UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

(Mark One)

For the fiscal year ended December 31 , 2021

OR

Commission file number 1-14569

PLAINS ALL AMERICAN PIPELINE, L.P.

(Exact name of registrant as specified in its charter)

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |||||||

| (Address of principal executive offices) | (Zip Code) | |||||||

Registrant’s telephone number, including area code: (713 ) 646-4100

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Trading Symbol(s) | Name of Each Exchange on Which Registered | ||||||||||||

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☑ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☑

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☑ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Accelerated filer ☐ | ||||||||

Non-accelerated filer ☐ | Smaller reporting company | |||||||

Emerging growth company | ||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☑

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☑

The aggregate market value of the approximately 467.6 million Common Units held by non-affiliates of the registrant (treating all executive officers and directors of the registrant and holders of 10% or more of the Common Units outstanding, for this purpose, as if they are affiliates of the registrant) on June 30, 2021 was approximately $5.3 billion, based on a closing price of $11.36 per Common Unit as reported on the Nasdaq Global Select Market on such date.

As of February 22, 2022, there were 705,043,477 Common Units outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

PLAINS ALL AMERICAN PIPELINE, L.P. AND SUBSIDIARIES

FORM 10-K—2021 ANNUAL REPORT

Table of Contents

| Page | ||||||||

2

FORWARD-LOOKING STATEMENTS

All statements included in this report, other than statements of historical fact, are forward-looking statements, including but not limited to statements incorporating the words “anticipate,” “believe,” “estimate,” “expect,” “plan,” “intend” and “forecast,” as well as similar expressions and statements regarding our business strategy, plans and objectives for future operations. The absence of such words, expressions or statements, however, does not mean that the statements are not forward-looking. Any such forward-looking statements reflect our current views with respect to future events, based on what we believe to be reasonable assumptions. Certain factors could cause actual results or outcomes to differ materially from the results or outcomes anticipated in the forward-looking statements. The most important of these factors include, but are not limited to:

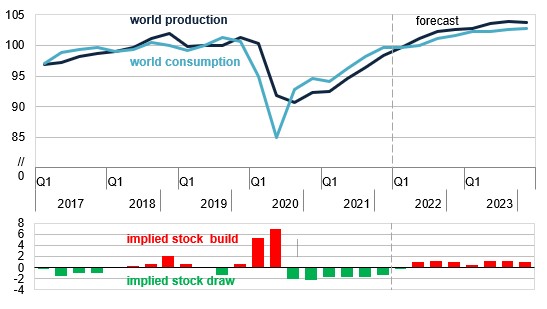

•declines in global crude oil demand and crude oil prices (whether due to the COVID-19 pandemic, future pandemics or other factors) that correspondingly lead to a significant reduction of North American crude oil and natural gas liquids (“NGL”) production (whether due to reduced producer cash flow to fund drilling activities or the inability of producers to access capital, or both, the unavailability of pipeline and/or storage capacity, the shutting-in of production by producers, government-mandated pro-ration orders, or other factors), which in turn could result in significant declines in the actual or expected volume of crude oil and NGL shipped, processed, purchased, stored, fractionated and/or gathered at or through the use of our assets and/or the reduction of commercial opportunities that might otherwise be available to us;

•the effects of competition and capacity overbuild in areas where we operate, including downward pressure on rates and margins, contract renewal risk and the risk of loss of business to other midstream operators who are willing or under pressure to aggressively reduce transportation rates in order to capture or preserve customers;

•negative societal sentiment regarding the hydrocarbon energy industry and the continued development and consumption of hydrocarbons, which could influence consumer preferences and governmental or regulatory actions that adversely impact our business;

•unanticipated changes in crude oil and NGL market structure, grade differentials and volatility (or lack thereof);

•general economic, market or business conditions in the United States and elsewhere (including the potential for a recession or significant slowdown in economic activity levels, the risk of persistently high inflation and continued supply chain issues, the impact of coronavirus variants on demand and growth, and the timing, pace and extent of economic recovery) that impact (i) demand for crude oil, drilling and production activities and therefore the demand for the midstream services we provide, and (ii) commercial opportunities available to us;

•the impact of current and future laws, rulings, governmental regulations, executive orders, trade policies, accounting standards and statements, and related interpretations, including legislation, executive orders or regulatory initiatives that arise out of pandemic related concerns, that prohibit, restrict or regulate hydraulic fracturing or that prohibit the development of oil and gas resources and the related infrastructure on lands dedicated to or served by our pipelines;

•environmental liabilities, litigation or other events that are not covered by an indemnity, insurance or existing reserves;

•loss of key personnel and inability to attract and retain new talent;

•fluctuations in refinery capacity in areas supplied by our mainlines and other factors affecting demand for various grades of crude oil and NGL and resulting changes in pricing conditions or transportation throughput requirements;

•the availability of, and our ability to consummate, divestitures, joint ventures, acquisitions or other strategic opportunities;

•the successful operation of joint ventures and joint operating arrangements we enter into from time to time, whether relating to assets operated by us or by third parties, and the successful integration and future performance of acquired assets or businesses;

•maintenance of our credit rating and ability to receive open credit from our suppliers and trade counterparties;

•the occurrence of a natural disaster, catastrophe, terrorist attack (including eco-terrorist attacks) or other event that materially impacts our operations, including cyber or other attacks on our electronic and computer systems;

•weather interference with business operations or project construction, including the impact of extreme weather events or conditions;

3

•significant under-utilization of our assets and facilities;

•the refusal or inability of our customers or counterparties to perform their obligations under their contracts with us (including commercial contracts, asset sale agreements and other agreements), whether justified or not and whether due to financial constraints (such as reduced creditworthiness, liquidity issues or insolvency), market constraints, legal constraints (including governmental orders or guidance), the exercise of contractual or common law rights that allegedly excuse their performance (such as force majeure or similar claims) or other factors;

•our inability to perform our obligations under our contracts, whether due to non-performance by third parties, including our customers or counterparties, market constraints, third-party constraints, supply chain issues, legal constraints (including governmental orders or guidance), or other factors or events;

•the incurrence of costs and expenses related to unexpected or unplanned capital expenditures, third-party claims or other factors;

•disruptions to futures markets for crude oil, NGL and other petroleum products, which may impair our ability to execute our commercial or hedging strategies;

•failure to implement or capitalize, or delays in implementing or capitalizing, on investment capital projects, whether due to permitting delays, permitting withdrawals or other factors;

•shortages or cost increases of supplies, materials or labor;

•tightened capital markets or other factors that increase our cost of capital or limit our ability to obtain debt or equity financing on satisfactory terms to fund additional acquisitions, investment capital projects, working capital requirements and the repayment or refinancing of indebtedness;

•the amplification of other risks caused by volatile financial markets, capital constraints, liquidity concerns and inflation;

•the use or availability of third-party assets upon which our operations depend and over which we have little or no control;

•the currency exchange rate of the Canadian dollar to the United States dollar;

•inability to recognize current revenue attributable to deficiency payments received from customers who fail to ship or move more than minimum contracted volumes until the related credits expire or are used;

•increased costs, or lack of availability, of insurance;

•the effectiveness of our risk management activities;

•fluctuations in the debt and equity markets, including the price of our units at the time of vesting under our long-term incentive plans;

•risks related to the development and operation of our assets; and

•other factors and uncertainties inherent in the transportation, storage, terminalling and marketing of crude oil, as well as in the processing, transportation, fractionation, storage and marketing of NGL.

Other factors described herein, as well as factors that are unknown or unpredictable, could also have a material adverse effect on future results. Please read Item 1A. “Risk Factors.” Except as required by applicable securities laws, we do not intend to update these forward-looking statements and information.

4

PART I

Items 1 and 2. Business and Properties

General

Plains All American Pipeline, L.P. is a publicly traded Delaware limited partnership. Our common units are listed on the Nasdaq Global Select Market (“Nasdaq”) under the ticker symbol “PAA.” Our business model integrates large-scale supply aggregation capabilities with the ownership and operation of critical midstream infrastructure systems that connect major producing regions to key demand centers and export terminals. As one of the largest midstream service providers in North America, we own an extensive network of pipeline transportation, terminalling, storage and gathering assets in key crude oil and natural gas liquids (“NGL”) producing basins (including the Permian Basin) and transportation corridors and at major market hubs in the United States and Canada. Our assets and the services we provide are primarily focused on crude oil and NGL.

Our business is based on the fundamental thesis that hydrocarbons are essential to the security and advancement of human quality of life and will continue to play a major long-term role in the world economy. We further believe that midstream energy infrastructure provides a critical link between energy supply and demand, and is fundamental to the maintenance and advancement of our modern-day standard of living. Acknowledging the need for multiple forms of energy to meet growing world-wide demand, we believe absolute hydrocarbon demand will increase over time, driven by global population growth and a desire to improve quality of life in lesser developed countries throughout the world. Furthermore, we believe existing energy infrastructure will play a critical role in supporting emerging energy and energy transition initiatives. As a result, we believe that midstream energy infrastructure will remain critical and valuable.

Our operations are conducted directly and indirectly through our primary operating subsidiaries, which comprise 100% of the assets and operations affiliated with Plains and its subsidiaries. As used in this Form 10-K and unless the context indicates otherwise, the terms “Partnership,” “Plains,” “PAA,” “we,” “us,” “our,” “ours” and similar terms refer to Plains All American Pipeline, L.P. and its subsidiaries.

5

Organizational Structure

The diagram below shows our organizational structure as of December 31, 2021 in a summarized format:

6

(1)Each Class C share represents a non-economic limited partner interest in PAGP. The number of Class C shares that we own is equal to the number of outstanding common units and Series A Preferred units (“Common Unit Equivalents”) that are entitled to vote, pro rata with the holders of PAGP Class A and Class B shares, for the election of eligible PAGP GP directors. The Class C shares function as a “pass-through” voting mechanism through which we vote at the direction of and as proxy for our common unitholders and Series A preferred unitholders in such director elections. Common units held by AAP and Series B preferred units are not entitled to vote in the election of directors.

(2)The Partnership holds (i) direct and indirect ownership interests in consolidated operating subsidiaries including, but not limited to, Plains Marketing, L.P., Plains Pipeline, L.P., Plains Midstream Canada ULC (“PMCULC”), Plains Oryx Permian Basin LLC (the “Permian JV”) and Red River Pipeline Company LLC (“Red River”) and (ii) indirect equity interests in unconsolidated entities including, but not limited to, BridgeTex Pipeline Company, LLC, Cactus II Pipeline LLC, Capline Pipeline Company LLC, Diamond Pipeline LLC, Eagle Ford Pipeline LLC, Eagle Ford Terminals Corpus Christi LLC, Saddlehorn Pipeline Company, LLC, White Cliffs Pipeline, L.L.C. and Wink to Webster Pipeline LLC.

Business Strategy

Our principal business strategy is to provide competitive and efficient midstream infrastructure and logistics services to producers, refiners and other customers. We strive to address regional supply and demand imbalances for crude oil and NGL in the United States and Canada by combining the strategic location and capabilities of our transportation, terminalling, storage, processing and fractionation assets with our commercial expertise. We intend to execute our strategy by:

•Focusing on operational excellence, continuous improvement and running a safe, reliable, environmentally and socially responsible operation;

•Using our well positioned network of midstream infrastructure in conjunction with our commercial capabilities to provide our customers with market access, flexibility and value chain solutions, capture market opportunities, address physical market imbalances, mitigate risks and generate sustainable cash flow and margin;

•Optimizing our asset portfolio and operations (including for emerging energy opportunities) to maximize returns on invested capital; and

•Pursuing a balanced, long-term financial strategy that is focused on maintaining an investment grade credit profile and enhancing financial flexibility by making disciplined capital allocation decisions.

We believe successful execution of this strategy will enable us to generate sustainable earnings and cash flow, and will position us to reduce leverage and maintain an investment grade credit profile while increasing returns to equity holders over time.

7

Competitive Strengths

We believe that the following competitive strengths position us to successfully execute our principal business strategy:

•We own a strategically located, geographically diverse and interconnected large-scale asset base that provides operational flexibility and commercial optionality. The majority of our primary transportation assets are in crude oil service, are located in well-established crude oil producing regions (with our largest asset presence in the Permian Basin) and other transportation corridors and are connected, directly or indirectly, with our terminals and facilities assets. The majority of our terminals and facilities assets are located at major trading locations and premium markets that serve as gateways to major North American refinery and distribution markets and key export terminals where we have strong business relationships. In addition, our pipeline, rail, truck and storage assets provide our customers and us with significant flexibility and optionality to satisfy demand and balance markets, and participate in emerging energy opportunities.

•Our full-service integrated model and long-term focus attracts broad, diverse and high-quality customer base that supports sustainable fee-based cash flow generation. Our strategically located and interconnected asset base enables us to provide our customers with a wide variety of services, including supply aggregation, quality segregation, flow assurance and market access. We focus on building long-term relationships and alignment of interests with our customers. We believe this approach has helped us build a high-quality portfolio of customers and contracts (including long-term, third-party transportation contracts and acreage dedication contracts) that provide long-term volume support for our assets and, in turn, support long-term fee-based cash flow generation from our assets.

•We possess specialized crude oil and NGL market knowledge. We believe our business relationships with participants in various phases of the crude oil and NGL distribution chain, from producers to refiners, as well as our own industry expertise (including our knowledge of North American crude oil and NGL flows), provide us with extensive market insight and an understanding of the North American physical crude oil and NGL markets that enables us to provide value chain solutions for our customers.

•Our merchant activities provide us with the opportunity to realize incremental margins. We believe the variety of our merchant activities provides us with a low-risk opportunity to generate incremental margin, the amount of which may vary depending on market conditions (such as differentials and certain competitive factors).

•We have the financial, strategic and technical skills needed to execute strategic transactions that support our business and financial objectives, including joint ventures, joint ownership arrangements, acquisitions and divestitures. Since 2016, we have consummated over 10 joint venture and/or joint ownership arrangements, including the Permian JV formation completed in October 2021, and completed over $4.5 billion of divestitures of non-core assets and/or strategic sales of partial interests in selected assets. In addition, although acquisitions and capital projects are not the primary focus of our current capital allocation priorities, since the completion of our initial public offering in 1998, we have completed and integrated over 90 acquisitions with an aggregate purchase price of approximately $13.7 billion and implemented investment capital projects totaling approximately $16.9 billion.

•We have an experienced management team whose interests are aligned with those of our unitholders. Our executive management team has an average of 30+ years of experience spanning across all sectors of the energy industry, as well as investment banking, and an average of 15 years with us or our predecessors and affiliates. In addition, through their ownership of common units and grants of phantom units, our management team has a vested interest in our continued success.

8

Financial Strategy

Targeted Credit Profile

We believe that a major factor in our continued success is our ability to maintain significant financial flexibility. An important part of our financial strategy is our commitment to maximizing free cash flow, continuing to reduce leverage and increasing cash returned to our unitholders.

In that regard, we intend to maintain a credit profile that we believe is consistent with investment grade credit ratings. We target a credit profile with the following attributes:

•a leverage multiple averaging between 3.75x to 4.25x, which is calculated as total debt plus 50% of preferred units, divided by Adjusted EBITDA attributable to PAA (See Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Results of Operations—Non-GAAP Financial Measures” for our definition of Adjusted EBITDA and a reconciliation to Adjusted EBITDA attributable to PAA.);

◦this is roughly equivalent to a long-term debt-to-Adjusted EBITDA attributable to PAA multiple of between 3.0x and 3.5x;

•an average long-term debt-to-total capitalization ratio of approximately 50% or less;

•an average total debt-to-total capitalization ratio of approximately 60% or less; and

•an average Adjusted EBITDA-to-interest coverage multiple of approximately 3.3x or better.

At December 31, 2021, our publicly-traded senior notes comprised approximately 99% of our long-term debt. Additionally, we also routinely incur short-term debt primarily in connection with our merchant activities that involve the simultaneous purchase and forward sale of crude oil and NGL. The crude oil and NGL purchased in these transactions are volumetrically hedged. These borrowings are self-liquidating as they are repaid with sales proceeds. We also incur short-term debt to fund New York Mercantile Exchange (“NYMEX”) and Intercontinental Exchange (“ICE”) margin requirements. In certain market conditions, these routine short-term debt levels may increase above baseline levels. Similar to our working capital borrowings, these borrowings are self-liquidating. We do not consider the working capital borrowings or margin requirements associated with these activities to be part of our long-term capital structure.

Values and Sustainability

Our Core Values include Safety and Environmental Stewardship, Accountability, Ethics and Integrity and Respect and Fairness. Our Code of Business Conduct sets forth the ways in which these Core Values govern how we conduct ourselves and engage in business relationships. Our approach to sustainability involves integrating prudent environmental, social and governance (“ESG”) practices throughout the organization with a focus on transparency and building trust among stakeholders, managing operating and business risks and minimizing environmental and climate-related impacts, and levering our people, assets and systems to maximize long-term value for our stakeholders. The tenets of sustainability align with our values, underpin our business strategy and offer a framework to measure and report our progress. Annual environmental, safety and operational performance targets help us measure progress toward meeting our sustainability objectives. Performance against such targets is also a factor in determining annual bonus compensation for our employees, which further incentivizes desired behaviors and outcomes. In addition, in 2021 we established a new Health, Safety, Environmental and Sustainability (“HSES”) Board Committee to provide additional oversight and perspectives with respect to HSES and ESG matters. Additional information regarding our Core Values and our commitment to environmental and social responsibility is available in the Sustainability section of our website. See “—Available Information” below.

9

Description of Segments and Associated Assets

Our business activities are conducted through two segments—Crude Oil and Natural Gas Liquids (“NGL”). Prior to the fourth quarter of 2021, our reporting segments were Transportation, Facilities and Supply and Logistics. The change in our segments is reflective of a change in how our Chief Operating Decision Maker (“CODM”) (our Chief Executive Officer) views our business and stems primarily from (i) a multi-year transition in the midstream energy industry driven by increased competition that has reduced the stand alone earnings opportunities of our supply and logistics activities such that those activities now primarily support our effort to increase the utilization of our Crude Oil and NGL assets and (ii) internal changes regarding the oversight and reporting of our assets and related results of operations. See Note 20 to our Consolidated Financial Statements for additional information.

We have an extensive network of pipeline transportation, terminalling, storage and gathering assets in key crude oil and NGL producing basins and transportation corridors and at major market hubs in the United States and Canada. The map and descriptions below highlight our more significant assets (including certain assets under construction or development) as of December 31, 2021. Unless the context requires otherwise, references herein to our “facilities” includes all of the pipelines, terminals, storage and other assets owned by us.

Following is a description of the activities and assets for each of our segments.

10

Crude Oil Segment

Crude Oil Market and Business Overview

Crude oil is a global commodity that serves as feedstock for many of the world’s essential refined products such as transportation fuels (gasoline, diesel, jet fuel) and heating oil, among others. While commodities are typically considered unspecialized, mass-produced and fungible, crude oil is neither unspecialized nor fungible. The crude slate available to North American and world-wide refineries consists of a substantial number of different grades and varieties. Each crude oil grade has distinguishing physical properties. For example, specific gravity (generally referred to as light or heavy), sulfur content (generally referred to as sweet or sour) and metals content, along with other characteristics, collectively result in varying economic attributes of a particular grade or type of crude oil. In many cases, these factors result in the need for such grades to be batched or segregated in the transportation and storage processes, blended to precise specifications or adjusted in value.

The lack of fungibility of the various grades of crude oil creates logistical transportation, terminalling and storage challenges and inefficiencies associated with regional volumetric supply and demand imbalances. These logistical inefficiencies are created as certain qualities of crude oil are indigenous to particular regions or countries. Also, each refinery has a distinct configuration of process units designed to handle particular grades of crude oil. The relative yields and the cost to obtain, transport and process the crude oil, combined with the value of finished goods created, drive a refinery’s choice of feedstock.

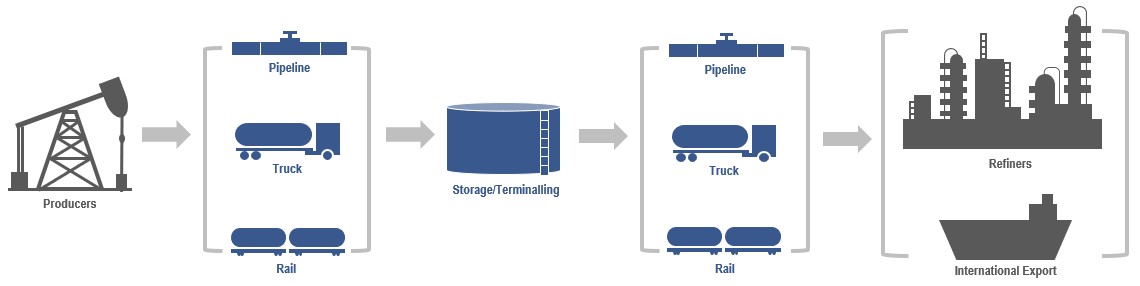

Our business model integrates large-scale supply aggregation capabilities with the ownership and operation of critical infrastructure systems that connect major producing regions (supply) to key demand centers (refineries) and export terminals. Our assets and our business strategy are designed to serve our producer and refiner customers by addressing regional crude oil supply and demand imbalances that exist in the United States and Canada. The nature and extent of supply and demand imbalances change from time to time as a result of a variety of factors, including global demand for exports; regional production declines and/or increases; refinery expansions, modifications and shut-downs; available transportation and storage capacity; and government mandates and related regulatory factors.

Our Crude Oil segment operations generally consist of gathering and transporting crude oil using pipelines, gathering systems, trucks and at times on barges or railcars, in addition to providing terminalling, storage and other facilities-related services utilizing our integrated assets across the United States and Canada. Our assets serve third parties and are also supported by our merchant activities. Our merchant activities include the purchase of crude oil supply and the movement of this supply on our assets to sales locations, including our terminals, third-party connecting carriers, regional hubs or to refineries. Our merchant activities are subject to our risk-management policies and may include the use of derivative instruments to hedge our exposure. Crude oil sales arrangements are also subject to our credit policies.

The figure below provides an illustrative and simplified overview of the assets and activities associated with our Crude Oil segment:

With respect to the transportation assets in this segment, we primarily generate revenue through a combination of tariffs, pipeline capacity agreements and other transportation fees. With respect to our facilities assets in this segment, we primarily generate revenue through a combination of month-to-month and multi-year agreements and arrangements which include (i) storage, throughput and loading/unloading fees at our crude oil facilities, and (ii) fees from condensate processing services. We also generate significant revenue through our commercial and merchant activities that supply volumes to our transportation and storage assets, although such activities are generally low margin.

11

Crude Oil Segment Assets Overview

As of December 31, 2021, in this segment we employed a variety of owned or, to a much lesser extent, leased long-term physical transportation and facilities assets throughout the United States and Canada, including approximately:

•18,300 miles of active crude oil transportation pipelines and gathering systems, and an additional 110 miles of pipelines that support our crude oil storage and terminalling facilities;

•74 million barrels of commercial crude oil storage capacity at our terminalling and storage locations;

•38 million barrels of active, above-ground tank capacity used to facilitate pipeline throughput and help maintain product quality segregation;

•four marine facilities in the United States;

•a condensate processing facility located in the Eagle Ford area of South Texas with an aggregate processing capacity of 120,000 barrels per day;

•seven crude oil rail terminals and 2,100 crude oil railcars; and

•640 trucks and 1,275 trailers.

Additionally, our assets include the linefill associated with our commercial activities, including approximately:

•15 million barrels of crude oil linefill in pipelines and tanks owned by us; and

•3 million barrels of crude oil utilized as linefill in pipelines owned by third parties or otherwise required as long-term inventory.

Crude Oil Pipelines

The following table presents active miles and average daily volumes for our crude oil pipelines in the United States and Canada as of December 31, 2021, grouped by geographic location:

| Region | Ownership Percentage | Approximate System Miles (1) | 2021 Average Net Barrels per Day (2) | |||||||||||||||||

| (in thousands) | ||||||||||||||||||||

| Permian Basin: | ||||||||||||||||||||

Gathering pipelines (3) | 40% - 65% | 4,895 | 1,643 | |||||||||||||||||

Intra-basin pipelines (4) | 50% - 100% | 815 | 1,740 | |||||||||||||||||

Long-haul pipelines (4) | 16% - 100% | 1,620 | 1,029 | |||||||||||||||||

| 7,330 | 4,412 | |||||||||||||||||||

| South Texas/Eagle Ford | 50% - 100% | 825 | 326 | |||||||||||||||||

| Mid-Continent | 50% - 100% | 2,485 | 455 | |||||||||||||||||

| Gulf Coast | 54% - 100% | 1,170 | 158 | |||||||||||||||||

| Rocky Mountain | 21% - 100% | 3,370 | 332 | |||||||||||||||||

| Western | 100% | 545 | 236 | |||||||||||||||||

| Canada | 100% | 2,575 | 286 | |||||||||||||||||

| Total | 18,300 | 6,205 | ||||||||||||||||||

(1)Includes total mileage of pipelines in which we own less than 100%.

12

(2)Represents average daily volumes for the entire year attributable to our interest for pipelines owned by unconsolidated entities or through undivided joint interests. Average daily volumes are calculated as the total volumes (attributable to our interest) for the year divided by the number of days in the year. Volumes reflect tariff movements and thus may be included multiple times as volumes move through our integrated system. Volumes associated with acquisitions represent total volumes for the number of days we actually owned the assets divided by the number of days in the period.

(3)All of our gathering pipelines in the Permian Basin are owned by the Permian JV, a consolidated entity in which we own a 65% interest. The Permian JV has a 40% interest in an unconsolidated entity that owns one of the gathering pipelines in the Permian Basin.

(4)Includes pipelines operated by a third party.

A significant portion of our crude oil pipeline assets are interconnected and are operated as a contiguous system. The following descriptions are organized by type and geographic location and represent a selection of our most significant assets. Pipeline capacities throughout these descriptions are based on our reasonable estimate of volumes that can be delivered from origin to final destination on our pipeline systems. We report pipeline volumes based on the tariffs charged for individual movements, some of which may only utilize a certain segment of a pipeline system (i.e. two short-haul movements on a pipeline from point A to point B and another from point B to point C would double the pipeline tariff volumes on a particular system versus a single point A to point C movement). As a result, at times, our reported tariff barrel movements may exceed our total capacity.

Our crude oil pipelines are comprised of:

•gathering pipelines that move crude oil from wellhead or central battery connections to regional market hubs;

•intra-basin pipelines that are used as a hub system allowing for a significant amount of flexibility by creating connections between regional hub locations; and

•long-haul pipelines that move crude oil from (i) regional market hubs to major market hubs such as Cushing, Oklahoma or to export facilities, including our Corpus Christi terminal, or (ii) a refinery or other major market hubs, such as the Houston market.

Gathering Pipelines

Permian Basin. We operate approximately 4,900 miles of gathering pipelines in both the Midland Basin and the Delaware Basin that in aggregate represent approximately 3.7 million barrels per day of pipeline capacity. This gathering capacity includes pipeline capacity that delivers volumes to regional market hubs. Approximately 75% of the capacity of our gathering systems is in the Delaware Basin. All of our gathering pipelines in the Permian Basin are owned by the Permian JV, a consolidated entity in which we own a 65% interest.

South Texas/Eagle Ford. We own and operate various gathering systems in the Eagle Ford that connect into our Eagle Ford joint venture pipeline system that can deliver crude oil into markets in the Corpus Christi area, or to third-party pipelines with access to Houston area refiners.

Mid-Continent. We own and operate gathering pipelines that source crude oil from Western and Central Oklahoma and Southwest Kansas for transportation and delivery into our terminal facilities at Cushing, Oklahoma.

Rocky Mountain. We own and operate pipelines that provide gathering services in the Bakken and the Powder River Basin.

Western. We own and operate a pipeline in the San Joaquin Valley that gathers locally produced crude oil, which is then delivered via our Line 63 pipeline system and/or Line 2000 pipeline for transportation to Los Angeles area refiners.

Canada. We own and operate gathering systems that source crude oil from truck terminals and pipeline-connected facilities to deliver to the Enbridge Mainline system at our Kerrobert and Regina terminals in Saskatchewan.

13

Intra-basin Pipelines

Permian Basin. Our intra-basin pipeline system in the Permian Basin has a capacity of approximately 3.1 million barrels per day and connects gathering pipelines and truck injection volumes to our owned and operated as well as third-party mainline pipelines that transport crude oil to major market hubs. This interconnected pipeline system is designed to provide shippers flow assurance, flexibility and access to multiple markets. A majority of the intra-basin pipeline system is owned by the Permian JV, a consolidated entity in which we own a 65% interest.

Canada. We own and operate intra-basin pipelines with capacity of approximately 300,000 barrels per day that deliver crude from northern and southern Alberta to the Edmonton, Alberta market hub. These pipelines provide shippers with flexibility to access the Enbridge and TransMountain long-haul pipelines along with the Imperial Oil Refinery. In addition, we have one cross-border pipeline that has the flexibility to move up to 40,000 barrels per day of Canadian crude oil to our Rocky Mountain area long-haul pipelines.

Long-haul Pipelines

Permian Basin. We own interests in multiple long-haul pipeline systems that, on a combined basis, represent approximately 1.7 million barrels per day of currently operational takeaway capacity (net to our ownership interests) out of the Permian Basin to major market hubs in Corpus Christi and Houston, Texas and Cushing, Oklahoma. Below is a description of some of our most significant long-haul pipeline systems within the Permian Basin region.

Permian to Cushing/Mid-Continent

•Basin Pipeline (Permian to Cushing). We own an 87% undivided joint interest (“UJI”) in and are the operator of Basin Pipeline. Basin Pipeline has three primary origination locations: Jal, New Mexico; Wink, Texas; and Midland, Texas and, in addition to making intra-basin movements, serves as the primary route for transporting crude oil from the Permian Basin to Cushing, Oklahoma. Basin Pipeline also receives crude oil from a facility in southern Oklahoma which aggregates South Central Oklahoma Oil Province (SCOOP) production.

•Sunrise II Pipeline. We operate the Sunrise II Pipeline and, through a UJI arrangement, own an 80% UJI, which equates to 400,000 barrels of the capacity of the pipeline. Our Sunrise II Pipeline transports crude oil from Midland and Colorado City to connecting carriers at Wichita Falls.

Permian to Gulf Coast

•BridgeTex Pipeline (Permian to Houston). We own a 20% interest in the legal entity that owns the BridgeTex Pipeline. The pipeline, operated by a subsidiary of Magellan Midstream Partners, L.P., originates at Colorado City, Texas and extends to Houston, Texas. The BridgeTex pipeline has a capacity of 440,000 barrels per day and is capable of receiving supply from both our Basin and Midland South (formerly Sunrise) pipelines.

•Cactus Pipeline (Permian to Corpus Christi). We own and operate the Cactus Pipeline, which has a capacity of 390,000 barrels per day, originates at McCamey, Texas and extends to Gardendale, Texas. The Cactus Pipeline connects to our Eagle Ford joint venture pipeline system at Gardendale for access to the Corpus Christi, Texas market. Movements to Corpus Christi are made on a joint tariff with the Eagle Ford joint venture pipeline.

•Cactus II Pipeline (Permian to Corpus Christi). We own a 65% interest in the legal entity that owns the Cactus II Pipeline (“Cactus II”), which we operate. Cactus II is a Permian mainline system that extends directly to the Corpus Christi market, and has a capacity of 670,000 barrels per day.

•Wink to Webster Pipeline. We own a 16% interest in the legal entity that owns the Wink to Webster Pipeline (“W2W Pipeline”), which in turn owns 100% of certain segments of the W2W Pipeline and a 71% UJI in the segment from Midland, Texas to Webster, Texas. The W2W Pipeline originates in the Permian Basin in West Texas and transports crude oil to multiple destinations in the Houston and Galveston market areas. The pipeline system will provide approximately 1.5 million barrels per day of crude oil capacity (1.1 million barrels per day, net to the UJI interest) and is supported by long-term shipper commitments. Phase one of the pipeline system from Midland, Texas to Webster, Texas is currently in service. Phase two, which increases the pipeline system to 1.5 million barrels per day of capacity, was placed in service in the first quarter of 2022, at which time long-term shipper commitments became effective. The third phase of the project, which includes the segments from Wink,

14

Texas to Midland, Texas and from Webster, Texas to Baytown, Texas, has been deferred by the partners until the fourth quarter of 2023.

South Texas/Eagle Ford. We own a 50% interest in the legal entity that owns the Eagle Ford Pipeline through a joint venture with a subsidiary of Enterprise. We serve as the operator of the Eagle Ford Pipeline, which has a total capacity of approximately 660,000 barrels per day and connects Permian and Eagle Ford area production to Corpus Christi, Texas refiners and terminals. Additionally, the Eagle Ford Pipeline has connectivity to Houston, Texas via a connection with Enterprise’s pipeline at Lyssy, Texas.

Mid-Continent. We own and operate various pipeline systems that extend from our Cushing terminal in Oklahoma to various refineries and/or crude oil hubs. Below is a description of some of our most significant pipeline systems in the Mid-Continent region.

•Diamond Pipeline (Cushing to Memphis). We own a 50% interest in the legal entity that owns the Diamond Pipeline through a joint venture with Valero Energy Corporation (“Valero”). We operate the Diamond Pipeline, which extends from our Cushing Terminal to Valero’s refinery in Memphis, Tennessee. The Diamond Pipeline is underpinned by a long-term minimum volume commitment and currently has a total capacity of 200,000 barrels per day.

•Red River Pipeline (Cushing to Longview). We own 67% of the legal entity that owns the Red River Pipeline through a joint venture with Delek Logistics Partners, LP (“Delek”). The Red River Pipeline is an approximately 235,000 barrel per day capacity pipeline that extends from our Cushing Terminal in Oklahoma to Longview, Texas, where it connects with various pipelines. The Red River Pipeline is supported by long-term shipper commitments, and we serve as operator. The Red River JV has an approximate 69% UJI in the pipeline segment from Cushing to Hewitt and owns 100% of the segment of the pipeline extending from Hewitt to Longview.

Gulf Coast. We own an approximate 54% interest in the legal entity that owns the Capline Pipeline. Upon completion of its reversal project in 2021, the Capline Pipeline extends from Patoka, Illinois to various terminals in St. James, Louisiana. The Capline Pipeline is supported by long-term shipper commitments, and a subsidiary of Marathon Petroleum Corporation serves as the operator.

Rocky Mountain. Our pipeline systems in the Rocky Mountain region provide access to our terminal in Cushing, Oklahoma as well as other major market hubs. We own and operate the Bakken North pipeline system that accommodates bidirectional flow and can move crude oil from the Bakken to the Enbridge Mainline system at Regina, Saskatchewan or from the Enbridge Mainline system to our terminal in Trenton, North Dakota. We own a UJI in the Western Corridor pipeline system that extends from the Canadian border to our terminal in Guernsey, Wyoming. This pipeline system receives crude oil from our Rangeland Pipeline in Canada. In addition to these assets, our largest Rocky Mountain area systems include the following joint venture pipelines, both of which connect to our terminal in Cushing, Oklahoma.

•Saddlehorn Pipeline. We own a 30% interest in the legal entity that owns the Saddlehorn Pipeline which, through a UJI arrangement, owns 290,000 barrels per day of capacity in the Saddlehorn Pipeline. The pipeline extends from the Niobrara and Denver-Julesburg (“DJ”) Basin to Cushing and is operated by Magellan. The Saddlehorn Pipeline is supported by minimum volume commitments.

•White Cliffs Pipeline. We own an approximate 36% interest in the entity that owns the White Cliffs Pipeline system through a joint venture with three other partners. The White Cliffs Pipeline system consists of one crude oil pipeline with approximately 100,000 barrels per day of capacity that extends from the DJ Basin to Cushing, Oklahoma and one NGL pipeline with approximately 90,000 barrels per day of capacity that extends from the DJ Basin to a tie-in location with the Southern Hills Pipeline in Oklahoma. The NGL pipeline is supported by a long-term capacity lease and long-term throughput agreements. A subsidiary of Energy Transfer LP serves as the operator of the pipelines.

Western. We own and operate the Line 63 and Line 2000 pipelines in California. Line 2000 is a mainline system that has the capacity to transport approximately 110,000 barrels per day from the San Joaquin Valley to refineries and terminal facilities in the Los Angeles area. Line 63 is used as a gathering and distribution system. The pipeline gathers crude oil in the San Joaquin Valley for delivery to Line 2000 and local refiners. In the Los Angeles area, the Line 63 distribution lines are used to move crude oil from Line 2000 to local refiners.

15

Crude Oil Storage and Terminalling Facilities

Our largest crude oil terminals are located in key market hubs, including Cushing, Oklahoma, St. James, Louisiana, Midland, Texas and Patoka, Illinois, and have connectivity to all major inbound and outbound pipelines and other terminals at these hubs.

We are the largest provider of crude oil terminalling services in Cushing, Oklahoma, which is one of the largest physical trading hubs in the United States and is the delivery point for crude oil futures contracts traded on the NYMEX. Our Cushing Terminal has been designated by the NYMEX as an approved delivery location for crude oil delivered under the NYMEX light sweet crude oil futures contract.

Our Cushing terminal is connected to our long-haul pipelines from the Permian Basin and Rocky Mountain regions, as well as to our Mid-Continent region gathering pipelines. Additionally, the terminal supplies crude oil to all of our joint venture, Mid-Continent region long-haul pipelines.

Our Midland terminal has access to all of the Permian JV gathering pipelines, either through direct connections, or through the Permian JV intra-basin pipelines. Likewise, the terminal is also either directly connected, or connected through the Permian JV intra-basin pipelines to all of our Permian Basin long-haul pipelines.

Our terminals at Corpus Christi, Texas, St. James, Louisiana and Mobile, Alabama all have docks and the capacity to export crude oil. In addition, our St James terminal has a rail unload facility that can move crude from rail cars to pipelines that service local refiners, or to our dock for export.

Our Patoka and St. James terminals are both connected to Capline pipeline, and the terminals will be a receipt and destination facility, respectively.

Our crude oil terminals have significant flexibility and operational capabilities, including large-scale multi-grade handling and segregation capabilities and multiple marine transportation loading and unloading capabilities. The table below presents our commercial crude oil storage capacity by location as of December 31, 2021:

| Crude Oil Storage Facilities | Total Capacity (MMBbls) | |||||||

| Cushing | 27 | |||||||

| St. James | 15 | |||||||

| Patoka | 7 | |||||||

| Permian Basin Area | 8 | |||||||

| Mobile and Ten Mile | 5 | |||||||

Corpus Christi (1) | 1 | |||||||

Other (2) | 11 | |||||||

| 74 | ||||||||

(1)We own 50% of this storage capacity through our investment in Eagle Ford Terminals Corpus Christi LLC.

(2)Amount includes approximately 2 million barrels of storage capacity associated with our crude oil rail terminal operations.

Condensate Processing Facility

Our Gardendale condensate processing facility is located in La Salle County, Texas. The facility stabilizes condensate that is primarily sourced from our Eagle Ford area gathering systems. The stabilized condensate is delivered to a third-party pipeline that delivers into Mont Belvieu, Texas. The facility has a total processing capacity of 120,000 barrels per day and usable storage capacity of 160,000 barrels. Throughput at the Gardendale processing facility is supplied by long-term commitments from producers.

16

Crude Oil Rail Facilities

We own crude oil rail loading facilities located at or near Carr, Colorado; Tampa, Colorado; Manitou, North Dakota; and Kerrobert, Saskatchewan. We own crude oil rail unloading facilities in St. James, Louisiana; Yorktown, Virginia; and Bakersfield, California. Our crude oil rail facilities have aggregate loading and unloading capacity of 264,000 and 350,000 barrels per day, respectively.

Natural Gas Liquids (“NGL”) Segment

NGL Market and Business Overview

NGL primarily includes ethane, propane, normal butane, iso-butane and natural gasoline, and is derived from natural gas production and processing activities, as well as crude oil refining processes. The individual NGL components are used for various purposes including heating, engine and industrial fuels, a component of motor gasoline and as the primary feedstock for petrochemical facilities that produce many everyday consumer products, including a wide range of plastics and synthetic rubber.

Our NGL segment operations involve natural gas processing and NGL fractionation, storage, transportation and terminalling. Our NGL revenues are primarily derived from a combination of (i) providing gathering, fractionation, storage, and/or terminalling services to third-party customers for a fee, and (ii) our merchant activities that support the assets. Our merchant activities include the acquisition of extraction rights from producers and/or shippers of the gas streams that pass through our Empress facility. The extraction rights allow us to process that gas at our Empress facility and extract the higher valued NGL from the gas stream. We then purchase natural gas to replace the thermal content attributable to the NGL that was extracted. We also acquire NGL mix supply and use our assets to store and fractionate it into finished products to sell to third party customers. We may also acquire finished NGL products to be seasonally stored in our storage caverns, which is then resold to third-party customers. Often times we will use derivative instruments to hedge the margins related to these merchant activities. Such hedging activity is governed by our risk management policies. NGL sales arrangements are also subject to our credit policies.

The figure below provides an illustrative and simplified overview of the assets and activities associated with our NGL segment:

17

NGL Segment Assets Overview

We operate a highly integrated network of assets, strategically positioned across Canada and the United States, with a particular focus on serving production from the liquids-rich Western Canadian Sedimentary Basin. As of December 31, 2021, the assets utilized in our NGL segment included the following:

•four natural gas processing plants;

•nine fractionation plants located throughout Canada and the United States with an aggregate useable capacity of approximately 200,100 barrels per day;

•NGL storage facilities with approximately 28 million barrels of capacity;

•approximately 1,620 miles of active NGL transportation pipelines and an additional 55 miles of pipeline that support our NGL storage facilities;

•16 NGL rail terminals and approximately 3,900 NGL rail cars; and

•approximately 220 trailers.

Additionally, our assets include the linefill associated with our commercial activities, including approximately:

•2 million barrels of NGL linefill in pipelines and tanks owned by us; and

•1 million barrels of NGL utilized as linefill in pipelines owned by third parties or otherwise required as long-term inventory.

The tables below present volumes and capacities for our NGL assets and activities as of December 31, 2021 and our natural gas processing and NGL infrastructure and activities are described further below.

| Natural Gas Processing Facilities | Ownership Interest | Gas Processing Capacity (Bcf/d) (1) | Average Inlet Volume (2) (Bcf/d) | |||||||||||||||||

| Empress | 66-100% | 5.5 | 2.7 | |||||||||||||||||

| NGL Fractionation Facilities | Ownership Interest | Fractionation Capacity (Bbls/d) (1) | Average Volume (2) (Bbls/d) | |||||||||||||||||

| Empress | 100 | % | 23,300 | 22,200 | ||||||||||||||||

| Fort Saskatchewan | 21-100% | 61,700 | 41,400 | |||||||||||||||||

| Sarnia | 62-84% | 75,000 | 52,500 | |||||||||||||||||

| Other | 82-100% | 40,100 | 13,400 | |||||||||||||||||

| 200,100 | 129,500 | |||||||||||||||||||

| NGL Storage Facilities | Storage Capacity (1) (MMBbls) | |||||||

| Fort Saskatchewan | 11 | |||||||

| Sarnia | 7 | |||||||

| Empress | 4 | |||||||

| Other | 6 | |||||||

| 28 | ||||||||

| Ownership Interest | Approximate System Miles (3) | Average Volumes (2) (MBbls/d) | ||||||||||||||||||

| NGL Pipelines | 21-100% | 1,620 | 179 | |||||||||||||||||

18

| Ownership Interest | Number of Rack Spots | Number of Storage Spots | ||||||||||||||||||

| NGL Rail Facilities | 75-100% | 277 | 1,527 | |||||||||||||||||

(1)Represents total average annual capacity of the facilities, net to our ownership interest.

(2)Average daily volumes are calculated as the total volumes for the year, net to our share, divided by the number of days in the year.

(3)Includes total mileage of pipelines in which we own less than 100%.

Natural Gas Processing and NGL Infrastructure

Our network of liquids infrastructure includes NGL fractionation facilities, underground NGL storage caverns, above ground storage tanks, NGL pipelines, and rail and truck terminals. With these assets, we process, fractionate, store and transport NGL such as ethane, propane, butane and condensate. The unique integrated and geographically diverse nature of our infrastructure provides the opportunity to maximize margins across the NGL value chain for both us and our customers, by enabling the movement of product from liquids rich producing regions to fractionators, refineries, export facilities and high-value market hubs across Canada. The most significant of these assets include the following:

Empress Facility

We own and/or operate four gas processing facilities near Empress, Alberta, with our ownership ranging from 66% to 100%. These facilities, referred to as straddle plants because they “straddle” gas transportation pipelines, process natural gas to extract ethane and NGL mix entrained in the gas stream before returning the gas to the transportation pipelines. We acquire the rights to extract the NGL from producers and/or shippers of the gas streams that pass through our Empress facility and then purchase natural gas to replace the thermal content attributable to the NGL that was extracted. The NGL mix can be fractionated at our Empress facility or transported along the Enbridge pipeline system for fractionation at our Sarnia facility.

Our Empress plants are capable of processing up to 5.5 Bcf of natural gas per day; however, supply available to these plants is typically in the 2.5 to 4.0 Bcf per day range. These plants produce approximately 50,000 to 85,000 barrels per day of ethane, and 30,000 to 50,000 barrels per day of NGL mix. Our Empress fractionation facility is capable of processing and producing up to 23,300 barrels per day of NGL products and is connected to rail loading infrastructure at Empress and our PPTC pipeline system which enables NGL to be transported to storage and loading terminals in Saskatchewan and Manitoba.

Co-Ed Pipeline

Our primary supply system, the Co-Ed NGL pipeline system, has transportation capacity of approximately 70,000 barrels per day and gathers NGL from Southwest and Central Alberta (Cardium, Deep Basin, and Alberta Montney) for delivery to our Fort Saskatchewan, Alberta NGL fractionation facilities.

Fort Saskatchewan Complex

Our Fort Saskatchewan facility is located near Edmonton, Alberta in one of the key North American NGL hubs. The facility is a receipt, storage, fractionation and delivery facility for NGL and is connected to other major NGL plants and pipeline systems in the area. The facility’s primary assets include 44,400 barrels per day of fractionation capacity, 12 storage caverns, and truck and rail loading capability. Our Fort Saskatchewan fractionation facility has a design capacity of 88,400 barrels per day and is able to produce up to approximately 44,400 barrels per day of propane, butane and condensate. The remaining throughput capacity is used to produce a propane and butane mix, which is transported via the Enbridge pipeline system to our Sarnia facility for further fractionation.

Within the Fort Saskatchewan area, we also hold an approximately 21% ownership in the Keyera Fort Saskatchewan facility, which includes fractionation capacity of approximately 17,300 barrels per day, net to our interest, and 16 storage caverns.

19

Sarnia Area

Our Sarnia Area facilities in Southwestern Ontario consist of (i) our Sarnia facility, (ii) our Windsor storage terminal and (iii) our St. Clair, Michigan terminal. The Sarnia facility is a large NGL fractionation and storage facility with rail and truck loading capabilities. The Sarnia Area facilities are served by a network of multiple pipelines connected to various refineries, chemical plants, and other pipeline and railroad systems in the area. This pipeline network also delivers product between our Sarnia facility and our Windsor and St. Clair storage facilities. The Sarnia fractionator receives NGL feedstock primarily from the Enbridge pipeline system and, to a lesser extent, from our rail unloading facility. The fractionation unit is able to produce an average of approximately 100,000 barrels per day of NGL products. Our ownership in the various processing units at the Sarnia fractionator ranges from 62% to 84%.

Impact of Commodity Price Volatility and Dynamic Market Conditions on Our Business Model

Crude oil, NGL and natural gas commodity prices have historically been very volatile. For example, in the last year, the prompt month NYMEX light, sweet futures contract (commonly referred to as “WTI”) price ranged from a low of approximately $48 per barrel to a high of approximately $85 per barrel. Similarly, there has also been volatility within the propane and butane markets as seen through the North American benchmark price located at Mont Belvieu, Texas, as well as with the basis differentials between Mont Belvieu prices and prices realized at various market hubs in North America.

While our objective is to position the Partnership such that our overall annual cash flow is not materially adversely affected by the absolute level of energy prices, market volatility associated with shifts between demand-driven markets and supply-driven markets or other similar dynamics has in the past, and may in the future create market conditions that are more challenging to our business model. In extended periods of lower crude oil and/or NGL prices, or periods where the supply and demand fundamentals compress regional location differentials, our financial results may be adversely impacted. In such market conditions, product flows on our pipelines or through our facilities may be adversely impacted. Alternatively, in periods where supply exceeds regional demand and/or pipeline egress, product flows on our pipelines or through our facilities may be favorably impacted. In executing our business model, we employ a variety of financial risk management tools and techniques to manage our financial risk, predominantly related to our merchant activities. These are discussed in greater detail in the “—Risk Management” section below.

In addition, relative contribution levels will vary from quarter-to-quarter due to seasonality, particularly with respect to our NGL merchant activities.

Risk Management

In order to hedge margins involving our physical assets and manage risks associated with our various commodity purchase and sale obligations and, in certain circumstances, to realize incremental margin during volatile market conditions, we use derivative instruments. We also use various derivative instruments to manage our exposure to interest rate risk and currency exchange rate risk. In analyzing our risk management activities, we draw a distinction between enterprise-level risks and trading-related risks. Enterprise-level risks are those that underlie our core businesses and may be managed based on management’s assessment of the cost or benefit of doing so. Conversely, trading-related risks (the risks involved in trading in the hopes of generating an increased return) are not inherent in our core business; rather, those risks arise as a result of engaging in trading activities. Our policy is to manage the enterprise-level risks inherent in our core businesses by using financial derivatives to protect our ability to generate cash flow and optimize asset profitability, rather than trying to profit from trading activity. Our commodity risk management policies and procedures are designed to monitor NYMEX, ICE and over-the-counter positions, as well as physical volumes, grades, locations, delivery schedules and storage capacity, to help ensure that our hedging activities address our risks. Our interest rate and currency exchange rate risk management policies and procedures are designed to monitor our derivative positions and ensure that those positions are consistent with our objectives and approved strategies. We have a risk management function that has direct responsibility and authority for our risk policies, related controls around commercial activities and procedures and certain other aspects of corporate risk management. Our risk management function also approves all new risk management strategies through a formal process. Our approved strategies are intended to mitigate and manage enterprise-level risks that are inherent in our core businesses.

20

Our policy is generally to structure our purchase and sales contracts so that price fluctuations do not materially affect our operating income, and not to acquire and hold physical inventory or derivatives for the purpose of speculating on outright commodity price changes. Although we seek to maintain a position that is substantially balanced within our merchant activities, we purchase crude oil, NGL and natural gas from thousands of locations and may experience net unbalanced positions for short periods of time as a result of production, transportation and delivery variances as well as logistical issues associated with inclement weather conditions and other uncontrollable events that may occur. When unscheduled physical inventory builds or draws do occur, they are monitored constantly and managed to a balanced position over a reasonable period of time. This activity is monitored independently by our risk management function and must take place within predefined limits and authorizations.

Credit

Our merchant activities in our Crude Oil and NGL segments require significant extensions of credit by our suppliers. In order to assure our ability to perform our obligations under the purchase agreements, various credit arrangements are negotiated with our suppliers. These arrangements include open lines of credit and, to a lesser extent, standby letters of credit issued under our hedged inventory facility or our senior unsecured revolving credit facility. In addition, storing crude oil, NGL or spec products in a contango market, or otherwise, requires us to have credit facilities to finance both the purchase of these products in the prompt month as well as margin requirements that may be required for the derivative instruments used to hedge our price exposure.

When we sell crude oil and NGL, we must determine the amount, if any, of credit to be extended to any given customer. Because our typical sales transactions can involve large volumes of crude oil or NGL, the risk of nonpayment and nonperformance by customers is a major consideration in our business. We believe our sales are made to creditworthy entities or entities with adequate credit support. See Note 3 to our Consolidated Financial Statements for further discussion of our credit review process and risk management procedures.

Customers

ExxonMobil Corporation and its subsidiaries accounted for 15%, 12% and 12% of our revenues for the years ended December 31, 2021, 2020 and 2019, respectively. Marathon Petroleum Corporation and its subsidiaries accounted for 12%, 13% and 12% of our revenues for the years ended December 31, 2021, 2020 and 2019, respectively. BP p.l.c. and its subsidiaries accounted for 10% of our revenues for the year ended December 31, 2021. Phillips 66 Company and its subsidiaries accounted for 11% of our revenues for the year ended December 31, 2019. No other customers accounted for 10% or more of our revenues during any of the three years ended December 31, 2021. The majority of revenues from these customers pertain to our Crude Oil segment merchant activities, and sales to these customers occur at multiple locations. If we were to lose one or more of these customers, there is risk that we would not be able to identify and access a replacement market at a comparable margin. For a discussion of credit and industry concentration risk, see Note 16 to our Consolidated Financial Statements.

Competition

Competition among pipelines is based primarily on transportation charges, access to producing areas and supply regions and demand for crude oil and NGL by end users. Although new pipeline projects represent a source of competition for our business, there are also existing third-party owned pipelines with excess capacity in the vicinity of our operations that expose us to significant competition based on the relatively low operating cost associated with moving an incremental barrel of crude oil or NGL through such unutilized capacity. In areas where additional infrastructure is being built or has been built to accommodate new or increased production or changing product flows, we face competition in providing the required infrastructure solutions as well as the risk that capacity in the area will be overbuilt for the foreseeable future. As a result of multiple pipeline expansions in the Permian Basin and other areas, together with meaningful changes and delays in expected production growth due to COVID-19 impacts, we anticipate competition for uncommitted barrels and contract renewals and extensions will continue to be amplified in the coming years, increasing our contract renewal and customer retention risk and putting downward pressure on tariffs and margins.

In addition, depending upon the specific movement, pipelines, which generally offer the lowest cost of transportation, may also face competition from other forms of transportation, such as truck, rail and barge. Although these alternative forms of transportation are typically higher cost, they can provide access to alternative markets at which a higher price may be realized for the commodity being transported, thereby overcoming the increased transportation cost.

21

We also face competition with respect to our merchant activities and facilities services. Our competitors include other crude oil and NGL pipeline and terminalling companies, other NGL processing and fractionation companies, the major integrated oil companies and their marketing affiliates, independent gatherers, private equity backed entities, banks that have established a trading platform, brokers and marketers of widely varying sizes, financial resources and experience. Some of these competitors have capital resources greater than ours. In addition, recently constructed pipelines supported by minimum volume commitments and/or acreage dedications could also amplify the level of competition for purchasing wellhead barrels, especially in the Permian Basin and thus impact our margins.

Ongoing Activities Related to Strategic Transactions

We are continuously engaged in the evaluation of potential transactions that support our current business strategy. In the past, such transactions have included the sale of non-core assets, the sale of partial interests in assets to strategic joint venture partners, acquisitions and large investment capital projects. With respect to a potential divestiture or acquisition, we may conduct an auction process or participate in an auction process conducted by a third party or we may negotiate a transaction with one or a limited number of potential buyers (in the case of a divestiture) or sellers (in the case of an acquisition). Such transactions could have a material effect on our financial condition and results of operations.

We typically do not announce a transaction until after we have executed a definitive agreement. In certain cases, in order to protect our business interests or for other reasons, we may defer public announcement of a transaction until closing or a later date. Past experience has demonstrated that discussions and negotiations regarding a potential transaction can advance or terminate in a short period of time. Moreover, the closing of any transaction for which we have entered into a definitive agreement may be subject to customary and other closing conditions, which may not ultimately be satisfied or waived. Accordingly, we can give no assurance that our current or future efforts with respect to any such transactions will be successful, and we can provide no assurance that our financial expectations with respect to such transactions will ultimately be realized. See Item 1A. “Risk Factors—Risks Related to Our Business—Divestitures and acquisitions involve risks that may adversely affect our business.”

22

Joint Venture and Joint Ownership Arrangements

We are party to more than 25 joint venture (“JV”) and undivided joint interest (“UJI”) arrangements with long-term partners throughout the industry value chain spanning across multiple North American basins. We believe that these capital-efficient arrangements provide strategic alignment with long-term industry partners, adding volume commitments to our systems and improving returns.

In October 2021, we and Oryx Midstream Holdings LLC (“Oryx Midstream”) completed the merger, in a cashless, debt-free transaction, of our respective Permian Basin assets, operations and commercial activities into a newly formed joint venture, the Permian JV. The Permian JV includes all of Oryx Midstream’s Permian Basin assets and, with the exception of our long-haul pipeline systems and certain of our intra-basin terminal assets, the vast majority of our assets located within the Permian Basin. We own 65% of the Permian JV, operate the combined assets and reflect the entity as a consolidated subsidiary in our consolidated financial statements. See Note 7 to our Consolidated Financial Statements for additional information.

The following table summarizes our significant JVs as of December 31, 2021:

Entity | Type of Operation | JV Ownership Percentage | ||||||||||||

| BridgeTex Pipeline Company, LLC | Crude Oil Pipeline | 20% | ||||||||||||

| Cactus II Pipeline LLC | Crude Oil Pipeline (1) | 65% | ||||||||||||

| Capline Pipeline Company LLC | Crude Oil Pipeline | 54% | ||||||||||||

| Diamond Pipeline LLC | Crude Oil Pipeline (1) | 50% | ||||||||||||

| Eagle Ford Pipeline LLC | Crude Oil Pipeline (1) | 50% | ||||||||||||

Eagle Ford Terminals Corpus Christi LLC | Crude Oil Terminal and Dock (1) | 50% | ||||||||||||

Plains Oryx Permian Basin LLC (2) (3) | Crude Oil Pipelines and Related Assets (1) | 65% | ||||||||||||

Red River Pipeline Company LLC (2) (4) | Crude Oil Pipeline (1) | 67% | ||||||||||||

Saddlehorn Pipeline Company, LLC (4) | Crude Oil Pipeline | 30% | ||||||||||||

| White Cliffs Pipeline, LLC | Crude Oil Pipeline | 36% | ||||||||||||

Wink to Webster Pipeline LLC (4) | Crude Oil Pipeline | 16% | ||||||||||||

(1)Assets are operated by Plains.

(2)We consolidate the entity based on control, with our partner’s interest accounted for as a noncontrolling interest.

(3)Entity owns a 40% interest in OMOG JV LLC, an unconsolidated entity that owns a crude oil pipeline.

(4)Entity owns a UJI in the crude oil pipeline.

The following table summarizes our significant UJIs as of December 31, 2021, excluding UJIs that are indirectly owned by us through JVs (e.g., Wink to Webster, Saddlehorn and Red River JVs):

| Asset | Type of Operation | UJI Ownership Percentage | |||||||||||||||

Basin Pipeline (1) | Crude Oil Pipeline | 87% | |||||||||||||||

Empress Processing (1) | NGL Facility | 66% to 92% | |||||||||||||||

Fort Saskatchewan NGL Storage and Fractionation (2) | NGL Facility | 21% to 48% | |||||||||||||||

Western Corridor System (2) | Crude Oil Pipeline | 21% to 58% | |||||||||||||||

Sarnia NGL Storage and Fractionation (2) | NGL Facility | 62% to 84% | |||||||||||||||

Sunrise II Pipeline (1) | Crude Oil Pipeline | 80% | |||||||||||||||

(1)Asset is operated by Plains.

(2)Certain of these assets are operated by Plains.

23

Divestitures

In 2016, we initiated a program to evaluate potential sales of non-core assets and/or sales of partial interests in assets to strategic joint venture partners to optimize our asset portfolio and strengthen our balance sheet and leverage metrics. Through December 31, 2021, we have completed asset sales totaling more than $4.5 billion.

Acquisitions

Since our initial public offering in 1998, the acquisition of midstream assets and businesses has been an important component of our business strategy. While the pace of our acquisition activity has slowed down in recent years, we continue to selectively analyze and pursue the acquisition of assets and businesses that are strategic and complementary to our existing operations. Over the last five years, we completed several acquisitions for an aggregate of approximately $2.0 billion. Such amount does not include the Permian JV formed in October 2021. See “Joint Venture and Joint Ownership Arrangements” above for additional information.

Capital Projects

Our extensive asset base and our relationships with long-term industry partners across the value chain provide us with opportunities for organic growth through the construction of additional assets that are complementary to, and expand or extend, our existing asset base. Our 2022 capital plan consists of capital-efficient, highly contracted projects that help address industry needs.

Total investment capital for the year ending December 31, 2022 is projected to be approximately $330 million, of which approximately half is expected to be associated with the Permian JV. Additionally, maintenance capital for 2022 is projected to be $220 million. Note that potential variation to current capital costs estimates may result from (i) changes to project design, (ii) final cost of materials and labor and (iii) timing of incurrence of costs due to uncontrollable factors such as receipt of permits or regulatory approvals and weather.

Regulation

Our assets, operations and business activities are subject to extensive legal requirements and regulations under the jurisdiction of numerous federal, state, provincial and local agencies. Many of these agencies are authorized by statute to issue, and have issued, requirements binding on the pipeline industry, related businesses and individual participants. The failure to comply with such legal requirements and regulations can result in substantial fines and penalties, expose us to civil and criminal claims, and cause us to incur significant costs and expenses. See Item 1A. “Risk Factors—Risks Related to Laws and Regulations—Our operations are subject to laws and regulations relating to protection of the environment and wildlife, operational safety, climate change and related matters that may expose us to significant costs and liabilities. The current laws and regulations affecting our business are subject to change and in the future we may be subject to additional laws, executive orders and regulations, which could adversely impact our business.” At any given time, there may be proposals, provisional rulings or proceedings in legislation or under governmental agency or court review that could affect our business. The regulatory burden on our assets, operations and activities increases our cost of doing business and, consequently, affects our profitability. We can provide no assurance that the increased costs associated with any new or proposed laws, rules or regulations will not be material. We may at any time also be required to apply significant resources in responding to governmental requests for information and/or enforcement actions.

The following is a summary of certain, but not all, of the laws and regulations affecting our operations.

24

Health, Safety and Environmental Regulation

General