| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| |

| |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

| |

| |

| (Address of principal executive offices) |

(Zip Code) |

| Title of each class: |

Name of each exchange on which registered: | |

| |

|

| ☒ |

Accelerated filer |

☐ | ||||

| Non-accelerated filer ☐ |

Smaller reporting company |

| ||||

| Emerging growth company |

|

| Document |

Part of 10-K into which incorporated | |

| Proxy Statement relating to Registrant’s 20 20 Annual Meeting of Stockholders |

Part III |

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered | ||

| Common stock |

|

New York Stock Exchange |

| Page |

||||||

| PART I |

||||||

| Item 1. |

1 |

|||||

| Item 1A. |

12 |

|||||

| Item 1B. |

19 |

|||||

| Item 2. |

19 |

|||||

| Item 3. |

19 |

|||||

| Item 4. |

19 |

|||||

| PART II |

||||||

| Item 5. |

20 |

|||||

| Item 6. |

22 |

|||||

| Item 7. |

25 |

|||||

| Item 7A. |

37 |

|||||

| Item 8. |

37 |

|||||

| Item 9. |

37 |

|||||

| Item 9A. |

37 |

|||||

| Item 9B. |

41 |

|||||

| PART III |

||||||

| Item 10. |

42 |

|||||

| Item 11. |

42 |

|||||

| Item 12. |

42 |

|||||

| Item 13. |

42 |

|||||

| Item 14. |

42 |

|||||

| PART IV |

||||||

| Item 15. |

43 |

|||||

| F- 1 |

||||||

Item 1. |

Business |

| Decking and Accessories |

Our principal decking products are Trex Transcend ® , Trex Select® , and Trex Enhance® . Late in 2018, we re-engineered our Enhance line to provide homeowners with a high-performance, lower-cost deck board designed to compete more directly with wood. Differentiating the Enhance collection is a scalloped profile that is lighter weight for easier handling and installation. Our high-performance, low-maintenance, eco-friendly composite decking products are comprised of a blend of 95 percent reclaimed wood fibers and recycled plastic film and feature a protective polymer shell for enhanced protection against fading, staining, mold and scratching.We also offer accessories to our decking products, including Trex Hideaway ® , a hidden fastening system for grooved boards, and Trex DeckLighting™ , an outdoor lighting system. Trex DeckLighting is a line of energy-efficient LED dimmable deck lighting, which is designed for use on posts, floors and steps. The line includes a post cap light, deck rail light, riser light and a recessed deck light. | ||

| Railing |

Our railing products are Trex Transcend Railing, Trex Select Railing, Trex Enhance Railing and Trex Signature ® aluminum railing. Trex Transcend Railing, made from approximately 40 percent recycled content, is available in the colors of Trex Transcend decking and finishes that make it appropriate for use with Trex decking products as well as other decking materials, which we believe enhances the sales prospects of our railing products. Trex Select Railing, made from approximately 40 percent recycled content, is offered in a white finish and is ideal for consumers who desire a simple clean finished look for their deck. Trex Enhance, made from approximately 40 percent recycled content, is available in three colors and is offered through home improvement retailers in kits that contain the complete railing system. Trex Signature aluminum railing, made from a minimum of 50 percent recycled content, is available in three colors and designed for consumers who want a sleek, contemporary look. | ||

| Fencing |

Our Trex Seclusions ® fencing product is offered through two specialty distributors. This product consists of structural posts, bottom rail, pickets, top rail and decorative post caps. | ||

| Steel Deck Framing |

Our triple-coated steel deck framing system called Trex Elevations ® leverages the strength and dimensional stability of steel to create a flat surface for our decking. Trex Elevations provides consistency and reliability that wood does not and is fire resistant. | ||

| Trex Outdoor Furniture ™ |

A line of outdoor furniture products manufactured and sold by PolyWood, Inc. | ||

| Trex RainEscape ® |

An above joist deck drainage system manufactured and sold by DriDeck Enterprises, LLC. | ||

| Trex CustomCurve ® |

A system manufactured and sold by Curvelt, LLC that allows contractors to heat and bend Trex Products while on the job site. | ||

| Trex Pergola ™ |

Pergolas made from low maintenance cellular PVC product, manufactured by Home & Leisure, Inc. dba Structureworks Fabrication. | ||

| Trex Latticeworks ™ |

Outdoor lattice boards manufactured and sold by Rhea Products, Inc. dba Acurio Latticeworks. | ||

| Trex Cornhole ™ Boards |

Cornhole boards manufactured and sold by IPC Global Marketing LLC. | ||

| Diablo ® Trex Blade |

A specialty saw blade for wood-alternative composite decking manufactured and sold by Freud America, Inc. | ||

| Trex SpiralStairs ™ and Structural Steel Posts |

A staircase alternative and structural steel posts for use with all deck substructures manufactured and sold by M. Cohen and Sons, Inc. dba The Iron Shop. | ||

| Trex Outdoor Kitchens, Cabinetry and Storage |

Outdoor kitchens, cabinetry and storage manufactured and sold by NatureKast Products, LLC prior to December 31, 2019, and Danver Stainless Outdoor Kitchens on and after January 1, 2020. | ||

| Trex Outdoor Fire & Water ™ |

A line of outdoor fire features, water elements and decorative planters manufactured by Custom Molded Products, LLC. | ||

| Architectural Railing Systems |

Our architectural railing systems are pre-engineered guardrails with options to accommodate styles ranging from classic and elegant wood top rail combined with sleek stainless components and glass infill, to modern and minimalist stainless cable and rod infill choices. Trex Commercial can also design, engineer and manufacture custom railing systems tailored to the customer’s specific material, style and finish. Many railing styles are achievable, including glass, mesh, perforated railing and cable railing. | ||

| Aluminum Railing Systems |

Our Trex Signature aluminum railings, made from a minimum of 50 percent recycled content, are a versatile, cost-effective and low-maintenance choice for a variety of interior and exterior applications that we believe blend form, function and style. The strength and durability of Trex Signature railings make them a choice for any commercial setting, from high-rise condominiums and resort projects to public walkways and balconies. Aluminum railings come in a variety of colors and stock lengths to accommodate project needs. | ||

| Staging Equipment and Accessories |

Our advanced modular, lightweight custom staging systems include portable platforms, orchestral shells, guardrails, stair units, barricades, camera platforms, VIP viewing decks, ADA infills, DJ booths, pool covers, and other custom applications. Our systems provide superior staging product solutions for facilities and venues with custom needs. Our modular stage equipment is designed to appear seamless, feel permanent, and maximize the functionality of the space. | ||

| • | Reclaimed Wood Fiber |

| contamination and is low in moisture. These facilities generate reclaimed wood fiber as a byproduct of their manufacturing operations. If the reclaimed wood fiber meets our specifications, our reclaimed wood fiber supply agreements generally require us to purchase at least a specified minimum and at most a specified maximum amount of reclaimed wood fiber. Depending on our needs, the amount of reclaimed wood fiber that we actually purchase within the specified range under any supply agreement may vary significantly from year to year. |

| • | Scrap Polyethylene |

| • | Innovation |

| • | Brand |

| • | Channels |

| our wood-alternative outdoor living products, thereby making our products available wherever our customers choose to purchase their decking, railing, steel deck framing and outdoor lighting products, and by continuing to develop our commercial market penetration for our railing and staging systems. |

| • | Quality |

| • | Cost |

| • | Customer Service |

| • | A comprehensive understanding of worker expectations and requirements; |

| • | Compliance to statutory, regulatory and other legal requirements; |

| • | Prevention considerations in all designs and redesigns of facilities, equipment, processes, work methods and products, and incorporation of safe design methods into all phases of hazard and risk mitigation; |

| • | Demonstrating employee safety leadership in all of our processes while striving for world class performance; and |

| • | Continual improvement by analyzing this commitment through the use of leading and lagging key performance indicators, such as safety observation audit completions, attendance at monthly safety training, safety work order completions, and targets related to recordable and lost time incident rates and days away or restricted time. |

| • | Management leadership and employee involvement; |

| • | Worksite analysis; |

| • | Hazard prevention and control; and |

| • | Safety and health training. |

Item 1A. |

Risk Factors |

| Risk |

Discussion | |

| Description: We may not be able to grow unless we increase market acceptance of our products, compete effectively and develop new products and applications. Impact: Our failure to compete successfully could have a material adverse effect on the ability of Trex Residential to replace wood products or increase our market share amongst wood-alternative products. • If our Trex Residential products do not meet emerging demands and preferences, we could lose market share, which could have a material adverse effect on our business.• In addition, substantially all of our revenues are derived from sales of our proprietary wood/polyethylene composite material. Although we have developed, and continue to develop, new products made from other materials, if we should experience significant problems, real or perceived, with acceptance of the Trex wood/polyethylene composite material, our lack of product diversification could have a significant adverse impact on our net sales levels.If our Trex Commercial products do not keep up with consumer trends, demands, and preferences we could lose market share, which could have a material adverse effect on our business. |

Our primary competition for Trex Residential products consists of wood products, which constitute a substantial majority of decking, railing, fencing, and deck framing sales. Since composite products were introduced to the market in the late 1980s, their market acceptance has increased. Our ability to grow depends, in part, on our success in continuing to convert demand for wood products into demand for composite Trex Residential products. Many of the conventional lumber suppliers with which we compete have established ties to the building and construction industry and have well-accepted products. Our ability to compete depends, in part, upon a number of factors outside our control, including the ability of competitors to develop new alternatives that are more competitive with Trex products. Our ability to identify and respond to emerging consumer demands and preferences for Trex Residential products depends, in part, on how successfully we develop, manufacture and market new products. To increase our market share, we must overcome: • Lack of awareness of the enhanced value of composite products in general and Trex Residential brand products in particular;• Resistance of many consumers and contractors to change from well-established wood products;• Consumer lack of awareness that the greater initial expense of Trex Residential products compared to wood is a one-time cost that is reduced over time as Trex Residential products have lower maintenance costs and a longer life span than wood;• Established relationships existing between suppliers of wood products and contractors and homebuilders;• Actual and perceived quality issues with first generation composite products; and | |

| |

• Competition from other wood-alternative manufacturers.Although Trex Commercial is a leading national provider of custom-engineered railing and staging systems for the commercial and multi-family market, including performing arts venues and sports stadiums, there is significant competition for projects. In order to effectively compete, we must continually produce and install high quality products and innovate with new products. |

| Risk |

Discussion | |

| Description: We may not be able to fully maintain our Trex Residential wholesaler and dealer channels. Impact: If Trex Residential fails to compete successfully for wholesale distributors and dealers, our business could experience material adverse effects, which could negatively impact profitability and cash flows. |

Trex Residential sells most of our composite decking and railing products through our network of wholesale distributors who, in turn, sell to retail lumber outlets. Our Trex Residential growth strategy depends on maintaining this network and on our ability to compete with other entities for these channels. In order to successfully compete for wholesaler distributors, dealers and retail lumber outlets, we must accurately assess their customers’ needs and preferences. | |

| Risk |

Discussion | |

| Description: Certain of our Trex Residential product customers account for a significant portion of our sales, and the loss of one or more of these customers could have an adverse effect on our business. Impact: The loss of a significant customer could have a significant negative impact on our business, results of operations and financial condition. |

A limited number of our Trex Residential product customers account for a significant percentage of our sales. We expect that a significant portion of our Trex Residential sales will continue to be sold through a small number of customers, and certain customers will continue to account for a significant portion of our sales. | |

| Risk |

Discussion | |

| Description: Our Trex Residential business is dependent on consistently producing a product which is available when needed to meet the demands of our customers. As our business grows, we must adjust capacity to meet customer needs and provide increased throughput on our existing capacity. Impact: Our Trex Residential sales growth and profitability could suffer from our failure to effectively pair supply and demand for our products. Our customers’ demands for varying quantities of products and delivery items throughout the year, and increased demand year to year, require monitoring and the ability to adjust production in accordance with these demands. Failure to do so can lead to lost or reduced sales and have a negative effect on earnings. |

In order to meet Trex Residential customer demand in a timely manner, we must adjust capacity to meet customer needs and provide increased throughput on our existing capacity. Our sourcing team must obtain raw materials on a timely basis at an appropriate volume. | |

| Risk |

Discussion | |

| Description: Our prospects for sales growth and profitability may be adversely affected if we fail to maintain product quality and product performance at an acceptable cost. Impact: If we are unable to produce high-quality products at standard manufacturing rates and yields, unit costs may be higher. A lack of product performance could impede acceptance of our products in the marketplace and negatively affect our profitability. Future increases to our Trex Residential warranty reserve could have a material adverse effect on our profitability and cash flows. In the event lawsuits relating to alleged product quality issues are brought against us in the future, such lawsuits may be costly and could cause adverse publicity, which in turn could result in a loss of consumer confidence in our products and reduce our sales. Product quality claims could increase our expenses, have a material adverse effect on demand for our products and decrease net sales, net income and liquidity. |

In order to expand our net sales and sustain profitable operations we must maintain the quality and performance of our products. Trex Residential continues to receive and settle claims and maintain a warranty reserve related to decking product produced at our Nevada facility prior to 2007 that exhibits surface flaking. We have limited our financial exposure by settling a nationwide class action lawsuit that provides that a consumer’s remedy is limited to the replacement of product and a partial labor reimbursement. However, because the establishment of reserves is an inherently uncertain process involving estimates of the number of future claims and the average cost of claims, our ultimate losses may differ from our warranty reserve. Increases to the warranty reserve and payments for related claims have had a material adverse effect on our profitability and cash flows. A number of class action lawsuits alleging defects in our products have been brought against us, all of which have been settled. | |

| Risk |

Discussion | |

| Description: Our business is subject to risks in obtaining the raw materials we use at acceptable prices. Impact: Our business could suffer from the termination of significant sources of raw materials, the payment of higher prices for raw materials, the quality of available raw materials, or from the failure to obtain sufficient additional raw materials to meet planned increases in production. |

The manufacture of our Trex Residential composite decking and railing products requires substantial amounts of wood fiber and scrap polyethylene. Our business strategy is to create a substantial cost advantage over our competitors by using scrap polyethylene. Our ability to obtain adequate supplies of wood fiber and scrap polyethylene depends on our success in developing new sources that meet our quality requirements, maintaining favorable relationships with suppliers and managing the collection of supplies from geographically dispersed locations. In addition to wood fiber and scrap polyethylene, we also use a small percentage of other materials in making our products, which are sometimes subject to volatility in supply and pricing and could negatively affect our profitability. The manufacture of our Trex Commercial products requires substantial amounts of aluminum, steel, glass and wood. These materials are also sometimes subject to volatility in pricing, which could negatively affect our profitability. | |

| Risk |

Discussion | |

| Description: We have limited ability to project inventory build-ups in our Trex Residential distribution channel that can negatively affect our sales in subsequent periods.Impact: We cannot definitively determine the level of inventory in the Trex Residential distribution channels at any time and, therefore, have limited ability to precisely project inventory build-ups in the Trex Residential two-step distribution channel. Significant increases in inventory levels in the distribution channel without a corresponding change in end-use demand could have an adverse effect on the timing of future sales. |

Trex Residential sells most of our composite decking and railing products through our network of wholesale distributors who, in turn, sell to retail outlets. The seasonal nature of, and changing conditions in, our industry can result in substantial fluctuations in inventory levels of Trex Residential products carried in our two-step distribution channel. Because of the seasonal nature of the demand for our products, our distribution channel partners must forecast demand for our products, place orders for the products, and maintain Trex Residential product inventories in advance of the prime deck-building season, which generally occurs in the latter part of the first calendar quarter through the third calendar quarter. Accordingly, our results for the second and third quarters are difficult to predict and past performance will not necessarily indicate future performance. Inventory levels respond to a number of changing conditions in our industry, including product price increases, increases in the number of competitive producers, the rapid pace of product introduction and innovation, changes in the levels of home-building and remodeling expenditures and the cost and availability of consumer credit. | |

| Risk |

Discussion | |

| Description: The demand for our Trex Residential products is negatively affected by adverse weather conditions. Impact: Seasonal, erratic, or prolonged adverse weather conditions may shift sales of Trex Residential products to future periods or decrease overall sales given the limited decking season in many locations, which could have a negative impact on our results of operations and liquidity. |

Our Trex Residential products are generally purchased shortly before installation and used in outdoor environments. As a result, there is a correlation between the amount of product we sell and weather conditions during the time they are to be installed. Seasonal, erratic or prolonged adverse weather conditions in certain geographic regions may interfere with ordinary construction, delay projects or lead to cessation of construction involving our products. | |

| Risk |

Discussion | |

| Description: We depend on third parties for transportation services and the lack of availability of transportation and/or increases in cost could materially adversely affect our business and operations. Impact: If the required supply of third-party transportation services is unavailable when needed, we may be unable to deliver our products in a timely manner and, therefore, unable to sell our products at full value, or at all. Similarly, if any of these providers were unavailable to deliver raw materials to us in a timely manner, we may be unable to manufacture our products in response to customer demand. This could harm our reputation, negatively impact our customer relationships and have a material adverse effect on our financial condition and results of operations. In addition, a material increase in transportation rates or fuel surcharges could have a material adverse effect on our profitability. |

Our business depends on the transportation by third parties of both raw materials to us and finished goods to our customers. In particular, a significant portion of our finished goods are transported by flatbed trucks, which are occasionally in high demand (especially at the end of calendar quarters) and/or subject to price fluctuations based on market conditions and the price of fuel. | |

| Risk |

Discussion | |

| Description: The demand for our products is influenced by the home improvement and commercial construction markets and could be adversely affected by conditions that negatively impact these markets. Impact: We cannot predict conditions that may negatively impact the home remodeling and new home construction environment. Any economic downturn or adverse changes in the home improvement market could reduce consumer income or equity capital available for spending on discretionary items, which could adversely affect the demand for our Trex Residential products. We cannot predict conditions that may negatively impact the commercial construction environment. Any economic downturn could negatively impact the availability of funding for commercial construction projects and the ability of Trex Commercial customers to engage in commercial construction activity, which could adversely affect the demand for Trex Commercial products. |

The demand for Trex Residential composite decking and railing products is influenced by the general health of the economy, the level of home improvement activity and, to a much lesser extent, new home construction. These factors are affected by home equity values, credit availability and interest rates, consumer confidence, income and spending habits, employment, inflation and general economic conditions. The demand for Trex Commercial railing and staging system products is influenced by the general health of the economy and the level of commercial construction activity, building variances, funding availability for large public use facilities, including sports stadiums and arenas, and the construction schedules of our projects. |

| Risk |

Discussion | |

| Description: We have significant capital invested in assets that may become obsolete or impaired and result in a charge to our earnings. Impact: The recognition of goodwill may result in an impairment charge to our earnings if circumstances change and reduce the fair value of the goodwill acquired below its carrying amount. Significant replacement of equipment or changes in the expected cash flows related to our assets could result in reduced earnings or cash flows in future periods. |

We have made and may continue to make significant capital investments in order to acquire businesses or operations that allow us to diversify into new product markets. These investments have resulted in, and may in the future result in, the recognition of goodwill. In addition, we have made and may continue to make significant capital investments to our property plant and equipment in order to improve or expand our manufacturing capabilities. These investments sometimes involve the implementation of new technology and replacement of existing equipment at our manufacturing facilities, which may result in charges to our earnings if the existing equipment is not fully depreciated. | |

| Risk |

Discussion | |

| Description: Our ability to continue to obtain financing on favorable terms, and the level of any outstanding indebtedness, could adversely affect our financial health and ability to compete. Impact: Our ability to make future principal and interest payments, borrow and repay amounts under our senior credit facility and continue to comply with our loan covenants will depend primarily on our ability to generate sufficient cash flow from operations. Our failure to comply with our loan covenants might cause our lenders to accelerate our repayment obligations under our senior credit facility, which may be declared payable immediately based on a default. |

Our ability to continue to obtain financing on favorable terms may limit our discretion on some business matters, which could make it more difficult for us to expand, finance our operations and engage in other business activities that may be in our interest. In addition, our senior credit facility may impose operating and financial restrictions. At certain periods during the year, we may borrow significant amounts on our senior credit facility for working capital purposes. In addition, we may borrow on the senior credit facility to pursue strategic opportunities or other general business matters. Accordingly, our future level of indebtedness and the terms of our borrowings could have important consequences. | |

| Risk |

Discussion | |

| Description: Cyberattacks and other security breaches could compromise our proprietary and confidential information which could harm our business and reputation. Impact: While we have certain safeguards in place to reduce the risk of and detect cyber-attacks, our information technology networks and infrastructure may be vulnerable to unpermitted access by hackers or other breaches, or employee error or malfeasance. Any such compromise of our data security and access to, or public disclosure or loss of, confidential business or proprietary information could disrupt our operations, damage our reputation, provide our competitors with valuable information and subject us to additional costs, which could adversely affect our business. |

In the ordinary course of our business, we generate, collect and store confidential and proprietary information, including intellectual property and business information. The secure storage, maintenance, and transmission of and access to this information is important to our operations and reputation. Computer hackers may attempt to penetrate our computer systems and, if successful, misappropriate our proprietary and confidential information including e-mails and other electronic communications.In addition, an employee, contractor, competitor, or other third party with whom we do business may attempt to obtain such information, and may purposefully or inadvertently cause a breach involving such information. We also collect limited information on consumers. Although we do not collect any highly sensitive information, there is a risk that a cybersecurity attack could compromise consumer’s names, addresses and other personal information. | |

Item 1B. |

Unresolved Staff Comments |

Item 2. |

Properties |

| Square Footage/ Acres |

Leased / Owned |

Lease Expiration Dates |

Location |

Purpose | |||||||

| Corporate Headquarters |

39,250 SF |

Leased |

2025 |

Virginia |

Office Space | ||||||

| Trex Residential |

1,671,852 SF |

Leased |

2020 – 2028 |

Virginia / Nevada |

Warehouse, Research and Development, Storage, Training and Manufacturing Facilities | ||||||

| Trex Residential |

705,000 SF / 129 Acres |

Owned |

N/A |

Virginia / Nevada |

Manufacturing Facilities, Storage and Office Space | ||||||

| Trex Commercial |

142,808 SF |

Leased |

2022 – 2028 |

Minnesota |

Warehouse, Facility and Office Space | ||||||

Item 3. |

Legal Proceedings |

Item 4. |

Mine Safety Disclosures. |

Item 5. |

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

| Period |

(a) Total Number of Shares (or Units) Purchased (1) |

(b) Average Price Paid per Share (or Unit) ($) |

(c) Total Number of Shares (or Units) Purchased as Part of Publicly Announced Plans or Programs (2) |

(d) Maximum number of Shares (or Units) that May Yet Be Purchased Under the Plan or Program |

||||||||||||

| October 1, 2019 – October 31, 2019 |

48,489 |

$ | 88.97 |

44,919 |

4,920,640 |

|||||||||||

| November 1, 2019 – November 30, 2019 |

39,060 |

$ | 87.49 |

39,060 |

4,881,580 |

|||||||||||

| December 1, 2019 – December 31, 2019 |

40,960 |

$ | 87.68 |

40,960 |

4,840,620 |

|||||||||||

| Quarter ended December 31, 2019 |

128,509 |

124,939 |

||||||||||||||

| (1) | During the three months ended December 31, 2019, 3,570 shares were withheld by, or delivered to, the Company pursuant to provisions in agreements with recipients of restricted stock granted under the Company’s 2014 Stock Incentive Plan allowing the Company to withhold, or the recipient to deliver to the Company, the number of shares having the fair value equal to tax withholding due. |

| (2) | On February 16, 2018, the Company’s Board of Directors authorized a common stock repurchase program of up to 5.8 million shares of the Company’s outstanding common stock (Stock Repurchase Program). The Stock Repurchase Program was publicly announced on February 21, 2018. During the three months ended December 31, 2019, the Company repurchased 124,939 shares under the Stock Repurchase Program. |

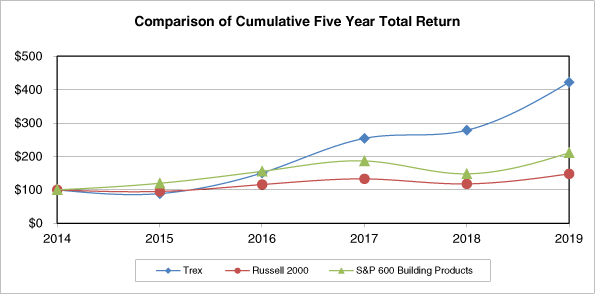

| 12/31/2014 |

12/31/2015 |

12/31/2016 |

12/31/2017 |

12/31/2018 |

12/31/2019 |

|||||||||||||||||||

| Trex Company, Inc. |

$ | 100.00 |

$ | 89.34 |

$ | 151.24 |

$ | 254.53 |

$ | 278.82 |

$ | 422.17 |

||||||||||||

| Russell 2000 Index |

$ | 100.00 |

$ | 95.59 |

$ | 115.96 |

$ | 132.95 |

$ | 118.31 |

$ | 148.52 |

||||||||||||

| S&P 600 Building Products |

$ | 100.00 |

$ | 119.97 |

$ | 155.70 |

$ | 187.18 |

$ | 148.27 |

$ | 210.82 |

||||||||||||

Item 6. |

Selected Financial Data |

| Year Ended December 31, (1) |

||||||||||||||||||||

| 2019 (2) |

2018 |

2017 (3) |

2016 (4) |

2015 (5) |

||||||||||||||||

| (In thousands, except share and per share data) |

||||||||||||||||||||

| Statement of Comprehensive Income Data: |

||||||||||||||||||||

| Net sales |

$ | 745,347 |

$ | 684,250 |

$ | 565,153 |

$ | 479,616 |

$ | 440,804 |

||||||||||

| Cost of sales |

438,844 |

389,356 |

321,780 |

292,521 |

285,935 |

|||||||||||||||

| Gross profit |

306,503 |

294,894 |

243,373 |

187,095 |

154,869 |

|||||||||||||||

| Selling, general and administrative expenses |

118,304 |

118,225 |

100,993 |

83,140 |

77,463 |

|||||||||||||||

| Income from operations |

188,199 |

176,669 |

142,380 |

103,955 |

77,406 |

|||||||||||||||

| Interest (income) expense, net |

(1,503 |

) | (192 |

) | 461 |

1,125 |

619 |

|||||||||||||

| Income before income taxes |

189,702 |

176,861 |

141,919 |

102,830 |

76,787 |

|||||||||||||||

| Provision for income taxes |

44,964 |

42,289 |

46,791 |

34,983 |

28,689 |

|||||||||||||||

| Net income |

$ | 144,738 |

$ | 134,572 |

$ | 95,128 |

$ | 67,847 |

$ | 48,098 |

||||||||||

| Basic earnings per share |

$ | 2.48 |

$ | 2.29 |

$ | 1.62 |

$ | 1.15 |

$ | 0.77 |

||||||||||

| Basic weighted average shares outstanding |

58,430,597 |

58,739,670 |

58,785,118 |

58,789,118 |

62,701,084 |

|||||||||||||||

| Diluted earnings per share |

$ | 2.47 |

$ | 2.28 |

$ | 1.61 |

$ | 1.15 |

$ | 0.76 |

||||||||||

| Diluted weighted average shares outstanding |

58,657,749 |

59,067,302 |

59,150,920 |

59,225,338 |

63,365,018 |

|||||||||||||||

| Cash Flow Data: |

||||||||||||||||||||

| Cash provided by operating activities |

$ | 156,352 |

$ | 138,121 |

$ | 101,865 |

$ | 85,293 |

$ | 62,634 |

||||||||||

| Cash used in investing activities |

(67,244 |

) | (33,733 |

) | (86,789 |

) | (10,202 |

) | (23,329 |

) | ||||||||||

| Cash used in financing activities |

(45,974 |

) | (29,203 |

) | (3,226 |

) | (62,422 |

) | (42,854 |

) | ||||||||||

| Other Data (unaudited): |

||||||||||||||||||||

| EBITDA (non-GAAP) (6) |

$ | 202,230 |

$ | 193,136 |

$ | 159,110 |

$ | 118,136 |

$ | 91,701 |

||||||||||

| Balance Sheet Data: |

||||||||||||||||||||

| Cash and cash equivalents |

$ | 148,833 |

$ | 105,699 |

$ | 30,514 |

$ | 18,664 |

$ | 5,995 |

||||||||||

| Working capital |

224,534 |

177,450 |

86,289 |

54,264 |

38,581 |

|||||||||||||||

| Total assets |

592,239 |

465,122 |

326,227 |

221,430 |

211,998 |

|||||||||||||||

| Total debt |

— |

— |

— |

— |

7,000 |

|||||||||||||||

| Total stockholders’ equity |

$ | 449,175 |

$ | 342,963 |

$ | 231,250 |

$ | 134,161 |

$ | 116,463 |

||||||||||

| 1) | All common stock share and per share data in the above table are presented on a post-split basis to reflect the two-for-one stock split of our common stock in the form of a stock dividend distributed on June 18, 2018 to stockholders of record at the close of business on May 23, 2018. |

| 2) | In January 1, 2019, the Company adopted Financial Accounting Standards Board (FASB) Accounting Standards Update (ASU) No. 2016-02, “Leases (Topic 842), |

| guidance within ASU Nos. 2018-01, 2018-10, 2018-11, 2018-20, and 2019-01 (collectively, the standard). The standard requires lessees to recognize operating leases on the balance sheet as a right-of-use (ROU) asset and a lease liability (current and non-current). The liability is equal to the present value of the lease payments over the remaining lease term. The asset is based on the liability, subject to certain adjustments. The Company elected the modified retrospective method of adoption, which allowed the Company to apply the standard as of the beginning of the period of adoption. As a result, at December 31, 2019 the Company reported an ROU asset in total assets and included the current portion of the lease liability in working capital. |

| 3) | On July 31, 2017, the Company’s newly-formed, wholly-owned subsidiary, Trex Commercial Products, Inc. acquired certain assets and assumed certain liabilities of Staging Concepts Acquisition, LLC. The Consolidated Financial Statements include the accounts of Trex Commercial Products, Inc. from the date of acquisition. Also, the tax legislation H.R.1, “An Act to Provide for Reconciliation Pursuant to Titles II and V of the Concurrent Resolution on the Budget for Fiscal Year 2018,” known as the Tax Cuts and Jobs Act (Act), was enacted on December 22, 2017. Accordingly, we have recognized the tax effects of the Act in our financial statements and related notes as of and for the year ended December 31, 2017. Deferred tax assets that existed as of the enactment date and that reversed after the Act’s effective date of January 1, 2018 were adjusted to reflect the new Federal statutory tax rate of 21%. The effect of the change in tax rate on the deferred tax assets was allocated to continuing operations as a discrete item. We finalized our analysis of the Act in 2018, which did not give rise to new deferred tax amounts. |

| 4) | Year ended December 31, 2016 was materially affected by a pre-tax increase of $9.8 million to the warranty reserve related to surface flaking. Also, during 2016, the Company adopted FASB ASU No. 2015-17, “Income Taxes (Topic 740): Balance Sheet Classification of Deferred Taxes. |

| Because the Company applied ASU No. 2015-17 prospectively in the quarterly period ended December 31, 2016, prior periods have not been adjusted. As a result, in 2016 deferred tax assets are now reported net of deferred tax liabilities, included as either a non-current asset or liability, and are no longer a component of working capital. Deferred tax assets or liabilities of prior fiscal years that were previously included in current assets or current liabilities continue to be reported as a component of working capital. |

| 5) | Year ended December 31, 2015 was materially affected by a pre-tax increase of $7.8 million to the warranty reserve, the majority of which related to surface flaking. |

| 6) | EBITDA represents net income before interest, income taxes, depreciation and amortization. EBITDA is not a measurement of financial performance under accounting principles generally accepted in the United States (GAAP). The Company has included data with respect to EBITDA because management evaluates and projects the performance of the Company’s business using several measures, including EBITDA. Management considers EBITDA to be an important supplemental indicator of the Company’s operating performance, particularly as compared to the operating performance of the Company’s competitors, because this measure eliminates many differences among companies in capitalization and tax structures, capital investment cycles and ages of related assets, as well as some recurring non-cash and non-operating charges to net income or loss. For these reasons, management believes that EBITDA provides important supplemental information to investors regarding the operating performance of the Company and facilitates comparisons by investors between the operating performance of the Company and the operating performance of its competitors. Management believes that consideration of EBITDA should be supplemental, because EBITDA has limitations as an analytical financial measure. These limitations include the following: |

| • | EBITDA does not reflect the Company’s cash expenditures, or future requirements for capital expenditures, or contractual commitments; |

| • | EBITDA does not reflect the interest expense, or the cash requirements necessary to service interest or principal payments, on the Company’s indebtedness; |

| • | Although depreciation and amortization are non-cash charges, the assets being depreciated and amortized will often have to be replaced in the future, and EBITDA does not reflect any cash requirements for such replacements; |

| • | EBITDA does not reflect the effect of earnings or charges resulting from matters the Company considers not to be indicative of its ongoing operations; and |

| • | Not all entities in the Company’s industry may calculate EBITDA in the same manner in which the Company calculates EBITDA, which limits its usefulness as a comparative measure. |

| Year Ended December 31, |

||||||||||||||||||||

| 2019 |

2018 |

2017 |

2016 |

2015 |

||||||||||||||||

| (In thousands) |

||||||||||||||||||||

| Net income |

$ | 144,738 |

$ | 134,572 |

$ | 95,128 |

$ | 67,847 |

$ | 48,098 |

||||||||||

| Plus interest (income) expense, net |

(1,503 |

) | (192 |

) | 461 |

1,125 |

619 |

|||||||||||||

| Plus income tax provision |

44,964 |

42,289 |

46,791 |

34,983 |

28,689 |

|||||||||||||||

| Plus depreciation and amortization |

14,031 |

16,467 |

16,730 |

14,181 |

14,295 |

|||||||||||||||

| EBITDA (non-GAAP) |

$ | 202,230 |

$ | 193,136 |

$ | 159,110 |

$ | 118,136 |

$ | 91,701 |

||||||||||

Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

| Decking and Accessories |

Trex Transcend ® decking Trex Enhance ® decking Trex Select ® decking Trex Hideaway ® hidden fastening system Trex DeckLighting ™ outdoor lighting system | ||

| Railing |

Trex Transcend Railing Trex Signature ® aluminum railing Trex Select Railing Trex Enhance Railing | ||

| Fencing |

Trex Seclusions ® | ||

| Steel Deck Framing System |

Trex Elevations ® | ||

| • | Increase in net sales of 9%, or $61.1 million, to $745.3 million in the twelve months ended December 31, 2019 compared to $684.3 million in the twelve months ended December 31, 2018. Net sales in 2019 were the highest of any year in our history. |

| • | Trex Residential net sales increased $81 million, or 13%, in 2019 compared to 2018, and were the highest of any year in our history. |

| • | Increase in gross profit of 4%, or $11.6 million, to $306.50 million for the twelve months ended December 31, 2019 compared to $294.9 million for the twelve months ended December 31, 2018. |

| • | Increase in net income to $144.7 million, also reflecting the highest of any year in our history. |

| • | Cash flows from operating activities were $156.4 million in the twelve months ended December 31, 2019 compared to $138.1 million in the twelve months ended December 31, 2018. |

| • | New capital expenditure program to increase production capacity at the Trex Residential facilities in Virginia and Nevada and projected at approximately $200 million in the aggregate by 2021. |

| • | Repurchase of 500,059 shares of our outstanding common stock under our Stock Repurchase Program in 2019, for a total of 959,380 shares repurchased under the program to date. |

| Year Ended December 31, |

||||||||||||

| 2019 |

2018 |

2017 |

||||||||||

| Claims unresolved beginning of period |

2,021 |

2,306 |

2,755 |

|||||||||

| Claims received (1) |

1,394 |

1,481 |

2,250 |

|||||||||

| Claims resolved (2) |

(1,691 |

) | (1,766 |

) | (2,699 |

) | ||||||

| Claims unresolved end of period |

1,724 |

2,021 |

2,306 |

|||||||||

| Average cost per claim (3) |

$ | 3,447 |

$ | 2,631 |

$ | 2,546 |

||||||

| (1) | Claims received include new claims received or identified during the period. |

| (2) | Claims resolved include all claims settled with or without payment and closed during the period. |

| (3) | Average cost per claim represents the average settlement cost of claims closed with payment during the period. |

| Year Ended December 31, |

$ Change |

% Change |

||||||||||||||

| 2019 |

2018 |

|||||||||||||||

| (dollars in thousands) |

||||||||||||||||

| Total net sales |

$ | 745,347 |

$ | 684,250 |

$ | 61,097 |

8.9 |

% | ||||||||

| Trex Residential net sales |

$ | 694,267 |

$ | 613,229 |

$ | 81,038 |

13.2 |

% | ||||||||

| Trex Commercial net sales |

$ | 51,080 |

$ | 71,021 |

$ | (19,941 |

) | (28.1 |

)% | |||||||

| Year Ended December 31, |

$ Change |

% Change |

||||||||||||||

| 2019 |

2018 |

|||||||||||||||

| (dollars in thousands) |

||||||||||||||||

| Cost of sales |

$ | 438,844 |

$ | 389,356 |

$ | 49,488 |

12.7 |

% | ||||||||

| % of total net sales |

58.9 |

% | 56.9 |

% | ||||||||||||

| Gross profit |

$ | 306,503 |

$ | 294,894 |

$ | 11,609 |

3.9 |

% | ||||||||

| Gross margin |

41.1 |

% | 43.1 |

% | ||||||||||||

| Year Ended December 31, |

$ Change |

% Change |

||||||||||||||

| 2019 |

2018 |

|||||||||||||||

| (dollars in thousands) |

||||||||||||||||

| Selling, general and administrative expenses |

$ | 118,304 |

$ | 118,225 |

$ | 79 |

0.1 |

% | ||||||||

| % of total net sales |

15.9 |

% | 17.3 |

% | ||||||||||||

| Year Ended December 31, |

$ Change |

% Change |

||||||||||||||

| 2019 |

2018 |

|||||||||||||||

| (dollars in thousands) |

||||||||||||||||

| Provision for income taxes |

$ | 44,964 |

$ | 42,289 |

$ | 2,675 |

6.3 |

% | ||||||||

| Effective tax rate |

23.7 |

% | 23.9 |

% | ||||||||||||

| Year Ended December 31 |

2019 Trex Residential |

2019 Trex Commercial |

2019 Trex Consolidated |

|||||||||

| Net income |

$ | 142,811 |

$ | 1,927 |

$ | 144,738 |

||||||

| Interest income, net |

(1,496 |

) | (7 |

) | (1,503 |

) | ||||||

| Income tax expense |

44,292 |

672 |

44,964 |

|||||||||

| Depreciation and amortization |

13,413 |

618 |

14,031 |

|||||||||

| EBITDA |

$ | 199,020 |

$ | 3,210 |

$ | 202,230 |

||||||

| Year Ended December 31 |

2018 Trex Residential |

2018 Trex Commercial |

2018 Trex Consolidated |

|||||||||

| Net income |

$ | 131,823 |

$ | 2,749 |

$ | 134,572 |

||||||

| Interest income, net |

(192 |

) | — |

(192 |

) | |||||||

| Income tax expense |

41,421 |

868 |

42,289 |

|||||||||

| Depreciation and amortization |

13,216 |

3,251 |

16,467 |

|||||||||

| EBITDA |

$ | 186,268 |

$ | 6,868 |

$ | 193,136 |

||||||

1 |

EBITDA represents net income before interest, income taxes, depreciation and amortization. EBITDA is not a measurement of financial performance under accounting principles generally accepted in the United States (GAAP). We have included data with respect to EBITDA because management evaluates the performance of its reportable segments using EBITDA. Management considers EBITDA to be an important supplemental indicator of our core operating performance because it eliminates interest, income taxes, and depreciation and amortization charges to net income and, in relation to its competitors, it eliminates differences among companies in capitalization and tax structures, capital investment cycles and ages of related assets. For these reasons, management believes that EBITDA provides important information regarding the operating performance of the Company and its reportable segments. |

| Year Ended December 31, |

$ Change |

% Change |

||||||||||||||

| 2019 |

2018 |

|||||||||||||||

| (dollars in thousands) |

||||||||||||||||

| Total EBITDA |

$ | 202,230 |

$ | 193,136 |

$ | 9,094 |

4.7 |

% | ||||||||

| Trex Residential EBITDA |

$ | 199,020 |

$ | 186,268 |

$ | 12,752 |

6.9 |

% | ||||||||

| Trex Commercial EBITDA |

$ | 3,210 |

$ | 6,868 |

$ | (3,658 |

) | (53.3 |

)% | |||||||

| Year Ended December 31, |

||||||||||||

| 2019 |

2018 |

2017 |

||||||||||

| Net cash provided by operating activities |

$ | 156,352 |

$ | 138,121 |

$ | 101,865 |

||||||

| Net cash used in investing activities |

(67,244 |

) | (33,733 |

) | (86,789 |

) | ||||||

| Net cash used in financing activities |

(45,974 |

) | (29,203 |

) | (3,226 |

) | ||||||

| Net increase in cash and cash equivalents |

$ | 43,134 |

$ | 75,185 |

$ | 11,850 |

||||||

| Total |

1 year |

2-3 years |

4-5 years |

After 5 years |

||||||||||||||||

| Purchase obligations (1) |

$ | 33,051 |

$ | 26,763 |

$ | 6,274 |

$ | 14 |

$ | — |

||||||||||

| Operating leases, including imputed interest (2) |

46,935 |

8,858 |

14,743 |

12,255 |

11,079 |

|||||||||||||||

| Total contractual obligations |

$ | 79,986 |

$ | 35,621 |

$ | 21,017 |

$ | 12,269 |

$ | 11,079 |

||||||||||

| (1) | Purchase obligations represent supply contracts with raw material vendors and service contracts for hauling raw materials. Open purchase orders written in the normal course of business for goods or services that are provided on demand have been excluded as the timing of which is not certain. |

| (2) | Operating leases represent office space, storage warehouses, manufacturing facilities and certain office and plant equipment under various operating leases, and include operating leases accounted for under Financial Accounting Standards Board Accounting Standards Codification Topic 842 and short-term leases. |

Item 7A. |

Quantitative and Qualitative Disclosures About Market Risk |

Item 8. |

Financial Statements and Supplementary Data |

Item 9. |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

Item 9A. |

Controls and Procedures |

| TREX COMPANY, INC. | ||||

| February 24, 2020 |

By: |

/s/ James E. Cline | ||

| James E. Cline President and Chief Executive Officer (Principal Executive Officer) | ||||

| February 24, 2020 |

By: |

/s/ Bryan H. Fairbanks | ||

| Bryan H. Fairbanks Executive Vice President and Chief Financial Officer (Principal Financial Officer) |

Item 9B. |

Other Information |

Item 10. |

Directors, Executive Officers and Corporate Governance |

Item 11. |

Executive Compensation |

Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

Item 14. |

Principal Accounting Fees and Services |

Item 15. |

Exhibits and Financial Statement Schedules |

| F- 2 |

||||

| Consolidated Financial Statements |

||||

| F- 4 |

||||

| F- 5 |

||||

| F- 6 |

||||

| F- 7 |

||||

| F- 8 |

| F- 34 |

| Page |

||||

| F- 2 |

||||

| Consolidated Financial Statements |

||||

| F- 4 |

||||

| F- 5 |

||||

| F- 6 |

||||

| F- 7 |

||||

| F- 8 |

||||

| Page |

||||

| F- 34 |

||||

| Surface Flaking Warranty | ||

| Description of the Matter |

At December 31, 2019, the Company’s surface flaking warranty reserve was $19.0 million. As discussed in Note 19 of the consolidated financial statements, the Company continues to receive and settle claims for decking products manufactured at its Nevada facility prior to 2007 that exhibit surface flaking and maintains a warranty reserve to provide for the settlement of these claims. The Company’s warranty reserve is based on an actuarial analysis of the number of claims to be settled and management’s estimate of the average cost to settle each claim. The actuarial analysis utilized determines a reasonably possible range of claims to be received and the percentage of those claims that will ultimately require payment. Auditing the surface flaking warranty reserve is complex and required the involvement of a specialist due to the highly judgmental nature of the actuarially determined number of claims. Auditing the reserve is also complex due to the judgmental nature of the significant assumptions made by management (e.g., the size of the affected decks, the availability and type of replacement material used, the cost of production of replacement material and the method of claim settlement) and used in the measurement process. These determinations, assumptions and judgments have a significant effect on the surface flaking reserve. | |

| How We Addressed the Matter in Our Audit |

We obtained an understanding, evaluated the design and tested the operating effectiveness of the controls over the Company’s measurement and valuation of the surface flaking warranty reserve. For example, we tested controls over the appropriateness of the assumptions used and the completeness and accuracy of the underlying data. To test the surface flaking warranty reserve, our audit procedures included, among others, evaluating the methodologies and the significant assumptions used. For example, we involved an actuarial specialist to assist us in independently calculating a range of the expected number of claims and compared that to the Company’s range. We also performed sensitivity analyses to evaluate changes in the liability that would result from changes in significant assumptions. In addition, we assessed the historical accuracy of management’s estimates to identify potential changes in the measurement and valuation of the surface flaking reserve. We performed audit procedures on the completeness and accuracy of the underlying data used by the Company in its analysis. |

| Year Ended December 31, |

||||||||||||

| 2019 |

2018 |

2017 |

||||||||||

| (In thousands, except share and per share data) |

||||||||||||

| Net sales |

$ | |

$ | |

$ | |

||||||

| Cost of sales |

|

|

|

|||||||||

| Gross profit |

|

|

|

|||||||||

| Selling, general and administrative expenses |

|

|

|

|||||||||

| Income from operations |

|

|

|

|||||||||

| Interest (income) expense, net |

( |

) | ( |

) | |

|||||||

| Income before income taxes |

|

|

|

|||||||||

| Provision for income taxes |

|

|

|

|||||||||

| Net income |

$ | |

$ | |

$ | |

||||||

| Basic earnings per common share |

$ | |

$ | |

$ | |

||||||

| Basic weighted average common shares outstanding |

|

|

|

|||||||||

| Diluted earnings per common share |

$ | |

$ | |

$ | |

||||||

| Diluted weighted average common shares outstanding |

|

|

|

|||||||||

| Comprehensive income |

$ | |

$ | |

$ | |

||||||

| December 31, |

||||||||

| 2019 |

2018 |

|||||||

| (In thousands) |

||||||||

| ASSETS |

||||||||

| Current Assets: |

||||||||

| Cash and cash equivalents |

$ | |

$ | |

||||

| Accounts receivable, net |

|

|

||||||

| Inventories |

|

|

||||||

| Prepaid expenses and other assets |

|

|

||||||

| Total current assets |

|

|

||||||

| Property, plant and equipment, net |

|

|

||||||

| Goodwill and other intangible assets, net |

|

|

||||||

| Operating lease assets |

|

|

||||||

| Other assets |

|

|

||||||

| Total Assets |

$ | |

$ | |

||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY |

||||||||

| Current Liabilities: |

||||||||

| Accounts payable |

$ | |

$ | |

||||

| Accrued expenses and other liabilities |

|

|

||||||

| Accrued warranty |

|

|

||||||

| Total current liabilities |

|

|

||||||

| Operating lease liabilities |

|

|

||||||

| Deferred income taxes |

|

|

||||||

| Non-current accrued warranty |

|

|

||||||

| Other long-term liabilities |

|

|

||||||

| Total Liabilities |

|

|

||||||

| Commitments and contingencies |

|

|

||||||

| Stockholders’ Equity: |

||||||||

| Preferred stock, $ |

|

|

||||||

| Common stock, $ |

|

|

||||||

| Additional paid-in capital |

|

|

||||||

| Retained earnings |

|

|

||||||

| Treasury stock, at cost, |

( |

) | ( |

) | ||||

| Total Stockholders’ Equity |

|

|

||||||

| Total Liabilities and Stockholders’ Equity |

$ | |

$ | |

||||

| Common Stock |

Additional Paid-In Capital |

Retained Earnings |

Treasury Stock |

Total |

||||||||||||||||||||||||

| Shares |

Amount |

Shares |

Amount |

|||||||||||||||||||||||||

| Balance, December 31, 2016 |

|

$ | |

$ | |

$ | |

|

$ | ( |

) | $ | |

|||||||||||||||

| Net income |

— |

— |

— |

|

— |

— |

|

|||||||||||||||||||||

| Employee stock plans |

|

|

|

— |

— |

— |

|

|||||||||||||||||||||

| Shares withheld for taxes on awards |

( |

) | ( |

) | ( |

) | — |

— |

— |

( |

) | |||||||||||||||||

| Stock-based compensation |

|

— |

|

— |

— |

— |

|

|||||||||||||||||||||

| Balance, December 31, 2017 |

|

|

|

|

|

( |

) | |

||||||||||||||||||||

| Net income |

— |

— |

— |

|

— |

— |

|

|||||||||||||||||||||

| Employee stock plans |

|

|

|

— |

— |

— |

|

|||||||||||||||||||||

| Shares withheld for taxes on awards |

( |

) | — |

( |

) | — |

— |

— |

( |

) | ||||||||||||||||||

| Stock-based compensation |

|

|

|

— |

— |

— |

|

|||||||||||||||||||||

| Repurchases of common stock |

( |

) | — |

— |

— |

|

( |

) | ( |

) | ||||||||||||||||||

| Balance, December 31, 2018 |

|

|

|

|

|

( |

) | |

||||||||||||||||||||

| Net income |

— |

— |

— |

|

— |

— |

|

|||||||||||||||||||||

| Employee stock plans |

|

|

|

— |

— |

— |

|

|||||||||||||||||||||

| Shares withheld for taxes on awards |

( |

) | — |

( |

) | — |

— |

— |

( |

) | ||||||||||||||||||

| Stock-based compensation |

|

|

|

— |

— |

— |

|

|||||||||||||||||||||

| Repurchases of common stock |

( |

) | — |

— |

— |

|

( |

) | ( |

) | ||||||||||||||||||

| Balance, December 31, 2019 |

|

$ | |

$ | |

$ | |

|

$ | ( |

) | $ | |

|||||||||||||||

| Year Ended December 31, |

||||||||||||

| 2019 |

2018 |

2017 |

||||||||||

| (In thousands) |

||||||||||||

| Operating Activities |

||||||||||||

| Net income |

$ | |

$ | |

$ | |

||||||

| Adjustments to reconcile net income to net cash provided by operating activities: |

||||||||||||

| Depreciation and amortization |

|

|

|

|||||||||

| Deferred income taxes |

|

|

|

|||||||||

| Stock-based compensation |

|

|

|

|||||||||

| Loss on disposal of property, plant and equipment |

|

|

|

|||||||||

| Other non-cash adjustments |

( |

) | ( |

) | ( |

) | ||||||

| Changes in operating assets and liabilities: |

||||||||||||

| Accounts receivable |

|

( |

) | ( |

) | |||||||

| Inventories |

|

( |

) | ( |

) | |||||||

| Prepaid expenses and other assets |

( |

) | ( |

) | ( |

) | ||||||

| Accounts payable |

( |

) | |

( |

) | |||||||

| Accrued expenses and other liabilities |

( |

) | |

|

||||||||

| Income taxes receivable/payable |

( |

) | |

|

||||||||

| Net cash provided by operating activities |

|

|

|

|||||||||

| Investing Activities |

||||||||||||

| Expenditures for property, plant and equipment and intangibles |

( |

) | ( |

) | ( |

) | ||||||

| Proceeds from sales of property, plant and equipment |

|

|

|

|||||||||

| Acquisition of business, net of cash acquired |

— |

— |

( |

) | ||||||||

| Net cash used in investing activities |

( |

) | ( |

) | ( |

) | ||||||

| Financing Activities |

||||||||||||

| Borrowings under line of credit |

|

|||||||||||

| Principal payments under line of credit |

( |

) | ( |

) | ( |

) | ||||||

| Repurchases of common stock |

( |

) | ( |

) | ( |

) | ||||||

| Proceeds from employee stock purchase and option plans |

|

|

|

|||||||||

| Financing costs |

( |

) | — |

— |

||||||||

| Net cash used in financing activities |

( |

) | ( |

) | ( |

) | ||||||

| Net increase in cash and cash equivalents |

|

|

|

|||||||||

| Cash and cash equivalents at beginning of year |

|

|

|

|||||||||

| Cash and cash equivalents at end of year |

$ | |

$ | |

$ | |

||||||

| Supplemental disclosures of cash flow information: |

||||||||||||

| Cash paid for interest |

$ | |

$ | |

$ | |

||||||

| Cash paid for income taxes, net |

$ | |

$ | |

$ | |

||||||

1. |

BUSINESS AND ORGANIZATION |

2. |

SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES |

Buildings |

||||

Machinery and equipment |

||||

Furniture and equipment |

||||

Forklifts and tractors |

||||

Computer equipment and software |

| • | Level 1 – Quoted prices for identical instruments in active markets. |

| • | Level 2 – Quoted prices for similar instruments in active markets; quoted prices for identical or similar instruments in markets that are not active; and model derived valuations in which all significant inputs and significant value drivers are observable in active markets. |

| • | Level 3 – Valuations derived from management’s best estimate of what market participants would use in pricing the asset or liability at the measurement date. Consideration is given to the risk inherent in the valuation technique and the risk inherent in the inputs to the model. |

3. |

ACQUISITION |

4. |

INVENTORIES |

2019 |

2018 |

|||||||

Finished goods |

$ | $ | ||||||

Raw materials |

||||||||

Total FIFO inventories |

||||||||

Reserve to adjust inventories to LIFO value |

( |

) | ( |

) | ||||

Total LIFO inventories |

$ | $ | ||||||

5. |

PREPAID EXPENSES AND OTHER ASSETS |

2019 |

2018 |

|||||||

Prepaid expenses |

$ | $ | ||||||

Revenues in excess of billings |

||||||||

Contract retainage |

||||||||

Income tax receivable |

||||||||

Other |

||||||||

Total prepaid expenses and other assets |

$ | $ | ||||||

6. |

GOODWILL AND OTHER INTANGIBLE ASSETS, NET |

7. |

PROPERTY, PLANT AND EQUIPMENT |

2019 |

2018 |

|||||||

Machinery and equipment |

$ | $ | ||||||

Building and improvements |

||||||||

Forklifts and tractors |

||||||||

Computer equipment |

||||||||

Furniture and fixtures |

||||||||

Construction in process |

||||||||

Land |

||||||||

Total property, plant and equipment |

||||||||

Accumulated depreciation |

( |

) | ( |

) | ||||

Total property, plant and equipment, net |

$ | $ | ||||||

8. |

ACCRUED EXPENSES AND OTHER LIABILITIES |

2019 |

2018 |

|||||||

Sales and marketing |

$ | $ | ||||||

Compensation and benefits |

||||||||

Operating lease liabilities |

||||||||

Manufacturing costs |

||||||||

Customer deposits |

||||||||

Billings in excess of revenues |

||||||||

Other |

||||||||

Total accrued expenses |

$ | $ | ||||||

9. |

DEBT |

10. |

LEASES |

Supplemental cash flow information (in thousands) |

||||

Cash paid for amounts included in the measurement of operating lease liabilities |

$ | |||

Operating ROU assets obtained in exchange for lease liabilities |

$ | |||

Supplemental balance sheet information (in thousands) |

||||

Operating lease right-of-use assets |

$ | |||

Operating lease liabilities: |

||||

Accrued expenses and other current liabilities |

$ | |||

Operating lease liabilities |

||||

Total operating lease liabilities |

$ | |||

Maturities of operating lease liabilities |

||||

2020 |

$ | |||

2021 |

||||

2022 |

||||

2023 |

||||

2024 |

||||

Thereafter |

||||

Total lease payments |

||||

Less imputed interest |

( |

) | ||

Total operating liabilities |

$ | |||

Year Ending December 31, |

||||

2019 |

$ |

|||

2020 |

||||

2021 |

||||

2022 |

||||

2023 |

||||

Thereafter |

||||

Total minimum lease payments |

$ |

|||

11. |

FINANCIAL INSTRUMENTS |

12. |

STOCKHOLDERS’ EQUITY |

Year Ended December 31, |

||||||||||||

2019 |

2018 |

2017 |

||||||||||

Numerator: |

||||||||||||

Net income |

$ |

$ |

$ |

|||||||||

Denominator: |

||||||||||||

Basic weighted average shares outstanding |

||||||||||||

Effect of dilutive securities: |

||||||||||||

Stock appreciation rights |

||||||||||||

Restricted stock |

||||||||||||

Diluted weighted average shares outstanding |

||||||||||||

Basic earnings per share |

$ |

$ |

$ |

|||||||||

Diluted earnings per share |

$ |

$ |

$ |

|||||||||

Year Ended December 31, |

||||||||||||

2019 |

2018 |

2017 |

||||||||||

Restricted stock |

||||||||||||

Stock appreciation rights |

||||||||||||

13. |

REVENUE FROM CONTRACTS WITH CUSTOMERS |

Year Ended December 31, 2019 |

Reportable Segment |

|||||||||||

Trex Residential |

Trex Commercial |

Total |

||||||||||

Timing of Revenue Recognition and Type of Contract |

||||||||||||

Products transferred at a point in time and variable consideration contracts |

$ | $ | — |

$ | ||||||||

Products transferred over time and fixed price contracts |

— |

|||||||||||

| $ | $ | $ | ||||||||||

Year Ended December 31, 2018 |

Reportable Segment |

|||||||||||

Trex Residential |

Trex Commercial |

Total |

||||||||||

Timing of Revenue Recognition and Type of Contract |

||||||||||||

Products transferred at a point in time and variable consideration contracts |

$ | $ | — |

$ | ||||||||

Products transferred over time and fixed price contracts |

— |

|||||||||||

| $ | $ | $ | ||||||||||

Year Ended December 31, 2017 |

Reportable Segment |

|||||||||||

Trex Residential |

Trex Commercial |

Total |

||||||||||

Timing of Revenue Recognition and Type of Contract |

||||||||||||

Products transferred at a point in time and variable consideration contracts |

$ | $ | — |

$ | ||||||||

Products transferred over time and fixed price contracts |

— |

|||||||||||

| $ | $ | $ | ||||||||||

14. |

STOCK-BASED COMPENSATION |

Year Ended December 31, |

||||||||||||

2019 |

2018 |

2017 |

||||||||||

Time-based restricted stock and restricted stock units |

$ | $ | $ | |||||||||

Performance-based restricted stock and restricted stock units |

||||||||||||

Stock appreciation rights |

||||||||||||

Employee stock purchase plan |

||||||||||||

Total stock-based compensation |

$ | $ | $ | |||||||||

Time-based Restricted Stock and Restricted Stock Unit |

Weighted-Average Grant Price Per Share |

|||||||

Nonvested at December 31, 2016 |

$ | |||||||

Granted |

$ | |||||||

Vested |

( |

) | $ | |||||

Forfeited |

( |

) | $ | |||||

Nonvested at December 31, 2017 |

$ | |||||||

Granted |

$ | |||||||

Vested |

( |

) | $ | |||||

Forfeited |

( |

) | $ | |||||

Nonvested at December 31, 2018 |

$ | |||||||

Granted |

$ | |||||||

Vested |

( |

) | $ | |||||

Forfeited |

( |

) | $ | |||||

Nonvested at December 31, 2019 |

$ | |||||||

Performance-based Restricted Stock and Performance-based Restricted Stock Units |

Weighted-Average Grant Price Per Share |

|||||||

Nonvested at December 31, 2016 |

$ |

|||||||

Granted |

$ |

|||||||

Vested |

( |

) |

$ |

|||||

Forfeited |

— |

$ |

— |

|||||

Nonvested at December 31, 2017 |

$ |

|||||||

Granted |

$ |

|||||||

Vested |

( |

) |

$ |

|||||

Forfeited |

— |

$ |

— |

|||||

Nonvested at December 31, 2018 |

$ |

|||||||

Granted |

$ |

|||||||

Vested |

( |

) |

$ |

|||||

Forfeited |

( |

) |

$ |

|||||

Nonvested at December 31, 2019 |

$ |

|||||||

Year Ended December 31, |

||||||||||||

2019 |

2018 |

2017 |

||||||||||

Dividend yield |

% | % | % | |||||||||

Average risk-free interest rate |

% | % | % | |||||||||

Expected term (years) |

||||||||||||

Expected volatility |

% | % | % | |||||||||

SARs |

Weighted-Average Grant Price Per Share |

Weighted- Average Remaining Contractual Life (Years) |

Aggregate Intrinsic Value as of December 31, 2019 |

|||||||||||||

Outstanding at December 31, 2016 |

$ | |||||||||||||||

Granted |

$ | |||||||||||||||

Exercised |

( |

) | $ | |||||||||||||

Canceled |

$ | |||||||||||||||

Outstanding at December 31, 2017 |

$ | |||||||||||||||

Granted |

$ | |||||||||||||||

Exercised |

( |

) | $ | |||||||||||||

Canceled |

$ | |||||||||||||||

Outstanding at December 31, 2018 |

$ | |||||||||||||||

Granted |

$ | |||||||||||||||

Exercised |

( |

) | $ | |||||||||||||

Canceled |

( |

) | $ | |||||||||||||

Outstanding at December 31, 2019 |

$ | $ | ||||||||||||||

Vested at December 31, 2019 |

$ | $ | ||||||||||||||

Exercisable at December 31, 2019 |

$ | $ | ||||||||||||||

15. |

EMPLOYEE BENEFIT PLANS |

16. |

INCOME TAXES |

Year Ended December 31, |

||||||||||||

2019 |

2018 |

2017 |

||||||||||

Current income tax provision: |

||||||||||||

Federal |

$ |

$ |

$ |

|||||||||

State |

||||||||||||

Deferred income tax provision: |

||||||||||||

Federal |

||||||||||||

State |

( |

) | ||||||||||

Total income tax provision |

$ |

$ |

$ |

|||||||||

Year Ended December 31, |

||||||||||||

2019 |

2018 |

2017 |

||||||||||

U.S. Federal statutory taxes |

$ | $ | $ | |||||||||

State and local taxes, net of U.S. Federal benefit |

||||||||||||

Permanent items |

||||||||||||

Excess tax benefits from vesting or settlement of stock compensation awards |

( |

) | ( |

) | ( |

) | ||||||

Domestic production activities deduction |

— |

— |

( |

) | ||||||||

Federal credits |

( |

) | ( |

) | ( |

) | ||||||

Other |

( |

) | ( |

) | ( |

) | ||||||

Total income tax provision |

$ | $ | $ | |||||||||

As of December 31, |

||||||||

2019 |

2018 |

|||||||

Deferred tax assets: |

||||||||

Net operating losses |

$ | $ | ||||||

Residential product warranty reserve |

||||||||

Stock-based compensation |

||||||||

Accruals not currently deductible and other |

||||||||

Inventories |

||||||||

Operat ing le ase liability |

— |

|||||||

State tax credit carryforwards |

||||||||

Gross deferred tax assets, before valuation allowance |

||||||||

Valuation allowance |

( |

) | ( |

) | ||||

Gross deferred tax assets, after valuation allowance |

||||||||

Deferred tax liabilities: |

||||||||

Depreciation |

( |

) | ( |

) | ||||

Operating lease right-of-use asset |

( |

) |

— |

|||||

Goodwill amortization |

( |

) | ( |

) | ||||

Inventories and other |

( |

) | ( |

) | ||||

Gross deferred tax liabilities |

( |

) | ( |

) | ||||

Net deferred tax liability |

$ | ( |

) | $ | ( |

) | ||

17. |

SEGMENT INFORMATION |

| • | Trex Residential manufactures composite decking and railing and related products marketed under the brand name Trex ® . The products are sold to its distributors and |