Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☒ |

Preliminary Proxy Statement | ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||

| ☐ |

Definitive Proxy Statement | |||||

| ☐ |

Definitive Additional Materials | |||||

| ☐ |

Soliciting Material Pursuant to §240.14a-12 |

Trex Company, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| 1) | Title of each class of securities to which transaction applies: |

| 2) | Aggregate number of securities to which transaction applies: |

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it is determined): |

| 4) | Proposed maximum aggregate value of transaction: |

| 5) | Total fee paid: |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| 1) | Amount Previously Paid: |

| 2) | Form, Schedule or Registration Statement No.: |

| 3) | Filing Party: |

| 4) | Date Filed: |

Table of Contents

Trex Company, Inc.

160 Exeter Drive

Winchester, Virginia 22603-8605

Notice of Annual Meeting of Stockholders

May 5, 2022

To our stockholders:

Notice is hereby given that the 2022 annual meeting of stockholders of Trex Company, Inc. will be held at Trex University, 331 Apple Valley Road, Winchester, Virginia, on Thursday, May 5, 2022, at 9:00 a.m., local time, for the following purposes:

| ➊ | to elect three directors of Trex Company, Inc.; |

| ➋ | to approve, on a non-binding advisory basis, the compensation of our named executive officers; |

| ➌ | to approve the First Certificate of Amendment to the Trex Company, Inc. Restated Certificate of Incorporation to increase the number of authorized shares of common stock, $0.01 par value per share, from 180,000,000 to 360,000,000; |

| ➍ | to ratify the appointment of Ernst & Young LLP as Trex Company’s independent registered public accounting firm for the 2022 fiscal year; and |

| ➎ | to transact such other business as may properly come before the annual meeting or any adjournment or postponement thereof. |

Only stockholders of record at the close of business on March 9, 2022 will be entitled to notice of and to vote at the annual meeting or any adjournment or postponement thereof.

All stockholders are cordially invited to attend this meeting.

We have elected to adopt the U.S. Securities and Exchange Commission rule that allows companies to furnish their proxy materials over the Internet. As a result, we are mailing a Notice Regarding the Availability of Proxy Materials (the “Notice of Availability”) to our stockholders instead of a paper copy of this Proxy Statement and our 2021 Annual Report. The Notice of Availability contains instructions on how to access and review those documents over the Internet. We believe that this process will allow us to provide our stockholders with the information they need in a more timely manner, while reducing the environmental impact and lowering the costs of printing and distributing our proxy materials. Stockholders who receive a Notice of Availability by mail and would like to receive a printed copy of our proxy materials should follow the instructions for requesting such materials included on the Notice of Availability.

Your vote is very important to us. Whether or not you plan to attend the meeting in person, your shares should be represented and voted. To vote, please complete and return your proxy card, or vote by telephone or via the Internet by following the instructions on your Notice of Availability. Returning a proxy card or otherwise submitting your proxy does not deprive you of your right to attend the annual meeting and vote in person.

By Order of the Board of Directors,

William R. Gupp

Senior Vice President,

Chief Legal Officer and Secretary

Dated: March 22, 2022

Table of Contents

| Page | |||||

| Proxy Summary | 1 | ||||

| Board of Directors | 2 | ||||

| General Information | 4 | ||||

| 4 | |||||

| 4 | |||||

| 4 | |||||

| 4 | |||||

| 5 | |||||

| 5 | |||||

| 5 | |||||

| Security Ownership | 8 | ||||

| Election of Directors | 10 | ||||

| 10 | |||||

| 10 | |||||

| Information About Retiring Directors, Nominees and Continuing Directors |

10 | ||||

| 10 | |||||

| 11 | |||||

| 12 | |||||

| 13 | |||||

| Corporate Governance | 15 | ||||

| 15 | |||||

| 15 | |||||

| 17 | |||||

| 18 | |||||

| 19 | |||||

| 20 | |||||

| 20 | |||||

| 21 | |||||

| 22 | |||||

| 22 | |||||

| 22 | |||||

| Non-Employee Director Compensation | 23 | ||||

| 2021 Non-Employee Director Compensation | 25 | ||||

| 2021 Non-Employee Director Equity Awards | 26 | ||||

| Named Executive Officers | 27 | ||||

| Compensation Discussion and Analysis | 28 | ||||

| 28 | |||||

| 28 | |||||

| 28 | |||||

| 30 | |||||

| TREX COMPANY, INC.

|

2022 PROXY STATEMENT

|

i

|

Table of Contents

| TABLE OF CONTENTS |

| ii

|

TREX COMPANY, INC.

|

2022 PROXY STATEMENT

|

Table of Contents

This summary highlights information contained elsewhere in this Proxy Statement. This summary does not contain all of the information you should consider. Please read the entire Proxy Statement carefully before voting.

| Annual Stockholders Meeting

|

Meeting Agenda

| |||||||

| Date |

Thursday, May 5, 2022

|

∎ Election of three directors

∎ Advisory vote on executive compensation

∎ Approve the First Certificate of Amendment to the Trex Company, Inc. Restated Certificate of Incorporation to increase the number of authorized shares of common stock, $0.01 par value per share, from 180,000,000 to 360,000,000

∎ Ratification of Ernst & Young LLP (“Ernst & Young”) as our independent registered public accounting firm for fiscal year 2022

∎ Transact other business that may properly come before the meeting

| ||||||

| Time |

9:00 a.m. Eastern Time

| |||||||

| Place |

Trex University 331 Apple Valley Road Winchester, Virginia 22602

| |||||||

| Record Date |

March 9, 2022

| |||||||

| Voting |

Stockholders as of the record date are entitled to vote. Each share of common stock is entitled to one vote for each director nominee and one vote for each of the proposals to be voted on.

| |||||||

Voting Matters and Vote Recommendation

| Item |

Board recommendation |

Reasons for recommendation | More information | |||||||||

| 1. Election of three directors. |

FOR | The Board and Nominating/Corporate Governance Committee believe that the three Board candidates possess the skills, experience, and diversity to effectively monitor performance, provide oversight, and advise management on the Company’s long-term strategy. | Page 10 | |||||||||

| 2. Non-binding advisory vote on executive compensation (“say-on-pay”). |

FOR | The Board of Directors believes that the Company’s executive compensation programs demonstrate the continuing focus by the Company on a pay-for-performance philosophy. | Page 57 | |||||||||

| 3. Approve the First Certificate of Amendment to the Trex Company, Inc. Restated Certificate of Incorporation to increase the number of authorized shares of common stock, $0.01 par value per share, from 180,000,000 to 360,000,000. |

FOR | The Board of Directors believes it is in the best interests of the Company to have additional authorized shares of common stock available for future business purposes, including potential stock splits, raising capital, acquisitions and employee equity plans. | Page 58 | |||||||||

| 4. Ratification of the appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for fiscal year 2022. |

FOR | Based on the Audit Committee’s assessment of Ernst & Young’s qualifications and performance, the Board of Directors and the Audit Committee believe that its retention for fiscal year 2022 is in the best interests of the Company. | Page 60 | |||||||||

| TREX COMPANY, INC.

|

2022 PROXY STATEMENT

|

1

|

Table of Contents

The following table provides summary information about each director.

|

Director Occupation |

Age | Director since |

Board Independent |

Other public boards |

Committee memberships |

Up for re-election at current Annual Meeting | ||||||||||||||||||||||||||

| AC | CC | NCGC | ||||||||||||||||||||||||||||||

|

Richard E. Posey* Retired; Former President and CEO, Moen Incorporated |

75 | 2009 | Yes | 0 |

|

|

No | |||||||||||||||||||||||||

| Bryan H. Fairbanks President and CEO, Trex Company, Inc. |

52 | 2020 | No | 0 | Yes | |||||||||||||||||||||||||||

|

Michael F. Golden Retired; Former President and CEO, Smith and Wesson Brands, Inc. |

67 | 2013 | Yes | 1 |

|

|

Yes | |||||||||||||||||||||||||

| Kristine L. Juster CEO, Kimball International, Inc. |

58 | 2019 | Yes | 1 |

|

|

Yes | |||||||||||||||||||||||||

|

Jay M. Gratz Retired; Former Executive Vice President and Chief Financial Officer, Ryerson Inc. |

69 | 2007 | Yes | 0 |

|

|

No | |||||||||||||||||||||||||

| Ronald W. Kaplan** Retired; Former President and CEO, Trex Company, Inc. |

70 | 2008 | Yes | 1 | No | |||||||||||||||||||||||||||

|

Gerald Volas Retired; Former CEO, TopBuild Corp. |

67 | 2014 | Yes | 1 |

|

|

No | |||||||||||||||||||||||||

| James E. Cline*** Retired; Former President and CEO, Trex Company, Inc. |

70 | 2015 | No | 1 | No | |||||||||||||||||||||||||||

|

Gena C. Lovett Former Vice President, Manufacturing, Safety and Quality, Defense, Space and Security of Boeing Company |

59 | 2021 | Yes | 2 |

|

|

No | |||||||||||||||||||||||||

| Patricia B. Robinson**** Retired; Former President of Mead School and Office Products |

69 | 2000 | Yes | 0 |

|

|

No | |||||||||||||||||||||||||

| * | Retiring effective May 5, 2022 |

| ** | Vice Chairman of the Board |

| *** | Chairman of the Board |

| **** | Lead Independent Director |

| AC |

Audit Committee |

|

Chair | |||

| CC |

Compensation Committee |

|

Member | |||

| NCGC |

Nominating/Corporate Governance Committee |

|

Financial expert | |||

| 2

|

TREX COMPANY, INC.

|

2022 PROXY STATEMENT

|

Table of Contents

| BOARD OF DIRECTORS |

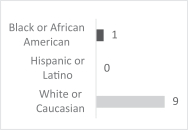

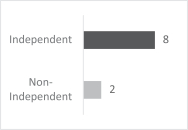

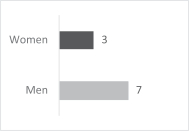

Director Demographics

| Racial/Ethnic Diversity1

|

Average Tenure

|

Independence

| ||

|

Gender Diversity1

|

Age Diversity

|

| 1 | Based on self-identified characteristics |

| TREX COMPANY, INC.

|

2022 PROXY STATEMENT

|

3

|

Table of Contents

Trex Company, Inc.

160 Exeter Drive

Winchester, Virginia 22603-8605

Annual Meeting of Stockholders

May 5, 2022

Proxy Statement

This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Directors (the “Board”) of Trex Company, Inc. (the “Company”, “we” or “our”) for use at the Company’s 2022 annual meeting of stockholders to be held at Trex University, 331 Apple Valley Road, Winchester, Virginia, on Thursday, May 5, 2022 at 9:00 a.m., local time. The purpose of the annual meeting and the matters to be acted upon are set forth in the accompanying notice of annual meeting.

Only stockholders of record at the close of business on March 9, 2022, the record date for the annual meeting (the “record date”), will be entitled to notice of and to vote at the annual meeting. As of February 28, 2022, we had 114,357,638 shares of common stock outstanding, which are our only securities entitled to vote at the annual meeting. Each share of common stock is entitled to one vote.

A list of stockholders entitled to vote at the annual meeting will be open to the examination of any stockholder, for any purpose germane to the meeting, during ordinary business hours for a period of ten days before the meeting at the Company’s offices at 160 Exeter Drive, Winchester, Virginia, and at the time and place of the meeting during the whole time of the meeting.

Notice of the Company’s annual meeting was mailed on or about March 22, 2022 to all stockholders as of the record date.

Those stockholders entitled to vote may vote their shares via the Proxy Card, or via the Internet, telephone or mail, following the instructions printed on the Notice of Availability.

Stockholders who receive a Notice of Availability and would like to receive a printed copy of our proxy materials should follow the instructions for requesting such materials included in the Notice of Availability.

From the date of the mailing of the Notice of Availability until the conclusion of the annual meeting, all of the proxy materials will be accessible on the Company’s website at www.trex.com/proxy.

Stockholders who execute proxies may revoke them by giving written notice to our Secretary any time before such proxies are voted. Attendance at the annual meeting shall not have the effect of revoking a proxy unless the stockholder so attending shall, in writing, so notify the Secretary at any time prior to the voting of the proxy at the annual meeting.

| 4

|

TREX COMPANY, INC.

|

2022 PROXY STATEMENT

|

Table of Contents

| GENERAL INFORMATION |

The Board does not know of any matter that is expected to be presented for consideration at the annual meeting, other than the election of three directors, a non-binding advisory vote on the compensation of our named executive officers, approval of the First Certificate of Amendment to the Trex Company, Inc. Restated Certificate of Incorporation to increase the number of authorized shares of common stock, $0.01 par value per share, from 180,000,000 to 360,000,000, and ratification of the appointment of our independent registered public accounting firm for the current fiscal year. However, if other matters properly come before the annual meeting, the persons named in the accompanying proxy intend to vote thereon in accordance with their judgment.

We are not engaging any company for the purpose of proxy solicitation in conjunction with this Proxy Statement. We will bear the cost of the annual meeting and the cost of soliciting proxies, including the cost of mailing any proxy materials. In addition to solicitation by mail, our directors, officers and regular employees (who will not be specifically compensated for such services) may solicit proxies by telephone or otherwise. Arrangements will be made with brokerage houses and other custodians, nominees and fiduciaries to forward proxies and proxy material to their principals, and we will reimburse them for their expenses. In addition, we have retained Broadridge Financial Solutions, Inc., or Broadridge, to assist in the mailing, collection, and administration of the proxy.

The 2021 Annual Report to stockholders and the 2021 Form 10-K are not proxy soliciting materials.

All proxies received pursuant to this solicitation will be voted except as to matters where authority to vote is specifically withheld. Where a choice is specified as to the proposal, proxies will be voted in accordance with such specification. If no instructions are given, the persons named in the proxy intend to vote:

| ∎ | FOR election of the nominees listed herein as directors; |

| ∎ | FOR approval, on a non-binding advisory basis, of the compensation of our named executive officers; |

| ∎ | FOR approval of the First Certificate of Amendment to the Trex Company, Inc. Restated Certificate of Incorporation to increase the number of authorized shares of common stock, $0.01 par value per share, from 180,000,000 to 360,000,000; and |

| ∎ | FOR ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for the 2022 fiscal year. |

A majority of the outstanding shares of common stock entitled to vote on the record date, whether present in person or represented by proxy, will constitute a quorum for the transaction of business at the annual meeting and any adjournment or postponement thereof. Abstentions and broker non-votes (which occur with respect to any proposal when a broker holds shares of a customer in its name and is not permitted to vote on that proposal without instruction from the beneficial owner of the shares and no instruction is given) will be counted as present or represented for purposes of establishing a quorum for the transaction of business.

| TREX COMPANY, INC.

|

2022 PROXY STATEMENT

|

5

|

Table of Contents

| GENERAL INFORMATION |

The following vote shall be required for approval of each matter:

| Voting Matter | Standard Required | |||

| Election of three directors. |

Majority, which means nominees for the Board of Directors will be elected if more votes are cast in favor of a nominee then are cast against such nominee by the holders of shares present in person or represented by proxy and entitled to vote at the Annual Meeting. Abstentions and broker non-votes will have no effect on the election of directors. As this proposal is considered a “non-routine” matter, brokers may vote their shares on the election of directors only if they have voting instructions from the beneficial owners of the shares.

In the event a nominee does not receive a majority of the votes cast on such nominee’s election, our Bylaws provide that the nominee must immediately submit a written offer of resignation to the Board. Within 60 days after the certification of the election results, the Nominating/Corporate Governance Committee will consider the director’s offer of resignation and recommend to the Board whether to accept the resignation or reject it. The Board will act on such recommendation within 90 days following receipt of the certification of the election results. If a director’s resignation is not accepted by the Board, then the director who tendered that resignation will continue to serve on the Board until the 2023 Annual Meeting of Stockholders and until his or her successor is elected and qualified, or until his or her earlier death, resignation or removal. | |||

| Non-binding advisory vote on executive compensation (“say-on-pay”); and

Ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for the 2022 fiscal year. |

Majority of the shares of common stock present in person or represented by proxy and entitled to vote on the matter at the Annual Meeting. Abstentions from voting on these proposals will not be treated as votes cast on this matter, and therefore, will not have any effect on determining the outcome. Brokers may vote their shares on the say-on-pay proposal only if they have voting instructions from the beneficial owners of the shares, and in the case of ratification of the appointment of the Company’s independent registered public accounting firm, brokers may vote their shares on this proposal even if they have not received instructions (ratification of the appointment of the independent registered public accounting firm is considered a “routine” matter for which a broker may exercise discretionary voting power). With respect to Proposal 2, as this proposal is considered a “non-routine” matter, broker non-votes will not be treated as votes cast on this matter, and therefore will not have any effect on determining the outcome. With respect to Proposal 4, as this proposal is considered a “routine” matter, we do not expect any “broker non-votes” in connection therewith. | |||

| 6

|

TREX COMPANY, INC.

|

2022 PROXY STATEMENT

|

Table of Contents

| GENERAL INFORMATION |

| Voting Matter | Standard Required | |||

| Approval of the First Certificate of Amendment to the Trex Company, Inc. Restated Certificate of Incorporation to increase the number of authorized shares of common stock, $0.01 par value per share, from 180,000,000 to 360,000,000. |

Majority of the shares of common stock issued and outstanding. As opposed to the majority standard for the non-binding advisory vote above, this is an absolute majority standard. Abstentions will have the same effect as a vote against this proposal. Note that this proposal is considered a “routine” matter for which the beneficial owner’s broker may exercise discretionary voting power. That is, if the beneficial owner does not instruct their broker on how to vote their shares on this proposal, then such broker will be permitted to vote their shares in its discretion. The beneficial owner can avoid having their broker vote their shares by providing such broker with their specific voting instructions. As this proposal is considered a “routine” matter, we do not expect any “broker non-votes” in connection therewith. | |||

| TREX COMPANY, INC.

|

2022 PROXY STATEMENT

|

7

|

Table of Contents

The following table presents, as of February 28, 2022, information based upon the Company’s records and filings with the U.S. Securities and Exchange Commission (“SEC”) regarding beneficial ownership of its common stock by the following persons:

∎ each person known to the Company to be the beneficial owner of more than 5% of the common stock;

∎ each director and each nominee to the Board;

∎ each executive officer of the Company named in the Summary Compensation Table following the Compensation Discussion and Analysis section of this Proxy Statement; and

∎ all directors and executive officers of the Company as a group.

As of February 28, 2022, there were 114,357,638 shares of common stock outstanding.

The following information has been presented in accordance with SEC rules and is not necessarily indicative of beneficial ownership for any other purpose. Under SEC rules, beneficial ownership of a class of capital stock as of any date includes any shares of such class as to which a person, directly or indirectly, has or shares voting power or investment power as of such date and also any shares as to which a person has the right to acquire such voting or investment power as of or within 60 days after such date through the exercise of any stock option, stock appreciation right, warrant or other right, without regard to whether such right expires before the end of such 60-day period or continues thereafter. If two or more persons share voting power or investment power with respect to specific securities, all of such persons may be deemed to be the beneficial owners of such securities.

| Name of Beneficial Owner |

Amount and Nature of Beneficial Ownership |

Percent of Class (%) (1) | ||||||

| BlackRock, Inc. (2) 55 East 52nd Street New York, New York 10055 |

11,228,231 | 9.82% | ||||||

| The Vanguard Group (3) 100 Vanguard Blvd. Malvern, PA 19355 |

10,423,686 | 9.11% | ||||||

| AllianceBernstein L.P. (4) 1345 Avenue of the Americas New York, NY 10105 |

7,014,090 | 6.13% | ||||||

| Adam D. Zambanini (5) |

189,681 | * | ||||||

| William R. Gupp (6) |

137,370 | * | ||||||

| Bryan H. Fairbanks (7) |

100,496 | * | ||||||

| Dennis C. Schemm (8) |

20,201 | * | ||||||

| James E. Cline (9) |

75,371 | * | ||||||

| Patricia B. Robinson (10) |

53,283 | * | ||||||

| Gerald Volas (11) |

36,155 | * | ||||||

| Richard E. Posey (12) |

32,336 | * | ||||||

| Michael F. Golden (13) |

30,791 | * | ||||||

| Jay M. Gratz (14) |

23,787 | * | ||||||

| Ronald W. Kaplan (15) |

17,479 | * | ||||||

| Kristine L. Juster (16) |

4,831 | * | ||||||

| Gena C. Lovett (17) |

985 | * | ||||||

| All directors and executive officers as a group (13 persons) (18) |

722,766 | * | ||||||

| * | Less than 1%. |

| (1) | The percentage of beneficial ownership as to any person as of February 28, 2022 is calculated by dividing the number of shares beneficially owned by such person, which includes the number of shares as to which such person has the right to acquire voting or investment power as of or within 60 days after February 28, 2022, by the sum of the number of shares outstanding as of February 28, 2022 plus the number of shares as to which such person has the right to acquire voting or investment power as of or within 60 days after |

| 8

|

TREX COMPANY, INC.

|

2022 PROXY STATEMENT

|

Table of Contents

| SECURITY OWNERSHIP |

| February 28, 2022. Consequently, the denominator used for calculating such percentage may be different for each beneficial owner. Except as otherwise indicated below and under applicable community property laws, the Company believes that the beneficial owners of the Company’s common stock listed in the table have sole voting and investment power with respect to the shares shown. |

| (2) | The information concerning BlackRock, Inc. is based on a Schedule 13G filed with the SEC on February 3, 2022, in which the reporting person reports that it has sole voting power with respect to 10,826,258 of the shares shown and sole dispositive power with respect to all of the shares shown. |

| (3) | The information concerning The Vanguard Group is based on a Schedule 13G filed with the SEC on February 10, 2022, in which the reporting person reports that it has shared voting power with respect to 69,092 of the shares shown, sole dispositive power with respect to 10,252,805 of the shares shown, and shared dispositive power with respect to 170,881 of the shares shown. |

| (4) | The information concerning AllianceBernstein L.P. is based on a Schedule 13G filed with the SEC on February 14, 2022, in which the reporting person reports that it has sole voting power with respect to 5,616,935 of the shares shown, sole dispositive power with respect to 6,891,924 of the shares shown, and shared dispositive power with respect to 122,166 of the shares shown. |

| (5) | The shares of common stock shown as beneficially owned by Mr. Zambanini include 32,178 unvested restricted stock units and 16,394 stock appreciation rights he has the right to exercise as of or within 60 days after February 28, 2022 and exclude 6,641 stock appreciation rights that are not scheduled to vest as of or within 60 days after February 28, 2022. |

| (6) | The shares of common stock shown as beneficially owned by Mr. Gupp include 34,461 unvested restricted stock units and 31,256 stock appreciation rights he has the right to exercise as of or within 60 days after February 28, 2022, and exclude 5,389 stock appreciation rights that are not scheduled to vest as of or within 60 days after February 28, 2022. |

| (7) | The shares of common stock shown as beneficially owned by Mr. Fairbanks include 37,610 unvested restricted stock units and 15,633 stock appreciation rights he has the right to exercise as of or within 60 days after February 28, 2022, and exclude 15,728 stock appreciation rights that are not scheduled to vest as of or within 60 days after February 28, 2022. |

| (8) | The shares of common stock shown as beneficially owned by Mr. Schemm include 13,235 unvested restricted stock units and 3,035 stock appreciation rights he has the right to exercise as of or within 60 days after February 28, 2022, and exclude 5,530 stock appreciation rights that are not scheduled to vest as of or within 60 days after February 28, 2022. |

| (9) | The shares of common stock shown as beneficially owned by Mr. Cline include 1,157 unvested restricted stock units and 65,522 stock appreciation rights he has the right to exercise as of or within 60 days after February 28, 2022. |

| (10) | The shares of common stock shown as beneficially owned by Ms. Robinson include 1,157 unvested restricted stock units. |

| (11) | The shares of common stock shown as beneficially owned by Mr. Volas include 1,157 unvested restricted stock units and 11,752 stock appreciation rights he has the right to exercise as of or within 60 days after February 28, 2022. |

| (12) | The shares of common stock shown as beneficially owned by Mr. Posey include 1,679 unvested restricted stock units and 5,668 stock appreciation rights he has the right to exercise as of or within 60 days after February 28, 2022. |

| (13) | The shares of common stock shown as beneficially owned by Mr. Golden include 1,157 unvested restricted stock units and 13,840 stock appreciation rights he has the right to exercise as of or within 60 days after February 28, 2022. |

| (14) | The shares of common stock shown as beneficially owned by Mr. Gratz include 1,157 unvested restricted stock units. |

| (15) | The shares of common stock shown as beneficially owned by Mr. Kaplan include 1,157 unvested restricted stock units. |

| (16) | The shares of common stock shown as beneficially owned by Ms. Juster include 1,589 unvested restricted stock units. |

| (17) | The shares of common stock shown as beneficially owned by Ms. Lovett include 985 unvested restricted stock units. |

| (18) | The shares of common stock shown as beneficially owned by all directors and named executive officers as a group include a total of 128,629 unvested restricted stock units and 163,100 stock appreciation rights they have the right to exercise as of or within 60 days after February 28, 2022, and exclude 33,288 stock appreciation rights that are not scheduled to vest as of or within 60 days after February 28, 2022. |

| TREX COMPANY, INC.

|

2022 PROXY STATEMENT

|

9

|

Table of Contents

(Proposal 1)

The Company’s Restated Certificate of Incorporation, as amended, provides that the Board is to be divided into three classes of directors, with the classes to be as nearly equal in number as possible. The current terms of office of the three current classes of directors expire at this annual meeting, at the annual meeting of stockholders in 2023 and at the annual meeting of stockholders in 2024, respectively. Upon the expiration of the term of office of each class, the nominees for such class will be elected for a term of three years to succeed the directors whose terms of office expire.

In accordance with the recommendation of the Nominating/Corporate Governance Committee, Mr. Fairbanks, Mr. Golden, and Ms. Juster have been nominated by the Board for election to the class with a three-year term that will expire at the annual meeting of stockholders in 2025. Mr. Fairbanks is being renominated to the class of directors whose term expires in 2025 to keep the number of directors in each class as nearly equal in number as possible after Mr. Posey retires from the Board effective as of the 2022 Annual Meeting of Shareholders. These nominees are incumbent directors.

Approval of the nominees requires the affirmative vote of a majority of the votes cast in favor of such nominee at the annual meeting. The term “Majority” for purposes of election of directors means that a nominee receives more votes in favor of such nominee then are cast against such nominee by the holders of shares present in person or represented by proxy and entitled to vote at the Annual Meeting. Abstentions and broker non-votes will have no effect on the election of directors. Brokers may vote their shares in favor of directors if they have voting instructions from the beneficial owners of the shares. Unless authority to do so is withheld, it is the intention of the persons named in the proxy to vote such proxy FOR the election of each of the nominees. If any of the nominees should become unable or unwilling to serve as a director, the persons named in the proxy intend to vote for the election of such substitute nominee for director as the Board may recommend. It is not anticipated that any of the nominees will be unable or unwilling to serve as a director.

The Board unanimously recommends that the stockholders of the Company vote FOR the election of the nominees to serve as directors.

Biographical information concerning each of the directors retiring, each of the nominees, and each of the directors continuing in office is presented below.

| Director |

Age | Director Since | ||||||

| Richard E. Posey |

75 | 2009 | ||||||

Richard E. Posey is retired. He served as President and Chief Executive Officer of Moen Incorporated, a manufacturer of faucets, between January 2002 and September 2007. Prior to joining Moen, he was President and Chief Executive Officer of Hamilton Beach / Proctor Silex, Inc., a manufacturer of small kitchen appliances, for five years. He began his career at S.C. Johnson & Son, a supplier of cleaning and other household products, where for 22 years he served in a series of increasingly responsible management positions, both overseas and in the U.S., culminating with Executive Vice President, Consumer Products, North America. He received a B.A. degree in English from The University of Southern California and a M.B.A. degree from the University of Michigan.

| 10

|

TREX COMPANY, INC.

|

2022 PROXY STATEMENT

|

Table of Contents

| ELECTION OF DIRECTORS (PROPOSAL 1) |

Mr. Posey was initially appointed by the Board in May 2009, and renominated in 2010, 2013, 2016 and 2019, because the Board felt it was important to find and include a member with consumer product experience. He was primarily chosen due to his professional experience as a chief executive of a number of consumer product companies, and his experience in sales and marketing of consumer products. Mr. Posey is retiring effective as of the 2022 Annual Meeting of Shareholders.

| Director |

Age | Director Since | ||||||

| Bryan H. Fairbanks |

52 | 2020 | ||||||

| Michael F. Golden |

67 | 2013 | ||||||

| Kristine L. Juster |

58 | 2019 | ||||||

Bryan H. Fairbanks has served as President and Chief Executive Officer of the Company since April 2020. He previously served as Executive Vice President and Chief Financial Officer of the Company between July 2018 and April 2020, and as Vice President and Chief Financial Officer of the Company between August 2015 and July 2018. Between March 2006 and August 2015, he served as Senior Director, Supply Chain, and between September 2012 and August 2015, he concurrently served as Executive Director, International Business Development, with the Company. He served as Director, Financial Planning and Analysis of the Company between May 2004 and March 2006. He served in numerous senior finance roles with the Ford Motor Company, a manufacturer of cars and trucks, between August 1994 and May 2004. He received a B.S. degree in accounting from the University of Dayton and a M.B.A. degree from the University of Pittsburgh.

Mr. Fairbanks was appointed to the Board in April 2020 upon his promotion to President and Chief Executive Officer, renominated in 2021, and this year, because the Board believes it is in the best interest of the Company that the Chief Executive Officer be a member of the Board, he has significant experience in finance, and because the Board determined it was important to have another member of the Board with expertise in this industry.

Michael F. Golden is retired. He served as President and Chief Executive Officer of Smith & Wesson Brands, Inc., a manufacturer of firearms and firearms-related products and accessories, between December 2004 and September 2011, and currently serves as a director of such company. He was employed in various executive positions with the Kohler Company, which manufactures kitchen and bath plumbing fixtures, furniture, tile, engines, and generators, and operates resorts, between February 2002 and December 2004, with his last position being the President of its Cabinetry Division. He was the President of Sales for the Industrial/Construction Group of the Stanley Works Company, which manufactures tools and hardware, between 1999 and 2002; Vice President of Sales for Kohler’s North American Plumbing Group between 1996 and 1998; and Vice President, Sales and Marketing for a division of The Black & Decker Corporation, which manufactures tools and hardware, where he was employed between 1981 and 1996. Between October 2012 and April 2021, he served on the Board of Directors of Quest Resources Holding Corporation, a company that provides management programs to reuse, recycle, and dispose of various waste streams and recyclables in the United States. He received a B.S. degree in Marketing from Pennsylvania State University and a M.B.A. degree from Emory University.

Mr. Golden was initially appointed by the Board in February 2013, and renominated in 2016, 2019, and this year because the Board felt it was important to find and include an additional member with experience as a chief executive officer and experience in growing branded consumer products companies.

Kristine L. Juster has served as Chief Executive Officer of Kimball International, a leading manufacturer of furnishings sold through a family of brands including Kimball, National, Kimball Hospitality, David Edward and D’style by Kimball Hospitality, since November 2018, and a director of such company since April 2016. Prior to joining Kimball International, Ms. Juster was employed by Newell Brands, Inc., in various positions of increasing responsibility, since 1995. During her tenure at Newell Brands, she held the role of President of the Home Décor Segment with the brands, Levelor and Kirsh; the Culinary Lifestyle Segment with the brand Calphalon; and the Global Writing Segment with brands such as Sharpie and Expo. She received a Bachelor of Applied Science degree, Hotel and Restaurant Management from Cornell University.

| TREX COMPANY, INC.

|

2022 PROXY STATEMENT

|

11

|

Table of Contents

| ELECTION OF DIRECTORS (PROPOSAL 1) |

Ms. Juster was initially appointed to the Board in October 2019, and renominated in 2020, and this year because of her professional experience as an executive of consumer products companies with strong brands. As a company with a strong consumer brand, the Board believes this is important experience to have on the Board.

| Director |

Age | Director Since | ||||||

| Jay M. Gratz |

69 | 2007 | ||||||

| Ronald W. Kaplan |

70 | 2008 | ||||||

| Gerald Volas |

67 | 2014 | ||||||

Jay M. Gratz is retired. Mr. Gratz served as a consultant and director of 10X Technologies, a high technology startup, between April 2017 and December 2018. He served as the Chief Financial Officer of VisTracks, Inc., an application enabling platform service provider, between March 2010 and January 2018, and a director of such company between April 2010 and January 2018. He was a partner in Tatum LLC, a national executive services and consulting firm that focuses on the needs of the Office of the CFO between February 2010 and March 2010. He was an independent consultant between October 2007 and February 2010. He served as Executive Vice President and Chief Financial Officer of Ryerson Inc., a metals processor and distributor, between 1999 and October 2007, and as President of Ryerson Coil Processing Division between November 2001 and October 2007. He served as Vice President and Chief Financial Officer of Inland Steel Industries, a steel company, between 1994 and 1998, and served in various other positions, including Vice President of Finance, within that company since 1975. Mr. Gratz is a Certified Public Accountant. He received a B.A. degree in economics from State University of New York in Buffalo and a M.B.A. degree from Northwestern University Kellogg Graduate School of Management.

Mr. Gratz was initially appointed to the Board in 2007, and renominated in 2008, 2011, 2014, 2017 and 2020, because the Board felt it was important to have a member with extensive financial experience. He is a Certified Public Accountant, served as a chief financial officer of another respected public company, and has experience dealing with a wide range of financial issues that the Board feels is beneficial to the Company. In addition, the Board also believed that Mr. Gratz previous and current service to the Company as Chairman of the Audit Committee is invaluable to the Company.

Ronald W. Kaplan retired as President and Chief Executive Officer of the Company on August 17, 2015, and remains the Vice Chairman. He served as Chairman between August 2015 and April 2020. He served as Chairman, President and Chief Executive Officer of the Company between May 2010 and August 2015, and as President and Chief Executive Officer of the Company between January 2008 and May 2010. He served as Chief Executive Officer of Continental Global Group, Inc., a manufacturer of bulk material handling systems, between February 2006 and December 2007. For 26 years prior to this, he was employed by Harsco Corporation, an international industrial services and products company, at which he served in a number of capacities, including as Senior Vice President-Operations, and, between 1994 and 2005, as President of Harsco’s Gas Technologies Group, which manufactures containment and control equipment for the global gas industry. He also serves on the Board of Directors of Caesarstone Sdot-Yam, Ltd., a company engaged in the manufacture and sale of engineered stone surfaces used for kitchen countertops, vanity tops and tiles. He received a B.A. degree in economics from Alfred University and an M.B.A. degree from the Wharton School of Business, University of Pennsylvania.

Mr. Kaplan was hired by the Company in January 2008 as its President and Chief Executive Officer. The Board believed that the Company at that time would greatly benefit from someone with prior professional experience as a chief executive officer of manufacturing companies, including experience leading companies through financial and operational “turnarounds”, which the Board felt was important experience for the Company at that time. He was initially appointed to the Board in 2008 because the Board believed that the Chief Executive Officer of the Company should serve on the Board, and renominated in 2011, 2014, 2017 and 2020, because of his experience as Chief Executive Officer of the Company and prior experience as a chief executive officer of manufacturing companies. He has retired as the Company’s Chief Executive Officer but remains as Vice Chairman of the Board

| 12

|

TREX COMPANY, INC.

|

2022 PROXY STATEMENT

|

Table of Contents

| ELECTION OF DIRECTORS (PROPOSAL 1) |

because the Board believes they can benefit from his experience with both the Company and in the industry in which the Company competes, and his experience in the Company’s finances, sales and marketing, and operations, including manufacturing and logistics.

Gerald Volas is retired. He served as Chief Executive Officer and a director of TopBuild Corp., a leading installer and distributor of insulation products, between June 2015 and December 2020. He was employed by Masco Corporation, one of the world’s leading manufacturers of brand-name products for the home improvement and new home construction industries, in various positions of increasing responsibility, between 1982 and June 2015. He served as a Group Executive responsible for almost all of Masco’s operating companies between February 2005 and June 2015. He served as President of Liberty Hardware, a Masco operating company, between April 2001 and February 2005, as a Group Controller supporting a variety of Masco operating companies between January 1996 and April 2001, and in progressive financial roles including Vice President/Controller at BrassCraft Manufacturing Company, a Masco operating company, between May 1982 to January 1996. He has served as a director of The Scotts Miracle-Gro Company, a lawn and garden products company, since August 2021. He is a Certified Public Accountant. He received a Bachelor of Business Administration degree from the University of Michigan.

Mr. Volas was initially appointed to the Board in March 2014, and renominated in 2017 and 2020, because of his professional experience as an executive of a consumer products company, with additional specific experience in the home improvement and new home construction industry. In addition, the Board felt it was important to find a member with extensive financial experience. He is a Certified Public Accountant, and has experience dealing with a wide range of financial issues that the Board feels is beneficial to the Company, and could potentially serve as Chairman of the Audit Committee in the future.

| Director |

Age | Director Since | ||||||

| James E. Cline |

70 | 2015 | ||||||

| Gena C. Lovett |

59 | 2021 | ||||||

| Patricia B. Robinson |

69 | 2000 | ||||||

James E. Cline is retired. He served as President and Chief Executive Officer of the Company between August 2015 and his retirement in April 2020, as Senior Vice President and Chief Financial Officer between August 2013 and August 2015, and as Vice President and Chief Financial Officer between March 2008 and July 2013. Between July 2005 and December 2007, he served as the President of Harsco GasServ, a division of Harsco Corporation and a manufacturer of containment and control equipment for the global gas industry. Between January 2008 and February 2008, in connection with the purchase of Harsco GasServ by Taylor-Wharton International LLC, which was owned by Windpoint Partners Company, he served as a consultant to the buyers by providing transition management and financial services. Between April 1994 and June 2005, he served as the Vice President and Controller of Harsco GasServ. He served in various capacities with Huffy Corporation between June 1976 and February 1994, including as the Director of Finance of its True Temper Hardware subsidiary, a manufacturer of lawn care and construction products. He has served as a director of Latham Group, Inc., a manufacturer of swimming pools, since March 2019. He received a B.S.B.A. degree in accounting from Bowling Green State University.

Mr. Cline was initially appointed to the Board in August 2015 upon his promotion to President and Chief Executive Officer, and renominated in 2016, 2018 and 2021 because the Board believed it was in the best interest of the Company that the Chief Executive Officer be a member of the Board, and because the Board felt it was important to have another member of the Board with significant expertise in this industry. In addition, he has in-depth knowledge and experience as the prior Chief Executive Officer of the Company, extensive knowledge of the industry in which the Company competes and prior experience as a chief executive officer of a manufacturing company.

| TREX COMPANY, INC.

|

2022 PROXY STATEMENT

|

13

|

Table of Contents

| ELECTION OF DIRECTORS (PROPOSAL 1) |

Gena C. Lovett served as the Vice President, Manufacturing, Safety and Quality, Defense, Space and Security of The Boeing Company, a manufacturer of airplanes, between July 2015 and June 2019. She served as Global Chief Diversity Officer between January 2012 and June 2015, and as Director, Manufacturing, Forging between July 2007 and January 2012 of Alcoa Corporation, a manufacturer of aluminum. She served in numerous roles with Ford Motor Company, a manufacturer of cars and trucks, between April 1992 and June 2007, most recently as Plant Manager, New Model Programs. She has served as a director of AdvanSix, Inc., a leading integrated producer of nylon solutions, chemical intermediates, and plant nutrients, since September 2021, and as a director of QuantumScape Corporation, a developer of next generation battery technology for electric vehicles, since January 2022. She received a B.A. degree in Criminal Justice from The Ohio State University, a M.B.A. degree from Baker Center for Graduate Studies, and a M.S. degree in Organizational Leadership from Benedictine University.

Ms. Lovett was appointed to the Board in March 2021, and renominated in 2021, because the Board believed it was important to find and include an additional member with experience in manufacturing and operations.

Patricia B. Robinson is retired. Ms. Robinson was an independent consultant between 1998 and 2020. Ms. Robinson served in a variety of positions with Mead Corporation, a forest products company, between 1977 and 1998, including President of Mead School and Office Products, Vice President of Corporate Strategy and Planning, President of Gilbert Paper, Plant Manager of a specialty machinery facility and Product Manager for new packaging product introductions. Ms. Robinson received a B.A. degree in economics from Duke University and a M.B.A. degree from the Darden School at the University of Virginia.

Ms. Robinson was initially appointed to the Board in November 2000, and renominated in 2003, 2006, 2009, 2012, 2015, 2018, and 2021, due to her professional experience as a President of a consumer products company and her experience with strategic planning and new product introductions. As a consumer products company that continues to innovate with new products, the Board believes this is important experience to have on the Board.

| 14

|

TREX COMPANY, INC.

|

2022 PROXY STATEMENT

|

Table of Contents

The Board currently consists of ten directors. Mr. Posey will retire from the Board effective as of the 2022 Annual Meeting of Shareholders at which time the Board intends to decrease the size of the Board from ten directors to nine directors.

The Board has three standing committees: the Audit Committee, the Compensation Committee and the Nominating/Corporate Governance Committee. During the Company’s 2021 fiscal year, the Board held five meetings, the Audit Committee held four meetings, the Compensation Committee held five meetings, and the Nominating/Corporate Governance Committee held five meetings. During 2021, each director attended at least 75% of the aggregate of the total number of meetings of the Board and of each committee of the Board on which such director served.

It is the Company’s policy that all directors should attend annual meetings of the Company’s stockholders. All of the directors attended the annual meeting in May 2021.

The Board does not have a strict retirement age for directors. However, the Board does believe that once a director attains a certain age, the Board should carefully consider whether such director’s continued service on the Board is in the best interests of the Company. The Company’s Corporate Governance Principles provide that at the adjournment of each annual meeting of stockholders, any director who is then age 75 or older shall tender his or her resignation to the Board, at which time the Board may elect to either accept such resignation or request that such director continue to serve on the Board.

Board Leadership Structure. Our Board is currently led by a non-executive Chairman, Mr. Cline, who retired as the Company’s President and Chief Executive Officer on April 28, 2020, and a non-executive Vice Chairman, Mr. Kaplan, who retired as the Company’s President and Chief Executive Officer on August 17, 2015. Our Board determined that retaining Mr. Cline as Chairman and Mr. Kaplan as Vice Chairman was in the best interests of the Company because it allows the Company to benefit from Mr. Cline’s and Mr. Kaplan’s significant experience and accumulated expertise in the Company’s industry and the Company’s internal policies, practices and procedures to effectively and expertly guide the Board. Mr. Cline’s and Mr. Kaplan’s familiarity with the Company’s executives reinforces that the Board and executives will operate with continuity and common purpose. The Board determined that having Mr. Cline as Chairman and Mr. Kaplan as Vice Chairman will allow Mr. Fairbanks, the Company’s President and Chief Executive Officer, to focus on executing the Company’s strategy and manage operations and performance. The Board is further comprised of a Lead Independent Director, an independent Audit Committee Chairman, an independent Compensation Committee Chairman, and an independent Nominating/ Corporate Governance Committee Chairman. These independent positions align with the Company’s corporate governance policies and practices and assure adequate independence of the Board.

Ms. Robinson served as Lead Independent Director between January 1, 2021 and May 5, 2021. Mr. Posey currently serves as Lead Independent Director for a term beginning on May 6, 2021 and ending on the date of the 2022 Annual Meeting. Both Ms. Robinson and Mr. Posey are experienced former chief executive officers. (For additional information regarding Ms. Robinson’s and Mr. Posey’s professional experience, please see “Election of Directors (Proposal 1”).” Pursuant to the Company’s Corporate Governance Principles, the responsibilities of the Lead Independent Director include: presiding at executive sessions of the independent directors; presiding at Board meetings in the absence of the Chairman and Vice Chairman; making recommendations and consulting with management with regard to Board meeting agendas, materials and schedules; and serving as a liaison between the independent directors and members of senior management.

Director Independence. The Board has affirmatively determined that all of the current directors, other than Mr. Cline, who is the Company’s current Chairman, and Mr. Fairbanks, who is the Company’s current President and Chief Executive Officer, are “independent” of the Company within the independence guidelines governing

| TREX COMPANY, INC.

|

2022 PROXY STATEMENT

|

15

|

Table of Contents

| CORPORATE GOVERNANCE |

companies listed on the New York Stock Exchange (“NYSE”). For a director to be “independent” under the NYSE guidelines, the Board must affirmatively determine that the director has no material relationship with the Company, either directly or as a partner, stockholder or officer of an organization that has a relationship with the Company.

The Board has adopted the following categorical standards of independence to assist it in determining whether a director has a material relationship with the Company. The following relationships between a director and the Company will not be considered material relationships that would preclude a finding by the Board that the director is independent under the NYSE guidelines:

∎ employment of the director or the director’s immediate family member by another company that makes payments to, or receives payments from, the Company or any of its subsidiaries for property or services in an amount which, in any single fiscal year, does not exceed the greater of $1,000,000 or 2% of such other company’s consolidated gross revenues; and

∎ a relationship of the director or the director’s immediate family member with a charitable organization, as an executive officer, board member, trustee or otherwise, to which the Company or any of its subsidiaries has made charitable contributions of not more than $50,000 annually in any of the last three years.

Furthermore, the Board has also determined, consistent with NYSE guidelines, a director is not independent if:

∎ The director is, or has been within the last three years, an employee of the Company, or an immediate family member is, or has been within the last three years, an executive officer of the Company.

∎ The director has received, or has an immediate family member who has received, during any twelve-month period within the last three years, more than $120,000 in direct compensation from the Company, other than director and committee fees and pension or other forms of deferred compensation for prior service (provided such compensation is not contingent in any way on continued service).

∎ The director is a current partner or employee of a firm that is the Company’s internal audit firm or independent registered public accounting firm; the director has an immediate family member who is a current partner of such a firm; the director has an immediate family member who is a current employee of such a firm and personally works on the Company’s internal or external audit; or the director or an immediate family member was within the last three years a partner or employee of such a firm and personally worked on the Company’s internal or external audit within that time.

∎ The director or an immediate family member is, or has been within the last three years, employed as an executive officer of another company where any of the Company’s present executive officers at the same time serves or served on that company’s compensation committee.

∎ The director is a current employee, or an immediate family member is a current executive officer, of a company that has made payments to, or received payments from, the Company for property or services in an amount which, in any of the last three fiscal years, exceeds the greater of $1,000,000, or 2% of such other company’s consolidated gross revenues.

Consistent with the NYSE guidelines, the Company’s corporate governance principles require the Company’s non-management directors to meet at least once each quarter without management present and, if the group of non-management directors includes any director who is not independent under NYSE guidelines, to meet at least once each year with only the independent directors present. The Company’s non-management directors, all of whom are independent under NYSE guidelines other than Mr. Cline, held five executive sessions in 2021. The independent directors held one executive session in 2021. Mr. Cline, as Chairman, acted as presiding director for each such executive session of non-management directors, and Mr. Posey, as Lead Independent Director, acted as presiding director for the executive session of independent directors.

| 16

|

TREX COMPANY, INC.

|

2022 PROXY STATEMENT

|

Table of Contents

| CORPORATE GOVERNANCE |

Our Board has three standing committees:

∎ Audit Committee, chaired by Mr. Gratz;

∎ Compensation Committee, chaired by Mr. Golden; and

∎ Nominating/Corporate Governance Committee, chaired by Mr. Posey between January 1, 2021 and May 5, 2021 and by Ms. Robinson after such date.

Each of these committees plays an important role in the governance and leadership of our Board and each is chaired by an independent director with significant business experience.

Audit Committee. During 2021, the Audit Committee of the Board was composed of five non-employee directors who meet the independence and expertise requirements of the NYSE listing standards: Mr. Gratz, who was the Chairman, Ms. Lovett, Mr. Posey, Ms. Robinson, and Mr. Volas. Pursuant to SEC rules, the Board has determined that Mr. Gratz and Mr. Volas are “audit committee financial experts,” as such term is defined for purposes of Item 407 of Regulation S-K promulgated by the SEC, and are independent of management. The Audit Committee held four meetings during 2021.

The Audit Committee operates under a written charter that is reviewed annually. The Audit Committee is responsible, among its other duties, for engaging, overseeing, evaluating and replacing the Company’s independent registered public accounting firm, pre-approving all audit and non-audit services by the independent registered public accounting firm, reviewing the scope of the audit plan and the results of each audit with management and the independent registered public accounting firm, reviewing the internal audit function, reviewing the adequacy of the Company’s system of internal controls over financial reporting and disclosure controls and procedures, reviewing the financial statements and other financial information included in the Company’s annual and quarterly reports filed with the SEC, reviewing the efficacy of the Company’s information security and technology risks (including cybersecurity) and related policies and procedures, which include receiving quarterly reports from our Senior Vice President and Chief Financial Officer (“CFO”) who is tasked with monitoring cybersecurity risks, and exercising oversight with respect to the Company’s Code of Conduct and Ethics and other policies and procedures regarding adherence with legal requirements. The Audit Committee has the authority to retain and terminate any third-party consultants and to obtain advice and assistance from internal and external legal, accounting and other advisers. The Audit Committee is authorized to delegate its authority to subcommittees as determined to be necessary or advisable. A current version of the Audit Committee charter is available on the Company’s website at www.trex.com/our-company/corporate-governance/committees-charters/.

Compensation Committee. During 2021, the Compensation Committee of the Board was composed of four non-employee directors who meet the independence requirements of the NYSE listing standards: Mr. Golden, who is chairman, Ms. Robinson between January 1, 2021 and May 5, 2021, Mr. Volas, Ms. Juster and Mr. Gratz since May 6, 2021. The Compensation Committee held five meetings during 2021.

The Compensation Committee operates under a written charter that is reviewed annually. Pursuant to its charter, the principal functions of the Compensation Committee are to review, determine and approve the compensation and benefits of the Company’s President and Chief Executive Officer (“CEO”) and the other executive officers named in the Summary Compensation Table following the Compensation Discussion and Analysis section of this Proxy Statement, or “named executive officers,” as well as other officers, and to administer the Company’s employee benefit programs, including its Amended and Restated 2014 Stock Incentive Plan (the “2014 Stock Incentive Plan”), Amended and Restated 1999 Employee Stock Purchase Plan (“1999 Employee Stock Purchase Plan”), annual cash incentive plan, and other incentive compensation plans, benefit plans and equity-based plans.

The Compensation Committee has the authority to retain and terminate any third-party compensation consultant and to obtain advice and assistance from internal and external legal, accounting and other advisers. (See the Compensation Discussion and Analysis section of this Proxy Statement for information regarding the practices of the Compensation Committee, including the role of the officers and the Compensation Committee’s compensation consultant in determining or recommending the amount and form of compensation paid to the named executive officers.) The Compensation Committee is authorized to delegate its authority to subcommittees as determined to

| TREX COMPANY, INC.

|

2022 PROXY STATEMENT

|

17

|

Table of Contents

| CORPORATE GOVERNANCE |

be necessary or advisable. A current version of the Compensation Committee charter is available on the Company’s website at www.trex.com/our-company/corporate-governance/committees-charters/.

Nominating/Corporate Governance Committee. During 2021, the Nominating/Corporate Governance Committee was composed of five non-employee directors who meet the independence requirements of the NYSE listing standards: Mr. Posey, who was chairman from January 1, 2021 until May 5, 2021, Ms. Robinson since May 6, 2021 and who is currently chairwoman, Mr. Golden, Mr. Gratz from January 1, 2021 until May 5, 2021, Ms. Juster, and Ms. Lovett. The Nominating/Corporate Governance Committee held five meetings during 2021.

The Nominating/Corporate Governance Committee operates under a written charter that is reviewed annually. The Nominating/Corporate Governance Committee is responsible for recommending candidates for election to the Board and for making recommendations to the Board regarding corporate governance matters, including Board size and membership qualifications, Board committees, corporate organization, and non-employee director compensation, and for succession planning for officers and key executives, performance evaluations of the CEO and other officers, programs for training and development of executive-level employees, and stockholder proposals regarding these matters. Also, the Nominating/Corporate Governance Committee oversees the Company’s environmental, social and governance (ESG) matters that are significant to the Company and periodically reviews the Company’s ESG strategy, initiatives and polices and receives updates from management on significant ESG activities.

The Nominating/Corporate Governance Committee has the authority to retain and terminate any search firm engaged to identify director candidates, and to obtain advice and assistance from outside counsel and any other advisors, as it deems appropriate in its sole discretion. The Nominating/Corporate Governance Committee is authorized to delegate its authority to subcommittees as determined to be necessary or advisable. A current version of the Nominating/Corporate Governance Committee charter is available on the Company’s website at www.trex.com/our-company/corporate-governance/committees-charters/.

Our Board recognizes the importance of effective risk oversight in running a successful business and in fulfilling its fiduciary responsibilities to the Company and its stockholders. While the CEO and other members of our senior leadership team are responsible for the day-to-day management of risk, our Board is responsible for ensuring that an appropriate culture of risk management exists within the Company and for setting the right “tone at the top,” overseeing our aggregate risk profile, and assisting management in addressing specific risks, such as strategic and competitive risks, financial risks, brand and reputation risks, legal risks, regulatory risks, and operational risks. In 2021, the Board also was advised by and consulted with senior management with respect to risks related to the COVID-19 pandemic, and its effects on the Company.

The Board believes that its current leadership structure best facilitates its oversight of risk by combining independent leadership, through an independent Lead Independent Director, independent board committees, and majority independent board composition, with an experienced Chairman and Vice Chairman and an experienced CEO who each have extensive knowledge of our business, history, and the complex challenges we face. The CEO’s in-depth understanding of these matters and involvement in the day-to-day management of the Company uniquely positions him to promptly identify and raise key business risks to the Board, call special meetings of the Board when necessary to address critical issues, and focus the Board’s attention on areas of concern. The Chairman, Vice Chairman, Lead Independent Director, independent committee chairs and other directors also are experienced executives who can and do raise issues for Board consideration and review, and are not hesitant to challenge management. The Board believes there is a well-functioning and effective balance between the Chairman, Vice Chairman, Lead Independent Director, independent board committees, independent board members, and the CEO, which enhances risk oversight.

The Board exercises its oversight responsibility for risk both directly and through its three standing committees. Throughout the year, the Board and each committee spend a portion of their time reviewing and discussing specific risk topics. The full Board is kept informed of each committee’s risk oversight and related activities through regular attendance at all committee meetings by all directors. Strategic, operational and competitive risks also are presented and discussed at the Board’s quarterly meetings, and more often as needed. On at least an

| 18

|

TREX COMPANY, INC.

|

2022 PROXY STATEMENT

|

Table of Contents

| CORPORATE GOVERNANCE |

annual basis, the Board conducts a review of our long-term strategic plans and members of senior management report on our top risks and the steps management has taken or will take to mitigate these risks. At each quarterly meeting, or more often as necessary, our CEO provides written and/or oral reports to the Board on the critical issues we face, and each officer reports on recent developments in their respective operating area. These reports include a discussion of business risks as well as a discussion regarding enterprise risk. In addition, at each quarterly meeting, or more often as necessary, the Senior Vice President, Chief Legal Officer and Secretary (“CLO”) as well as the General Counsel update the Board on material legal and regulatory matters.

The Audit Committee is responsible for reviewing the framework by which management discusses our risk profile and risk exposures with the full Board and its committees. The Audit Committee meets regularly with our CFO, independent registered public accounting firm, internal auditor, CLO, General Counsel, and other members of senior management to discuss our major financial risk exposures, financial reporting, internal controls, credit and liquidity risk, compliance risk, and key operational risks. The Audit Committee meets regularly in separate executive sessions with the independent registered public accounting firm and internal auditor, as well as with committee members only, to facilitate a full and candid discussion of risk and other issues.

The Compensation Committee is responsible for overseeing human capital and compensation risks, including evaluating and assessing risks arising from our compensation policies and practices and ensuring executive compensation is aligned with performance. The Compensation Committee is also charged with monitoring our incentive and equity-based compensation plans, including employee benefit plans, reviewing and retaining compensation advisers, and considering the results of the non-binding advisory say-on-pay vote and determine what adjustments, if any, are necessary or appropriate for the Company to make to its compensation policies and practices in light of the results of such vote. The Compensation Committee meets regularly with the CLO and also the General Counsel and other executive officers as well as in separate sessions with the Company’s external compensation consultant to facilitate a full and candid discussion of executive performance and compensation.

The Nominating/ Corporate Governance Committee oversees risks related to our overall corporate governance, including Board and committee composition, Board size and structure, Board compensation, director independence, our corporate governance profile and ratings and ESG-related strategies, initiatives and policies. The Committee also is actively engaged in overseeing risks associated with succession planning for the Board and management.

The Board of Directors, its committees and the Company’s management recognize the importance of environmental, social and governance (“ESG”) matters and how they impact our stakeholders. During 2021, the Company assigned oversight of ESG-related initiatives and performance to the Nominating/Corporate Governance Committee and continued its focus on several ESG initiatives that matter to our customers, employees, communities, stockholders and the environment. We believe appropriately responding to ESG issues is an important component of corporate social responsibility and comprehensive fiscal management. In light of the continued importance surrounding ESG matters, the Company is active in establishing and improving programs, practices and policies to maximize the benefit to the Company, our stockholders, employees, customers and the communities we impact. We believe that strong ESG programs and practices are critical to attracting the best talent, executing on our strategies, maintaining a robust supplier and channel partner base, and innovating to meet our consumers’ evolving expectations.

The Company’s policies, practices and programs include engagement with external stakeholders to learn about their priorities and get their feedback; coordination of relevant company projects and initiatives; and alignment with the Company’s strategies and implementation.

Further, the Board and its committees review and discuss with management matters related to human capital management, including the Company’s commitments and progress on diversity, equity and inclusion, employee engagement, compensation and benefits, business conduct and compliance, and executive succession planning. During 2021, the Board and its committees also reviewed and discussed with management the impact of the COVID-19 pandemic on the Company’s employees, supply chain, and business, and management’s strategies and initiatives to respond to, and mitigate, adverse impacts, including enhanced health and safety measures for the Company’s workforce.

| TREX COMPANY, INC.

|

2022 PROXY STATEMENT

|

19

|

Table of Contents

| CORPORATE GOVERNANCE |

We are committed to conducting operations and activities in a manner that provides and maintains safe and healthy working conditions, protects the environment, and conserves natural resources. In meeting this commitment, it is our policy that no employee shall engage in any conduct that violates any environmental, health or safety law or is otherwise inconsistent with the health and safety needs of our employees and the environmental needs of our communities. We are also committed to the continual improvement of our environmental management systems, our environmental, health and safety programs, and to the prevention of pollution.

On June 28, 2021 the Company published its third annual ESG Report that highlighted several achievements including:

| ∎ | Reinforcing Trex’s commitment to environmental sustainability at the core of its products and operations. |

| ∎ | Prioritizing employees’ health and well-being throughout the COVID-19 pandemic. |

| ∎ | Fostering a company culture that upholds the values of diversity, equity and inclusion. |

| ∎ | Growing production capacity sustainably. |

| ∎ | Giving back to local communities. |

The Company is committed to continuing its ESG commitment and will continue its communications with customers, employees, communities and stockholders regarding its ESG initiatives in the upcoming 2021 ESG Report. A copy of the Company’s current ESG report is available on the Company’s website at www.trex.com/why-trex/esg.

In connection with the Company’s ESG efforts, in addition to our Code of Conduct and Ethics, the Company has adopted a Human Rights Policy, a Vendor and Customer Code of Conduct and Ethics, an Environmental Policy and an Occupational Health and Safety Policy. A current version of each of these policies is available on the Company’s website at www.trex.com/our-company/.

No member of the Compensation Committee was an officer or employee of the Company or any subsidiary of the Company during 2021. There are no interlock relationships as defined in the applicable SEC rules.

The Board has adopted a director nominations policy (the “nominations policy”). The purpose of the nominations policy is to set forth the process by which candidates for directors are selected. The nominations policy is administered by the Nominating/Corporate Governance Committee of the Board.

The Board does not currently prescribe any minimum qualifications for director candidates. Consistent with the criteria for the selection of directors approved by the Board, the Nominating/Corporate Governance Committee will take into account the Company’s current needs and the qualities needed for Board service, including experience and achievement in business, finance, technology or other areas relevant to the Company’s activities; reputation, ethical character and maturity of judgment; diversity of viewpoints, backgrounds and experiences; absence of conflicts of interest that might impede the proper performance of the responsibilities of a director; independence under SEC and NYSE rules; service on other boards of directors; sufficient time to devote to Board matters; ability to work effectively and collegially with other Board members; and diversity. In considering the diversity of candidates, the Committee considers an individual’s background, viewpoints, professional experience, education and skill, race, ethnicity, gender, age and/or national origin. In the case of incumbent directors whose terms of office are set to expire, the Nominating/Corporate Governance Committee will review such directors’ overall service to the Company during their term, including the number of meetings attended, level of participation, quality of performance and any transactions of such directors with the Company during their term. For those potential new director candidates who appear upon first consideration to meet the Board’s selection criteria, the Nominating/Corporate Governance Committee will conduct appropriate inquiries into their background and qualifications and, depending on the result of such inquiries, arrange for in-person meetings with the potential candidates.

| 20

|

TREX COMPANY, INC.

|

2022 PROXY STATEMENT

|

Table of Contents

| CORPORATE GOVERNANCE |