UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act File Number 811-09025

New Covenant Funds

SEI Investments

One Freedom Valley Drive

Oaks, PA 19456

The Corporation Trust Company

Corporation Trust Center

1209 Orange Street

Wilmington, Delaware 19801

Registrant’s telephone number, including area code: 1-877-835-4531

Date of fiscal year end: June 30, 2017

Date of reporting period: December 31, 2016

| Item 1. | Reports to Stockholders. |

| December 31, 2016 |

| SEMI-ANNUAL REPORT |

| New Covenant Funds |

|

ñ New Covenant Growth Fund |

|

ñ New Covenant Income Fund |

|

ñ New Covenant Balanced Growth Fund |

|

ñ New Covenant Balanced Income Fund |

|

|

||||

| 1 | ||||

|

|

||||

| 20 | ||||

|

|

||||

| 21 | ||||

|

|

||||

| 22 | ||||

|

|

||||

| 24 | ||||

|

|

||||

| 28 | ||||

|

|

||||

| 39 | ||||

|

|

||||

| Board of Trustees Considerations in Approving the Advisory and Sub-Advisory Agreements |

40 | |||

|

|

||||

The Trust files its complete schedule of portfolio holdings with the Securities and Exchange Commission (the ‘‘Commission’’) for the first and third quarters of each fiscal year on Form N-Q within sixty days after the end of the period. The Trust’s Forms N-Q are available on the Commission’s website at http://www.sec.gov, and may be reviewed and copied at the Commission’s Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

A description of the policies and procedures that the Trust uses to determine how to vote proxies relating to portfolio securities, as well as information relating to how a Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30, is available (i) without charge, upon request, by calling 1-877-835-4531; and (ii) on the Commission’s website at http://www.sec.gov.

SCHEDULE OF INVESTMENTS (UNAUDITED)

December 31, 2016

New Covenant Growth Fund

| New Covenant Funds / Semi-Annual Report / December 31, 2016 | 1 |

SCHEDULE OF INVESTMENTS (UNAUDITED)

December 31, 2016

New Covenant Growth Fund (Continued)

| 2 | New Covenant Funds / Semi-Annual Report / December 31, 2016 |

| New Covenant Funds / Semi-Annual Report / December 31, 2016 | 3 |

SCHEDULE OF INVESTMENTS (UNAUDITED)

December 31, 2016

New Covenant Growth Fund (Concluded)

| 4 | New Covenant Funds / Semi-Annual Report / December 31, 2016 |

SCHEDULE OF INVESTMENTS (UNAUDITED)

December 31, 2016

New Covenant Income Fund

| New Covenant Funds / Semi-Annual Report / December 31, 2016 | 5 |

SCHEDULE OF INVESTMENTS (UNAUDITED)

December 31, 2016

New Covenant Income Fund (Continued)

| 6 | New Covenant Funds / Semi-Annual Report / December 31, 2016 |

| New Covenant Funds / Semi-Annual Report / December 31, 2016 | 7 |

SCHEDULE OF INVESTMENTS (UNAUDITED)

December 31, 2016

New Covenant Income Fund (Continued)

| 8 | New Covenant Funds / Semi-Annual Report / December 31, 2016 |

| New Covenant Funds / Semi-Annual Report / December 31, 2016 | 9 |

SCHEDULE OF INVESTMENTS (UNAUDITED)

December 31, 2016

New Covenant Income Fund (Continued)

| 10 | New Covenant Funds / Semi-Annual Report / December 31, 2016 |

| New Covenant Funds / Semi-Annual Report / December 31, 2016 | 11 |

SCHEDULE OF INVESTMENTS (UNAUDITED)

December 31, 2016

New Covenant Income Fund (Continued)

| 12 | New Covenant Funds / Semi-Annual Report / December 31, 2016 |

| New Covenant Funds / Semi-Annual Report / December 31, 2016 | 13 |

SCHEDULE OF INVESTMENTS (UNAUDITED)

December 31, 2016

New Covenant Income Fund (Continued)

| 14 | New Covenant Funds / Semi-Annual Report / December 31, 2016 |

| New Covenant Funds / Semi-Annual Report / December 31, 2016 | 15 |

SCHEDULE OF INVESTMENTS (UNAUDITED)

December 31, 2016

New Covenant Income Fund (Concluded)

| 16 | New Covenant Funds / Semi-Annual Report / December 31, 2016 |

| New Covenant Funds / Semi-Annual Report / December 31, 2016 | 17 |

SCHEDULE OF INVESTMENTS (UNAUDITED)

December 31, 2016

New Covenant Balanced Growth Fund

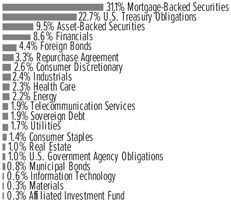

Sector Weightings†:

†Percentages are based on total investments.

| 18 | New Covenant Funds / Semi-Annual Report / December 31, 2016 |

SCHEDULE OF INVESTMENTS (UNAUDITED)

December 31, 2016

New Covenant Balanced Income Fund

Sector Weightings†:

†Percentages are based on total investments.

| New Covenant Funds / Semi-Annual Report / December 31, 2016 | 19 |

STATEMENTS OF ASSETS AND LIABILITIES ($ THOUSANDS) (UNAUDITED)

December 31, 2016

| Growth Fund | Income Fund |

Balanced Growth Fund |

Balanced Income Fund | |||||||||||||

| Assets: |

||||||||||||||||

| Investments, at value† |

$ | 379,209 | $ | 303,531 | $ | — | $ | — | ||||||||

| Repurchase Agreements, at value †† |

— | 10,500 | — | — | ||||||||||||

| Affiliated investments, at value†† |

11,120 | 1,027 | 286,364 | 77,127 | ||||||||||||

| Cash |

6,376 | 689 | — | 3 | ||||||||||||

| Dividends and interest receivable |

436 | 1,702 | 174 | 77 | ||||||||||||

| Receivable for investment securities sold |

298 | 1,774 | — | — | ||||||||||||

| Foreign tax reclaim receivable |

58 | 1 | — | — | ||||||||||||

| Receivable for fund shares sold |

1 | 66 | 59 | 6 | ||||||||||||

| Cash pledged as collateral for futures contracts |

— | 224 | — | — | ||||||||||||

| Receivable for variation margin |

— | 43 | — | — | ||||||||||||

| Prepaid expenses |

18 | 14 | 13 | 4 | ||||||||||||

| Total Assets |

397,516 | 319,571 | 286,610 | 77,217 | ||||||||||||

| Liabilities: |

||||||||||||||||

| Options written, at value †††† |

— | 16 | — | — | ||||||||||||

| Investment advisory fees payable |

144 | 69 | — | — | ||||||||||||

| Administration fees payable |

68 | 51 | 20 | 9 | ||||||||||||

| Shareholder servicing fees payable |

34 | 25 | — | — | ||||||||||||

| Social witness and licensing fees payable |

20 | 37 | — | — | ||||||||||||

| Trustees’ fees payable |

3 | 2 | 2 | 1 | ||||||||||||

| Payable for fund shares redeemed |

1 | 17 | 76 | 7 | ||||||||||||

| Payable for investment securities purchased |

— | 16,787 | — | — | ||||||||||||

| Income distribution payable |

— | 417 | — | — | ||||||||||||

| Payable for variation margin |

— | 53 | — | — | ||||||||||||

| Accrued expense payable |

129 | 98 | 64 | 18 | ||||||||||||

| Total Liabilities |

399 | 17,572 | 162 | 35 | ||||||||||||

| Net Assets |

$ | 397,117 | $ | 301,999 | $ | 286,448 | $ | 77,182 | ||||||||

|

† Cost of investments |

$ | 324,406 | $ | 304,635 | $ | — | $ | — | ||||||||

| †† Cost of repurchase agreements |

— | 10,500 | — | — | ||||||||||||

| ††† Cost of affiliated investments |

11,120 | 1,027 | 241,614 | 67,537 | ||||||||||||

| †††† Cost (premiums received) |

— | 17 | — | — | ||||||||||||

| Net Assets: |

||||||||||||||||

| Paid-in Capital — (unlimited authorization — par value $0.001) |

$ | 340,029 | $ | 355,193 | $ | 253,260 | $ | 69,753 | ||||||||

| Undistributed (distributions in excess of) net investment income |

(64 | ) | (353 | ) | 21 | 7 | ||||||||||

| Accumulated net realized gain (loss) on investments, affiliated investments, capital gain distributions from affiliated investments, written options, futures contracts and foreign currency transactions |

2,359 | (51,803 | ) | (11,583 | ) | (2,168 | ) | |||||||||

| Net unrealized appreciation (depreciation) on investments and affiliated investments |

54,803 | (1,104 | ) | 44,750 | 9,590 | |||||||||||

| Net unrealized appreciation on futures contracts |

— | 60 | — | — | ||||||||||||

| Net unrealized appreciation on written option contracts |

— | 1 | — | — | ||||||||||||

| Net unrealized appreciation (depreciation) on foreign currencies and translation of other assets and liabilities denominated in foreign currencies |

(10 | ) | 5 | — | — | |||||||||||

| Net Assets |

$ | 397,117 | $ | 301,999 | $ | 286,448 | $ | 77,182 | ||||||||

| Net Asset Value, Offering and Redemption Price Per Share |

$ | 36.82 | $ | 23.03 | $ | 91.17 | $ | 19.96 | ||||||||

| (397,116,943 ÷ | (301,998,723 ÷ | (286,447,947 ÷ | (77,182,101 ÷ | |||||||||||||

| 10,786,635 shares) | 13,113,775 shares) | 3,142,050 shares) | 3,865,967 shares) | |||||||||||||

Amounts designated as “—” are $0 or have been rounded to $0.

The accompanying notes are an integral part of the financial statements.

| 20 | New Covenant Funds / Semi-Annual Report / December 31, 2016 |

STATEMENTS OF OPERATIONS ($ THOUSANDS) (UNAUDITED)

For the period ended December 31, 2016

| Growth Fund | Income Fund |

Balanced Growth Fund |

Balanced Income Fund |

|||||||||||||

| Investment Income: |

||||||||||||||||

| Dividend income |

$ | 3,515 | $ | — | $ | — | $ | — | ||||||||

| Dividend income from affiliated registered investment company |

12 | — | 1,885 | 591 | ||||||||||||

| Interest income |

17 | 3,565 | 2 | 1 | ||||||||||||

| Less: foreign taxes withheld |

— | — | — | — | ||||||||||||

| Total Investment Income |

3,544 | 3,565 | 1,887 | 592 | ||||||||||||

| Expenses: |

||||||||||||||||

| Investment advisory fees |

1,249 | 631 | — | — | ||||||||||||

| Administration fees |

403 | 301 | 288 | 78 | ||||||||||||

| Social witness and licensing fees |

302 | 225 | — | — | ||||||||||||

| Shareholder servicing fees |

202 | 150 | — | — | ||||||||||||

| Trustee fees |

3 | 2 | 2 | 1 | ||||||||||||

| Chief compliance officer fees |

1 | 1 | 1 | — | ||||||||||||

| Transfer agent fees |

47 | 35 | 33 | 9 | ||||||||||||

| Professional fees |

24 | 19 | 18 | 5 | ||||||||||||

| Printing fees |

18 | 13 | 13 | 3 | ||||||||||||

| Registration fees |

16 | 12 | 11 | 4 | ||||||||||||

| Custodian fees |

5 | 6 | 5 | 1 | ||||||||||||

| Other expenses |

13 | 49 | 6 | 2 | ||||||||||||

| Total Expenses |

2,283 | 1,444 | 377 | 103 | ||||||||||||

| Less: |

||||||||||||||||

| Waiver of investment advisory fees |

(284 | ) | (239 | ) | — | — | ||||||||||

| Waiver of administration fees |

— | — | (173 | ) | (24) | |||||||||||

| Net Expenses |

1,999 | 1,205 | 204 | 79 | ||||||||||||

| Net Investment Income |

1,545 | 2,360 | 1,683 | 513 | ||||||||||||

| Net Realized and Change in Unrealized Gain (Loss) on Investments: |

||||||||||||||||

| Net Realized Gain (Loss) on: |

||||||||||||||||

| Investments |

20,796 | 14 | — | 123 | ||||||||||||

| Affiliated investments |

— | — | (63 | ) | (61) | |||||||||||

| Written options |

— | 79 | — | — | ||||||||||||

| Futures contracts |

117 | 463 | — | — | ||||||||||||

| Net Change in Unrealized Appreciation (Depreciation) on: |

||||||||||||||||

| Investments |

8,816 | (7,313 | ) | — | — | |||||||||||

| Affiliated investments |

— | — | 10,206 | 812 | ||||||||||||

| Written options |

— | 2 | — | — | ||||||||||||

| Futures contracts |

(50 | ) | 107 | — | — | |||||||||||

| Foreign currency transactions and translation of other assets and liabilities denominated in foreign currencies |

(2 | ) | — | — | — | |||||||||||

| Net Increase (Decrease) in Net Assets Resulting from Operations |

$ | 31,222 | $ | (4,288 | ) | $ | 11,826 | $ | 1,387 | |||||||

Amounts designated as “—” are $0 or have been rounded to $0.

The accompanying notes are an integral part of the financial statements.

| New Covenant Funds / Semi-Annual Report / December 31, 2016 | 21 |

STATEMENTS OF CHANGES IN NET ASSETS ($ THOUSANDS)

For the six month period ended December 31, 2016 (Unaudited) and the year ended June 30, 2016

| Growth Fund | Income Fund | |||||||||||||||

| 07/01/16 to | 07/01/15 to | 07/01/16 to | 07/01/15 to | |||||||||||||

| 12/31/16 | 06/30/16 | 12/31/16 | 06/30/16 | |||||||||||||

| Operations: |

||||||||||||||||

| Net investment income |

$ | 1,545 | $ | 3,008 | $ | 2,360 | $ | 5,092 | ||||||||

| Net realized gain (loss) from investments, affiliated investments, written options and futures contracts |

20,913 | (13,208 | ) | 556 | 3,522 | |||||||||||

| Net realized loss on foreign currency transactions |

— | (3 | ) | — | — | |||||||||||

| Net change in unrealized appreciation (depreciation) on investments, affiliated investments, written options and futures contracts |

8,766 | (3,927 | ) | (7,204 | ) | 3,039 | ||||||||||

| Net change in unrealized appreciation (depreciation) on foreign currency transactions and translation of other assets and liabilities denominated in foreign currency |

(2 | ) | — | — | 5 | |||||||||||

| Net increase (decrease) in net assets resulting from operations |

31,222 | (14,130 | ) | (4,288 | ) | 11,658 | ||||||||||

| Dividends and Distributions From: |

||||||||||||||||

| Net investment income |

(2,015 | ) | (2,425 | ) | (2,731 | ) | (5,431 | ) | ||||||||

| Net realized gains |

— | (26,424 | ) | — | — | |||||||||||

| Total dividends and distributions |

(2,015 | ) | (28,849 | ) | (2,731 | ) | (5,431 | ) | ||||||||

| Capital Share Transactions: |

||||||||||||||||

| Proceeds from shares issued |

4,484 | 40,997 | 18,933 | 30,013 | ||||||||||||

| Reinvestment of dividends & distributions |

348 | 25,637 | 311 | 602 | ||||||||||||

| Cost of shares redeemed |

(31,865 | ) | (44,870 | ) | (7,391 | ) | (43,972 | ) | ||||||||

| increase (decrease) in net assets derived from capital share transactions |

(27,033 | ) | 21,764 | 11,853 | (13,357 | ) | ||||||||||

| Net increase (decrease) in net assets |

2,174 | (21,215 | ) | 4,834 | (7,130 | ) | ||||||||||

| Net Assets: |

||||||||||||||||

| Beginning of Period |

394,943 | 416,158 | 297,165 | 304,295 | ||||||||||||

| End of Period |

$ | 397,117 | $ | 394,943 | $ | 301,999 | $ | 297,165 | ||||||||

| Undistributed (Distributions in Excess of) Net Investment Income Included in Net Assets at Period End |

$ | (64 | ) | $ | 406 | $ | (353 | ) | $ | 18 | ||||||

| Share Transactions: |

||||||||||||||||

| Shares issued |

122 | 1,207 | 815 | 1,297 | ||||||||||||

| Shares issued in lieu of dividends and distributions |

10 | 740 | 14 | 26 | ||||||||||||

| Shares redeemed |

(884 | ) | (1,280 | ) | (315 | ) | (1,900 | ) | ||||||||

| Increase (Decrease) in net assets derived from share transactions |

(752 | ) | 667 | 514 | (577 | ) | ||||||||||

Amounts designated as “—” are $0 or have been rounded to $0.

The accompanying notes are an integral part of the financial statements.

| 22 | New Covenant Funds / Semi-Annual Report / December 31, 2016 |

| Balanced Growth Fund | Balanced Income Fund | |||||||||||||||

| 07/01/16 to 12/31/16 |

07/01/15 to 06/30/16 |

07/01/16 to 12/31/16 |

07/01/15 to 06/30/16 |

|||||||||||||

| Operations: |

||||||||||||||||

| Net investment income |

$ | 1,683 | $ | 2,677 | $ | 513 | $ | 930 | ||||||||

| Net realized gain (loss) from affiliated investments |

(63 | ) | (2,208 | ) | 62 | (674) | ||||||||||

| Capital gain distributions received from affiliated investments |

— | 11,355 | — | 1,784 | ||||||||||||

| Net change in unrealized appreciation (depreciation) on affiliated investments |

10,206 | (13,521 | ) | 812 | (970) | |||||||||||

| Net increase (decrease) in net assets resulting from operations |

11,826 | (1,697 | ) | 1,387 | 1,070 | |||||||||||

| Dividends and Distributions From: |

||||||||||||||||

| Net investment income |

(2,109 | ) | (5,355 | ) | (710 | ) | (1,221) | |||||||||

| Net realized gains |

(6,991 | ) | (25,693 | ) | (1,021 | ) | (4,082) | |||||||||

| Total dividends and distributions |

(9,100 | ) | (31,048 | ) | (1,731 | ) | (5,303) | |||||||||

| Capital Share Transactions: |

||||||||||||||||

| Proceeds from shares issued |

7,080 | 19,348 | 2,434 | 5,760 | ||||||||||||

| Reinvestment of dividends & distributions |

8,356 | 28,515 | 1,446 | 4,631 | ||||||||||||

| Cost of shares redeemed |

(16,144 | ) | (28,248 | ) | (4,299 | ) | (8,416) | |||||||||

| Increase (decrease) in net assets derived from capital share transactions |

(708 | ) | 19,615 | (419 | ) | 1,975 | ||||||||||

| Net increase (decrease) in net assets |

2,018 | (13,130 | ) | (763 | ) | (2,258) | ||||||||||

| Net Assets: |

||||||||||||||||

| Beginning of Period |

284,430 | 297,560 | 77,945 | 80,203 | ||||||||||||

| End of Period |

$ | 286,448 | $ | 284,430 | $ | 77,182 | $ | 77,945 | ||||||||

| Undistributed Net Investment Income Included in Net Assets at Period End |

$ | 21 | $ | 447 | $ | 7 | $ | 204 | ||||||||

| Share Transactions: |

||||||||||||||||

| Shares issued |

75 | 209 | 119 | 283 | ||||||||||||

| Shares issued in lieu of dividends and distributions |

91 | 317 | 72 | 234 | ||||||||||||

| Shares redeemed |

(173 | ) | (303 | ) | (211 | ) | (415) | |||||||||

| Increase (Decrease) in net assets derived from share transactions |

(7 | ) | 223 | (20 | ) | 102 | ||||||||||

Amounts designated as “—” are $0 or have been rounded to $0.

The accompanying notes are an integral part of the financial statements.

| New Covenant Funds / Semi-Annual Report / December 31, 2016 | 23 |

For the six month period ended December 31, 2016 (Unaudited) and the years ended June 30,

For a Share Outstanding Throughout the Period

| Growth Fund | ||||||||||||||||||||||||

| 2016@ | 2016 | 2015 | 2014 | 2013 | 2012(1) | |||||||||||||||||||

| Net Asset Value, Beginning of Period |

$34.23 | $38.28 | $43.70 | $37.28 | $32.23 | $32.53 | ||||||||||||||||||

| Investment Activities: |

||||||||||||||||||||||||

| Net investment income(2) |

0.14 | 0.27 | 0.22 | 0.23 | 0.28 | 0.31 | ||||||||||||||||||

| Net realized and unrealized gains (losses) on securities and foreign currency transactions(2) |

2.63 | (1.67) | 2.29 | 8.55 | 5.20 | (0.38) | ||||||||||||||||||

| Total from investment activities |

2.77 | (1.40) | 2.51 | 8.78 | 5.48 | (0.07) | ||||||||||||||||||

| Dividends and Distributions from: |

||||||||||||||||||||||||

| Net investment income |

(0.18) | (0.21) | (0.22) | (0.24) | (0.43) | (0.23) | ||||||||||||||||||

| Net realized gains |

– | (2.44) | (7.71) | (2.12) | – | – | ||||||||||||||||||

| Total dividends and distributions |

(0.18) | (2.65) | (7.93) | (2.36) | (0.43) | (0.23) | ||||||||||||||||||

| Net Asset Value, End of Period |

$36.82 | $34.23 | $38.28 | $43.70 | $37.28 | $32.23 | ||||||||||||||||||

| Total Return† |

8.11% | (3.68)% | 6.41% | 24.18% | 17.11% | (0.15)% | ||||||||||||||||||

| Supplemental Data and Ratios: |

||||||||||||||||||||||||

| Net assets, end of period ($ Thousands) |

$397,117 | $394,943 | $416,158 | $424,852 | $369,133 | $652,311 | ||||||||||||||||||

| Ratio of net expenses to average net assets |

0.99% | 1.02% | 1.02% | 1.02% | 0.99% | 0.97% | ||||||||||||||||||

| Ratio of expenses to average net assets, excluding waivers |

1.13% | 1.14% | 1.12% | 1.15% | 1.15% | 1.03% | ||||||||||||||||||

| Ratio of net investment income to average net assets |

0.76% | 0.76% | 0.54% | 0.55% | 0.81% | 1.01% | ||||||||||||||||||

| Portfolio turnover rate |

27% | 103% | 107% | 86% | 47% | 83% | ||||||||||||||||||

| † | Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

| (1) | As disclosed in Note 1, prior to February 20, 2012, the Funds’ investment advisor was One Compass Advisors, a wholly owned subsidiary of the Presbyterian Church (U.S.A.) Foundation. |

| (2) | Per share net investment income and net realized and unrealized gains/(losses) calculated using average shares. |

| @ | For the six month period ended December 31, 2016. All ratios for the period have been annualized. |

Amounts designated as “—” are $0 or have been rounded to $0.

The accompanying notes are an integral part of the financial statements

| 24 | New Covenant Funds / Semi-Annual Report / December 31, 2016 |

| Income Fund | ||||||||||||||||||||||||

| 2016@ | 2016 | 2015 | 2014 | 2013 | 2012(1) | |||||||||||||||||||

| Net Asset Value, Beginning of Period |

$23.58 | $23.09 | $23.13 | $22.77 | $23.28 | $22.85 | ||||||||||||||||||

| Investment Activities: |

||||||||||||||||||||||||

| Net investment income(2) |

0.18 | 0.40 | 0.35 | 0.34 | 0.29 | 0.60 | ||||||||||||||||||

| Net realized and unrealized gains (losses) on securities (2) |

(0.52) | 0.51 | (0.01) | 0.41 | (0.41) | 0.62 | ||||||||||||||||||

| Total from investment activities |

(0.34) | 0.91 | 0.34 | 0.75 | (0.12) | 1.22 | ||||||||||||||||||

| Dividends and Distributions from: |

||||||||||||||||||||||||

| Net investment income |

(0.21) | (0.42) | (0.38) | (0.39) | (0.39) | (0.79) | ||||||||||||||||||

| Total dividends and distributions |

(0.21) | (0.42) | (0.38) | (0.39) | (0.39) | (0.79) | ||||||||||||||||||

| Net Asset Value, End of Period |

$23.03 | $23.58 | $23.09 | $23.13 | $22.77 | $23.28 | ||||||||||||||||||

| Total Return† |

(1.44)% | 4.00% | 1.46% | 3.31% | (0.55)% | 5.45% | ||||||||||||||||||

| Supplemental Data and Ratios: |

||||||||||||||||||||||||

| Net assets, end of period ($ Thousands) |

$301,999 | $297,165 | $304,295 | $309,039 | $291,669 | $374,870 | ||||||||||||||||||

| Ratio of net expenses to average net assets |

0.80% | 0.80% | 0.80% | 0.80% | 0.77% | 0.75% | ||||||||||||||||||

| Ratio of expenses to average net assets, excluding waivers |

0.96% | 0.98% | 0.95% | 0.98% | 0.95% | 0.81% | ||||||||||||||||||

| Ratio of net investment income to average net assets |

1.57% | 1.71% | 1.50% | 1.50% | 1.23% | 2.60% | ||||||||||||||||||

| Portfolio turnover rate |

55% | 202% | 115% | 168% | 295% | 95% | ||||||||||||||||||

| † | Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

| (1) | As disclosed in Note 1, prior to February 20, 2012, the Funds’ investment advisor was One Compass Advisors, a wholly owned subsidiary of the Presbyterian Church (U.S.A.) Foundation. |

| (2) | Per share net investment income and net realized and unrealized gains/(losses) calculated using average shares. |

| @ | For the six month period ended December 31, 2016. All ratios for the period have been annualized. |

The accompanying notes are an integral part of the financial statements.

| New Covenant Funds / Semi-Annual Report / December 31, 2016 | 25 |

FINANCIAL HIGHLIGHTS (Concluded)

For the six month period ended December 31, 2016 (Unaudited) and the years ended June 30,

For a Share Outstanding Throughout the Period

| Balanced Growth Fund | ||||||||||||||||||||||||

| 2016@ | 2016 | 2015 | 2014 | 2013 | 2012(1) | |||||||||||||||||||

| Net Asset Value, Beginning of Period |

$90.32 | $101.71 | $101.92 | $89.69 | $82.87 | $82.33 | ||||||||||||||||||

| Investment Activities: |

||||||||||||||||||||||||

| Net investment income(2) |

0.54 | 0.88 | 0.85 | 1.43 | 1.08 | 1.25 | ||||||||||||||||||

| Net realized and unrealized gains (losses) on securities (2) |

3.27 | (1.63) | 3.71 | 12.23 | 6.96 | 0.41 | ||||||||||||||||||

| Total from investment activities |

3.81 | (0.75) | 4.56 | 13.66 | 8.04 | 1.66 | ||||||||||||||||||

| Dividends and Distributions from: |

||||||||||||||||||||||||

| Net investment income |

(0.68) | (1.72) | (2.86) | (1.43) | (1.22) | (1.12) | ||||||||||||||||||

| Net realized gains |

(2.28) | (8.92) | (1.91) | – | – | – | ||||||||||||||||||

| Total dividends and distributions |

(2.96) | (10.64) | (4.77) | (1.43) | (1.22) | (1.12) | ||||||||||||||||||

| Net Asset Value, End of Period |

$91.17 | $90.32 | $101.71 | $101.92 | $89.69 | $82.87 | ||||||||||||||||||

| Total Return† |

4.20% | (0.50)% | 4.54% | 15.30% | 9.77% | 2.07% | ||||||||||||||||||

| Supplemental Data and Ratios: |

||||||||||||||||||||||||

| Net assets, end of period ($ Thousands) |

$286,448 | $284,430 | $297,560 | $305,924 | $271,518 | $258,499 | ||||||||||||||||||

| Ratio of net expenses to average net assets* |

0.14% | 0.14% | 0.14% | 0.14% | 0.14% | 0.14% | ||||||||||||||||||

| Ratio of expenses to average net assets, excluding waivers* |

0.26% | 0.27% | 0.26% | 0.27% | 0.27% | 0.17% | ||||||||||||||||||

| Ratio of net investment income to average net assets |

1.17% | 0.94% | 0.83% | 1.48% | 1.24% | 1.55% | ||||||||||||||||||

| Portfolio turnover rate |

3% | 14% | 13% | 6% | 7% | 9% | ||||||||||||||||||

| † | Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

| * | The expense ratios do not include expenses of the underlying affiliated investment companies. |

| (1) | As disclosed in Note 1, prior to February 20, 2012, the Funds’ investment advisor was One Compass Advisors, a wholly owned subsidiary of the Presbyterian Church (U.S.A.) Foundation. |

| (2) | Per share net investment income and net realized and unrealized gains/(losses) calculated using average shares. |

| @ | For the six month period ended December 31, 2016. All ratios for the period have been annualized. |

Amounts designated as “—” are $0 or have been rounded to $0.

The accompanying notes are an integral part of the financial statements.

| 26 | New Covenant Funds / Semi-Annual Report / December 31, 2016 |

| Balanced Income Fund | ||||||||||||||||||||||||

| 2016@ | 2016 | 2015 | 2014 | 2013 | 2012(1) | |||||||||||||||||||

| Net Asset Value, Beginning of Period |

$20.06 | $21.20 | $21.55 | $19.95 | $19.25 | $18.97 | ||||||||||||||||||

| Investment Activities: |

||||||||||||||||||||||||

| Net investment income(2) |

0.13 | 0.24 | 0.22 | 0.30 | 0.26 | 0.41 | ||||||||||||||||||

| Net realized and unrealized gains (losses) on securities (2) |

0.22 | 0.02 | 0.46 | 1.68 | 0.76 | 0.22 | ||||||||||||||||||

| Total from investment activities |

0.35 | 0.26 | 0.68 | 1.98 | 1.02 | 0.63 | ||||||||||||||||||

| Dividends and Distributions from: |

||||||||||||||||||||||||

| Net investment income |

(0.18) | (0.31) | (0.47) | (0.30) | (0.32) | (0.35) | ||||||||||||||||||

| Net realized gains |

(0.27) | (1.09) | (0.56) | (0.08) | – | – | ||||||||||||||||||

| Total dividends and distributions |

(0.45) | (1.40) | (1.03) | (0.38) | (0.32) | (0.35) | ||||||||||||||||||

| Net Asset Value, End of Period |

$19.96 | $20.06 | $21.20 | $21.55 | $19.95 | $19.25 | ||||||||||||||||||

| Total Return† |

1.77% | 1.41% | 3.22% | 10.01% | 5.34% | 3.42% | ||||||||||||||||||

| Supplemental Data and Ratios: |

||||||||||||||||||||||||

| Net assets, end of period ($ Thousands) |

$77,182 | $77,945 | $80,203 | $85,622 | $81,818 | $85,602 | ||||||||||||||||||

| Ratio of net expenses to average net assets* |

0.20% | 0.20% | 0.20% | 0.20% | 0.20% | 0.18% | ||||||||||||||||||

| Ratio of expenses to average net assets, excluding waivers* |

0.26% | 0.27% | 0.25% | 0.26% | 0.27% | 0.20% | ||||||||||||||||||

| Ratio of net investment income to average net assets |

1.31% | 1.19% | 1.04% | 1.44% | 1.30% | 2.18% | ||||||||||||||||||

| Portfolio turnover rate |

2% | 17% | 15% | 9% | 7% | 9% | ||||||||||||||||||

| † | Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

| * | The expense ratios do not include expenses of the underlying affiliated investment companies. |

| (1) | As disclosed in Note 1, prior to February 20, 2012, the Funds’ investment advisor was One Compass Advisors, a wholly owned subsidiary of the Presbyterian Church (U.S.A.) Foundation. |

| (2) | Per share net investment income and net realized and unrealized gains/(losses) calculated using average shares. |

| @ | For the six month period ended December 31, 2016. All ratios for the period have been annualized. |

Amounts designated as “—” are $0 or have been rounded to $0.

The accompanying notes are an integral part of the financial statements.

| New Covenant Funds / Semi-Annual Report / December 31, 2016 | 27 |

NOTES TO FINANCIAL STATEMENTS (UNAUDITED)

December 31, 2016

1. ORGANIZATION

New Covenant Funds (the “Trust”), an open-end, diversified management investment company, was organized as a Delaware business trust on September 30, 1998. It currently consists of four investment funds: New Covenant Growth Fund (“Growth Fund”), New Covenant Income Fund (“Income Fund”), New Covenant Balanced Growth Fund (“Balanced Growth Fund”), and New Covenant Balanced Income Fund (“Balanced Income Fund”), (individually, a “Fund,” and collectively, the “Funds”). The Funds commenced operations on July 1, 1999. The Trust’s authorized capital consists of an unlimited number of shares of beneficial interest of $0.001 par value. Effective February 20, 2012, the Funds’ investment adviser is SEI Investments Management Corporation (the “Adviser”). Prior to February 20, 2012, the Funds’ investment adviser was One Compass Advisors, a wholly owned subsidiary of the Presbyterian Church (U.S.A.) Foundation.

The objectives of the Funds are as follows:

| Growth Fund | Long-term capital appreciation. | |

| Income Fund | High level of current income with preservation of capital. | |

| Balanced Growth Fund | Capital appreciation with less risk than would be present in a portfolio of only common stocks. | |

| Balanced Income Fund | Current income and long-term growth of capital. | |

2. SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of the significant accounting policies followed by the Funds.

Use of Estimates — The preparation of financial statements, in conformity with U.S. generally accepted accounting principles (“U.S. GAAP”), requires management to make estimates and assumptions that affect the reported amount of assets and liabilities and disclosure of contingent assets and liabilities as of the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

Security Valuation — Securities listed on a securities exchange, market or automated quotation system for which quotations are readily available (except for securities traded on NASDAQ) are valued at the last quoted sale price on the primary exchange or market (foreign or domestic) on which they are traded, or, if there is no such reported sale, at the most recent quoted bid price. For securities traded on NASDAQ, the NASDAQ Official Closing Price will be used. Debt securities are priced based upon valuations provided by independent, third-party pricing agents, if available. Such values generally reflect the last reported sales price if the security is actively traded. The third-party pricing agents may also value debt securities at an evaluated bid price by employing methodologies that utilize actual market transactions, broker-supplied valuations, or other methodologies designed to identify the market value for such securities. Debt obligations acquired with remaining maturities of sixty days or less may be valued at their amortized cost, which approximates market value. The prices for foreign securities are reported in local currency and converted to U.S. dollars using currency exchange rates. Prices for most securities held in the Funds are provided daily by recognized independent pricing agents. If a security price cannot be obtained from an independent, third-party pricing agent, the Funds seek to obtain a bid price from at least one independent broker.

Securities for which market prices are not “readily available” are valued in accordance with fair value procedures established by the Trust’s Board of Trustees. The Trust’s fair value procedures are implemented through a fair value committee (the “Committee”) designated by the Trust’s Board of Trustees. Some of the more common reasons that may necessitate that a security be valued using fair value procedures include: the security’s trading has been halted or suspended; the security has been de-listed from a national exchange; the security’s primary trading market is temporarily closed at a time when under normal conditions it would be open; or the security’s primary pricing source is not able or willing to provide a price. When a security is valued in accordance with the fair value procedures, the Committee will determine the value after taking into consideration relevant information reasonably available to the Committee.

For securities that principally trade on a foreign market or exchange, a significant gap in time can exist between the time of a particular security’s last trade and the time at which a Fund calculates its net asset value. The closing prices of such securities may no longer reflect their market value at the time a Fund calculates net asset value if an event that could materially affect the value of those securities (a “Significant Event”) has occurred between the time of the

| 28 | New Covenant Funds / Semi-Annual Report / December 31, 2016 |

security’s last close and the time that a Fund calculates net asset value. A Significant Event may relate to a single issuer or to an entire market sector. If the adviser or sub-adviser of a Fund becomes aware of a Significant Event that has occurred with respect to a security or group of securities after the closing of the exchange or market on which the security or securities principally trade, but before the time at which a Fund calculates net asset value, the adviser or sub-adviser may request that a Fair Value Committee Meeting be called. In addition, the Trust’s administrator monitors price movements among certain selected indices, securities and/or baskets of securities that may be an indicator that the closing prices received earlier from foreign exchanges or markets may not reflect market value at the time a Fund calculates net asset value. If price movements in a monitored index or security exceed levels established by the administrator, the administrator notifies the adviser or sub-adviser for any Fund holding the relevant securities that such limits have been exceeded. In such event, the adviser or sub-adviser makes the determination whether a Fair Value Committee Meeting should be called based on the information provided.

The Growth Fund holds international securities that also use a third-party fair valuation vendor. The vendor provides a fair value for foreign securities held by this Fund based on certain factors and methodologies (involving, generally, tracking valuation correlations between the U.S. market and each non-U.S. security). Values from the fair value vendor are applied in the event that there is a movement in the U.S. market that exceeds a specific threshold that has been established by the Committee. The Committee has also established a “confidence interval” which is used to determine the level of historical correlation between the value of a specific foreign security and movements in the U.S. market before a particular security will be fair valued when the threshold is exceeded. In the event that the threshold established by the Committee is exceeded on a specific day, the Growth Fund will value the non-U.S. securities that exceed the applicable “confidence interval” based upon the adjusted prices provided by the fair valuation vendor.

Options for which the primary market is a national securities exchange are valued at the last sale price on the exchange on which they are traded, or, in the absence of any sale, at the closing bid price. Options not traded on a national securities exchange are valued at the last quoted bid price.

The assets of the Balanced Growth Fund and the Balanced Income Fund (the “Balanced Funds”) consist primarily of investments in underlying affiliated investment companies, which are valued at their respective daily net asset values in accordance with the established NAV of each fund.

In accordance with U.S. GAAP, fair value is defined as the price that a Fund would receive upon selling an investment in an orderly transaction to an independent buyer in the principal or most advantageous market of the investment. A three tier hierarchy has been established to maximize the use of observable and minimize the use of unobservable inputs and to establish classification of fair value measurements for disclosure purposes. Inputs refer broadly to the assumptions that market participants would use in pricing an asset. Inputs may be observable or unobservable. Observable inputs are inputs that reflect the assumptions market participants would use in pricing the asset or liability based on market data obtained from sources independent of the reporting entity. Unobservable inputs are inputs that reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability based on the best information available in the circumstances.

The three-tier hierarchy of inputs is summarized in the three broad Levels listed below:

Level 1 — quoted prices in active markets for identical investments

Level 2 — other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risks, etc.)

Level 3 — significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments)

The valuation techniques used by the Funds to measure fair value during the period ended December 31, 2016 maximized the use of observable inputs and minimized the use of unobservable inputs.

For the period ended December 31, 2016, there have been no significant changes to the Trust’s fair valuation methodologies. For details of the investment classifications reference the Schedules of Investments.

| New Covenant Funds / Semi-Annual Report / December 31, 2016 | 29 |

NOTES TO FINANCIAL STATEMENTS (UNAUDITED) (Continued)

December 31, 2016

Securities Transactions and Investment Income — Security transactions are recorded on the trade date. Cost used in determining net realized capital gains and losses on the sale of securities is determined on the basis of specific identification. Dividend income and expense is recognized on the ex-dividend date, and interest income or expense is recognized using the accrual basis of accounting.

Distributions received on securities that represent a return of capital or capital gains are recorded as a reduction of cost of investments and/or as a realized gain. The Trust estimates the components of distributions received that may be considered nontaxable distributions or capital gain distributions.

Amortization and accretion is calculated using the scientific interest method, which approximates the effective interest method over the holding period of the security. Amortization of premiums and discounts is included in interest income.

Cash and Cash Equivalents — Idle cash and currency balances may be swept into various overnight sweep accounts and are classified as cash equivalents on the Statement of Assets and Liabilities. These amounts, at times, may exceed United States federally insured limits. Amounts swept are available on the next business day.

Expenses — Expenses that are directly related to a Fund are charged directly to that Fund. Other operating expenses of the Funds are prorated to the Funds on the basis of relative net assets.

Foreign Currency Translation — The books and records of the Funds investing in international securities are maintained in U.S. dollars on the following basis:

(I) market value of investment securities, assets and liabilities at the current rate of exchange; and

(II) purchases and sales of investment securities, income and expenses at the relevant rates of exchange prevailing on the respective dates of such transactions.

The Funds do not isolate that portion of gains and losses on investments in equity securities that is due to changes in the foreign exchange rates from that which is due to changes in market prices of equity securities.

The Funds report certain foreign-currency-related transactions as components of realized gains for financial reporting purposes, whereas such components are treated as ordinary income for Federal income tax purposes.

Repurchase Agreements — To the extent consistent with its investment objective and strategies, a Fund may enter into repurchase agreements which are secured by obligations of the U.S. Government with a bank, broker-dealer or other financial institution. Each repurchase agreement is at least 102% collateralized and marked-to-market. However, in the event of default or bankruptcy by the counterparty to the repurchase agreement, realization of the collateral may by subject to certain costs, losses or delays.

Futures Contracts — To the extent consistent with its investment objective and strategies, a Fund may use futures contracts for tactical hedging purposes as well as to enhance the Fund’s returns. These Funds’ investments in futures contracts are designed to enable the Funds to more closely approximate the performance of their benchmark indices. Initial margin deposits of cash or securities are made upon entering into futures contracts. The contracts are marked-to-market daily and the resulting changes in value are accounted for as unrealized gains and losses. Variation margin payments are paid or received, depending upon whether unrealized gains or losses are incurred. When contracts are closed, the Funds record a realized gain or loss equal to the difference between the proceeds from (or cost of) the closing transaction and the amount invested in the contract.

Risks of entering into futures contracts include the possibility that there will be an imperfect price correlation between the futures and the underlying securities. Second, it is possible that a lack of liquidity for futures contracts could exist in the secondary market, resulting in an inability to close a position prior to its maturity date. Third, futures contracts involve the risk that a Fund could lose more than the original margin deposit required to initiate a futures transaction.

Finally, the risk exists that losses could exceed amounts disclosed on the Statements of Assets and Liabilities. Refer to each Fund’s Schedule of Investments for details regarding open futures contracts as of December 31, 2016, if applicable.

Options Writing/Purchasing — To the extent consistent with its investment objective and strategies, a Fund may invest in financial options contracts for the purpose of hedging its existing portfolio securities, or securities that a Fund intends to purchase, against fluctuations in fair market value caused by changes in prevailing market interest rates. A Fund may also invest in financial option contracts to enhance its returns. When the Fund writes or purchases

| 30 | New Covenant Funds / Semi-Annual Report / December 31, 2016 |

an option, an amount equal to the premium received or paid by the Fund is recorded as a liability or an asset and is subsequently adjusted to the current market value of the option written or purchased. Premiums received or paid from writing or purchasing options which expire unexercised are treated by the Fund on the expiration date as realized gains or losses. The difference between the premium and the amount paid or received on affecting a closing purchase or sale transaction, including brokerage commissions, is also treated as a realized gain or loss. If an option is exercised, the premium paid or received is added to the cost of the purchase or proceeds from the sale in determining whether the Fund has realized a gain or a loss.

The risk in writing a call option is a Fund may give up the opportunity for profit if the market price of the security increases. The risk in writing a put option is a Fund may incur a loss if the market price of the security decreases and the option is exercised. The risk in purchasing an option is a Fund may pay a premium whether or not the option is exercised. The Funds also have the additional risk of being unable to enter into a closing transaction at an acceptable price if a liquid secondary market does not exist. Option contracts also involve the risk that they may not work as intended due to unanticipated developments in market conditions or other causes.

Forward Treasury Commitments — To the extent consistent with its investment objective and strategies, the Growth Fund and Income Fund may invest in commitments to purchase U.S. Treasury securities on an extended settlement basis. Such transactions involve the commitment to purchase a security with payment and delivery taking place in the future, sometimes a month or more after the transaction date. The Funds account for such transactions as purchases and sales and record an unrealized gain or loss each day equal to the difference between the cost of the purchase commitment and the current market value. Realized gains or losses are recorded upon closure or settlement of such commitments. No interest is earned prior to settlement of the transaction. These instruments are subject to market fluctuation due to changes in interest rates and the market value at the time of settlement could be higher or lower than the purchase price. A Fund may incur losses due to changes in the value of the underlying treasury securities from interest rate fluctuations or as a result of counterparty nonperformance. These transactions may increase the overall investment exposure for a Fund (and so may also create investment leverage) and involve a risk of loss if the value of the securities declines prior to the settlement date.

Master Limited Partnerships — To the extent consistent with its investment objective and strategies, a Fund may invest in entities commonly referred to as “MLPs” that are generally organized under state law as limited partnerships or limited liability companies. The Funds intend to primarily invest in MLPs receiving partnership taxation treatment under the Internal Revenue Code of 1986 (the “Code”), and whose interests or “units” are traded on securities exchanges like shares of corporate stock. To be treated as a partnership for U.S. federal income tax purposes, an MLP whose units are traded on a securities exchange must receive at least 90% of its income from qualifying sources such as interest, dividends, real estate rents, gain from the sale or disposition of real property, income and gain from mineral or natural resources activities, income and gain from the transportation or storage of certain fuels, and, in certain circumstances, income and gain from commodities or futures, forwards and options with respect to commodities. Mineral or natural resources activities include exploration, development, production, processing, mining, refining, marketing and transportation (including pipelines) of oil and gas, minerals, geothermal energy, fertilizer, timber or industrial source carbon dioxide. An MLP consists of a general partner and limited partners (or in the case of MLPs organized as limited liability companies, a managing member and members). The general partner or managing member typically controls the operations and management of the MLP and has an ownership stake in the partnership. The limited partners or members, through their ownership of limited partner or member interests, provide capital to the entity, are intended to have no role in the operation and management of the entity and receive cash distributions. The MLPs themselves generally do not pay U.S. Federal income taxes. Thus, unlike investors in corporate securities, direct MLP investors are generally not subject to double taxation (i.e., corporate level tax and tax on corporate dividends). Currently, most MLPs operate in the energy and/or natural resources sector.

Delayed Delivery Transactions — To the extent consistent with its investment objective and strategies, the Growth Fund and Income Fund may purchase or sell securities on a when-issued or delayed delivery basis. These transactions involve a commitment by those Funds to purchase or sell securities for a predetermined price or yield, with payment and delivery taking place beyond the customary settlement period. When delayed delivery purchases are outstanding, the Funds will set aside liquid assets in an amount sufficient to meet the purchase price. When purchasing a security on a delayed delivery basis, that Fund assumes the rights and risks of ownership of the security, including the risk of price and yield fluctuations, and takes such fluctuations into account when determining its net asset value. Those Funds may dispose of or renegotiate a delayed delivery transaction after it is entered into, and may sell when-issued securities before they are delivered, which may result in a capital gain or loss. When those

| New Covenant Funds / Semi-Annual Report / December 31, 2016 | 31 |

NOTES TO FINANCIAL STATEMENTS (UNAUDITED) (Continued)

December 31, 2016

Funds have sold a security on a delayed delivery basis, that Fund does not participate in future gains and losses with respect to the security.

Dividends and Distributions to Shareholders — Dividends from net investment income are declared and paid to shareholders quarterly for the Growth Fund, Balanced Growth Fund and Balanced Income Fund; declared and paid monthly for the Income Fund. Dividends and distributions are recorded on the ex-dividend date. Any net realized capital gains will be distributed at least annually by the Funds.

Illiquid Securities — A security is considered illiquid if it cannot be sold or disposed of in the ordinary course of business within seven days or less for its approximate carrying value on the books of a Fund. Valuations of illiquid securities may differ significantly from the values that would have been used had an active market value for these securities existed. As of December 31, 2016, the Funds did not own any illiquid securities.

Investments in Real Estate Investment Trusts (“REITs”) — Dividend income is recorded based on the income included in distributions received from the REIT investments using published REIT reclassifications including some management estimates when actual amounts are not available. Distributions received in excess of this estimated amount are recorded as a reduction of the cost of investments or reclassified to capital gains. The actual amounts of income, return of capital, and capital gains are only determined by each REIT after its fiscal year-end, and may differ from the estimated amounts.

3. AGREEMENTS AND OTHER TRANSACTIONS WITH AFFILIATES

Administration Agreement — The Trust entered into an Administration Agreement with SEI Investments Global Funds Services (the “Administrator”). Under the Administration Agreement, the Administrator provides administrative and accounting services to the Funds. Under the terms of the Administration Agreement, the Administrator is entitled to a fee of 0.20% of each Fund’s average daily net assets. The Administrator has voluntarily agreed to waive a portion of its fee so that the total annual expenses of the Balanced Growth Fund and the Balanced Income Fund, exclusive of acquired fund fees and expenses, will not exceed certain voluntary expense limitations adopted by the Adviser. Accordingly, the voluntary expense limitations are 0.14% and 0.20% for the Balanced Growth Fund and the Balanced Income Fund, respectively. These voluntary waivers may be terminated at any time.

Transfer Agent Servicing Agreement — In 2008, the Trust entered into a transfer agent servicing agreement (“Agreement”) with U.S. Bancorp Fund Services, LLC (“USBFS”), an indirect, wholly-owned subsidiary of U.S. Bancorp. Under the terms of the Agreement, USBFS is entitled to account based fees and annual fund level fees, as well as reimbursement of out-of-pocket expenses incurred in providing transfer agency services.

Investment Advisory Agreement — The Trust, on behalf of each Fund, entered into an Investment Advisory Agreement (“Agreement”) with SEI Investments Management Corporation (the “Adviser”). Under the Agreement, the Adviser is responsible for the investment management of the Funds and receives an annual advisory fee of 0.62% for the Growth Fund and 0.42% for the Income Fund. The Adviser does not receive an advisory fee for the Balanced Growth Fund and Balanced Income Fund. The Adviser has voluntarily agreed to waive a portion of its fee so that the total annual expenses of the Growth and Income Funds, exclusive of acquired fund fees and expenses, will not exceed certain voluntary expense limitations adopted by the Adviser. Effective November 1, 2016, the voluntary expense limitations are 0.93% and 0.80% for the Growth Fund and Income Fund, respectively. Subsequent to November 1, 2016, the voluntary expense limitations were 1.02% and 0.80% for the Growth Fund and Income Fund, respectively. These voluntary waivers may be terminated by the Adviser at any time.

The Adviser has entered into sub-advisory agreements to assist in the selection and management of investment securities in the Growth Fund and the Income Fund. It is the responsibility of the sub-advisers, under the direction of the Adviser, to make day-to-day investment decisions for these Funds. The Adviser, not the Funds, pays each sub-adviser a quarterly fee, in arrears, for their services. The Adviser pays sub-advisory fees directly from its own advisory fee. The sub-advisory fees are based on the assets of the Fund allocated to the sub-adviser for which the sub-adviser is responsible for making investment decisions.

The following are the sub-advisers for the Growth Fund: BlackRock Investment Management, LLC, Brandywine Global Investment Management, LLC, Coho Partners, Ltd., Parametric Portfolio Associates LLC and Waddell & Reed Investment Management Company.

The following are the sub-advisers for the Income Fund: Income Research & Management and Western Asset Management Company.

| 32 | New Covenant Funds / Semi-Annual Report / December 31, 2016 |

Shareholder Service Plan and Agreement—The Trust entered into a Shareholder Service Plan and Agreement (the “Agreement”) with the Distributor. Per the Agreement, a Fund is authorized to make payments to certain entities which may include investment advisors, banks, trust companies and other types of organizations (“Authorized Service Providers”) for providing administrative services with respect to shares of the Funds attributable to or held in the name of the Authorized Service Providers for its clients or other parties with whom they have a servicing relationship. Under the terms of the Agreement, the Growth Fund and the Income Funds are authorized to pay an Authorized Service Provider a shareholder servicing fee at an annual rate of up to 0.10% of the average daily net asset value of the Growth Fund and Income Fund, respectively, which fee will be computed daily and paid monthly, for providing certain administrative services to Fund shareholders with whom the Authorized Service Provider has a servicing relationship.

Distribution Agreement — The Trust issues shares of the Funds pursuant to a Distribution Agreement with SEI Investments Distribution Co. (the “Distributor”), a wholly owned subsidiary of SEI Investments Company (“SEI”). In consideration of the services and facilities to be provided by the Distributor or any service provider, each of the Growth Fund and the Income Fund (if such Fund has issued Shares) will pay to the Distributor a fee, as agreed from time to time, at an annual rate of up to 0.10% (ten basis points) of the average daily net asset value of the Growth Fund and the Income Fund, respectively, which fee will be computed daily and paid monthly.

Social Witness Services and License Agreement — The Trust retained New Covenant Trust Company (“NCTC”) to ensure that each Fund continues to invest consistent with social witness principles adopted by the General Assembly of the Presbyterian Church (U.S.A.). No less than annually, NCTC will provide the Trust with an updated list of issuers in which the Funds will be prohibited from investing.

NCTC will distribute to the Trust proxy voting guidelines and shareholder advocacy services for the Funds that NCTC deems to be consistent with social witness principles adopted by the General Assembly of the Presbyterian Church

(U.S.A.). The Trust also engages NCTC to vote Fund proxies consistent with such proxy voting guidelines. NCTC shall monitor and review and, as necessary, amend the Proxy Voting Guidelines periodically to ensure that they remain consistent with the social witness principles.

NCTC also grants to the Trust a non-exclusive right and license to use and refer to the trade name, trademark and/ or service mark rights to the name “New Covenant Funds” and the phrase “Funds with a Mission”, in the name of the Trust and each Fund, and in connection with the offering, marketing, promotion, management and operation of the Trust and the Funds.

In consideration of the services provided by NCTC, the Growth Fund and the Income Fund will each pay to NCTC a fee at an annual rate of 0.15% of the average daily net asset value of the shares of such Fund, which fee will be computed daily and paid monthly.

Payment to Affiliates — Certain officers and/or interested trustees of the Trust are also officers of the Distributor, the Adviser, the Administrator or NCTC. The Trust pays each unaffiliated Trustee an annual fee for attendance at quarterly and interim board meetings. Compensation of officers and affiliated Trustees of the Trust is paid by the Adviser, the Administrator or NCTC.

A portion of the services provided by the Chief Compliance Officer (“CCO”) and his staff, whom are employees of the Administrator, are paid for by the Trust as incurred. The services include regulatory oversight of the Trust’s Adviser, sub-advisers and service providers as required by SEC regulations. The CCO’s services have been approved by and are reviewed annually by the Board.

Investment in Affiliated Security — The Funds may invest excess cash in the SEI Daily Income Trust (SDIT) Government Fund, an affiliated money market fund. The Balanced Funds invest in the Growth Fund and Income Fund.

Interfund Lending — The SEC has granted an exemption that permits the Trust to participate in an interfund lending program (the ‘‘Program’’) with existing or future investment companies registered under the 1940 Act that are advised by SIMC (the ‘‘SEI Funds’’). The Program allows the SEI Funds to lend money to and borrow money from each other for temporary or emergency purposes. Participation in the Program is voluntary for both borrowing and lending funds. Interfund loans may be made only when the rate of interest to be charged is more favorable to the lending fund than an investment in overnight repurchase agreements (‘‘Repo Rate’’), and more favorable to the borrowing fund than the rate of interest that would be charged by a bank for short-term borrowings (‘‘Bank Loan Rate’’). The Bank Loan Rate will be determined using a formula reviewed annually by the SEI Funds’ Board

| New Covenant Funds / Semi-Annual Report / December 31, 2016 | 33 |

NOTES TO FINANCIAL STATEMENTS (UNAUDITED) (Continued)

December 31, 2016

of Trustees. The interest rate imposed on interfund loans is the average of the Repo Rate and the Bank Loan Rate. During the period ended December 31, 2016, the Trust did not participate in interfund lending.

4. DERIVATIVE TRANSACTIONS

The International Swaps and Derivatives Association, Inc. Master Agreements and Credit Support Annexes (“ISDA Master Agreements”) maintain provisions for general obligations, representations, agreements, collateral, and events of default or termination. The occurrence of a specified event of termination may give a counterparty the right to terminate all of its contracts and affect settlement of all outstanding transactions under the applicable ISDA Master Agreement.

To reduce counterparty risk with respect to Over The Counter (“OTC”) transactions, the Funds have entered into master netting arrangements, established within the Fund’s ISDA master agreements, which allow the Funds to make (or to have an entitlement to receive) a single net payment in the event of default (close-out netting) for outstanding payables and receivables with respect to certain OTC positions in swaps for each individual counterparty. In addition, the Funds may require that certain counterparties post cash and/or securities in collateral accounts to cover their net payment obligations for those derivative contracts subject to ISDA Master Agreements. If the counterparty fails to perform under these contracts and agreements, the cash and/or securities will be made available to the Funds.

For financial reporting purposes, the Funds do not offset derivative assets and derivative liabilities that are subject to netting arrangements in the Statement of Assets and Liabilities and therefore disclose these derivative assets and derivative liabilities on a gross basis. Bankruptcy or insolvency laws of a particular jurisdiction may impose restrictions on or prohibitions against the right of offset in bankruptcy, insolvency or other events.

Collateral terms are contract specific for OTC derivatives. For derivatives traded under an ISDA Master Agreement, the collateral requirements are typically calculated by netting the mark to market amount of each transaction under such agreement and comparing that amount to the value of any collateral currently pledged by the Funds or the counterparty. For financial reporting purposes, cash collateral that has been pledged to cover obligations of the Funds, if any, is reported separately on the Statement of Assets and Liabilities as cash pledged as collateral. Non-cash collateral pledged by the Funds, if any, is noted in the Schedules of Investments. Generally, the amount of collateral due from or to a party must exceed a minimum transfer amount threshold before a transfer has to be made. To the extent amounts due to the Funds from its counterparties are not fully collateralized, contractually or otherwise, the Funds bear the risk of loss from counterparty nonperformance.

The following is a summary of the variation margin of exchange-traded financial derivative instruments of the Funds as of December 31, 2016 ($ Thousands):

| Financial Derivative Asset | Financial Derivative Liability | |||||||||

|

|

| |||||||||

| Variation Margin Asset | Market value | Variation Margin Liability | ||||||||

|

|

|

|||||||||

| Fund | Futures | Written Options | Futures | Total | ||||||

|

|

| |||||||||

| Income Fund |

$ 43 | $ 16 | $ 53 | $ 69 | ||||||

Cash with a total market value of $224 ($ Thousands) has been pledged as collateral for exchange-traded derivative instruments as of December 31, 2016.

Written options transactions entered into during the period ended December 31, 2016 are summarized as follows:

| Income Fund | ||||

|

| ||||

| Number of Contracts |

Premiums ($ Thousands) | |||

|

| ||||

| Balance at beginning of period |

12 | $ 5 | ||

| Written |

271 | 95 | ||

| Expired |

(244) | (83) | ||

|

| ||||

| Balance at end of period |

39 | $ 17 | ||

|

| ||||

| 34 | New Covenant Funds / Semi-Annual Report / December 31, 2016 |

5. INVESTMENT TRANSACTIONS

| The cost of security purchases and the proceeds from the sale and maturities of securities, excluding U.S. government and other short-term investments, for the period ended December 31, 2016, were as follows: |

|

|

||||||||||||||||

| Fund | Purchases Short-Term ($ Thousands) |

Sales (excluding Short-Term Investments & U.S. Government Securities) ($ Thousands) |

Purchases of U.S. Government Securities ($ Thousands) |

Sales of U.S. Government Securities ($ Thousands) |

||||||||||||

|

|

||||||||||||||||

| Growth Fund |

$ 100,682 | $ 114,840 | $ – | $ – | ||||||||||||

| Income Fund |

32,080 | 38,755 | 143,725 | 119,742 | ||||||||||||

| Balanced Growth Fund |

8,339 | 16,573 | – | – | ||||||||||||

| Balanced Income Fund |

1,728 | 3,394 | – | – | ||||||||||||

The following is a summary of the transactions with affiliates for the period ended December 31, 2016:

| Value 6/30/2016 ($ Thousands) |

Purchases at Cost ($ Thousands) |

Proceeds from Sales ($ Thousands) |

Realized Gain (Loss) ($ Thousands) |

Unrealized Gain (Loss) ($ Thousands) |

Value 12/31/2016 ($ Thousands) |

Dividends from Affiliates ($ Thousands) |

||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||

| Growth Fund |

||||||||||||||||||||||||||||

| SDIT Government Fund |

$ 18,618 | $ 23,942 | $ (31,440) | $ – | $ – | $ 11,120 | $ 12 | |||||||||||||||||||||

| Income Fund |

||||||||||||||||||||||||||||

| SDIT Government Fund |

935 | 49,391 | (49,299) | – | – | 1,027 | – | |||||||||||||||||||||

| Balanced Growth Fund |

||||||||||||||||||||||||||||

| New Covenant Growth Fund |

172,525 | – | (14,701) | 12 | 12,711 | 170,547 | 870 | |||||||||||||||||||||

| New Covenant Income Fund |

109,043 | 8,339 | (1,872) | (75) | (2,505) | 112,930 | 1,013 | |||||||||||||||||||||

| SDIT Government Fund |

2,769 | 9,141 | (9,023) | – | – | 2,887 | 2 | |||||||||||||||||||||

| Balanced Income Fund |

||||||||||||||||||||||||||||

| New Covenant Growth Fund |

27,763 | – | (2,605) | 93 | 1,936 | 27,187 | 139 | |||||||||||||||||||||

| New Covenant Income Fund |

49,375 | 1,728 | (789) | (32) | (1,124) | 49,158 | 452 | |||||||||||||||||||||

| SDIT Government Fund |

780 | 3,504 | (3,502) | – | – | 782 | – | |||||||||||||||||||||

6. FEDERAL TAX INFORMATION

It is each Fund’s intention to continue to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code and distribute all of its taxable income (including net capital gains). Accordingly, no provision for federal income tax is required.

Dividends from net investment income and distributions from net realized capital gains are determined in accordance with U.S. Federal income tax regulations, which may differ from those amounts determined under U.S. GAAP. These book/tax differences are either temporary or permanent in nature. To the extent these differences are permanent, they are charged or credited to paid-in capital, undistributed net investment income or accumulated net realized gain, as appropriate, in the period that the differences arise.

The tax character of dividends and distributions paid during the last two years ended June 30 were as follows:

|

|

||||||||||||||||||

| Ordinary Income ($ Thousands) |

Long Term Capital Gains ($ Thousands) |

Total Taxable Deductions ($ Thousands) |

Total Distributions Paid ($ Thousands) |

|||||||||||||||

|

|

||||||||||||||||||

| Growth Fund |

2016 | $ 9,729 | $ 19,120 | $ 28,849 | $ 28,849 | |||||||||||||

| 2015 | 15,913 | 58,109 | 74,022 | 74,022 | ||||||||||||||

| Income Fund |

2016 | 5,431 | – | 5,431 | 5,431 | |||||||||||||

| 2015 | 4,984 | – | 4,984 | 4,984 | ||||||||||||||

| Balanced Growth Fund |

2016 | 5,830 | 25,218 | 31,048 | 31,048 | |||||||||||||

| 2015 | 9,579 | 4,482 | 14,061 | 14,061 | ||||||||||||||

| Balanced Income Fund |

2016 | 1,340 | 3,963 | 5,303 | 5,303 | |||||||||||||

| 2015 | 2,080 | 1,897 | 3,977 | 3,977 | ||||||||||||||

| New Covenant Funds / Semi-Annual Report / December 31, 2016 | 35 |

NOTES TO FINANCIAL STATEMENTS (UNAUDITED) (Continued)

December 31, 2016

As of June 30, 2016, the components of distributable earnings (accumulated losses) were as follows:

|

|

||||||||||||||||||||||||||||

| Undistributed ($ Thousands) |

Undistributed Long-Term Capital Gain ($ Thousands) |

Capital Loss ($ Thousands) |

Post- October Losses ($ Thousands) |

Unrealized Appreciation ($ Thousands) |

Other Temporary Differences ($ Thousands) |

Total Distributable Earnings (Accumulated Losses) ($ Thousands) |

||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||

| Growth Fund |

$ | 407 | $ | – | $ | – | $ | (13,780) | $ | 41,305 | $ | (51) | $ | 27,881 | ||||||||||||||

| Income Fund |

509 | – | (51,027) | – | 6,152 | (1,809) | (46,175) | |||||||||||||||||||||

| Balanced Growth Fund |

520 | 6,916 | – | – | 23,026 | – | 30,462 | |||||||||||||||||||||

| Balanced Income Fund |

259 | 967 | – | – | 6,547 | – | 7,773 | |||||||||||||||||||||

Post October losses represent losses realized on investment transactions from November 1, 2015 through June 30, 2016 that, in accordance with Federal income tax regulations, the Funds may defer and treat as having arisen in the following fiscal year. Deferred Late-Year Losses represent ordinary losses realized on investment transactions from January 1, 2016 through June 30, 2016 and specified losses realized on investment transactions from November 1, 2015 through June 30, 2016, that, in accordance with Federal income tax regulations, the Fund defers and treats as having arisen in the following fiscal year.

For Federal income tax purposes, capital loss carryforwards incurred in taxable years beginning before December 22, 2010 may be carried forwards for a maximum period of eight years and applied against future net realized gains. At June 30, 2016, the breakdown of capital loss carryforwards was as follow:

|

|

||||||||

| Expires 2018 ($ Thousands) |

Total Capital Loss Carryforwards ($ Thousands) June 30, 2016 |

|||||||

|

|

||||||||

| Income Fund |

$ 51,027 | $51,027 | ||||||

Under the recently enacted Regulated Investment Company Modernization Act of 2010, the Funds are permitted to carry forward capital losses incurred in taxable years beginning after December 22, 2010 for an unlimited period. However, any losses incurred during those future taxable years will be required to be utilized prior to the losses incurred in pre-enactment taxable years. As a result of this ordering rule, pre-enactment capital loss carryforwards may be more likely to expire unused. Additionally, post-enactment capital losses that are carried forward will retain their character as either short-term or long-term capital losses rather than being considered all short-term as under previous law.

During the fiscal year ended June 30, 2016, the following Funds utilized capital loss carryforwards to offset capital gains.

|

|

||||

| Amount Utilized ($ Thousands) |

||||

|

|

||||

| Income Fund |

$ 4,074 | |||

For Federal income tax purposes, the cost of securities owned at June 30, 2016, and the net realized gains or losses on securities sold for the period were not materially different from amounts reported for financial reporting purposes. These differences are primarily due to wash sales, MLP basis adjustments and basis adjustments from investments in registered investment companies which cannot be used for Federal income tax purposes in the current year and have been deferred for use in future years.

| 36 | New Covenant Funds / Semi-Annual Report / December 31, 2016 |

The aggregate gross unrealized appreciation and depreciation on total investments held by the Funds at December 31, 2016 was as follows:

|

|

||||||||||||||||

| Federal Tax Cost ($ Thousands) |

Aggregate Gross Unrealized Appreciation ($ Thousands) |

Aggregate Gross Unrealized Depreciation ($ Thousands) |

Net Unrealized Appreciation |

|||||||||||||

|

|

||||||||||||||||

| New Covenant Growth Fund |

$ | 335,526 | $ | 62,009 | $ | (7,206) | $ | 54,803 | ||||||||

| New Covenant Income Fund |

316,162 | 2,551 | (3,655) | (1,104) | ||||||||||||

| New Covenant Balanced Growth Fund |

241,614 | 45,521 | (771) | 44,750 | ||||||||||||

| New Covenant Balanced Income Fund |

67,537 | 10,226 | (636) | 9,590 | ||||||||||||

Management has analyzed the Funds’ tax positions taken on Federal income tax returns for all open tax years and has concluded that as of December 31, 2016, no provision for income tax would be required in the Funds’ financial statements. The Funds’ Federal and state income and Federal excise tax returns for tax years for which the applicable statutes of limitations have not expired are subject to examination by the Internal Revenue Service and state departments of revenue.

7. CONCENTRATIONS/RISKS

In the normal course of business, the Trust enters into contracts that provide general indemnifications by the Trust to the counterparty to the con- tract. The Trust’s maximum exposure under these arrangements is dependent on future claims that may be made against the Trust and, therefore, cannot be estimated; however, management believes that, based on experience, the risk of loss from such claims is considered remote.

The market values of the Income Fund’s investments may change in response to interest rate changes and other factors. During periods of falling interest rates, the values of fixed income securities generally rise. Conversely, during periods of rising interest rates, the values of such securities generally decline. Changes by recognized rating agencies in the ratings of any fixed income security and in the ability of an issuer to make payments of interest and principal may also affect the value of these investments.

The Growth Fund concentrates its investments in securities of foreign issuers in various countries. These investments may involve certain considerations and risks not typically associated with investments in the United States, as a result of, among other factors, the possibility of future political and economic developments and the level of governmental supervision and regulation of securities markets in the respective countries.

The Funds will not invest more than 15% of the value of their net assets in securities that are illiquid because of restrictions on transferability or other reasons. Repurchase agreements with deemed maturities in excess of seven days are subject to this 15% limit. The Funds may purchase securities which are not registered under the Securities Act of 1933 (the “Securities Act”) but which can be sold to “qualified institutional buyers” in accordance with Rule 144A under the Securities Act. In some cases, such securities are classified as “illiquid securities;” however, any such security will not be considered illiquid so long as it is determined by the Adviser, under guidelines approved by the Board of Trustees, that an adequate trading market exists for that security. This investment practice could have the effect of increasing the level of illiquidity in a Fund during any period that qualified institutional buyers become uninterested in purchasing these restricted securities.

The Income Fund may invest a limited amount of assets in debt securities which are rated below investment grade (hereinafter referred to as “lower- rated securities”) or which are unrated but deemed equivalent to those rated below investment grade by the portfolio managers. The lower the ratings of such debt securities, the greater their risks. These debt instruments generally offer a higher current yield than that available from higher-grade issues, and typically involve greater risks. The yields on lower-rated securities will fluctuate over time. In general, prices of all bonds rise when interest rates fall and fall when interest rates rise. Lower-rated securities are subject to adverse changes in general economic conditions and to changes in the financial condition of their issuers. During periods of economic downturn or rising interest rates, issuers of these instruments may experience financial stress that could adversely affect their ability to make payments of principal and interest, and increase the possibility of default.