Table of Contents

As filed with the Securities and Exchange Commission on November 16, 2011

Registration No. 333-177434

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

PRE-EFFECTIVE AMENDMENT No. 1 To

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

CENTRAL FEDERAL CORPORATION

(Exact name of registrant as specified in its charter)

| Delaware |

6035 |

34-1877137 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification No.) |

2923 Smith Road, Fairlawn, Ohio 44333

(330) 666-7979

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Eloise L. Mackus, Esq., Chief Executive Officer, General Counsel and Corporate Secretary

2923 Smith Road, Fairlawn, Ohio 44333

(330) 666-7979

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| James S. Fleischer, P.C. Martin L. Meyrowitz, P.C. SILVER, FREEDMAN & TAFF, L.L.P. (a limited liability partnership including professional corporations) 3299 K Street, N.W., Suite 100 Washington, DC 20007 (202) 295-4500 |

Jason Hodges, Esq. Vorys, Sater, Seymour and Pease LLP 221 East Fourth Street Atrium Two Cincinnati, Ohio 45202 (513) 723-8590 | |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box. þ

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer ¨ | Accelerated filer ¨ | Non-accelerated filer ¨ | Smaller reporting company þ | |||

| (Do not check if a smaller reporting company) | ||||||

CALCULATION OF REGISTRATION FEE

|

| ||||||||

| Title of Each Class of Securities to be Registered(1) |

Amount to be Registered |

Proposed Maximum Offering Price |

Proposed Maximum Aggregate Offering Price |

Amount of Registration Fee | ||||

| Subscription Rights, each to purchase one share of our Common Stock, $0.01 par value per share(1) |

— | — | — | — (2) | ||||

| Common stock, $0.01 par value per share, underlying the Subscription Rights |

— | — | $30,000,000 | $3,483.00 (3) | ||||

| Warrants |

— | — | — | — (4) | ||||

| Shares of Common Stock underlying the Warrants |

— |

— |

$7,500,000 |

$870.75 (3) | ||||

| Total |

— |

— |

$37,500,000 |

$4,353.75 (5)(6) | ||||

|

| ||||||||

|

| ||||||||

| (1) | This registration statement relates to (a) the subscription rights to purchase shares of our common stock, (b) shares of our common stock deliverable upon the exercise of the subscription rights (c) warrants deliverable upon the purchase of every four shares of common stock and (d) the shares of our common stock deliverable upon the exercise of the warrants. |

| (2) | The subscription rights are being issued without consideration. Pursuant to Rule 457(g), no separate registration fee is payable with respect to the subscription rights being offered hereby since the subscription rights are being registered in the same registration statement as the securities to be offered pursuant thereto. |

| (3) | Calculated pursuant to Rule 457(o) based on an estimate of the proposed maximum offering price. |

| (4) | Pursuant to Rule 457(g), no separate registration fee is payable with respect to the warrants being offered hereby since the warrants are being registered in the same registration statement as the securities to be offered pursuant thereto. |

| (5) | Pursuant to Rule 457(p), the filing fee of $4,353.75 previously paid in connection with the Registration Statement on Form S-1 (No.333-177097) filed by the Registrant on September 30, 2011 and withdrawn on October 21, 2011 is offset against the entire filing fee for this Registration Statement. As a result, no filing fee is due in connection with this filing. |

| (6) | Previously paid. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

PROSPECTUS

30 million Shares of Common Stock

Including up to 24,965,000 Shares of Common Stock

Issuable upon the exercise of Subscription Rights at $1.00 per share

Warrants to purchase up to 7,500,000 shares of Common Stock

We are conducting a rights offering and an offering of common stock to the public on a best efforts basis at a price of $1.00 per share. We are distributing, at no charge to our stockholders, non-transferable subscription rights to purchase up to 24,965,000 shares of our common stock. In the rights offering, you will receive one subscription right for each share of common stock you owned as of 5:00 p.m. Eastern Time, on [ Record Date ], the record date of the rights offering. As of the close of business on [ Record Date ], there were 4,127,789 shares of common stock issued and outstanding. We must sell a minimum of 17,465,000 shares in the rights offering and the public offering, if any, to complete the rights offering.

Each subscription right will entitle you to purchase 6.048 shares of our common stock at the subscription price of $1.00 per share, which we refer to as the basic subscription privilege. If you fully exercise your basic subscription privilege and other stockholders do not fully exercise their basic subscription privileges, you will be entitled to exercise an over-subscription privilege, subject to certain limitations and subject to allotment, to purchase a portion of the unsubscribed shares of our common stock at the same subscription price of $1.00 per share. Funds we receive from subscribers in the rights offering will be held in escrow by the subscription/escrow agent until the rights offering is completed or canceled. To the extent you properly exercise your over-subscription privilege for an amount of shares that exceeds the number of the unsubscribed shares available to you, any excess subscription payments received by the subscription/escrow agent will be returned to you promptly, without interest, following the expiration of the rights offering.

The subscription rights will expire if they are not exercised by 5:00 p.m., Eastern Time, on [ Subscription Expiration Date ]. We reserve the right to extend the expiration date one or more times, but in no event will we extend the rights offering beyond [ Subscription Extension Date ].

At the minimum of the offering, we expect to contribute funds to our subsidiary, CFBank, to enable it to exceed all of its regulatory capital requirements, including the higher capital requirements imposed by the CFBank Cease and Desist Order described later in this prospectus, to be considered “well capitalized.”

We have separately entered into standby purchase agreements with certain standby purchasers (Standby Purchasers). Pursuant to the standby purchase agreements, the Standby Purchasers have agreed to acquire from us, at the subscription price of $1.00 per share, a total of 5,035,000 shares of common stock. The Standby Purchasers have conditioned their purchase of shares of common stock upon the receipt by Central Federal Corporation, referred to as CFC, of $16.5 million in net proceeds from the rights offering and the public offering, if any. As a result, the purchase by the Standby Purchasers (5,035,000 shares of common stock) is conditioned on the sale by CFC of 17,465,000 shares in the rights offering and the public offering, if any. Although the 5,035,000 shares subscribed for by the Standby Purchasers are included in the registration statement of which this prospectus forms a part, the shares subscribed for by the Standby Purchasers are in addition to the up to 24,965,000 shares offered in the rights offering and the public offering, if any. The aggregate maximum number of shares that may be sold in the rights offering, any public offering and to the Standby Purchasers is 30,000,000.

We reserve the right to cancel the rights offering at any time. In the event the rights offering is cancelled, all subscription payments received by the subscription/escrow agent will be returned promptly, without interest, and the sale to the Standby Purchasers will not be completed.

We may offer any shares of common stock that remain unsubscribed for (after taking into account all over-subscription rights exercised) at the expiration of the rights offering to the public at $1.00 per share. Any public offering of shares of common stock that remain unsubscribed shall be on a best efforts basis. The public offering of unsubscribed shares of common stock shall terminate on [ Subscription Expiration Date + [18] days ].

For each four shares purchased in the rights offering or public offering, purchasers will receive, without charge, a warrant to purchase one additional share of common stock at a purchase price of $1.00 per share. The warrant will be exercisable for a period of three years from the closing of the offerings, may be exercised only by cash payments and will be non-transferable. The Standby Purchasers will be issued warrants on the same terms and conditions as those issued to purchasers in the rights offering and public offering.

You should carefully consider whether to exercise your subscription rights prior to the expiration of the rights offering. All exercises of subscription rights are irrevocable. Our Board of Directors is making no recommendation regarding your exercise of the subscription rights. The subscription rights may not be sold, transferred or assigned and will not be listed for trading on the Nasdaq Capital Market (Nasdaq) or any other stock exchange or market.

Our common stock is traded on Nasdaq under the trading symbol “CFBK.” The last reported sales price of our shares of common stock on [ Current Date ] was $[ ] per share.

Table of Contents

OFFERING SUMMARY

PRICE: $1.00 PER SHARE

| Minimum | Maximum | |||||||

| Number of shares |

22,500,000 | 30,000,000 | ||||||

| Gross offering proceeds |

$ | 22,500,000 | $ | 30,000,000 | ||||

| Estimated offering expenses excluding financial advisory fees and expenses |

$ | 520,000 | $ | 520,000 | ||||

| Financial advisory fees and expenses (1) |

$ | 560,683 | $ | 973,183 | ||||

| Financial advisory fees and expenses per share |

$ | 0.03 | $ | 0.03 | ||||

| Net proceeds |

$ | 21,419,317 | $ | 28,506,817 | ||||

| Net proceeds per share |

$ | 0.95 | $ | 0.95 | ||||

| (1) | We have engaged ParaCap Group, LLC (ParaCap) as our financial advisor and information agent in connection with the rights offering and the offering to the Standby Purchasers, and in identifying and managing one or more qualifying broker-dealers to act as a selling group in connection with the public offering, if any. This is not an underwritten offering. Neither ParaCap nor any other broker-dealer is obligated to purchase any of the shares of common stock that are being offered for sale. See “Plan of Distribution — Financial Advisor” for a discussion of ParaCap’s compensation. Financial advisory fees at the minimum of the offering assume that $259,000 of common stock is sold to directors and employees of CFC or CFBank at a fee of 1.00%, $17.2 million of common stock is sold pursuant to the exercise of basic subscription rights at a 1.5% fee and $5.0 million of common stock is sold to the Standby Purchasers at a $200,000 fee. Financial advisory fees at the maximum of the offering assume that $259,000 of common stock is sold to directors and employees of CFC or CFBank at a fee of 1.00%, $17.2 million of common stock is sold pursuant to the exercise of basic subscription rights at a 1.5% fee, $5.0 million of common stock is sold to the Standby Purchasers at a $200,000 fee and $7.5 million is sold pursuant to the exercise of over-subscription rights and the public offering at a 5.50% fee. |

This investment involves risks, including the possible loss of principal.

Please read “Risk Factors” beginning on page 23.

These securities are not deposits, savings accounts or other obligations of any bank and are not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Neither the Securities and Exchange Commission, the Board of Governors of the Federal Reserve System, the Office of the Comptroller of the Currency, nor any state securities regulator has approved or disapproved of these securities or determined if this prospectus is accurate or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is [ Date SEC Approves Prospectus ].

Table of Contents

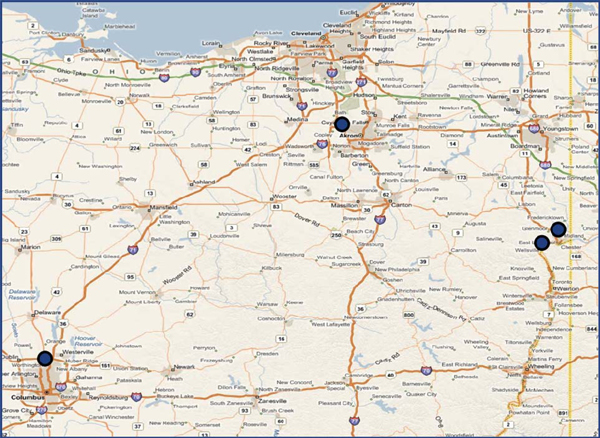

CFBank

Office Locations

Calcutta, Ohio

49028 Foulks Drive

Calcutta, Ohio 43920

330-385-4323

Fairlawn, Ohio

2923 Smith Road

Fairlawn, Ohio 44333

330-666-7979

Wellsville, Ohio

601 Main Street

Wellsville, Ohio 43968

330-532-1517

Worthington, Ohio

7000 North High Street

Worthington, Ohio 43085

614-334-7979

Table of Contents

| 1 | ||||

| 8 | ||||

| 23 | ||||

| 34 | ||||

| 36 | ||||

| 36 | ||||

| 37 | ||||

| 38 | ||||

| 40 | ||||

| 41 | ||||

| 44 | ||||

| 51 | ||||

| 54 | ||||

| 54 | ||||

| 56 | ||||

| 61 | ||||

| 61 | ||||

| 61 | ||||

You should rely only on the information contained in or incorporated by reference into this prospectus. We have not, and our financial advisor, ParaCap, has not, authorized anyone to provide you with additional or different information. The information contained in or incorporated by reference into this prospectus is accurate only as of the date of this prospectus regardless of the time of delivery of this prospectus or any exercise of the subscription rights. Our business, financial condition, results of operations and prospects may have changed since those dates. We are not making an offer of these securities in any state or jurisdiction where the offer is not permitted.

No action is being taken in any jurisdiction outside the United States to permit a public offering of the common stock or possession or distribution of this prospectus in that jurisdiction. Persons who come into possession of this prospectus in jurisdictions outside the United States are required to inform themselves about and to observe any restrictions as to this offering and the distribution of this prospectus applicable to those jurisdictions.

Unless the context indicates otherwise, all references in this prospectus to “CFC,” “we,” “our” and “us” refer to Central Federal Corporation and our subsidiaries, including CFBank; except that in the discussion of our subscription rights and capital stock and related matters, these terms refer solely to Central Federal Corporation and not to any of our subsidiaries. In this prospectus, we will refer to the rights offering, the offering to the Standby Purchasers and the public offering, if any, collectively as the “stock offering.”

Table of Contents

QUESTIONS AND ANSWERS RELATING TO THE STOCK OFFERING

What is the rights offering?

We are distributing, at no charge, to holders of our shares of common stock, non-transferable subscription rights to purchase shares of our common stock. You will receive one subscription right for each share of common stock you owned as of 5:00 p.m., Eastern Time, on [ Record Date ], the record date. Each subscription right entitles the holder to a basic subscription privilege and an over-subscription privilege, which are described below. The shares to be issued in the rights offering, like our existing shares of common stock, will be traded on Nasdaq under the symbol “CFBK.”

What is the basic subscription privilege?

Each subscription right gives our stockholders the opportunity to purchase 6.048 shares of our common stock at a subscription price of $1.00 per share for each share of our common stock they held of record as of 5:00 p.m., Eastern Time, on the record date. Fractional shares of our common stock resulting from the exercise of the basic subscription privilege will be eliminated by rounding down to the nearest whole share. For example, if you owned 100 shares of our common stock as of 5:00 p.m., Eastern Time, on the record date, you would have received 100 subscription rights and would have the right to purchase 604 shares of common stock for $1.00 per share. You may exercise all or any portion of your basic subscription privilege or you may choose not to exercise any subscription rights at all. However, if you exercise less than your full basic subscription privilege, you will not be entitled to purchase any additional shares by using your over-subscription privilege.

If you hold a CFC stock certificate, the number of rights you may exercise pursuant to your basic subscription privilege is indicated on the enclosed rights certificate. If you hold your shares in the name of a custodian bank, broker, dealer or other nominee, you will not receive a rights certificate. Instead, the Depository Trust Company (DTC) will issue one subscription right to the nominee record holder for each share of our common stock that you own at the record date. If you are not contacted by your custodian bank, broker, dealer or other nominee, you should contact your nominee as soon as possible.

What is the over-subscription privilege?

In the event that you purchase all of the shares of our common stock available to you pursuant to your basic subscription privilege, you may also choose to purchase a portion of any shares of our common stock that are not purchased by our other stockholders through the exercise of their basic subscription privileges. You should indicate on your rights certificate or communication from your broker how many additional shares you would like to purchase pursuant to your over-subscription privilege.

If sufficient shares of common stock are available, we will seek to honor your over-subscription request in full. If, however, over-subscription requests exceed the number of shares of common stock available to be purchased pursuant to the over-subscription privilege, we will allocate the available shares of common stock among stockholders who over-subscribed by multiplying the number of shares requested by each stockholder through the exercise of their over-subscription privileges by a fraction that equals (x) the number of shares available to be issued through over-subscription privileges divided by (y) the total number of shares requested by all subscribers through the exercise of their over-subscription privileges. As described above for the basic subscription privilege, we will not issue fractional shares through the exercise of over-subscription privileges.

In order to properly exercise your over-subscription privilege, you must deliver the subscription payment related to your over-subscription privilege at the time you deliver payment related to your basic subscription privilege. Because we will not know the actual number of unsubscribed shares prior to the expiration of the rights offering, if you wish to maximize the number of shares you purchase pursuant to your over-subscription privilege, you will need to deliver payment in an amount equal to the aggregate subscription price for the maximum number of shares of our common stock that may be available to you. For that calculation, you must assume that no other stockholder, other than you, will subscribe for any shares of our common stock pursuant to their basic subscription privilege. See “The Rights Offering—The Subscription Rights—Over-Subscription Privilege.”

1

Table of Contents

What is the offering to the Standby Purchasers?

We have separately entered into standby purchase agreements with the Standby Purchasers. Pursuant to the standby purchase agreements, the Standby Purchasers have agreed to acquire from us, at the subscription price of $1.00 per share, 5,035,000 shares of common stock. The Standby Purchasers have conditioned their purchase of shares of common stock upon the receipt by CFC of $16.5 million in net proceeds from the rights offering and the public offering, if any. As a result, the purchase of any shares by the Standby Purchasers is conditioned on the sale by CFC of 17,465,000 shares in the rights offering and the public offering, if any.

Subject to receipt of regulatory approval, we have agreed to provide the Standby Purchasers the right to designate five candidates for appointment to the Board of Directors of CFC. We currently expect these director designees to be Timothy T. O’Dell, founder and principal of Chetwood Group, a strategic business advisory firm, and former president and chief executive officer of Fifth Third Bank of Central Ohio; Thad R. Perry, former senior partner of Accenture; Robert E. Hoeweler, chief executive officer of a group of companies owned by the Hoeweler family; James Howard Frauenberg, II, principal owner of Addison Holdings, LLC, which manages investments of private individuals and has been active in opening new franchises for two retail chains, Five Guys and Flip Flops; and Donal Malenick, former chief executive officer of Columbus Steel Castings and president of Worthington Steel. On the closing date, we have agreed to pay the aggregate sum of up to $80,000 to Timothy T. O’Dell (on behalf of all of the Standby Purchasers approved by Timothy T. O’Dell) for reimbursement of actual fees, costs and legal expenses incurred by the Standby Purchasers. On the closing date, subject to the approval of any and all applicable regulators, Timothy T. O’Dell also shall receive $90,000 from CFC on behalf of himself, Thad R. Perry and Robert E. Hoeweler, in consideration of the efforts of such individuals in connection with the negotiation of the standby purchase agreements.

Why are we conducting the stock offering?

We are engaging in the stock offering to raise capital to improve CFBank’s capital position and to retain additional capital at CFC. See “Use of Proceeds.” Our Board of Directors has chosen to raise capital through a rights offering to give our stockholders the opportunity to limit ownership dilution by buying additional shares of common stock. Our Board of Directors also considered several alternative capital raising methods prior to concluding that the rights offering was the best option under the current circumstances. We believe that the rights offering will strengthen our financial condition by generating additional cash and increasing our capital position; however, our Board of Directors is making no recommendation regarding your exercise of the subscription rights. We cannot assure you that we will not need to seek additional financing or engage in additional capital offerings in the future.

How was the $1.00 per share subscription price determined?

In determining the subscription price, our Board of Directors considered a number of factors, including: the price at which our stockholders might be willing to participate in the rights offering; historical and current trading prices for our common stock; the need for liquidity and capital; negotiations with the Standby Purchasers; and the desire to provide an opportunity to our stockholders to participate in the rights offering on a pro rata basis. In conjunction with its review of these factors, our Board of Directors also reviewed our history and prospects, including our past and present earnings and losses, our prospects for future earnings, our current financial condition and regulatory status and subscription prices in various rights offerings by other companies. We did not request and have not received a fairness opinion regarding the subscription price. The subscription price is not necessarily related to our book value, net worth or any other established criteria of value and may or may not be considered the fair value of our common stock to be offered in the rights offering. You should not assume or expect that, after the stock offering, our shares of common stock will trade at or above the $1.00 subscription price.

Am I required to exercise all of the subscription rights I receive in the rights offering?

No. You may exercise any number of your subscription rights, or you may choose not to exercise any subscription rights. If you do not exercise any subscription rights, the number of shares of our common stock you own will not change. However, if you choose not to exercise your basic subscription rights in full, your ownership interest in CFC will be diluted as a result of the stock offering. Even if you fully exercise your basic subscription rights, but do not exercise a certain level of over-subscription rights, you may experience dilution as a result of the sale of shares to the Standby Purchasers. In addition, if you do not exercise your basic subscription privilege in full, you will not be entitled to participate in the over-subscription privilege.

2

Table of Contents

How soon must I act to exercise my subscription rights?

If you received a rights certificate and elect to exercise any or all of your subscription rights, the subscription/escrow agent must receive your completed and signed rights certificate and payment prior to the expiration of the rights offering, which is [ Subscription Expiration Date ], at 5:00 p.m., Eastern Time. If you hold your shares in the name of a custodian bank, broker, dealer or other nominee, your nominee may establish a deadline prior to 5:00 p.m., Eastern Time, on [ Subscription Expiration Date ]by which you must provide it with your instructions to exercise your subscription rights and payment for your shares. Our Board of Directors may, in its discretion, extend the rights offering one or more times, but in no event will the expiration date be later than [Subscription Expiration Date plus [18] days ]. Our Board of Directors may cancel or amend the rights offering at any time. In the event that the rights offering is cancelled, all subscription payments received will be returned promptly, without interest.

Although we will make reasonable attempts to provide this prospectus to holders of subscription rights, the rights offering and all subscription rights will expire at 5:00 p.m., Eastern Time on [ Subscription Expiration Date ] (unless extended), whether or not we have been able to locate each person entitled to subscription rights.

May I transfer my subscription rights?

No. You may not sell, transfer or assign your subscription rights to anyone. Subscription rights will not be listed for trading on Nasdaq or any other stock exchange or market. Rights certificates may only be completed by the stockholder named in the certificate.

Are we requiring a minimum subscription to complete the rights offering?

There is no individual minimum purchase requirement in the rights offering. However, we cannot complete the stock offering unless we receive aggregate subscriptions of at least $17.5 million (17,465,000 shares) of common stock in the rights offering and the public offering, if any, excluding the sale of $5.0 million of common stock to the Standby Purchasers.

Has our Board of Directors made a recommendation to our stockholders regarding the rights offering?

No. Neither our Board of Directors, ParaCap, nor any other person is making a recommendation regarding your exercise of the subscription rights. Stockholders who exercise subscription rights risk investment loss on new money invested. We cannot predict the price at which our shares of common stock will trade; therefore, we cannot assure you that the market price for our common stock will be at or above the subscription price or that anyone purchasing shares at the subscription price will be able to sell those shares in the future at the same price or a higher price. You are urged to make your decision based on your own assessment of our business and the rights offering. Please see “Risk Factors” for a discussion of some of the risks involved in investing in our common stock.

Are there any limits on the number of shares I may purchase in the rights offering or own as a result of the rights offering?

Persons, together with associates or groups acting in concert, may purchase up to a number of shares such that upon completion of the stock offering the person owns up to 9.9% of CFC’s common stock outstanding. This 9.9% limitation is 15% for our largest stockholder as of the date of this prospectus. This stockholder currently has regulatory permission to own over 10% of our common stock without becoming a savings and loan holding company. See “Risk Factors—Risks Related to Our Business—CFC could, as a result of the stock offering, including the shares issued to the Standby Purchasers, and/or future investments in our common stock by holders of 5% or more of our common stock, experience an “ownership change” for tax purposes that could cause CFC to permanently lose a significant portion of its net operating loss carry-forwards, or reduce the annual amount that can be recognized to offset future income.”

In addition, we will not issue shares of our common stock pursuant to the exercise of basic subscription rights or over-subscription rights, to any person or entity who, in our sole opinion, could be required to obtain prior clearance or approval from or submit a notice to any state or federal bank regulatory authority to acquire, own or control such shares if, as of [ Subscription Expiration Date ], such clearance or approval has not been obtained and/or any applicable waiting period has not expired. If we elect not to issue shares in such a case, the unissued shares will become available to satisfy over-subscriptions by other stockholders pursuant to their subscription rights and will thereafter be available in the public offering of shares, if any.

3

Table of Contents

How do I exercise my subscription rights if I own shares in certificate form?

If you hold a CFC stock certificate and you wish to participate in the rights offering, you must take the following steps:

| • | deliver a properly completed and signed rights certificate, and related subscription documents, to the subscription/escrow agent before 5:00 p.m., Eastern Time, on [ Subscription Expiration Date ]; and |

| • | deliver payment to the subscription/escrow agent (as described below) before 5:00 p.m., Eastern Time, on [ Subscription Expiration Date ]. |

In certain cases, you may be required to provide additional documentation or signature guarantees.

Please follow the delivery instructions on the rights certificate. Do not deliver documents to CFC. You are solely responsible for completing delivery to the subscription/escrow agent of your subscription documents, rights certificate and payment. We urge you to allow sufficient time for delivery of your subscription materials to the subscription/escrow agent so that they are received by the subscription/escrow agent by 5:00 p.m., Eastern Time, on [ Subscription Expiration Date ].

If you send a payment that is insufficient to purchase the number of shares you requested, or if the number of shares you requested is not specified in the forms, the payment received will be applied to exercise your subscription rights to the fullest extent possible based on the amount of the payment received, subject to the availability of shares under the over-subscription privilege and the elimination of fractional shares. Any excess subscription payments received by the subscription/escrow agent will be returned promptly, without interest, following the expiration of the rights offering.

What form of payment is required to purchase the shares of our common stock?

As described in the instructions accompanying the rights certificate, payments submitted to the subscription/escrow agent must be made in full in United States currency by:

| • | wire transfer to Registrar and Transfer Company, the subscription/escrow agent; or |

| • | personal check drawn on a U.S. bank, or bank check drawn on CFBank, payable to Registrar and Transfer Company, the subscription/escrow agent. |

Payment will be deemed to have been received by the subscription/escrow agent only upon the subscription/escrow agent’s receipt of the wire transfer, a bank check drawn on CFBank, or any personal check drawn on a U.S. bank, upon receipt and clearance of such check.

Please note that funds paid by personal check may take at least seven business days to clear. Accordingly, if you wish to pay by means of a personal check, we urge you to make payment sufficiently in advance of the expiration date to ensure that the subscription/escrow agent receives cleared funds before that time. We also urge you to consider payment by means of a wire transfer or bank check drawn on CFBank.

What should I do if I want to participate in the rights offering, but my shares are held in the name of a custodian bank, broker, dealer or other nominee?

If you hold your shares of common stock through a custodian bank, broker, dealer or other nominee, then your nominee is the record holder of the shares you own. If you are not contacted by your nominee, you should contact your nominee as soon as possible. Your nominee must exercise the subscription rights on your behalf for the shares of common stock you wish to purchase. You will not receive a rights certificate. Please follow the instructions of your nominee. Your nominee may establish a deadline that may be before the 5:00 p.m., Eastern Time, [ Subscription Expiration Date ] expiration date that we have established for the rights offering.

What should I do if I want to participate in the rights offering, but my shares are held in my account under the CFBank Employees’ Savings and Profit Sharing Plan and Trust (401(k) plan)?

4

Table of Contents

If shares of our common stock are held in your account under our 401(k) plan you are not eligible to exercise subscription rights. Investing in CFC common stock is not a permitted investment under this plan. You may purchase shares in the public offering, if any.

When will I receive my new shares?

If you purchase stock in the rights offering by submitting a rights certificate and payment, we will mail you a confirmation that the shares have been credited to you in book-entry form as soon as practicable after the expiration date of the stock offering. No stock certificates will be issued. If your shares as of [ Record Date ] were held by a custodian bank, broker, dealer or other nominee, and you participate in the rights offering, you will not receive stock certificates for your new shares. Your nominee will be credited with the number of shares of common stock you purchase in the rights offering as soon as practicable after the expiration of the stock offering.

When will I receive my warrants?

If you purchase stock in the rights offering by submitting a rights certificate and payment, we will mail you a warrant certificate as soon as practicable after the expiration date of the stock offering. If your shares as of [ Record Date ] were held by a custodian bank, broker, dealer or other nominee, and you participate in the rights offering, your nominee will receive a warrant certificate as soon as practicable after the expiration of the stock offering. Standby Purchasers and purchasers of shares in the public offering, if any, will receive a warrant certificate as soon as practicable after the completion of the stock offering.

After I send in my payment and rights certificate, may I cancel my exercise of subscription rights?

No. All exercises of subscription rights are irrevocable unless the rights offering is terminated, even if you later learn information that you consider to be unfavorable to the exercise of your subscription rights. You should not exercise your subscription rights unless you are certain that you wish to purchase shares of our common stock in the rights offering.

Are there any conditions to completing the rights offering?

Yes. In order to complete the rights offering, we must sell the minimum offering amount of at least 17,465,000 shares of common stock in the rights offering and/or the public offering, and receive net proceeds of at least $16.5 million.

Will our directors and officers participate in the rights offering?

Yes. We expect our current directors and officers will subscribe for, in the aggregate, approximately 258,500 shares of common stock, or $258,500, in the rights offering. The purchase price paid by them will be $1.00 per share, the same paid by all other persons who purchase shares of our common stock in the stock offering. Following the stock offering, our current directors and executive officers, together with their affiliates, are expected to own approximately 466,823 shares of common stock, or 1.8% and 1.4% of our total outstanding shares of common stock, assuming the sale at the minimum and maximum of the offering range, respectively. Following the stock offering, our current directors and five new directors and executive officers are expected to own approximately 2,766,823 shares of common stock, or between 10.4 % and 8.1% of our total outstanding shares of common stock, assuming the sale at the minimum and maximum of the offering range, respectively.

What agreements do we have with the Standby Purchasers and will the Standby Purchasers receive any compensation for their commitment?

Timothy T. O’Dell, on behalf of the Standby Purchasers, executed a non-disclosure agreement and accordingly gained access to limited nonpublic information about the stock offering. Subsequently, the Standby Purchasers negotiated and executed standby purchase agreements. Pursuant to these agreements, the Standby Purchasers have agreed to acquire from us, at the subscription price of $1.00 per share, 5,035,000 shares of common stock. The Standby Purchasers have conditioned their purchase of shares of common stock upon the receipt by CFC of $16.5 million in net proceeds from the rights offering and the public offering, if any. As a result, the purchase by the Standby Purchasers (5,035,000 shares of common stock) is conditioned on the sale by CFC of 17,465,000 shares in the rights offering and the public offering, if any.

Subject to receipt of regulatory approval, we have agreed to provide the Standby Purchasers the right to designate five candidates for appointment to the board of directors of CFC. We currently expect these director designees to be Timothy T. O’Dell, Thad R. Perry, Robert E. Hoeweler, James Howard Frauenberg, II and Donal

5

Table of Contents

Malenick. The business experience of each of these persons is described below under the heading “Summary – Proposed and Existing New Management and Directors.” On the closing date, we have agreed to pay the aggregate sum of up to $80,000 to Timothy T. O’Dell (on behalf of all of the Standby Purchasers approved by Timothy T. O’Dell) for reimbursement of actual fees, costs and legal expenses incurred by such Standby Purchasers. In addition, on the Closing Date, subject to the approval of any and all applicable regulators, Timothy T. O’Dell shall receive $90,000 from CFC on behalf of himself, Thad R. Perry and Robert E. Hoeweler, in consideration of the efforts of such individuals in connection with the negotiation of the standby purchase agreements.

How many shares will the Standby Purchasers own after the stock offering?

After the stock offering, the Standby Purchasers have represented to us that they and their affiliates will own 5,035,000 shares of our common stock or 18.9% of our outstanding shares if we sell the minimum amount of common stock and 14.8% of our outstanding shares if we sell the maximum amount of common stock.

What effects will the stock offering have on our outstanding common stock?

As of [ Record Date ], we had 4,127,798 shares of our common stock issued and outstanding. Assuming no options are exercised prior to the expiration of the rights offering and assuming all shares are sold in the stock offering, we expect between 26,627,798 and 34,127,798 shares of our common stock will be outstanding immediately after completion of the stock offering at the minimum and maximum of the offering range, respectively.

The issuance of shares of our common stock in the stock offering will dilute, and thereby reduce, your proportionate ownership in our shares of common stock unless you fully exercise your basic subscription privilege and a certain level of your over-subscription privilege. In addition, the issuance of shares of our common stock at the subscription price, which is less than the tangible book value per common share as of September 30, 2011, will reduce the tangible book value per share of shares held by you prior to the stock offering.

How much will we receive in net proceeds from the stock offering?

We expect the aggregate proceeds from the stock offering, net of expenses, to be between $21.4 million and $28.5 million. Based on the capital plan and business plan we have adopted and which has been approved by regulators, we intend to invest $13.5 million of the net proceeds in CFBank to improve its regulatory capital position, and retain the remainder of the net proceeds at CFC. The net proceeds we retain may be used for general corporate purposes. See “Use of Proceeds.”

Are there risks in exercising my subscription rights?

Yes. The exercise of your subscription rights involves risks. Exercising your subscription rights involves the purchase of additional shares of our common stock and should be considered carefully. Among other things, you should carefully consider the risks described under the heading “Risk Factors” in this prospectus.

If the rights offering is not completed, will my subscription payment be refunded to me?

Yes. The subscription/escrow agent will hold all funds it receives in a segregated bank account until completion of the rights offering. If the rights offering is not completed, all subscription payments received by the subscription/escrow agent will be returned promptly, without interest. If your shares are held in the name of a custodian bank, broker, dealer or other nominee, it may take longer for you to receive the refund of your subscription payment because the subscription/escrow agent will return payments through the record holder of your shares.

What is the public offering of shares?

If shares of common stock remain available for sale after the closing of the rights offering, we may offer and sell those remaining shares to the public on a best efforts basis at the $1.00 per share subscription price.

What fees or charges apply if I purchase shares of common stock in the stock offering?

We are not charging any fee or sales commission to issue subscription rights to you or to issue shares to you if you exercise your subscription rights (other than the subscription price) or if you purchase shares in the public offering, if any. If you exercise your subscription rights through a custodian bank, broker, dealer or other nominee, you are responsible for paying any fees your nominee may charge you.

6

Table of Contents

What is the role of ParaCap in the stock offering?

We have entered into an agreement with ParaCap, pursuant to which ParaCap is acting as our financial advisor and information agent in connection with the rights offering and the offering to the Standby Purchasers, and in identifying and managing one or more qualifying broker-dealers to act as a selling group in connection with the public offering of shares, if any. Neither ParaCap nor any other broker-dealer is acting as an underwriter nor will ParaCap or any other broker-dealer be obligated to purchase any shares of our common stock in the stock offering. We have agreed to pay certain fees to, and expenses of, ParaCap.

Who should I contact if I have other questions?

If you have other questions regarding CFC, CFBank or the stock offering, or if you have any questions regarding completing a rights certificate or submitting payment in the rights offering, please contact our information agent, ParaCap, at ( ) [ ] (toll free), Monday through Friday (except bank holidays), between 9:00 a.m. and 4:00 p.m., Eastern Time.

What are the terms of the warrants that will be issued in connection with the issuance and sale of the common stock?

All purchasers of common stock in the stock offering, including the Standby Purchasers, will receive, without additional charge, one warrant to purchase one additional share of common stock for each four shares purchased in the stock offering. The warrants will be exercisable for three years following completion of the stock offering at an exercise price of $1.00 per share. The exercise price will be payable only by cash or check. The warrants will not be transferrable, no fractional warrants will be issued and the number of warrants issued will be rounded down. By way of example, a purchaser purchasing four shares of common stock will receive one warrant and a purchaser purchasing seven shares of common stock will receive one warrant, while a purchaser purchasing eight shares of common stock will receive two warrants. The number of shares for which warrants may be exercised and the exercise price applicable to the warrants will be proportionately adjusted in the event that we pay stock dividends or make distributions of our common stock, or subdivide, combine or reclassify outstanding shares of our common stock such as in a stock split or reverse stock split.

Will there be a reverse stock split?

Our stockholders have given our Board of Directors the discretionary authority to affect a reverse stock split following completion of the stock offering. The Board, if it determines a reverse stock split is in the best interests of CFC and its stockholders, may select a ratio of new shares to shares held before the reverse stock split between 1-for-2 and 1-for-5.

7

Table of Contents

The following summary contains basic information about us and the stock offering. Because it is a summary, it may not contain all of the information that is important to you. For additional information before making a decision to invest in our shares of common stock, you should read this prospectus carefully, including the sections entitled “The Rights Offering” and “Risk Factors” and the information incorporated by reference in this prospectus, including our audited consolidated financial statements and the accompanying notes included in our Annual Report on Form 10-K for the fiscal year ended December 31, 2010, and our unaudited consolidated financial statements in our Quarterly Report on Form 10-Q for the fiscal quarter ended September 30, 2011.

Central Federal Corporation (CFC).

CFC is the holding company for CFBank. CFC owns and operates CFBank; Ghent Road, Inc, which owns land adjacent to CFBank’s Fairlawn, Ohio office; Smith Ghent LLC, which owns CFC’s headquarters in Fairlawn, Ohio; and Central Federal Capital Trust I, which raised additional funding for CFC in 2003 through the issuance of trust preferred securities. The business of CFC consists primarily of the business of CFBank. CFBank is a federally chartered savings association operating through four offices located in Fairlawn, Worthington, Calcutta and Wellsville, Ohio. CFBank has operated continuously for 119 years, having been founded in 1892. CFC’s headquarters is located at 2923 Smith Road, Fairlawn, Ohio 44333 and its telephone number is (330) 666-7979.

CFBank is a community-oriented financial institution offering a variety of financial services to meet the needs of the communities we serve. Our business model emphasizes personalized service, clients’ access to decision makers, solution-driven lending and quick execution, efficient use of technology and the convenience of online internet banking, mobile banking, remote deposit, corporate cash management and telephone banking. We attract deposits from the general public and use the deposits, together with borrowings and other funds, primarily to originate commercial and commercial real estate loans, single-family and multi-family residential mortgage loans and home equity lines of credit. The majority of our customers are small businesses, small business owners and consumers.

Our principal market area for loans and deposits includes the following Ohio counties: Summit County through our office in Fairlawn, Ohio; Franklin County through our office in Worthington, Ohio; and Columbiana County through our offices in Calcutta and Wellsville, Ohio. We originate commercial and residential real estate loans and business loans primarily throughout Ohio.

Our net income is dependent primarily on net interest income, which is the difference between the interest income earned on loans and securities and our cost of funds, consisting of interest paid on deposits and borrowed funds. Net interest income is affected by regulatory, economic and competitive factors that influence interest rates, loan demand, the level of non-performing assets and deposit flows. Net income is also affected by, among other things, loan fee income, provisions for loan losses, service charges, gains on loan sales, operating expenses and franchise and income taxes. Operating expenses principally consist of employee compensation and benefits, occupancy, Federal Deposit Insurance Corporation (FDIC) insurance premiums and other general and administrative expenses. Funds for these activities are provided principally by deposits, Federal Home Loan Bank (FHLB) advances and other borrowings, repayments of outstanding loans and securities, sales of loans and securities and operating revenues.

At September 30, 2011, we had total consolidated assets of $265.4 million, total deposits of $226.7 million and total stockholders’ equity of $11.4 million.

Recent Operational Challenges

Deterioration in Asset Quality. The significant volatility and disruption in capital, credit and financial markets which started in 2008 continued to have a detrimental effect on our national and local economies in 2011. Like many financial institutions across the United States, our operations have been significantly negatively impacted by these continued adverse economic conditions. During 2009 and 2010, and continuing into our current fiscal year, the increasing duration and lingering nature of the current recessionary economic environment and its detrimental effects on our borrowers, including deterioration in client business performance, declines in borrowers’ cash flows and lower collateral values for assets and properties securing loans, have resulted in a significant increase in our

8

Table of Contents

level of criticized and classified assets, nonperforming assets and charge-offs of problem loans. At the same time, competition among depository institutions in our markets for deposits and quality loans has increased significantly. These market conditions, the tightening of credit and widespread reduction in general business activity have led to increased deficiencies in our loan portfolio, a decreased net interest margin and increased market volatility.

As a result of the deterioration in our asset quality, we recorded provisions for loan losses of $2.3 million during the nine months ended September 30, 2011 and $8.5 million and $9.9 million during the years ended December 31, 2010 and 2009, respectively, which significantly negatively impacted our earnings. Due primarily to the deterioration in our asset quality, and resulting provisions for loans losses, our regulatory capital ratios also have been negatively impacted.

Since its appointment in May and June 2010, our new management team has taken several significant steps to assess and improve the credit quality of existing loans and loan relationships and improve our lending operations. These steps included:

| • | independent loan reviews in the second quarter of 2010 covering in excess of 80% of the commercial, commercial real estate and multi-family residential loan portfolios; |

| • | an additional independent loan review of the same portfolios in the fourth quarter of 2010 and the second quarter of 2011; |

| • | an independent review to assess the methodology used to determine the level of the allowance for loan and lease losses (ALLL) as of June 30, 2010 and June 30, 2011; |

| • | the addition of new personnel to direct our commercial banking activities; |

| • | use of a loan workout firm to assist in addressing troubled loan relationships; and |

| • | reorganization and enhancement of our credit and workout functions, as well as additional staffing in these areas. |

These steps were designed to assess credit quality, improve collection and workout efforts with troubled borrowers and enhance the loan underwriting and approval process. See “—Business Strategy of Our Restructured Management Team—Improve Our Asset Quality.” As a result of these initiatives, the level of nonperforming loans and criticized and classified loans has decreased each quarter since June 30, 2010. In addition, the Company’s allowance for loan losses as a percentage of total loans has increased from 2.97% as of December 31, 2009 to 4.20% as of September 30, 2011.

CFC Participation in the Troubled Asset Relief Program (TARP) Capital Purchase Program. On December 5, 2008, in connection with the TARP Capital Purchase Program, CFC issued to the U.S. Department of the Treasury (Treasury) 7,225 shares of Central Federal Corporation Fixed Rate Cumulative Perpetual Preferred Stock, Series A (Preferred Stock) for $7,225,000. The Preferred Stock initially pays quarterly dividends at a five percent annual rate, which increases to nine percent after February 14, 2014, on a liquidation preference of $1,000 per share. CFC’s Board of Directors elected to defer dividend payments on the preferred stock beginning with the dividend payable on November 15, 2010 in order to preserve cash at CFC. As of September 30, 2011, four quarterly dividend payments had been deferred. Cumulative deferred dividends accrued but not paid totaled $370,000 at September 30, 2011 and $90,000 at December 31, 2010. Pursuant to the CFC Cease and Desist Order entered into with the Office of Thrift Supervision (OTS) on May 25, 2011, CFC may not declare, make, or pay any cash dividends (including dividends on the Preferred Stock, or its common stock) or other capital distributions or purchase, repurchase or redeem or commit to purchase, repurchase, or redeem any equity stock without the prior written non-objection of the Board of Governors of the Federal Reserve System. In connection with the issuance of the Preferred Stock, CFC also issued to Treasury a warrant to purchase 336,568 shares of its common stock at an exercise price of $3.22 per share (Warrant).

Regulatory Restrictions. On May 25, 2011, CFBank entered into a Cease and Desist Order with the OTS, the primary regulator of CFC and CFBank at the time the Orders were issued. Beginning on July 21, 2011, in

9

Table of Contents

accordance with the Dodd-Frank Wall Street Reform and Consumer Protection Act (Dodd-Frank Act), the Board of Governors of the Federal Reserve System (Fed) replaced the OTS as the federal banking regulator of CFC and the Office of the Comptroller of the Currency (OCC) replaced the OTS as the primary federal banking regulator of CFBank. All references to the Regulator refer to the OTS regarding CFC and the Bank before July 21, 2011 and to the Fed regarding CFC and the OCC regarding the Bank on and after July 21, 2011.

CFBank Cease and Desist Order. The CFBank Cease and Desist Order requires CFBank to take several actions, including, but not limited to:

| • | No later than September 30, 2011, CFBank shall achieve and maintain a Tier 1 (Core) Capital Ratio of at least 8.0% and a Total Risk-Based Capital Ratio of at least 12.0%. CFBank has not met this requirement. |

| • | By June 30, 2011, CFBank was required to submit to the Regulator a written capital and business plan to achieve and maintain the foregoing capital levels. The plan must cover the period from July 1, 2011 through December 31, 2013. The Plan must: (i) identify the specific sources and methods by which additional capital will be raised; (ii) detail CFBank’s capital preservation and enhancement strategies; (iii) contain operating strategies to achieve realistic core earnings; (iv) include quarterly financial projections; and (v) identify all relevant assumptions made. This plan has been submitted as required. |

| • | Upon written notice of non-objection from the Regulator, CFBank must implement and adhere to the plan. |

| • | By December 31, 2011 and each December 31 thereafter, the plan must be updated to incorporate CFBank’s budget and profit projections for the next two years. |

| • | Within 45 days after the end of each quarter following implementation of the plan, the Board of Directors must review written quarterly variance reports from projections and document this review and any remedial action in CFBank’s minutes of the meeting of the Board of Directors. This review must include documentation of the internal and external risks affecting CFBank’s ability to successfully implement the plan. Each variance report must be provided to the Regulator. |

| • | In the event CFBank fails to meet the capital requirements of the CFBank Cease and Desist Order, fails to comply with the plan or at the request of the Regulator, CFBank shall prepare and submit a contingency plan to the Regulator within 15 days of such event. The contingency plan must detail actions to be taken to achieve either a merger or acquisition of CFBank by another depository institution or a voluntary liquidation of CFBank. The Regulator has extended this requirement until the earlier of 15 days after termination of this stock offering or January 31, 2012. |

| • | CFBank may not originate, participate in or acquire any non-residential real estate loans or commercial loans (together, non-homogeneous loans) without the prior written non-objection of the Regulator. This provision was waived by the Regulator on November 9, 2011. |

| • | CFBank may not release any borrower or guarantor from liability on any non-homogeneous loan without the prior written non-objection of the Regulator. This provision was waived by the Regulator on November 9, 2011. |

| • | By June 24, 2011, the Bank was required to revise its credit administration policies, procedures, practices and controls to address all corrective actions related to credit administration noted in the latest Report of Examination by the Regulator. These revisions have been made. |

| • | By August 23, 2011, CFBank was required to submit to the Regulator a detailed written plan with specific strategies, targets and timeframes to reduce CFBank’s level of problem assets. This plan has been submitted. |

| • | By September 22, 2011, CFBank was required to develop individual written specific workout plans for each adversely classified asset or real estate owned of $500,000 or greater, and must monitor and document the status of each problem asset and workout plan quarterly. CFBank must provide the Regulator a copy of each |

10

Table of Contents

| report documenting the status of the problem asset and workout plans on a quarterly basis. CFBank is complying with this requirement. |

| • | By July 31, 2011, the Board of Directors of CFBank was required to develop and submit for Regulator comment a written management succession plan. The Board of Directors of CFBank has received an extension of this deadline to January 31, 2012. |

| • | CFBank must submit to the Regulator a weekly written assessment of its current liquidity position. By June 24, 2011, CFBank was required to revise its liquidity and funds management policy to address all corrective actions related to liquidity and funds management noted in the latest Report of Examination by the Regulator. This policy was required to include a contingency funding plan. The revised policy was submitted to the Regulator for comment by June 24, 2011. This policy was adopted and is being adhered to. CFBank has not yet been notified by the Regulator that the policy is acceptable. [Status] |

| • | By June 24, 2011, CFBank was required to ensure that all violations of law and/or regulation noted in the latest Report of Examination by the Regulator are corrected and that adequate policies, procedures and systems are established or revised and implemented to prevent future violations. All violations have been corrected and policies and systems have been revised to prevent future violations. |

| • | The Board of Directors must cause to be prepared a quarterly tracking report to monitor compliance with the CFBank Cease and Desist Order. The Board of Directors must certify that each director has reviewed the report and must document any corrective actions taken. The tracking report and Board of Directors certification must be submitted to the Regulator. This is being done as required. |

| • | CFBank may not increase its total assets during any quarter in excess of an amount equal to interest credited on deposits during the prior quarter without the prior written non-objection of the Regulator. |

| • | CFBank may not accept, renew or roll over any brokered deposit without a specific waiver from the FDIC. CFBank received one limited waiver from the FDIC, which expired on September 20, 2011, and requested and received a second limited waiver, which expires on December 19, 2011. CFBank expects to request a third waiver. |

| • | CFBank may not declare or pay dividends or make any other capital distributions without the prior written approval of the Regulator. |

| • | CFBank may not enter into, renew, extend or revise any contractual arrangement relating to compensation or benefits for any senior executive officer or director unless prior written notice is provided to the Regulator. |

| • | CFBank must comply with the Regulator prior notification requirements for changes in directors and senior executive officers. |

| • | CFBank may not make any “golden parachute payments” unless CFBank has complied with 12 C.F.R. Part 359. |

| • | CFBank may not enter into any arrangement or contract with a third party service provider that is significant to the overall operation or financial condition of CFBank or outside the normal course of business, without the written non-objection of the Regulator. |

CFC Cease and Desist Order. The CFC Cease and Desist Order requires CFC to take several actions, including, but not limited to:

| • | By June 30, 2011, CFC was required to submit to the Regulator a written capital plan to enhance the consolidated capital of CFC. The plan must cover the period from July 1, 2011 through December 31, 2013. |

11

Table of Contents

| The plan must include: (i) a ratio of tangible capital to tangible assets established by the Board of Directors commensurate with CFC’s consolidated risk profile; (ii) specific plans to reduce the risks to CFC from current debt levels and debt service requirements; (iii) quarterly cash flow projections for CFC on a stand alone basis that identify both the expected sources and uses of funds; (iv) quarterly pro forma consolidated and unconsolidated CFC balance sheets and income statements demonstrating CFC’s ability to attain and maintain the minimum tangible equity capital ratios established by the Board of Directors; (v) detailed scenarios to stress-test the tangible capital targets; and (vi) detailed descriptions of all relevant assumptions and projections along with supporting documentation. This plan has been submitted as required and approved by the Regulator. |

| • | Upon written notice of non-objection from the Regulator, CFC must implement and adhere to the plan. |

| • | CFC must notify the Regulator of any material negative event affecting CFC within five days of the event. |

| • | By December 31, 2011 and each December 31 thereafter, the plan must be updated to incorporate CFC’s budget and cash flow projections for the next two years. |

| • | Within 45 days after the end of each quarter following implementation of the plan, the Board of Directors must review written quarterly variance reports from plan projections and document this review and any remedial action in CFC’s minutes of the meeting of the Board of Directors. Each variance report must be provided to the Regulator. This is being done as required. |

| • | CFC shall not declare or pay any cash dividends or capital distributions on its stock or repurchase such shares without the prior written non-objection of the Regulator. |

| • | CFC shall not incur, issue, rollover, renew or pay interest or principal on any debt without the prior written non-objection of the Regulator. |

| • | CFC shall not enter into, renew, extend or revise any contractual arrangements related to compensation or benefits with any director or senior executive officer of CFC without first providing the Regulator prior written notice. |

| • | CFC shall not make any “golden parachute payment” unless it complies with 12 C.F.R. Part 359. |

| • | CFC shall comply with the Regulator’s prior notification requirements for changes in directors and senior executive officers. |

| • | The Board of Directors must cause to be prepared a quarterly tracking report to monitor compliance with the CFC Cease and Desist Order. The Board of Directors must certify that each director has reviewed the report and must document any corrective actions taken. The tracking report and Board of Directors certification must be submitted to the Regulator. |

The CFC and CFBank Cease and Desist Orders will remain in effect until terminated, modified or suspended by the Regulator. In the standby purchase agreements, a condition to the obligation of the Standby Purchasers to purchase $5.0 million of common stock is the elimination of certain requirements contained in the CFC and CFBank Cease and Desist Orders. See “The Rights Offering—Standby Commitment—Conditions to Closing.”

Compliance with Cease and Desist Orders. We have taken such actions as we believe are necessary to comply with all requirements of the CFC and CFBank Cease and Desist Orders which are currently effective and are continuing to work toward compliance with the provisions of the CFC and CFBank Cease and Desist Orders having future compliance dates. Although we did not comply with the higher capital ratio requirements by the September 30, 2011 required date, based on informal discussions with our Regulators and due to the pendency of the stock offering, management does not expect that any additional material restrictions or penalties will be imposed by Regulators as a result of not complying with the September 30, 2011 deadline, assuming we are able to raise sufficient capital in this stock offering.

12

Table of Contents

Failure to comply with the CFC and CFBank Cease and Desist Orders could result in the initiation of further regulatory enforcement action, including the imposition of further operating restrictions. Regulators could also instruct us to seek a merger partner. We have incurred, and expect to continue to incur, significant additional regulatory compliance expense in connection with the CFC and CFBank Cease and Desist Orders. For further information, see “Risk Factors—Risks Related to Our Business— We are subject to restrictions imposed by Cease and Desist Orders issued by the Regulators. We have incurred and expect to continue to incur significant additional regulatory compliance expense in connection with the Cease and Desist Orders. Failure to comply with the Cease and Desist Orders could result in additional enforcement action against us.”

Impact of Asset Growth and Brokered Deposit Restrictions. The regulatory restrictions on asset growth and brokered deposits have not materially impacted and, in the near future, are not expected to have a material impact on our operations or asset size. Our operations have been and are expected to continue to be focused on reducing nonperforming assets, which will reduce our asset size. Additionally, the prohibition on origination of nonresidential real estate loans and commercial loans will result in a reduction in our asset size. As our asset size decreases, brokered deposits are not expected to be needed to fund the lower level of assets. At September 30, 2011, CFBank had $56.4 million in brokered deposits with maturity dates from October 2011 through August 2016. At September 30, 2011, cash and unpledged securities totaled $65.1 million, which was sufficient to cover all brokered deposit maturities.

Proposed and Existing New Management and Directors

Since June 2010, significant changes have been made to the management team and upon completion of the stock offering, a new Chief Executive Officer, a new President and five new board members of CFC and CFBank are expected to be appointed. This proposed new management team has extensive experience in the banking industry, both with large financial institutions and community banks, and has deep business connections in the Columbus, Ohio market. Eloise L. Mackus, our chief executive officer, general counsel and secretary since May, 2010, is expected to remain with CFC and CFBank as general counsel and secretary and Therese A. Liutkus, our President, chief financial officer and treasurer since June, 2010, is expected to remain with CFC and CFBank as chief financial officer and treasurer.

Each proposed new director will be compensated at the same rate as all current directors of CFC and CFBank are compensated. There are no formal agreements or arrangements with the proposed new directors. Neither the proposed Chief Executive Officer, nor the proposed President will receive any employment or severance agreement. Each will receive a salary to be determined by the board of directors and will be eligible to participate in any bonus, pension, medical or other compensation and benefit plan generally available to our executive officers.

Proposed New Chairman. Following the completion of the stock offering, Robert E. Hoeweler is expected to serve as the Chairman of the Board of Directors of CFC and CFBank. Mr. Hoeweler is chief executive officer of a diverse group of companies owned by the Hoeweler family. The Hoeweler holdings include manufacturing, communication, distribution, business services and venture capital entities. Mr. Hoeweler has served on the boards of directors of one of the country’s largest privately owned waste and recycling companies since 1986 and a privately owned commercial bakery since 1988. Past board affiliations include Skipjack Financial Services from 1996-2009, a provider of payment processing services, which the Hoeweler family led from its inception through the sale to a super-regional banking company that is a global top five payment processor, and Winton Financial, Inc. from 1988-2004, a savings and loan holding company located in Cincinnati, Ohio, from its initial public offering in 1998 through its ultimate sale in 2005 to WesBanco, Inc. Mr. Hoeweler is a graduate of the University of Cincinnati.

Proposed New Chief Executive Officer. Timothy T. O’Dell is expected to serve as the Chief Executive Officer of CFC and CFBank following completion of the stock offering. Mr. O’Dell is currently the owner of the Chetwood Group, which provides advisory services to a number of privately held enterprises in construction, health care, real estate and professional services. Prior to founding Chetwood in 2003, Mr. O’Dell spent 22 years at Fifth Third Bank, and was a senior executive with Fifth Third’s Central Ohio operations for 12 of those years, concluding his tenure serving as President and Chief Executive Officer. For 10 of his years with Fifth Third – Central Ohio, Mr. O’Dell also served

13

Table of Contents

as a senior lender and managed its commercial banking and residential and commercial real estate divisions. Under Mr. O’Dell’s supervision, Fifth Third’s Central Ohio division grew by $4 billion in deposits and $5 billion in loans from organic growth and through strategic acquisitions. Mr. O’Dell serves on the board of the Columbus Chamber of Commerce and The Ohio State University Medical Center, and he was a founding investor in the Ohio TechAngel Venture Fund. Mr. O’Dell is a graduate of Marshall University and received an MBA from Xavier University.

Proposed New President. Following completion of the stock offering Thad R. Perry is expected to serve as the President of CFC and CFBank. Mr. Perry was a Senior Partner with Accenture for over 30 years where he was involved in consulting, transaction structuring, and management of operations. He operated the firm’s Columbus, Ohio practice and developed its regulated industries practice. Mr. Perry also obtained considerable international experience during his time at Accenture. From 1988 through 1998, Mr. Perry managed Accenture’s German, Austrian and Swiss practices, which accounted for nearly $1 billion in gross revenues. He was also the Chief Operating Officer of Western Europe operations, and served on Accenture’s European Management Board and the Global Strategic Planning, Management, Markets, Executive, Outsourcing, and Technology Committees. He was also heavily involved in directing the firm’s strategy and mobilization initiatives associated with East Europe, and supervised ongoing operations there. His experiences in banking include the transformation of both the technical and business processes for credit card, internet banking and security, stock and trading exchanges, international banking and customer relationship management. Mr. Perry has an engineering degree and MBA from The Ohio State University, and has been honored as a Distinguished Alumnus from both colleges. Mr. Perry is also a Certified Public Accountant (inactive).

Proposed New Directors. Subject to receipt of approvals of our Regulators, we have agreed to provide the Standby Purchasers the right to designate five candidates for appointment to the board of directors of CFC. In addition to Timothy T. O’Dell, Thad R. Perry and Robert E. Hoeweler, we currently expect the director designees to be James Howard Frauenberg, II and Donal Malenick.

James Howard Frauenberg, II is the principal owner of Addison Holding, LLC which manages investments of private individuals and has been active in opening new franchises for two retail chains, Five Guys and Flip Flops. Mr. Frauenberg was a senior officer with Check Smart Financial in Dublin, Ohio from 1995 to 2008, when he resigned.

Donal Malenick was chief executive officer of Columbus Steel Castings from 2003 through 2008. Prior to that, Mr. Malenick was president of Worthington Steel from 1976 to 1999. Mr. Malenick is a board member of Max and Ermas Restaurants of Columbus, Ohio and was a member of KeyBank’s advisory board from 2001 to 2005. [Update status since 2008]

New Senior Commercial Banking Officer. Timothy R. Fitzwater joined CFBank in June 2010 as Senior Commercial Officer. Prior to joining CFBank, he had been retired for four years after a 36 year career with National City Bank (now PNC), rising to President of the Northeast Region headquartered in Akron. This region encompassed the cities of Akron, Canton, Youngstown, Niles, Warren and smaller cities along the Ohio River. The banks in this region had approximately $3 billion in assets and a commercial lending portfolio of approximately $1 billion.

New Head of Commercial Loan Workout. In November 2010, Kemper Allison was promoted to Vice President, Commercial Loan Workout of CFBank. Mr. Allison joined CFBank in February 2010, after having served as senior vice president and chief lending officer with Advantage Bank in Worthington, Ohio for nearly eight years. He had held positions of increasing responsibility over the prior 14 years, beginning with Bank One, Akron, N.A. and progressing to State Savings Bank and others in the Columbus area.

New Senior Credit Officer. In November 2010, Keith Anderson was promoted to Senior Credit Officer of CFBank. Mr. Anderson has been with CFBank since June 2005, having previously served as senior credit officer for over six years with Champaign National Bank in Bath, Ohio. Prior to that, he had been the senior credit officer with Summit Bank, headquartered in Fairlawn, Ohio for six years.

14

Table of Contents

Business Strategy of Our Proposed and Existing New Management Team