21\F7V1118 Excess Catastrophe Reinsurance Contract Effective: July 1, 2021 FedNat Insurance Company Sunrise, Florida and Monarch National Insurance Company Sunrise, Florida and Maison Insurance Company Baton Rouge, Louisiana _______________________ Certain identified information has been omitted from this exhibit because it is not material and would be competitively harmful if publicly disclosed. Redactions are indicated by [***].

21\F7V1118 Table of Contents Article Page 1 Classes of Business Reinsured 1 2 Commencement and Termination 1 3 Territory 3 4 Exclusions 3 5 Retention and Limit 4 6 Florida Hurricane Catastrophe Fund 5 7 Other Reinsurance 5 8 Reinstatement 5 9 Definitions 6 10 Loss Occurrence 7 11 Loss Notices and Settlements 9 12 Cash Call 9 13 Salvage and Subrogation 10 14 Reinsurance Premium 10 15 Sanctions 11 16 Late Payments 11 17 Offset 13 18 Severability of Interests and Obligations 13 19 Access to Records 13 20 Liability of the Reinsurer 14 21 Net Retained Lines (BRMA 32E) 14 22 Errors and Omissions (BRMA 14F) 14 23 Currency (BRMA 12A) 14 24 Taxes (BRMA 50B) 15 25 Federal Excise Tax (BRMA 17D) 15 26 Reserves 15 27 Insolvency 16 28 Arbitration 17 29 Service of Suit (BRMA 49C) 18 30 Severability (BRMA 72E) 18 31 Governing Law (BRMA 71B) 18 32 Confidentiality 19 33 Non-Waiver 20 34 Agency Agreement (BRMA 73A) 20 35 Notices and Contract Execution 20 36 Intermediary 21 Schedule A

21\F7V1118 Table of Contents Article Page 1 Classes of Business Reinsured 1 2 Commencement and Termination 1 3 Territory 3 4 Exclusions 3 5 Retention and Limit 4 6 Florida Hurricane Catastrophe Fund 5 7 Other Reinsurance 5 8 Reinstatement 5 9 Definitions 6 10 Loss Occurrence 7 11 Loss Notices and Settlements 9 12 Cash Call 9 13 Salvage and Subrogation 10 14 Reinsurance Premium 10 15 Sanctions 11 16 Late Payments 11 17 Offset 13 18 Severability of Interests and Obligations 13 19 Access to Records 13 20 Liability of the Reinsurer 14 21 Net Retained Lines (BRMA 32E) 14 22 Errors and Omissions (BRMA 14F) 14 23 Currency (BRMA 12A) 14 24 Taxes (BRMA 50B) 15 25 Federal Excise Tax (BRMA 17D) 15 26 Reserves 15 27 Insolvency 16 28 Arbitration 17 29 Service of Suit (BRMA 49C) 18 30 Severability (BRMA 72E) 18 31 Governing Law (BRMA 71B) 18 32 Confidentiality 19 33 Non-Waiver 20 34 Agency Agreement (BRMA 73A) 20 35 Notices and Contract Execution 20 36 Intermediary 21 Schedule A

21\F7V1118 Page 1 Excess Catastrophe Reinsurance Contract Effective: July 1, 2021 entered into by and between FedNat Insurance Company Sunrise, Florida and Monarch National Insurance Company Sunrise, Florida and Maison Insurance Company Baton Rouge, Louisiana (hereinafter collectively referred to as the "Company" except to the extent individually referred to) and The Subscribing Reinsurer(s) Executing the Interests and Liabilities Agreement(s) Attached Hereto (hereinafter referred to as the "Reinsurer") Article 1 - Classes of Business Reinsured By this Contract the Reinsurer agrees to reinsure the excess liability which may accrue to the Company under its policies in force at the effective time and date hereof or issued or renewed at or after that time and date, and classified by the Company as Property business, including but not limited to, Dwelling Fire, Inland Marine, Mobile Home, Commercial and Homeowners business (including any business assumed from Citizens Property Insurance Corporation), subject to the terms, conditions and limitations set forth herein and in Schedule A attached hereto. Article 2 - Commencement and Termination A. This Contract shall become effective at 12:01 a.m., Eastern Standard Time, July 1, 2021, with respect to losses arising out of loss occurrences commencing at or after that time and date, and shall remain in force until 12:01 a.m., Eastern Standard Time, July 1, 2022. B. Notwithstanding the provisions of paragraph A above, the Company may terminate a Subscribing Reinsurer's percentage share in this Contract at any time by giving written notice to the Subscribing Reinsurer in the event any of the following circumstances occur: 1. The Subscribing Reinsurer's policyholders' surplus (or its equivalent under the Subscribing Reinsurer's accounting system) at the inception of this Contract has been reduced by 20.0% or more of the amount of surplus (or the applicable equivalent) 12 months prior to that date; or

21\F7V1118 Page 2 2. The Subscribing Reinsurer's policyholders' surplus (or its equivalent under the Subscribing Reinsurer's accounting system) at any time during the term of this Contract has been reduced by 20.0% or more of the amount of surplus (or the applicable equivalent) at the date of the Subscribing Reinsurer's most recent financial statement filed with regulatory authorities and available to the public as of the inception of this Contract; or 3. The Subscribing Reinsurer's A.M. Best's Financial Strength Rating has been assigned or downgraded below A- and/or Standard & Poor's Financial Strength Rating has been assigned or downgraded below BBB+; or 4. The Subscribing Reinsurer has become, or has announced its intention to become, merged with, acquired by or controlled by any other entity or individual(s) not controlling the Subscribing Reinsurer's operations previously; or 5. A State Insurance Department or other legal authority has ordered the Subscribing Reinsurer to cease writing business; or 6. The Subscribing Reinsurer has become insolvent or has been placed into liquidation, receivership, supervision, administration, winding-up or under a scheme of arrangement, or similar proceedings (whether voluntary or involuntary) or proceedings have been instituted against the Subscribing Reinsurer for the appointment of a receiver, liquidator, rehabilitator, supervisor, administrator, conservator or trustee in bankruptcy, or other agent known by whatever name, to take possession of its assets or control of its operations; or 7. The Subscribing Reinsurer has reinsured its entire liability under this Contract without the Company's prior written consent; or 8. The Subscribing Reinsurer has ceased assuming new or renewal property or casualty treaty reinsurance business; or 9. The Subscribing Reinsurer has hired an unaffiliated runoff claims manager that is compensated on a contingent basis or is otherwise provided with financial incentives based on the quantum of claims paid; or 10. The Subscribing Reinsurer has failed to comply with the funding requirements set forth in the Reserves Article. C. The "term of this Contract" as used herein shall mean the period from 12:01 a.m., Eastern Standard Time, July 1, 2021 to 12:01 a.m., Eastern Standard Time, July 1, 2022. However, if this Contract is terminated, the "term of this Contract" as used herein shall mean the period from 12:01 a.m., Eastern Standard Time, July 1, 2021 to the effective time and date of termination. D. If this Contract is terminated or expires while a loss occurrence covered hereunder is in progress, the Reinsurer's liability hereunder shall, subject to the other terms and conditions of this Contract, be determined as if the entire loss occurrence had occurred prior to the

21\F7V1118 Page 2 2. The Subscribing Reinsurer's policyholders' surplus (or its equivalent under the Subscribing Reinsurer's accounting system) at any time during the term of this Contract has been reduced by 20.0% or more of the amount of surplus (or the applicable equivalent) at the date of the Subscribing Reinsurer's most recent financial statement filed with regulatory authorities and available to the public as of the inception of this Contract; or 3. The Subscribing Reinsurer's A.M. Best's Financial Strength Rating has been assigned or downgraded below A- and/or Standard & Poor's Financial Strength Rating has been assigned or downgraded below BBB+; or 4. The Subscribing Reinsurer has become, or has announced its intention to become, merged with, acquired by or controlled by any other entity or individual(s) not controlling the Subscribing Reinsurer's operations previously; or 5. A State Insurance Department or other legal authority has ordered the Subscribing Reinsurer to cease writing business; or 6. The Subscribing Reinsurer has become insolvent or has been placed into liquidation, receivership, supervision, administration, winding-up or under a scheme of arrangement, or similar proceedings (whether voluntary or involuntary) or proceedings have been instituted against the Subscribing Reinsurer for the appointment of a receiver, liquidator, rehabilitator, supervisor, administrator, conservator or trustee in bankruptcy, or other agent known by whatever name, to take possession of its assets or control of its operations; or 7. The Subscribing Reinsurer has reinsured its entire liability under this Contract without the Company's prior written consent; or 8. The Subscribing Reinsurer has ceased assuming new or renewal property or casualty treaty reinsurance business; or 9. The Subscribing Reinsurer has hired an unaffiliated runoff claims manager that is compensated on a contingent basis or is otherwise provided with financial incentives based on the quantum of claims paid; or 10. The Subscribing Reinsurer has failed to comply with the funding requirements set forth in the Reserves Article. C. The "term of this Contract" as used herein shall mean the period from 12:01 a.m., Eastern Standard Time, July 1, 2021 to 12:01 a.m., Eastern Standard Time, July 1, 2022. However, if this Contract is terminated, the "term of this Contract" as used herein shall mean the period from 12:01 a.m., Eastern Standard Time, July 1, 2021 to the effective time and date of termination. D. If this Contract is terminated or expires while a loss occurrence covered hereunder is in progress, the Reinsurer's liability hereunder shall, subject to the other terms and conditions of this Contract, be determined as if the entire loss occurrence had occurred prior to the

21\F7V1118 Page 3 termination or expiration of this Contract, provided that no part of such loss occurrence is claimed against any renewal or replacement of this Contract. Article 3 - Territory The territorial limits of this Contract shall be identical with those of the Company's policies. However, the territorial limits of this Contract as respects FedNat Insurance Company shall only apply to risks located within the State of Florida. Article 4 - Exclusions A. This Contract does not apply to and specifically excludes the following: 1. Reinsurance assumed by the Company under obligatory reinsurance agreements, except business assumed by the Company from Citizens Property Insurance Corporation. 2. Hail damage to growing or standing crops. 3. Business rated, coded or classified as Flood insurance or which should have been rated, coded or classified as such. 4. Business rated, coded or classified as Mortgage Impairment and Difference in Conditions insurance or which should have been rated, coded or classified as such. 5. Title insurance and all forms of Financial Guarantee, Credit and Insolvency. 6. Aviation, Ocean Marine, Boiler and Machinery, Fidelity and Surety, Accident and Health, Animal Mortality and Workers Compensation and Employers Liability. 7. Errors and Omissions, Malpractice and any other type of Professional Liability insurance. 8. Loss and/or damage and/or costs and/or expenses arising from seepage and/or pollution and/or contamination, other than contamination from smoke. Nevertheless, this exclusion does not preclude payment of the cost of removing debris of property damaged by a loss otherwise covered hereunder, subject always to a limit of 25.0% of the Company's property loss under the applicable original policy. 9. Loss or liability as excluded under the provisions of the "War Exclusion Clause" attached to and forming part of this Contract. 10. Nuclear risks as defined in the "Nuclear Incident Exclusion Clause - Physical Damage - Reinsurance (U.S.A.)" attached to and forming part of this Contract. 11. Loss or liability excluded by the Pools, Associations and Syndicates Exclusion Clause (Catastrophe) attached to and forming part of this Contract and any assessment or

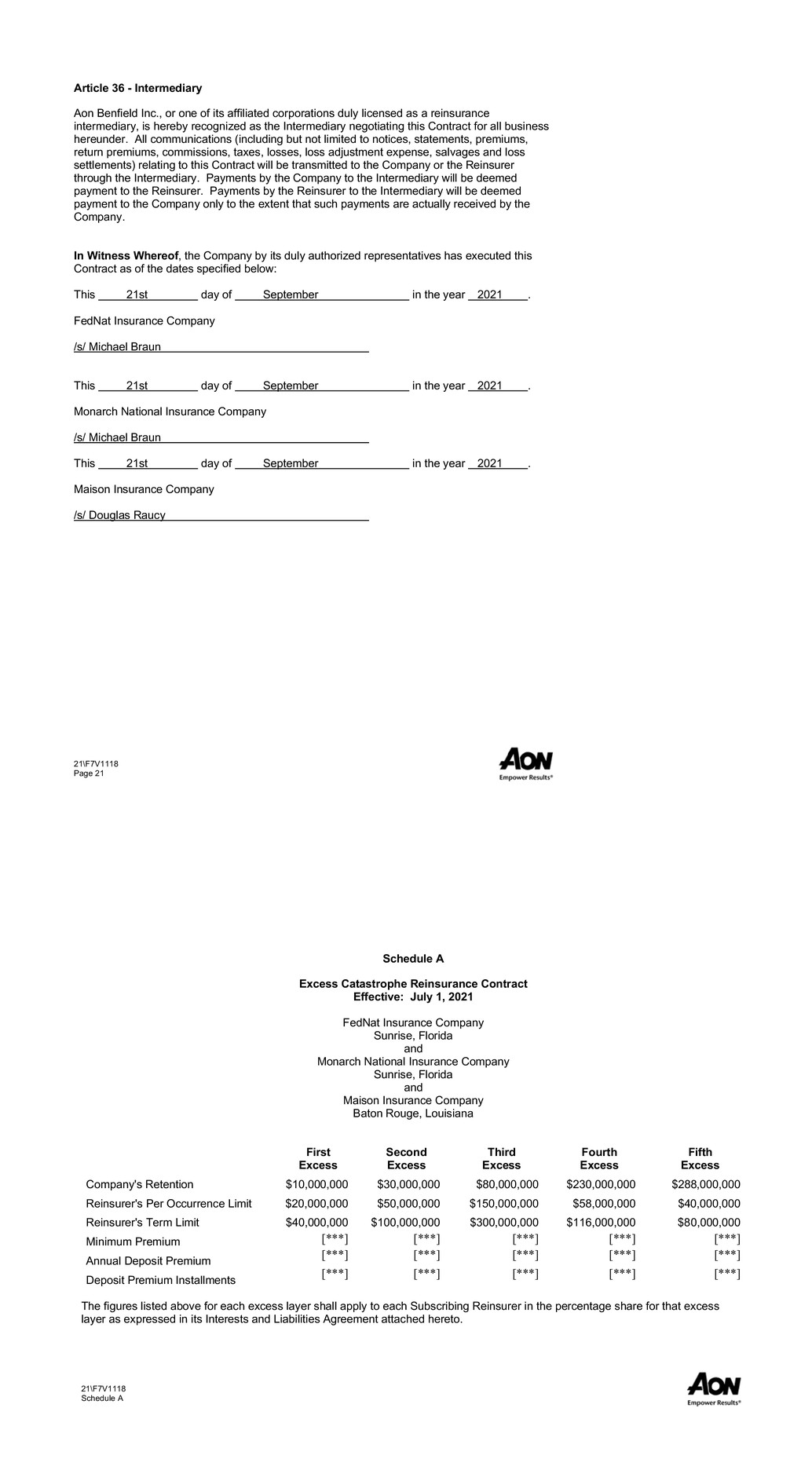

21\F7V1118 Page 4 similar demand for payment related to the FHCF or Citizens Property Insurance Corporation. 12. Loss or liability of the Company arising by contract, operation of law, or otherwise, from its participation or membership, whether voluntary or involuntary, in any insolvency fund. "Insolvency fund" includes any guaranty fund, insolvency fund, plan, pool, association, fund or other arrangement, however denominated, established or governed, which provides for any assessment of or payment or assumption by the Company of part or all of any claim, debt, charge, fee or other obligation of an insurer, or its successors or assigns, which has been declared by any competent authority to be insolvent, or which is otherwise deemed unable to meet any claim, debt, charge, fee or other obligation in whole or in part. 13. Losses in the respect of overhead transmission and distribution lines other than those on or within 150 meters (or 500 feet) of the insured premises. 14. Mold, unless resulting from a peril otherwise covered under the policy involved. 15. Loss or liability as excluded under the provisions of the "Terrorism Exclusion" attached to and forming part of this Contract. 16. Loss or liability as excluded under the provisions of the "Limited Cyber Loss Exclusion No. 1 (Property Treaty Reinsurance)" attached to and forming part of this Contract. 17. Loss or liability as excluded under the provisions of the "Limited Communicable Disease Exclusion No. 2 (Property Treaty Reinsurance)" attached to and forming part of this Contract. Article 5 - Retention and Limit A. As respects each excess layer of reinsurance coverage provided by this Contract, the Company shall retain and be liable for the first amount of ultimate net loss, shown as "Company's Retention" for that excess layer in Schedule A attached hereto, arising out of each loss occurrence. The Reinsurer shall then be liable, as respects each excess layer, for the amount by which such ultimate net loss exceeds the Company's applicable retention, but the liability of the Reinsurer under each excess layer shall not exceed the amount, shown as "Reinsurer's Per Occurrence Limit" for that excess layer in Schedule A attached hereto, as respects any one loss occurrence. B. Notwithstanding the provisions above, no claim shall be made hereunder as respects losses arising out of loss occurrences commencing during the term of this Contract unless at least two risks insured or reinsured by the Company are involved in such loss occurrence. For purposes hereof, the Company shall be the sole judge of what constitutes "one risk."

21\F7V1118 Page 4 similar demand for payment related to the FHCF or Citizens Property Insurance Corporation. 12. Loss or liability of the Company arising by contract, operation of law, or otherwise, from its participation or membership, whether voluntary or involuntary, in any insolvency fund. "Insolvency fund" includes any guaranty fund, insolvency fund, plan, pool, association, fund or other arrangement, however denominated, established or governed, which provides for any assessment of or payment or assumption by the Company of part or all of any claim, debt, charge, fee or other obligation of an insurer, or its successors or assigns, which has been declared by any competent authority to be insolvent, or which is otherwise deemed unable to meet any claim, debt, charge, fee or other obligation in whole or in part. 13. Losses in the respect of overhead transmission and distribution lines other than those on or within 150 meters (or 500 feet) of the insured premises. 14. Mold, unless resulting from a peril otherwise covered under the policy involved. 15. Loss or liability as excluded under the provisions of the "Terrorism Exclusion" attached to and forming part of this Contract. 16. Loss or liability as excluded under the provisions of the "Limited Cyber Loss Exclusion No. 1 (Property Treaty Reinsurance)" attached to and forming part of this Contract. 17. Loss or liability as excluded under the provisions of the "Limited Communicable Disease Exclusion No. 2 (Property Treaty Reinsurance)" attached to and forming part of this Contract. Article 5 - Retention and Limit A. As respects each excess layer of reinsurance coverage provided by this Contract, the Company shall retain and be liable for the first amount of ultimate net loss, shown as "Company's Retention" for that excess layer in Schedule A attached hereto, arising out of each loss occurrence. The Reinsurer shall then be liable, as respects each excess layer, for the amount by which such ultimate net loss exceeds the Company's applicable retention, but the liability of the Reinsurer under each excess layer shall not exceed the amount, shown as "Reinsurer's Per Occurrence Limit" for that excess layer in Schedule A attached hereto, as respects any one loss occurrence. B. Notwithstanding the provisions above, no claim shall be made hereunder as respects losses arising out of loss occurrences commencing during the term of this Contract unless at least two risks insured or reinsured by the Company are involved in such loss occurrence. For purposes hereof, the Company shall be the sole judge of what constitutes "one risk."

21\F7V1118 Page 5 Article 6 - Florida Hurricane Catastrophe Fund The Company has purchased 90.0% of the FHCF mandatory layer of coverage and shall be deemed to inure to the benefit of this Contract. Loss adjustment expense recoveries paid by the FHCF in excess of the actual loss adjustment expense paid by the Company shall inure to the benefit of the Company and shall not reduce the amount of ultimate net loss hereunder. Further, any FHCF loss reimbursement shall be deemed to be paid to the Company in accordance with the FHCF reimbursement contract at the full payout level set forth therein and will be deemed not to be reduced by any reduction or exhaustion of the FHCF's claims-paying capacity as respects the mandatory FHCF coverage. Article 7 - Other Reinsurance The Company shall be permitted to carry other reinsurance, recoveries under which shall inure solely to the benefit of the Company and be entirely disregarded in applying all of the provisions of this Contract. Article 8 - Reinstatement A. In the event all or any portion of the reinsurance under any excess layer of reinsurance coverage provided by this Contract is exhausted by ultimate net loss, the amount so exhausted shall be reinstated immediately from the time the loss occurrence commences hereon. As respects the First Excess Layer, the Company shall not pay any additional premium. As respects the Second Excess Layer through the Fifth Excess Layer, for each amount so reinstated the Company agrees to pay additional premium equal to the product of the following: 1. The percentage of the occurrence limit for the excess layer reinstated (based on the ultimate net loss paid by the Reinsurer under that excess layer); times 2. The earned reinsurance premium for the excess layer reinstated for the term of this Contract (exclusive of reinstatement premium). B. Whenever the Company requests payment by the Reinsurer of any ultimate net loss under any excess layer hereunder, the Company shall submit a statement to the Reinsurer of reinstatement premium due the Reinsurer for that excess layer. If the earned reinsurance premium for any excess layer for the term of this Contract has not been finally determined as of the date of any such statement, the calculation of reinstatement premium due for that excess layer shall be based on the amount, shown as "Annual Deposit Premium" for that excess layer in Schedule A attached hereto, and shall be readjusted when the earned reinsurance premium for that excess layer for the term of this Contract has been finally determined. Any reinstatement premium shown to be due the Reinsurer for any excess layer as reflected by any such statement (less prior payments, if any, for that excess layer) shall be payable by the Company concurrently with payment by the Reinsurer of the requested ultimate net loss for that excess layer. Any return reinstatement premium shown to be due the Company shall be remitted by the Reinsurer as promptly as possible after receipt and verification of the Company's statement.

21\F7V1118 Page 6 C. Notwithstanding anything stated herein, the liability of the Reinsurer for ultimate net loss under any excess layer of reinsurance coverage provided by this Contract shall not exceed either of the following: 1. The amount, shown as "Reinsurer's Per Occurrence Limit" for that excess layer in Schedule A attached hereto, as respects loss or losses arising out of any one loss occurrence; or 2. The amount, shown as "Reinsurer's Term Limit" for that excess layer in Schedule A attached hereto, in all during the term of this Contract. Article 9 - Definitions A. "Loss adjustment expense," regardless of how such expenses are classified for statutory reporting purposes, as used in this Contract shall mean all costs and expenses allocable to a specific claim that are incurred by the Company in the investigation, appraisal, adjustment, settlement, litigation, defense or appeal of a specific claim, including court costs and costs of supersedeas and appeal bonds, and including a) pre-judgment interest, unless included as part of the award or judgment; b) post-judgment interest; c) legal expenses and costs incurred in connection with coverage questions and legal actions connected thereto, including Declaratory Judgment Expense; and d) expenses and a pro rata share of salaries of the Company field employees, and expenses of other Company employees who have been temporarily diverted from their normal and customary duties and assigned to the field adjustment of losses covered by this Contract. Loss adjustment expense as defined above does not include unallocated loss adjustment expense. Unallocated loss adjustment expense includes, but is not limited to, salaries and expenses of employees, other than in (d) above, and office and other overhead expenses. B. "Loss in excess of policy limits" and "extra contractual obligations" as used in this Contract shall mean: 1. "Loss in excess of policy limits" shall mean 90.0% of any amount paid or payable by the Company in excess of its policy limits, but otherwise within the terms of its policy, such loss in excess of the Company's policy limits having been incurred because of, but not limited to, failure by the Company to settle within the policy limits or by reason of the Company's alleged or actual negligence, fraud or bad faith in rejecting an offer of settlement or in the preparation of the defense or in the trial of an action against its insured or reinsured or in the preparation or prosecution of an appeal consequent upon such an action. Any loss in excess of policy limits that is made in connection with this Contract shall not exceed 25.0% of the actual catastrophe loss. 2. "Extra contractual obligations" shall mean 90.0% of any punitive, exemplary, compensatory or consequential damages paid or payable by the Company, not covered by any other provision of this Contract and which arise from the handling of any claim on business subject to this Contract, such liabilities arising because of, but not limited to, failure by the Company to settle within the policy limits or by reason of the Company's alleged or actual negligence, fraud or bad faith in rejecting an offer of settlement or in the preparation of the defense or in the trial of an action against its

21\F7V1118 Page 6 C. Notwithstanding anything stated herein, the liability of the Reinsurer for ultimate net loss under any excess layer of reinsurance coverage provided by this Contract shall not exceed either of the following: 1. The amount, shown as "Reinsurer's Per Occurrence Limit" for that excess layer in Schedule A attached hereto, as respects loss or losses arising out of any one loss occurrence; or 2. The amount, shown as "Reinsurer's Term Limit" for that excess layer in Schedule A attached hereto, in all during the term of this Contract. Article 9 - Definitions A. "Loss adjustment expense," regardless of how such expenses are classified for statutory reporting purposes, as used in this Contract shall mean all costs and expenses allocable to a specific claim that are incurred by the Company in the investigation, appraisal, adjustment, settlement, litigation, defense or appeal of a specific claim, including court costs and costs of supersedeas and appeal bonds, and including a) pre-judgment interest, unless included as part of the award or judgment; b) post-judgment interest; c) legal expenses and costs incurred in connection with coverage questions and legal actions connected thereto, including Declaratory Judgment Expense; and d) expenses and a pro rata share of salaries of the Company field employees, and expenses of other Company employees who have been temporarily diverted from their normal and customary duties and assigned to the field adjustment of losses covered by this Contract. Loss adjustment expense as defined above does not include unallocated loss adjustment expense. Unallocated loss adjustment expense includes, but is not limited to, salaries and expenses of employees, other than in (d) above, and office and other overhead expenses. B. "Loss in excess of policy limits" and "extra contractual obligations" as used in this Contract shall mean: 1. "Loss in excess of policy limits" shall mean 90.0% of any amount paid or payable by the Company in excess of its policy limits, but otherwise within the terms of its policy, such loss in excess of the Company's policy limits having been incurred because of, but not limited to, failure by the Company to settle within the policy limits or by reason of the Company's alleged or actual negligence, fraud or bad faith in rejecting an offer of settlement or in the preparation of the defense or in the trial of an action against its insured or reinsured or in the preparation or prosecution of an appeal consequent upon such an action. Any loss in excess of policy limits that is made in connection with this Contract shall not exceed 25.0% of the actual catastrophe loss. 2. "Extra contractual obligations" shall mean 90.0% of any punitive, exemplary, compensatory or consequential damages paid or payable by the Company, not covered by any other provision of this Contract and which arise from the handling of any claim on business subject to this Contract, such liabilities arising because of, but not limited to, failure by the Company to settle within the policy limits or by reason of the Company's alleged or actual negligence, fraud or bad faith in rejecting an offer of settlement or in the preparation of the defense or in the trial of an action against its

21\F7V1118 Page 7 insured or reinsured or in the preparation or prosecution of an appeal consequent upon such an action. An extra contractual obligation shall be deemed, in all circumstances, to have occurred on the same date as the loss covered or alleged to be covered under the policy. Any extra contractual obligations that are made in connection with this Contract shall not exceed 25.0% of the actual catastrophe loss. Notwithstanding anything stated herein, this Contract shall not apply to any loss in excess of policy limits or any extra contractual obligation incurred by the Company as a result of any fraudulent and/or criminal act by any officer or director of the Company acting individually or collectively or in collusion with any individual or corporation or any other organization or party involved in the presentation, defense or settlement of any claim covered hereunder. C. "Policies" as used in this Contract shall mean all policies, contracts and binders of insurance or reinsurance. D. "Ultimate net loss" as used in this Contract shall mean the sum or sums (including loss in excess of policy limits, extra contractual obligations and loss adjustment expense, as defined herein) paid or payable by the Company in settlement of claims and in satisfaction of judgments rendered on account of such claims, after deduction of all salvage, all recoveries and all claims on inuring insurance or reinsurance, whether collectible or not. Nothing herein shall be construed to mean that losses under this Contract are not recoverable until the Company's ultimate net loss has been ascertained. Article 10 - Loss Occurrence A. The term "loss occurrence" shall mean the sum of all individual losses directly occasioned by any one disaster, accident or loss or series of disasters, accidents or losses arising out of one event which occurs within the area of one state of the United States or province of Canada and states or provinces contiguous thereto and to one another. However, the duration and extent of any one "loss occurrence" shall be limited to all individual losses sustained by the Company occurring during any period of 168 consecutive hours arising out of and directly occasioned by the same event, except that the term "loss occurrence" shall be further defined as follows: 1. As regards a named storm, all individual losses sustained by the Company occurring during any period (a) from and after 12:00 a.m. Eastern Standard Time on the date a watch, warning, advisory, or other bulletin (whether for wind, flood or otherwise) for such named storm is first issued by the National Hurricane Center ("NHC") or its successor or any other division of the National Weather Service ("NWS"), (b) continuing for a time period thereafter during which such named storm continues, regardless of its category rating or lack thereof and regardless of whether the watch, warning, or advisory or other bulletin remains in effect for such named storm and (c) ending 96 hours following the issuance of the last watch, warning or advisory or other bulletin for such named storm or related to such named storm by the NHC or its successor or any other division of the NWS. "Named storm" shall mean any storm or storm system that has been declared by the NHC or its successor or any other division of the NWS to be a named storm at any time, which may include, by way of example and not limitation, hurricane, wind, gusts, typhoon, tropical storm, hail, rain,

21\F7V1118 Page 8 tornados, cyclones, ensuing flood, storm surge, water damage, fire following, sprinkler leakage, riots, vandalism, and collapse, and all losses and perils (including, by way of example and not limitation, those mentioned previously in this sentence) in each case arising out of, caused by, occurring during, occasioned by or resulting from such storm or storm system, including by way of example and not limitation the merging of one or more separate storm(s) or storm system(s) into a combined storm surge event. However, the named storm need not be limited to one state or province or states or provinces contiguous thereto. 2. As regards storm or storm systems that are not a named storm, including, by way of example and not limitation, ensuing wind, gusts, typhoon, tropical storm, hail, rain, tornados, cyclones, ensuing flood, storm surge, fire following, sprinkler leakage, riots, vandalism, collapse and water damage, all individual losses sustained by the Company occurring during any period of 144 consecutive hours arising out of, caused by, occurring during, occasioned by or resulting from the same event. However, the event need not be limited to one state or province or states or provinces contiguous thereto. 3. As regards riot, riot attending a strike, civil commotion, vandalism and malicious mischief, all individual losses sustained by the Company occurring during any period of 96 consecutive hours within the area of one municipality or county and the municipalities or counties contiguous thereto arising out of and directly occasioned by the same event. The maximum duration of 96 consecutive hours may be extended in respect of individual losses which occur beyond such 96 consecutive hours during the continued occupation of an assured's premises by strikers, provided such occupation commenced during the aforesaid period. 4. As regards earthquake (the epicenter of which need not necessarily be within the territorial confines referred to in the introductory portion of this paragraph) and fire following directly occasioned by the earthquake, only those individual fire losses which commence during the period of 168 consecutive hours may be included in the Company's loss occurrence. 5. As regards freeze, only individual losses directly occasioned by collapse, breakage of glass and water damage (caused by bursting frozen pipes and tanks) may be included in the Company's loss occurrence. 6. As regards firestorms, brush fires and any other fires or series of fires, irrespective of origin (except as provided in subparagraphs 3 and 4 above), all individual losses sustained by the Company which commence during any period of 168 consecutive hours within the area of one state of the United States or province of Canada and states or provinces contiguous thereto and to one another may be included in the Company's loss occurrence. B. For all loss occurrences hereunder, the Company may choose the date and time when any such period of consecutive hours commences, provided that no period commences earlier than the date and time of the occurrence of the first recorded individual loss sustained by the Company arising out of that disaster, accident, or loss or series of disasters, accidents, or losses. Furthermore:

21\F7V1118 Page 8 tornados, cyclones, ensuing flood, storm surge, water damage, fire following, sprinkler leakage, riots, vandalism, and collapse, and all losses and perils (including, by way of example and not limitation, those mentioned previously in this sentence) in each case arising out of, caused by, occurring during, occasioned by or resulting from such storm or storm system, including by way of example and not limitation the merging of one or more separate storm(s) or storm system(s) into a combined storm surge event. However, the named storm need not be limited to one state or province or states or provinces contiguous thereto. 2. As regards storm or storm systems that are not a named storm, including, by way of example and not limitation, ensuing wind, gusts, typhoon, tropical storm, hail, rain, tornados, cyclones, ensuing flood, storm surge, fire following, sprinkler leakage, riots, vandalism, collapse and water damage, all individual losses sustained by the Company occurring during any period of 144 consecutive hours arising out of, caused by, occurring during, occasioned by or resulting from the same event. However, the event need not be limited to one state or province or states or provinces contiguous thereto. 3. As regards riot, riot attending a strike, civil commotion, vandalism and malicious mischief, all individual losses sustained by the Company occurring during any period of 96 consecutive hours within the area of one municipality or county and the municipalities or counties contiguous thereto arising out of and directly occasioned by the same event. The maximum duration of 96 consecutive hours may be extended in respect of individual losses which occur beyond such 96 consecutive hours during the continued occupation of an assured's premises by strikers, provided such occupation commenced during the aforesaid period. 4. As regards earthquake (the epicenter of which need not necessarily be within the territorial confines referred to in the introductory portion of this paragraph) and fire following directly occasioned by the earthquake, only those individual fire losses which commence during the period of 168 consecutive hours may be included in the Company's loss occurrence. 5. As regards freeze, only individual losses directly occasioned by collapse, breakage of glass and water damage (caused by bursting frozen pipes and tanks) may be included in the Company's loss occurrence. 6. As regards firestorms, brush fires and any other fires or series of fires, irrespective of origin (except as provided in subparagraphs 3 and 4 above), all individual losses sustained by the Company which commence during any period of 168 consecutive hours within the area of one state of the United States or province of Canada and states or provinces contiguous thereto and to one another may be included in the Company's loss occurrence. B. For all loss occurrences hereunder, the Company may choose the date and time when any such period of consecutive hours commences, provided that no period commences earlier than the date and time of the occurrence of the first recorded individual loss sustained by the Company arising out of that disaster, accident, or loss or series of disasters, accidents, or losses. Furthermore:

21\F7V1118 Page 9 1. For all loss occurrences other than those referred to in subparagraphs A.1., A.2., and A.3. above, only one such period of 168 consecutive hours shall apply with respect to one event. 2. As regards those loss occurrences referred to in subparagraphs A.1. and A.2., only one such period of consecutive hours (as set forth therein) shall apply with respect to one event, regardless of the duration of the event. 3. As regards those loss occurrences referred to in subparagraph A.3. above, if the disaster, accident, or loss or series of disasters, accidents, or losses occasioned by the event is of greater duration than 96 consecutive hours, then the Company may divide that disaster, accident, or loss or series of disasters, accidents, or losses into two or more loss occurrences, provided that no two periods overlap and no individual loss is included in more than one such period. C. It is understood that losses arising from a combination of two or more perils as a result of the same event may be considered as having arisen from one loss occurrence. Notwithstanding the foregoing, the hourly limitations as stated above shall not be exceeded as respects the applicable perils, and no single loss occurrence shall encompass a time period greater than 168 consecutive hours, except as regards those loss occurrences referred to in subparagraphs A.1., A.4. and A.6. above. Article 11 - Loss Notices and Settlements A. Whenever losses sustained by the Company are reserved by the Company for an amount greater than 50.0% of the Company's respective retention under any excess layer hereunder and/or appear likely to result in a claim under such excess layer, the Company shall notify the Subscribing Reinsurers under that excess layer and shall provide updates related to development of such losses. The Reinsurer shall have the right to participate in the adjustment of such losses at its own expense. B. All loss settlements made by the Company, provided they are within the terms of this Contract and the terms of the original policy (with the exception of loss in excess of policy limits or extra contractual obligations coverage, if any, under this Contract), shall be binding upon the Reinsurer, and the Reinsurer agrees to pay all amounts for which it may be liable upon receipt of reasonable evidence of the amount paid by the Company. Article 12 - Cash Call Notwithstanding the provisions of the Loss Notices and Settlements Article, upon the request of the Company, the Reinsurer shall pay any amount with regard to a loss settlement or settlements that are scheduled to be made (including any payments projected to be made) within the next 20 days by the Company, subject to receipt by the Reinsurer of a satisfactory proof of loss. Such agreed payment shall be made within 10 days from the date the demand for payment was transmitted to the Reinsurer.

21\F7V1118 Page 10 Article 13 - Salvage and Subrogation The Reinsurer shall be credited with salvage (i.e., reimbursement obtained or recovery made by the Company, less the actual cost, excluding salaries of officials and employees of the Company and sums paid to attorneys as retainer, of obtaining such reimbursement or making such recovery) on account of claims and settlements involving reinsurance hereunder. Salvage thereon shall always be used to reimburse the excess carriers in the reverse order of their priority according to their participation before being used in any way to reimburse the Company for its primary loss. The Company hereby agrees to enforce its rights to salvage or subrogation relating to any loss, a part of which loss was sustained by the Reinsurer, and to prosecute all claims arising out of such rights, if, in the Company's opinion, it is economically reasonable to do so. Article 14 - Reinsurance Premium A. As premium for each excess layer of reinsurance coverage provided by this Contract, the Company shall pay the Reinsurer a premium equal to the product of the following (or a pro rata portion thereof in the event the term of this Contract is less than 12 months), subject to a minimum premium of the amount, shown as "Minimum Premium" for that excess layer in Schedule A attached hereto (or a pro rata portion thereof in the event the term of this Contract is less than 12 months): 1. The amount, shown as "Annual Deposit Premium" for that excess layer in Schedule A attached hereto; times 2. The percentage calculated by dividing (a) the actual Probable Maximum Loss ("PML") determined by the Company's wind insurance in force on September 30, 2021, by (b) the original PML of $[***]. However, if the difference between the amount, shown as "Annual Deposit Premium" for that excess layer in Schedule A attached hereto, and the premium calculated in accordance with this paragraph A for the excess layer is less than a 5.0% increase or decrease, the premium due the Reinsurer shall equal the amount, shown as "Annual Deposit Premium" for that excess layer in Schedule A attached hereto. B. The Company's PML shall be derived by averaging the applicable data for the 20-year and 100-year return period produced by Applied Insurance Research (AIR) Touchstone v8.2 and Risk Management Solutions (RMS) RiskLink v18.1 catastrophe modeling software, in the long-term perspective, including secondary uncertainty and loss amplification, but excluding storm surge. It is understood that the calculation of the actual PML shall be based on the amount, shown as "Reinsurer's Per Occurrence Limit" for that excess layer in Schedule A attached hereto.

21\F7V1118 Page 10 Article 13 - Salvage and Subrogation The Reinsurer shall be credited with salvage (i.e., reimbursement obtained or recovery made by the Company, less the actual cost, excluding salaries of officials and employees of the Company and sums paid to attorneys as retainer, of obtaining such reimbursement or making such recovery) on account of claims and settlements involving reinsurance hereunder. Salvage thereon shall always be used to reimburse the excess carriers in the reverse order of their priority according to their participation before being used in any way to reimburse the Company for its primary loss. The Company hereby agrees to enforce its rights to salvage or subrogation relating to any loss, a part of which loss was sustained by the Reinsurer, and to prosecute all claims arising out of such rights, if, in the Company's opinion, it is economically reasonable to do so. Article 14 - Reinsurance Premium A. As premium for each excess layer of reinsurance coverage provided by this Contract, the Company shall pay the Reinsurer a premium equal to the product of the following (or a pro rata portion thereof in the event the term of this Contract is less than 12 months), subject to a minimum premium of the amount, shown as "Minimum Premium" for that excess layer in Schedule A attached hereto (or a pro rata portion thereof in the event the term of this Contract is less than 12 months): 1. The amount, shown as "Annual Deposit Premium" for that excess layer in Schedule A attached hereto; times 2. The percentage calculated by dividing (a) the actual Probable Maximum Loss ("PML") determined by the Company's wind insurance in force on September 30, 2021, by (b) the original PML of $[***]. However, if the difference between the amount, shown as "Annual Deposit Premium" for that excess layer in Schedule A attached hereto, and the premium calculated in accordance with this paragraph A for the excess layer is less than a 5.0% increase or decrease, the premium due the Reinsurer shall equal the amount, shown as "Annual Deposit Premium" for that excess layer in Schedule A attached hereto. B. The Company's PML shall be derived by averaging the applicable data for the 20-year and 100-year return period produced by Applied Insurance Research (AIR) Touchstone v8.2 and Risk Management Solutions (RMS) RiskLink v18.1 catastrophe modeling software, in the long-term perspective, including secondary uncertainty and loss amplification, but excluding storm surge. It is understood that the calculation of the actual PML shall be based on the amount, shown as "Reinsurer's Per Occurrence Limit" for that excess layer in Schedule A attached hereto.

21\F7V1118 Page 11 For informational purposes, to follow is the estimated PML based on the estimated 9-30- 2021 PML: Software 20-Year PML 100-Year PML Average 20 & 100 AIR v8.2 $[***] $[***] $[***] RMS v18.1 $[***] $[***] $[***] Estimated PML at 9-30-2021 (average AIR & RMS): $[***] C. The Company shall pay the Reinsurer an annual deposit premium for each excess layer of the amount, shown as "Annual Deposit Premium" for that excess layer in Schedule A attached hereto, in four equal installments of the amount, shown as "Deposit Premium Installment" for that excess layer in Schedule A attached hereto, on July 1 and October 1 of 2021, and on January 1 and April 1 of 2022. However, in the event this Contract is terminated, there shall be no deposit premium installments due after the effective date of termination. D. On or before June 30, 2022, the Company shall provide a report to the Reinsurer setting forth the premium due hereunder for each excess layer for the term of this Contract, computed in accordance with paragraph A above, and any additional premium due the Reinsurer or return premium due the Company for each such excess layer shall be remitted promptly. Article 15 - Sanctions Neither the Company nor any Subscribing Reinsurer shall be liable for premium or loss under this Contract if it would result in a violation of any mandatory sanction, prohibition or restriction under United Nations resolutions or the trade or economic sanctions, laws or regulations of the European Union, United Kingdom or United States of America that are applicable to either party. Article 16 - Late Payments A. The provisions of this Article shall not be implemented unless specifically invoked, in writing, by one of the parties to this Contract. B. In the event any premium, loss or other payment due either party is not received by the intermediary named in the Intermediary Article (hereinafter referred to as the "Intermediary") by the payment due date, the party to whom payment is due may, by notifying the Intermediary in writing, require the debtor party to pay, and the debtor party agrees to pay, an interest charge on the amount past due calculated for each such payment on the last business day of each month as follows: 1. The number of full days which have expired since the due date or the last monthly calculation, whichever the lesser; times 2. 1/365ths of the six-month United States Prime rate as quoted in The Wall Street Journal on the first business day of the month for which the calculation is made; times

21\F7V1118 Page 12 3. The amount past due, including accrued interest. It is agreed that interest shall accumulate until payment of the original amount due plus interest charges have been received by the Intermediary. C. The establishment of the due date shall, for purposes of this Article, be determined as follows: 1. As respects the payment of routine deposits and premiums due the Reinsurer, the due date shall be as provided for in the applicable section of this Contract. In the event a due date is not specifically stated for a given payment, it shall be deemed due 30 days after the date of transmittal by the Intermediary of the initial billing for each such payment. 2. Any claim or loss payment due the Company hereunder shall be deemed due 10 days after the proof of loss or demand for payment is transmitted to the Reinsurer. If such loss or claim payment is not received within the 10 days, interest will accrue on the payment or amount overdue in accordance with paragraph B above, from the date the proof of loss or demand for payment was transmitted to the Reinsurer. 3. As respects a "cash call" made in accordance with the Cash Call Article, payment shall be deemed due 10 days after the demand for payment is transmitted to the Reinsurer. If such loss or claim payment is not received within the 10 days, interest shall accrue on the payment or amount overdue in accordance with paragraph B above, from the date the demand for payment was transmitted to the Reinsurer. 4. As respects any payment, adjustment or return due either party not otherwise provided for in subparagraphs 1, 2, and 3 of this paragraph C, the due date shall be as provided for in the applicable section of this Contract. In the event a due date is not specifically stated for a given payment, it shall be deemed due 10 days following transmittal of written notification that the provisions of this Article have been invoked. For purposes of interest calculations only, amounts due hereunder shall be deemed paid upon receipt by the Intermediary. D. Nothing herein shall be construed as limiting or prohibiting a Subscribing Reinsurer from contesting the validity of any claim, or from participating in the defense of any claim or suit, or prohibiting either party from contesting the validity of any payment or from initiating any arbitration or other proceeding in accordance with the provisions of this Contract. If the debtor party prevails in an arbitration or other proceeding, then any interest charges due hereunder on the amount in dispute shall be null and void. If the debtor party loses in such proceeding, then the interest charge on the amount determined to be due hereunder shall be calculated in accordance with the provisions set forth above unless otherwise determined by such proceedings. If a debtor party advances payment of any amount it is contesting, and proves to be correct in its contestation, either in whole or in part, the other party shall reimburse the debtor party for any such excess payment made plus interest on the excess amount calculated in accordance with this Article.

21\F7V1118 Page 12 3. The amount past due, including accrued interest. It is agreed that interest shall accumulate until payment of the original amount due plus interest charges have been received by the Intermediary. C. The establishment of the due date shall, for purposes of this Article, be determined as follows: 1. As respects the payment of routine deposits and premiums due the Reinsurer, the due date shall be as provided for in the applicable section of this Contract. In the event a due date is not specifically stated for a given payment, it shall be deemed due 30 days after the date of transmittal by the Intermediary of the initial billing for each such payment. 2. Any claim or loss payment due the Company hereunder shall be deemed due 10 days after the proof of loss or demand for payment is transmitted to the Reinsurer. If such loss or claim payment is not received within the 10 days, interest will accrue on the payment or amount overdue in accordance with paragraph B above, from the date the proof of loss or demand for payment was transmitted to the Reinsurer. 3. As respects a "cash call" made in accordance with the Cash Call Article, payment shall be deemed due 10 days after the demand for payment is transmitted to the Reinsurer. If such loss or claim payment is not received within the 10 days, interest shall accrue on the payment or amount overdue in accordance with paragraph B above, from the date the demand for payment was transmitted to the Reinsurer. 4. As respects any payment, adjustment or return due either party not otherwise provided for in subparagraphs 1, 2, and 3 of this paragraph C, the due date shall be as provided for in the applicable section of this Contract. In the event a due date is not specifically stated for a given payment, it shall be deemed due 10 days following transmittal of written notification that the provisions of this Article have been invoked. For purposes of interest calculations only, amounts due hereunder shall be deemed paid upon receipt by the Intermediary. D. Nothing herein shall be construed as limiting or prohibiting a Subscribing Reinsurer from contesting the validity of any claim, or from participating in the defense of any claim or suit, or prohibiting either party from contesting the validity of any payment or from initiating any arbitration or other proceeding in accordance with the provisions of this Contract. If the debtor party prevails in an arbitration or other proceeding, then any interest charges due hereunder on the amount in dispute shall be null and void. If the debtor party loses in such proceeding, then the interest charge on the amount determined to be due hereunder shall be calculated in accordance with the provisions set forth above unless otherwise determined by such proceedings. If a debtor party advances payment of any amount it is contesting, and proves to be correct in its contestation, either in whole or in part, the other party shall reimburse the debtor party for any such excess payment made plus interest on the excess amount calculated in accordance with this Article.

21\F7V1118 Page 13 E. Interest charges arising out of the application of this Article that are $1,000 or less from any party shall be waived unless there is a pattern of late payments consisting of three or more items over the course of any 12-month period. Article 17 - Offset The Company and the Reinsurer may offset any balance or amount due from one party to the other under this Contract or any other contract heretofore or hereafter entered into between the Company and the Reinsurer, whether acting as assuming reinsurer or ceding company. The provisions of this Article shall not be affected by the insolvency of either party. Article 18 - Severability of Interests and Obligations The rights, duties and obligations set forth below shall apply as if this Contract were a separate contract between the Subscribing Reinsurers and each named reinsured company: A. Balances payable by any Subscribing Reinsurer to or from any reinsured party under the Contract shall not serve to offset any balances recoverable to, or from, any other reinsured party to the Contract and balances payable shall be separated by named reinsured company and paid directly to the appropriate named reinsured company's bank account. B. Balances recoverable by any Subscribing Reinsurer to or from any reinsured party under the Contract shall not serve to offset any balances payable to, or from, any other reinsured party to the Contract. C. Reports and remittances made to the Reinsurer in accordance with the applicable articles of the Contract are to be in sufficient detail to identify both the Reinsurer's loss obligations due to each named reinsured company and each named reinsured company's premium remittance under the report. D. In the event of the insolvency of any of the parties to the Contract, offset shall be only allowed in accordance with the laws of the insolvent party's state of domicile. E. Nothing in this Article shall be construed to provide a separate retention, Reinsurer's limit of liability any one loss occurrence or Reinsurer's annual limit of liability for each named reinsured company. Article 19 - Access to Records The Reinsurer or its designated representatives shall have access at any reasonable time to all records of the Company which pertain in any way to this reinsurance, provided the Reinsurer gives the Company at least 15 days prior notice of request for such access. However, a Subscribing Reinsurer or its designated representatives shall not have any right of access to the records of the Company if it is not current in all undisputed payments due the Company. "Undisputed" as used herein shall mean any amount that the Subscribing Reinsurer has not contested in writing to the Company specifying the reason(s) why the payments are disputed.

21\F7V1118 Page 14 Article 20 - Liability of the Reinsurer A. The liability of the Reinsurer shall follow that of the Company in every case and be subject in all respects to all the general and specific stipulations, clauses, waivers and modifications of the Company's policies and any endorsements thereon. However, in no event shall this be construed in any way to provide coverage outside the terms and conditions set forth in this Contract. B. Nothing herein shall in any manner create any obligations or establish any rights against the Reinsurer in favor of any third party or any persons not parties to this Contract. Article 21 - Net Retained Lines (BRMA 32E) A. This Contract applies only to that portion of any policy which the Company retains net for its own account (prior to deduction of any underlying reinsurance specifically permitted in this Contract), and in calculating the amount of any loss hereunder and also in computing the amount or amounts in excess of which this Contract attaches, only loss or losses in respect of that portion of any policy which the Company retains net for its own account shall be included. B. The amount of the Reinsurer's liability hereunder in respect of any loss or losses shall not be increased by reason of the inability of the Company to collect from any other reinsurer(s), whether specific or general, any amounts which may have become due from such reinsurer(s), whether such inability arises from the insolvency of such other reinsurer(s) or otherwise. Article 22 - Errors and Omissions (BRMA 14F) Inadvertent delays, errors or omissions made in connection with this Contract or any transaction hereunder shall not relieve either party from any liability which would have attached had such delay, error or omission not occurred, provided always that such error or omission is rectified as soon as possible after discovery. Article 23 - Currency (BRMA 12A) A. Whenever the word "Dollars" or the "$" sign appears in this Contract, they shall be construed to mean United States Dollars and all transactions under this Contract shall be in United States Dollars. B. Amounts paid or received by the Company in any other currency shall be converted to United States Dollars at the rate of exchange at the date such transaction is entered on the books of the Company.

21\F7V1118 Page 14 Article 20 - Liability of the Reinsurer A. The liability of the Reinsurer shall follow that of the Company in every case and be subject in all respects to all the general and specific stipulations, clauses, waivers and modifications of the Company's policies and any endorsements thereon. However, in no event shall this be construed in any way to provide coverage outside the terms and conditions set forth in this Contract. B. Nothing herein shall in any manner create any obligations or establish any rights against the Reinsurer in favor of any third party or any persons not parties to this Contract. Article 21 - Net Retained Lines (BRMA 32E) A. This Contract applies only to that portion of any policy which the Company retains net for its own account (prior to deduction of any underlying reinsurance specifically permitted in this Contract), and in calculating the amount of any loss hereunder and also in computing the amount or amounts in excess of which this Contract attaches, only loss or losses in respect of that portion of any policy which the Company retains net for its own account shall be included. B. The amount of the Reinsurer's liability hereunder in respect of any loss or losses shall not be increased by reason of the inability of the Company to collect from any other reinsurer(s), whether specific or general, any amounts which may have become due from such reinsurer(s), whether such inability arises from the insolvency of such other reinsurer(s) or otherwise. Article 22 - Errors and Omissions (BRMA 14F) Inadvertent delays, errors or omissions made in connection with this Contract or any transaction hereunder shall not relieve either party from any liability which would have attached had such delay, error or omission not occurred, provided always that such error or omission is rectified as soon as possible after discovery. Article 23 - Currency (BRMA 12A) A. Whenever the word "Dollars" or the "$" sign appears in this Contract, they shall be construed to mean United States Dollars and all transactions under this Contract shall be in United States Dollars. B. Amounts paid or received by the Company in any other currency shall be converted to United States Dollars at the rate of exchange at the date such transaction is entered on the books of the Company.

21\F7V1118 Page 15 Article 24 - Taxes (BRMA 50B) In consideration of the terms under which this Contract is issued, the Company will not claim a deduction in respect of the premium hereon when making tax returns, other than income or profits tax returns, to any state or territory of the United States of America or the District of Columbia. Article 25 - Federal Excise Tax (BRMA 17D) A. The Reinsurer has agreed to allow for the purpose of paying the Federal Excise Tax the applicable percentage of the premium payable hereon (as imposed under Section 4371 of the Internal Revenue Code) to the extent such premium is subject to the Federal Excise Tax. B. In the event of any return of premium becoming due hereunder the Reinsurer will deduct the applicable percentage from the return premium payable hereon and the Company or its agent should take steps to recover the tax from the United States Government. Article 26 - Reserves A. The Reinsurer agrees to fund its share of amounts, including but not limited to, the Company's ceded unearned premium and outstanding loss and loss adjustment expense reserves (including all case reserves plus any reasonable amount estimated to be unreported from known loss occurrences) (hereinafter referred to as "Reinsurer's Obligations") by: 1. Clean, irrevocable and unconditional letters of credit issued and confirmed, if confirmation is required by the insurance regulatory authorities involved, by a bank or banks meeting the NAIC Securities Valuation Office credit standards for issuers of letters of credit and acceptable to said insurance regulatory authorities; and/or 2. Escrow accounts for the benefit of the Company; and/or 3. Cash advances; if the Reinsurer: 1. Is unauthorized in any state of the United States of America or the District of Columbia having jurisdiction over the Company and if, without such funding, a penalty would accrue to the Company on any financial statement it is required to file with the insurance regulatory authorities involved; or 2. Has an A.M. Best Company's Financial Strength Rating equal to or below B++ at the inception of this Contract. The Reinsurer, at its sole option, may fund in other than cash if its method and form of funding are acceptable to the insurance regulatory authorities involved.

21\F7V1118 Page 16 B. With regard to funding in whole or in part by letters of credit, it is agreed that each letter of credit will be in a form acceptable to insurance regulatory authorities involved, will be issued for a term of at least one year and will include an "evergreen clause," which automatically extends the term for at least one additional year at each expiration date unless written notice of non-renewal is given to the Company not less than 30 days prior to said expiration date. The Company and the Reinsurer further agree, notwithstanding anything to the contrary in this Contract, that said letters of credit may be drawn upon by the Company or its successors in interest at any time, without diminution because of the insolvency of the Company or the Reinsurer, but only for one or more of the following purposes: 1. To reimburse itself for the Reinsurer's share of unearned premiums returned to insureds on account of policy cancellations, unless paid in cash by the Reinsurer; 2. To reimburse itself for the Reinsurer's share of losses and/or loss adjustment expense paid under the terms of policies reinsured hereunder, unless paid in cash by the Reinsurer; 3. To reimburse itself for the Reinsurer's share of any other amounts claimed to be due hereunder, unless paid in cash by the Reinsurer; 4. To fund a cash account in an amount equal to the Reinsurer's share of amounts, including but not limited to, the Reinsurer's Obligations as set forth above, funded by means of a letter of credit which is under non-renewal notice, if said letter of credit has not been renewed or replaced by the Reinsurer 10 days prior to its expiration date; 5. To refund to the Reinsurer any sum in excess of the actual amount required to fund the Reinsurer's share of amounts, including but not limited to, the Reinsurer's Obligations as set forth above, if so requested by the Reinsurer. In the event the amount drawn by the Company on any letter of credit is in excess of the actual amount required for B(1), B(2) or B(4), or in the case of B(3), the actual amount determined to be due, the Company shall promptly return to the Reinsurer the excess amount so drawn. Article 27 - Insolvency A. In the event of the insolvency of the Company, this reinsurance shall be payable directly to the Company or to its liquidator, receiver, conservator or statutory successor on the basis of the liability of the Company without diminution because of the insolvency of the Company or because the liquidator, receiver, conservator or statutory successor of the Company has failed to pay all or a portion of any claim. It is agreed, however, that the liquidator, receiver, conservator or statutory successor of the Company shall give written notice to the Reinsurer of the pendency of a claim against the Company indicating the policy or bond reinsured which claim would involve a possible liability on the part of the Reinsurer within a reasonable time after such claim is filed in the conservation or liquidation proceeding or in the receivership, and that during the pendency of such claim, the Reinsurer may investigate such claim and interpose, at its own expense, in the proceeding where such claim is to be adjudicated, any defense or defenses that it may deem available to the Company or its liquidator, receiver, conservator or statutory successor. The expense thus incurred by the

21\F7V1118 Page 16 B. With regard to funding in whole or in part by letters of credit, it is agreed that each letter of credit will be in a form acceptable to insurance regulatory authorities involved, will be issued for a term of at least one year and will include an "evergreen clause," which automatically extends the term for at least one additional year at each expiration date unless written notice of non-renewal is given to the Company not less than 30 days prior to said expiration date. The Company and the Reinsurer further agree, notwithstanding anything to the contrary in this Contract, that said letters of credit may be drawn upon by the Company or its successors in interest at any time, without diminution because of the insolvency of the Company or the Reinsurer, but only for one or more of the following purposes: 1. To reimburse itself for the Reinsurer's share of unearned premiums returned to insureds on account of policy cancellations, unless paid in cash by the Reinsurer; 2. To reimburse itself for the Reinsurer's share of losses and/or loss adjustment expense paid under the terms of policies reinsured hereunder, unless paid in cash by the Reinsurer; 3. To reimburse itself for the Reinsurer's share of any other amounts claimed to be due hereunder, unless paid in cash by the Reinsurer; 4. To fund a cash account in an amount equal to the Reinsurer's share of amounts, including but not limited to, the Reinsurer's Obligations as set forth above, funded by means of a letter of credit which is under non-renewal notice, if said letter of credit has not been renewed or replaced by the Reinsurer 10 days prior to its expiration date; 5. To refund to the Reinsurer any sum in excess of the actual amount required to fund the Reinsurer's share of amounts, including but not limited to, the Reinsurer's Obligations as set forth above, if so requested by the Reinsurer. In the event the amount drawn by the Company on any letter of credit is in excess of the actual amount required for B(1), B(2) or B(4), or in the case of B(3), the actual amount determined to be due, the Company shall promptly return to the Reinsurer the excess amount so drawn. Article 27 - Insolvency A. In the event of the insolvency of the Company, this reinsurance shall be payable directly to the Company or to its liquidator, receiver, conservator or statutory successor on the basis of the liability of the Company without diminution because of the insolvency of the Company or because the liquidator, receiver, conservator or statutory successor of the Company has failed to pay all or a portion of any claim. It is agreed, however, that the liquidator, receiver, conservator or statutory successor of the Company shall give written notice to the Reinsurer of the pendency of a claim against the Company indicating the policy or bond reinsured which claim would involve a possible liability on the part of the Reinsurer within a reasonable time after such claim is filed in the conservation or liquidation proceeding or in the receivership, and that during the pendency of such claim, the Reinsurer may investigate such claim and interpose, at its own expense, in the proceeding where such claim is to be adjudicated, any defense or defenses that it may deem available to the Company or its liquidator, receiver, conservator or statutory successor. The expense thus incurred by the

21\F7V1118 Page 17 Reinsurer shall be chargeable, subject to the approval of the Court, against the Company as part of the expense of conservation or liquidation to the extent of a pro rata share of the benefit which may accrue to the Company solely as a result of the defense undertaken by the Reinsurer. B. Where two or more Subscribing Reinsurers are involved in the same claim and a majority in interest elect to interpose defense to such claim, the expense shall be apportioned in accordance with the terms of this Contract as though such expense had been incurred by the Company. C. It is further understood and agreed that, in the event of the insolvency of the Company, the reinsurance under this Contract shall be payable directly by the Reinsurer to the Company or to its liquidator, receiver or statutory successor, except as provided by Section 4118(a) of the New York Insurance Law or except (1) where this Contract specifically provides another payee of such reinsurance in the event of the insolvency of the Company or (2) where the Reinsurer with the consent of the direct insured or insureds has assumed such policy obligations of the Company as direct obligations of the Reinsurer to the payees under such policies and in substitution for the obligations of the Company to such payees. Article 28 - Arbitration A. As a condition precedent to any right of action hereunder, in the event of any dispute or difference of opinion hereafter arising with respect to this Contract, it is hereby mutually agreed that such dispute or difference of opinion shall be submitted to arbitration. One Arbiter shall be chosen by the Company, the other by the Reinsurer, and an Umpire shall be chosen by the two Arbiters before they enter upon arbitration, all of whom shall be active or retired disinterested executive officers of insurance or reinsurance companies or Lloyd's London Underwriters. In the event that either party should fail to choose an Arbiter within 30 days following a written request by the other party to do so, the requesting party may choose two Arbiters who shall in turn choose an Umpire before entering upon arbitration. If the two Arbiters fail to agree upon the selection of an Umpire within 30 days following their appointment, each Arbiter shall nominate three candidates within 10 days thereafter, two of whom the other shall decline, and the decision shall be made by drawing lots. B. Each party shall present its case to the Arbiters within 30 days following the date of appointment of the Umpire. The Arbiters shall consider this Contract as an honorable engagement rather than merely as a legal obligation and they are relieved of all judicial formalities and may abstain from following the strict rules of law. The decision of the Arbiters shall be final and binding on both parties; but failing to agree, they shall call in the Umpire and the decision of the majority shall be final and binding upon both parties. Judgment upon the final decision of the Arbiters may be entered in any court of competent jurisdiction. C. If more than one Subscribing Reinsurer is involved in the same dispute, all such Subscribing Reinsurers shall, at the option of the Company, constitute and act as one party for purposes of this Article and communications shall be made by the Company to each of the Subscribing Reinsurers constituting one party, provided, however, that nothing herein shall impair the rights of such Subscribing Reinsurers to assert several, rather than joint,

21\F7V1118 Page 18 defenses or claims, nor be construed as changing the liability of the Subscribing Reinsurers participating under the terms of this Contract from several to joint. D. Each party shall bear the expense of its own Arbiter, and shall jointly and equally bear with the other the expense of the Umpire and of the arbitration. In the event that the two Arbiters are chosen by one party, as above provided, the expense of the Arbiters, the Umpire and the arbitration shall be equally divided between the two parties. E. Any arbitration proceedings shall take place at a location mutually agreed upon by the parties to this Contract, but notwithstanding the location of the arbitration, all proceedings pursuant hereto shall be governed by the law of the state in which the Company has its principal office. Article 29 - Service of Suit (BRMA 49C) (Applicable if the Reinsurer is not domiciled in the United States of America, and/or is not authorized in any State, Territory or District of the United States where authorization is required by insurance regulatory authorities) A. It is agreed that in the event the Reinsurer fails to pay any amount claimed to be due hereunder, the Reinsurer, at the request of the Company, will submit to the jurisdiction of a court of competent jurisdiction within the United States. Nothing in this Article constitutes or should be understood to constitute a waiver of the Reinsurer's rights to commence an action in any court of competent jurisdiction in the United States, to remove an action to a United States District Court, or to seek a transfer of a case to another court as permitted by the laws of the United States or of any state in the United States. B. Further, pursuant to any statute of any state, territory or district of the United States which makes provision therefor, the Reinsurer hereby designates the party named in its Interests and Liabilities Agreement, or if no party is named therein, the Superintendent, Commissioner or Director of Insurance or other officer specified for that purpose in the statute, or his successor or successors in office, as its true and lawful attorney upon whom may be served any lawful process in any action, suit or proceeding instituted by or on behalf of the Company or any beneficiary hereunder arising out of this Contract. Article 30 - Severability (BRMA 72E) If any provision of this Contract shall be rendered illegal or unenforceable by the laws, regulations or public policy of any state, such provision shall be considered void in such state, but this shall not affect the validity or enforceability of any other provision of this Contract or the enforceability of such provision in any other jurisdiction. Article 31 - Governing Law (BRMA 71B) This Contract shall be governed by and construed in accordance with the laws of the State of Florida.

21\F7V1118 Page 18 defenses or claims, nor be construed as changing the liability of the Subscribing Reinsurers participating under the terms of this Contract from several to joint. D. Each party shall bear the expense of its own Arbiter, and shall jointly and equally bear with the other the expense of the Umpire and of the arbitration. In the event that the two Arbiters are chosen by one party, as above provided, the expense of the Arbiters, the Umpire and the arbitration shall be equally divided between the two parties. E. Any arbitration proceedings shall take place at a location mutually agreed upon by the parties to this Contract, but notwithstanding the location of the arbitration, all proceedings pursuant hereto shall be governed by the law of the state in which the Company has its principal office. Article 29 - Service of Suit (BRMA 49C) (Applicable if the Reinsurer is not domiciled in the United States of America, and/or is not authorized in any State, Territory or District of the United States where authorization is required by insurance regulatory authorities) A. It is agreed that in the event the Reinsurer fails to pay any amount claimed to be due hereunder, the Reinsurer, at the request of the Company, will submit to the jurisdiction of a court of competent jurisdiction within the United States. Nothing in this Article constitutes or should be understood to constitute a waiver of the Reinsurer's rights to commence an action in any court of competent jurisdiction in the United States, to remove an action to a United States District Court, or to seek a transfer of a case to another court as permitted by the laws of the United States or of any state in the United States. B. Further, pursuant to any statute of any state, territory or district of the United States which makes provision therefor, the Reinsurer hereby designates the party named in its Interests and Liabilities Agreement, or if no party is named therein, the Superintendent, Commissioner or Director of Insurance or other officer specified for that purpose in the statute, or his successor or successors in office, as its true and lawful attorney upon whom may be served any lawful process in any action, suit or proceeding instituted by or on behalf of the Company or any beneficiary hereunder arising out of this Contract. Article 30 - Severability (BRMA 72E) If any provision of this Contract shall be rendered illegal or unenforceable by the laws, regulations or public policy of any state, such provision shall be considered void in such state, but this shall not affect the validity or enforceability of any other provision of this Contract or the enforceability of such provision in any other jurisdiction. Article 31 - Governing Law (BRMA 71B) This Contract shall be governed by and construed in accordance with the laws of the State of Florida.