its stated maturity at a specified price (typically greater than par) only if certain prescribed conditions are met (“call protection”). An issuer may redeem a Non-Investment Grade Bond if, for example, the issuer can refinance the debt at a lower cost due to declining interest rates or an improvement in the credit standing of the issuer. Senior Loans typically have no such call protection. For premium bonds (bonds acquired at prices that exceed their par or principal value) purchased by the Fund, prepayment risk may be enhanced.

Issuer Risk.

The value of corporate income-producing securities held by the Fund may decline for a number of reasons, which directly relate to the issuer, such as management performance, financial leverage and reduced demand for the issuer’s goods and services.

Leverage Risk.

Leverage, including leverage from the issuance of preferred shares and borrowings, creates risks, including the likelihood of greater volatility of NAV and market price of, and distributions from, the common shares and the risk that fluctuations in dividend rates on preferred shares and in the costs of borrowings may affect the return to common shareholders. To the extent the income derived from investments purchased with funds received from leverage exceeds the cost of leverage, the Fund’s distributions will be greater than if leverage had not been used. Conversely, if the income from the investments purchased with such funds is not sufficient to cover the cost of leverage, the amount of income available for distribution to common shareholders will be less than if leverage had not been used. In the latter case, the investment adviser may nevertheless determine to maintain the Fund’s leveraged position if it deems such action to be appropriate. While the Fund has preferred shares or borrowings outstanding, an increase in short-term rates would also result in an increased cost of leverage, which would adversely affect the Fund’s income available for distribution. In connection with its borrowings and preferred shares, the Fund will be required to maintain specified asset coverage by applicable federal securities laws and (as applicable) the terms of the preferred shares and its credit facility. The Fund may be required to dispose of portfolio investments on unfavorable terms if market fluctuations or other factors cause the required asset coverage to be less than the prescribed amount. There can be no assurance that a leveraging strategy will be successful.

Foreign Investment Risk.

Foreign investments can be adversely affected by political, economic and market developments abroad, including the imposition of economic and other sanctions by the United States or another country against a particular country or countries, organizations, entities and/or individuals. There may be less publicly available information about foreign issuers because they may not be subject to reporting practices, requirements or regulations comparable to those to which U.S. companies are subject. Adverse changes in investment regulations, capital requirements or exchange controls could adversely affect the value of the Fund’s investments. Foreign markets may be smaller, less liquid and more volatile than the major markets in the United States, and as a result, Fund share values may be more volatile. Trading in foreign markets typically involves higher expense than trading in the United States. The Fund may have difficulties enforcing its legal or contractual rights in a foreign country.

Emerging Markets Investment Risk

. Investment markets within emerging market countries are typically smaller, less liquid, less developed and more volatile than those in more developed markets like the United States, and may be focused in certain sectors. Emerging market securities often involve greater risks than developed market securities. The information available about an emerging market issuer may be less reliable than for comparable issuers in more developed capital markets.

Currency Risk.

Exchange rates for currencies fluctuate daily. The value of foreign

investments

may be affected favorably or unfavorably by changes in currency exchange rates in relation to the U.S. dollar. Currency markets generally are not as regulated as securities markets and currency transactions are subject to settlement, custodial and other operational risks.

See Endnotes and Additional Disclosures in this report.

Eaton Vance

Senior Income Trust

June 30, 2024

The Fund's Investment Objectives, Principal Strategies and Principal Risks

‡

— continued

Derivatives Risk.

The Fund’s exposure to derivatives involves risks different from, or possibly greater than, the risks associated with investing directly in securities and other investments. The use of derivatives can lead to losses because of adverse movements in the price or value of the security, instrument, index, currency, commodity, economic indicator or event underlying a derivative (“reference instrument”), due to failure of a counterparty or due to tax or regulatory constraints. Derivatives may create leverage in the Fund, which represents a non-cash exposure to the underlying reference instrument. Leverage can increase both the risk and return potential of the Fund. Derivatives risk may be more significant when derivatives are used to enhance return or as a substitute for a cash investment position, rather than solely to hedge the risk of a position held by the Fund. Use of derivatives involves the exercise of specialized skill and judgment, and a transaction may be unsuccessful in whole or in part because of market behavior or unexpected events. Changes in the value of a derivative (including one used for hedging) may not correlate perfectly with the underlying reference instrument. Derivative instruments traded in over-the-counter markets may be difficult to value, may be illiquid, and may be subject to wide swings in valuation caused by changes in the value of the underlying reference instrument. If a derivative’s counterparty is unable to honor its commitments, the value of Fund shares may decline and the Fund could experience delays in (or be unable to achieve) the return of collateral or other assets held by the counterparty. The loss on derivative transactions may substantially exceed the initial investment. A derivative investment also involves the risks relating to the reference instrument underlying the investment.

U.S. Government Securities Risk.

Different types of U.S. government securities are subject to different levels of credit risk, including the risk of default, depending on the nature of the particular government support for that security. Although certain U.S. Government sponsored agencies (such as the Federal Home Loan Mortgage Corporation and the Federal National Mortgage Association) may be chartered or sponsored by acts of Congress, their securities are neither issued nor guaranteed by the U.S. Treasury. With respect to U.S. government securities that are not backed by the full faith and credit of the United States, there is a risk that the U.S. Government will not provide financial support to such U.S. government agencies, instrumentalities or sponsored enterprises if not obligated to do so by law. U.S. Treasury and U.S. Government agency securities generally have a lower return than other obligations because of their higher credit quality and market liquidity.

Pooled Investment Vehicles Risk.

Pooled investment vehicles are open- and closed-end investment companies and exchange-traded funds (“ETFs”). Pooled investment vehicles are subject to the risks of investing in the underlying securities or other investments. Shares of closed-end investment companies and ETFs may trade at a premium or discount to NAV and are subject to secondary market trading risks. In addition, the Fund will bear a pro rata portion of the operating expenses of a pooled investment vehicle in which it invests.

Equity Securities Risk.

The value of equity securities and related instruments may decline in response to adverse changes in the economy or the economic outlook; deterioration in investor sentiment; interest rate, currency, and commodity price fluctuations; adverse geopolitical, social or environmental developments; issuer and sector-specific considerations; unexpected trading activity among retail investors; or other factors. Market conditions may affect certain types of stocks to a greater extent than other types of stocks. If the stock market declines in value, the value of the Fund’s equity securities will also likely decline. Although prices can rebound, there is no assurance that values will return to previous levels.

Liquidity Risk.

The Fund is exposed to liquidity risk when trading volume, lack of a market maker or trading partner, large position size, market conditions, or legal restrictions impair its ability to sell particular investments or to sell them at advantageous market prices. Consequently, the Fund may have to accept a lower price to sell an investment or continue to hold it or keep the position open, sell other investments to raise cash or abandon an investment opportunity, any of which could have a negative effect on the Fund’s performance. These effects may be exacerbated during times of financial or political stress.

Market Discount Risk.

As with any security, the market value of the common shares may increase or decrease from the amount initially paid for the common shares. The Fund’s common shares have traded both at a premium and at a discount relative to NAV. The shares of closed-end management investment companies frequently trade at a discount from their NAV. This is a risk separate and distinct from the risk that the Fund’s NAV may decrease.

Money Market Instrument Risk.

Money market instruments may be adversely affected by market and economic events, such as a sharp rise in prevailing short-term interest rates; adverse developments in the banking industry, which issues or guarantees many money market instruments; adverse economic, political or other developments affecting issuers of money market instruments; changes in the credit quality of issuers; and default by a counterparty.

Reinvestment Risk.

Income from the Fund’s portfolio will decline if and when the Fund invests the proceeds from matured, traded or called debt obligations into lower yielding instruments.

Inflation Risk.

Inflation risk is the risk that the value of assets or income from investments will be worth less in the future as inflation decreases the value of money. As inflation increases, the real value of the common shares and distributions thereon can decline. In addition, during any periods of rising inflation, dividend rates of preferred shares would likely increase, which would tend to further reduce returns to common shareholders. This risk is mitigated to some degree by the Fund’s investments in Senior Loans.

Risks Associated with Active Management.

The success of the Fund’s investment strategy depends on portfolio management’s successful application of analytical skills and investment judgment. Active management involves subjective decisions and there is no guarantee that such decisions will produce the desired results or expected returns.

See Endnotes and Additional Disclosures in this report.

Eaton Vance

Senior Income Trust

June 30, 2024

The Fund's Investment Objectives, Principal Strategies and Principal Risks

‡

— continued

Recent Market Conditions.

The outbreak of COVID-19 and efforts to contain its spread resulted in closing borders, enhanced health screenings, changes to healthcare service preparation and delivery, quarantines, cancellations, disruptions to supply chains and customer activity, as well as general concern and uncertainty. The impact of this coronavirus, and the effects of other infections illness outbreaks, epidemics and pandemics, may be short term or may continue for an extended period of time. Health crises caused by outbreaks of disease may exacerbate other pre-existing political, social and economic risks and disrupt normal market conditions and operations. For example, a global pandemic or other widespread health crisis could cause substantial market volatility and exchange trading suspensions and closures. In addition, the increasing interconnectedness of markets around the world may result in many markets being affected by events or conditions in a single country or region or events affecting a single or small number of issuers. The coronavirus outbreak and public and private sector responses thereto led to large portions of the populations of many countries working from home for indefinite periods of time, temporary or permanent layoffs, disruptions in supply chains, and lack of availability of certain goods. The impact of such responses could adversely affect the information technology and operational systems upon which the Fund and the Fund’s service providers rely, and could otherwise disrupt the ability of the employees of the Fund’s service providers to perform critical tasks relating to the Fund. Any such impact could adversely affect the Fund’s performance, or the performance of the securities in which the Fund invests and may lead to losses on your investment in the Fund.

Cybersecurity Risk.

With the increased use of technologies by Fund service providers to conduct business, such as the Internet, the Fund is susceptible to operational, information security and related risks. The Fund relies on communications technology, systems, and networks to engage with clients, employees, accounts, shareholders, and service providers, and a cyber incident may inhibit the Fund’s ability to use these technologies. In general, cyber incidents can result from deliberate attacks or unintentional events. Cybersecurity failures by or breaches of the Fund’s investment adviser or administrator and other service providers (including, but not limited to, the custodian or transfer agent), and the issuers of securities in which the Fund invests, may disrupt and otherwise adversely affect their business operations. This may result in financial losses of the Fund, impede Fund trading, interfere with the Fund’s ability to calculate its NAV, limit a Fund shareholders’ ability to transact business or cause violations of applicable privacy and other laws, regulatory fines, penalties, reputational damage, reimbursement or other compensation costs, litigation costs, or additional compliance costs.

Geopolitical Risk.

The increasing interconnectivity between global economies and markets increases the likelihood that events or conditions in one country, region, sector, industry or market or, with respect to one company, may adversely impact issuers in a different country, region, industry or market. For example, adverse developments in the banking or financial services could impact companies operating in various sectors or industries and adversely impact the Fund’s investments. Securities in the Fund’s portfolio may underperform due to inflation (or expectations for inflation), interest rates, global demand for particular products or resources, natural disasters, health emergencies (such as epidemics and pandemics), terrorism, regulatory events and governmental or quasi-governmental actions. The occurrence of global events similar to those in recent years, such as terrorist attacks around the world, natural disasters, health emergencies, social and political discord, war or debt crises and downgrades, among others, may result in market volatility and may have long term effects on both the U.S. and global financial markets. Other financial, economic and other global market and social developments or disruptions may result in similar adverse circumstances, and it is difficult to predict when similar events affecting the U.S. or global financial markets may occur, the effects that such events may have and the duration of those effects (which may last for extended periods). Such global events may negatively impact broad segments of businesses and populations, cause a significant negative impact on the performance of the Fund’s investments, adversely affect and increase the volatility of the Fund’s share price and/or exacerbate preexisting political, social and economic risks to the Fund. The Fund’s operations may be interrupted and any such event(s) could have a significant adverse impact on the value and risk profile of the Fund’s portfolio. There is a risk that you may lose money by investing in the Fund.

Regulatory Risk.

To the extent that legislation or state or federal regulators that regulate certain financial institutions impose additional requirements or restrictions with respect to the ability of such institutions to make loans, particularly in connection with highly leveraged transactions, the availability of Senior Loans for investment may be adversely affected. Further, such legislation or regulation could depress the market value of Senior Loans.

Market Disruption.

Global instability, war, geopolitical tensions and terrorist attacks in the United States and around the world have previously resulted, and may in the future result in market volatility and may have long-term effects on the United States and worldwide financial markets and may cause further economic uncertainties in the United States and worldwide. The Fund cannot predict the effects of significant future events on the global economy and securities markets. A similar disruption of the financial markets could impact interest rates, auctions, secondary trading, ratings, credit risk, inflation and other factors relating to the common shares. In particular, Non-Investment Grade Bonds and Senior Loans tend to be more volatile than higher rated fixed-income securities so that these events and any actions resulting from them may have a greater impact on the prices and volatility of Non-Investment Grade Bonds and Senior Loans than on higher rated fixed-income securities.

Anti-Takeover Provisions.

The Fund’s Agreement and Declaration of Trust (the “Declaration of Trust”) and Amended and Restated By-Laws include provisions that could have the effect of limiting the ability of other persons or entities to acquire control of the Fund or to change the composition of its Board. For example, pursuant to the Fund’s Declaration of Trust, the Board is divided into three classes of Trustees with each class serving for a three-year term and certain types of transactions require the favorable vote of holders of at least 75% of the outstanding shares of the Fund.

General Fund Investing Risks.

The Fund is not a complete investment program and there is no guarantee that the Fund will achieve its investment objective. It is possible to lose money by investing in the Fund. An investment in the Fund is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

There have been no material changes to the Fund’s investment objectives or principal investment strategies since June 30, 2023.

See Endnotes and Additional Disclosures in this report.

Eaton Vance

Senior Income Trust

June 30, 2024

The purpose of the table below is to help you understand all fees and expenses that you, as a common shareholder, would bear directly or indirectly. The table reflects the Trust’s issuance of preferred shares and borrowings, and shows Trust expenses as a percentage of net assets attributable to common shares for the year ended June 30, 2024.

Common shareholder transaction expenses |

|

| Sales load paid by you (as a percentage of offering price) |

— 1 |

| Offering expenses (as a percentage of offering price) |

None 2 |

| Dividend reinvestment plan fees |

$5.00 3 |

Annual expenses |

Percentage of net assets

attributable to common shares4 |

| Investment adviser fee |

1.09% 5 |

| Interest and fee expense 6 |

1.21 7 |

| Other expenses |

0.91 |

| Acquired fund fees and expenses |

0.12 |

| Total annual Trust operating expenses |

3.33% |

| Dividends on preferred shares |

2.46 7 |

| Total annual Trust operating expenses and dividends on preferred shares |

5.79% |

Example

The following example illustrates the expenses that common shareholders would pay on a $1,000 investment in common shares, assuming (i) total annual expenses and dividends on preferred shares of 5.79% of net assets attributable to common shares in years 1 through 10; (ii) a 5% annual return; and (iii) all distributions are reinvested at NAV:

1 Year |

3 Years |

5 Years |

10 Years |

| $58 |

$172 |

$284 |

$557 |

The above table and example and the assumption in the example of a 5% annual return are required by regulations of the U.S. Securities and Exchange Commission (“SEC”) that are applicable to all investment companies; the assumed 5% annual return is not a prediction of, and does not represent, the projected or actual performance of the Trust’s common shares. In addition, while the example assumes reinvestment of all dividends and distributions at NAV, participants in the Trust’s dividend reinvestment plan may receive common shares purchased or issued at a price or value different from NAV. The example does not include sales load or estimated offering costs, which would cause the expenses shown in the example to increase. The example should not be considered a representation of past or future expenses, and the Trust’s actual expenses may be greater or less than those shown. Moreover,

the

Trust’s actual rate of return may be greater or less than the hypothetical 5% return shown in the example.

1

If common shares are sold to or through underwriters, the Prospectus Supplement will set forth any applicable sales load.

2

Eaton Vance Management (“EVM”) will pay the expenses of the offering (other than the applicable commissions); therefore, offering expenses are not included in the Summary of Fund Expenses. Offering expenses generally include, but are not limited to, the preparation, review and filing with the SEC of the Trust’s registration statement (including its current Prospectus Supplement, the accompanying Prospectus and Statement of Additional Information (“SAI”)), the preparation, review and filing of any associated marketing or similar materials, costs associated with the printing, mailing or other distribution of its current Prospectus Supplement, the accompanying Prospectus, SAI and/or marketing materials, associated filing fees, stock exchange listing fees, and legal and auditing fees associated with the offering.

3

You will be charged a $5.00 service charge and pay brokerage charges if you direct the plan agent to sell your common shares held in a dividend reinvestment account.

4

Stated as a percentage of average net assets attributable to common shares for the year ended June 30, 2024.

5

The investment adviser fee paid by the Trust to EVM is based on the average weekly gross assets of the Trust, including all assets attributable to any form of investment leverage that the Trust may utilize. Accordingly, if the Trust were to increase investment leverage in the future, the investment adviser fee will increase as a percentage of net assets. Pursuant to the investment advisory agreement, the investment adviser fee was computed at an annual rate of 0.71% of the Trust’s average weekly gross assets through April 30, 2024 and beginning May 1, 2024, at 0.70% of the Trust’s average weekly gross assets, and is payable monthly. The annual investment adviser fee rate shall be reduced to the following as of the stated date: May 1, 2025: 0.69% and May 1, 2026: 0.55%.

6

Interest and fee expense relates to the notes payable.

7

As of June 30, 2024, the outstanding borrowings represented approximately 7.66% leverage and the preferred shares represented approximately 23.99% leverage, totaling 31.65% leverage.

Eaton Vance

Senior Income Trust

June 30, 2024

Trading and NAV Information

The Trust’s common shares have traded both at a premium and a discount to NAV. The Trust cannot predict whether its shares will trade in the future at a premium or discount to NAV. The provisions of the Investment Company Act of 1940, as amended (the “1940 Act”), generally require that the public offering price of common shares (less any underwriting commissions and discounts) must equal or exceed the NAV per share of a company’s common stock. The issuance of common shares may have an adverse effect on prices in the secondary market for the Trust’s common shares by increasing the number of common shares available, which may put downward pressure on the market price for the Trust’s common shares. Shares of common stock of closed-end investment companies frequently trade at a discount from NAV.

In addition, the Trust’s Board of Trustees has authorized the Trust to

repurchase

up to 10% of its outstanding common shares

as

of the last day of the prior calendar year at market prices when shares are trading at a discount to net asset value. The share repurchase program does not obligate the Trust to purchase a specific amount of shares. The results of the share repurchase program are disclosed in the Trust’s annual and semi-annual reports to shareholders.

The following table sets forth for each of the periods indicated the high and low closing market prices for the common shares on the New York Stock Exchange, and the corresponding NAV per share and the premium or discount to NAV per share at which the Trust’s common shares were trading as of such date.

| |

Market Price ($) |

|

NAV per Share on

Date of Market Price ($) |

|

NAV Premium/(Discount) on

Date of Market Price (%) |

Fiscal Quarter Ended |

High |

Low |

|

High |

Low |

|

High |

Low |

| June 30, 2024 |

6.50 |

6.29 |

|

6.23 |

6.18 |

|

4.33 |

1.78 |

| March 31, 2024 |

6.74 |

6.23 |

|

6.25 |

6.23 |

|

7.84 |

0.00 |

| December 31, 2023 |

6.31 |

5.60 |

|

6.19 |

6.09 |

|

1.94 |

(8.05) |

| September 30, 2023 |

5.96 |

5.40 |

|

6.22 |

6.13 |

|

(4.18) |

(11.91) |

| June 30, 2023 |

5.46 |

5.21 |

|

6.11 |

6.00 |

|

(10.64) |

(13.17) |

| March 31, 2023 |

5.76 |

5.25 |

|

6.15 |

5.98 |

|

(6.34) |

(12.21) |

| December 31, 2022 |

5.51 |

5.12 |

|

6.00 |

5.92 |

|

(8.17) |

(13.51) |

| September 30, 2022 |

5.86 |

5.24 |

|

6.36 |

6.01 |

|

(7.86) |

(12.81) |

Eaton Vance

Senior Income Trust

June 30, 2024

The following table sets forth information regarding the Trust’s outstanding bank loans and preferred shares as of the end of each of the Trust’s last ten fiscal years. The information in the table below was taken from the Trust’s financial statements for each fiscal year in the ten-year period ended June 30, 2024, and such financial statements have been audited by Deloitte & Touche LLP, the Trust’s independent registered public accounting firm.

Fiscal Year Ended |

Notes

Payable

Outstanding

(in 000's) |

Asset

Coverage

per $1,000

of Notes

Payable ¹ |

Preferred

Shares

Outstanding |

Asset

Coverage

per

Preferred

Share ² |

Involuntary

Liquidation

Preference

per

Preferred

Share ³ |

Approximate

Market

Value per

Preferred

Share ³ |

| June 30, 2024 |

$12,000 |

13,064 |

1,504 |

$79,014 |

$25,000 |

$25,000 |

| June 30, 2023 |

20,000 |

8,235 |

1,504 |

71,481 |

25,000 |

25,000 |

| June 30, 2022 |

26,000 |

6,531 |

1,504 |

66,752 |

25,000 |

25,000 |

| June 30, 2021 |

103,000 |

3,903 |

1,504 |

71,484 |

25,000 |

25,000 |

| June 30, 2020 |

95,000 |

3,866 |

1,504 |

69,242 |

25,000 |

25,000 |

| June 30, 2019 |

103,000 |

3,957 |

1,504 |

72,464 |

25,000 |

25,000 |

| June 30, 2018 |

93,000 |

4,587 |

2,464 |

68,989 |

25,000 |

25,000 |

| June 30, 2017 |

92,000 |

4,613 |

2,464 |

69,078 |

25,000 |

25,000 |

| June 30, 2016 |

25,000 |

15,472 |

4,400 |

71,629 |

25,000 |

25,000 |

| June 30, 2015 |

60,000 |

7,267 |

4,400 |

64,119 |

25,000 |

25,000 |

1

Calculated by subtracting the Trust’s total liabilities (not including the notes payable and preferred shares) from the Trust’s total assets, and dividing the result by the notes payable balance in thousands.

2

Calculated by subtracting the Trust’s total liabilities (not including the notes payable and preferred shares) from the Trust’s total assets, dividing the result by the sum of the value of the notes payable and liquidation value of the preferred shares, and multiplying the result by the liquidation value of one preferred share.

3

Plus accumulated and unpaid dividends.

Eaton Vance

Senior Income Trust

June 30, 2024

Endnotes and Additional Disclosures

| † |

The views expressed in this report are those of the portfolio manager(s) and are current only through the date stated at the top of this page. These views are subject to change at any time based upon market or other conditions, and Eaton Vance and the Fund(s) disclaim any responsibility to update such views. These views may not be relied upon as investment advice and, because investment decisions are based on many factors, may not be relied upon as an indication of trading intent on behalf of any Eaton Vance fund. This commentary may contain statements that are not historical facts, referred to as “forward-looking statements.” The Fund’s actual future results may differ significantly from those stated in any forward-looking statement, depending on factors such as changes in securities or financial markets or general economic conditions, the volume of sales and purchases of Fund shares, the continuation of investment advisory, administrative and service contracts, and other risks discussed from time to time in the Fund’s filings with the Securities and Exchange Commission. |

‡ |

The information contained herein is provided for informational purposes only and does not constitute a solicitation of an offer to buy or sell Fund shares. Common shares of the Fund are available for purchase and sale only at current market prices in secondary market trading. |

| |

|

1 |

Morningstar® LSTA® US Leveraged Loan Index SM is an unmanaged index of the institutional leveraged loan market. Morningstar® LSTA® Leveraged Loan indices are a product of Morningstar, Inc. (“Morningstar”) and have been licensed for use. Morningstar® is a registered trademark of Morningstar licensed for certain use. Loan Syndications and Trading Association® and LSTA® are trademarks of the LSTA licensed for certain use by Morningstar, and further sublicensed by Morningstar for certain use. Neither Morningstar nor LSTA guarantees the accuracy and/or completeness of the Morningstar® LSTA® US Leveraged Loan IndexSM or any data included therein, and shall have no liability for any errors, omissions, or interruptions therein. Unless otherwise stated, index returns do not reflect the effect of any applicable sales charges, commissions, expenses, taxes or leverage, as applicable. It is not possible to invest directly in an index. |

2 |

Performance results reflect the effects of leverage. Included in the average annual total return at NAV for the five- and ten-year periods, as applicable, is the impact of the 2017 and 2019 tender and repurchase of a portion of the Fund’s APS at 95% and 92% of the Fund’s APS per share liquidation preference, respectively. Had these transactions not occurred, the total return at NAV would be lower for the Fund. Included in the average annual total return at NAV for the five- and ten-year periods is the impact of the 2021 tender offer by the Fund for a portion of its common shares at 99% of the Fund’s NAV. Had this tender offer not occurred, the total return at NAV would be lower for the Fund. |

3 |

The shares of the Fund often trade at a discount or premium to their net asset value. The discount or premium may vary over time and may be higher or lower than what is quoted in this report. For up-to-date premium/discount information, please refer to https://funds.eatonvance.com/closed-end-fund-prices.php. |

4 |

The Distribution Rate is based on the Fund’s last regular distribution per share in the period (annualized) divided by the Fund’s NAV or market price at the end of the period. The Fund’s distributions may be comprised of amounts characterized for federal income tax purposes as qualified and non-qualified ordinary dividends, capital gains and nondividend distributions, also known as return of capital. For additional information about nondividend distributions, please refer to Eaton Vance Closed-End Fund Distribution Notices (19a) posted on our website, eatonvance.com. The Fund will determine the federal income tax character of distributions paid to a shareholder after the end of the calendar year. This is reported on the IRS form 1099-DIV and provided to the shareholder shortly after each year-end. For information about the tax character of distributions made in prior calendar years, please refer to Performance-Tax Character of Distributions on the Fund’s webpage available at eatonvance.com. The Fund’s distributions are determined by the investment adviser based on its current assessment of the Fund’s long-term return potential. Fund distributions may be affected by numerous factors including changes in Fund performance, the cost of financing for leverage, portfolio holdings, realized and projected returns, and other factors. As portfolio and market conditions change, the rate of distributions paid by the Fund could change. |

5 |

Leverage represents the liquidation value of the Fund’s APS and borrowings outstanding as a percentage of Fund net assets applicable to common shares plus APS and borrowings outstanding. Use of leverage creates an opportunity for income, but creates risks including greater price volatility. The cost of leverage rises and falls with changes in short-term interest rates. The Fund may be required to maintain prescribed asset coverage for its leverage and may be required to reduce its leverage at an inopportune time. |

| |

Fund profile subject to change due to active management. |

Eaton Vance

Senior Income Trust

June 30, 2024

| Asset-Backed Securities — 10.1% |

Security |

Principal

Amount

(000's omitted) |

Value |

| ARES XXXIIR CLO Ltd., Series 2014-32RA, Class D, 11.434%, (3 mo. SOFR + 6.112%), 5/15/30 (1)(2) |

$ |

1,000 |

$ 1,002,712 |

| ARES XXXIV CLO Ltd., Series 2015-2A, Class ER, 12.429%, (3 mo. SOFR + 7.112%), 4/17/33 (1)(2) |

|

550 |

550,427 |

| Benefit Street Partners CLO XVIII Ltd., Series 2019-18A, Class ER, 12.34%, (3 mo. SOFR + 7.012%), 10/15/34 (1)(2) |

|

500 |

503,633 |

| BlueMountain CLO XXVI Ltd., Series 2019-26A, Class ER, 12.716%, (3 mo. SOFR + 7.392%), 10/20/34 (1)(2) |

|

1,000 |

1,004,764 |

| Canyon Capital CLO Ltd., Series 2019-2A, Class ER, 12.34%, (3 mo. SOFR + 7.012%), 10/15/34 (1)(2) |

|

400 |

397,519 |

| Carlyle Global Market Strategies CLO Ltd.: |

|

|

|

| Series 2012-3A, Class DR2, 12.09%, (3 mo. SOFR + 6.762%), 1/14/32 (1)(2) |

|

600 |

601,719 |

| Series 2015-5A, Class DR, 12.286%, (3 mo. SOFR + 6.962%), 1/20/32 (1)(2) |

|

500 |

493,494 |

| Cedar Funding X CLO Ltd., Series 2019-10A, Class ER, 12.086%, (3 mo. SOFR + 6.762%), 10/20/32 (1)(2) |

|

500 |

502,412 |

| Galaxy XV CLO Ltd., Series 2013-15A, Class ER, 12.235%, (3 mo. SOFR + 6.907%), 10/15/30 (1)(2) |

|

500 |

501,269 |

| Galaxy XXI CLO Ltd., Series 2015-21A, Class ER, 10.836%, (3 mo. SOFR + 5.512%), 4/20/31 (1)(2) |

|

500 |

501,399 |

| Golub Capital Partners CLO 23M Ltd., Series 2015-23A, Class ER, 11.336%, (3 mo. SOFR + 6.012%), 1/20/31 (1)(2) |

|

600 |

602,194 |

| Neuberger Berman Loan Advisers CLO 31 Ltd., Series 2019-31A, Class ER, 12.086%, (3 mo. SOFR + 6.762%), 4/20/31 (1)(2) |

|

500 |

503,710 |

| Palmer Square CLO Ltd.: |

|

|

|

| Series 2013-2A, Class DRR, 11.429%, (3 mo. SOFR + 6.112%), 10/17/31 (1)(2) |

|

450 |

451,938 |

| Series 2019-1A, Class DR, 12.084%, (3 mo. SOFR + 6.762%), 11/14/34 (1)(2) |

|

500 |

502,052 |

| Regatta XIV Funding Ltd., Series 2018-3A, Class E, 11.535%, (3 mo. SOFR + 6.212%), 10/25/31 (1)(2) |

|

300 |

300,328 |

| Regatta XVI Funding Ltd., Series 2019-2A, Class E, 12.59%, (3 mo. SOFR + 7.262%), 1/15/33 (1)(2) |

|

500 |

503,376 |

| Vibrant CLO XI Ltd., Series 2019-11A, Class D, 12.356%, (3 mo. SOFR + 7.032%), 7/20/32 (1)(2) |

|

500 |

498,800 |

| Voya CLO Ltd., Series 2013-1A, Class DR, 12.07%, (3 mo. SOFR + 6.742%), 10/15/30 (1)(2) |

|

1,000 |

903,212 |

| Wellfleet CLO Ltd., Series 2020-1A, Class D, 12.83%, (3 mo. SOFR + 7.502%), 4/15/33 (1)(2) |

|

550 |

542,436 |

Total Asset-Backed Securities

(identified cost $10,855,962) |

|

|

$ 10,867,394 |

Security |

Shares |

Value |

| BlackRock Floating Rate Income Strategies Fund, Inc. |

|

6,311 |

$ 81,664 |

Total Closed-End Funds

(identified cost $87,555) |

|

|

$ 81,664 |

Security |

Shares |

Value |

| Aerospace and Defense — 0.0% |

| IAP Worldwide Services LLC (3)(4)(5) |

|

28 |

$ 0 |

| |

|

|

$ 0 |

| Commercial Services & Supplies — 0.1% |

| Monitronics International, Inc. (4)(5) |

|

4,716 |

$ 99,035 |

| Phoenix Services International LLC (4)(5) |

|

7,568 |

37,367 |

| Phoenix Services International LLC (4)(5) |

|

690 |

3,407 |

| |

|

|

$ 139,809 |

| Electronics/Electrical — 0.0% (6) |

| Skillsoft Corp. (4)(5) |

|

1,256 |

$ 17,370 |

| |

|

|

$ 17,370 |

| Entertainment — 0.1% |

| New Cineworld Ltd. (4)(5) |

|

7,709 |

$ 134,667 |

| |

|

|

$ 134,667 |

| Health Care — 0.2% |

| Envision Parent, Inc. (4)(5) |

|

19,128 |

$ 192,476 |

| |

|

|

$ 192,476 |

| Household Durables — 0.3% |

| Serta Simmons Bedding, Inc. (4)(5) |

|

35,996 |

$ 260,971 |

| Serta SSB Equipment Co. (3)(4)(5) |

|

35,996 |

0 |

| |

|

|

$ 260,971 |

| Investment Companies — 0.0% (6) |

| Aegletes BV (4)(5) |

|

6,311 |

$ 13,695 |

| |

|

|

$ 13,695 |

| Pharmaceuticals — 0.4% |

| Covis Midco 1 SARL, Class A (4)(5) |

|

147 |

$ 75 |

| Covis Midco 1 SARL, Class B (4)(5) |

|

147 |

75 |

| Covis Midco 1 SARL, Class C (4)(5) |

|

147 |

75 |

14

See Notes to Financial Statements.

Eaton Vance

Senior Income Trust

June 30, 2024

Portfolio of Investments — continued

Security |

Shares |

Value |

| Pharmaceuticals (continued) |

| Covis Midco 1 SARL, Class D (4)(5) |

|

147 |

$ 75 |

| Covis Midco 1 SARL, Class E (4)(5) |

|

147 |

75 |

| Mallinckrodt International Finance SA (4)(5) |