As filed with the Securities and Exchange Commission on December 13, 2021

Registration No. 333-253160

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

PRE-EFFECTIVE AMENDMENT NO. 3

TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

AppTech Corp.

(Exact Name of Registrant as Specified in its Charter)

| Wyoming | 7389 | 66-0847995 | ||

| (State or other jurisdiction

of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification No.) |

5876 Owens Avenue

Suite 100

Carlsbad, California 92008

(760) 707-5959

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Luke D’Angelo

Chief Executive Officer

5876 Owens Avenue

Suite 100

Carlsbad, California 92008

(760) 707-5959

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Andrew M. Tucker, Esq. Nelson Mullins Riley & Scarborough LLP 101 Constitution Ave NW, Suite 900 Washington, DC 20001 Telephone: (202) 689-2800 |

Ross Carmel, Esq. Philip Magri, Esq. Carmel, Milazzo & Feil LLP 55 W 39th Street, 18th Floor New York, NY 10018 Telephone: (212) 658-0458 |

Approximate date of commencement of proposed sale to public: As soon as practicable after this Registration Statement is declared effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☒ | Smaller reporting company | ☒ |

| Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

CALCULATION OF REGISTRATION FEE

| Title of Each Class of Securities to Be Registered (1) | Proposed Maximum Aggregate Offering Price | Amount of Registration Fee | ||||||||

| Units consisting of shares of Common Stock, par value $0.001 per share, and Warrants to purchase shares of Common Stock included as part of the Units (2)(3) | $ | 17,250,000 | $ | 1,599.08 | ||||||

| Common Stock included as part of the Units (4) | $ | $ | — | |||||||

| Warrants to purchase shares of Common Stock included as part of the Units (3)(4) | $ | — | $ | — | ||||||

| Shares of Common Stock issuable upon exercise of the Warrants (5) | $ | 21,570,871 | $ | 1,999.62 | ||||||

| Total (6) | $ | 38,820,871 | $ | 3,598.70 | ||||||

| (1) | In the event of a stock split, stock dividend, or similar transaction involving our Common Stock, the number of shares registered shall automatically be increased to cover the additional shares of Common Stock issuable pursuant to Rule 416 under the Securities Act. |

| (2) | Each Unit consists of one share of Common Stock and one Warrant, each Warrant is exercisable for one share of Common Stock at a price per share equal to 125% of the public offering price per Unit. |

| (3) | Includes shares and Warrants that may be issued upon exercise of a 45-day option granted to the underwriters to cover over-allotments, if any (the “Over-Allotment Option”). |

| (4) | In accordance with Rule 457(i) under the Securities Act, because the shares of the registrant’s common stock underlying the Warrants are registered hereby, no separate registration fee is required with respect to the Warrants registered hereby. |

| (5) | Includes shares of common stock which may be issued upon exercise of additional Warrants which may be issued upon exercise of the Over-Allotment Option. |

| (6) | The registrant previously paid $3,678.85 in connection with a prior filing of this registration statement. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until this Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to such Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

| PRELIMINARY PROSPECTUS | Subject to completion, dated December 13, 2021 |

2,912,621 Units

Each Unit Consisting of

One share of Common Stock and

One Warrant to Purchase One Share of Common Stock

APPTECH CORP.

This is a firm commitment underwritten public offering of units (the “Units”) of AppTech Corp., a Wyoming corporation (the “Company,” “we,” “us,” “our”). We expect the initial public offering price to be between $4.15 and $6.15 per Unit. Each Unit consists of one share of common stock, $0.001 par value per share, and one warrant (each, a “Warrant” and collectively, the “Warrants”) to purchase one share of common stock from the date of issuance until the fifth anniversary of the date of issuance at an exercise price of $6.44 per share (each a “Warrant Share” and collectively, the “Warrant Shares”), constituting 125% of the price of each Unit sold in this offering based on an assumed initial offering price of $5.15 per Unit, the midpoint of the range. The Units have no stand-alone rights and will not be certificated or issued as stand-alone securities. The shares of common stock and the Warrants comprising the Units are immediately separable and will be issued separately in this offering. Each Warrant offered hereby is immediately exercisable on the date of issuance and will expire five years from the date of issuance.

We are a fully reporting company under Section 12(g) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Our common stock is currently traded on the OTC Markets under the Symbol “APCX.” As of December 9, 2021, the reported closing price for our Common Stock as quoted on the OTC Markets was $1.23 per share ($11.69 per share, assuming a reverse stock split of 1-for-9.5). There is currently no public market for the offered Warrants. We have applied to list our common stock and the Warrants on the Nasdaq Capital Market, or Nasdaq, under the symbols “APCX” and “APCXW,” respectively. There can be no assurance that we will be successful in listing our Common Stock or Warrants on the Nasdaq Capital Market. However, we will not complete this offering unless we are so listed.

The offering price of the Units will be determined between us and EF Hutton, division of Benchmark Investments, LLC, the representative of the underwriters in connection with this offering, taking into consideration our historical performance and capital structure, prevailing market conditions, and overall assessment of our business, and will not be based upon the price of our common stock on the OTC. Therefore, the assumed public offering price of the Units used throughout this prospectus may not be indicative of the actual public offering price for our Units.

Unless otherwise noted and other than in our financial statements and the notes thereto, the share and per share information in this prospectus reflects a proposed 1-for-9.5 reverse stock split of our outstanding common stock and treasury stock to occur concurrently with the effective date of the registration statement of which this prospectus is a party and prior to the closing of this offering.

Investing in our securities involves a high degree of risk. Before buying any securities, you should carefully read the discussion of the material risks of investing on our securities under the heading “Risk Factors” beginning on page 13 of this prospectus as well as other information contained in this prospectus before you invest.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed on the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

| Per Share | Total | |||||||

| Public offering price | $ | $ | ||||||

| Underwriting discount (1) | $ | $ | ||||||

| Proceeds, before expenses, to us | $ | $ | ||||||

| (1) | See “Underwriting” for additional information regarding total underwriter compensation. The amount of offering proceeds to us presented in this table does not give effect to any exercise of the: (i) Warrants underlying the Units in this offering and (ii) the Over-Allotment Option. |

We have granted the underwriters a 45-day option to purchase up to 873,786 additional shares and/or Warrants, solely to cover over-allotments, if any (the “Over-Allotment Option”). If the underwriters exercise the Over-Allotment Option in full, the total underwriting discounts payable by us will be $1,380,000 and the total proceeds to us, before expenses, will be $ 15,870,000.

The underwriters expect to deliver the securities against payment to the investors in this offering on or about _____, 2021.

Sole Book-Running Manager

EF HUTTON

division of Benchmark Investments, LLC

The date of this prospectus is _________, 202__.

TABLE OF CONTENTS

Neither we nor the underwriters have authorized anyone to provide you with information different from, or in addition to, that contained in this prospectus, any amendment or supplement to this prospectus or any free writing prospectus prepared by or on behalf of us or to which we have referred you. We and the underwriters take no responsibility for, and can provide no assurances as to the reliability of, any information that others may give you. This prospectus is not an offer to sell, not is it seeking an offer to buy, these securities in any jurisdiction where the offer or sale is not permitted. The information contained in this prospectus or in any free writing prospectus is only accurate as of its date, regardless of its time of delivery or the time of any sale of our common stock. Our business, financial condition, results of operations and prospects may have changed since that date.

For investors outside the United States: Neither we nor any of the underwriters have done anything that would permit this offering or possession or distribution of this prospectus or any free writing prospectus we may provide to you in connection with this offering in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the shares of our common stock and the distribution of this prospectus and any such free writing prospectus outside of the United States.

Numerical figures included in this prospectus have been subject to rounding adjustments. Accordingly, numerical figures shown as totals in various tables may not be arithmetic aggregations of the figures that precede them.

MARKET DATA

The market data and certain other statistical information used throughout this prospectus are based on independent industry publications, governmental publications, reports by market research firms or other independent sources that we believe to be reliable sources. Industry publications and third-party research, surveys and studies generally indicate that their information has been obtained from sources believed to be reliable, although they do not guarantee the accuracy or completeness of such information. We are responsible for all of the disclosure contained in this prospectus, and we believe these industry publications and third-party research, surveys and studies are reliable. While we are not aware of any misstatements regarding any third-party information presented in this prospectus, their estimates, in particular, as they relate to projections, involve numerous assumptions, are subject to risks and uncertainties, and are subject to change based on various factors, including those discussed under the section entitled “Risk Factors” and elsewhere in this prospectus. Some data are also based on our good faith estimates.

TRADEMARKS

We own or have rights to various trademarks, service marks and trade names that we use in connection with the operation of our business. This prospectus may also contain trademarks, service marks and trade names of third parties, which are the property of their respective owners. Our use or display of third parties’ trademarks, service marks and trade names or products in this prospectus is not intended to, and does not imply a relationship with, or endorsement or sponsorship by us. Solely for convenience, the trademarks, service marks and trade names referred to in this prospectus may appear without the ®, TM or SM symbols, but the omission of such references is not intended to indicate, in any way, that we will assert, to the fullest extent under applicable law, our rights or the right of the applicable owner of these trademarks, service marks and trade names.

ii

This summary highlights information contained in greater detail elsewhere in this prospectus. Because it is a summary, it does not contain all of the information that you should consider in making your investment decision. Before investing in our common stock, you should carefully read this prospectus in its entirety, including the “Risk Factors,” “Special Note Regarding Forward Looking Statements,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the financial statements and the notes to those financial statements in each case included in this prospectus.

As used in this prospectus, unless the context otherwise requires, references to “AppTech,” the “Company,” “we,” “us” and “our” refer to AppTech Corp.

Our Company

Overview

Through our scalable cloud-based platform architecture and infrastructure coupled with our commerce experiences development and delivery model, we intend to simplify and streamline digital financial services for corporations, small and midsized enterprises (“SMEs”) and consumers. We will accomplish this through innovative omnichannel payment and digital banking technologies that complement our core merchant services capabilities. We believe there is opportunity to generate significant revenue for the Company the near future by providing innovative commerce solutions and experiences that resonate with clients, their customers, and the market as a whole. Further, our soon to be launched modular platform will equip forward-thinking financial institutions, technology companies, and SMEs with operational efficiencies, such as automated financial controls and reconciliation in addition to manual administration.

Today, our Company’s merchant services solutions provide financial processing for businesses to accept cashless and/or contactless payments, such as credit cards, ACH, wireless payments, and more. Our patented, exclusively licensed, and proprietary merchant services software will offer, new integrated solutions for frictionless digital and mobile payment acceptance including acceptance of alternative payment methods (“APMs”). We are extending and enhancing these capabilities with software that solves for multi-use case, multi-channel, API-driven, account-based issuer processing for card, digital tokens, and payment transfer transactions. Our scalable business model allows for expansive white-labeling, SaaS, and embedded solutions that will drive the digital transformation of financial services and generate diverse revenue streams for our company.

The financial services industry is going through a period of intensive change driven by the advancement of technology, the adaptation to societal changes resulting from COVID-19, and the rapid rise of contactless transactions. End-users expect ease of use and an enhanced user experience in all their daily financial interactions. In this rapidly evolving digital marketplace, our prospective clients, such as merchants and independent software vendors (“ISVs”), have broad and frequently changing requirements to meet consumer expectations and operational efficiencies to maintain their competitive edge.

Providing basic payment acceptance and “lowest price” models is no longer the winning formula to support the market. These entities recognize that staying competitive in the digital age requires a partner with a platform and services capable of delivering flexibility and growth while streamlining operations to continually deliver increased revenue and profitability opportunities. Our pricing is extremely competitive, but we believe the value we create for financial institutions, technology companies, and SMEs through our technology, deployment model, services and consultative approach will create true differentiation from our competitors.

Our global financial services platform architecture and infrastructure is designed to be flexible and configurable to meet current and future market needs. This will empower our clients to take advantage of future platform development and new innovative digital financial solutions by leveraging off-the-shelf experiences and consuming our APIs. Additionally, by taking a holistic view of all aspects of our clients’ business, including risk, volume, user experience, integration capabilities and technical needs, we will create optimal and extensible financial technology solutions at a rapid pace.

Through exclusive licensing and partnership agreements to complement our patented technology capabilities, we believe we will become leaders in the embedded payment and digital banking sectors by supporting digital, tokenized, multi-channel, embedded API-driven transactions. We intend to accelerate this position through the integration of our merchant services and a secure text payment solution with extensive digital account-based and multi-channel issuer payment processing capabilities. We believe that this will enable us to provide our clients an end-to-end payment acceptance and digital banking solution powering straight-through processing and embedded payment opportunities in the B2B space. We expect to support clients through the development of custom and off-the-shelf experiences by delivering these solutions through public APIs and Webhooks.

1

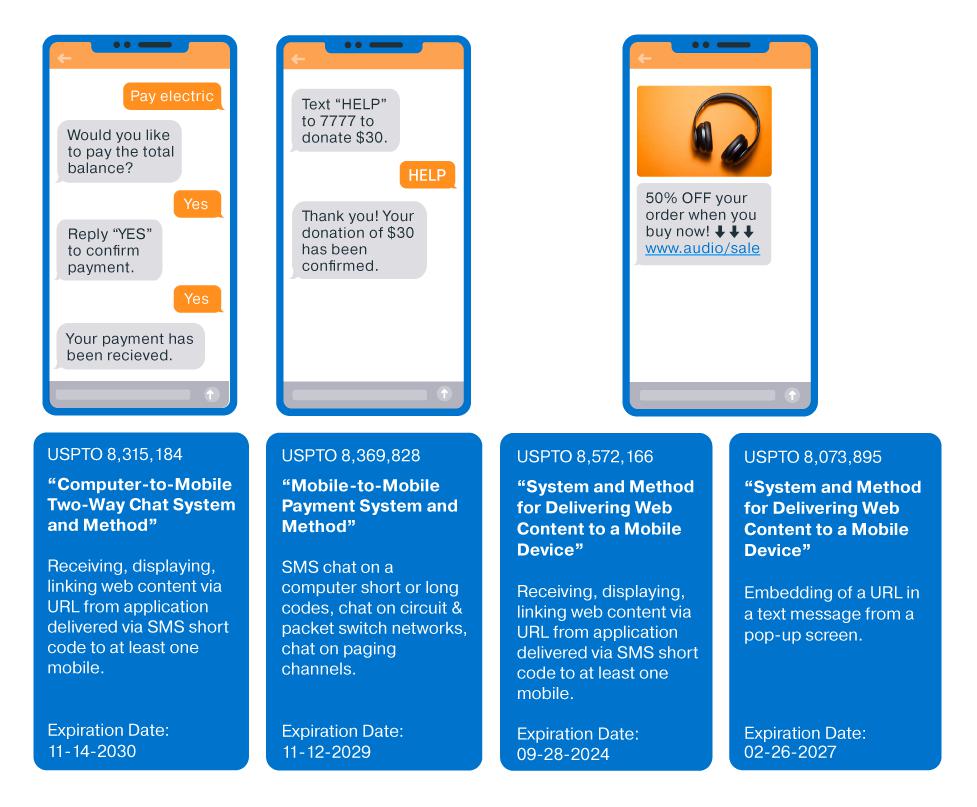

A key to the company’s success and market penetration is the continued development of enterprise-grade, patent protected software for SMS text payments via a mobile device. Our patented technology manages text messaging for processing payments, notification, response, authentication, marketing, advertising, information queries and reports. Once an account is established through a multi-currency digital wallet, neither internet connectivity nor a specific application is required to process payments between merchants and end-users. These features will be particularly beneficial for unbanked and under banked individuals in developing or emerging markets where access to the internet on a mobile device and modern banking institutions may not be readily available. In addition, our software platform will extend merchants’ marketplace capabilities by creating new avenues and channels to request and receive frictionless, digital payments and engaging end-users by utilizing a familiar, convenient, and widely adopted technology.

We believe our technologies will greatly increase the adoption of mobile payments and alternate banking solutions in sectors that must quickly adapt and migrate towards new technologies that facilitate convenient and safe contactless payments. To survive and succeed in this environment, businesses need to adopt new technologies to engage, communicate and process payments with their customers from a supplier that widely supports innovation and adaptation as the industry evolves. By embracing technological advancement in the payment and banking industries, we are well-positioned to meet the growing needs of existing and prospective clients and intend for our current and future products to be at the forefront of solving these accelerated market needs.

We are also expanding upon our financial technology foundation into the telehealth and remote patient monitoring sectors in response to cultural shifts and new healthcare demands of society. We have identified a need for the integration of payment acceptance technologies into the burgeoning telehealth sector. We believe this sector’s focus to date has been on providing health-related telecommunications but the way in which fees and payments for these services are requested and accepted is being overlooked. We intend to fill this identified shortfall by developing technologies and payment-related services to aid companies providing telehealth solutions. Through a strategic partnership, we plan to help bring to market personal emergency response and remote patient monitoring services and equipment to help ensure the safety of elderly and injured or sick patients while providing peace of mind to family members, care givers and retirement communities. These solutions increase patients’ access to comprehensive care options and allow medical teams to intervene in a timely manner to avoid more serious health concerns. By providing financial and administrative services we will have the opportunity to receive substantial revenue share from recurring revenue billed through Medicare with the potential for substantial growth and substantial profit margins.

Industry Background

The financial technology and payment processing industries are an integral part of today’s worldwide financial structure. The electronic payments industry is massive, with growth fueled by powerful long-term trends that continue to increase the acceptance and use of electronic payments compared to paper-based payments. According to The Nilson Report, purchase volume on credit, debit and prepaid cards in the United States was approximately $6.1 trillion in 2018 and is estimated to reach nearly $10.4 trillion by 2027, a compound annual growth rate, or CAGR, of 6.1%.1

According to American Banker, banking and financial services incumbents are failing to compete on customer experience, which is a weakness fintechs are very successfully exploiting.2 In fact, based on a 2019 PwC Global Fintech Report, industry executives believe that 25% or more of their business could be at risk of being lost to standalone fintechs within five years.3 Furthermore, according to Allied Market Research, The global digital banking platform market size was valued at $3.95 billion in 2019 and is projected to reach $10.87 billion by 2027, growing at a CAGR of 13.6% from 2020 to 2027.4 All of this research and expert opinion provides a clear picture of the opportunities ahead for fintechs that can provide innovative commerce solutions and experiences that resonate with clients, their customers and the market as a whole.

According to a Walker report, customer experience will overtake price and product features as the key brand differentiator this year. Moreover, according to research from PwC, an immersive and engaging customer experience drives more customer spending.5 In fact, 86% of buyers are willing to pay more when immersed in a great customer experience - Experience outweighs cost.

The payment processing industry continues to evolve rapidly based on the application of new technology and changing customer needs. Changes in technology have allowed for new payment methods, such as mobile and contactless payments which is driving demand for new innovative solutions to meet consumer expectations. This results in businesses increasingly being required to deliver new, convenient methods of interacting with their customers to ensure loyalty and repeat business. As consumers continue to integrate mobile devices into their lives, there will be increased demand to conduct business on these devices. According to Global Industry Analysts, the global mobile payment market was valued at $1,449.56 billion in 2020 and is expected to reach over $5,399.6 billion in 2026 with growth at a CAGR of 24.5% over the forecast period (2021 - 2026).6

GSMA Intelligence reported in 2019 that globally, there are more than 9.2 billion mobile connections and 5.1 billion mobile subscribers with text messaging capabilities.7 Statista asserted that just over 3.9 billion of these devices have access to mobile internet.8

1 Nilson Report – Payment Cards in the U.S. Projected, October 2020.

2 American Banker and Monigle, Humanizing the Bank Customer Experience, 2021.

3 PricewaterhouseCoopers, LLP– Global Fintech Report, 2019.

4 Allied Market Research – Digital Banking Platform Market Size to Hit $10.87 Billion by 2027, at 13.6% CAGR, October 2020.

5 Walker Resources – Customers 2020: A Progress Report.

6 Global Industry Analysts – Consumer Mobile Payments – Global Market Trajectory and Analytics, October 2021.

7 GSM Association – The State of Mobile Internet Connectivity 2019.

8 Statista Research Department – Mobile Internet Usage Worldwide – Statistics and Facts, July 2021.

2

The pandemic environment of 2020 added fuel to the fire and accelerated these trends in a way no one could have predicted. An Accenture study found that a total of 2.7 trillion transactions worth $48 trillion shifted from cash to other forms of payments, representing a $300 billion opportunity for payment providers. The pandemic also narrowed the generational gap between digital payment preferences, with nearly two thirds (64%) of consumers saying they used contactless cards during the pandemic.

Telehealth uses information and communication technology to overcome distance barriers and improve access to healthcare. According to Fortune Business Insights, the global telehealth market size was valued at $61.40 billion in 2019 and is projected to reach $559.52 billion by 2027, exhibiting a CAGR of 25.2% during the forecast period. Reports and Data reported the remote patient monitoring market is forecast to reach $2.14 billion by 2027 with a CAGR of 14.1%.

Our Competitive Strengths

We believe our adaptable technology stack and product offerings differentiate us from our competitors. Our products and solutions help to eliminate much of our sector’s reliance on legacy payment rails and financial systems. The design and delivery are not being restricted by antiquated foundational technology. Management believes the applicability and frictionless nature of our products will offer an immediate impact on the digital financial services industry. Further, the solutions we intend to deliver to our clients will be driven off user-centered design principles to providing seamless, best-in-class experiences to the end-user.

Digital transformation is complex for most companies sighting such concerns around shifting company culture, legacy systems, rigidity of platforms and processes, inefficiencies in skillsets and knowledge. Additionally, even when these companies see the value in digital transformation, often these companies face an inability to properly shift resources to new technology while maintaining customers on existing platforms. Non-discretionary spend required to “keep the lights on” outweighs leadership’s ability to invest in future technology which results in a vulnerabilities and competitive threats.

3

Our financial services platform is intended to empower our clients with an extensible, adaptable framework capable of dynamically solving challenges found across the financial services industry. Further, this ability will allow us to drive deeply and expediently into specific market segments to solve problems that we find to be a continued burden on our client’s and their customer base. Based on market, client and end-user research and discovery, it is expected that these unique solutions produced for client’s will be highly leverageable across these segments to deliver experiences at scale while producing rapid revenue and profitability.

As we increase our client base and deployment of solutions to meet our client’s specifications, we will continue to grow these “off-the-shelf” experiences that will ultimately lower our development costs while increasing speed to market. In addition, we are positioned to utilize this model to grow industry partnerships and app marketplace plugins thus further leveraging our capabilities and market reach.

Founded on a modern core platform backed by an intelligent financial technology framework, our ability to rapidly deploy solutions and experiences that are otherwise cumbersome, expensive and often fall short of expectations will prove successful. Once launched, our position is to penetrate deep into certain segments to build a model that will directly drive growth. Gaining robust insights in these segments while delivering best-in-class experiences will also produce future opportunities to expand our off-the-shelf solutions to other verticals or sub-verticals that are challenged with solving similar problems.

While our core foundational platform will continue to adapt and grow based on new innovations, we will soon launch into the market with an extremely robust and innovative set of secure digital banking and payments features and functionality. This will allow us to quickly deliver the future of digital finance to meet the demands of the markets we intend to serve without the deployment burdens encumbering the market today.

Additionally, the patent protection to some of our products is uncommon within the fintech industry. This protection prevents competitors from replicating our products to carve away at our anticipated market share. Therefore, backing our text payment and lead generation products with patents strengthens the viability of such products by limiting direct competition and strengthening strategic partnerships. It is expected that we will also expand our patent portfolio through new innovations and acquisitions.

Our patent protected text payment system’s anticipated capabilities also set us apart. By creating a product that permits mobile payments without the need for a data plan, internet or an application -after an initial account is established-, we will have the unique ability to extend our customer base to target unbanked and underbanked individuals primarily in developing or emerging markets. Integrating consumers that are not traditionally included in the payment space will allow us to have a larger potential market than many of our competitors.

Our Growth Strategy

We intend to grow by leveraging our existing IP, continually developing products and solutions, establishing strategic partnerships and seeking selective acquisitions that uniquely complement our core business to meet growing market demand. From traditional merchant accounts to customizable inbound and outbound payment solutions, we intend to modernize and enhance the payment processing and digital banking capabilities for businesses throughout the world. Our business objective is to generate revenue based on licensing and subscription fees, transactional processing fees, product line growth, and continual advancement of our IP portfolio.

Our target market is forward-thinking financial institutions, technology companies, and SMEs seeking to broaden their distribution through the addition of digital omnichannel payments and digital banking technologies. We will serve these markets by reducing integration complexity and streamlining their integrated financial services capabilities.

4

SMEs generally lack the resources of large enterprises to invest heavily in technology. As a result, they are more dependent on service providers, like AppTech, to handle critical functions including payment acceptance and other support services and are likely to be early adopters of new services that will further increase their efficiency and drive growth. Additionally, we are targeting financial institutions looking to maintain their ability to compete by digitizing their financial services offerings to meet market demand. By enhancing their customer’s user experience through the development of innovative and user centric multi-channel, multi-currency, digital financial products, they will be able to maintain customer loyalty.

We intend to support a multi-method distribution model to achieve our vision. By providing delivery flexibility, we can rapidly engage and develop the right go-to-market strategies. As previously mentioned, not only are off-the-shelf solutions available, but we also offer embedded experiences that can be deployed using a growing portfolio of Open and Private APIs for developers to build unique experiences based on business cases and requirements.

Further, by offering clients a full array of marketing technology services, omnichannel payments and digital banking technologies, we will enable them to better interact with their customers and provide additional, dynamic means of processing both inbound and outbound financial transactions.

Businesses’ financial technology needs are increasingly complex. As electronic and mobile commerce continues to grow, businesses have no alternative but to use technology to better meet customer’s expectations. We believe that delivering innovative, adaptive, scalable, and operationally efficient products that meet their financial services needs will result in rapid market penetration for our anticipated products launches.

While leveraging new technology is vital to our growth plan, it is equally important that the technology is relevant and seamlessly fits into and benefits our end-user’s daily lives. Consumers are sometimes reluctant to alter their typical routines, especially when it relates to financial services. The anticipated launch of our text payment system and broader digital banking and payments solutions will meet both needs. We will offer financial technologies that do not rely on legacy rails thus increasing the opportunity to improve the end-user’s digital experiences. Once properly developed and rolled out, we anticipate rapid adoption.

We seek to grow our business by pursuing the following strategies:

| ● | Increasing our customer base by offering unique and compelling, patent protected technology solutions; | |

| ● | Driving growth in our merchant services business through new and flexible technologies, including our secure text payment system, that will enable our customers to adapt to a rapidly changing marketplace; | |

| ● | Rolling-out our API-driven, account-based, issuer processing solution for card, digital token, and payment transfer transactions that will enable us to target multi-currency and multi-channel digital banking and embedded B2B payment opportunities; | |

| ● | Providing advanced technology to our clients to engage end-users via lead generation and text marketing services to enable businesses to better communicate with their customers and integrate our full suite of products; | |

| ● | Maintaining technological leadership by continuing to innovate and improve our scalable, extensible, cloud-based technology; | |

| ● | Pursuing strategic acquisitions, investments, or partnerships to complement and bolster our suite of fintech products; | |

| ● | Creating cross-selling synergies through white-labeling or SaaS distribution enabling us to provide a holistic suite of products and services to financial institutions, technology companies, and SMEs; | |

| ● | Utilizing a scalable business model to eliminate certain barriers to rapid growth; and | |

| ● | Expanding into the telehealth sector by offering advanced remote patient monitoring technologies. |

5

Our market growth strategies will focus on the following elements: (1) new product development and delivery (2) market penetration (3) market expansion (4) IP, strategic acquisitions, and partnerships.

It is imperative that upon entrance into the market with the new platform, we focus on delivering an enhanced experience to our existing digital client base. As we roll this out, we will also continue discussions with our current and continually evolving pipeline of prospects to understand these opportunities and the value that we can bring to solve their needs. This strategy also provides growth opportunities with these clients, increases customer satisfaction and potential referrals, and produces valuable feedback into our product prioritization and roadmap.

Maintaining focus to deliver our technology to selective target market segments also allows us to deliver a deeper, more targeted set of solutions and experiences. In turn this will grow our knowledge within these select segments that will translate into further innovation and market penetration.

This continual development process will contribute to our overall strategy of delivering new, innovative technologies and solutions. It is expected that bringing these to market will expand opportunities in complimentary and new market segments. Given the Platform’s flexibility and a la carte capabilities, adapting these solutions and delivering new experiences is a core tenant to growth.

In addition, core to our values and strategy is the opportunity for growth through intellectual property. This is inclusive of the existing patent portfolio while also coupled with future innovation. It is also important to continually evaluate new technologies, market entrants and complimentary solutions to ensure continued growth. We expect that this will include strategic acquisitions of complimentary offerings and portfolio customers, while also focusing on strategic partnerships where we find synergy in our vision.

With years of fintech experience and a deep understanding of the industry, management believes we can leverage this expertise, industry contacts and past clients to accelerate market penetration. Engaging individuals with the ability to integrate our products may prove invaluable. Further, through our channel partnerships, we have an expansive network of potential clients that continue to show interest in our strategy and opportunity to embed our financial technologies into their solutions.

Management believes there are substantial opportunities in emerging and developing markets for our anticipated products. Our mobile payment and digital banking solutions offer innovative avenues to unbanked and underbanked communities to transact and provide remittances. Further, since internet connectivity is not required for our text payment solution, individuals with limited internet access will still be able transact. These two factors could open our products to markets with immense growth potential.

With our in-house expertise and our internationally experienced and proven team of subject matter experts via our partnership with Infinios Financial Services BSC’s (formally NEC Payments), we are focused on resources on delivering growth using the strategies described above. Both teams operate together in full confidence that the business is being powered by innovative technology IP running on robust, secure and scalable cloud infrastructure. We expect to continue the innovative development of the core platform while also developing alongside targeted market segments and clients to deliver productized, secure and scalable solutions and experiences.

Management also believes our partnership with Silver Alert Services, LLC will be the initial foothold for our expansion in the telehealth sector. Our strategic partnership providing financial services in support of their remote patient monitoring devices provides the opportunity to create substantial revenue. However, with the emergence of new telehealth platforms and the rapid shift towards e-visits, many of which require a private payer model, we believe our payment acceptance technology, specifically our embedded capabilities will have widespread application in the sector.

Risks Associated with our Business

An investment in our common stock involves a high degree of risk. You should carefully consider the risks summarized below. These risks are discussed more fully in the section titled “Risk Factors” following this prospectus summary. These risks include, but are not limited to, the following:

| ● | our going concern and history of losses; | |

| ● | uncertainty associated with anticipated launch of our financial services platform and other potential advanced payment solutions we intend to launch in the future; | |

| ● | substantial investment and costs associated with new potential revenue streams and their corresponding contractual obligations; | |

| ● | dependence on third-party channel and referral partners, who comprise a significant portion of our sales force, for gaining new clients; | |

| ● | a slowdown or reduction in our sales in due to a reduction in end user demand, unanticipated competition, regulatory issues, or other unexpected circumstances; | |

| ● | uncertainty regarding our ability to achieve profitability and positive cash flow through the commercialization of the products we offer or intend to offer in the future; | |

| ● | dependence on third-party payment processors to facilitate our merchant services capabilities; | |

| ● | delay in or failure to obtain regulatory approval of our financial services platform or any future products in additional countries; |

6

| ● | our ability to operate our business while timely making payments pursuant to our loan agreements; | |

| ● | our need to raise additional financing to fund daily operations and successfully grow our Company; | |

| ● | our ability to retain and recruit appropriate employees, in particular a productive sales force; | |

| ● | current and future laws and regulations; | |

| ● | general economic uncertainty associated with the COVID-19 pandemic; | |

| ● | the adverse effects of COVID-19, and its unpredictable duration, in regions where we have customers, employees and distributors; | |

| ● | the adverse effects of COVID-19 on processing volumes resulting from (a) limitations on in-person access to our merchants’ businesses or (b) the unwillingness of customers to visit our merchants’ businesses; | |

| ● | the possibility that the economic impact of COVID-19 will lead to changes in how consumers make purchases that we are unable to monetize; and | |

| ● | the other factors described in “Risk Factors.” |

Listing on the Nasdaq Capital Market

Our common stock is currently quoted on the OTC Markets under the symbol “APCX.” In connection with this offering, we have applied to list our common stock and the Warrants on the Nasdaq Capital Market (“Nasdaq”) under the symbols “APCX” and “APCXW,” respectively. If Nasdaq approves our listing application, we expect to list our Common Stock and Warrants upon consummation of the offering, at which point our Common Stock will cease to be traded on the OTC. Nasdaq’s listing requirements for the Nasdaq Capital Market include, among other things, a stock price threshold. As a result, prior to effectiveness of our registration statement of which this prospectus is a part, we will need to take the necessary steps to meet Nasdaq’s listing requirements, including, but not limited to effectuating a reverse split of our Common Stock (as further discussed below). If Nasdaq does not approve the listing of our Common Stock and the Warrants, we will not proceed with this offering. There can be no assurance that our Common Stock or Warrants will be listed on Nasdaq.

Reverse Stock Split

We intend to effect a reverse stock split of our common stock at a ratio of 1-for-9.5 at the time of the effectiveness of the registration statement of which this prospectus forms a part and prior to the closing of this offering. No fractional shares will be issued in connection with the reverse stock split and all such fractional interests will be rounded up to the nearest whole number of shares of common stock. The conversion or exercise prices of our issued and outstanding convertible securities, stock options and warrants will be adjusted accordingly. All information presented in this prospectus other than in our consolidated financial statements and the notes thereto assumes a 1-for-9.5 reverse stock split of our outstanding shares of common stock, and unless otherwise indicated, all such amounts and corresponding conversion price or exercise price data set forth in this prospectus have been adjusted to give effect to such assumed reverse stock split.

Corporate Information

We were originally formed as a Florida corporation on July 2, 1998 as Health Express USA, Inc. On August 29, 2005, we changed our name to CSI Business, Inc and reincorporated as a Nevada corporation. On September 15, 2006, we changed our name to Natural Nutrition Inc. On October 27, 2009, we changed our name to AppTech Corp. We filed Articles of Domestication to change the domicile of the Company from Nevada to Wyoming on July 18, 2011. We will reincorporate in Delaware prior to the completion of this offering. Our principal executive offices are located at 5876 Owens Avenue, Suite 100, Carlsbad, California 92008. Our phone number is (760) 707-5959. Our website address is www.apptechcorp.com. We do not incorporate the information on or accessible through our website into this prospectus. We have included our website address in this prospectus solely as an inactive textual reference.

Implications of Being a Smaller Reporting Company

We are a “smaller reporting company” as defined in the Exchange Act. We may take advantage of certain of the scaled disclosures available to smaller reporting companies until the fiscal year following the determination that our voting and non-voting common stock held by non-affiliates is more than $250 million measured on the last business day of our second fiscal quarter, or our annual revenues are less than $100 million during the most recently completed fiscal year and our voting and non-voting common stock held by non-affiliates is less than $700 million measured on the last business day of our second fiscal quarter.

7

THE OFFERING

| Offered Securities: | 2,912,621 Units, each Unit consisting of one share of our Common Stock and one Warrant to purchase one share of our Common Stock from the date of issuance until the fifth anniversary of such date for an assumed $6.44 per share (125% of the assumed $5.15 public offering price of one Unit, the midpoint of the price range set forth on the cover page of this prospectus). The Units will not be certificated or issued in stand-alone form. The shares of our Common Stock and the Warrants underlying the Units are immediately separable upon issuance and will be issued separately in this offering. |

| Offering Price per Unit (assumed): | Assumed $5.15 per Unit, the midpoint of the price range set forth on the cover page of this prospectus. |

| Over-Allotment Option: | We have granted the underwriters a 45-day option to purchase up to an aggregate of 436,893 additional shares and/or436,893 additional Warrants at the public offering price, less underwriting discounts and commissions, on the same terms as set forth in this prospectus, solely to cover over-allotments, if any. |

| Description of Warrants: | Each Warrant will have an exercise price per share of 125% of the public offering price per Unit, will be exercisable immediately and will expire on the fifth anniversary of the original issuance date. Each Warrant is exercisable for one share of common stock, subject to adjustment in the event of stock dividends, stock splits, stock combinations, reclassifications, reorganizations or similar events affecting our common stock as described herein. Each holder of purchase Warrants will be prohibited from exercising its Warrant for shares of our common stock if, as a result of such exercise, the holder, together with its affiliates, would own more than 4.99% of the total number of shares of our common stock then issued and outstanding. However, any holder may increase such percentage to any other percentage not in excess of 9.99%. The terms of the Warrants will be governed by a Warrant Agent Agreement, dated as of the effective date of this offering, between us and Transfer Online, Inc., as the warrant agent (the “Warrant Agent”). This offering also relates to the offering of the shares of common stock issuable upon the exercise of the Warrants (the “Warrant Shares”). For more information regarding the Warrants, you should carefully read the section titled “Description of Securities—Warrants” in this prospectus. |

| Common Stock Outstanding Before Offering (1): | 113,389,601 shares |

| Common stock Outstanding After Offering (2): | 15,285,261 shares, or 15,787,689 shares of if the underwriters exercise their over-allotment option in full, in each case assuming none of the Warrants issued in this offering are exercised. |

8

| Use of Proceeds: | We estimate that we will receive net proceeds from this offering of approximately $13.471 million, or approximately $15.541 million if the underwriters exercise their option to purchase additional shares in full, assuming an initial public offering price of $5.15 per Unit, the midpoint of the price range set forth on the cover page of this prospectus, and after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us. We currently intend to use the net proceeds from this offering, together with our existing cash, to fund the research and development of our technologies, expand our marketing efforts and for general working capital purposes. See “Use of Proceeds” below. |

| Underwriters Compensation: | In connection with this offering, the underwriters will receive an underwriting discount equal to 8% of the gross proceeds from the sale of Units in the offering. We will also reimburse the underwriter for certain out-of-pocket actual expenses related to the offering and the representative of the underwriter shall be entitled to a non-accountable expense allowance equal to one percent (1%) of the public offering price. See “Underwriting” starting on page 82of this prospectus. |

| Proposed Nasdaq Capital Market Listing and Symbols: | Our common stock is presently quoted on the over the counter markets under the symbol “APCX.” We intend to file an application to have our common stock and the Warrants listed on Nasdaq under the symbols “APCX” and “APCXW,” respectively. No assurance can be given that such listing will be approved or that a trading market will develop for the common stock and Warrants. We will not proceed with this offering in the event the common stock and Warrants are not approved for listing on Nasdaq. |

| Lock-Up Agreements: | We and our directors, officers and certain stockholders have agreed with the underwriter not to offer for sale, issue, sell, contract to sell, pledge or otherwise dispose of any of our Common Stock or securities convertible into Common Stock for a period of 360 days after the date of this prospectus. See “Underwriting-Lock-Up Agreements” on page 82 of this prospectus. |

| Reverse Stock Split: | On February 2, 2021, our Board approved a reverse stock split of the Common Stock within the range of 1-for-2 to 1-for-12 of our issued and outstanding shares of our Common Stock, subject to stockholder approval. The holders of a majority of outstanding voting capital stock approved the reverse stock split by written consent in lieu of a meeting on April 16, 2021, and authorized the Board, in its discretion, to determine the final ratio. We intend to effectuate the reverse split of our common stock in a ratio to be determined by the Board prior to consummation of this offering. Unless otherwise stated and other than in our financial statements and the notes thereto, all share and per share information in this prospectus reflects a proposed reverse stock split of the outstanding common stock and treasury stock of the Company at an assumed 1-for-9.5 ratio to occur immediately following the effective date but prior to the closing of the offering. |

| Dividend Policy: | We have not historically paid dividends on our common stock. |

| Risk Factors: | An investment in our securities involves a high degree of risk. You should read this prospectus carefully, including the section entitled “Risk Factors” starting on page 13of this prospectus and the consolidated financial statements and the related notes to those statements included in this prospectus, before deciding to invest in our securities. |

9

| (1) | The number of shares of common stock to be outstanding immediately before this offering excludes: |

| ● | the exercise of 955,184 shares of common stock issuable up on the exercise of outstanding stock options at a weighted average exercise price of $5.32 per share; | |

| ● | the exercise of 50,526 shares of common stock issuable up on the exercise of outstanding warrants at a weighted average exercise price of $5.94 per share. This does not include any adjustment to the exercise price in connection with potential EMA Financial, LLC reset provisions. Further, upon closing of this Offering, the exercise price will reset to the $5.15 Offering price; | |

| ● | the exercise of 194,316 shares of common stock issuable up on the exercise of outstanding convertible securities at a weighted average exercise price of $5.50 per share. This does not include any adjustment to the conversion price in connection with potential EMA Financial, LLC reset provisions. Further, upon closing of this Offering, the conversion price will reset to the $5.15 Offering price; | |

| ● | the issuance of 115,342 shares of common stock in accordance with our 2020 Equity Incentive Plan currently in reserve; | |

| ● | the conversion of 14shares of series A preferred stock convertible into 1,149 shares of common stock. |

| (2) | The number of shares of common stock to be outstanding immediately following this offering excludes: |

| ● | shares of common stock listed under footnote (1); | |

| ● | 2,912,621 shares of common stock issuable upon the exercise of Warrants included in the units; | |

| ● | 436,893 shares of common stock issuable upon the exercise of the underwriter’s over-allotment option to purchase 15% of additional shares of common stock and/or Warrants, in any combination thereof, from us in this offering to cover over-allotments, if any (the “Over-Allotment Option”). |

Except as otherwise indicated, all information in this prospectus assumes that:

| ● | None of the Warrants underlying the Units in this offering have been exercised; | |

| ● | No shares of common stock or Warrants have been issued pursuant to the Underwriters’ Over-Allotment Option; | |

| ● | No awards have been issued pursuant to the Company’s 2020 Equity Incentive Plan. |

10

SUMMARY FINANCIAL DATA

The statement of operations data for the nine months ended September 30, 2021 and September 30, 2020, and the years ended December 31, 2020 and 2019 have been derived from our unaudited financial statements and our audited financial statements, respectively, included elsewhere in this prospectus. The balance sheet data as of September 30, 2021 and December 31, 2020 have been derived from our unaudited financial statements and our audited financial statements, respectively, included elsewhere in this prospectus. In the opinion of management, the audited financial statements include all adjustments, consisting of only normal and recurring adjustments, necessary for a fair presentation of such financial data. You should read the financial data together with our “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” our financial statements and notes thereto, and other financial information are included elsewhere in this prospectus. Our historical results are not necessarily indicative of our results in any future period and results from our interim period may not necessarily be indicative of the results of the entire year. Pro forma share and per share amounts presented herein reflect the implementation of the 1-for- reverse stock split as if it had occurred at the beginning of the earliest period presented.

Statements of Operations –

| For the Nine Months | For the Years | |||||||||||||||

| Ended September 30, | Ended December 31, | |||||||||||||||

| 2021 | 2020 | 2020 | 2019 | |||||||||||||

| Revenues | $ | 92,410 | $ | 105,357 | $ | 329,500 | $ | 256,138 | ||||||||

| Cost of revenues | 41,774 | 48,759 | 140,372 | 101,638 | ||||||||||||

| Gross profit | 50,636 | 56,598 | 189,128 | 154,500 | ||||||||||||

| Operating expenses: | ||||||||||||||||

| General and administrative, including stock based compensation of $31,352, $1,066,386, $1,620,703 and $2,357,125, respectively | 1,360,187 | 1,089,808 | 3,749,456 | 1,020,869 | ||||||||||||

| Excess fair value of equity issuance over assets received | 1,090,716 | — | — | |||||||||||||

| Research and development | — | 2,999 | 49,250 | 82,057 | ||||||||||||

| Total operating expenses | 2,450,903 | 1,092,807 | 3,798,706 | 1,102,926 | ||||||||||||

| Loss from operations | (2,400,267 | ) | (1,036,209 | ) | (3,609,578 | ) | (948,426 | ) | ||||||||

| Other income (expenses) | ||||||||||||||||

| Interest expense | (478,009 | ) | (71,723 | ) | (342,321 | ) | (288,784 | ) | ||||||||

| Sale of Domain | — | — | 72,500 | — | ||||||||||||

| Day on derivative loss | — | — | (389,712 | ) | — | |||||||||||

| Change in fair value of derivative liability | 135,469 | — | 71,764 | — | ||||||||||||

| Forgiveness of debt | — | — | 9,000 | — | ||||||||||||

| Other income (expenses) | 161 | — | 1,030 | (106,000 | ) | |||||||||||

| Total other income (expenses) | (342,379 | ) | (71,723 | ) | (577,739 | ) | (394,784 | ) | ||||||||

| Loss before provision for income taxes | (2,742,646 | ) | (1,107,932 | ) | (4,187,317 | ) | (1,343,210 | ) | ||||||||

| Provision for income taxes | — | — | — | — | ||||||||||||

| Net loss | $ | (2,742,646 | ) | $ | (1,107,932 | ) | $ | (4,187,317 | ) | $ | (1,343,210 | ) | ||||

| Basic and diluted net loss per common share | $ | (0.02 | ) | (0.01 | ) | $ | (0.05 | ) | $ | (0.02 | ) | |||||

| Weighted-average number of shares used basic and diluted per share amounts | 111,906,997 | 86,984,021 | 86,520,231 | 84,473,862 | ||||||||||||

11

Balance Sheets – As of September 30, 2021 and December 31, 2020

| September 30, | December 31, | |||||||

| 2021 | 2020 | |||||||

| ASSETS | ||||||||

| Current assets | ||||||||

| Cash | $ | 22,495 | $ | 57,497 | ||||

| Accounts receivable | 34,829 | 40,635 | ||||||

| Prepaid expenses | 93,516 | 6,696 | ||||||

| Total current assets | 150,840 | 104,828 | ||||||

| Capitalized prepaid software development and license | 7,058,922 | — | ||||||

| Prepaid offering cost | 25,000 | — | ||||||

| Note receivable | 25,500 | 17,500 | ||||||

| Right of use asset | 203,938 | 249,825 | ||||||

| Security deposit | 7,536 | 7,536 | ||||||

| TOTAL ASSETS | $ | 7,471,736 | $ | 379,689 | ||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY (DEFICIT) | ||||||||

| Current liabilities | ||||||||

| Accounts payable | $ | 1,732,924 | $ | 1,635,384 | ||||

| Accrued liabilities | 1,726,628 | 2,632,334 | ||||||

| Right of use liability | 58,979 | 52,161 | ||||||

| Stock repurchase liability | 430,000 | 430,000 | ||||||

| Loans payable related parties | — | 34,400 | ||||||

| Convertible notes payable, net of $63,578 and $280,174 debt discount | 665,922 | 639,826 | ||||||

| Convertible notes payable related parties | — | 372,000 | ||||||

| Notes payable | 384,742 | 1,104,981 | ||||||

| Notes payable related parties | 684,863 | 708,493 | ||||||

| Derivative liabilities | 492,830 | 597,948 | ||||||

| Total current liabilities | 6,176,888 | 8,207,527 | ||||||

| Long-term liabilities | ||||||||

| Accounts payable | 15,000 | 75,000 | ||||||

| Right of use liability | 179,195 | 224,492 | ||||||

| Notes Payable, net of current portion | 160,040 | 67,400 | ||||||

| Total long-term liabilities | 354,235 | 366,892 | ||||||

| TOTAL LIABILITIES | 6,531,123 | 8,574,419 | ||||||

| Commitments and contingencies (Note 8) | ||||||||

| Stockholders’ Equity (Deficit) | ||||||||

| Series A preferred stock; $0.001 par value; 100,000 shares authorized; 14 shares issued and outstanding at September 30, 2021 and December 31, 2020 | — | — | ||||||

| Common stock, $0.001 par value; 1,000,000,000 shares authorized; 113,125,715 and 88,511,657 and outstanding at September 30, 2021 and December 31, 2020, respectively | 113,126 | 88,512 | ||||||

| Additional paid-in capital | 121,269,598 | 36,664,488 | ||||||

| Accumulated deficit | (120,442,111 | ) | (44,947,730 | ) | ||||

| Total stockholders’ equity (deficit) | 940,613 | (8,194,730 | ) | |||||

| TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY (DEFICIT) | $ | 7,471,736 | $ | 379,689 | ||||

12

An investment in our securities is speculative and involves a high degree of risk including the risk of a loss of your entire investment. You should carefully consider the following risk factors. These risk factors contain, in addition to historical information, forward looking statements that involve risks and uncertainties. Our actual results could differ significantly from the results discussed in the forward-looking statements. The occurrence of any of the adverse developments described in the following risk factors and in the documents incorporated herein by reference could materially and adversely harm our business, financial condition, results of operations or prospects. In such event, the value of our securities could decline, and you could lose all or a substantial portion of the money that you pay for our securities. In addition, the risks and uncertainties discussed below are not the only ones we face. Our business, financial condition, results of operations or prospects could also be harmed by risks and uncertainties not currently known to us or that we currently do not believe are material, and these risks and uncertainties could result in a complete loss of your investment. In assessing the risks and uncertainties described below, you should also refer to the other information contained in this prospectus (as supplemented or amended).

Risks Related to Our Company and Industry

We face risks related to Coronavirus (COVID-19) which could significantly disrupt our research and development, operations, sales, and financial results.

Our business could be further impacted by the effects of the COVID-19 outbreak. In addition to global macroeconomic effects, the COVID-19 outbreak and any other related adverse public health developments has caused disruption to our operations and sales activities. Our third-party vendors, third-party distributors, and our customers have been and will be disrupted by worker absenteeism, quarantines and restrictions on employees’ ability to work, office and factory closures, disruptions to ports and other shipping infrastructure, border closures, or other travel or health-related restrictions. Depending on the magnitude of such effects on our activities or the operations of our third-party vendors and third-party distributors, the supply of our products will be delayed, which could adversely affect our business, operations and customer relationships. In addition, COVID-19 or other disease outbreak will in the short-run and may over the longer term adversely affect the economies and financial markets of many countries, resulting in an economic downturn that will affect demand for our products and services and impact our operating results. There can be no assurance that any decrease in sales resulting from COVID-19 will be offset by increased sales in subsequent periods. Although the magnitude of the impact of the COVID-19 outbreak on our business and operations remains uncertain, the continued spread of COVID-19 or the occurrence of other epidemics and the imposition of related public health measures and travel and business restrictions will adversely impact our business, financial condition, operating results and cash flows. In addition, we have experienced and will experience disruptions to our business operations resulting from quarantines, self-isolations, or other movement and restrictions on the ability of our employees to perform their jobs that may impact our ability to develop and design our products and services in a timely manner or meet required milestones or customer commitments.

Our independent registered public accounting firm’s report contains an explanatory paragraph that expresses substantial doubt about our ability to continue as a “going concern.”

As reflected in the accompanying financial statements in this prospectus, during the nine months ended September 30, 2021 and 2020, the Company incurred a net loss of $75,494,381 and $2,898,406 and used cash of $3,027,981 and $303,235 in operating activities. In addition, the Company had a working capital deficit of $6,026,048 and an accumulated deficit of $120,442,111 as of September 30, 2021. During the years ended December 31, 2020 and 2019, the Company incurred a net loss of $4,187,317 and $1,343,210 and used cash of $591,386 and $760,544 in operating activities. Our independent registered public accounting firm’s report on our audited financial statements as of and for the year ended December 31, 2020 included an explanatory paragraph indicating that there is substantial doubt about our ability to continue as a going concern. If we are unable to continue as a going concern, we may have to liquidate our assets, and the values we receive for our assets in liquidation or dissolution could be significantly lower than the values reflected in our financial statements. The inclusion of a going concern explanatory paragraph by our independent registered public accounting firm, our lack of cash resources and our potential inability to continue as a going concern may materially adversely affect our share price and our ability to raise new capital, enter into critical contractual relations with third parties and otherwise execute our development strategy.

13

The payment processing industry is highly competitive. Such competition could adversely affect the fees we receive, and as a result, our margins, business, financial condition and results of operations.

The market for payment processing services is highly competitive and has relatively low barriers to entry. Other providers of payment processing services have established a sizable market share in the merchant acquiring sector and service more clients than we do. Our growth will depend, in part, on a combination of the continued growth of the electronic payment market and our ability to increase our market share through technological advancement.

Our payment and software solutions compete against many forms of financial services and payment systems, including electronic, mobile and integrated payment platforms as well as cash and checks. Our competitors include traditional merchant acquirers such as financial institutions, affiliates of financial institutions and well-established payment processing companies that target our existing clients and potential clients directly, including Bank of America Merchant Services, Chase Paymentech, Elavon, Inc. (a subsidiary of U.S. Bancorp), Fiserv, Inc., Global Payments, Inc. and Fidelity National Information. In addition, we compete with vendors that are specifically targeting ISVs and VARs as distribution partners for their merchant acquiring services, such as Stripe, Inc., Square, Inc., Toast, Inc., PayPal Holdings, Inc., Braintree (owned by PayPal), Adyen, Ltd., and OpenEdge (a division of Global Payments).

Many of our competitors have substantially greater financial, technological, management and marketing resources than we have. Accordingly, if these competitors specifically target our business model, they may be able to offer more attractive fees or payment terms and advances to our clients and more attractive compensation to our distribution partners. They also may be able to offer and provide products and services that we do not offer. There are also a large number of small providers of processing services that provide various ranges of services to our clients and our potential clients. This competition may effectively limit the prices we can charge and requires us to control costs aggressively in order to maintain acceptable profit margins. Further, in regard to certain products, if the use of payment cards other than Visa or Mastercard grows, or if there is increased use of certain debit cards, our average profit per transaction could be reduced. Competition could also result in a loss of existing distribution partners and clients and greater difficulty attracting new distribution partners and clients. One or more of these factors could have a material adverse effect on our business, financial condition and results of operations.

In addition, we are also subject to risks as a result of changes in business habits of our vendors and customers as they adjust to the competitive marketplace. For example, consumer behavior may change regarding the use of payment card transactions, including the relative increased use of cash, crypto-currencies, other emerging or alternative payment methods and payment card systems that we or our processing partners do not adequately support or that do not provide adequate commissions to parties like us. Any failure to timely integrate emerging payment methods into our software, to anticipate consumer behavior changes or to contract with processing partners that support such emerging payment technologies could cause us to lose traction among our customers or referral sources, including industry associations, resulting in a corresponding loss of revenue, if those methods become popular among end-users of their services.

14

If we are unable to obtain additional funding when needed, our business operations will be harmed, and if we do obtain additional financing, our then-existing shareholders may suffer substantial dilution.

As we take steps in the commercialization and marketing of our technologies, or respond to potential opportunities and/or adverse events, our working capital needs may change. We anticipate that if our cash and cash equivalents are insufficient to satisfy our liquidity requirements, we will require additional funding to sustain our ongoing operations and to continue our research and development activities. Specifically, we have contractual obligations under a license and service agreement with a partner that requires payment of fees which exceeds our current liquidity. We do not have any contracts or commitments for additional funding, and there can be no assurance that financing will be available in amounts or on terms acceptable to us, if at all, if needed. The inability to obtain additional capital will restrict our ability to grow and may reduce our ability to conduct business operations. If we are unable to obtain additional financing to finance a revised growth plan, we will likely be required to curtail such plans or cease our business operations. Any additional equity financing may involve substantial dilution to our then existing shareholders.

The loss of key personnel or the inability of replacements to quickly and successfully perform in their new roles could adversely affect our business.

We depend on the leadership and experience of our relatively small number of key executive management personnel, particularly our Chairman of the Board, Chief Executive Officer and Chief Investment Officer, Luke D’Angelo, our President and Chief Operating Officer, Virgilio Llapitan, our Chief Financial Officer, Gary Wachs, and our Chief Technology Officer, Benjamin Jenkins. The loss of the services of any of these key executives or any of our executive management members could have a material adverse effect on our business and prospects, as we may not be able to find suitable individuals to replace such personnel on a timely basis or without incurring increased costs, or at all. Furthermore, if we lose or terminate the services of one or more of our key employees or if one or more of our current or former executives or key employees joins a competitor or otherwise competes with us, it could impair our business and our ability to successfully implement our business plan. Additionally, if we are unable to hire qualified replacements for our executive and other key positions in a timely fashion, our ability to execute our business plan would be harmed. Even if we can quickly hire qualified replacements, we would expect to experience operational disruptions and inefficiencies during any transition. We believe that our future success will depend on our continued ability to attract and retain highly skilled and qualified personnel. There is a high level of competition for experienced, successful personnel in our industry. Our inability to meet our executive staffing requirements in the future could impair our growth and harm our business.

15

Our financial statements may be materially affected if our estimates prove to be inaccurate as a result of our limited experience in making critical accounting estimates.

Financial statements prepared in accordance with GAAP require the use of estimates, judgments, and assumptions that affect the reported amounts. Actual results may differ materially from these estimates under different assumptions or conditions. These estimates, judgments, and assumptions are inherently uncertain, and, if they prove to be wrong, then we face the risk that charges to income will be required. In addition, because we have limited experience in making these estimates, judgments, and assumptions, the risk of future charges to income may be greater than if we had more experience in these areas. Any such charges could significantly harm our business, financial condition, results of operations, and the price of our securities.

An inability to develop and introduce products in a timely and cost-effective manner may damage our business.

Our sales and profitability depend on our ability to bring products to market and meet customer demands before they begin to lose interest in a given product. There is no guarantee that we will be able to develop and source our products in a timely manner and on a cost-effective basis to meet constantly changing consumer demands. Unforeseen delays or difficulties in the development process, significant increases in the planned cost of development, and manufacturing delays or changes in anticipated consumer demand for our products and new brands may cause the introduction date for products to be later than anticipated. They may also reduce or eliminate the profitability of such products or, in some situations, may cause a product or new brand introduction to be discontinued.

Our operating results may fluctuate significantly as a result of a variety of factors, many of which are outside of our control, which could cause fluctuations in the price of our securities.

We are subject to the following factors that may negatively affect our operating results:

| ● | the announcement or introduction of new products by our competitors; | |

| ● | our ability to upgrade and develop our systems and infrastructure to accommodate growth; | |

| ● | our ability to attract and retain key personnel in a timely and cost-effective manner; | |

| ● | technical difficulties; | |

| ● | the amount and timing of operating costs and capital expenditures relating to the expansion of our business, operations, and infrastructure; | |

| ● | our ability to identify and enter into relationships with appropriate and qualified third-party providers for necessary development and other relevant services; | |

| ● | regulation by federal, state, or local governments; | |

| ● | general economic conditions, as well as economic conditions specific to payment processing, banking and consumer discretionary spending; and | |

| ● | Various risks related to health epidemics, pandemics and similar outbreaks, such as the coronavirus pandemic, which may have material adverse effects on our business, financial position, results of operations and/or cash flows. |